When Buying a Pair of Jeans Competes With Filling a Prescription at CVS in Target

Stories about three fashion brands have me thinking about women and their health economics. Stay with me. Target unveiled its new line of clothing, Universal Thread, which features pieces that are accessible to women who may be dealing with physical limitations or sensory challenges. I first read about Universal Thread on The Mighty website, which is a community of over 1 million people interested in connecting on health and disabilities. As The Mighty described, the brand Universal Thread, “is centered around denim since it is a staple in many women’s wardrobes, but denim can be uncomfortable for many people with disabilities

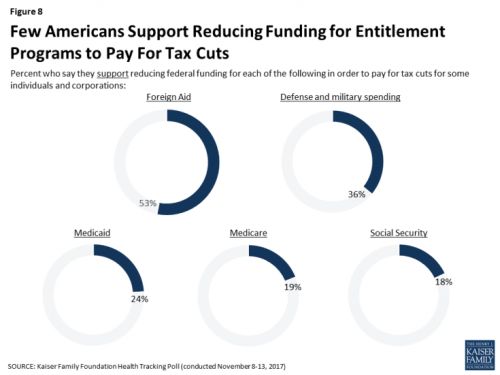

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

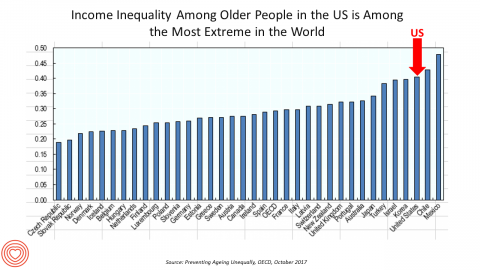

Income Inequality For Older Americans Among Highest in the World – What This Means for Healthcare

Old-age inequality among current retirees in the U.S. is already greater than in ever OECD country except Chile and Mexico, revealed in Preventing Ageing Unequally from the OECD. Key findings from the report are that: Inequalities in education, health, employment and income start building up from early ages At all ages, people in bad health work less and earn less. Over a career, bad health reduces lifetime earnings of low-educated men by 33%, while the loss is only 17% for highly-educated men Gender inequality in old age, however, is likely to remain substantial: annual pension payments to the over-65s today are

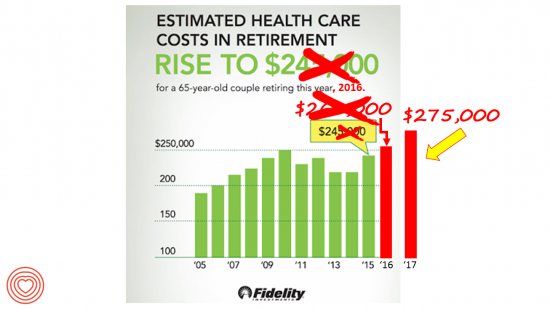

A Couple Retiring Today Will Need $275,000 For Health Care Expenses

A 65-year-old couple in America, retiring in 2017, will need to have saved $275,000 to cover their health and medical costs in retirement. This represents a $15,000 (5.8%) increase from last year’s number of $260,000, according to the annual retirement healthcare cost study from Fidelity Investments. This number does not include long-term care costs — only medical and health care spending. Here’s a link to my take on last year’s Fidelity healthcare retirement cost study: Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year. Note that the 2016 cost was also $15,000 greater than the retirement healthcare costs calculated

Loneliness and Isolation Kill: Health Depends on Purpose

In the U.S., one-third of people age 65 and over have difficulty walking 3 city blocks. Hold that thought, and consider the role of purpose in life: purpose drives well-being, inoculating one’s life with meaning, direction, and goals, as the On Purpose guru Victor Strecher explains in his amazing graphic manifesto. Having a higher sense of purpose in life is associated with higher probability of people engaging in healthier behaviors, such as greater physical activity and seeking preventive healthcare; better biological functioning; and, lower risk of disease. Four researchers from the Harvard School of Public Health connected the dots between

20% of the US Economy Will Be Healthcare Spending in 2025

Price increases and growing use of healthcare services will drive national health spending (NHE) in the U.S. to 20% of the nation’s economy by 2025, according to projections calculated by a team from the Centers for Medicare and Medicaid Services (CMS). Health spending will reach $3.6 trillion dollars this year. These were published in a Web-First article in Health Affairs on 15 February 2017 The caveat on these numbers is that the CMS team used economic models based on “current-law framework:” these make no assumptions about legislative changes that may occur in healthcare reform between 2017 and 2025. While that’s a

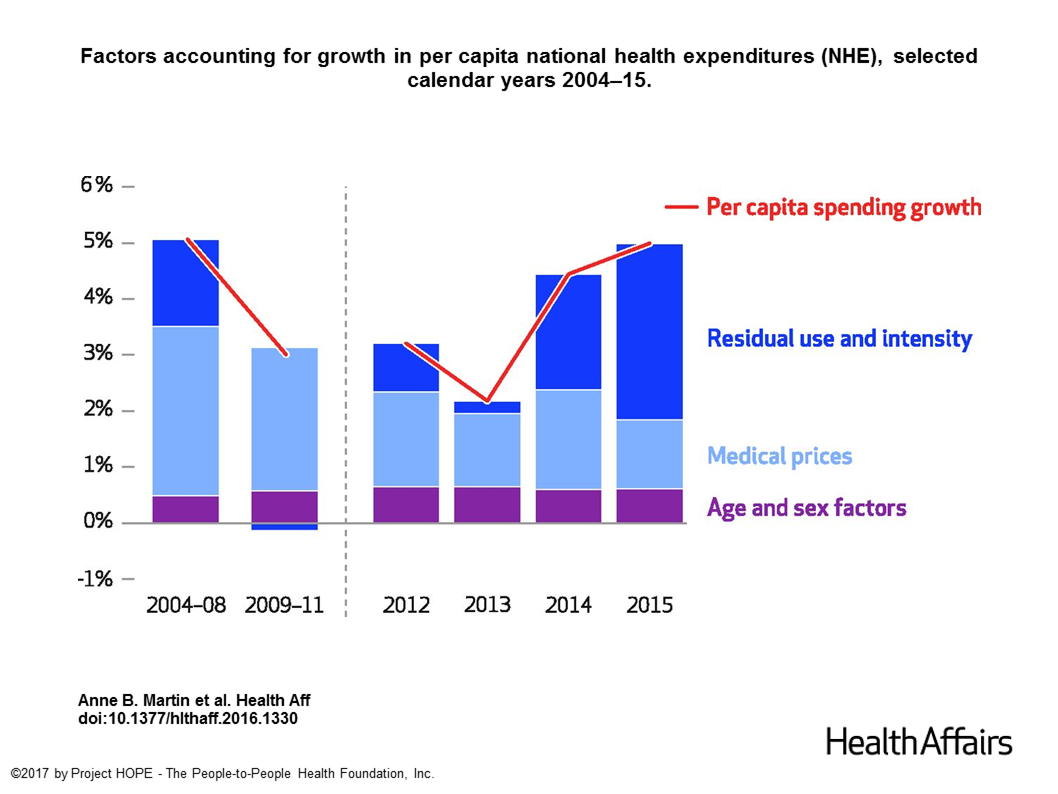

U.S. Healthcare Spending Hit Nearly $10,000 A Person In 2015

Spending on health care in the U.S. hit $3.2 trillion in 2015, increasing 5.8% from 2014. This works out to $9,990 per person in the U.S., and nearly 18% of the nation’s gross domestic product (GDP). Factors that drove such significant spending growth included increases in private health insurance coverage owing to the Affordable Care Act (ACA) coverage (7.2%), and spending on physician services (7.2%) and hospital care (5.6%). Prescription drug spending grew by 9% between 2014 and 2015 (a topic which I’ll cover in tomorrow’s Health Populi discussing IMS Institute’s latest report into global medicines spending). The topic of

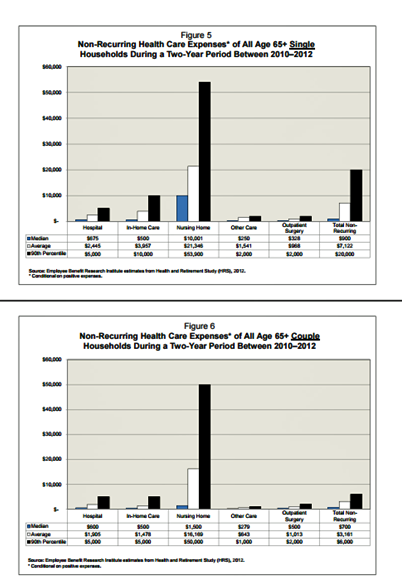

Older Couples Have Lower Out-of-Pocket Healthcare Costs Than Older Singles

It takes a couple to bend the health care cost curve when you’re senior in America, according to the EBRI‘s latest study into Differences in Out-of-Pocket Health Care Expenses of Older Single and Couple Households. In previous research, The Employee Benefit Research Institute (EBRI) has calculated that health care expenses are the second-largest share of household expenses after home-related costs for older Americans. Health care costs consume about one-third of spending for people 60 years and older according to Credit Suisse. But for singles, health care costs are significantly larger than for couples, EBRI’s analysis found. The average per-person out-of-pocket spending for

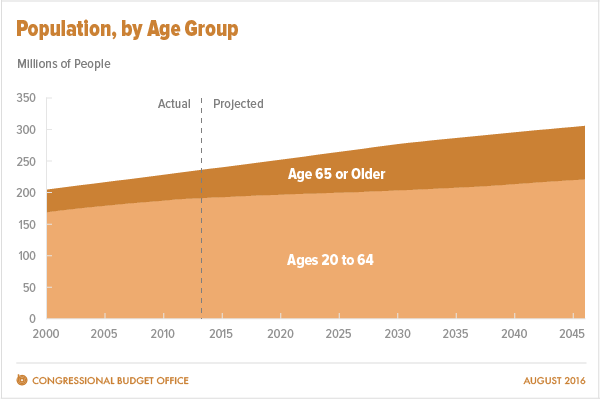

Aging America Is Driving Growth in Federal Healthcare Spending

Federal healthcare program costs are the largest component of mandatory spending in the U.S. budget, according to An Update to the Budget and Economic Outlook: 2016 to 2026 from the U.S. Congressional Budget Office (CBO). Federal spending for healthcare will increase $77 billion in 2016, about 8% over 2015, for a total of $1.1 trillion. The CBO believes that number overstates the growth in Medicare and Medicaid because of a one-time payment shift of $22 bn to Medicare (from 2017 back into 2016); adjusting for this, CBO sees Federal healthcare spending growing 6% (about $55 bn) this year. The driver

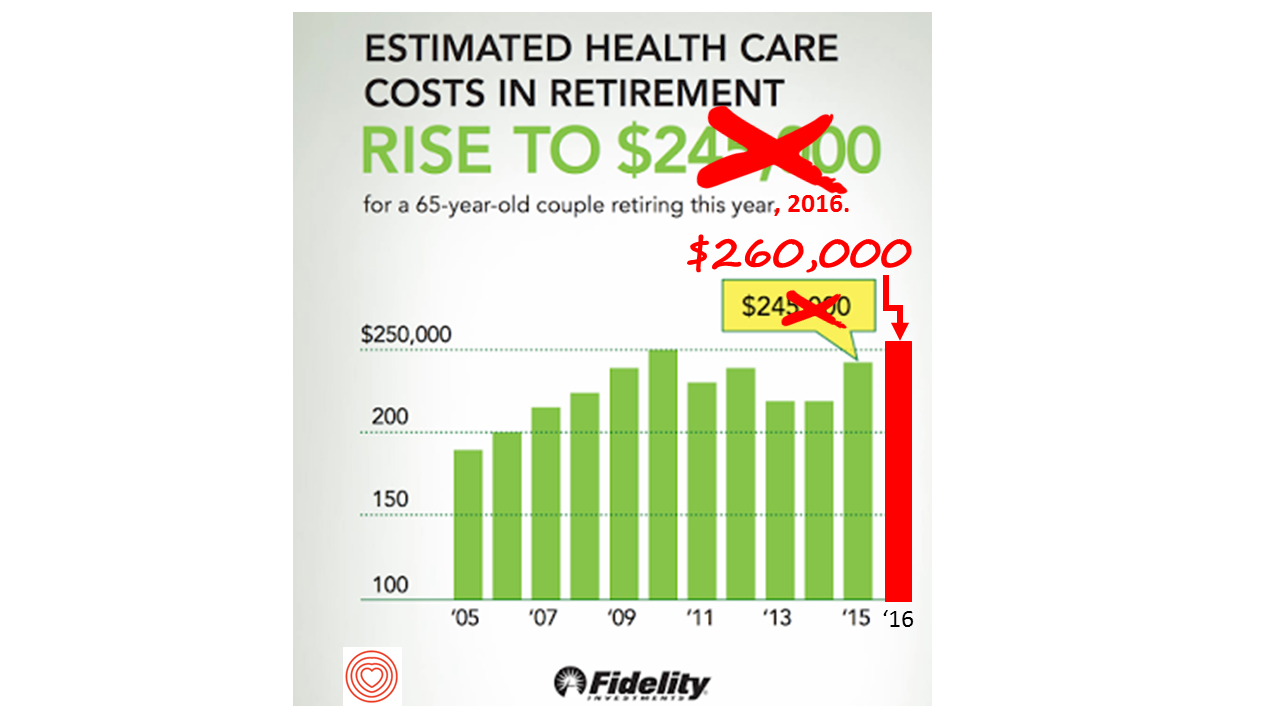

Health Care Costs in Retirement Will Run $260K If You’re Retiring This Year

If you’re retiring in 2016, you’ll need $260,000 to cover your health care costs during your retirement years. In 2015, that number was $245,000, so retiree health care costs increased 6% in one year according to Fidelity’s Retirement Health Care Cost Estimator. The 6% annual cost increase is exactly what the National Business Group on Health found in their recently published 2017 Health Plan Design Survey polling large employers covering health care, discussed here in Health Populi. The 6% health care cost increases are driven primary by people using more health services and the higher costs for many medicines — specifically, specialty

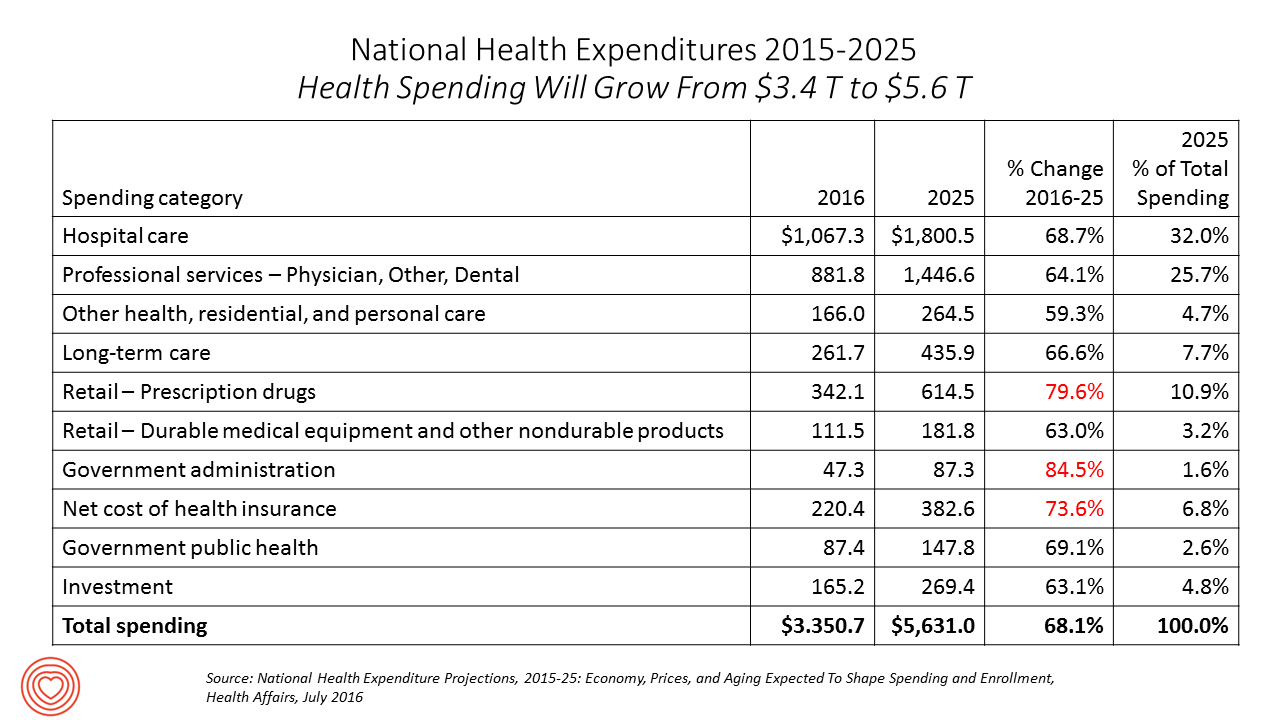

U.S. Health Spending Will Comprise 20% of GDP in 2025

Spending on health care in America will comprise $1 in every $5 of gross domestic product in 2025, according to National Health Expenditure Projections, 2015-25: Economy, Prices, And Aging Expected to Shape Spending and Enrollment, featured in the Health Affairs July 2016 issue. Details on national health spending are shown by line item in the table, excerpted from the article. Health spending will grow by 5.8% per year, on average, between 2015 and 2025, based on the calculations by the actuarial team from the Centers for Medicare and Medicaid Services (CMS), authors of the study. The team noted that the Affordable Care

Food As Medicine Update: Kroger, the FDA, and Walmart

There’s growing recognition of the role of food in health, on both the supply side of grocers, food growers and consumer marketers; and, among consumers who are, increasingly, shopping for food with health on their minds. 8 in 10 consumers in the U.S. enter a grocery store thinking about the health attributes of what they’re about to choose from the aisles that are stocked with more gluten-free, GMO-labelled, and organic products, according to the 2015 Deloitte Pantry Study. Our physicians have begun to “prescribe” food, especially as the collective BMI of Americans has reached medically catastrophic levels. See this forecast from

What Health Care Can Learn from the Blood Clot Community

“Our goal is to create an aware and engaged, irritating set of patients who create a dialogue with health care providers once they’ve had a [blood] clot,” explained Randy Fenninger, CEO of the National Blood Clot Alliance (NBCA). NBCA’s tagline and hashtag is “Stop the Clot.” Welcome to the multi-stakeholder community involved with deep vein thrombosis (DVT) and, clinically speaking, Venous Thromboembolism (VTE). We’re talking blood clots, and the public health burden of this condition is big: it’s a leading cause of death and disability. One in 4 people in the world die of conditions caused by thrombosis. I had

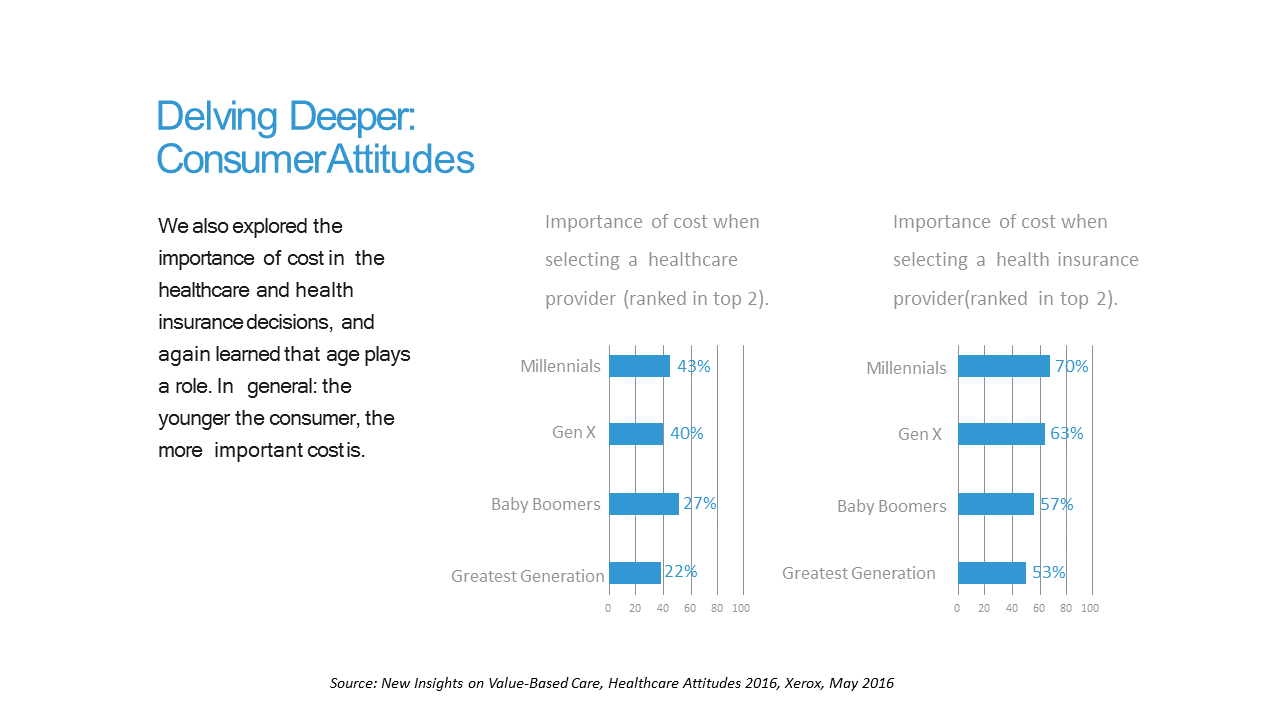

Costs and Connection At the Core of Consumers’ Health-Value Equations

Cost ranks first among the factors of selecting health insurance for most Americans across the generations. As a result, most consumers are likely to shop around for both health providers and health plans, learned through a 2016 Xerox survey detailed in New Insights on Value-Based Care, Healthcare Attitudes 2016. The younger the consumer, the more important costs are, Xerox’s poll found, shown in the first chart. Thus, “shopping around” is more pronounced among younger health consumers — although a majority people who belong to Boomer and Greatest Generation cohorts do shop around for both health providers and health insurance plans —

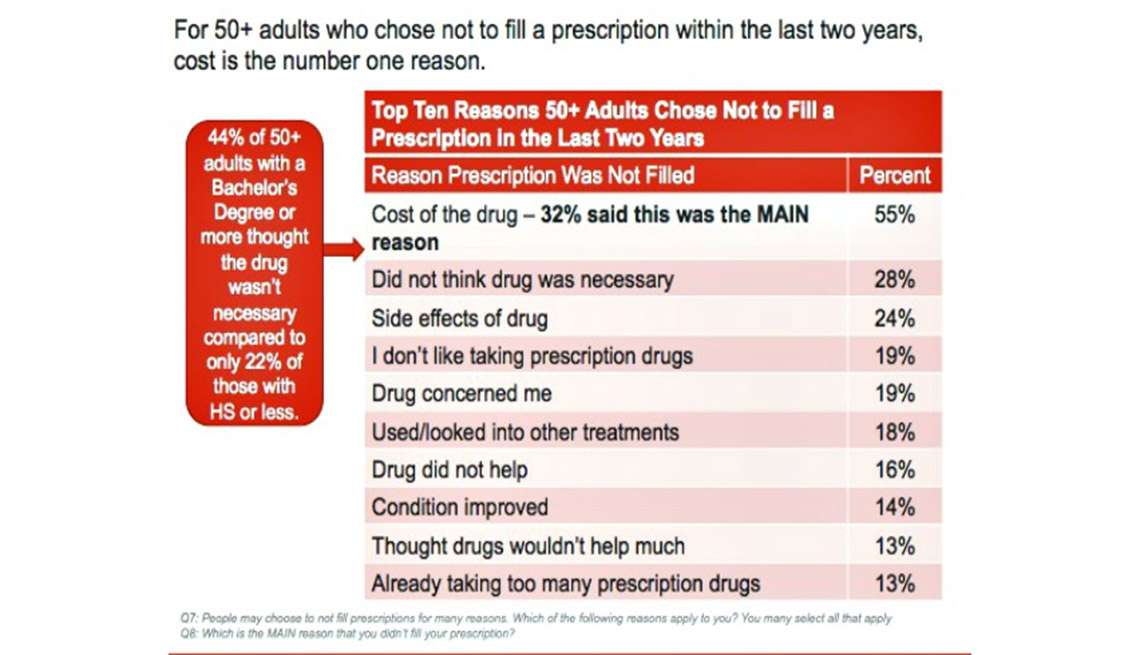

Control Drug Costs and Regulate Pharma, Most Older Americans Say

The top reason people in America over 50 don’t fill a prescription is the cost of the drug, according to the AARP 2015 Survey on Prescription Drugs. Eight in 10 people 50+ think the cost of prescription drugs is too high, and 4 in 10 are concerned about their ability to afford their medications. Thus, nearly all people over 50 think it’s important for politicians (especially presidential candidates) to control Rx drug costs. Older consumers are connecting dots between the cost of their medications and direct-to-consumer prescription drug advertising: 88% of the 50+ population who have seen or heard drug

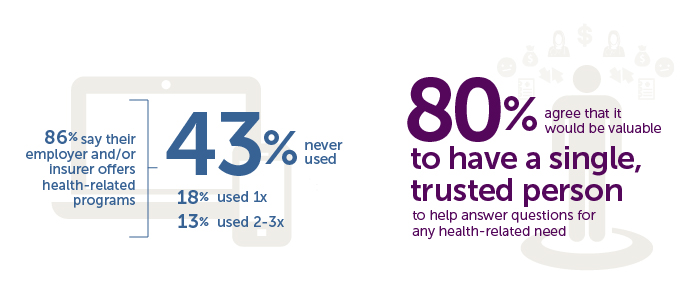

Generation Gaps in Health Benefit Engagement

Older workers and retirees in the U.S. are most pleased with their healthcare experiences and have the fewest problems accessing services and benefits. But, “younger workers [are] least comfortable navigating U.S. healthcare system,” which is the title of a press release summarizing results of a survey conducted among 1,536 U.S. adults by the Harris Poll for Accolade in September 2015. Results of this Accolade Consumer Healthcare Experience Index poll were published on April 12, 2016. Accolade, a healthcare concierge company serving employers, insurers and health systems, studied the experiences of people covered by health insurance to learn about the differences across age

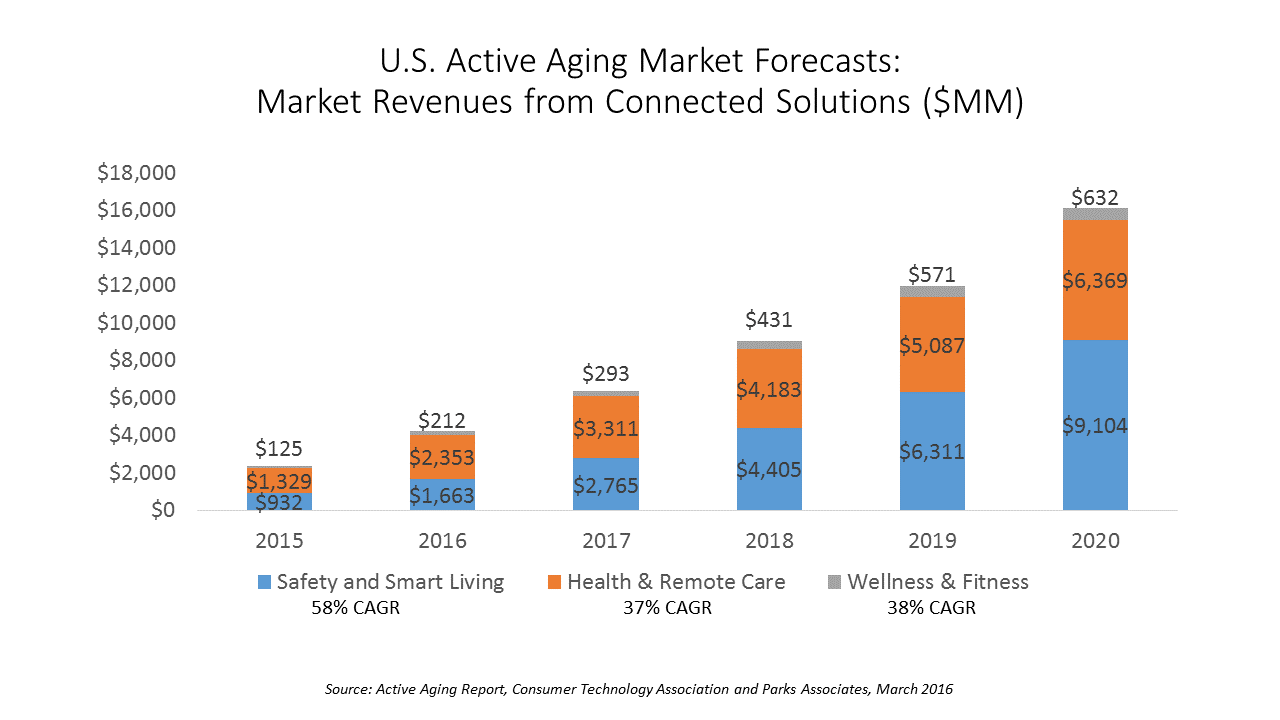

Better Aging Through Technology

There are 85 million people getting older in America, all mindfully working to not go gentle into their good nights — that is, working hard to stay young and well for as long as they can. This is the market for “active aging” technology products, which will be worth nearly $43 billion in 2020, according to a report from the Consumer Technology Association (CTA), the Active Aging Study. CTA and Parks Associates define the active aging technology market in three segments with several categories under each: Safety and smart living, which includes safety monitoring, emergency response (PERS), smart living, and home

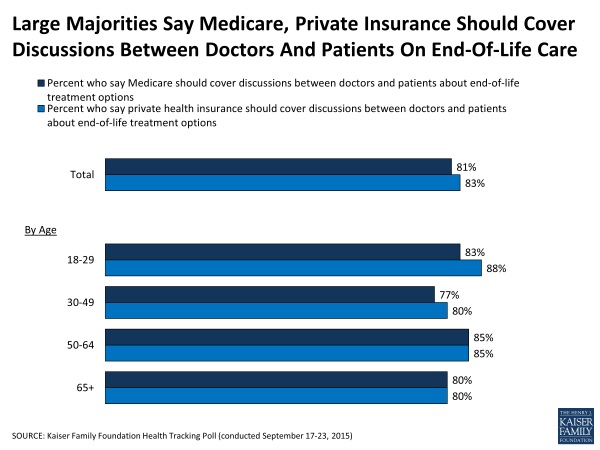

Insurance Should Pay For End-of-Life Conversation, Most Patients Say

8 in 10 people in the U.S. say that Medicare as well as private health insurance plans should pay for discussions held between patients and doctors about hatlhcare at the end-of-life. The September 2015 Kaiser Family Foundation Health Tracking Poll asks people their opinions about talking end-of-life with their doctors. The vast majority of people support the concept and physicians being paid for holding such conversations in doctor-patient relationship. The question is germane because the Obama Administration has announced plans to pay doctors for office visits to discuss end-of-life (EOL) issues with Medicare patients. There isn’t a huge variation across

Doctors who write right: Gawande, Topol and Wachter put people at the center of health/care

There’s a trifecta of books written by three brilliant doctors that, together, provide a roadmap for the 21st century continuum of health care: The Patient Will See You Now by Eric Topol, MD; The Digital Doctor from Robert Wachter, MD; and, Being Mortal, by Atul Gawande. Each book’s take provides a lens, through the eyes of a hands-on healthcare provider, on healthcare delivery today (the good, the warts and all) and solutions based on their unique points-of-view. This triple-review will move, purposefully, from the digitally, technology optimistic “Gutenberg moment” for democratizing medicine per Dr. Topol, to the end-game importance of

What Mavis Staples taught us about health at SXSW

While I am all health, all-the-time when I’m at the annual South-by-Southwest meet-up in Austin, I had the opportunity to attend the premiere of the documentary, Mavis! (exclamation point included and appropriate, given the energy and joy in the title’s subject). “Mavis” is Mavis Staples, who you should know for her music, as singer with her family’s group, The Staple Singers; and, for as a positive force for good. In fact, she’s a lesson in whole health, which is why I’m writing about here on Health Populi which is dedicated to health where we live, work, play, pray…and sing. For

Digital health love – older people who use tech like health-tech, too

As people take on self-service across all aspects of daily living, self-care in health is growing beyond the use of vitamins/minerals/supplements, over-the-counter meds, and trying out the blood-pressure cuff in the pharmacy waiting for a prescription to be filled. Today, health consumers the world over have begun to engage in self-care using digital technologies. And this isn’t just a phenomenon among people in the Millennial generation. Most seniors who regularly use technology (e.g., using computers and mobile phones) are also active in digitally tracking their weight, for example, learned in a survey by Accenture. Older people who use technology in daily

Women-centered design and mobile health: heads-up, 2014 mHealth Summit

This post is written as part of the Disruptive Women on Health’s blog-fest celebrating the 2014 mHealth Summit taking place 7-11 December 2014 in greater Washington, DC. Women and mobile health: let’s unpack the intersection. On the supply side of the equation, Good Housekeeping covered health tracking-meets-fashion bling in the magazine a few weeks ago in article tucked between how to cook healthy Thanksgiving side dishes and tips on getting red wine stains out of tablecloths. This ad appeared in a major sporting goods chain’s 2014 Black Friday pre-print in my city’s newspaper last week. And along with consumer electronics brand faves like

Health costs in retirement: the standard of living

On their list of top financial worries, 1 in 2 Americans is most concerned about not having enough money for retirement, not being able to pay medical costs if they get sick, and not being able to maintain a desired standard of living. Gallup’s annual Economy and Personal Finance poll, conducted in early April 2014, finds that even in the wake of a healthier economy, people feel health-finance insecure. While ability to pay medical bills ranked #2 on the list of 9 fiscal worries, the proportion of Americans with this concern fell from a high of 62% in 2012 to

Be thankful for your good life. Now think about what a good death would be.

This Thanksgiving, we’re once again participating in the annual Engage With Grace blog rally, encouraging those who haven’t considered their end-of-life preferences to start thinking about them, and asking those who have done it to consider how their decisions may have changed over time. It’s good food for thought. Wishing you all a happy, healthy holiday season. Most of us find ourselves pretty fascinating… flipping through photos and slowing down for the ones where we’re included, tweeting our favorite tidbits of information, Facebook-ing progress on this or that… We find other people captivating as well. In fact, there’s a meme going around

There’s fear of health care costs in peoples’ retirement visions

While working people in the U.S. are feeling better about the nation’s economy, Americans aren’t putting much money into savings for retirement. The reasons for this are many, but above all is what Mercer calls “the specter of health care costs in retirement” in the Mercer Workplace Survey for 2013. In addition to peoples’ concerns about future health care costs, reasons for not putting money away for the future include flat personal income, slow economic growth and financial literacy challenges around how much 401(k) savings can be tax-deferred. On the slow economic growth perception, Mercer found that, on the upside, people

Delaying aging to bend the cost-curve: balancing individual life with societal costs

Can we age more slowly? And if so, what impact would senescence — delaying aging — have on health care costs on the U.S. economy? In addition to reclaiming $7.1 trillion over 50 years, we’d add an additional 2.2 years to life expectancy (with good quality of life). This is the calculation derived in Substantial Health And Economic Returns From Delayed Aging May Warrant A New Focus For Medical Research, published in the October 2013 issue of Health Affairs. The chart graphs changes in Medicare and Medicaid spending in 3 scenarios modeled in the study: when aging is delayed, more people qualify

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

Taking vitamins can save money and impact the U.S. economy – and personal health

When certain people use certain dietary supplements, they can save money, according to a report from the Council for Responsible Nutrition and Frost and Sullivan, the analysts. The report is aptly titled, Smart Prevention – Health Care Cost Savings Resulting from the Targeted Use of Dietary Supplements. Its subtitle emphasizes the role of dietary supplements as a way to “combat unsustainable health care cost growth in the United States.” Specifically, the use of eight supplements in targeted individuals who can most benefit from them can save individuals and health systems billions of dollars. The eight money-saving supplements are: > Omega-3 > B

Happy today, nervous about health and money tomorrow: an Aging in America update

Most older Americans 60 years of age and up (57%) say the last year of their lives has been “normal” – a large increase from the 42% who said life was normal in 2012. And nearly 9 in 10 older Americans are confident in their ability to maintain a high quality of life in their senior years. The good news is that seniors are maintaining a positive outlook on aging and their future. The downside: older people aren’t doing much to invest in their future health for the long run. They’re also worried about the financial impact of living longer.

The health/wealth disconnect in America

Two in 3 Americans are uncomfortable with their financial situation. And most are totally oblivious to how much money they will need to spend on health care in the future. Seven in 10 people expect to spend less than 10% of their monthly retirement income on medical and dental expenses; but the real number is 30% of income needed for health care in retirement, according to The Urban Institute. The Wellness for Life survey, conducted for Aviva, the life and disability company, collaborating with the Mayo Clinic, finds an American health citizen out of touch with their personal health economics.

Americans feeling more financially insecure

One in three workers does not feel financially secure. The proportion of Americans who feel “not at all secure” grew to 16% from 12% between 2011 and 2012, based on the question, “When it comes to paying your bills and keeping up with living expenses, how financially secure do you feel these days?” Women are much more likely than men to feel financially insecure, representing a 33% growth rate in financial insecurity. These sobering financial statistics come to us from the UNUM study, 2012 Employee Education and Enrollment Survey: Employee Perspectives on Financial Security, published May 8, 2013. Based on the question asked – paying

Health is wealth and wealth, health

It’s America Saves Week (February 25-March 2, 2013). Do you know what your savings rate is? If you’re in the center of the American savings bell curve, you probably don’t have a savings plan with specific goals and don’t know your net worth. Two-thirds of U.S. adults say they have sufficient emergency savings for unexpected expenses like a visit to a doctor. However, only one-half of non-retired people believe they’re saving enough for a retirement where they’ll have a “desirable standard of living.” This six annual survey by the Consumer Federation of America, the American Savings Education Council, and the

Health care cost illiteracy: consumers feel the pinch of growing costs, but don’t understand the “why?”

Health care costs for workers lucky enough to receive health insurance at work nearly doubled since 2002. Wages in that decade grew by 33%. This growing affordability gap between health costs vs. wages is shown in the chart. Health consumers in America sharply perceive this gap, according to an analysis of eight focus groups, Consumer Attitudes on Health Care Costs: Insights from Focus Groups in Four U.S. Cities from the Robert Wood Johnson Foundation. To health-covered workers, though, health care “costs” are defined as out-of-pocket health spending for insurance premiums, co-payments and deductibles that come out of paychecks and pocketbooks — not

Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Health as long-term deficit driver – the CBO points out tough choices

There are many forks in the road facing us in the U.S. for deficit reduction, as the picture shows. This is the cover graphic for Choices for Deficit Reduction, a report from the Congressional Budget Office (CBO) published November 2012. Those roads could be labeled “Medicare” and “Medicaid,” as health is the #1 deficit driver for the American economy — most notably, Medicare and long-term care services financed via Medicaid. The CBO expects that per capita spending on health care, already at 18% of the national economy in 2012, will continue to grow faster than spending on other goods and

Americans’ top financial concerns are money for retirement and health care

It’s the morning after the historic 2012 Presidential Election, with President Barack Obama winning a second term in the face of a sputtering economy and eventual Fiscal Cliff as of December 31, 2012. As we toast with our beverage of choice that night, we will also be worrying about our top financial concerns: how we’ll fund our retirements, and how we’ll pay for health care eventually, and now while we’re actively employed. The Harris Poll of November 5, 2012, reveals that 3 in 4 people in the U.S. who aren’t yet retired worry they won’t have enough money to slow

Consumers blame insurance and pharma for health costs, but love their primary care doctors

The 78% of U.S. adults with primary care physicians (think: medical homes) are very satisfied with their doctors’ visits. The main reasons for this high level of satisfaction include communication (listening, talking), customer service (caring, personable), and clinical (good diagnosis and treatment). More women than men have a primary care physician relationship, more college grads do, and more people with incomes of $75,000 a year or more do, as well. 90% of those 55 and over have a primary care doctor – a stat heavily influenced by the fact that Medicare coverage kicks in for older people. This consumer profile

What’s on senior Americans’ minds? Medicare and money

What’s keeping seniors up at night when it comes to retirement? #1, according to 6 in 10 seniors, is the future of Medicare, followed by having enough money to enjoy retirement. In particular, 61% of seniors are concerned about future out-of-pocket health care costs. It’s all about Medicare and money for U.S. seniors, found in the Allsup Medicare Advisor Seniors Survey, Medicare Planning and Trends Among Seniors, published in October 2012. Medicare could be the most beloved government program ever, as 89% of seniors say they’re satisfied with Medicare coverage. Given the program’s shaky financial future, Allsup wanted to get

Aging in the US – seniors are health-confident, less financially so

Most seniors look forward to aging in place, and are confident in their ability to do so. Such is the top-line feel-good finding from the National Council on Aging‘s (NCOA) survey, The United States of Aging, sponsored by USA Today and United Healthcare. A majority of seniors have a sense of purpose and plans for their future. Three-fourths of older Americans say staying physically fit through exercise and proactively managing their health is important. However, only 36% of seniors say they exercise or engage in physical activity every day. 11% never do. The most common chronic conditions noted by seniors

Thinking about Dad as Digital “Mom”

What is a Mom, and especially, who is a “Digital Mom?” I’ve been asked to consider this question in a webinar today hosted by Enspektos, who published the report Digging Beneath the Surface: Understanding the Digital Health Mom in May 2012. I wrote my review of that study in Health Populi here on May 15. In today’s webinar, my remarks are couched as “Caveats About the Digital Mom: a multiple persona.” Look at the graphic. On the left, the first persona is a mother with children under 18. Most “mom segmentations” in market research focus on this segment. But what

Rising cost of healthcare a headache among affluent Americans

For the third year in a row, wealthy Americans cite increasing health costs as their top financial concern. Furthermore, 1 in 3 affluent Americans are more concerned about the financial stress that could accompany a health event than they are about how that condition could affect their quality of life. Merrill Lynch Wealth Management, part of Bank of America, conducted the firm’s annual poll among 1,000 Americans with investable assets of at least $250,000, in December 2011. The investment firm has looked at richer Americans’ views on financial concerns since 2009. The chart shows rising health care costs to be

Michael Graves: architect-turned-health designer at Social Media Week

Michael Graves is one of the greatest architects of our, or any, time. He is now dedicating himself to re-imagining what the patient’s experience in a hospital room can be: not just less humiliating and frustrating, but in fact a healing experience in an aesthetically comforting and user-friendly environment. Graves, longtime affiliated with Princeton University, is famous among mainstream consumers as one of Target’s first designers of home products for the past 13 years, from teapots and cooking gear to kitchen cleaning accessories. Sadly for us mass consumers, this will be his last year of designing for Target. He told the

Designing health technology for people at home

The Internet, broadband, mobile health platforms, and consumers’ demand for more convenient health care services are fueling the development and adoption of health technologies in peoples’ homes. However, designing products that people will delight in using is based on incorporating human factors in design. Human factors are part of engineering science and account for the people using the device, the equipment being used, and the tasks the people are undertaking. The model illustrates these three interactive factors, along with the outer rings of environments: health policy, community, social, and physical. Getting these aspects right in the design of health technologies meant for

Unretirement: the number of Americans planning to retire at 67 is plummeting

Two publications this week reinforce the new reality of health and financial insecurity: The Vanishing Middle America issue of Advertising Age (October 17, 2011 issue) and the Sun Life Financial U.S. Unretirement Index – Fall 2011 with the subtitle, “Americans’ trust in retirement reaches a tipping point.” The chart shows the retirement coin’s two sides: since 2008, the proportion of people in the U.S. who expect to retire by 67 dropped from 52% down to 35%; and, those who believe they will be working full-time (I emphasize “full,” not “part,” time) grew from 19% to 29%. 61% of working Americans plan to

A long-term care crisis is brewing around the world: who will provide and pay for LTC?

By 2050, the demand for long-term care (LTC) workers will more than double in the developed world, from Norway and New Zealand to Japan and the U.S. Aging populations with growing incidence of disabilities, looser family ties, and more women in the labor force are driving this reality. This is a multi-dimensional problem which requires looking beyond the issue of the simple aging demographic. Help Wanted? is an apt title for the report from The Organization of Economic Cooperation and Development (OECD), subtitled, “providing and paying for long-term care.” The report details the complex forces exacerbating the LTC carer shortage, focusing

Verizon expanding into remote and mobile health for senior living – what it means for healthy aging and medical costs

The announcement that Verizon, the telecommunications giant, will partner with Healthsense, a home health monitoring company, indicates that the adoption of telehealth services beyond project pilots and government-funds required to bolster the market is real. Verizon is upgrading the FiOS network, which it will extend to senior housing and assisted living communities that would use Healthsense’s suite of remote health monitoring, personal emergency response systems, wireless nurse call, and wellness monitoring products. The broadband FiOS network is upgradeable to 100 megabits per second, which would enable the bandwidth required by home health technologies that require high performance and reliable network connectivity. These

The Post-Health Plan Health Plan: Humana

“If nothing else, the health reform bill has signaled the beginning of the end of the health plan as we know and love it,” David Brailer, once health IT czar under President GW Bush and now venture capitalist, is quoted in Reuters on Hot Healthcare Investing Trends for 2011. One health plan Brailer called out that could be relevant in the post-reform, post-recessionary US health world is Humana. I had the opportunity to spend time with Paul Kusserow, Chief Strategy Officer for Humana, during the HIMSS11 meeting. Our conversation began with me asking why the chief strategist for Humana would

Caregiving, enabled through technology and trust

Caregivers identify the most helpful technologies that benefit them in providing care to family and friends as personal health record tracking, medication support, caregiving coordination, and monitoring and transmitting symptoms. These technologies are seen to help caregivers save time, make caregiving logistically easier, make the care recipient feel safer, reduce stress and enhance feelings of being effective. The most formidable obstacle preventing caregivers from adopting beneficial technologies is cost, followed by the technology not addressing the caregiver’s most pressing challenges, care recipient resistance to using the device, privacy issues, diminishing the care recipient’s sense of independence and pride. The National Alliance

Dis-connected health – interest in remote health monitoring falls with age

The majority of Americans generally like the idea of remote home monitoring for health. 3 in 5 adults (62%) across all age groups say communication with doctors via home monitoring devices would improve their health. However, only 35% of people age 65 and over are interested in home health monitoring. Interest in remote home health monitoring decreases with age. The disconnect is that 90% of Americans age 65 and older have at least one chronic health condition, according to the Centers for Disease Control. Practice Fusion commissioned a survey from GfK Roper in November 2010 through the GfK Omnibus survey among 1,008 adults

Be Thankful: Engage With Grace

Now that the turkey, champagne, stuffing and other glorious carbs have been consumed. the real dessert is whipped cream on the pumpkin pie: the gift of a conversation about Life and Grace. We each have our stories about how a loved one’s life has ended. If we’re lucky, that beloved person had a good death: in sleep, perhaps, or of simply old age with no hospital events or trauma. Then there are the Rest-of-Us who have the stories of long and painful endings. When you’re already in the situation of making tough health decisions, it’s tough, it’s emotional, it’s irrational,

Caregivers use online and social media for long-term care information

Most caregivers involved with home care services would be inclined to dialogue with other caregivers in an online forum or social networking site, according to a survey, How the Web and new social media have influenced the home care decision-making process, from Walker Marketing, Inc. Furthermore, 91% of caregivers would be likely to conduct research after receiving a provider referral by a professional source; while 78% would rely on a physician for recommendations, caregivers ultimately make their own decisions on long-term care providers. Websites are generally considered highly credible by caregivers, and are important sources of information for engaged caregivers on sources

The biggest consumers of prescription drugs, seniors, need patient-centered medical homes, too

“The use of medications in older patients is arguably the single most important health care intervention in the industrialized world,” Dr. Jerry Avorn asserts in a concise analysis called Medication Use in Older Patients in the October 13, 2010, issue of the Journal of the American Medical Association (JAMA). Since the population over 65 is the biggest consumer of health care services (and thus, driver of costs), and continues to grow, the segment commands the attention of health system stakeholders: policymakers, payers, medical schools, and pharmaceutical drug researchers. Medicare Part D, which covers payment for seniors’ drug costs, put the Federal government in the

Seniors Are Happy With Rx Plans, Five Years After Part D Begins

Contrary to stereotypes, older people can adapt, learn, and use new products and services. The introduction of Medicare Part D five years ago was an experiment in public policy, with some policymakers fretting about seniors’ ability to navigate a new system. It appears Medicare Part D is a hit, and people are working well with it across gender, age cohorts, incomes (from very low to upper-income strata), educational levels, and especially very sick and disabled people. Among all seniors, 90% have prescription drug coverage. 61% of U.S. adults 65 and over have a Medicare prescription drug plan, 16% are covered by an employer-sponsored

Can GE, Intel and Mayo bring good things to home monitoring?

Three major consumer and health industry brand names are coming together to launch a telehealth home monitoring project: GE, Intel and the Mayo Clinic. Each organization has a deep bench and history in the health vertical, covering different segments of the market. With this project, 3 industry leaders partner to learn about home health monitoring’s challenges and opportunities in real-life, with real people. The project goal is to evaluate the effectiveness of daily in-home monitoring technology measured in 2 ways: reduced hospital admissions and reduced visits to the emergency room. For the project, Intel brings its Health Guide into the

Being Digital Doesn’t Always Mean You’re Young, Demographically Speaking

Being younger demographically doesn’t mean you’re younger, digitally-speaking. Your Real Age isn’t your Digital Age, according to Wells Fargo‘s survey into Americans’ use of advanced tools for daily tasks. The categories of peoples’ digital maturity include: – Digital teens, who are people who are online but don’t use all tools at a ‘high level’ – Digital novices are those people who manage basic tasks online but aren’t yet connecting with others online or managing more complex tasks – Digital adults have the highest digital age, as demonstrated by their using online tools for daily tasks, interacting with others online, and

Caregiving in the USA – the burden intensifies, and technology’s promise

29% of people in the U.S. have served as unpaid family caregivers in the past year. That’s 66 million people, mostly female (66%), middle age (on average 48 years old), usually taking care of a relative (86%).These sobering stats come out of Caregiving in the U.S. 2009, a study from the National Alliance for Caregiving in collaboration with AARP. The research, funded by the MetLife Foundation, follows up a similar study in 2004 and shows the proportion of Americans caregiving has substantially changed over the past five years.But both caregivers of adults and those for whom they provide care are

Aging, economics and consumer-generated media — implications for health

Advertising Age analyzes census data on aging and diversity in America, and comes up with some interesting conclusions for consumer marketers. Here at Health Populi, we’re all-health, all-the-time, so I’m going to discuss author Peter Francese’s findings through our health lens. In addition, McKinsey published its insights into aging boomers in the report, Talkin’ ‘Bout My Generation, which I will also discuss. Francese begins with the one-two punch that marketers in the U.S. are already faced with the economic downturn coupled with consumer-generated media (e.g., blogs, online videos, e-pinions.com, ad infinitum). The third challenge to add to these two market-shapers

Gil Bashe, Chair Global Health and Purpose with FINN Partners,

Gil Bashe, Chair Global Health and Purpose with FINN Partners,  Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast