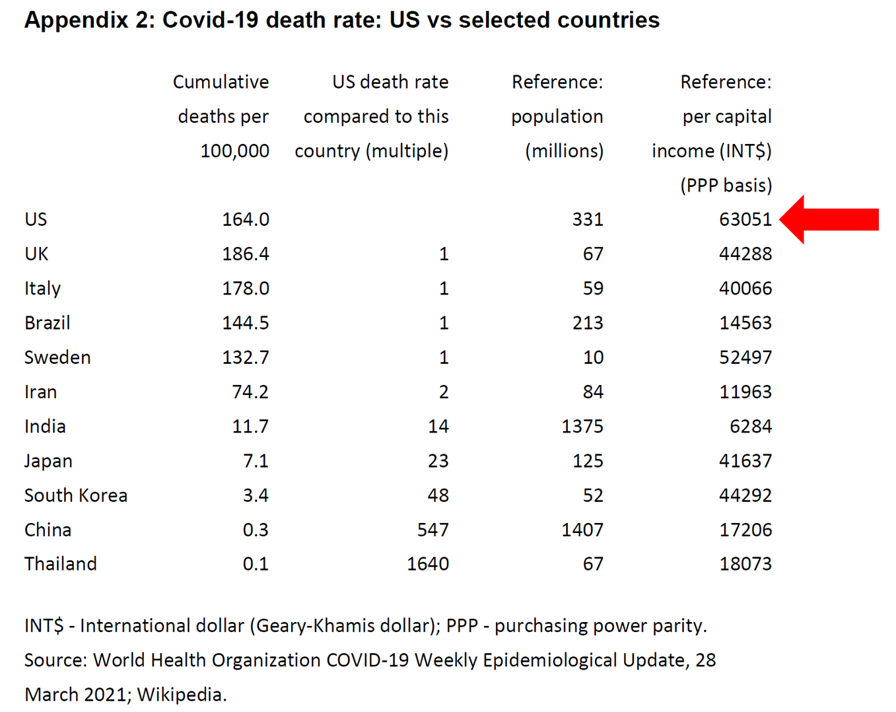

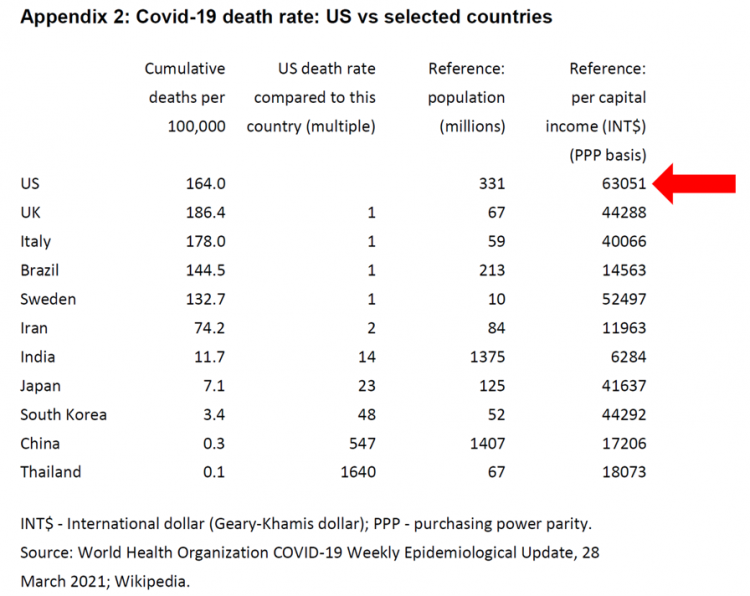

The United States has among the highest per capita incomes in the world. The U.S. also has sustained among the highest death rates per 100,000 people due to COVID-19, based on epidemiological data from the World Health Organization’s March 28, 2021, update.

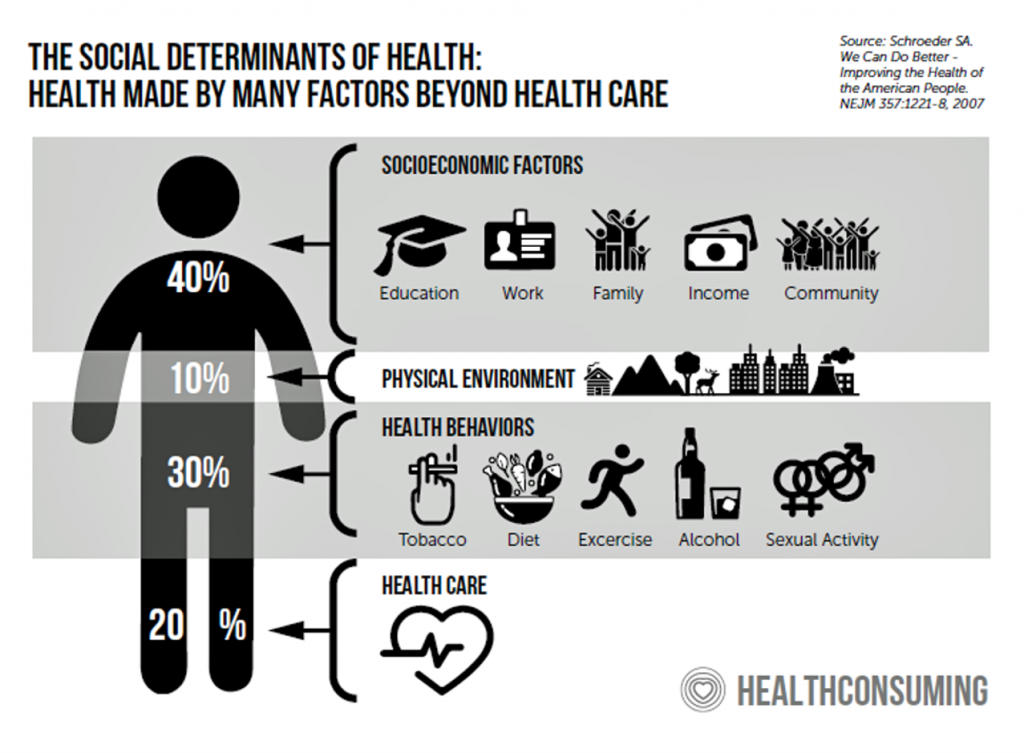

Higher incomes won’t prevent a person from death-by-coronavirus, but risks for the social determinants of health — exacerbated by income inequality — will and do.

Higher incomes won’t prevent a person from death-by-coronavirus, but risks for the social determinants of health — exacerbated by income inequality — will and do.

I have the good fortune of access to a study group paper shared by Paul Sheard, Research Fellow at the Mossaver-Rahmani Center for Business and Government at the Harvard Kennedy School.

In reviewing this paper, I was struck by Appendix 2, featured on the last page. Here you have the exhibit, with my addition of a big red arrow pointing to the first line of the chart.

The top line of this chart shows data for the U.S., and the far right column lists per capita income by country (WONK ALERT – here “PPP” is not the “Paycheck Protection Program” but “purchasing power parity” a dollar conversion which allows us to compare incomes across countries accounting for different price levels).

Compared with other countries in this analysis, Americans enjoy the highest per capita income at $63,051, roughly 50% greater than citizens of the U.K. or Italy.

Now look at the first column, cumulative deaths per 100,000 people: the U.S. reached 164, the UK 186, and Italy 178.

Now look at Japan and South Korea, with per capita incomes similar to the UK and Italy.

But the cumulative death rates per 100,000 in Japan and S. Korea were 7.1 and 3.4, respectively – a fraction of those seen in the U.S., U.K., and Italy.

In the paper, Paul outlined several key points relevant to the health/care ecosystem; three in particular resonated with me through the health-economic lens:

In the paper, Paul outlined several key points relevant to the health/care ecosystem; three in particular resonated with me through the health-economic lens:

- A unique aspect to the U.S. macroeconomic policy response was government suppressing economic activity.

- The pandemic also exposed fragilities in the global economy, and,

- Triggered structural changes, amplifying several pre-existing trends.

These three line-items exacted some dramatic and negative impacts to America’s healthcare sector. The shutdown of the U.S. economy and subsequent #WorkFromHome orders together compelled patients to avoid physical contact with healthcare providers. While this inspired a fast-pivot to telehealth and virtual care platforms, hospitals and doctors sustained $billion losses in 2020, documented month-by-month by Kaufman Hall’s reports.

Millions of people in the U.S. also lost health insurance through job-loss, or could not afford to keep up with health insurance premium payments due to furlough or hours cut, the Commonwealth Fund learned in the pandemic.

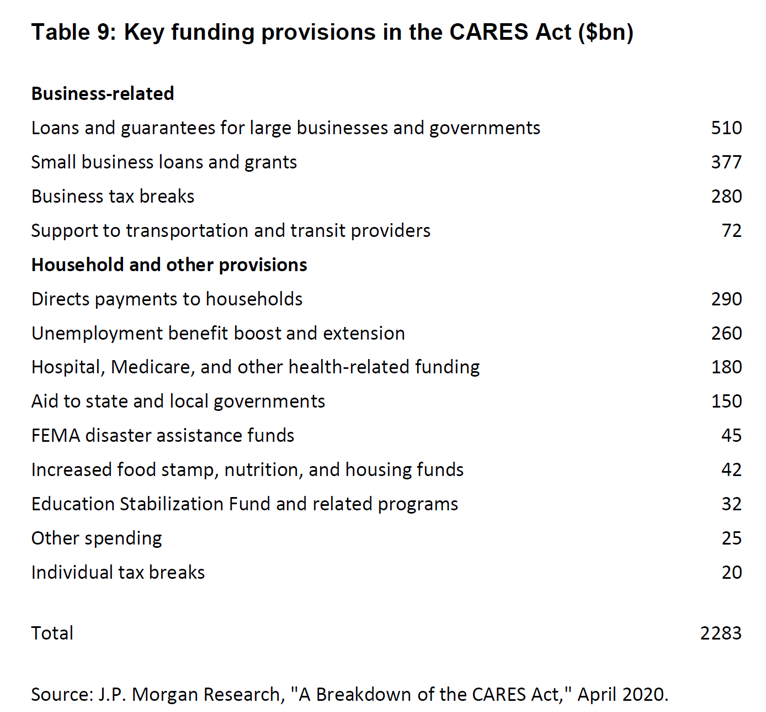

The chart here marked as “Table 9” inventories key funding provisions from the CARES Act enacted in 2020, which included funding to hospitals and health care providers to help address healthcare’s fiscal shock. In addition, direct payments to households, unemployment benefits, and money for food security aimed to help people with some level of income replacement and nutrition support in the short-term.

The second point on the pandemic’s exposing fragilities in the global economy speaks to the point of U.S. dependence on other countries for PPE as well as ingredients and components for medicines and medical equipment.

The St. Louis Federal Reserve published this report in April 2020 at the early phase of the pandemic to highlight the nation’s dependence on importing medical equipment and supplies from abroad — especially, from China.

The third point is the pandemic’s triggering structural changes in the U.S. economy that amplified several pre-existing trends. Of the warts-and-all weaknesses of the U.S. health care system accelerated and highlighted in our year of COVID were the inequities long plaguing American healthcare.

Within weeks of the World Health Organization calling the virus a “pandemic” in March 2020, I wrote this post in April 2020 based on the CDC’s early identification of health disparities due to the coronavirus based on race and ethnicity.

Another inequity amplified by the pandemic was the digital divide between U.S. households with broadband connectivity and those without. Citizens with broadband could work from home when required by employers, and students, shut out from attending school or college in-person, could study and learn from home.

Furthermore, the economic decline caused by the exogeneous shock of the pandemic was the so-called “She-Cession” with more women in the U.S. adversely impacted financially than men.

Health Populi’s Hot Points: In considering Paul’s paper through my own health economic lens, I actually started from the back page and moved toward the front.

Health Populi’s Hot Points: In considering Paul’s paper through my own health economic lens, I actually started from the back page and moved toward the front.

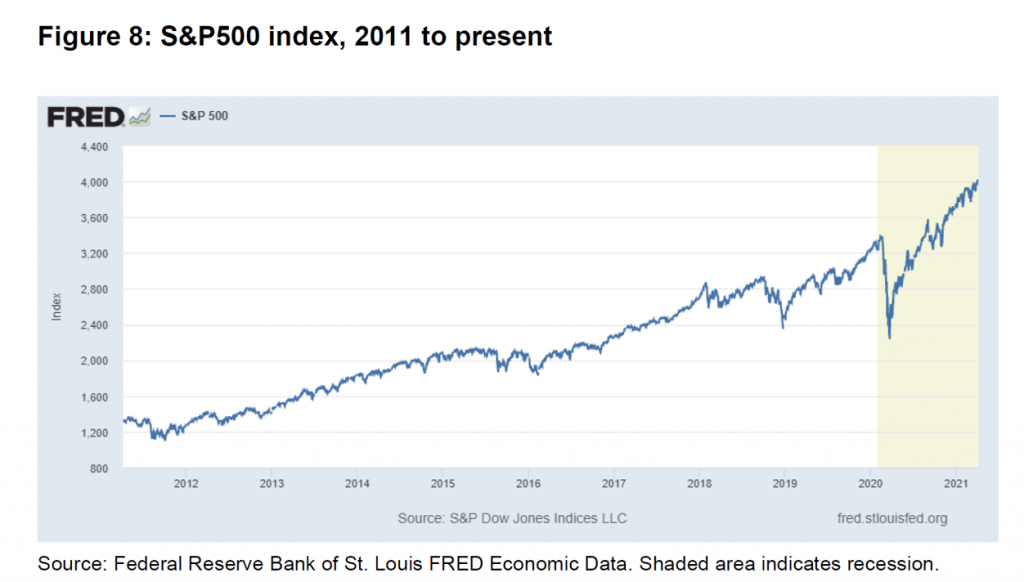

Here’s one of the earlier exhibits from the paper, showing hockey-stick growth of the U.S. stock market using the S&P500 index. The shaded area is the COVID-19 recessionary period, with the shocking drop in the S&P in early 2020. Then, we see the steady rise of the S&P500 to the current day, exceeding previous records from the pre-Coronavirus era.

This rise in equity prices was wonderful financial news for those people invested in the stock market. However, fewer Black and Hispanic Americans have investments in the market, the Federal Reserve observed in a report on Disparities in Wealth by Race and Ethnicity, published in September 2020.

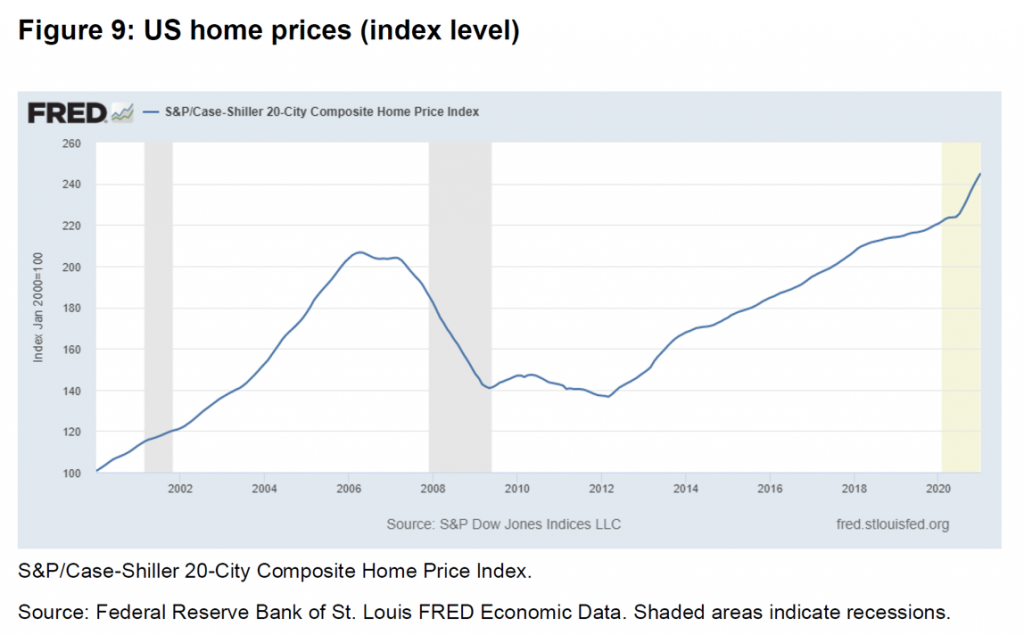

Now check out another of Paul’s exhibits, Figure 9, which demonstrates the growth in U.S. home prices during the recession — increasing at a faster slope in the recession (shaded area) than the growth rate pre-COVID.

Now check out another of Paul’s exhibits, Figure 9, which demonstrates the growth in U.S. home prices during the recession — increasing at a faster slope in the recession (shaded area) than the growth rate pre-COVID.

Once again, people of color in the U.S. are more likely to rent a home than own one, given income inequality and other financial disparities between Whites, Blacks, and Hispanics in America. In fact, housing hardships exacerbated during the pandemic in three ways, according to data analyzed by the Brookings Institute:

- Evictions and foreclosures,

- Rent and mortgage delinquency, and

- Utility payments skipped.

Given this worsened housing security situation for people of color in the U.S., with housing prices increasing in the pandemic, many of these folks could not afford to become home-buyers in 2021 at higher price-points.

Income and housing are but two key social determinants that underpin an individual’s and community’s health and well-being. The U.S. is the highest-income country with the greatest rate of deaths due to COVID-19. The Biden Administration’s proposals to address income disparities, job training, broadband, and infrastructure aim at the roots of well-being to avert downstream illness and disability while mitigating the impacts of income inequality and long-term systemic racism in institutions like housing, banking, employment and, indeed, health care delivery.

Income and housing are but two key social determinants that underpin an individual’s and community’s health and well-being. The U.S. is the highest-income country with the greatest rate of deaths due to COVID-19. The Biden Administration’s proposals to address income disparities, job training, broadband, and infrastructure aim at the roots of well-being to avert downstream illness and disability while mitigating the impacts of income inequality and long-term systemic racism in institutions like housing, banking, employment and, indeed, health care delivery.

Thanks to Paul Sheard of the Harvard Kennedy School for sharing his insights into the U.S. macroeconomic policy response to the pandemic; his wisdom provided some context for me to frame the post-COVID U.S. health care microeconomy, as plotted in this post.

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast