One in two consumers in the U.S. feel their well-being or healing was negatively impacted by difficulty paying for their medical care.

Welcome to the convergence of patients’ health care life with financial and retail lives, we learn from the 2024 Healthcare Financial Experience Study from Cedar.

And that patient’s positive clinical experience can absolutely reverse the consumer’s perception of the provider, noted by this quote from OSU’s Chief Financial Officer Vincent Tammaro:

“We’ve cured you of your ailment, but we’ve harmed you financially.”

That’s a form of financial toxicity that has ramifications for the entire health system enterprise beyond the surgical suite or cancer center.

The bottom-line, literally: four in ten consumers would not pay a medical bill if they cannot understand the administrative experience.

Cedar polled 1,239 U.S. adults ages 26 and over via an online study conducted in April and May 2023. Each person interviewed was responsible for health care decisions and paying the bill at least once int he past twelve months.

Patients-as-payers need more help in understanding medical bills, their health plan benefits, and financial assistance options such as paying over time, zero-interest payment plans and other programs.

As consumers experience with their credit cards and other financial service portals online, patients want real-time information access that provide clear explanations about the specific deductibles and out-of-pocket costs they face, explanations of benefits (EOBs) that are clear, and medical account balances.

Health Populi’s Hot Points: More than ever, a patient’s health care experience is at her convergence of her medical life, her retail life, and her financial life.

And increasingly, a consumer’s mental health is impacted in this financial stress. Note the 58% of patients told Cedar that paying for a healthcare bill was stressful.

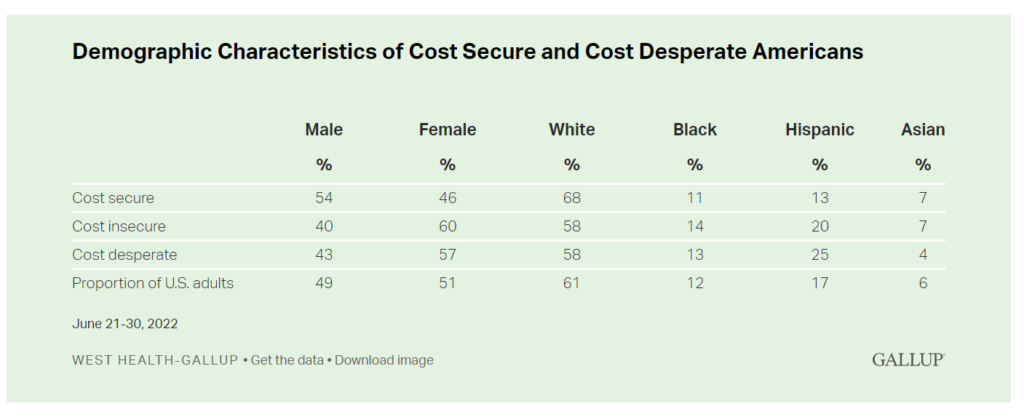

Cedar’s findings on stress and household medical bills jibes with research from Gallup noting that stress was prominent among U.S. adults struggling to pay for health care. Gallup identified three tiers of consumers facing medical bills termed as cost secure, cost insecure, and cost desperate. The less financially set patients are those who,

- If cost insecure, 32% of U.S. adults, have recently been unable to pay for care or medicine; or,

- If cost desperate, 7% of U.S. adults, are unable to pay for care or medicine if needed “today.”

Note that if one is female or Hispanic, you’d be more likely to have trouble covering health care costs or accessing quality care.

One of Cedar’s recommendations for addressing the patient-payer experience challenge is for patients to discuss their financial distress with their physicians, as recommended by Caitlin Donovan of the Patient Advocate Foundation.

Because finances and health are so inter-related in America, “that has to be a conversation.”

By doing so adds yet another work-flow to already-stressed physicians and their office staff, too often lacking the granular level of detailed information to address patients’ specific health-finance situations.

That then begs the question: where should this conversation happen where it can be most constructive and problem-resolving? This reminds me of our adding the conversation of social determinants of health into physician encounters….when the root causes of these risks come from well outside of doctors’ and hospitals’ control and influence.

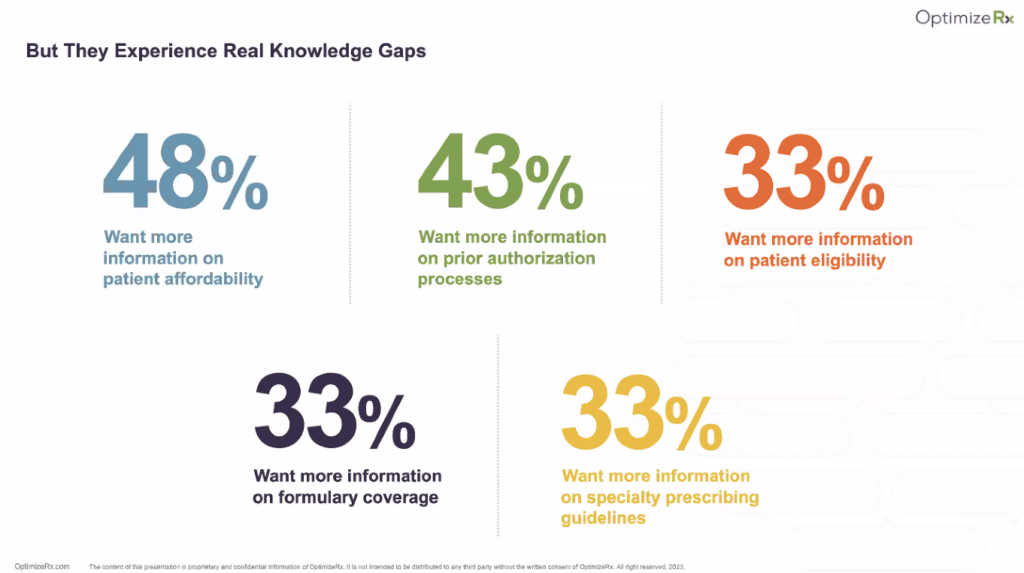

OptimizeRx hosted a webinar yesterday on Omnichannel, AI and the ‘Next-Best Action’ — looking at the future of physician engagement through the lens of pharma.

These five data points come out of the survey data which polled physicians and found that three-quarters of them report difficulty staying up to date on new therapies — and 48% want more information on patient affordability.

As Mark Bard, who leads the DHC Group, succinctly put the clinicians’ need: “Help me, help my patients.” And he rightly said that sentiment goes double if the physician works in oncology dealing with high-cost specialty drugs (for more on this see this Health Populi blog post on the subject).

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for