A Profile of Health Consumer-Generations’ Use of Digital Health – Rock Health Takes Us Through the Ages

In the past year, most consumers in the U.S. have used virtual care, tracked at least one health metric digitally, and own a wearable or connected health device. Digital health has certainly gone mainstream across U.S. consumers, with varying utilization and motivation by generation, we learn in the report, Screenagers to Silver Surfers: How each generation clicks with care from Rock Health. To segment health consumers by age/generation, the RH team mined the firm’s 10th Consumer Adoption of Digital Health Survey which polled over 8,000 U.S. adults in 2024 on peoples’ perspectives

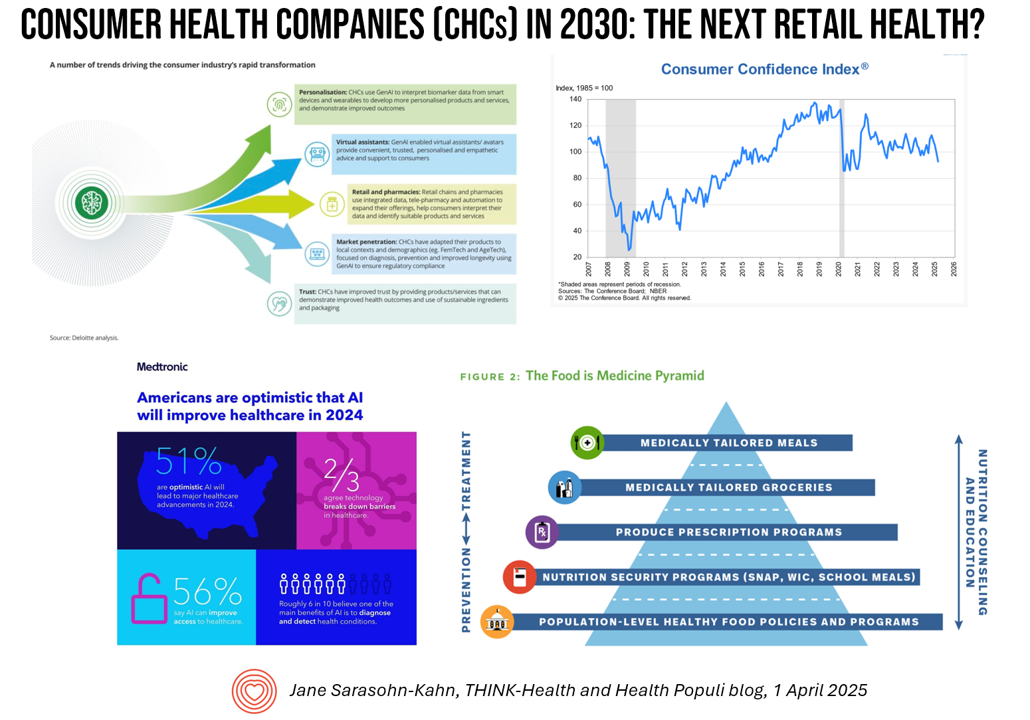

What is a Consumer Health Company? Riffing Off of Deloitte’s Report on CHCs/A 2Q2025 Look at Self-Care Futures

The health care landscape in 2030 will feature an expanded consumer health industry that will become, “an established branch of the health ecosystem focused on promoting health, preventing, disease, treating symptoms and extending healthy longevity,” according to a report published by Deloitte in September 2024, Accelerating the future: The rise of a dynamic consumer health market. While this report hit the virtual bookshelf about six months ago, I am revisiting it on this first day of the second quarter of 2025 because of its salience in this moment of uncertainties across our professional and personal lives — particularly related to

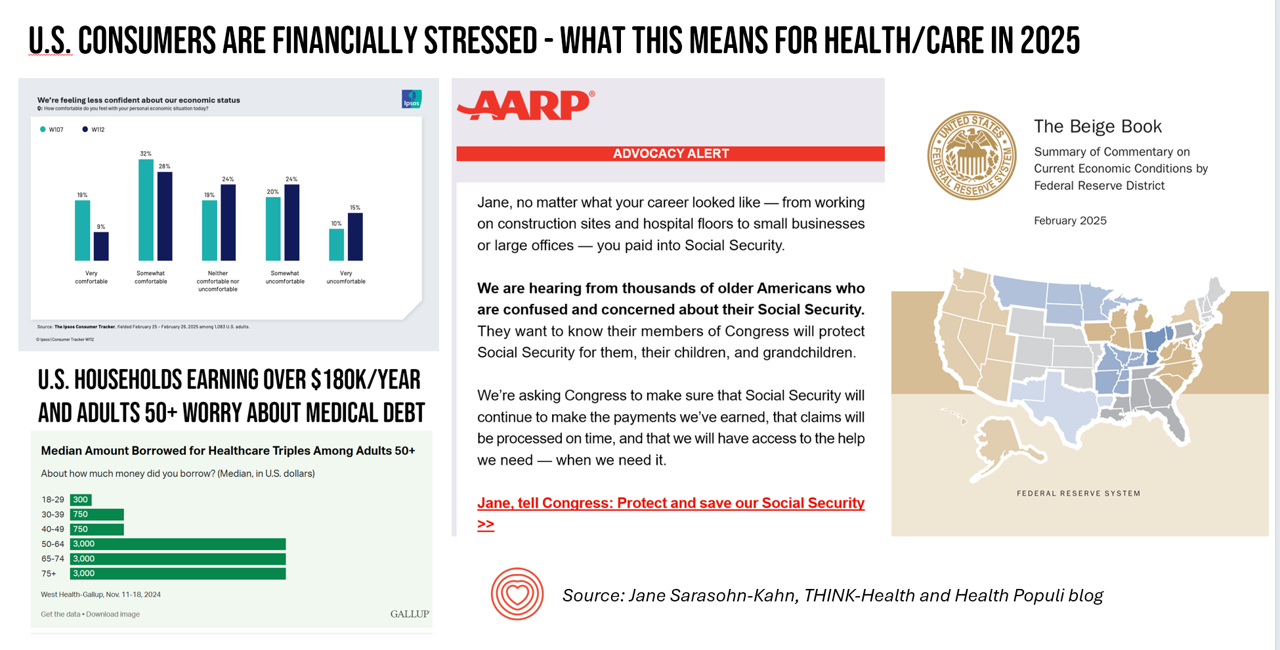

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

Seeing Health/Care Everywhere at CES 2025: My Preview for #CES2025

Health/care is everywhere is the mantra on the back of my business card. And at #CES2025, that will indeed be the situation. The 2025 convening of CES (once known as the Consumer Electronics Show) in Las Vegas officially kicks off on 7 January 2025. But I’ll be there beginning 3rd January, scheduling pre-show meetings with innovators, analysts, and my own clients who will be attending the meeting. This will be my 15th year participating in CES, and marking over a decade as a member of the Consumer Technology Association (CTA). As someone who has tracked

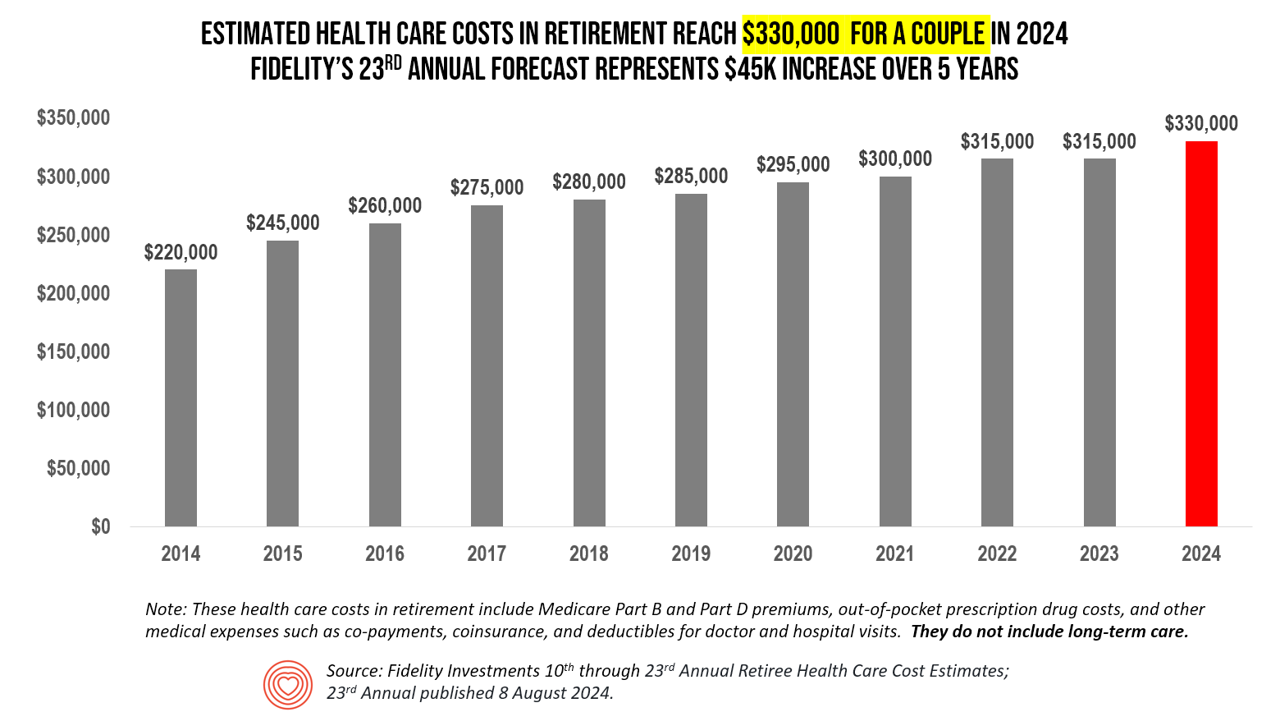

The Health Care Costs for Someone Retiring in 2024 in the U.S. Will Reach $165,000 – Fidelity’s 23rd Annual Update

The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast. I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K. Fidelity began

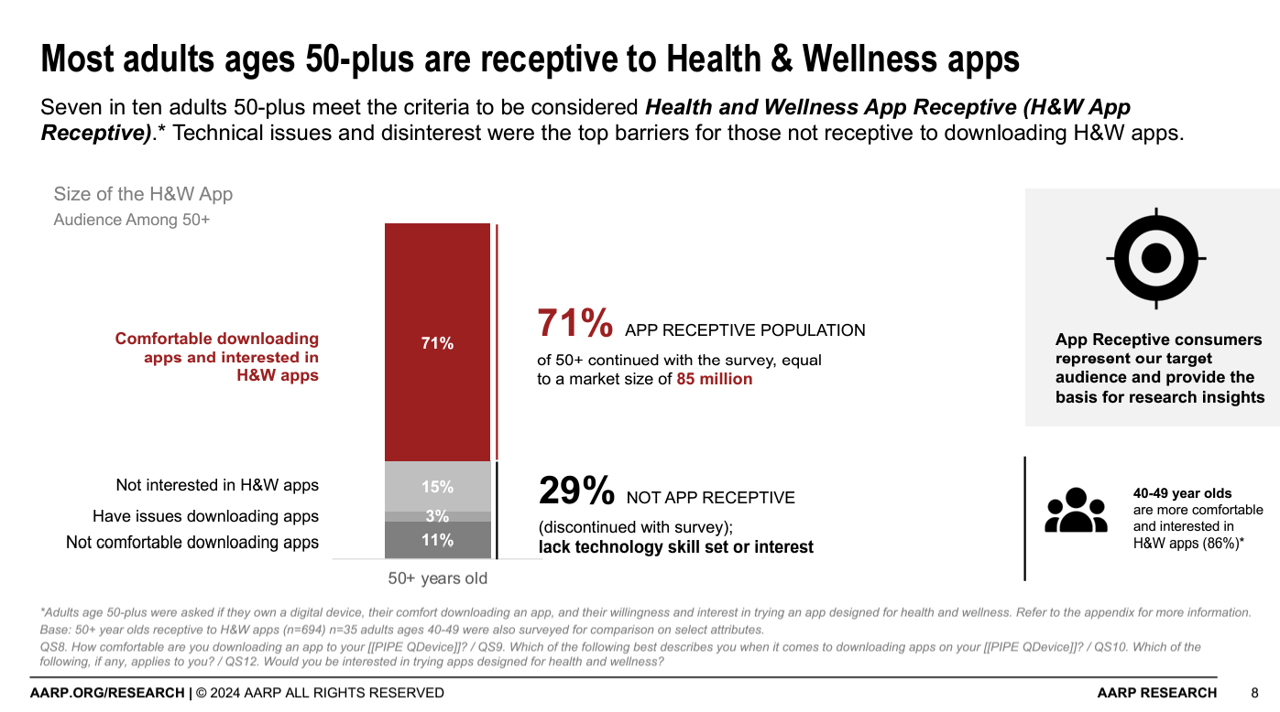

Older Americans Mostly Receptive to Apps for Health, but Chronically Ill People Could Use a Nudge (and a Payer)

AARP found that 7 in 10 people ages 50+ are “app-receptive” for health and wellness apps in Unlocking Health and Wellness Apps: Experiences of Adults Age 50-Plus, a summary of research conducted with U.S. consumers 50 and over from AARP. The methodology for this study included only older consumers who were comfortable in downloading apps to smartphones or tablets, and were willing to do so — whom AARP considered the target audience for this research. In addition, the respondents surveyed were also at least interested in trying apps designed for health and wellness, thus dubbed “health

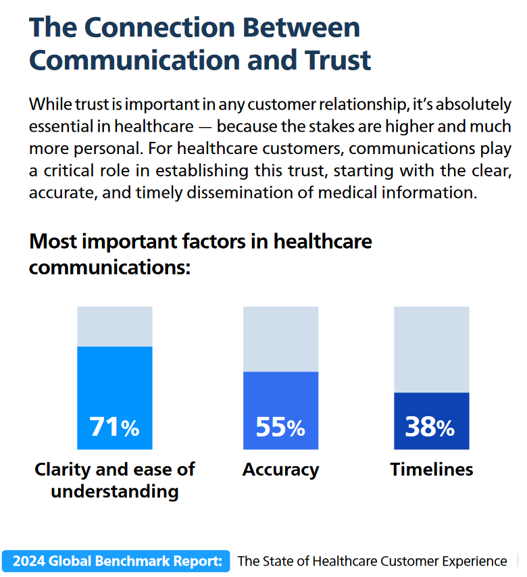

Globally Patients Seek Clear Communications to Build Trust with Healthcare, Especially in the AI Era

Globally, patients are growing consumer muscles leaning into trust that’s building on communications that connect with them, based on insightful research from Smart Communications. This consumer research was fielded by Toluna and Harris Interactive in February and March 2024. In The State of Customer Conversations, the report assesses input from global consumers from the APAC region (Australia, New Zealand, China, Hong Kong, Taiwan, Japan, and Singapore), German-speaking markets (Austria, Germany, Switzerland), the United Kingdom, and the U.S. The research revealed five key findings, shown in the first exhibit: Communications are increasingly important

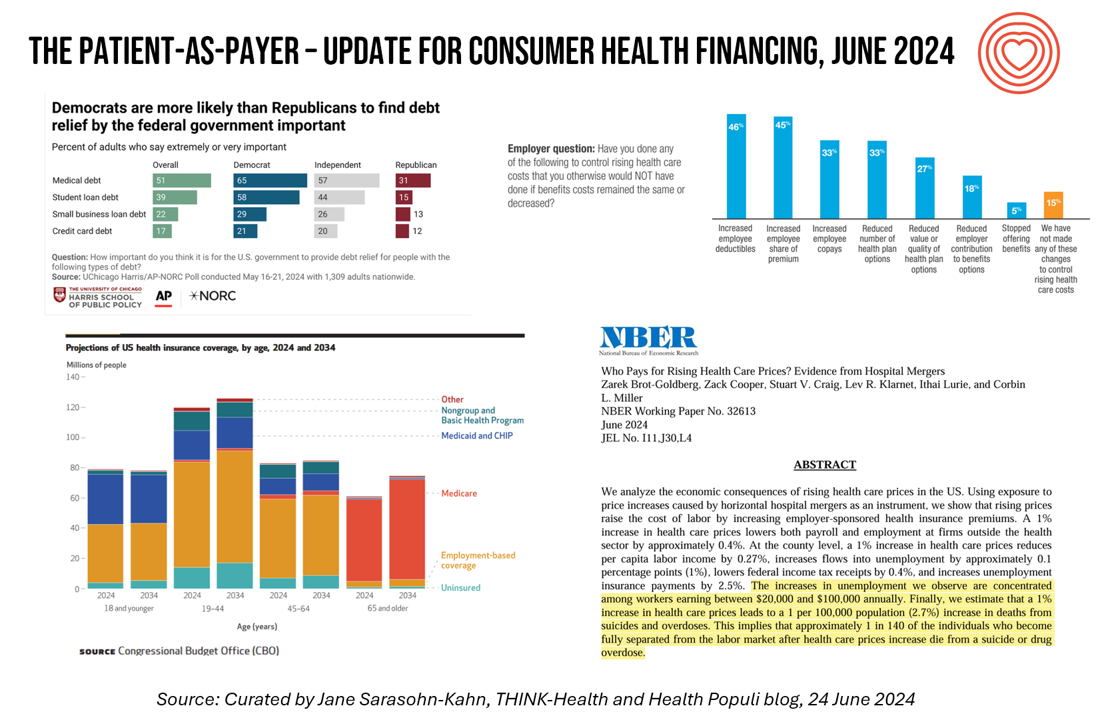

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

Most Older People Want to Age in Place and Are Adopting Technologies At Home To Do So

The vast majority of older people (95%) want to “age in place” — that is, stay put in their homes and avoid moving into long-term care residences or elsewhere. One approach for enabling aging-in-place is peoples’ adoption of various technologies, a topic surveyed by U.S. News & World Report. In April 2024, U.S. News interviewed 1,500 U.S. adults ages 55 and over on their views toward technology and everyday life at home. The first graphic from U.S. News’ study report, published earlier this month, shows that older people identified six categories of

A Springtime Re-Set for Self-Care, From Fitness to Cozy Cardio: Peloton’s Latest Consumer Research

How many people do you know that don’t know their cholesterol or their BMI, their net worth or IQ, their credit score, astrological sign, or ancestry pie-chart? Chances are fewer and fewer as most people have gained access to medical records and lab test results on patient portals, calorie burns on smartwatches, credit scores via monthly credit card payments online, and completing spit tests from that popularly gifted Ancestry DNA test kits received during the holiday season. Meet “The Guy Who Didn’t Know His Cholesterol” conceived by Roz Chast,

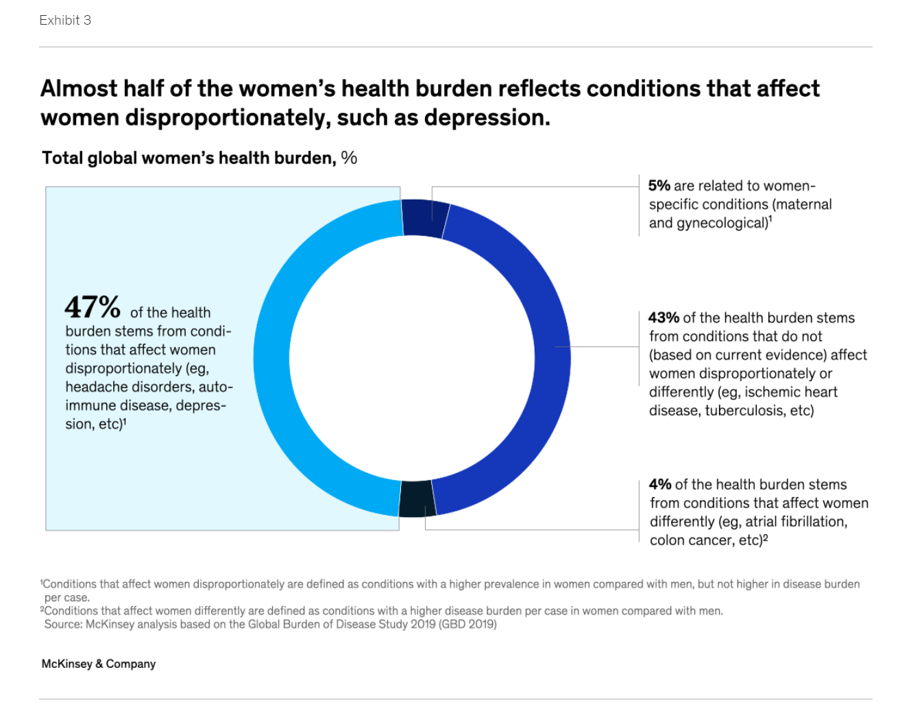

The Women’s Health Gap Is Especially Wide During Her Working Years – Learning from McKinsey, the World Economic Forum, and AARP in Women’s History Month

There’s a gender-health gap that hits women particularly hard when she is of working age — negatively impacting her own physical and financial health, along with that of the community and nation in which she lives. March being Women’s History Month, we’ve got a treasure-trove of reports to review — including several focusing on health. I’ll dive into two for this post, to focus in on the women’s health gap that’s especially wide during her working years. The reports cover research from the McKinsey Health Institute collaborating with the World Economic Forum on

A Tale of Two Houses: House Calls at #CES2024 with Amazon and AARP + Samsung

The growing movement of health care to the home is evident by a growing list of point solutions featured at CES 2024. Digital health has been a fast-growing category of consumer-facing devices at CES for over a decade. But with the growing ubiquity of connectivity, cloud computing, sensors and this year AI “everywhere,” a person’s home as their health-hub is an increasingly practical scenario. I track many categories of products at CES each year, and this year added into my portfolio the smart kitchen and smart bathroom. We’ve had components of these two

Our Homes as HealthQuarters – Finding Health and Well-Being at CES 2023

For over ten years, digital health technology has been a fast-growing area at the annual CES, the largest convention covering consumer electronics in the world. When the meet-up convenes over 100,000 tech-folk in Las Vegas at the start of 2023, we’ll see even more health and self-care tools and services at #CES23 — along with new-new things displayed in aisles well outside of the physical space on the Las Vegas Convention Center map labeled “digital health” at this year’s CES in the North Hall. Some context: my company has been a member

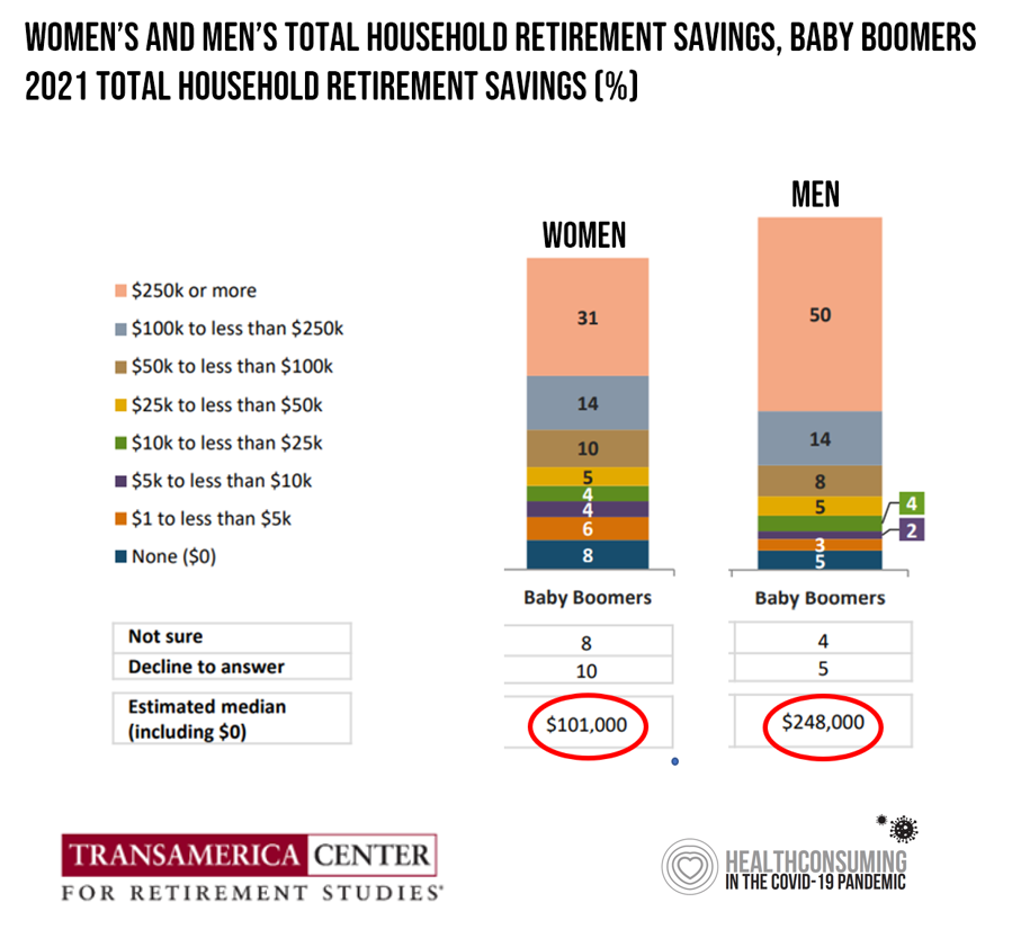

Men Work in Retirement for Healthy Aging; Women, for the Money – Transamerica Looks at Retirement in 2022

Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS). As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.” Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The

Consumers’ Dilemma: Health and Wealth, Smartwatches and Transparency

Even as spending on healthcare per person in the United States is twice as much as other wealthy countries in the world, Americans’ health status ranks rock bottom versus those other rich nations. The U.S. health system continues to be marred by health inequalities and access challenges for man health citizens. Furthermore, American workers’ rank top in the world for feeling burnout from and overworked on the job. Welcome to The Consumer Dilemma: Health and Wellness,, a report from GWI based on the firm’s ongoing consumer research on peoples’ perspectives in the wake of

Fastest-Growing Brands for 2021 Are About Digital Money, Social Connections and Boomers’ Best Lives

Two pharmaceutical companies bubble up among the 20 fastest-growing brands for 2021 in Morning Consult’s report on the Fastest-Growing Brands of 2021. But the surprise in this year’s top 20 brand rankings was that five of them addressed consumers’ financial flows: Coinbase, AfterPay. Cash App, Mastercard, Chime, and Bitcoin. One year ago when I covered this study, I found that the fastest-growing brands of 2020 had everything to do with the pandemic. They dealt with home entertainment, digital connectivity, hygiene, and indeed, health (with Pfizer and AstraZeneca the two pharma brands top-of-mind for consumers). In this year’s update, exploring consumers’

Wearables Are Good For Older People, Too — The Latest From Laurie Orlov

The COVID-19 pandemic accelerated a whole lot of digital transformation for people staying home. For digital natives, that wasn’t such an exogenous shock. For older people who are digital immigrants, they will remember their initial Zoom get-together’s with much-missed family, ordering groceries online in the first ecommerce purchase, and using telemedicine for the first time as a digital health front-door. Laurie Orlov, tech industry veteran, writer, speaker and elder care advocate, is the founder of the encyclopedic Aging and Health Technology Watch website. She takes this propitious moment to assess The Future of Wearables and Older Adult in a new report.

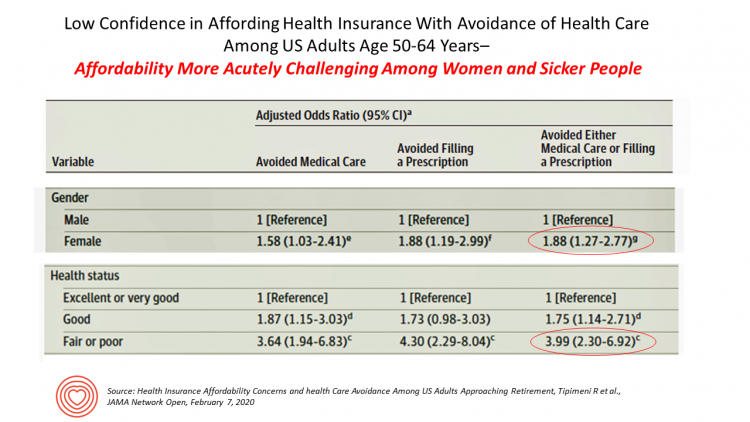

Health Care Costs Concern Americans Approaching Retirement – Especially Women and Sicker People

Even with the prospect of enrolling in Medicare sooner in a year or two or three, Americans approaching retirement are growing concerned about health care costs, according to a study in JAMA Network Open. The paper, Health Insurance Affordability Concerns and health Care Avoidance Among US Adults Approaching Retirement, explored the perspectives of 1,028 US adults between 50 and 64 years of age between November 2018 and March 2019. The patient survey asked one question addressing two aspects of “health care confidence:” “Please rate your confidence with the following:” Being able to afford the cost of your health insurance nad

How a Razor Bolsters Health, Wellness and Love for Caregiving

The market for caregiving is growing and the business community has, finally, begun to pay attention. The Washington Post referred to this market as a “gold rush” to design smart shoes, custom razors and technology for the “over-65 crowd.” Caregiving in the U.S., the seminal report from AARP, estimated that 43,5 million adults in the U.S. had provided unpaid care to an adult or child in the past year, about one in five people being caregivers. Over half of caregivers are women, and are about 49 years of age on average. Caregivers spent over 24 hours a week providing care go

Patients Growing Health Consumer Muscles Expect Digital Services

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned. Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year. One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people

The Convergence of Health/Care and Real Estate

There’s no denying the growth of telehealth, virtual visits, remote health monitoring and mHealth apps in the healthcare landscape. But these growing technologies don’t replace the role of real estate in health, wellness and medical care. Health care is a growing force in retail real estate, according to the ICSC, the acronym for the International Council of Shopping Centers, which has been spending time analyzing, in their words, “what landlords should know in eyeing tenants from a $3.5 trillion industry.” Beyond the obvious retail clinic segment, the ICSC points out a key driving growth lever for its stakeholders, recognizing that,

Most Americans Over 50 Not Buying Groceries Online….Yet

Only 17% of Americans over 50 years of age shopped for groceries online by mid-2018. But older people in the U.S. have underlying demands and needs that could nudge them to do online grocery shopping, unearthed in a survey from AARP Foundation and IFIC, the International Food Industry Council Foundation. Typically, older Americans who shop online tend to be college-educated, work full-time, and earn higher incomes. Older people with mobility issues also shop more online than folks without such challenges. But even among those older people who shop online for food, they do so less frequently than younger people do.

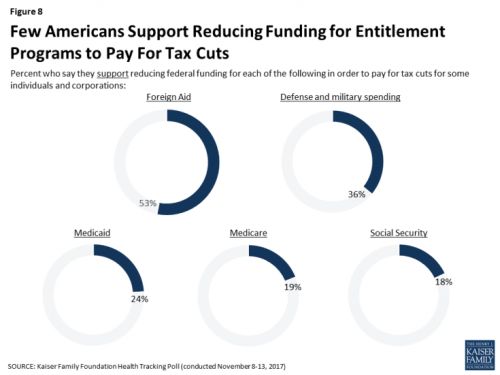

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

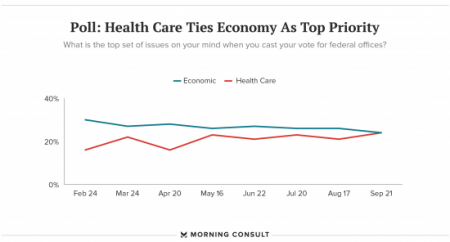

The Patient As Payor – Americans Bundle Financial Wellness and Healthcare Costs

Healthcare and the economy tied for US voters’ top issue last week, as the prospects for repealing the Affordable Care Act faded by the weekend. This Morning Consult poll was published 28th September 2017, as it became clear that the Graham-Cassidy health reform bill would lose at least three key votes the legislation needed for passage: from Rand Paul, Susan Collins, and John McCain. Liz Hamel, who directs the Kaiser Family Foundation’s survey research, told Morning Consult that, “when people say ‘health care,’ they often are actually talking about the economic issue of health care.”

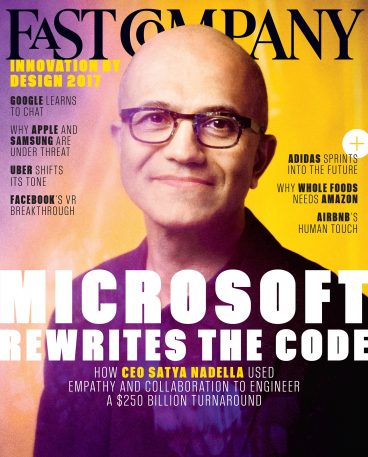

Envisioning Healthcare Innovation and Value with Microsoft

Fast Company’s October 2017 issue leads with a cover story featuring Microsoft’s CEO Satya Nadella, with the title, “Microsoft Rewrites the Code.” The issue of Fast.Co is devoted to the theme of innovation by design, and the 8-page story on the company emphasizes the themes of empathy and collaboration in re-imagining the organization. I lead with this because I’m now in Orlando preparing to participate in Microsoft’s annual meeting called Envision. This conference brings together the company’s clients from around the world, representing major industry segments. I’m grateful to be invited to participate in the first of six sessions devoted

How Amazon Has Primed Healthcare Consumers – My Update with Frances Dare, Accenture

“I want what I want, when and how I want it.” If you think that sounds like a spoiled child, that’s not who I’m quoting. It’s you, if you are a mainstream consumer in the U.S., increasingly getting “primed” by Amazon which is setting a new bar for retail experience in terms of immediacy, customer service, and breadth of offerings. I talked about this phenomenon in my Health Populi post, How Amazon Has Primed Healthcare Consumers. The blog discussed my take on Accenture’s latest study into healthcare consumers based on the report’s press release. I appreciated the opportunity to sit

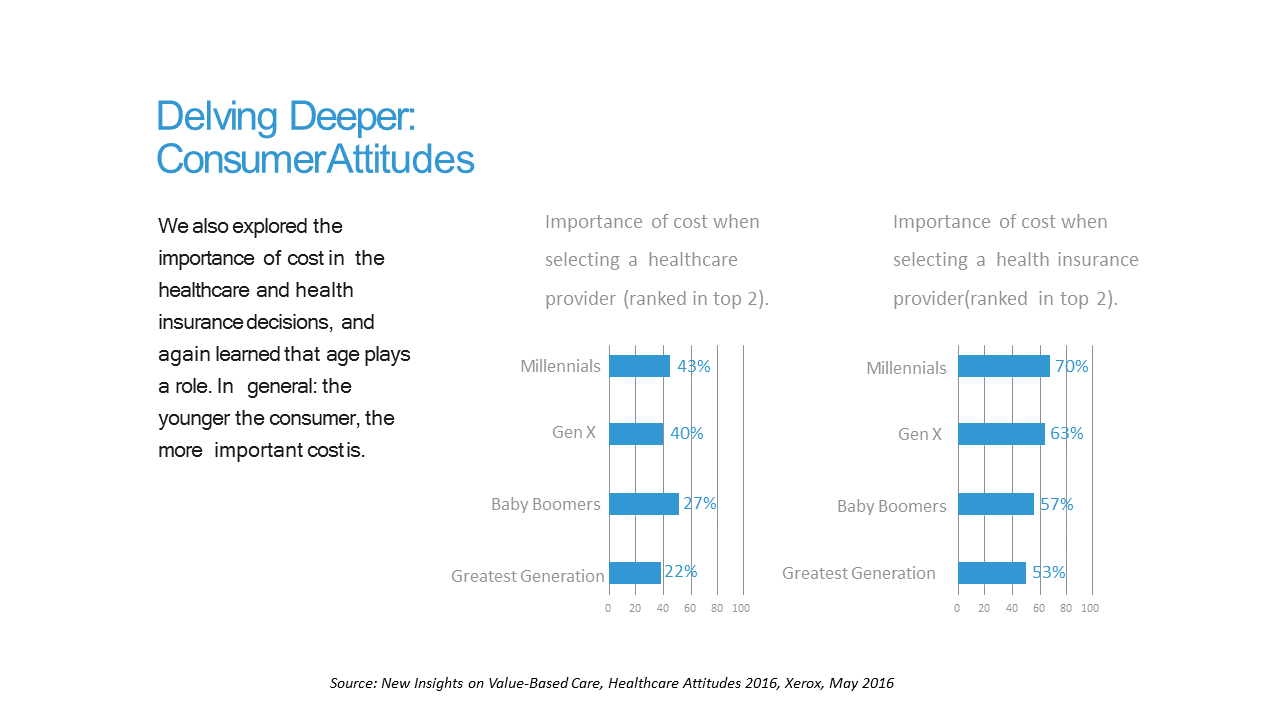

Costs and Connection At the Core of Consumers’ Health-Value Equations

Cost ranks first among the factors of selecting health insurance for most Americans across the generations. As a result, most consumers are likely to shop around for both health providers and health plans, learned through a 2016 Xerox survey detailed in New Insights on Value-Based Care, Healthcare Attitudes 2016. The younger the consumer, the more important costs are, Xerox’s poll found, shown in the first chart. Thus, “shopping around” is more pronounced among younger health consumers — although a majority people who belong to Boomer and Greatest Generation cohorts do shop around for both health providers and health insurance plans —

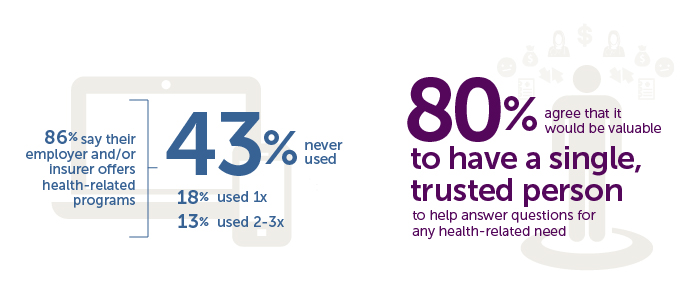

Generation Gaps in Health Benefit Engagement

Older workers and retirees in the U.S. are most pleased with their healthcare experiences and have the fewest problems accessing services and benefits. But, “younger workers [are] least comfortable navigating U.S. healthcare system,” which is the title of a press release summarizing results of a survey conducted among 1,536 U.S. adults by the Harris Poll for Accolade in September 2015. Results of this Accolade Consumer Healthcare Experience Index poll were published on April 12, 2016. Accolade, a healthcare concierge company serving employers, insurers and health systems, studied the experiences of people covered by health insurance to learn about the differences across age

Digital health love – older people who use tech like health-tech, too

As people take on self-service across all aspects of daily living, self-care in health is growing beyond the use of vitamins/minerals/supplements, over-the-counter meds, and trying out the blood-pressure cuff in the pharmacy waiting for a prescription to be filled. Today, health consumers the world over have begun to engage in self-care using digital technologies. And this isn’t just a phenomenon among people in the Millennial generation. Most seniors who regularly use technology (e.g., using computers and mobile phones) are also active in digitally tracking their weight, for example, learned in a survey by Accenture. Older people who use technology in daily

Fish oil and yoga are the most-used alternative “medicines”

1 in 3 U.S. adults used some form of complementary and alternative medicine (CAM) in the U.S. in 2012, led by fish oil in the herbal supplements category, and yoga in the services category. While use of complementary products and services in health has remained unchanged at about 34% of Americans using CAM, the adoption of yoga in American life has doubled among adults in the past decade to about 1 in 10 adults doing some form of yoga. The report, the Use of Complementary Health Approaches in the U.S., a National Health Interview Survey conducted for the National Center for

The phone is a gateway drug to health: what MyFitnessPal knows, and what Under Armour gets

65 million people know that food journaling works for losing weight, that it’s engaging to do on a well-designed app, and that health is social. MyFitnessPal (MFP) has the distinction of being a top health app used longer by more people and more effectively than probably any other mobile health tool. Under Armour, the athletic goods company, now has MFP under its corporate umbrella, along with Endomondo, another very popular motivating mobile health tool. You may know Under Armour as a company that manufactures and markets functional workout gear. But this deal is so not about the wearable. It’s about

Getting real about consumer demand for wearables: Accenture slows us down

Are you Feelin’ Groovy about wearables? Well slow down, you move too fast… …at least, according to Accenture’s latest survey into consumers’ perspectives on new technologies, published this week in conjunction with the 2015 Consumer Electronics Show in Las Vegas, the largest annual convention in the U.S. featuring technology for people. At #CES2015, we’re seeing a rich trove of blinged-out, multi-sensor, shiny new wearable things at the 2015 Consumer Electronics Show. Swarovski crystals are paired with Misfit Wearables, called the Swarovski Shine, shown here as a shiny new thing, indeed. Withings launched its Activite fitness tracking watch in new colors.

The Internet of Healthy Me – putting digital health in context for #CES2015

Men are from Mars and Women, Venus, when it comes to managing health and using digital tools and apps, based on a poll conducted by A&D Medical, who will be one of several hundred healthcare companies exhibiting at the 2015 Consumer Electronics Show this week in Las Vegas. Digital health, connected homes and cars, and the Internet of Things (IoT) will prominently feature at the 2015 Consumer Electronics Show in Las Vegas this week. I’ll be attending this mega-conference, meeting up with digital health companies and platform providers that will enable the Internet of Healthy “Me” — consumers’ ability to self-track,

Women-centered design and mobile health: heads-up, 2014 mHealth Summit

This post is written as part of the Disruptive Women on Health’s blog-fest celebrating the 2014 mHealth Summit taking place 7-11 December 2014 in greater Washington, DC. Women and mobile health: let’s unpack the intersection. On the supply side of the equation, Good Housekeeping covered health tracking-meets-fashion bling in the magazine a few weeks ago in article tucked between how to cook healthy Thanksgiving side dishes and tips on getting red wine stains out of tablecloths. This ad appeared in a major sporting goods chain’s 2014 Black Friday pre-print in my city’s newspaper last week. And along with consumer electronics brand faves like

Power to the health care consumer – but how much and when?

Oliver Wyman’s Health & Life Sciences group names its latest treatise on the new-new health care The Patient-to-Consumer Revolution, subtitled: “how high tech, transparent marketplaces, and consumer power are transforming U.S. healthcare.” The report kicks off with the technology supply side of “Health Market 2.0,” noting that “the user experience of health care is falling behind” other industry segments — pointing to Uber for transport, Amazon for shopping, and Open Table for reserving a table. The authors estimate that investments in digital health and healthcare rose “easily ten times faster” than the industry has seen in the past. Companies like

How smart do you want your home to be?

Smarter homes can conserve energy, do dirty jobs, and remind you to take your medicine. In doing all these things, smart homes can also collect data about what you do inside every single room of that home. The fast convergence of Wi-Fi and sensors are laying the foundation for the Internet of Things, where objects embedded with sensors do things they’re specially designed to do, and collect information while doing them. This begs the questions: what do you want to know about yourself and your family? How much do you want to know? And, with whom do you want to

Health Care Everywhere at the 2014 Consumer Electronics Show

When the head of the Consumer Electronics Association gives a shout-out to the growth of health products in his annual mega-show, attention must be paid. The #2014CES featured over 300 companies devoted to “digital health” as the CEA defines the term. But if you believe that health is where we live, work, play, and pray, then you can see health is almost everywhere at the CES, from connected home tech and smart refrigerators to autos that sense ‘sick’ air and headphones that amplify phone messages for people with hearing aids, along with pet activity tracking devices like the Petbit. If

Health is everywhere – seeing health in JWT’s Top 100 Trends for 2014

Of 100 broad-based trends to expect in 2014, most relate in some way to health. I’ve reviewed every one of the 100 forecast points in JWT’s 100 Things to Watch in 2014 report, and it seems Health is Everywhere. Let me point out many, which I’ve allocated to health-ified buckets (note that JWT organizes the list of 100 by alphabet, from “A” to “Z,” so they are not in any prioritized or strategic order). The most direct-health impacting bucket of trends are those in health tech. These include E-cigarette regulation (#35), Glassware (#42), Haptic technology (#46), Needle-free vaccines (#64), Oculus Rift (#65), OTT TV (#66), Telediagnostics

mHealth will join the health ecosystem – prelude to the 2014 Consumer Electronics Show

The rise of digital health at the 2014 Consumer Electronics Show signals the hockey-stick growth of consumer-facing health devices for fitness and, increasingly, more medical applications in the hands of people, patients, and caregivers. This year at #CES2014, while the 40% growth of the CES digital health footprint will get the headlines, the underlying story will go beyond wristbands and step-tracking generating data from an N of 1 to tools that generate data to bolster shared-decision making between people and the health system, and eventually support population health. For example: – Aetna is partnering with J&J to deploy their Care4Today

Be thankful for your good life. Now think about what a good death would be.

This Thanksgiving, we’re once again participating in the annual Engage With Grace blog rally, encouraging those who haven’t considered their end-of-life preferences to start thinking about them, and asking those who have done it to consider how their decisions may have changed over time. It’s good food for thought. Wishing you all a happy, healthy holiday season. Most of us find ourselves pretty fascinating… flipping through photos and slowing down for the ones where we’re included, tweeting our favorite tidbits of information, Facebook-ing progress on this or that… We find other people captivating as well. In fact, there’s a meme going around

There’s fear of health care costs in peoples’ retirement visions

While working people in the U.S. are feeling better about the nation’s economy, Americans aren’t putting much money into savings for retirement. The reasons for this are many, but above all is what Mercer calls “the specter of health care costs in retirement” in the Mercer Workplace Survey for 2013. In addition to peoples’ concerns about future health care costs, reasons for not putting money away for the future include flat personal income, slow economic growth and financial literacy challenges around how much 401(k) savings can be tax-deferred. On the slow economic growth perception, Mercer found that, on the upside, people

Delaying aging to bend the cost-curve: balancing individual life with societal costs

Can we age more slowly? And if so, what impact would senescence — delaying aging — have on health care costs on the U.S. economy? In addition to reclaiming $7.1 trillion over 50 years, we’d add an additional 2.2 years to life expectancy (with good quality of life). This is the calculation derived in Substantial Health And Economic Returns From Delayed Aging May Warrant A New Focus For Medical Research, published in the October 2013 issue of Health Affairs. The chart graphs changes in Medicare and Medicaid spending in 3 scenarios modeled in the study: when aging is delayed, more people qualify

Economics of obesity and heart disease: We, the People, can bend the curves

The “O” word drives health costs in America ever-upward. Without bending the obesity curve downward toward healthy BMIs, America won’t be able to bend that stubborn cost curve, either. The Economic Impacts of Obesity report from Alere Wellbeing accounts for the costs of chronic diseases and how high obesity rates play out in the forms of absenteeism, presenteeism, and direct health care costs to employers, workers and society-at-large. Among the 10 costliest physical health conditions, the top 3 are angina, hypertension and diabetes — all related to obesity and amenable to lifestyle behavior change. The top-line numbers set the context:

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

Happy today, nervous about health and money tomorrow: an Aging in America update

Most older Americans 60 years of age and up (57%) say the last year of their lives has been “normal” – a large increase from the 42% who said life was normal in 2012. And nearly 9 in 10 older Americans are confident in their ability to maintain a high quality of life in their senior years. The good news is that seniors are maintaining a positive outlook on aging and their future. The downside: older people aren’t doing much to invest in their future health for the long run. They’re also worried about the financial impact of living longer.

Cost prevents people from seeking preventive health care

3 in 4 Americans say that out-of-pocket costs are the main reason they decide whether or not to seek preventive care, in A Call for Change: How Adopting a Preventive Lifestyle Can Ensure a Healthy Future for More Americans from TeleVox, the communications company, published in June 2013. TeleVox surveyed over 1,015 U.S. adults 18 and over. That’s the snapshot on seeking care externally: but U.S. health consumers aren’t that self-motivated to undertake preventive self-care separate from the health system, either, based on TeleVox’s finding that 49% of people say they routinely exercise, and 52% say they’ve attempted to improve eating habits.

1 in 3 people is interested in doing mobile health, but they skew younger

The headline for the HarrisInteractive/HealthDay mobile health (mHealth) survey reads, “Lots of Americans Want Health Care Via Their Smartphones.” But underneath that bullish forecast are statistics illustrating that the heaviest users of health care services in America — people 65 and over — have the least interest in mHealth tools. Overall, 37% of U.S. adults are interested in managing health via smartphones or tablets: about 1 in 3 people. As the chart shows, the greatest interest in communicating with doctors via mobile phones and tablets is among people 25-49. Reminders to fill prescription and participate in wellness programs is also

The emerging economy for consumer health and wellness

The notion of consumers’ greater skin in the game of U.S. health care — and the underlying theory of rational economic men and women that would drive people to greater self-care — permeated the agenda of the 2nd annual Consumer Health & Wellness Innovation Summit, chaired by Lisa Suennen of Psilos Ventures. Lisa kicked off the meeting providing a wellness market landscape, describing the opportunity that is the ‘real’ consumer-driven health care: people getting and staying well, and increasing participation in self-management of chronic conditions. The U.S. health system is transforming, she explained, with payors beginning to look like computer

The health/wealth disconnect in America

Two in 3 Americans are uncomfortable with their financial situation. And most are totally oblivious to how much money they will need to spend on health care in the future. Seven in 10 people expect to spend less than 10% of their monthly retirement income on medical and dental expenses; but the real number is 30% of income needed for health care in retirement, according to The Urban Institute. The Wellness for Life survey, conducted for Aviva, the life and disability company, collaborating with the Mayo Clinic, finds an American health citizen out of touch with their personal health economics.

Call it DTH, direct to home: Pfizer is shipping Viagra direct to consume

While the blockbuster erectile dysfunction (ED) drug has been shipped directly to consumer’s homes for years via pharmacy benefits management companies and specialty pharmacy retailers catering to the ED segment, Pfizer wants in on the transaction and has decided to get into the Direct-to-Consumer (DTC) distribution business for a prescription drug. Call this market development Direct-to-Home, or DTH. This is a kind of sentinel event signaling a pharmaceutical manufacturer cutting out the middle-man (read: retail pharmacy), and in this case getting up-close-and-personal with users of a drug that represents quality of life. Another motivation for Pfizer is trying to stem

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

Bill Clinton’s public health, cost-bending message thrills health IT folks at HIMSS

In 2010, the folks who supported health care reform were massacred by the polls, Bill Clinton told a rapt audience of thousands at HIMSS13 yesterday. In 2012, the folks who were against health care reform were similarly rejected. President Clinton gave the keynote speech at the annual HIMSS conference on March 6, 2013, and by the spillover, standing-room-only crowd in the largest hall at the New Orleans Convention Center, Clinton was a rock star. Proof: with still nearly an hour to go before his 1 pm speech, the auditorium was already full with only a few seats left in the

Health is wealth and wealth, health

It’s America Saves Week (February 25-March 2, 2013). Do you know what your savings rate is? If you’re in the center of the American savings bell curve, you probably don’t have a savings plan with specific goals and don’t know your net worth. Two-thirds of U.S. adults say they have sufficient emergency savings for unexpected expenses like a visit to a doctor. However, only one-half of non-retired people believe they’re saving enough for a retirement where they’ll have a “desirable standard of living.” This six annual survey by the Consumer Federation of America, the American Savings Education Council, and the

Health care cost illiteracy: consumers feel the pinch of growing costs, but don’t understand the “why?”

Health care costs for workers lucky enough to receive health insurance at work nearly doubled since 2002. Wages in that decade grew by 33%. This growing affordability gap between health costs vs. wages is shown in the chart. Health consumers in America sharply perceive this gap, according to an analysis of eight focus groups, Consumer Attitudes on Health Care Costs: Insights from Focus Groups in Four U.S. Cities from the Robert Wood Johnson Foundation. To health-covered workers, though, health care “costs” are defined as out-of-pocket health spending for insurance premiums, co-payments and deductibles that come out of paychecks and pocketbooks — not

Most women want to be healthy, buy healthy

Health and wellness motivations among women cross all generations, driving them to purchase products that bolster health as they define it…not how media and stereotyping advertising have typically portrayed it, according to a survey report from Anthem Worldwide, What Women Really Want From Health and Wellness. Over all generations, 3 in 4 women say they make choices to benefit their health and wellness. Anthem asked women about the “external voices” of health/wellness messaging versus their “internal voice.” The external represent societal expectations: over 80% of women expect to take responsibility for their family’s health, and about 70% of women say the

More consumers want to make health care decisions

U.S. consumers’ desire to take an active role in their health decisions is growing, according to the Altarum Institute Survey of Consumer Health Care Opinions. 61% of people want to make health decisions either on their own (26%) or with input from their doctor (38%). The proportion of people wanting to be “completely in charge of my decisions” rose 4 percentage points in one year, from 2011. This statistic skews younger, with 33% of people 25-34 and 31% of those 35-44 wanting to be “completely in charge.” Only 17% of those 55-64 felt like being totally in charge of their

The Internet as self-diagnostic tool, and the role of insurance in online health

1 in 3 U.S. adults have enough trust in online health resources that they’ve gone online to diagnose a condition for themselves or a friend. “For one-third of U.S. adults, the Internet is a diagnostic tool,” according to Health Online, the latest survey on online health from the Pew Internet & American Life Project. Nearly one-half of these people eventually sought medical attention. One-third did not. Women are more likely to do online medical diagnoses than men do, as do more affluent, college-educated people. When people perceive they’re ‘really’ sick, 70% get information and care from a health professional and

One-third of U.S. consumers plan to buy a new fitness tech in 2013, but most buyers are already healthy

Over one-third of U.S. consumers plan to buy a new fitness technology in the next year, especially women. They’ll buy these at mass merchants (females in particular, shopping at Target and Walmart), sporting goods retailers (more male buyers here), online and at electronics stores like Best Buy. These potential buyers consider themselves in good or excellent physical health. They’ll see the latest applications on retail store shelves in pedometers, calorie trackers, fitness video games, digital weight scales, and heart rate monitors that will be launched this week at the 2013 Consumer Electronics Show in Las Vegas. In advance of the

Consumers want digital communications from providers, from payment reminders to patient care via email

85% of U.S. health consumers say that emails, text messages, and voicemails are at least as helpful as in-person or phone conversations with health providers, according to the TeleVox Healthy World study, Technology Beyond the Exam Room. The study was based on surveys conducted with over 2,200 health providers across specialties, and 1,015 U.S. adults over 18. Furthermore, one in 3 consumers admit to being more honest when talking about medical needs via automated voice response systems, emails or texts than face-to-face with a health provider. And 3 in 10 consumers believe that receiving digital health communications from providers such

Health as long-term deficit driver – the CBO points out tough choices

There are many forks in the road facing us in the U.S. for deficit reduction, as the picture shows. This is the cover graphic for Choices for Deficit Reduction, a report from the Congressional Budget Office (CBO) published November 2012. Those roads could be labeled “Medicare” and “Medicaid,” as health is the #1 deficit driver for the American economy — most notably, Medicare and long-term care services financed via Medicaid. The CBO expects that per capita spending on health care, already at 18% of the national economy in 2012, will continue to grow faster than spending on other goods and

What’s on senior Americans’ minds? Medicare and money

What’s keeping seniors up at night when it comes to retirement? #1, according to 6 in 10 seniors, is the future of Medicare, followed by having enough money to enjoy retirement. In particular, 61% of seniors are concerned about future out-of-pocket health care costs. It’s all about Medicare and money for U.S. seniors, found in the Allsup Medicare Advisor Seniors Survey, Medicare Planning and Trends Among Seniors, published in October 2012. Medicare could be the most beloved government program ever, as 89% of seniors say they’re satisfied with Medicare coverage. Given the program’s shaky financial future, Allsup wanted to get

Aging in the US – seniors are health-confident, less financially so

Most seniors look forward to aging in place, and are confident in their ability to do so. Such is the top-line feel-good finding from the National Council on Aging‘s (NCOA) survey, The United States of Aging, sponsored by USA Today and United Healthcare. A majority of seniors have a sense of purpose and plans for their future. Three-fourths of older Americans say staying physically fit through exercise and proactively managing their health is important. However, only 36% of seniors say they exercise or engage in physical activity every day. 11% never do. The most common chronic conditions noted by seniors

Thinking about Dad as Digital “Mom”

What is a Mom, and especially, who is a “Digital Mom?” I’ve been asked to consider this question in a webinar today hosted by Enspektos, who published the report Digging Beneath the Surface: Understanding the Digital Health Mom in May 2012. I wrote my review of that study in Health Populi here on May 15. In today’s webinar, my remarks are couched as “Caveats About the Digital Mom: a multiple persona.” Look at the graphic. On the left, the first persona is a mother with children under 18. Most “mom segmentations” in market research focus on this segment. But what

What we can learn from centenarians about health

To get to be 100 years or older requires exercise, social connectedness, and good sleep, according to a majority of centennarians polled in UnitedHealthcare’s 100@100 Survey, 2012 Report of Findings. The key findings of this fascinating survey are that: Centenarians have better eating and sleeping habits than Boomers. One-half of centenarians regularly exercise. The most common forms of exercise are walking or hiking, muscle strengthening, gardening, indoor cardio exercise, exercise classes, and yoga/Tai Chi or other mind/body/spirit forms. Social networks bolster health, with most old-old people communicating with family or friends nearly every day And, laughter is a vitamin, with most

Social media in health help (more) people take on the role of health consumer

One in 3 Americans uses social media for health discussions. Health is increasingly social, and PwC has published the latest data on the phenomenon in their report, Social media ‘likes’ healthcare: from marketing to social business, published this week. PwC polled 1,060 U.S. adults in February 2012 to learn their social media habits tied to health. Among all health consumers, the most common use of social media in health is to access health-related consumer reviews of medications or treatments, hospitals, providers, and insurance plans, as shown in the graph. Social media enables people to be better health “consumers” by giving them peers’

Rising cost of healthcare a headache among affluent Americans

For the third year in a row, wealthy Americans cite increasing health costs as their top financial concern. Furthermore, 1 in 3 affluent Americans are more concerned about the financial stress that could accompany a health event than they are about how that condition could affect their quality of life. Merrill Lynch Wealth Management, part of Bank of America, conducted the firm’s annual poll among 1,000 Americans with investable assets of at least $250,000, in December 2011. The investment firm has looked at richer Americans’ views on financial concerns since 2009. The chart shows rising health care costs to be

Michael Graves: architect-turned-health designer at Social Media Week

Michael Graves is one of the greatest architects of our, or any, time. He is now dedicating himself to re-imagining what the patient’s experience in a hospital room can be: not just less humiliating and frustrating, but in fact a healing experience in an aesthetically comforting and user-friendly environment. Graves, longtime affiliated with Princeton University, is famous among mainstream consumers as one of Target’s first designers of home products for the past 13 years, from teapots and cooking gear to kitchen cleaning accessories. Sadly for us mass consumers, this will be his last year of designing for Target. He told the

Make 2012 the year of living health-fully

When I would meet up with clients and friends during the latter half of 2011, people whom I hadn’t seen for months would do a double-take when they saw me. “What have you done?” they have asked. In this first post of 2012, I will share with Health Populi readers my story of 2011 — a year of living health-fully for me. One of the blessings of my work-life is that I have access to some of the great minds in health and health care. But not until I began to personally harness their wisdom, intentionally incorporating what they’ve learned into my own life-flow and

Unretirement: the number of Americans planning to retire at 67 is plummeting

Two publications this week reinforce the new reality of health and financial insecurity: The Vanishing Middle America issue of Advertising Age (October 17, 2011 issue) and the Sun Life Financial U.S. Unretirement Index – Fall 2011 with the subtitle, “Americans’ trust in retirement reaches a tipping point.” The chart shows the retirement coin’s two sides: since 2008, the proportion of people in the U.S. who expect to retire by 67 dropped from 52% down to 35%; and, those who believe they will be working full-time (I emphasize “full,” not “part,” time) grew from 19% to 29%. 61% of working Americans plan to

A long-term care crisis is brewing around the world: who will provide and pay for LTC?

By 2050, the demand for long-term care (LTC) workers will more than double in the developed world, from Norway and New Zealand to Japan and the U.S. Aging populations with growing incidence of disabilities, looser family ties, and more women in the labor force are driving this reality. This is a multi-dimensional problem which requires looking beyond the issue of the simple aging demographic. Help Wanted? is an apt title for the report from The Organization of Economic Cooperation and Development (OECD), subtitled, “providing and paying for long-term care.” The report details the complex forces exacerbating the LTC carer shortage, focusing

Working past 70 is the new retirement

American workers are worried about outliving their savings and not being able to meet the financial needs of their families, according to The 12th Annual Retirement Survey from the Transamerica Center for Retirement Studies. The study paints a picture of 4,080 U.S. workers who forecast insecure financial futures. Their personal portraits find them working into older ages than they had previously expected to — before the recession. 54% of workers plan to work in retirement. 39% of workers will retire after age 70, or not at all. It’s not only Baby Boomers who expect to work past 65. Two-thirds of workers in their

The Post-Health Plan Health Plan: Humana

“If nothing else, the health reform bill has signaled the beginning of the end of the health plan as we know and love it,” David Brailer, once health IT czar under President GW Bush and now venture capitalist, is quoted in Reuters on Hot Healthcare Investing Trends for 2011. One health plan Brailer called out that could be relevant in the post-reform, post-recessionary US health world is Humana. I had the opportunity to spend time with Paul Kusserow, Chief Strategy Officer for Humana, during the HIMSS11 meeting. Our conversation began with me asking why the chief strategist for Humana would

The Connected Patient: some forces converging in the market, but barriers remain

Remote health monitoring, which enables people to track health and daily living metrics when they are in one place and communicate those measures to another node via some communications platform, is not a new concept. Telehealth, telemedicine, consumer-facing health electronics like USB-ported blood pressure monitors, and some mobile apps can all fall under the broad umbrella of remote health monitoring. There are strong market forces converging to enable health citizens to connect to their providers, institutions, payors, health coaches, caregivers, and each other. Still, a balanced look under the remote health monitoring hood reminds us that old saw taught to me by colleagues

Robert Reich connects the dots between the macroeconomy, angst, politics and health care costs

“I’m not a class warrior. I’m a class worrier,” Robert Reich told a standing-room only crowd of thousands of health IT geeks as he delivered the first keynote address of the annual meeting of HIMSS, the Healthcare Information Management and Systems Society. This year’s crowd will have reached about 31,000 people interested in health information technology’s transformative role in health care. The 31K represents an 18% increase in attendance from last year’s crowd. The HIMSS economy is strong. Robert Reich warns, however, that the U.S. macroeconomy is far from healthy…and health care costs will be a long-term threat to the

As health care demand is constrained, who will pay for medical innovations? Reflections on Moody’s analysis

“Employers and health insurers, through benefit design and medical management, are now playing a larger role in curbing use of healthcare services….spurring a more permanent cultural shift in consumer behavior,” Moody’s writes in a special comment dated February 16, 2011. “This will continue to constrain healthcare demand even as the economy recovers.” The chart illustrates one of the main reasons for the so-called “constrained healthcare demand:” increasing costs on health consumers. Look at the slope of the line on average out-of-pocket maximum costs for an employee receiving health insurance at work: the raw number grew from $2,742 in 2008 to

Meeker & Murphy on Mobile – through the lens of health

We technology market data junkies look to several thought leaders throughout the year for updates on their forecasts: one of these, for me, is Mary Meeker. Now with KPCB (who some of you know as Kleiner Perkins Caulfield & Myers, the Silicon Valley venture capital company), Meeker has surveyed the morphing field of mobile and finalized her snapshot in Top Mobile Internet Trends, along with her colleague Matt Murphy. Meeker’s Top 10 (drum roll, please) are that: 1. Mobile platforms have reached c4itical mass 2. Mobile is global 3. Social networking is accelerating growth of mobile 4. Time shifting is driving mobile use

1 in 10 jobs in the U.S. is in health care – an all-time high that will go even higher

In February 2011, 1 in 10 jobs in the U.S. is in health care employment; nearly 14 million people in the U.S. work in health care employment, with health care representing 10.7% of all jobs in America. The growth rate of health care jobs rose 1.2 percentage points since the recession kicked in late 2007. Since the start of the recession, health employment grew 6.3%; the number of non-health jobs fell by 6.8%. The chart starkly illustrates this story. Altarum Institute has crunched the health job numbers from the Bureau of Labor Statistics (BLS) and published their analysis in Health Sector Economic Indicators, published

Affluent boomers worry about health costs in retirement

Affluent Baby Boomers in the U.S. foresee a retirement with a more active lifestyle, with a better standard of living and engagement in work. 1 in 4 see continuing their education or learning a new trade, and 1 in 5 anticipate starting or furthering their business. These aspirations are tempered with many financial concerns — top among them being rising health care costs and expenses (a concern for 2 in 3 affluent Boomers), and ensuring that retirement assets will last throughout their lifetime (a worry among 1 in 2 Boomers). Merrill Lynch surveyed affluent U.S. adults on their retirement concerns

Caregiving, enabled through technology and trust

Caregivers identify the most helpful technologies that benefit them in providing care to family and friends as personal health record tracking, medication support, caregiving coordination, and monitoring and transmitting symptoms. These technologies are seen to help caregivers save time, make caregiving logistically easier, make the care recipient feel safer, reduce stress and enhance feelings of being effective. The most formidable obstacle preventing caregivers from adopting beneficial technologies is cost, followed by the technology not addressing the caregiver’s most pressing challenges, care recipient resistance to using the device, privacy issues, diminishing the care recipient’s sense of independence and pride. The National Alliance

The growing costs of health scuttle Boomers’ retirement plans

As household incomes in the U.S. have been, at best, stagnating in the past several years, the cost of health insurance premiums rose three times faster between 2003 and 2009. By 2015, the average premium for a family of four will reach nearly $18,000, according to The Commonwealth Fund. State Trends in Premiums and Deductibles, 2003-2009: How Building on the Affordable Care Act Will Help Stem the Tide of Rising Costs and Eroding Benefits from the Fund calculates that deductibles per insured person in the U.S. increased an average of 77% between 2003-09. In a related analysis, the Fund forecasts the

Caregivers use online and social media for long-term care information

Most caregivers involved with home care services would be inclined to dialogue with other caregivers in an online forum or social networking site, according to a survey, How the Web and new social media have influenced the home care decision-making process, from Walker Marketing, Inc. Furthermore, 91% of caregivers would be likely to conduct research after receiving a provider referral by a professional source; while 78% would rely on a physician for recommendations, caregivers ultimately make their own decisions on long-term care providers. Websites are generally considered highly credible by caregivers, and are important sources of information for engaged caregivers on sources

Long-term care costs are rising faster than general health costs in the U.S.

If you thought the percentage of annual medical inflation in the U.S. was high at 3.7% in September 2010, hang on to your wallets: the cost of long-term health care in America is increasing even faster than medical costs every year. Assisted living costs increased 5.2% between 2009 and 2010, and the cost of a private room in a nursing home grew 4.6%. If you live in Alaska, you’re particularly hard hit if you need long-term care: the highest rate for a semi-private nursing home room in that Last Frontier state is $610 for a semi-private room and $687 for a

More Americans Covered by Government Health Programs As Employers’ Coverage Drops

In 2010, fewer Americans are receiving health coverage from employers. At the same time, more health citizens are being covered by government programs, including Medicaid, Medicare, military and veterans’ benefits. The proportion of people on government health insurance rolls increased from 22.5% in January 2008 to 25.4% in August 2010. This represents an increase of about 13%. The proportion of Americans covered by employers fell from 50% to 45.5%, a 9% decline. Thus, the number of U.S. health citizens getting absorbed into government-sponsored health programs is growing faster than the loss in the ranks of people covered by private sector health insurance. Data

Prescription Drug Nation

In 2008, 2 in 3 people in the U.S. over 60 took 3 or more prescription drug medications in the past month, and 14% of kids 11 and under regularly took an Rx. The CDC’s National Center for Health Statistics latest issue brief on prescription drug use illustrates that prescription drugs are as much of American popular culture and life as fast-moving consumer goods. It’s the more intense use of Rx drugs, 5 or more, where the most significant growth has been since 1999-2000, when 6.3% of Americans took 5 or more prescription drugs in the past month. In 2007-8, the proportion

Health care is not a luxury good – it just feels like it is

What is a luxury good? A good working definition is a good for which demand increases as income grows. Contrast this to a “necessity good,” something that people need regardless of level of income. Baby Boomers are morphing their idea of what constitutes a luxury good versus a necessity in light of the recession, according to a new study from New York Life, MainStay Investments Boomer Retirement Lifestyle Study, published August 5, 2010. The chart illustrates that 3 in 4 Boomers put health care costs as a top #1 or #2 retirement concern. Furthermore, 98% of Boomers called health care

Mayberry RFDHHS

Now showing in a 60-second spot during the 6 o’clock news: Andy Griffith’s got the starring role in promoting the peoples’ use of the Patient Protection and Affordable Care Act of 2010 (PPACA). Here is the announcement of the ad in The White House blog of July 30 2010. In the ad, Andy, now 84, recalls the signing of Medicare by President Johnson and moves into some details about the good things PPACA brings to seniors in the U.S. The Christian Science Monitor covers the story and shows the video here. This has caused quite a stir among Republicans who say

Partnering up for health @ home – the GE-Intel link-up

A decade ago, I was engaged by a consumer health company to lead a scenario planning exercise on the future of the health consumer. We developed four scenarios, one of which was called something like “MicrosoftMerckGEGenMills.” In that futureworld, several Big Organizations would come together to serve consumers in caring for themselves outside of traditional care settings, like hospitals, doctors’ offices, and nursing homes. The beauty of scenario planning when done well is that, if you’ve done it for a long time, you sometimes get one right. Witness the New Deal between GE and Intel, partnering up to develop solutions

Women are the digital mainstream – especially in health

Social networking is key to women’s experience with the Internet, according to comScore’s report, Women on the Web: How Women are Shaping the Internet. Women spend 39% more time on social networks online than men do. comScore studied the “Mars versus Venus” differences between men and women online, discovering that gender stereotypes only go so far. The chart shows the differences between women and men and their e-retail relationships. In stereotypical “men” categories of computer hardware and software, and sports/outdoor, for example, men and women aren’t all that different — only a couple of percentage points difference at most for these categories. Health has

Running out money in retirement: the role of health costs

1 in 2 Baby Boomers born between 1948 and 1954 planning to retire in the first wave of Boomer retirements is at-risk of running out of money in retirement, according to the EBRI Retirement Readiness Rating. The Rating gauges just how prepared retirees are to finance their lives when they retire. This is defined as the percentage of pre-retirement households at-risk of not having enough money in retirement to pay for basic expenses such as housing, food, shelter, and uninsured health expenses. The net risk is determined as a function of retirement savings such as Social Security, IRAs, pensions, housing equity

Being Digital Doesn’t Always Mean You’re Young, Demographically Speaking

Being younger demographically doesn’t mean you’re younger, digitally-speaking. Your Real Age isn’t your Digital Age, according to Wells Fargo‘s survey into Americans’ use of advanced tools for daily tasks. The categories of peoples’ digital maturity include: – Digital teens, who are people who are online but don’t use all tools at a ‘high level’ – Digital novices are those people who manage basic tasks online but aren’t yet connecting with others online or managing more complex tasks – Digital adults have the highest digital age, as demonstrated by their using online tools for daily tasks, interacting with others online, and

Caregiving in the USA – the burden intensifies, and technology’s promise

29% of people in the U.S. have served as unpaid family caregivers in the past year. That’s 66 million people, mostly female (66%), middle age (on average 48 years old), usually taking care of a relative (86%).These sobering stats come out of Caregiving in the U.S. 2009, a study from the National Alliance for Caregiving in collaboration with AARP. The research, funded by the MetLife Foundation, follows up a similar study in 2004 and shows the proportion of Americans caregiving has substantially changed over the past five years.But both caregivers of adults and those for whom they provide care are

Cost increases for drugs most-used by older Americans are higher than inflation

For a consumer who’s enrolled in Medicare and takes three brand name prescription drugs on a chronic basis, the average increase in the cost of the medications used to treat those conditions increased by nearly $2,100 between 2002 and 2008. Between 2007 and 2008, the average increase in drug price over 3 therapies was $556. These findings, and other details describing price increases for 211 prescription drugs int he “Medicare Rx market basket,” are found in the AARP’s latest Rx Watchdog Report: Trends in Prices of Prescription Drugs Used by Medicare Beneficiaries. AARP began the series of drug price Watchdog

Seniors grab brands for Part D, and generics for self-pay

Seniors are acting like true, Adam Smith-style Rational Economic Man and Woman when it comes to their behavior as Medicare Part D enrollees. They go for the more expensive prescription drug brands when covered by the government; once getting to the ‘donut hole,’ though, seniors opt for lower-cost generics. Medco Health discovered this in their latest study into Medicare drug trends. Their conclusion is that Medicare could save more money if seniors went for generics 100% of the time. Rational selection, indeed. In a study from the Kaiser Family Foundation (KFF), Medicare Prescription Drug Plans in 2008 and

The cost of beauty, an American obsession

About $7 billion is spent each year on cosmetics. Another $1.5 billion is spent on breast augmentation, $1.3 billion on lipoplasty, and nearly $1 billion on abdominoplasty — aka, “tummy tucks.” Beauty At Any Cost is an important report from the YWCA. The organization has quantified the economic costs of the never-ending search for ‘beauty,’ and broken down the health implications, and impacts on interpersonal relationships — especially as these issues translate to young girls. One of the most serious behaviors cited in this report include that fact that over 1/2 of teenage girls use unhealthy weight control behaviors such

Centenarians say a long life is all about staying connected

The key to longevity isn’t about taking vitamins or consuming health care or yogurt…it’s staying connected to family, friends, and world events. That news comes to us from the third Evercare 100 @ 100 Survey which details ultra-seniors’ views on politics and the good life. Evercare surveyed in-depth 100 centenarians. Collectively, their views challenge stereotypes of the oldest Americans alive today. There are 84,000 of them, according to the U.S. Bureau of the Census. For example, 19% of centenarians use cell phones, 7% email, and 3% online date. Google is a boon to looking for old, lost friends.

Aging, economics and consumer-generated media — implications for health

Advertising Age analyzes census data on aging and diversity in America, and comes up with some interesting conclusions for consumer marketers. Here at Health Populi, we’re all-health, all-the-time, so I’m going to discuss author Peter Francese’s findings through our health lens. In addition, McKinsey published its insights into aging boomers in the report, Talkin’ ‘Bout My Generation, which I will also discuss. Francese begins with the one-two punch that marketers in the U.S. are already faced with the economic downturn coupled with consumer-generated media (e.g., blogs, online videos, e-pinions.com, ad infinitum). The third challenge to add to these two market-shapers

A profile of silver surfers: don’t discount older web-searchers

There’s a growing cadre of older people online, and they’re an attractive demographic, according to Focalyst, a joint venture of the AARP and Millward Brown, a market research and branding company. The researchers found that “matures” spend 750,000,000 minutes a day on the Internet (sounds like a song from Rent–the AARP version of 525,600 Minutes). Focalyst calls the group of people age 62 and over “Matures Online.” The Insight Report: April 2008 finds that matures are just as likely to be persuaded by an Internet ad as younger consumers. Is this what Martha would consider a “good thing” or not-so-good?

Profiles of older health care consumers: living longer, longing for technology

Older Americans are healthier and more prosperous than previous generations. Furthermore, older people want to adopt technologies that will help them age well in their homes. Two new reports together provide a new look into aging in America. Older Americans 2008: Key Indicators of Well-Being is a wide-reaching data compendium which paints a current profile on aging in America through 38 measures that depict the well-being of older Americans. Measures include demographics, economics, health status, health risks and behaviors, and the cost and use of health services. The Chartbook is well worth reviewing to gain insights into this fast-growing population

Health, the New Status Symbol

We’d rather be healthy than wealthy, according to a new survey from Manning Selvage & Lee (MS&L), the PR firm that’s part of the global communications company, Publicis. MS&L polled Americans’ beliefs on health and self-esteem. Three-quarters (72%) of Americans say that being physically healthy is a symbol of personal success. 91% of Americans said they’d rather be described ads “healthy” than “wealthy.” 71% said they’d rather be seen as someone who “looks really healthy” vs. someone who’s nicely “put together or well-dressed.” These will be glad tidings for MS&L’s client base. MS&L serves a global health clientele which includes

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for