American workers are worried about outliving their savings and not being able to meet the financial needs of their families, according to The 12th Annual Retirement Survey from the Transamerica Center for Retirement Studies. The study paints a picture of 4,080 U.S. workers who forecast insecure financial futures. Their personal portraits find them working into older ages than they had previously expected to — before the recession.

American workers are worried about outliving their savings and not being able to meet the financial needs of their families, according to The 12th Annual Retirement Survey from the Transamerica Center for Retirement Studies. The study paints a picture of 4,080 U.S. workers who forecast insecure financial futures. Their personal portraits find them working into older ages than they had previously expected to — before the recession.

54% of workers plan to work in retirement. 39% of workers will retire after age 70, or not at all.

It’s not only Baby Boomers who expect to work past 65. Two-thirds of workers in their 20s, and 3 in 4 workers in their 30s, do not believe they’ll have saved enough money to retire. And, people with higher household incomes expect to keep on working as well as those in less affluent households.

While 56% of workers say they have a retirement plan, only 10% have it written down. At least half of those with a plan, written or not, say they’ve factored in Medicare, Social Security and health costs.

The survey polled 4,080 U.S. workers 18 and older (in full and part-time jobs in for-profit companies of 10 employees and higher) online between January and March 2011.

Health Populi’s Hot Points: Last week’s news from the Medicare Trustees that the Medicare Trust Fund will be broke in 2024 puts the Transamerica findings into even sharper focus. This is 5 years sooner than previous forecasts.

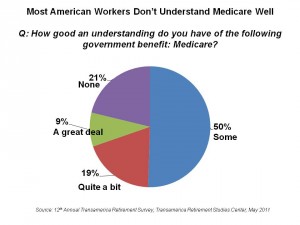

People will work longer to pay for their everyday lives due to the uncertain economy, stock market and pension plan losses, and the rising costs of health care. Medicare economics will play into future retirees’ spending even more significantly than many of them/us realize, based on Transamerica’s findings on Medicare literacy shown in the pie chart.

There are two Big Implications here: first, save more money; second, U.S. health citizens must work harder to stay healthy and stave off non-communicable diseases borne by lifestyle choices like smoking, lack of physical activity, drinking alcohol in excess, and poor nutrition choices. Here’s where employer health benefits and health plan sponsors for Medicare and Medicaid can help people nudge their way to healthier microchoices. Technology, mobile and EHR/PHR platforms, would underpin this solution.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,