As we wrestle with just “what” health care will look like “after COVID,” there’s one certainty that we can embrace in our health planning and forecasting efforts: that’s the persistence of telehealth and virtual care into health care work- and life-flows, for clinicians and consumers alike and aligned.

There’s been a flurry of research into this question since the hockey-stick growth of telemedicine visits were evident in March 2020, just days after the World Health Organization uttered the “P-word:” pandemic.

There’s been a flurry of research into this question since the hockey-stick growth of telemedicine visits were evident in March 2020, just days after the World Health Organization uttered the “P-word:” pandemic.

Three recent reports (among many others!) bolster the business and clinical cases for telehealth in America in terms of:

- A “quarter-trillion-dollar post-COVID-19 reality,” coined by McKinsey & Company;

- The return of patients to healthcare sites, from Kaufman Hall; and,

- The future of virtual health, via Deloitte Center for health Solutions and the ATA.

Some 3 in 4 U.S. consumers would be interested in using telehealth going forward, McKinsey’s consumer survey from May 20, 2020, found.

On the provider side of the telehealth equation, telehealth visits fast-scaled between 50 to 175 times pre- and post-COVID’s emergence, McKinsey’s physician survey learned. Most providers also reported they were more comfortable using telehealth post-COVID.

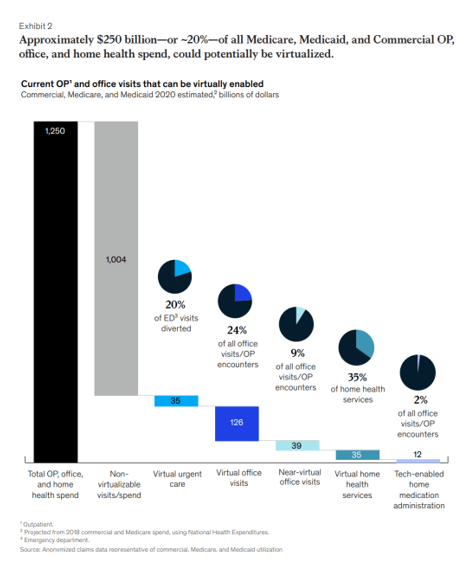

McKinsey’s report models outpatient and office visits that can be virtually enabled for patients covered by both commercial and public sector health plans (Medicare and Medicaid). The first chart presents McKinsey’s estimates of virtual visits by type, gauging that about 20% of outpatient, office and home health spending could be “virtualized.”

Those estimates include,

- 20% of diverted emergency department visits

- 24% of all office visits and outpatient encounters, plus

- 9% of “near-virtual” office visits (at sites in the community, outside of the office and patient’s home – think: pharmacies, testing labs, schools, company health centers, etc.)

- 35% of home health services, and

- 2% of tech-enabled home medication administration (think: specialty drugs come home).

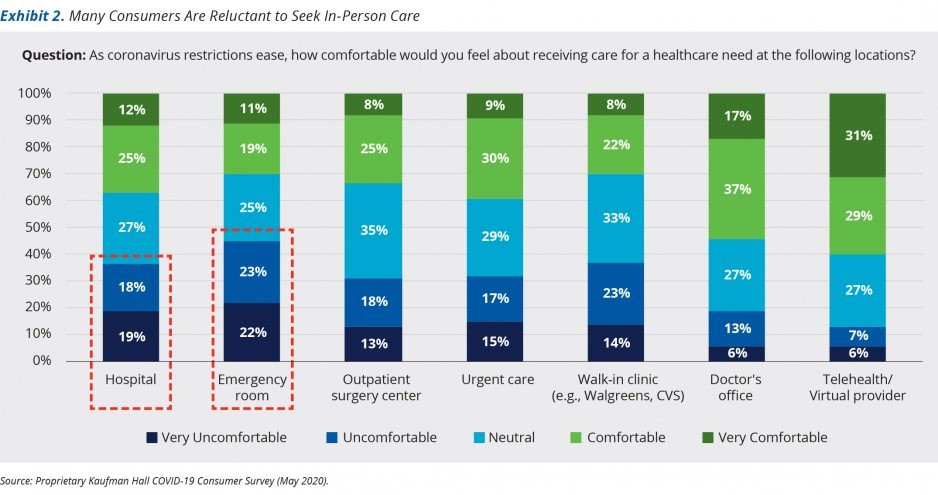

Kaufman Hall asked, “When will patients return?” in a May 2020 report out of the company’s consumer survey. This second bar chart comes from the report illustrating the rise of virtual care at the furthest-right bar. The green shades illustrate that consumers are “comfortable” receiving care via virtual providers and telehealth platforms, moreso than via any other care on-ramp — much more than hospitals, ERs, outpatient surgery centers, urgent care clinics, or walk-in clinics.

Kaufman Hall asked, “When will patients return?” in a May 2020 report out of the company’s consumer survey. This second bar chart comes from the report illustrating the rise of virtual care at the furthest-right bar. The green shades illustrate that consumers are “comfortable” receiving care via virtual providers and telehealth platforms, moreso than via any other care on-ramp — much more than hospitals, ERs, outpatient surgery centers, urgent care clinics, or walk-in clinics.

By May 2020, 60% of consumers were extremely or moderately concerned about COVID-19 directly affecting their or a loved one’s health, and another 21% “somewhat concerned.” Only 4% of people were “not at all concerned” about the coronavirus affecting their health.

In light of these continuing concerns in the pandemic, most consumers said it would be important (moderately or extremely) for health care providers to manage consumers’ risks in seeking care for non-emergency health issues. Most tactics Kaufman Hall gauged were seen as important to most consumers — such as staff wearing PPE, other patients wearing PPE, social distancing, staff getting COVID-tested, additional room cleaning, and temperature screening.

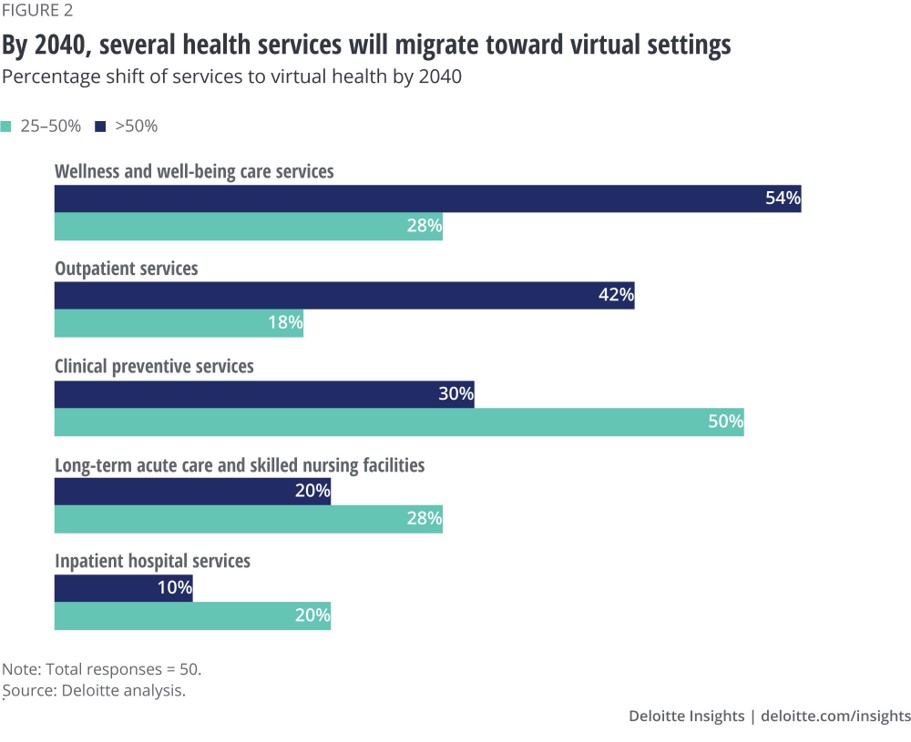

The Deloitte report boldly looks forward to 2030 and 2040, imagining that several forms of healthcare will migrate to virtual formats. The third horizontal bar chart shows these areas. with most wellness and well-being care shifting to virtual, and a bulk of outpatient and preventive services going virtual. In addition, long-term care and inpatient hospital services will see large proportions of care delivered virtually, re-defining just what a “hospital” and “long-term care” will look and feel like in a decade.

The Deloitte report boldly looks forward to 2030 and 2040, imagining that several forms of healthcare will migrate to virtual formats. The third horizontal bar chart shows these areas. with most wellness and well-being care shifting to virtual, and a bulk of outpatient and preventive services going virtual. In addition, long-term care and inpatient hospital services will see large proportions of care delivered virtually, re-defining just what a “hospital” and “long-term care” will look and feel like in a decade.

COVID-19 has taught health care providers and patients about the benefits of telehealth, enabling early detection, supporting and triaging patients (away from the emergency department and hospital outpatient clinics), and moving care to the home and more convenient, accessible, and risk-managed community-based settings.

Furthermore, industry representatives surveyed in the Deloitte research pointed to areas of opportunity for virtual health including behavioral health (where mental health has seen a wake-up call in the pandemic), oncology, musculoskeletal care, and provider-to-provider consultations (for expert opinions and specialists crowd-sourcing knowledge, for example).

Health Populi’s Hot Points: COVID-19 was, among other phenomena, a wake-up call to the weaknesses and deficiencies of the U.S. health care system.

Health Populi’s Hot Points: COVID-19 was, among other phenomena, a wake-up call to the weaknesses and deficiencies of the U.S. health care system.

The conclusion of the Deloitte report includes a provocative paragraph about thinking bigger outside of hospital and doctors’ office walls to keep consumers healthy:

“While there is no simple solution, a likely place to start is looking at how an expanded health ecosystem — which includes nontraditional players such as churches and schools, employers and business leaders, government leaders, financial services companies, retailers, and local organizations — can come together around the goal of improving health. Our success in addressing the drivers of health likely depends on the ability to partner more effectively within this ecosystem.”

In the eyes of consumers, and especially post-COVID-19 consumers, health care is found virtually “everywhere” — in the grocery store, the faith-based institution, the pharmacy, the school, the barbershop and beauty salon and spa, in the medical cannabis storefront, in parks and gardens, through eCommerce sites, and especially — at home.

This graphic comes out of my book, HealthConsuming: From Health Consumer to Health Citizen. Published last year before the pandemic emerged. I made the case for health care — wearable, shareable, and virtual, with “retail health” on-ramps and touch points “everywhere,” as the diagram illustrates.

As patients-as-consumers learned how to use Zoom and WhatsApp and other digital convening on-ramps for social occasions in the #StayHome era, they’re adopting these for health care, wellness, and mental well-being, too.

Last week, Seema Verma, Administrator for the Centers for Medicare and Medicaid Services, spoke at a teleconference and addressed that the telehealth waivers CMS extended during the pandemic could continue post-COVID. There will be major pressure from both providers and consumers (and election voters) to do so.

Telehealth and virtually-delivered services are now, simply, part of health and health care in the U.S.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for