Two announcements this week add important initiatives to patients’ growing choices that speak to their consumer-sides’ sense of value and personal healthcare cost-containment:

- Amazon launched RxPass, a generic medicines subscription service; and,

- Dollar General promoted its mobile health service powered by DocGo on demand for health visits, “right outside the store.”

These two programs come from outside of the legacy health care system of so-called incumbents — hospitals, health systems, health insurance — leveraging two brand-names beloved to many consumers for convenience, price transparency, and sheer cost.

First, check out Amazon Pharmacy’s RxPass.

Amazon announced the program in this press release today.

Top-line, the announcement said that,

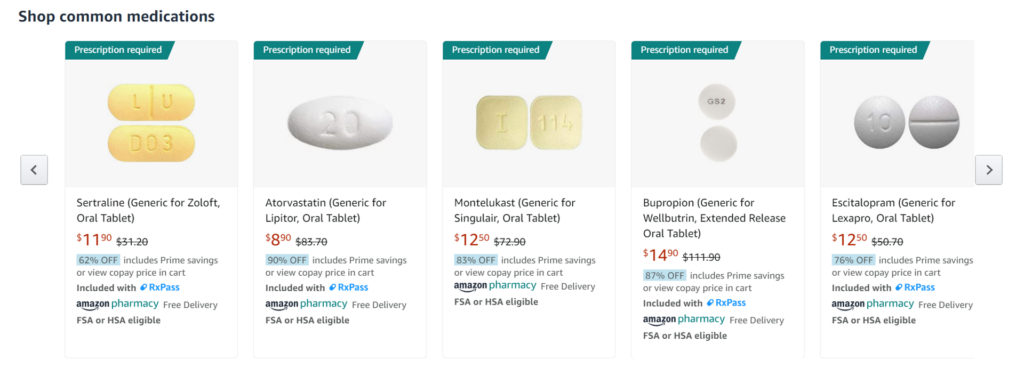

“In addition to all the savings, convenience, and entertainment they already enjoy, Prime members can now receive all of their eligible generic medications for just $5 a month and have them delivered free to their door. Medications that treat more than 80 common conditions, such as high blood pressure, anxiety, and acid reflux, are included in the RxPass subscription.”

While Prime membership growth has begun to stall in 2023, the fastest-growing demographic during the pandemic was older people — most of whom consume maintenance medications for chronic conditions like heart disease (take statins, blood pressure meds), mental health management (see Zoloft generic in the graphic on the left), and respiratory conditions (note Singulair in the picture at the center).

Patients receiving 90-day supply of drugs via mail order are already used to that delivery channel, so Amazon RxPass adds the lower-cost factor to the convenient delivery/ecommerce mode which consumers, younger and older alike, have come to expect.

Now take a look at Dollar General’s expanding medical visit platform channeled by DocGo on demand.

This brings a new riff or definition to the phrase “mobile health,” providing as the PR says, “quick, easy health visits. Right outside the store.”

I wrote about Dollar General’s growing health care strategy in July 2021 here in Health Populi, and in December 2022 its project with the Consumer Healthcare Products Association to bolster health literacy for over-the-counter medicines.

The trend to Dollar and Convenience Stores (C-Stores) to grow health care muscles and product aisles has been percolating for some years: I pointed out the growing retail health ecosystem in my book HealthConsuming, noting that, “Even convenience or ‘C-stores,’ which have a reputation for selling ‘Cokes and smokes,’ are reinventing small footprint shops for health. 7-Eleven, Circle K, Wawa, are all responding to health-conscious consumers’ preferences for nutritious foods and on-the-go access.”

Health Populi’s Hot Points: Expect incumbent health care stakeholders — hospitals, health systems, health plans — to be developing their own strategies addressing the evolving DTC consumer retail health ecosystem.

Take Optum, which this week launched the Price Edge tool to help steer patients to the “lowest price generic medicines” according to the program’s press release. The price-comparison tool exclusively focused on generic drugs will be available to Optum Rx members.

“Compared to most direct-to-consumer prescription drug prices, Optum Rx already offers a lower price nearly 90% of the time and Price Edge ensures a competitive consumer price on generic drugs with every transaction. Price Edge scans available prices and automatically provides the lowest available pricing to the member. If there is a lower cost to the member outside of their insurance benefit, Price Edge automatically applies that price.

Unlike other direct-to-consumer pharmacy solutions or cash market pricing, transactions initiated through Price Edge count toward the member’s deductible and out-of-pocket maximum. Plan sponsors also do not incur additional administrative fees for implementing Price Edge and their members automatically access the tool within their plan at no cost. Additionally, by capturing all transactions within the member benefit, Price Edge maintains continuity of safety protocols and safeguards against contraindications between medications,” Optum explains.

In the meantime, Dollar General’s over-arching message asks health consumers, “Why pay drug store prices?”

The DG Wellbeing banner and branding will speak to many value-conscious, financially stressed patient-consumers managing tight household budgets and feeling dis-empowered facing the price of a dozen eggs and other family-fiscal pressures in 2023.

We’ll observe how patients-as-consumers’ behaviors might change and shift to the newer on-ramps and front-doors to health care services and products. Amazon and Dollar General updates give us two more signposts in the evolving (read: growing) retail health landscape and choice architecture for patients paying out-of-pocket for healthcare.

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a