Health Insurance Coverage Among Smaller U.S. Businesses Is Eroding: A Signal From JPMorganChase

Working-age people in the U.S. depend on their employers to provide health insurance; just over one-half of people in America receive employer-sponsored health insurance. But a concerning signal has emerged that calls into question how sustainable the uniquely American employer-sponsored health plan model is: that is that one in 3 small businesses in the U.S. stopped covering health insurance after the worst of the pandemic health effects in 2023 as the companies payroll expenses continued to increase, a statistic raised in The consistency of health insurance coverage in small business: industry challenges and insights, a report from the JPMorganChase Institute

What is a Consumer Health Company? Riffing Off of Deloitte’s Report on CHCs/A 2Q2025 Look at Self-Care Futures

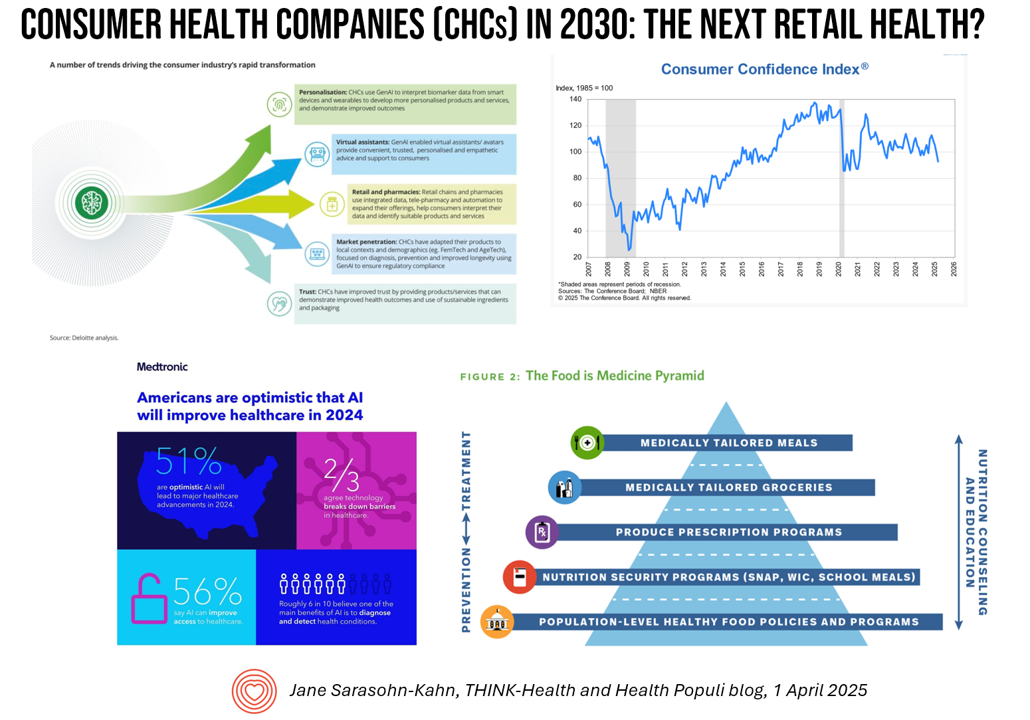

The health care landscape in 2030 will feature an expanded consumer health industry that will become, “an established branch of the health ecosystem focused on promoting health, preventing, disease, treating symptoms and extending healthy longevity,” according to a report published by Deloitte in September 2024, Accelerating the future: The rise of a dynamic consumer health market. While this report hit the virtual bookshelf about six months ago, I am revisiting it on this first day of the second quarter of 2025 because of its salience in this moment of uncertainties across our professional and personal lives — particularly related to

The Growth of DIY Digital Health – What’s Behind the Zeitgeist of Self-Reliance?

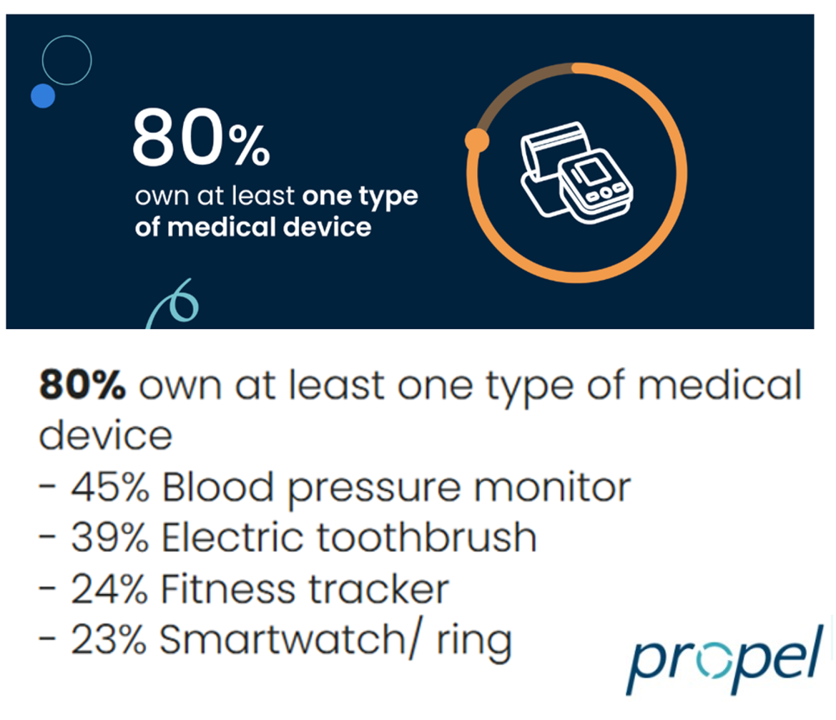

Most people in the U.S. use at least one medical device at home — likely a blood pressure monitor. used by nearly one-half of people based on a survey of 2,000 consumers conducted for Propel Software. The Propel study’s insights build on what we know is a growing ethos among health consumers seeking to take more control over their health care and the rising costs of medical bills and out-of-pocket expenses. That includes oral health and dental bills: 2 in 5 U.S. consumers use electric toothbrushes (a growing smart-device category at the

Improve Sleep, Improve the World and Health: ResMed’s Look at Global Sleep Trends

The world would be a better place if we had more, and better quality sleep. That’s the hopeful conclusion from the fifth annual Global Sleep Survey from ResMed. ResMed’s global reach with the sleeping public enabled the company to access the perspectives of over 30,000 respondents in 13 markets, finding that one in 3 people have trouble falling or staying asleep 3 or more times a week. We now live in “a world struggling with poor sleep” — “a world without rest,” ResMed coins our sleepless situation. The irony is that most people believe

The Health Insurance Premium for a Family Averages $25,572 in 2024 – KFF’s Annual Update on Employer-Sponsored Benefits

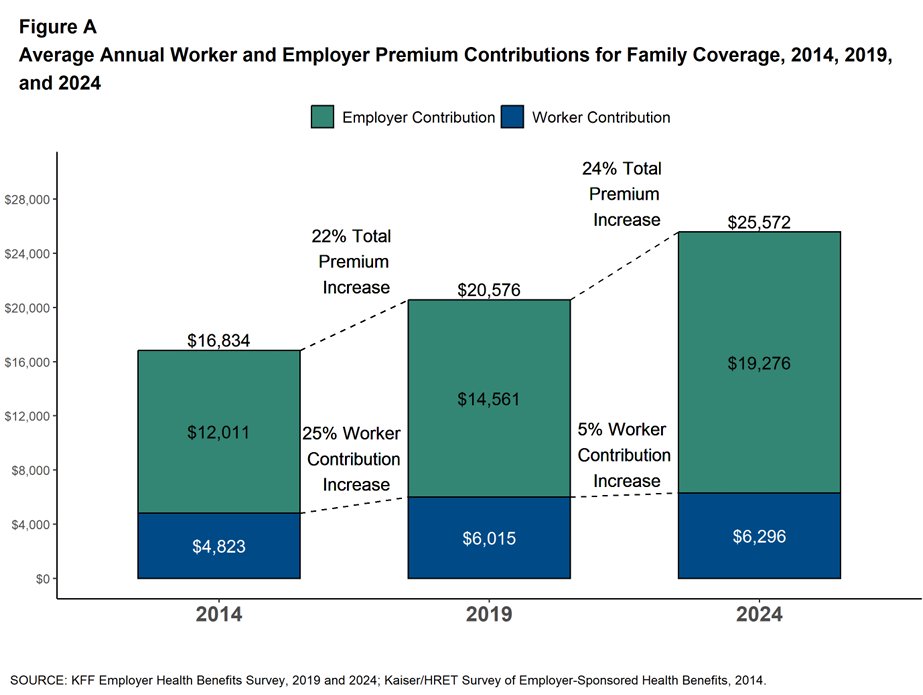

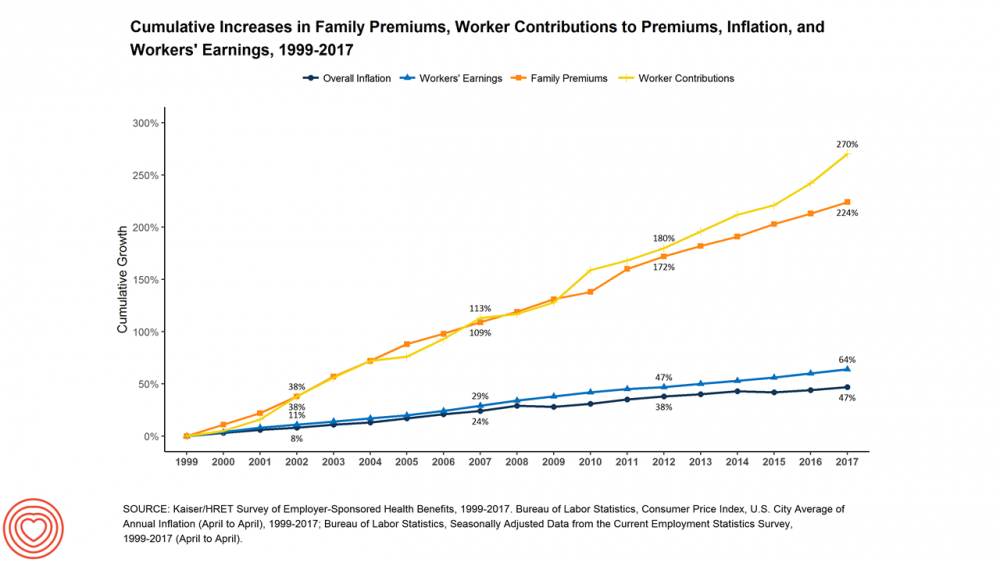

The premium for employer-sponsored health plans grew by 6-7% between 2023 and 2024, according to the report on Employer Health Benefits 2024 Annual Survey from the Kaiser Family Foundation, KFF’s 26th annual study into U.S. companies’ spending on workers’ health care. In 2024 the average annual health insurance premium for family coverage is $25,572, split by 75% covered by the employer (just over $19,000) and 25% borne by the employee ($6,296), shown in the first chart from the report. The nearly $26K family premium is the average across all plan types in the

How Business Can Bolster Determinants of Health: The Marmot Review for Industry

“Until now, focus on….the social determinants of health has been for government and civil society. The private sector has not been involved in the discussion or, worse, has been seen as part of the problem. It is time this changed,” asserts the report, The Business of Health Equity: The Marmot Review for Industry, sponsored by Legal & General in collaboration with University College London (UCL) Institute of Health Equity, led by Sir Michael Marmot. Sir Michael has been researching and writing about social determinants of health and health equity for decades, culminating publications

Go Local and Go Beyond Medical Care: What Hospitals, Health Plans, and Pharma Can Do to Rebuild Trust

Without trust, people do not engage with health care providers, health plans, or life science companies….nor do many people accept “science fact.” I explore the sad state of Trust and Health Care. published in the Medecision Liberate Health blog, with a positive and constructive call-to-action for health care industry stakeholders to consider in re-building this basic driver of well-being. That is, trust as a determinant of health. Edelman’s 2022 Trust Barometer came out in January 2022, coinciding as it annually does with the World Economic Forum’s meeting in Davos, Switzerland. Every year, WEF convenes the world’s biggest thinkers to wrestle with the

What John Mackey of Whole Foods Said at the 2022 HIMSS Conference – and Why This is Important for the Whole Health Ecosystem

HIMSS convenes its annual conference this week in Orlando, kicking off with an Executive Summit that featured John Mackey, the CEO and Co-Founder of Whole Foods, in conversation with Cris Ross, CIO of the Mayo Clinic. Mackey said in support of his long-held belief that food is the”best solution” to address Americans’ health. As for health care? Not so much, at least as it’s delivered in the United States. ”Why don’t we have clinics that help people change their diets and lifestyles so that they can reverse the disease or prevent it?” Mackey asked, rhetorically. ”It’s astounding. There’s a huge entrepreneurial

The Trust Deficit Is Bad for Health: A Health/Care Lens on the 2022 Edelman Trust Barometer

“Health is the cornerstone to our core needs, thereby the cornerstone to trust.” So wrote Kirsty Graham, Global Leader of Sectors and Global Chair of Health at Edelman, in an essay explaining the 2022 Edelman Trust Barometer. If it’s January, it must be time for the World Economic Forum in Davos, the annual setting for Edelman’s launch of the company’s Trust Barometer. While WEF is mostly virtual this year due to the pandemic, Edelman has released the survey of global citizens’ views on trust in institutions right on-time and in full and sobering detail. I welcome and dig into the

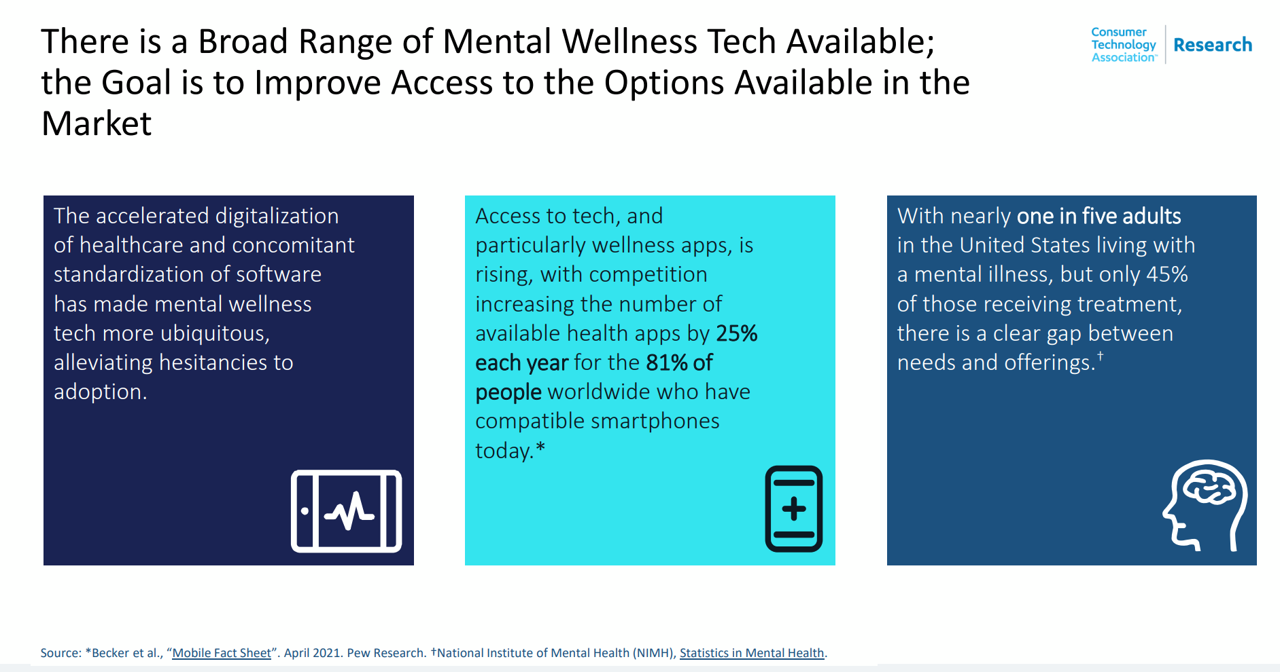

Mental Health at CES 2022 – The Consumer’s Context for Wellbeing in the New Year

As we enter COVID-19’s “junior year,” one unifying experience shared by most humans are feelings of pandemic fatigue: anxiety, grief, burnout, which together diminish our mental health. There are many signposts pointing to the various flavors of mental and behavioral health challenges, from younger peoples’ greater risk of depression and suicide ideation to increased deaths of despair due to overdose among middle-aged people. And about one-in-three Americans has made a 2022 New Year’s resolution involving some aspect of mental health, the American Psychiatric Association noted approaching the 2021 winter holiday season. Underneath this overall statistic are important differences across various

Health Care Planning for 2022 – Start with a Pandemic, Then Pivot to Health and Happiness

One of my favorite Dr. Seuss characters is the narrator featured in the book, I Had Trouble In Getting to Solla-Sollew. I frequently use this book when conducting futures and scenario planning sessions with clients in health/care. “The story opens with our happy-go-lucky narrator taking a stroll through the Valley of Vung where nothing went wrong,” the Seussblog explains. Then one day, our hero (shown here on the right side of the picture from the book) is not paying attention to where he is walking….thus admitting, “And I learned there are troubles of more than one kind, some come from

The 2022 Health Populi TrendCast for Consumers and Health Citizens

I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra: “”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,” coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law. This feels especially apt right “now” as we enter 2022,

Consider Mental Health Equity on World Mental Health Day

COVID-19 exacted a toll on health citizens’ mental health, worsening a public health challenge that was already acute before the pandemic. It’s World Mental Health Day, an event marked by global and local stakeholders across the mental health ecosystem. On the global front, the World Health Organization (WHO) describes the universal phenomenon and burden of mental health on the Earth’s people… Nearly 1 billion people have a mental disorder Depression is a leading cause of disability worldwide, impacting about 5% of the world’s population People with severe mental disorders like schizophrenia tend to die as much as 20 years earlier

Genentech’s Look Into the Mirror of Health Inequities

In 2020, Genentech launched its first study into health inequities. The company spelled out their rationale to undertake this research very clearly: “Through our work pursuing groundbreaking science and developing medicines for people with life-threatening diseases, we consistently witness an underrepresentation of non-white patients in clinical research. We have understood inequities and disproportionate enrollment in clinical trials existed, but nowhere could we find if patients of color had been directly asked: ‘why?’ So, we undertook a landmark study to elevate the perspectives of these medically disenfranchised individuals and reveal how this long-standing inequity impacts their relationships with the healthcare system

Chronic Medical Conditions, Mental Health, and Equity On Employers’ Minds for 2022 – Employee Health in the Wake of COVID-19

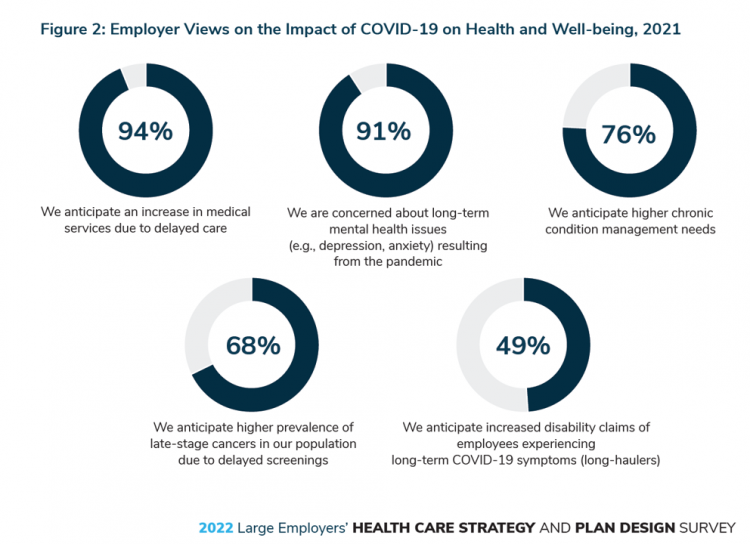

One in two people in the U.S. receive health insurance through employers. As large employers tend to be on the vanguard of benefit plan design, it’s useful to understand how these companies are thinking ahead on behalf of their employees. With that objective, it’s always instructive to explore the annual study from the Business Group on Health, the 2022 Large Employers’ Health Care Strategy and Plan Design Survey. As a result of the COVID-19 pandemic, large employees have many concerns about worker and dependents’ health. The biggest firms in America providing health insurance for workers are expecting an increase in

The Stress of the Caregiver: The Most Over-Utilized, Unpaid Stakeholder in U.S. Healthcare

We’ve long know that “the patient” has been an under-utilized resource in the U.S. healthcare system since Dr. Charles Safran testified with that statement to Congress way back in 2004…an era where bipartisanship for health IT was a real thing. Today, with the insights of Alexandra Drane (Founder of ARCHANGELS) and Dr. Nirav Shah (of Stanford University), we know that caregivers are among the most over-utilized resources in the U.S. healthcare system — overused, over-stressed, under-paid, detailed n How Health Systems Can Care for Caregivers, published in the NEJM Catalyst July 2021 issue. In this study, Drane and Shah analyze

Primary Care 2.0 – How Crossover Health is “Re-Bundling” Health Care

In 2020, investments in digital health reached $14.1 bn, much of which went into niche applications like lab testing, medication adherence, and on-demand triage for urgent care. These companies targeting primary care components represent the “unbundling of the family doctor,” as CB Insights recently coined the market trend. Fragmentation is a hallmark of the U.S. health care system, or more aptly “non-system” as my old friend J.D. Kleinke noted in his book titled Oxymorons….published in 2001. Twenty years later, we confront primary care as a dichotomy: as unbundled pieces of (we hope) innovation, and in organizations re-imagining a new continuity

Rebuilding Resilience, Trust, and Health – Deloitte’s Latest on Health Care and Sustainability

The COVID-19 pandemic has accelerated health care providers’ and plans’ investment in digital technologies while reducing capital spending on new physical assets, we learn in Building resilience during the COVID-19 pandemic and beyond from the Deloitte Center for Health Solutions. What must be built (or truly re-built), health care leaders believe, is first and foremost trust, followed by financial viability to ensure long-term resilience and sustainability — for the workforce, the organization, the community, and leaders themselves. For this report, Deloitte interviewed 60 health care chief financial officers to gauge their perspectives during the pandemic looking at the future of

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

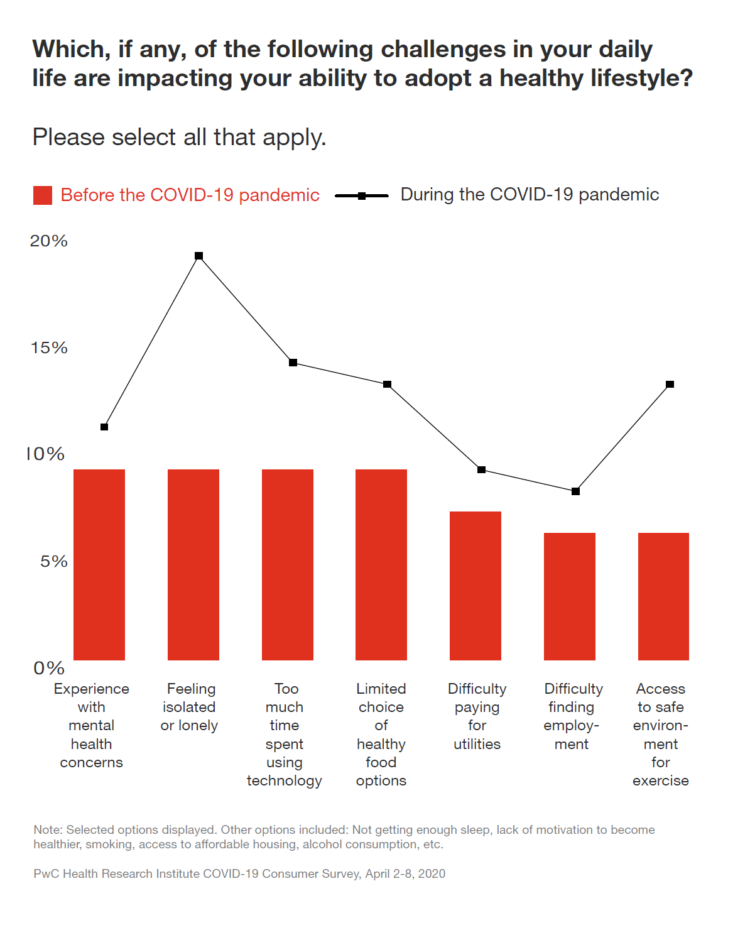

COVID-19’s Consumer Health Care Behaviors: Telehealth, Trauma, and Trust, via PwC

In a matter of several weeks, people living in the U.S. have endured massive personal social, emotional, physical and fiscal disruption due to the COVID-19 pandemic. State mandates to shelter at home, the adoption of wearing face masks and covers in public, and re-making dining tables and dens into home-working spaces for kids in school or parents telecommuting, American homes have morphed into petri dishes of people undergoing dramatic changes in a very short time. A new report from PwC looks at peoples’ changes in health behaviors in the first two months of the pandemic, asking whether these changes will

The Suicide Rate in America Increased by 40% between 2000 and 2017. Blue Collar Workers Were Much More At Risk.

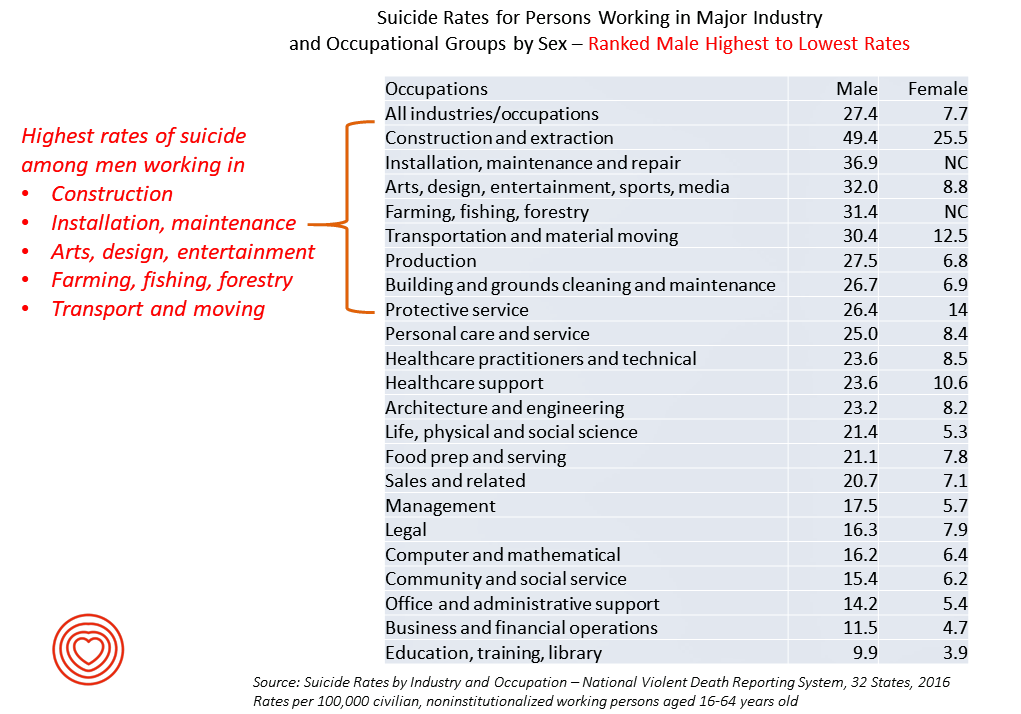

The rate of suicide in the U.S. rose from 12.9 per 100,000 population to 18.0 between 2000 and 2017, a 40% increase. Those workers most at-risk for suiciding were men working in construction and mining, maintenance, arts/design/entertainment/sports/media, farming and fishing, and transportation. For women, working in construction and mining, protective service, transportation, healthcare (support and practice), the arts and entertainment, and personal care put them at higher risk of suicide. The latest report from the CDC on Suicide Rates by Industry and Occupation provides a current analysis of the National Violent Death Reporting System which collects data from 32 states,

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

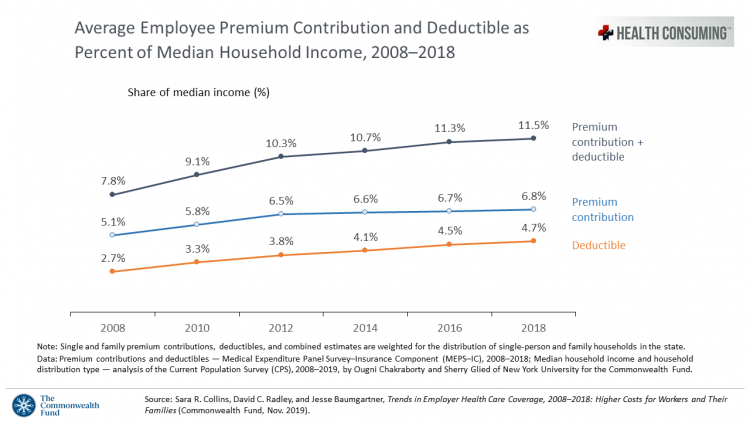

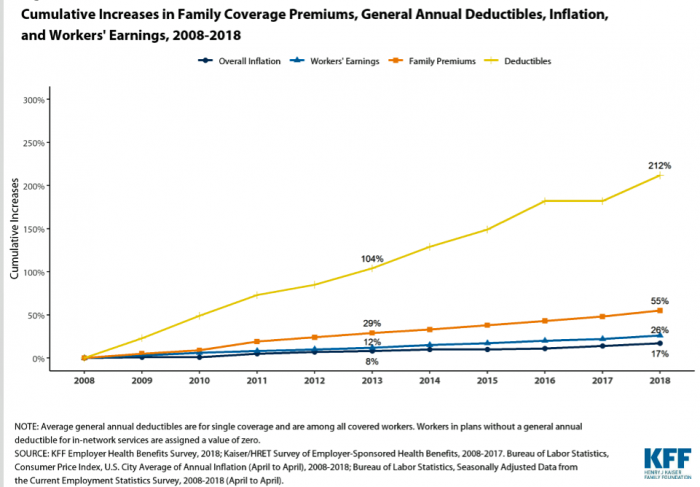

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

Thinking About Health Care One Year From the 2020 Presidential Election

Today is 4th November 2019, exactly one year to the day that Americans can express their political will and cast their vote for President of the United States. Health care will be a key issue driving people to their local polling places, so it’s an opportune moment to take the temperature on U.S. voters’ perspectives on healthcare reform. This post looks at three current polls to gauge how Americans are feeling about health care reform 365 days before the 2020 election, and one day before tomorrow’s 2019 municipal and state elections. Today’s Financial Times features a poll that found two-thirds

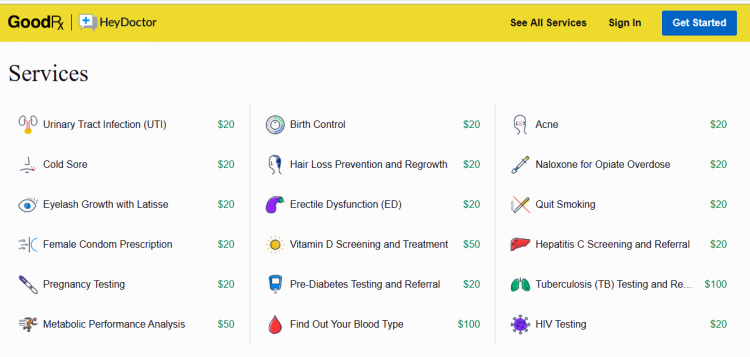

Health @ Retail – Prelude to GMDC SelfCare Summit with Updates from Hims & Hers, GoodRx, Sam’s Club and Amazon Care

“We knew millions of people weren’t getting the care they needed — they were either too embarrassed to seek help or felt stuck in a system that was confusing and intimidating. Digital health has the potential to radically change the way people approach their wellness and, since launching in 2017, we’ve outpaced even our own expectations, delivering more than 1 million Hims & Hers products to our customers. In collaboration with highly-qualified doctors and healthcare providers, we’ve built a digital health platform that is changing the way people talk about and receive the care they need.” That’s a verbatim paragraph

A Portrait of the Health Consumer as Confused, Cost-Challenged, and Out of Control

Patients in the U.S. are confused, cost-challenged and lacking control, according to The Consumer Healthcare Paradox from Maestro Health, an employee health and benefits company. Data illustrating that “paradox” is shown in the second chart: while 78% percent of patients told Maestro Health their health care experience is positive, 69% feel they lack control over their patient journey. Quality health care in America is too expensive, 79% of consumers said. Furthermore, one in two U.S. patients had received a medical bill that was higher than they anticipated it would be. Finally, one in two U.S. patients said the quality of

Intent, Insiders/Outsiders and Insights — Disney Institute’s Women’s Leadership Summit

There are many forms of magic inspired by Disney, the company. There’s the obvious attraction, the Magic Kingdom, that was Walt’s original destination vision, “imagineered” in 1932. Then there are other kinds of magic. The one I’m deep into in the moment is inspiration, ideation, and “reimagineering” my own thinking about work, legacy, and social justice. I’m grateful to have had the opportunity to spend much of this week at the inaugural Disney Institute Women’s Leadership Summit. The Institute convened about 300 women (and a handful of brave “He-for-She” men keen on diversity) in Orlando to learn about and brainstorm

In the Modern Workplace, Workers Favor More Money, New Kinds of Benefits, and Purpose

Today, April 2nd, is National Employee Benefits Day. Who knew? To mark the occasion, I’m mining an important new report from MetLife, Thriving in the New Work-Life World, the company’s 17th annual U.S. employee benefit trends study with new data for 2019. For the research, MetLife interviewed 2,500 benefits decision makers and influencers of companies with at least two employees. 20% of the firms employed over 10,000 workers; 20%, 50 and fewer staff. Companies polled represented a broad range of industries: 11% in health care and social assistance, 10% in education, 9% manufacturing, 8% each retail and information technology, 7%

Financial Stress Is An Epidemic In America, Everyday Health Finds

One in three working-age people in the U.S. have seen a doctor about something stress-related. Stress is a way of American life, based on the findings in The United States of Stress, a survey from Everyday Health. Everyday Health polled 6,700 U.S. adults between 18 and 64 years of age about their perspectives on stress, anxiety, panic, and mental and behavioral health. Among all sources of stress, personal finances rank as the top stressor in the U.S. Over one-half of consumers say financial issues regularly stress them out. Finances, followed by jobs and work issues, worries about the future, and relationships cause

As Workers’ Healthcare Costs Increase, Employers Look to Telehealth and Wearable Tech to Manage Cost & Health Risks

Family premiums for health insurance received at the workplace grew 5% in 2018: to $19,616, according to the 2018 KFF Employer Health Benefits Survey released today by the Kaiser Family Foundation (KFF). These two trends combine for a 212% increase in workers’ deductibles in the past decade. This is about eight times the growth of workers’ wages in the U.S. in the same period. Thus, the main takeaway from the study, KFF President and CEO Drew Altman noted, is that rising health care costs absolutely remain a burden for employers — but a bigger problem for workers in America. Given that

Wealth is Health and Health, Wealth, Fidelity Knows – with Weight a Major Risk Factor

The two top stressors in American life are jobs and finances. “My weight” and my family’s health follow just behind these across the generations. Total Well-Being, a research report from Fidelity Investments, looks at the inter-connections between health and wealth – the combined impact of physical, mental, and fiscal factors on our lives. The first chart summarizes the study’s findings, including the facts that: One-third of people have less than three months of income in the bank for emergency Absenteeism is 29% greater for people who don’t have sufficient emergency funds saved People who are highly stressed tend not to

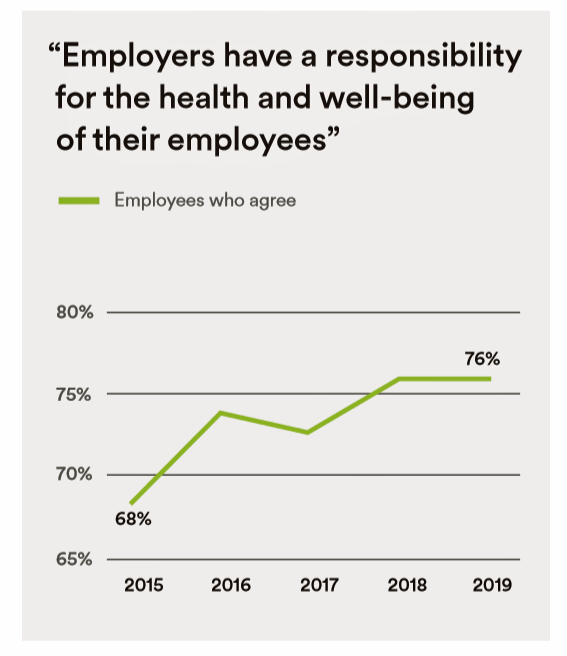

Employers Take on Health Activism, Embracing Behavioral Health, Virtual Care, AI, and Transparency

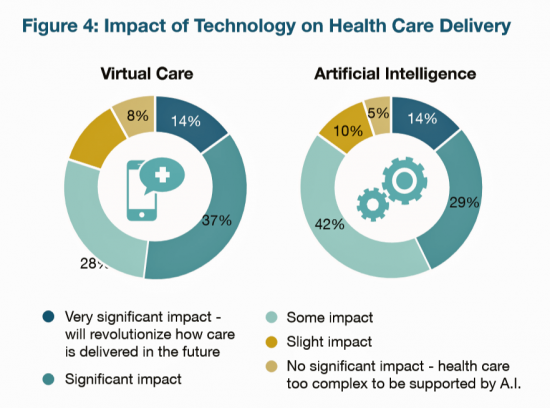

More U.S. employers are growing activist roles as stakeholders in the healthcare system, according to the 2019 Large Employers Health Care Strategy and Plan Design Survey from the National Business Group on Health (NBGH). Consider the Amazon-Berkshire Hathaway-JPMorgan Chase link up between Jeff Bezos, Warren Buffet, and Jamie Dimon, as the symbol of such employer-health activism. The NBGH report is based on survey results collected from 170 large employers representing 13 million workers and 19 million covered lives (families/dependents). This annual survey is one of the most influential such reports released each year, providing a current snapshot of large employers’ views

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

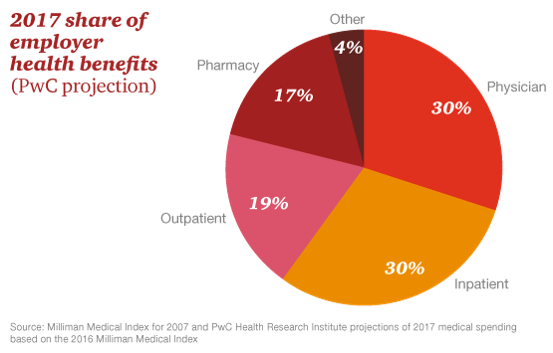

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

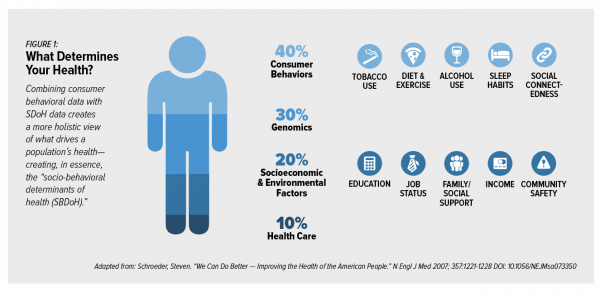

Add Behavioral Data to Social Determinants For Better Patient Understanding

“Health agencies will have to become at least as sophisticated as other consumer/retail industries in analyzing a variety of data that helps uncover root causes of human behavior,” Gartner recommended in 2017. That’s because “health” is not all pre-determined by our parent-given genetics. Health is determined by many factors in our own hands, and in forces around us: physical environment, built environment, and public policy. These are the social determinants of health, but knowing them even for the N of 1 patient isn’t quite enough to help the healthcare industry move the needle on outcomes and costs. We need to

The 2018 Edelman Trust Barometer – What It Means for Health/Care in America

Trust in the United States has declined to its lowest level since the Edelman Trust Barometer has conducted its annual survey among U.S. adults. Welcome to America in Crisis, as Edelman brands Brand USA in 2018. In the 2018 Edelman Trust Barometer, across the 28 nations polled, trust among the “informed public” in the U.S. “plunged,” as Edelman describes it, by 23 points to 45. The Trust Index in America is now #28 of 28 countries surveyed (that is, rock bottom), dropping below Russia and South Africa. “The public’s confidence in the traditional structures of American leadership is now fully

In the U.S., Spend More, Get Less Health Care: the Latest HCCI Data

Picture this scenario: you, the consumer, take a dollar and spend it, and you get 90 cents back. In what industry is that happening? Here’s the financial state of healthcare in America, explained in the 2016 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI). We live in an era of Amazon-Primed consumers, digital couponing, and expectations of free news in front of paywalls. We are all in search of value, even as the U.S. economy continues to recover on a macroeconomic basis. But that hasn’t yet translated to many peoples’ home economics. In this personal

Four Things We Want in 2017: Financial Health, Relationships, Good Food, and Sleep

THINK: money and love. To find health, working-aged people seek financial stability and good relationships, according to the Consumer Health POV Report from Welltok, meQuilibrium, and Zipongo, featured in their webinar broadcast today. The online consumer survey was conducted among 2,000 full-time working U.S. adults in August 2017, segmented roughly into thirds by Boomers (37%), Gen Xers (32%), and Millennials (31%). Much lower down the priority list for healthy living are managing food, sleep, and stress based on the poll. Feeling stress is universal across most consumers in each of the three generational cohorts, especially related to work and finance.

Employees Continue To Pick Up More Health Insurance Costs, Even As Their Growth Slows

The average cost of an employer=sponsored health plan for a family reached $18,764 in 2017. While this premium grew overall by a historically relative low of 3.4%, employees covered under that plan faced an increase of 8.3% over what their plan share cost them in 2016, according to the 2017 Employer Health Benefit Survey published today by the Kaiser Family Foundation. [Here’s a link to the 2016 KFF report, which provided the baseline for this 8.3% calculation]. Average family premiums at the workplace rose 19% since 2012, a slowdown from the two previous five-year periods — 30% between 2007 and 2012, and

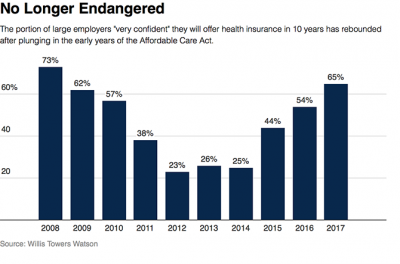

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

As High Deductible Health Plans Grow, So Does Health Consumers’ Cost-Consciousness

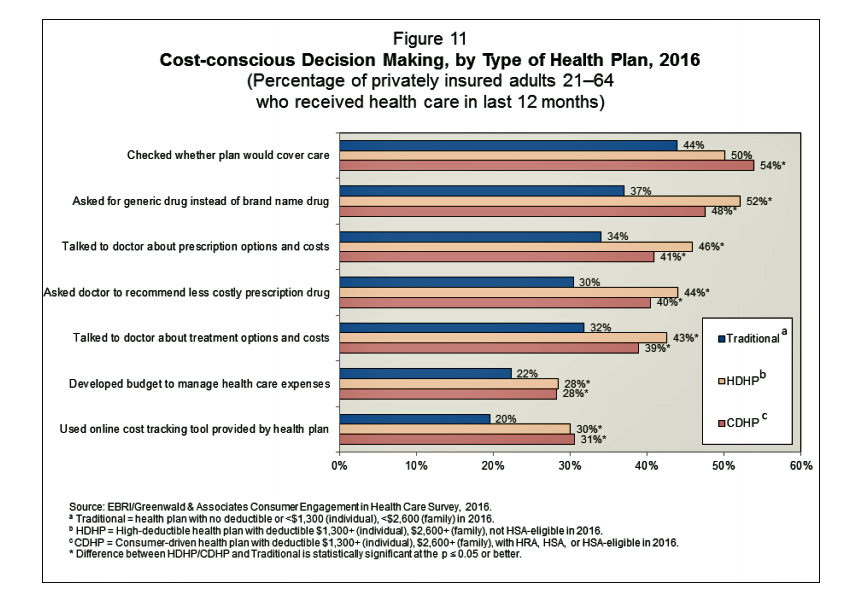

A person enrolled in a high-deductible health insurance plan is more likely to be cost-conscious than someone with traditional health insurance. Cost-consciousness behaviors including checking whether a plan covers care, asking for generic drugs versus a brand name pharmaceutical, and using online cost-tracking tools provided by health plans, according to the report, Consumer Engagement in Health Care: Findings from the 2016 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey from EBRI, the Employee Benefit Research Institute. A high deductible is correlated with more engaged health plan members, EBRI believes based on the data. One example: more than one-half of people enrolled

Employers Changing Health Care Delivery – Health Reform At Work

Large employers are taking more control over health care costs and quality by pressuring changes to how care is actually delivered, based on the results from the 2017 Health Plan Design Survey sponsored by the National Business Group on Health (NBGH). Health care cost increases will average 5% in 2017 based on planned design changes, according to the top-line of the study. The major cost drivers, illustrated in the wordle, will be specialty pharmacy (discussed in yesterday’s Health Populi), high cost patient claims, specific conditions (such as musculoskeletal/back pain), medical inflation, and inpatient care. To temper these medical trend increases,

Workplace Wellness Goes Holistic, Virgin Pulse Finds

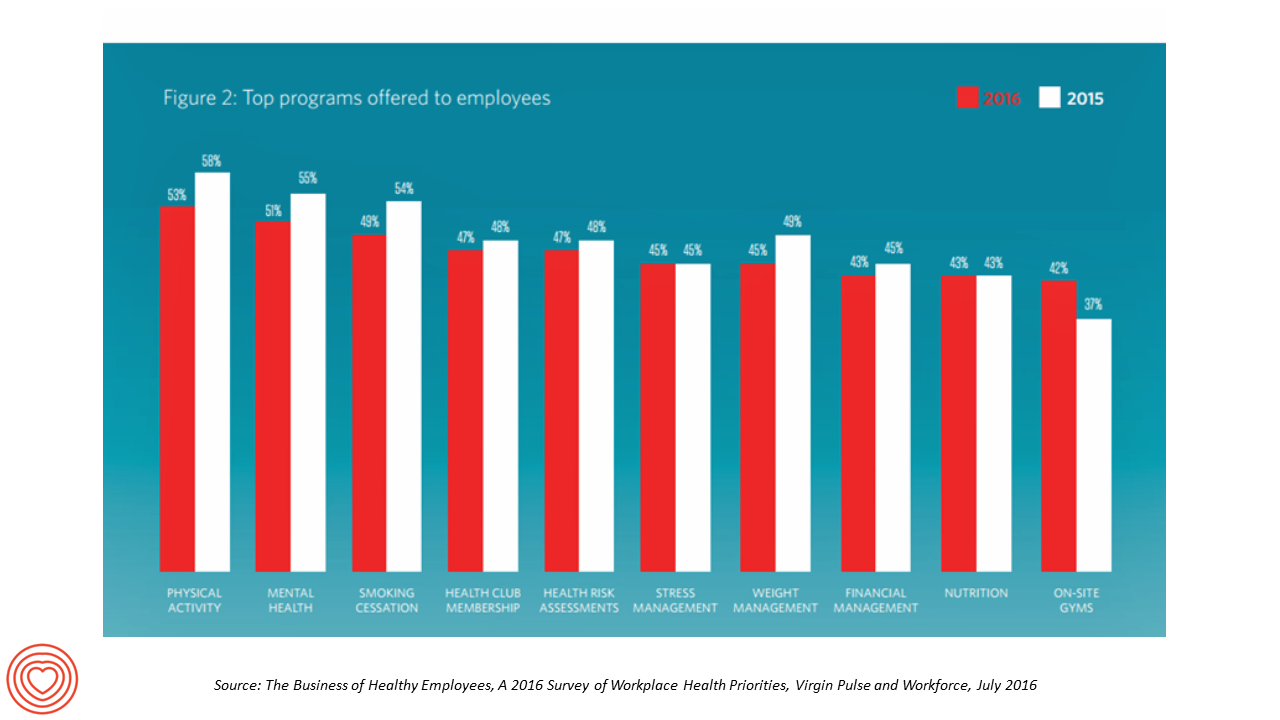

“Work is the second most common source of stress, just behind financial worries,” introduces The Business of Healthy Employees report from Virgin Pulse, the company’s 2016 survey of workplace health priorities published this week. Virgin Pulse collaborated with Workforce magazine, polling 908 employers and 1,818 employees about employer-sponsored health care, workers’ health habits, and wellness benefit trends. Workplace wellness programs are becoming more holistic, integrating a traditional physical wellness focus with mental, social, emotional and financial dimensions for 3 in 4 employers. Wearable technology is playing a growing role in the benefit package and companies’ cultures of health, as well

The State of Health Benefits in 2016: Reallocating the Components

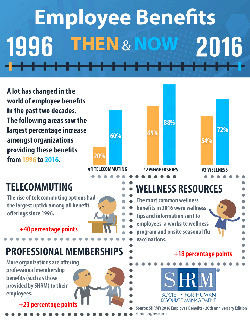

Virtually all employers who offer health coverage to workers extend health benefits to all full-time employees. 94% offer health care coverage to opposite-sex spouses, and 83% to same-sex spouses. One-half off health benefits to both opposite-sex and same-sex domestic partners (unmarried). Dental insurance, prescription drug coverage, vision insurance, mail order prescription programs, and mental health coverage are also offered by a vast majority (85% and over) of employers. Welcome to the detailed profile of workplace benefits for the year, published in 2016 Employee Benefits, Looking Back at 20 Years of Employee Benefits Offerings in the U.S., from the Society for Human

PwC’s “Behind the Numbers” – Where the Patient Stands

The growth of health care costs in the U.S. is expected to be a relatively moderate 6.5% in 2017, the same percentage increase as between 2015 and 2016, according to Medical Cost Trend: Behind the Numbers 2017, an annual forecast from PwC. As the line chart illustrates, the rate of increase of health care costs has been declining since 2007, when costs were in double-digit growth mode. Since 2014, health care cost growth has hovered around the mid-six percent’s, considered “low growth” in the PwC report. What’s driving overall cost increases is price, not use of services: in fact, health care

One in Two People Use Wearable Tech in 2016

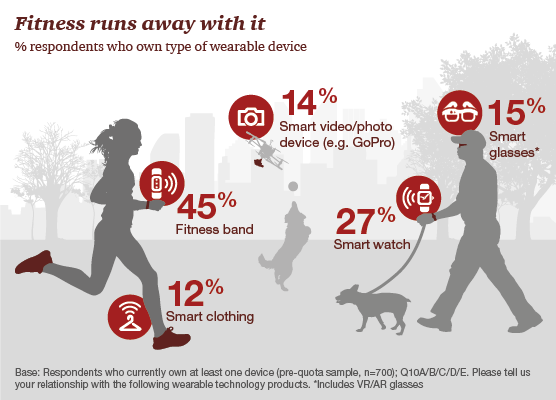

Nearly 1 in 2 people own at least one wearable device, up from 21% in 2014; one-third of people own more than one such device that tracks some aspect of everyday life, according to PwC’s latest research on the topic, The Wearable Life 2.0 – Connected living in a wearable world, from PwC. Wearable technology in this report is defined as accessories and clothing incorporating computer and advanced electronic technologies, such as fitness trackers, smart glasses (e.g., Google Glass), smartwatches, and smart clothing. Specifically, 45% of people own a fitness band, such as a Fitbit, the most popular device in this

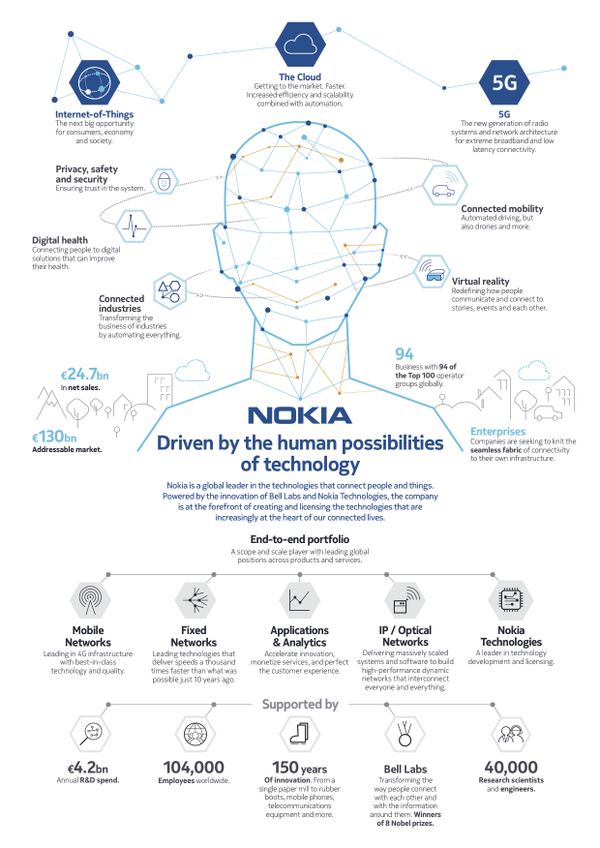

Withings Inside: Nokia’s Digital Health Vision

The first health news I read this morning in my Google Alerts was a press release explaining that Nokia planned to acquire Withings for EU170 (about $190mm). As an early adopter and devoted user of the Withings Smart Body Analyzer, I took this news quite personally. “What will Nokia be doing with my beloved Withings?” I asked myself via Twitter early this morning. As if on cue, a public relations pro with whom I’ve been collegial for many years contacted me to see if I’d like to talk with the Founder and CEO of Withings, Cédric Hutchings, and Ramzi Haidamus,

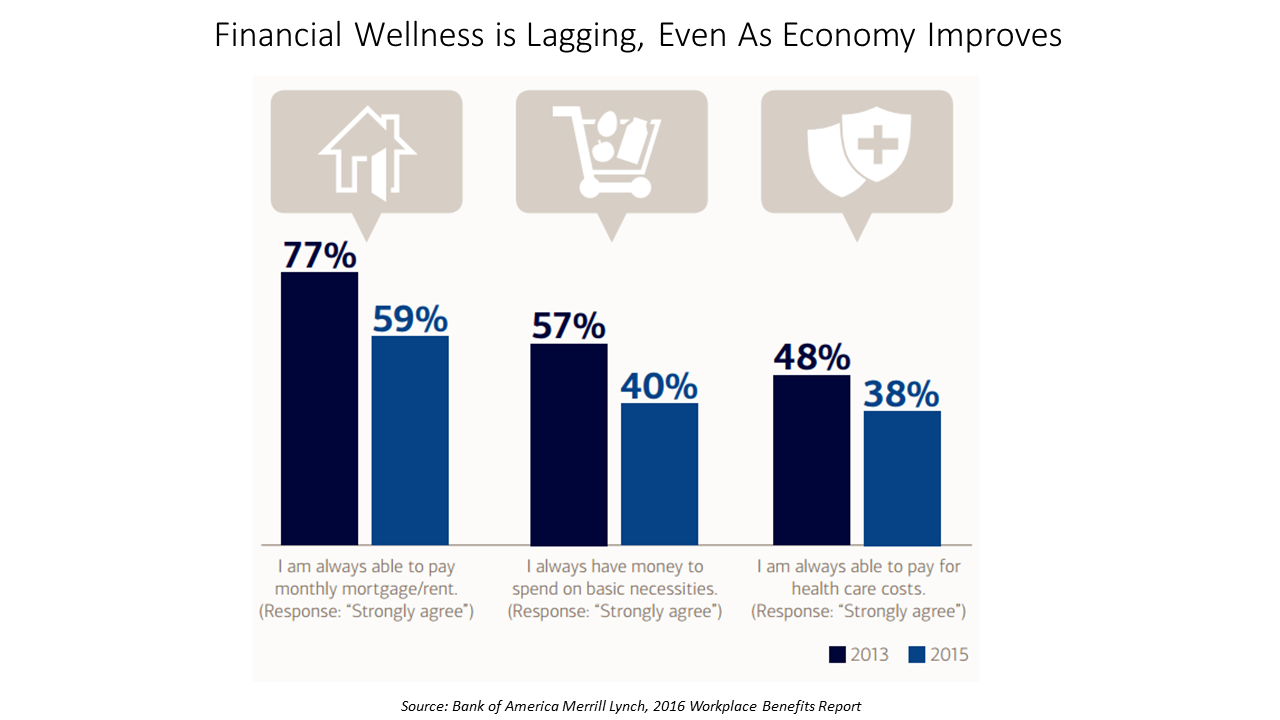

Financial Wellness Declines In US, Even As Economy Improves

American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch. The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this

The Link Between Eating and Financial Health

People who more consistently track their calories and food intake are more likely to be fiscally fit than people who do not, suggesting a link between healthy eating and financially wellness. I learned this through a survey conducted in February 2016 among 4,118 people using the Lose It! mobile app, which enables people to track their daily nutrition. Some 25 million people have downloaded Lose It! The app is one of the most consistently-used mobile health tools available in app stores. The Rutgers School of Environmental and Biological Sciences has explored the financial impact of improved health behaviors, asserting that,

Behavioral Economics in Motion: UnitedHealthcare and Qualcomm

What do you get when one of the largest health insurance companies supports the development of a medical-grade activity tracker, enables data to flow through a HIPAA-compliant cloud, and nudges consumers to use the app by baking behavioral economics into the program? You get Motion from UnitedHealthcare, working with Qualcomm Life’s 2net cloud platform, a program announced today during the 2016 HIMSS conference. What’s most salient about this announcement in the context of HIMSS — a technology convention — is that these partners recognize the critical reality that for consumers and their healthcare, it’s not about the technology. It’s about

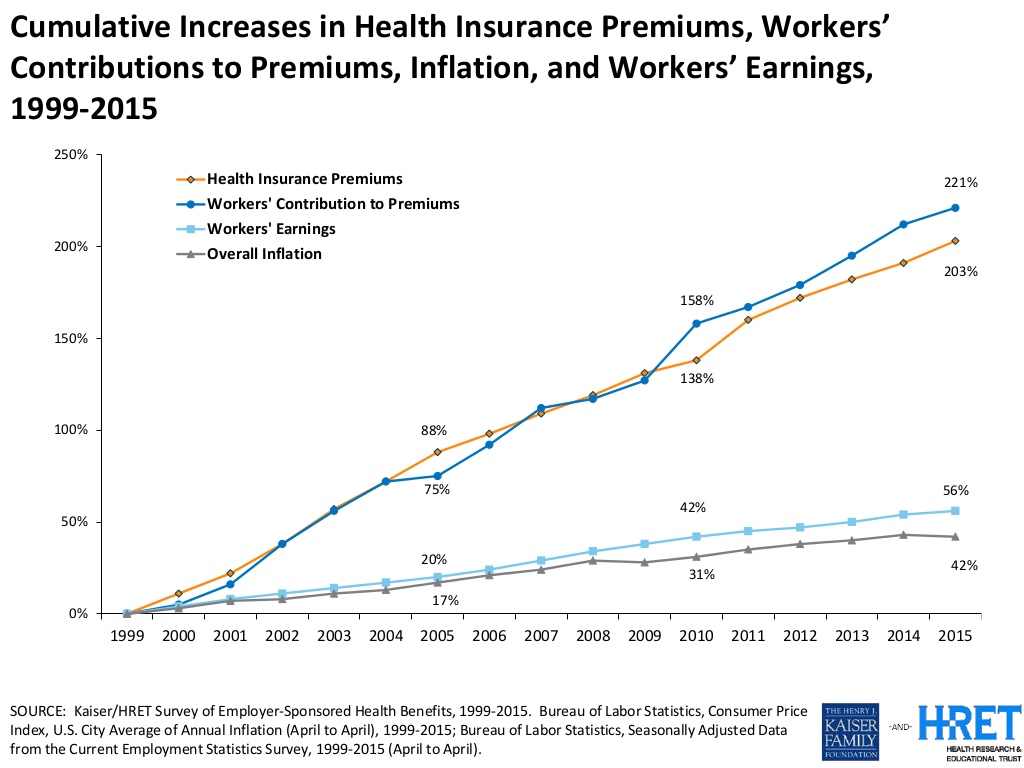

Health consumers’ cost increases far outpace wage growth

American workers are working to pay for health care costs, having traded off wage increases for health premiums, out-of-pocket costs and growing high deductibles. Welcome to the 2015 Employer Health Benefits survey conducted annually by the Kaiser Family Foundation (KFF) and Health Research & Educational Trust (HRET). Premiums are growing seven times faster than wages. The report calculates that high-deductibles for health insurance have grown 67% from 2010 to 2015. In the same period, wages grew a paltry 10%, while the Consumer Price Index rose 9%. The first chart illustrates that growing gap between relatively flat wages and spirally health

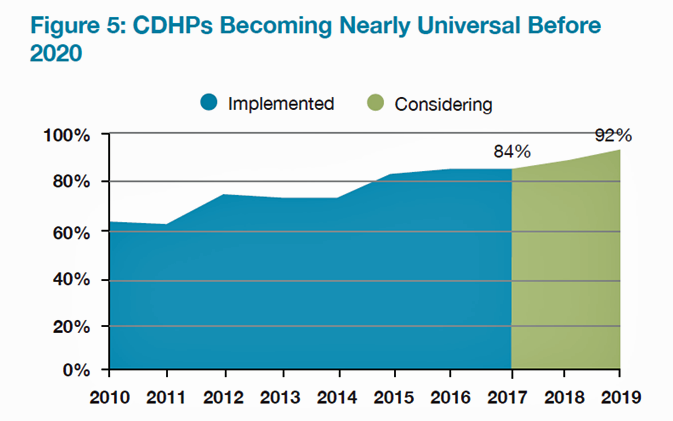

Employers pushing consumerism for health benefits in 2016

This is the dawning of the Age of Consumer-Driven Health, the tipping point of which has been passed. The data point for this assertion comes from the National Business Group on Health‘s annual 2016 Large Employers’ Health Plan Design Survey. The tagline, “reducing costs while looking to the future,” suggests some of the underlying tactics employers will use to manage their financial burden of providing health insurance to workers. That burden will continue to shift to employees and their dependents in the form of greater cost-sharing: for premiums, co-pays and co-insurance, and the hallmark of consumer-driven health plans (CDHPs): high(er) deductibles.

Fitness tech will boost holiday retail sales for consumer electronics

Sales of computers and tablets and LCD TVs won’t be hot on peoples’ holiday shopping lists in 2015. But smartwatches, health and fitness tech, and 4K Ultra HD TVs will be in peoples’ gift wish-lists and under homes’ holiday trees. The Consumer Electronics Association (CEA) published its 2015 U.S. Consumer Electronics Sales and Forecasts report, and it shows a shifting retail picture where traditional consumer electronics categories — notably computers and mainstream TVs — are declining in demand. But new-new categories are expected to buoy 2015 retail sales. The new categories of consumer electronics will generate about $10 bn (wholesale

Sports and the Internet of Things: the Scoop & Score podcast

From elite soccer and football fields to youth athletes in public school gyms, wearable technology has come to sports bringing two big benefits of gathering data at the point of exercise: to gauge performance and coach back to the athlete in real time, and to prevent injury. I discussed the advent of the Internet of Things in sports on the Scoop and Score podcast with Andrew Kahn, sports journalist and writer, and Stephen Kahn, sports enthusiast and business analyst. [In full disclosure these two Kahn’s are also my brilliant nephews.] We recorded the podcast on July 14, 2015, the day

Employers go beyond physical health in 2015, adding financial and stress management

Workplace well-being programs are going beyond physical wellness, incorporating personal stress management and financial management. Nearly one-half of employers offer these programs in 2015. Another one-third will offer stress management in the next one to three years, and another one-fourth will offer financial management to workers, according to Virgin Pulse’s 2015 survey of workplace health priorities, The Busness of Healthy Employees. The survey was published June 1st 2015, kicking off Employee Wellbeing Month, which uses the Twitter hashtag #EWM15. It takes a village to bolster population health and wellness, so Virgin Pulse is collaborating with several partners in this effort

Musings with Mary Meeker on the Digital/Health Nexus

People in the U.S. spend over five-and-a-half hours a day with digital media in 2015, with time on mobile devices exceeding use of laptop and desktop computers. The growth of mobile means people are using and seeking more just-in-time services in daily living, and this has big implications for health/care, based on the annual mega-report on Internet Trends from Mary Meeker, KPCB’s internet analyst. “People” in health/care are patients, consumers and caregivers; people in health/care are also health plan administrators, employer benefits managers, doctors, nurses, allied health professionals, financial managers in hospitals, pharmacists, and the entire range of humans who

Purchase of wearable fitness trackers expected to grow in 2015, but one-half of Americans would “never” buy one

Headphones and smartphones are the top two electronics products U.S. consumers intend to purchase in 2015. But the emerging consumer electronics categories of wearable fitness trackers, smart watches, and smarthome devices (especially “smart” thermostats) are positioned to grow, too, in 2015, according to the 17th Annual CE Ownership and Market Potential Study from the Consumer Electronics Association (CEA). Wearable trackers have an installed base of about 17 million devices in the U.S., with 11% of U.S. households intending to purchase a tracker in 2015 — 6 percentage points up from 2014 (about a 50% increase over 2014). There are about 6 million smart

Health is where we live, work, and shop…at Walgreens

Alex Gourley, President of The Walgreen Company, addressed the capacity crowd at HIMSS15 in Chicago on 13th April 2015, saying his company’s goal is to “make good health easier.” Remember that HIMSS is the “Health Information and Management Systems Society” — in short, the mammoth health IT conference that this year has attracted over 41,000 health computerfolk from around the world. So what’s a nice pharmacy like you, Walgreens, doing in a Place like McCormick amidst 1,200+ health/tech vendors? If you believe that health is a product of lifstyle behaviors at least as much as health “care” services (what our

Humana and Weight Watchers Partner in Weight Loss for Employers

More employers are recognizing the link between workers who may be overweight or obese on one hand, and health care costs, employee engagement and productivity on the other. As a result, some companies are adopting wellness programs that focus on weight loss as part of an overall culture of health at the workplace. Humana and Weight Watchers are the latest example of two health brands coming together to address what is one of the toughest behavior changes known to humans: losing weight. Humana will extend access to Weight Watchers for the health plan’s enrollees in an integrated wellness program. The program

Employers grow wellness programs, and ramp up support for fitness tech

Offering wellness programs is universal among U.S. employers, who roughly divide in half regarding their rationale for doing so: about one-half offer wellness initiatives to invest in and increase worker health engagement, and one-half to control or reduce health care costs. Two-thirds of companies offering wellness will increase their budgets, according to the International Foundation of Employee Benefit Plans (IFEBP) report, Workplace Wellness Trends, 2015 survey results. The IFEBP polled 479 employers in October 2014, covering corporate, public, and multi-employer funds in the U.S. and Canada. The statistics discussed in this post refer solely to U.S. organizations included in the study

Physicians and mobile health – moving from “mobile” to simply “care”

February may be American Heart Month, African-American History Month, and Marfan Syndrome Awareness Month. But based on the volume of studies and reports published in the past two weeks, ’tis also the season for talking mobile health and doctors. This Health Populi post trend-weaves the findings. The big picture for mobile in health is captured by Citrix in its Mobile Analytics Report, dated February 2015. Everyday people are using mobile in work and daily living, blurring the distinctions between the various hats people wear. These roles, whether business or pleasure or life, happen 24×7, enabling through mobile platforms, Citrix found.

Whole (Health) Foods – the next retail clinic?

Long an advocate for consumer-directed health in his company, John Mackey, co-CEO and co-Founder of Whole Foods Market, is talking about expanding the food chain’s footprint in retail health. “Americans are sick of being sick,” Mackey is quoted in “Whole Foods, Half Off,” a story published in Bloomberg on January 29, 2015. Mackey talks about being inspired by Harris Rosen, a CEO in Florida, who has developed a workplace clinic for employees’ health care that drives high quality, good outcomes, and lower costs. Mackey imagines how Whole Foods could do the same, beginning in its hometown in Austin, TX. He

Telehealth is in demand, driven by consumer convenience and cost – American Well speaks

Evidence of the rise of retail health grows, with the data point that on-demand health care is in-demand by 2 in 3 U.S. adults. American Well released the Telehealth Index: 2015 Consumer Survey, revealing an American health public keen on video visits with doctors as a viable alternative to visiting the emergency room. Virtual visits are especially attractive to people who have children living at home. [For context, this survey defines “telehealth” as a remote consultation between doctor and patient]. Convenience drives most peoples’ interest in telehealth: saving time and money, not leaving home if feeling unwell, and “avoiding germs

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Building the health ecosystem: new bedfellows coming together

2015 is already becoming a year where bedfellows of different stripes are joining together to build a health care ecosystem well beyond hospitals, doctors and health plans. Announcements launched last week at the 2015 Consumer Electronics Show in Las Vegas, and coming out this week at the J.P. Morgan Conference in San Francisco, the first two weeks of 2015 reveal that new entrants and legacy health stakeholders are crossing corporate and cultural chasms to (try and) solve challenges that prevent us from getting to that Holy Grail of The Triple Aim: improving health care outcomes, driving down per capita costs,

Getting real about consumer demand for wearables: Accenture slows us down

Are you Feelin’ Groovy about wearables? Well slow down, you move too fast… …at least, according to Accenture’s latest survey into consumers’ perspectives on new technologies, published this week in conjunction with the 2015 Consumer Electronics Show in Las Vegas, the largest annual convention in the U.S. featuring technology for people. At #CES2015, we’re seeing a rich trove of blinged-out, multi-sensor, shiny new wearable things at the 2015 Consumer Electronics Show. Swarovski crystals are paired with Misfit Wearables, called the Swarovski Shine, shown here as a shiny new thing, indeed. Withings launched its Activite fitness tracking watch in new colors.

The Internet of Healthy Me – putting digital health in context for #CES2015

Men are from Mars and Women, Venus, when it comes to managing health and using digital tools and apps, based on a poll conducted by A&D Medical, who will be one of several hundred healthcare companies exhibiting at the 2015 Consumer Electronics Show this week in Las Vegas. Digital health, connected homes and cars, and the Internet of Things (IoT) will prominently feature at the 2015 Consumer Electronics Show in Las Vegas this week. I’ll be attending this mega-conference, meeting up with digital health companies and platform providers that will enable the Internet of Healthy “Me” — consumers’ ability to self-track,

PwC on wearables – the health opportunity is huge, but who will pay?

“A wearable future is around the corner,” PwC says. So it’s appropriate the consulting firm’s new report is indeed titled The Wearable Future. Wearable technologies — smartwatches, sensor-laden workout gear, activity tracking wristbands, and Google Glass, among them — are more than individual tracking and information devices. They’re part of a larger ecosystem called The Internet of Things (IoT), which is made of lots of stuff, each ‘thing’ incorporating a sensor that measures something. Those measurements can track virtually everything that someone does throughout the day: beyond the obvious steps taken, hours slept, and GPS coordinates, sensors can sense movement

Health-wear – at Health 2.0, health met fashion, function and care

Wearables met health and medicine at the 8th annual Health 2.0 Conference in Santa Clara, CA, last week. I had the real pleasure of shepherding a wearables panel of five innovators during the conference, in a well-attended session followed by an energetic Q&A. The organizations who demonstrated their tools and brainstormed the wearables market included, in alphabetical order, Atlas Wearables, Heartmath, MySugr, SunSprite and Withings. I hasten to add that among the five presenters, two were women: that 2 in 5 = 40% gender representation is, happily to my way of thinking about women’s roles in health-making, a very good

Employers engaging in health engagement

Expecting health care cost increases of 5% in 2015, employers in the U.S. will focus on several tactics to control costs: greater offerings of consumer-directed health plans, increasing employee cost-sharing, narrowing provider networks, and serving up wellness and disease management programs. The National Business Group on Health’s Large Employers’ 2015 Health Plan Design Survey finds employers committed to health engagement in 2015 as a key strategy for health benefits. More granularly, addressing weight management, smoking cessation, physical activity, and stress reduction, will be top priorities, shown in the first chart. An underpinning of engagement is health care consumerism — which

Dialing Dr. Verizon – the telecomms company launches virtual house calls

Expanding its wireless footprint in health care, Verizon, the telecommunications company, announced the start of Verizon Virtual Visits today. The program will be marketed to employers and health plans to enable patients to see doctors at home or when traveling, via Verizon’s wireless network. I spoke with Christine Izui, Verizon’s quality officer, mobile health solution, earlier this week about Virtual Visits. We discussed the market forces that support the growth of telehealth and, in particular, physician visits “anywhere:” There is an under-supply and poor distribution of primary care doctors and certain specialties around the U.S. Employers and health plan sponsors are

Wearable tech + the workplace: driving employee health

Employer wellness programs are growing in the U.S., bundled with consumer-directed plans and health savings accounts. A wellness company’s work with employee groups is demonstrating that workers who adopt mobile health technologies — especially “wearables” coupled with smartphone apps — helps change behavior and drive health outcomes. Results of one such program are summarized in Wearables at Work, a technical brief from Vitality, a joint venture of Humana and Discovery Ltd., published April 23, 2014. Vitality has been working in workplace wellness since 2005, first using pedometers to track workers’ workouts. In 2008, Vitality adopted the Polar heart rate monitor for

Zero kilometers and the future of food

I have seen the future of food and it is in Italy at a grocery chain called Conad, which launched a locavore-focused brand called Sapori & Dintorni. Here in Florence, Italy, where I’m spending a week’s holiday with my family, we stay in an apartment in the Oltrarno – just south of the Arno River, up a short hill from the southern tip of the Ponte Vecchio, the old bridge known for its gold and silver jewelry. But the real gem in this neighborhood is that grocery store, whose Sapori & Dintorni label represents food sourced from Italy’s great food

Why a grocery chain supports health data liquidity

The CEO of a family-owned grocery store chain wrote a letter to New York State lawmakers to support $65 million worth of spending on a computer system for health information in the state. That grocer is Danny Wegman, and that project is the Statewide Health Information Network, aka SHIN-NY. In his letter beginning, “Dear New York Legislator,” Wegman identifies several benefits he expects would flow out of the health IT project: 1. Improve health care for all New Yorkers 2. Lower health care costs, through reducing hospital readmission rates and reducing duplicate testing. 3. Lead to health data “liquidity” (my

The digital health bubble – is it about to burst? #SXSW

That’s a useful and timely question, given the news that Castlight Health will launch its IPO with valuations north of $1 billion. Yes, “billions,” and according to a MarketWatch analysis, “it’s a bargain at $1 billion.” So then – do we anticipate a bubble? asked Marc Monseau of the Mint Collective, the convener of our panel who brought together Robert Stern, a successful health-tech entrepreneur whose latest venture, @PointofCare, focuses on patient engagement; Marco Smit of Next Innovation Health Partners (parting from the Health 2.0 Conference family where he led Health 2.0 Advisors for several years); and me. Some key

Employers spending more on wellness in 2014, with growing focus on food

Employers continue to invest in wellness programs aimed at improving employees’ health. In 2014, 3 in 4 employers plan to offer incentives to employees who participate in health improvement programs compared = and the financial value of these incentives has grown to $500, up from $338 in 2010. In its fifth year, the National Business Group on Health (NBGH)/Fidelity Investments have conducted their benefit consulting survey, culminating in the report, Employer Investments in Improving Employee Health. In the past 5 years, employers have increased their investments in wellness: the chart illustrates the growth of programs addressing physical activity/weight management and health eating,

Patient engagement and mobile health – design and timing matter

Thinking about personal health information technology – the wearable devices, remote health monitors, digital weight scales, and Bluetooth-enabled medical equipment scaled for the home – there are two glasses. One is half-full and the other, half-empty. The half-full glass is the proliferation of consumer-facing devices like Fitbit, Jawbone and Nike, which comprise the lion’s market share in the health wearables segment; the mass adoption of mobile phones and tablets; consumers’ multi-screen media behavior (as tracked by Nielsen); and consumers’ growing share of medical spending, now about 40% of annual spending (or something north of $8,000 for a family of four

The new retail health: Bertolini of Aetna connects dots between the economy and health consumers

3 in 4 people in America will buy health care at retail with a subsidy within just a few years, according to Mark Bertolini, CEO of Aetna. Bertolini was the first keynote speaker this week at the 2014 HIMSS conference convened in Orlando. Bertolini’s message was grounded in health economics 101 (about which frequent readers of Health Populi are accustomed to hearing). A healthy community drives a healthy local economy, and healthier people are more economically satisfied, Bertolini explained. The message: health care can move from being a cost driver to being an economic engine. But getting to a healthy

Watson goes wellness

IBM’s data analytics engine Watson, having cut its teeth on complex health care conditions like cancer, is now entering an even more challenging space: wellness. Why is wellness more challenging? Because understanding a person’s wellness goes beyond mining data from health care claims silos in hospitals, pharmacies, and physicians’ electronic health records. Wellness happens where we live, work, play and pray. Wellness is nurtured through choices made every day at home, in the workplace, and at moments-of-truth in the grocery store and restaurant where slick marketing messages planted in our subconscious compete with our more rational minds that tell us to

Do People Really Want To Tech Their Health? in Huffington Post

This post appeared in my Huffington Post column on January 16, 2013. In the afterglow of the 2014 Consumer Electronics Show (CES), away from the neon lights of Las Vegas, 4D curved TV screens, and uber-hip Google Glass wearers, a big question remains: Do we, the people, really want to tech our way to self-health? The number of digital health companies exhibiting at CES grew by 40 percent, exceeding 300 based on the count of the International Consumer Electronics Association, sponsor of the event. The hockey-stick growth of “wearable technology” seen at the 2014 Consumer Electronics Show begs the question: Are there

Schizo about smoking

There’s truly good news for public health about smoking: January 11th marked the 50th anniversary of the U.S. Surgeon General’s Report on Smoking and Health. That’s five decades’ worth of progress raising peoples’ awareness about the toxic impact of nicotine and chemicals embodied in cigarettes, and deleterious impacts on health and the economy. As a result, smoking rates have been cut in half since 1964, as the downward-sloping graph illustrates. With that happy news in my subconscious, I took a long walk, tracked by my digital device, through the Venetian Hotel in Las Vegas last week, bound for the 2014 Consumer Electronics

Health Care Everywhere at the 2014 Consumer Electronics Show

When the head of the Consumer Electronics Association gives a shout-out to the growth of health products in his annual mega-show, attention must be paid. The #2014CES featured over 300 companies devoted to “digital health” as the CEA defines the term. But if you believe that health is where we live, work, play, and pray, then you can see health is almost everywhere at the CES, from connected home tech and smart refrigerators to autos that sense ‘sick’ air and headphones that amplify phone messages for people with hearing aids, along with pet activity tracking devices like the Petbit. If

Wear It Well – Fashion Mashes Up With Health At #CES2014

Madame Onassis got nothing on you, Rod Stewart complimented in his hit You Wear It Well in 1972. Now we can all wear it well, based on the fashion-meets-health-mashups at the 2014 Consumer Electronics Show. Several events underline this observation at the CES this year: – Fitbit has signed up Tory Burch to put her mark accessorizing the company’s activity trackers – The CSR Bluetooth smart pendant was designed with the chic jeweler Cellini; the device can receive alerts from an iPhone (think: medication adherence, or a message from mom in Florida). This is featured in the first photo. –

3 Things I Know About Health Care in 2014

We who are charged with forecasting the future of health and health care live in a world of scenario planning, placing bets on certainties (what we know we know), uncertainties (what we know we don’t know), and wild cards — those phenomena that, if they happen in the real world, blow our forecasts to smithereens, forcing a tabula rasa for a new-and-improved forecast. There are many more uncertainties than certainties challenging the tea leaves for the new year, including the changing role of health insurance companies and how they will respond to the Affordable Care Act implementation and changing mandates

Employers will strongly focus on costs in health benefit plans for 2014; so must consumers

Employers who sponsor health insurance in America are at a fork on a cloudy road: they know that they’re in the midst of changes happening in the U.S. health system. Except for one certainty: that health care costs too much. So employers’ plans for health benefits in 2014 strongly focus on getting a return-on-investment from health spending in an uncertain climate, according to Deloitte’s 2013 Survey of U.S. Employers. Key findings are that: Employers will grow their use of workers’ cost-sharing, continuing to shift more financial responsibility onto employees They will expand other tactics they believe will help address cost

Color us stressed – how to deal

Coast-to-coast, stress is the modus vivendi for most Americans: 55% of people feel stressed in every day life, according to a study from Televox. A Stressful Nation: Americans Search for a Healthy Balance paints a picture of a nation of physically inactive people working too hard and playing too little. And far more women feel the stress than men do. 64% of people say they’re stressed during a typical workday. 52% of people see stress negatively impacting their lives. And nearly one-half of people believe they could better manage their stress. As a result, physicians say that Americans are experiencing negative

Mobile health apps – opportunity for patients and doctors to co-create the evidence

There are thousands of downloadable apps that people can use that touch on health. But among the 40,000+ mobile health apps available in iTunes, which most effectively drive health and efficient care? To answer that question, the IMS Institute for Healthcare Informatics analyzed 43,689 health, fitness and medical apps in the Apple iTunes store as of June 2013. These split into what IMS categorized as 23,682 “genuine” health care apps, and 20,007 falling into miscellaneous categories such as product-specific apps, fashion and beauty, fertility, veterinary, and apps with “gimmicks” (IMS’s word) with no obvious health benefit. Among the 23,682 so-called

Innovating and thriving in value-based health – collaboration required

In health care, when money is tight, labor inputs like nurses and doctors stretched, and patients wanting to be treated like beloved Amazon consumers, what do you do? Why, innovate and thrive. This audacious Holy Grail was the topic for a panel II moderated today at the Connected Health Symposium, sponsored by Partners Heathcare, the Boston health system that includes Harvard’s hospitals and other blue chip health providers around the region. My panelists were 3 health ecosystem players who were not your typical discussants at this sort of meeting: none wore bow ties, and all were very entrepreneurial: Jeremy Delinsky

The new era of consumer health risk management: employers “migrate” risk

The current role of health insurance at work is that it’s the “benefits” part of “compensation and benefits.” Soon, benefits will simply be integrated into “compensation and compensation.” That is, employers will be transferring risk to employees for health care. This will translate into growing defined contribution and cost-shifting to employees. Health care sponsorship by employers is changing quite quickly, according to the 2013 Aon Hewitt Health Care Survey published in October 2013. Aon found that companies are shifting to individualized consumer-focused approaches that emphasize wellness and “health ownership” by workers to bolster behavior change and, ultimately, outcomes. The most

Economics of obesity and heart disease: We, the People, can bend the curves

The “O” word drives health costs in America ever-upward. Without bending the obesity curve downward toward healthy BMIs, America won’t be able to bend that stubborn cost curve, either. The Economic Impacts of Obesity report from Alere Wellbeing accounts for the costs of chronic diseases and how high obesity rates play out in the forms of absenteeism, presenteeism, and direct health care costs to employers, workers and society-at-large. Among the 10 costliest physical health conditions, the top 3 are angina, hypertension and diabetes — all related to obesity and amenable to lifestyle behavior change. The top-line numbers set the context:

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

The slow economy is driving slower health spending; but what will employers do?

By 2022, $1 in every $5 worth of spending in the U.S. will go to health care in some way, amounting to nearly $15,000 for each and every person in America. From biggest line item on down, health spending will go to payments to: Hospitals, representing about 32% of all spending Physicians and clinical costs, 20% of spending Prescription drugs, 9% of spending Nursing, continuing care, and home health care, together accounting for over 8% of health spending (added together for purposes of this analysis) Among other categories like personal care, durable medical equipment, and the cost of health insurance.

Defining Mobile Health – the blur between health and health care

Mobilising Healthcare, a new report from Juniper Research, segments the mobile health sector into “healthcare” and “health & fitness” segments. The research summary notes that fitness is a relatively new market compared with health “care,” which has been around for eons. Fitness, the analysts say, “is exempt from government intervention.” Mobile healthcare (“mHealth”) applications explored include SMS health messaging, remote health provision such as cardiac monitoring, electronic health records and personal health records. In mFitness, Juniper looks into mobile tech for athletes and fitness conscious people, and activity tracking including heart function, distance, respiration, and perspiration, among other parameters. mHealth

HSAs for Dummies: improving health insurance literacy

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans. While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time. This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes

Working for health care in 2013: workers’ health insurance cost burden still grows faster than wages

Insurance premium costs grew 4% for families between 2012 and 2013, with workers now bearing 39% of health premiums in 2013 compared with only 26% ten years ago, in 2003. That’s a 50% increase in health plan premium “burden” for working families, by my calculation. This snapshot of health insurance in 2013 comes to us from the 2013 Employer Health Benefits Survey, provided by the Kaiser Family Foundation (KFF) and the Health Research & Educational Trust (HRET). This research is one of the most important annual reports to hit the health care industry every year, and this year’s analysis provides strategic context

Cost prevents people from seeking preventive health care

3 in 4 Americans say that out-of-pocket costs are the main reason they decide whether or not to seek preventive care, in A Call for Change: How Adopting a Preventive Lifestyle Can Ensure a Healthy Future for More Americans from TeleVox, the communications company, published in June 2013. TeleVox surveyed over 1,015 U.S. adults 18 and over. That’s the snapshot on seeking care externally: but U.S. health consumers aren’t that self-motivated to undertake preventive self-care separate from the health system, either, based on TeleVox’s finding that 49% of people say they routinely exercise, and 52% say they’ve attempted to improve eating habits.

Urgent care centers: if we build them, will all patients come?

Urgent care centers are growing across the United States in response to emergency rooms that are standing-room-only for many patients trying to access them. But can urgent care centers play a cost-effective, high quality part in stemming health care costs and inappropriate use of ERs for primary care. That’s a question asked and answered by The Surge in Urgent Care Centers: Emergency Department Alternative or Costly Convenience? from the Center for Studying Health System Change by Tracy Yee et. al. The Research Brief defines urgent care centers (UCCs) as sites that provide care on a walk-in basis, typically during regular

What to expect from health care between now and 2018

Employers who provide health insurance are getting much more aggressive in 2013 and beyond in terms of increasing employees’ responsibilities for staying well and taking our meds, shopping for services based on cost and value, and paying doctors based on their success with patients’ health outcomes and quality of care. Furthermore, nearly one-half expect that technologies like telemedicine, mobile health apps, and health kiosks in the back of grocery stores and pharmacies are expected to change the way people regularly receive health care. What’s behind this? Increasing health care costs, to be sure, explains the 18th annual survey from the National

Money and health, migraines and sleep: how stress directly impacts health and wealth

There’s an issue that doctors and patients don’t discuss that’s among the most important contributors to ill health: it’s money, and it’s something Alexandra Drane calls an “Unmentionable.” Alex, Founder, Chief Visionary, and Board Chair at Eliza Corporation, coined Unmentionables as those aspects of daily living which everyone deals with, but few like to talk about: like sex (whether too much, too little), drugs (abusing), drinking (too much), toileting problems (such as incontinence or pooping problems), sleep trouble, and caring for others (not ourselves so much). These daily life challenges can negatively impact health, with financial stress being one of

As health cost increases moderate, consumers will pay more: will they seek less expensive care?

While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960. That’s due to “the imperative to do more with less has paved the way for a true transformation of the

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

The emerging economy for consumer health and wellness

The notion of consumers’ greater skin in the game of U.S. health care — and the underlying theory of rational economic men and women that would drive people to greater self-care — permeated the agenda of the 2nd annual Consumer Health & Wellness Innovation Summit, chaired by Lisa Suennen of Psilos Ventures. Lisa kicked off the meeting providing a wellness market landscape, describing the opportunity that is the ‘real’ consumer-driven health care: people getting and staying well, and increasing participation in self-management of chronic conditions. The U.S. health system is transforming, she explained, with payors beginning to look like computer

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for