U.S. employers have been implementing various flavors of consumer-directed health plans for the better part of a decade. But consumers feel neither “directed” nor especially competent in managing their way through these plans.

U.S. employers have been implementing various flavors of consumer-directed health plans for the better part of a decade. But consumers feel neither “directed” nor especially competent in managing their way through these plans.

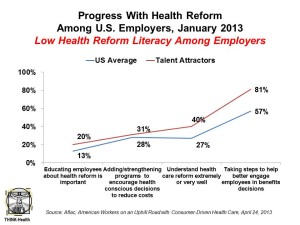

It appears that employers also have their own sort of health plan illiteracy when it comes to understanding health reform — the Affordable Care Act — according to the 2013 Aflac WorkForces Report (AWR) based on a survey of 1,900 benefits managers and over 5,200 U.S. workers conducted in January 2013.

While you might know the Aflac Duck, you may not be aware that Aflac is the top seller of supplemental and guaranteed-renewable insurance in the U.S.

While you might know the Aflac Duck, you may not be aware that Aflac is the top seller of supplemental and guaranteed-renewable insurance in the U.S.

The survey reveals an American population that’s largely unaware of the key details underlying health reform: the concept of health insurance exchanges, for example, where 76% of U.S. workers aren’t knowledgeable. But it’s not just the new-new health plan concepts that consumers don’t understand: 49% (1 in 2) Americans aren’t knowledgeable about health reimbursement accounts.

As employers shift more costs on workers, coupling their plans with medical savings vehicles like HRAs, MSAs and HRAs, employers aren’t effectiveely educating workers on how to use these plans. Over one-half of the companies polled by Aflac have in fact implemented high-deductible health plans in the past 3 years. This shift toward HDHPs will continue beyond 2013.

As workers’ out-of-pocked costs for health expenses are projected to average $3,301 by 2014, most workers (3 in 4) say they are not saving more to meet this growing OOP line item.

Other key findings from the survey are that

- 72% of consumers haven’t heard the phrase “consumer-driven health care,” and of those who have heard of it, 38% don’t understand it.

- Over one-half of workers said they’d prefer not to be more in control over their health insurance expenses and options because they will not have the time or knowledge to effectively manage it.

- 53% of workers worry they may not be able to adequately manage their health insurance coverage, leaving their family less protected than they currently are.

- Only 26% of workers agree that they’ll have better health insurance protection for their family because they will have greater control over how and where they utilize their health insurance.

- 24% say they’ll be able to save more money in the long-term by taking greater ownership in their health care expenses and options.

- 76% of consumers agree that health care reform is too complicated to understand.

- 55% of workers have done nothing to prepare for changes to the health system, with 3/4 saying, “I believe my employer will educate me about changes to my health care coverage as a result of health care reform….”

- Yet, only 13% of companies said that educating employees about health care reform is important for their organization.

Health Populi’s Hot Points: Not only aren’t workers who receive health insurance from their employers prepared to put on their consumer health hats, but they’re largely unprepared to play personal health financial managers, as well. Only 24% of workers thought they would be financially prepared in the event of an emergency or serious illness, and 46% have less than $1,000 to be able to pay for out-of-pocket expenses involved with an unexpected illness or accident. 25% of workers have under $500 to set aside for that purpose.

It’s no surprise, then, that 40% of workers would have to borrow from their 401(k) accounts, friends and family to pay for out-of-pocket costs due to an unexpected serious illness. 28% would use a credit card.

The Aflac survey paints a picture of a dis-empowered health consumer with a deer-in-the-headlights look when “health reform” and health costs are mentioned. While it’s clear the governments at both Federal and State levels aren’t prepared for implementing the Affordable Care Act, they’re in good company: neither consumers nor employers seem ready, willing or able to embrace the ACA.

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for