In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals.

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals.

Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked savings for medical spending.

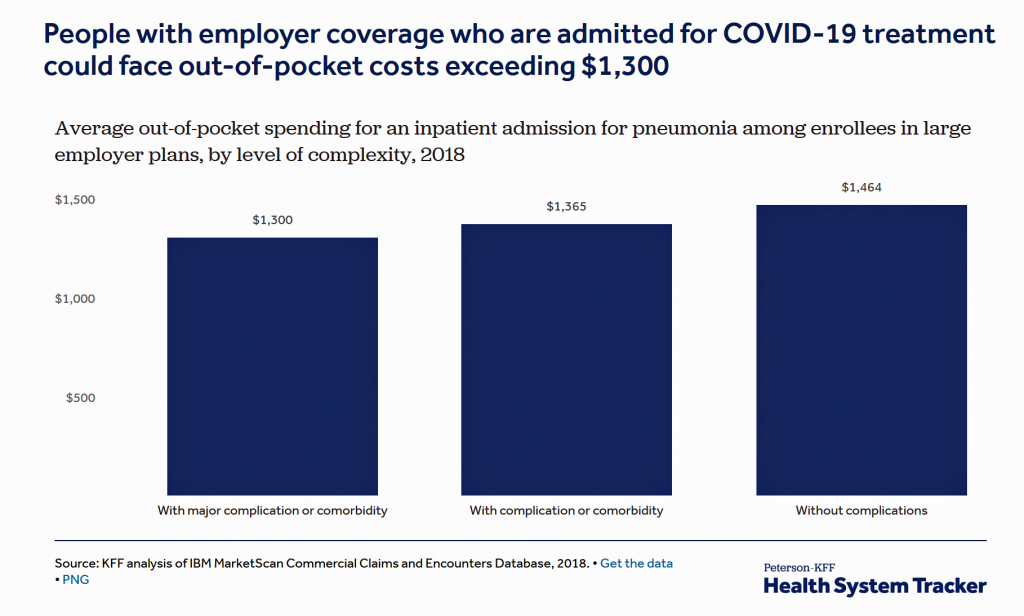

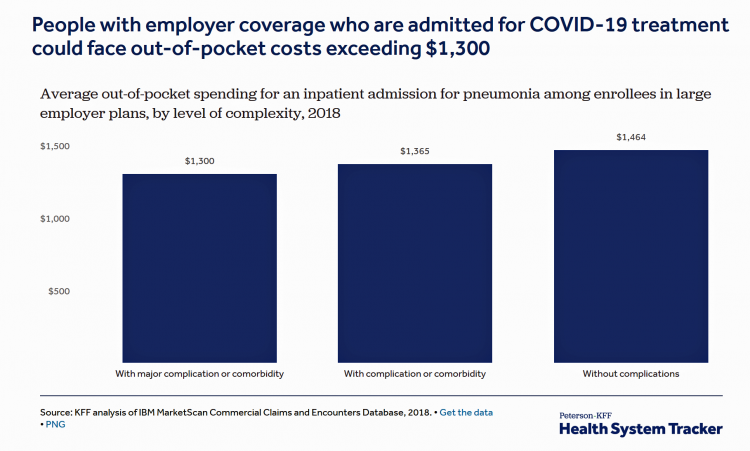

The Kaiser Family Foundation (KFF) and Peterson Center on Healthcare collaborate on strategic health issues. This week, the Peterson-KFF Health System Tracker project published estimates for inpatient care and out-of-pocket spending for hospital admissions due to the coronavirus . Hospital costs could average over $20,000, the report calculated. This is based on models for treating pneumonia in U.S. hospitals using 2018 data, for an active working population covered by large employers’ health plans.

The out-of-pocket cost estimate for patients who have employer-sponsored health plan coverage could generate costs over $1,300.

The out-of-pocket cost estimate for patients who have employer-sponsored health plan coverage could generate costs over $1,300.

Let’s revisit the denominator here: this is $1,300 for people who have health insurance provided through the workplace working in large companies.

Remember that on average in the U.S., Americans report having well under $1,000 savings in bank accounts. Some estimates gauge U.S. savings at $400 or less.

The Peterson-KFF analysis raises the issue of surprise billing, which has been a common experience for millions of U.S. patients who have received bills after hospital discharge from providers (both hospitals and doctors) who may have been out of the health plan’s network of approved providers, or simply charge costs above the insurance company negotiated amount agreed with the provider.

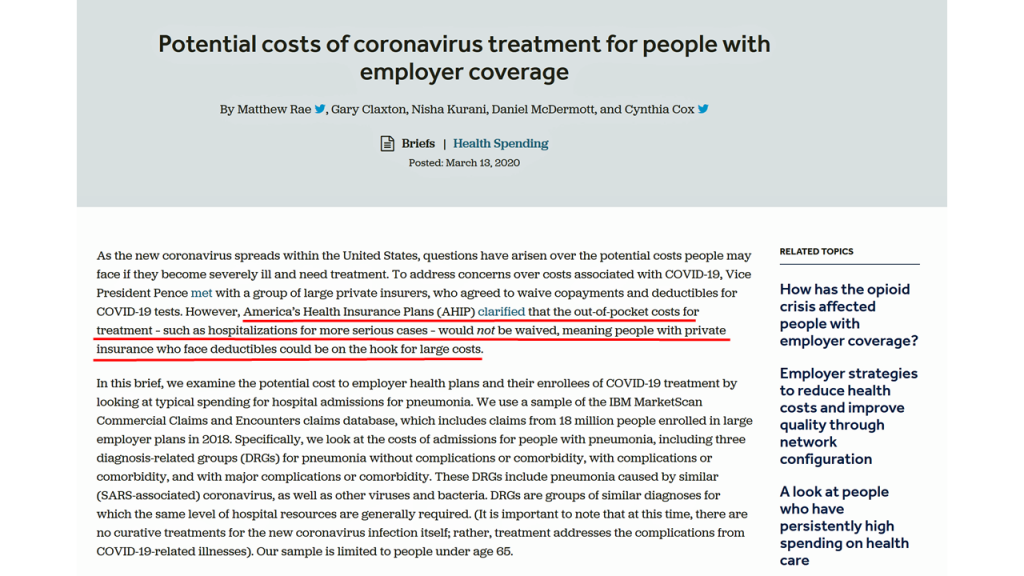

Health Populi’s Hot Points: The report’s first paragraph makes it clear that out-of-pocket costs for treatment would not be waived by health care insurance companies — “meaning people with private insurance who face deductibles could be on the hook for large costs,” the start of this analysis calls out.

Health Populi’s Hot Points: The report’s first paragraph makes it clear that out-of-pocket costs for treatment would not be waived by health care insurance companies — “meaning people with private insurance who face deductibles could be on the hook for large costs,” the start of this analysis calls out.

Remember that this fiscal model focuses on employer-based coverage for workers who have commercial health insurance and work with large companies. This analysis did not look at patients working in smaller firms who, if insured, tend to have higher deductibles from those plans. The out-of-pocket costs, and surprise bills, would probably be greater burdens on these insured people.

As the White House, Congress and other policymakers who work in health continue to address the clinical pandemic challenge of the coronavirus, it’s very clear that the financial aspects of COVID-19 will be part of the epidemic’s impact in the immediate term and ongoing for months to come. In Joe Biden’s plan to address Americans’ health economics of COVID-19, he calls for covering medical treatment costs via an emergency medical plan, described in his campaign website. This would be a critical component for any legislation that the U.S. Congress passes to address the coronavirus crisis in America.

In just the past few weeks, this pandemic has revealed the worst aspects of the fragmented U.S. health system, which have demonstrated, one falling domino at a time, the criticality of the U.S. ensuring (with an “e”) universal health care as a civil right.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for