Beyond the physical and clinical aspects of the COVID-19 pandemic are financial hits that people are taking in the shutdown of large parts of the U.S. economy, impacting jobs, wages, and health insurance rolls.

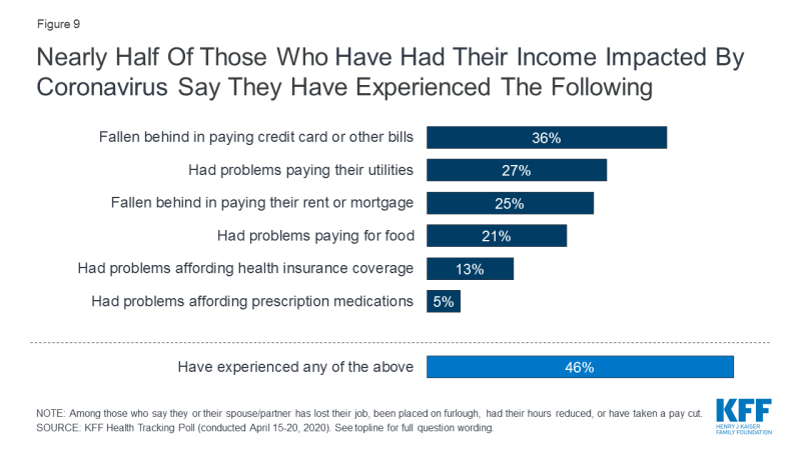

Some 1 in 2 people in the U.S. who have had their income impacted by the coronavirus have either fallen behind in paying off credit card debt or other bills, had problems paying for utilities, have lagged in paying for housing (rent or mortgage), been challenged paying for food, or other out-of-pocket costs. We learn about these fiscal hits from COVID-10 from the latest Health Tracking Poll from Kaiser Family Foundation, published 24 April 2020.

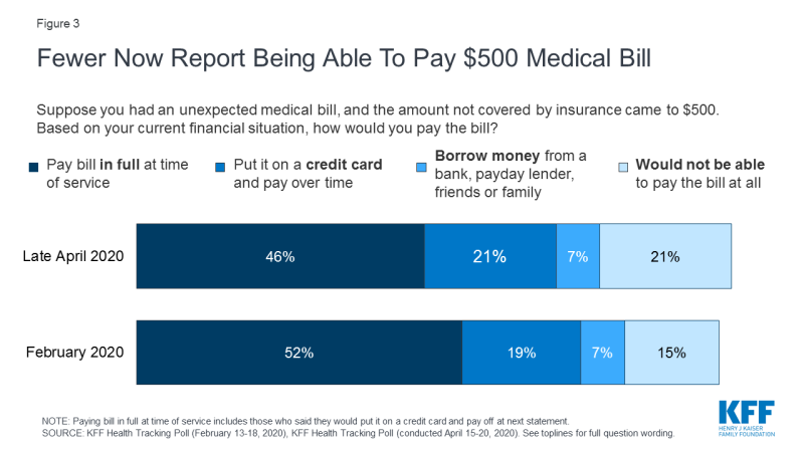

With most Americans living paycheck to paycheck, lacking sufficient savings or liquidity to cover emergency expenses (beyond the emergency room in a hospital), fewer people can now pay a $500 medical bill, KFF found. This worsened between February and late April 2020, the second chart shows, with less than 50% of people able to pay a $500 healthcare bill in full at the time of service. 1 in 5 people couldn’t pay the bill at all, and another 1 in 5 would put the $500 on a credit card and pay off over time.

With most Americans living paycheck to paycheck, lacking sufficient savings or liquidity to cover emergency expenses (beyond the emergency room in a hospital), fewer people can now pay a $500 medical bill, KFF found. This worsened between February and late April 2020, the second chart shows, with less than 50% of people able to pay a $500 healthcare bill in full at the time of service. 1 in 5 people couldn’t pay the bill at all, and another 1 in 5 would put the $500 on a credit card and pay off over time.

This, when U.S. consumer credit card debt ballooned to record highs in February 2020 since just before the Great Recession of 2008, according to the Federal Reserve Bank of New York.

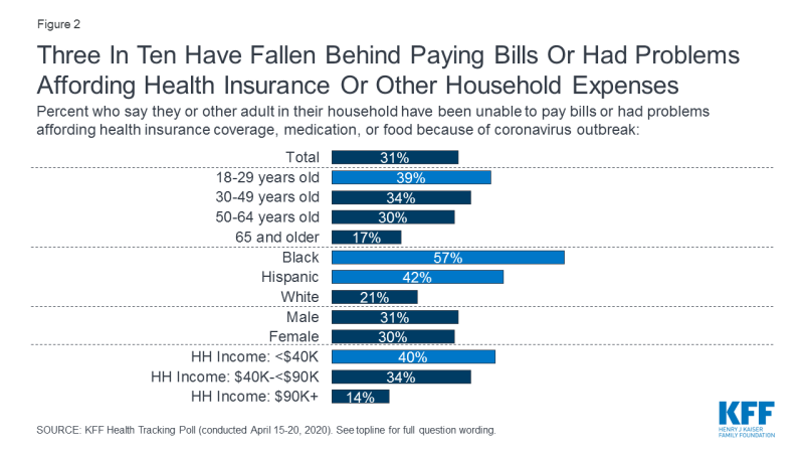

It’s no surprise, then, that during the pandemic, more Americans are falling behind paying bills or for health insurance. This varies by demographic, shown in the third chart, with younger people, people of color, and lower income householders experiencing greater financial stress than others in the U.S.

It’s no surprise, then, that during the pandemic, more Americans are falling behind paying bills or for health insurance. This varies by demographic, shown in the third chart, with younger people, people of color, and lower income householders experiencing greater financial stress than others in the U.S.

Socioeconomic status underpins health inequities and, in the pandemic, higher levels of mortality due to the coronavirus, I’ve discussed here in Health Populi. While the COVID-19 virus doesn’t purposefully discriminate, people with compromised immune systems and exposures suffer disproportionately from very serious risks to the pandemic.

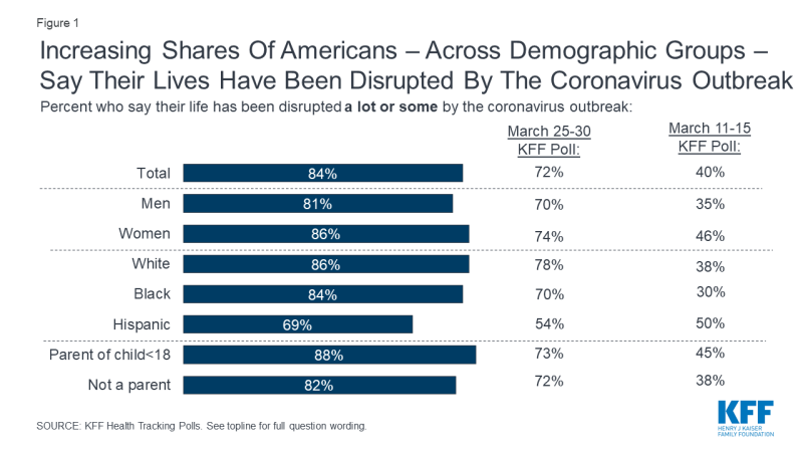

One-half of the workforce in February 2020 lost a job, had work hours reduced, or pay cuts due to the coronavirus. And, for 3 in 4 Americans, loss of income was a problem, the KFF survey learned: for 41%, a “major” problem, and for 32%, a “minor” problem. This, of course, more adversely impacted people earning lower household incomes below $40,000 a year (for 58% of these folks) compared with 39% of people earning $40K-$90K and 23% of those earning over $90,000 a year.

Among those who have had their job negatively impacted by COVID-19, most people expect to have their previous jobs back within six months — by October 2020.

Health Populi’s Hot Points: COVID-19 is wreaking havoc on individual and household economies, as well as the national U.S. economy which will be headed into a recession in 2020 and into 2021, based on the IMF’s latest forecast. In addition, the downward spiral of American macroeconomic and shut-down businesses will result in lower tax payments to the U.S. and State treasuries, further negatively impacting Social Security coffers and the retirement security for Americans looking toward the latter 2020s.

Health Populi’s Hot Points: COVID-19 is wreaking havoc on individual and household economies, as well as the national U.S. economy which will be headed into a recession in 2020 and into 2021, based on the IMF’s latest forecast. In addition, the downward spiral of American macroeconomic and shut-down businesses will result in lower tax payments to the U.S. and State treasuries, further negatively impacting Social Security coffers and the retirement security for Americans looking toward the latter 2020s.

The KFF late April 2020 study included other questions about social distancing, health impacts and technology, which I’ll cover later this week in Health Populi. Stay tuned to these important findings, which together profile the reshaping of U.S. health consumers in and beyond 2020.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for