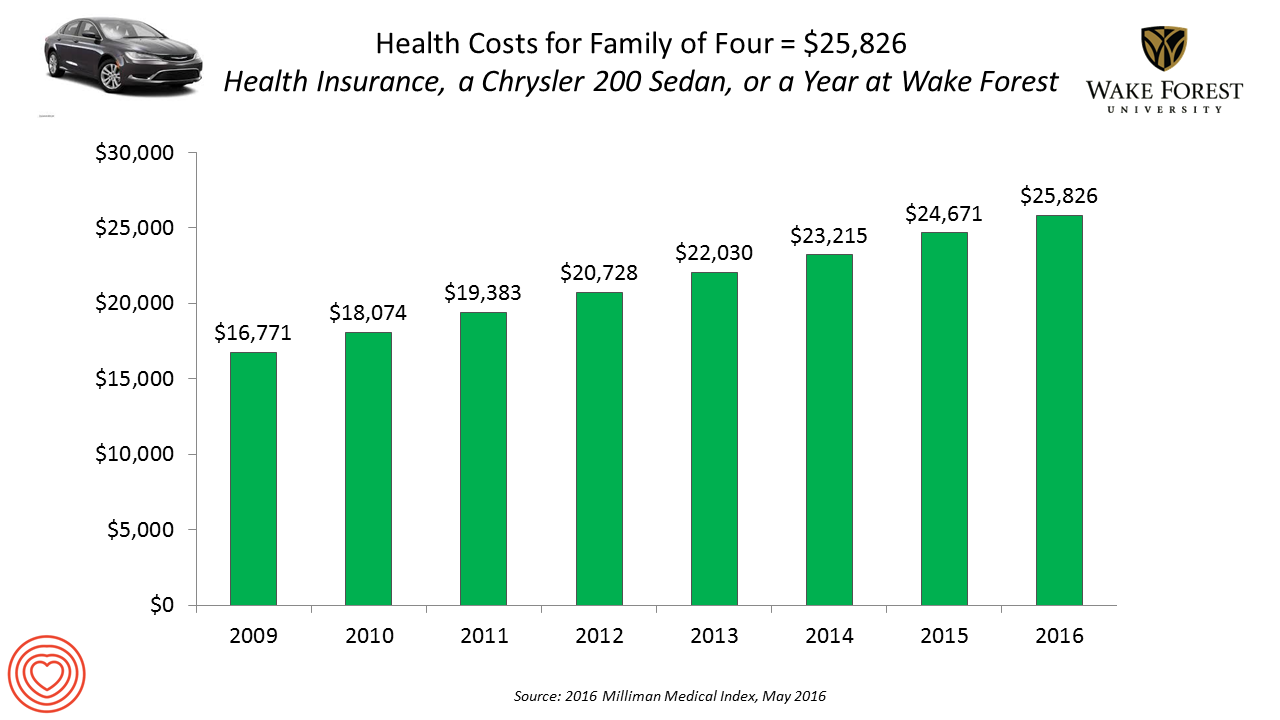

Healthcare Costs for a Family of Four Will Be $25,826 in 2016

If you had exactly $25,826 in your pocket today, would you rather buy a new Chrysler 200 sedan, send a son or daughter to a year of college at Wake Forest University, or pay for your family’s health care in an employer-sponsored preferred provider organization? Welcome to the annual 2016 Milliman Medical Index (MMI), one of the most important health economic studies I’ve relied on for many years. This year’s underlying question is, “Who cooked up this expensive recipe?” posed in the report’s title. The key statistics in this year’s MMI are that: Healthcare costs for a typical family of four

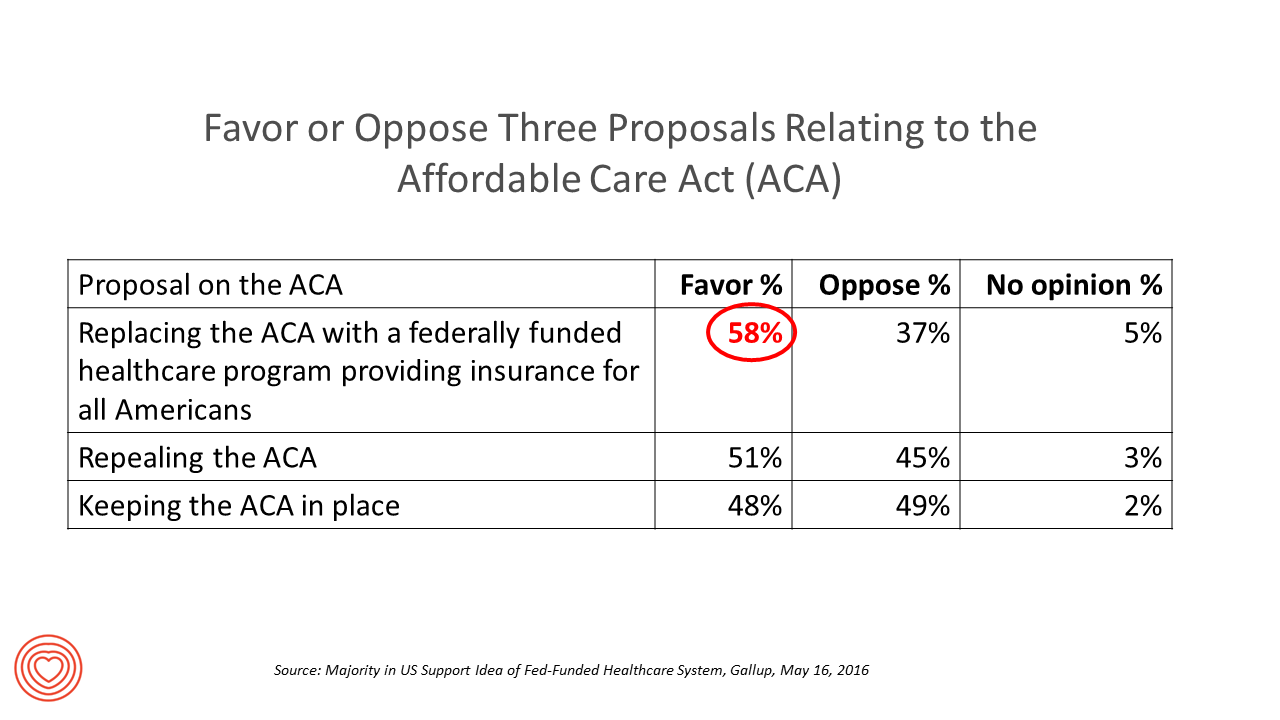

Most Americans Favor A Federally-Funded Health System

6 in 10 people in the US would like to replace the Affordable Care Act with a national health insurance program for all Americans, according to a Gallup Poll conducted on the phone in May 2016 among 1,549 U.S. adults. By political party, RE: Launch a Federal/national health insurance plan (“healthcare a la Bernie Sanders”): Among Democrats, 73% favor the Federal/national health insurance plan, and only 22% oppose it; 41% of Republicans favor it and 55% oppose it. RE: Repeal the ACA (“healthcare a la Donald Trump”): Among Democrats, 25% say scrap the ACA, and 80% of Republicans say to do

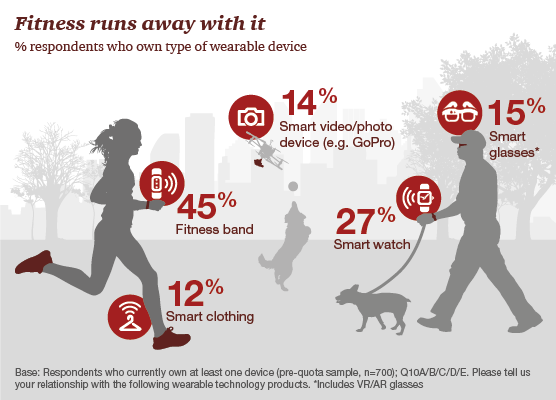

One in Two People Use Wearable Tech in 2016

Nearly 1 in 2 people own at least one wearable device, up from 21% in 2014; one-third of people own more than one such device that tracks some aspect of everyday life, according to PwC’s latest research on the topic, The Wearable Life 2.0 – Connected living in a wearable world, from PwC. Wearable technology in this report is defined as accessories and clothing incorporating computer and advanced electronic technologies, such as fitness trackers, smart glasses (e.g., Google Glass), smartwatches, and smart clothing. Specifically, 45% of people own a fitness band, such as a Fitbit, the most popular device in this

GoHealthEvents, An Online Source For Consumer Retail Health Opportunities

“Health comes to your local store,” explains the recently-launched portal, GoHealthEvents. This site is a one-stop shop for health consumers who are seeking health screenings and consults in local retail channels like big box stores, club stores, drug stores, and grocery stores. Events covered include cholesterol, diabetes, heart health, nutrition, osteoporosis, senior health, vaccinations and immunizations. By simply submitting a zip code, a health consumer seeking these kinds of services can identify where and when a local retailer will provide it. I searched on my own zip code in suburban Philadelphia, and found the following opportunities taking place in the

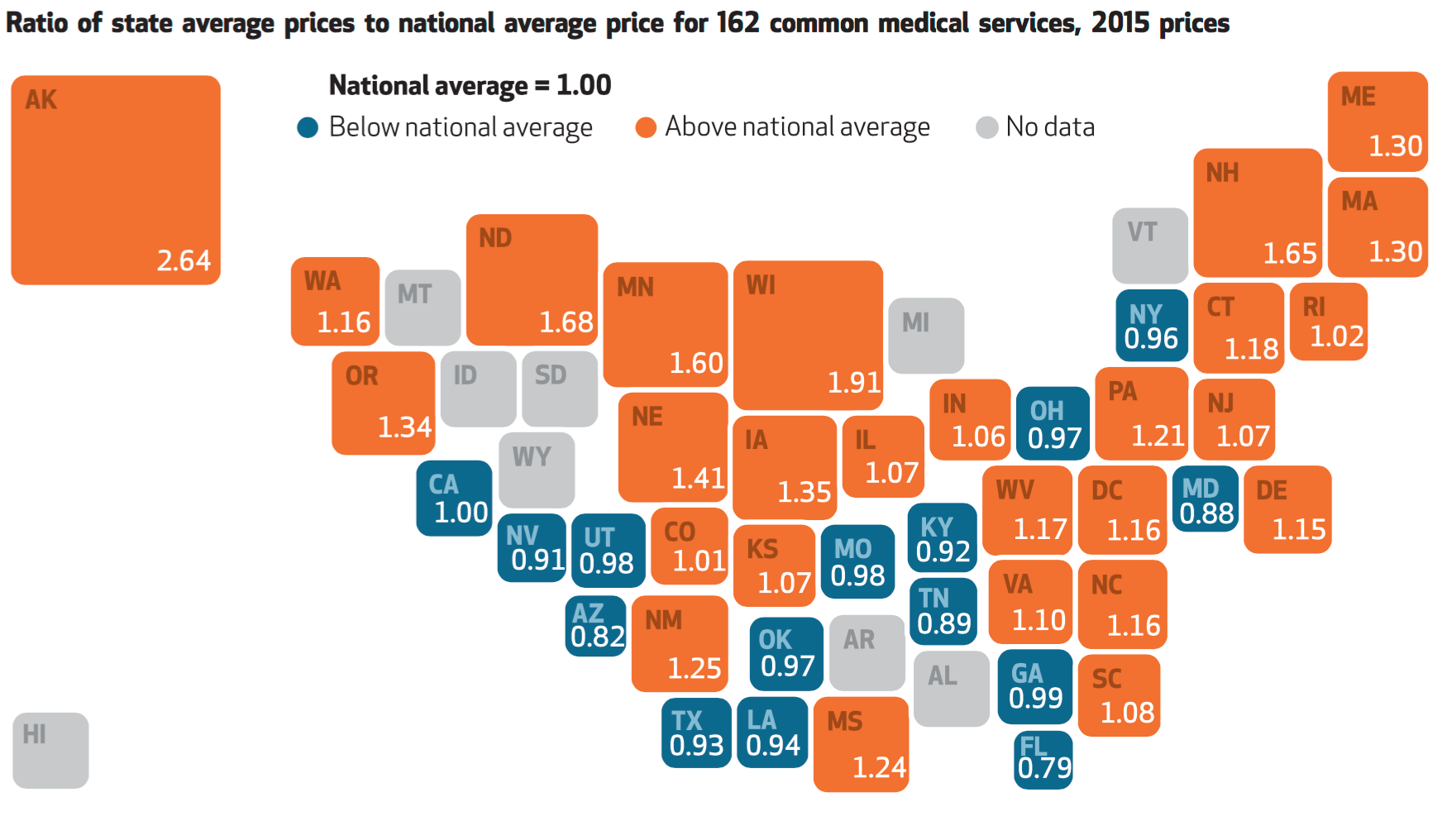

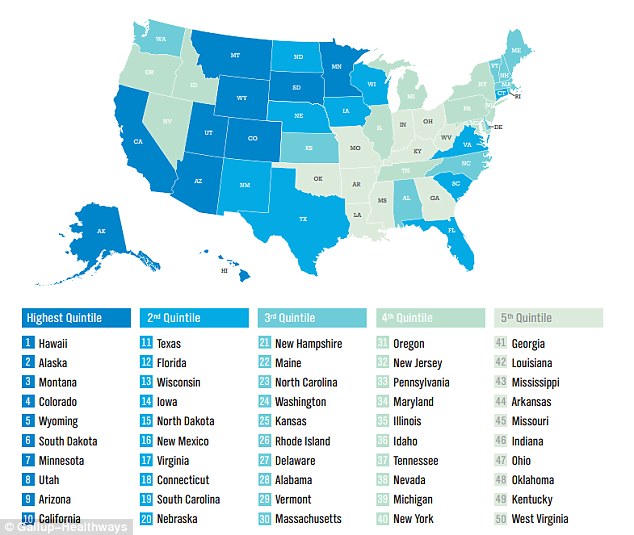

For Healthcare Costs, Geography is Destiny

Where you live in America determines what you might pay for healthcare. In this health economic scenario, as Napoleon is rumored to have said, “geography is destiny.” If you’re searching for low-cost health care, Ohio may just be your state of choice. The map illustrates these health care disparities across the U.S. in 2015, when the price of a single service could vary by more than 200% between one state and another: say, Alaska versus Arizona, or Wisconsin compared to Florida. Even within states, like Ohio, the average price of a pregnancy ultrasound in Cleveland ran nearly three times that received in

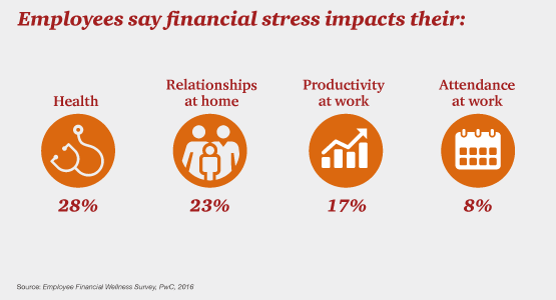

Money, Stress and Health: The American Worker’s Trifecta

Financial stress impacts health, relationships, and work productivity and attendance for employees in the U.S. It’s the American worker’s trifecta, a way of life for a growing proportion of people in the U.S. PwC’s 2016 Employee Financial Wellness Survey for 2016 illustrates the reality of fiscally-challenged working women and men that’s a national epidemic. Some of the signs of the financial un-wellness malaise are that, in 2016: 40% of employees find it difficult to meet their household expenses on time each month 51% of employees consistently carry balances on their credit cards (with a large increase here among Baby Boomers

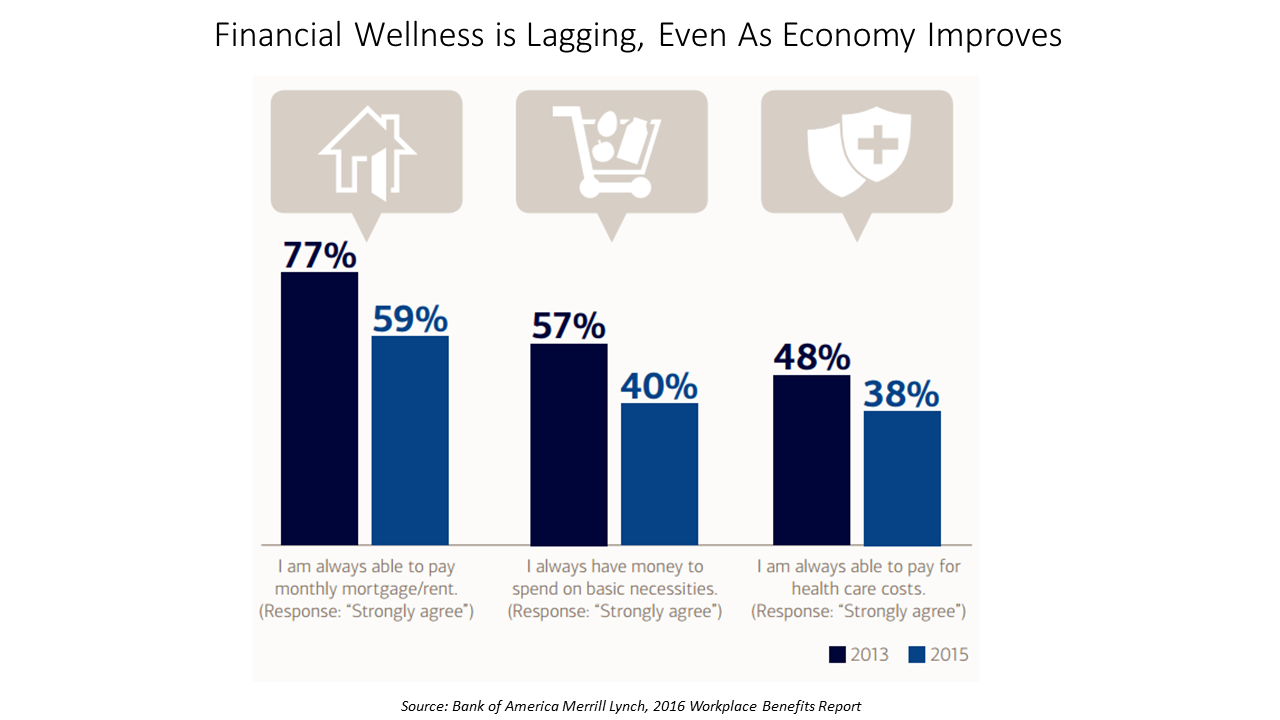

Financial Wellness Declines In US, Even As Economy Improves

American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch. The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this

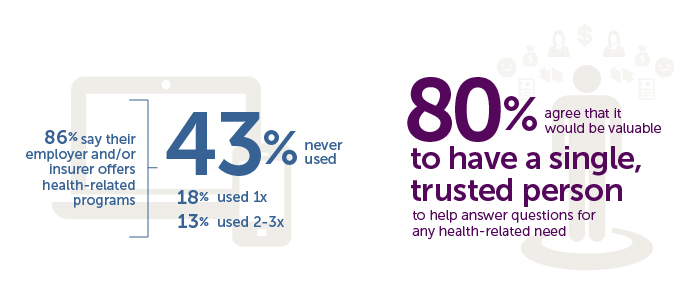

Generation Gaps in Health Benefit Engagement

Older workers and retirees in the U.S. are most pleased with their healthcare experiences and have the fewest problems accessing services and benefits. But, “younger workers [are] least comfortable navigating U.S. healthcare system,” which is the title of a press release summarizing results of a survey conducted among 1,536 U.S. adults by the Harris Poll for Accolade in September 2015. Results of this Accolade Consumer Healthcare Experience Index poll were published on April 12, 2016. Accolade, a healthcare concierge company serving employers, insurers and health systems, studied the experiences of people covered by health insurance to learn about the differences across age

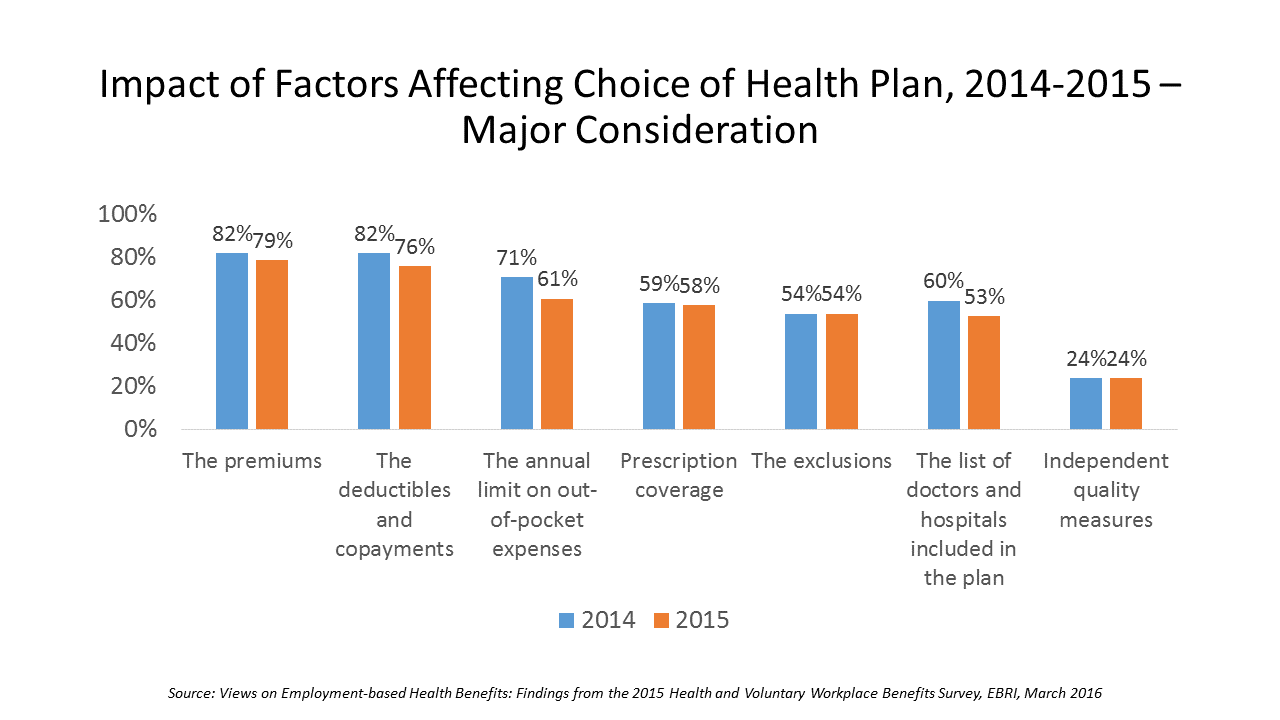

Cost Comes Before “My Doctor” In Picking Health Insurance

Consumers are extremely price-sensitive when it comes to shopping for health insurance. The cost of health insurance premiums, deductibles and copays, prescription drug coverage and out-of-pocket expenses rank higher in the minds of health insurance shoppers than the list of doctors and hospitals included in a health plan for health consumers in 2015. The Employee Benefit Research Institute (EBRI) surveyed 1,500 workers in the U.S. ages 21-64 for their views on workers’ satisfaction with health care in America. The results of this study are compiled in EBRI’s March 2016 issue of Notes, Views on Employment-based Health Benefits: Findings from the 2015 Health

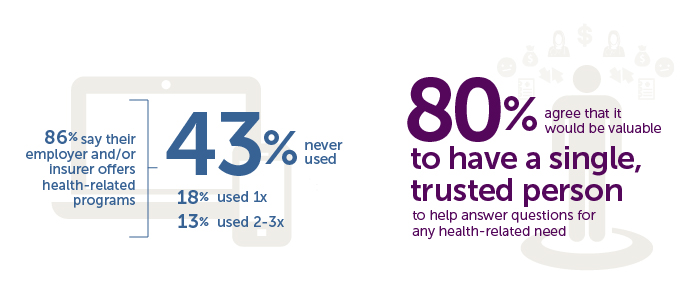

People Want Healthcare Sherpas

8 in 10 Americans would like one trusted person to help them figure out their health care, according to the Accolade Consumer Healthcare Experience Index Poll, conducted by The Harris Poll. The study gauged how Americans feel about their healthcare, especially focusing on employer-sponsored health insurance. One-third of people (32%) aren’t comfortable with navigating medical benefits and the healthcare system; a roughly percentage of people aren’t comfortable with their personal knowledge to make financial investments, either (35%). Buying a car, a home, technology and electronics? Consumers are much more comfortable shopping for these things. Consumers say that the most onerous

What Retail Financial Services Can Teach Healthcare

“Banks and insurance companies that cannot keep pace will find their customers, busy pursuing flawless service models and smart solutions, have moved on without them and they are stranded on the wrong side of the digital divide — from which there will be no return,” according to a report on The Future of Retail Financial Services from Cognizant, Marketforce, and Pegasystems. You could substitute “healthcare providers” for “banks and insurance companies,” because traditional health industry stakeholders are equally behind the consumer demand for digital convenience. This report has important insights relevant to health providers, health plans and suppliers (especially for

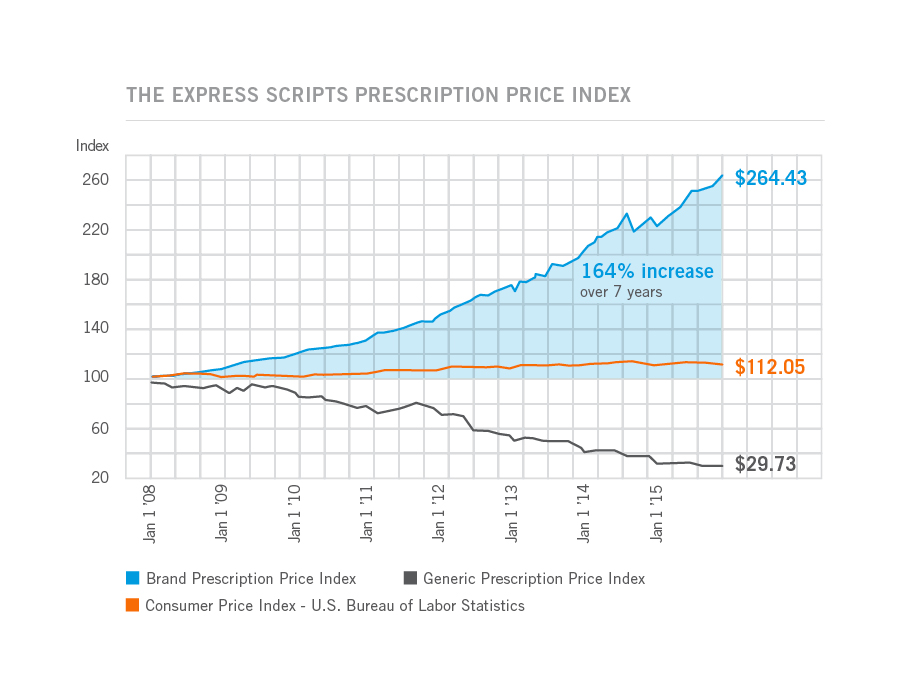

The Rise and Rise of (Specialty) Prescription Drug Prices

Prices for the most commonly used branded prescription drugs grew from a base index of $100 in 2008 to to $264 in 2015, based on the Express Scripts 2015 Drug Trend Report. This is illustrated by the upwardly-sloping blue line in the chart. In contrast, the market basket of the most commonly used generic drugs fell from the $100 index in 2008 to $29.73, shown by the declining black line in the graph. The $112.05 is calculated from a market basket of commonly purchased household goods which cost $100 in 2008, a relatively flat line which puts the 264% rise in

The Link Between Eating and Financial Health

People who more consistently track their calories and food intake are more likely to be fiscally fit than people who do not, suggesting a link between healthy eating and financially wellness. I learned this through a survey conducted in February 2016 among 4,118 people using the Lose It! mobile app, which enables people to track their daily nutrition. Some 25 million people have downloaded Lose It! The app is one of the most consistently-used mobile health tools available in app stores. The Rutgers School of Environmental and Biological Sciences has explored the financial impact of improved health behaviors, asserting that,

Being a Woman is a Social Determinant of Health – Happyish International Women’s Day

Today is International Women’s Day. Being a woman is a social determinant of health (for the worse). To mark the occasion of the Day, The International Labour Organization (ILO) published a report on women and work yesterday, finding that in the 178 countries studied, inequality between women and men persists across labor markets. And while there’s been progress in women’s education over the past twenty years, this hasn’t resulted in women advancing career paths and wage equality. It struck me this morning, reading both (paper versions of) the Wall Street Journal and the Financial Times that the latter had two FT-sponsored ads marking

Tying Health IT to Consumers’ Financial Health and Wellness

As HIMSS 2016, the annual conference of health information technology community, convenes in Vegas, an underlying market driver is fast-reshaping consumers’ needs that go beyond personal health records: that’s personal health-financial information and tools to help people manage their growing burden of healthcare financial management. There’s a financial risk-shift happening in American health care, from payers and health insurance plan sponsors (namely, employers and government agencies) to patients – pushing them further into their role as health care consumers. The burden of health care costs weighs heavier on younger U.S. health citizens, based on a survey from the Xerox Healthcare

Health Consumers Look For Cost and Convenience

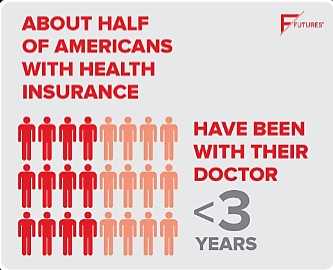

In a growing on-demand society, coupled with a burden of more out-of-pocket health care costs, U.S.health consumers tend to vote with their pocketbooks for healthcare based on cost and convenience, at least when it comes to prescription drug demand, according to the Finn Futures Health Poll conducted by Finn Partners. The survey was conducted in November 2015 among 1,000 U.S. online adults. 51% of consumers have been with their current health plans and primary care physicians for three years or less, which Finn Partners sees as a sign that brand loyalty isn’t a top motivation for health consumers signing on

Improving the Patient Experience in Legacy Health Systems – My Start-Up Health Interview

The so-called legacy healthcare system are the incumbents in American health care — hospitals, physician practices, pharma, health plans, and other organizations that have long-served and been reimbursed by traditional volume-based payment. Patients, now morphing in to health consumers, look to these stakeholders to provide new levels of service, accessibility, convenience, transparency and value — the likes of which people find in their daily life in other market sectors. Those consumer demands are pressuring the health system as we know it in many new ways, which I discussed with Unity Stoakes, Co-Founder of Startup Health, at the Health 2.0 Conference in

It’s Good to Be Hawaiian When It Comes to Health – the 2015 States of Well-Being

Where you live in the U.S. is a risk factor for your health. Hawaii, Alaska, Montana, Colorado and Wyoming rank highest on the State of American Well-Being 2015 State Well-Being Rankings, the Gallup-Healthways Well-Being Index. Well-Being is based on an index of five components that people self-assess: purpose, social, financial, community, and physical. See the map: the darker blue the state, the healthier the population perceives itself to be. Note more light blue to the northeast and south, and dark blue in the mountain states, Alaska and Hawaii. Some states have stayed in the top-tier of wellness since 2012: Hawaii

Prescription Drug Costs Will Be In Health Benefits Bullseye in 2016

Prescription drug costs have become a front-and-center health benefits cost issue for U.S. employers in 2015, and in 2016 the challenge will be directly addressed through more aggressive utilization management (such as step therapy and prior authorization), tools to enable prescription intentions like DUR, and targeting fraud, waste and abuse. Consumers, too, will be more financially responsible for cost-sharing prescription drugs, in terms of deductibles and annual out-of-pocket limits, as described in the PBMI 2015-206 Prescription Drug Benefit Cost and Plan Design Report, sponsored by Takeda. The Pharmacy Benefit Management Institute has published this report for 15 years, which provides neutral, detailed survey

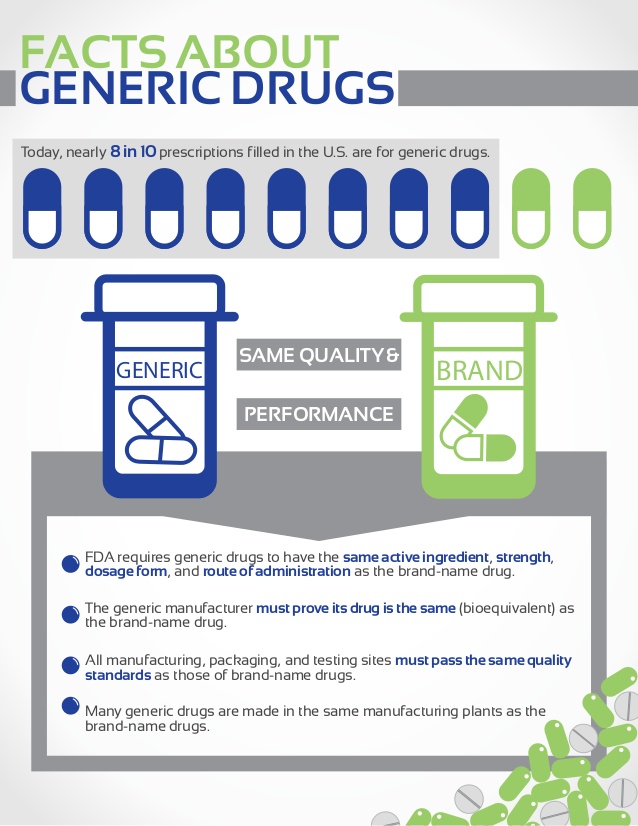

Americans Like Generic Drugs Over Brands

“What’s in a name?” Juliet asked in Shakespeare’s play. For medicines consumers in the U.S., not much. Most Americans prefer generics products, according to The Harris Poll’s survey. 7 in 10 U.S. adults choose generics over brands when given a choice. 3 in 10 people say they would “always” choose generics, whether a prescription drug or an over-the-counter product (store brand, private label). While most people across all age groups would choose generics over brand ames for meds, parents with children in the households would more likely choose a brand name (36% with vs. 28% without kids). Still, 66% of

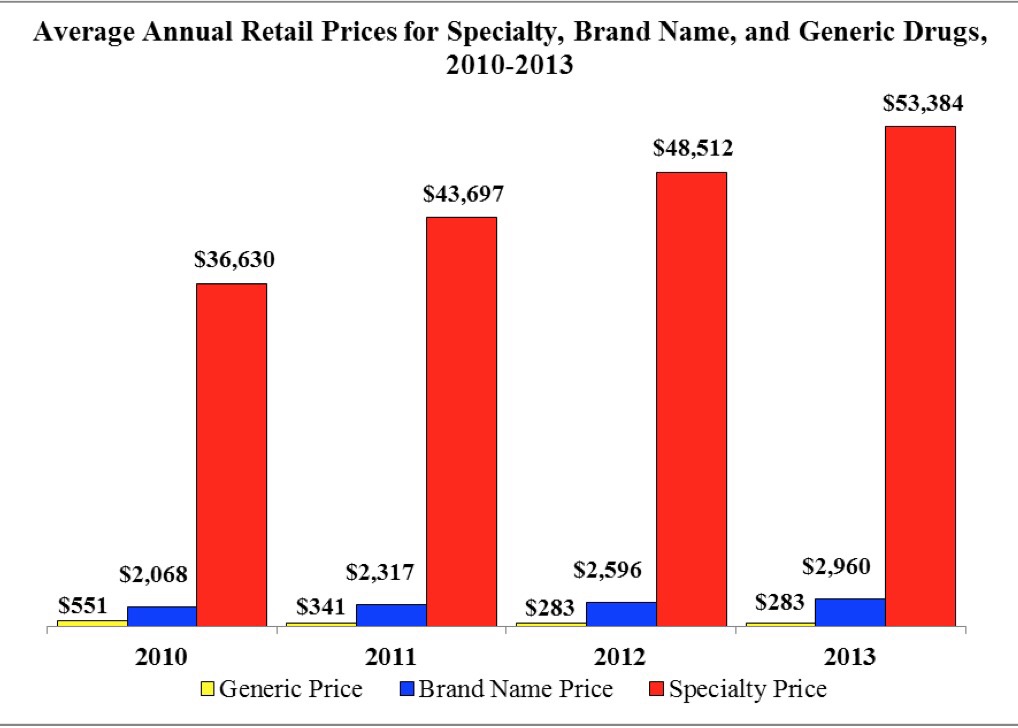

The Average Price of a New Specialty Drug Exceeds Median U.S. Annual Income; and a Tweet from Pam Anderson

The average price for a specialty drug was $53,384 in 2013; the average household income was $52,250. Thus, even allocating 100% of a family’s annual earnings to pay for a drug wouldn’t stretch far enough to cover it in 2013, nor would it do so today in 2015. This sober health economic artifact comes from the latest Rx Price Watch Report from the AARP, detailing cost trends for prescription drugs across all segments — generics, brands and specialty drugs. Contrast, as well, the $53K for the average specialty drug with the median 2013 Social Security benefit payout of $15,526 and median Medicare

American health citizens hungry for cost controls

Most Americans support price controls on drug and medical device manufacturers, hospitals, and payments to doctors, along with allowing Medicare to negotiate drug prices. U.S. health citizens, now consumers, have been experiencing sticker-shock when it comes to prices on medical bills upon hospital discharge, leaving the doctor’s office, filling a prescription at a pharmacy or receiving a specialty drug recommended for a serious medical condition. The HealthDay/Harris Poll of 5 November 2015 quantifies their observation that Americans Want Bold Steps to Keep Health Care Costs in Check. The topline of the Poll shows that: 73 percent support price controls on

My Breakfast With Alain – On Health Consumers and the New Retail Health

My National Health Care Consumer Week, I’ll coin this, looking back on flying some 12,000 airmiles over six days, criss-crossing America from the City of Brotherly Love to Sacramento, back to Philly and then to Los Angeles. Finally, today, heading home to Philadelphia and my beloved, most necessary Tempur-Pedic bed, a loving husband and some therapeutic TV binge-watching. It’s Friday and I’m at LAX, reflecting on a week of meeting with three groups of healthcare executives and stakeholders who all wanted to hear my take on the evolution of patients, people, caregivers, all, morphing into health care consumers. The lens

In 2016 Prescription Drugs Will Be The Fastest-Growing Component of Healthcare Costs

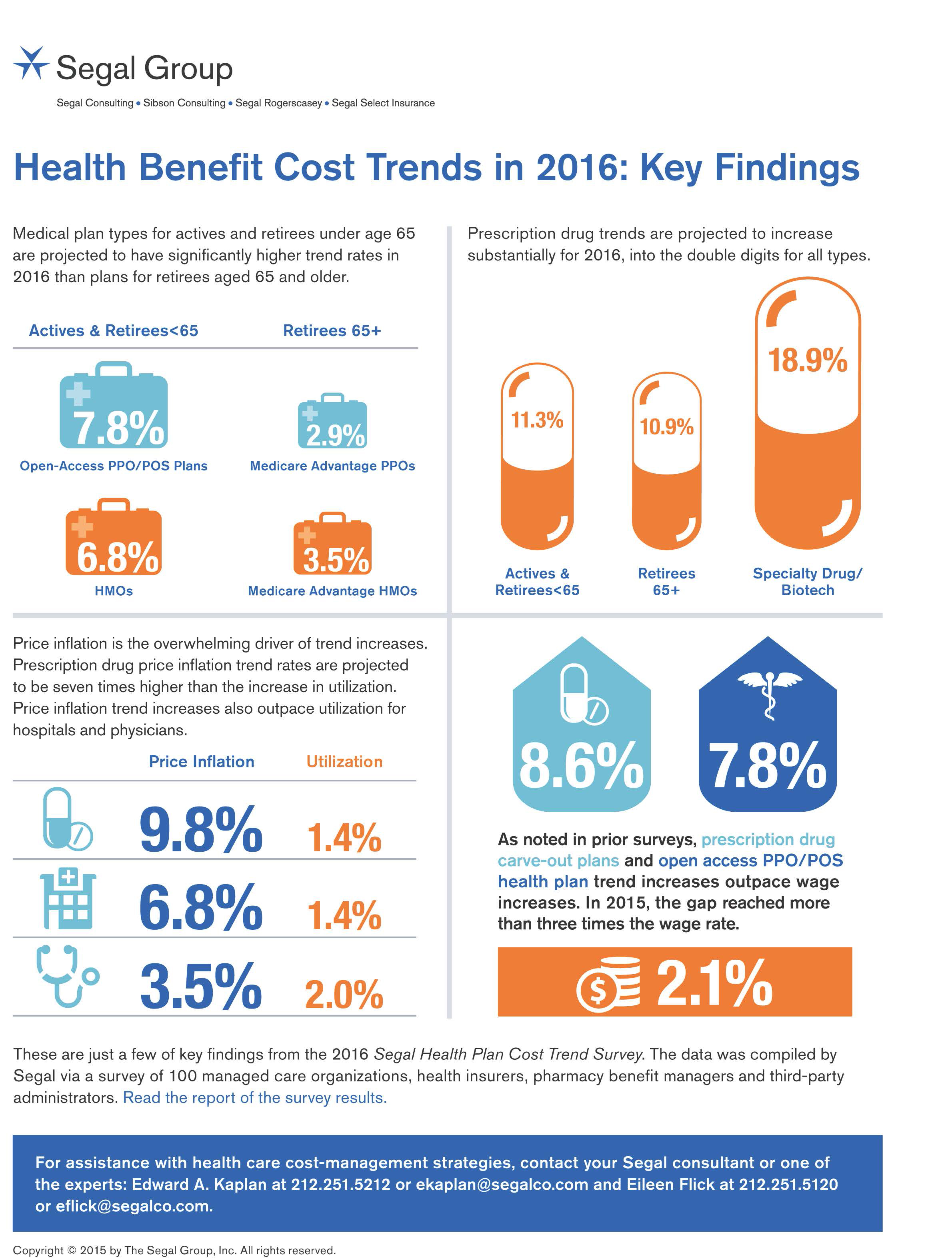

In 2016, prescription drug trend will rise over 11%. In contrast, medical trend growth for high-deductible health plans is expected to be 8%, hospital services 8.2%, and physician services 5.5%, according to the 2016 Segal Health Plan Cost Trend Survey released in September 2015. By definition, “trend” is the forecast of per capita health insurance claims cost increases that incorporate many factors include price inflation, utilization, government-mandated benefits, and new therapies and technologies. Consider the upper right portion of the infographic which illustrates Segal’s data: the 3 “capsule” diagrams show that specialty drug trend is anticipated to be 18.9% in

U.S. Consumers’ View of Pharma Goes Negative in 2015

Americans’ views of the pharmaceutical industry have fallen in the past year, with negative perceptions outweighing positive ones, shown in the line graph from the Gallup Poll. Pharma’s low-lying reputation among consumers sits among others including the legal field, healthcare, oil and gas, and the Federal government which ranked lowest across all 25 sectors Gallup analyzed. Gallup surveyed 1,011 U.S. adults in in the first week of August 2015 via telephone. Since 2003, Gallup notes, the pharma industry has consistently ranked in the bottom third of industries operating in the U.S. Pharma respect is in the eye of the consumer-beholder

A Company’s Healthy Bottom Line Requires Healthy Employees

“What is the meaning of health to our businesses?” asked Dr. Thomas Parry of the Integrated Benefits Institute (IBI) at a dinner last night, convened by the Pittsburgh Business Group on Health on the eve of the organization’s annual meeting being held today in Steel City. I was fortunate to attend the dinner and hear Dr. Parry speak; I will be addressing the meeting today on the topic, “Building a Better Health Consumer.” The IBI is researching the direct link between the top line of a healthy employee base and healthy workers’ impacts on the bottom line. A report will be

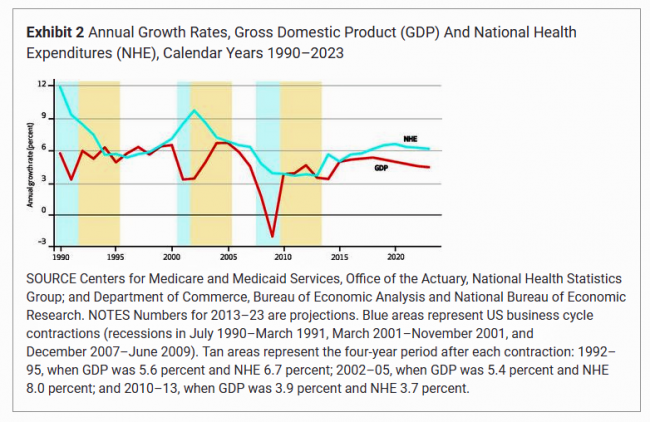

Medicare Makes the Case for Outcomes, As Increasing Costs Loom

Health costs in America will grow faster (again), and health outcomes have improved in the past decade. This week, two of the most important health journals feature health economics data and analyses that paint the current landscape of the U.S. health care system – the good, the warts, and the potential. Health Affairs provides the big economic story played out by the forecasts of the Centers for Medicare and Medicaid Services (CMS) in National Health Expenditure Projections, 2014-24: Spending Growth Faster Than Recent Trends. The topline of the forecast is that health spending growth in the U.S. will annually average

What the SCOTUS ACA ruling means for health consumers

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America? I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for

Most Americans say drug prices are unreasonable and blame company profits

Three-quarters of U.S. adults say the cost of prescription drugs are unreasonable, and blame high medication prices set by profitable pharmaceutical companies according to the Kaiser Family Foundation Health Tracking Poll for June 2015. Profits made by drug companies are the #1 reason Americans cite among major factors that contribute to the price of prescription drugs (among 77% of people), followed by the cost of medical research (64%), the cost of marketing and advertising (54%), and the cost of lawsuits (49%). Regardless of the cost, 71% of people say that health insurance should “always” pay for high-cost drugs. At the same

The 3 tectonic forces shaping patients – it’s BIO week

Patients in the U.S. are transforming into health care consumers, and in 2015 there are 3 underlying forces shaping that new consumer. This week kicks off the annual BIO conference in Philadelphia, and today Klick Health, the digital communications firm, convenes a group of thought leaders in healthcare to brainstorm markets, financing, and the state of pharmaceutical and life science innovation. An underlying theme throughout this meet-up is patient’s role in health/care. Patients are people, consumers, caregivers, mothers, fathers, sisters, brothers, friends, neighbors, community members, taxpayers, all. We’re old, we’re young, we’re mobile and not-so-much, we’re amputees, we’re migraneurs, we’re cancer

It’s still the prices, stupid – health care costs drive consumerism

“It’s the prices, stupid,” wrote Uwe Reinhardt, Gerald F. Anderson and colleagues in the May 2003 issue of Health Affairs. Exactly twelve years later, three reports out in the first week of June 2015 illustrate that salient observation that is central to the U.S. healthcare macroeconomy. Avalere reports that spending on prescription drugs increased over 13% in 2014, with half of the growth attributable to new product launches over the past two years. Spending on pharmaceuticals has grown to 13% of overall health spending, and the growth of that spending between 2013-14 was the fastest since 2001. In light of

Employers go beyond physical health in 2015, adding financial and stress management

Workplace well-being programs are going beyond physical wellness, incorporating personal stress management and financial management. Nearly one-half of employers offer these programs in 2015. Another one-third will offer stress management in the next one to three years, and another one-fourth will offer financial management to workers, according to Virgin Pulse’s 2015 survey of workplace health priorities, The Busness of Healthy Employees. The survey was published June 1st 2015, kicking off Employee Wellbeing Month, which uses the Twitter hashtag #EWM15. It takes a village to bolster population health and wellness, so Virgin Pulse is collaborating with several partners in this effort

How Growing Income Inequality Hurts Everyone, and Especially Our Health

Income inequality has increased in most developed countries, and especially in the U.S., according to the OECD’s report, In It Together: Why Less Inequality Benefits All, published in May 2015. The red arrow in the first chart shows where the U.S. ranks versus other developed nations in income inequality, which is defined as the wealth gap between rich and poor people. The U.S. has the greatest income inequality in the developed world. The second chart shows data for the U.S. on benefits provided to low-wage workers (the bottom 25% of wage earners) versus high-wage workers (the top 25% of earners).

Musings with Mary Meeker on the Digital/Health Nexus

People in the U.S. spend over five-and-a-half hours a day with digital media in 2015, with time on mobile devices exceeding use of laptop and desktop computers. The growth of mobile means people are using and seeking more just-in-time services in daily living, and this has big implications for health/care, based on the annual mega-report on Internet Trends from Mary Meeker, KPCB’s internet analyst. “People” in health/care are patients, consumers and caregivers; people in health/care are also health plan administrators, employer benefits managers, doctors, nurses, allied health professionals, financial managers in hospitals, pharmacists, and the entire range of humans who

Avoiding Wrinkles: A World Without Tobacco

May 31st is World No Tobacco Day, heralded by the World Health Organization, and celebrated by the advocacy group Action on Smoking and Health (with the very appropriate acronym ASH). Smoking is one of the most addictive (anti-)health behaviors around, so persuading people to quit the habit continues to challenge public health advocates. Enter ASH’s engaging campaign called “The Wrinkler,” with the introductory question, “Ever notice how some people who are 25 look 45?” The video continues to explain how we can “expedite the aging process….Ladies, wish you were half your age? Don’t wait for him to look younger; make yourself

All women are health workers

The spiritual and emotional top the physical in women’s definition of “health,” based on a multi-country survey conducted in Brazil, Germany, Japan, the UK and the U.S. The Power of the Purse, a research project sponsored by the Center for Talent Innovation, underscores women’s primary role as Chief Medical Officers in their families and social networks. The research was sponsored by health industry leaders including Aetna, Bristol-Myers Squibb, Cardinal Health, Eli Lilly and Company, Johnson & Johnson, Merck & Co., Merck KGaA, MetLife, Pfizer, PwC, Strategy&, Teva, and WPP. The study’s summary infographic is titled How the Healthcare Industry Fails

Health care costs for a family of four in the U.S. reach $24,671 in 2015

The cost of a PPO for a family of four in America hits $24,671 in 2015, growing 6.3% over 2014’s cost. The growth in health care costs will be driven by high specialty prescription drug costs. The 6.3% growth rate in health costs is a stark increase compared with the twelve month April 2014-March 2015 decline in the Consumer Price Index of -0.1%. Welcome to the 2015 Milliman Medical Index, subtitled “Will the typical American family of four be driving a ‘Cadillac plan’ by 2018?” The MMI gauges the average cost of an employer-sponsored preferred provider organization (PPO) health plan and includes all

Purchase of wearable fitness trackers expected to grow in 2015, but one-half of Americans would “never” buy one

Headphones and smartphones are the top two electronics products U.S. consumers intend to purchase in 2015. But the emerging consumer electronics categories of wearable fitness trackers, smart watches, and smarthome devices (especially “smart” thermostats) are positioned to grow, too, in 2015, according to the 17th Annual CE Ownership and Market Potential Study from the Consumer Electronics Association (CEA). Wearable trackers have an installed base of about 17 million devices in the U.S., with 11% of U.S. households intending to purchase a tracker in 2015 — 6 percentage points up from 2014 (about a 50% increase over 2014). There are about 6 million smart

Supersize Rx: the impact of specialty drug spending and Hep C in 2014

The number of people in the U.S. spending over $100,000 a year on prescription drugs tripled in 2014, according to Super Spending: U.S. Trends in High-Cost Medication Use, from The Express Scripts Lab. Express Scripts is a pharmacy benefits management company that manages over one billion prescriptions a year. The company analyzed prescription drug claims for 31.5 million health plan members for this study, in commercially insured, Medicare, and Medicaid plans. The big-dollar story in 2014 was Hepatitis C, with a relatively small patient population but a super-sized drug spend as the first chart shows: a very tall blue bar (Rx

Happy 25 million, MinuteClinic and CVS Health!

Call it a Silver Million Anniversary, if you will: The MinuteClinic just saw its 25 millionth patient. This is a milestone in the evolution and growth of retail health in America, a trend-marker in this growing health industry segment that will become increasingly used by consumers, patients, parents, and caregivers. CVS bought the MinuteClinic in 2006, when the organization treated seven illnesses. Today, MinuteClinic offers 65 services and vaccinations in nearly 1,000 clinics located in 31 states and Washington, DC. In addition, MinuteClinic will grow the number of clinic locations in both existing and new markets. The company will open

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

The Consumer in the New Health Economy: Out-of-Pocket

The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not. Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.” U.S. News &

Capital investments in health IT moving healthcare closer to people

In recent weeks, an enormous amount of money has been raised by organizations using information technology to move health/care to people where they live, work, and play… This prompted one questioner at the recent ANIA annual conference to ask me after my keynote speech on the new health economy, “Is the hospital going the way of the dinosaur?” Before we get to the issue of possible extinction of inpatient care, let’s start with the big picture on digital health investment for the first quarter of 2015. Some $429 mm was raised for digital health in the first quarter of 2015,

Banks — a new entrant in the health/care landscape

TD Bank gifted free Fitbit activity trackers to new customers signing up for savings accounts in the 2015 New Year. John Hancock is discounting life insurance premiums for clients who track steps and take on preventive care strategies. And Banco Sabadell in Spain, along with Westpac in New Zealand and Standard Chartered in the United Kingdom are all piloting wearable technology for consumer financial management. Financial wellness is an integral part of peoples’ overall health, so financial services companies are putting their collective corporate feet into the health/care market. Banks and consumer investment companies are new entrants in health/care as

Nurses are consumers’ trusted partners-in-health

The two most trusted health professionals in the eyes of U.S. consumers are nurses and pharmacists, and both of these health workers will be key partners for people wanting to engage in health/care. That was my introductory message kicking off the annual conference of ANIA, the American Nursing Informatics Association, in Philadelphia on April 24, 2015. Meeting in the City of Brotherly Love gave ANIA the opportunity to theme the meeting a “Declaration of Nursing Informatics,” carrying that theme through the exhibition hall with a Benjamin Franklin lookalike walking the floor availing himself of attendees’ requests for selfie-taking with the

Health = love. Care = love. Healthcare? Meh

Bruce Broussard, CEO of Humana, forgot the charger for his smartwatch on a business trip. Stopping into a consumer electronics store, he was struck by the options he faced of various wearable technologies. He ended up buying a new watch, which he uses for exercise tracking. “Technology is such an important part of the direction of health care,” Broussard told the HIMSS 2015 audience in his keynote address on 14 April 2015. But Broussard was quick to point out to the thousands of technology geeks that comprise HIMSS’s membership that improving the health/care system isn’t just about technology: “we have

Health is where we live, work, and shop…at Walgreens

Alex Gourley, President of The Walgreen Company, addressed the capacity crowd at HIMSS15 in Chicago on 13th April 2015, saying his company’s goal is to “make good health easier.” Remember that HIMSS is the “Health Information and Management Systems Society” — in short, the mammoth health IT conference that this year has attracted over 41,000 health computerfolk from around the world. So what’s a nice pharmacy like you, Walgreens, doing in a Place like McCormick amidst 1,200+ health/tech vendors? If you believe that health is a product of lifstyle behaviors at least as much as health “care” services (what our

John Hancock flips the life insurance policy with wellness and data

When you think about life insurance, images of actuaries churning numbers to construct mortality tables may come to mind. Mortality tables show peoples’ life expectancy based on various demographic characteristics. John Hancock is flipping the idea life insurance to shift it a bit in favor of “life” itself. The company is teaming with Vitality, a long-time provider of wellness tools programs, to create insurance products that incorporate discounts for healthy living. The programs also require people to share their data with the companies to quality for the discounts, which the project’s press release says could amount to $25,000 over the

Workers at work for the health benefits but absent when it comes to talking costs

As much as the Affordable Care Act is bolstering health insurance rolls for the uninsured, people who have enjoyed health insurance at work continue to highly value that benefit, according to a survey from Benz Communications and Quantum Workplace published April 2015. Based on a national sample of over 2,000 employees surveyed in October 2014 about workplace benefits. The research re-confirms the long-term reality of workers working in America for the health benefit. Benz/Quantum note that 89% of workers say health benefits play a part in remaining on-the-job, and half say the health benefit is a “major” part of remaining

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

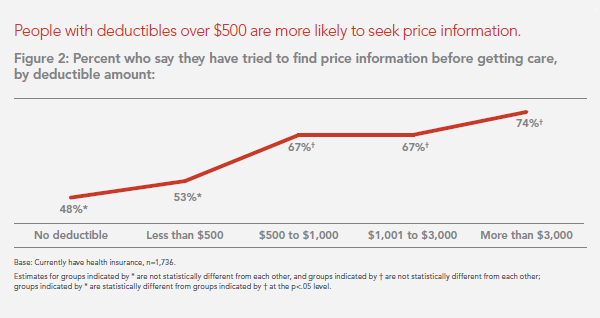

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Americans are spending $1 in $5 on health care

People in the U.S. are spending over 20.6% of their income on health care, according to data published by the U.S. Department of Commerce on March 2, 2015. This is up from 15% of personal income in 1990. Note the slope of this curve, moving up the X-Y axes from southwest to northwest. Now note the slope of the curves in the second chart, which illustrates consumer spending on other household goods and services: cars, housing, clothing, education, groceries, and eating outside of the home. Spending on these home budget line items remained relatively flat over the 25 year period 1990-2015,

Digital health love – older people who use tech like health-tech, too

As people take on self-service across all aspects of daily living, self-care in health is growing beyond the use of vitamins/minerals/supplements, over-the-counter meds, and trying out the blood-pressure cuff in the pharmacy waiting for a prescription to be filled. Today, health consumers the world over have begun to engage in self-care using digital technologies. And this isn’t just a phenomenon among people in the Millennial generation. Most seniors who regularly use technology (e.g., using computers and mobile phones) are also active in digitally tracking their weight, for example, learned in a survey by Accenture. Older people who use technology in daily

Most people want to go digital for health – especially the un-well

2 in 3 people in the U.S. would use a mobile app to manage their health, especially for diet and nutrition, medication reminders, tracking symptoms, and recording physical activity. The fifth annual Pulse of Online Health survey from Makovsky finds that digital health is blurring into peoples’ everyday lives. We’ve covered previous Makovsky digital health surveys here on Health Populi; last year, we focused on consumers managing risk in digital health platforms, and in 2013, the state of seeking health information online. That most consumers would go beyond health information search to the more engaging pursuit of managing health over

A health agenda comes to the 2015 Oscars

The 87th annual 2015 Oscars show (#Oscars15) feted more than the movie industry: the event celebrated health in both explicit and subtle ways. Julianne Moore took the golden statuette for Best Actress, playing the title role in Still Alice, the story a woman diagnosed with early-onset Alzheimer’s Disease. In accepting her award, Moore spoke of the need to recognize and “see” people with Alzheimer’s – so many people feel isolated and marginalized, Moore explained. Movies help us feel seen and not alone – and people with Alzheimer’s need to be seen so we can find a cure, she asserted. See Moore’s lovely

Employers grow wellness programs, and ramp up support for fitness tech

Offering wellness programs is universal among U.S. employers, who roughly divide in half regarding their rationale for doing so: about one-half offer wellness initiatives to invest in and increase worker health engagement, and one-half to control or reduce health care costs. Two-thirds of companies offering wellness will increase their budgets, according to the International Foundation of Employee Benefit Plans (IFEBP) report, Workplace Wellness Trends, 2015 survey results. The IFEBP polled 479 employers in October 2014, covering corporate, public, and multi-employer funds in the U.S. and Canada. The statistics discussed in this post refer solely to U.S. organizations included in the study

Whole (Health) Foods – the next retail clinic?

Long an advocate for consumer-directed health in his company, John Mackey, co-CEO and co-Founder of Whole Foods Market, is talking about expanding the food chain’s footprint in retail health. “Americans are sick of being sick,” Mackey is quoted in “Whole Foods, Half Off,” a story published in Bloomberg on January 29, 2015. Mackey talks about being inspired by Harris Rosen, a CEO in Florida, who has developed a workplace clinic for employees’ health care that drives high quality, good outcomes, and lower costs. Mackey imagines how Whole Foods could do the same, beginning in its hometown in Austin, TX. He

Fiscal and physical fitness: TD Bank makes the link

What does a bank have to do with health? Plenty, if you listen to 70% of consumers who say that financial health has a positive impact on physical health. TD Bank released the Fiscal Fitness survey this week, finding that consumers make a direct connection between fiscal and physical fitness. That’s what we here at THINK-Health refer to as financial wellness. TD learned that 80% of consumers made a health resolution in the New Year and 69% of people made a financial resolution 40% of people want to save more and spend less, and 42% want to get healthy and

Hug your physician – chances are, s/he’s burned out

If you’re meeting with a physician in the next week or two, put on your empathy hat: chances are, they are feeling burned-out. Overall 46% of physicians report they were burned out in 2014, up from just under 40% last year. Medscape’s Physician Lifestyle Report 2015 finds that at least one-half of physicians are burned-out who work in critical care, emergency medicine, family medicine, internal medicine, general surgery, and infectious disease (including HIV). And, at least 37% of physicians are burned-out working in all other specialties, shown in the first chart. Medscape gauges doctors’ self-assessments of burnout with a lens

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Getting real about consumer demand for wearables: Accenture slows us down

Are you Feelin’ Groovy about wearables? Well slow down, you move too fast… …at least, according to Accenture’s latest survey into consumers’ perspectives on new technologies, published this week in conjunction with the 2015 Consumer Electronics Show in Las Vegas, the largest annual convention in the U.S. featuring technology for people. At #CES2015, we’re seeing a rich trove of blinged-out, multi-sensor, shiny new wearable things at the 2015 Consumer Electronics Show. Swarovski crystals are paired with Misfit Wearables, called the Swarovski Shine, shown here as a shiny new thing, indeed. Withings launched its Activite fitness tracking watch in new colors.

The Internet of Healthy Me – putting digital health in context for #CES2015

Men are from Mars and Women, Venus, when it comes to managing health and using digital tools and apps, based on a poll conducted by A&D Medical, who will be one of several hundred healthcare companies exhibiting at the 2015 Consumer Electronics Show this week in Las Vegas. Digital health, connected homes and cars, and the Internet of Things (IoT) will prominently feature at the 2015 Consumer Electronics Show in Las Vegas this week. I’ll be attending this mega-conference, meeting up with digital health companies and platform providers that will enable the Internet of Healthy “Me” — consumers’ ability to self-track,

Trend-weaving the 2015 health care trends

‘Tis the season for annual health trendcasting, which is part of my own business model. Here’s a curated list of some of my favorite trend reports for health care in the new year, with my Hot Points in the conclusion, below, summarizing the most salient trends among them. TechCrunch’s Top 5 Healthcare Predictions for 2015: In this succinct forecast, Walmart grows its presence as a health plan, startups get more pharm-funding, hospitals channel peer-to-peer lending, Latinos emerge as a “most-desired” health care segment, and Amazon disrupts the medical supply chain. Experian 2015 Data Breach Forecast: Healthcare security breaches will be

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Women-centered design and mobile health: heads-up, 2014 mHealth Summit

This post is written as part of the Disruptive Women on Health’s blog-fest celebrating the 2014 mHealth Summit taking place 7-11 December 2014 in greater Washington, DC. Women and mobile health: let’s unpack the intersection. On the supply side of the equation, Good Housekeeping covered health tracking-meets-fashion bling in the magazine a few weeks ago in article tucked between how to cook healthy Thanksgiving side dishes and tips on getting red wine stains out of tablecloths. This ad appeared in a major sporting goods chain’s 2014 Black Friday pre-print in my city’s newspaper last week. And along with consumer electronics brand faves like

Pharma industry update – drug spending, R&D costs, generics, and Botox

The U.S. leads in pharmaceutical drug spending. Global growth in pharmaceuticals will spike in 2014, according to the IMS Institute on Healthcare Informatics report on global pharma spending. The U.S. spends more per capita (per person) than any nation in the study, at about $1400 US dollars expected in pharmaceutical spending in 2018, owing to fewer patent expiries (the end, for now, of the patent cliff) and rising prices (think: specialty drugs like Sovaldi and oncology drugs). The next-biggest spender on Rx will be Japan, at just over $800 per person in pharmaceutical spending in 2018. The “EU5” (UK, Germany, France, Italy

Health insurance companies rank low on consumer experience

The corporate reputation, brand equity, of the health insurance continues to be low relative to other financial service industry benchmarks, found in the ACSI Finance and Insurance Report 2014. Customer satisfaction with health insurance companies fell between 2013 and 2014, especially attributed to higher costs hitting consumers in group (employer-based) policies. The 2014 American Customer Satisfaction Index (ACSI) is informed by interviews with 6,819 consumers interviewed via phone and email between July and September 2014. Customers of financial services companies (banks, credit unions, health insurance, life insurance, property & casualty, and internet brokerages) were asked to provide their opinions about named-firms

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Women worry about being bag-ladies – the health implications of financial un-wellness

My post, Even Rich Girls Worry About Being Bag Ladies, was published in the Huffington Post this week. In the analysis, I weave the results of several seminal surveys on women, money, and health that have been conducted in the past few months. The bottom-line: even the most affluent women are financially stressed, and that stress is leading women to re-define what it means to be personally successful. When it comes to personal health, financial wellness is part of overall well-being, as defined by women who place being healthy above having money. Avoiding debt is the nuance here, not amassing

Power to the health care consumer – but how much and when?

Oliver Wyman’s Health & Life Sciences group names its latest treatise on the new-new health care The Patient-to-Consumer Revolution, subtitled: “how high tech, transparent marketplaces, and consumer power are transforming U.S. healthcare.” The report kicks off with the technology supply side of “Health Market 2.0,” noting that “the user experience of health care is falling behind” other industry segments — pointing to Uber for transport, Amazon for shopping, and Open Table for reserving a table. The authors estimate that investments in digital health and healthcare rose “easily ten times faster” than the industry has seen in the past. Companies like

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

Hug your doctor: s/he needs it, according to the 2014 Physician Foundation survey

While the medical profession has reached a so-called state of crisis, there’s also a “changing of the guard” happening in the profession where doctors are re-imagining what it means to be physician in the era of value-based, technology-enabled health care. Such is the state of the union — or dis-union — of the U.S. medical profession. The 2014 Survey of America’s Physicians from Physicians Foundation finds that 4 in 5 U.S. doctors are over-extended or reaching full capacity in their practices. This is up from 2012. Only 19% of doctors say they have time to see more patients. That may be

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Health on the 2014 Gartner Hype Cycle

Remote health monitoring is in the Trough of Disillusionment. Wearables are at the Peak of Inflated Expectations, with Big Data leapfrogging wearables from the 2013 forecast — both descending toward the Disillusionment Trough. Mobile (remote) health monitoring, however, has fallen into that Trough of Disillusionment as RHM has been undergoing reality checks in the health care system especially for monitoring and patient self-management of heart disease (most notably heart failure) and diabetes. Welcome to the 2014 edition of the Gartner Hype Cycle, one of my most-trusted data sources for doing health industry forecasts in my advisory work. Compared with last year’s

Understanding the patient journey – using real-world data

It’s de rigueur for any organization marketing a product or service in health care to be “patient-centered” these days. “Patient engagement” and “health engagement” are phrases found on health conference agendas, whether pitching to attendees in pharma and life sciences, health IT, health insurance, or healthcare (to hospitals and physicians, alike). One paradigm for patient-centricity that’s more mature than most is IMS Health’s Patient Journey construct, which the data-driven company has been talking about since 2012. While the concept focused mainly on pharmaceutical marketing and medication adherence, it’s useful for all industry segments looking to motivate behavior change in health

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

Employers engaging in health engagement

Expecting health care cost increases of 5% in 2015, employers in the U.S. will focus on several tactics to control costs: greater offerings of consumer-directed health plans, increasing employee cost-sharing, narrowing provider networks, and serving up wellness and disease management programs. The National Business Group on Health’s Large Employers’ 2015 Health Plan Design Survey finds employers committed to health engagement in 2015 as a key strategy for health benefits. More granularly, addressing weight management, smoking cessation, physical activity, and stress reduction, will be top priorities, shown in the first chart. An underpinning of engagement is health care consumerism — which

Blurred lines: health, pharmacy, food and care

In the past few weeks, several events bolster the reality that health and health care are in Blurred Lines mode. Not Robin Thicke Blurred Lines, mind you, but the Venn Diagram overlapping kind. Walmart launched real primary care clinics in South Carolina and Texas. These will provide services beyond urgent care, charging $4 a visit for company employees and $40 a visit for other people The U.S. Department of Agriculture issued a report promoting “nudges” to grocery shoppers enrolled in the Supplemental Nutrition Access Program (SNAP) to buy healthy foods Apple is talking with Cleveland Clinic, Johnson Hopkins, and Mount Sinai Medical

Over-the-counter drugs – an asset in the collaborative, DIY health economy

Nations throughout the world are challenged by the cost of health care: from Brazil to China, India to the Philippines, and especially in the U.S., people are morphing into health care consumers. Three categories of health spending in the bulls-eye of countries’ Departments of Health are prescription drugs, and the costs of care in hospitals and doctors’ offices. In the U.S., one tactic for cost containment in health is “switching” certain prescription drugs to over-the-counter products – those deemed to be efficacious and safe for patients to take without seeking treatment from a doctor. Over-the-counter drugs (OTCs) are available every

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

Self-care – the role of OTCs for personal health financial management

Make-over your medicine cabinet. That’s a key headline for International Self-Care Day (ISD) on July 24, 2014, an initiative promoting the opportunity for people to take a greater role in their own health care and wellness. Sponsored by the Consumer Healthcare Products Association (CHPA), consumer products companies, health advocacy organizations, and legislators including John Barrow (D-GA), a co-sponsor of H.R. 2835 (aka the Restoring Access to Medications Act), the Day talked about the $102 billion savings opportunity generated through people in the U.S. taking on more self-care through using over-the-counter medicines. After the 2008 Recession hit the U.S. economy, industry analysts

Consumer healthcare spending is up, and “fun spending” is down

This is the summer of big spending leaps for groceries, gas and health care. Here’s hoping that food, energy and visits to doctors make us happy, because we won’t be getting much joy from travel, dining out, leisure activities, or consumer electronics purchases, all of which are declining in terms of consumer spending. The Gallup survey published July 12, 2014, finds that 59% of people are spending more on groceries, 58% on gas/fuel, and 42% on health care. Net spending on each of those spending categories increased 49%, 46%, and 34% respectively this week compared with one year ago. Personal

Who’s Looking at You? consumer-generated data, Big Data, & health

Opportunities abound for sharing data “for good” – to turbocharge clinical trials, inform medical research, anticipate and better manage epidemics, and focus on individual health goals benchmarking oneself vs. peers. At the same time, third party data brokers and marketing interests with which consumers have no direct connection of knowledge are scraping together bits of personal information from internet clouds, social networks, and retail data from which profits are made. And that value does not accrue to the very individuals whose data are being sold. Here’s Looking At You: How Personal Health Information Gets Tracked And Used, published by California HealthCare

Stress Is US

“Reality is the leading cause of stress among those in touch with it,” Lily Tomlin once quipped. Perhaps in 2014, America is the land of stress because we’re all so in touch with reality. THINK: reality TV, social networks as the new confessional, news channeling 24×7, and a world of too much TMI. So no surprise, then, that one-half of the people in the U.S. have had a major stressful event or experience in the last year. And health tops the list of stressful events in This American Life in the forms of illness and disease (among 27% of people)

Health consumers – largely in charge, engaged and cost conscious

3 in 5 people in the U.S. would like to take the lead on making medical decisions for themselves, according to the Altarum Institute Survey of Consumer Health Care Opinions, Spring 2014 edition, published July 2014. Another 30% of people want to make a joint decision with equal input from their doctor. Together, the math calculates to 9 in 10 Americans seeking major roles in medical decisions. Altarum’s survey paints a picture of consumers looking to take charge in health care, seeking information about symptoms and clinical issues. 7 in 10 people look up health information before seeing their doctor,

How smart do you want your home to be?

Smarter homes can conserve energy, do dirty jobs, and remind you to take your medicine. In doing all these things, smart homes can also collect data about what you do inside every single room of that home. The fast convergence of Wi-Fi and sensors are laying the foundation for the Internet of Things, where objects embedded with sensors do things they’re specially designed to do, and collect information while doing them. This begs the questions: what do you want to know about yourself and your family? How much do you want to know? And, with whom do you want to

World No Tobacco Day v2014 – let’s raise (more) taxes on tobacco

Tomorrow is World No Tobacco Day. The use of tobacco is one of the most preventable public health issues on the planet. And the global tobacco epidemic contributed to 100 million deaths around the world in the 20th century. 6 million people die every year due to tobacco use — including 600,000 deaths due to exposure to secondhand smoke. About 500 million people living today will be dead from the use of tobacco products if current smoking habits continue, the World Health Organization (WHO) expects. WHO sponsors the World No Tobacco Day every year on May 31. For this year’s

The Milliman Medical Index at $23,215: A Toyota Prius, a tonne of tin, or health insurance for a family?

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm. The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin. While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6%

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Chaos, then Creation, Part 5

The consumer demand side for healthcare transparency is hungry for the light to shine on health care costs, quality and information that’s relevant and meaningful to the individual. The supply side is fast-growing, with websites and portals, government-sponsored projects, commercial-driven start-ups, and numerous mobile apps. These tools endeavor to: Help people find and access services Schedule appointments Compare peer consumers’ reviews for those providers Calculate and prepare for out-of-pocket co-payments deriving from their health plan Negotiate prices with providers Pay for the services, and Reconcile the payment with a high-deductible health plan or health savings account. On the demand side, consumers

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Will Your Health Plan Be Your Transparency Partner? – Part 3

Three U.S. health plans cover about 100 million people. Today, those three market-dominant health plans — Aetna, Humana and UnitedHealthcare — announced that they will post health care prices on a website in early 2015. Could this be the tipping point for health care transparency so long overdue? These 3 plans are ranked #1, #4 and #5 in terms of market shares in U.S. health insurance. Together, they will share price data with the Health Care Cost Institute (HCCI), a not-for-profit organization dedicated to research on U.S. health spending. An important part of the backstory is that the HCCI was

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

The retailization of digital health: Consumer Electronics Association mainstreams health

The Consumer Electronics Association (CEA) has formed a new Health and Fitness Technology Division, signalling the growing-up and mainstreaming of digital health in everyday life. The CEA represents companies that design, manufacture and market goods for people who pay for stuff that plugs into electric sockets and operate on batteries — like TVs, phones, music playing and listening, kitchen appliances, electronic games, and quite prominent at the 2014 Consumer Electronics Show, e-cigarettes (rebranding “safe smoking” as “vaping” technology). In its press release announcing this news, CEA President and CEO Gary Shapiro says, “Technology innovations now offer unprecedented opportunities for consumers to

Health costs in retirement: the standard of living

On their list of top financial worries, 1 in 2 Americans is most concerned about not having enough money for retirement, not being able to pay medical costs if they get sick, and not being able to maintain a desired standard of living. Gallup’s annual Economy and Personal Finance poll, conducted in early April 2014, finds that even in the wake of a healthier economy, people feel health-finance insecure. While ability to pay medical bills ranked #2 on the list of 9 fiscal worries, the proportion of Americans with this concern fell from a high of 62% in 2012 to

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,