As the annual HLTH conference convenes this week in Las Vegas, numerous reports have been published to coincide with the meeting updating various aspects of technology, health care, providers and patients. In this post, I’m weaving together several of the papers that speak to the intersection of health care, consumers, and technology – the sweet spot here on Health Populi. I hope to provide attendees of HLTH 2024 along with my readers who aren’t in Vegas useful context for assessing the new ideas and business model announcements as well as a practical summary for those of you in planning mode for health care in 2025. You’ll find links embedded for all the reports I mention.

Let’s start with the pocketbook of the patient — now a key payer in health systems’ revenue cycle management processes on the health system side, and continuing challenge for medical debt for U.S. patients. (For more on that, check out Jelly Roll, Lainey Wilson, and Valerie June’s involvement in the Power to the Patients movement).

PwC’s 2024 U.S. Healthcare Consumer Insights Survey gauged peoples’ views on health care affordability. Four in 10 consumers found health care costs management but could not afford to pay more; 3 in 10 were struggling to pay their current health care costs.

More patient-consumers are connecting the dots between the cost of care between one site versus another. Patients-as-payers seek virtual care for two key reasons: convenience and cost. And convenience actually mashes up costs for everyday people in the form of time-costs.

PwC’s research found that many consumers would prefer a virtual care visit over an in-person doctor visit, varying by age group:

More younger patients under 35 years of age prefer virtual care compared with people over 55 — but even among older people in the U.S., 50% of those 55-64 prefer virtual over F2F with a physician, and over 40% of patients 65 and over would prefer a virtual visit — a significant shift in patient preferences compared with pre-pandemic levels.

This is borne out in Deloitte’s just-published survey research into health consumers, looking into the growing disconnect between virtual health availability and consumer demand.

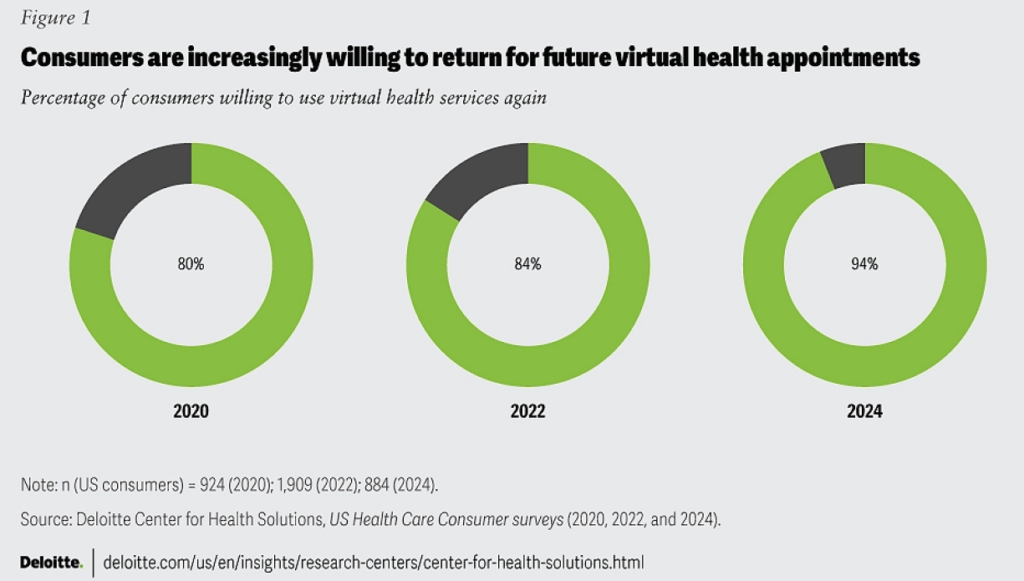

The green circle diagram from Deloitte’s report documents a growing willingness among patients to use virtual health services, increasing from 80% of consumers willing to use telehealth in 2020, 84% in 2022, and 94% in 2024.

The reasons patients prefer these virtual visits are convenience, convenience, and convenience: for access to available appointment times, for a time of day for the appointment, and for a shorter wait to get that appointment.

Then cost — 32% of patients preferred the virtual visit because it saved them money.

Research from Circana, who would not be a typical HLTH exhibitor but who provide us with great research into consumers and retail behavior, looked at The Digital Health Consumer in a September 2024 report. In this research. Circana focused on how health consumers were increasingly engaging with digital health tools as they expanded their approaches to personal well-being in terms of, first, mental and social health (for 77% of U.S. consumers), managing weight (among 59%), fine-tuning lifestyle habits for health (57%), and to boost energy (for 39% of consumers).

Circana discovered that fitness watches were the most-used health monitoring device consumers are using to support health and wellness — with 70% of people using a fitness watch or tracker. Other frequently-used digital health tools included,

- Blood pressure monitors, for 41% of consumers in the U.S.

- Blood sugar monitors, among 22%

- Blood oxygen monitors, 19%

- Heart rate monitors, 1%

- Smart/connected scale, 14%, and,

- Electronic food scale, 12%.

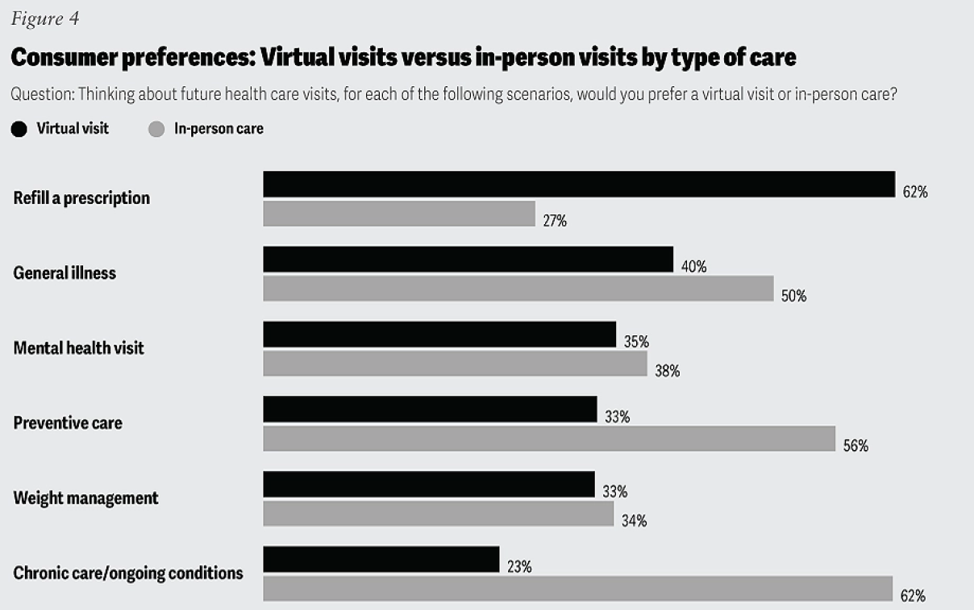

Health Populi’s Hot Points: Returning to the Deloitte consumer insights, we find that consumers value virtual visits versus in-person visits depending what services folks are looking to accomplish for their health and well-being. The greatest preference for virtual visits would be for refilling a prescription, by far the most demanded flavor for a virtual platform among 62% of consumers. Next in preference for virtual health was dealing with a general illness (40%), followed by a mental health visit (for 35%), preventive care (33%), weight management (32%), and chronic care management (23%).

I’d like to call out for a complete context-setting for 2025 the continued demand/supply gap for mental health services, which has been one category of good news in and beyond the COVID-19 pandemic in terms of (1) broad stakeholder recognition of this gap in supply and (2) greater consumer engagement in telehealth for mental health access, breaking down taboos and expanding access to care in places where people did not have easy on-ramps to therapy.

This last chart comes from our friends at the Integrated Benefits Institute who have been publishing a series of reports on mental health — this chart coming from the Institute’s report on the Social Determinants of Mental Health. Technology has helped to scale mental and behavioral health services to people with under-served demand, as well as addressing various factors of the social determinant risks that can erode peoples’ mental well-being — say, social isolation and loneliness, or lack of ability to attend a faith service which could be “Zoom-able” for a person with connectivity to the home.

Finally, check out this persona that PwC developed from this year’s health consumer research; this group of people are characterized as tech-resistant with health at-risk — likely a Medicare-covered population, at high-risk for not exercising or engaging in wellness activities — while having low digital adoption compared with five other personae in this study.

In developing services and products to scale health and well-being for all, being clear and inclusive about health consumers’ tastes and preferences, health risks and conditions, and technology realities are key to embed in our planning and design thinking. As an over-arching converging theme at HLTH is techquity mashed with sound business models, knowing how end-user patients relate to their personal health — as consumers and health citizens all — we can avoid shiny new thing syndrome and serve up useful, hopefully enchanting, tools that engage people in health and providers in scaling their services and preserving their own professional well-being.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're