Not all “retail health” sites are created equal, U.S. consumers seem to be saying in a new study from Wolters Kluwer Health, the company’s second Pharmacy Next: Consumer Care and Cost Trends survey.

Specifically, consumers have begun to differentiate between health care delivered at a retail pharmacy versus care offered at a retail store — such as Target or Walmart (both named as sites that offer “health clinics in department stores” in the study press release). While 58% of Americans were likely to visit a local pharmacy as a “first step” when faced with a non-emergency medical situation and 79% of people trusted their local pharmacy to provide care more than clinic staff at a department store.

Strikingly, the trust deficit with retail stores for medical care was substantial, with 80% of consumers telling Wolters Kluwer that they would “probably never” go to a department store for health care.

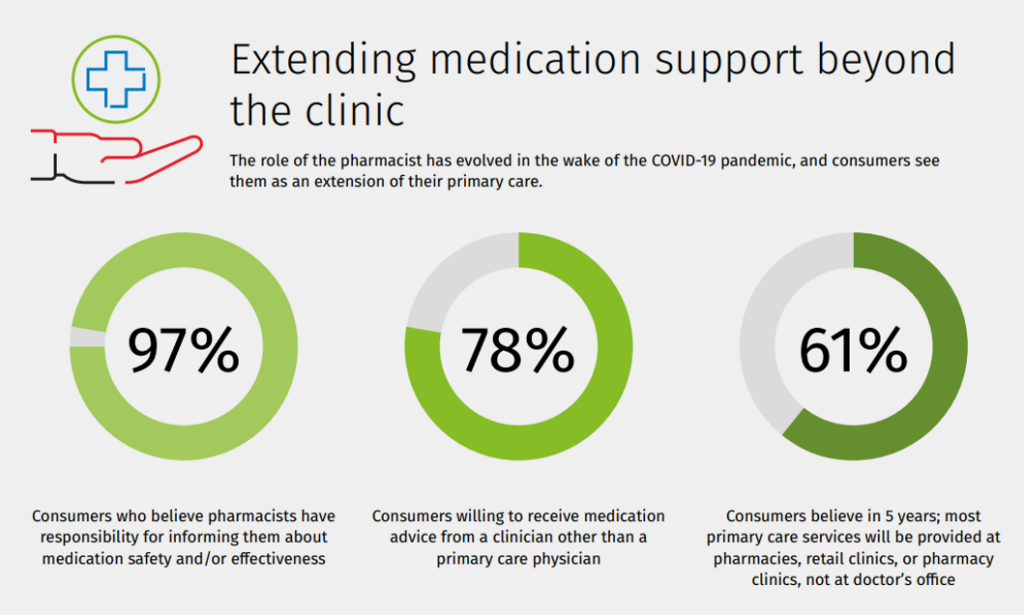

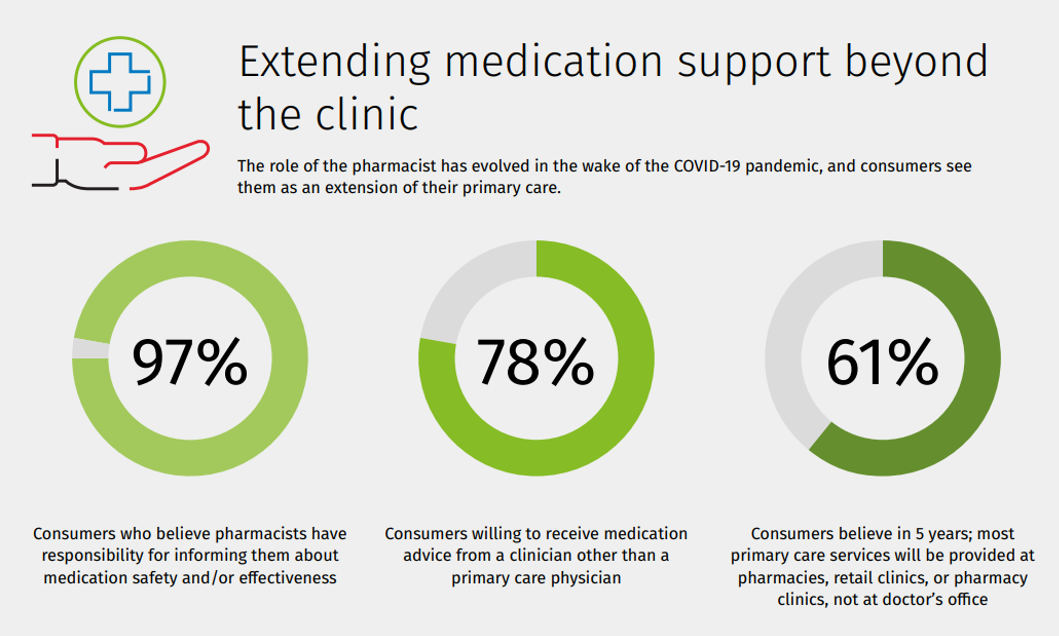

4 in 5 consumers would be willing to receive medication advice from a clinician other than a primary care physician — namely, a pharmacist, nurse, or nurse practitioner, whom consumers would also trust to diagnose minor illness as well as prescribe medication.

In 5 years, 61% of U.S. consumer foresee that most primary care will be delivered at pharmacies, retail clinics, or pharmacy clinics — not in doctors’ offices, the study found.

A key driving force inspiring onsumers’ pivot to retail health — in particular, the pharmacy as an on-ramp to health care services — is cost.

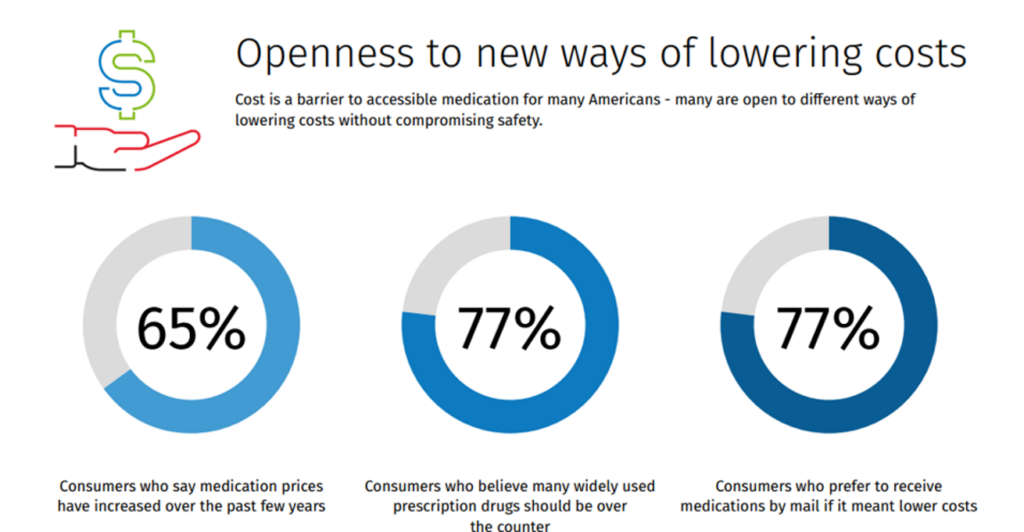

Over 2 in 5 consumers chose not to fill a prescription, Wolters Kluwer found. Two-thirds of consumers said medication prices increased int he past two years, shown in the second chart from the study.

The vast majority of U.S. consumers, thus, look to pharmacists and clinicians to advise them on lower cost options for medicines and other health care issues. Furthermore, three-quarters of people said that many widely used prescription drugs shown to be safe should be made available over-the-counter, or “switched” to OTC.

To that point, “Americans are ready for the pharmacist as prescriber,” Wolters Kluwer learned in research conducted in December 2022. In that survey, three in four U.S. adults were open to have medications prescribed by a specially-trained pharmacist instead of a doctor. Younger patients were more inclined to be open to the pharmacist-as-prescriber, but even 58% of Boomers and older Americans supported the concept.

Wolters Kluwer surveyed 1,017 U.S. adults 18 and over for the latest study, with interviews fielded in March 2023.

Health Populi’s Hot Points: Health care delivery is decentralizing, Wolters Kluwer noted in its discussion of the context for the study, as care is moving closer to where people live (or inside the walls of their homes), work (at the office, with the employer being much-trusted for health information), play (in safe outdoor environments and walkable cities), and learn (at schools and faith-based institutions).

“Pharmacies [are] moving to [the] heart of primary care,” Wolters Kluwer’s summary concludes, noting that trust in pharmacy is growing as health consumers’ costs are rising.

Thus, OTC medicines and generic drugs are highly-valued and trusted by consumers, taking up their fiscal-medical role as the patient-as-the-payer.

The pharmacist is a key influencer in the OTC sector, Brian Owens, SVP of commerce strategy and inclusive retail at VMLYR, recently explained in Chain Drug Review. “COVID-19 has increased the importance of having the retail pharmacist recommendation in consumer health shopper marketing,” Brian asserted. “When the FDA authorized pharmacists to prescribe Paxlovid to widen access to timely treatment, it signaled a recognition that pharmacists’ roles can indeed expand to include prescribing,” he observed.

Brian envisions the opportunity to leverage pharmacist influencer telehealth platforms into OTC categories in real-time. This could scale the pharmacist through virtual care and continue to build the strong trust that health consumers already have with retail pharmacists.

I also envision the growing force of retail pharmacies co-located with grocery stores, where consumers can implement their interest and value in food-as-medicine concepts for build healthy grocery carts based on the consumers’ own sense of values and value. Breaking down siloes between different departments in retail health — from food to health and beauty to prescription drugs and OTC will help consumers better organize for and “own” their health.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a