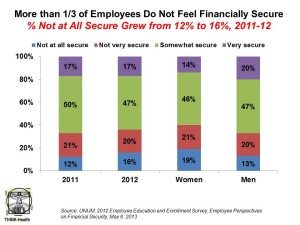

One in three workers does not feel financially secure. The proportion of Americans who feel “not at all secure” grew to 16% from 12% between 2011 and 2012, based on the question, “When it comes to paying your bills and keeping up with living expenses, how financially secure do you feel these days?”

Women are much more likely than men to feel financially insecure, representing a 33% growth rate in financial insecurity.

These sobering financial statistics come to us from the UNUM study, 2012 Employee Education and Enrollment Survey: Employee Perspectives on Financial Security, published May 8, 2013.

Based on the question asked – paying bills and keeping up with living expenses – UNUM paints a picture of people who largely live paycheck to paycheck , 50% of whom are not confident they’ll have money for future expenses or a potential disability (with more women than men feeling this way).

Peoples’ perceptions of the quality of their health benefits directly correlates to how they perceive their personal financial security: those people who rate their benefit packages at work excellent or very good also say they’re financially secure.

Conversely, the 55% of workers rating their benefits as fair or poor say they’re not financially secure.

As a result of growing sentiments of financial insecurity, most workers have pushed out their expected age of retirement, at least by 2.6 years on average over the age they expected five years ago.

UNUM polled 1,890 working adults online in December 2012.

Health Populi’s Hot Points: Few American workers have enjoyed pay raises in the past decade, with most people trading off wage increases in exchange for benefits: specifically, health benefits, which claim a growing share of U.S. business profit margins.

UNUM suggests that employees more highly value their employers who better communicate the value of benefits, with 81% of workers who rated their benefit education highly also judging their employers as a good place to work.

There are implications we can draw from this study as employers look toward the fourth quarter of 2013 when the Affordable Care Act kicks into its implementation phase for workers who can access health insurance exchanges. Americans remain confused with many misperceptions concerning the ACA: a major mystery is among workers who may already receive health insurance, but because of their tax bracket will be entitled to a subsidy to purchase health insurance on an exchange.

Aflac learned in its own survey of workers that they are looking to their employers to educate them on the ACA. Yet most employers seem to have other priorities, based on that poll.

Without concerted and engaging education efforts about ACA tactics for consumers – call it an ACA Toolkit for Dummies (which we all are under the current circumstances) -workers may feel even more financially strapped and inept once they are faced with purchasing insurance versus paying a fine for not carrying it.

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast  This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're

This conversation with Lynn Hanessian, chief strategist at Edelman, rings truer in today's context than on the day we recorded it. We're