Gird your wallets, U.S. consumers: watch the dollars flow out-of-pocket for prescription drugs in 2014, as predicted by the 2013-2014 Prescription Drug Benefit Cost and Plan Design Report published by the Pharmacy Benefit Management Institute (PBMI) this week. Constraints covering most plan members are:

Gird your wallets, U.S. consumers: watch the dollars flow out-of-pocket for prescription drugs in 2014, as predicted by the 2013-2014 Prescription Drug Benefit Cost and Plan Design Report published by the Pharmacy Benefit Management Institute (PBMI) this week. Constraints covering most plan members are:

- Step therapy

- Prior authorization (to get approvals to fill high-cost drugs, notably growth hormones, injectables, controlled substances, Retin-A, and medications for sleep disorders, and

- Compulsory 90 day refills at retail (90-day dispensing for chronic meds).

This Report, sponsored by Takeda, is the gold standard of drug benefit trends, having been published since 1995.

Average 30-day copayments for 3-tier Rx plans (which cover two-thirds of employees vs. 2- and 4-tier plans) for generic, preferred brand, and non-preferred branded drugs are $11, $30-32, and $56, respectively. Specialty copayments average $107, ranging from $40 to $275. Coinsurance percentages for nonpreferred brands at retail 30 days as well as mail average 39%.

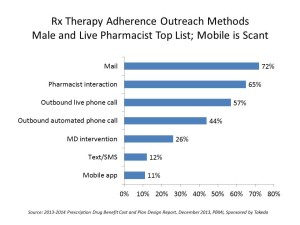

This cost-sharing is being coupled with medication adherence – drug plans working to nudge patients to take their prescribed drugs at the right dose, right time. The first graph shows that the most common form of outreach for Rx adherence is via mail, with 7 in 10 plans using this Old School communications method. Mail is followed by ‘live’ pharmacist intervention and live phone calls, used by 65% and 57%, respectively.

Mobile methods, like test/SMS messaging and mobile apps are used much less frequently for medication adherence management, with 12% and 11% shares.

The survey among 478 U.S. employers was done in March-April 2013. Together, the companies polled represent 22.5 million plan members.

Health Populi’s Hot Points: PBMI characterizes the trends from 2013 into 2014 as “holding steady,” saying that the advent of health insurance exchanges (public and private), mandatory coverage provisions in the ACA, and the list of essential health benefits in the law have stalled big changes in drug benefit planning.

Health Populi’s Hot Points: PBMI characterizes the trends from 2013 into 2014 as “holding steady,” saying that the advent of health insurance exchanges (public and private), mandatory coverage provisions in the ACA, and the list of essential health benefits in the law have stalled big changes in drug benefit planning.

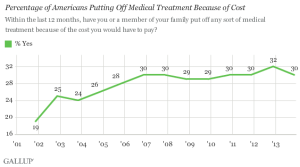

But peoples’ wages are static and so in fact consumers aren’t holding steady – they’re self-rationing, according to Gallup’s latest poll finding that costs are keeping 30% of people in the U.S. from getting health care. That self-rationing is shown in the first chart.

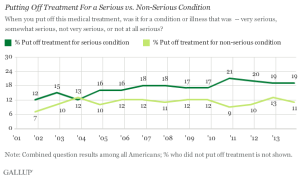

What’s confounding and more concerning is that the

According to the 2013 International Foundation of Employee Benefit Plans Employer-Sponsored Health Care: ACA’s Impact Survey, more employers are increasing workers’ share of premium costs, increasing the employee portion of dependent coverage costs, increasing in-network deductibles, and increasing out-of-pocket limits.

Expect more self-rationing in 2014 as people take on more costs, but don’t yet cotton onto how to deal with high-deductible health plans, save money in health savings accounts, and prioritize other household spending like food, energy, clothing, and technology purchases.

The opportunity for mobile tactics, like texting and SMS, and mobile apps, is ripe. Mail and pharmacist interventions don’t flow well into peoples’ everyday lives, 24×7: they are one-time, intermittent strategies. So while some people are pondering not filling the prescription, opting out of paying for it, as Gallup suggests is happening (confirmed in the Kaiser Family Foundation’s Health Tracking Polls of consumer behavior in the post-recession health economy), mobile communications can help reverse this trend and move people to do the right thing by their prescription drugs. This report finds that this could be a missed opportunity for the next year for both pharma manufacturers who could benefit from more filled scripts over time, and patients whose health outcomes could be improved by sticking with prescribed medication regimens.

Thank you FeedSpot for

Thank you FeedSpot for