With 70 different clinical trials for GLP-1 drugs in process with the FDA, payers — and other stakeholders in the health care ecosystem — have the semaglutide-SENSE top of mind, based on my ongoing updating of this fast-moving market space.

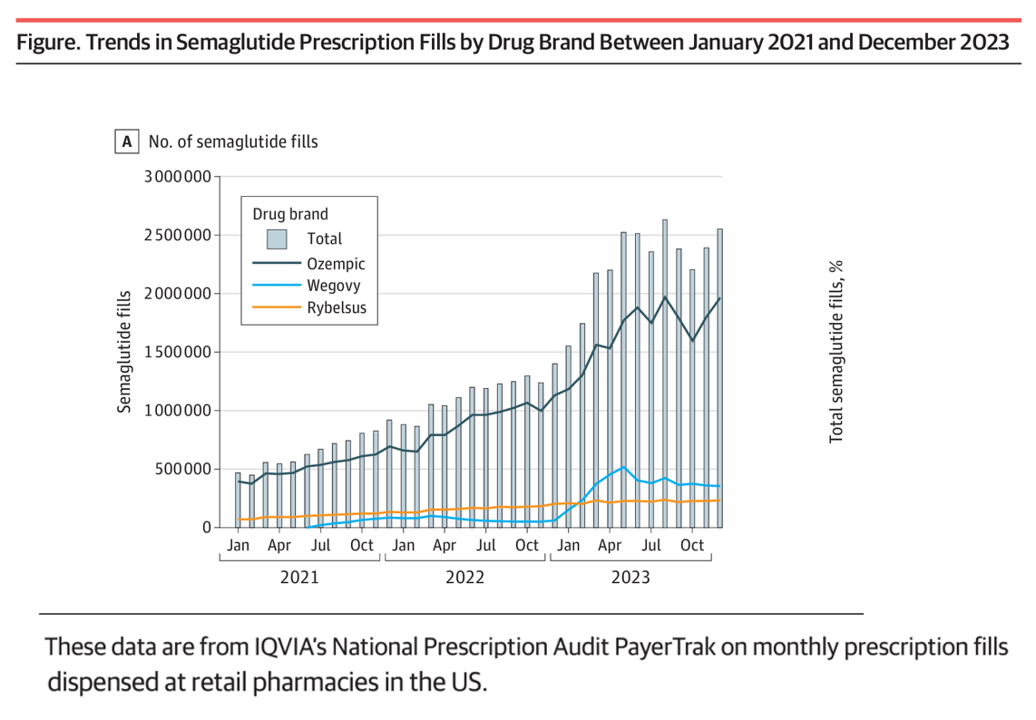

For overall market context on pace-of-growth in adoption, check out this chart from a JAMA Health Forum research letter on Prescription Fills for Semaglutide Products by Payment Method, published August 2nd.

The study was based on the IQVIA National Prescription Audit PayerTrak data which captures 92% of Rx’s filled at retail pharmacies in the U.S. The bar and line chart here shows the trajectory of 3 GLP-1s from January 2021 to the end of 2023: Ozempic, by far the most-prescribed of the three medicines represented over 70% of the fills in the period; Wegovy and Rybelsus were adopted at a much lower rate by late 2023.

By December 2023, there were nearly 2.6 million prescriptions for semaglutide filled at retail pharmacies.

Now we tie that utilization to the source of payment. In 2023, commercial payers covered most of these prescription drug fills for all three brands in the study:

- 61% of Ozempic fills were covered by commercial insurers, 28.5% by Medicare Part D, and nearly 10% by Medicaid

- For Wegovy, 9 in 10 Rx’s were covered by commercial plans, 8% by Medicaid, and only 1% by Medicare Part D, and,

- Rybelsus prescriptions were covered by commercial payers (58%), 33% by Part D, and just under 9% by Medicaid.

In their conclusion, the researchers cite limitations of the study which includes a call for future research into how changes in Medicare Part D and Medicaid coverage restrictions could drive disparities in access to these “essential medications,” in the words of the authors.

Now consider these findings in light of the commercial payer segment — namely, how employers that cover health care for workers are wrestling with the cost of GLP-1s as a component of medical trend as well as overall compensation. The top-line thing to know here is that David Cordani, CEO of Cigna (which owns the PBM Express Scripts with a market share of 23%) said in the company’s recent earnings call for 2Q2024, “This class of drug is on tap to be the number 1 pharmacy benefit trend driver for plans of all sizes this year. The impact will grow.”

The International Foundation of Employee Benefit Plans (IFEBP) surveyed companies in May 2024 and found that 57% provided coverage for diabetes only (an increase from 49% in 2023( and 34% provided coverage for both diabetes and weight loss (up from 26% in 2023).

“Employers indicated that 8.9% is the average representation of GLP-1 drugs used for weight loss in total annual claims for their organization, an increase over the 2023 average of 6.9%,” the IFEBP calculated.

This is one data point informing various companies’ and payers’ shaping effective strategies for managing this fast-growing, high-cost category. A new study from Gallagher, published July 30th, covered the firm’s annual 2024 U.S. Physical & Emotional Wellbeing Report.

Gallagher found that one-half of employers in their study were including weight management programs in physical wellbeing initiative — making mindful decisions around insurance coverage for GLP-1s for obesity. These are managed with utilization management programs and prior authorizations. Gallagher notes that “choosing not to cover new WLMs (weight-loss medications) creates a distinct challenge to benefits design,” given that some of the drugs have been approved to treat diabetes and increasingly other medical conditions (e.g., watch for sleep apnea indications).

I’ll add two other lenses on the latest GLP-1 studies that I’m finding useful for my client work — one on safety and risks of online semaglutide purchases, and one on health consumer impacts of GLP-1 use on grocery store shopping and household spending.

On the safety/risk front, JAMA Network Open published a research letter on August 2nd which observed that GLP-1 products actively being sold without prescription by illegal pharmacies has found vendors shipping unregistered and falsified products, in the words of the researchers.

U.S. poison centers have reported a 1,500% increase in calls related to semaglutide,” the authors note, highlighting the need for pharmacovigilance of the online channeling of these medicines. In addition, some online pharmacies also engaged in scams resulting in non-delivery of the products paid for by the online shopper.

For those consumers going off the traditional retail pharmacy grid, some have been drawn to Hims & Hers which received permission to compound GLP-1 medicines due to the FDA giving the drug shortage status. Blake Madden of Hospitalogy wrote this week that, “In the midst of the shortage, we’re seeing this obesity play going exactly as expected. For context, Hims launched its comprehensive weight loss portfolio in December 2023 and complemented this offering in May 2024 by announcing GLP-1 access for Hims customers – oral medication kits first for $79/month and then compounded GLP-1 injections for $199/month.” Blake noted that Hims is offering this in 30 states so far through its DTC telehealth platform.

For GLP-1 patient-consumers, Grocery Doppio’s data demonstrates that their grocery basket size has shrunk, reducing spending at the supermarket. The biggest losers have been products and their manufacturers in the snack and soda aisles of the store (#2 in the four matrix chart here). The grocery store winners were healthy alternatives especially lean proteins, meal replacements, and health snack alternatives (#3 in the chart).

Grocery Doppio polled U.S. shoppers from January 1, 2022 to June 20, 2024.

Health Populi’s Hot Points: Among Grocery Doppio’s recommendations for restoring GLP-1 consumers’ grocery shopping loyalty are providing in-store nutrition education and increasing digital marketing efforts on health and food-as-medicine.

Consumers’ growing ethos of seeing food as part of overall household health and self-care is the larger phenomenon under which Grocery Doppio’s reco’s fit. We know the use of GLP-1s, when they occasion very fast weight loss, can lead to muscle loss and other unintended side effects that food, protein-infused beverages, and vitamins and supplements can help mitigate. The role of grocery stores with co-located pharmacies and dietician/nutritionist human capital are welcome additions to self-care consumers, especially when other community touchpoints can be brought into a consumer’s personal health ecosystem. Collaboration is called for when it comes to weight loss, for every payer’s ROI — especially the consumer’s.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for