How Consumers’ Economic Sentiments Are Shaping Peoples’ Financial and Emotional Well-Being (Spoiler: Not So Good): Learning from CivicScience

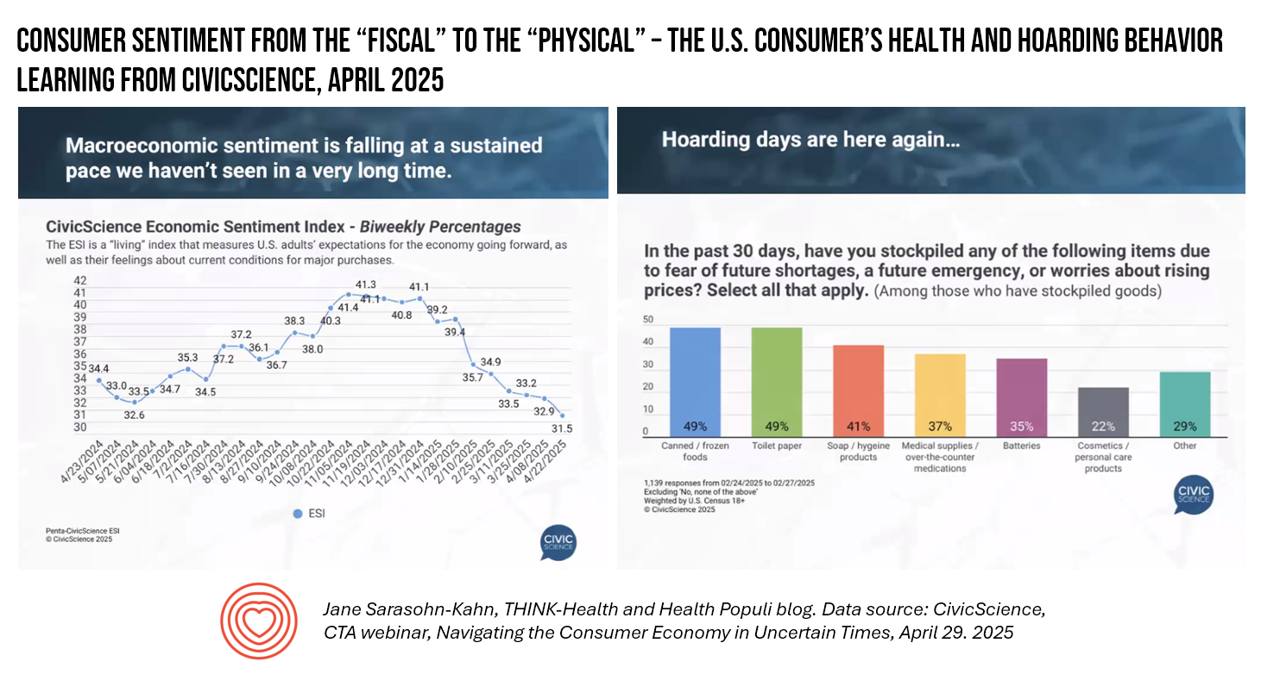

When it comes to health, the words “fiscal” and “physical” are morphing as peoples’ economic feelings (the “fiscal”) are shaping physical and emotional health, we find in U.S. consumer data presented by John Dick, Founder and CEO of CivicScience. The Consumer Technology Association convened a special session with John, who painted a portrait of the U.S. consumer at a point in time — late April 2025 — reminding us more than once during the hourlong session that, “Everything is constantly changing.” One certainty that we can be sure of, in the dismal-scientist way

Are We Liberated Yet? Tariffs Can Impact Financial Health (Riffing on MoneyLion’s Health Is Wealth Report)

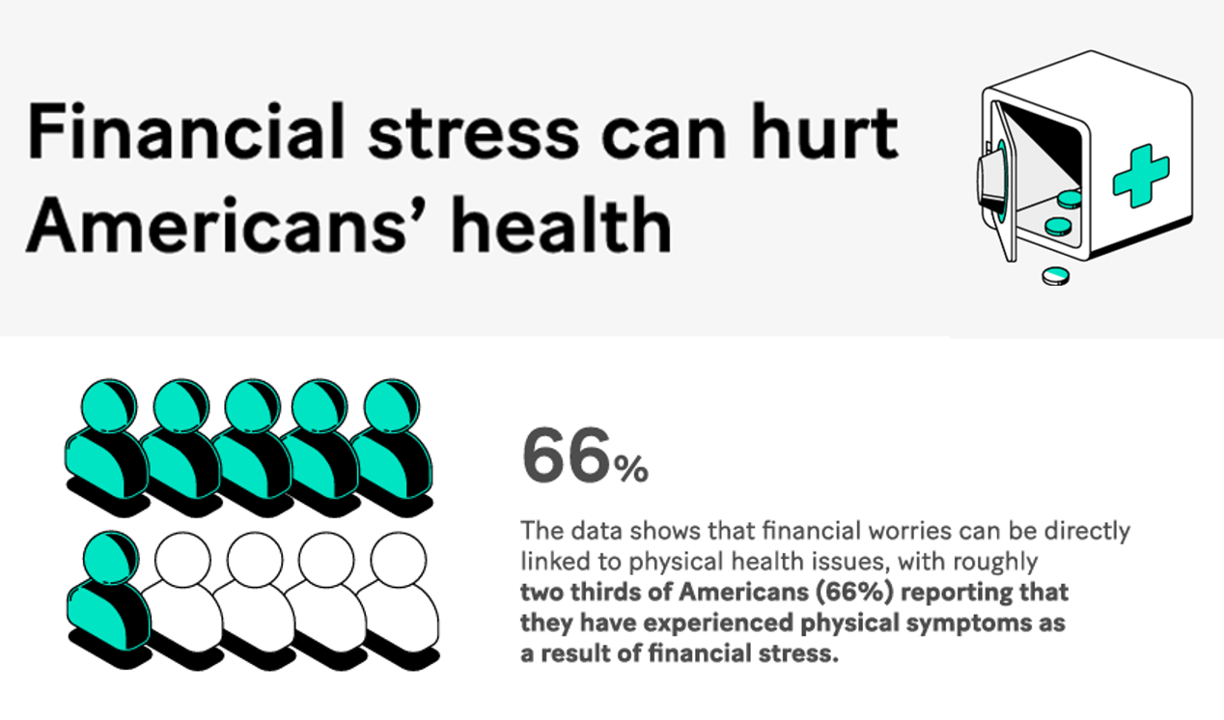

Americans’ financial health was already stressing consumers out leading up to Liberation Day, April 2nd, when President Trump announced tariffs on dozens of countries with whom the U.S. buys and sells goods. A new report from MoneyLion and Mastercard called Health is Wealth is well-timed for today’s Health Populi blog. The study was fielded by The Harris Poll online among 2,092 U.S. adults 18 and older between February 28 and March 4, 2025, so it was completed a month before the tariffs came to hit peoples’ 401(k) savings and employers’ company stock market caps.

The Growth of DIY Digital Health – What’s Behind the Zeitgeist of Self-Reliance?

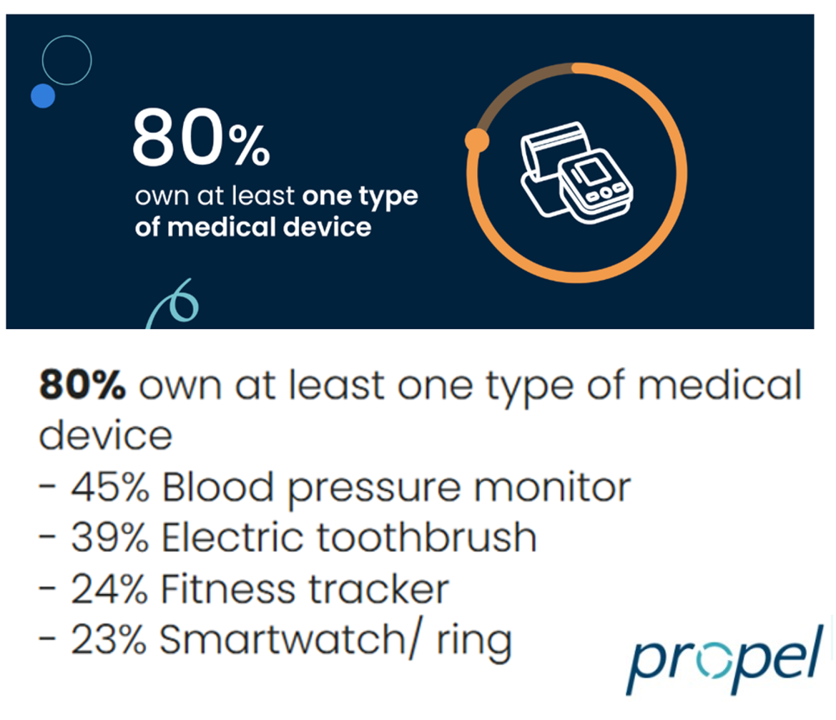

Most people in the U.S. use at least one medical device at home — likely a blood pressure monitor. used by nearly one-half of people based on a survey of 2,000 consumers conducted for Propel Software. The Propel study’s insights build on what we know is a growing ethos among health consumers seeking to take more control over their health care and the rising costs of medical bills and out-of-pocket expenses. That includes oral health and dental bills: 2 in 5 U.S. consumers use electric toothbrushes (a growing smart-device category at the

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

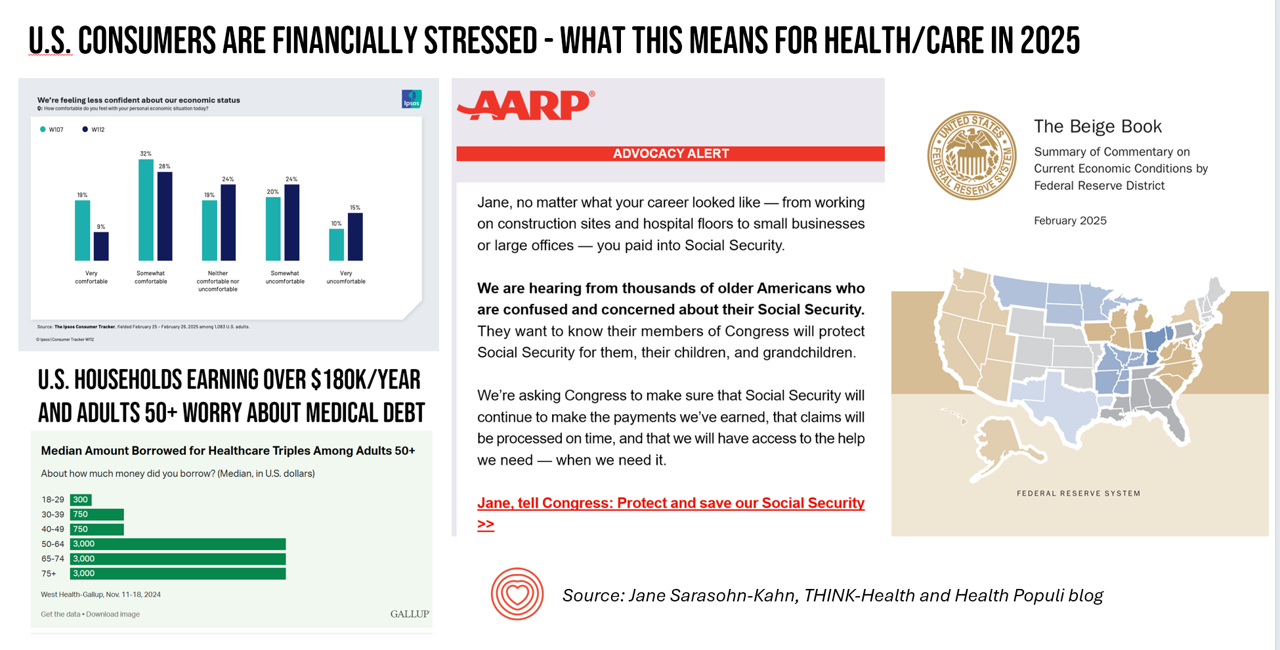

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

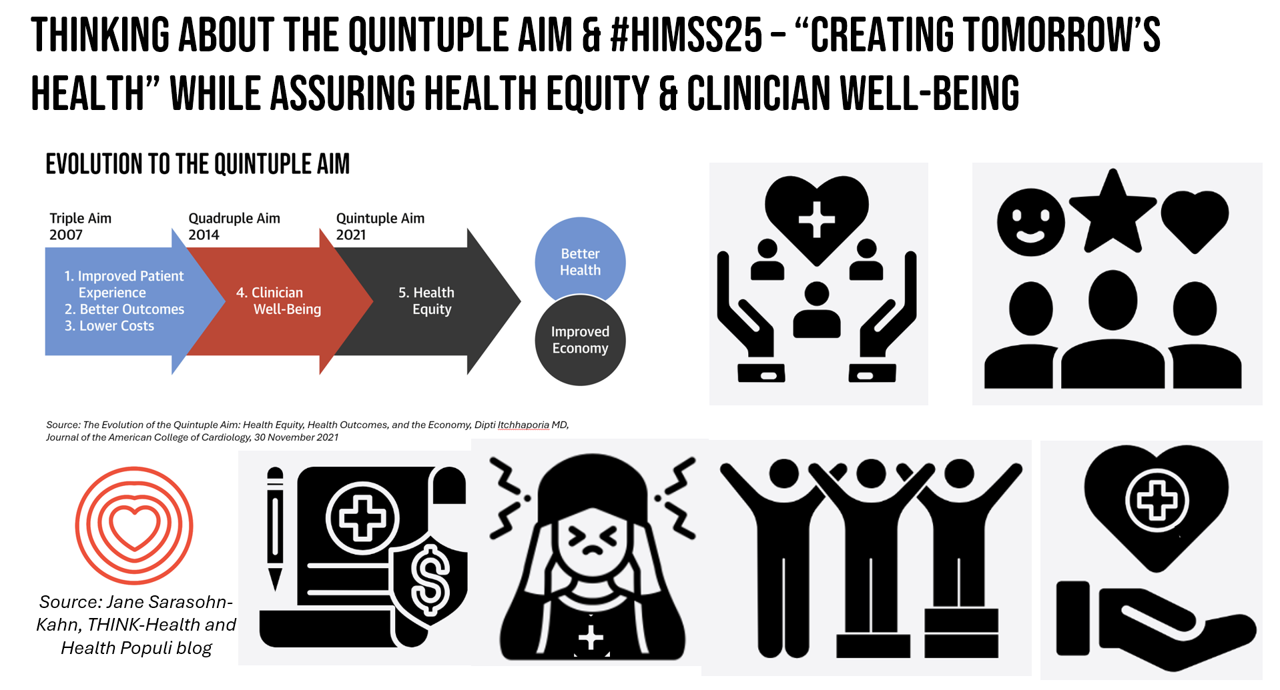

Think Quintuple Aim This Week at #HIMSS25

As HIMSS 2025, the largest annual conference on health information and innovation meets up in Las Vegas this week, we can peek into what’s on the organization’s CEO’s mind leading up to the meeting in this conversation between Hal Wolf, CEO of HIMSS, and Gil Bashe, Managing Director of FINN Partners. If you are unfamiliar with HIMSS, Hal explains in the discussion that HIMSS’s four focuses are digital health transformation, the deployment and utilization of AI as a tool, cybersecurity to protect peoples’ personal information and its use, and, workforce development. I have my own research agenda(s) underneath these themes

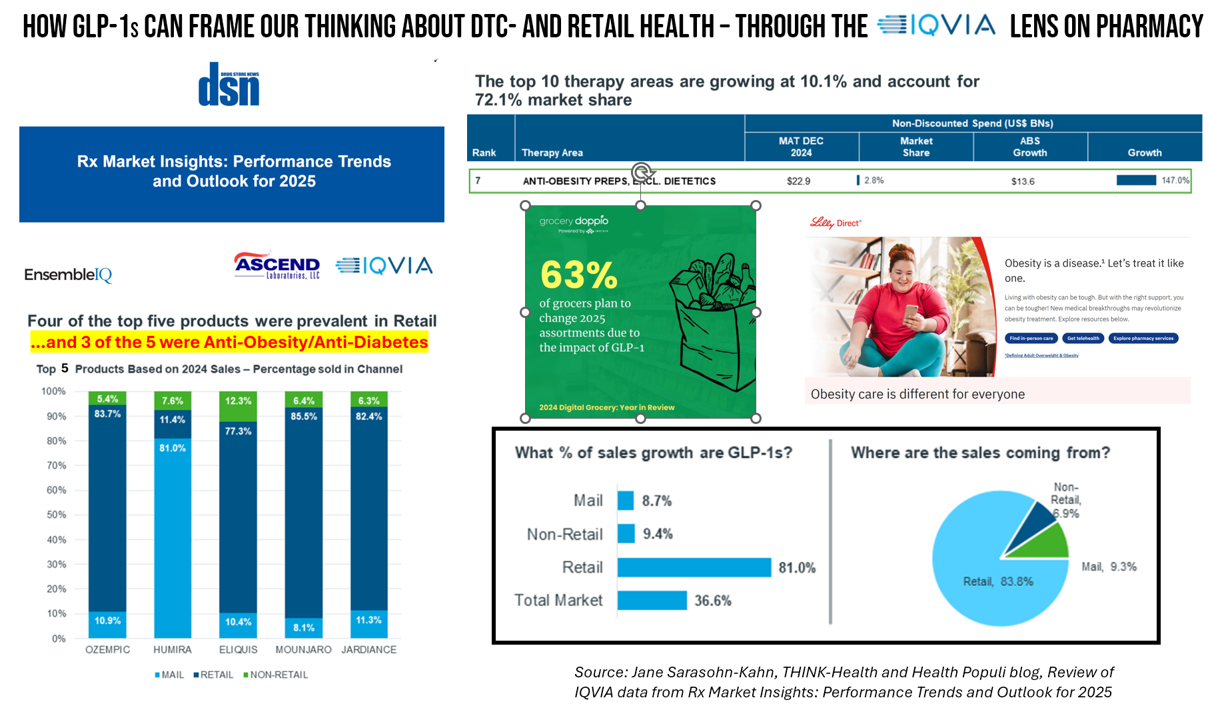

GLP-1s at the Pharmacy – A Lens on Consumer-Driven Retail Health (with Hims & Hers stock price update)

The nature of retail pharmacy is changing, with both threats and opportunities re-shaping the business itself, and the pharmacy’s role in the larger health/care ecosystem. To keep sharp on the topics, I attended Rx Market Insights: Performance Trends and Outlook for 2025, a data-rich session presented on February 18 by IQVIA and sponsored by Ascend Laboratories. The webinar was hosted by DSN (Drug Store News), appropriately so because the action-packed hour went into detail providing the current state of prescription drugs and the pharmacy in America. Doug Long, IQVIA’s VP of Industry Relations, and Scott Biggs, the company’s Director of Supplier

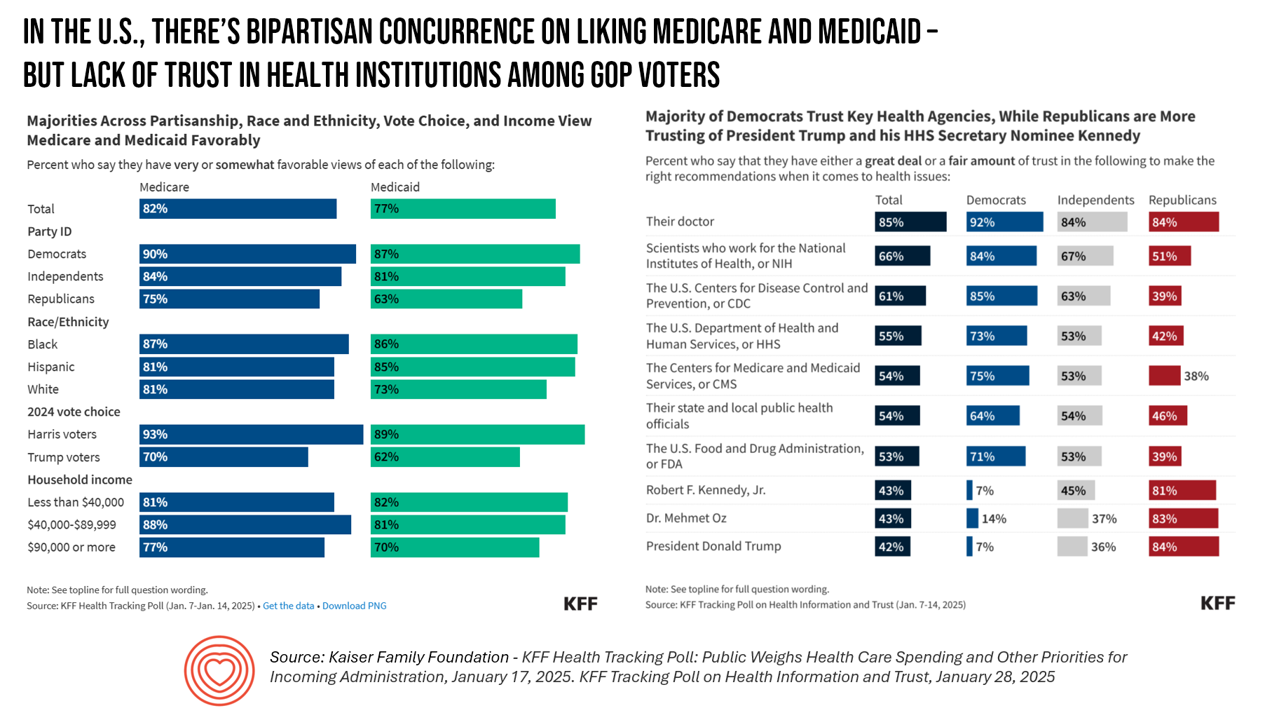

Some Bipartisan Concurrence on Health Care Issues in the U.S. – But Trust in Health Care Isn’t Bipartisan – KFF’s January 2025 Polls

Two polls from one poll source paint at once a bipartisan and bipolar picture of U.S. health citizens when it comes to health care issues versus health care institutions in America. The Kaiser Family Foundation has hit the 2025 health policy ground running in publishing the January 2025 Health Tracking Poll last week and a poll on health care trust and mis-information yesterday. First, the health tracking poll which finds some concurrence between Democrats and Republicans on several big issues facing Americans and various aspects of their health care. As

Trust and Grievance in 2025: The Edelman Trust Barometer on MLK Jr. Day Converging with the World Economic Forum Kick-Off and the Inauguration of the 47th U.S. President

At the start of each new year comes the World Economic Forum meet-up in Davos, Switzerland and with that conference start today, 20 January 2025, the publication of the Edelman Trust Barometer. Now in the study’s 25th annual edition, the Edelman Trust Barometer this year finds us, globally, in a Crisis of Grievance which is eroding trust. Edelman surveyed 1,150 residents (plus or minus) in each of 28 countries around the world, yielding over 33,000 citizens’ voices sharing perspectives on trust and institutions. Interviews were fielded from late October to mid-November 2024.

Americans’ Views on the Quality of Healthcare Fell to a Record Low — with Costs Ranking as the Most Urgent Problem for Health in the U.S.

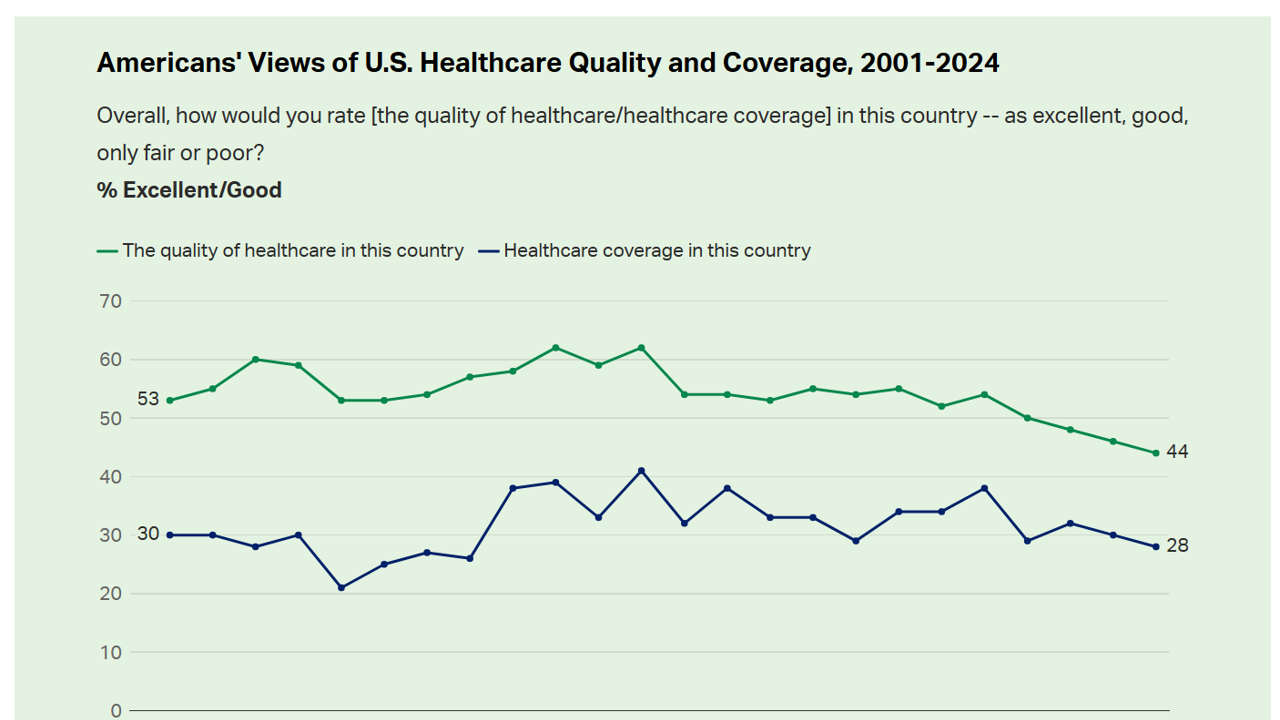

Americans’ perception of the quality of health care in the U.S. fell to the lowest level since 2001, Gallup found in a poll of U.S. health citizens’ views on health care quality, published December 6, 2024. In 2024, only 44% of Americans said that the quality of health care int he U.S. was excellent or good — conversely, 56% of Americans though health care quality was only fair or poor. By political party, that included 50% of Democrats evaluating the quality of care highly compared with 42% of Republicans. Only 28% of people in

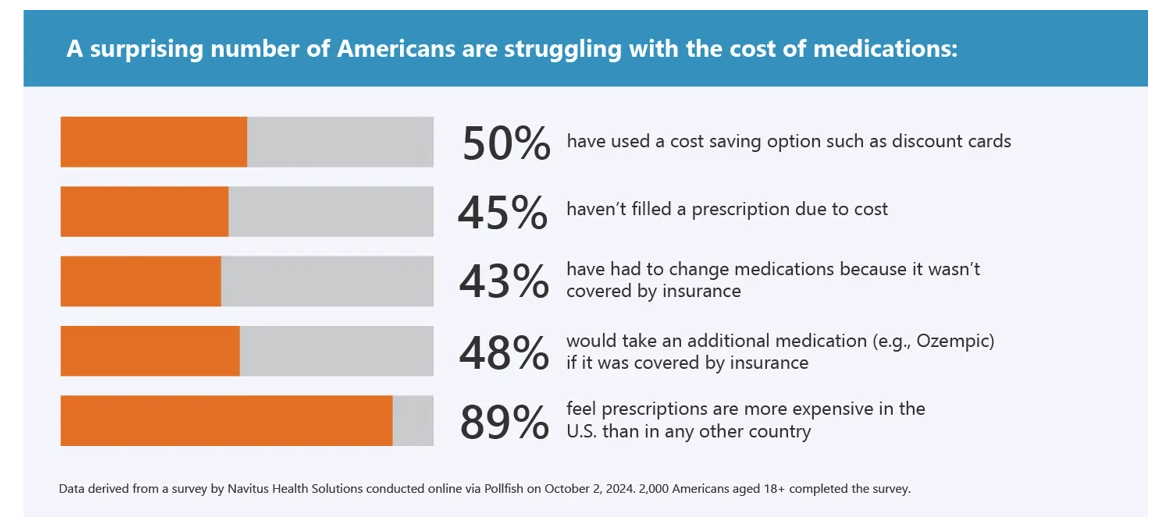

What Stays True for U.S. Health Care Post #Election2024 (1) – Consumers’ Dissatisfaction with Drug Prices

For health care, there are many uncertainties as we reflect, one week after the 2024 U.S. elections, on probably policy and market impacts that we can expect in 2025 and beyond. In today’s Health Populi post, I’ll reflect on the first of several certainties we-know-we-know about U.S. health citizens and key factors shaping the American health ecosystem. In this first of several posts on “What Stays True for U.S. Health Care Post #Election2024,” I’ll focus on U.S. consumer dissatisfaction with drug prices — across political party identification. Let’s set the context with data from a recently-published

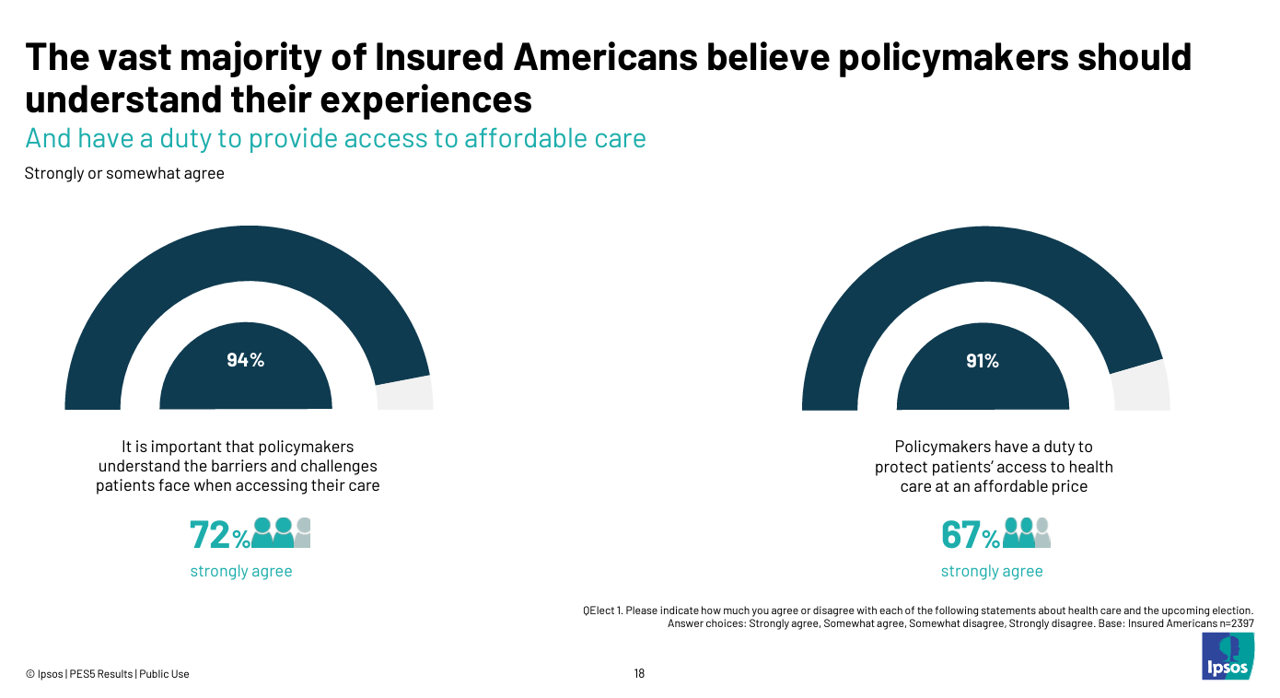

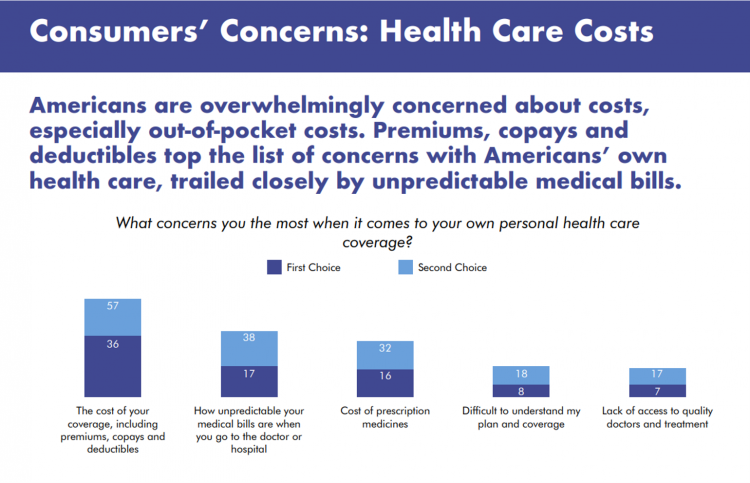

Health Care Costs and Access On U.S. Voters’ Minds – Even If “Not on the Ballot” – Ipsos/PhRMA

Today marks eight days before #Election2024 in the U.S. While many political pundits assert that “health care is not on the ballot,” I contend it is on voters’ minds in many ways — related to the economy (the top issue in America), social equity, and even immigration (in terms of the health care workforce). In today’s Health Populi blog, I’m digging into Access Denied: patients speak out on insurance barriers and the need for policy change, a study conducted by Ipsos on behalf of PhRMA, the Pharmaceutical Research and Manufacturers of America — the pharma industry’s advocacy organization (i.e., lobby

Closing the Chasm Between Patients and Clinicians With Digital Health Tools – Some Health Consumer Context for #HLTHUSA

As the annual HLTH conference convenes this week in Las Vegas, numerous reports have been published to coincide with the meeting updating various aspects of technology, health care, providers and patients. In this post, I’m weaving together several of the papers that speak to the intersection of health care, consumers, and technology – the sweet spot here on Health Populi. I hope to provide attendees of HLTH 2024 along with my readers who aren’t in Vegas useful context for assessing the new ideas and business model announcements as well as a practical summary for those of you in planning mode for

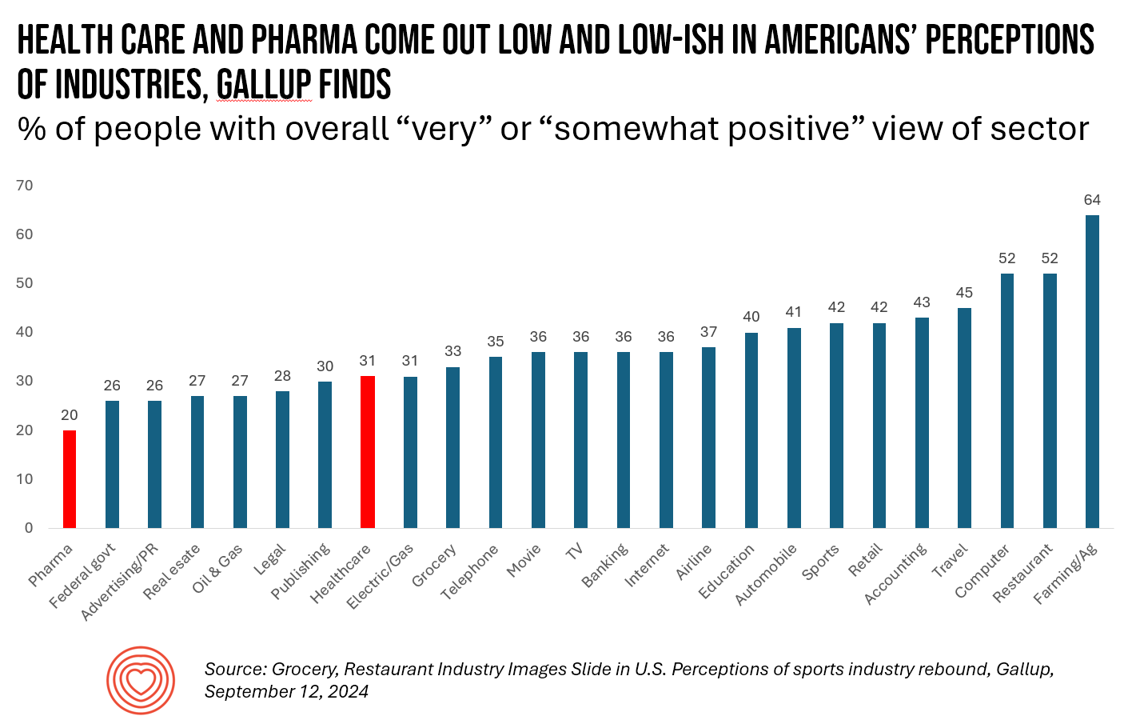

Americans’ Perspectives on Pharma and Healthcare Industries Are Low and Low-Ish Compared with Most Other Sectors

Only 20% of U.S. adults have a positive view of the pharmaceutical industry, garnering the lowest positive vibes among Americans in Gallup’s latest survey on peoples’ opinions of industries in America. About 1 in 3 Americans feel positively about health care in the U.S., on par with publishing and the electric/gas industries — on the lower end of these findings. By far, the top-perceived industry in the U.S. is agriculture and farming, taking the first spot with 64% of Americans’ positive views. Restaurants and the computer sector get 52% positives, although Gallup points out

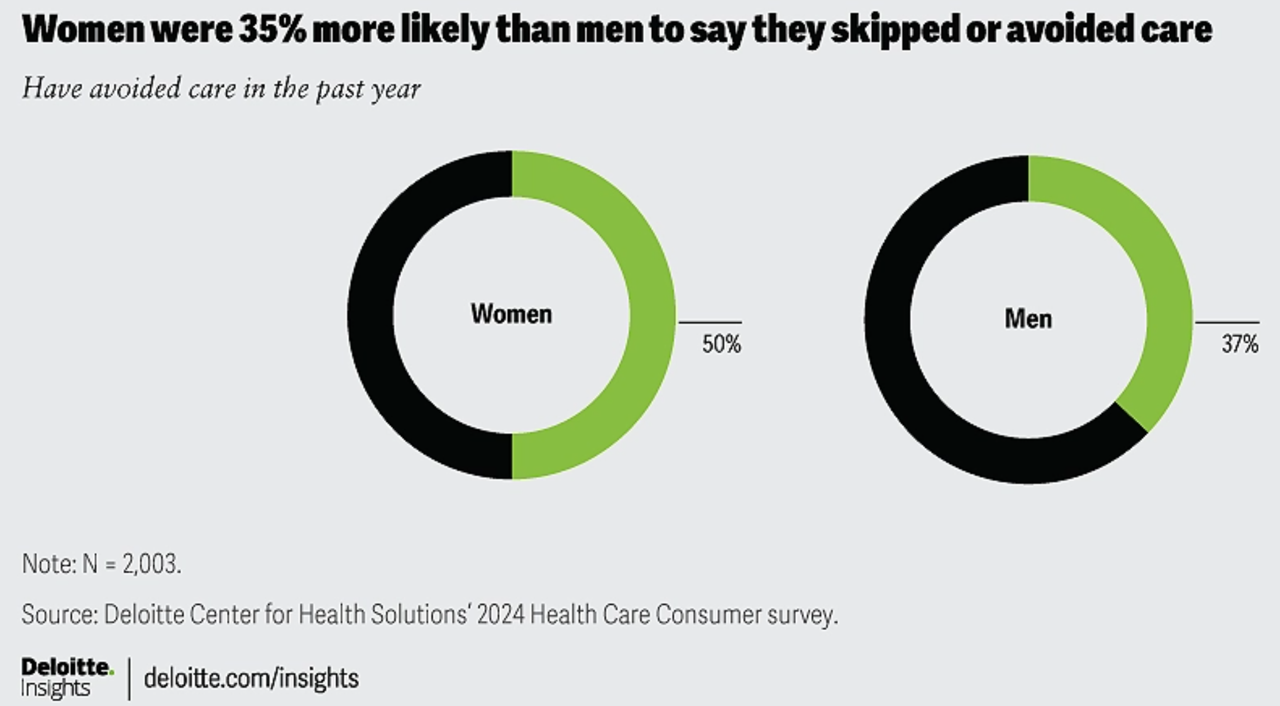

1 in 2 U.S. Women (“The Bedrock of Society”) Self-Ration Care – the Latest Deloitte Findings

Women in the U.S. are more likely to avoid care than men in America, Deloitte found in the consulting firm’s latest survey on consumers and health care. Deloitte coins this phenomenon as a “triple-threat” that women face in the U.S. health care environment, the 3 “threats” being, Affordability, Access, and, Prior experience — that is the health disparity among women who have seen personal mis-diagnosis, bias, or treatment that hasn’t been consistent with current protocols and practices. The data come out of Deloitte’s fielding of the U.S. consumer survey in February and March, 2024.

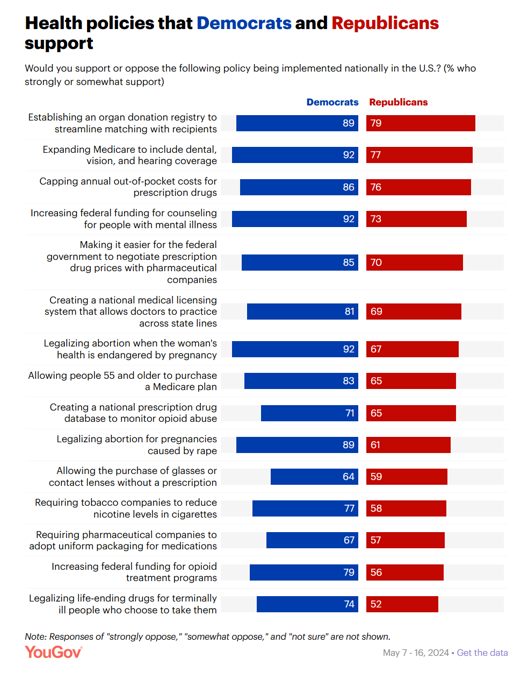

Where Democrats and Republicans Agree on Health Care Policies – From Medicare and Prescription Drugs to Gun Safety

In a super-divided electorate like the U.S. with about 60 days leading up to the 2024 Elections, we might assume there are no “purple” areas of agreement between the Red (Republicans) and the Blue (Democrats) thinking in PANTONE color politics. Surprisingly, there are many health policies on which Democrats and Republicans concur, as found in a series of YouGov polls conducted in May 2024. YouGov fielded the health policies poll in five waves online, each among roughly 1,100 U.S. adults in May 2004. This bar chart summarizes health

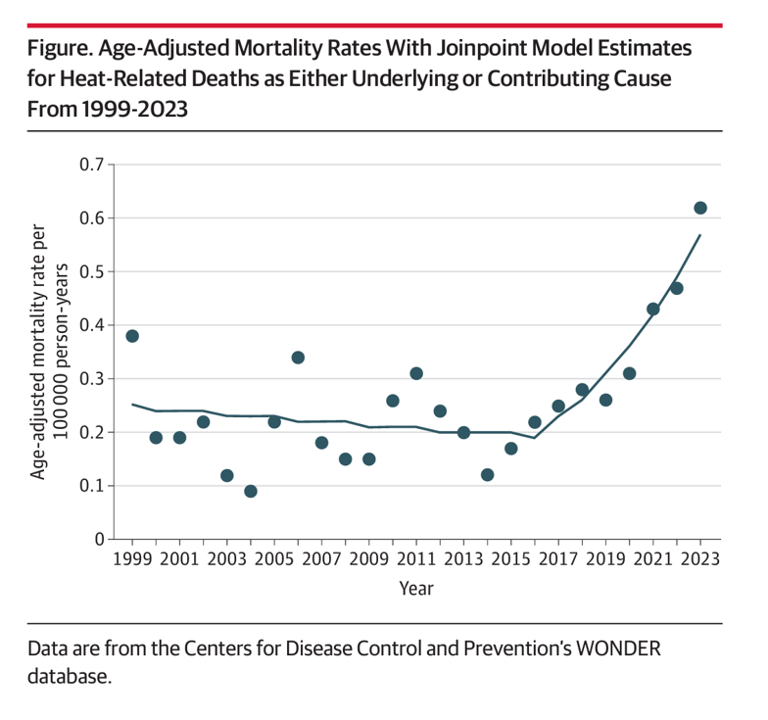

The Impacts of Heat on Health Across All Dimensions – from Death to “Heat-Flation” on the Pocketbook

Rising energy bills are confronting U.S. households (and indeed, health citizens in many parts of the world) due to extreme heat, PBS reported on 1st September. But the record heat waves in so much of the world is impacting both peoples’ fiscal and financial well-being along with physical health impacts, ranging from exacerbating chronic respiratory conditions to, literally, risks to lives. A recent letter to JAMA, published August 26, 2024, quantifies Trends of Heat-Related Deaths in the U.S., 1999-2023. The authors examined studies finding exposure to extreme heat associated with mortality,

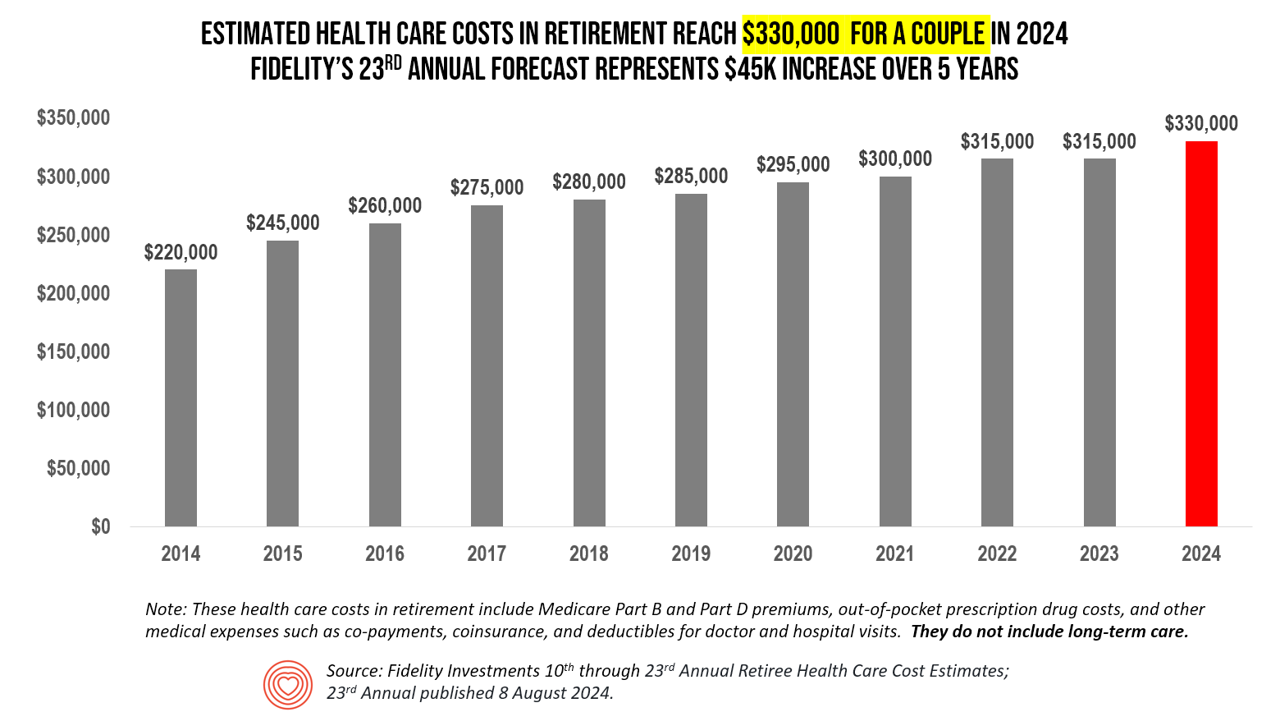

The Health Care Costs for Someone Retiring in 2024 in the U.S. Will Reach $165,000 – Fidelity’s 23rd Annual Update

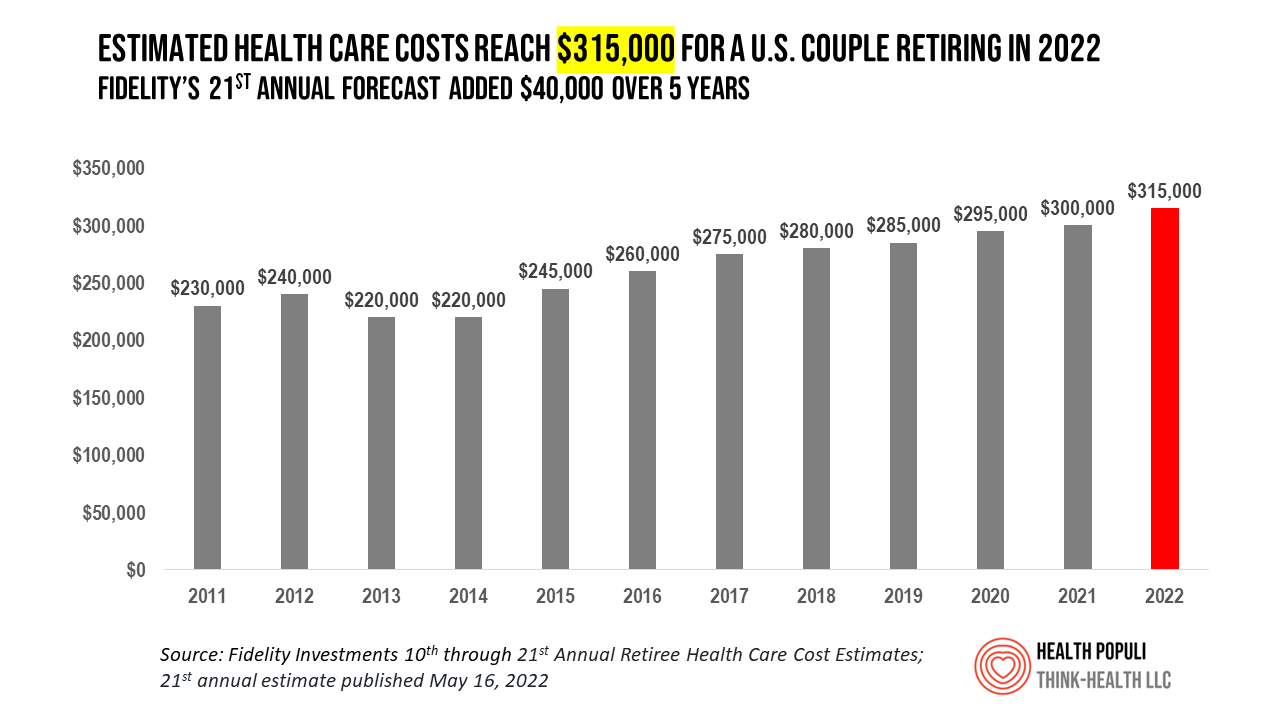

The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast. I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K. Fidelity began

Retail Health Update for Pharmacy – Mail Order Beats Brick & Mortar, J.D. Power Finds

People have been undergoing their own human kind of digital transformations, turbocharged during the pandemic for many who never used Zoom or Amazon Prime or Uber. That consumer-borne digital transformation has shaped people as health consumers, many having used telehealth and appointment-scheduling online. And peoples’ relationships with pharmacies are also changing, with more health consumers finding greater satisfaction with their mail order pharmacy experiences than with moat retail brick and mortar chain drug stores, the latest J.D. Power 2024 U.S. Pharmacy Study found. It’s clear that mail order is

“Listen to Me:” Personalization in Health Care Starts With Taking Patients’ Voices Seriously – the 15th Beryl Institute-Ipsos PX Pulse Survey

Patients’ experience with health care in the U.S. dropped to its lowest point over the past year, explained in the 15th release of The Beryl Institute – Ipsos PX Pulse survey. The study into U.S. adult consumers’ perspectives defined “patient experience” (PX) as, “The sum of all interactions, shaped by an organization’s culture, that influence patient perceptions across the continuum of care.” The survey was fielded by Ipsos among 1,018 U.S. adults in March 2024. Health care providers (and other industry stakeholders that go B2B or B2B2C (or P) are all thinking

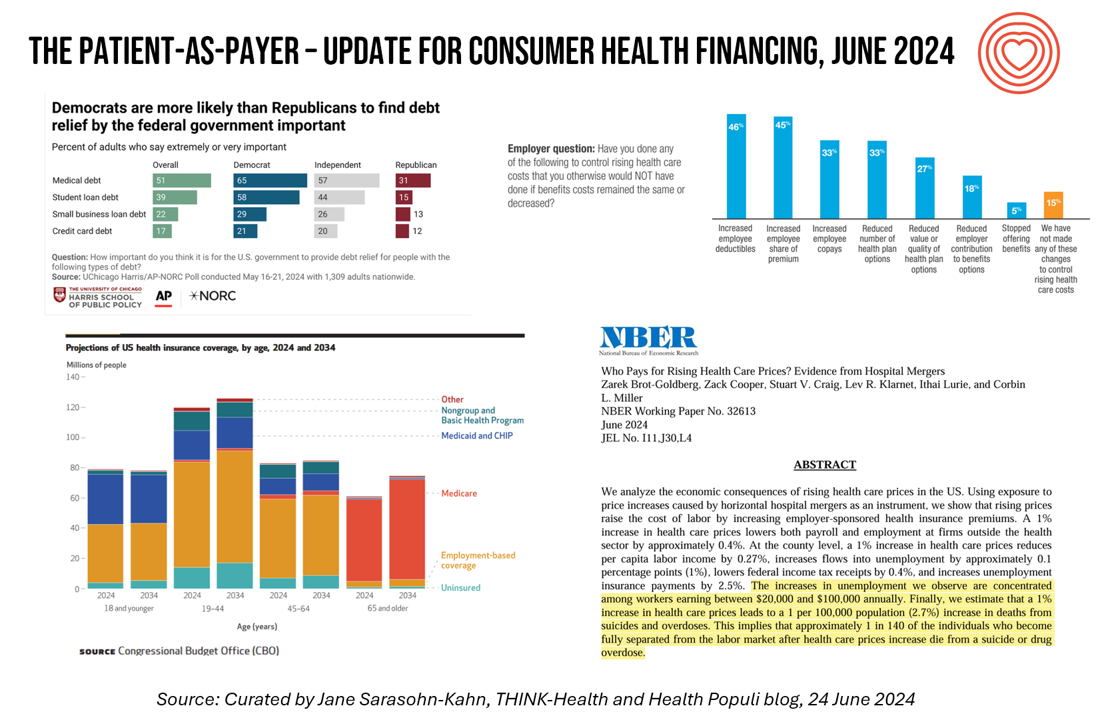

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

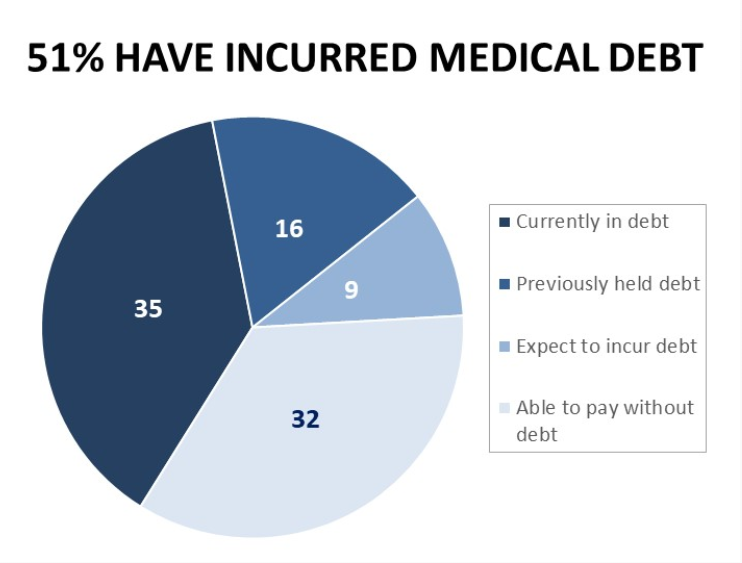

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

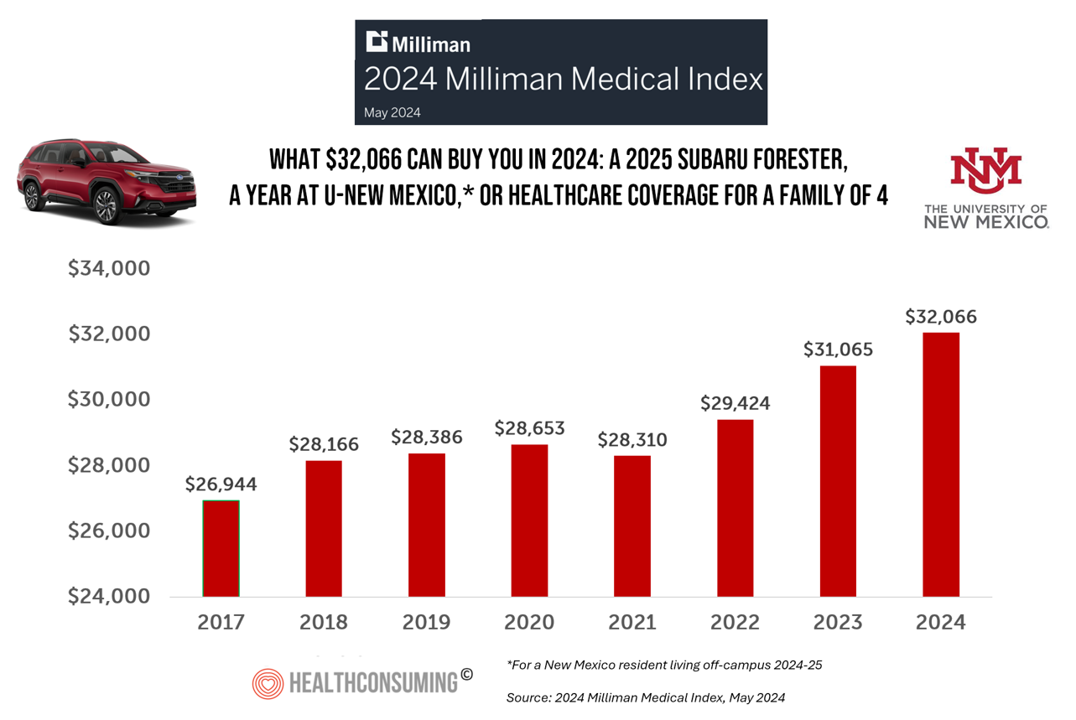

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

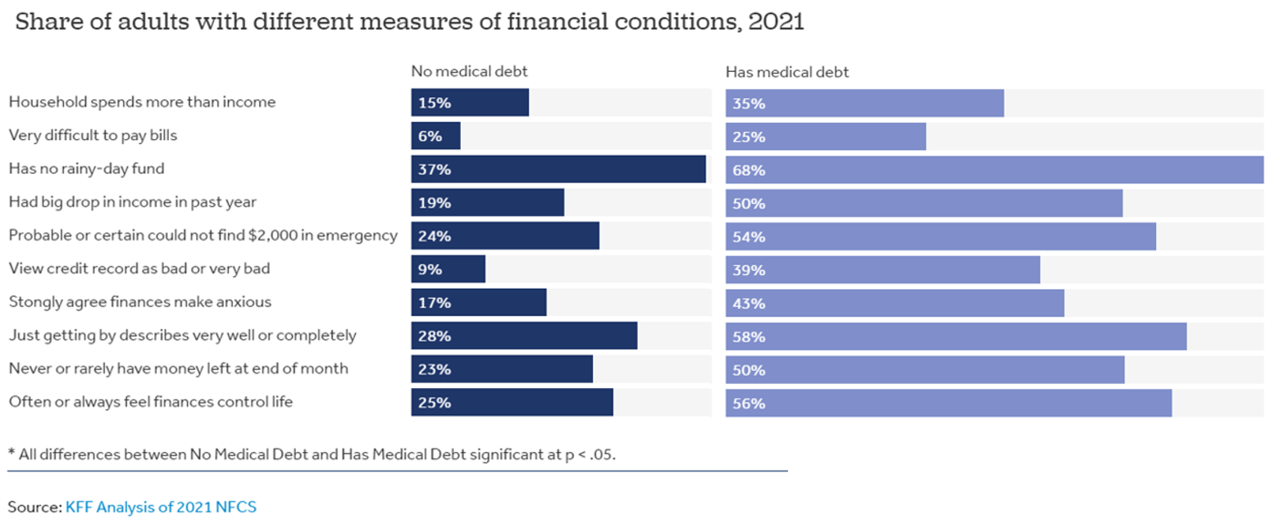

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

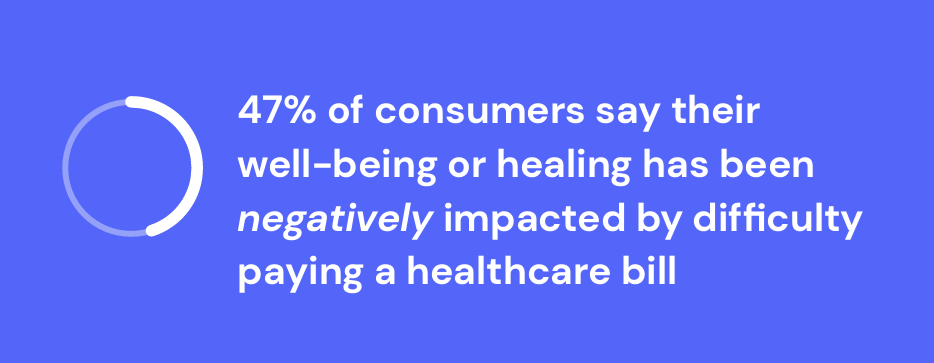

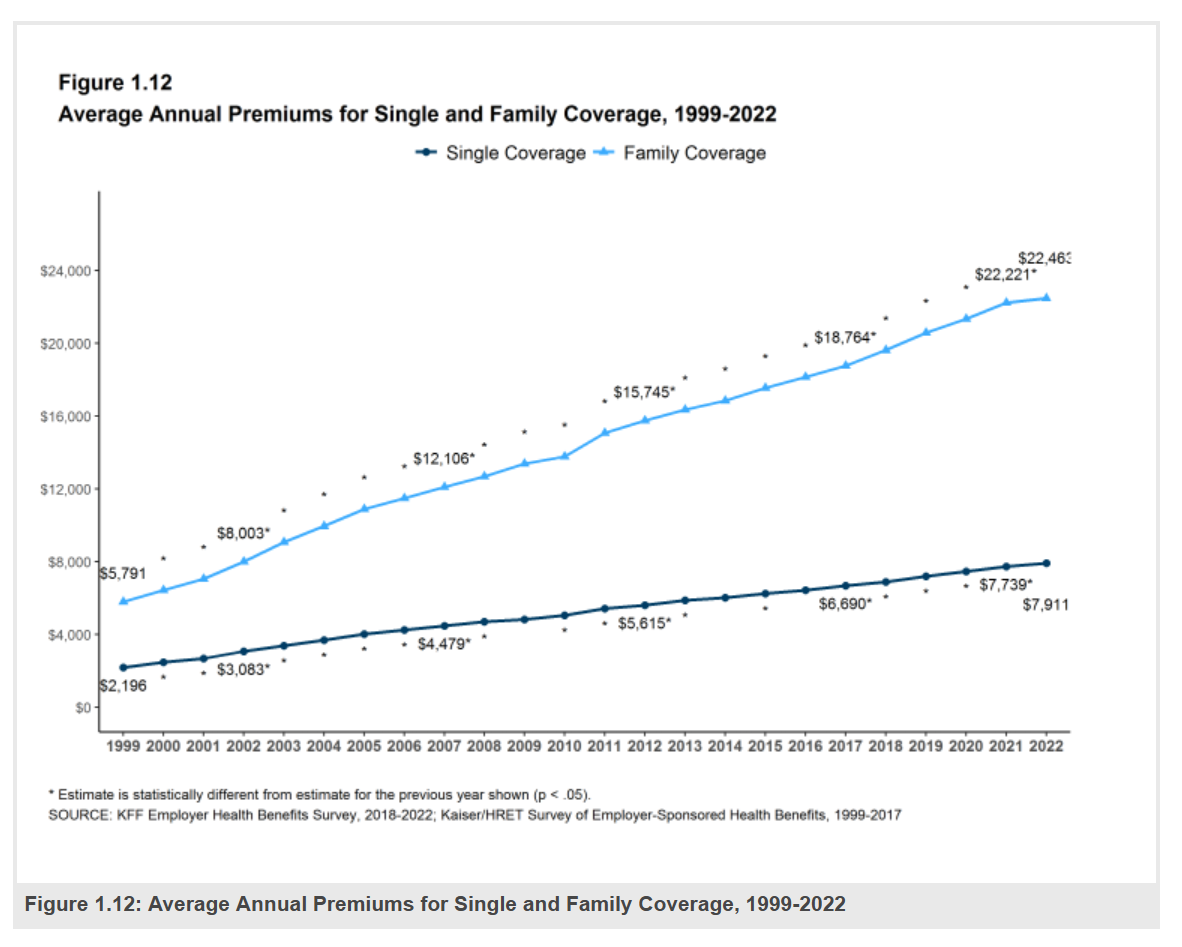

Money and Mental Health in the U.S. – How Difficulty Paying Medical Bills Can Hurt Healing and Well-Being

There is growing evidence on the connection between people’s financial health and their mental health, explored and explained in Understanding the Mental-Financial Health Connection, a study published by the Financial Health Network. Keep that relationship in mind in the context of a new forecast from Kaiser Family Foundation estimate the 2023 cost for employer-sponsored insurance for a family to reach nearly $24,000 in 2023. That cost is a 7% increase over last year, and is expected to be split with companies covering $17K (about 70%) and employees about $6600 (roughly 30%). KFF heard that

To Avert a GLP-1 Cost Tsunami, Add Lifestyle Interventions: Learning from Virta Health

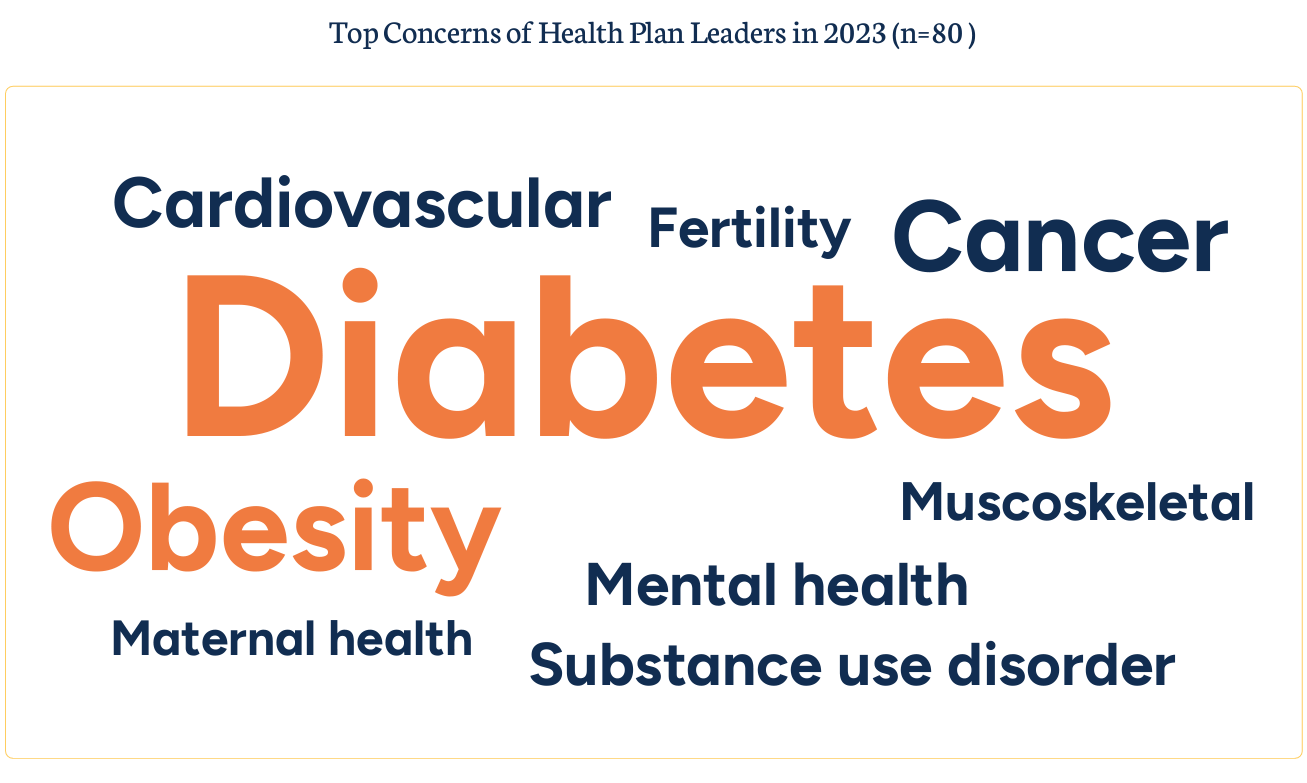

With consumer and prescriber interest in GLP-1 receptor agonist drugs “soaring,” health plan managers have a new source of financial stress and clinical questions on their to-do list. A team of Virta Health leaders held a webinar on 13th July 2023 to explain the results of a study the company just completed assessing health plan execs’ current views on Ozempic and other GLP-1 medicines with a view on both clinical outcomes and cost implications for this growing category of drugs that address diabetes and obesity. Indeed, diabetes and obesity are top health concerns among the

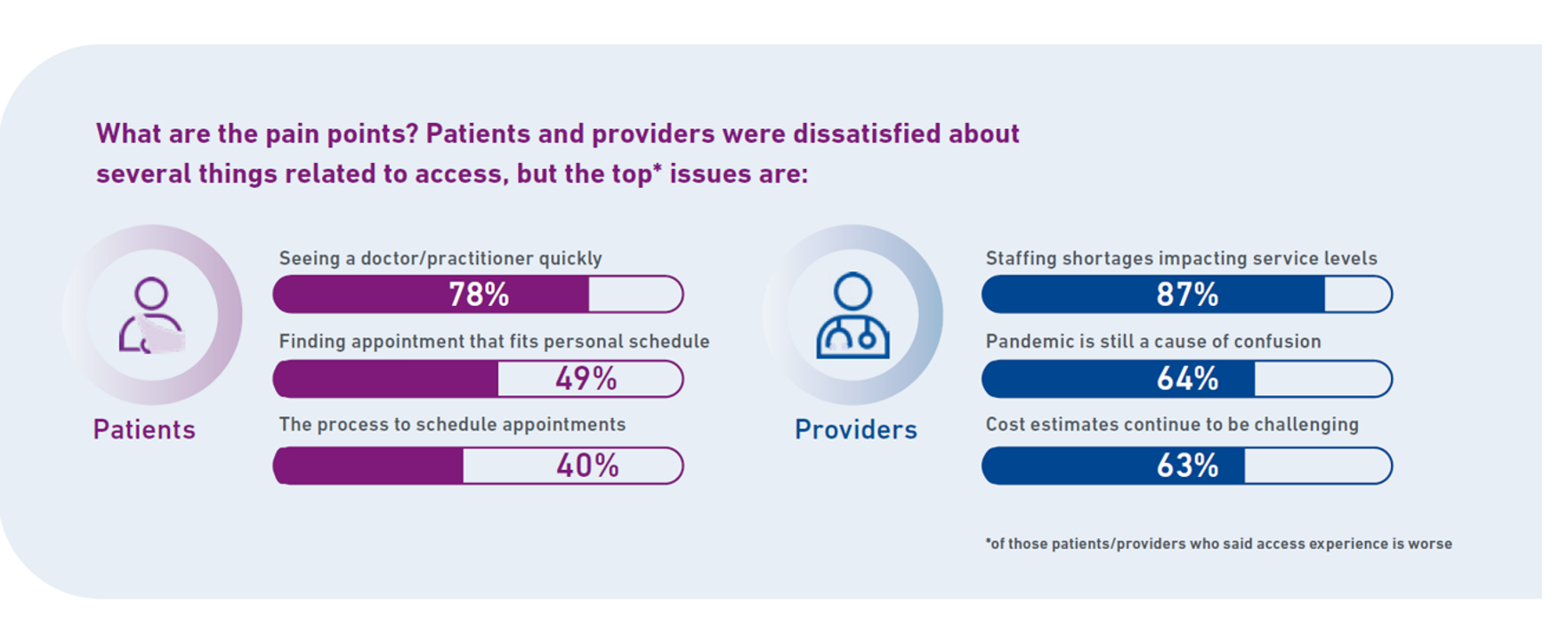

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

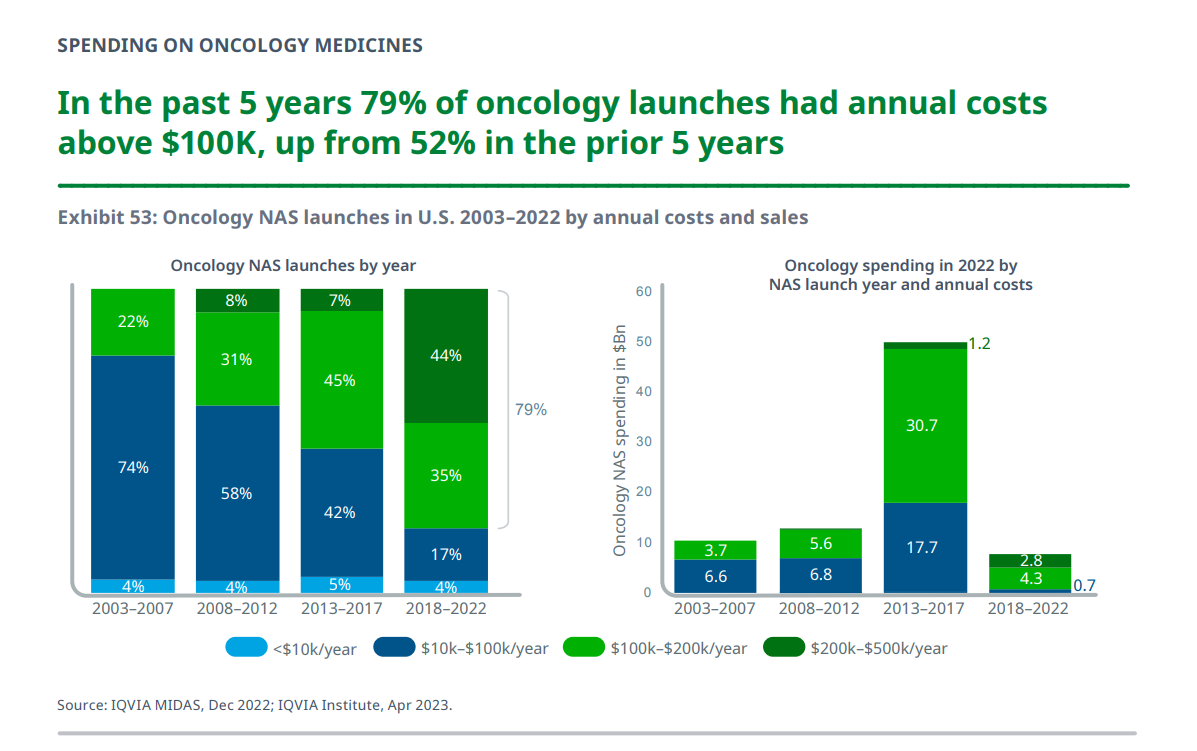

Consumers and Cancer: 3 Patient-Focused Charts From IQVIA on the State of the Oncology in 2023 – and Introducing CancerX

It’s time for the annual ASCO conference, currently convening the American Society for Clinical Oncology in Chicago. Starting 2nd June, there have been dozens of positive announcements updating research and therapies bringing hope to the 2 million new patients who will be diagnosed with cancer in the U.S. in 2023, and millions of more people worldwide. Just in time for #ASCO2023, the IQVIA Institute published their annual report on Global Oncology Trends 2023 – Outlook to 2027, an update featuring pipelines, therapy approvals, research updates, costs of oncology products, and patients.

Medical Debt: “The Debt of Necessity” – A Current U.S. Picture from the CFPB

On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report. For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed

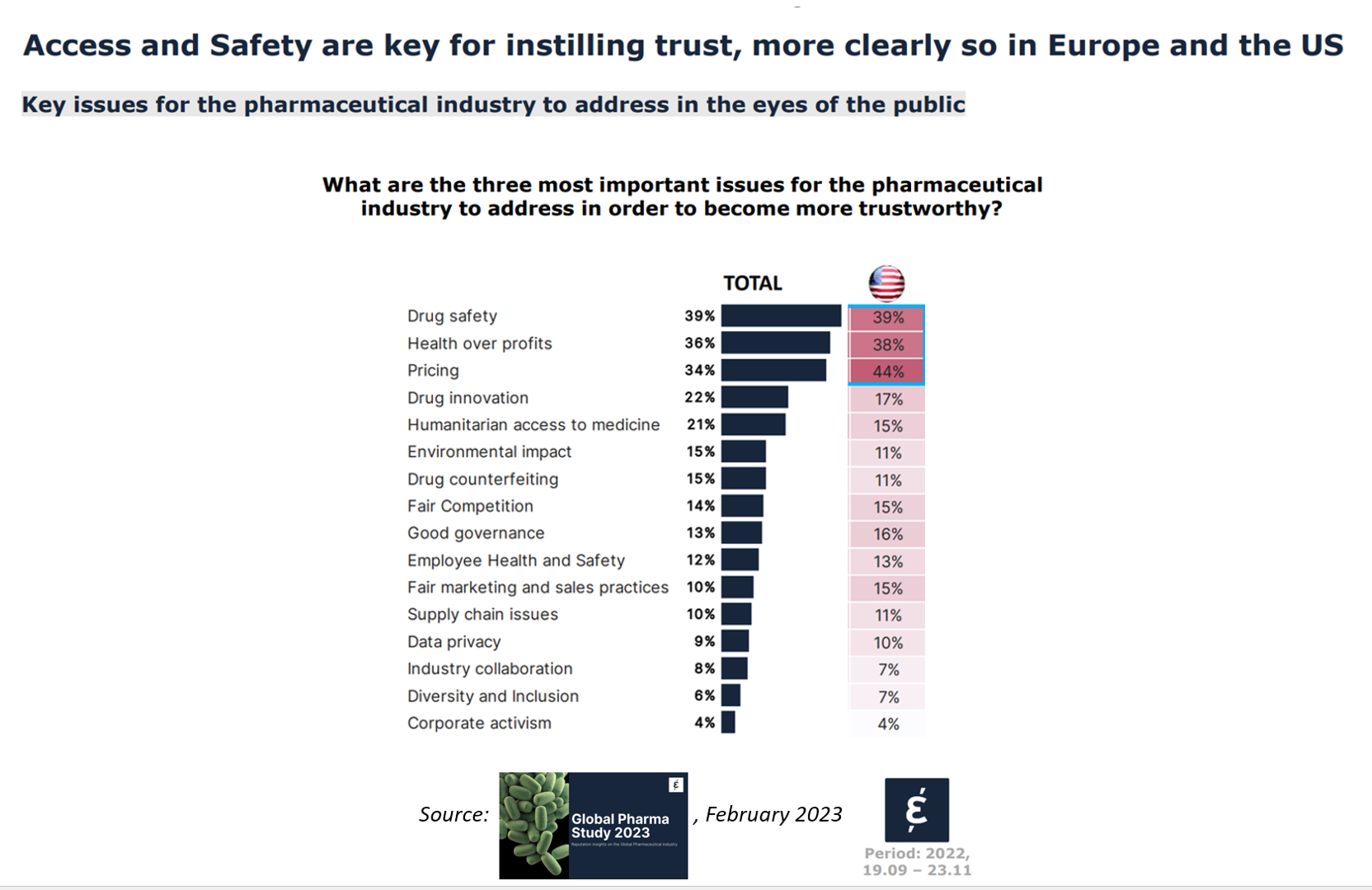

The Reputation of Pharma Among U.S. Consumers Is Tied More to Pricing Than to Innovation

In the U.S., price and the cost of medicines is tied to how people feel about the pharma industry, evidenced in the Global Pharma Study 2023 from Caliber. Caliber, a reputation and corporate strategy consultancy, fielded survey research among over 17,000 health consumers including U.S. adults between 18 and 75 years of age as well as health citizens living in Brazil, China, France, Germany, Japan, and the UK. Caliber assessed the reputation of 16 industries, globally, finding that pharma ranked 10th among the 16, just below automotive and just above chemicals (and well

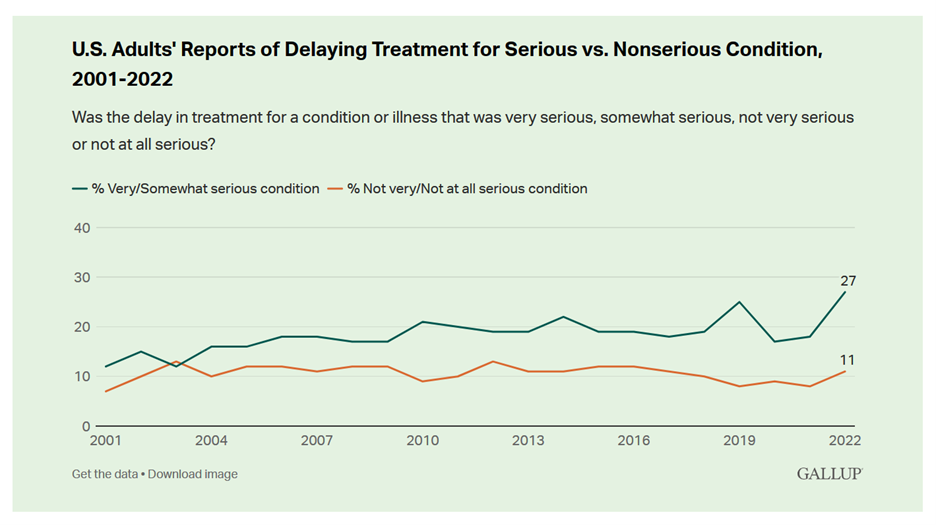

Record Numbers of People in the U.S. Putting Off Medical Care Due to Cost – A New “Pink Tax” on Women?

More people in the U.S. than ever have put off medical care due to cost, according to Gallup’s latest poll of patients in America. Gallup conducted the annual Health and Healthcare poll U.S. adults in November and December 2022. This was the highest level of self-rationing care due to cost the pollster has found since its inaugural study on the topic in 2001. This was also the most dramatic year-on-year increase of postponing treatment due to cost in the study’s history. Note the substantial difference in women avoiding

Dollar General & CHPA Collaborate to Bolster Health Consumers’ Literacy and Access for OTC Pain Meds and Self-Care

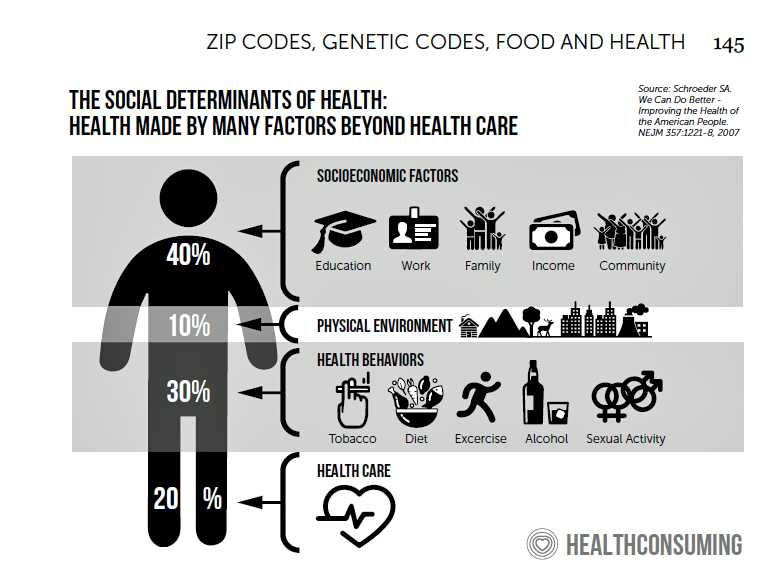

Health is “made” where we live, work, play, pray, learn….and shop. I spend a lot of time these days in the growing health/care ecosystem where retail health is broadening to address social determinants and drivers of health – namely food, transportation, broadband access, education, environment, and financial wellness – all opportunities for self-care and health engagement. For many years, I have followed the activities of CHPA, the Consumer Healthcare Products Association, and have participated in some of their conferences. Their recent announcement of a collaboration with Dollar General speaks to the growing role of self-care for all people.

$22,463 Can Get You a Year of College in Connecticut, a Round of Ref Work in the Stanley Cup Playoffs, or Health Benefits for a Worker’s Family

Employers covering health insurance for workers’ families will face insurance premiums reaching, on average, $22,463. That is roughly what a year at an independent college in Connecticut would cost, or a round of pay for a ref in the Stanley Cup playoffs. With that sticker-shock level of health plan costs, welcome to the 2022 Employer Health Benefits Survey from Kaiser Family Foundation, KFF’s annual study of employer-sponsored health care. Each year, KFF assembles data we use all year long for strategic and tactical planning in U.S. health care. This mega-study looks at

The Patient as Prescription Drug Payer – The GoodRx Playbook

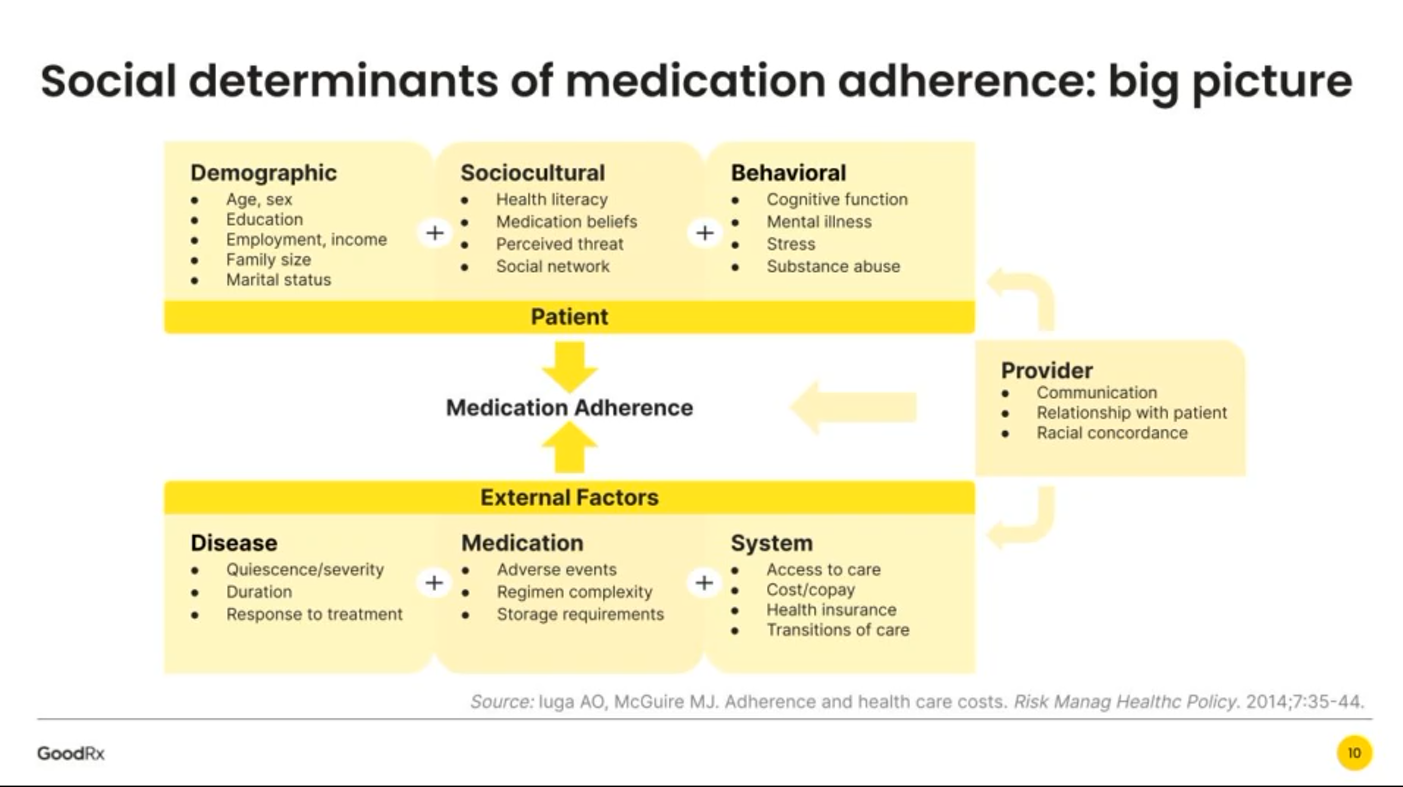

Patients have more financial skin-in-their-healthcare-games facing high-deductibles and direct out-of-pocket costs for medical bills…including prescription drugs. I collaborated with GoodRx on a “yellow paper” discussing The Health Consumers as Payer, with implications and calls-to-action for pharma and life science companies. You can download the paper at this link. The report is intended to be a playbook for understanding patients’ growing role as consumers and health care payers, providing insights into peoples’ home economic mindsets and how these impact a patient’s adherence to medication based on cost and perceived value. With inflation facing household

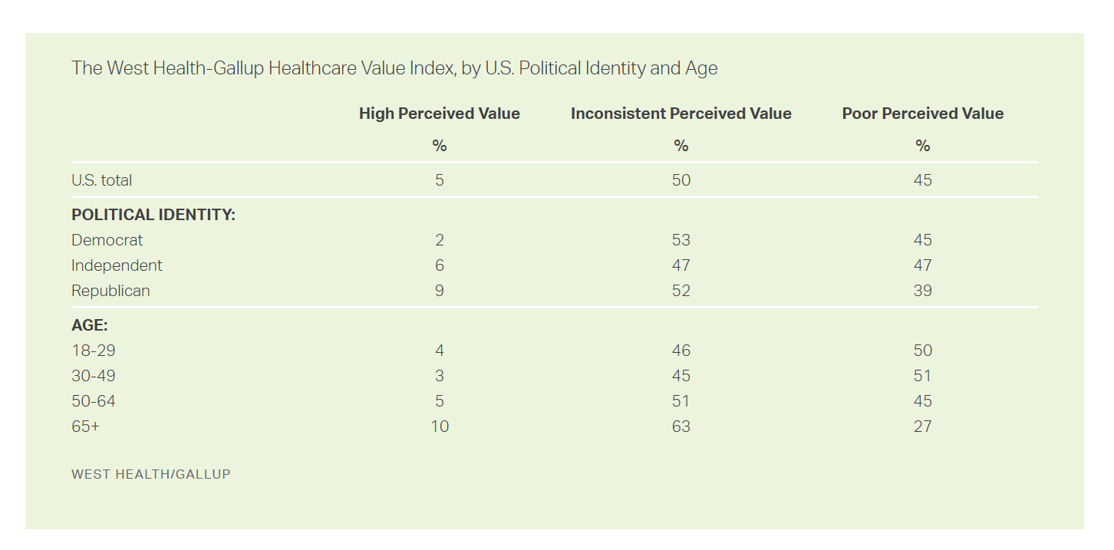

Health Care Costs Are a Driver of Health Across All of America – Especially for Women

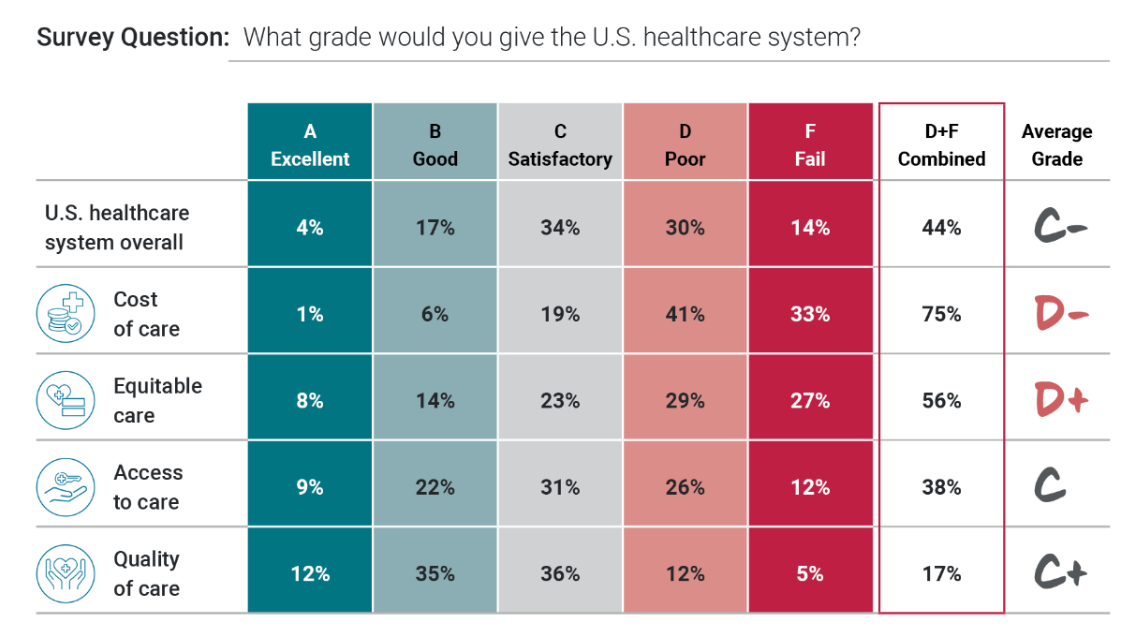

Three in four people in America grade health care costs a #fail, at grade “D” or lower. This is true across all income categories, from those earning under $24,000 a year to the well-off raking in $180K or more, we learn in Gallup’s poll conducted with West Health, finding that Majorities of people rank cost and equity of U.S. healthcare negatively. Entering the fourth quarter of 2022, several studies were published in the past week which reinforce the reality that Americans are facing high health care costs, preventing many from seeking necessary medical services, and hitting under-served health citizens even harder

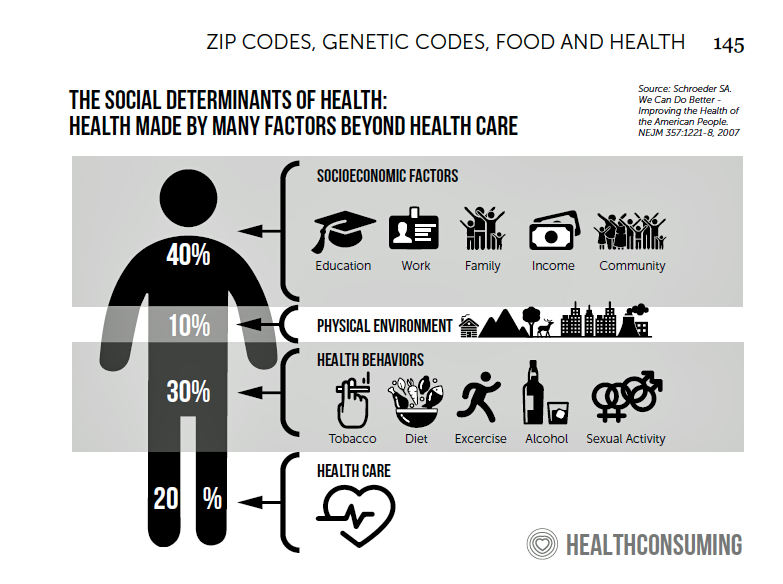

Remember the Social Determinants of Health When Prescribing Drugs

Thinking about the social determinants of prescription drugs, how people take medicines in real life in my latest post in Medecision’s Liberate Health blog. I had one of those special lightbulb moments when listening to Mauricio Gonzalez-Arias, M.D. of NYC Health + Hospitals and Suvida Healthcare discussing medication adherence and what prevents us from taking our meds as prescribed. His discussion on social determinants’ role in shaping our relationship with prescriptions was powerful, and the jumping off point for this essay. Medication adherence is a challenge that fiscally costs the

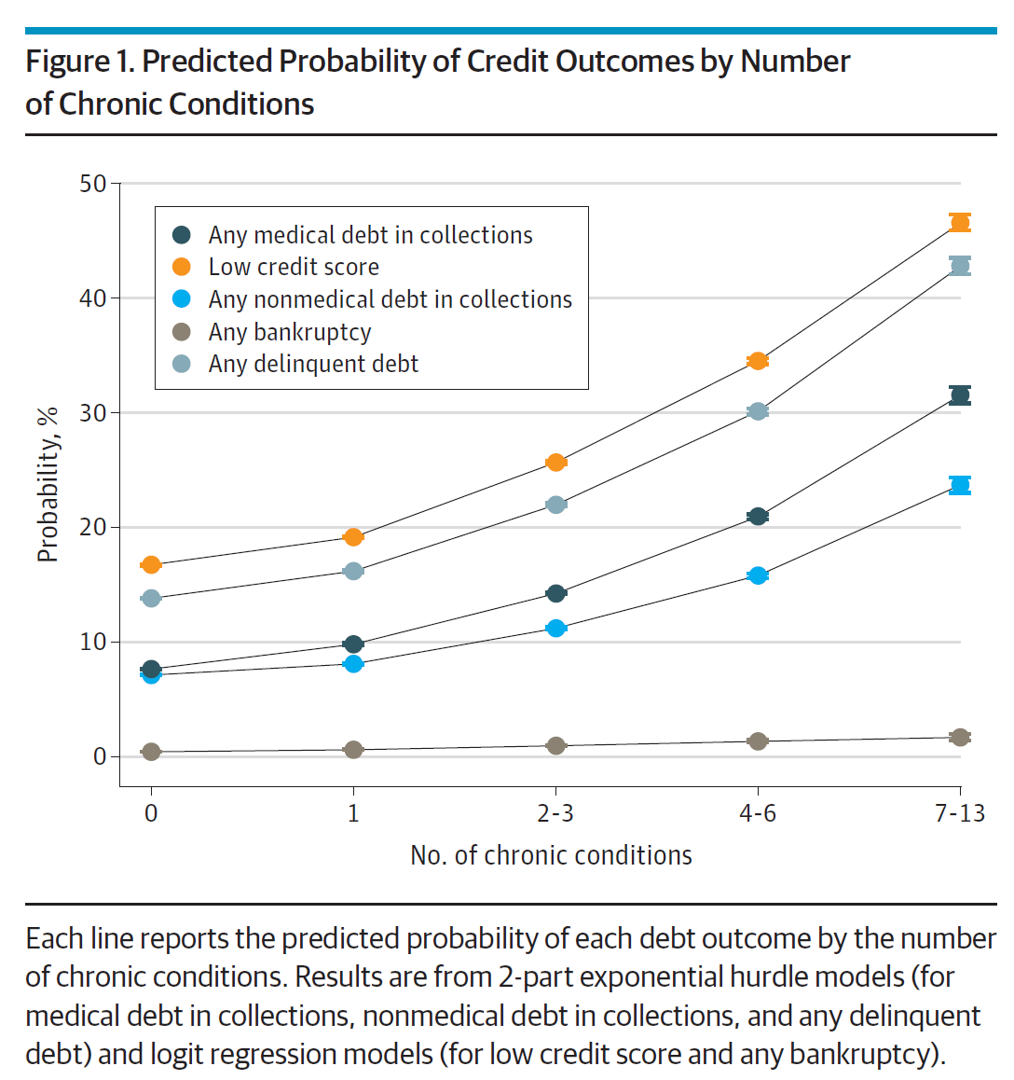

The More Chronic Conditions, the More Likely a Patient Will Have Medical Debt

There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine. Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan. The first chart illustrates the predicted probability of credit outcomes based on the

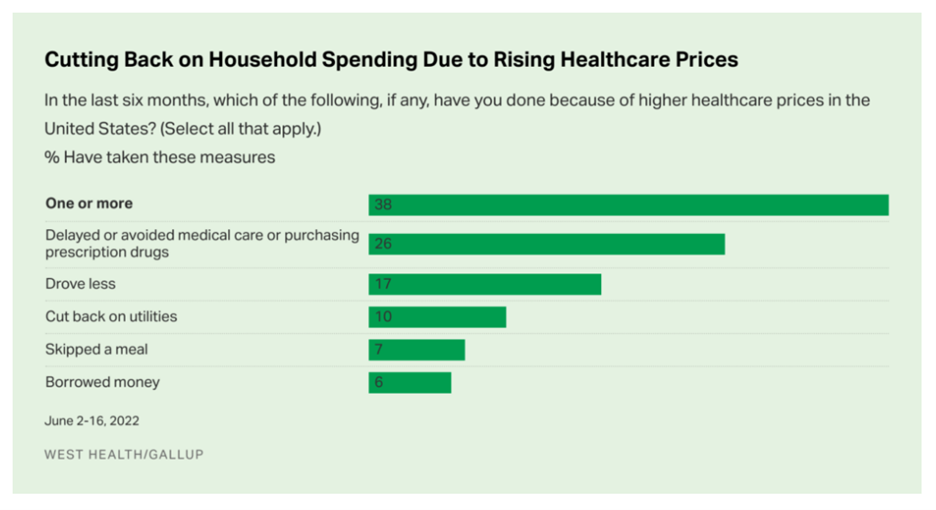

Americans Rationing Healthcare in the Inflationary Era; Out-of-Pocket Expenses Are the Concern

Nearly 100 million people in the U.S. cut back on healthcare due to costs in the first half of 2022, according to the latest poll on health care costs form Gallup and West Health, gauging Americans’ financial health in June 2022. That’s the month when inflation in the U.S. reached 9.1%, a 40-year high. Among Americans’ cuts to household spending was the most common medical self-rationing behavior, delaying or avoiding care or purchasing prescription drugs, the survey found. Nearly 4 in 5 people in the U.S. had delayed care or prescription meds between January

Patient Support Isn’t Just About the Price of Therapy: It’s About Safety, Really Rich Data and Trust

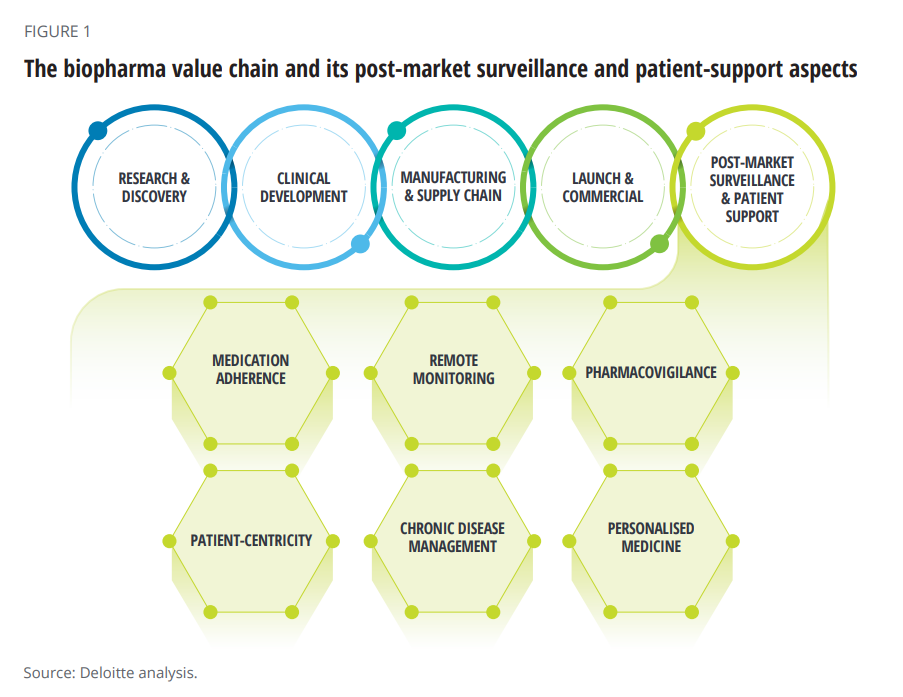

When I talk about patient support programs (PSPs), I’m most often focused on supporting peoples’ access to medicines due to costs, bolstering health literacy, and addressing health citizens’ risks of drivers of health that can be obstacles to optimal health outcomes (those challenging social determinants of health). A new report from Deloitte on Intelligent post-launch patient support speaks to another crucial definition of patient support: post-market surveillance and patient safety. The paper’s central thesis is that improving patient support is a critical step in the biopharma value chain, illustrated in the first diagram

Gas ‘N Healthcare – How Transportation Links to Health Care Access and Financial Health

Some patients dealing with cancer at Mercy Health’s Lourdes Hospital have been supplied with gas cards. This gesture is enabling families to get to medical appointments around Paducah, Kentucky where, this week, car drivers faced regular gas priced at an average of $4.16 a gallon compared with $2.92 one year ago. Here’s the Hospital’s Facebook page featuring their gratitude to FiveStar Food Mart, the American Cancer Society, and the Mercy Health Foundation. “By providing cancer patients with gas cards, the cancer care team at Mercy Health Lourdes Hospital in Paducah hopes to mitigate financial challenges

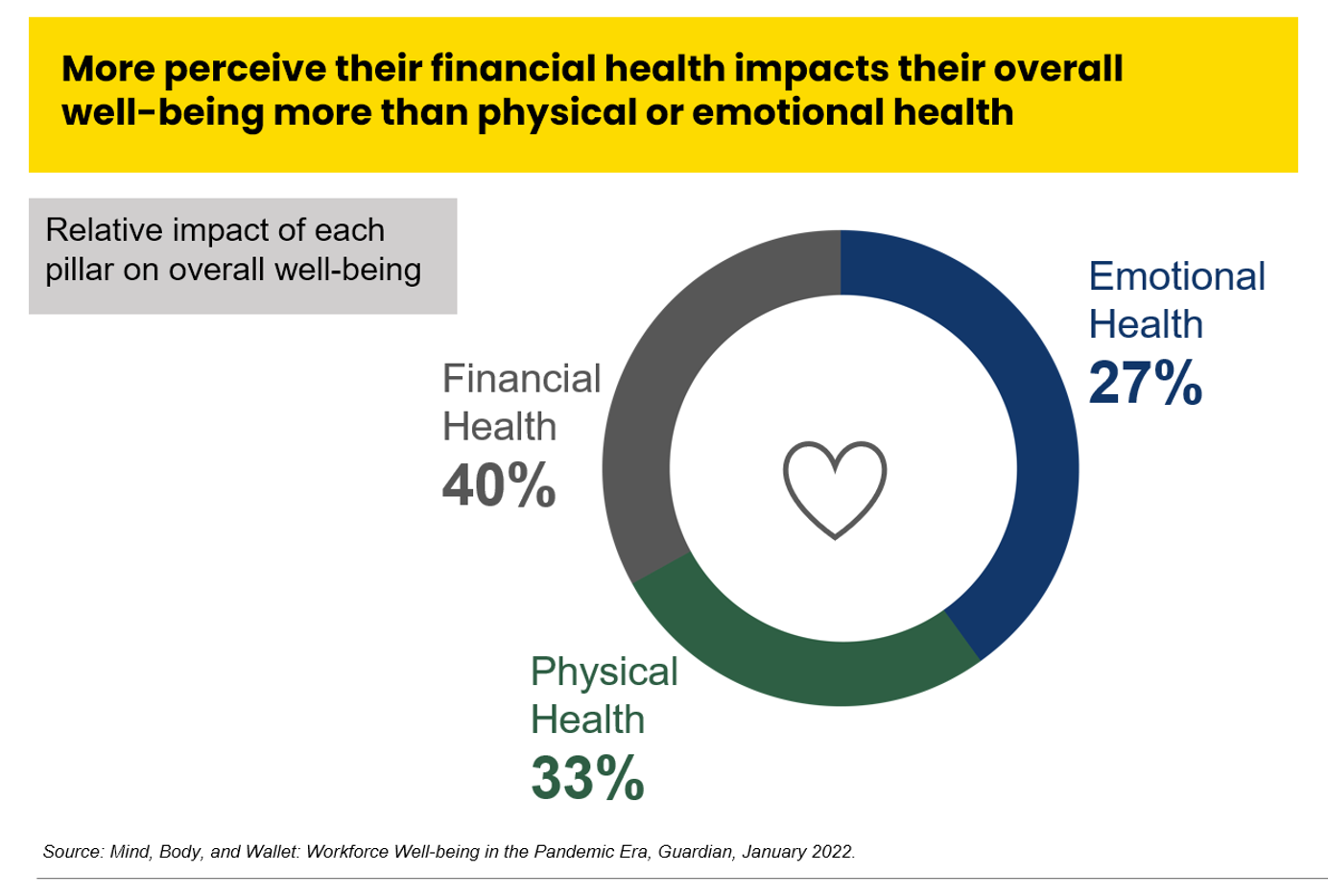

The Unbearable Heaviness of Inflation: Will Consumers’ Financial Stress Erode Their Health?

“Inflation is the big story,” the economics team at Morning Consult told us yesterday in a call on “How to Think Like An Economist.” While I already thought I did that, Team @MorningConsult updated us on the current state of consumers and what’s weighing most heavily on their minds…inflation being #1. An hour after the Morning Consult session, I brainstormed the topic of consumers-as-payers of medical bills and prescription drugs with GoodRx strategy leaders. In my data wonkiness, inflation certainly played a starring role in setting the stage for Mind, Body and Wallet — the title of one of the sources

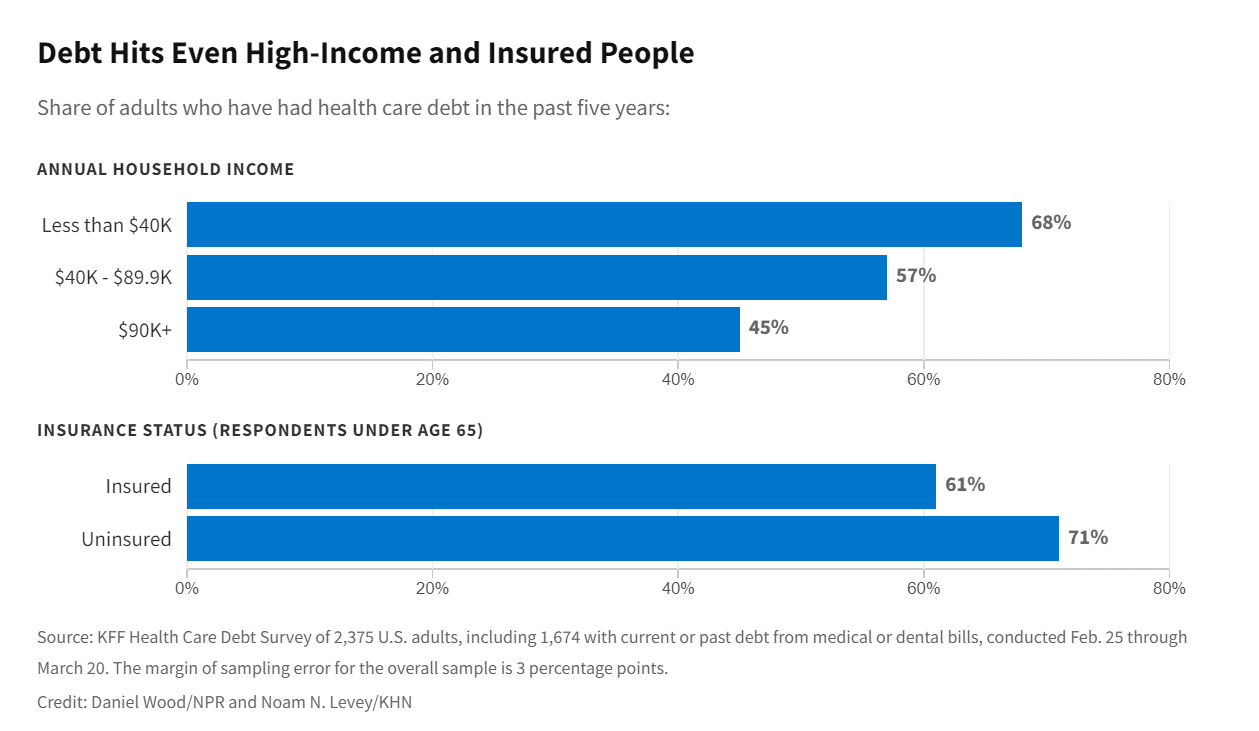

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

Jasper, Scaling a Human Touch for People Dealing with Cancer, Now With Walgreens

Each year, the first Sunday in June marks National Cancer Survivors Day. This year’s NCSD occurred two days ago on Sunday, 5th June. When you’re a cancer survivor, or happen to love one, every day is time to be grateful and celebrate that survival of someone who has come through a cancer journey. We all know (or are) people who have survived cancer. We know that the recipe for battling cancer goes beyond chemotherapy. We know of the resilience and grit required in the process: body, mind, and spirit. “Celebrate Life” is the mantra of NCSD, as this year’s campaign

What If Costco Designed the Prescription Drugs Sales Model?

The good news about prescription drugs, in the context of medical spending in the U.S., is that 9 in 10 medicines prescribed are generics. They comprise only 3% of all U.S. healthcare spending. But there’s bad news about prescription drugs in the context of medical spending in America. U.S. Consumers Overpay for Generic Drugs, a new paper from the Leonard Schaeffer Center for Health Policy & Economics asserts, with recommendations to address the intermediaries who benefit from the way Americans currently pay for medicines. Generics are “an American success story,” the authors call out, bringing

Health Care Costs At Retirement in 2022 Hit $315,000, Fidelity Forecasts

A couple retiring in 2022 should budget $315,000 to cover their health care costs in retirement, based on the 21st annual Retiree Health Care Cost Estimate from Fidelity Investments. For context, note that the median sales price of a home in the U.S. in April 2022 was $391,200. It’s important to understand what the $315,000 for “health care costs” in retirement does not cover, explained in Fidelity’s footnoted methodology: the assumption is that the hypothetical opposite-sex couple is enrolled in Original Medicare (not Medicare Advantage), and the cost estimate does not include other health-related expenses

People Thinking More About the Value of Health Care, Beyond Cost

The rate of people in the U.S. skipping needed health care due to cost tripled in 2021. This prompted West Health (the Gary and Mary West nonprofit organizations’ group) and Gallup to collaborate on research to quantified Americans’ views on and challenges with personal medical costs. This has resulted in The West Health-Gallup Healthcare Affordability Index and Healthcare Value Index. The team’s research culminated in the top-line finding that some 112 million people in the U.S. struggle to pay for their care. That’s about 4.5 in 10 health citizens. Furthermore, 93% of people

Patients Look Beyond the Pandemic to Pharma for Engagement, Innovation, and Integrity

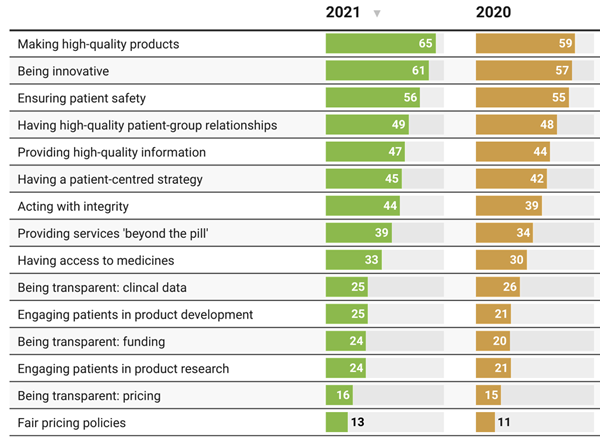

The COVID-19 pandemic has impacted patients who were already deeply engaged with their own health care before the coronavirus emerged. Compared with a year ago, more patients and their advocates are seeking quality therapies, innovation, engagement, and integrity from pharmaceutical companies, based on research published today from PatientView. PatientView, based in the UK, has collaborated with over 40,000 patient advocacy organizations globally marking over 10 years doing this research. The eleventh annual report on the Corporate Reputation of Pharma was conducted among 2,150 patient groups between November 2021 and February 2022, covering health citizens in Europe (with 1,229 organizations), North

In the New Inflationary Era, Gas and Health Care Costs Top Household Budget Concerns

Inflation and rising prices are the biggest problem facing America, most people told the Kaiser Family Foundation March 2022 Health Tracking Poll. Underpinning that household budget concern are gas and health care costs. Overall, 55% of people in the U.S. pointed to inflation as the top challenge the nation faces (ranging from 46% of Democrats to 70% of Republicans). Second most challenging problem facing the U.S. was Russia’s invasion into Ukraine, noted by 18% of people — from 14% of Republicans up to 23% of Democrats. The COVID-19 pandemic has fallen far down Americans’ concerns list tied third place with

The Financial Toxicity of Health Care Costs: From Cancer to FICO Scores

The financial toxicity of health care costs in the U.S. takes center stage in Health Populi this week as several events converge to highlight medical debt as a unique feature in American health care. “Medical debt is the most common collection tradeline reported on consumer credit records,” the Consumer Financial Protection Bureau called out in a report published March 1, 2022. CFPB published the report marking two years into the pandemic, discussing concerns about medical debt collections and reporting that grew during the COVID-19 crisis. Let’s connect the dots on: A joint announcement this week from three major credit agencies,

Will “Buy Now, Pay Later” Financing Help Health Consumers Pay Their Medical Bills?

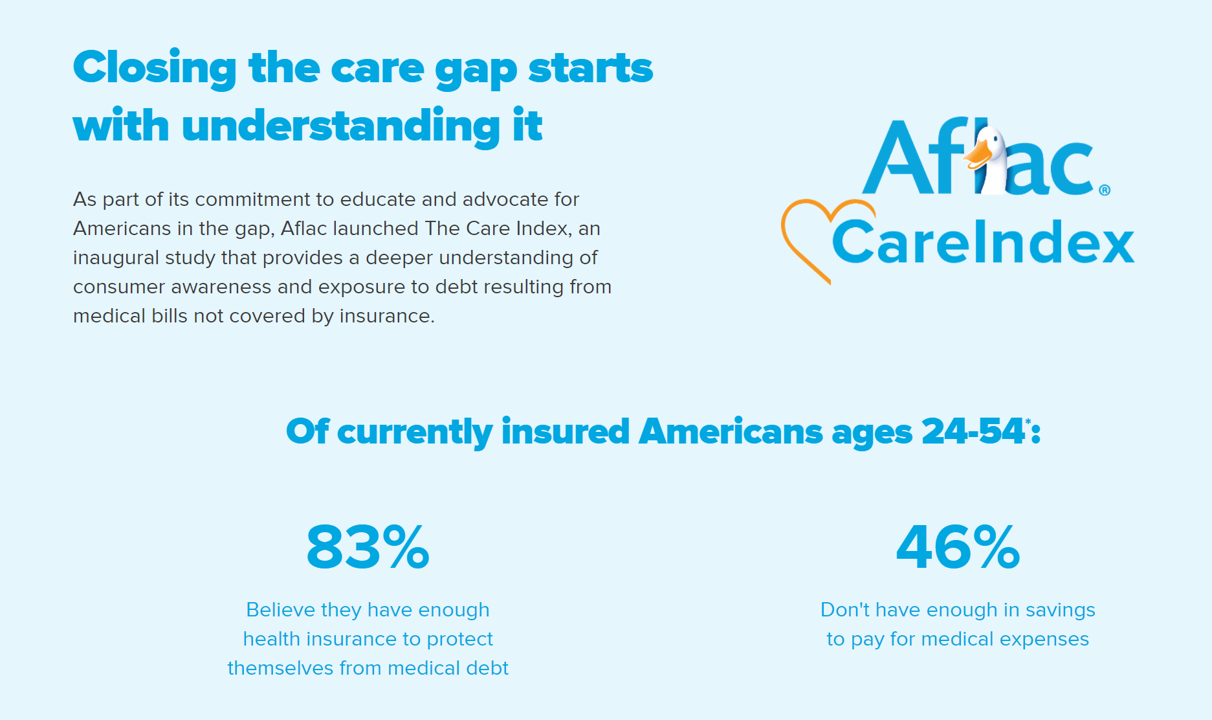

Aflac, our favorite duck-mascot-representing company, has launched the Close the Gap initiative featuring spokesman Deion Sanders, one of the good guys in the Football Hall of Fame. Recognizing the fact that nearly one-half of insured Americans don’t have enough in savings to pay for medical expenses, the company established the Aflac Care Index to educate and advocate for peoples’ health and financial security — including those people who have health care coverage. While U.S. consumers are facing historically high levels of inflation for household spending on food, petrol, and home goods, health consumers will be dealing with greater out-of-pocket spending based

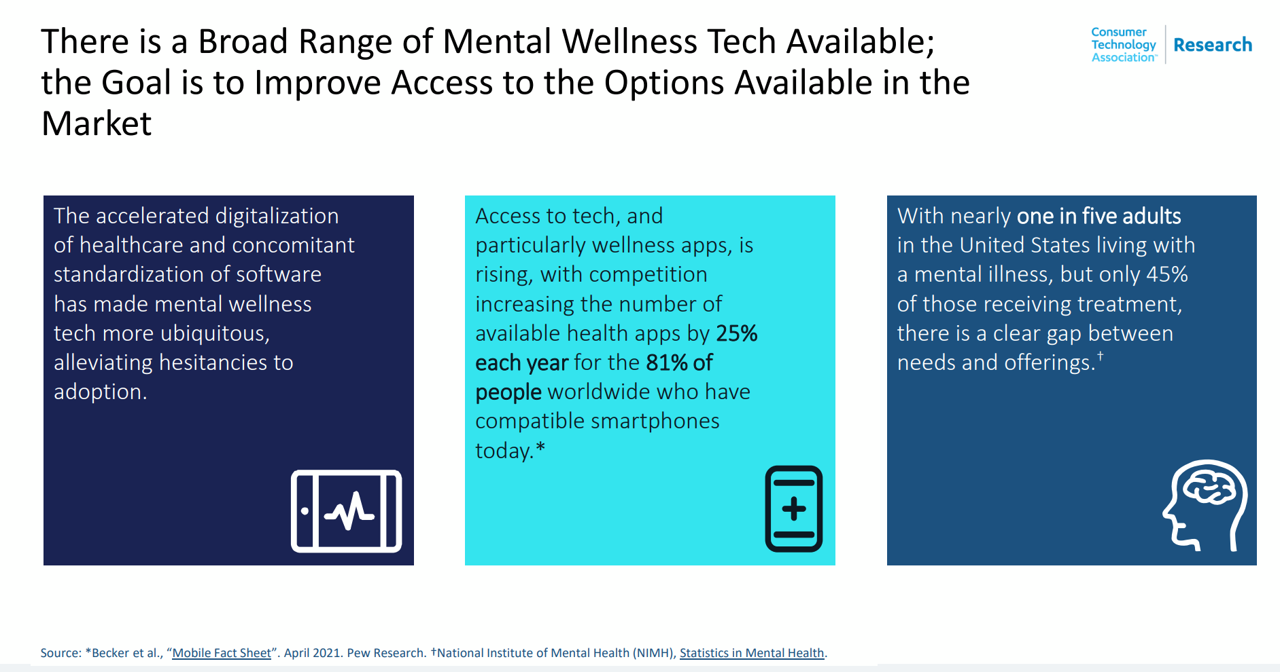

Mental Health at CES 2022 – The Consumer’s Context for Wellbeing in the New Year

As we enter COVID-19’s “junior year,” one unifying experience shared by most humans are feelings of pandemic fatigue: anxiety, grief, burnout, which together diminish our mental health. There are many signposts pointing to the various flavors of mental and behavioral health challenges, from younger peoples’ greater risk of depression and suicide ideation to increased deaths of despair due to overdose among middle-aged people. And about one-in-three Americans has made a 2022 New Year’s resolution involving some aspect of mental health, the American Psychiatric Association noted approaching the 2021 winter holiday season. Underneath this overall statistic are important differences across various

Aflac Finds Health Care and Financial Stress will “Dampen 2021 Holiday Magic” in U.S. Households

Most U.S. householders that experienced COVID-19 expect their 2021 December holidays will be impacted in terms of reducing their holiday gift or decor spending, canceling holiday travel plans to see family or friends, or canceling holiday events, according to the 2021 Aflac Health Care Issues Survey. Aflac polled 1,003 U.S. adults in September 2021 to gauge Americans’ financial health perspectives approaching the end of Year 2 of the COVID-19 pandemic in America. Families with children feel particularly strapped for the 2021 holiday season: while they will be less likely to reduce holiday spending, one-half are concerned about medical expenses compared with

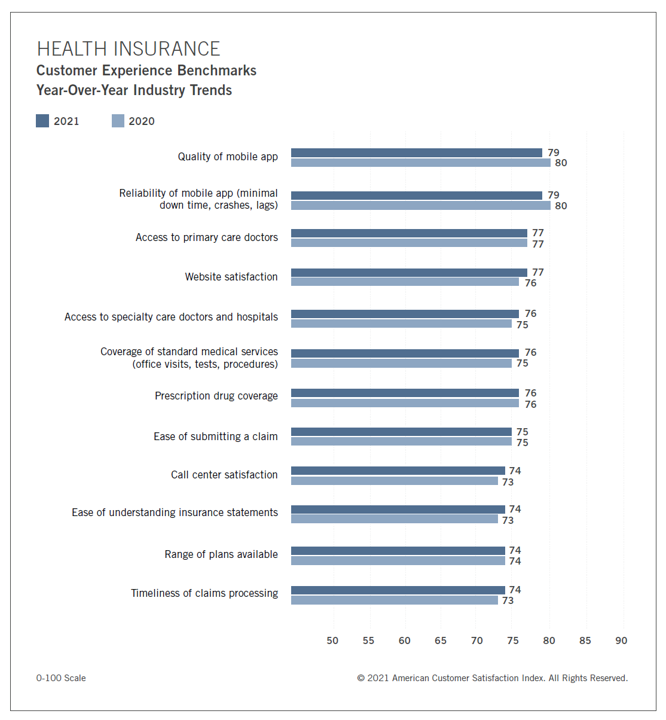

Health Plan Consumer Experience Scores Reflect Peoples’ Digital Transformation – ACSI Speaks

In the U.S., peoples’ expectations of their health care experience is melding with their best retail experience — and that’s taken a turn toward their digital and ecommerce life-flows. The American Customer Satisfaction Index Insurance and Health Care Study 2020-2021 published today, recognizing consumers’ value for the quality of health insurance companies’ mobile apps and reliability of those apps. Those digital health expectations surpass peoples’ benchmarks for accessing primary care doctors and specialty care doctors and hospitals, based on ACSI’s survey conducted among 12,274 customers via email. The study was fielded between October 2020 and September 2021. Year on year,

Be Mindful About What Makes Health at HLTH

“More than a year and a half into the COVID-19 outbreak, the recent spread of the highly transmissible delta variant in the United States has extended severe financial and health problems in the lives of many households across the country — disproportionately impacting people of color and people with low income,” reports Household Experiences in America During the Delta Variant Outbreak, a new analysis from the Robert Wood Johnson Foundation, NPR, and the Harvard Chan School of Public Health. As the HLTH conference convenes over 6,000 digital health innovators live, in person, in Boston in the wake of the delta

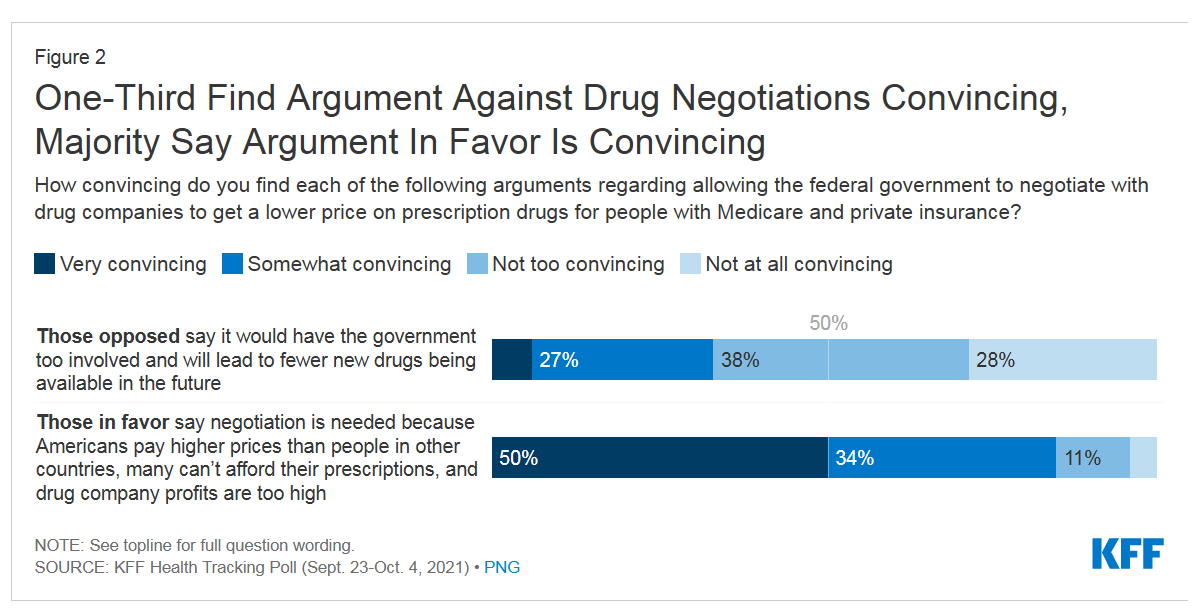

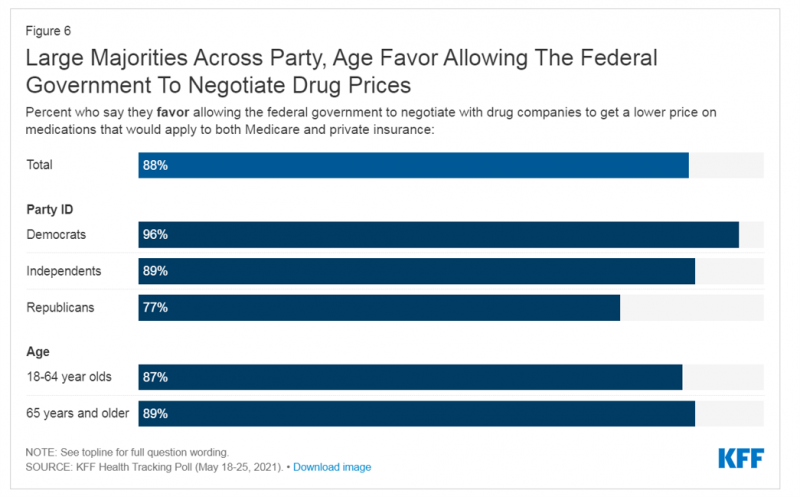

Support for Drug Price Negotiation Brings Partisans Together in the U.S.

Most U.S. adults across political parties favor allowing the Federal government authority to negotiate for drug prices — even after hearing the arguments against the health policy. Drug price negotiation, say by the Medicare program, is a unifying public policy in the current era of political schisms in America, based on the findings in a special Kaiser Family Foundation (KFF) Health Tracking Poll conducted in late September-early October 2021. Overall, 4 in 5 Americans favor allowing the Federal government negotiating power for prescription drug prices, shown in the first chart from the KFF report. By party, nearly all Democrats agree

Pondering Prescription Drugs: Pricing Rx and Going Direct-to-Consumer

There is one health care public policy issue that unites U.S. voters across political party: that is the consumer-facing costs of prescription drugs. With the price of medicines in politicians’ and health citizens’ cross-hairs, the pharmaceutical and biotech industries have responded in many ways to the Rx pricing critiques from consumers (via, for example, Consumer Reports/Consumers Union and AARP), hospitals (through the American Hospital Association), and insurance companies (from AHIP, America’s Health Insurance Plans). The latest poll from the University of Chicago/Harris Public Policy and the Associate Press-NORC Center for Public Affairs Research quantifies the issue cross-party, finding that 74%

Doctors’ Offices Morph into Bill Collectors As Patients Face Growing Out-Of-Pocket Costs

In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around. That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned

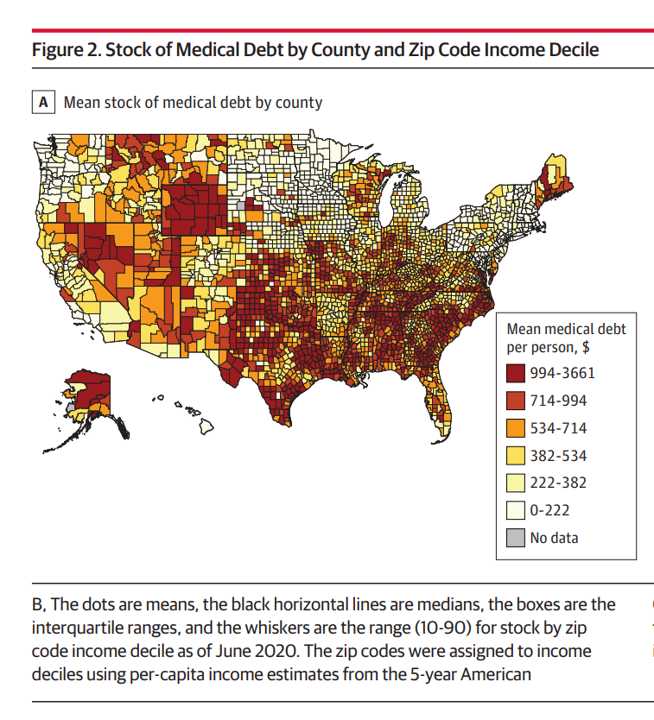

Medical Debt in the U.S. Greater in States That Did Not Expand Medicaid

The level of medical debt in America exceeded debt of other types in 2020. Furthermore, the flow of medical debt was greater among health citizens living in states that did not expand Medicaid as part of the Affordable Care Act, compared with patients who reside in Medicaid expansion states, according to an original research essay, Medical Debt in the US, 2009-2020 published in JAMA on 20 July 2021. The first line chart illustrates the trends in medical debt in collections by state expansion of Medicaid, with the bottom darkest line representing debt in collections in Medicaid expansion states from the

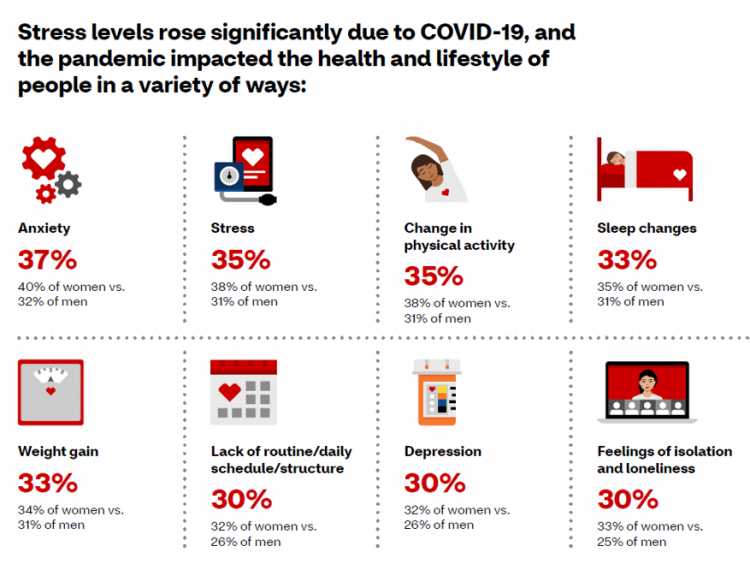

CVS Finds Differences in Mental and Behavioral Health Among Men Vs. Women in the Pandemic

As the COVID-19 pandemic shifts to a more endemic phase — becoming part of peoples’ everyday life for months to come — impacts on peoples’ mental health will persist, according to new research from CVS Health in the company’s annual Health Care Insights Study. CVS conducted the annual Health Care Insights Study among 1,000 U.S. adults in March 2021. To complement the consumer study, an additional survey was undertaken among 400 health care providers including primary care physicians and specialists, nurse practitioners, physician assistants, RNs and pharmacists. CVS has been tracking the growing trend of health care consumerism in the

Healthy Living Trends Inspired by COVID-19: Retailers, Food, and Consumers’ Growing Self-Care Muscles

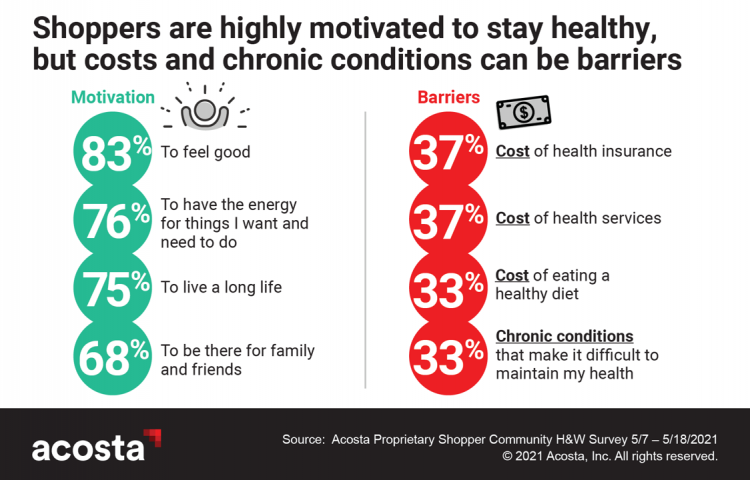

“Self-care” took on new meaning and personal work-flows for people living in and through the coronavirus pandemic in the U.S. Acosta, the retail market research pro’s, updated our understanding consumers evolving as COVID-19 Has Elevated the Health and Wellness Trends of the Recent Years, results of a survey conducted among in May 2021. In the U.S., consumers’ take on self-care has most to do with healthy eating and nutrition (for 1 in 2 people), getting regular medical checkups (for 42%), taking exercise, relaxing, using vitamins and supplements, and getting good sleep. Healthy relationships are an integral part of self-care for

Dollar General, the Latest Retail Health Destination?

“What if…healthcare happened where we live, work, play, pray and shop, delivering the highest levels of retail experience?” I asked and answered in my book HealthConsuming: From Health Consumer to Health Citizen. The chapter called “The new retail health” began with that “what if,” and much of the book responded with the explanation of patients evolving toward health consumers and, ultimately, health citizens empowered and owning their health and care. This week, Dollar General announced the hiring of its first Chief Medical Officer, Dr. Albert Wu. With that announcement, America’s largest dollar-store chain makes clear its ambitions to join a

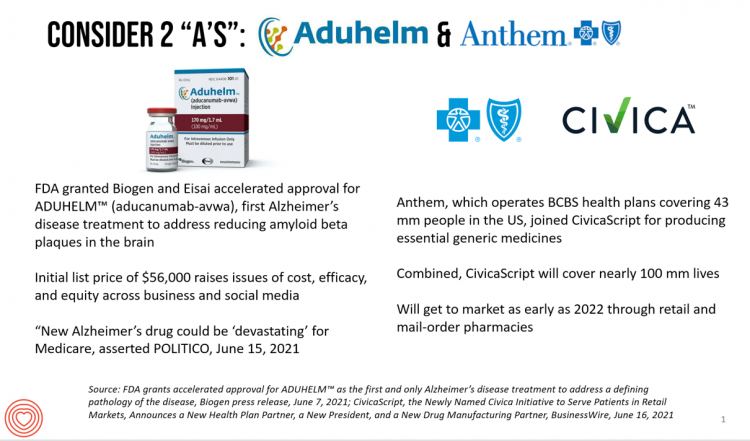

Aduhelm and Alzheimer’s Disease: A Potential Medicare Budget-Buster Puts A Blazing Light on Health Care Costs and Innovation

The FDA’s approval of the first therapy to treat Alzheimer’s Disease in over twenty years brought attention to a not-yet-convened debate of U.S. health care costs and spending, innovation, and return-on-the-investment (as well as “for whom” do the returns accrue). In my latest post for Medecision, I explore different angles on the Aduhelm and Alzheimer’s discussion, covering: The macro- and micro-economics of Alzheimer’s and the $56,000 list price for the drug The FDA regulatory process and aftermath U.S. consumers’ bipartisan support for drug price regulation through Medicare negotiation and private/commercial sector adoption Congressional legislation addressing the price of medicines in

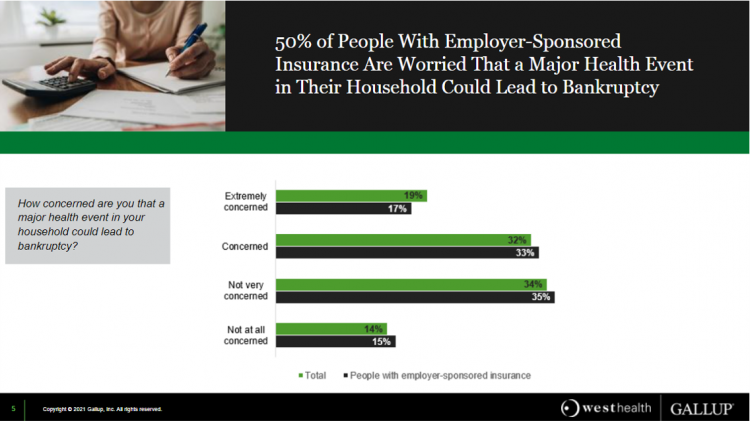

One in Two Americans with Work-Based Insurance Worries That Healthcare Costs Could Lead to Bankruptcy

One in two people in the U.S. with employer-sponsored health insurance worry that a major health event in their household could lead to bankruptcy, according to research gathered by West Health and Gallup in Business Speaks: The Future of Employer-Sponsored Insurance. Gallup and West Health presented their study in a webinar earlier this week; in today’s post, I feature a few key data points that particularly resonate as I celebrate/appreciate yesterday’s U.S. Supreme Court’s ruling on the Affordable Care Act (i.e., California v. Texas) combined with a new study published in JAMA Network Open, discussed below the digital fold in

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

What Do Democrats and Republicans Agree On? Allowing Negotiations to Lower Rx Prices

People living in the U.S. have weathered over fifteen months of life-shifts for work, school, prayer, fitness, and social lives. So you might think that the most important public priority for Congress might have something to do with COVID-19, vaccines, or health insurance coverage. But across all priorities, it turns out that prescription drug costs rank higher in Americans’ minds than any other issue in the Kaiser Family Foundation Health Tracking Poll for May 2021. Two-thirds of U.S. adults said that allowing the federal government and private insurance plans to negotiate for lower prices on Rx drugs was their top

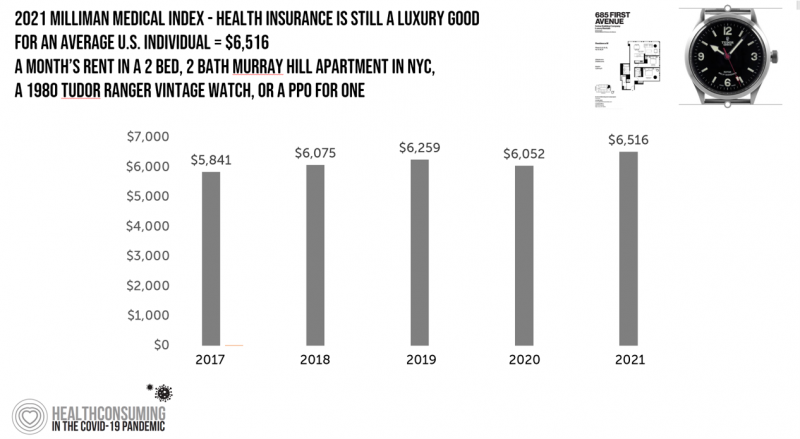

The Cost of Health Care for a Family of 4 in America Will Reach $28,256 in 2021

The good news for health care costs for a family of four in America is that they fell, for the first time in like, ever, in 2020. But like a déjà vu all over again, annual health care costs for a family of four enrolled in a PPO will climb to over $28,000 in 2021, based on the latest 2021 Milliman Medical Index (MMI). The first chart shows how health care costs declined in our Year of COVID, 2020, by over $1,000 for that hypothetical U.S. family. But costs rise with a statistical vengeance this year, by nearly $2,200 per family–about

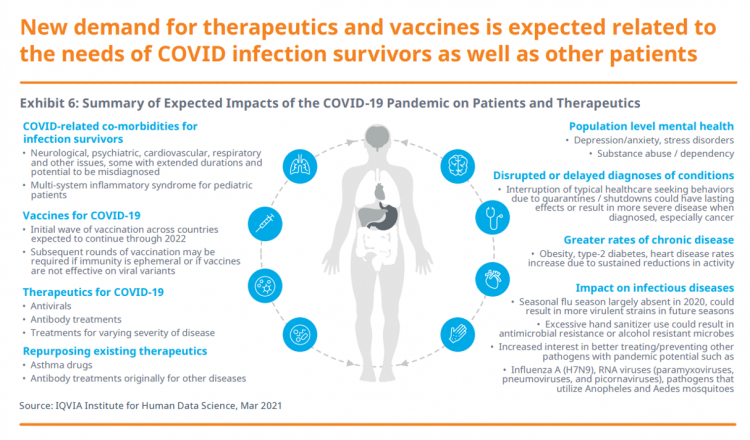

Spending on Medicines In and Post-COVID Say a Lot About Patients and Larger Healthcare Trends – an IQVIA Update

Spending on medicines, globally, will rebound this year and rise above pre-pandemic levels through 2025. Between 2021 and 2025, the annual growth global growth rate for prescription drugs spending is expected to range from 3% to 6%, a $1.6 trillion bill for the worlds’s total Rx medicines market. That relatively low single-digit growth rate is tempered by savings from biosimilars and the loss of brand exclusivity (that is, more generics coming to market). On the faster-growth side, we can expect two big therapeutic areas to drive spending upward: oncology and immunology, projected to expand by 9% to 12% each year

And the Oscar Goes To….Power to the Patients!

Health care has increased its role in popular culture over the years. In movies in particular, we’ve seen health care costs and hassles play featured in plotlines in As Good as it Gets [theme: health insurance coverage], M*A*S*H [war and its medical impacts are hell], and Philadelphia [HIV/AIDS in the era of The Band Played On], among dozens of others. And this year’s Oscar winner for leading actor, Anthony Hopkins, played The Father, who with his family is dealing with dementia. [The film, by the way, garnered six nominations and won two]. When I say “Oscar” here on the Health

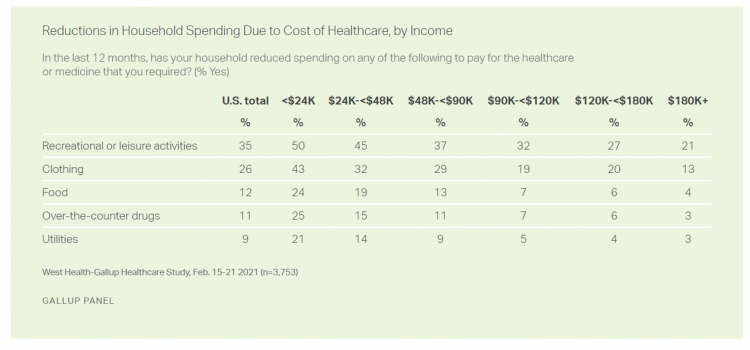

The Cost of Healthcare Can Drive Medical Rationing and Crowd Out Other Household Spending

One in five people in the U.S. cannot afford to pay for quality health care — an especially acute challenge for Black and Hispanic Americans, according to a West Health-Gallup poll conducted in March 2021, a year into the COVID-19 pandemic. “The cost of healthcare and its potential ramifications continues to serve as a burdensome part of day-to-day life for millions of Americans,” the study summary observed. Furthermore, “These realities can spill over into other health issues, such as delays in diagnoses of new cancer and associated treatments that are due to forgoing needed care,” the researchers expected. The first table

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

Ten Forces Shaping Health Care in 2021: A View from CVS Health

Expanding omni-channel, data-driven, cost-effective health care in the community, tailoring that care, and attending to mental health paint the picture of health through the lens of CVS Health. The company published the Health Trends Report 2021 today, calling out ten forces shaping health care this year. Those themes are, The Year of the Pharmacist The Next Step Forward in Cardiac Care Cancer Needs a Better Roadmap The EHR Hits Its Stride The Mental Health Shadow of COVID-19 Tailor Care to the Older Patient More Agents that Predict Disease Paying for the New Medical Miracle Virtual Care Goes Mainstream, and Diabetes

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

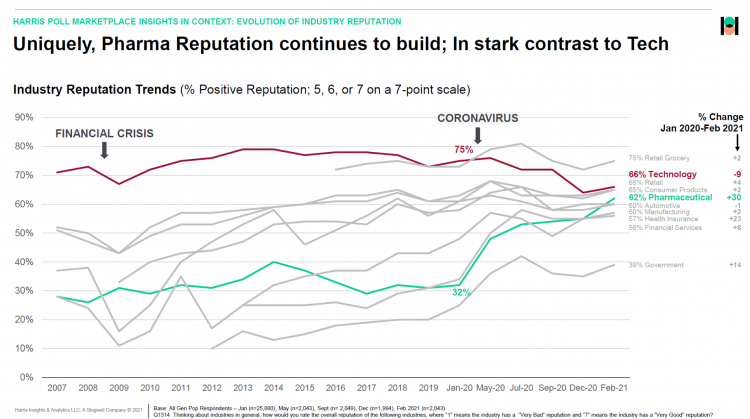

The Remarkable Rise of Pharma’s Reputation in the Pandemic

The reputation of the pharmaceutical industry gained a “whopping” 30 points between January 2020 and February 2021, based on the latest Harris Poll in their research into industries’ reputations. The study was written up by Beth Snyder Bulik in FiercePharma. Beth writes that, “a whopping two-thirds of Americans now offer a thumbs-up on pharma” as the title of her article, calling out the 30-point gain from 32% in January 2020 to 62% in February 2021. Thanks to Rob Jekielek, Managing Director of the Harris Poll, for sharing this graph with me for us to understand the details comparing pharma’s to

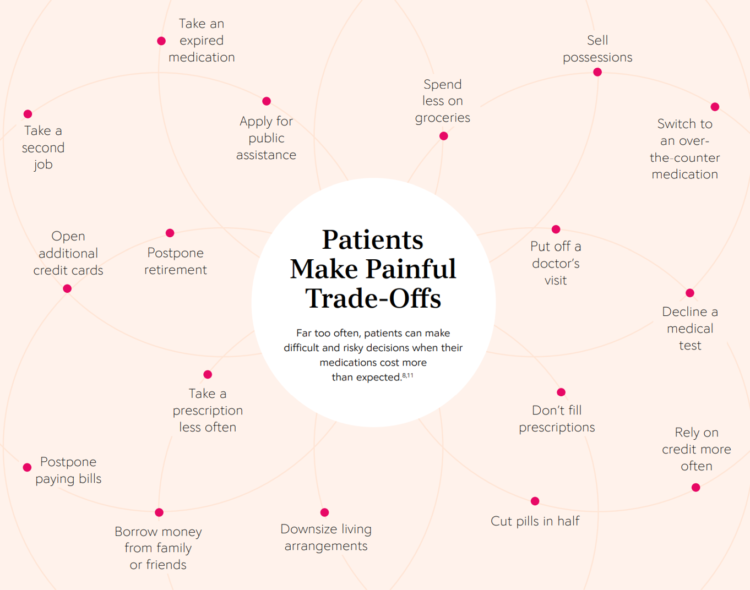

The Social Determinants of Prescription Drugs – A View From CoverMyMeds

The COVID-19 pandemic forced consumers to define what were basic or essential needs to them; for most people, those items have been hygiene products, food, and connectivity to the Internet. There’s another good that’s essential to people who are patients: prescription drugs. A new report from CoverMyMeds details the current state of medication access weaving together key health care industry and consumer data. The reality even before the coronavirus crisis emerged in early 2020 was that U.S. patients were already making painful trade-offs, some of which are illustrated in the first chart from the report. These include self-rationing prescription drug

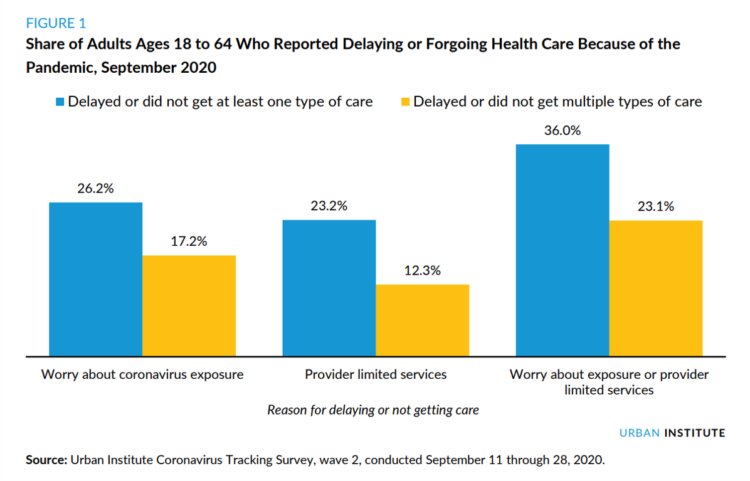

Three in Four People Avoiding Health Care in the Pandemic Have Had Chronic Conditions

By the autumn of 2020, U.S. physicians grew concerned that patients who were avoiding visits to doctor’s offices were missing care for chronic conditions, discussed in in Delayed and Forgone Health Care for Nonelderly Adults during the COVID-19 Pandemic from the Urban Institute. More than three-fourths of people who delayed or forewent care had at least one chronic health condition. The pandemic may have led to excess deaths from diabetes, dementia, hypertension, heart disease, and stroke, as well as record drug overdoses in the 12 months ending in May 2020. In their JAMA editorial on these data, Dr. Bauchner and

U.S. Health Consumers’ Growing Financial Pressures, From COVID to Cancer

Before the coronavirus pandemic, patients had been transforming into health care payors, bearing high deductibles, greater out of pocket costs, and financial risk shifting to them for medical spending. In the wake of COVID-19, we see health consumers-as-payors impacted by the pandemic, as well as for existing diagnoses and chronic care management. There is weakening in U.S. consumers’ overall household finances, the latest report from the U.S. Bureau of Economic Analysis (BEA) asserted (published 25 November 2020). In John Leer’s look into the BEA report in Morning Consult, he wrote, “Decreases in income, the expiration of unemployment benefits and increased

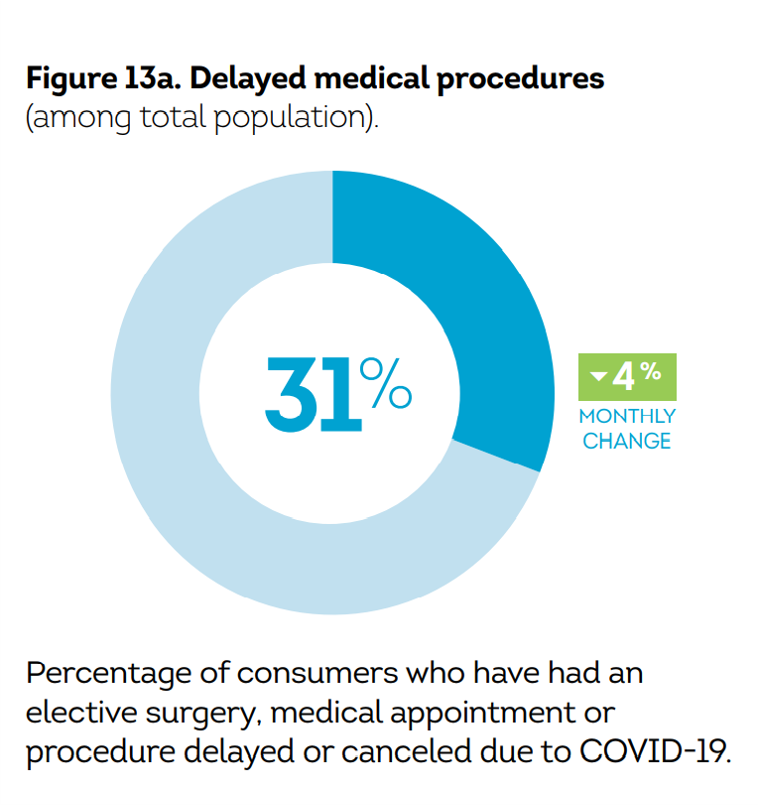

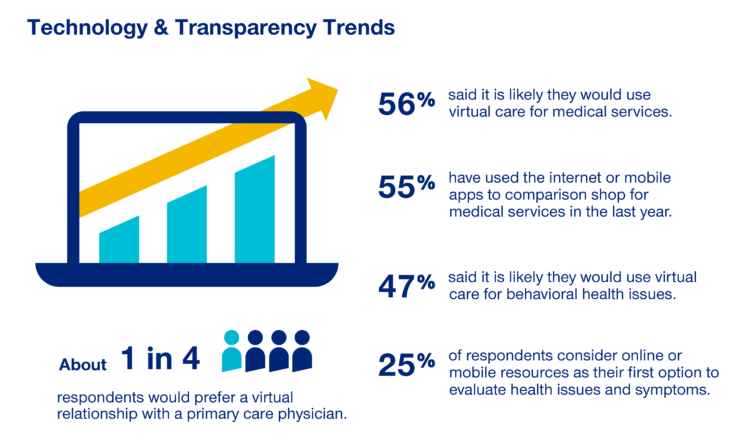

The COVID-19 Era Has Grown Health Consumer Demand for Virtual Care

Over one-half of Americans would likely use virtual care for their healthcare services, and one in four people would actually prefer a virtual relationship with a primary care physician, according to the fifth annual 2020 Consumer Sentiment Survey from UnitedHealthcare. What a difference a pandemic can make in accelerating patients’ adoption of digital health tools. This survey was conducted in mid-September 2020, and so the results demonstrate U.S. health consumers’ growing digital health “muscles” in the form of demand and confidence in using virtual care. One in four people would consider online options as their first-line to evaluating personal health

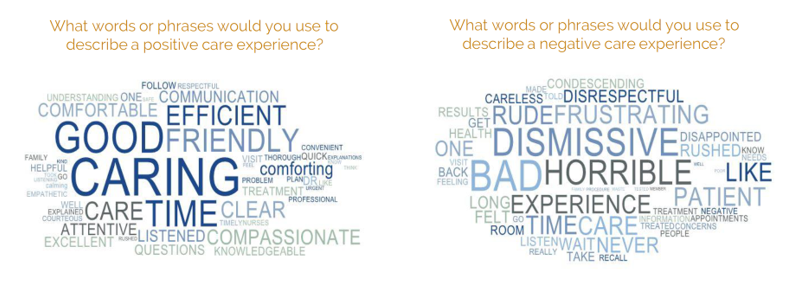

Healthcare Costs, Access to Data, and Partnering With Providers: Patients’ Top User Experience Factors

As patients returned to in-person, brick-and-mortar health care settings after the first wave of COVID-19 pandemic, they re-enter the health care system with heightened consumer expectations, according to the Beryl Institute – Ipsos Px Pulse report, Consumer Perspectives on Patient Experience in the U.S. Ipsos conducted the survey research among 1,028 U.S. adults between 23 September and 5 October 2020 — giving consumers many months of living in the context of the coronavirus. This report is a must-read for people involved with patient and consumer health engagement in the U.S. and covers a range of issues. My focus in this

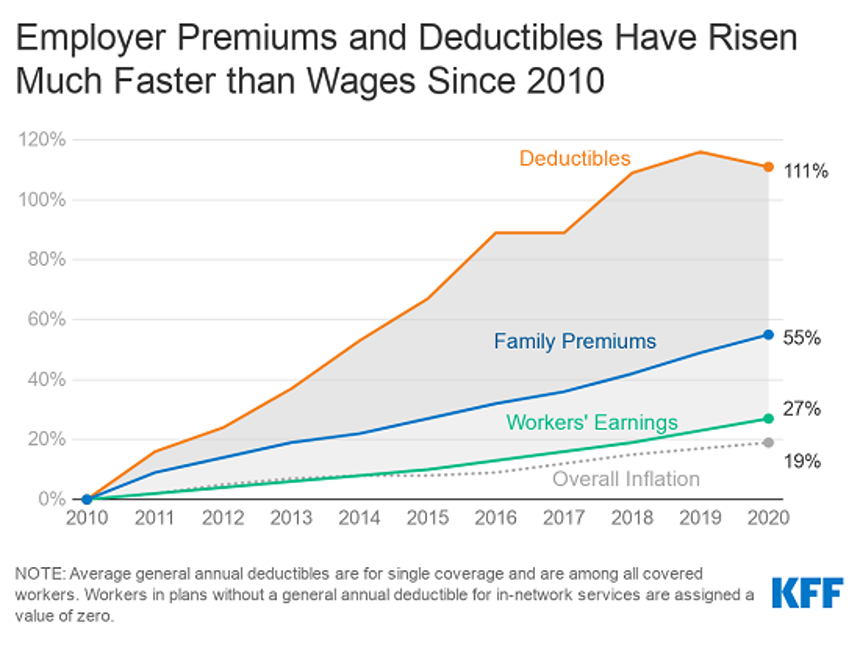

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

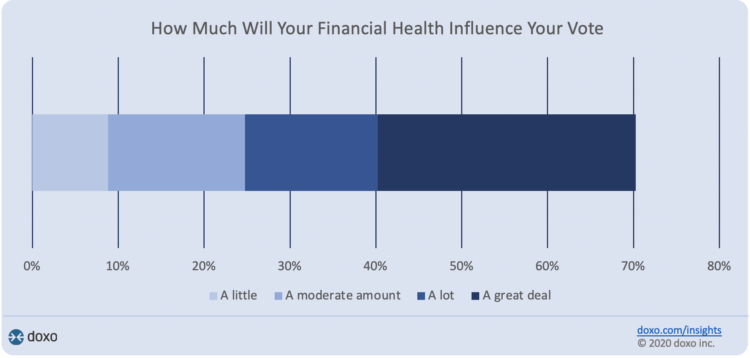

Financial Health Is On Americans’ Minds Just Weeks Before the 2020 Elections

Financial health is part of peoples’ overall health. As Americans approach November 3, 2020, the day of the real-time U.S. Presidential and down-ballot elections, personal home economics are front-of-mind. Twenty-seven days before the 2020 elections, 7 in 10 Americans say their financial health will influence their votes this year, according to the doxoINSIGHTS survey which shows personal financial health as a key voter consideration in the Presidential election. Doxo, a consumer payments company, conducted a survey among 1,568 U.S. bill-paying households in late September 2020. The study has a 2% margin of error. U.S. voters facing this year’s election are

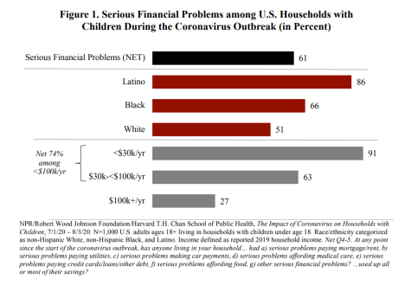

Social Determinants of Health Travel in Groups – At the Root Is Household Income

The U.S. health care community is collectively embracing the concept of social determinants of health that have become so obvious in understanding the disparities of health outcomes wrought by the coronavirus pandemic. Research from the Harvard Chan School of Public Health conducted with the Robert Wood Johnson Foundation and NPR illustrates the fact that people who are at risk for one social determinant of health tend to be challenged by a bucket of them. The survey research reported in The Impact of Coronavirus on Households With Children, published on 30th September, found that 61% of U.S. households with children had

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

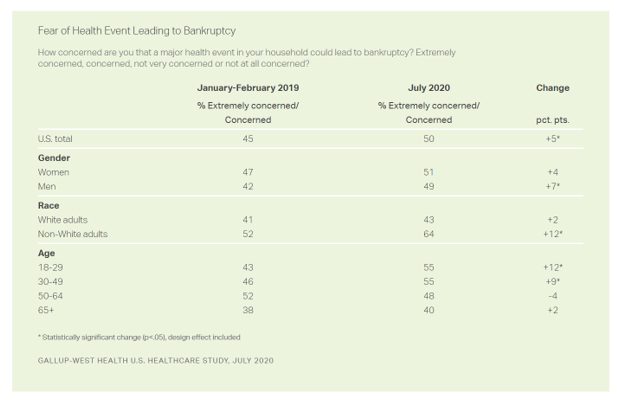

Americans Worry About Medical Bankruptcy, As Prescription Drug Costs Play Into Voters’ Concerns

One in two people in the U.S. are concerned that a major health event in their family would lead to bankruptcy, up 5 percent points over the past eighteen months. In a poll conducted with West Health, Gallup found that more younger people are concerned about medical debt risks, along with more non-white adults, published in their study report, 50% in U.S. Fear Bankruptcy Due to Major Health Event. The survey was fielded in July 2020 among 1,007 U.S. adults 18 and older. One of the basic questions in studies like these is whether a consumer could cover a $500

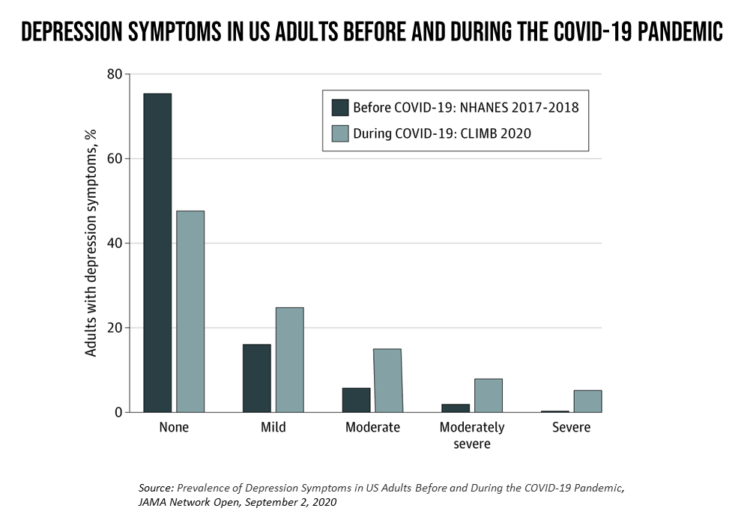

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

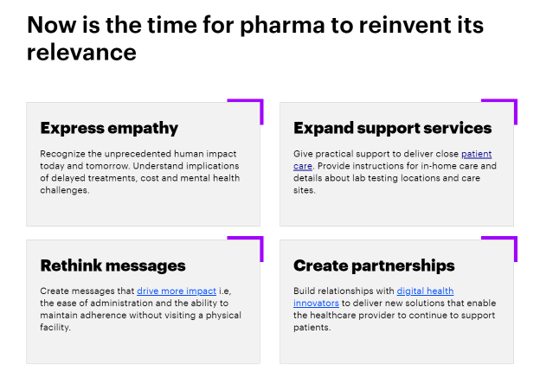

Pharma’s Future Relevance Depends on Empathy, Messaging, Partnering, and Supporting Patients and Providers

COVID-19 is re-shaping all industries, especially health care. And the pharma industry is challenged along with other health care sectors. In fact, the coronavirus crisis impacts on pharma are especially accelerated based on how the pandemic has affected health care providers, as seen through research from Accenture published in Reinventing Relevance: New Models for Pharma Engagement with Healthcare Providers in a COVID-19 World. For the study, Accenture surveyed 720 health care providers in general practice, oncology, immunology, and cardiology working in China, France, Japan, the United Kingdom, and the U.S., in May and June 2020. Top-line, Accenture points to four

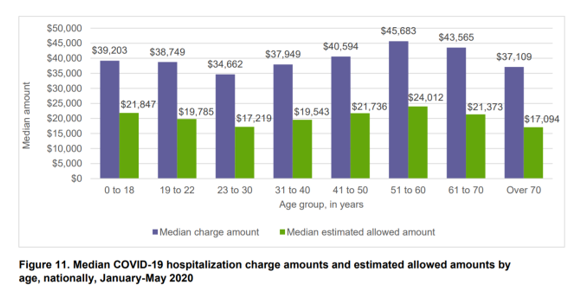

The Median Hospital Charge In the U.S. for COVID-19 Care Ranges From $34-45K

The median charge for hospitalizing a patient with COVID-19 ranged from $34,662 for people 23 to 30, and $45,683 for people between 51 and 60 years of age, according to FAIR Health’s research brief, Key Characteristics of COVID-19 Patients published July 14th, 2020. FAIR Health based these numbers on private insurance claims associated with COVID-19 diagnoses, evaluating patient demographics (age, gender, geography), hospital charges and estimated allowed amounts, and patient comorbidities. They used two ICD-10-CM diagnostic codes for this research: U07.1, 2019-nCoV acute respiratory disease; and, B97.29, other coronavirus as the cause of disease classified elsewhere which was the original code

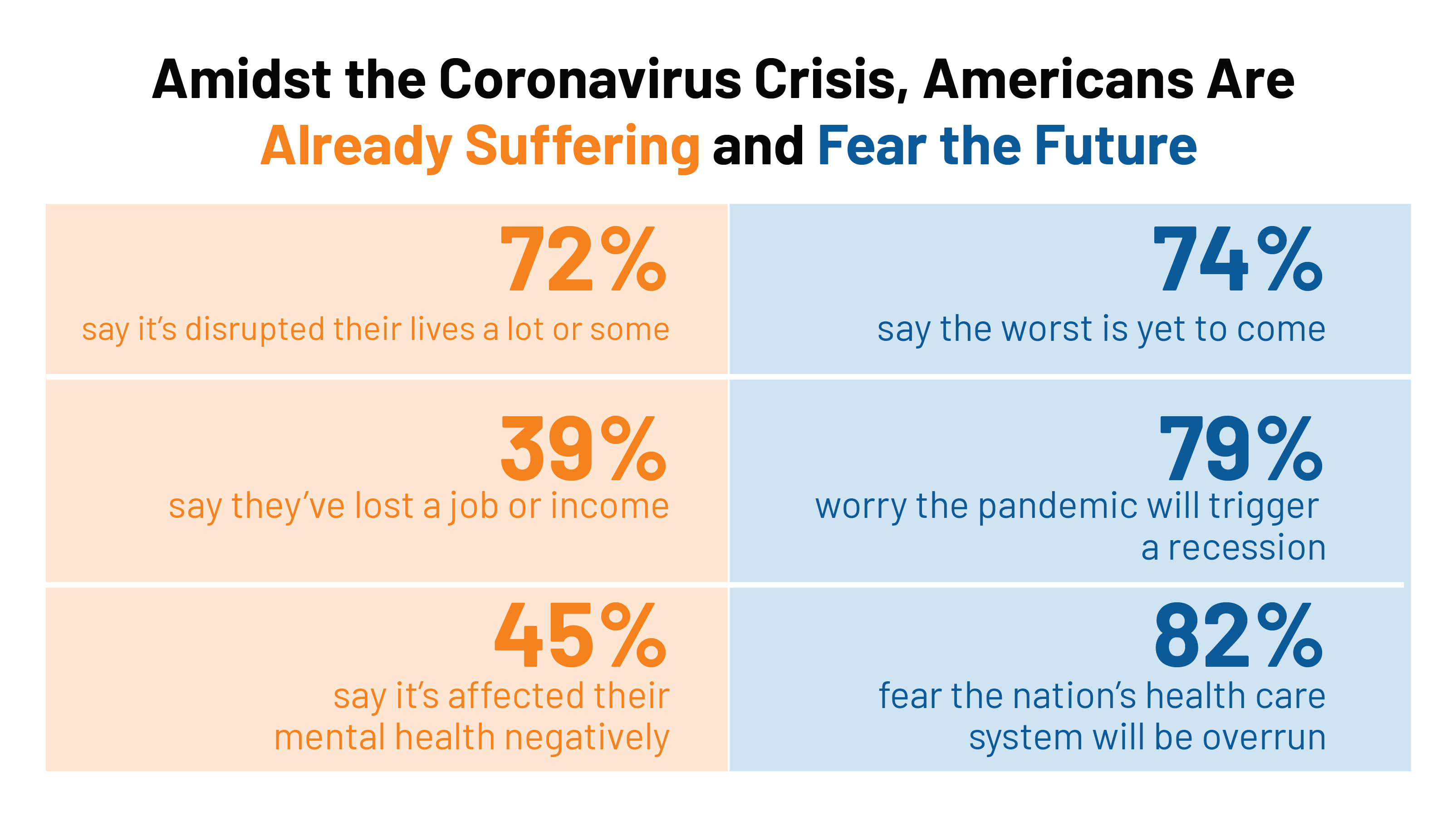

A Toxic Side Effect of the Coronavirus: Financial Unwellness

One in two people in the U.S. say their financial health has been negatively impacted by the COVID-19 pandemic, through job loss, income disruption, or reduced work hours. The 2020 Financial Wellness Census, from Prudential found that one-half of U.S. adults are anxious about their financial future as of May 2020, an increase from 38% in late 2019. Prudential surveyed 3,000 U.S. adults across three generational cohorts: Millennials, Gen X, and Baby Boomers. The economic hit from the pandemic has disproportionately impacted people of color, younger people, women, small business owners, gig workers, and people working in retailer harder than

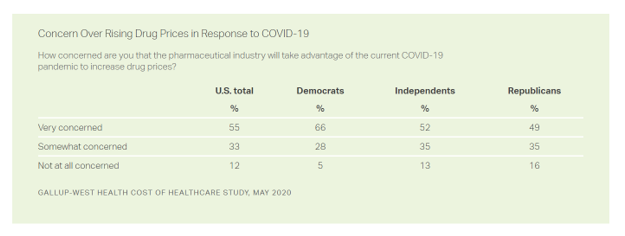

Americans Across Political Party Worry About Prescription Drug Prices – Especially to Deal with COVID-19

Nine in ten Americans is concerned about the price of prescription drugs in the wake of the coronavirus pandemic, Gallup and West Health found in their survey on the cost of healthcare, published today. A majority of people across political party share this concern: overall, 88% of U.S. adults are concerned about rising drug prices in response to COVID19, split across party ID with: 94% of Democrats, 86% of Independents, and 84% of Republicans. By demographics, more women than men are concerned about rising costs for the three health care spending categories the survey studied: drug prices, insurance premiums, and

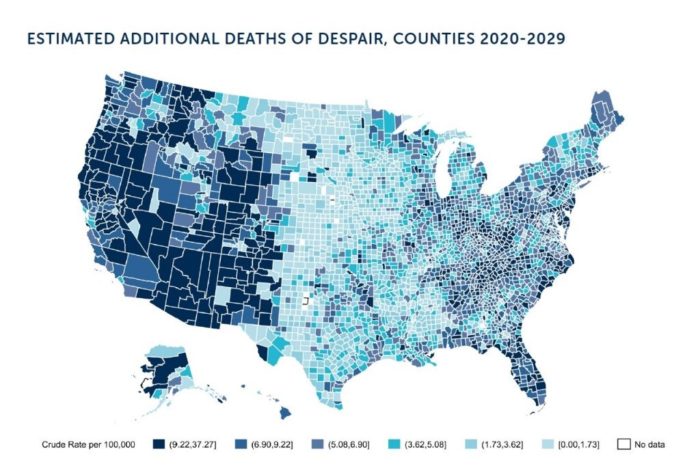

How COVID-19 Is Driving More Deaths of Despair

In the current state of the COVID-19 pandemic, we all feel like we are living in desperate times. If you are a person at-risk of dying a Death of Despair, you’re even more at-risk of doing so in the wake of the Coronavirus in America. Demonstrating this sad fact of U.S. life, the Well Being Trust and Robert Graham Center published Projected Deaths of Despair from COVID-19. The analysis quantifies the impact of isolation and loneliness combined with the dramatic economic downturn and mass unemployment with the worsening of mental illness and income inequity on the epidemic of Deaths of

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

In the US COVID-19 Pandemic, A Tension Between the Fiscal and the Physical

“Act fast and do whatever it takes,” insists the second half of the title of a new eBook with contributions from forty leading economists from around the world. The first half of the title is, Mitigating the COVID Economic Crisis. The book is discussed in a World Economic Forum essay discussing the economists’ consensus to “act fast.” As the U.S. curve adds new American patients testing positive for the coronavirus, the book and essay illustrate the tension between health consumer versus the health citizen in the U.S. For clinical context, as I write this post on 24th March 2020, today’s U.S.

Job #1 for Next President: Reduce Health Care Costs – Commonwealth Fund & NBC News Poll

Four in five U.S. adults say lowering the cost of health care in America should be high priority for the next American president, according to a poll from The Commonwealth Fund and NBC News. Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms. The first chart illustrates that lowering health care costs is a priority that crosses political parties. This is true for all flavors of health care costs, including health insurance deductibles and premiums, out-of-pocket costs for prescription drugs, and the cost of long-term care. While

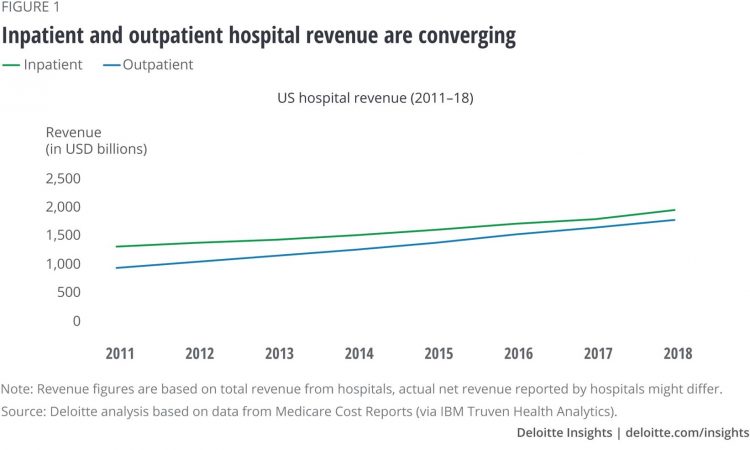

Outpatient is the New Inpatient – The Future of Hospitals in America

Outpatient revenue is crossing the curve of inpatient income. This is the new reality for U.S. hospitals and why I’ve titled this post, “outpatient is the new inpatient,” a future paradigm for U.S. hospitals This realization is informed by data in a new report from Deloitte, Where have the many hospital inpatient gone? The line chart illustrates Deloitte’s top and bottom line: “The shift toward outpatient is happening and will likely have a tremendous impact on operations, business models, staffing, and capital. Health systems should prepare for the future today and start thinking not only about how to manage their

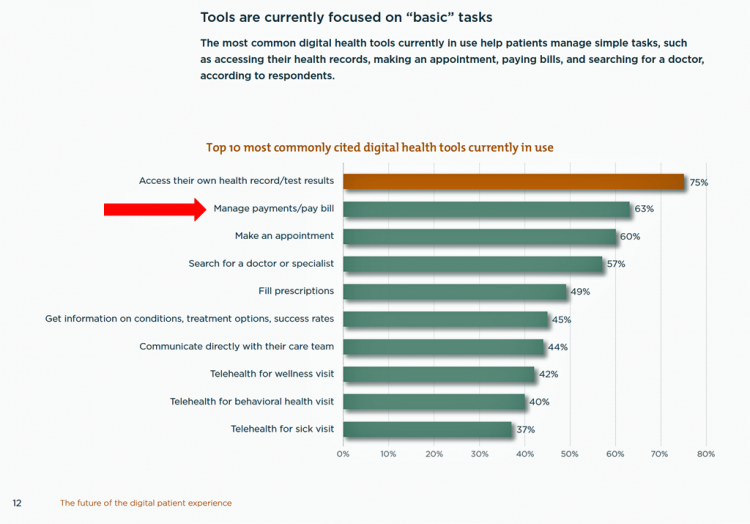

Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience, the latest report from HIMSS and the Center for Connected Medicine (CCM). The big gap in supply to patients vs. demand by health consumers is highlighted by what the arrow in the chart below points to: managing payments and paying bills. Nowhere in the top 10 most commonly provided digital tools is one for price transparency, cost comparing or cost estimating. In the

Americans’ Top 2 Priorities for President Trump and Congress Are To Lower Health Care and Rx Costs

Health care pocketbook issues rank first and second place for Americans in these months leading up to the 2020 Presidential election, according to research from POLITICO and the Harvard Chan School of Public Health published on 19th February 2020. This poll underscores that whether Democrat or Republican, these are the top two domestic priorities among Americans above all other issues polled including immigration, trade agreements, infrastructure and regulations. The point that Robert Blendon, Harvard’s long-time health care pollster, notes is that, “Even among Democrats, the top issues…(are) not the big system reform debates…They’re worried about their own lives, their own

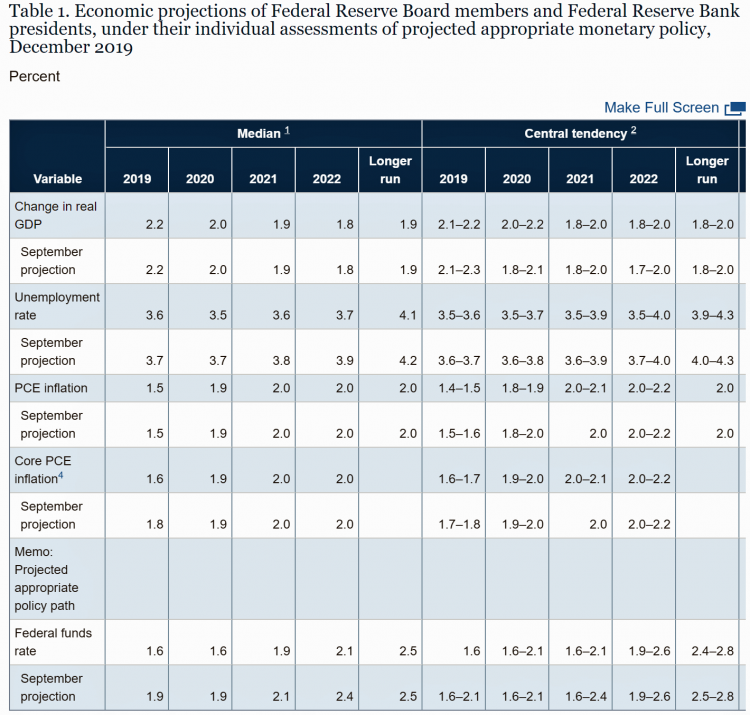

The Federal Reserve Chairman Speaks Out on Health Care Costs: “Spending But Getting Nothing”

On February 12, 2020, the Chairman of the Federal Reserve Bank of the U.S. submitted the Semiannual Monetary Policy Report to Congress and testified to the Senate Banking Committee. Chairman Jerome Powell detailed the current state of the economy, discussing the state of the macroeconomy, GDP growth, unemployment, inflation, and projections for 2022 and beyond. The top line data points are shown in the first chart. After his prepared remarks, Chairman Powell responded to questions from members of the Senate Banking Committee. Senator Ben Sasse (R-Neb.) asked him about health care costs’ impact on the national U.S. economy. The Chairman

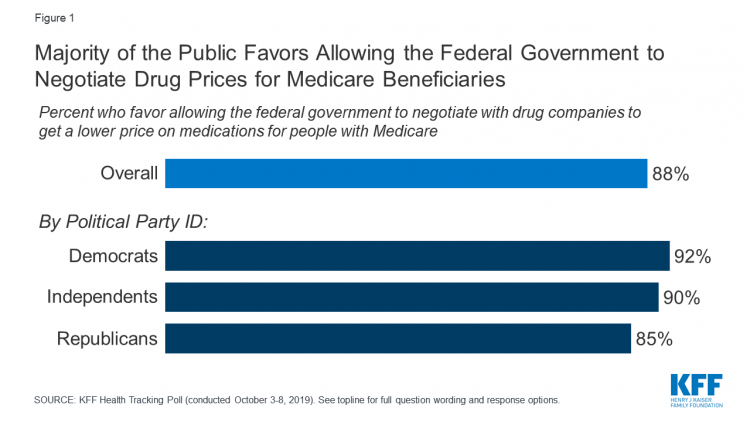

The State of the Union for Prescription Drug Prices

Tonight, President Trump will present his fourth annual State of the Union address. This morning we don’t have a transcript of the speech ahead of the event, but one topic remains high on U.S. voters’ priorities, across political party – prescription drug prices. Few issues unite U.S. voters in 2020 quite like supporting Medicare’s ability to negotiate drug prices with pharmaceutical companies, shown by the October 2019 Kaiser Family Foundation Health Tracking Poll. Whether Democrat, Independent, or Republican, most people living in America favor government intervention in regulating the cost of medicines in some way. In this poll, the top

The 2020 Social Determinants of Health: Connectivity, Art, Air and Love

Across the U.S., the health/care ecosystem warmly embraced social determinants of health as a concept in 2019. A few of the mainstreaming-of-SDoH signposts in 2019 were: Cigna studying and focusing in on loneliness as a health and wellness risk factor Humana’s Bold Goal initiative targeting Medicare Advantage enrollees CVS building out an SDOH platform, collaborating with Unite US for the effort UPMC launching a social impact program focusing on SDoH, among other projects investing in social factors that bolster public health. As I pointed out in my 2020 Health Populi trendcast, the private sector is taking on more public health

In 2020, PwC Expects Consumers to Grow DIY Healthcare Muscles As Medical Prices Increase

The new year will see a “looming tsunami” of high prices in healthcare, regulation trumping health reform, more business deals reshaping the health/care industry landscape, and patients growing do-it-yourself care muscles, according to Top health industry issues of 2020: Will digital start to show an ROI from the PwC Health Research Institute. I’ve looked forward to reviewing this annual report for the past few years, and always learn something new from PwC’s team of researchers who reach out to experts spanning the industry. In this 14th year of the publication, PwC polled executives from payers, providers, and pharma/life science organizations. Internally,

Hospitals Suffer Decline in Consumer Satisfaction

While customer satisfaction with health insurance plans slightly increased between 2018 and 2019, patient satisfaction with hospitals fell in all three settings where care is delivered — inpatient, outpatient, and the emergency room, according to the 2018-2019 ACSI Finance, Insurance and Health Care Report. ACSI polls about 300,000 U.S. consumers each year to gauge satisfaction with over 400 companies in 46 industries. For historic trends, you can check out my coverage of the 2014 version of this study here in Health Populi. The 2019 ACSI report bundles finance/banks, insurance (property/casualty, life and health) and hospitals together in one document. Health

Thank you FeedSpot for

Thank you FeedSpot for