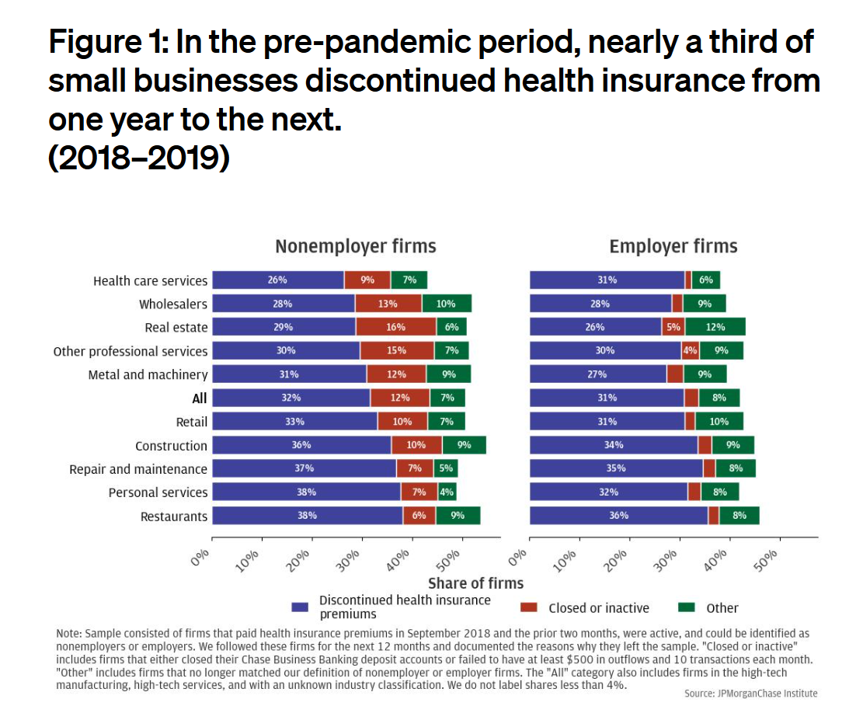

Health Insurance Coverage Among Smaller U.S. Businesses Is Eroding: A Signal From JPMorganChase

Working-age people in the U.S. depend on their employers to provide health insurance; just over one-half of people in America receive employer-sponsored health insurance. But a concerning signal has emerged that calls into question how sustainable the uniquely American employer-sponsored health plan model is: that is that one in 3 small businesses in the U.S. stopped covering health insurance after the worst of the pandemic health effects in 2023 as the companies payroll expenses continued to increase, a statistic raised in The consistency of health insurance coverage in small business: industry challenges and insights, a report from the JPMorganChase Institute

U.S. Health Care in 2025 Requires Scenario Planning: The Uncertainties (AI!?) That Inspire DIY Healthcare

As Weight Watchers prepares to initiate bankruptcy proceedings, I file the news event under “thinking the unthinkable.” “Thinking about the unthinkable” is what Herman Kahn, a father of scenario planning, asked us to do when he pioneered the process. In this book, for Kahn, “the unthinkable” was thermonuclear war, and the year was 1962. The book was tag-lined as “must reading for an informed public” and in it, Kahn I’ve been drawn back to this book lately because of a more intense workflow using

Are We Liberated Yet? Tariffs Can Impact Financial Health (Riffing on MoneyLion’s Health Is Wealth Report)

Americans’ financial health was already stressing consumers out leading up to Liberation Day, April 2nd, when President Trump announced tariffs on dozens of countries with whom the U.S. buys and sells goods. A new report from MoneyLion and Mastercard called Health is Wealth is well-timed for today’s Health Populi blog. The study was fielded by The Harris Poll online among 2,092 U.S. adults 18 and older between February 28 and March 4, 2025, so it was completed a month before the tariffs came to hit peoples’ 401(k) savings and employers’ company stock market caps.

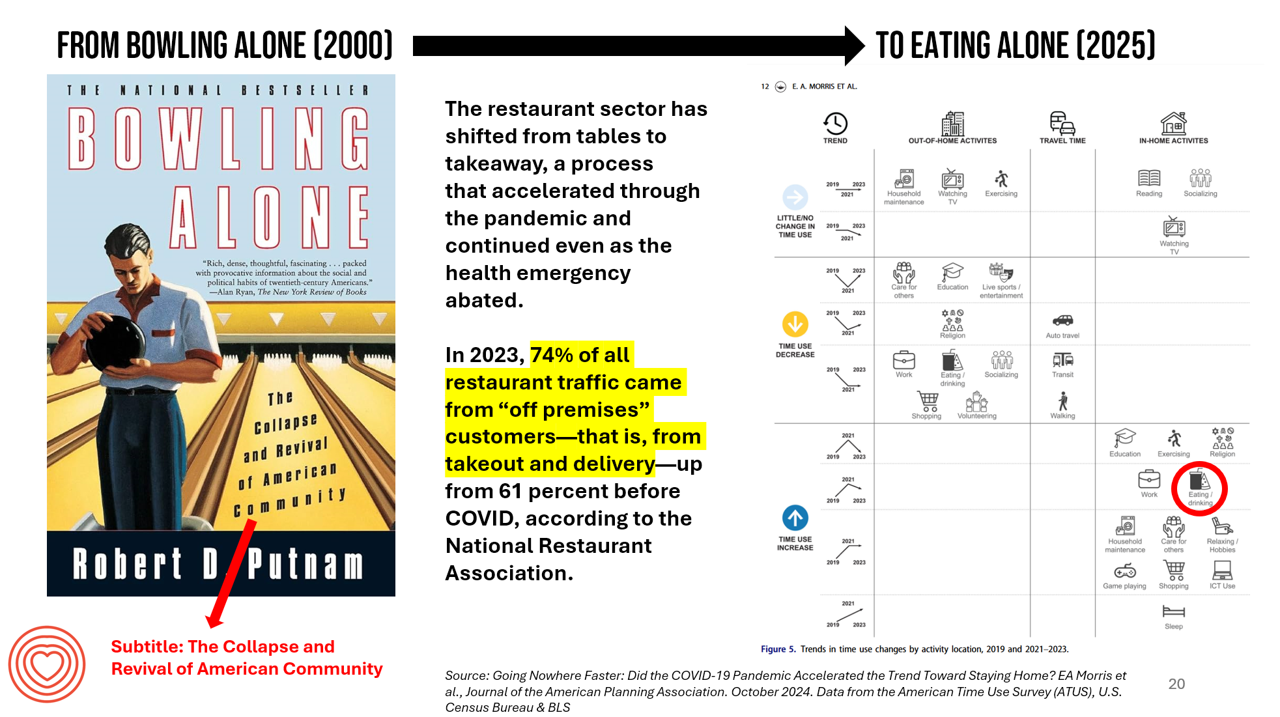

From Bowling Alone to Eating Alone – What the Shift to Take-Out Food Means for Our Social Well-Being and Mental Health

New data from the American Time Use Survey, research conducted by the U.S. Census Bureau and the Bureau of Labor Statistics, shows that Americans now favor eating in-home compared with eating out at restaurants. Corroborating this shift is other data from the National Restaurant Association sharing that 74% of all restaurant traffic in 2023 came from “off premises” customers — that is, from takeout and delivery — up from 61% in the pre-COVID era. What does this mean for our health, well-being, and sense of community and connectivity? I’m preparing a new talk to

The Growth of DIY Digital Health – What’s Behind the Zeitgeist of Self-Reliance?

Most people in the U.S. use at least one medical device at home — likely a blood pressure monitor. used by nearly one-half of people based on a survey of 2,000 consumers conducted for Propel Software. The Propel study’s insights build on what we know is a growing ethos among health consumers seeking to take more control over their health care and the rising costs of medical bills and out-of-pocket expenses. That includes oral health and dental bills: 2 in 5 U.S. consumers use electric toothbrushes (a growing smart-device category at the

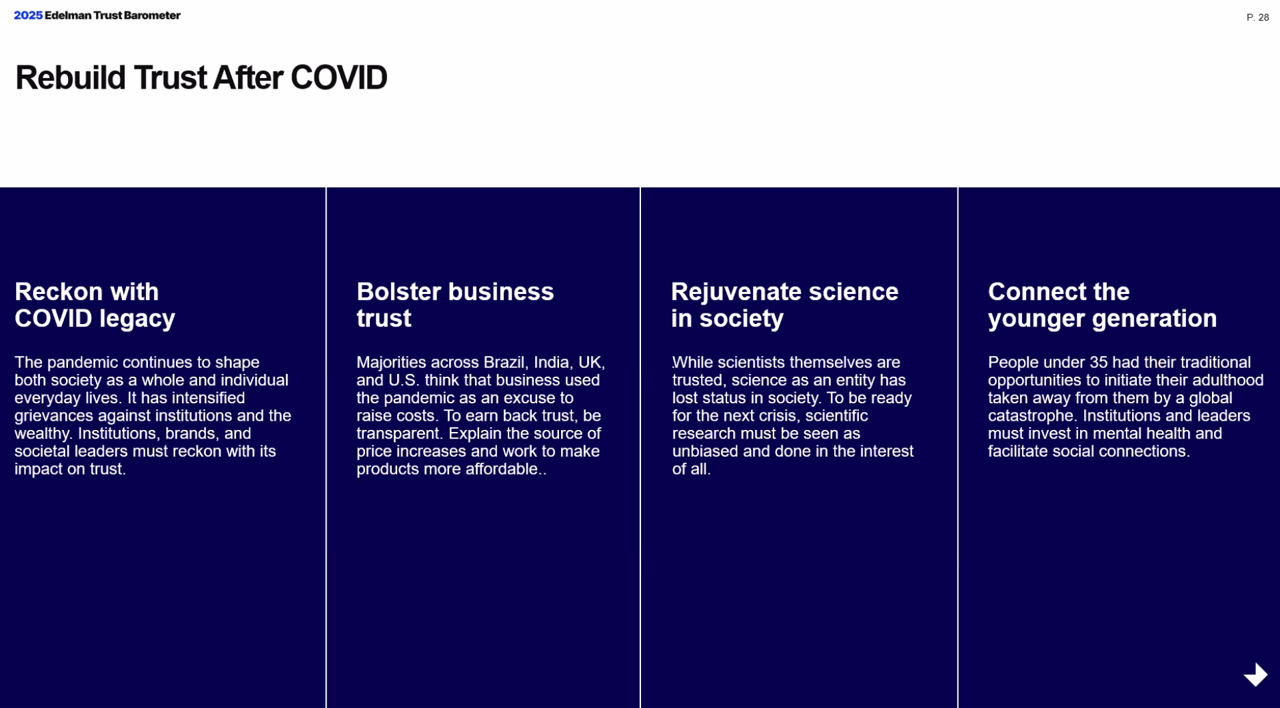

A Mis-Trust Hangover for Health Care 5 Years After COVID Began – an Edelman Trust Barometer Update

On March 11, 2020, The World Health Organization announced that the coronavirus was deemed a pandemic. WHO Director-General Dr. Tedros Adhanom Ghebreyesus asserted, “We have called every day for countries to take urgent and aggressive action. We have rung the alarm bell loud and clear.” Five years later, Edelman has fielded a survey to determine what some 4,000 health citizens living in 4 countries (Brazil, India, the UK, and the U.S.) are thinking and feeling about life after COVID-19 — and especially where their trust lies in institutions, fellow citizens, and future public health emergencies. I listened in on a discussion

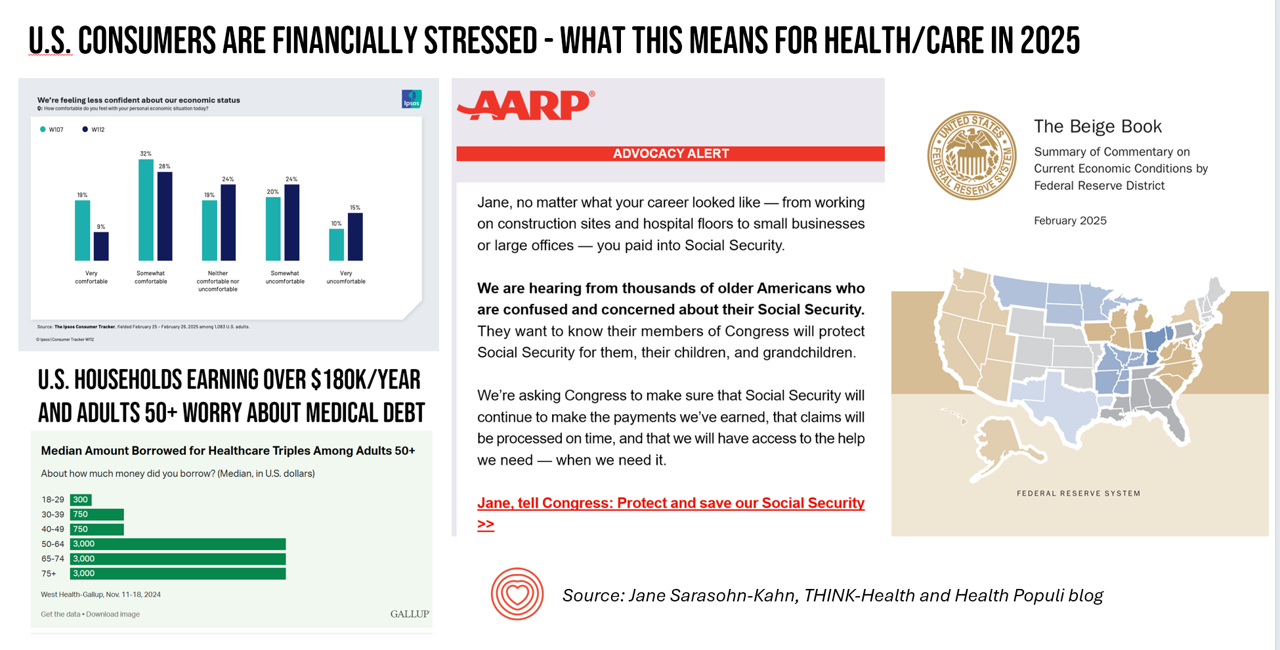

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

Improve Sleep, Improve the World and Health: ResMed’s Look at Global Sleep Trends

The world would be a better place if we had more, and better quality sleep. That’s the hopeful conclusion from the fifth annual Global Sleep Survey from ResMed. ResMed’s global reach with the sleeping public enabled the company to access the perspectives of over 30,000 respondents in 13 markets, finding that one in 3 people have trouble falling or staying asleep 3 or more times a week. We now live in “a world struggling with poor sleep” — “a world without rest,” ResMed coins our sleepless situation. The irony is that most people believe

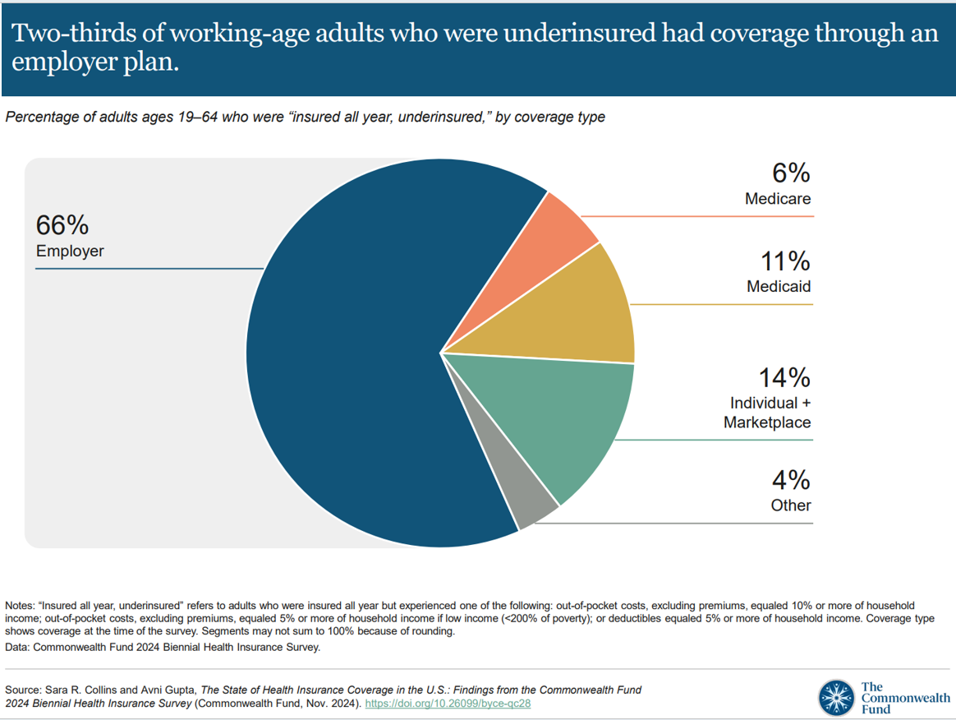

Workers Feel “Stuck,” Under-Insured, Financially Stressed, and Neglecting Mental Health

“It’s the economy stupid,” Jennifer Tescher, CEO of the Financial Health Network, titles her latest column in Forbes. Published two weeks after the 2024 U.S. elections, Jennifer’s assertion sums up what, ex post facto, we know about what most inspired American voters at the polls in November 2024: the economy, economics, inflation, the costs of daily living….pick your noun, but it’s all about those Benjamins right now for mainstream American consumers across many demographic cuts. With that realization, we must remind ourselves as we enter a new year under a second-term President Trump that health care spending for everyday people

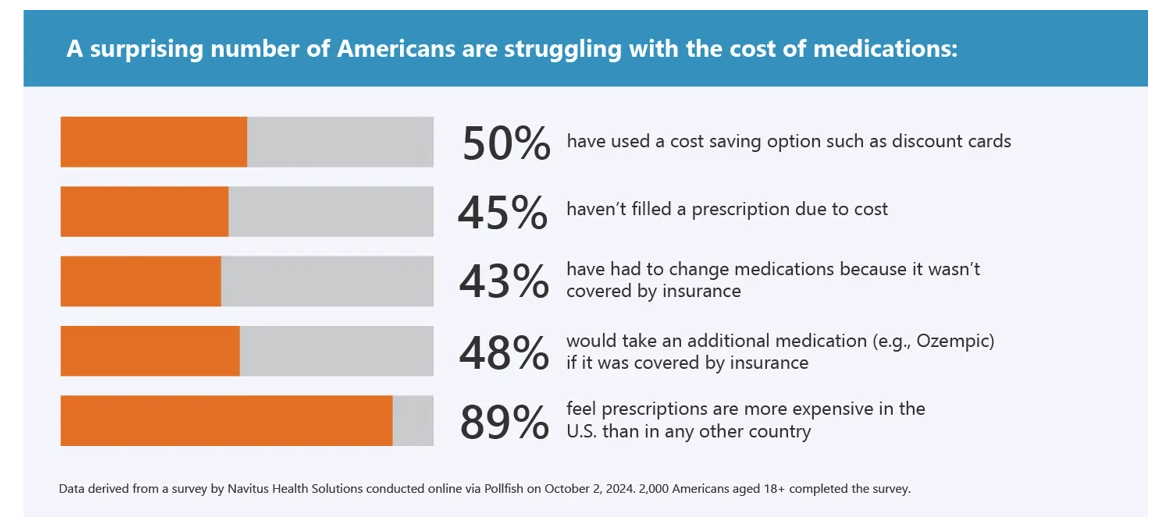

What Stays True for U.S. Health Care Post #Election2024 (1) – Consumers’ Dissatisfaction with Drug Prices

For health care, there are many uncertainties as we reflect, one week after the 2024 U.S. elections, on probably policy and market impacts that we can expect in 2025 and beyond. In today’s Health Populi post, I’ll reflect on the first of several certainties we-know-we-know about U.S. health citizens and key factors shaping the American health ecosystem. In this first of several posts on “What Stays True for U.S. Health Care Post #Election2024,” I’ll focus on U.S. consumer dissatisfaction with drug prices — across political party identification. Let’s set the context with data from a recently-published

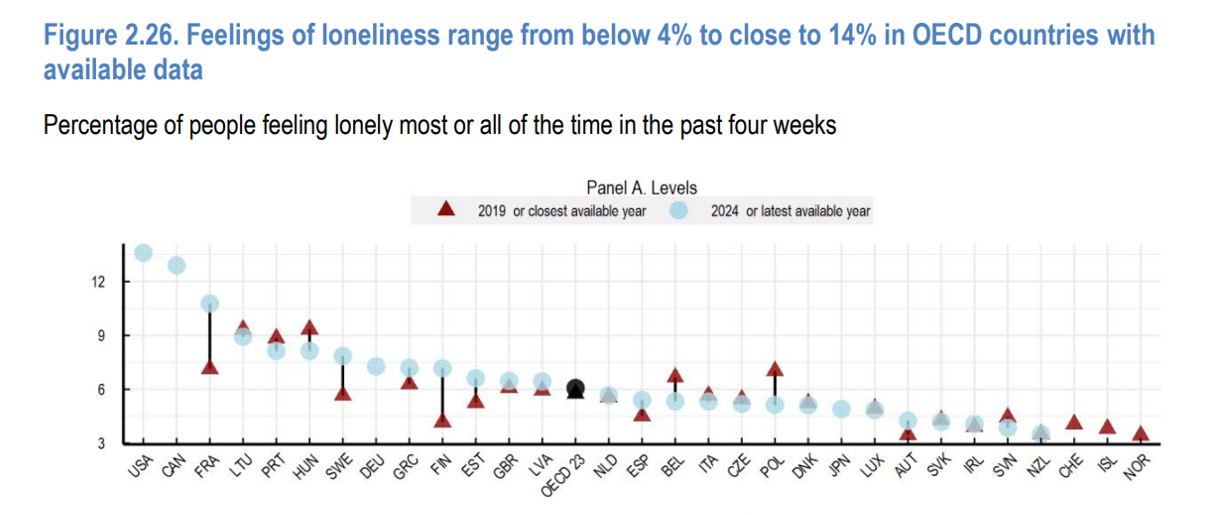

How’s Life? Around the World – In the U.S., It’s the Sadness That Stands Out

A new report from the OECD asks the question, “How’s Life?” with the tagline letting us know the plotline focuses on “well-being and resilience in times of crisis.” The Organization of Economic Cooperation and Development (OECD) has tracked the well-being of member nations for the past six years, taking a broad view on the definition of holistic health — including physical, mental, financial, and social aspects of people living in OECD countries. The first “How’s Life?” report was published at the height of the global financial crisis; the authors of this report introduce it saying that, “the

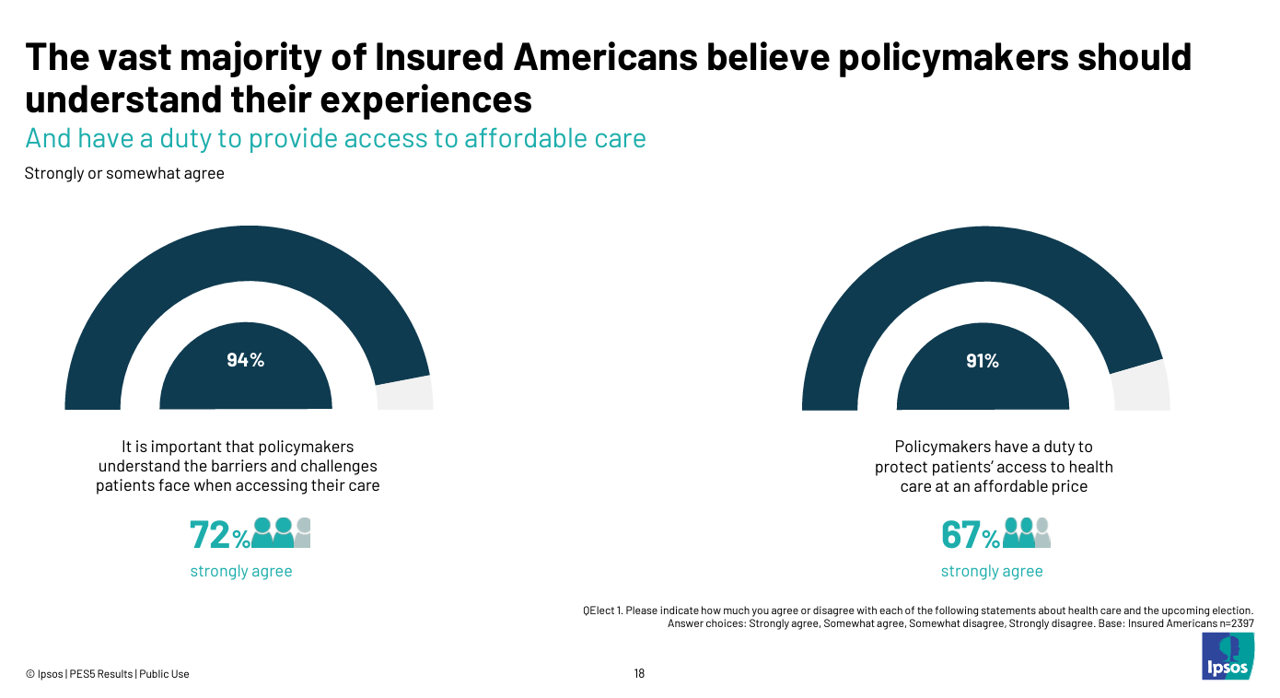

Health Care Costs and Access On U.S. Voters’ Minds – Even If “Not on the Ballot” – Ipsos/PhRMA

Today marks eight days before #Election2024 in the U.S. While many political pundits assert that “health care is not on the ballot,” I contend it is on voters’ minds in many ways — related to the economy (the top issue in America), social equity, and even immigration (in terms of the health care workforce). In today’s Health Populi blog, I’m digging into Access Denied: patients speak out on insurance barriers and the need for policy change, a study conducted by Ipsos on behalf of PhRMA, the Pharmaceutical Research and Manufacturers of America — the pharma industry’s advocacy organization (i.e., lobby

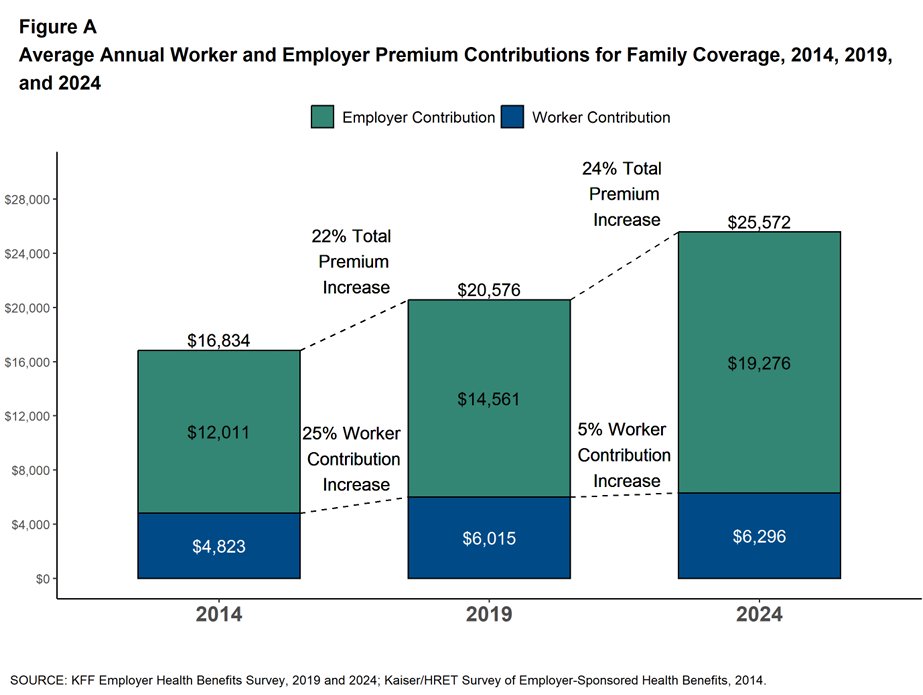

The Health Insurance Premium for a Family Averages $25,572 in 2024 – KFF’s Annual Update on Employer-Sponsored Benefits

The premium for employer-sponsored health plans grew by 6-7% between 2023 and 2024, according to the report on Employer Health Benefits 2024 Annual Survey from the Kaiser Family Foundation, KFF’s 26th annual study into U.S. companies’ spending on workers’ health care. In 2024 the average annual health insurance premium for family coverage is $25,572, split by 75% covered by the employer (just over $19,000) and 25% borne by the employee ($6,296), shown in the first chart from the report. The nearly $26K family premium is the average across all plan types in the

Obesity is a Public Health Epidemic in the U.S. — The Case for GLP-1 Coverage, Affordability and Equity

“If the U.S. were sensible, weight management would be treated as a public health issue,” David Cutler writes in the JAMA Health Forum dated August 15, 2024. Dr. Cutler, distinguished economics professor at Harvard, talks about “the pathology of U.S. health care” citing the example of weight loss medications — in short, the uptake of GLP-1 drugs to address Type 2 diabetes first, and subsequently obesity. Dr. Cutler notes that the price of these drugs in the U.S. “far exceeds” that of other countries: specifically, 9 times that of the prices in Germany and the Netherlands

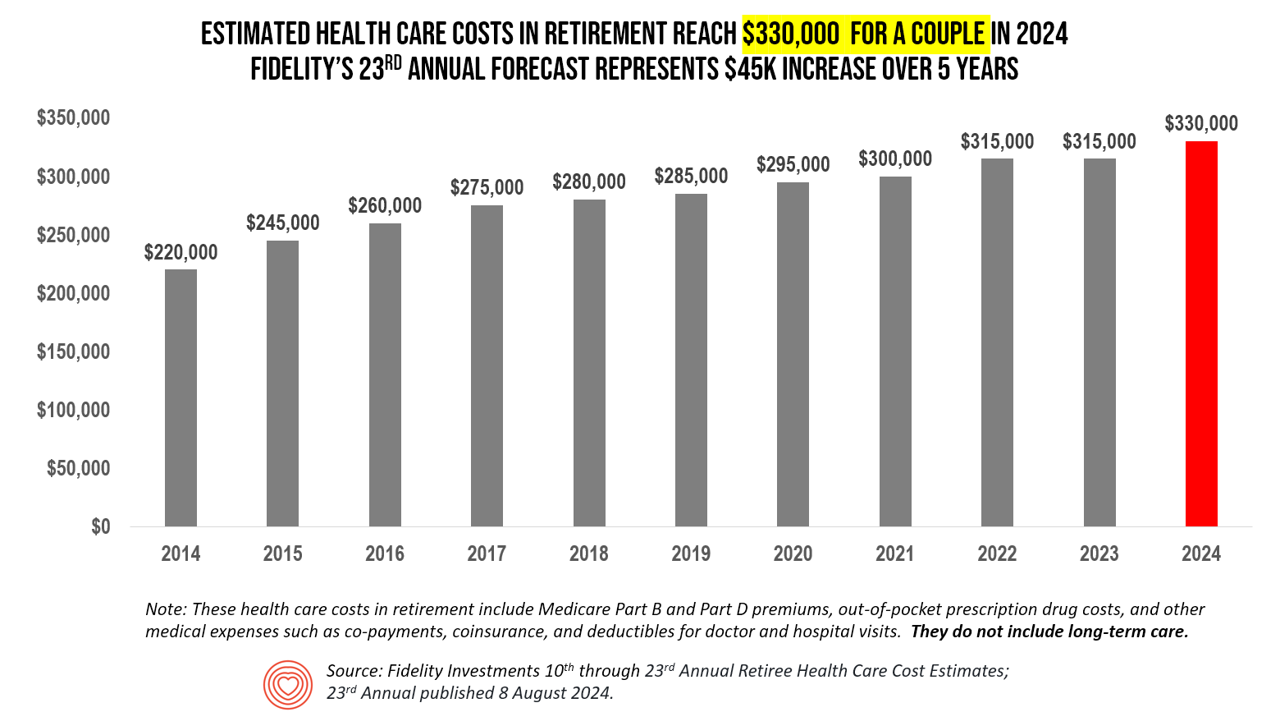

The Health Care Costs for Someone Retiring in 2024 in the U.S. Will Reach $165,000 – Fidelity’s 23rd Annual Update

The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast. I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K. Fidelity began

The Cost of GLP-1 Drugs on Payers’ Minds as Nearly 1/3rd of U.S. Consumers Could Become Users

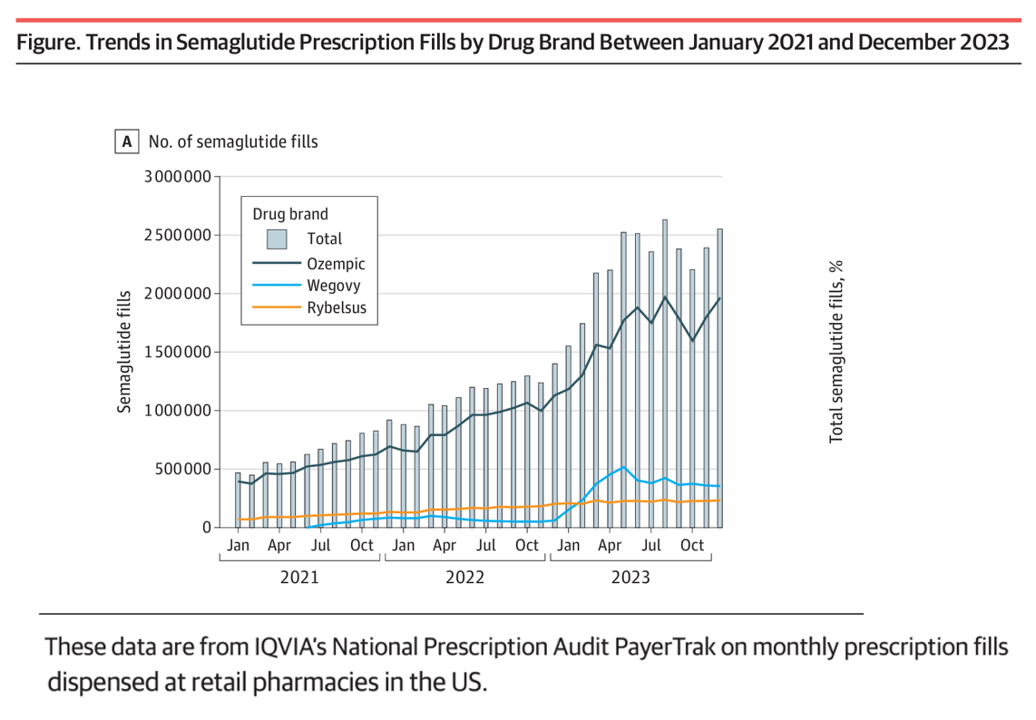

With 70 different clinical trials for GLP-1 drugs in process with the FDA, payers — and other stakeholders in the health care ecosystem — have the semaglutide-SENSE top of mind, based on my ongoing updating of this fast-moving market space. For overall market context on pace-of-growth in adoption, check out this chart from a JAMA Health Forum research letter on Prescription Fills for Semaglutide Products by Payment Method, published August 2nd. The study was based on the IQVIA National Prescription Audit PayerTrak data which captures 92% of Rx’s filled at retail pharmacies in

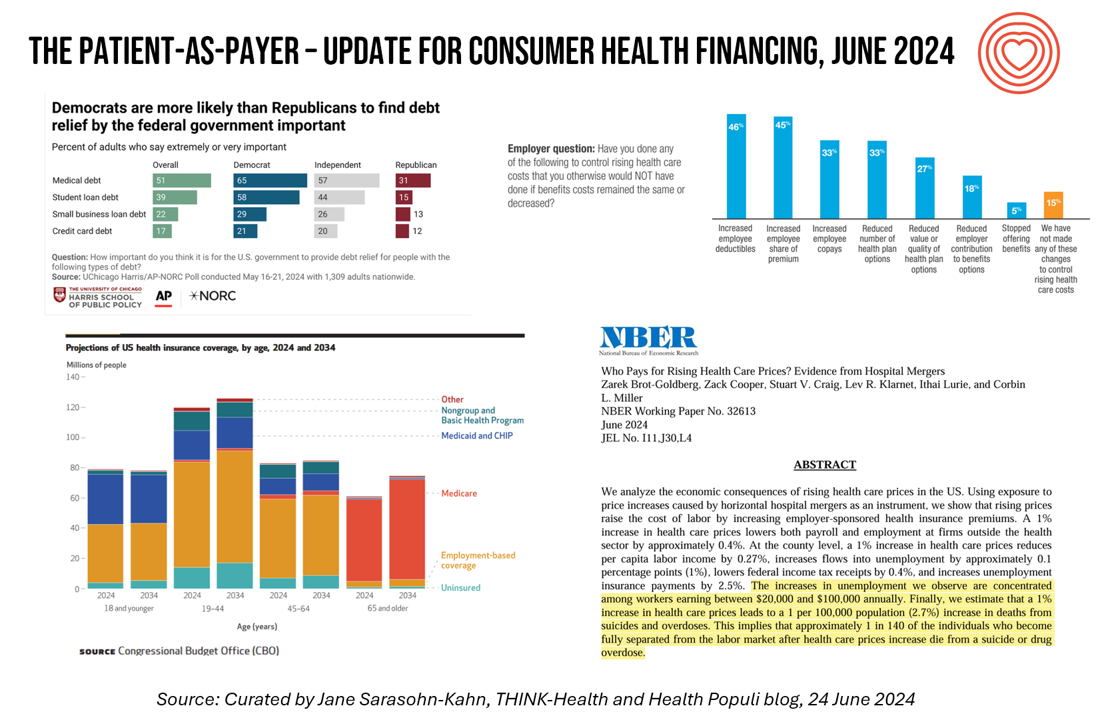

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

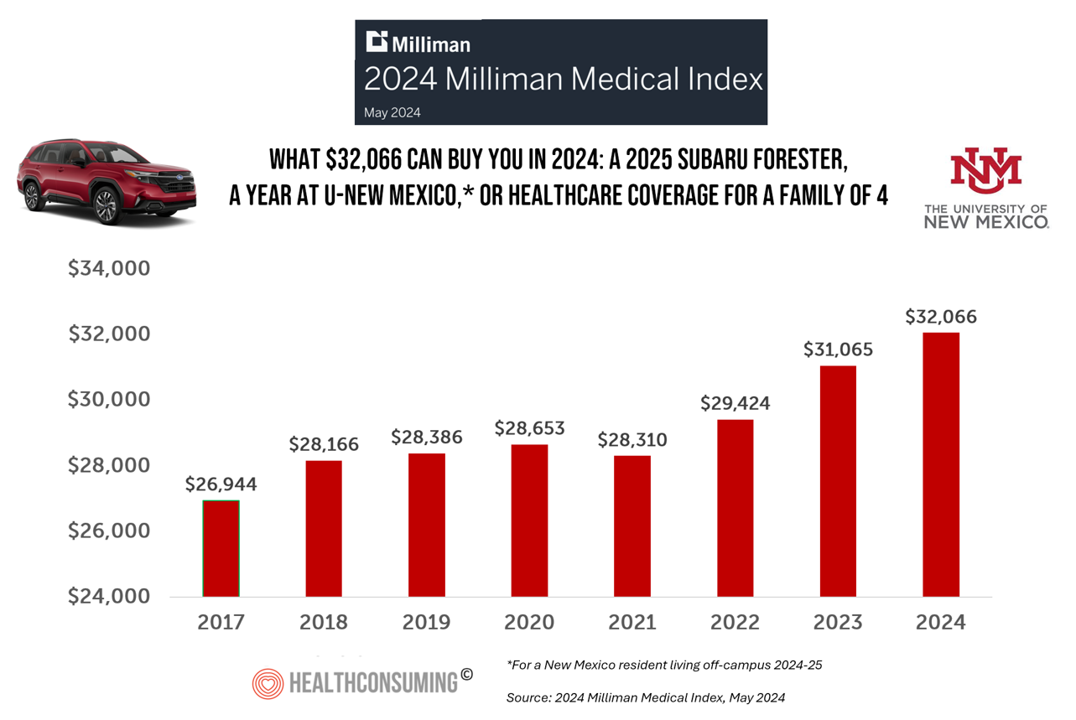

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

The Thematic Roadmap for AHIP 2024: What the Health Insurance Conference Will Cover

Health insurance plans make mainstream media news every week, whether coverage deals with the cost of a plan, the cost of out-of-network care, prior authorizations, or cybersecurity and ransomware attacks, among other front-page issues. This week, AHIP (the acronym for the industry association of America’s Health Insurance Plans) is convening in Las Vegas for its largest annual 2024 meeting. We expect at least 2,400 attendees registered for the meeting, and they’ll not just be representing the health insurance industry itself; folks will attend #AHIP2024 from other industry segments including pharmaceuticals, technology, hospitals and health systems, and the investment and financial services

Inflation, Health, and the American Consumer – “The Devil Wears Kirkland”

The Wall Street Journal reported yesterday that surging hospital prices are helping to keep inflation high. Hospital costs rose 7.7% last month, the highest increase in 13 years. This chart from WSJ’s reporting illustrates the >2x change in the CPI for hospitals vs the overall rate of price increases. Hospitals are not alone in price cliffs, with health insurance premiums spiking last year at the fastest rate in a decade, the Labor Statistics data showed. “For patients and their employers, the increases have meant higher health-insurance premiums, as well as limiting wage

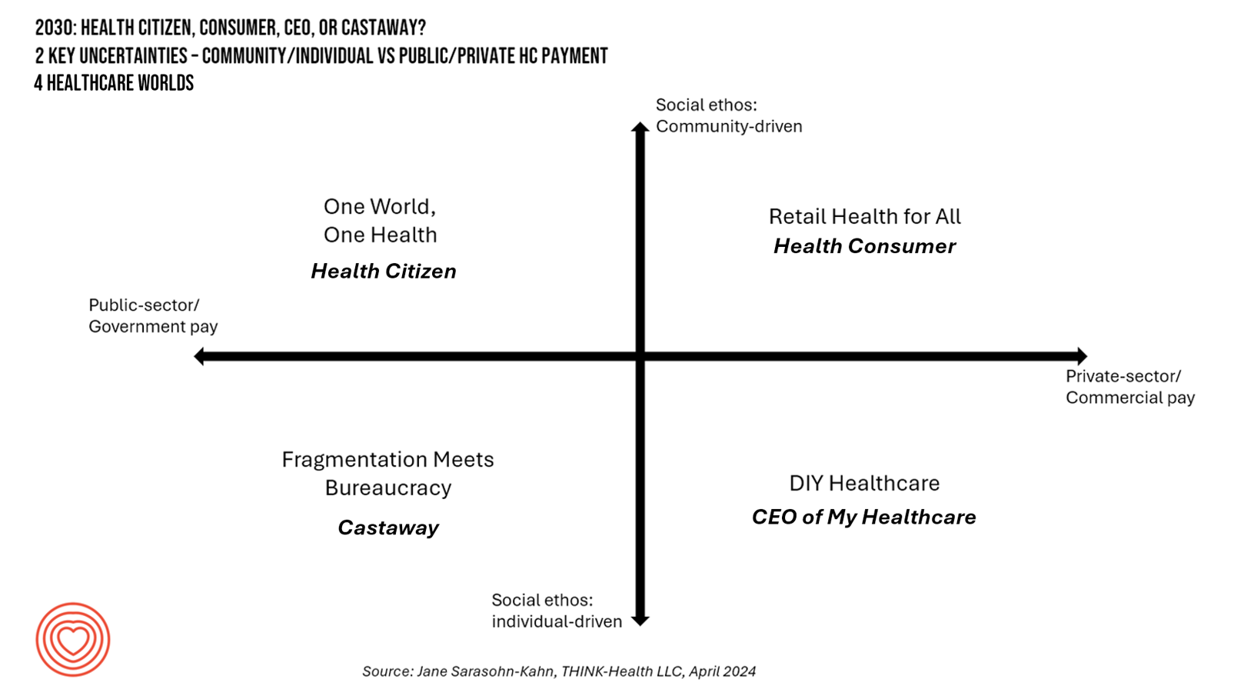

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 1

In the past few years, what event or innovation has had the metaphorical impact of hitting you upside the head and disrupted your best-laid plans in health care? A few such forces for me have been the COVID-19 pandemic, the emergence of Chat-GPT, and Russia’s invasion of Ukraine. That’s just three, and to be sure, there are several others that have compelled me to shift my mind-set about what I thought I knew-I-knew for my work with organizations spanning the health care ecosystem. I’m a long-time practitioner of scenario planning, thanks to the early education at the side of Ian

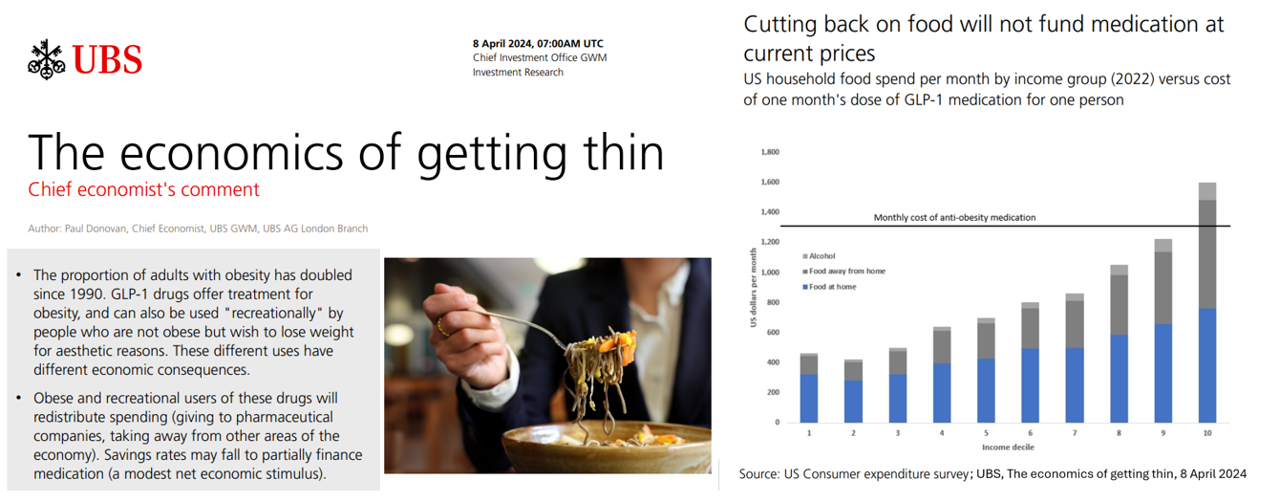

Considering Equity and Consumer Impacts of GLP-1 Drugs – A UBS Economist Weighs In

Since the introduction of GLP-1 drugs on the market, their use has split into two categories: for obesity and “recreationally,” according to the Chief Economist with UBS (formerly known as Union Bank of Switzerland). Paul Donovan, said economist, discusses The economics of getting thin in his regularly published comment blog. “These different uses have different economic consequences,” Donovan explains: Obese patients who use GLP-1s should become more productive employees, Donovan expects — less subject to prejudice, and less likely to be absent from work. While so-called recreational GLP-1 consumers may experience these

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

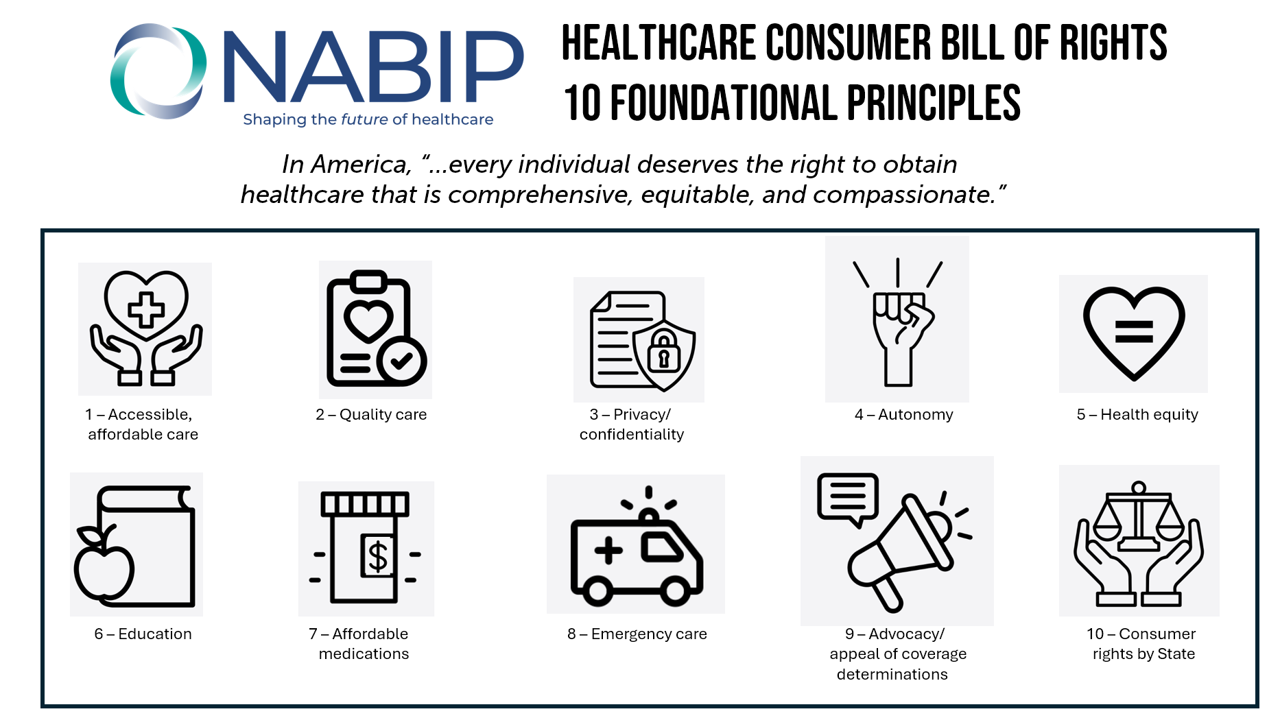

A Health Consumer Bill of Rights: Assuring Affordability, Access, Autonomy, and Equity

Let’s put “health” back into the U.S. health care system. That’s the mantra coming out of this week’s annual Capitol Conference convened by the National Association of Benefits and Insurance Professionals (NABIP). (FYI you might know of NABIP by its former acronym, NAHU, the National Association of Health Underwriters). NABIP, whose members represent professionals in the health insurance benefits industry, drafted and adopted a new American Healthcare Consumer Bill of Rights launched at the meeting. While the digital health stakeholder community is convening this week at VIVE in Los Angeles to share innovations in health tech, NABIP

From Evolution to Innovation, from Health Care to Health: How Health Plans With Collaborators Are Re-Defining the Industry

As a constant observer and advisor across the health/care ecosystem, for me the concept of a “health plan” in the U.S. is getting fuzzier by the day. Furthermore, health plan members now see themselves as medical bill payers, seeking value and consumer-level services for their health insurance premium investment. Weaving these ideas together is my mission in preparing a session to deliver at the upcoming AHIP 2024 conference in June, I’m thinking a lot about the evolving nature of health insurance, plans, and the organizations that provide them. To help me define first principles, I turned to the American father

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

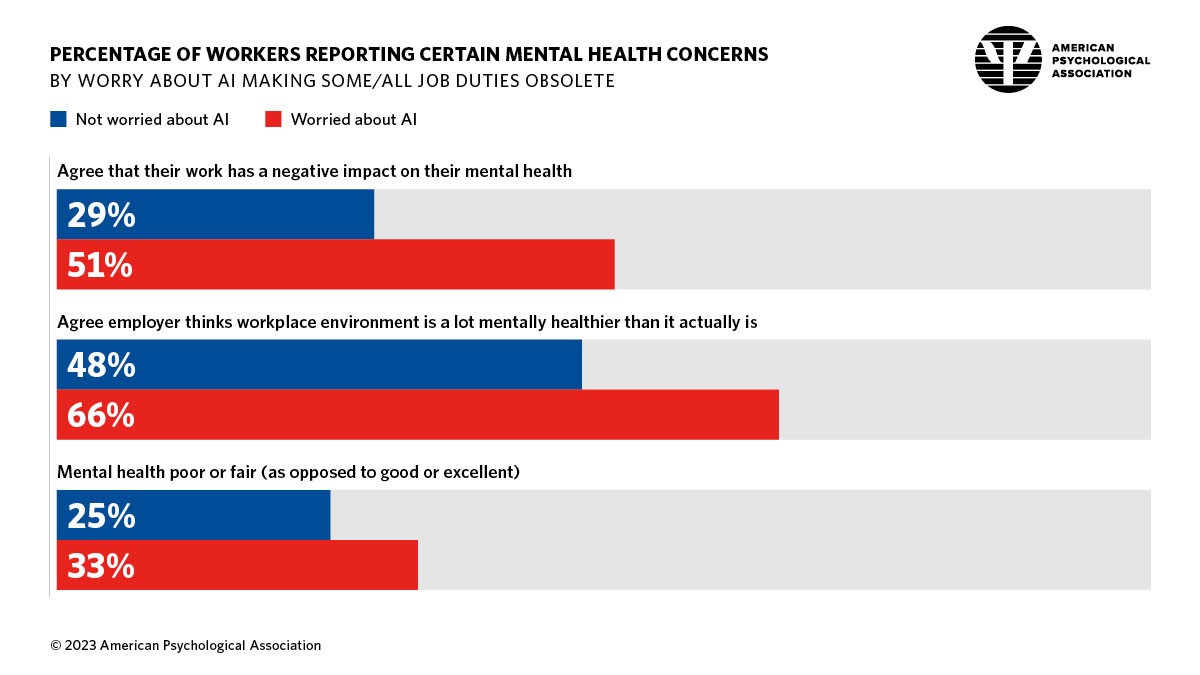

Working in America: AI Is the Next Major Job Stressor

Workers in America are worried about the potential impacts that artificial intelligence (AI) could have on the workplace and jobs, according to Work in America: Artificial Intelligence, Monitoring Technology and Psychological Well-Being, a study from the American Psychological Association (APA). For many years, we’ve been tracking APA’s Stress in America studies gauging Americans’ mental health before the pandemic and during the pandemic. To social and political stress, we must now add in another stressor to peoples’ daily lives: concerns about AI and the potential for it to make one’s job obsolete, with the subsequent

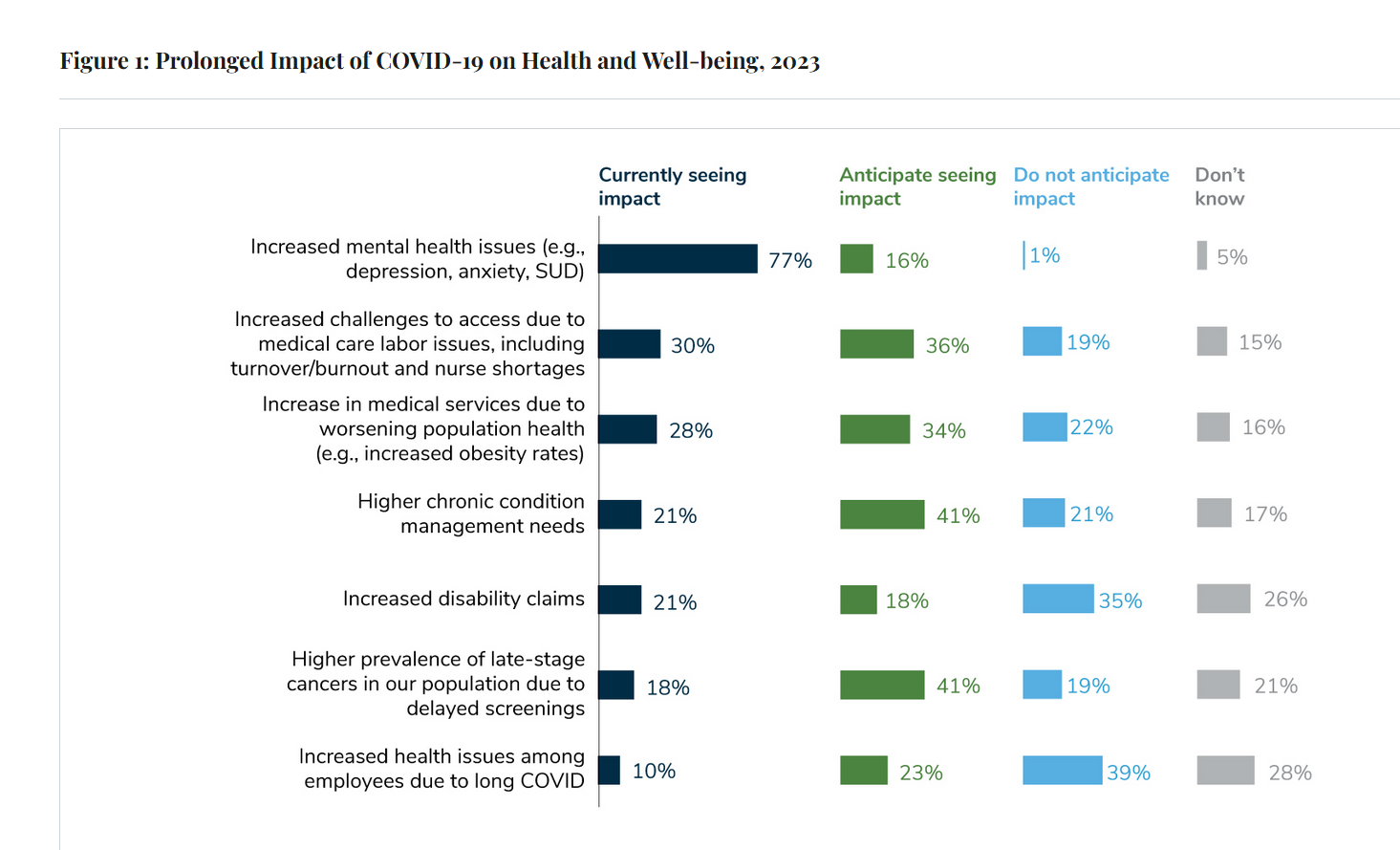

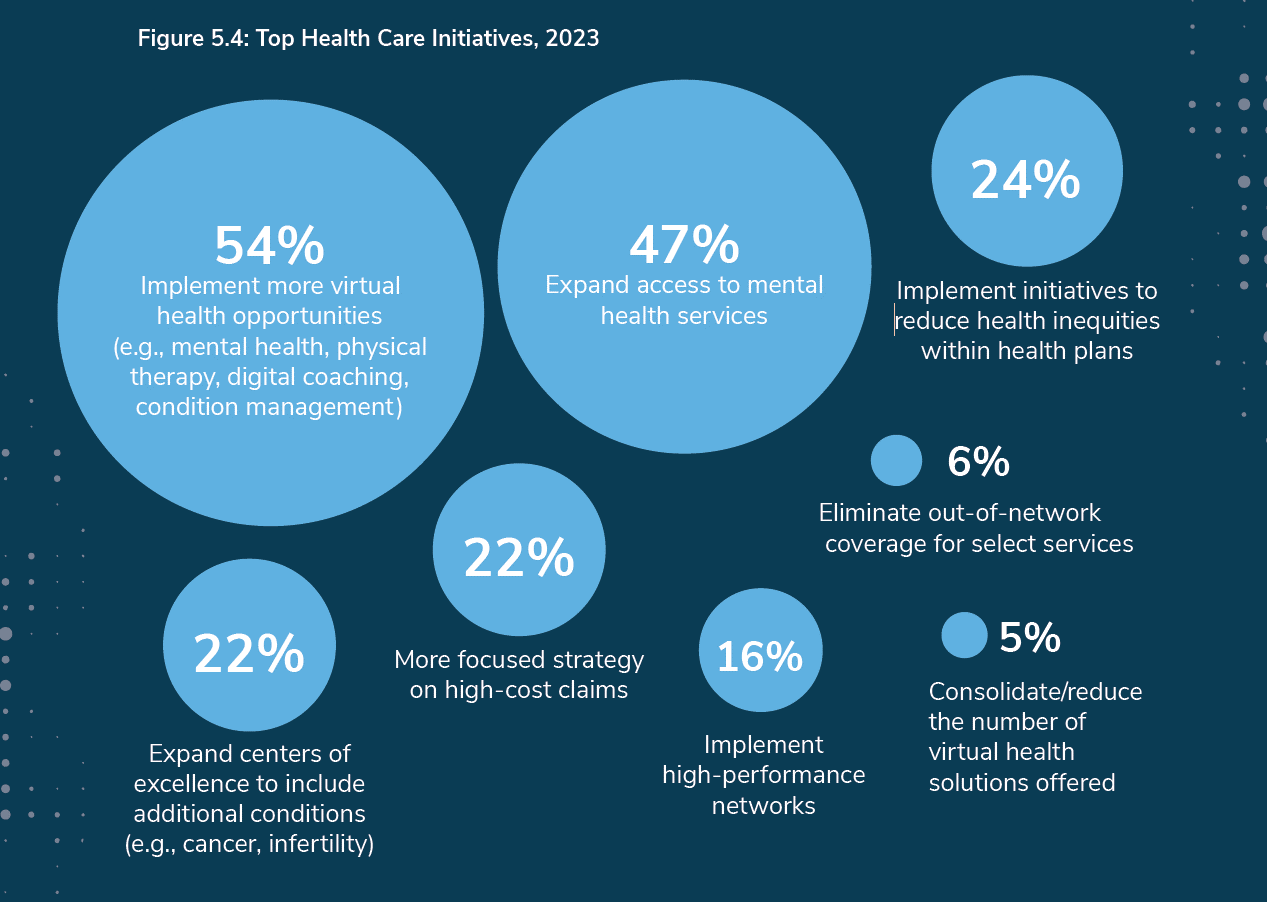

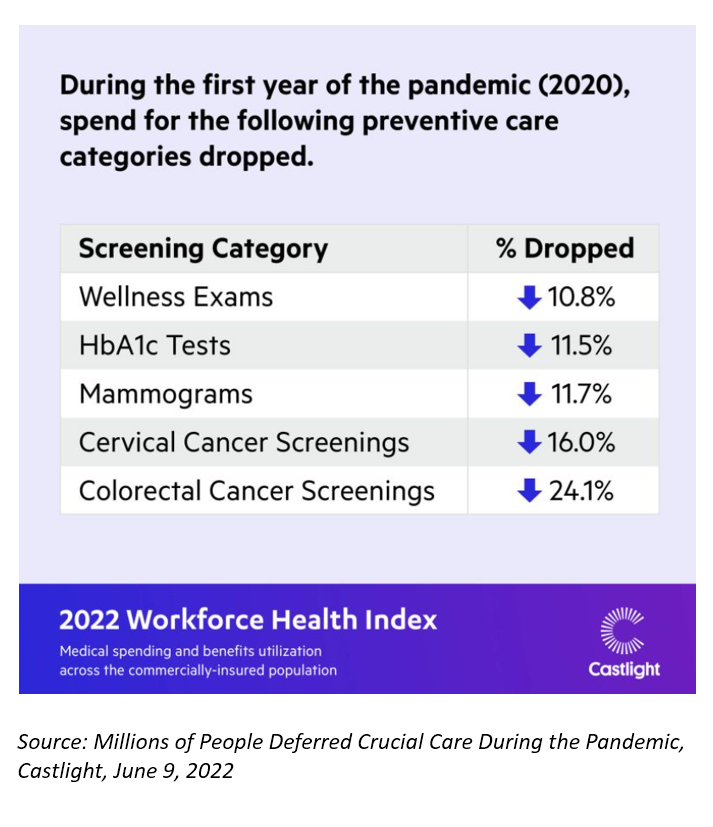

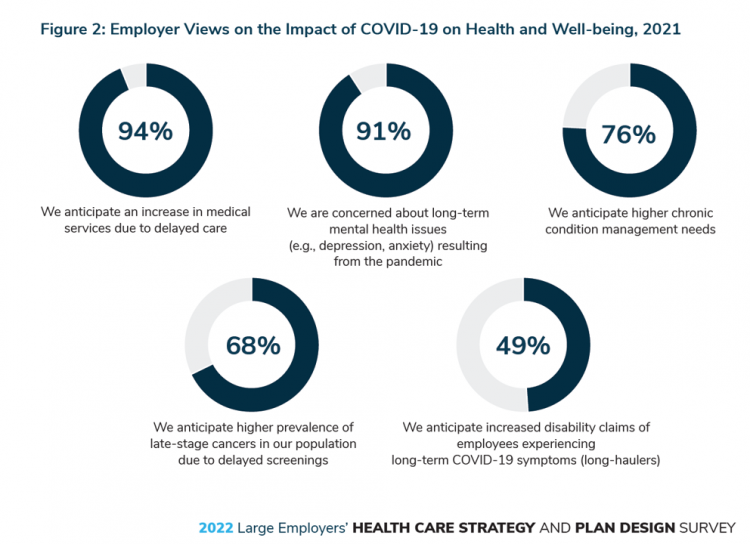

Large Employers Expect More Employees Will Experience Prolonged Health Impacts Due to COVID-19. and a Note About Telehealth Engagement

Due to their delayed return to medical services and diagnostic testing in the COVID-19 pandemic era, U.S. employees are expected to sustain serious health impacts that will drive employers’ health care costs, envisioned in the 2024 Large Employer Health Care Strategy Survey from the Business Group on Health (BGH). Dealing with mental health issues is the top health and well-being impact workers in large companies are addressing in 2023. Looking forward, large employers foresee their workers will be seeking care for chronic conditions and later-stage cancers that are diagnosed due to delayed screenings.

To Avert a GLP-1 Cost Tsunami, Add Lifestyle Interventions: Learning from Virta Health

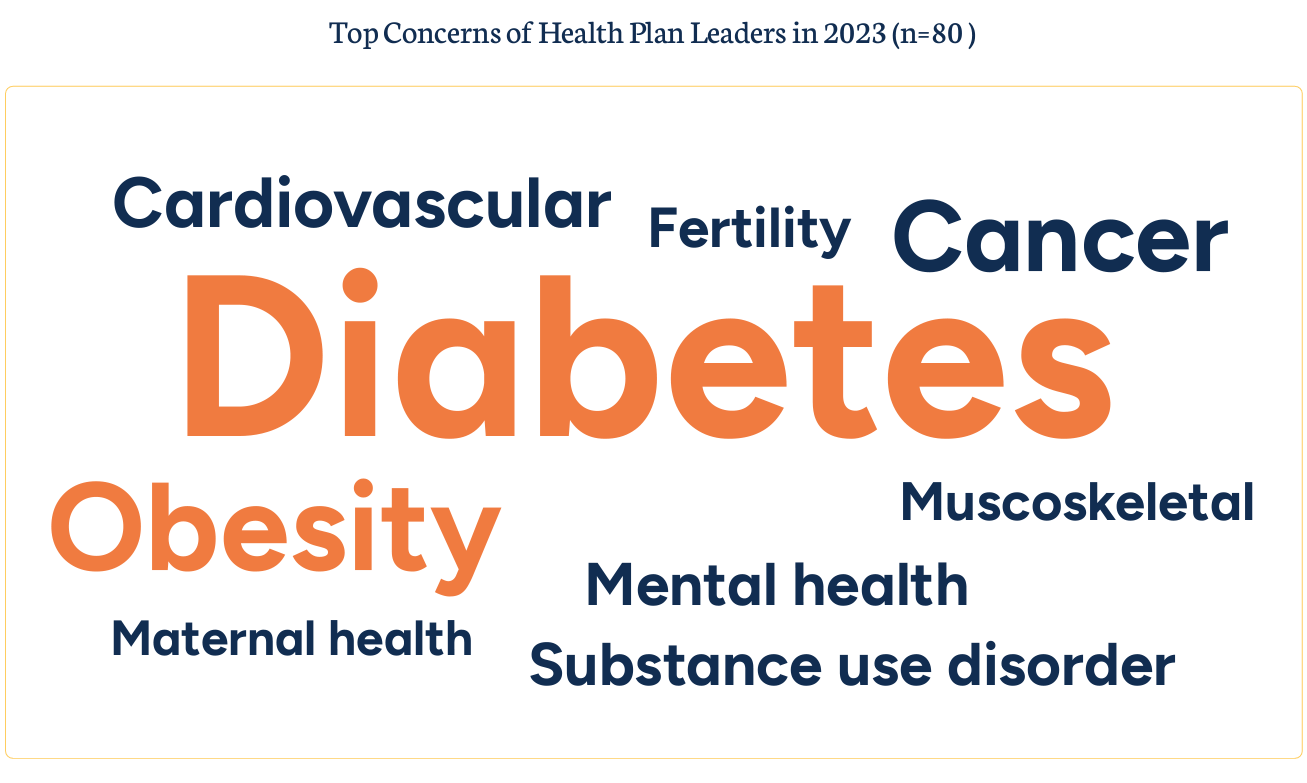

With consumer and prescriber interest in GLP-1 receptor agonist drugs “soaring,” health plan managers have a new source of financial stress and clinical questions on their to-do list. A team of Virta Health leaders held a webinar on 13th July 2023 to explain the results of a study the company just completed assessing health plan execs’ current views on Ozempic and other GLP-1 medicines with a view on both clinical outcomes and cost implications for this growing category of drugs that address diabetes and obesity. Indeed, diabetes and obesity are top health concerns among the

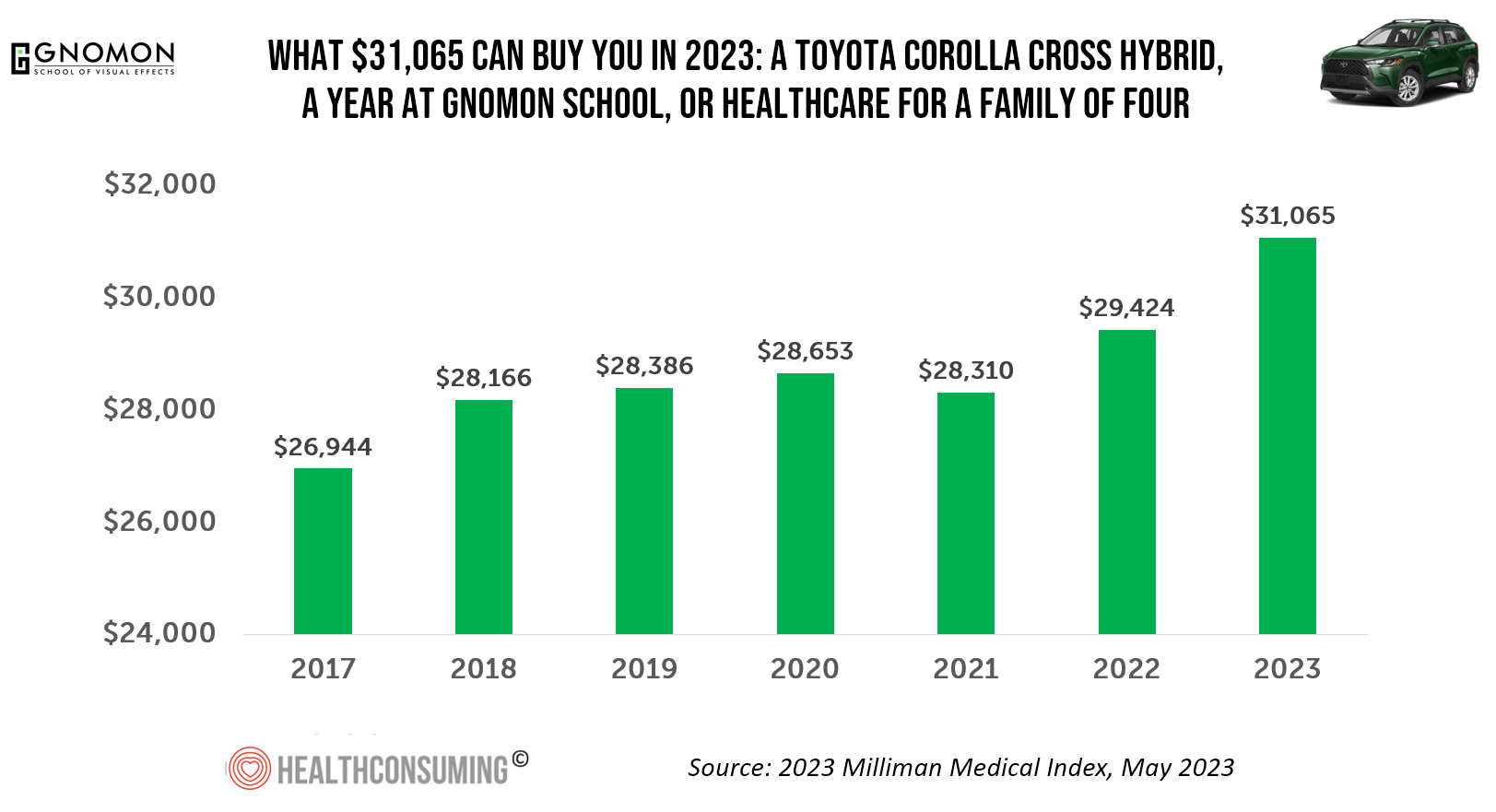

What $31,065 Can Buy You: a Toyota Corolla Cross Hybrid, a Year at Gnomon School, or Healthcare for a Family of 4 in America

“Healthcare costs came roaring back in 2021” after falling in 2020. In 2023, that roaring growth in health care costs continues with expected growth of 5.6%. For 2023, you could take your $31K+ and buy a Toyota Corolla Cross Hybrid auto, fund a year at the Gnomon School in Hollywood toward a degree in animation or game design, or buy healthcare for your family of 4. Welcome to this year’s annual look at health care costs for a “typical” U.S. family explained in the 2023 Milliman Medical Index (MMI).

Consumers Expect Every Company to Play a Meaningful Role in “My Health” – New Insights from the 2023 Edelman Trust Barometer

People have expanded their definitions of health in 2023, with mental health supplanting physical health for the top-ranked factor in feeling healthy. Welcome to the Edelman Trust Barometer Special Report: Trust and Health, released this week, with striking findings about how the economic, post-pandemic life, pollution and climate change all feed mis-trust among citizens living in 13 countries — and their eroding trust for health care systems. While these factors vary by country in terms of relative contribution to citizen trust, note that in the U.S., social polarization plays an outsized role in factors that “make us

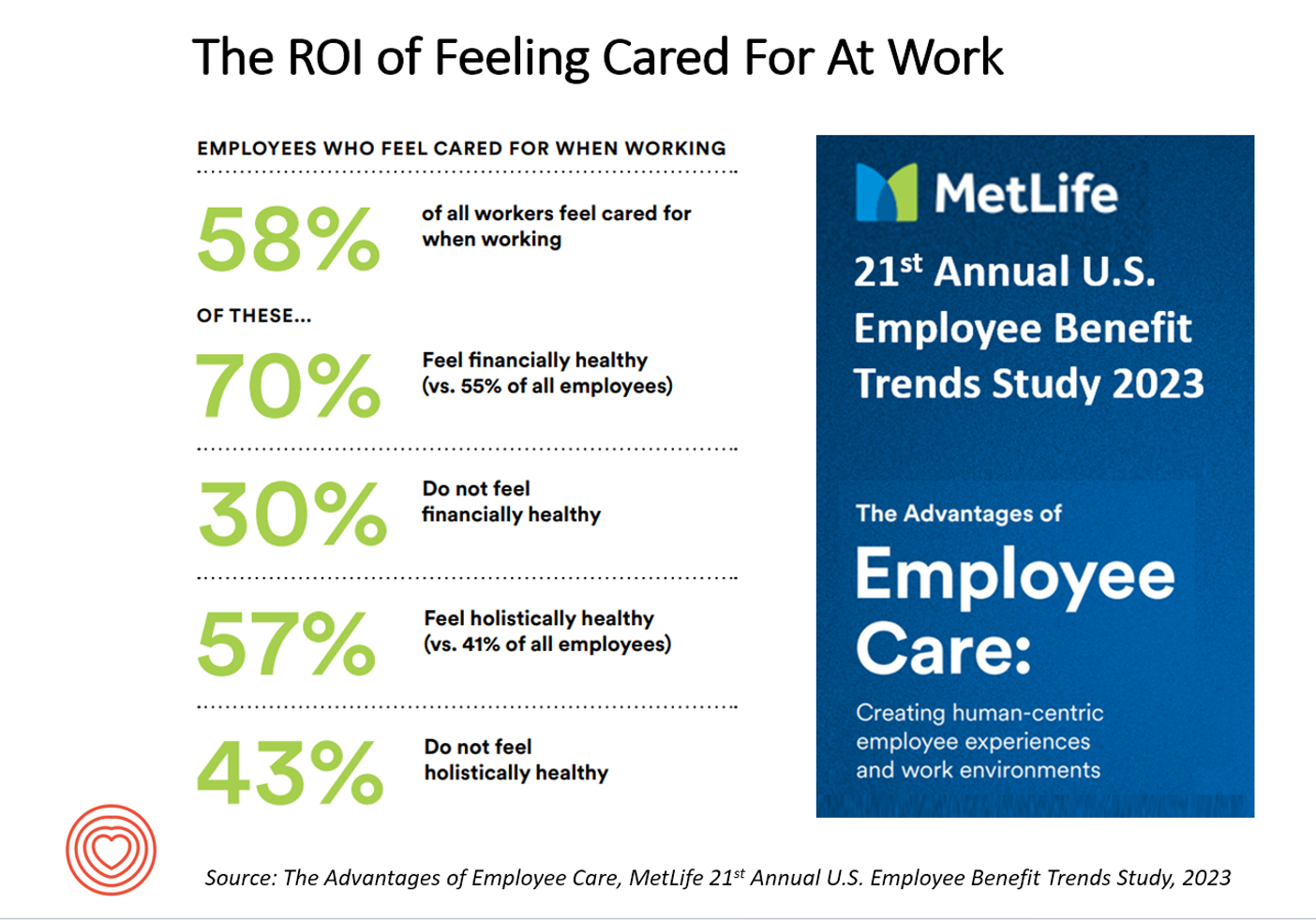

The ROI on Feeling Cared-For At Work – Employer Trust, Love, and Building the Joyconomy

“Can employers afford not to care?” MetLife’s 21st annual U.S. Employee Benefit Trends Study asks and answers that question, with a resounding and evidence-based “NO.” I’m in Salt Lake City today discussing the drivers of health, “yesterday, today, and tomorrow” at the Virgin Pulse Thrive Summit, celebrating the ten-year anniversary of the company. As you would expect from an organization that is part of Richard Branson’s business ecosystem, the meeting will be energetically produced, delivering insights wrapped in info-taining ways. One of those features will be my being invited to create a

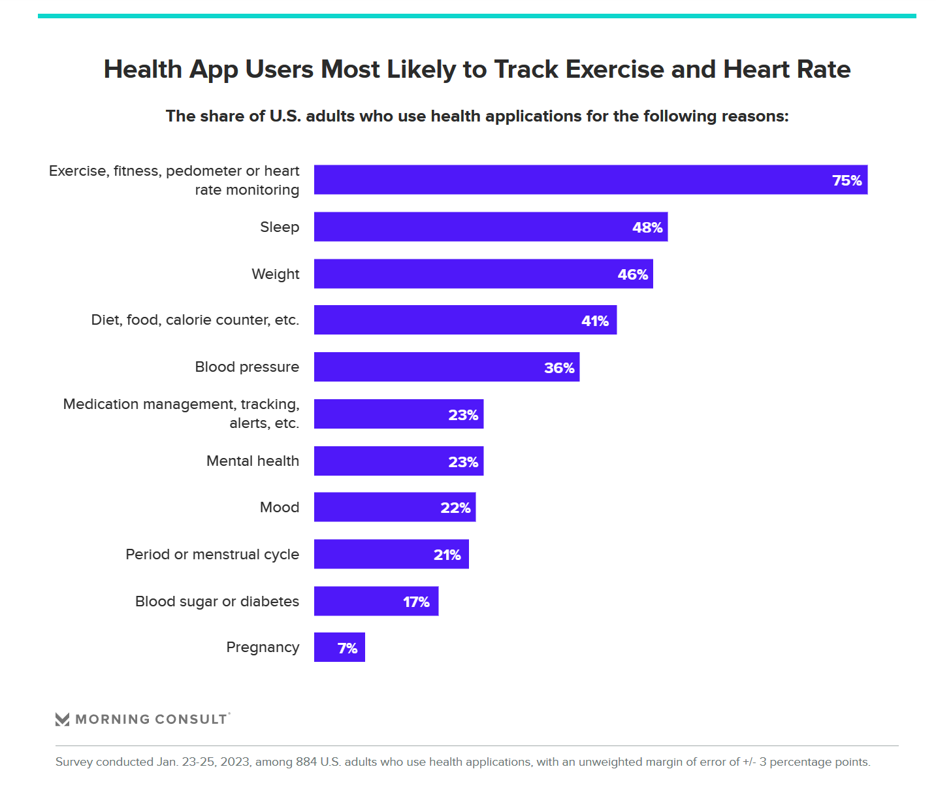

People Using Health Apps and Wearable Tech Most Likely Track Exercise and Heart Rate, Sleep and Weight – But Cost Is Still A Barrier

Over one in three U.S. consumers use a health app or wearable technology device to track some aspect of their health. “The public’s use of health apps and wearables has increased in recent years but digital health still has room to grow,” a new poll from Morning Consult asserts, published today. Among digital health tech users, most check into them at least once every day in the past month. One in four use these tech’s multiple times a day, the first pie chart illustrates. Eighteen percent of people use their digital

Wellness in 2023 Is About Connections, Mental Health and Science – Global Wellness Summit’s 2023 Trends

Consumers’ wellness life-flows and demands in 2023 will go well beyond exercise resolutions, eating more greens, and intermittent fasting as a foodstyle. It’s time for us to get the annual update on health consumers from the multi-faceted team who curated the Global Wellness Summit’s annual report on The Future of Wellness 2023 Trends. In this year’s look into wellness for the next few years, we see that health-oriented consumers are seeking solutions for dealing with loneliness and mental health, weight and hydration, travel-as-medicine as health destinations, and — not surprisingly —

When Household Economics Blur with Health, Technology and Trust – Health Populi’s 2023 TrendCast

People are sick of being sick, the New York Times tells us. “Which virus is it?” the title of the article updating the winter 2022-23 sick-season asked. Entering 2023, U.S. health citizens face physical, financial, and mental health challenges of a syndemic, inflation, and stress – all of which will shape peoples’ demand side for health care and digital technology, and a supply side of providers challenged by tech-enabled organizations with design and data chops. Start with pandemic ennui The universal state of well-being among us mere humans is pandemic ennui: call it languishing (as opposed to flourishing), burnout, or

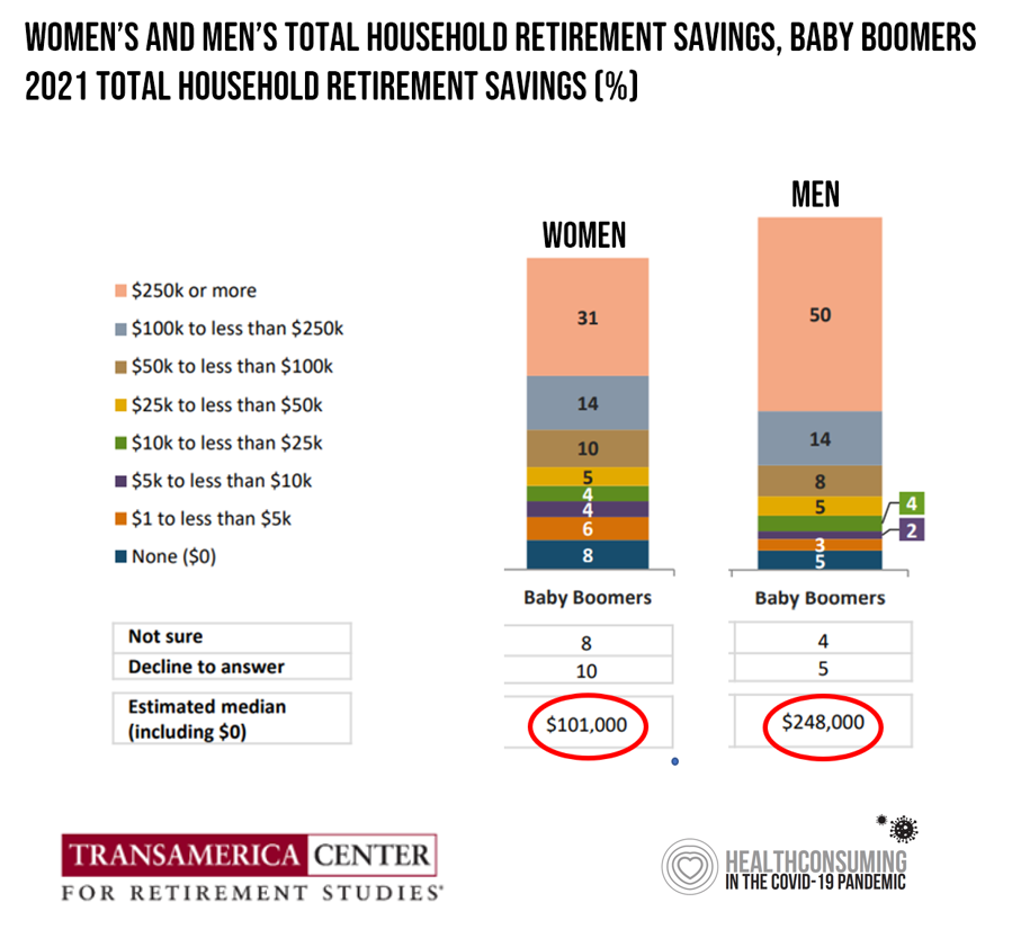

Men Work in Retirement for Healthy Aging; Women, for the Money – Transamerica Looks at Retirement in 2022

Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS). As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.” Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The

Thinking Value-Based Health Care at HLTH 2022 – A Call-to-Action

The cost of health insurance for a worker who buys into a health plan at work in 2022 reached $22,463 for their family. The average monthly mortgage payment was $1,759 in mid-2022. “When housing and health both rank as basic needs in Maslow’s hierarchy, what’s a health system to do?” I ask in an essay published today on Crossover Health’s website titled Value-Based Care: Driving a Social Contract of Trust and Health. The answer: embrace value-based care. Warren Buffett wrote Berkshire Hathaway shareholders in 2008, asserting that, “Price is what you pay. Value

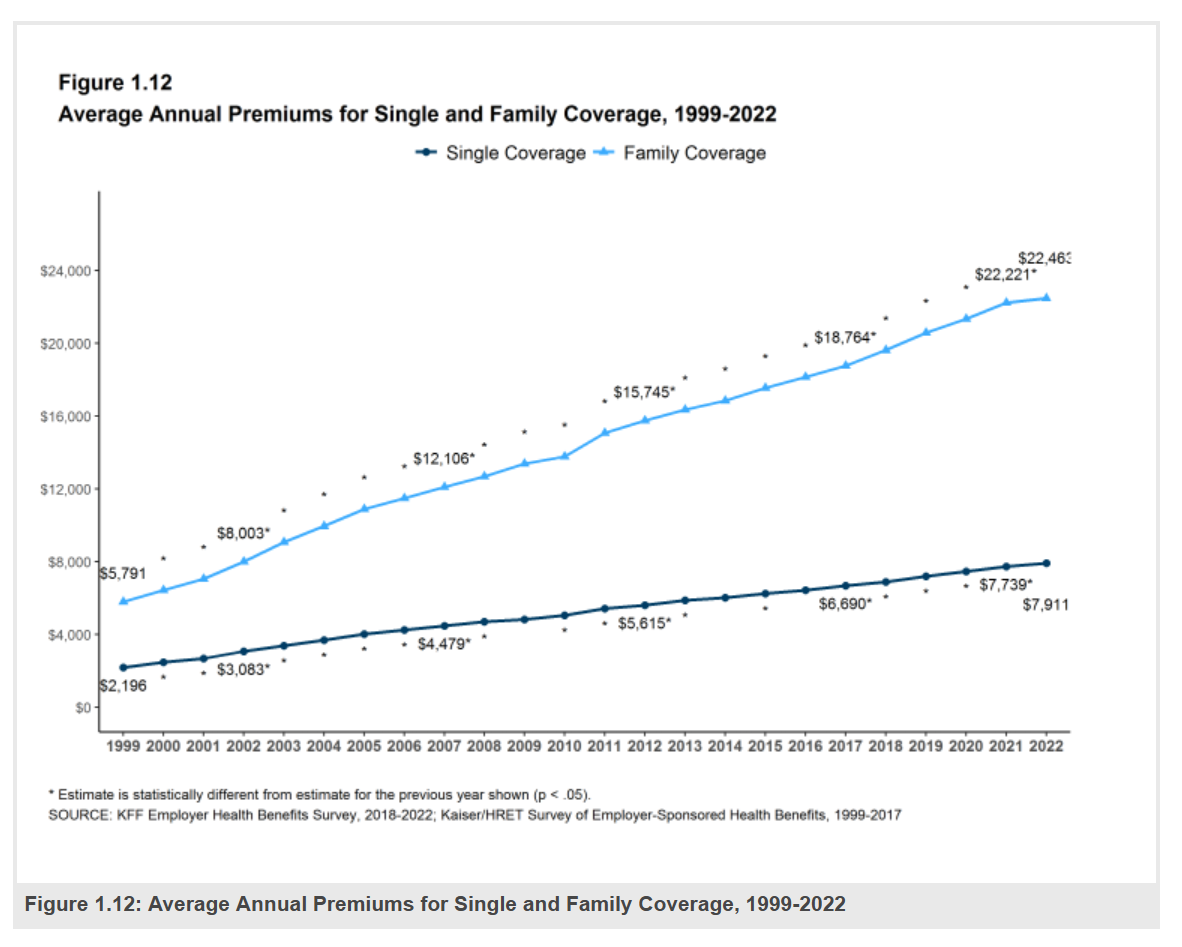

$22,463 Can Get You a Year of College in Connecticut, a Round of Ref Work in the Stanley Cup Playoffs, or Health Benefits for a Worker’s Family

Employers covering health insurance for workers’ families will face insurance premiums reaching, on average, $22,463. That is roughly what a year at an independent college in Connecticut would cost, or a round of pay for a ref in the Stanley Cup playoffs. With that sticker-shock level of health plan costs, welcome to the 2022 Employer Health Benefits Survey from Kaiser Family Foundation, KFF’s annual study of employer-sponsored health care. Each year, KFF assembles data we use all year long for strategic and tactical planning in U.S. health care. This mega-study looks at

How Will the “New” Health Economy Fare in a Macro-Economic Downturn?

What happens to a health care ecosystem when the volume of patients and revenues they generate decline? Add to that scenario a growing consensus for a likely recession in 2023. How would that further impact the micro-economy of health care? A report from Trilliant on the 2022 Trends Shaping the Health Economy helps to inform our response to that question. Start with Sanjula Jain’s bottom-line: that every health care stakeholder will be impacted by reduced yield. That’s the fewer patients, less revenue prediction, based on Trilliant’s 13 trends re-shaping the U.S. health

Virtual Care and Mental Health Top of Mind for Employers’ Workplaces in 2023

The concept that all companies are “health care companies” takes on greater import in the wake of the pandemic. The 2023 Large Employers’ Health Care Strategy and Plan Design Survey from the Business Group on Health (BGH) found that two in three large employers see their health and well-being strategy as an integral part of their overall workforce strategy. This is our annual go-to study guiding us on the private sector’s big thinking about health care plans and investments on workers’ behalf. The first line chart illustrates how this phenomenon shot up in importance for

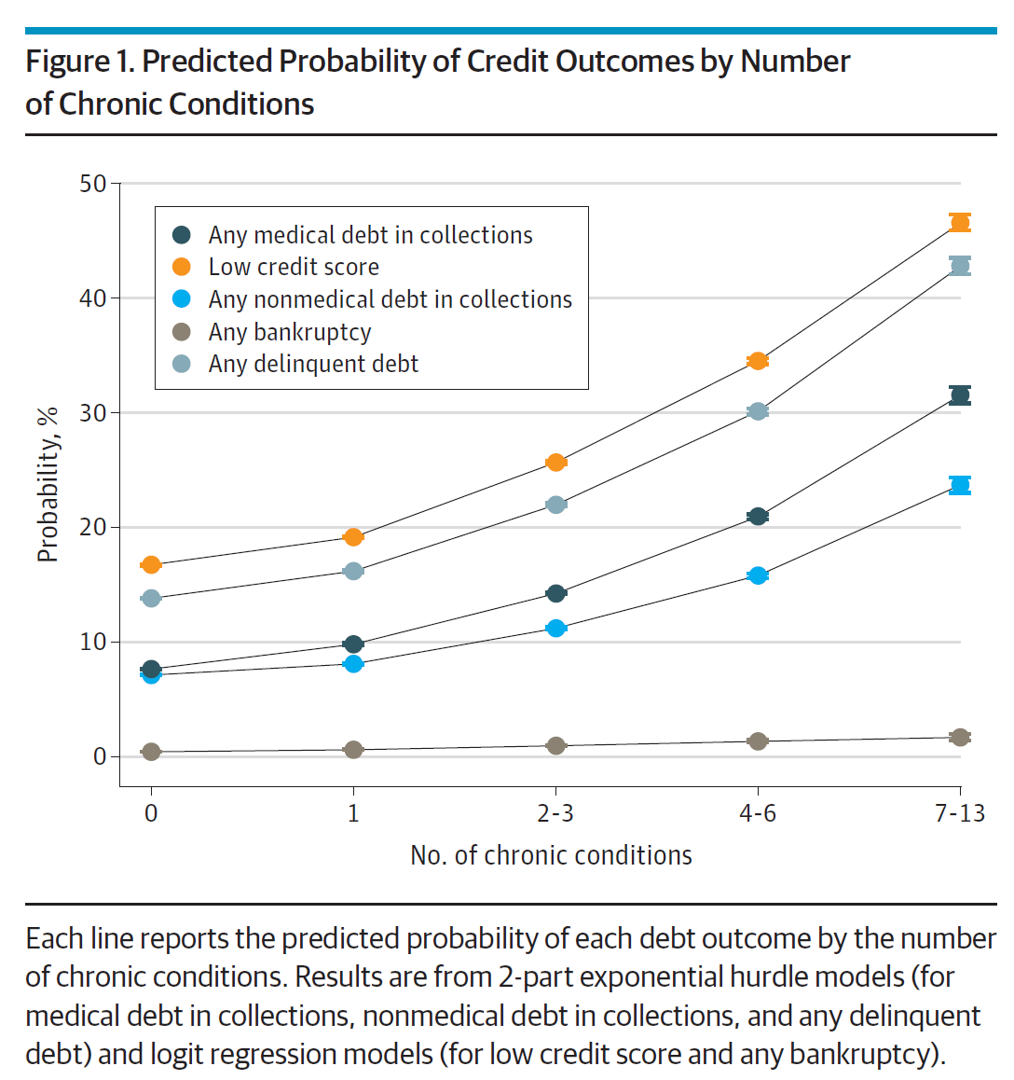

The More Chronic Conditions, the More Likely a Patient Will Have Medical Debt

There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine. Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan. The first chart illustrates the predicted probability of credit outcomes based on the

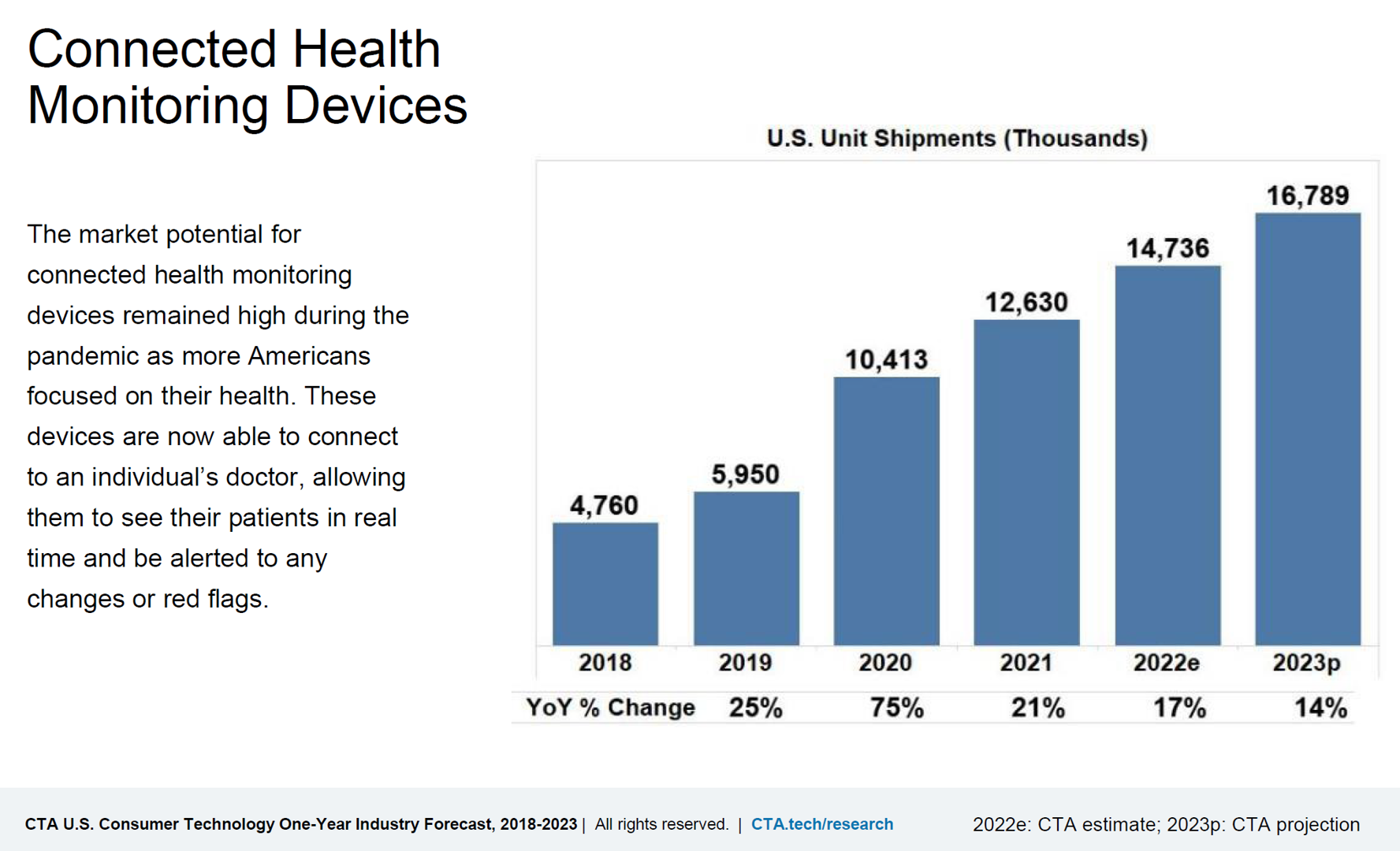

In A Declining Consumer Tech Spending Forecast, Consumer Health Tech Will Grow in 2022: Reading the CTA Tea Leaves

Supply chain challenges, inflation, and plummeting consumer economic sentiment are setting the stage for a decline in consumer electronics revenues for 2022. However, there will be some bright spots of growth for consumer tech spending, for 5G smartphones, smart home applications, gaming, and health technologies, noted in the Consumer Technology Association’s CTA U.S. Consumer Technology One-Year Industry Forecast, 2018-2023. Underneath the overall industry spend of $503 billion, a 0.2% drop from 2021, CTA expects software, gaming, video and audio streaming spending will grow by 3.5% and hardware to fall by 1.4% this year. With

Consumers’ Dilemma: Health and Wealth, Smartwatches and Transparency

Even as spending on healthcare per person in the United States is twice as much as other wealthy countries in the world, Americans’ health status ranks rock bottom versus those other rich nations. The U.S. health system continues to be marred by health inequalities and access challenges for man health citizens. Furthermore, American workers’ rank top in the world for feeling burnout from and overworked on the job. Welcome to The Consumer Dilemma: Health and Wellness,, a report from GWI based on the firm’s ongoing consumer research on peoples’ perspectives in the wake of

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

Use of Preventive Health Services Declined Among Commercially Insured People – With Big Differences in Telehealth for Non-White People, Castlight Finds

Declines in preventive care services like cancer screenings and blood glucose testing concern employers, whose continued to cover health insurance for employees during the pandemic. “As we enter the third year of the COVID-19 pandemic, employers continue to battle escalating clinical issues, including delayed care for chronic conditions, postponed preventive screenings, and the exponential increase in demand for behavioral health services,” the Chief Medical Officer for Castlight Health notes in an analysis of medical claims titled Millions of People Deferred Crucial Care During the Pandemic, published in June. The

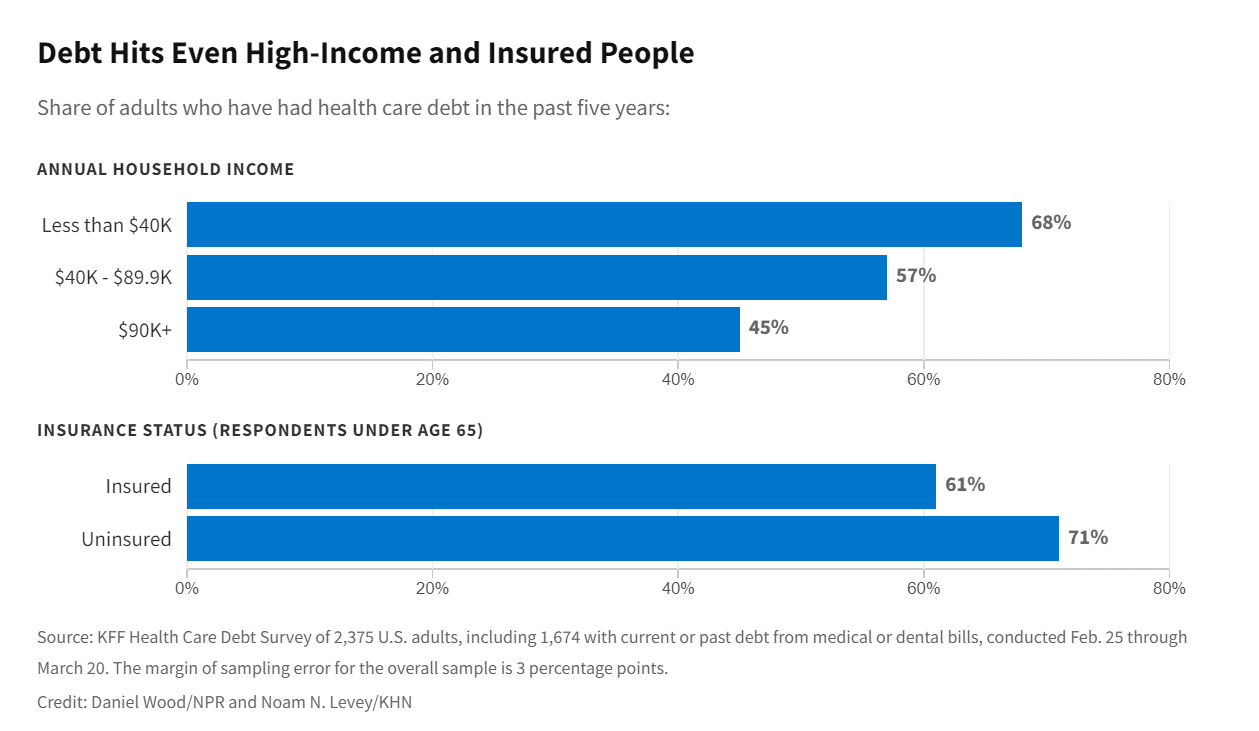

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

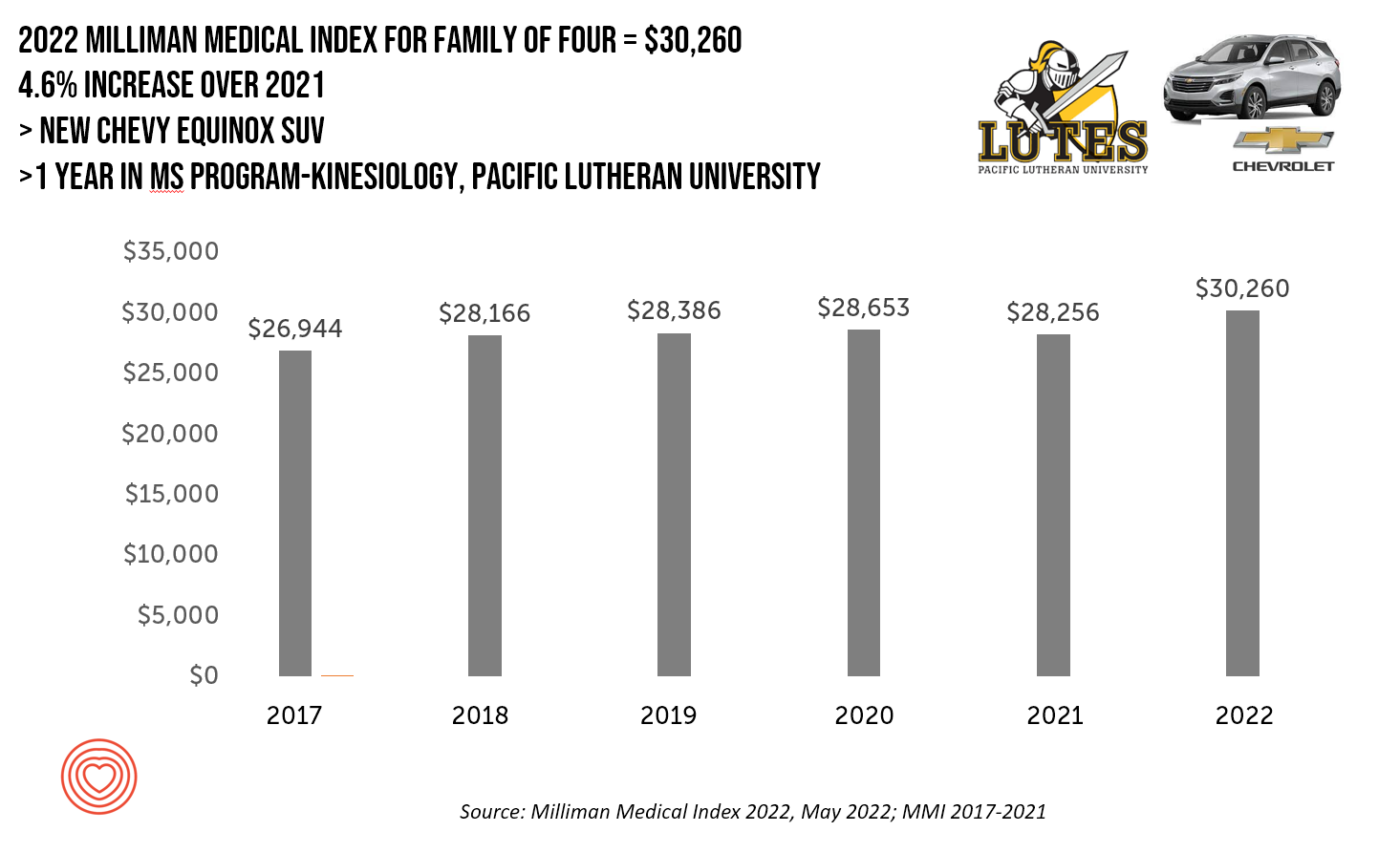

A New Chevy Equinox SUV, a Year in Grad School, or Health Care for Four – The 2022 Milliman Medical Index

A new Chevy Equinox SUV, a year in an MS program in kinesiology at Pacific Lutheran U., or health care for a family of four. At $30,260, you could pick one of these three options. Welcome to this year’s 2022 Milliman Medical Index, which annually calculates the health care costs for a median family of 4 in the U.S. I perennially select two alternative purchases for you to consider aligning with the MMI medical index. I have often picked a new car at list price and a year’s tuition at a U.S. institution of

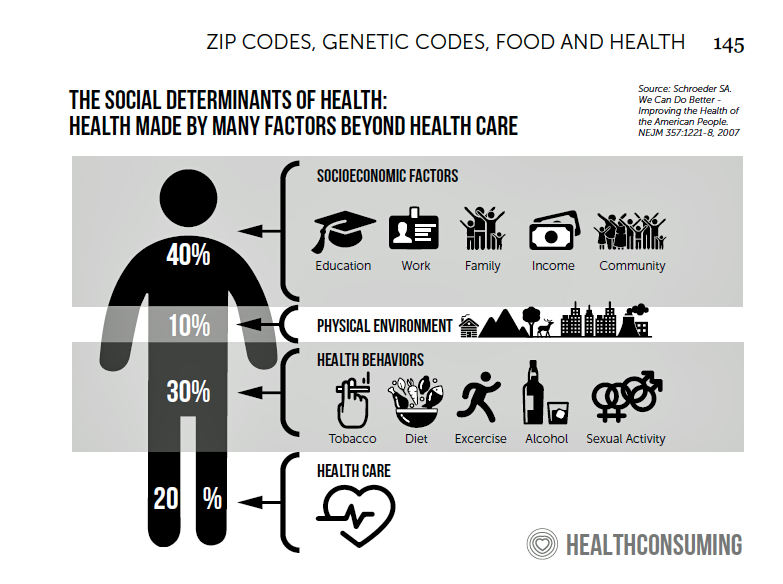

How Business Can Bolster Determinants of Health: The Marmot Review for Industry

“Until now, focus on….the social determinants of health has been for government and civil society. The private sector has not been involved in the discussion or, worse, has been seen as part of the problem. It is time this changed,” asserts the report, The Business of Health Equity: The Marmot Review for Industry, sponsored by Legal & General in collaboration with University College London (UCL) Institute of Health Equity, led by Sir Michael Marmot. Sir Michael has been researching and writing about social determinants of health and health equity for decades, culminating publications

Stress in America on the Pandemic’s 2nd Anniversary: Money, Inflation, and War Add to Consumers’ Anxiety

As we mark the second anniversary of the COVID-19 pandemic, the key themes facing health citizens deal with money, inflation, and war — “piled on a nation stuck in COVID-19 survival mode,” according to the latest poll on Stress in America from the American Psychological Association. Financial health is embedded in peoples’ overall sense of well-being and whole health. Many national economies entered the coronavirus pandemic in early 2020 already marked by income inequality. The public health crisis exacerbated that, especially among women who were harder hit financially in the past two years than men were. That situation was even worse

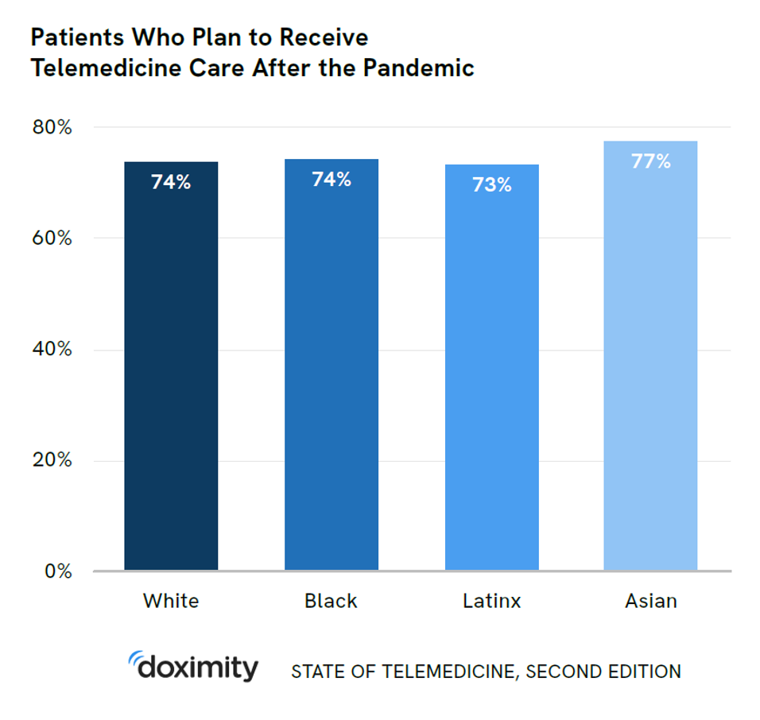

Doximity Study Finds Telehealth Is Health for Every Day Care

There’s more evidence that doctors and patients, both, want to use telehealth after the COVID-19 pandemic fades. Doximity’s second report on telemedicine explores both physicians’ and patients’ views on virtual care, finding most doctors and health consumers on the same page of virtual care adoption. For the physicians’ profile, Doximity examined 180,000 doctors’ who billed Medicare for telemedicine claims between January 2020 and June 2021. Telemedicine use did not vary much across physician age groups. Doctors in specialties that manage chronic illnesses were more likely to use telehealth: endocrinology (think: diabetes), gastroenterology, rheumatology, urology, nephrology, cardiology, ENT, neurology, allergy, and

Health Care Planning for 2022 – Start with a Pandemic, Then Pivot to Health and Happiness

One of my favorite Dr. Seuss characters is the narrator featured in the book, I Had Trouble In Getting to Solla-Sollew. I frequently use this book when conducting futures and scenario planning sessions with clients in health/care. “The story opens with our happy-go-lucky narrator taking a stroll through the Valley of Vung where nothing went wrong,” the Seussblog explains. Then one day, our hero (shown here on the right side of the picture from the book) is not paying attention to where he is walking….thus admitting, “And I learned there are troubles of more than one kind, some come from

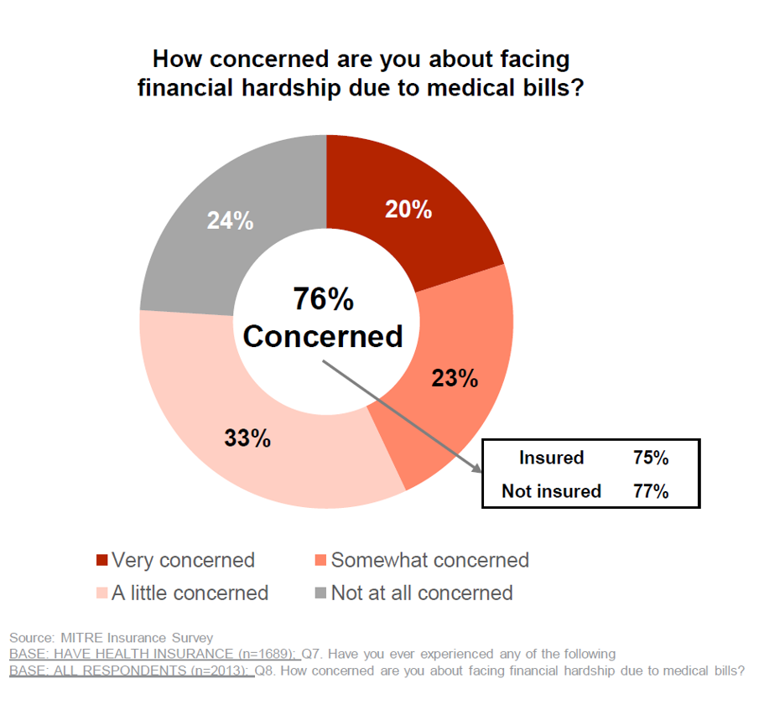

3 in 4 Insured Americans Worried About Medical Bills — Especially Women

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care). But even with health insurance coverage, most health-insured people are concerned about medical costs in America, found in a MITRE-Harris Poll on U.S. consumers’ health insurance perspectives published today. “Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of

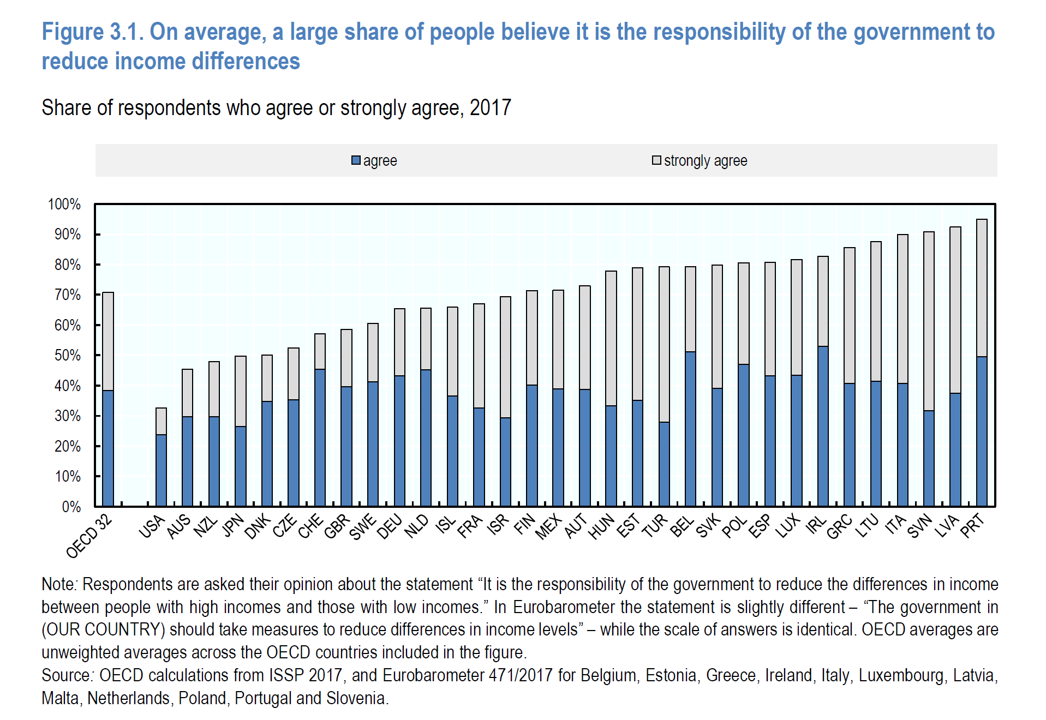

Does Inequality Matter in the U.S.? Health and the Great Gatsby Curve

Compared with the rest of the developed world, people living in the U.S. may be concerned about income inequality, but their demand for income redistribution is the lowest among peer citizens living in 31 other OECD countries. In their latest report, Does Inequality Matter? the OECD examines how people perceive economic disparities and social mobility across the OECD 32 (the world’s developed countries from “A” Australia to “U,” the United Kingdom). Overall the OECD 32 average fraction of people who believe it is the government’s responsibility to reduce income differences among those who think disparities are too large is 80%

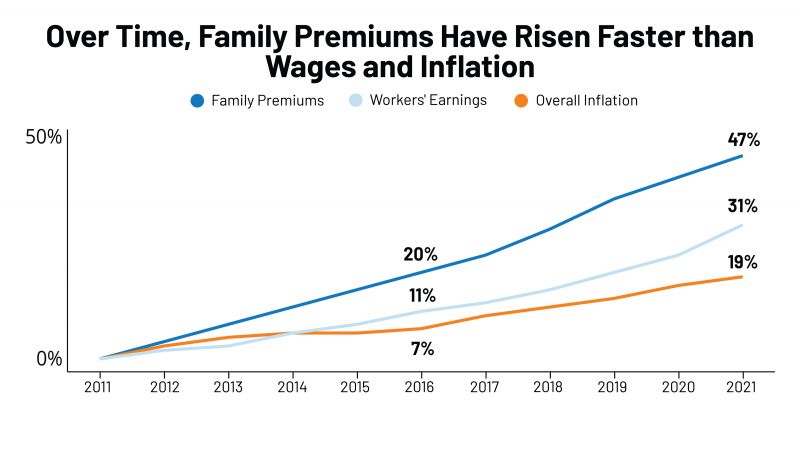

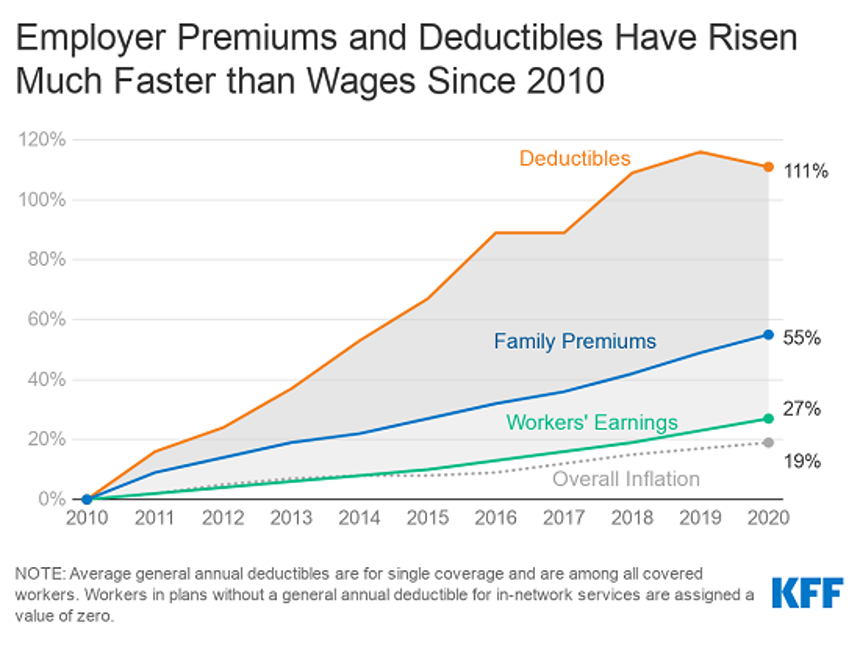

The Cost to Cover Health Insurance for a Family in America Is $22,221

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages. That family health plan premium reached $22,221, an increase of 22% since 2016, we learn in the annual report from Kaiser Family Foundation, 2021 Employer Health Benefits Survey. This report is our go-to encyclopedia of statistics on health insurance year-after-year, surveying companies’ annual health insurance strategies for coverage and tactics for managing spending and workers’ health outcomes. This 2021 update takes into account the impacts and influence of COVID-19 on workers’

Be Mindful About What Makes Health at HLTH

“More than a year and a half into the COVID-19 outbreak, the recent spread of the highly transmissible delta variant in the United States has extended severe financial and health problems in the lives of many households across the country — disproportionately impacting people of color and people with low income,” reports Household Experiences in America During the Delta Variant Outbreak, a new analysis from the Robert Wood Johnson Foundation, NPR, and the Harvard Chan School of Public Health. As the HLTH conference convenes over 6,000 digital health innovators live, in person, in Boston in the wake of the delta

Consider Mental Health Equity on World Mental Health Day

COVID-19 exacted a toll on health citizens’ mental health, worsening a public health challenge that was already acute before the pandemic. It’s World Mental Health Day, an event marked by global and local stakeholders across the mental health ecosystem. On the global front, the World Health Organization (WHO) describes the universal phenomenon and burden of mental health on the Earth’s people… Nearly 1 billion people have a mental disorder Depression is a leading cause of disability worldwide, impacting about 5% of the world’s population People with severe mental disorders like schizophrenia tend to die as much as 20 years earlier

Genentech’s Look Into the Mirror of Health Inequities

In 2020, Genentech launched its first study into health inequities. The company spelled out their rationale to undertake this research very clearly: “Through our work pursuing groundbreaking science and developing medicines for people with life-threatening diseases, we consistently witness an underrepresentation of non-white patients in clinical research. We have understood inequities and disproportionate enrollment in clinical trials existed, but nowhere could we find if patients of color had been directly asked: ‘why?’ So, we undertook a landmark study to elevate the perspectives of these medically disenfranchised individuals and reveal how this long-standing inequity impacts their relationships with the healthcare system

Chronic Medical Conditions, Mental Health, and Equity On Employers’ Minds for 2022 – Employee Health in the Wake of COVID-19

One in two people in the U.S. receive health insurance through employers. As large employers tend to be on the vanguard of benefit plan design, it’s useful to understand how these companies are thinking ahead on behalf of their employees. With that objective, it’s always instructive to explore the annual study from the Business Group on Health, the 2022 Large Employers’ Health Care Strategy and Plan Design Survey. As a result of the COVID-19 pandemic, large employees have many concerns about worker and dependents’ health. The biggest firms in America providing health insurance for workers are expecting an increase in

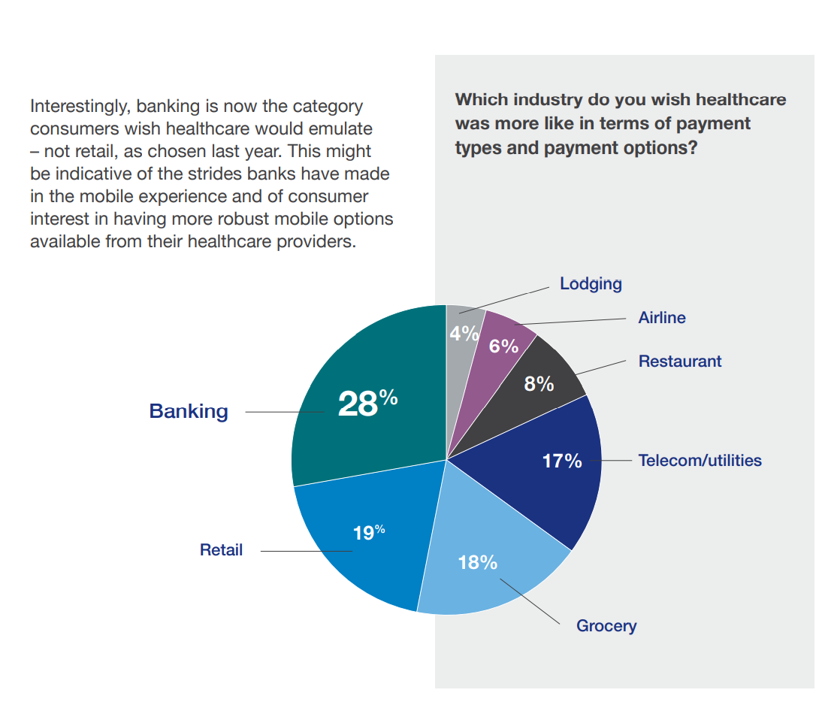

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

Pondering Prescription Drugs: Pricing Rx and Going Direct-to-Consumer

There is one health care public policy issue that unites U.S. voters across political party: that is the consumer-facing costs of prescription drugs. With the price of medicines in politicians’ and health citizens’ cross-hairs, the pharmaceutical and biotech industries have responded in many ways to the Rx pricing critiques from consumers (via, for example, Consumer Reports/Consumers Union and AARP), hospitals (through the American Hospital Association), and insurance companies (from AHIP, America’s Health Insurance Plans). The latest poll from the University of Chicago/Harris Public Policy and the Associate Press-NORC Center for Public Affairs Research quantifies the issue cross-party, finding that 74%

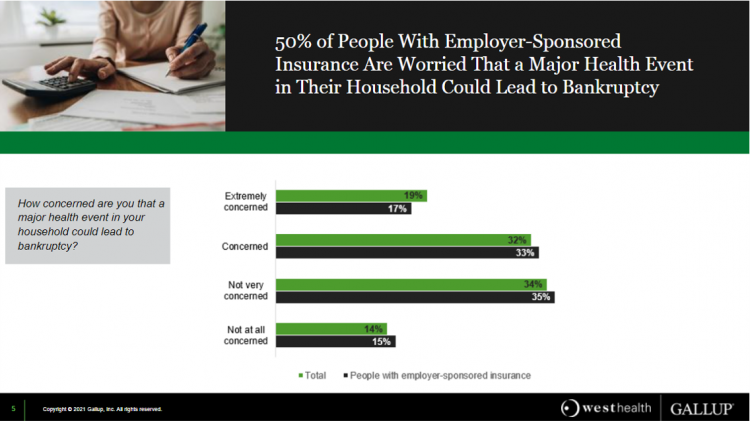

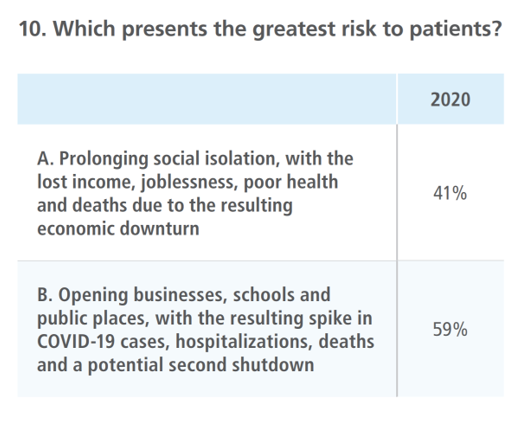

One in Two Americans with Work-Based Insurance Worries That Healthcare Costs Could Lead to Bankruptcy

One in two people in the U.S. with employer-sponsored health insurance worry that a major health event in their household could lead to bankruptcy, according to research gathered by West Health and Gallup in Business Speaks: The Future of Employer-Sponsored Insurance. Gallup and West Health presented their study in a webinar earlier this week; in today’s post, I feature a few key data points that particularly resonate as I celebrate/appreciate yesterday’s U.S. Supreme Court’s ruling on the Affordable Care Act (i.e., California v. Texas) combined with a new study published in JAMA Network Open, discussed below the digital fold in

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

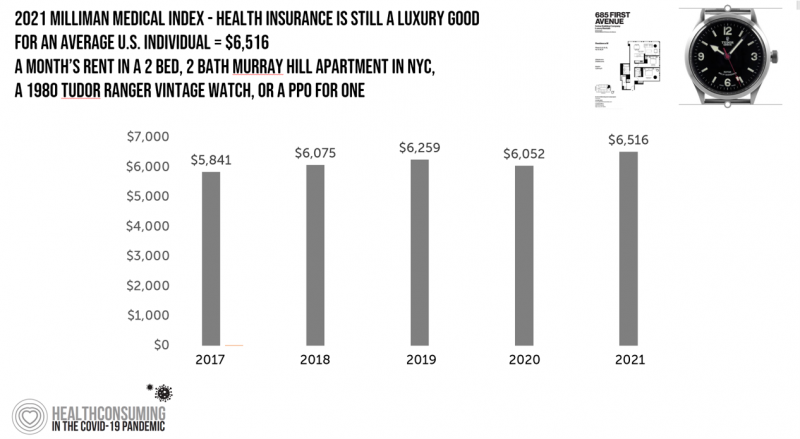

The Cost of Health Care for a Family of 4 in America Will Reach $28,256 in 2021

The good news for health care costs for a family of four in America is that they fell, for the first time in like, ever, in 2020. But like a déjà vu all over again, annual health care costs for a family of four enrolled in a PPO will climb to over $28,000 in 2021, based on the latest 2021 Milliman Medical Index (MMI). The first chart shows how health care costs declined in our Year of COVID, 2020, by over $1,000 for that hypothetical U.S. family. But costs rise with a statistical vengeance this year, by nearly $2,200 per family–about

Virtual Health Tech Enables the Continuum of Health from Hospital to Home

In the COVID-19 pandemic, as peoples’ daily lives shifted closer and closer to home, and for some weeks and months home-all-the-time, health care, too, moved beyond brick-and-mortar hospitals and doctors’ offices. The public health crisis accelerated “what’s next” for health care delivery, detailed in A New Era of Virtual Health, a report published by TripleTree. TripleTree is an investment bank that has advised health care transactions since 1997. As such, the team has been involved in digital health financing and innovation for 24 years, well before the kind of platforms, APIs, and cloud computing now enabling telehealth and care, everywhere. The

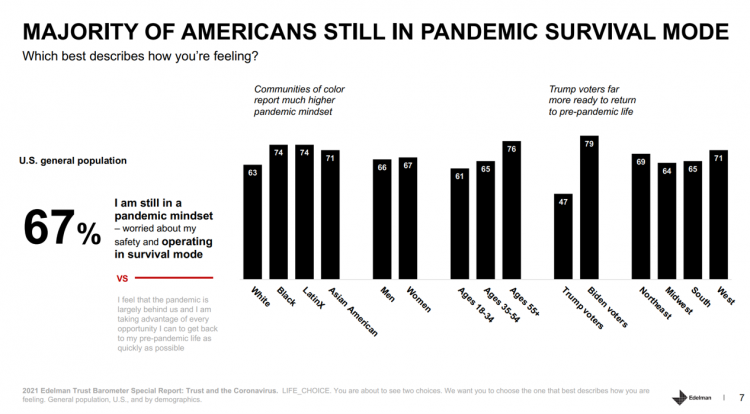

The Continued Erosion of Trust in the Age of COVID

A year into the COVID-19 pandemic, most Americans are still in “survival mode,” according to an update of the 2021 Edelman Trust Barometer, Trust and the Coronavirus in the U.S. Updating the company’s annual Trust Barometer, Edelman conducted a new round of interviews in the U.S. among 2,500 people in early March. [For context, you can read my take on the 2021 Edelman Trust Barometer published during the World Economic Forum in January 2021 here in Health Populi]. The first chart shows that two in three people in the U.S. are still in a pandemic mindset, worried about safety and

Primary Care 2.0 – How Crossover Health is “Re-Bundling” Health Care

In 2020, investments in digital health reached $14.1 bn, much of which went into niche applications like lab testing, medication adherence, and on-demand triage for urgent care. These companies targeting primary care components represent the “unbundling of the family doctor,” as CB Insights recently coined the market trend. Fragmentation is a hallmark of the U.S. health care system, or more aptly “non-system” as my old friend J.D. Kleinke noted in his book titled Oxymorons….published in 2001. Twenty years later, we confront primary care as a dichotomy: as unbundled pieces of (we hope) innovation, and in organizations re-imagining a new continuity

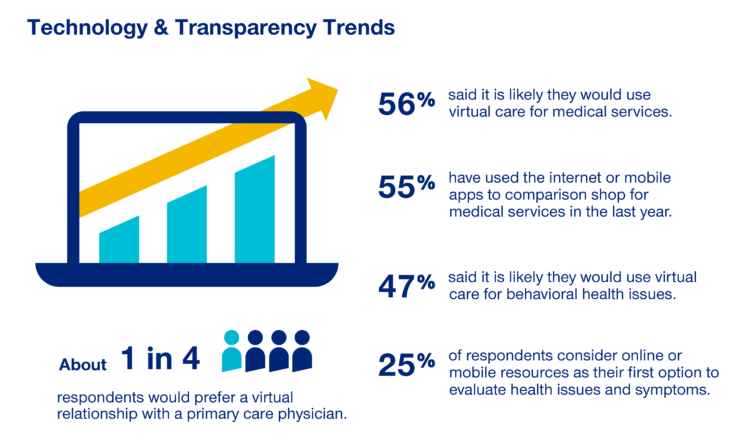

The COVID-19 Era Has Grown Health Consumer Demand for Virtual Care

Over one-half of Americans would likely use virtual care for their healthcare services, and one in four people would actually prefer a virtual relationship with a primary care physician, according to the fifth annual 2020 Consumer Sentiment Survey from UnitedHealthcare. What a difference a pandemic can make in accelerating patients’ adoption of digital health tools. This survey was conducted in mid-September 2020, and so the results demonstrate U.S. health consumers’ growing digital health “muscles” in the form of demand and confidence in using virtual care. One in four people would consider online options as their first-line to evaluating personal health

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

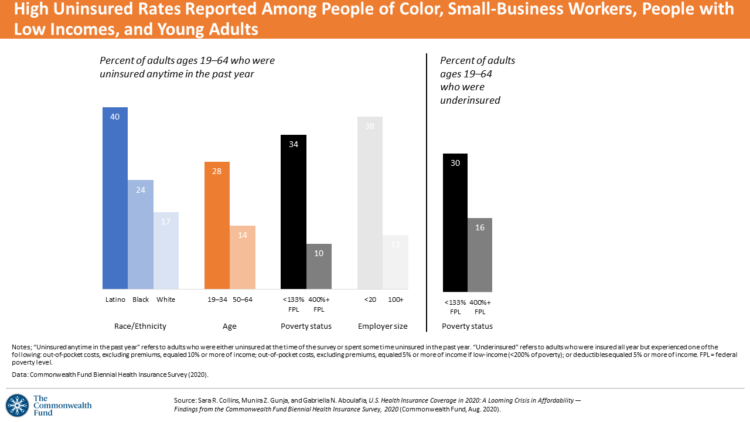

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

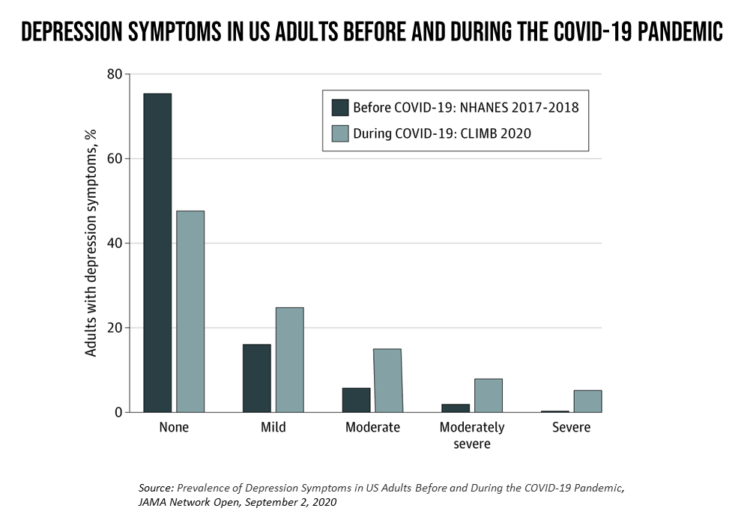

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

Health Insurance Affordability in the Time of the Coronavirus Pandemic

The coronavirus pandemic has revealed many flaws in the U.S. healthcare system, first and foremost the nation’s patchwork public health infrastructure and health inequities in mortality rates due to COVID-19. The Commonwealth Fund‘s biennial report, published as the pandemic continues into and beyond the third quarter of 2020, sheds light on another weakness in U.S. healthcare: the cost of health insurance relative to working Americans’ relatively flat incomes. I explored the details of this study in a post titled Health Insurance Affordability: A Call-to-Action for Healthcare Industry Stakeholders in the Pandemic, published on the Medecision Liberation blog site. The survey

Physicians Practicing in the Age of COVID-19: Lower Incomes, More Telehealth

In the midst of the coronavirus pandemic, two certainties emerge in the lives of physicians: they are generating less revenue, and they have adopted more virtual care in practices. The Physicians Foundation surveyed 3,513 physicians in July 2020 on their perspectives on COVID-19 and how the pandemic has impacted practices and patients. This study is part one of three conducted by the Foundation this year, subtitled the “COVID-19 Impact Edition” of the 2020 Survey of America’s Physicians which the Foundation conducts each year. Merritt Hawkins conducted the study on behalf of the Foundation, shifting the focus to the pandemic. This

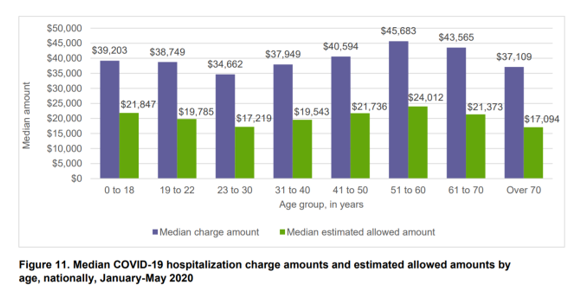

The Median Hospital Charge In the U.S. for COVID-19 Care Ranges From $34-45K

The median charge for hospitalizing a patient with COVID-19 ranged from $34,662 for people 23 to 30, and $45,683 for people between 51 and 60 years of age, according to FAIR Health’s research brief, Key Characteristics of COVID-19 Patients published July 14th, 2020. FAIR Health based these numbers on private insurance claims associated with COVID-19 diagnoses, evaluating patient demographics (age, gender, geography), hospital charges and estimated allowed amounts, and patient comorbidities. They used two ICD-10-CM diagnostic codes for this research: U07.1, 2019-nCoV acute respiratory disease; and, B97.29, other coronavirus as the cause of disease classified elsewhere which was the original code

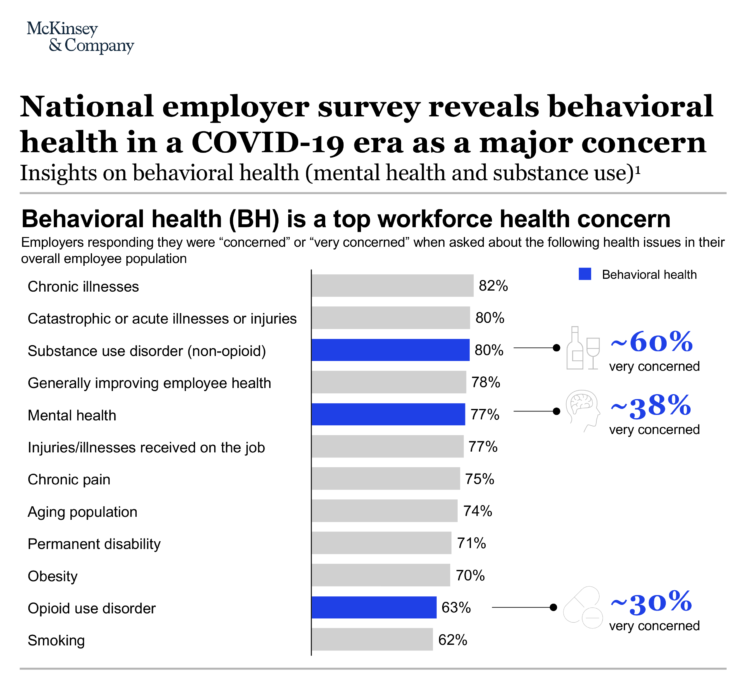

As Americans Start to Return-to-Work in the Summer of COVID, Mental Health is a Top Concern Among Employers

Most U.S. employers worry about workers’ mental health and substance use as employees begin returning to work in the summer of 2020. About 4 in 5 U.S. companies are “very concerned” or “concerned” about employees’ chronic illnesses, acute illnesses, and injuries along with behavioral health issue, based on McKinsey’s annual employer survey which coincided this year with the COVID-19 pandemic. Challenges of opioid use in the workforce remain a concern for two-thirds of U.S. companies, as well. Some 9 in 10 U.S. companies say behavioral health has a negative impact on workforce productivity. In response, 7 in 10 employers are

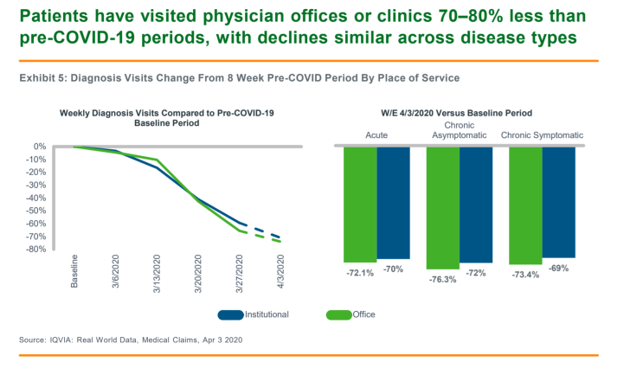

How COVID-19 Has Re-Shaped Health Care Delivery So Far

COVID-19 is re-shaping health care in America across many dimensions. In Shifts in Healthcare Demand, Delivery and Care During the COVID-19 Era, IQVIA presents a multi-faceted profile of the early impacts of the pandemic on U.S. health care. In the report, published in April 2020, IQVIA mined the company’s many data bases that track real-time data, including medical claims, flu data, sales data, oncology medical and pharmacy claims, formularies, among other sources. Top-line, IQVIA spotted the following key shifts in U.S. health care since the start of the coronavirus pandemic: Patients’ use of health services Impacts on medicine use, influenced

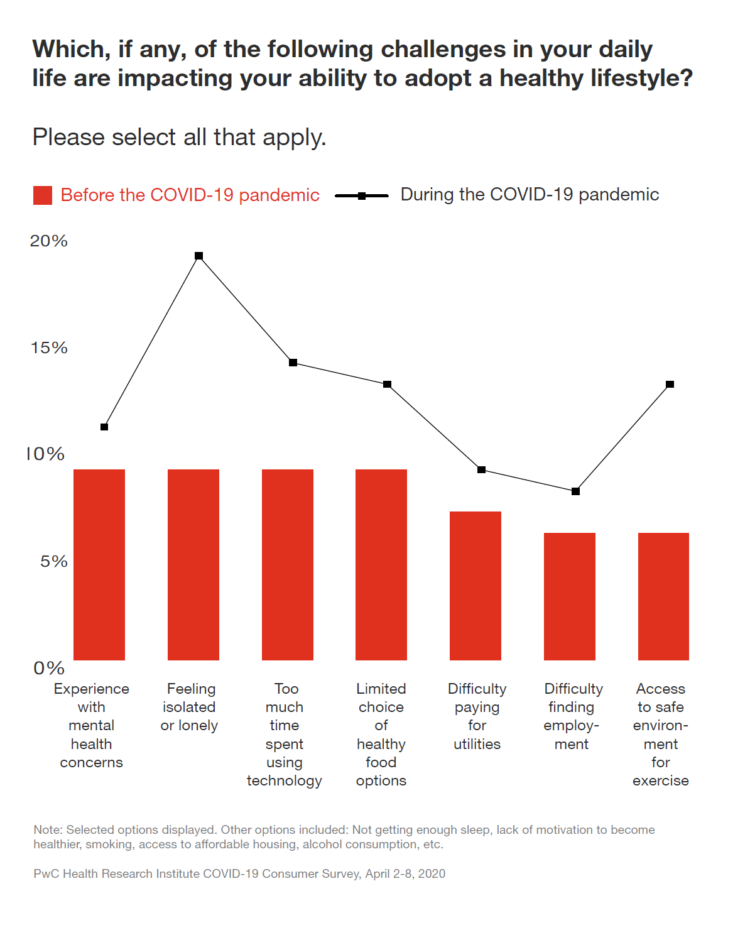

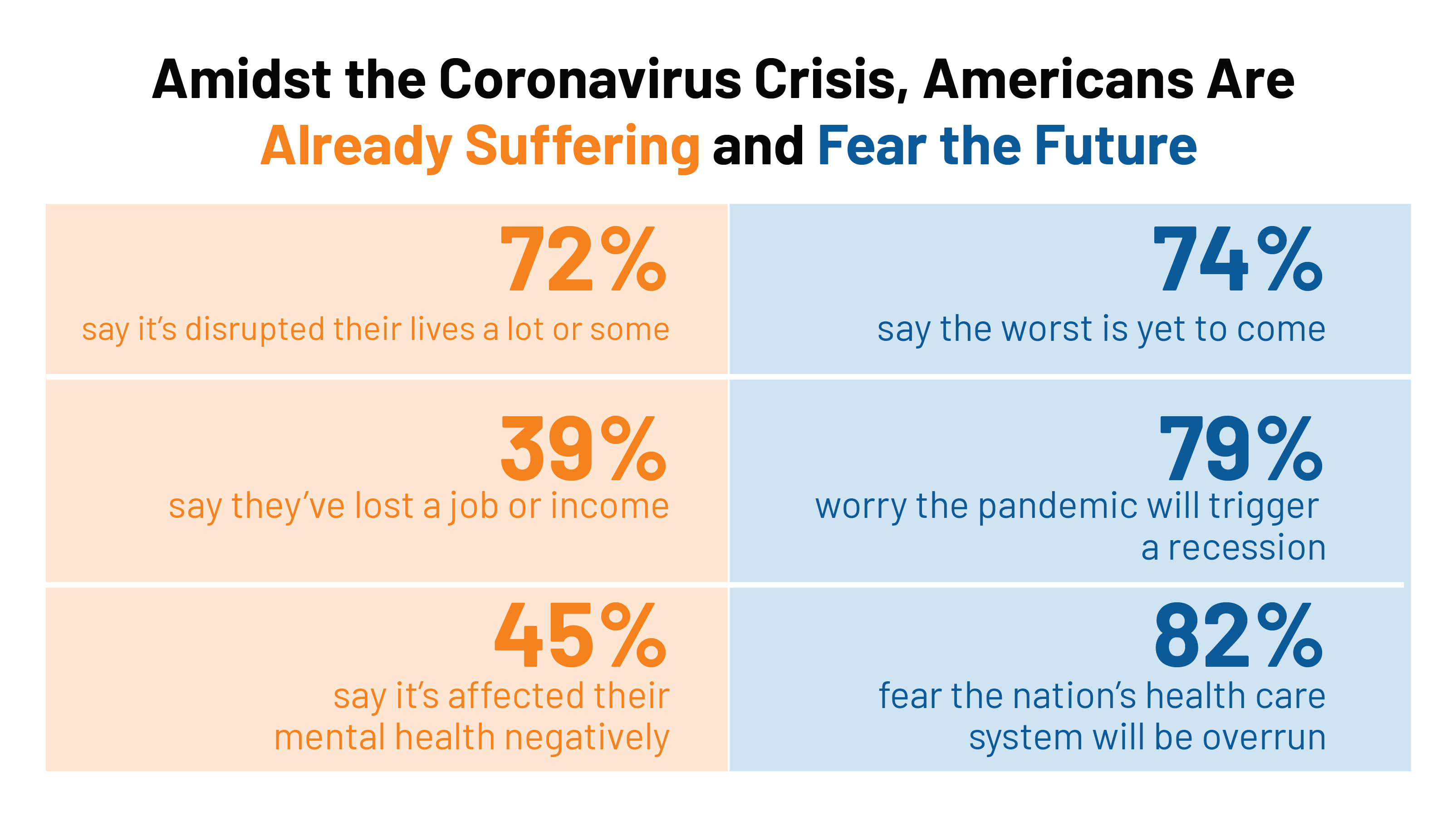

COVID-19’s Consumer Health Care Behaviors: Telehealth, Trauma, and Trust, via PwC

In a matter of several weeks, people living in the U.S. have endured massive personal social, emotional, physical and fiscal disruption due to the COVID-19 pandemic. State mandates to shelter at home, the adoption of wearing face masks and covers in public, and re-making dining tables and dens into home-working spaces for kids in school or parents telecommuting, American homes have morphed into petri dishes of people undergoing dramatic changes in a very short time. A new report from PwC looks at peoples’ changes in health behaviors in the first two months of the pandemic, asking whether these changes will

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

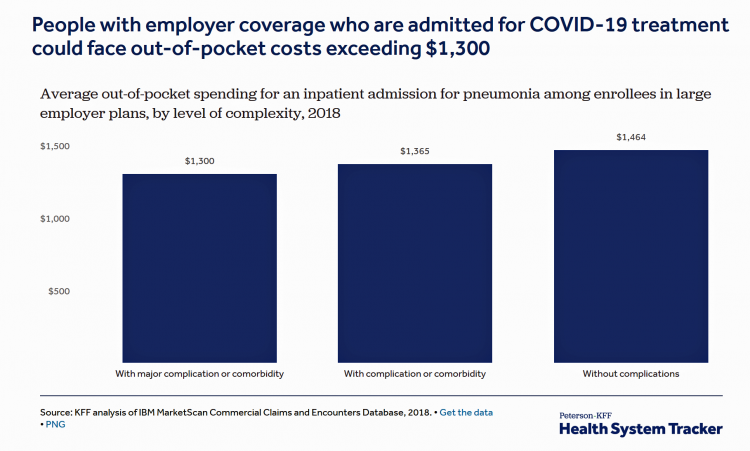

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

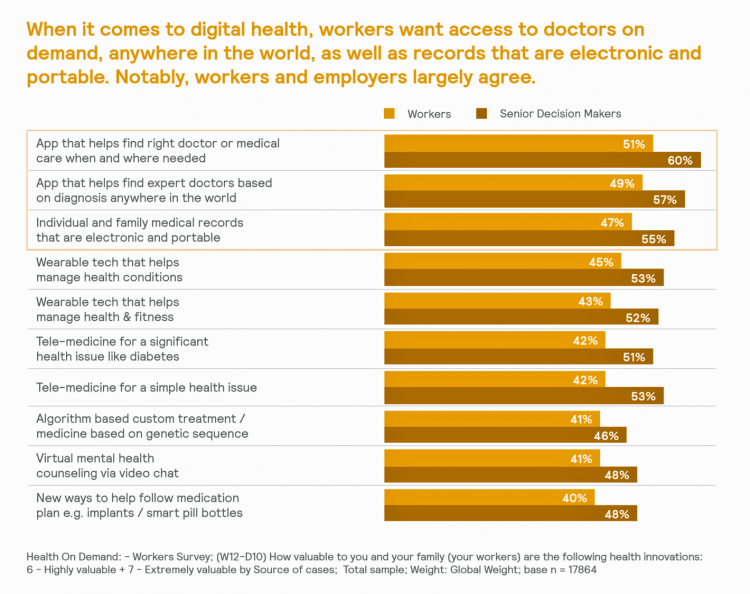

Most Workers and their Employers Want to Receive Digital Healthcare On-Demand

Most employers and their workers see the benefits of digital health in helping make health care more accessible and lower-cost, according to survey research published in Health on Demand from Mercer Marsh Benefits. Interestingly, more workers living in developing countries are keener on going digital for health than people working in wealthier nations. Mercer’s study was global, analyzing companies and their employees in both mature and growth economies around the world. In total, Mercer interviewed 16,564 workers and 1,300 senior decision makers in companies. The U.S. sample size was 2,051 employees and 100 decision makers. There’s a treasure trove of insights

Come Together – A Health Policy Prescription from the Bipartisan Policy Center

Among all Americans, the most popular approach for improving the health care in the U.S. isn’t repealing or replacing the Affordable Care Act or moving to a Medicare-for-All government-provided plan. It would be to improve the current health care system, according to the Bipartisan Policy Center’s research reported in a Bipartisan Rx for America’s Health Care. The BPC is a truly bipartisan organization, co-founded by Former Democratic Senate Majority Leaders Tom Daschle and George Mitchell, and Former Republican Senate Majority Leaders Howard Baker and Bob Dole. While this political week in America has revealed deep chasms between the Dems and

What’s Causing Fewer Primary Care Visits in the US?

Americans who have commercial health insurance (say, through an employer or union) are rarely thought to face barriers to receiving health care — in particular, primary care, that front line provider and on-ramp to the health care system. But in a new study published in the Annals of Internal Medicine, commercially-insured adults were found to have visited primary care providers (PCPs) less often, and 1 in 2 had no PCP visits in one year. In Declining Use of Primary Care Among Commercially Insured Adults in the United States, 2008-2016, the researchers analyzed data from a national sample of adult health

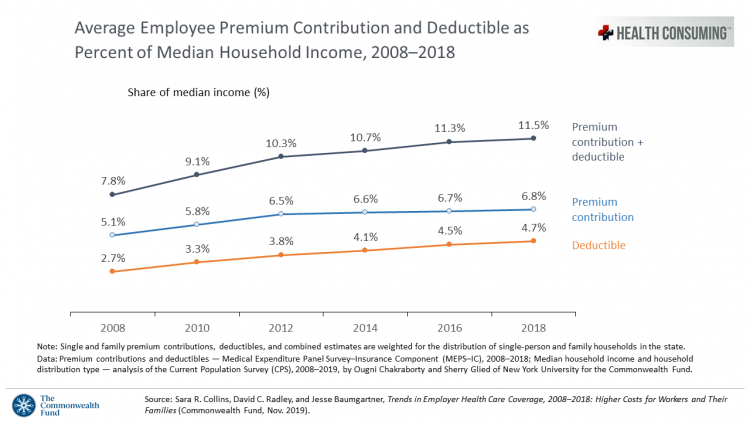

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

Thinking About Health Care One Year From the 2020 Presidential Election

Today is 4th November 2019, exactly one year to the day that Americans can express their political will and cast their vote for President of the United States. Health care will be a key issue driving people to their local polling places, so it’s an opportune moment to take the temperature on U.S. voters’ perspectives on healthcare reform. This post looks at three current polls to gauge how Americans are feeling about health care reform 365 days before the 2020 election, and one day before tomorrow’s 2019 municipal and state elections. Today’s Financial Times features a poll that found two-thirds

There Is No Health Without Mental Health – Today Is World Mental Health Day

There is no health without mental health. Every 40 seconds, someone loses their life to suicide. So #LetsTalk (the Twitter hashtag to share stories and research and support on the social feed). Today is October 10th, World Mental Health Day. As we go about our lives today and truly every day, we should be mindful that mental health is all about each of us individually, and all of us in our communities and in the world. First, let’s hear from Prince Harry and Ed Sheeran (who, video spoiler alert, decides to pivot his lyrics to a draft song titled “Gingers

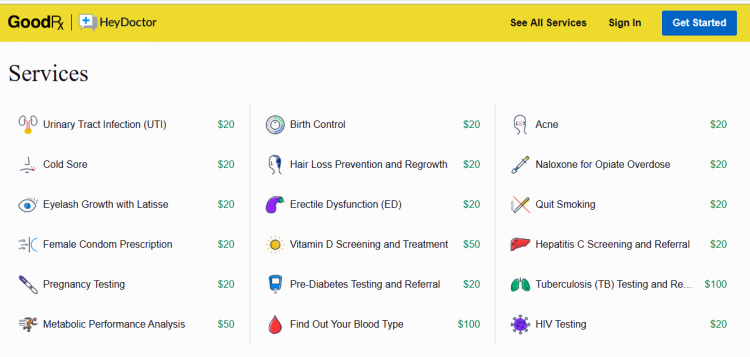

Health @ Retail – Prelude to GMDC SelfCare Summit with Updates from Hims & Hers, GoodRx, Sam’s Club and Amazon Care

“We knew millions of people weren’t getting the care they needed — they were either too embarrassed to seek help or felt stuck in a system that was confusing and intimidating. Digital health has the potential to radically change the way people approach their wellness and, since launching in 2017, we’ve outpaced even our own expectations, delivering more than 1 million Hims & Hers products to our customers. In collaboration with highly-qualified doctors and healthcare providers, we’ve built a digital health platform that is changing the way people talk about and receive the care they need.” That’s a verbatim paragraph

Worrying About Paying for Health Care Is the Norm in America

Among stresses facing people at least 50 years of age, health care costs rank top of mind compared with other issues like long-term care, health insurance, Social Security, taxes, and being read to retire. Worries about health care costs are particularly stressful among future retirees, 8 of 10 of whom share this top concern along with 7 in 10 recent retirees and 6 in 10 people retired for at least a decade. Health care stress cuts in two ways: most people are worried about paying for health care, as well as experienced an unanticipated decline in their health, according to

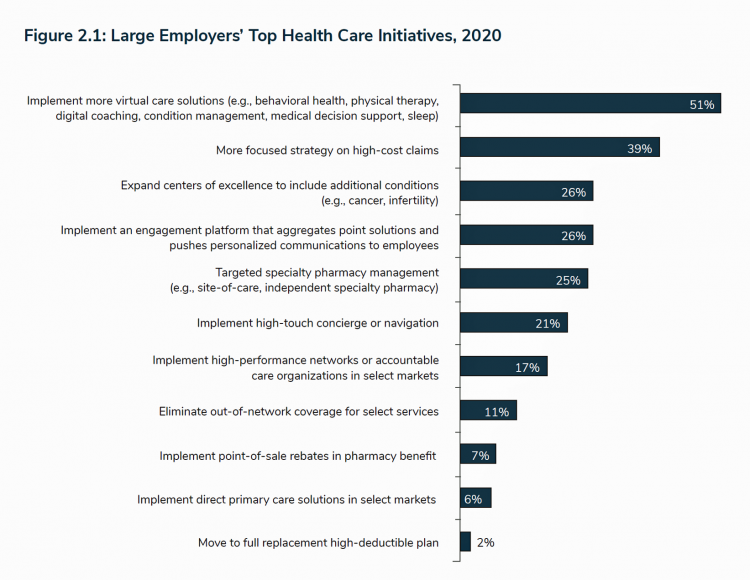

Getting More Personal, Virtual and Excellent – the 2020 NBGH Employer Report

In 2020, large employers will be “doubling down” efforts to control health care costs. Key strategies will include deploying more telehealth and virtual health care services, Centers of Excellence for high-cost conditions, and getting more personal in communicating and engaging through platforms. This is the annual forecast for 2020 brought to us by the National Business Group of Health (NBGH), the Large Employers’ Health Care Strategy and Plan Design Survey. The 42-page report is packed with strategic and tactical data looking at the 2020 tea leaves for large employers, representing over 15 million covered lives. Nearly 150 companies were surveyed

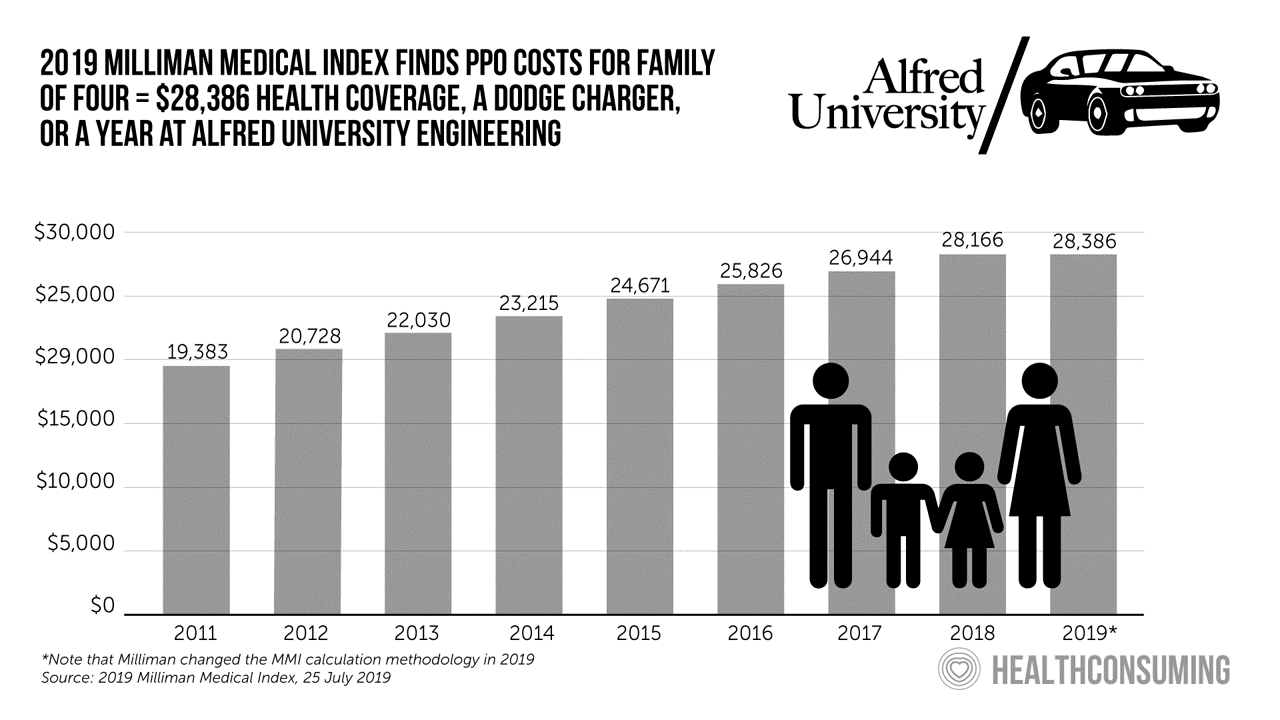

Milliman Finds PPO for Family of 4 in 2019 Will Cost $28,386

This year, an employer-sponsored PPO for a family of four in the U.S. will cost $28,386, a 3.6% increase over 2018, according to the 2019 Milliman Medical Index (MMI). Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University. The Milliman MMI team has updated the methodology for the Index; the chart shown here is my own, recognizing that the calculations and assumptions beneath the 2019 data point differ from previous years. The key points of the report are that:

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

The 3 A’s That Millennials Want From Healthcare: Affordability, Accessibility, Availability

With lower expectations of and satisfaction with health care, Millennials in America seek three things: available, accessible, and affordable services, research from the Transamerica Center for Health Studies has found. Far and away the top reason for not obtaining health insurance in 2018 was that it was simply too expensive, cited by 60% of Millennials. Following that, 26% of Millennials noted that paying the tax penalty plus personal medical expenses were, together, less expensive than available health options. While Millennials were least likely to visit a doctor’s office in the past year, they had the most likelihood of making a

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

In the Modern Workplace, Workers Favor More Money, New Kinds of Benefits, and Purpose

Today, April 2nd, is National Employee Benefits Day. Who knew? To mark the occasion, I’m mining an important new report from MetLife, Thriving in the New Work-Life World, the company’s 17th annual U.S. employee benefit trends study with new data for 2019. For the research, MetLife interviewed 2,500 benefits decision makers and influencers of companies with at least two employees. 20% of the firms employed over 10,000 workers; 20%, 50 and fewer staff. Companies polled represented a broad range of industries: 11% in health care and social assistance, 10% in education, 9% manufacturing, 8% each retail and information technology, 7%

Isn’t It Eyeconic? Vision Care in the Evolving Health Care Ecosystem

The vision/optical industry is one piece of the health/care ecosystem, but the segment has not been as directly impacted by patients’ new consumer muscles until just about now. It feels like the vision industry is at an inflection point at this moment, I intuited during yesterday’s convening of Decoding the Consumer: The new science of customer behavior, the theme of the 13th annual global leadership summit hosted by Vision Monday, a program of Jobson Medical Information which is part of the WebMD family. I was grateful to have an opportunity to share my views with attendees on the vision patient as

National Health Spending Will Reach Nearly 20% of U.S. GDP By 2027

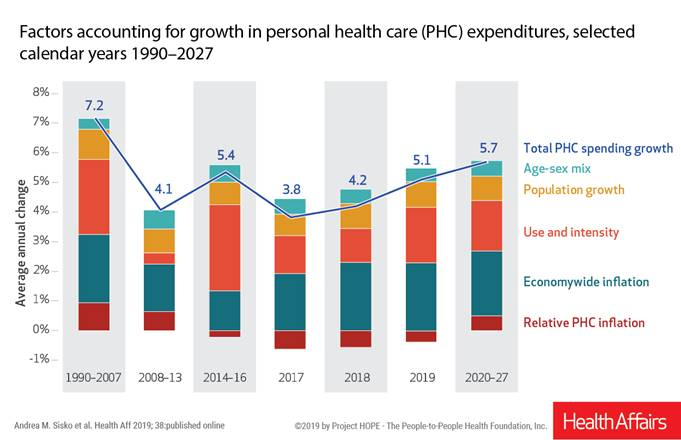

National health spending in the U.S. is expected to grow by 5.7% every year from 2020 to 2027, the actuaries at the Centers for Medicare and Medicaid Services forecast in their report, National Health Expenditure Projections, 2018-2927: Economic And Demographic Trends Drive Spending And Enrollment Growth, published yesterday by Health Affairs. For context, note that general price inflation in the U.S. was 1.6% for the 12 months ending January 2019 according to the U.S. Bureau of Labor Statistics. This growth rate for health care costs exceeds every period measured since the high of 7.2% recorded in 1990-2007. The bar chart illustrates the

Telehealth and Virtual Care Are Melting Into “Just” Health Care at HIMSS19

Just as we experienced “e-business” departments blurring into ecommerce and everyday business processes, so is “telehealth” morphing into, simply, health care delivery as one of many channels and platforms. Telehealth and virtual care are key education topics and exhibitor presences at HIMSS19. Several factors underpin the adoption of telehealth in 2019: Consumers’ demand for accessible, lower-cost health care services as people face greater financial responsibility for paying the medical bill (via high-deductible health plans and greater out-of-pocket costs for co-payments) Some consumers’ lacking or losing health insurance as ACA coverage eroded in the past two years, resulting in these patients

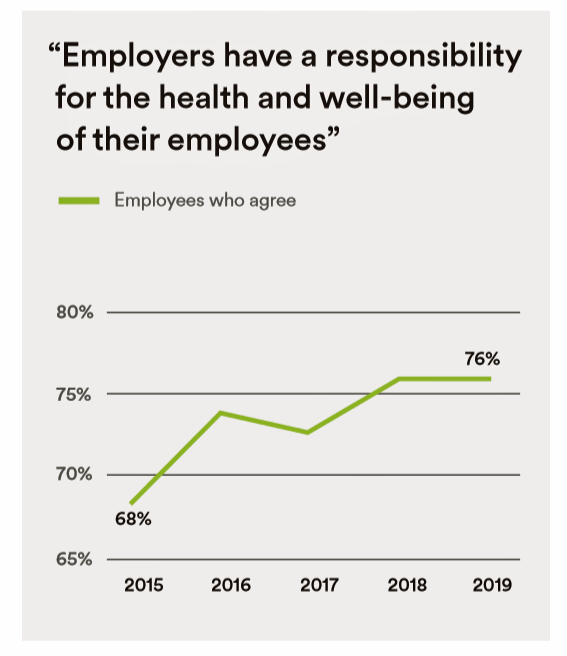

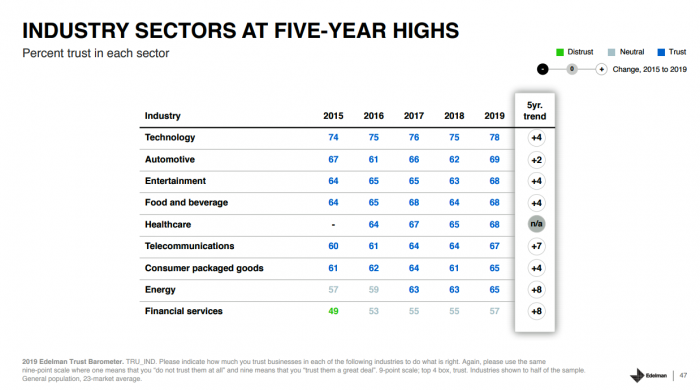

Trust in 2019 Via Edelman: The Plotline for Women and Healthcare

Fewer than one-half of consumers trust in government and media. Three-quarters trust employers, who in 2019 are the top-trusted institution according to the 2019 Edelman Trust Barometer released last week in Davos at the World Economic Forum. Consumers in the U.S. over-index for trust in employers, with 80% of people saying they have a strong relationship with “my employer,” compared with 73% of Britons, 66% of the French, and 59% of people in Japan. What’s underneath this is employers being trusted to provide certainty: most workers look to their employer to be a trustworthy source of information about social issues and

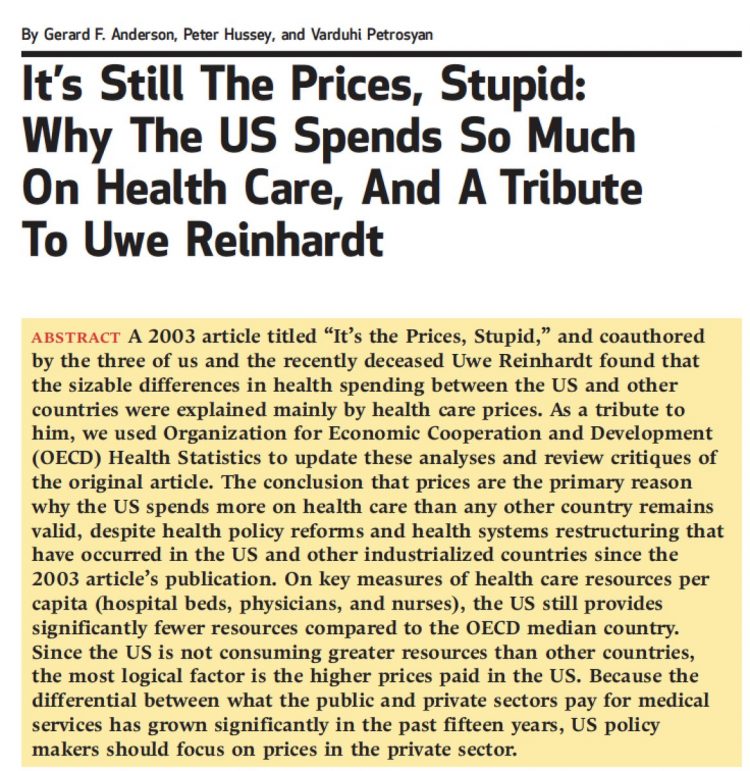

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

Costs, Consumerism, Cyber and Care, Everywhere – The 2019 Health Populi TrendCast

Today is Boxing Day and St. Stephens Day for people who celebrate Christmas, so I share this post as a holiday gift with well-wishes for you and those you love. The tea leaves have been brewing here at THINK-Health as we prepared our 2019 forecast at the convergence of consumers, health, and technology. Here’s our trend-weaving of 4 C’s for 2019: costs, consumerism, cyber and care, everywhere… Health care costs will continue to be a mainstream pocketbook issue for patients and caregivers, with consequences for payors, suppliers and ultimately, policymakers. Legislators inside the DC Beltway will be challenged by the

While National Health Care Spending Growth Slowed in 2017, One Stakeholder’s Financial Burden Grew: The Consumer’s

National health care spending growth slowed in 2017 to the post-recession rate of 3.9%, down from 4.8% in 2016. Per person, spending on health care grew 3.2% to $10,739 in 2017, and the share of GDP spent on medical care held steady at 17.9%. Healthcare spending in America is a $3.5 trillion micro-economy…roughly the size of the entire GDP of Germany, and about $1 trillion greater than the entire economy of France. These annual numbers come out of the annual report from the Centers for Medicare and Medicaid Services, published yesterday in Health Affairs. Underneath these macro-health economic numbers is

Loneliness, Public Policy and AI – Lessons From the UK For the US

There’s a shortage of medical providers in the United Kingdom, a nation where healthcare is guaranteed to all Britons via the most beloved institution in the nation: The National Health Service. The NHS celebrated its 70th anniversary in July this year. The NHS “supply shortage” is a result of financial cuts to both social care and public health. These have negatively impacted older people and care for people at home in Great Britain. This article in the BMJ published earlier this year called for increasing these investments to ensure further erosion of population and public health outcomes, and to prevent

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for