It’s the morning after the historic 2012 Presidential Election, with President Barack Obama winning a second term in the face of a sputtering economy and eventual Fiscal Cliff as of December 31, 2012. As we toast with our beverage of choice that night, we will also be worrying about our top financial concerns: how we’ll fund our retirements, and how we’ll pay for health care eventually, and now while we’re actively employed.

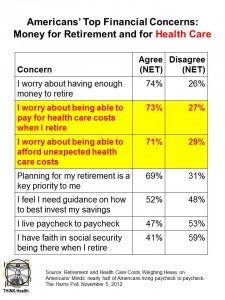

The Harris Poll of November 5, 2012, reveals that 3 in 4 people in the U.S. who aren’t yet retired worry they won’t have enough money to slow down, or pay for health care in the event that they do.

Furthermore, 71% of American adults say they’re also worried about paying for unexpected health care costs ‘now,’ as shown in the chart. That’s because nearly one-half of people (47%) are living paycheck to paycheck, with no wiggle room for spending beyond that take-home pay that’s remained relatively flat in the past several years.

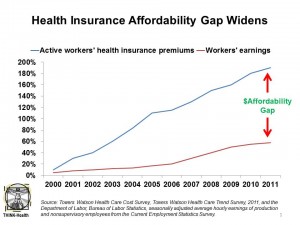

This, during a time when health care costs for families have increased much more quickly beyond wages, which have stayed horizontal.

This, during a time when health care costs for families have increased much more quickly beyond wages, which have stayed horizontal.

Harris’s SVP David Krane opines, “Rather than creating products and services that could alleviate these concerns, bringing peace of mind to their customers, the financial services industry continues to focus its marketing on products and services related to spending and further debt accumulation.”

Health Populi’s Hot Points: People rank financial health nearly as highly as physical health: in the 2008 Edelman Health Barometer, 82% of U.S. adults said personal financial health was part of whole health, following physical health, mental health, and physical appearance.

I’ve argued since this blog’s inception over five years ago — a year before the advent of the Great Recession of 2008 — that health economics are part of larger macroeconomics. People’s household health “microeconomics” play mightily into their overall spending, with employees covering 40% of annual health costs when covered by an employer. That amounted to over $8,000 in 2012 for the average family of four.

There’s a growing and necessary role for financial services companies to play in peoples’ health care. Many have taken up the revenue segment of funding for long-term care, but the Harris Poll speaks to a larger issue about personal financial security. It would behoove public policy and financial service companies to focus in on this growing concern for U.S. health citizens. The demand is there among Americans who clearly identify the concern of paying for health care. Banks and investment companies can play a crucial role in this segment of retail health, or #healthcareDIY.

Otherwise, the Fiscal Cliff looms for both the macroeconomy and the microeconomy of health care.

Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a