In the U.S., aging in and staying at home is a priority for most people over the age of 45 — and for nearly one-half of younger people between 18 and 44 — we learn in Best Buy Health’s Research Brief discussing the company’s survey of 1,000 U.S. consumers.

Best Buy Health, the health-focused operation which is part of the electronics retailer Best Buy, worked with Sage Growth Partners to assess 1,000 U.S. consumers, 18 years and over, on their perspectives on health care, technology, aging in place, and caregiving. The research was fielded in April 2024.

Best Buy Health (BBH) describes itself in terms of, “creating a future where delivery of healthcare in the home is tech-enabled and human0centered, by developing solutions for consumers to get well and stay well on their own, or with the support of trusted healthcare providers.”

The “how” is through, in BBH’s words, “curating the right technology, delivered at the right time, and connect(ing) it with a layer value added services to deliver personalized care at the home — at scale.”

This post summarizes some key findings on the consumer demand side for staying home, empowered and enabled by various technologies that can support independent aging, living, and medical care as more acute services shift from hospital-to-home.

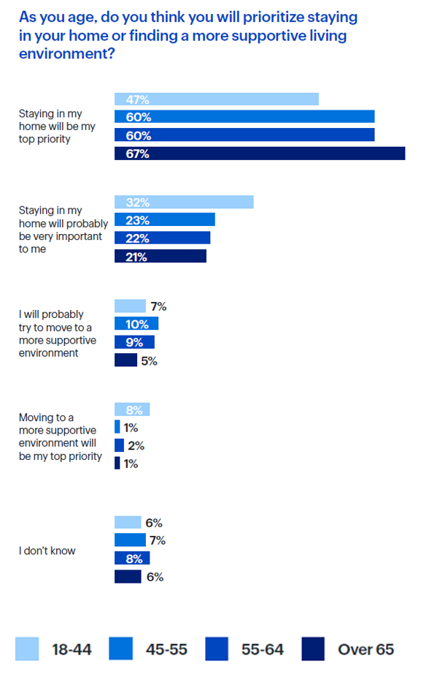

First, in terms of demand and expectations, here’s the top-priority most consumers point to in terms of staying in their home. The older we get, we can see from the progressively longer bars in the top-line, the more important staying in our homes seems to become.

This reminds me of that phrase you often see on auto bumper stickers, “Objects in mirror are closer than they appear.”

Interestingly, fewer younger consumers feel “very well supported” in their current living environment — that would be 28% of those 18-44, 35% of those 45-55, and 46% of people 55-64.

There is growing understanding of various types of medical care moving to and/or enabled at home for folks themselves or someone they care for.

For hospital-at-home, 7 in 10 or more people across all age groups would be interested, for treatment equal to services provided in a traditional hospital setting but delivered in the comfort and safety of home.

For early discharge monitoring, being moved from inpatient monitoring to home monitoring with follow-up care and support, again in the comfort and safety of that patient’s home.

For chronic disease management programs, vast majority interest across all age groups to support people managing long-term health conditions such as asthma, diabetes, or hypertension — involving a mix of education, lifestyle support changes, monitoring and tailored medical interventions.

The study asked consumers about their interest in various medical technologies that can be used to accomplish health goals, including telehealth applications, smart monitors to track vital signs, fall detection symptoms, and voice-controlled assistive technology (think Alexa-meets-healthcare).

Across the four technologies studied, we see that more younger people (that is, 18-44 in this survey) are generally more interested in each technology — roughly 3 in 4 of this youngest cohort — than older people, who are most interested in fall detection symptoms, and smart monitors. Still the over-65 group in large numbers — roughly one-half — would be interested in telehealth, smart monitors, and fall detection systems.

It’s the voice-controlled tech that’s less attractive to the oldest age group of consumers, but still garnering 41% of the group’s interest in voice-tech to help accomplish health goals.

Health Populi’s Hot Points: A key component — and potential barrier — to the scaling of moving medical care to an older person’s home is caregiving. That is, is there a human being in the patient’s/client’s life who can take on the quarterback role that consumes huge time, financial, and emotional chunks of that loved one’s life.

The BBH research doesn’t speak to the “human OS” side of caregiving, but did explicitly ask caregivers about several key barriers to moving care home: most notably, cost, by far the top challenge in this scenario, and then privacy, and several “lack of knowing how” aspects of the home-based medical technology including not knowing…

- How to use it

- How to fix it if it breaks

- How to install it

- Where to buy it

- How to share information with the doctor.

Of course, Best Buy Health has responses for those issues, starting with its own business model and staffing of knowledgeable digital health technicians, as well as collaborating with local health systems for continuity of care, trusted relationships with clinicians, and a willing group of health care administrators who are seeing the future of care delivered in an omnichannel fashion and with greater consumer-and-caregiver engagement in the process.

Today, Verizon announced its entry into the smart ring marketspace in collaboration with Ultrahuman’s Ring AIR product line. Smart rings have gained a lot of traction with some health consumers keen to adopt a wearable technology that lived beyond the wrist.

The category has competition including OURA, the Samsung Galaxy and Whoop, which I discussed here in Health Populi.

Let me leave you with a recent conversation featuring Jason Oberfest, VP of OURA, hosted by Parks Associates as part of their perennial Connected Health Summit held earlier this month. The Parks team recently forecasted that 12% of U.S. householders were planning to acquire a smart ring in the next six month, shown in the bar chart comparing smart ring demand with the intent to purchase smart watches, fitness trackers, GPS sports watches, and hybrid watches.

Jason said,

“Too many (digital health) solutions focus on visualizing the raw data as the main benefit. For instance, how many hours did I spend doing this thing, how much energy did my HVAC consume, what is the water quality reading? Developers need to get beyond quantified self / quantified house to focus on the benefit in context for the user to have more mainstream uptake.”

We have a concept for smart homes in our work and experience, and we surely continue to evolve our concepts of useful, evidence-based digital health tools. Welcome to the era of the Quantified House, which Best Buy Health — and OURA, et. al. — now enable.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a