3 in 4 American workers who receive health insurance at the workplace have been impacted by increasing health care costs. As a result, more are self-rationing health care; this is taking many forms, including delaying visits to the doctor, skipping a recommended visit, and not filling prescriptions written by the doctor.

3 in 4 American workers who receive health insurance at the workplace have been impacted by increasing health care costs. As a result, more are self-rationing health care; this is taking many forms, including delaying visits to the doctor, skipping a recommended visit, and not filling prescriptions written by the doctor.

Most concerning is that the 14% drop in the percent of employees trying to take better care of themselves in the past year, according to Employee Perspectives on Health Care: The Affordability Gap, from Towers Watson.

As health costs rise, employee satisfaction is falling — this is particularly true for people with chronic conditions. While 72% of insured workers are concerned that employers will increase out-of-pocket health costs, even those with over $150K household income are worried about growing OOP costs (67%). A majority of younger people under 40, too, are nearly as worried as people over 40 about growing OOP health costs.

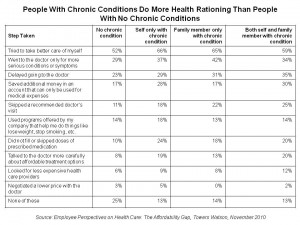

It’s people with chronic conditions who are in fact doing more health rationing, as detailed in the chart from Towers Watson’s report. For example, 29% of people with no chronic conditions went to the doctor only for more serious conditions or symptoms in the past year; 37% of people with a chronic condition said they went to the doctor only for serious conditions. 23% of healthy people said they delayed going to the doctor; 29% of the chronically ill workers delayed going to the doctor. 10% of people with no chronic conditions didn’t fill a prescription; 24% of chronically ill people didn’t fill an Rx.

Health Populi’s Hot Points: This research uncovers a more risk-averse mentality among workers with health insurance. For those who are managing chronic health conditions, however, risk-aversion is coupled with irrational health behavior in the form of delaying treatment and skipping prescription meds. As the affordability gap increasingly hits workers, even those with household incomes above $150,000 a year, employers need to design health benefits that provide helpful, health-ful nudges toward sound personal health behaviors. Value-based insurance design principles need to take into account workers’ personal beliefs about health and money. These values are inextricably linked in the post-recession economic lives of health citizens.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for