In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around.

That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned their healthcare shoppers’ personae as much as the proponents of so-called consumer-driven health care originally conceived.

The reality of patients entering doctors’ offices expecting to deal with their health care cost challenges is spelled out in The Increasing Role of Physician Practices as Bill Collectors – Destined for Failure, published in JAMA, 30 July 2021.

The reality of patients entering doctors’ offices expecting to deal with their health care cost challenges is spelled out in The Increasing Role of Physician Practices as Bill Collectors – Destined for Failure, published in JAMA, 30 July 2021.

Specifically, as the viewpoint’s title attests, doctors taking on the role as bill collectors are “destined for failure.”

But consumers, on the demand side of this equation, continue to want to discuss health care costs with their physicians.

The bottom-line for doctors is that they have been compelled to collect, “sometimes hundreds of dollars directly from patients, often months after care has been delivered,” the JAMA authors observe, given the design of high-deductible health plans.

They cite the statistic that nearly one-third of out-of-pocket costs were uncollected when the patient balance was over $2–, often sold to collection agencies or written off as “uncollectible.”

Adding to the “failure” prospects is that working with collection agencies can result in receiving pennies on the dollar and ultimately alienating patients, losing them in the practice, and potentially being dissed in social media further eroding the physician-patient relationship both with the billed patient and prospects that often get referred by positive word-of-mouth from patient to patient in family and friend groups.

The article discusses the promises and problems with a growing supply of new companies targeting the patient billing, payment, and revenue-cycle management space, most of which are painted with the brush of improving “patient experience.”

Ultimately, this may be just tinkering around the edges of a much larger, fundamental issue: the burden of out-of-pocket costs hit both patients and physicians hard and meaningfully, albeit in different ways.

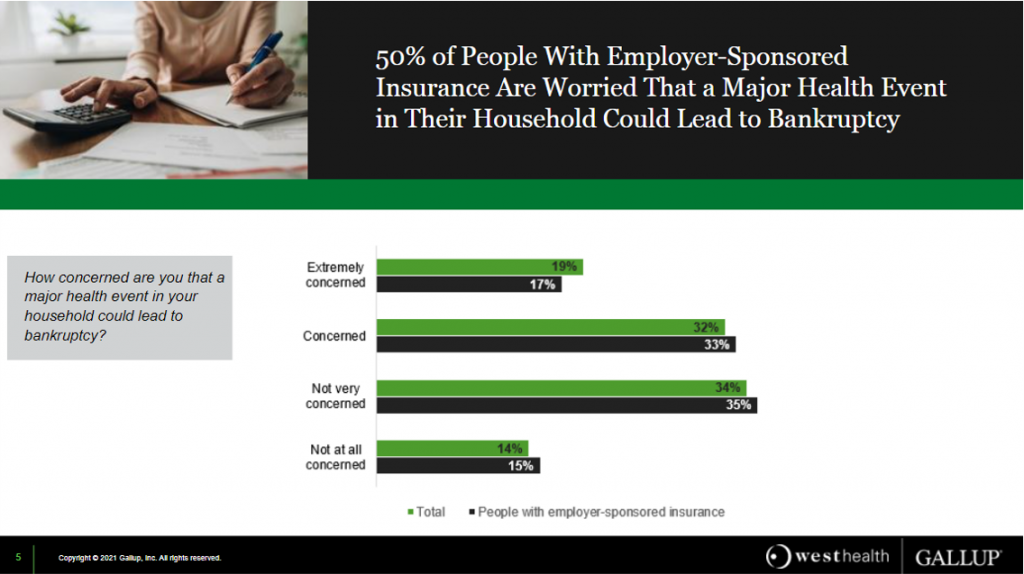

Health Populi’s Hot Points: While having health insurance is better than being uninsured, people in the U.S. who receive coverage through the workplace are still quite concerned that they are but one diagnosis away from bankruptcy — specifically, medical bankruptcy.

Health Populi’s Hot Points: While having health insurance is better than being uninsured, people in the U.S. who receive coverage through the workplace are still quite concerned that they are but one diagnosis away from bankruptcy — specifically, medical bankruptcy.

A recent Gallup/West Health poll, published in June, found that 1 in 2 people with workplace health insurance were worried about that health event leading to bankruptcy, shown in the bar chart from the study. This gets to the affordability adjective, that first “A” in the acronym, “ACA.”

Unaffordability to many patients-as-payors comes in the form of deductibles, and co-payments for care and medicines.

Gallup/West Health further learned that one in four workers think their employer isn’t doing enough to control health care costs, with most looking for the Federal government to set limits on hospital costs, drug price increases, and prices charge for out-of-network care.

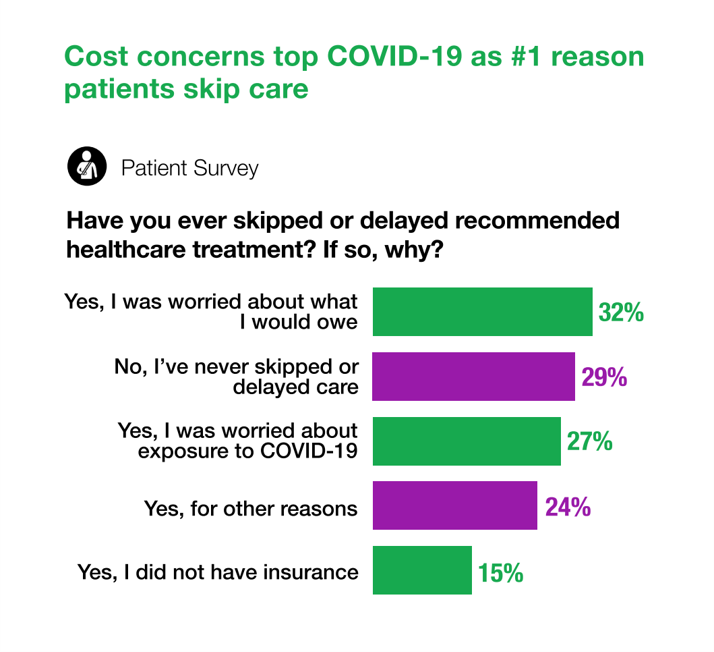

By summer 2021, as the fourth wave of COVID-19 sobered people living in America to the long, long tail of the coronavirus pandemic, cost concerns were a bigger reason for people skipping health care than potential exposure to the virus, shown in the last chart.

By summer 2021, as the fourth wave of COVID-19 sobered people living in America to the long, long tail of the coronavirus pandemic, cost concerns were a bigger reason for people skipping health care than potential exposure to the virus, shown in the last chart.

This insight comes from the Patientco annual survey report on the state of the patient financial experience. One-third of people was worried about what they would owe in the medical bill, and just over one-fourth of people were concerned about exposure to COVID-19.

In the context of the JAMA viewpoint that doctors are playing the role of bill collectors, health care providers in the Patientco study said that one-half of patients cancelled visits because they were worried about exposure to the coronavirus; 41% were concerned about costs.

One of the key insights in this study was that nearly one-half of patients needed financial assistance for bills over $500; 66% of people facing bills over $1,000 needed assistance.

Ultimately, financial hardships and medical cost toxicity faced by patients does not only affect consumers and their families: high-deductibles and the emergence of doctor-as-bill-collector negatively impacts physicians and their own practice experience, as well.

For another brilliantly-informed physician’s viewpoint, read Dr. Robert Pearl’s piece in Forbes on How Health Insurance Became America’s Biggest Hustle.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're