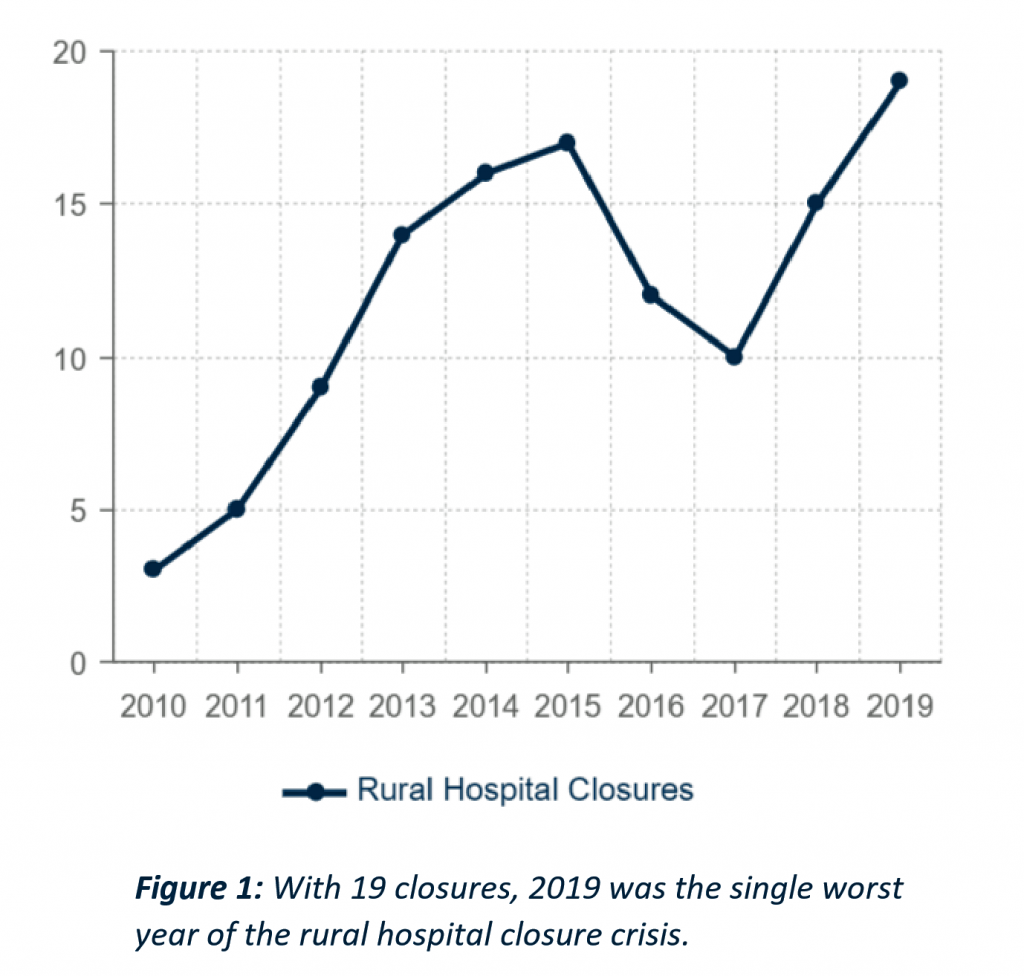

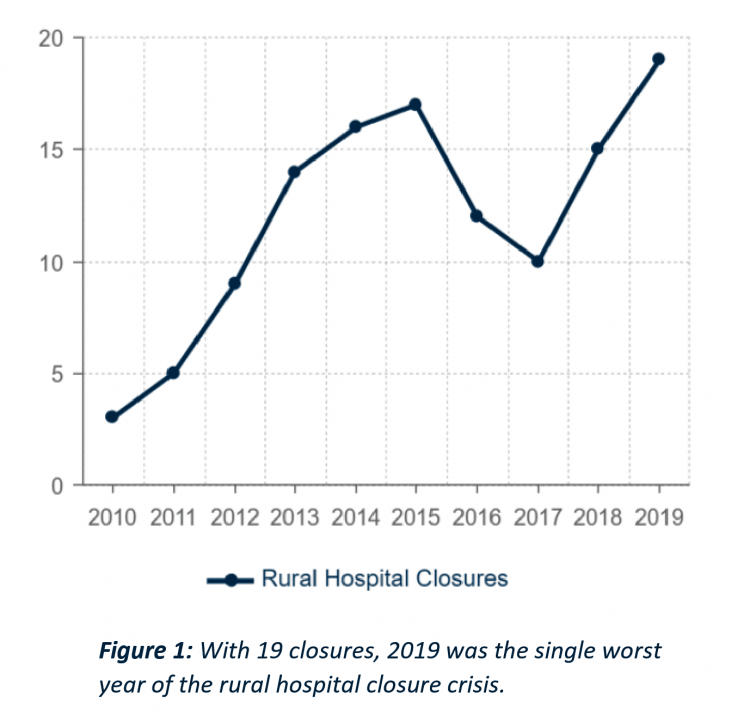

There are 1,844 rural hospitals operating in the U.S. That number is down by 19 in the 2019 calendar year, the worst year of rural hospital closings seen in the past decade. That hockey-stick growth of closures is shown in the first chart, where 34 rural hospitals shut down in the past 2 years.

There are 1,844 rural hospitals operating in the U.S. That number is down by 19 in the 2019 calendar year, the worst year of rural hospital closings seen in the past decade. That hockey-stick growth of closures is shown in the first chart, where 34 rural hospitals shut down in the past 2 years.

Rural U.S. hospitals are in poor fiscal health. “The accelerated rate at which rural hospitals are closing continues to unsettle the rural healthcare community and demands a more nuanced investigation into rural hospital performance,” threatening the stability of the rural health safety net, according to the Chartis Center for Rural Health’s latest research.

In The Rural Health Safety Net Under Pressure: Rural Hospital Vulnerability, the Chartis team documents the erosion of these small, remote institutions which provide the only inpatient resource for health citizens living in their geographically large service areas. I’ve extracted four charts from the report to help us understand the current and near-term future prospects for rural hospitals “under pressure,” as the report’s title describes. The first line chart illustrates rural hospital closures since 2010.

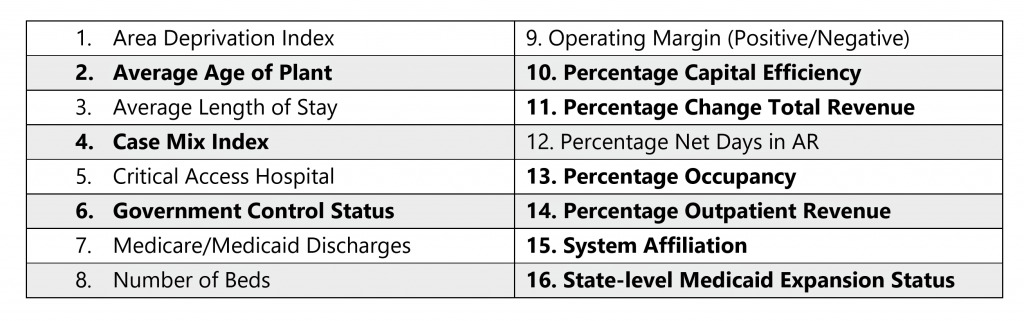

The research analyzed sixteen metrics that together quantify the sustainability of rural hospitals, looking at a geography’s “area deprivation index” — the community’s socioeconomic status as a measure for social determinants of health — along with an institution’s operating margin, net days in accounts receivable (that is, how late payor and patient payments are), and whether the hospital’s state expanded Medicaid under the Affordable Care Act, among other characteristics.

The research analyzed sixteen metrics that together quantify the sustainability of rural hospitals, looking at a geography’s “area deprivation index” — the community’s socioeconomic status as a measure for social determinants of health — along with an institution’s operating margin, net days in accounts receivable (that is, how late payor and patient payments are), and whether the hospital’s state expanded Medicaid under the Affordable Care Act, among other characteristics.

Chartis found nine of these to be most important in predicting closure: average age of the plant, case mix index, government control status, percentage capital efficiency, percentage change total revenue, percentage occupancy, percentage outpatient revenue, system affiliation, and state-level Medicaid expansion status.

The third graphic (second of my four chosen charts) compares two of the sixteen metrics, median operating margin and percent with negative operating margin, against the hospitals’ states that expanded Medicaid versus those that did not expand Medicaid.

The third graphic (second of my four chosen charts) compares two of the sixteen metrics, median operating margin and percent with negative operating margin, against the hospitals’ states that expanded Medicaid versus those that did not expand Medicaid.

The result is that rural hospitals operating in Medicaid expansion states have fared better in terms of operating margins than hospitals in non-expansion states. The statistical power of Medicaid expansion was very impactful: if a rural hospital is located in a Medicaid expansion state, it decreased the likelihood of closure by 62% on average.

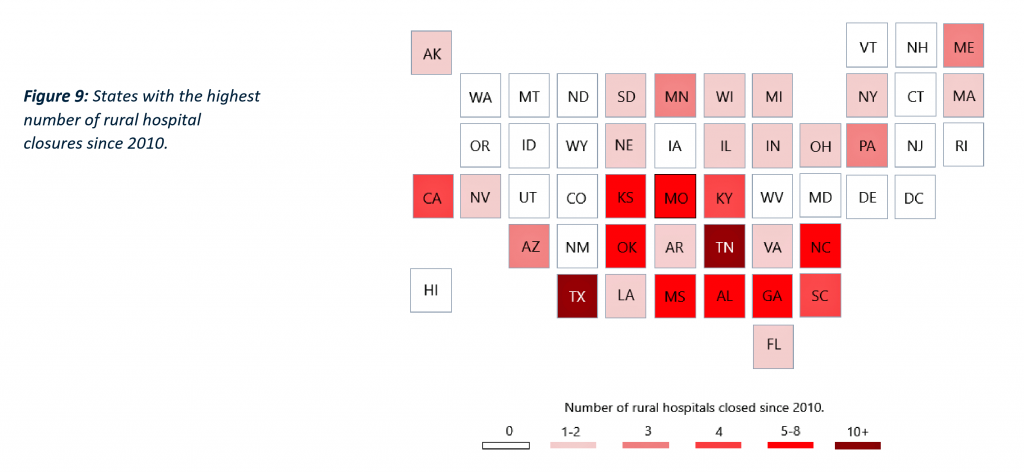

Now we’ll move to the third chart, a heat map which shows those states with the highest number of rural hospital closures since 2010. The darker red shades represent the states with the greatest rural hospital losses. Note that these tend to be in the southern U.S. and lower Great Plains.

Now we’ll move to the third chart, a heat map which shows those states with the highest number of rural hospital closures since 2010. The darker red shades represent the states with the greatest rural hospital losses. Note that these tend to be in the southern U.S. and lower Great Plains.

Tennessee and Texas have lost the most rural hospitals, following by the Carolinas, Georgia, Alabama, Mississippi, Oklahoma, Kentucky, Missouri and Kansas.

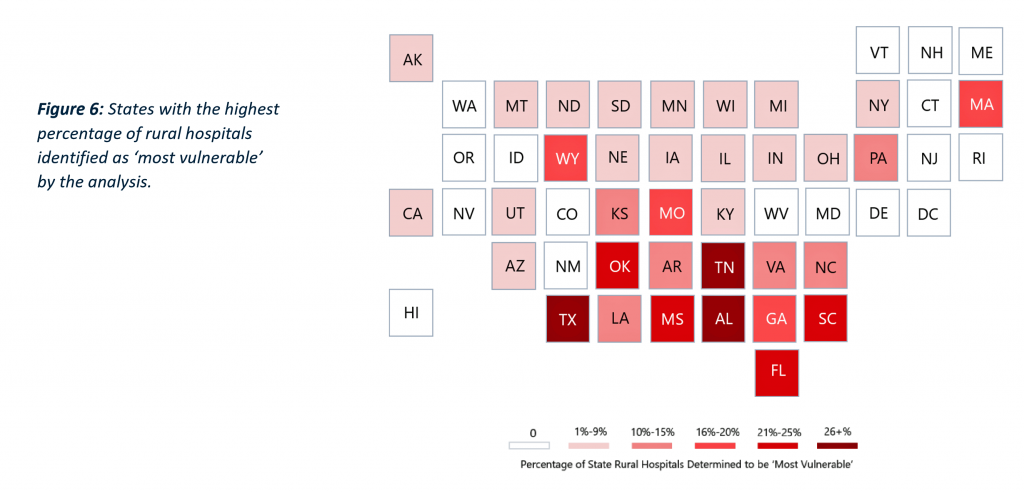

The fourth chart is a heat map that indicates high-risk states where existing rural hospitals are most vulnerable to closure based on the sixteen metrics.

These states are also those largely in the southern U.S. and lower Great Plains with higher vulnerability in Massachusetts as well.

Health Populi’s Hot Points: The nine key high-impact factors suggest areas where rural hospitals could risk-manage for their survival. Ultimately, they synthesize into capital access and funding, providing services to attract and treat patients, and affiliate with larger systems as well as government control.

Given the current Federal government negative or at best, null views on funding health care and expanding Medicaid, the opportunity for the private sector and non-profit organizations to fill that chasm is clear. I’ve called out the growing role of new entrants to health care along with expanding existing retail health providers for these purposes.

The nation’s major retail pharmacy chains often say they’re located within a few miles of most Americans. This may not be the case for all rural U.S. health citizens, but the point remains that retail health has been serving the un- and under-insured for many years. We forecast that this will expand over the near and longer term as all health consumers are seeking more convenient, accessible, value-priced health care services. While these industry players won’t be building inpatient capacity in the near-term, they will be even more important ambulatory and primary care touch points for people in exurban and rural regions of America.

Over time, depending on the politics of health care reform, the safety net and social determinants policies (e.g., for food and nutrition, education, transportation, and income inequality/tax policy), the private sector of retail health may play even larger roles in rural and exurban America. Walmart and CVS/health, for example, could bolster the supply side for secondary care beyond primary care and behavioral health, for mobile diagnostic imaging, sophisticated lab testing, and rehab to the home. Best Buy, with plans to build a $50 billion business to support people aging well at home, envisions a role in this potential hospital-to-home movement. Note that Best Buy says its 997 Best Buy stores in the U.S. have 70% of the U.S. population living within 10 miles of one of them.

Telehealth, too, can serve rural U.S. health citizens at home, in schools, in community centers and churches…as long as broadband or other connectivity is accessible from the N of 1 in those geographies, from the health care provider to the patient or caregiver.

And the likes of Amazon, Apple, Google and Microsoft all have investments in health care infrastructure, AI and collaborations with providers that can serve community care in many ways.

The future of the rural hospital? Time to re-imagine as the future of rural health and healthcare.

Thank you FeedSpot for

Thank you FeedSpot for