In the Modern Workplace, Workers Favor More Money, New Kinds of Benefits, and Purpose

Today, April 2nd, is National Employee Benefits Day. Who knew? To mark the occasion, I’m mining an important new report from MetLife, Thriving in the New Work-Life World, the company’s 17th annual U.S. employee benefit trends study with new data for 2019. For the research, MetLife interviewed 2,500 benefits decision makers and influencers of companies with at least two employees. 20% of the firms employed over 10,000 workers; 20%, 50 and fewer staff. Companies polled represented a broad range of industries: 11% in health care and social assistance, 10% in education, 9% manufacturing, 8% each retail and information technology, 7%

The Evolution of Self-Care for Consumers – Learning and Sharing at CHPA

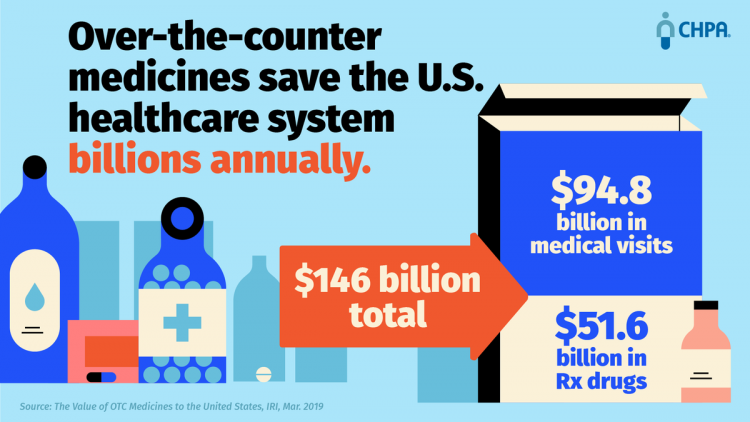

Self-care in health goes back thousands of years. Reading from Hippocrates’ Corpus about food and clean air’s role in health sounds contemporary today. And even in our most cynical moments, we can all hearken back to our grandmothers’ kitchen table wisdom for dealing with skin issues, the flu, and broken hearts. The annual conference of the Consumer Healthcare Products Association (CHPA) convened this week, and I was grateful to attend and speak on the evolving retail health landscape yesterday. Gary Downing, CEO of Clarion Brands and Chairman of the CHPA Board, kicked off the first day with a nostalgic look

Loving Wegmans and Amazon, Hating on the US Government: the Axios Harris Poll 100 in 2019

Americans love grocery stores, responsible retailers, technology and Amazon, Axios and Harris Poll found in this year’s top 100 visible company poll. The bottom five of the 100 include a big bank that ripped off consumers, a bankrupt retailer, a Big Tobacco company, and two organizations led by President Trump: The Trump Organization (#98) and the U.S. Government (#100). The summary points to five key findings in the report: The U.S. Government is the worst “company” in America according to “The Citizens of America,” in the words of Axios and Harris Poll. Americans have acquired “prime” tastes and expectations through

National Health Spending Will Reach Nearly 20% of U.S. GDP By 2027

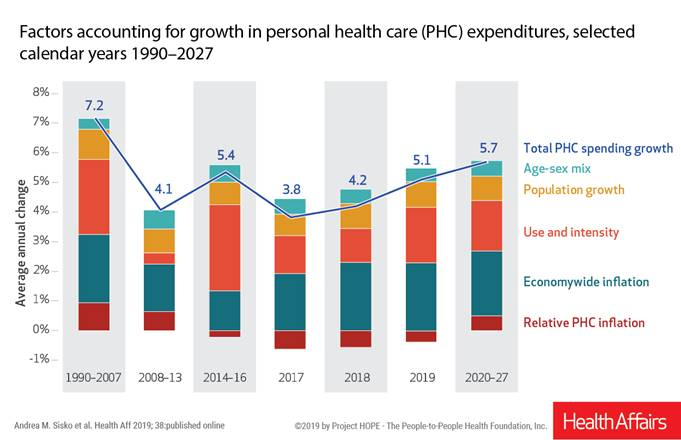

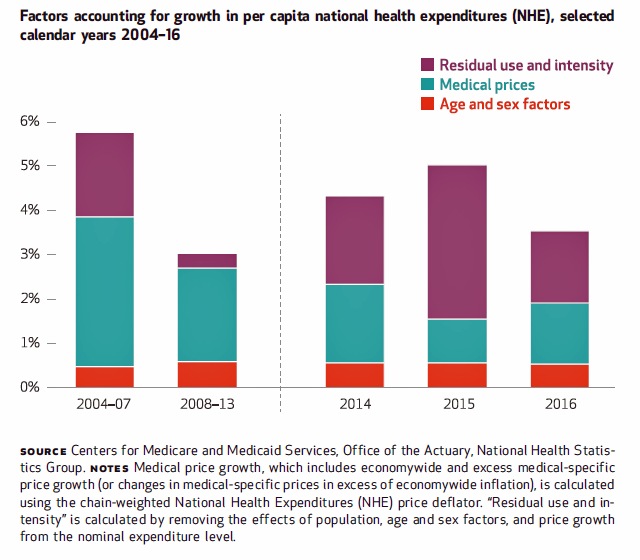

National health spending in the U.S. is expected to grow by 5.7% every year from 2020 to 2027, the actuaries at the Centers for Medicare and Medicaid Services forecast in their report, National Health Expenditure Projections, 2018-2927: Economic And Demographic Trends Drive Spending And Enrollment Growth, published yesterday by Health Affairs. For context, note that general price inflation in the U.S. was 1.6% for the 12 months ending January 2019 according to the U.S. Bureau of Labor Statistics. This growth rate for health care costs exceeds every period measured since the high of 7.2% recorded in 1990-2007. The bar chart illustrates the

“Telehealth is a digital distribution channel for health care” – catching up with Roy Schoenberg, President and CEO of American Well

Ten years ago, two brothers, physicians both, started up a telemedicine company called American Well. They launched their service first in Hawaii, where long distances and remote island living challenged the supply and demand sides of health care providers and patients alike. A decade later, I sat down for a “what’s new?” chat with Roy Schoenberg, American Well President and CEO. In full transparency, I enjoy and appreciate the opportunity to meet with Roy (or very occasionally Ido, the co-founding brother-other-half) every year at HIMSS and sometimes at CES. In our face-to-face brainstorm this week, we covered a wide range

Telehealth and Virtual Care Are Melting Into “Just” Health Care at HIMSS19

Just as we experienced “e-business” departments blurring into ecommerce and everyday business processes, so is “telehealth” morphing into, simply, health care delivery as one of many channels and platforms. Telehealth and virtual care are key education topics and exhibitor presences at HIMSS19. Several factors underpin the adoption of telehealth in 2019: Consumers’ demand for accessible, lower-cost health care services as people face greater financial responsibility for paying the medical bill (via high-deductible health plans and greater out-of-pocket costs for co-payments) Some consumers’ lacking or losing health insurance as ACA coverage eroded in the past two years, resulting in these patients

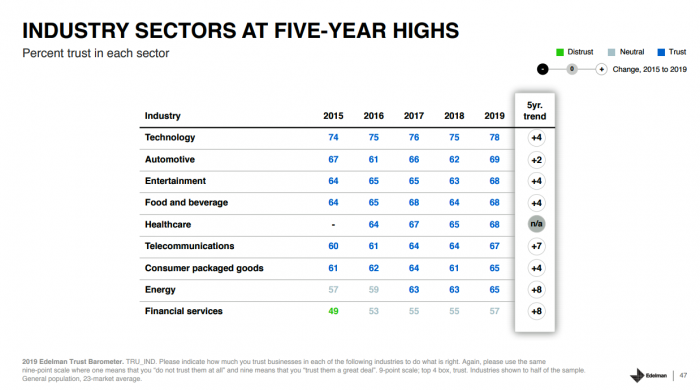

Trust in 2019 Via Edelman: The Plotline for Women and Healthcare

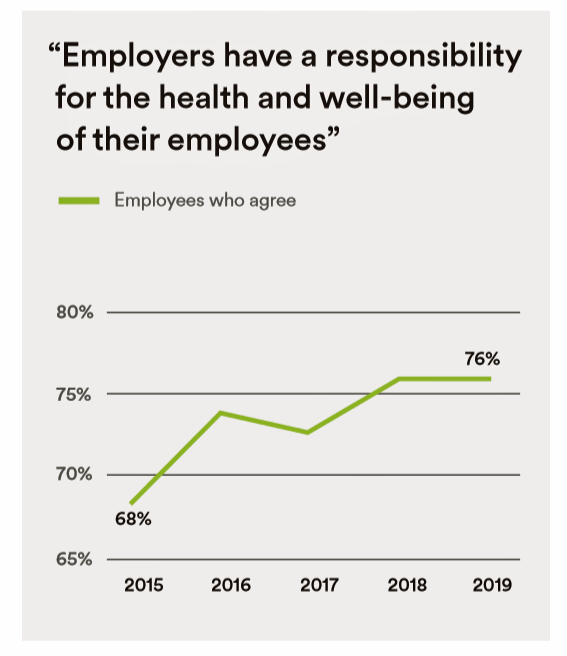

Fewer than one-half of consumers trust in government and media. Three-quarters trust employers, who in 2019 are the top-trusted institution according to the 2019 Edelman Trust Barometer released last week in Davos at the World Economic Forum. Consumers in the U.S. over-index for trust in employers, with 80% of people saying they have a strong relationship with “my employer,” compared with 73% of Britons, 66% of the French, and 59% of people in Japan. What’s underneath this is employers being trusted to provide certainty: most workers look to their employer to be a trustworthy source of information about social issues and

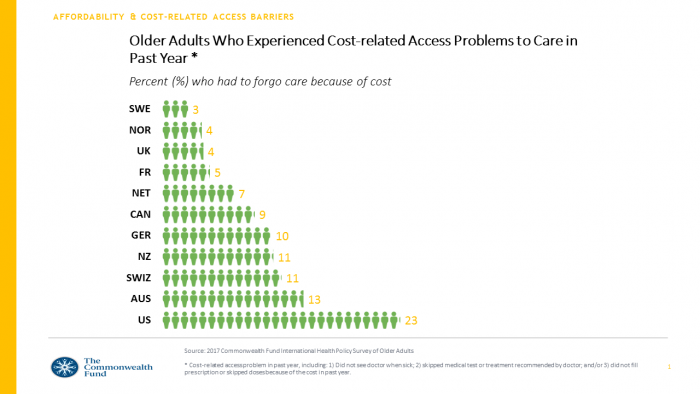

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

Costs, Consumerism, Cyber and Care, Everywhere – The 2019 Health Populi TrendCast

Today is Boxing Day and St. Stephens Day for people who celebrate Christmas, so I share this post as a holiday gift with well-wishes for you and those you love. The tea leaves have been brewing here at THINK-Health as we prepared our 2019 forecast at the convergence of consumers, health, and technology. Here’s our trend-weaving of 4 C’s for 2019: costs, consumerism, cyber and care, everywhere… Health care costs will continue to be a mainstream pocketbook issue for patients and caregivers, with consequences for payors, suppliers and ultimately, policymakers. Legislators inside the DC Beltway will be challenged by the

Consumers Want Help With Health: Can Healthcare Providers Supply That Demand?

Among people who have health insurance, managing the costs of their medical care doesn’t rank as a top frustration. Instead, attending to health and wellbeing, staying true to an exercise regime, maintaining good nutrition, and managing stress top U.S. consumers’ frustrations — above managing the costs of care not covered by insurance. And maintaining good mental health and staying on-track with health goals come close to managing uncovered costs, Oliver Wyman’s 2018 consumer survey learned. These and other important health consumer insights are revealed in the firm’s latest report, Waiting for Consumers – The Oliver Wyman 2018 Consumer Survey of US

Loneliness, Public Policy and AI – Lessons From the UK For the US

There’s a shortage of medical providers in the United Kingdom, a nation where healthcare is guaranteed to all Britons via the most beloved institution in the nation: The National Health Service. The NHS celebrated its 70th anniversary in July this year. The NHS “supply shortage” is a result of financial cuts to both social care and public health. These have negatively impacted older people and care for people at home in Great Britain. This article in the BMJ published earlier this year called for increasing these investments to ensure further erosion of population and public health outcomes, and to prevent

Koen Kas, the Gardener of Health Tech Delights

The future of healthcare is not about being sick, Prof. Dr. Koen Kas believes. Having spent many years in life sciences in both research and as an entrepreneur, Koen now knows that getting and staying healthy isn’t about just developing medicines and med-tech: optimally, health requires a tincture of delight, Koen advises in his breakthrough, innovative book, Your Guide to Delight. Healthcare must go beyond traditional user-centered design, Koen’s experience has shown, and aspire toward design-to-delight. The concept of “delight” in healthcare, such as we experience in hospitality, grocery stores, and entertainment, is elusive. I’ve observed this, too, in my

How Digital Health Can Stimulate Economic Development

It’s National Health IT Week in the US, so I’m kicking off the week with this post focused on how digital health can bolster economic development. As the only health economist in the family of the 2018 HIMSS Social Media Ambassadors, this is a voice through which I can uniquely speak. In February 2009, President Barack Obama signed into law the American Recovery and Reinvestment Act (ARRA), less formally known as the Stimulus Bill. This was the legislation best known for addressing and helping to bring the U.S. out of the Great Recession. A lesser-known component of ARRA was Title

As Workers’ Healthcare Costs Increase, Employers Look to Telehealth and Wearable Tech to Manage Cost & Health Risks

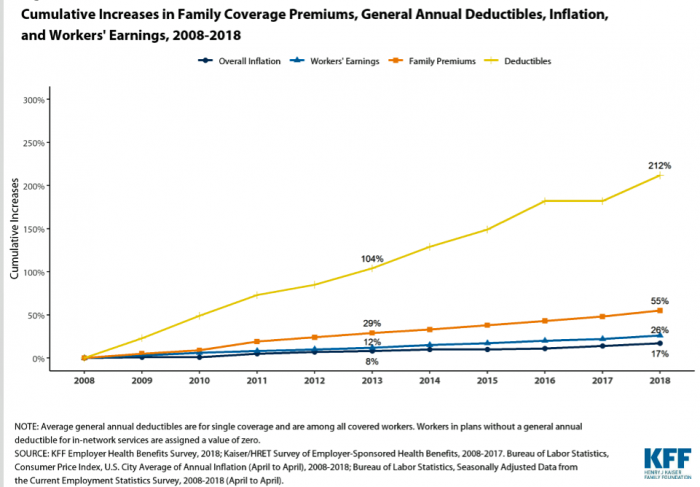

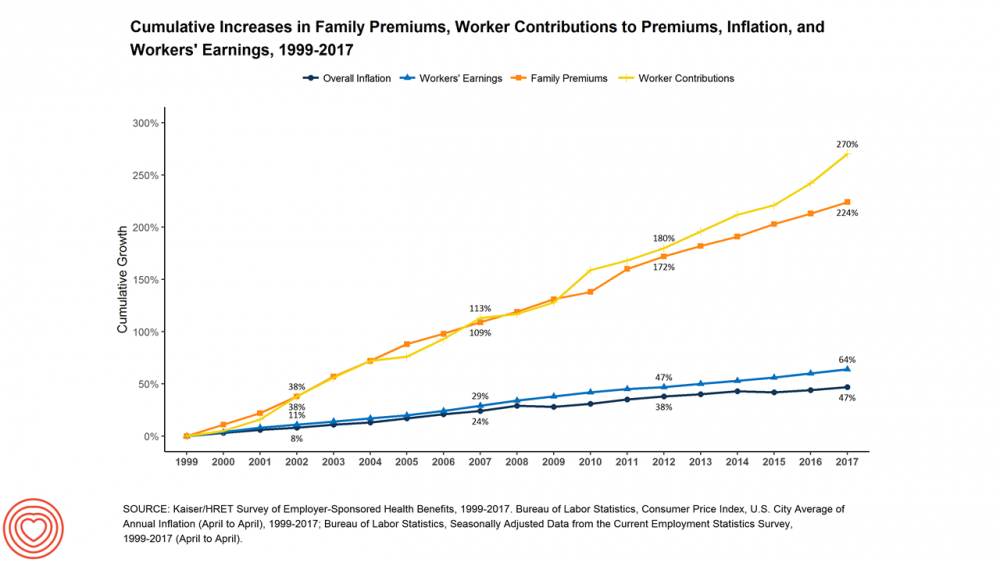

Family premiums for health insurance received at the workplace grew 5% in 2018: to $19,616, according to the 2018 KFF Employer Health Benefits Survey released today by the Kaiser Family Foundation (KFF). These two trends combine for a 212% increase in workers’ deductibles in the past decade. This is about eight times the growth of workers’ wages in the U.S. in the same period. Thus, the main takeaway from the study, KFF President and CEO Drew Altman noted, is that rising health care costs absolutely remain a burden for employers — but a bigger problem for workers in America. Given that

More U.S. Companies Offering Health Insurance After 8 Years of Decline

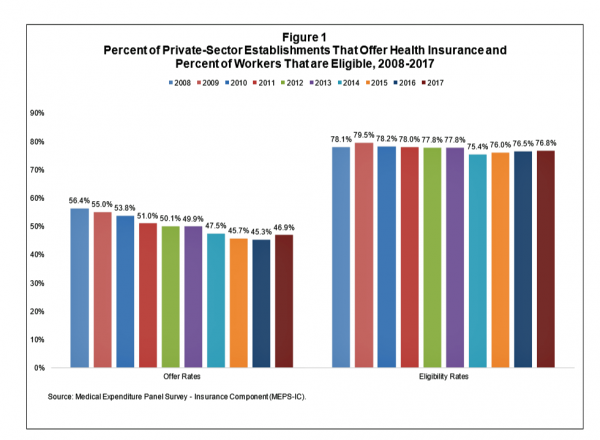

After eight years of decline, more U.S. employers offered health insurance to workers in 2017, EBRI reports in its latest Issue Brief. In 2017, 46.9% of U.S. companies offered health insurance to their employees, up by 1.6 percentage points from a low of 45.3% in 2016. For perspective, ten years earlier in 2008, 56.4% of employers offered health insurance, shown in the first bar chart (Figure 1 from the EBRI report). The largest percentage point increase in health plan offer-rates came from the smallest companies, those with less than 10 employees: while 21.7% of those companies offered health insurance in

Wealth is Health and Health, Wealth, Fidelity Knows – with Weight a Major Risk Factor

The two top stressors in American life are jobs and finances. “My weight” and my family’s health follow just behind these across the generations. Total Well-Being, a research report from Fidelity Investments, looks at the inter-connections between health and wealth – the combined impact of physical, mental, and fiscal factors on our lives. The first chart summarizes the study’s findings, including the facts that: One-third of people have less than three months of income in the bank for emergency Absenteeism is 29% greater for people who don’t have sufficient emergency funds saved People who are highly stressed tend not to

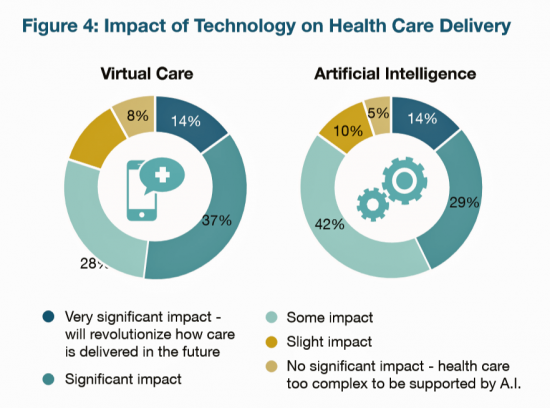

Employers Take on Health Activism, Embracing Behavioral Health, Virtual Care, AI, and Transparency

More U.S. employers are growing activist roles as stakeholders in the healthcare system, according to the 2019 Large Employers Health Care Strategy and Plan Design Survey from the National Business Group on Health (NBGH). Consider the Amazon-Berkshire Hathaway-JPMorgan Chase link up between Jeff Bezos, Warren Buffet, and Jamie Dimon, as the symbol of such employer-health activism. The NBGH report is based on survey results collected from 170 large employers representing 13 million workers and 19 million covered lives (families/dependents). This annual survey is one of the most influential such reports released each year, providing a current snapshot of large employers’ views

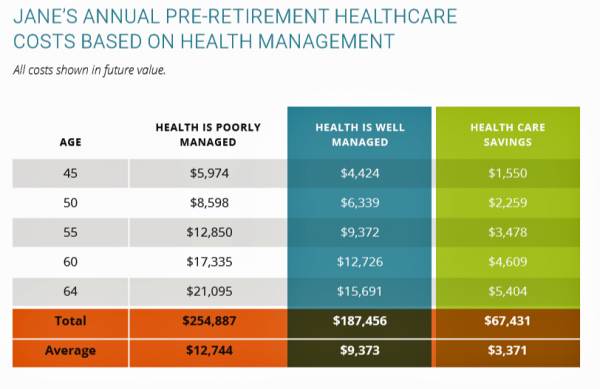

How Taking Care of Your Health Boosts Savings Accounts

It will cost about $275,000 for a couple retiring in the U.S. this year to cover their healthcare costs for the rest of their life in retirement, Fidelity estimated. But Americans are notoriously pretty undisciplined about saving money, compared with peers living in other developed countries. How to address this challenge? Show people what improving their personal health can do to boost their 401(k) plans. This tactic is discussed in Health & Retirement Savings: Leveraging Healthcare Costs to Drive 401(k) Contributions & Improve Health, from HealthyCapital, a joint venture of Mercy health systems and HealthView Services. The chart illustrates three

Design, Empathy and Ethics Come to Healthcare: HXD

Design-thinking has come to health/care, finally, and Amy Cueva has been beating this drum for a very long time. I’m delighted to be in her collegial circle, speaking at the conference about the evolving healthcare consumer who’s financially strapped, stressed-out, and Amazon Primed for customer service. I’m blogging live while attending HXD 2018 in Cambridge, MA, the health/care design conference convened by Mad*Pow, 26th and 27th June 2018. Today was Day 1 and I want to recap my learnings and share with you. Amy, Founder and Chief Experience Office of Mad*Pow, kicked off the conference with context-setting and inspiration. Design

Food as Medicine Update: Danone Goes B-Corp, Once Upon a Farm Garners Garner, and Livongo Buys Retrofit

As the nation battles an obesity epidemic that adds $$ costs to U.S. national health spending, there are many opportunities to address this impactful social determinant of health to reduce health spending per person and to drive public and individual health. In this post, I examine a few very current events in the food-as-medicine marketspace. Big Food as an industry gets a bad rap, as Big Tobacco and Big Oil have had. In the case of Big Food, the public health critique points to processed foods, those of high sugar content (especially when cleverly marketed to children), and sustainability. But

Healthcare Access and Cost Top Americans’ Concerns in Latest Gallup Poll

Healthcare — availability and affordability — is a more intense worry for Americans in March 2018 than crime and violence, Federal spending, guns, drug use, and hunger and homelessness. The Gallup Poll, fielded in the first week of March 2018, found that peoples’ overall economic and employment concerns are on the decline since 2010, at the height of the Great Recession which began in 2008. While 70% of Americans were worried about economic matters in 2010, only 34% of people in the U.S. were worried about the economy, and 23% about unemployment, in March 2018. Gallup has asked this “worry”

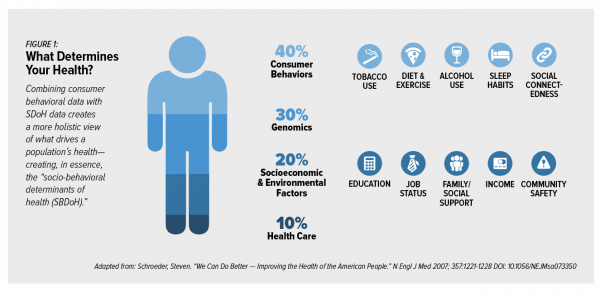

Add Behavioral Data to Social Determinants For Better Patient Understanding

“Health agencies will have to become at least as sophisticated as other consumer/retail industries in analyzing a variety of data that helps uncover root causes of human behavior,” Gartner recommended in 2017. That’s because “health” is not all pre-determined by our parent-given genetics. Health is determined by many factors in our own hands, and in forces around us: physical environment, built environment, and public policy. These are the social determinants of health, but knowing them even for the N of 1 patient isn’t quite enough to help the healthcare industry move the needle on outcomes and costs. We need to

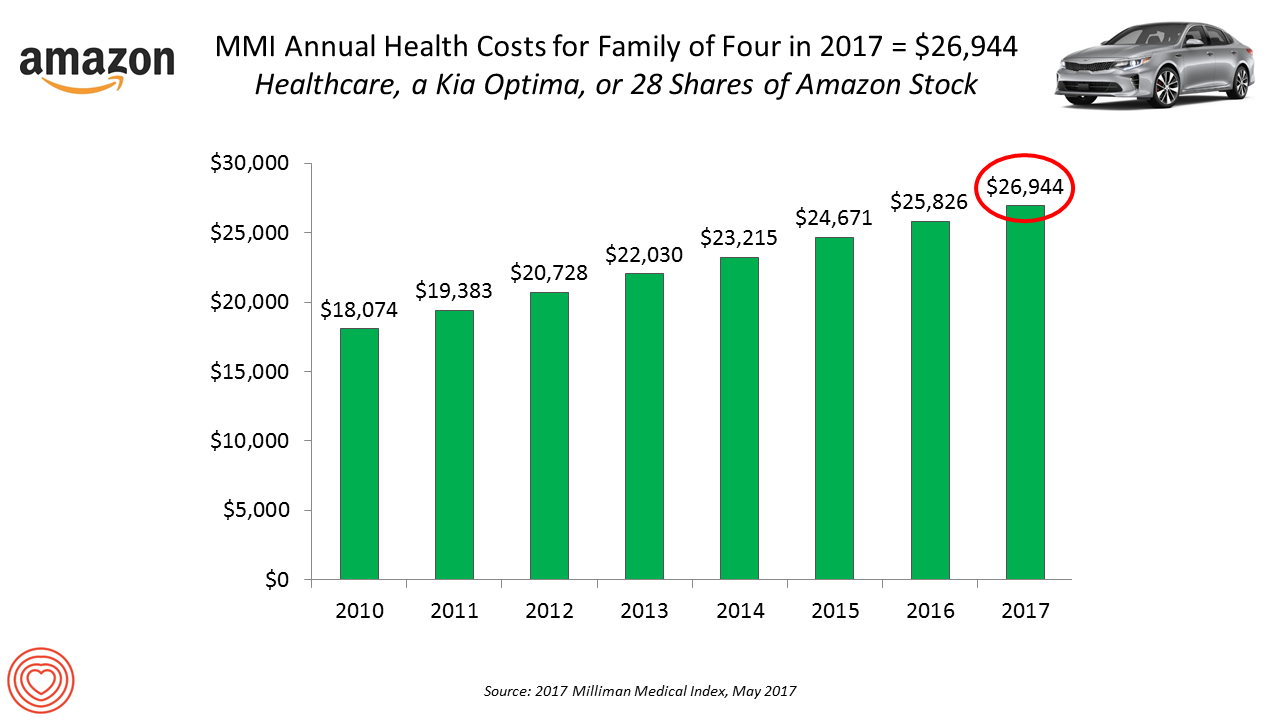

Warren Buffett’s Healthcare Cost Tapeworm & His Alliance with Amazon and JPMorgan

The fact that the average U.S. employer committed to spend nearly $27,000 a year for a PPO to cover a family of 4 in America in 2017 is the most important rationale underlying the announcement that Amazon, Berkshire-Hathaway, and JP Morgan made on 30th January 2017. That news immediately shook Wall Street trading, sending downward shocks down the proverbial spines of healthcare insurance plans and suppliers to the industry — legacy healthcare companies that scale patient-members and healthcare supplies, like pills and surgical implants. The “new competition” chart published in the Wall Street Journal in the morning illustrates those shock

The 2018 Edelman Trust Barometer – What It Means for Health/Care in America

Trust in the United States has declined to its lowest level since the Edelman Trust Barometer has conducted its annual survey among U.S. adults. Welcome to America in Crisis, as Edelman brands Brand USA in 2018. In the 2018 Edelman Trust Barometer, across the 28 nations polled, trust among the “informed public” in the U.S. “plunged,” as Edelman describes it, by 23 points to 45. The Trust Index in America is now #28 of 28 countries surveyed (that is, rock bottom), dropping below Russia and South Africa. “The public’s confidence in the traditional structures of American leadership is now fully

Hug Your Physician: S/He Needs It – Listening to the 2018 Medscape National Physician Burnout & Depression Report

Two in five U.S. physicians feels burned out, according to the Medscape National Physician Burnout & Depression Report for 2018. This year, Medscape explicitly adds the condition of “depression” to its important study, and its title. In 2017, the Medscape report was about bias and burnout. Physicians involved in primary care specialties and critical care are especially at-risk for burnout, the study found. One in five OBGYNs experience both burnout and depression. Furthermore, there’s a big gender disparity when it comes to feeling burned out: nearly one-half of female physicians feel burnout compared with 38% of male doctors. Being employed by

The Patient as Payor – Consumers and the Government Bear the Largest Share of Healthcare Spending in America

The biggest healthcare spenders in the United States are households and the Federal government, each responsible for paying 28% of the $3.3 trillion spent in 2016. Private business — that is, employers covering healthcare insurance — paid for 20% of healthcare costs in 2016, based on calculations from the CMS Office of the Actuary’s report on 2016 National Health Expenditures. The positive spin on this report is that overall national health spending grew at a slower rate in 2016, at 4.3% after 5.8% growth in 2015. This was due to a decline in the growth rates for the use of

The State of Financial Wellness and Health in America – Suffering Across the Ages

Nearly one-half of Americans are challenged by low financial well-being. Compared to emotional/mental, job/career, social, physical, and financial, it’s this last lens on personal health that gets the lowest ratings for the largest number of Americans. The second most worrying factor diminishing well-being is a tie between physical health and social health. Welcome to The uncomfortable reality of financial wellbeing, a report on the 2017 Financial Mindset Study Highlights from Alight Solutions, an HR services company. The first chart arrays the well-being rankings across the five factors, showing that just over one-half of Americans have more positive views on their emotional

Movin’ Out(patient) – The Future of the Hospital is Virtual at UPMC

In 2016, most consultations between patients and Kaiser-Permanente Health Plan were virtual — that is, between consumers and clinicians who were not in the same room when the exam or conversation took place. Virtual healthcare may be the new black for healthcare providers. Mercy Health System in St. Louis launched a virtual hospital in 2016, covered here in the Health Populi post, “Love, Mercy, and Virtual Healthcare.” Intermountain Healthcare announced plans to build a virtual hospital in 2018. And, earlier this month, UPMC’s CEO, Jeffrey Romoff, made healthcare headlines saying, “UPMC desires to be the Amazon of healthcare.” UPMC, aka University of Pittsburgh

Employees Continue To Pick Up More Health Insurance Costs, Even As Their Growth Slows

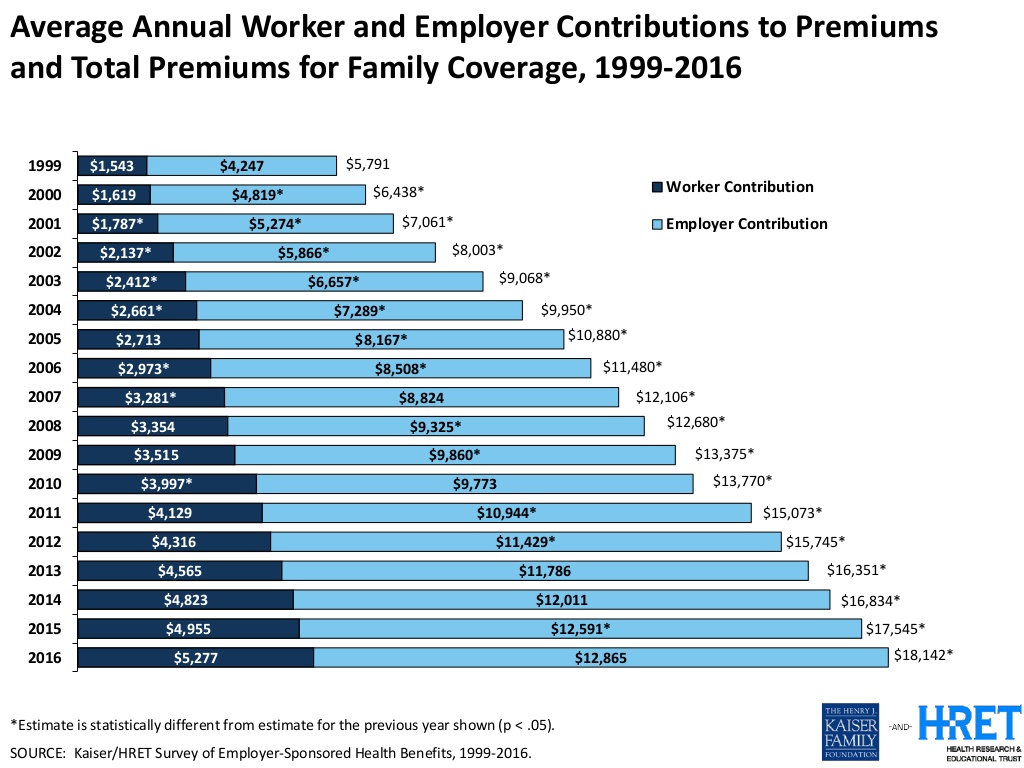

The average cost of an employer=sponsored health plan for a family reached $18,764 in 2017. While this premium grew overall by a historically relative low of 3.4%, employees covered under that plan faced an increase of 8.3% over what their plan share cost them in 2016, according to the 2017 Employer Health Benefit Survey published today by the Kaiser Family Foundation. [Here’s a link to the 2016 KFF report, which provided the baseline for this 8.3% calculation]. Average family premiums at the workplace rose 19% since 2012, a slowdown from the two previous five-year periods — 30% between 2007 and 2012, and

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

Employer Health Benefits Stable In the Midst of Uncertain Health Politics

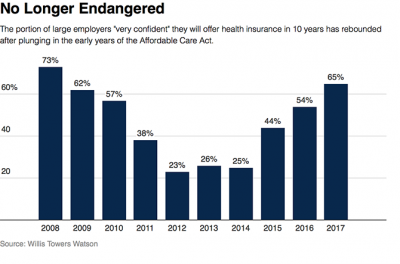

As we look for signs of stability in U.S. health care, there’s one stakeholder that’s holding firm: employers providing healthcare benefits. Two studies out this week demonstrate companies’ commitment to sponsoring health insurance benefits….with continued tweaks to benefit design that nudges workers toward healthier behaviors, lower cost-settings, and greater cost-sharing. As Julie Stone, senior benefits consultant with Willis Towers Watson (WLTW), noted, “The extent of uncertainty in Washington has made people reluctant to make changes to their benefit programs without knowing what’s happening. They’re taking a wait-and-see attitude.” First, the Willis Towers Watson 22nd annual Best Practices in Health Care Employer

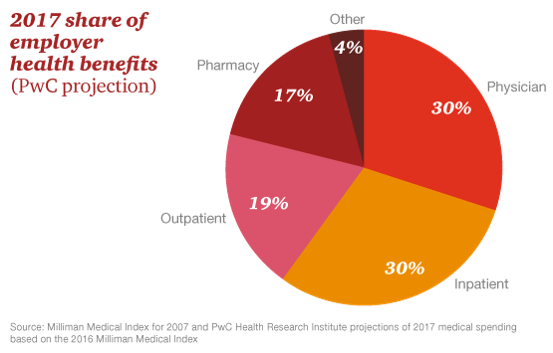

Pharmacy and Outpatient Costs Will Take A Larger Portion of Health Spending in 2018

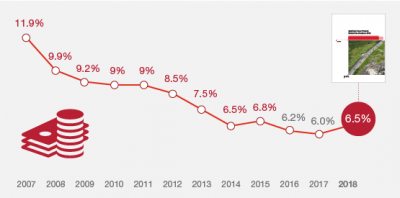

Health care costs will trend upward by 6.5% in 2018 according to the forecast, Medical Cost Trends: Behind the Numbers 2018, from PwC’s Health Research Institute. The expected increase of 6.5% is a half-percentage point up from the 2017 rate of 6.0%, which is 8% higher than last year’s rate matching that of 2014. PwC’s Health Research Institute has tracked medical cost trends since 2007, as the line chart illustrates, when trend was nearly double at nearly 12%. The research consider medical prices, health care services and goods utilization, and a PwC employer benefit cost index for the U.S. The key

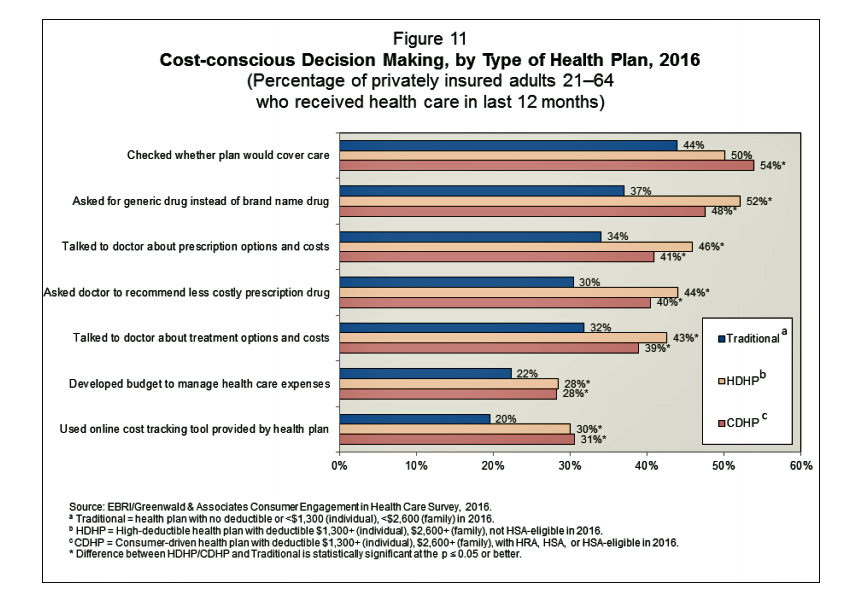

As High Deductible Health Plans Grow, So Does Health Consumers’ Cost-Consciousness

A person enrolled in a high-deductible health insurance plan is more likely to be cost-conscious than someone with traditional health insurance. Cost-consciousness behaviors including checking whether a plan covers care, asking for generic drugs versus a brand name pharmaceutical, and using online cost-tracking tools provided by health plans, according to the report, Consumer Engagement in Health Care: Findings from the 2016 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey from EBRI, the Employee Benefit Research Institute. A high deductible is correlated with more engaged health plan members, EBRI believes based on the data. One example: more than one-half of people enrolled

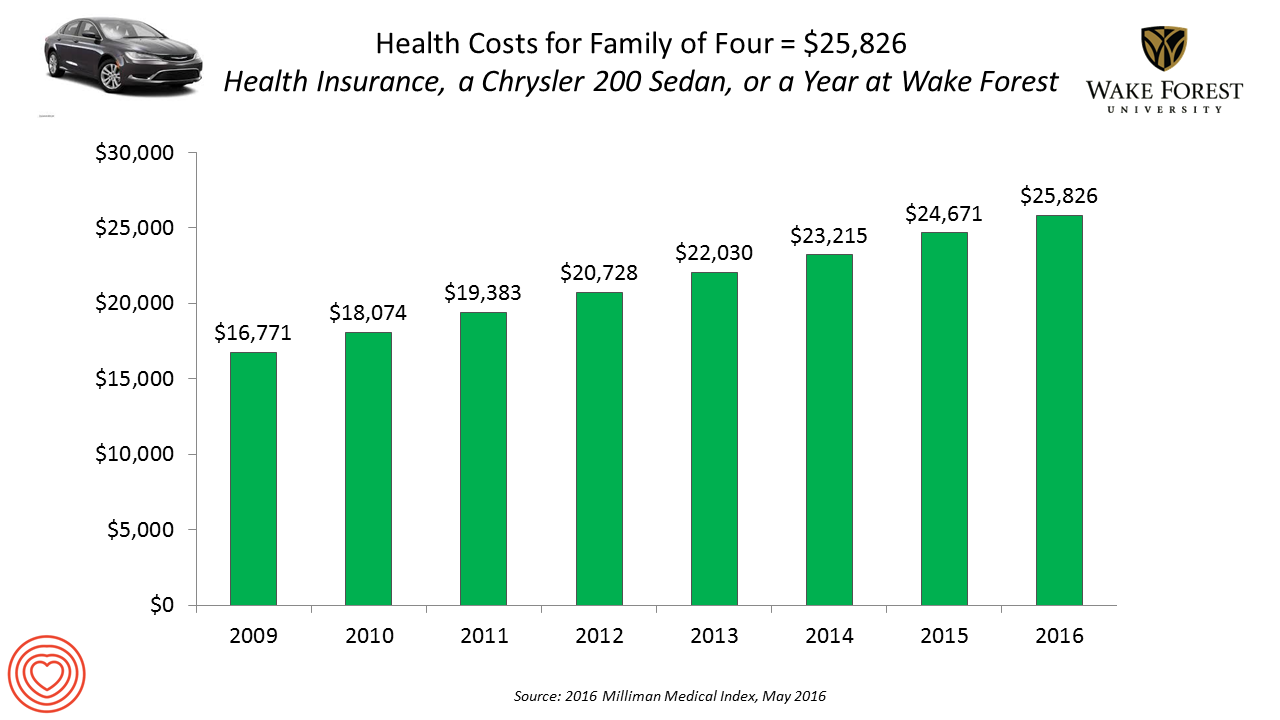

Healthcare Costs for a Family of Four Will Reach $27,000 in 2017

If you had $27,000 in your wallet, would you spend it on a 2017 Kia Optima sedan, 28 shares of Amazon stock, or healthcare? $26,944 is this year’s estimate of what healthcare will cost a family of four in the U.S., based on the 2017 Milliman Medical Index (MMI). This is based on the projected total costs of healthcare for a family covered by an employer-sponsored PPO plan. Milliman, the actuarial consulting firm, has conducted the MMI going back to 2001. I’ve watched the rise and rise of this index for years, explained annually in the Health Populi blog since its inception

Shopping Food for Health is Mainstream, But Nutrition Confusion is Super-Sized

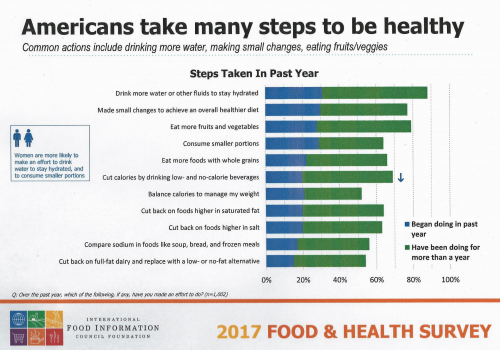

Americans are overwhelmingly keen to use food for their health, and overwhelmed by the amount of nutrition information they face to make good shopping and eating decisions. Welcome to “food confusion,” a phenomenon gleaned from the 12th Annual Food and Health Survey conducted by the International Food Information Council Foundation (IFIC). This 12th annual survey from IFIC finds that most Americans take many steps to be healthy. In the past year, the most popular health-steps include drinking more for hydration, making small changes to achieve a healthier diet, consuming smaller portions, eating more fruits and vegetables, and eating more whole grains.

Building Digital Trust Is Now Part of Serving Up Healthcare

The most trusted stewards for protecting consumers’ health data are “my providers:” “my” physician (88%), “my” pharmacy (85%), and “my” hospital” (84%). according to the Accenture 2017 Consumer Survey on Healthcare Cybersecurity and Digital Trust. Who’s least-trusted? Government (56%) and tech companies (57%). Note, though, that most Americans (over 50%) trust these health data holders — it’s just that fewer people trust them than healthcare providers, who are top health information protectors in health consumers’ trust rosters. Accenture commissioned Nielsen to conduct this survey in November 2016 in seven countries. The results discussed here in Health Populi focus on the

Health Care Worries Top Terrorism, By Far, In Americans’ Minds

Health care is the top concern of American families, according to a Monmouth University Poll conducted in the week prior to Donald Trump’s Presidential inauguration. Among U.S. consumers’ top ten worries, eight in ten directly point to financial concerns — with health care costs at the top of the worry-list for 25% of people. Health care financial worries led the second place concern, job security and unemployment, by a large margin (11 percentage points) In third place was “everyday bills,” the top concern for 12% of U.S. adults. Immigration was the top worry for only 3% of U.S. adults; terrorism and

The Growth of Digital Health @Retail

This post was written to support the upcoming meeting of the PCHA, the Personal Connected Health Alliance, to be held 11-14 December 2016 at the Gaylord Hotel in greater Washington, DC. You can follow the events and social content via Twitter using the hashtag #Connect2Health. Have you visited your local Big Box, discount or consumer electronics store lately? You’ll find expanding shelf space for digital health technologies aimed squarely at consumers. 2017 promises even more of them, aimed at helping people accomplish health tasks once performed in hospitals and by healthcare providers, or tasks not yet delivered in today’s healthcare

Americans Have Begun to Raid Retirement Savings for Current Healthcare Costs

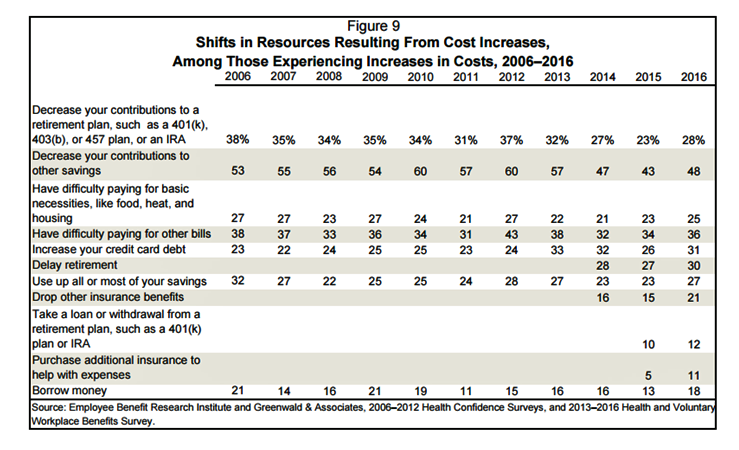

While American workers appreciate the benefits they receive at work, people are concerned about health care costs. And consumers’ collective response to rising health care costs is changing the way they use health care services and products, like prescription drugs. Furthermore, 6 in 10 U.S. health citizens rank healthcare as poor (27%) or fair (33%). This sober profile on healthcare consumers emerges out of survey research conducted by EBRI (the Employee Benefit Research Institute), analyzed in the report Workers Like Their Benefits, Are Confident of Future Availability, But Dissatisfied With the Health Care System and Pessimistic About Future Access and

Looking for Amazon in Healthcare

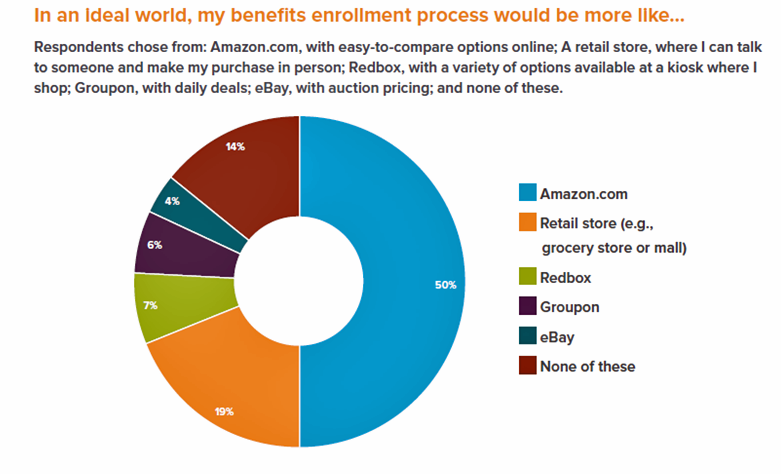

Consumers have grown accustomed to Amazon, and increasingly to the just-in-time convenience of Amazon Prime. Today, workers who sign onto employee benefit portals are looking for Amazon-style convenience, access, and streamlined experiences, found in the Aflac Workforces Report 2016. Aflac polled 1,900 U.S. adults employed full or part time in June and July 2016 to gauge consumers’ views on benefit selections through the workplace. Consumers have an overall angst and ennui about health benefits sign-ups: 72% of employees say reading about benefits is long, complicated, or stressful 48% of people would rather do something unpleasant like talking to their ex or

Employer Health Insurance Costs $18,142 in 2016, in KFF Study

Consumers face increasing health insurance deductibles in 2016, faster-growing than earnings and well above general price inflation, featured in the Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 2016. This report, updated annually, is the go-to source on the availability of, cost for, and trends in U.S. employer-based health plans. The average annual health insurance premium in 2016 reached $18,142, the survey found, about $600 more than in 2015. Over the past ten years since 2006, workers’ contributions to health insurance premiums increased 78%; employers’ contributions grew 58% over the decade. To help stem costs, employers are adopting new services to

The State of Mobile Apps in 2016 and Healthcare Implications

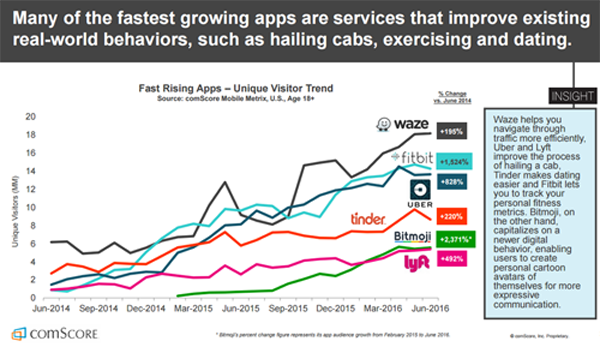

Some of the fastest-growing mobile phone apps help people manage life-tasks every day, like getting real-time directions when driving, finding dates, getting rides, and tracking health, according to The 2016 U.S. Mobile App Report from comScore. The chart from the comScore Mobile Metrix survey illustrates some popular apps well-used by people on smartphones, with one of the fastest growth rates found for the Fitbit app — 1,524% growth over two years, from June 2014 to June 2016. In comparison, the Uber app visits increased 828% in the period, half as fast, and the Tinder app, 220%. Some key topline results of

Employers Changing Health Care Delivery – Health Reform At Work

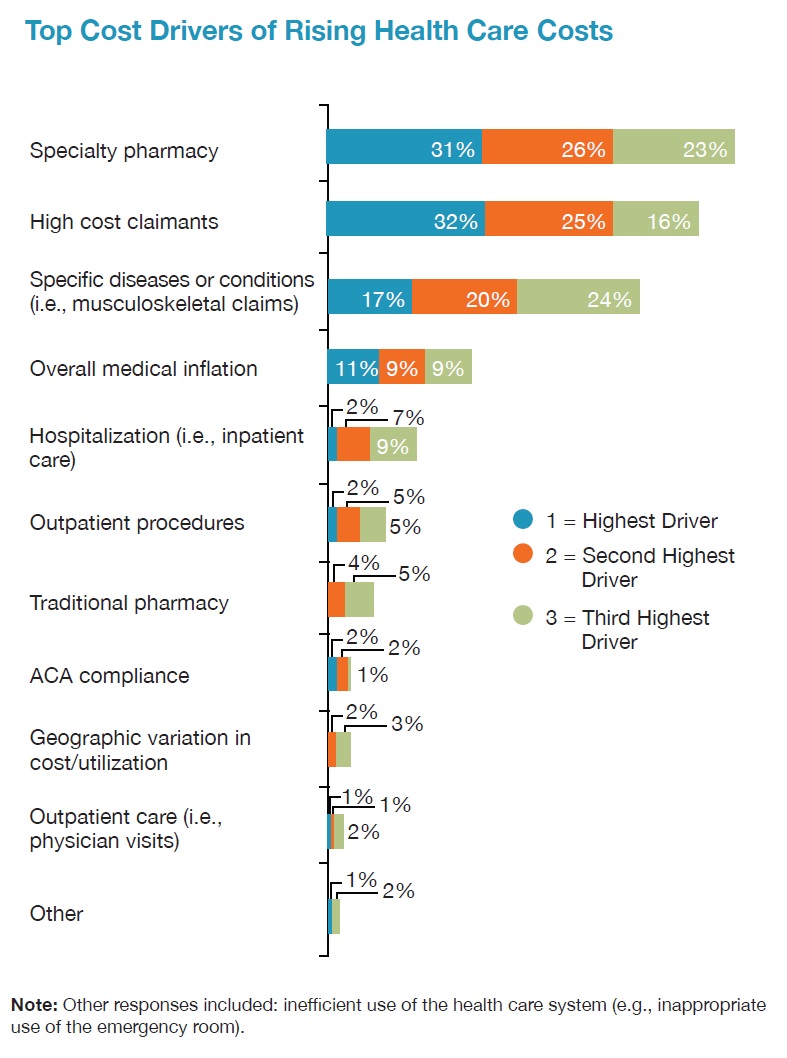

Large employers are taking more control over health care costs and quality by pressuring changes to how care is actually delivered, based on the results from the 2017 Health Plan Design Survey sponsored by the National Business Group on Health (NBGH). Health care cost increases will average 5% in 2017 based on planned design changes, according to the top-line of the study. The major cost drivers, illustrated in the wordle, will be specialty pharmacy (discussed in yesterday’s Health Populi), high cost patient claims, specific conditions (such as musculoskeletal/back pain), medical inflation, and inpatient care. To temper these medical trend increases,

PhRMA vs. Employers: Healthcare Costs In the Eye of the Beholder

In the past week, the Pharmaceutical Research and Manufacturers of America (PhRMA), the advocacy organization for the branded prescription drug industry, published Medicines: Costs in Context,” the group’s lens on the value of prescription drugs in the larger healthcare economy. Their view: that prescription drug costs comprise a relatively low share of health care spending in America, and a high-value one at that. PhRMA contends that 10% of the health care dollar was allocated to prescription drugs in 2015, the same proportion as in 1960. “Even with new treatments for hepatitis C, high cholesterol and cancer, spending on retail prescription

More Patients Morph Into Financially Burdened Health Consumers

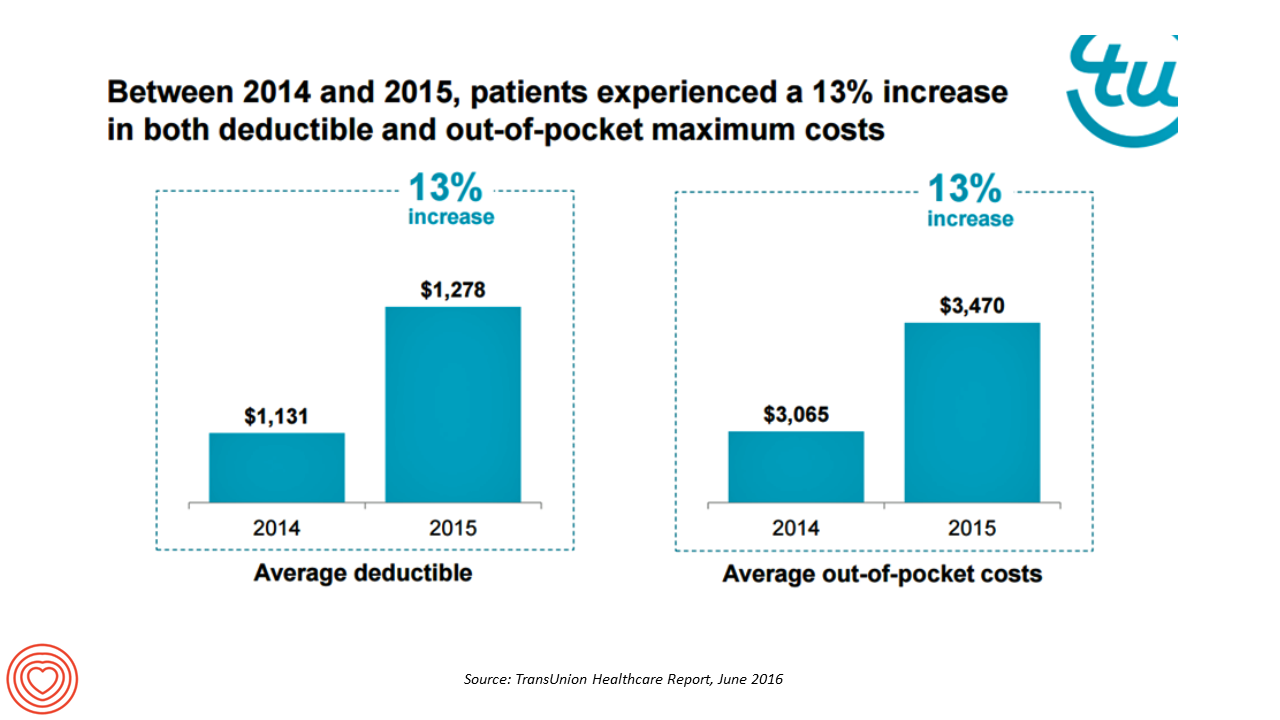

Health care payment responsibility continues to shift from employers to employee-patients, More of those patients are morphing into financially burdened health consumers, according to TransUnion, the credit agency and financial risk information company, in the TransUnion Healthcare Report published in June 2016. Patients saw a 13% increase in their health insurance deductible and out-of-pocket (OOP) maximum costs between 2014 and 2015. At the same time, the average base salary in the U.S. grew 3% in 2015, SHRM estimated. Thus, deductibles and OOP costs grew for consumers more than 4 times faster than the average base salary from 2014 to 2015. In

Workplace Wellness Goes Holistic, Virgin Pulse Finds

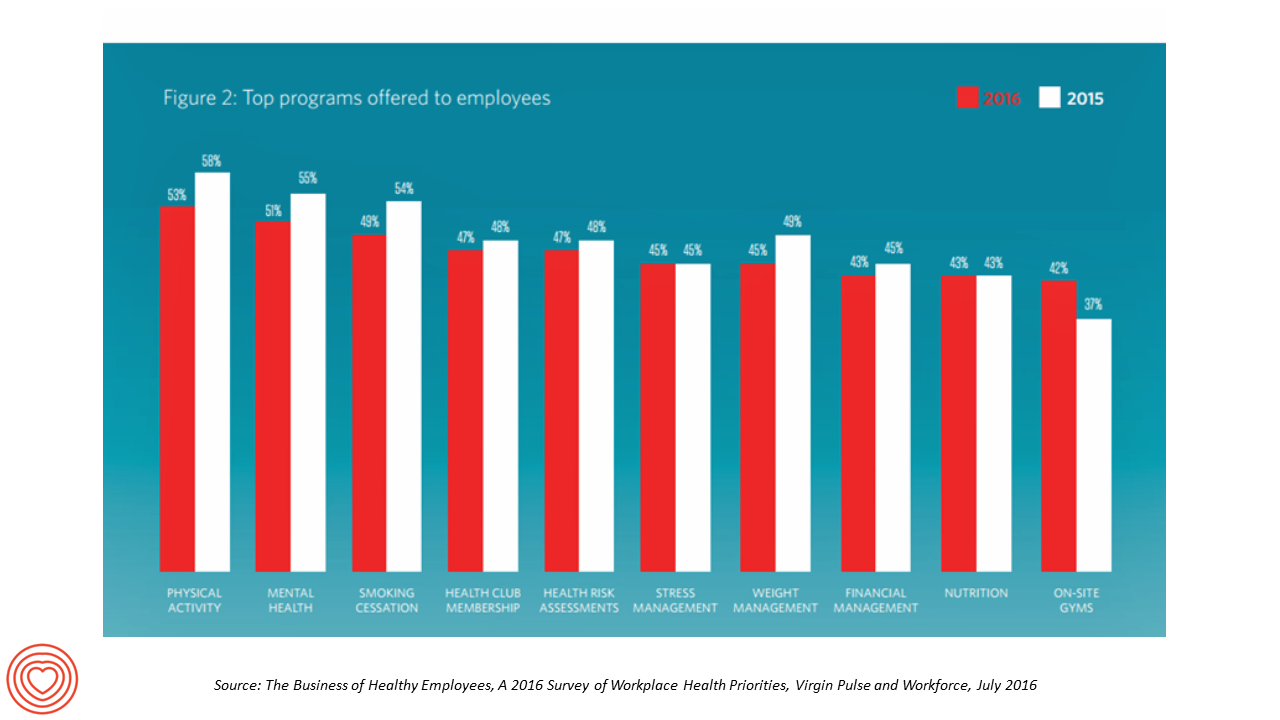

“Work is the second most common source of stress, just behind financial worries,” introduces The Business of Healthy Employees report from Virgin Pulse, the company’s 2016 survey of workplace health priorities published this week. Virgin Pulse collaborated with Workforce magazine, polling 908 employers and 1,818 employees about employer-sponsored health care, workers’ health habits, and wellness benefit trends. Workplace wellness programs are becoming more holistic, integrating a traditional physical wellness focus with mental, social, emotional and financial dimensions for 3 in 4 employers. Wearable technology is playing a growing role in the benefit package and companies’ cultures of health, as well

The State of Health Benefits in 2016: Reallocating the Components

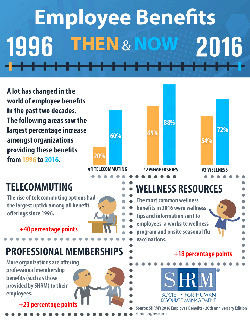

Virtually all employers who offer health coverage to workers extend health benefits to all full-time employees. 94% offer health care coverage to opposite-sex spouses, and 83% to same-sex spouses. One-half off health benefits to both opposite-sex and same-sex domestic partners (unmarried). Dental insurance, prescription drug coverage, vision insurance, mail order prescription programs, and mental health coverage are also offered by a vast majority (85% and over) of employers. Welcome to the detailed profile of workplace benefits for the year, published in 2016 Employee Benefits, Looking Back at 20 Years of Employee Benefits Offerings in the U.S., from the Society for Human

PwC’s “Behind the Numbers” – Where the Patient Stands

The growth of health care costs in the U.S. is expected to be a relatively moderate 6.5% in 2017, the same percentage increase as between 2015 and 2016, according to Medical Cost Trend: Behind the Numbers 2017, an annual forecast from PwC. As the line chart illustrates, the rate of increase of health care costs has been declining since 2007, when costs were in double-digit growth mode. Since 2014, health care cost growth has hovered around the mid-six percent’s, considered “low growth” in the PwC report. What’s driving overall cost increases is price, not use of services: in fact, health care

Healthcare Costs for a Family of Four Will Be $25,826 in 2016

If you had exactly $25,826 in your pocket today, would you rather buy a new Chrysler 200 sedan, send a son or daughter to a year of college at Wake Forest University, or pay for your family’s health care in an employer-sponsored preferred provider organization? Welcome to the annual 2016 Milliman Medical Index (MMI), one of the most important health economic studies I’ve relied on for many years. This year’s underlying question is, “Who cooked up this expensive recipe?” posed in the report’s title. The key statistics in this year’s MMI are that: Healthcare costs for a typical family of four

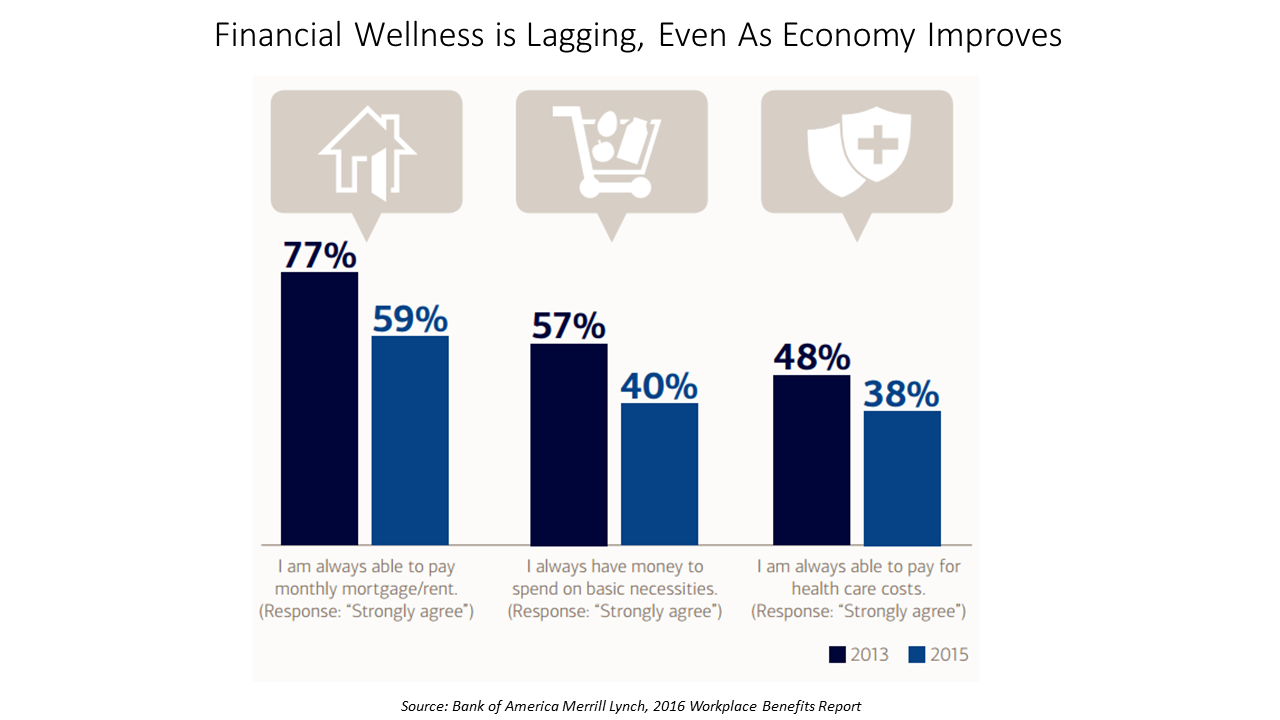

Financial Wellness Declines In US, Even As Economy Improves

American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch. The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this

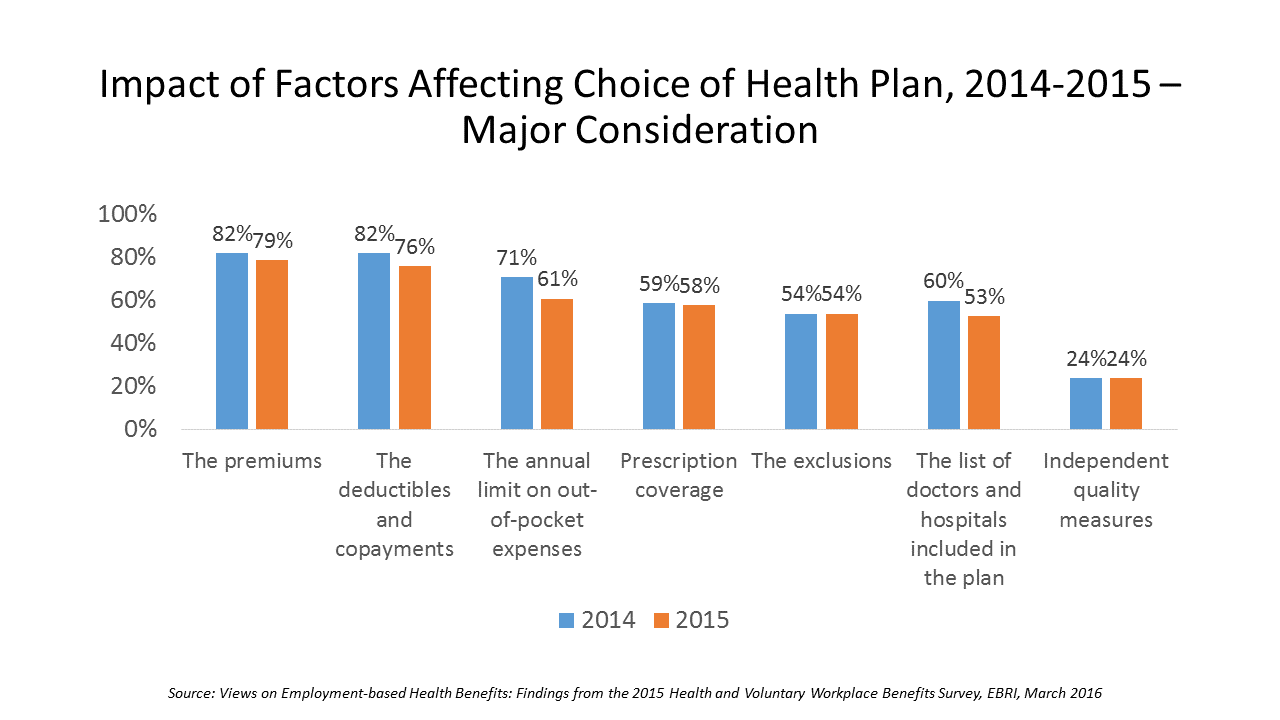

Cost Comes Before “My Doctor” In Picking Health Insurance

Consumers are extremely price-sensitive when it comes to shopping for health insurance. The cost of health insurance premiums, deductibles and copays, prescription drug coverage and out-of-pocket expenses rank higher in the minds of health insurance shoppers than the list of doctors and hospitals included in a health plan for health consumers in 2015. The Employee Benefit Research Institute (EBRI) surveyed 1,500 workers in the U.S. ages 21-64 for their views on workers’ satisfaction with health care in America. The results of this study are compiled in EBRI’s March 2016 issue of Notes, Views on Employment-based Health Benefits: Findings from the 2015 Health

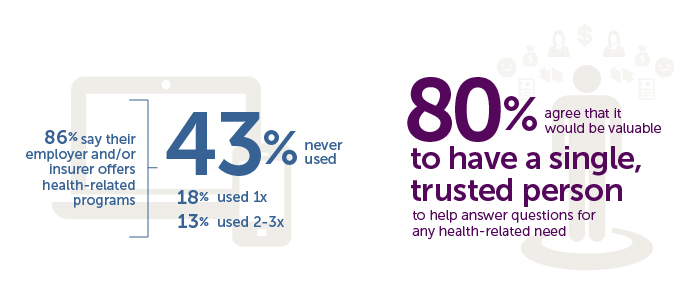

People Want Healthcare Sherpas

8 in 10 Americans would like one trusted person to help them figure out their health care, according to the Accolade Consumer Healthcare Experience Index Poll, conducted by The Harris Poll. The study gauged how Americans feel about their healthcare, especially focusing on employer-sponsored health insurance. One-third of people (32%) aren’t comfortable with navigating medical benefits and the healthcare system; a roughly percentage of people aren’t comfortable with their personal knowledge to make financial investments, either (35%). Buying a car, a home, technology and electronics? Consumers are much more comfortable shopping for these things. Consumers say that the most onerous

Sleep And Health/Tech – It’s National Sleep Awareness Week

One in three people suffer from some form of insomnia in the U.S. With sleep a major contributor to health and wellness, we recognize it’s National Sleep Awareness Week. As a health economist, I’m well aware of sleep’s role in employee productivity, absenteeism and presenteeism. U.S. companies lose 11.3 days of lost work performance per person who suffers from insomnia, according to research from a Harvard-based team published in the journal Sleep. The cost of this to U.S. business is about $63 billion annually. Science writers at the BBC developed a long list of modern-life issues that deter us from

Prescription Drug Costs Will Be In Health Benefits Bullseye in 2016

Prescription drug costs have become a front-and-center health benefits cost issue for U.S. employers in 2015, and in 2016 the challenge will be directly addressed through more aggressive utilization management (such as step therapy and prior authorization), tools to enable prescription intentions like DUR, and targeting fraud, waste and abuse. Consumers, too, will be more financially responsible for cost-sharing prescription drugs, in terms of deductibles and annual out-of-pocket limits, as described in the PBMI 2015-206 Prescription Drug Benefit Cost and Plan Design Report, sponsored by Takeda. The Pharmacy Benefit Management Institute has published this report for 15 years, which provides neutral, detailed survey

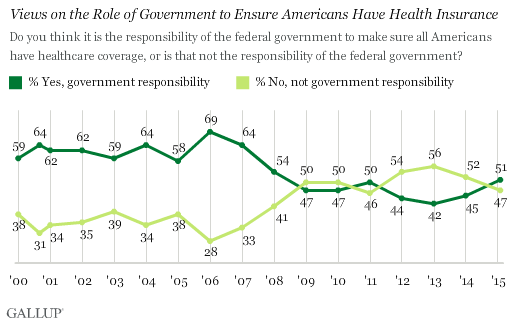

51% of Americans Say It’s Government’s Responsibility To Provide Health Insurance

For the first time since 2008, a majority of Americans say government is responsible for ensuring that people have health insurance. The first chart shows the crossing lines between those who see government-assured health insurance in the rising dark green line in 2015, and people who see it as a private sector responsibility. The demographics and sentiments underneath the 51% are important to parse out: people who approve of the Affordable Care Act are over 3x more likely to believe in government sponsoring health insurance versus those who disapprove, 80% compared with 26%. The demographic differences are also striking, detailed

What Retail Telemedicine Means For Healthcare Providers

Direct-to-consumer retail health options are fast-growing in the U.S. health ecosystem. CVS Health brought three telemedicine vendors to its pharmacy brick-and-mortar stores. CVS also acquired Target’s pharmacies, expanding its retail health footprint. Rite Aid has added HealthSpot kiosks to its pharmacies, while Walgreens expanded its relationship with MDLive. And, Cox Cable acquired Trapollo to bring remote health monitoring into subscribers’ homes, along with the cable company’s venture with Cleveland Clinic, Vivre Health. Coupled with the growing supply side of telemedicine vendors, the latest National Business Group on Health survey found that most large employers plan to expand the telemedicine services they

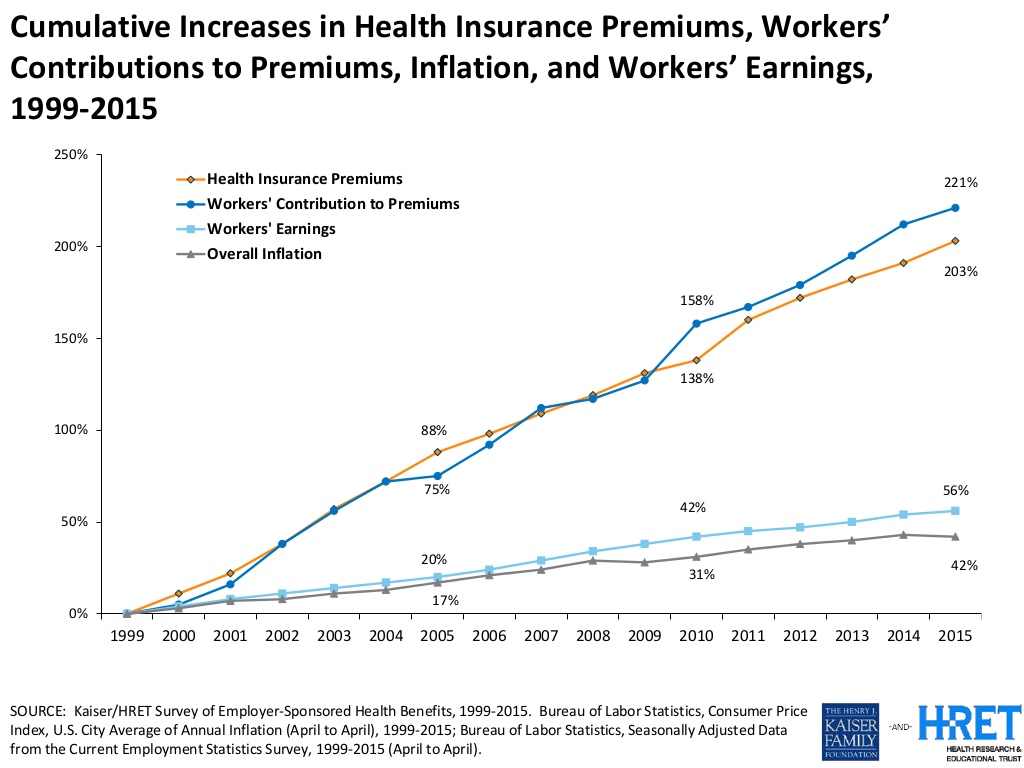

Health consumers’ cost increases far outpace wage growth

American workers are working to pay for health care costs, having traded off wage increases for health premiums, out-of-pocket costs and growing high deductibles. Welcome to the 2015 Employer Health Benefits survey conducted annually by the Kaiser Family Foundation (KFF) and Health Research & Educational Trust (HRET). Premiums are growing seven times faster than wages. The report calculates that high-deductibles for health insurance have grown 67% from 2010 to 2015. In the same period, wages grew a paltry 10%, while the Consumer Price Index rose 9%. The first chart illustrates that growing gap between relatively flat wages and spirally health

Fitbit Means Business When It Comes To Privacy

Fitbit, the company that makes and markets the most popular activity tracker, is getting serious about its users’ personal data. The company announced that it will enter into HIPAA business associate agreements with employers, health plans, and companies that offer workers the devices and the apps that organize and analyze consumers’ personal data. The Health Insurance Portability and Accountability Act (HIPAA) protects patients’ personal health information generated in a doctor’s office, a hospital, lab, and other healthcare entities covered under the law (as such, “covered entities”). However, data generated through activity tracking devices such as Fitbit’s many wearable technologies have

A Company’s Healthy Bottom Line Requires Healthy Employees

“What is the meaning of health to our businesses?” asked Dr. Thomas Parry of the Integrated Benefits Institute (IBI) at a dinner last night, convened by the Pittsburgh Business Group on Health on the eve of the organization’s annual meeting being held today in Steel City. I was fortunate to attend the dinner and hear Dr. Parry speak; I will be addressing the meeting today on the topic, “Building a Better Health Consumer.” The IBI is researching the direct link between the top line of a healthy employee base and healthy workers’ impacts on the bottom line. A report will be

Employers pushing consumerism for health benefits in 2016

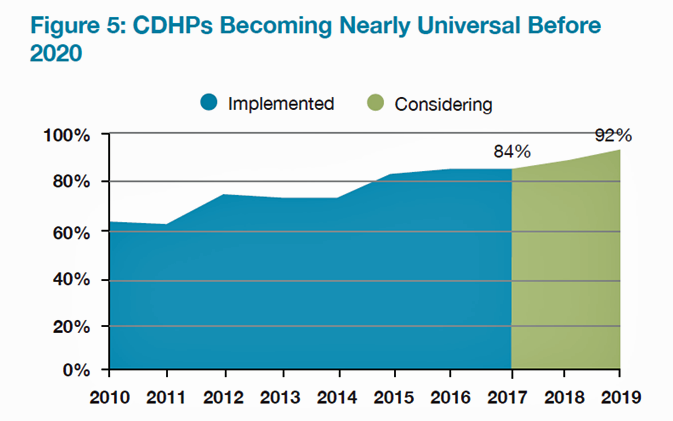

This is the dawning of the Age of Consumer-Driven Health, the tipping point of which has been passed. The data point for this assertion comes from the National Business Group on Health‘s annual 2016 Large Employers’ Health Plan Design Survey. The tagline, “reducing costs while looking to the future,” suggests some of the underlying tactics employers will use to manage their financial burden of providing health insurance to workers. That burden will continue to shift to employees and their dependents in the form of greater cost-sharing: for premiums, co-pays and co-insurance, and the hallmark of consumer-driven health plans (CDHPs): high(er) deductibles.

Sports and the Internet of Things: the Scoop & Score podcast

From elite soccer and football fields to youth athletes in public school gyms, wearable technology has come to sports bringing two big benefits of gathering data at the point of exercise: to gauge performance and coach back to the athlete in real time, and to prevent injury. I discussed the advent of the Internet of Things in sports on the Scoop and Score podcast with Andrew Kahn, sports journalist and writer, and Stephen Kahn, sports enthusiast and business analyst. [In full disclosure these two Kahn’s are also my brilliant nephews.] We recorded the podcast on July 14, 2015, the day

Congratulations, Fitbit – what $4.1 bn looks like

When I clipped you to my underwear for the first time in 2011, I’d no idea that you were about to change my life, health and mindfulness. You were my first digital activity tracker and since then, I’ve purchased three versions of you…as well as others. Fitbit, you really did change my life and help me become more mindful of my activity, my calorie burn, ultimately supporting me in losing weight and keeping it off. Since its launch in 2009, the brand name “Fitbit” has become synonymous with digital activity tracking, the most popular digital pedometer on the market —

Employers go beyond physical health in 2015, adding financial and stress management

Workplace well-being programs are going beyond physical wellness, incorporating personal stress management and financial management. Nearly one-half of employers offer these programs in 2015. Another one-third will offer stress management in the next one to three years, and another one-fourth will offer financial management to workers, according to Virgin Pulse’s 2015 survey of workplace health priorities, The Busness of Healthy Employees. The survey was published June 1st 2015, kicking off Employee Wellbeing Month, which uses the Twitter hashtag #EWM15. It takes a village to bolster population health and wellness, so Virgin Pulse is collaborating with several partners in this effort

Avoiding Wrinkles: A World Without Tobacco

May 31st is World No Tobacco Day, heralded by the World Health Organization, and celebrated by the advocacy group Action on Smoking and Health (with the very appropriate acronym ASH). Smoking is one of the most addictive (anti-)health behaviors around, so persuading people to quit the habit continues to challenge public health advocates. Enter ASH’s engaging campaign called “The Wrinkler,” with the introductory question, “Ever notice how some people who are 25 look 45?” The video continues to explain how we can “expedite the aging process….Ladies, wish you were half your age? Don’t wait for him to look younger; make yourself

Mental health at the workplace – US companies rank #1 for stress

People with anxiety, depression, interpersonal challenges, and substance abuse go to work every day. Together, these factors erode the mental health and wellbeing of workers, and this negatively impacts companies’ productivity, workplace morale, and profitability. Employers are increasingly taking notice of their role in promoting mental health on-the-job, a trend captured in the report Promoting Mental Well-being: Addressing Worker Stress and Psychosocial Risks, an international survey of employers published in May 2015 by Buck Consultants, part of Xerox. The survey polled 439 employers in 31 countries, and the report focuses on the results in four of those nations: Brazil, Singapore, the

Workers at work for the health benefits but absent when it comes to talking costs

As much as the Affordable Care Act is bolstering health insurance rolls for the uninsured, people who have enjoyed health insurance at work continue to highly value that benefit, according to a survey from Benz Communications and Quantum Workplace published April 2015. Based on a national sample of over 2,000 employees surveyed in October 2014 about workplace benefits. The research re-confirms the long-term reality of workers working in America for the health benefit. Benz/Quantum note that 89% of workers say health benefits play a part in remaining on-the-job, and half say the health benefit is a “major” part of remaining

Humana and Weight Watchers Partner in Weight Loss for Employers

More employers are recognizing the link between workers who may be overweight or obese on one hand, and health care costs, employee engagement and productivity on the other. As a result, some companies are adopting wellness programs that focus on weight loss as part of an overall culture of health at the workplace. Humana and Weight Watchers are the latest example of two health brands coming together to address what is one of the toughest behavior changes known to humans: losing weight. Humana will extend access to Weight Watchers for the health plan’s enrollees in an integrated wellness program. The program

Employers grow wellness programs, and ramp up support for fitness tech

Offering wellness programs is universal among U.S. employers, who roughly divide in half regarding their rationale for doing so: about one-half offer wellness initiatives to invest in and increase worker health engagement, and one-half to control or reduce health care costs. Two-thirds of companies offering wellness will increase their budgets, according to the International Foundation of Employee Benefit Plans (IFEBP) report, Workplace Wellness Trends, 2015 survey results. The IFEBP polled 479 employers in October 2014, covering corporate, public, and multi-employer funds in the U.S. and Canada. The statistics discussed in this post refer solely to U.S. organizations included in the study

Whole (Health) Foods – the next retail clinic?

Long an advocate for consumer-directed health in his company, John Mackey, co-CEO and co-Founder of Whole Foods Market, is talking about expanding the food chain’s footprint in retail health. “Americans are sick of being sick,” Mackey is quoted in “Whole Foods, Half Off,” a story published in Bloomberg on January 29, 2015. Mackey talks about being inspired by Harris Rosen, a CEO in Florida, who has developed a workplace clinic for employees’ health care that drives high quality, good outcomes, and lower costs. Mackey imagines how Whole Foods could do the same, beginning in its hometown in Austin, TX. He

Telehealth is in demand, driven by consumer convenience and cost – American Well speaks

Evidence of the rise of retail health grows, with the data point that on-demand health care is in-demand by 2 in 3 U.S. adults. American Well released the Telehealth Index: 2015 Consumer Survey, revealing an American health public keen on video visits with doctors as a viable alternative to visiting the emergency room. Virtual visits are especially attractive to people who have children living at home. [For context, this survey defines “telehealth” as a remote consultation between doctor and patient]. Convenience drives most peoples’ interest in telehealth: saving time and money, not leaving home if feeling unwell, and “avoiding germs

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Building the health ecosystem: new bedfellows coming together

2015 is already becoming a year where bedfellows of different stripes are joining together to build a health care ecosystem well beyond hospitals, doctors and health plans. Announcements launched last week at the 2015 Consumer Electronics Show in Las Vegas, and coming out this week at the J.P. Morgan Conference in San Francisco, the first two weeks of 2015 reveal that new entrants and legacy health stakeholders are crossing corporate and cultural chasms to (try and) solve challenges that prevent us from getting to that Holy Grail of The Triple Aim: improving health care outcomes, driving down per capita costs,

The Internet of Healthy Me – putting digital health in context for #CES2015

Men are from Mars and Women, Venus, when it comes to managing health and using digital tools and apps, based on a poll conducted by A&D Medical, who will be one of several hundred healthcare companies exhibiting at the 2015 Consumer Electronics Show this week in Las Vegas. Digital health, connected homes and cars, and the Internet of Things (IoT) will prominently feature at the 2015 Consumer Electronics Show in Las Vegas this week. I’ll be attending this mega-conference, meeting up with digital health companies and platform providers that will enable the Internet of Healthy “Me” — consumers’ ability to self-track,

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Power to the health care consumer – but how much and when?

Oliver Wyman’s Health & Life Sciences group names its latest treatise on the new-new health care The Patient-to-Consumer Revolution, subtitled: “how high tech, transparent marketplaces, and consumer power are transforming U.S. healthcare.” The report kicks off with the technology supply side of “Health Market 2.0,” noting that “the user experience of health care is falling behind” other industry segments — pointing to Uber for transport, Amazon for shopping, and Open Table for reserving a table. The authors estimate that investments in digital health and healthcare rose “easily ten times faster” than the industry has seen in the past. Companies like

From comprehensive coverage to skin-in-the-game healthcare: Kaiser Family Foundation’s annual survey

For employer-sponsored health care, trends continue for health premium costs to increase, high-deductible health plans to gain adoption, and cost-sharing to shift to workers in companies’ health plans. This is the top-line of the just-released Kaiser Family Foundation (KFF) 2014 Employer Health Benefits Survey, the annual go-to resource on company-sponsored health care trends and realities. As the Kaiser Family Foundation team said during their teleconference to health writers this morning, employer-sponsored health care in America is moving “from comprehensive coverage to skin-in-the-game coverage.” The extent of said skin-in-the-game varies from small to large firms: in small companies (defined in this

Inflection point for telehealth in 2014

The supply side of telehealth has been readying itself for nearly a decade. The demand side appears to be aligning in 2014 for adoption to grow and sustain (some) solid business models. On the demand side, Towers Watson’s 2014 survey of large employers forecasts growth among companies that will offer telemedicine in 2015. Towers found that 37% of employers planned to offer telemedicine to workers as a lower-cost site of care; 34% more employers were considering telemedicine in 2016 or 2017. The health benefits adviser calculates that employers could save over $6 billion if industry replaces virtual health consultations with

Employers engaging in health engagement

Expecting health care cost increases of 5% in 2015, employers in the U.S. will focus on several tactics to control costs: greater offerings of consumer-directed health plans, increasing employee cost-sharing, narrowing provider networks, and serving up wellness and disease management programs. The National Business Group on Health’s Large Employers’ 2015 Health Plan Design Survey finds employers committed to health engagement in 2015 as a key strategy for health benefits. More granularly, addressing weight management, smoking cessation, physical activity, and stress reduction, will be top priorities, shown in the first chart. An underpinning of engagement is health care consumerism — which

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

The Milliman Medical Index at $23,215: A Toyota Prius, a tonne of tin, or health insurance for a family?

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm. The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin. While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6%

Wearable tech + the workplace: driving employee health

Employer wellness programs are growing in the U.S., bundled with consumer-directed plans and health savings accounts. A wellness company’s work with employee groups is demonstrating that workers who adopt mobile health technologies — especially “wearables” coupled with smartphone apps — helps change behavior and drive health outcomes. Results of one such program are summarized in Wearables at Work, a technical brief from Vitality, a joint venture of Humana and Discovery Ltd., published April 23, 2014. Vitality has been working in workplace wellness since 2005, first using pedometers to track workers’ workouts. In 2008, Vitality adopted the Polar heart rate monitor for

Employers spending more on wellness in 2014, with growing focus on food

Employers continue to invest in wellness programs aimed at improving employees’ health. In 2014, 3 in 4 employers plan to offer incentives to employees who participate in health improvement programs compared = and the financial value of these incentives has grown to $500, up from $338 in 2010. In its fifth year, the National Business Group on Health (NBGH)/Fidelity Investments have conducted their benefit consulting survey, culminating in the report, Employer Investments in Improving Employee Health. In the past 5 years, employers have increased their investments in wellness: the chart illustrates the growth of programs addressing physical activity/weight management and health eating,

HIMSS14 Monday Morning Quarterback – The Key Takeaways

Returning to terra firma following last week’s convening of the 2014 annual HIMSS conference…taking some time off for family, a funeral, the Oscars, and dealing with yet another snowstorm…I now take a fresh look back at #HIMSS14 at key messages. In random order, the syntheses are: Healthcare in America has entered an era of doing more, with less...and health information technology is a strategic investment for doing so. The operational beacon going forward is moving toward The Triple Aim: building population health, enhancing the patient’s experience, and lowering costs per patient. The CEO of Aetna, Mark Bertolini, spoke of the

Patient engagement and mobile health – design and timing matter

Thinking about personal health information technology – the wearable devices, remote health monitors, digital weight scales, and Bluetooth-enabled medical equipment scaled for the home – there are two glasses. One is half-full and the other, half-empty. The half-full glass is the proliferation of consumer-facing devices like Fitbit, Jawbone and Nike, which comprise the lion’s market share in the health wearables segment; the mass adoption of mobile phones and tablets; consumers’ multi-screen media behavior (as tracked by Nielsen); and consumers’ growing share of medical spending, now about 40% of annual spending (or something north of $8,000 for a family of four

A CT for $300 or $2,781 – why health price transparency matters

Charges for medical, pharmacy and dental services can vary by more than 300%. This means that in one place, a procedure that costs $100 can cost $300 for the same treatment in another location or practice, discovered by Change Healthcare in their latest Healthcare Transparency Index 2013 Q3 Report, published in January 2014. The 300% is the average overall across dozens of health services used by the 67,000 plan members Change Healthcare analyzed based on health plan enrollees’ health care utilization in the third quarter of 2013. These health care services include office visits (behavioral health, physical therapy and

Employers will strongly focus on costs in health benefit plans for 2014; so must consumers

Employers who sponsor health insurance in America are at a fork on a cloudy road: they know that they’re in the midst of changes happening in the U.S. health system. Except for one certainty: that health care costs too much. So employers’ plans for health benefits in 2014 strongly focus on getting a return-on-investment from health spending in an uncertain climate, according to Deloitte’s 2013 Survey of U.S. Employers. Key findings are that: Employers will grow their use of workers’ cost-sharing, continuing to shift more financial responsibility onto employees They will expand other tactics they believe will help address cost

Color us stressed – how to deal

Coast-to-coast, stress is the modus vivendi for most Americans: 55% of people feel stressed in every day life, according to a study from Televox. A Stressful Nation: Americans Search for a Healthy Balance paints a picture of a nation of physically inactive people working too hard and playing too little. And far more women feel the stress than men do. 64% of people say they’re stressed during a typical workday. 52% of people see stress negatively impacting their lives. And nearly one-half of people believe they could better manage their stress. As a result, physicians say that Americans are experiencing negative

Bundles in health care are the prix fixe menu

Ordering up and financing health care in the U.S. looks like the proverbial Chinese food menu, picking and paying for “one from column A, and one from column C.” But that’s no way to operate a well-oiled machine for delivering quality health care, according to Healthcare Shifts from á la Carte to Prix Fixe from Strategy&, an analysis of the fragmented, high-cost and only fair quality American health system. One solution to this challenge is bundled payment. “No one has an overarching view of the entire process,” the report opines, “with an eye toward improving customer service, quality, or costs.” Further exacerbating the sub-optimal

Innovating and thriving in value-based health – collaboration required

In health care, when money is tight, labor inputs like nurses and doctors stretched, and patients wanting to be treated like beloved Amazon consumers, what do you do? Why, innovate and thrive. This audacious Holy Grail was the topic for a panel II moderated today at the Connected Health Symposium, sponsored by Partners Heathcare, the Boston health system that includes Harvard’s hospitals and other blue chip health providers around the region. My panelists were 3 health ecosystem players who were not your typical discussants at this sort of meeting: none wore bow ties, and all were very entrepreneurial: Jeremy Delinsky

The new era of consumer health risk management: employers “migrate” risk

The current role of health insurance at work is that it’s the “benefits” part of “compensation and benefits.” Soon, benefits will simply be integrated into “compensation and compensation.” That is, employers will be transferring risk to employees for health care. This will translate into growing defined contribution and cost-shifting to employees. Health care sponsorship by employers is changing quite quickly, according to the 2013 Aon Hewitt Health Care Survey published in October 2013. Aon found that companies are shifting to individualized consumer-focused approaches that emphasize wellness and “health ownership” by workers to bolster behavior change and, ultimately, outcomes. The most

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

The health care automat – Help Yourself to healthcare via online marketplaces

Imagine walking into a storefront where you can shop for an arthroscopy procedure, mammogram, or appointment with a primary care doctor based on price, availability, quality, and other consumers’ opinions? Welcome to the “health care automat,” the online healthcare marketplace. This is a separate concept from the new Health Insurance Marketplace, or Exchange. This emerging way to shop for and access health care services is explored in my latest paper for the California HealthCare Foundation (CHCF), Help Yourself: The Rise of Online Healthcare Marketplaces. What’s driving this new wrinkle in retail health care are: U.S. health citizens morphing into consumers,

10 Reasons Why ObamaCare is Good for US

When Secretary Sebelius calls, I listen. It’s a sort of “Help Wanted” ad from the Secretary of Health and Human Services Kathleen Sebelius that prompted me to write this post. The Secretary called for female bloggers to talk about the benefits of The Affordable Care Act last week when she spoke in Chicago at the BlogHer conference. Secretary Sebelius’s request was discussed in this story from the Associated Press published July 25, 2013. “I bet you more people could tell you the name of the new prince of England than could tell you that the health market opens October 1st,” the

Urgent care centers: if we build them, will all patients come?

Urgent care centers are growing across the United States in response to emergency rooms that are standing-room-only for many patients trying to access them. But can urgent care centers play a cost-effective, high quality part in stemming health care costs and inappropriate use of ERs for primary care. That’s a question asked and answered by The Surge in Urgent Care Centers: Emergency Department Alternative or Costly Convenience? from the Center for Studying Health System Change by Tracy Yee et. al. The Research Brief defines urgent care centers (UCCs) as sites that provide care on a walk-in basis, typically during regular

What to expect from health care between now and 2018

Employers who provide health insurance are getting much more aggressive in 2013 and beyond in terms of increasing employees’ responsibilities for staying well and taking our meds, shopping for services based on cost and value, and paying doctors based on their success with patients’ health outcomes and quality of care. Furthermore, nearly one-half expect that technologies like telemedicine, mobile health apps, and health kiosks in the back of grocery stores and pharmacies are expected to change the way people regularly receive health care. What’s behind this? Increasing health care costs, to be sure, explains the 18th annual survey from the National

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

The part-time medical home: retail health clinics

The number of retail health clinics will double between 2012 and 2015, according to a research brief from Accenture, Retail medical clinics: From Foe to Friend? published in June 2013. What are the driving market forces promoting the growth of retail clinics? Accenture points to a few key factors: Hospitals’ need to rationalize use of their emergency departments, which are often over-crowded and incorrectly utilized in cases of less-than-acute care. In addition, hospitals are now financially motivated under the Affordable Care Act (ACA, health reform) to reduce readmissions of patients into beds (particularly Medicare patients with acute myocardial infarction [heart attacks],

The emerging economy for consumer health and wellness

The notion of consumers’ greater skin in the game of U.S. health care — and the underlying theory of rational economic men and women that would drive people to greater self-care — permeated the agenda of the 2nd annual Consumer Health & Wellness Innovation Summit, chaired by Lisa Suennen of Psilos Ventures. Lisa kicked off the meeting providing a wellness market landscape, describing the opportunity that is the ‘real’ consumer-driven health care: people getting and staying well, and increasing participation in self-management of chronic conditions. The U.S. health system is transforming, she explained, with payors beginning to look like computer

Consumer-directed health isn’t always so healthy

Giving health consumers more skin in the game doesn’t always lead to them making sound health decisions. Over four years in consumer-directed health plans, enrollees used one-quarter fewer visits to doctors every year and filled one fewer prescription drugs. CDHP members also received fewer recommended cancer screenings, and visited the emergency room more often. These rational health consumer theory-busting findings were published in the June 2013 issue of the Health Affairs article, Consumer-Directed Health Plans Reduce The Long-Term Use of Outpatient Physician Visits And Prescription Drugs by Paul Fronstin of the Employee Benefit Research Institute and colleagues from IBM and RxEconomics,

Wellness at work – Virgin tells it all

Health, happiness and engagement among employees are closely-linked and drive productivity in the workplace. But there’s a gap between the kind of wellness services employers offer workers to bolster health, and the programs that people actually want. The current state of employer wellness programs is described in a survey conducted by Virgin HealthMiles and Workforce, The Business of Healthy Employees: A Survey of Workplace Health Priorities, published in June 2013. There’s a gap between what workers want for wellness and what employers are offering. Most-demanded by workers are health on-site food choices desired by 79% of employees; but, only 33%

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,