Consumers have been shell-shocked with health care costs — an increasing proportion of household spending in the U.S. This is true for the increasing costs consumers bear in the traditional health system. However, consumers are continuing to spend discretionary income on non-traditional health services such as complementary and alternative medicine (CAM) providers and products, along with vitamins/minerals/supplements and weight loss regimes.

Consumers have been shell-shocked with health care costs — an increasing proportion of household spending in the U.S. This is true for the increasing costs consumers bear in the traditional health system. However, consumers are continuing to spend discretionary income on non-traditional health services such as complementary and alternative medicine (CAM) providers and products, along with vitamins/minerals/supplements and weight loss regimes.

With increasing health cost burdens on households, those householders have less money to allocate to other aspects of life. In particular, growing medical costs have translated into greater credit problems for American consumers, according to The hidden costs of U.S. health care for consumers: A comprehensive analysis from Deloitte Center for Health Solutions.

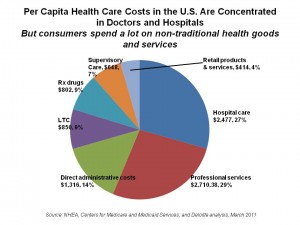

Deloitte is thinking out of the box at all categories of out-of-pocket spending on health. Seven categories of spending make up this analysis:

- Hospital care

- Insurance and direct administrative costs

- Long-term care

- Professional services (physician and clinical, CAM practitioners, ambulatory, other ambulatory, weight-loss, dental)

- Retail products and services (durable medical equipment, nutrition/supplements, CAM products, health publications)

- Prescription drugs, from all retail channels

- Supervisory care: unpaid care provided to family member or friend.

Based on this comprehensive accounting of OOP costs, Deloitte estimates that consumers are spending nearly 15% more OOP on health goods and services than the Federal government accounts for. These costs are largely allocated to line items the National Health Expenditure Accounts doesn’t inventory in its estimates of consumer health spending. These areas include nutritional products and functional foods, complementary and alternative medicine, and mental health/substance abuse.

A major area that’s under-counted by government statistics is “informal caregiving” — that is, people caring for other people (usually loved ones) without getting paid to do this. Deloitte calculates this value to be $199 billion — more than long-term care monies spent on nursing homes, $144 billion, and home care, estimated to be $72 billion. These costs make up about 55% of all additional health costs borne by consumers.

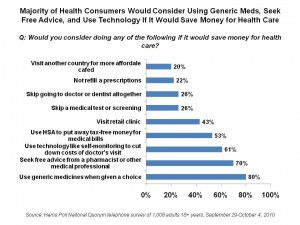

Health Populi’s Hot Points: To save money spent on health, consumers are becoming savvier health care shoppers with a retail ethos. They are seeking alternative sources of advice — such as from their trusted pharmacist — and are using non-traditional health retail channels like retail clinics and online physician access (e.g., via AmericanWell). Most consumers are keen on generic drugs versus paying for therapeutically equivalent branded pharmaceutical products. Those choices are largely rational and intelligent. On the other hand, some consumers are self-rationing due to cost, by postponing or avoiding recommended medical tests and treatments, or skipping filling prescriptions. Saving money in the short-run that way will probably cost more in the longer-run in terms of medical costs, quality of life, and productivity for employers.

Health Populi’s Hot Points: To save money spent on health, consumers are becoming savvier health care shoppers with a retail ethos. They are seeking alternative sources of advice — such as from their trusted pharmacist — and are using non-traditional health retail channels like retail clinics and online physician access (e.g., via AmericanWell). Most consumers are keen on generic drugs versus paying for therapeutically equivalent branded pharmaceutical products. Those choices are largely rational and intelligent. On the other hand, some consumers are self-rationing due to cost, by postponing or avoiding recommended medical tests and treatments, or skipping filling prescriptions. Saving money in the short-run that way will probably cost more in the longer-run in terms of medical costs, quality of life, and productivity for employers.

Deloitte found that 17% of U.S. health consumers spend over one-fourth of their household budget on health care services, products, drugs, insurance, co-pays, deductibles and other out-of-pocket expenses. An additional 13% spend between 16% and 25% of their household budgets on OOP health costs. The health household microeconomy truly competes with other big-dollar household spending — house payments, utilities, petrol for the car, and clothing.

Accounting for all health care costs, as the consumer ‘feels’ and ‘spends” them, gives an accurate picture of the full extent of health spending “pain” felt by U.S. health citizens.

Thank you FeedSpot for

Thank you FeedSpot for