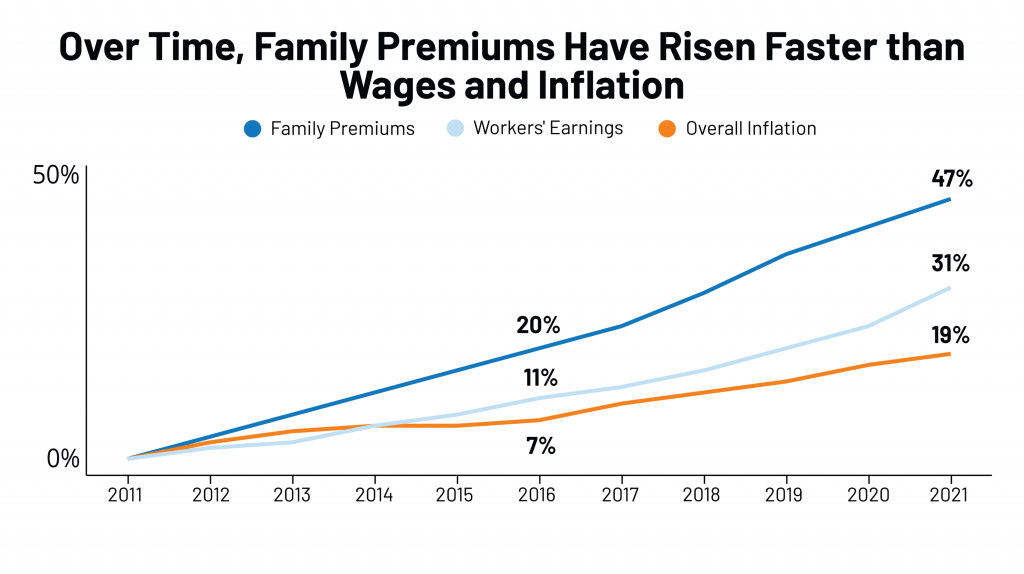

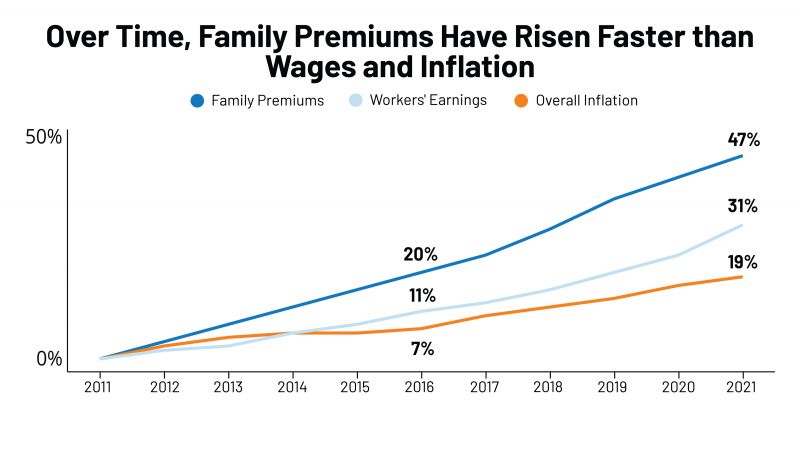

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages.

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages.

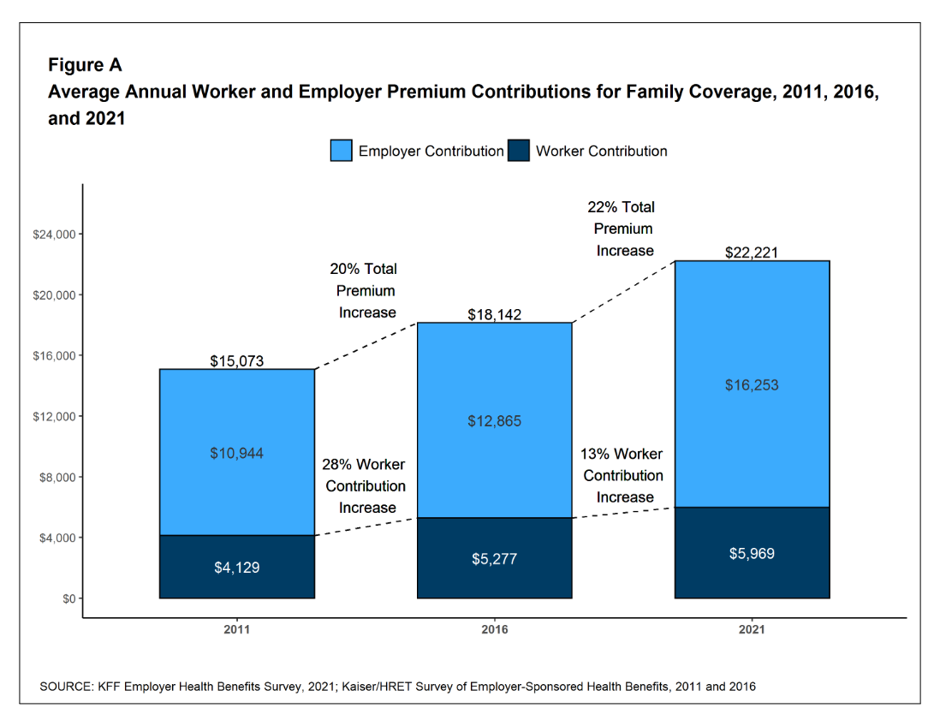

That family health plan premium reached $22,221, an increase of 22% since 2016, we learn in the annual report from Kaiser Family Foundation, 2021 Employer Health Benefits Survey.

This report is our go-to encyclopedia of statistics on health insurance year-after-year, surveying companies’ annual health insurance strategies for coverage and tactics for managing spending and workers’ health outcomes.

This 2021 update takes into account the impacts and influence of COVID-19 on workers’ wellness, access to services, and of course, the cost of health plans.

Figure A shows the family health insurance premium cost-sharing between employers and workers over ten years. The premium cost-growth between 2011 and 2016 was 20%, and between 2016 and 2021, 22%.

Figure A shows the family health insurance premium cost-sharing between employers and workers over ten years. The premium cost-growth between 2011 and 2016 was 20%, and between 2016 and 2021, 22%.

The employee’s share grew from $4,129 in 2011 to nearly $6,000 in 2021, 45% growth over the decade.

It’s important to note that workers employed by smaller companies face much higher premium shares than covered workers in large firms: 37$ compared with 24%.

Premiums also vary between industries: premiums for covered workers in agriculture/mining/construction and manufacturing are relatively low compared with premiums for health care workers (who faced the highest family premiums at $23,313 across all plan types).

Firms with a large share of lower-wage workers are also less likely to be covered by their company than employees in companies with fewer lower-wage workers.

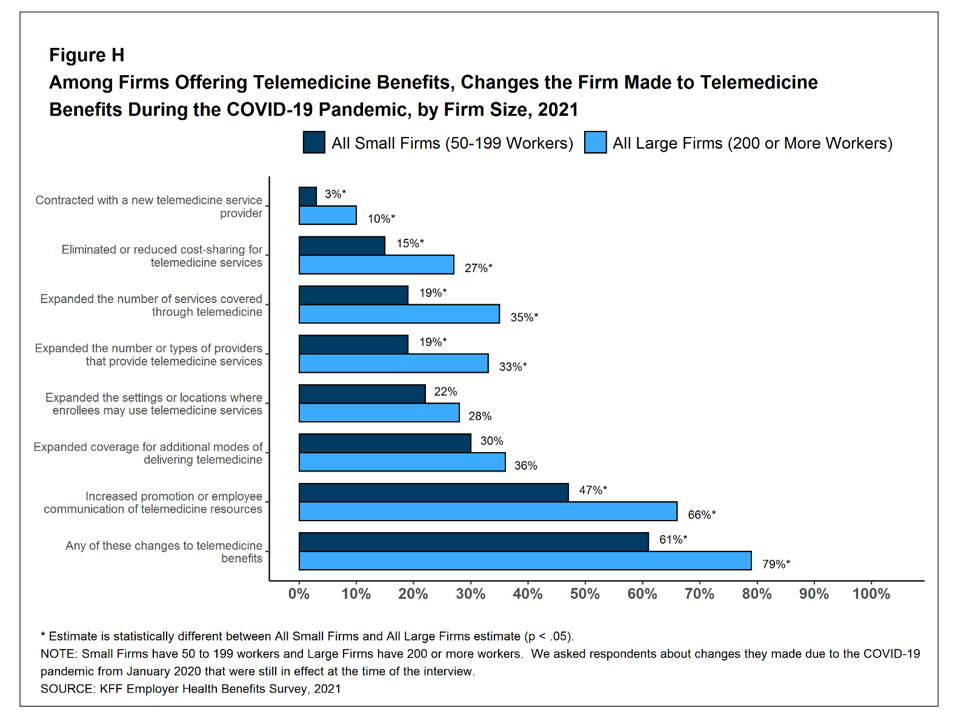

The coronavirus pandemic has fast-tracked telehealth in the U.S. Over a few years leading up to the COVID-19 emergence in early 2020, large employers had begun to adopt telemedicine in health plan benefits for workers, noted by the Business Group on Health’s membership surveys.

The coronavirus pandemic has fast-tracked telehealth in the U.S. Over a few years leading up to the COVID-19 emergence in early 2020, large employers had begun to adopt telemedicine in health plan benefits for workers, noted by the Business Group on Health’s membership surveys.

KFF quantified firms offering telemedicine benefits, shown in Figure H here from the report.

Overall, 95% of firms with 50 or more workers that offered health benefits cover some aspect of telemedicine.

Figure H illustrates changes companies have made to their virtual care benefits during the pandemic comparing large and small firms. More larger firms made changes to their telemedicine benefits than smaller firms, such as increasing communication and promotion of the virtual care benefits, expanding coverage to new models for telemedicine, expanding locations where workers could use the services, and expanding services covered through telemedicine — notably, teletherapy.

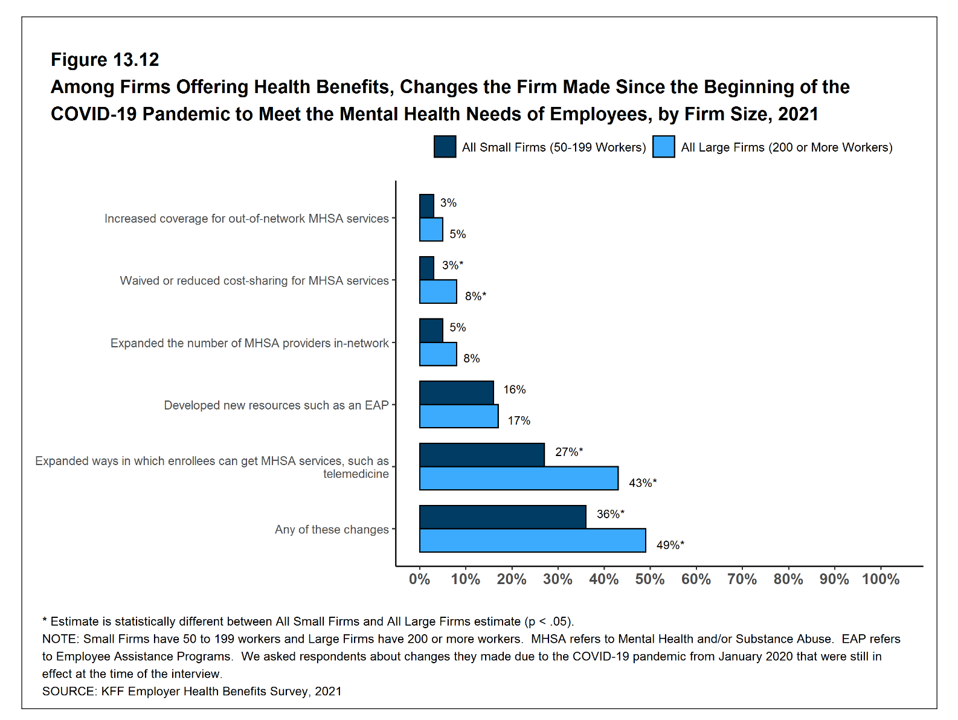

The next chart labeled Figure 13.12 illustrates the similar question of changes made to a health benefit — here, mental health services for employees, by the size of company. One-half of larger companies made changes to mental health coverage compared with one-third of smaller companies. In particular, see that 43% of large companies expanded ways to cover tele-mental health.

The next chart labeled Figure 13.12 illustrates the similar question of changes made to a health benefit — here, mental health services for employees, by the size of company. One-half of larger companies made changes to mental health coverage compared with one-third of smaller companies. In particular, see that 43% of large companies expanded ways to cover tele-mental health.

In general, KFF notes that the pandemic and social and economic disruptions exerted “an unprecedented level of stress” on people all over the world. Many employers expanded services to assist workers and their families to deal with these stressors, such as expanding employee assistance programs and offering new services for people working from home.

Check out the nearly 200-page report to explore more of the detailed findings on prescription drug coverage, retiree health benefits, price transparency, and self-insured employer trends. This is your annual manual for understanding the uniquely American style of financing health care from the workplace. And you can also mine this Health Populi blog for my annual coverage of this report, going back to 2009.

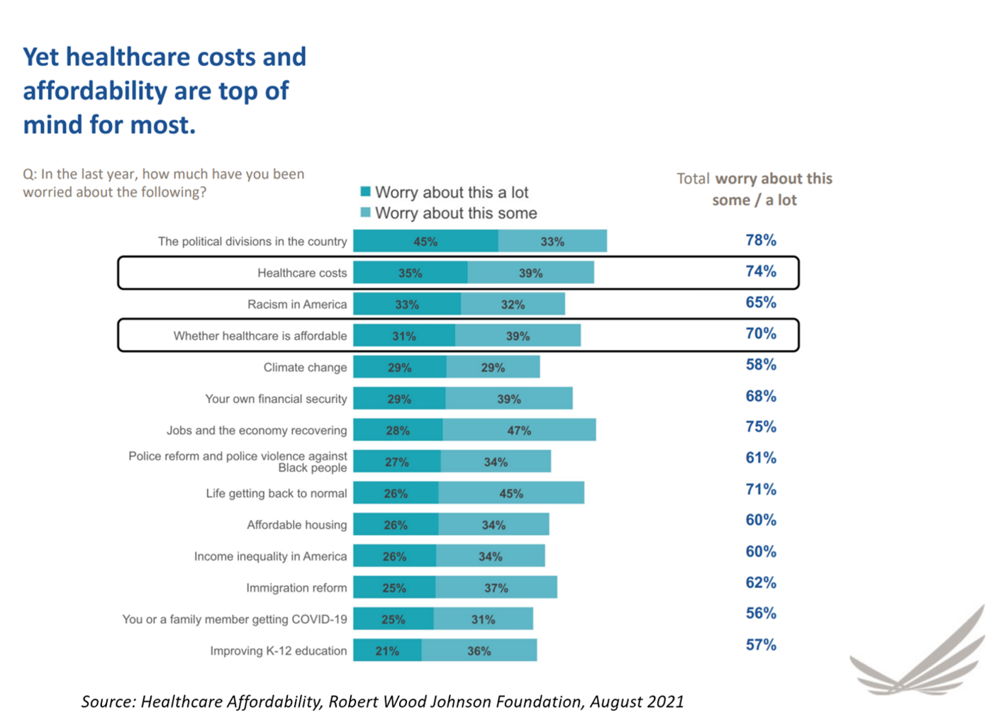

Health Populi’s Hot Points: Health care and household medical spending continue to be on Americans’ minds, the Robert Wood Johnson Foundation learned in their survey on healthcare affordability, conducted in the summer of 2021.

Health Populi’s Hot Points: Health care and household medical spending continue to be on Americans’ minds, the Robert Wood Johnson Foundation learned in their survey on healthcare affordability, conducted in the summer of 2021.

The bar chart from the study illustrates that just after the political divisions in the U.S., people are most worried about health care costs and whether health care is affordable, along with racism in America.

The Foundation also found that while health citizens might have positive perceptions about the care they received, they continue to worry and/or be confused about their health care costs — prompting financial anxiety.

Over one-half of people in the U.S. have sacrificed some aspect of their health care due to cost concerns — often self-rationing and avoiding care, not filling prescriptions for medicines, or skipping mental health care that has been recommended.

One of half of people in America also said that healthcare costs have harmed their personal finances, and at least 1 in 3 people said costs have had negative impacts on their own or family’s mental and physical health.

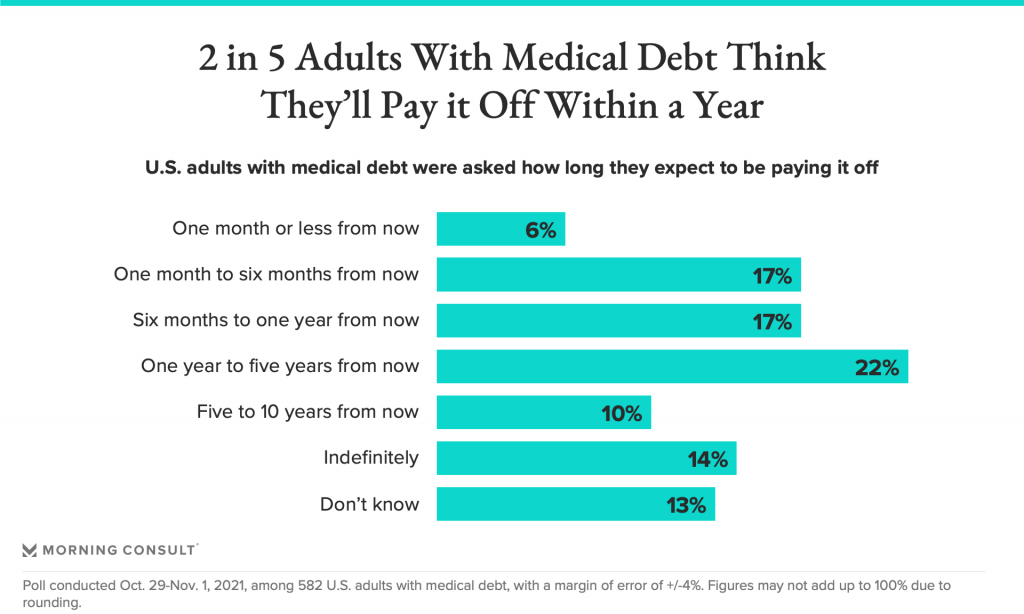

Given this health-financing profile that the Robert Wood Johnson Foundation painted for health consumers in 2021, a new poll from Morning Consult should not surprise us concerning medical debt.

Given this health-financing profile that the Robert Wood Johnson Foundation painted for health consumers in 2021, a new poll from Morning Consult should not surprise us concerning medical debt.

Morning Consult polled U.S. adults between October 29 and November 1, 2021, learning that 46% of U.S. adults with medical debt expect to take at least a year to pay it off.

Beneath that statistic, 1 in 5 would take from one to five years to pay off the medical debt, 10% five to ten years, and 14% said “indefinitely.” Another 13T didn’t know “when” they would pay off their medical debt.

The consumer-facing costs and financial risks for health insurance and prescription drugs will continue to be on Americans’ minds in and beyond 2021. Inflation worries for household spending on food, energy, and gas tanks will further exacerbate peoples’ kitchen-table spending concerns.

The need for health care access delivered through telehealth and virtual care platforms is clear, and innovations are being served up to patients seeking care from home and closer to home. Employers are responding to that demand, and that’s an important development the KFF report quantifies, along with a growing company embrace of mental health services for people at work at working-from-home.

Given the cost of health insurance in 2021, the nature of people facing high-deductibles, and growing inflation worries, health-financial anxieties will play into peoples’ everyday lives, further burdening peoples’ mental mindsets.

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,