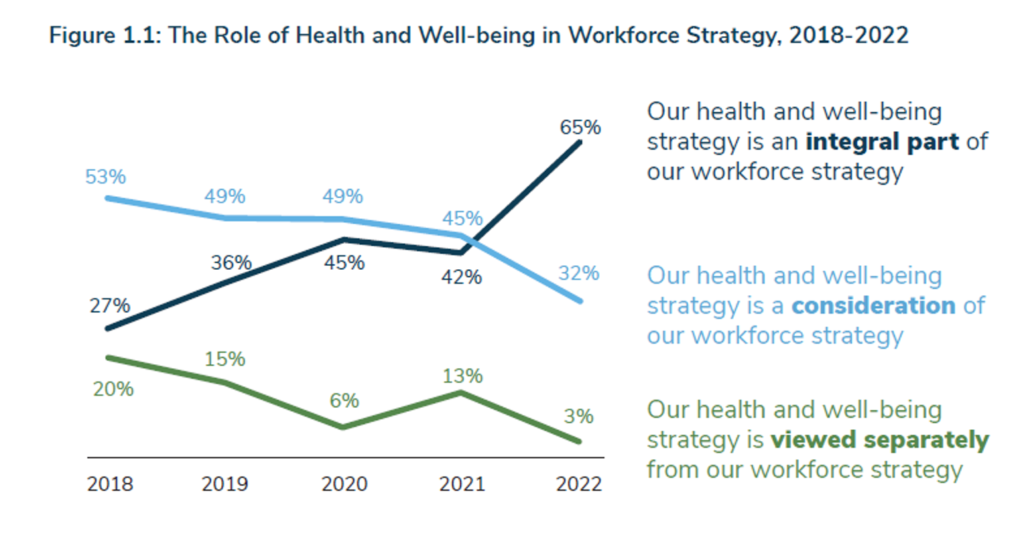

The concept that all companies are “health care companies” takes on greater import in the wake of the pandemic. The 2023 Large Employers’ Health Care Strategy and Plan Design Survey from the Business Group on Health (BGH) found that two in three large employers see their health and well-being strategy as an integral part of their overall workforce strategy. This is our annual go-to study guiding us on the private sector’s big thinking about health care plans and investments on workers’ behalf.

The first line chart illustrates how this phenomenon shot up in importance for large companies between 2021 and 2022.

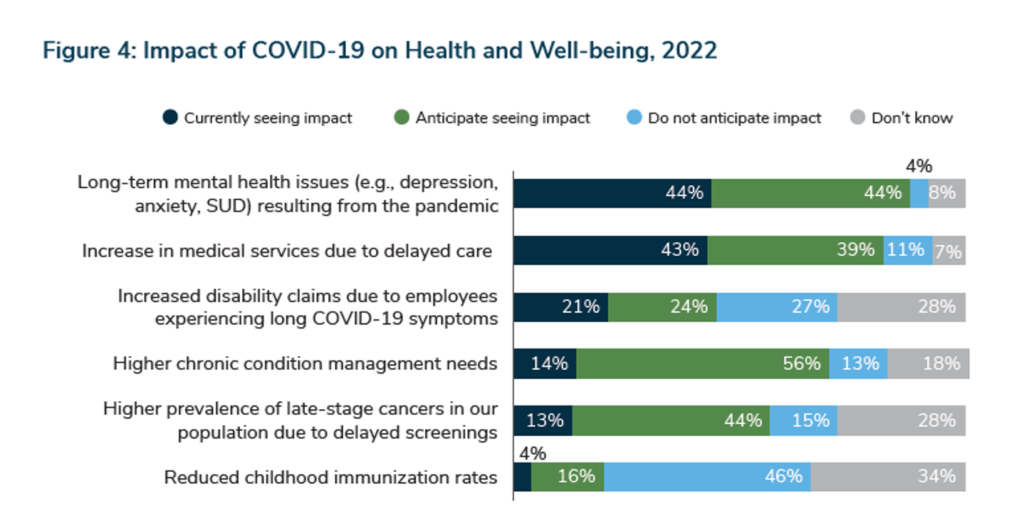

One big point underneath this big trend is that 21% of employers saw increased disability claims due to long COVID and another 1 in 4 companies expect to see that increase at some point.

And long-term mental health issues were seen as the #1 impact coming out of the pandemic.

Mental health conditions such as anxiety, depression, and substance use disorder rank first in COVID-19 impacts on health and well-being seen at the workplace. Second, employees’ delaying medical care has resulted in driving medical services utilization higher in 2022, with more chronic condition needs as well.

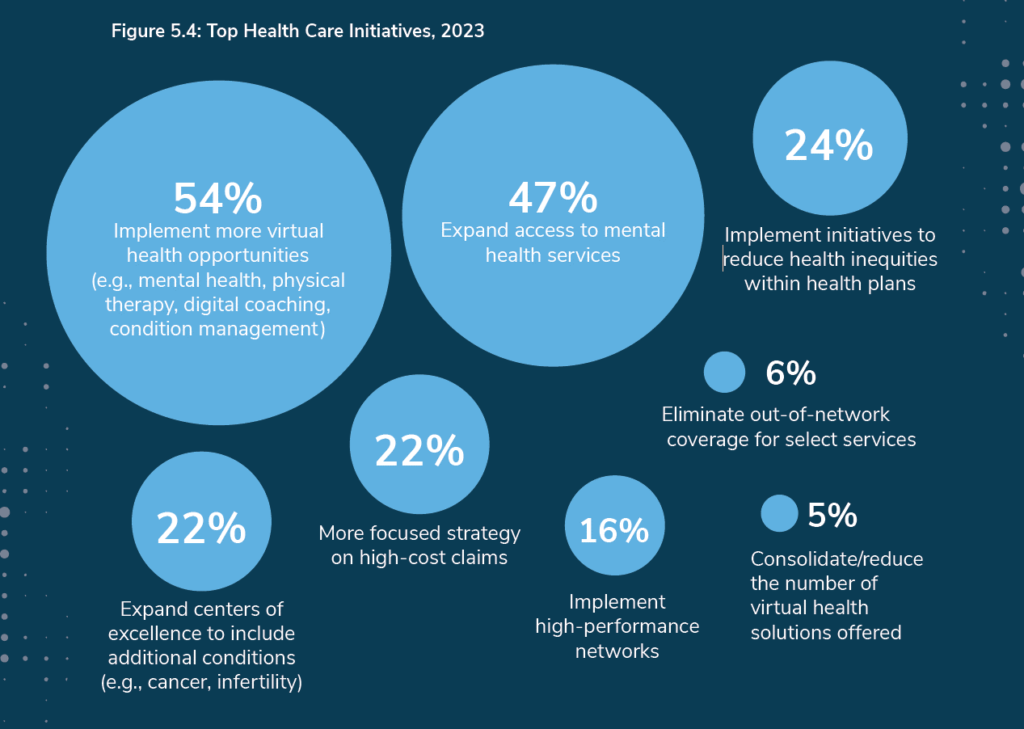

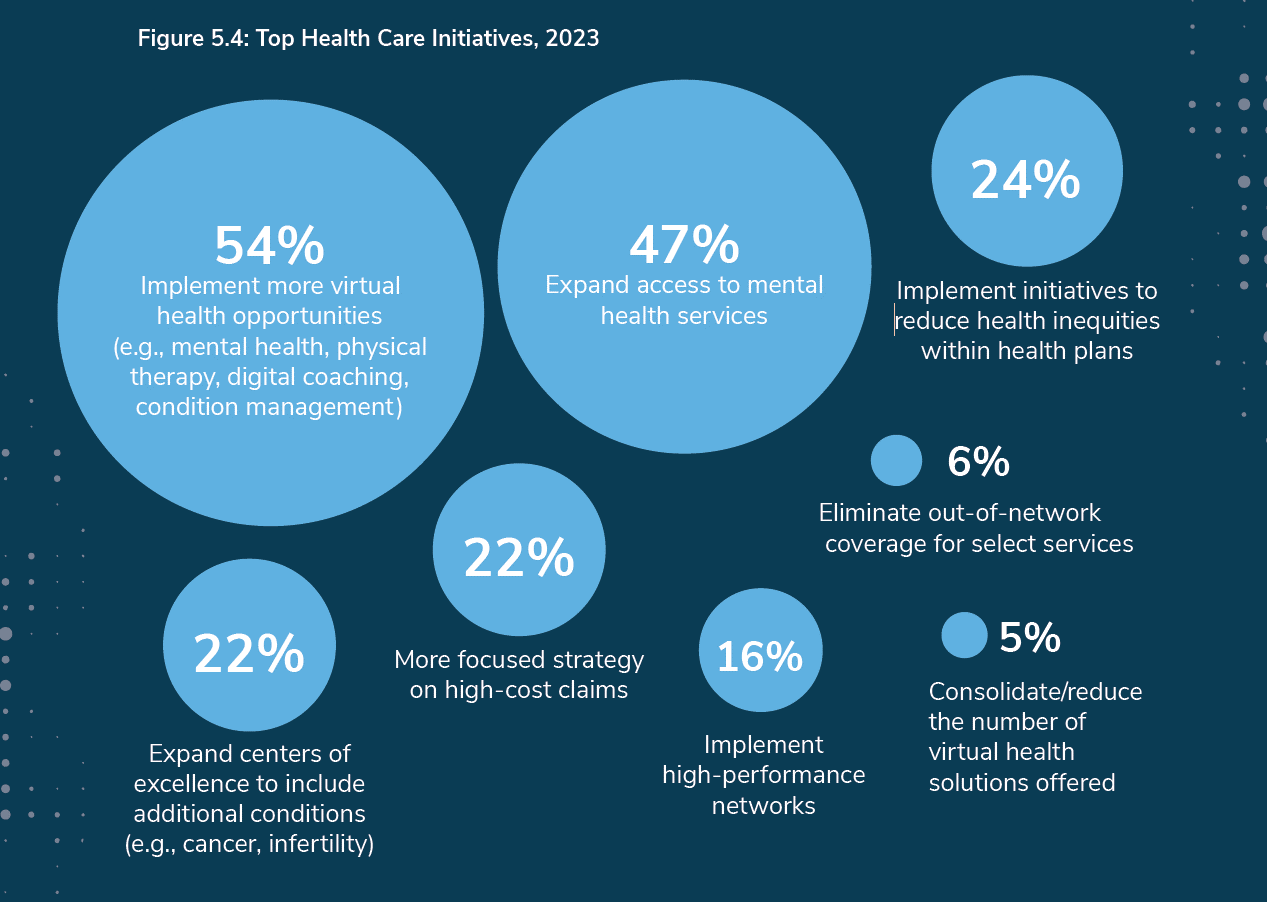

The bubble chart summarizes large employer’s top health care initiatives, beginning with most implementing more care via virtual platforms for mental health, physical therapy, chronic condition management and other services.

Expanding telehealth is universally embraced by the big employers, 94% of whom told BGH they would do so in 2022 and beyond. To be sure, mental health services expansion will be part of virtual care growth.

Health care cost management is always on employers’ minds, in this round of the annual survey an especially acute pain point as the median health care trend increase in 2021 was 8.2% — a height not seen for many years. The 8 percent number came on the heels of “0%” trend growth in 2020 in the midst of the pandemic, when medical distancing and patient avoidance of care was a side effect of pandemic’s physical distancing and many health consumers’ concerns about exposure to the virus.

Health Populi’s Hot Points: Amazon’s announcement of shuttering Amazon Care by year-end offered a rationale of not addressing employers’ demands for a comprehensive solution to their health care strategies.

Still, Amazon remains committed to building out health care offerings including those to companies, as it continues the journey to acquiring One Medical and jockeys to position an offer for Signify Health, as of the writing of this post.

The BGH study gives us a roadmap for the next few years’ of post-pandemic pain points employers seek to quell, good information for Amazon’s and others’ strategies to fold into strategies.

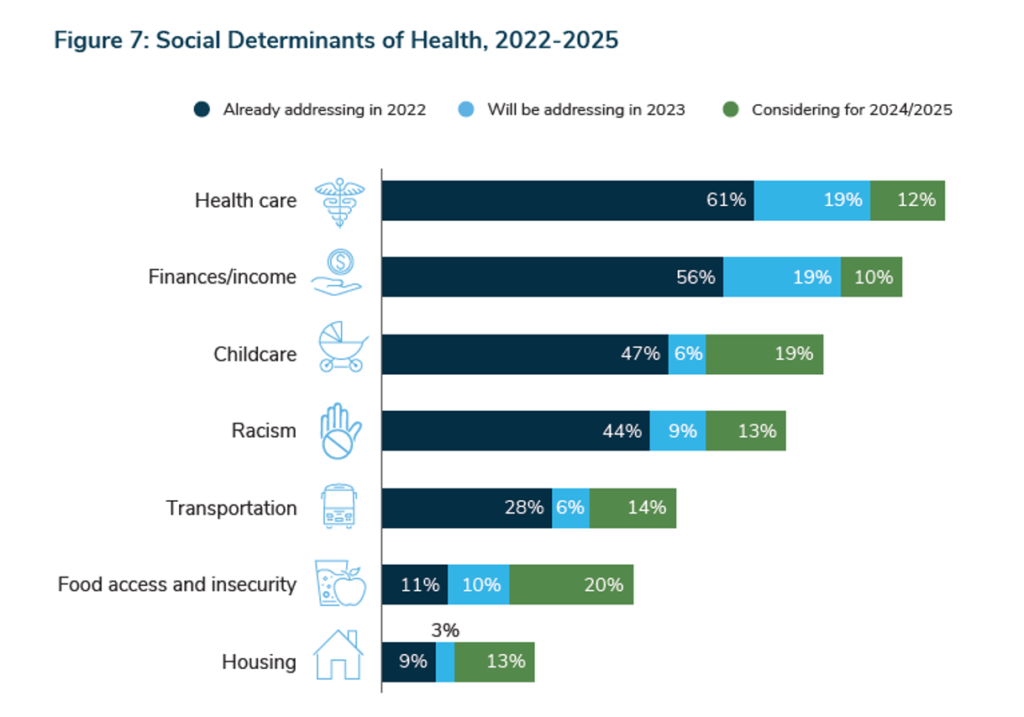

Another key lens to keep front-and-center is employers’ embrace of determinants of health to bolster equity, inclusion, and population health outcomes.

The bar chart quantifies large employers’ priorities to address among the drivers of health, top of which are health care access (including affordability), finance and workers’ financial health and well-being, childcare (found to be a key obstacle to many parents’ “Great Reconsideration” in their return to work, or not), racism, transportation, and food access.

I’ll call out food access here at the 20% of employers saying they will consider this SDoH for 2024-2025. Currently, food inflation is a major household budget challenge for mainstream Americans, and two years from now, large employers point to food security as the top issue to consider among the other drivers of health. Childcare is nearly tied for that front place.

Employers are seen as one of the few trust-worthy go-to institutions in 2022, the latest Edelman Trust Barometer discovered. Companies are playing a role of refuge, information (especially for health/care), and support among working people in the U.S. and other nations.

Companies are indeed all playing starring roles in health and will be doing so….with the uncertainty of economic growth or recession both nationally and globally a key factor to track for the coming months looking toward 2024.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,