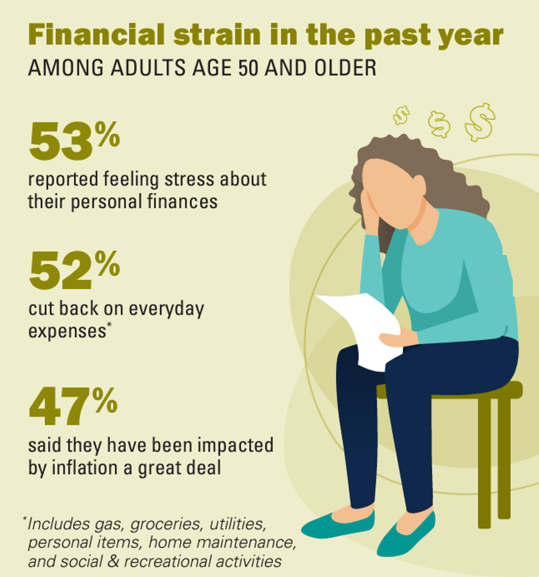

Over one-half of people 50 years of age and older in the U.S. have felt financial strain in the past year, resulting in 1 in 2 folks cutting back on everyday expenses like groceries and gas.

We learn that nearly one-half of people 50 and over say they’ve been impacted by inflation “a great deal” in Making Ends Meet: Financial Strain and Well-Being Among Older Adults, the latest report from the Institute for Healthcare Policy and Innovation’s National Poll on Healthy Aging based at the University of Michigan (my alma mater).

The poll was conducted by NORC at the University of Chicago for IHPI and administered online and via phone in February and March 2024 among 3,379 adults age 50 to 101.

Underneath the top-line stat of roughly 1 in 2 older (over 50+) Americans facing financial distress, note that younger people 50-64, women more than men, and people of color are more likely to have faced cutbacks in their everyday expenses in the past year.

Furthermore, it’s people in poor or fair health that are much more likely to face household financial cutbacks compared with their healthier older peers, as well as those in poor or fair mental health — the latter, but a factor of 50% more (76% cutting back expenses vs. 49%).

What kinds of expenses were older Americans cutting back? These took the form of discretionary spending (among 47%), saving for the future (29%), 19% using credit cards without paying off the monthly balance, 15% cutting back on necessities.

One in four people 50 and over said they or someone in their households had taken money out of their savings or retirement plan to cover spending.

The U-Michigan Poll team noted that health problems can further exacerbate due to financial strains, leading to poorer health.

Health Populi’s Hot Points: These latest insights into older Americans’ financial well-being provide important context for considering what the implications of the Project 2025 policy paper could be for older people in the U.S. under a Republican (which for the 2024 GOP side of ledger would mean a Donald Trump) Administration starting in 2025. The coalition of over 100 organizations behind the initiative is led by The Heritage Foundation.

Officially termed “The 2025 Presidential Transition Project,” this 922-page report addresses five areas of policy goals:

- Taking the Reins of Government

- The Common Defense

- The General Welfare

- The Economy, and,

- Independent Regulatory Agencies.

The Project 2025 website notes the document culled input from over 400 “scholars and policy experts.” A review by CNN found that at least 140 people who had worked for President Trump have been involved with Project 2025.

For some specifics on Medicare, start in the section “The General Welfare” on page 283, and you can read the following:

“When our Founders wrote in the Constitution that the federal government would ‘promote the general Welfare,’ they could not have fathomed a massive bureaucracy that would someday spend $3 trillion in a single year….Approximately half of that colossal sum was spent by the Department of Health and Human Services (HHS) alone — the belly of the massive behemoth that is the modern administrative state.”

That sets the stage for the document’s mindset on public health and health citizenship.

Two paragraphs later, the chapter goes further into the hostility toward public health:

“HHS is also home to the Centers for Disease Control and Prevention (CDC) and the National Institutes of Health (NIH), the duo most responsible – along with President Joe Biden — for the irrational, destructive, un-American mask and vaccine mandates that were imposed upon an ostensibly free people during the COVID-19 pandemic.”

There is much more detail underneath these paragraphs on health for women, for the LGBTQ+ community, among other population groups, but I’ll focus here on Social Security and Medicare. A few of the specific policy prescriptions relevant to the subject of the U-Michigan National Poll on Healthy Aging would be the report’s proposed,

- For Social Security, Project 2025 discusses cuts to Social Security and increasing the full retirement age from 67 to 70. The Alliance of Retired Americans calculated that this proposal would amount to a cut of nearly 20% in lifetime benefits for each new SS beneficiary.

- For Medicare, Project 2025’s plan identifies Medicare Advantage (MA) the default enrollment option for newly-eligible Medicare enrollees. MA is not always the program of choice for older Americans who may be dealing with chronic conditions or otherwise need out-of-network specialty care. Furthermore, MA plans do not always work well for Americans living in rural areas.

A June 2024 poll conducted among 1,000 registered voters by Navigator on behalf of the health advocacy group Protect Our Care found that most Americans opposed the health care policies published in Project 2025. The chart here illustrates the various health policies polled and the opinions of Democrats, Independents, and respondents who self-described as Non-MAGA Republicans or MAGA Republicans.

Specifically, 78% of U.S. adults said cutting Social Security benefits by raising the retirement age would “hurt the country,” which included,

- 90% of Democrats

- 81% of Independents

- 71% of Non-MAGA Republicans, and,

- 58% of MAGA Republicans.

If you want to know more about Project 2025, check out the website linked above to explore the original document for exact language in each policy area. For further coverage on the blueprint’s implications for Medicare, Social Security, and other policy areas, here are some touch points that may be useful:

- In Newsweek, What Project 2025 Could Do to Social Security?

- In Yahoo Finance, What a Trump Presidency Could Mean for Social Security in 2025

- In Kiplinger (the financial planning magazine), Project 2025 Tax Overhaul Blueprint: What You Need to Know

- From the Georgetown University McCourt School of Public Policy, Project 2025 Blueprint Also Includes Draconian Cuts to Medicaid

- In Rolling Stone, A Guide to Project 2025, the Right’s Terrifying Plan to Remake America

- From the Alliance for Retired Americans, Fact Sheet: Project 2025

- From The Hill, What is Project 2025, Heritage Foundation’s outline of conservative priorities?

In closing out this post, I’ll conclude with a quote from the U-Michigan National Poll on Health Aging report’s press release:

“Despite the slowing of inflation, higher costs over the past couple of years have had lingering consequences for debt and savings,” said Indira Venkat, AARP Senior Vice President of Research. “Every adult in America deserves to retire with dignity and financial security, yet recent AARP research shows that among adults age 50+ who are not yet retired, over 1 in 4 today never expect to retire and 1 in 5 adults have no retirement savings at all.”

Here, the AARP leader notes the Association’s lens on older Americans’ financial health and need for a safety net — which was the original purpose for Medicare’s launch in 1965. Given the likelihood of older Americans voting as a bloc to prevent negative changes to Medicare and Social Security, seniors and those closer to retirement — with an emphasis on women and lower-income Americans — should become more informed about the policy proposals embedded in Project 2025.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're