“Inflation is the big story,” the economics team at Morning Consult told us yesterday in a call on “How to Think Like An Economist.”

While I already thought I did that, Team @MorningConsult updated us on the current state of consumers and what’s weighing most heavily on their minds…inflation being #1.

An hour after the Morning Consult session, I brainstormed the topic of consumers-as-payers of medical bills and prescription drugs with GoodRx strategy leaders. In my data wonkiness, inflation certainly played a starring role in setting the stage for Mind, Body and Wallet — the title of one of the sources of my plotline.

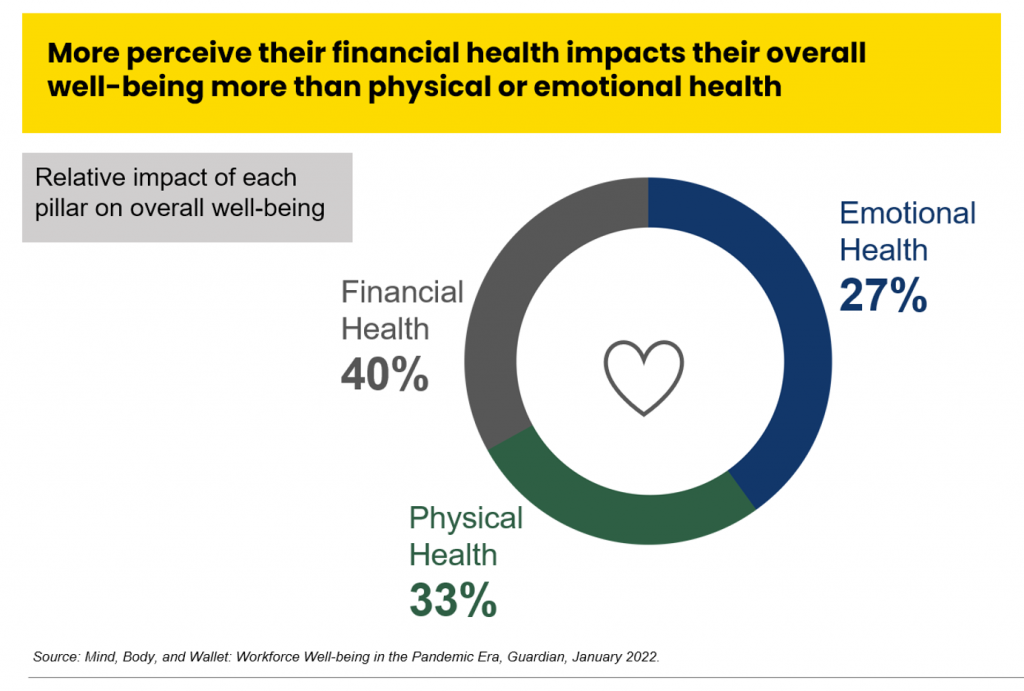

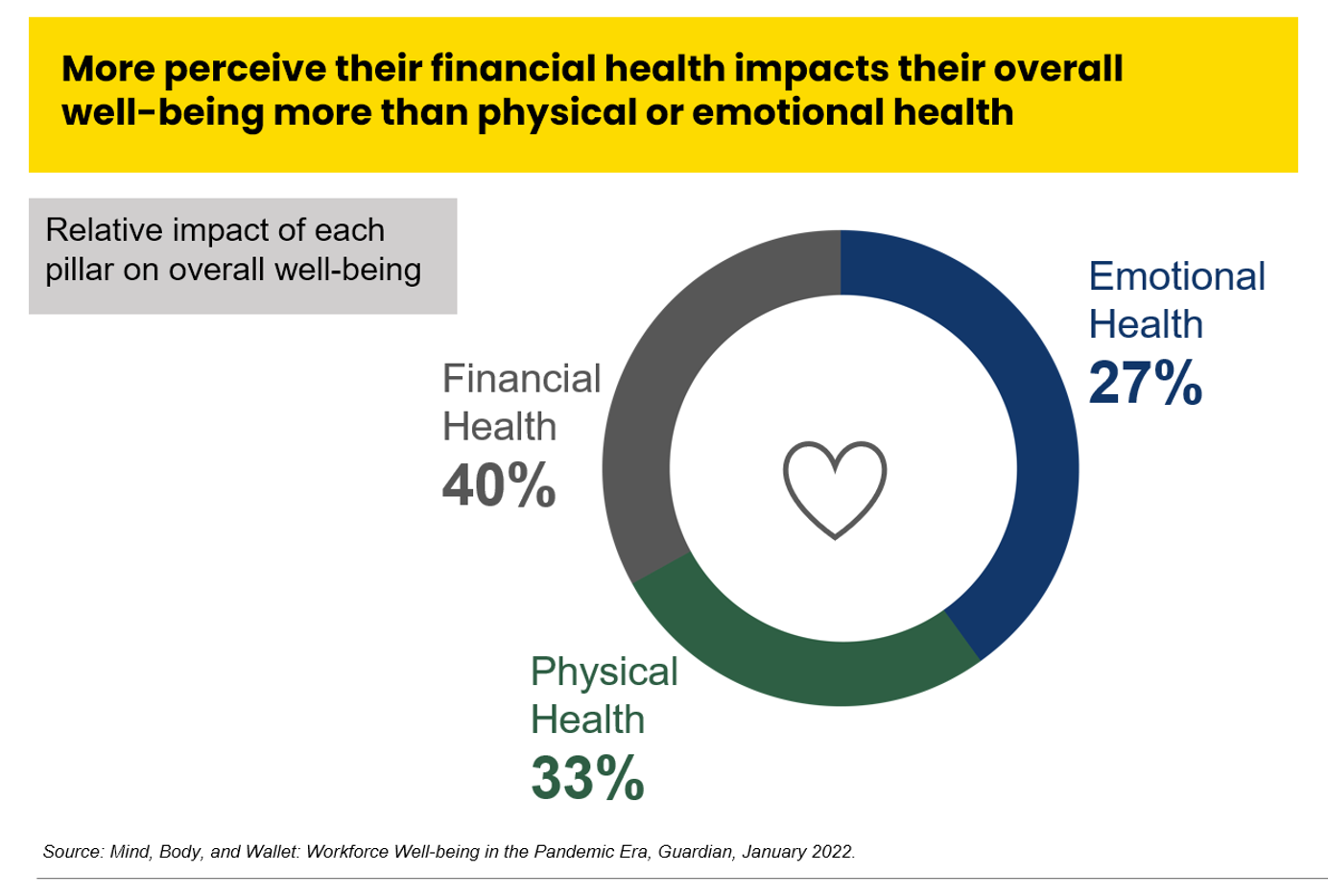

In that report, Guardian, an insurance and financial services company, asked people to rank the macro factors that shape their wellbeing. In order of priority and concern were,

- Financial health, accounting for 40% of well-being

- Physical health, comprising 33% of well-being, followed by

- Emotional health, making up 27% of well-being.

This consumer research was conducted in January 2022 — well before a gallon of gas cost an average of $4.98 in the U.S. this week (and to make our U.S. car-driving readers feel better, according to Global Petrol Prices, a gallon of petrol ran $7.82 in Belgium, $8.66 in the United Kingdom, and a whopping $11.35 in Hong Kong the week of 20 June 2022).

What Guardian learned from its 4th annual Workplace Benefits Study was that Americans aren’t feeling so well, garnering an index score of 3.26 out of 5…”barely a passing grade,” in the scoring of Guardian.

“Working Americans are worried about money — and their concern is growing.

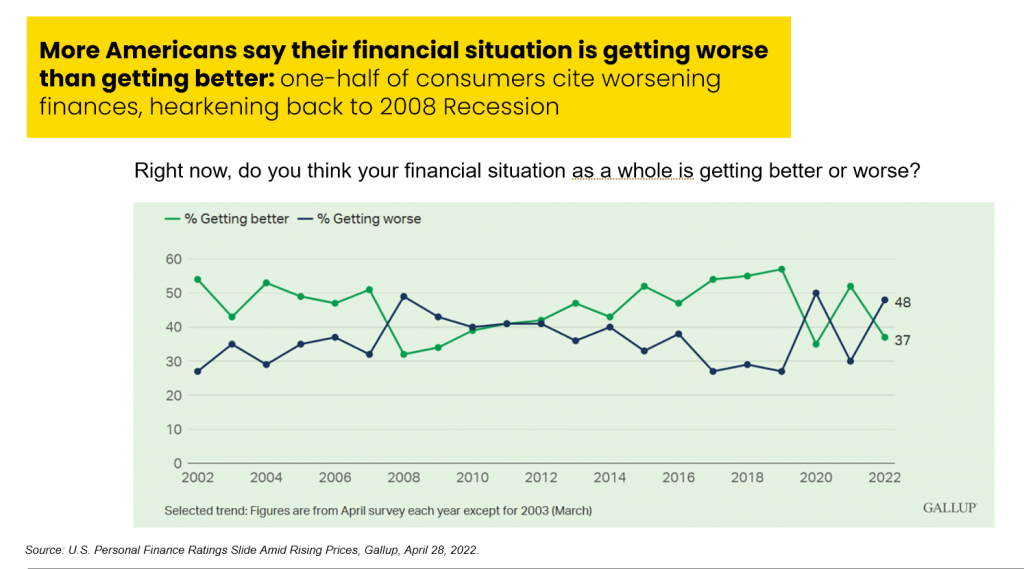

Gallup concurs. This line chart comes from the pollster’s April poll into Americans’ personal financial ratings, which spiked downward by April 2022….as inflation was heating up.

By April, one-half of people living in America said their financial situation was getting worse, a reversal of fortune from several steady years of personal financial improvement which kicked off in 2011 as the U.S. emerged from the Great Recession of 2008.

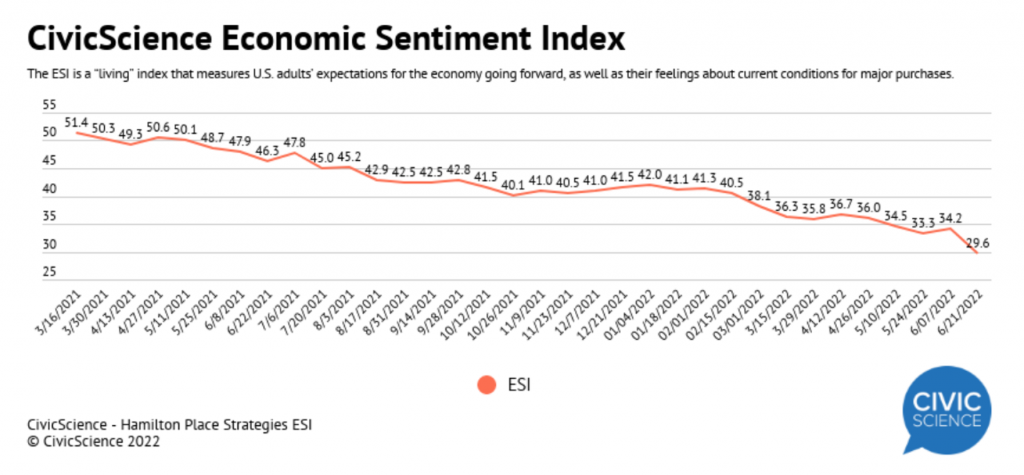

Health Populi’s Hot Points: Even before inflation began to heat up in late 2021, accelerating by spring 2022, consumer sentiment was falling, in fact, for eight straight months since last August 2021, CivicScience’s ongoing consumer research shows.

By June 22, economic sentiment fell sharply by 4.6 points which was the biggest two-week decline in the past year — and the lowest level since CivicScience launched this study in 2013.

While consumers are feeling financially unsettled, various bankers, analysts, and CEOs are weighing in with their own observations of the current financial downturn. For example:

- Jamie Dimon, Chair and CEO of JPMorgan, warned of the U.S. economy devolving into a “hurricane”

- Goldman Sachs President and COO John Waldron said this was the most challenging fiscal environment he’s ever faced

- The 3 new R’s according to Citibank CEO Jane Fraser are “Rates, Russia, and Recession,” and

- Elon Musk, Tesla CEO, said he had a “super bad feeling” about the economy.

So do mainstream Americans.

If and when the National Bureau of Economic Research determines the U.S. economy is in a recession, most consumers are already feeling a visceral downturn in their household finances.

Older Americans have already adjusted health care spending, Gallup and West Health recently found. The Center for the New Middle Class published data demonstrating that Americans are “feeling the sting of inflation in gas [and] healthcare costs.”

And this week, the Annals of Internal Medicine published research from a clinical team at Brigham & Women’s Hospital calculated the potential $3.6 billion savings that Medicare Part D could accrue if the program bought generic drugs at the prices offered through the Mark Cuban Cost Plus Drug Company. (Yes, that Mark Cuban).

The recently-launched company currently offers about 200 of the most commonly prescribed generic drugs, priced at a 15% markup plus a $3 dispensing fee and $5 shipping fee. (The company has plans to expand to as many as 1,000 medicines).

The news of the Shark Tank star’s potential drug cost savings has hit mass media news outlets both national and local. U.S. health citizens are health care payers, and household inflation for basic needs — food, gas, energy, and other family spending — is going to impact peoples’ health behaviors in different ways. The financial guress Jean Chatzky tweeted, it “Takes a Shark” to pull this kind of result off given the lack of prescription drug reform progress Congress has achieved.

Guardian got the title of its 2022 report just right with “Mind, Body and Wallet.” If you didn’t believe the patient was the payer before now….it’s time to get on with embedding financial health considerations into your health care business strategies.

[For more on another successful cost-saving prescription drug program, check out my recent blog on Costco as a value-driven pharmacy].

Thank you FeedSpot for

Thank you FeedSpot for