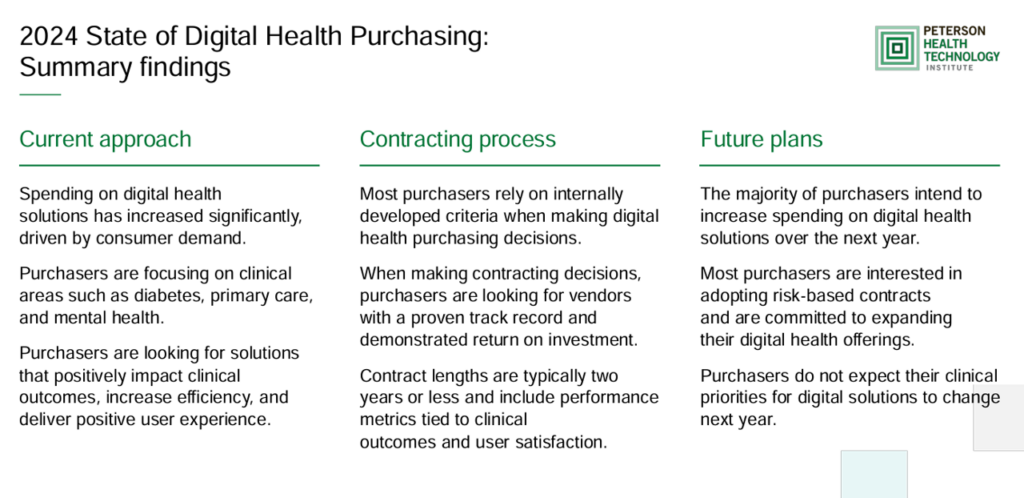

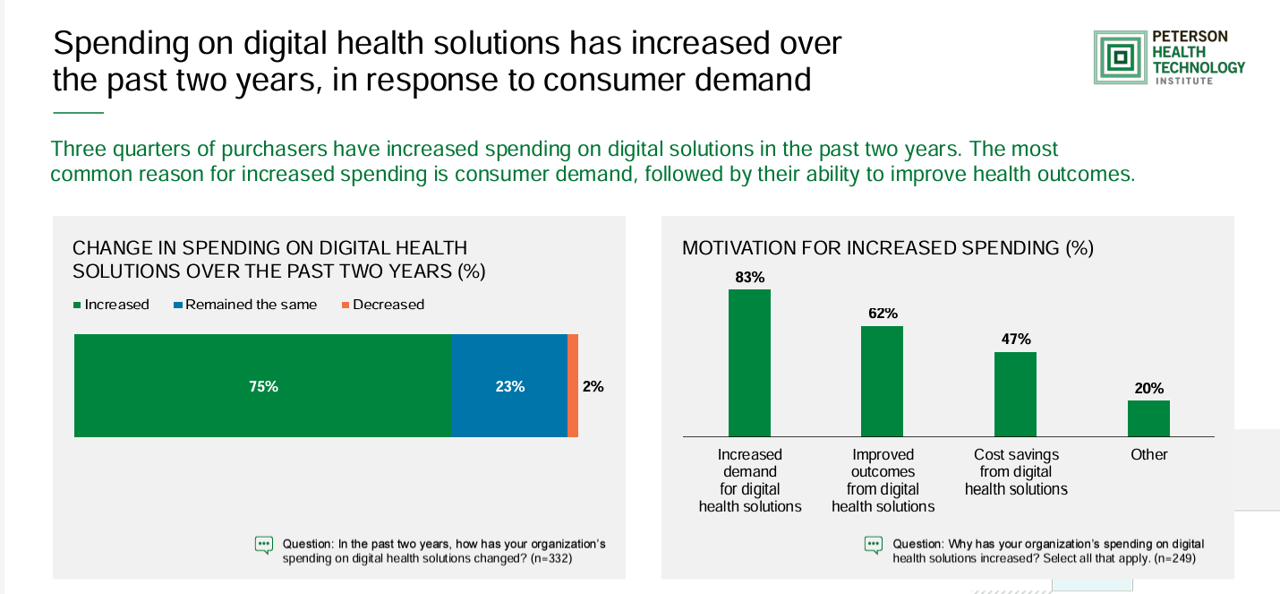

The marketing for purchasing digital health technologies is expecting to grow, driven by increased consumer demands for tech-based solutions, improved outcomes enabled through the innovations, and cost savings derived from deploying the technologies. That’s the top-line finding in the 2024 State of Digital Health Purchasing from the Peterson Health Technology Institute (PHTI).

PHTI surveyed 322 digital health decision makers working in employers, health plans, and health systems, fielding the study in July and August 2024.

3 in 4 purchasers grew spending on digital health technologies in the past two years, PHTI learned.

While most purchasers plan to increase spending on digital health tools, there is interest in adopting risk-based contracts where vendors share in the success (or lack thereof) of the implementation.

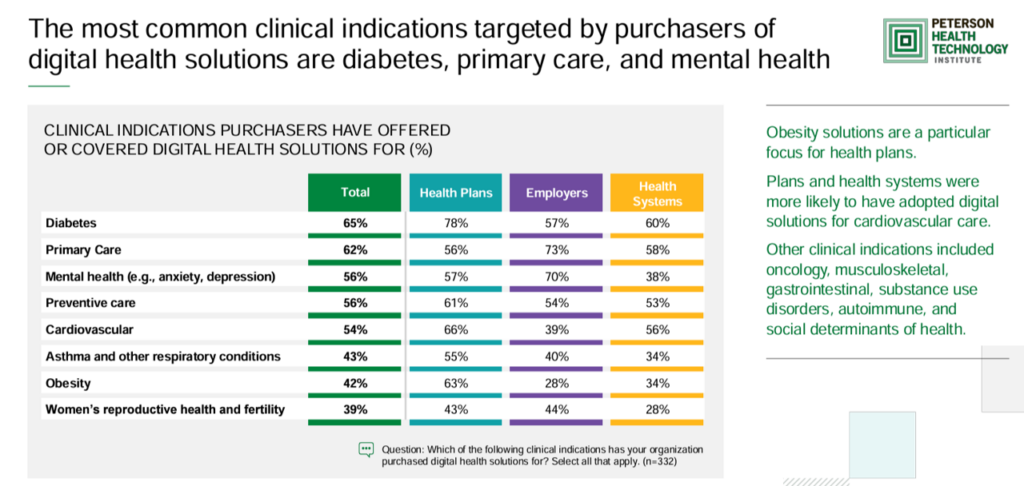

This is not a build-it-and-they-will-come business proposition anymore: digital health tools must address specific clinical conditions and deliver on outcomes. The most common conditions employers, plans, and health systems are covering via digital tools are diabetes, among two-thirds of the purchasers; primary care, for 62%; and mental health, preventive care, and cardiovascular conditions for over 50% of purchasers.

These clinical priorities vary by purchaser-type: for example, diabetes and obesity solution in particular are in highest demand by health plans. For employers, the areas most focused for digital health spending are primary care and mental health. Among health systems, the top purchasing areas clinically were for diabetes, primary care, cardiovascular and prevention.

The bottom-line for purchases is that digital health solutions should improve health outcomes, reduce spending on conditions and overall health care costs, and improve access to health care services.

Health Populi’s Hot Points: Evidence, evidence, evidence: that is crucial for tech innovators to prove out when innovating, marketing, and supporting digital health innovations.

The last chart tells us that Evidence & Outcomes is the top priority among all three purchaser types when evaluating whether to offer a specific digital health solution.

Investing in case studies and proof-of-outcomes must be part of a digital health innovator’s toolkit. All digital health technology purchasers (and increasingly, the DTC-consumer-facing market as well) will be Missourian in spirit: show-me-the-evidence. The key evidence points each purchaser might prioritize may vary, so knowing the user and customer value and values-set will be a success factor for digital health innovators who are maturing in their experience of buying, implementing, and evaluating these solutions.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're