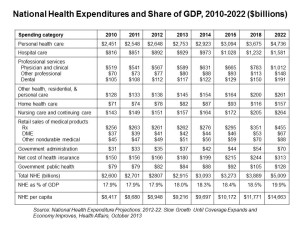

By 2022, $1 in every $5 worth of spending in the U.S. will go to health care in some way, amounting to nearly $15,000 for each and every person in America.

By 2022, $1 in every $5 worth of spending in the U.S. will go to health care in some way, amounting to nearly $15,000 for each and every person in America.

From biggest line item on down, health spending will go to payments to:

- Hospitals, representing about 32% of all spending

- Physicians and clinical costs, 20% of spending

- Prescription drugs, 9% of spending

- Nursing, continuing care, and home health care, together accounting for over 8% of health spending (added together for purposes of this analysis)

- Among other categories like personal care, durable medical equipment, and the cost of health insurance.

These details on health spending are shown in the table, which comes out of the annual report on U.S. health expenditures published in Health Affairs’ National Health Expenditure Projections, 2012-22: Slow Growth Until Coverage Expands And Economy Improves.

The bottom line: health costs will increase by 6.1% as the Affordable Care Act is implemented in 2014, an increase from the relatively low 3.8% in 2013. Beyond 2014, this forecast expects annual spending growth around 6% every year to 2022, when growth hits 6.5%.

This analysis, by actuary staff of the Centers for Medicare and Medicaid Services, provides annual snapshots on health economic forces shaping up for that year, culminating in discussions by key segments – medical services and products, and payers (Medicare, private health insurance, and consumer out-of-pocket spending).

The media coverage of these statistics has been all-over-the-board, from sanguine “good news” headlines to more dramatic negative views, such as this one from the UK Financial Times titled, “US Health Spending Expected to Surge” (apologies for the paywall).

As with all forecasts, the assumptions are important to call out to understand how the numbers fall out: the assumptions in this model come out of the 2013 Medicare Trustees Report, and include actuarial cost estimates from the Affordable Care Act post-the Supreme Court decision and the one-year delay in implementing the employer mandate.

A key variable, which the authors make clear, is that this model does not account for the possible “change in providers’ behavior in reaction to an influx of newly insured patients.”

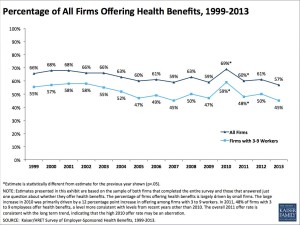

Health Populi’s Hot Points: The proportion of employers sponsoring health benefits has been eroding for the past ten years, a trend which isn’t accounted for in the CMS actuaries’ model. Thus, I will call out a second wild card variable that’s key beyond “providers’ behavior” changes: that is, whether employers will continue to sponsor health insurance in the post-ACA world.

Health Populi’s Hot Points: The proportion of employers sponsoring health benefits has been eroding for the past ten years, a trend which isn’t accounted for in the CMS actuaries’ model. Thus, I will call out a second wild card variable that’s key beyond “providers’ behavior” changes: that is, whether employers will continue to sponsor health insurance in the post-ACA world.

We’ve seen in just the past week several employer responses just days before the Health Insurance Marketplaces start at “go” on October 1, 2013:

- Walgreens, the nation’s largest pharmacy chain, is moving workers onto private health insurance exchanges, covered here in Washington Post

- GE and IBM shifting retirees onto insurance exchanges (private and public)

- Small business weighing higher out-of-pocket costs and deductibles for workers, in the Wall Street Journal.

Depending what lens you see through in health and health care, when considering the CMS forecast, it’s important to put your filter on the projections and think about the wild cards in your neck of the woods. In the macro-economic context, the question of employer-sponsorship of health plans impacts every segment of the health industry, and most especially people-patients-consumers.

Other wild card variables you might consider are:

- Consumer behavior under high-deductible and consumer-driven health plans: will people be smart or not-so-much in effectively utilizing these benefits?

- What will be the impact of employer-sponsored wellness programs? Note that this week, Penn State pulled back on its “heavily-sticked” and less carrot-incentivized well program, explained here in the New York Times?

- What would the impact of a fast-growing economy do to health care coverage in the U.S.?

- Will Accountable and Value-Based Care begin to bend the cost curve before 2022?

- What will the impact of telehealth and peoples’ embrace of self-health technology (mHealth, Quantified Self, etc.) be on patient-consumer-caregiver behavior to change these numbers?

Doing scenario planning considering these kinds of variables that are most important and most uncertain for your business or organization is highly recommended: as the Financial Times story points out, how you see these data depends on how you’re looking at them and what hat you’re wearing.

Thank you FeedSpot for

Thank you FeedSpot for