Employers spend about $10,000 each year per active employee for health care. In return, they’re looking for value for their money in the form of cost-effective, efficient health care that yields optimal outcomes for insured workers and their families. The ROI isn’t as great as employers as investors in worker health would like to see. As a result, companies are looking to comparative effectiveness research as a tool to help make better health spending decisions — for the companies themselves and for employees.

Employers spend about $10,000 each year per active employee for health care. In return, they’re looking for value for their money in the form of cost-effective, efficient health care that yields optimal outcomes for insured workers and their families. The ROI isn’t as great as employers as investors in worker health would like to see. As a result, companies are looking to comparative effectiveness research as a tool to help make better health spending decisions — for the companies themselves and for employees.

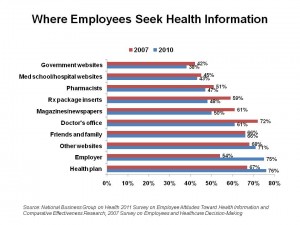

The National Business Group on Health (NBGH) surveyed 1,538 employees at large employers to ascertain workers’ views on health information and comparative effectiveness research (CER). NBGH found 3 in 4 workers looked to their employers as a resource for health information in 2010, a substantial increase from 1 in 2 employees in 2007. Most employees want employers to provide information on quality ratings for health plans and how to improve employee health, along with help to find and use quality information to get better care.

Health plans, websites, and friends and family are other trusted sources of health information among most adults receiving health insurance from employers.

Sources of health information receding in importance since 2007 are doctors, print media, and prescription drug package inserts.

Insured workers polled have a high degree of health engagement, with:

- 8 in 10 seeking information about symptoms prior to a visit to the doctor

- 7 in 10 bringing a list of questions to the doctor’s visit

- 1 in 2 bringing an advocate with them

- 1 in 2 asking their doctor about an ad they saw for a prescription drug

- Nearly one-half taking notes during the visit, and

- 4 in 10 bringing information found online to discuss with their doctor during the visit.

81% of employees have heard of CER at least a few times, and virtually all workers see CER as important. Most people polled, however, believe that most medical information available is too complex for the average person to understand.

Health Populi’s Hot Points: Health insurance as a proportion of workers’ wages has grown over the past decade, with actual wages staying stable. It’s the growth of health costs that have been largely responsible for driving total compensation packages up — not the worker’s wage. Both employers and employees are spending more on health care than ever before. For companies, providing health insurance can eat into profit margins that take a company with thin margins (e.g., supermarkets, service businesses) from the black to the red.

For covered workers, health cost sharing is eating into larger proportions of workers’ pay: the rise of health costs has outstripped any rise in incomes. Since 2005, while wages have increased 18%, workers’ contributions to premiums increased 47% — nearly twice as fast as the rise in the health insurance’s overall cost, according to Kaiser Family Foundation.

Will CER be a panacea for smarter health spending? It won’t do the whole trick, but it could be an important tool that better informs health spending in favor of rational allocation of health care dollars. Part of that trick will be communicating, in plain and engaging language, the meaning of the research to health citizens. Keep the actuaries out of that job, and give the task to creative communicators.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,