- Because health coverage in the U.S. is founded on an employer-based system, unemployment usually leads to uninsurance.

- COBRA is thought to be a lifeline for workers who lose their jobs/

However, obstacles can get in the way of laid-off workers who want to secure health coverage:

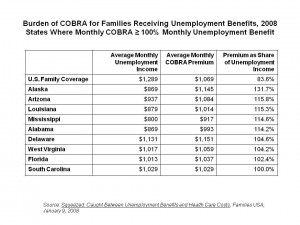

- At 84% of unemployment benefits, COBRA would be unaffordable to the average worker.

- For laid-off workers whose companies went out of business, HIPAA provides protections — of a sort. HIPAA offers workers who had at least 18 months of coverage the right to buy into a plan in the individual insurance market. But there is no federal law that governs how much these plans can charge for the plan. Families USA found that in some state high-risk pools, such premiums can be twice as high as the average premiums charged in the individual health insurance market.

- Finally, Medicaid doesn’t cover all unemployed workers who are childless. Furthermore, as most Governors face budget shortfalls, the possibility of Medicaid absorbing the growing number of uninsured, unemployed workers is at great risk.

Don’t depend on the Governors to easily cover unemployed workers. In 2008, the Kaiser Family Foundation (KFF) calculated that for every 1% increase in unemployment, there would be a 1.1 million person increase in the number of the uninsured and a 1 million person increase in Medicaid; KFF’s slide is on the ride illustrating this calculation. That metric was based on Governors bringing in tax receipts that could cover the status quo scenario for Medicaid.

Now that most Governors’ budgets are in the red, and health and education cuts are on the on the rise in these states, KFF will no doubt be recalculating the 1:1.1 ratio to show an increase in the latter half of the equation.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a