As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report.

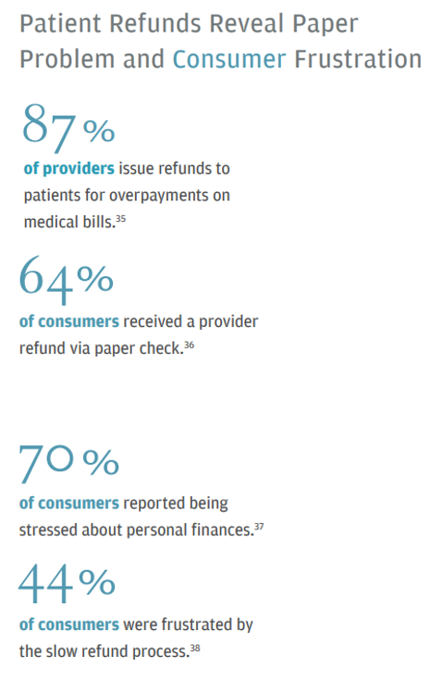

The overall takeaway for patients in this study is that health care is disconnected from consumers, in the words of the JPM/InstaMed report. Paper checks are still a go-to form of payment to patients and plan members, and there remains lots of confusion among patients when it comes to up-front pricing and eventually the EOB statements resulting from the claims payment process.

This report compiled quantitative data from payments processed on the InstaMed network amounting to some $656 billion in healthcare payments in addition to results from three qualitative surveys that Qualtrics conducted polling consumers, providers and payors in 2023. This Health Populi post focuses on the consumer-patient-as-payer aspects of the report.

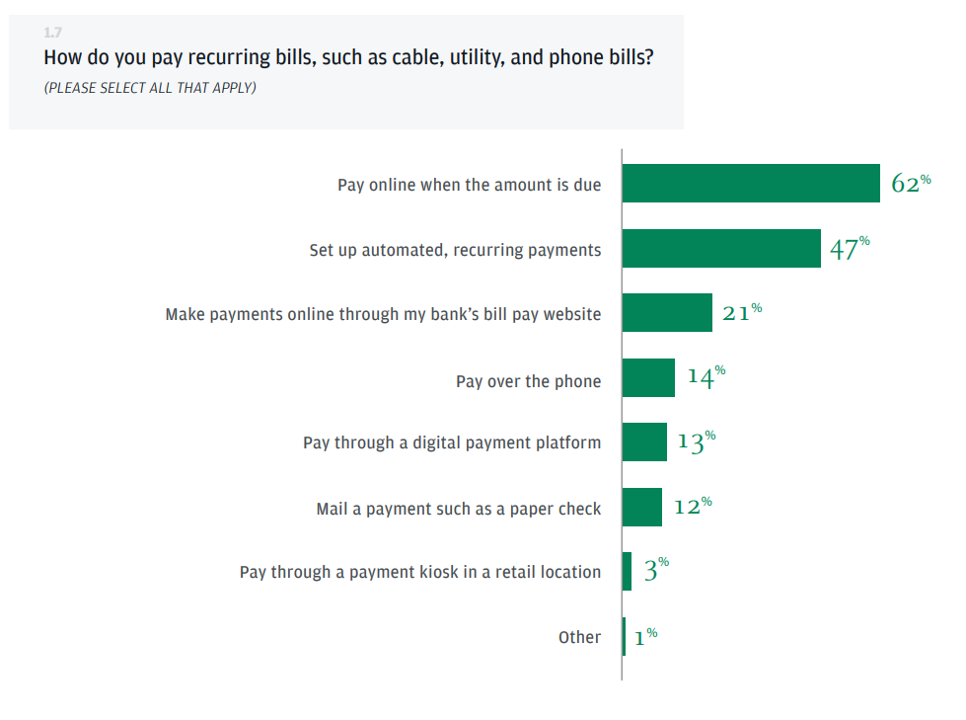

The “disconnect” between health care and patient-payers is that in peoples’ everyday consumers lives, they pay bills primarily online (when the amount is due) as well as via automated payments for recurring bills.

This is the modus operandi for bill payment among U.S. consumers, who in the words of JPM/InstaMed, “eclipse providers with digital adoption.”

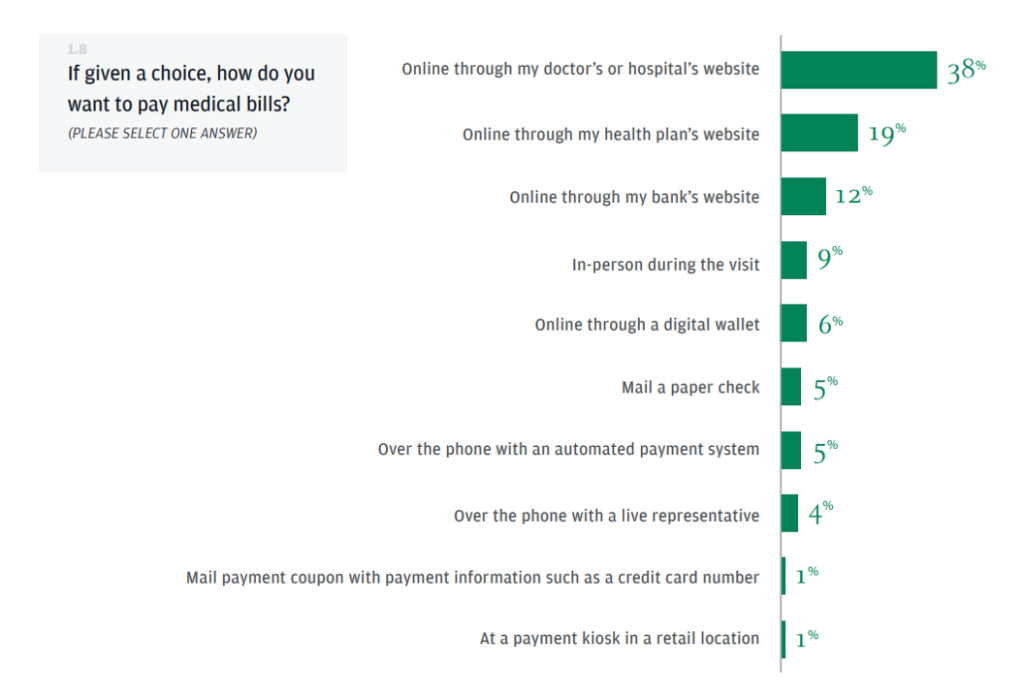

In the best of all possible medical payments worlds, U.S. consumers would prefer to pay those bills online through their doctor’s or hospital’s websites (for 38% of patients). That’s twice as many patients who would prefer to pay their health care bills on doctor’s or provider’s websites versus online through their health plan’s website (19%).

Mailing a paper check? That garners only 5% of patients’ preferences.

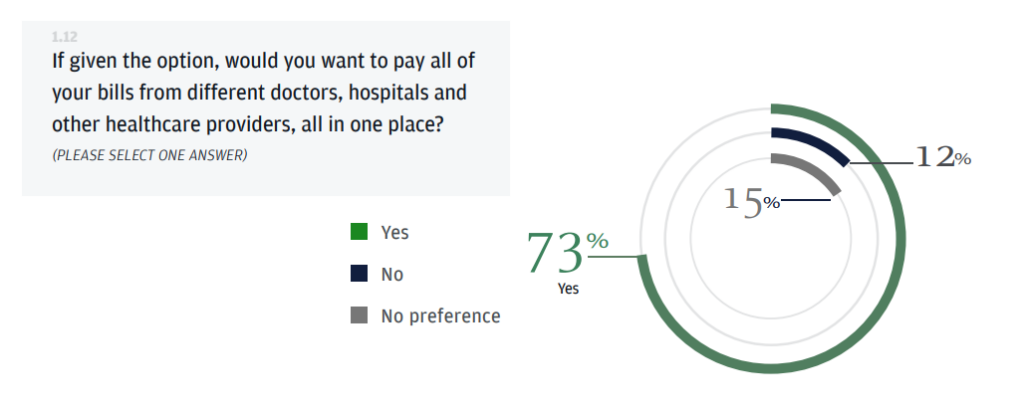

A payment Holy Grail for patients would be to be able to pay all medical bills from different doctors, institutions, and other sources of bills in one place — noted by three-fourths of consumers.

“A new payment infrastructure is demonstrating that change is possible and can have positive impacts in healthcare,” the report concludes. “The data clearly show that when innovative options are implemented, growth and optimization soon follow.”

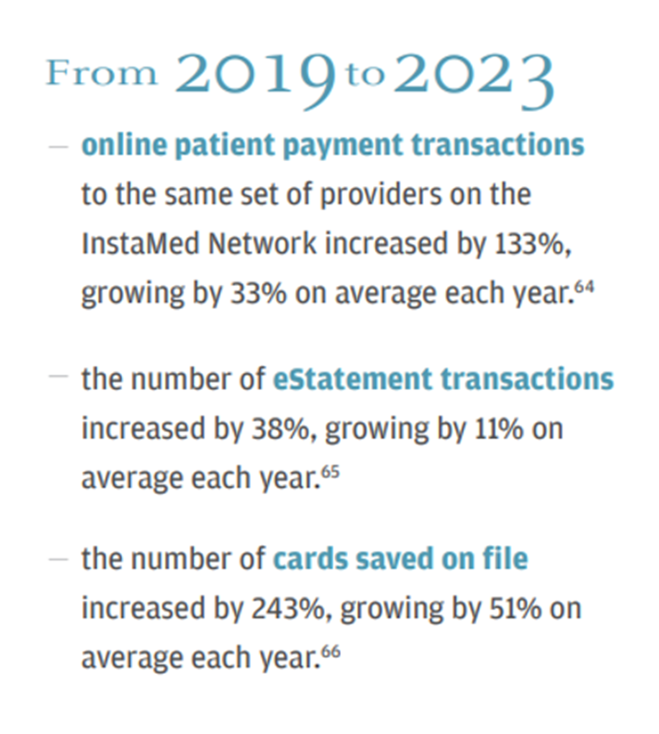

Health Populi’s Hot Points: This last graphic includes three data points illustrating that consumers have been shifting their payment behavior online and via digital formats since 2019. Patients-as-payers are using credit cards much more frequently, working with eStatements (opting out of paper-based communications as they have done for other bill types), and submitting payments online — InstaMed noting their online patient payment transactions have grown 33% per year between 2019 to 2023.

Further bolstering the rationale for providers and plans to invest more in digital and online patient payment transformation, Qualtrics found that 63% of consumers would be comfortable with AI making the payment process easier.

The financial lives of patients in America continues to play out in U.S. consumers’ broader health care experiences as financial health is baked into peoples’ overall sense of health and well-being. I’ll be further exploring the “health care consumer experience stack” at the upcoming AHIP conference in June, wanting to communicate this important point to plans and health systems for whom the Paper Chase is also still a major work flow as well as for their patients-members.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're