For health care, there are many uncertainties as we reflect, one week after the 2024 U.S. elections, on probably policy and market impacts that we can expect in 2025 and beyond. In today’s Health Populi post, I’ll reflect on the first of several certainties we-know-we-know about U.S. health citizens and key factors shaping the American health ecosystem.

In this first of several posts on “What Stays True for U.S. Health Care Post #Election2024,” I’ll focus on U.S. consumer dissatisfaction with drug prices — across political party identification.

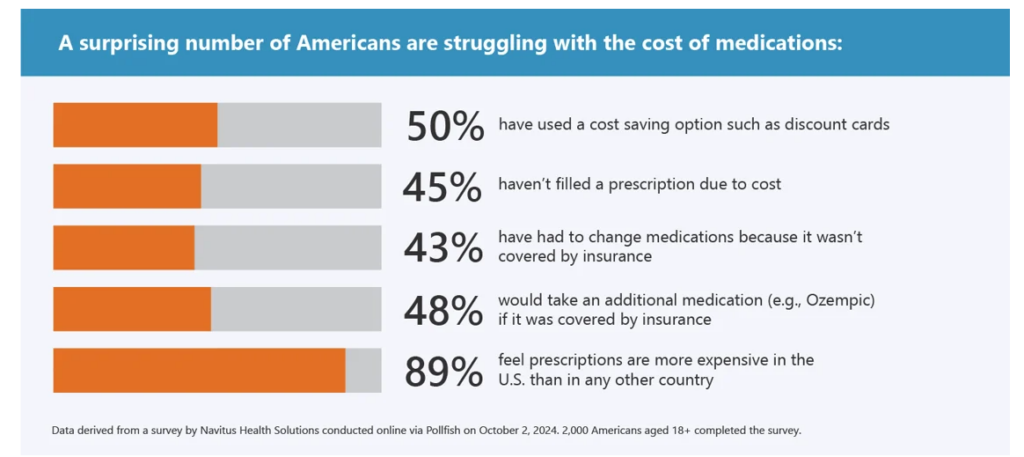

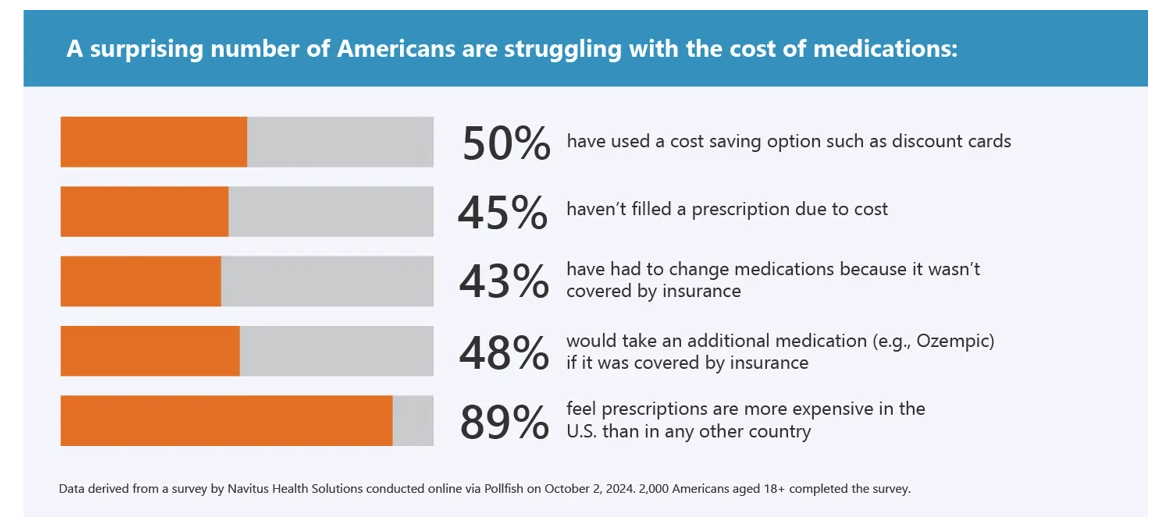

Let’s set the context with data from a recently-published study from Navitus Health Solutions exploring 2,000 U.S. insured consumers’ perspectives on prescription drug pricing and the role of PBMs (pharmacy benefit managers). Pollfish conducted this study online in October 2024.

9 in 10 insured Americans felt that prescriptions are more expensive in the U.S. than anywhere else in the world. One-half reported using a cost-saving option like a discount card.

Nearly one-half of insured consumers had not filled a prescription due to cost. At the same time, one-half of people would likely take an additional medication were it covered by insurance.

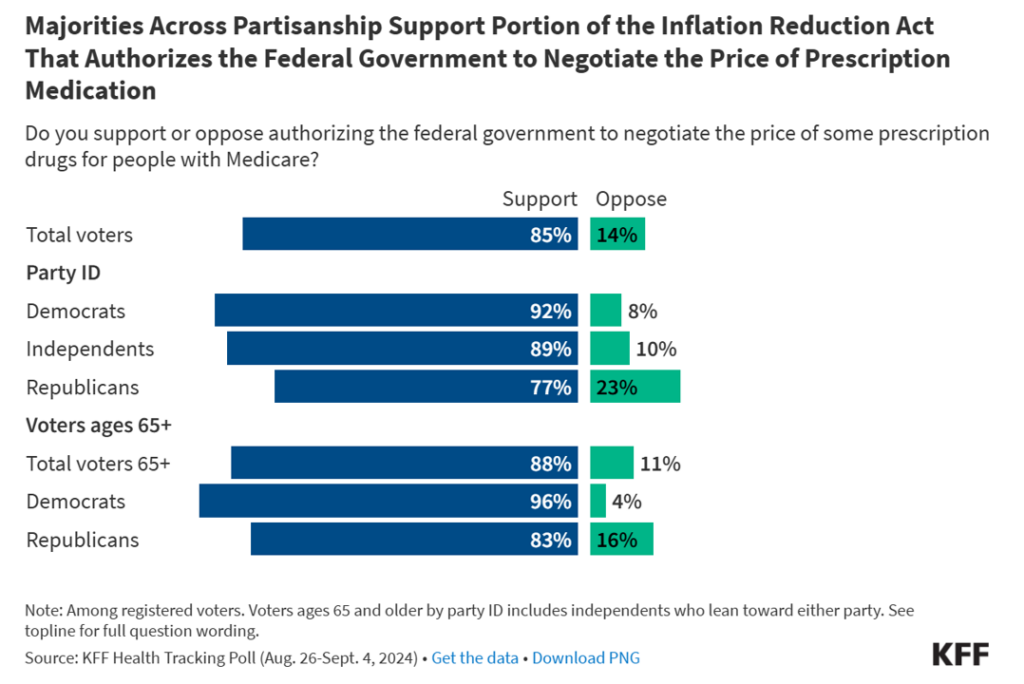

Cross-political party ID, Americans have all the feels and support for the Federal Government ot negotiate the price of prescription medications, Kaiser Family Foundation’s Health Tracking Poll found in the August-September 2024 survey. The chart here illustrates the breakdown between Democrats, Independents, and Republications — with support for drug price negotiation among between 77% (of Republications) and 92% (of Democrats). Among people over 65, that support is nearly 100% of Democrats and 4 in 5 Republicans.

Health Populi’s Hot Points: AHIP, the U.S. health insurance advocacy organization, recently published its perennial look into “the health care dollar” in the U.S. Here’s AHIP’s assessment of U.S. health spending per dollar, with hospital costs (adding inpatient and outpatient hospital costs together with ER spending) ranking first at over 40 cents per dollar, followed by prescription drug costs exceeding 24 cents on the dollar.

Because prescription medicine spending is quite visible to the patient, I’ve been commenting that the patient has morphed into a key payer for health care — thus sensitive to lack of transparency and information about their personal cost of medicines based on their health plan before that retail-moment-of-truth — the ultimate cost at the point of purchase at the pharmacy, or the receipt of an explanation of benefits determining the patient-consumer’s final cost of a medicine.

That’s the consumer-patient-health citizen side of this policy issue, which we feel quite certain about in our planning assumptions in the post-Trump (47) health policy environment. What’s uncertain is the policy-making side of things, and how the market will respond to evolving views on PBMs and policy reforms that may emerge in an “Agenda 47” environment.

Further complicating this through the market/policy lens could be attempts to roll back ACA/Obamacare provisions, Medicaid expansion or contraction depending on the individual state Governor’s point-of-view on health care coverage for their health citizens, and then the pharma industry and individual companies’ approaches to pricing, access, and patient support programs.

I’ll maintain for the planning process over the coming 1-5 years that the prescription drug line item in American households will “feel” like a retail expense depending on the family’s health issues and economic confidence in their personal and community economies. And this will be part of consumers’ mindsets and spending stressors regardless of their political affiliation.

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a