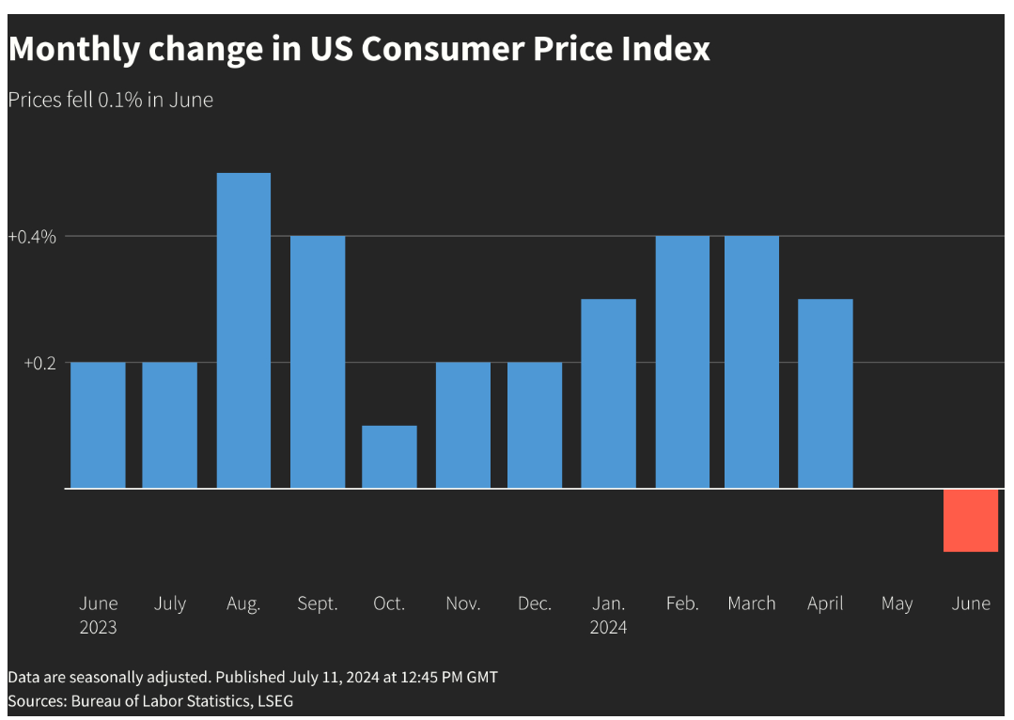

The U.S. Bureau of Labor Statistics had good news for American consumers long-facing inflation for household spending over the past couple of years, announcing on July 11, 2024, that the general consumer price index (CPI) fell, lowering real prices for people buying airline tickets, used cars and trucks, communication, and petrol to fill auto tanks.

That positive economic news did not extend to medical care and personal care, the BLS reported, whose costs increased by 3.3% and 3.2%, respectively. (Motor vehicle insurance costs grew a whopping 19.5% in the report, FYI).

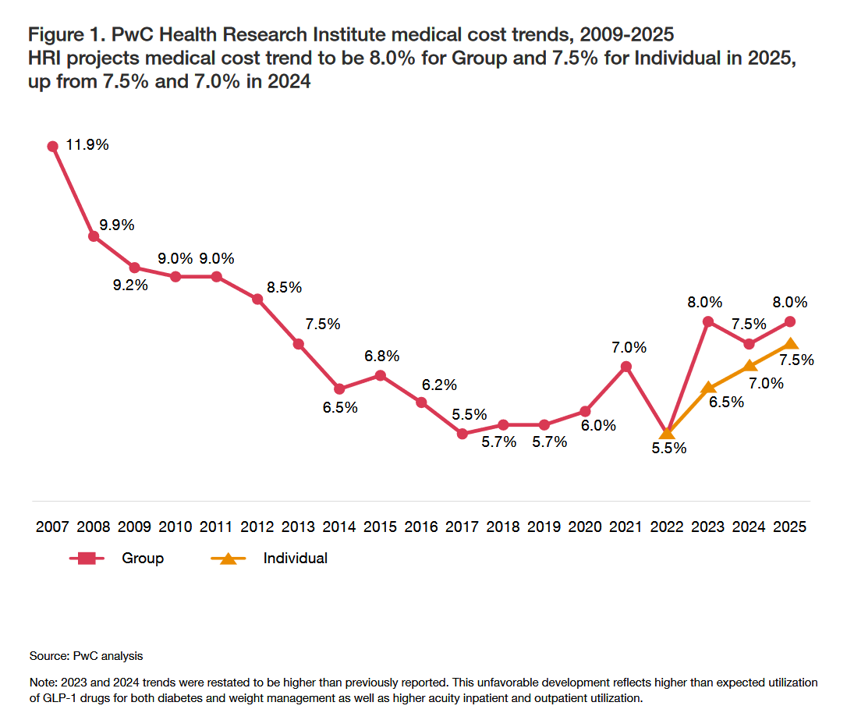

Following the BLS report on the CPI for June 2024, PwC published their new annual report from PwC titled Behind the Numbers 2025 tells us that commercial health care spending is expected to grow some 8.0% for Group plans and 7.5% for Individual health plans — increasing from 7.5% and 7.0%, respectively.

As PwC’s line chart illustrates, the 8.0% growth for group health insurance plans is the highest rate of medical cost trend growth since 2012. Health plan cost trend dramatically fell in 2022, thereafter rebounding as patients returned to medical care after a period of “medical distancing,” avoiding in-person care whether in hospital outpatient departments or doctors’ offices.

What’s driving costs up is health care providers passing operating expense costs on to health insurers, which the latest Altarum Institute July 2024 Health Sector Economic Indicators Brief details.

PwC also identified several key “inflators:” GLP-1 drugs, greater patient acuity leading to more service utilization, and the rising demand for behavioral health services.

“Deflators,” factors that could lower costs in 2025, include biosimilar prescription drugs coming to market, and greater attention to integrating care across the continuum that, when effective, can lower spending.

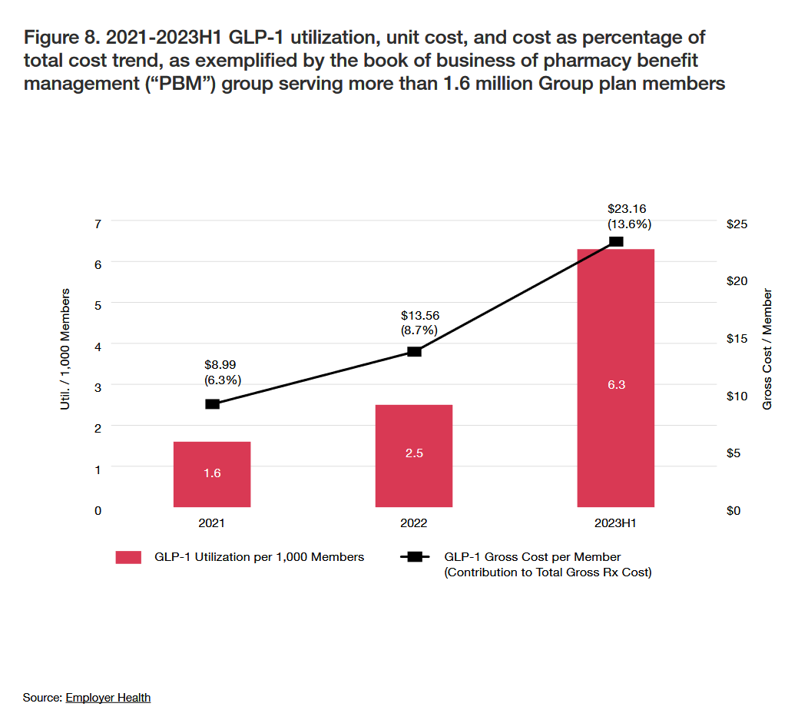

We’ve discussed the hockey-stick rise in the adoption and persistent use of GLP-1 drugs for managing diabetes and obesity here in Health Populi. This graph diagrams utilization, unit cost, and cost as a percent of overall medical cost trend: note that by the middle of 2023, GLP-1 drug costs for Group health plan members comprised 13.6% of a major pharmacy benefit management (PBM) company, shown in the third bar. Each red bar quantifies the GLP-1 utilization per 1,000 Members of the plan, from a low of 1.6 in 2021 to 7.3 in 2023H1.

In dollar terms, the math works out to a gross cost per member of $8.99 in 2021 rising to $23.16 in 2023H1.

Other new treatments that have come on-stream or will do so in 2025, particular in the central nervous system/CNS category and neurological conditions are also expected to drive up costs in 2025.

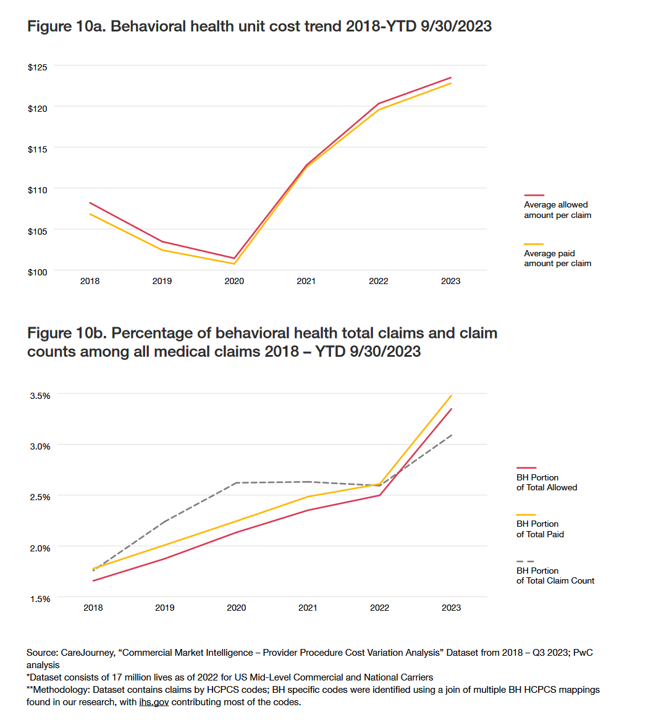

Note, too, the driving cost-force of behavioral health, which has grown in adoption as the COVID-19 pandemic revealed the unmet and fast-growing need for mental health care — across the generations. This is where telehealth has filled the gap for demand, as the supply of therapists has been poorly distributed and, at the same time, taboo for getting care declined with the mainstreaming acceptance that mental health is embedded in overall health and well-being.

The line chart shows us that from 2020 onward, the unit cost trend for behavioral health spiked to 2023 from about $100 to $125m and that behavioral health claims as a percent of all medical claims more than doubled between 2018 to the third quarter of 2023.

[As a sidebar, consider this research in JAMA Psychiatry published this week on the relationship between mental health and medical debt in America].

In addition to considering inflators that increase costs and deflators that can reduce spending, PwC suggests we also consider some trends that could move this needle up or down, such as CMS price transparency, the implementation of GenAI, prospects for Medicaid, the impact of the No Surprises Act of 2022 (on in-network vs out-of-network utilization — think ERs and radiology, for prime examples), and implications of the Inflation Reduction Act (IRA) especially on prescription drug pricing.

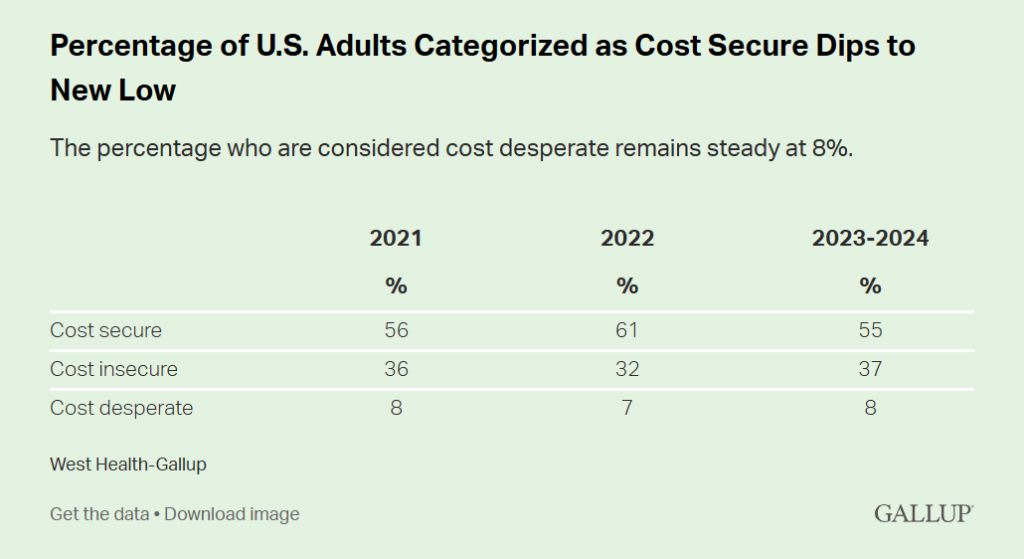

Health Populi’s Hot Points: Affording health care is a greater challenge for more Americans these days, the latest West Health-Gallup Health Care Affordability Index research revealed this week. See here the level of cost-insecurity rose to 37% in 2023-24 from 32% in 2022. At the same time, the percent of U.S. adults seen as cost-secure fell from 61% in 2022 to 55% in 2023-24.

A third tier is the cost-desperate, defined as people who report being unable to pay for health care and prescription drugs, saying they would not have access to affordable quality care “today.” West Health + Gallup detail several scenarios of people who are cost-desperate in 2024 versus folks who are cost-secure. The person who is cost-desperate would be at least 10X more likely to have cut back on utilities and food to pay for medical care in the past year. That person might also be 7X more likely to have had a member of their family or a friend die in the past year after not receiving necessary medical care due to an inability to pay for it.

In their conclusion of the Index analysis, West Health + Gallup points to some 72 million people in the U.S. (equal to one in 3 U.S. adults) who avoided seeking medical care due to cost in the past 3 months. One-third were specifically worried about paying for prescription drugs in the next 12 months, an increase from 25% in 2022. Millions of seniors (8 million, the report quantifies) in Medicare were also part of this large contingent of health citizens concerned about their ability to access medicines. This will remain on the minds of many voters who will prioritize health care access as an issue driving them to the polls in November 2024.

Thank you FeedSpot for

Thank you FeedSpot for