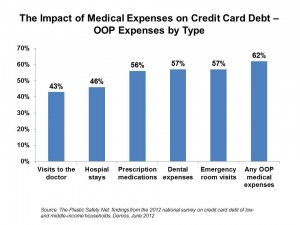

More than 2 in 3 U.S. households with debt point to medical spending as a key contributor to their indebtedness. Among the out-of-pocket (OOP) costs that drive household debt are the cost emergency room visits, dental expenses, prescription medications, inpatient hospital stays, and visits to the doctor, shown in the chart.

Welcome to The Plastic Safety Net, the use of credit cards to fund living expenses in America, a phenomenon explained in a report from Demos, published in May 2012. Demos surveyed nearly 1,000 low- and middle-income households in February and March 2012 to gauge the rate of use of credit cards as a “safety net” for daily living costs.

While on average credit card debt has declined, 40% of households use credit cads to pay for basic living expenses like rent, groceries and utilities because their checking accounts don’t have enough saved to pay for current expenses. Exacerbating this situation is that unemployment and medical bills, with half of households carrying debt from OOP medical expenses on credit cards — with an average of $1,678.

Among people who admit to having poor credit, 55% say that unpaid medical bills or medical debts contributed to their low credit profile.

In the Demos survey, the #1 contributor to current credit card debt is medical expenses, cited by 76% of households. The second highest expense driving household debt is car repairs, followed by purchases of non-essential goods and services, home repairs, and major purchases of goods and services.

Health Populi’s Hot Points: The typical household, Demos found, puts $800 of medical bills on their credit card that results in debt. In addition, 30% of households in debt have medical debt beyond the credit card — on average $6,476.

Medical debt caused one-half of householders with debt to skip health care treatments such as avoiding a medical test or follow up (36%), not filling a prescription (33%), or not seeing a doctor when necessary (39%).

Medical debt is therefore a source of self-rationing health care.

Thank you, Trey Rawles of @Optum, for including me on

Thank you, Trey Rawles of @Optum, for including me on  I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  For the past 15 years,

For the past 15 years,