The Healthiest Communities in the U.S. After the Pandemic – U.S. News & Aetna Foundation’s Post-COVID Lists

Some of America’s least-healthy communities are also those that index greater for vaccine hesitancy and other risks for well-being, found in U.S. News & World Report’s 2021 Healthiest Communities Rankings. U.S. News collaborated with the Aetna Foundation, CVS Health’s philanthropic arm, in this fourth annual list of the top geographies for well-being in the U.S. Six of the top ten healthiest towns in America are located in the state of Colorado. But #1 belongs to Los Alamos County, New Mexico, which also ranked first in ___. Beyond Colorado and New Mexico, we find that Virginia fared well for health in

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

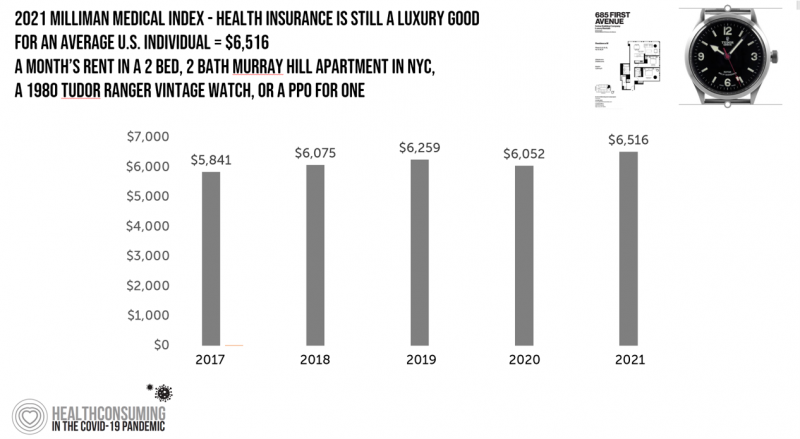

The Cost of Health Care for a Family of 4 in America Will Reach $28,256 in 2021

The good news for health care costs for a family of four in America is that they fell, for the first time in like, ever, in 2020. But like a déjà vu all over again, annual health care costs for a family of four enrolled in a PPO will climb to over $28,000 in 2021, based on the latest 2021 Milliman Medical Index (MMI). The first chart shows how health care costs declined in our Year of COVID, 2020, by over $1,000 for that hypothetical U.S. family. But costs rise with a statistical vengeance this year, by nearly $2,200 per family–about

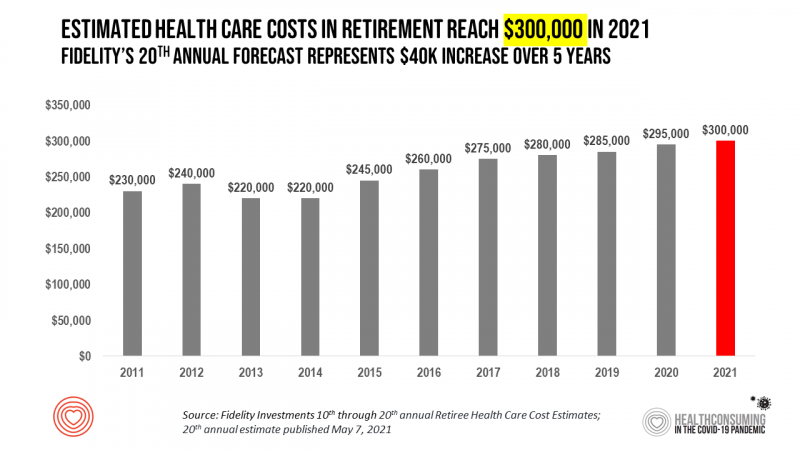

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

And the Oscar Goes To….Power to the Patients!

Health care has increased its role in popular culture over the years. In movies in particular, we’ve seen health care costs and hassles play featured in plotlines in As Good as it Gets [theme: health insurance coverage], M*A*S*H [war and its medical impacts are hell], and Philadelphia [HIV/AIDS in the era of The Band Played On], among dozens of others. And this year’s Oscar winner for leading actor, Anthony Hopkins, played The Father, who with his family is dealing with dementia. [The film, by the way, garnered six nominations and won two]. When I say “Oscar” here on the Health

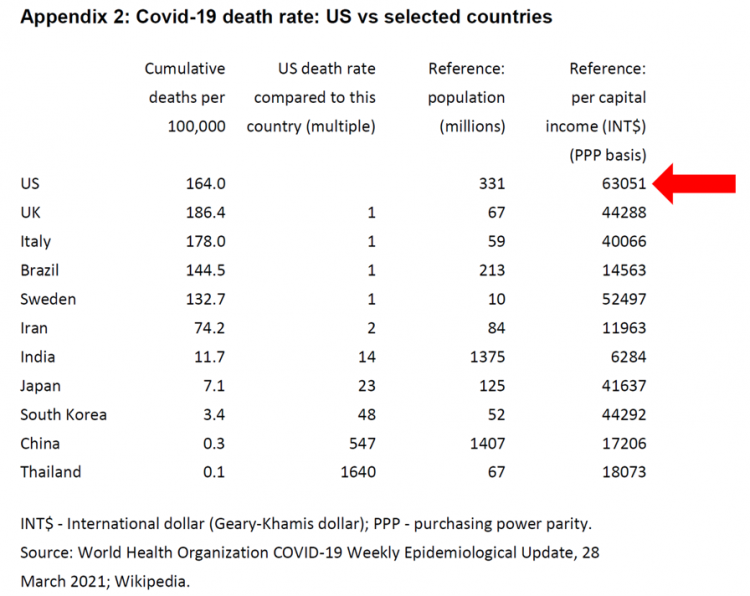

The Pandemic’s Death Rate in the U.S.: High Per Capita Income, High Mortality

The United States has among the highest per capita incomes in the world. The U.S. also has sustained among the highest death rates per 100,000 people due to COVID-19, based on epidemiological data from the World Health Organization’s March 28, 2021, update. Higher incomes won’t prevent a person from death-by-coronavirus, but risks for the social determinants of health — exacerbated by income inequality — will and do. I have the good fortune of access to a study group paper shared by Paul Sheard, Research Fellow at the Mossaver-Rahmani Center for Business and Government at the Harvard Kennedy School. In reviewing

The Cost of Healthcare Can Drive Medical Rationing and Crowd Out Other Household Spending

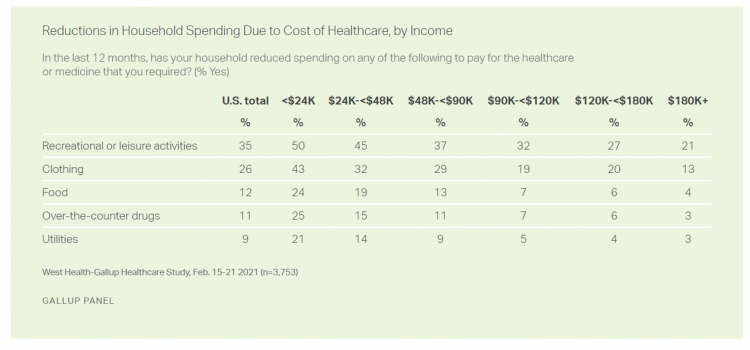

One in five people in the U.S. cannot afford to pay for quality health care — an especially acute challenge for Black and Hispanic Americans, according to a West Health-Gallup poll conducted in March 2021, a year into the COVID-19 pandemic. “The cost of healthcare and its potential ramifications continues to serve as a burdensome part of day-to-day life for millions of Americans,” the study summary observed. Furthermore, “These realities can spill over into other health issues, such as delays in diagnoses of new cancer and associated treatments that are due to forgoing needed care,” the researchers expected. The first table

Housing as Prescription for Health/Care – in Medecision Liberation

COVID-19 ushered in the era of our homes as safe havens for work, shopping, education, fitness-awaking, bread-baking, and health-making. In my latest essay written for Medecision, I weave together new and important data and evidence supporting the basic social determinant of health — shelter, housing, home — and some innovations supporting housing-as-medicine from CVS Health, UnitedHealth Group, AHIP, Brookings Institution, the Urban Land Institute, and other stakeholders learning how housing underpins our health — physical, mental, financial. Read about a wonderful development from Communidad Partners, working with the Veritas Impact Partners group, channeling telehealth to housing programs serving residents with

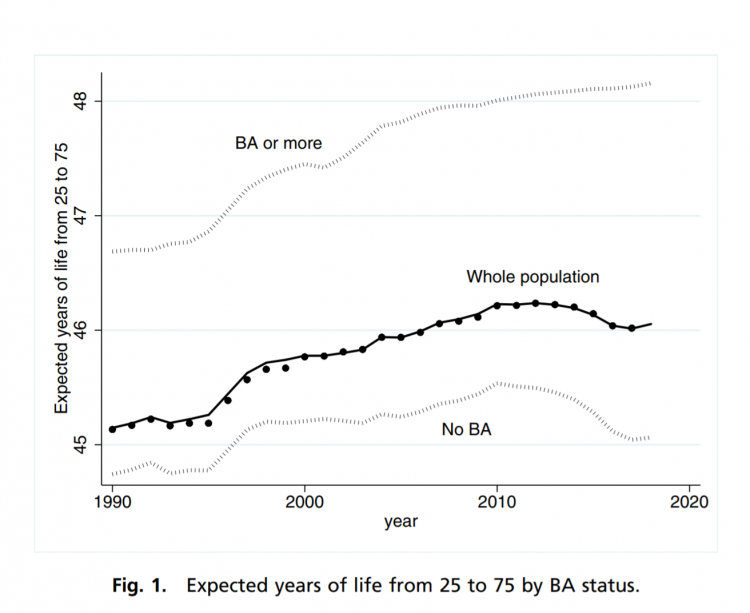

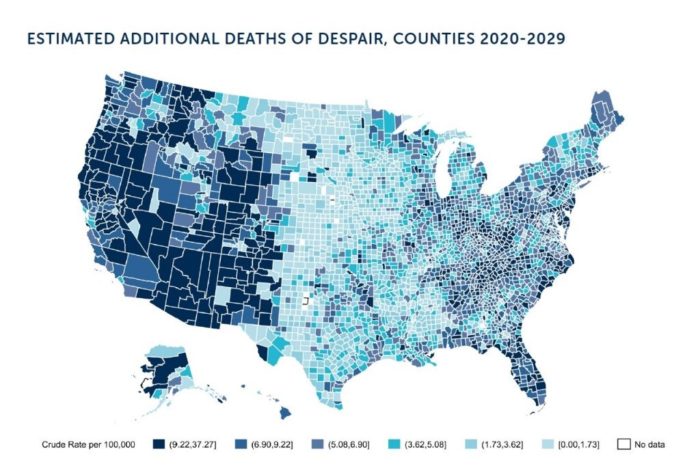

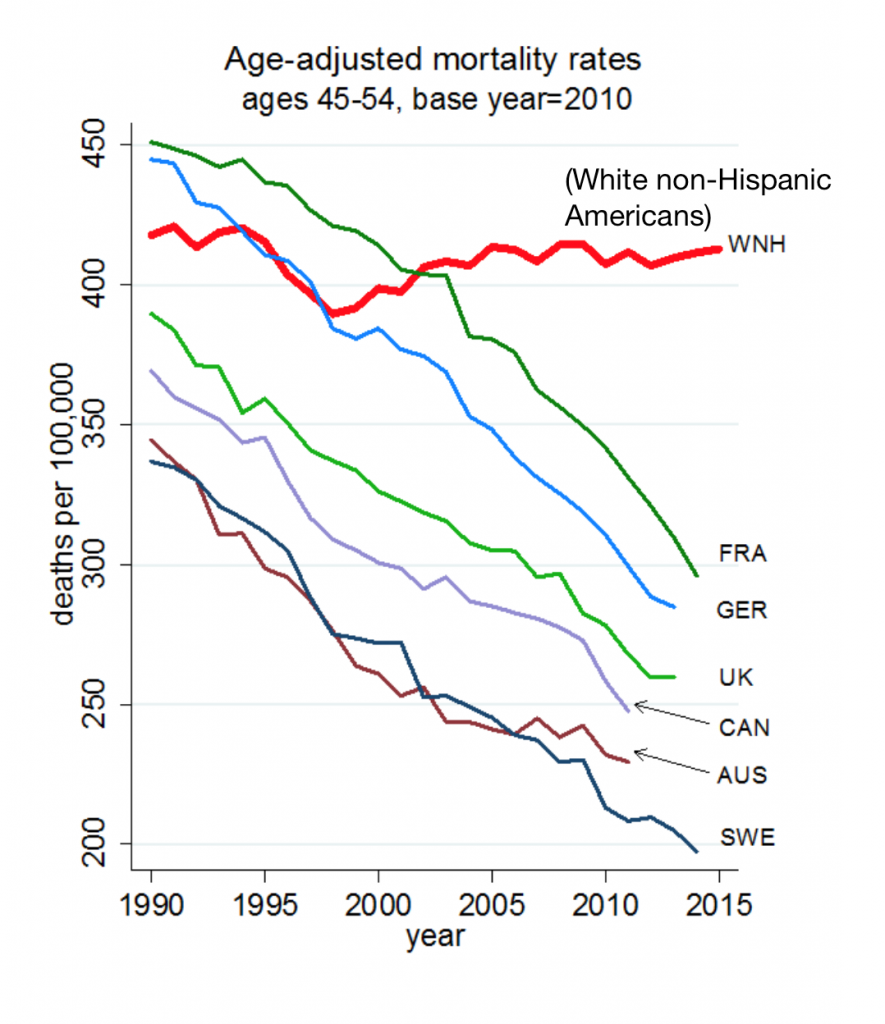

A BA Degree as Prescription for a Longer Life – Update on Deaths of Despair from Deaton and Case

“Without a four-year college diploma, it is increasingly difficult to build a meaningful and successful life in the United States,” according to an essay in PNAS, Life expectancy in adulthood is falling for those without a BA degree, but as educational gaps have widened, racial gaps have narrowed by Anne Case and Angus Deaton. Case and Deaton have done extensive research on the phenomenon of Deaths of Despair, the growing epidemic of mortality among people due to accidents, drug overdoses, and suicide. Case and Deaton wrote the book on Deaths of Despair (detailed here in Health Populi), Case and Deaton

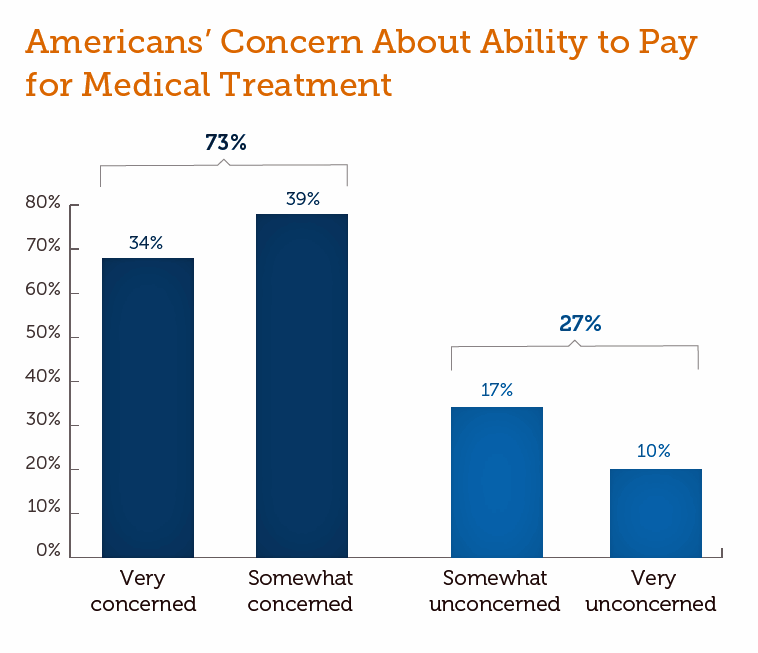

How to Restore Americans’ Confidence in U.S. Health Care: Deal With Access and Cost

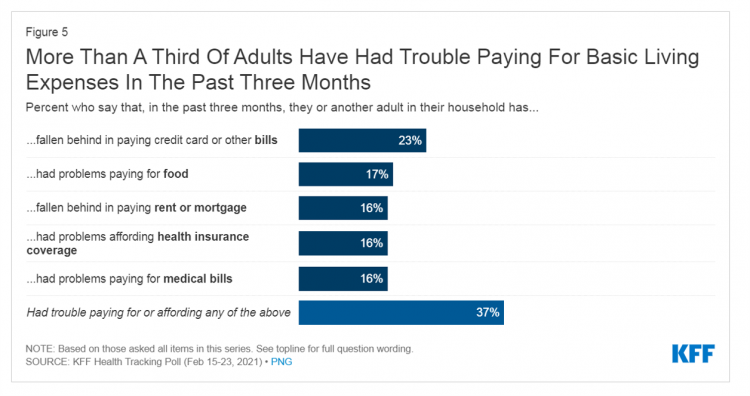

With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves. But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices. Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access. The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one

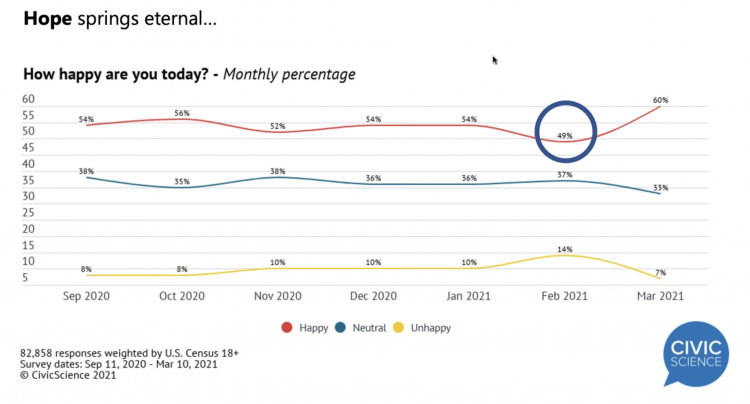

“Hope Springs Eternal” With the COVID Vaccine for Both Joe Biden and Most People in the U.S.

More Americans are happier in March 2021 than they’ve been for a year, based on consumer research from Civic Science polling U.S. adults in early March 2021. For the first time, a larger percent of Americans said they were better off financially since the start of the pandemic. This week, Civic Science shared their latest data on what they’re seeing beyond the coronavirus quarantine era to forecast trends that will shape a post-COVID America. Buoying peoples’ growing optimism was the expectation of the passage of the American Cares Act, which President Biden signed into effect yesterday. The HPA-CS Economic Sentiment Index

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

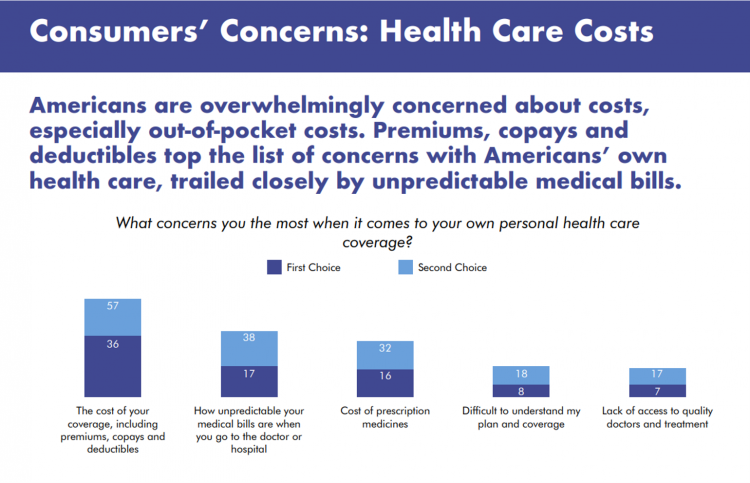

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

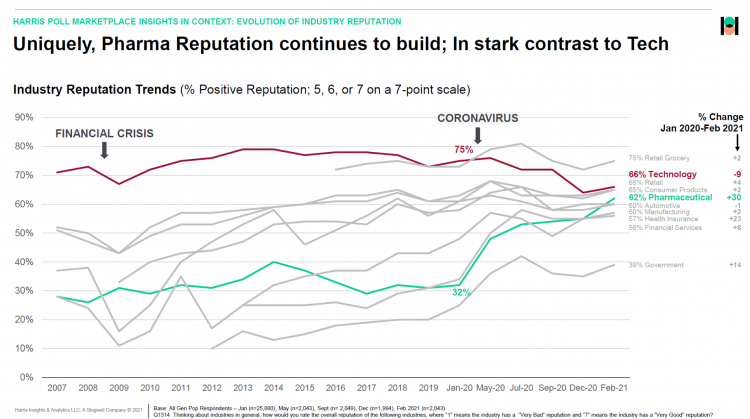

The Remarkable Rise of Pharma’s Reputation in the Pandemic

The reputation of the pharmaceutical industry gained a “whopping” 30 points between January 2020 and February 2021, based on the latest Harris Poll in their research into industries’ reputations. The study was written up by Beth Snyder Bulik in FiercePharma. Beth writes that, “a whopping two-thirds of Americans now offer a thumbs-up on pharma” as the title of her article, calling out the 30-point gain from 32% in January 2020 to 62% in February 2021. Thanks to Rob Jekielek, Managing Director of the Harris Poll, for sharing this graph with me for us to understand the details comparing pharma’s to

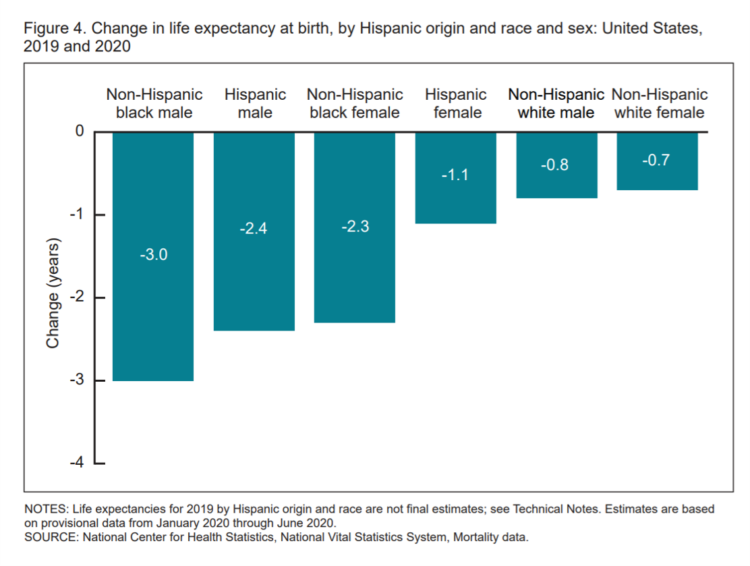

Americans Lost Future Life-Years in 2020: How Much Life Was Lost Depends on the Color of One’s Skin

Some people remark about 2020 being a “lost year” in the wake of the coronavirus pandemic. That happens to be a true statement, sadly not in jest: in the U.S., life expectancy at birth fell by one full year over the first half of 2020 compared with 2019, to 77.8 years. In 2019, life expectancy at birth was 78.8 years, according to data shared by the National Center for Health Statistics (NCHS), part of the Centers for Disease Control and Prevention (CDC). Life expectancy at birth declined for both females and males, shown in the first chart. The differences between

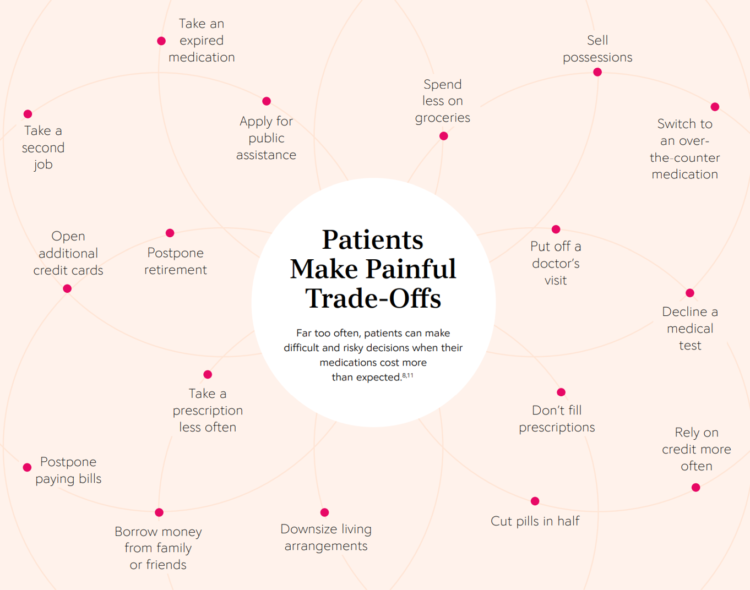

The Social Determinants of Prescription Drugs – A View From CoverMyMeds

The COVID-19 pandemic forced consumers to define what were basic or essential needs to them; for most people, those items have been hygiene products, food, and connectivity to the Internet. There’s another good that’s essential to people who are patients: prescription drugs. A new report from CoverMyMeds details the current state of medication access weaving together key health care industry and consumer data. The reality even before the coronavirus crisis emerged in early 2020 was that U.S. patients were already making painful trade-offs, some of which are illustrated in the first chart from the report. These include self-rationing prescription drug

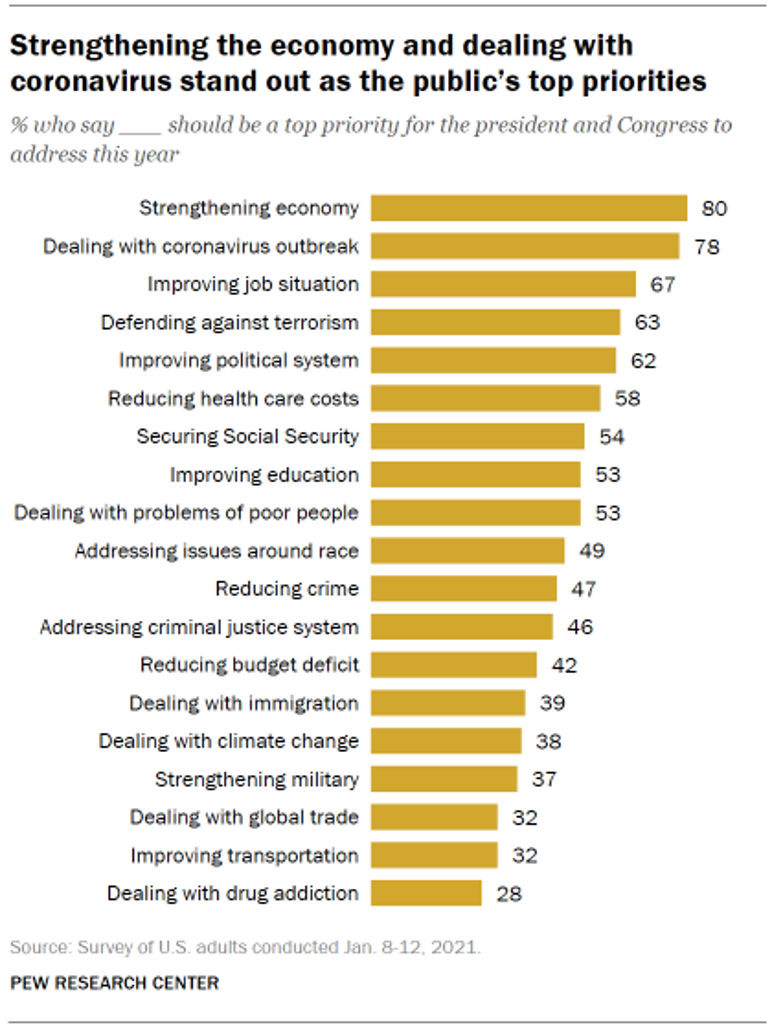

Americans A Year Into the Pandemic – A View from Pew

Nearly a year into the COVID-19 pandemic, the same percent of Americans say strengthening the U.S. economy and dealing with the coronavirus outbreak should be a top priority for President Biden and Congress to address this year, according to data from the Pew Research Center collected during the second week of January 2021. Two-thirds of people in the U.S. also want government leaders to prioritize improving the employment situation, defending against terrorism, and improving the political system, the study learned. At Americans’ low end of the priority list for the President and Congress are dealing with global trade, improving transportation,

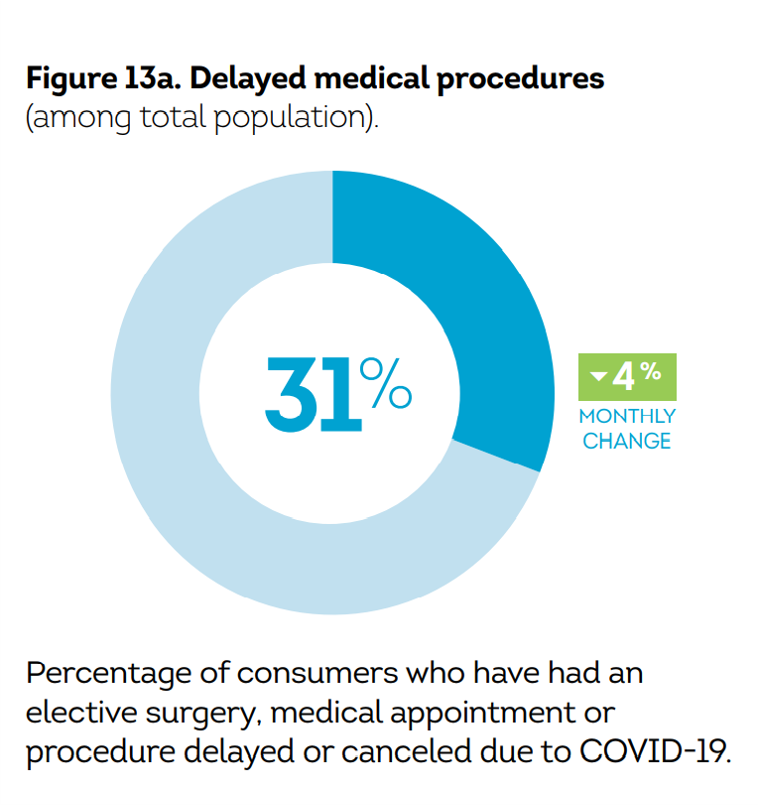

Call It Deferring Services or Self-Rationing, U.S. Consumers Are Still Avoiding Medical Care

Patients in the U.S. have been self-rationing medical care for many years, well before any of us knew what “PPE” meant or how to spell “coronavirus.” Nearly a decade ago, I cited the Kaiser Family Foundation Health Security Watch of May 2012 here in Health Populi. The first chart here shows that one in four U.S. adults had problems paying medical bills, largely delaying care due to cost for a visit or for prescription drugs. Fast-forward to 2020, a few months into the pandemic in the U.S.: PwC found consumers were delaying treatment for chronic conditions. In October 2020, The American Cancer

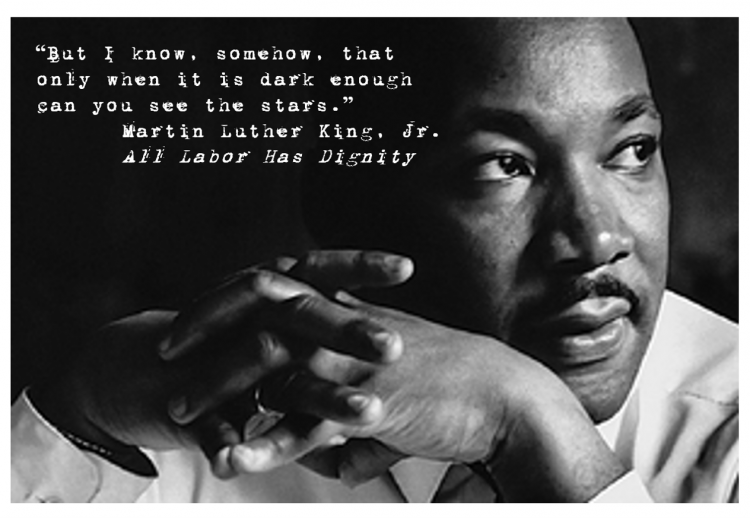

Preaching Health Equity in the Era of COVID on Martin Luther King, Jr. Day

Today as we appreciate the legacy of Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would deliver two months later in Washington, DC. Wisdom from the speech: “But now more than ever before, America is forced to grapple with this problem, for the shape of the world today does not afford us the luxury of an anemic democracy. The price that this nation must pay for the continued oppression and exploitation of the Negro or any other minority group is

The Digital Consumer, Increasingly Connected to Health Devices; Parks Associates Kicking Off #CES2021

In 2020, the COVID-19 pandemic drove U.S. consumers to increase spending on electronics, notably laptops, smartphones, and desktop computers. But the coronavirus era also saw broadband households spending more on connecting health devices, with 42% of U.S. consumers owning digital health tech compared with 33% in 2015, according to research discussed in Supporting Today’s Connected Consumer from Parks Associates. developed for Sutherland, the digital transformation company. Consumer electronics purchase growth was, “likely driven by new social distancing guidelines brought on by COVID-19, which requires many individuals to work and attend school from home. Among the 26% of US broadband households

“The virus is the boss” — U.S. lives and livelihoods at the beginning of 2021

“The virus is the boss,” Austan Goolsbee, former Chair of the Council of Economic Advisers under President Obama, told Stephanie Ruhle this morning on MSNBC. Goolsbee and Jason Furman, former Chair of Obama’s Council of Economic Advisers, tag-teamed the U.S. economic outlook following today’s news that the U.S. economy lost 140,000 jobs — the greatest job loss since April 2020 in the second month of the pandemic. The 2020-21 economic recession is the first time in U.S. history that a downturn had nothing to do with the economy per se. As Uwe Reinhardt, health economist guru, is whispering in my

The 2021 Health Populi TrendCast – Health Care, Self-Care, and the Rebirth of Love in Public Health

In numerology, the symbolic meaning behind the number “21” is death and re-birth. In tarot cards, 21 is a promise of fulfillment, triumph, and victory. How apropos that feels right now as we say goodbye and good riddance to 2020 and turn the page for a kinder, gentler, healthier New Year. It would be sinful to enter a New Year as challenging as 2021 promises to be without taking the many lessons of our 2020 pandemic life and pain into account. For health care in America, it is a time to re-build and re-imagine a better, more equitable landscape for

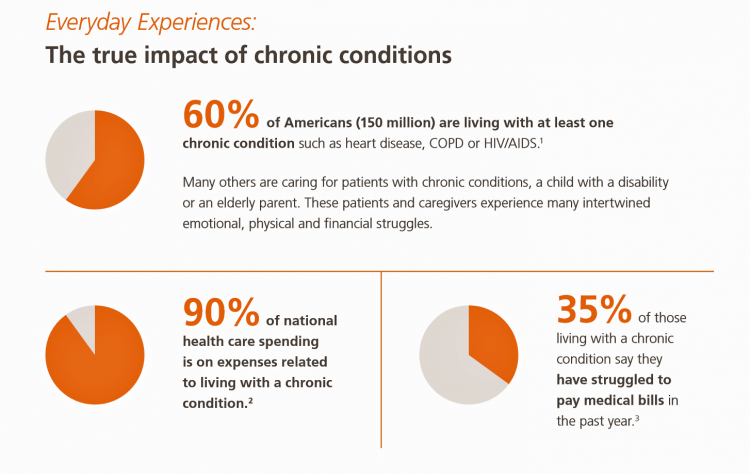

U.S. Health Consumers’ Growing Financial Pressures, From COVID to Cancer

Before the coronavirus pandemic, patients had been transforming into health care payors, bearing high deductibles, greater out of pocket costs, and financial risk shifting to them for medical spending. In the wake of COVID-19, we see health consumers-as-payors impacted by the pandemic, as well as for existing diagnoses and chronic care management. There is weakening in U.S. consumers’ overall household finances, the latest report from the U.S. Bureau of Economic Analysis (BEA) asserted (published 25 November 2020). In John Leer’s look into the BEA report in Morning Consult, he wrote, “Decreases in income, the expiration of unemployment benefits and increased

Consumers Seek Health Features in Homes: How COVID Is Changing Residential Real Estate

The coronavirus pandemic has shifted everything that could “come home,” home. THINK: tele-work, home schooling for both under-18s and college students, home cooking, entertainment, working out, and even prayer. All of this DIY-from-home stuff has been motivated by both mandates to #StayHome and #WorkFromHome by government leaders, as well as consumers seeking refuge from contracting COVID-19. This risk-shift to our homes has led consumers to re-orient their demands for home purchase features. Today, home is ideally defined as a safe place, offering comfort and refuge for families, discovered in the America at Home Study. The Study is a joint project of

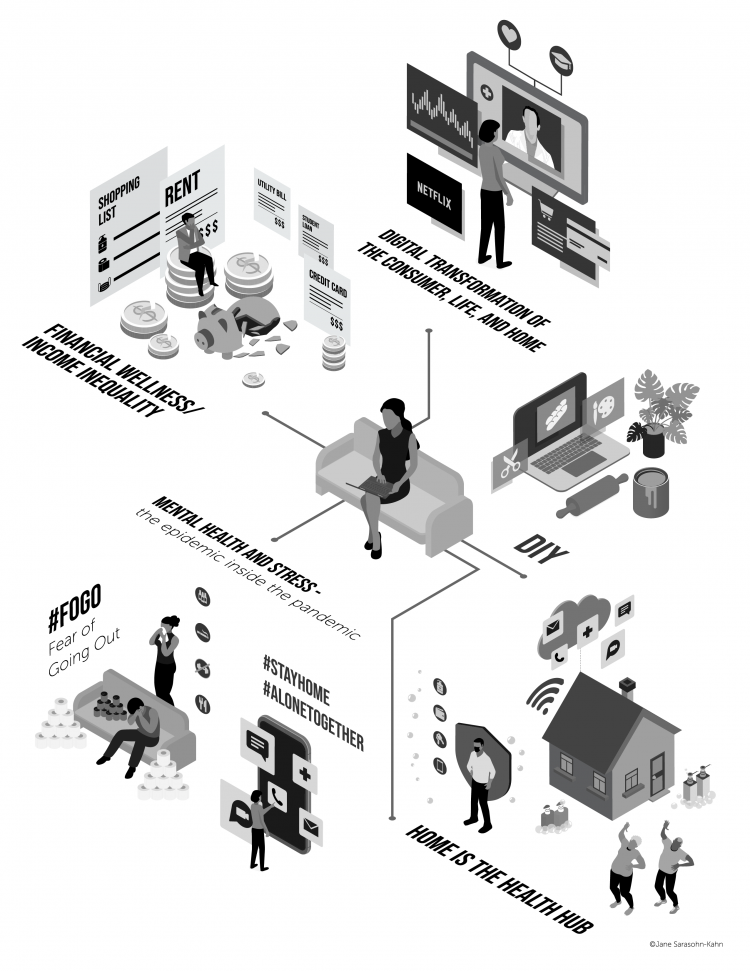

The COVID Healthcare Consumer – 5 Trends Via The Medecision Liberation Blog

The first six months into the coronavirus pandemic shocked the collective system of U.S. consumers for living, learning, laboring, and loving. I absorbed all kinds of data about consumers in the wake of COVID-19 between March and mid-August 2020, culminating in my book, Health Citizenship: How a virus opened hearts and minds, published in September on Kindle and in print in October. In this little primer, I covered the five trends I woven based on all that data-immersion, following up the question I asked at the end of my previous book, HealthConsuming: when and how would Americans claim their health

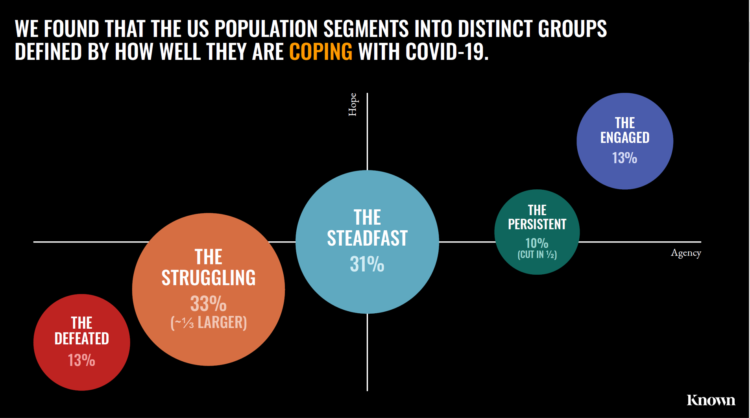

The Pandemic Has Been a Shock to Our System – Learning from Known

The coronavirus pandemic has been a shock to people across all aspects of everyday living, for older and younger people, for work and school, for entertainment and travel — all impacting our hearts, minds, and wallets. “As the bedrock of daily life was shaken, uncertainty predictably emerged as the prevailing emotion of our time but this universal problem was eliciting a highly differentiated reaction in different people,” Kern Schireson, CEO of Known, observed. His company has conducted a large quantitative and qualitative research program culminating in a first report, The Human Condition 2020: A Shock To The System. Known’s team of

Rebuilding Resilience, Trust, and Health – Deloitte’s Latest on Health Care and Sustainability

The COVID-19 pandemic has accelerated health care providers’ and plans’ investment in digital technologies while reducing capital spending on new physical assets, we learn in Building resilience during the COVID-19 pandemic and beyond from the Deloitte Center for Health Solutions. What must be built (or truly re-built), health care leaders believe, is first and foremost trust, followed by financial viability to ensure long-term resilience and sustainability — for the workforce, the organization, the community, and leaders themselves. For this report, Deloitte interviewed 60 health care chief financial officers to gauge their perspectives during the pandemic looking at the future of

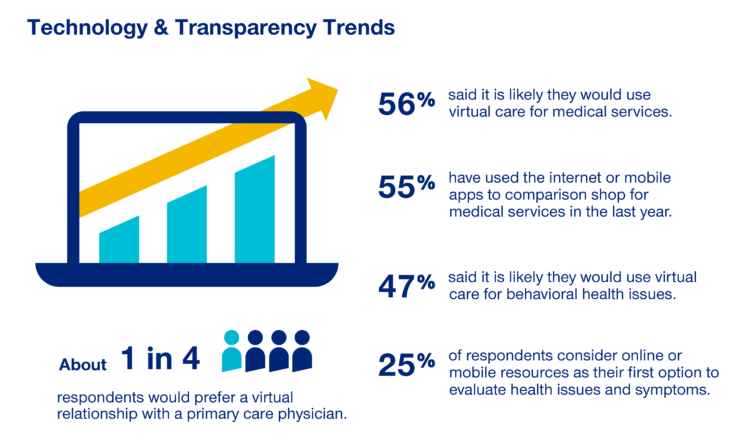

The COVID-19 Era Has Grown Health Consumer Demand for Virtual Care

Over one-half of Americans would likely use virtual care for their healthcare services, and one in four people would actually prefer a virtual relationship with a primary care physician, according to the fifth annual 2020 Consumer Sentiment Survey from UnitedHealthcare. What a difference a pandemic can make in accelerating patients’ adoption of digital health tools. This survey was conducted in mid-September 2020, and so the results demonstrate U.S. health consumers’ growing digital health “muscles” in the form of demand and confidence in using virtual care. One in four people would consider online options as their first-line to evaluating personal health

Voting for Health in 2020

In the 2018 mid-term elections, U.S. voters were driven to polls with health care on their minds. The key issues for health care voters were costs (for care and prescription drugs) and access (read: protecting pre-existing conditions and expanding Medicaid). Issue #2 for 2018 voters was the economy. In 2020, as voting commences in-person tomorrow on 3rd November, U.S. voters have lives and livelihoods on their minds. It’s the pandemic – our physical lives looming largest in the polls – coupled with our fiscal and financial lives. Health is translating across all definitions for U.S. voters in November 2020: for

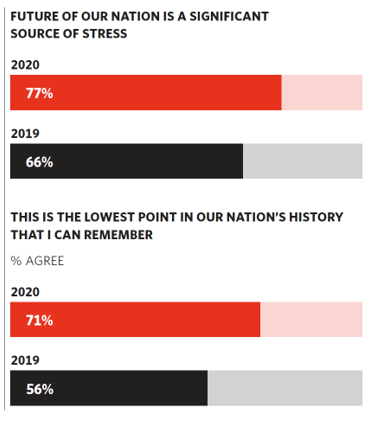

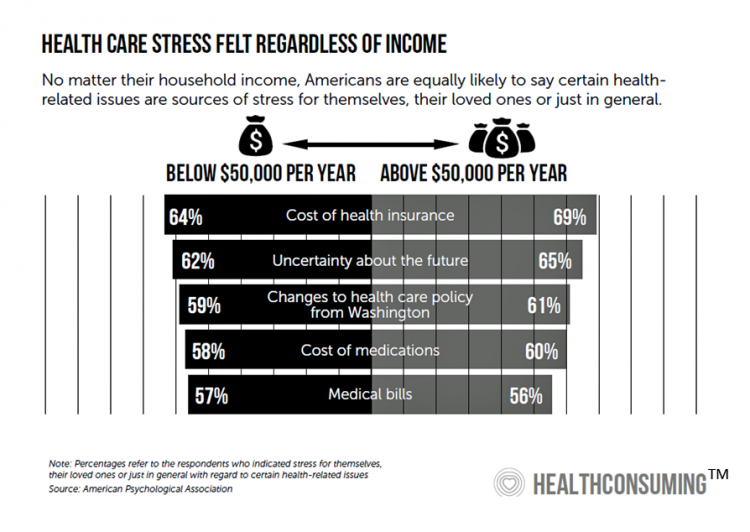

Stress in America, Like COVID-19, Impacts All Americans

With thirteen days to go until the U.S. #2020Elections day, 3rd November, three in four Americans say the future of America is a significant source of stress, according to the latest Stress in America 2020 study from the American Psychological Association. Furthermore, seven in 10 U.S. adults believe that “now” is the lowest point in the nation’s history that they can remember. “We are facing a national mental health crisis that could yield serious health and social consequences for years to come,” APA introduces their latest read into stressed-out America. Two in three people in the U.S. say that the

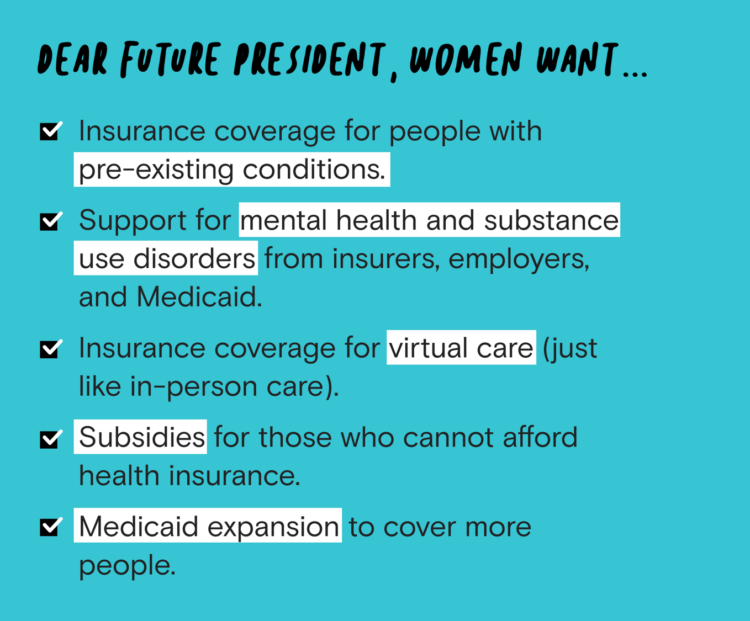

Women’s Health Policy Advice for the Next Occupant of the White House: Deal With Mental Health, the Pandemic, and Health Care Costs

2020 marked the centennial anniversary of the 19th Amendment to the U.S. Constitution, giving women the right to vote. In this auspicious year for women’s voting rights, as COVID-19 emerged in the U.S. in February, women’s labor force participation rate was 58%. Ironic timing indeed: the coronavirus pandemic has been especially harmful to working women’s lives, the Brookings Institution asserted last week in their report in 19A: The Brookings Gender Equality Series. A new study from Tia, the women’s health services platform, looks deeply into COVID-19’s negative impacts on working-age women and how they would advise the next occupant of

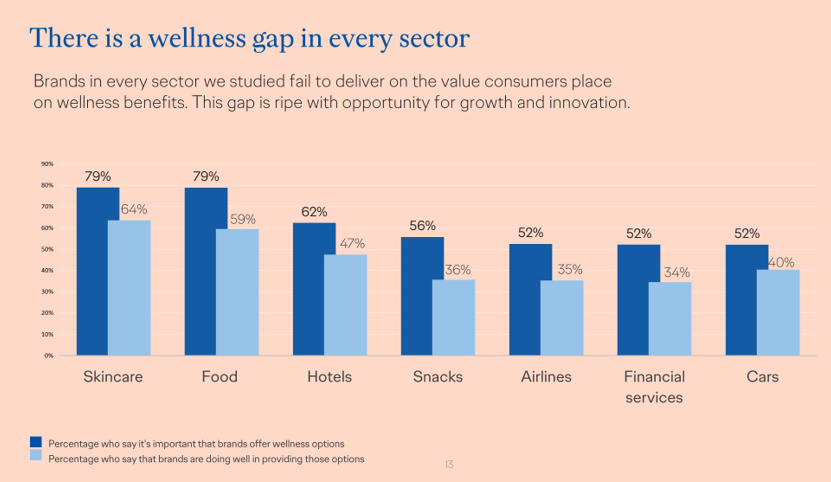

The COVID-19 Pandemic Has Accelerated Our Demand for Wellness – Learning from Ogilvy

Every company is a tech company, strategy consultants asserted over the past decade. The coronavirus pandemic has revealed that every company is a health and wellness company now, at least in the eyes of consumers around the world. In The Wellness Gap, the health and wellness team at Ogilvy explores the mindsets of consumers in 14 countries to learn peoples’ perspectives on wellness brands and how COVID-19 has impacted consumers’ priorities. A total of 7,000 interviews were conducted in April 2020, in Asia, Europe, Latin America, and North America — including 500 interviews in the U.S. The first chart illustrates

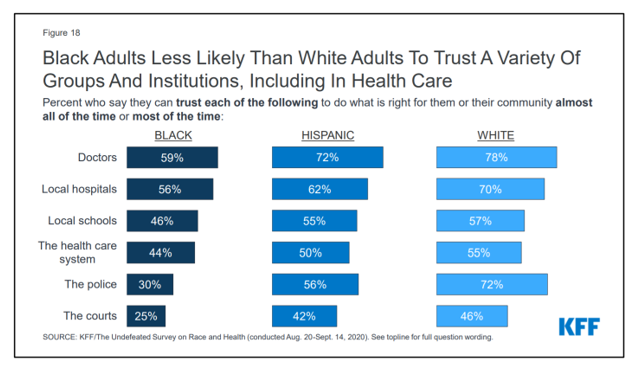

Black Health Should Matter More in America: The Undefeated Survey on Race and Health

In 2020, most Black people, men and women alike, feel it is a bad time to be Black in America. More than twice as many Black men believed that in 2020 compared with 2006. More than four times as many Black women believed that it’s a bad time to be Black in America in 2020 versus 2011, we learn in The Undefeated Survey on Race and Health from Kaiser Family Foundation (KFF). KFF collaborated with The Undefeated, ESPN’s project that focuses on sports, race, and culture. The Undefeated program was started in May 2016, and has become a thought leader

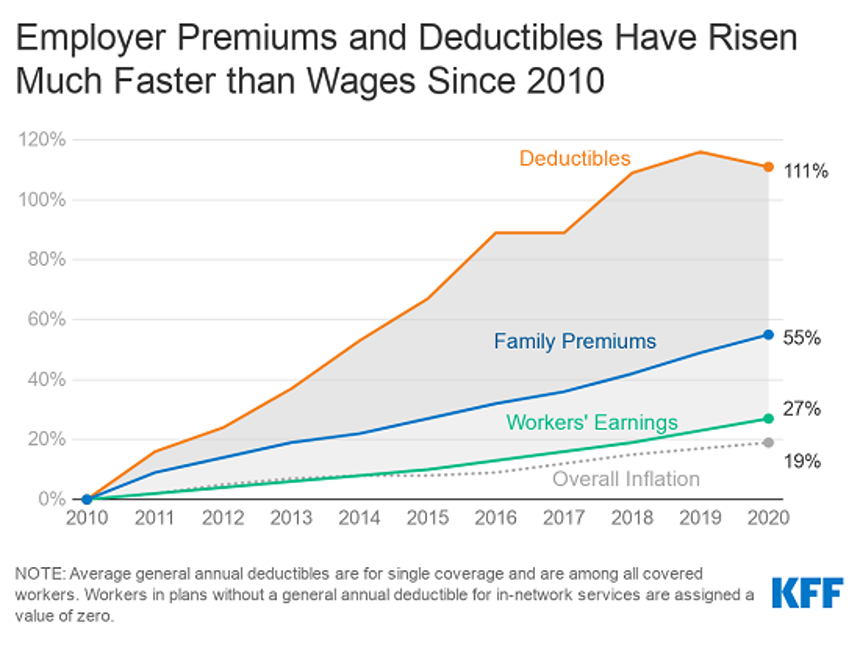

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

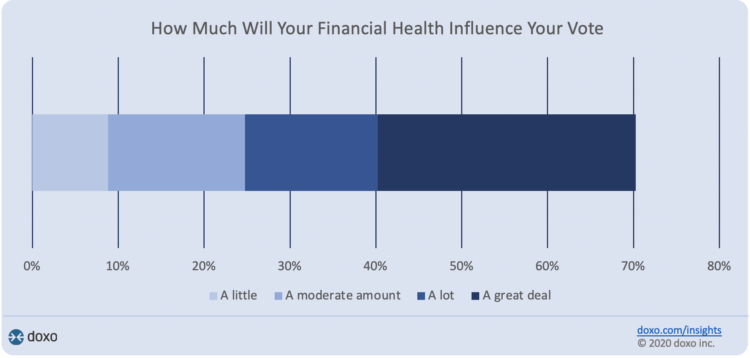

Financial Health Is On Americans’ Minds Just Weeks Before the 2020 Elections

Financial health is part of peoples’ overall health. As Americans approach November 3, 2020, the day of the real-time U.S. Presidential and down-ballot elections, personal home economics are front-of-mind. Twenty-seven days before the 2020 elections, 7 in 10 Americans say their financial health will influence their votes this year, according to the doxoINSIGHTS survey which shows personal financial health as a key voter consideration in the Presidential election. Doxo, a consumer payments company, conducted a survey among 1,568 U.S. bill-paying households in late September 2020. The study has a 2% margin of error. U.S. voters facing this year’s election are

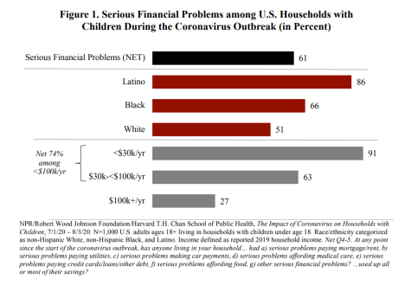

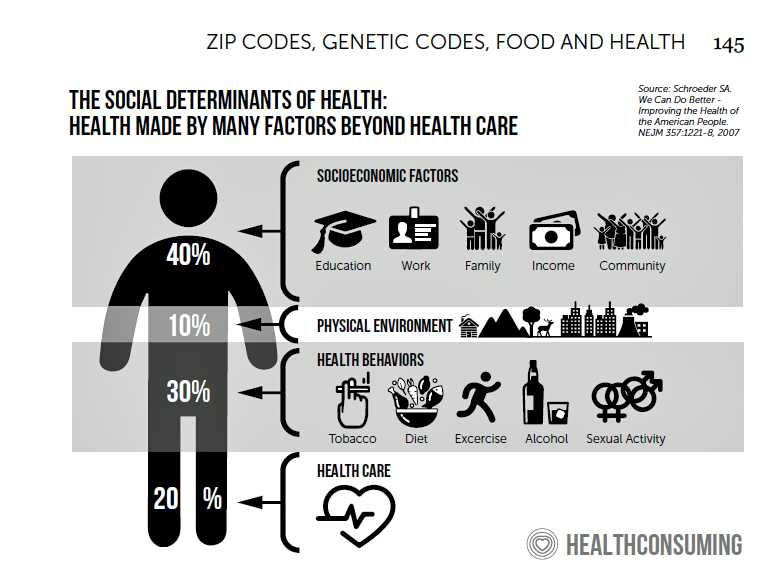

Social Determinants of Health Travel in Groups – At the Root Is Household Income

The U.S. health care community is collectively embracing the concept of social determinants of health that have become so obvious in understanding the disparities of health outcomes wrought by the coronavirus pandemic. Research from the Harvard Chan School of Public Health conducted with the Robert Wood Johnson Foundation and NPR illustrates the fact that people who are at risk for one social determinant of health tend to be challenged by a bucket of them. The survey research reported in The Impact of Coronavirus on Households With Children, published on 30th September, found that 61% of U.S. households with children had

Redefining PPE As Primary Care, Public Health, and Health Equity – The Community PPE Index

In May 2020, the Oxford English Dictionary (OED) re-visited the acronym, “PPE.” As OED evolves the definition of PPE, the wordsmiths could borrow from OSHA’s website, noting that PPE, “is equipment worn to minimize exposure to hazards that cause serious workplace injuries and illnesses. These injuries and illnesses may result from contact with chemical, radiological, physical, electrical, mechanical, or other workplace hazards. Personal protective equipment may include items such as gloves, safety glasses and shoes, earplugs or muffs, hard hats, respirators, or coveralls, vests and full body suits.” Perhaps Definition 3 in the OED could be updated by a blog

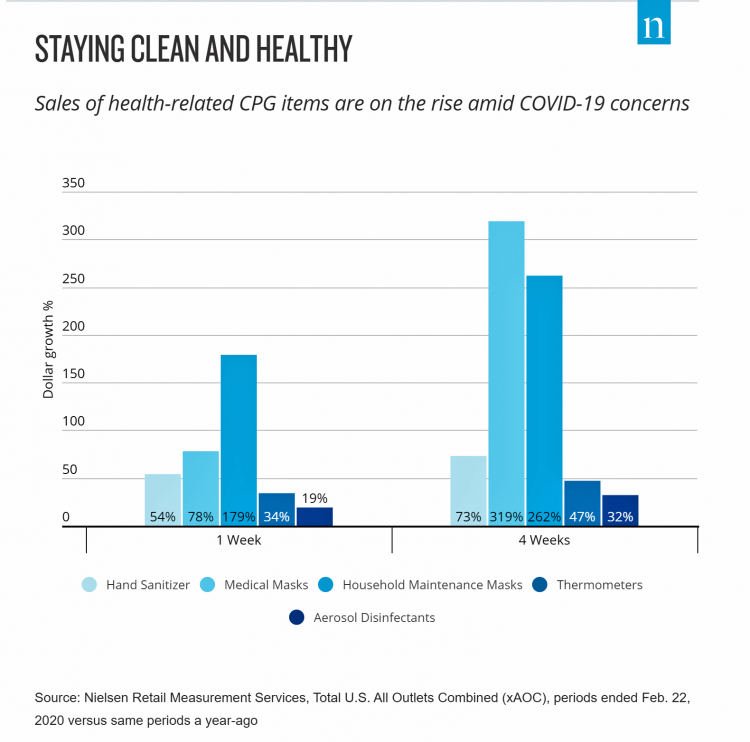

DIY Health Care and Self-Care Accelerating in the Pandemic

The coronavirus pandemic has spawned many side-effects re-shaping consumers’ everyday lives. Among them, more time at home, DIY life-flows, and financial well-being are driving growth of self-care health care. An article in the latest Drug Store News talks about consumers growing more health-conscious, adopting natural, homeopathic products. “It’s about more than washing your hands,” David Salazar explains. “Fending off illness has become a state of mind for many consumers throughout the COVID-19 pandemic.” In feeling dis-empowered in the face of the pandemic – with the first shock of the Great Lockdown and stay-at-home mandates – we’ve taken on more do-it-yourself behaviors, from

Health Citizenship in America. If Not Now, When?

On February 4th, 2020, in a hospital in northern California, the first known inpatient diagnosed with COVID-19 died. On March 11th, the World Health Organization called the growing prevalence of the coronavirus a “pandemic.” On May 25th, George Floyd, a 46-year-old Black man, died at the hands of police in Minneapolis. This summer, the Dixie Chicks dropped the “Dixie” from their name, and NASCAR cancelled the confederate flag from their tracks. Today, nearly 200,000 Americans have died due to the novel coronavirus. My new book, Health Citizenship: How a virus opened hearts and minds, launched this week. In it, I

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

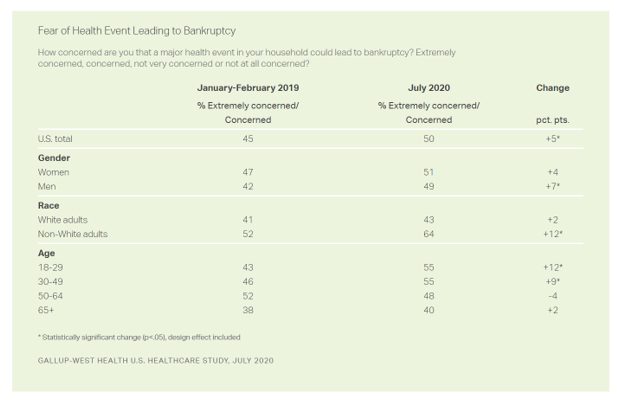

Americans Worry About Medical Bankruptcy, As Prescription Drug Costs Play Into Voters’ Concerns

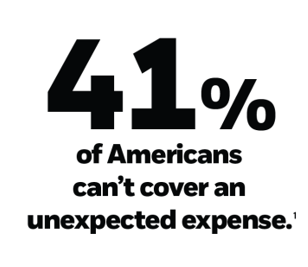

One in two people in the U.S. are concerned that a major health event in their family would lead to bankruptcy, up 5 percent points over the past eighteen months. In a poll conducted with West Health, Gallup found that more younger people are concerned about medical debt risks, along with more non-white adults, published in their study report, 50% in U.S. Fear Bankruptcy Due to Major Health Event. The survey was fielded in July 2020 among 1,007 U.S. adults 18 and older. One of the basic questions in studies like these is whether a consumer could cover a $500

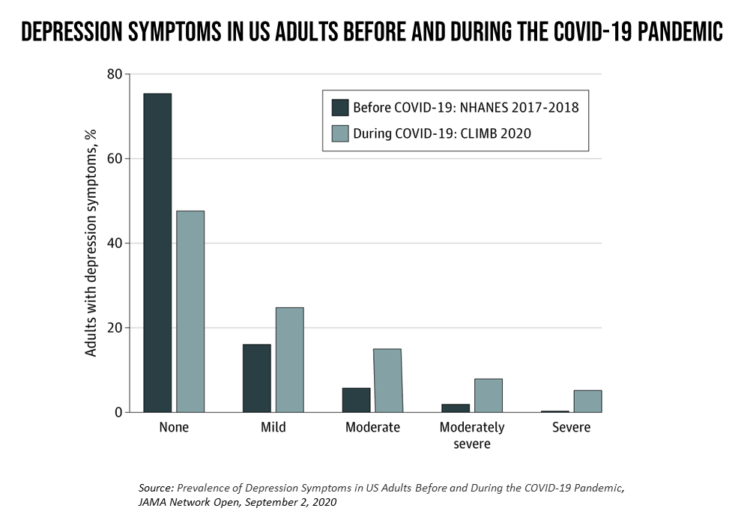

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

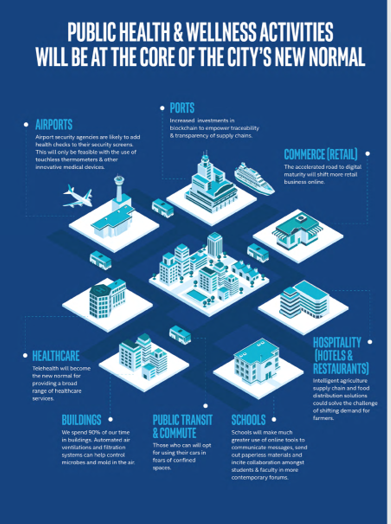

How COVID-19 Is Reshaping Cities and Inspiring Healthcare Innovation

The coronavirus pandemic added a new concept to our collective, popular lexicon: “social distancing” and “physical distancing.” This was one pillar for the public health prescription we were given to help mitigate the spread of a very tricky, contagious virus. A major negative impact of our sheltering in place, working from home, and staying indoors has been a sort of clearing out of cities where people congregate for work, for culture, for entertainment, for education, for travel and tourism…for living out our full and interesting lives and livelihoods. Intel gave Harbor Research a mandate to “re-imagine life in a post-pandemic

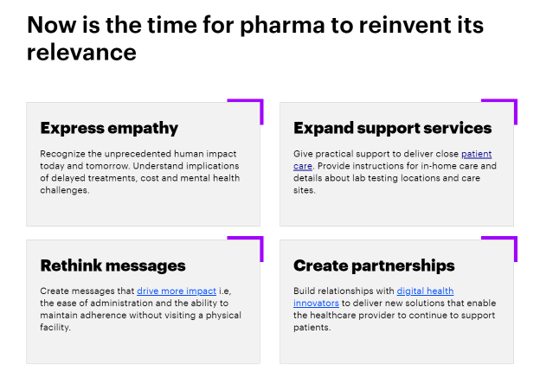

Pharma’s Future Relevance Depends on Empathy, Messaging, Partnering, and Supporting Patients and Providers

COVID-19 is re-shaping all industries, especially health care. And the pharma industry is challenged along with other health care sectors. In fact, the coronavirus crisis impacts on pharma are especially accelerated based on how the pandemic has affected health care providers, as seen through research from Accenture published in Reinventing Relevance: New Models for Pharma Engagement with Healthcare Providers in a COVID-19 World. For the study, Accenture surveyed 720 health care providers in general practice, oncology, immunology, and cardiology working in China, France, Japan, the United Kingdom, and the U.S., in May and June 2020. Top-line, Accenture points to four

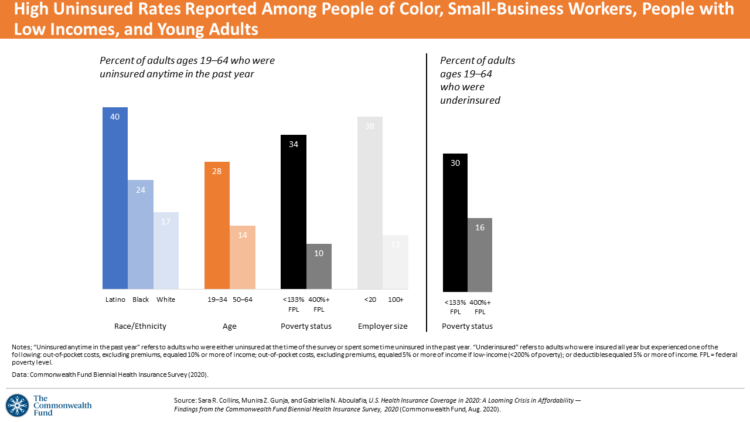

Health Insurance Affordability in the Time of the Coronavirus Pandemic

The coronavirus pandemic has revealed many flaws in the U.S. healthcare system, first and foremost the nation’s patchwork public health infrastructure and health inequities in mortality rates due to COVID-19. The Commonwealth Fund‘s biennial report, published as the pandemic continues into and beyond the third quarter of 2020, sheds light on another weakness in U.S. healthcare: the cost of health insurance relative to working Americans’ relatively flat incomes. I explored the details of this study in a post titled Health Insurance Affordability: A Call-to-Action for Healthcare Industry Stakeholders in the Pandemic, published on the Medecision Liberation blog site. The survey

My ABCovid-19 Journal – Day 1 of 5, “A” through “E”

My friends… It’s time in this pandemic journey that I take a full week to re-charge and bask in the midst of nature, a lake, farm-to-table food, wine-making, and the love of and therapeutic time with my wonderful husband. My gift to you all this week, 10th – 14th August, is to share with you pages from my “ABCovid-19 Journal” that I created/curated in the first weeks of the coronavirus pandemic. We all have our hacks for managing stress and discomfort, and in the first weeks of COVID-19, this was my life-saver. Journaling is one of my self-care strategies; think

The Racial Divide Due to COVID-19 Also Applies to Healthcare and Pharma Costs

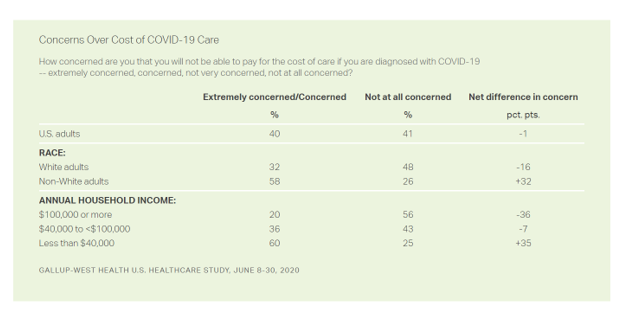

Into the sixth month of the coronavirus pandemic in the U.S., it’s clear that COVID-19 has wreaked a greater mortality and morbidity impact on people of color than on white adults. A new Gallup-West Health poll found that the coronavirus also concerns more non-white Americans than whites when it comes to the cost of health care and medicines to deal with the effects of COVID-19. Considering the cost of COVID-19 treatment, across all U.S. adults, 40% of people are concerned (extremely/concerned), and 41% are “not at all concerned.” Broken down by race, there is a stark difference in levels of

We Are All About Hygiene, Groceries, and Personal Care in the Midst of the Coronavirus Pandemic

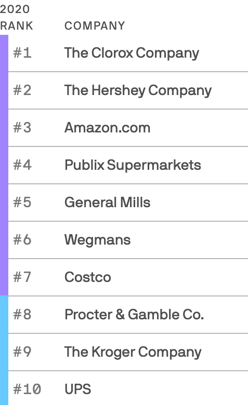

Pass me the Clorox…tip the UPS driver…love thy grocer. These are our daily life-flows in the Age of COVID-19. Our basic needs are reflected in the new 2020 Axios-Harris Poll, released today. For the past several years, I’ve covered the Harris Poll of companies’ reputation rankings here in Health Populi. Last year, Wegmans, the grocer, ranked #1; Amazon, #2. In the wake of the COVID-19 pandemic, U.S. consumers’ basic needs are emerging as health and hygiene, food, and technology, based on the new Axios-Harris Poll on the top 100 companies. This year’s study was conducted in four waves, with the

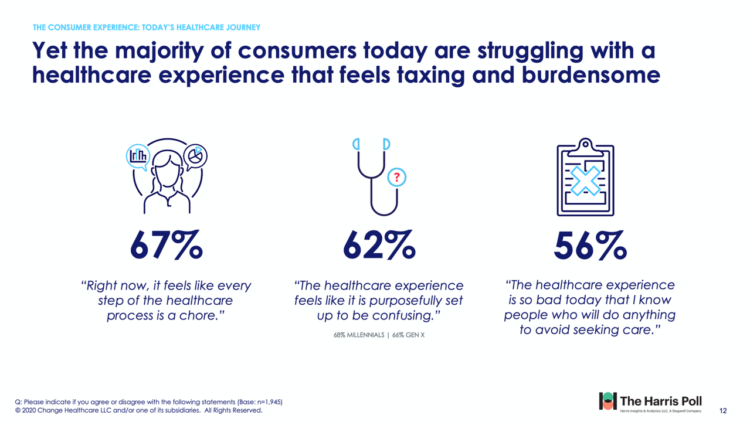

The Unbearable Heaviness of Healthcare in America – the Change Healthcare/Harris Poll

The phrase, “burden of health care,” has two usual meanings: one, to do with the massive chronic care burden, and the other, involving costs. There’s a third area of burden in U.S. health care — the onerous patient experience in finding and accessing care, assessed in the 2020 Change Healthcare – Harris Poll Consumer Experience Index. Two in three U.S. consumers feel like “every step of the healthcare process is a chore.” That burdensome patient experience leads to one in two people in America avoiding seeking care, the poll found. That’s not just self-rationing health care due to costs, but due

Return-To-School Is Stressing Out U.S. Parents Across Income, Race and Political Party

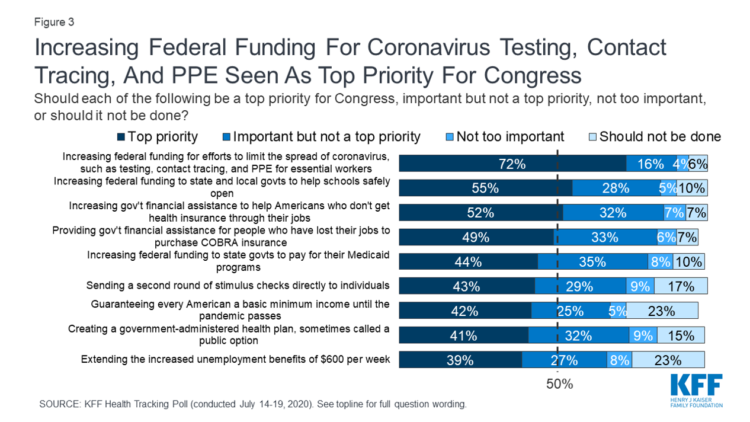

The worse of the coronavirus pandemic is yet to come, most Americans felt in July 2020. That foreboding feeling is shaping U.S. parents’ concerns about their children returning to school, with the calendar just weeks away from educators opening their classrooms to students, from kindergarten to the oldest cohort entering senior year of high school. The Kaiser Family Foundation’s July 2020 Health Tracking Poll focuses on the COVID-19 pandemic, return-to-school, and the governments’ response. KFF polled 1,313 U.S. adults 18 and older between July 14 to 19, 2020. The first line chart illustrates Americans’ growing concerns about the coronavirus, shifting

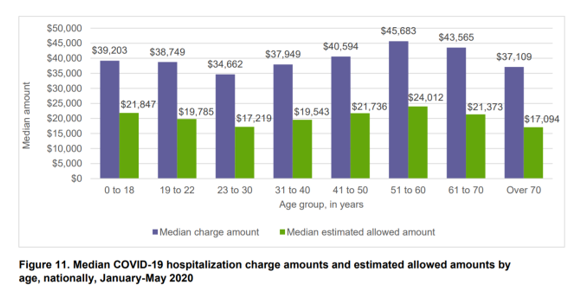

The Median Hospital Charge In the U.S. for COVID-19 Care Ranges From $34-45K

The median charge for hospitalizing a patient with COVID-19 ranged from $34,662 for people 23 to 30, and $45,683 for people between 51 and 60 years of age, according to FAIR Health’s research brief, Key Characteristics of COVID-19 Patients published July 14th, 2020. FAIR Health based these numbers on private insurance claims associated with COVID-19 diagnoses, evaluating patient demographics (age, gender, geography), hospital charges and estimated allowed amounts, and patient comorbidities. They used two ICD-10-CM diagnostic codes for this research: U07.1, 2019-nCoV acute respiratory disease; and, B97.29, other coronavirus as the cause of disease classified elsewhere which was the original code

A Toxic Side Effect of the Coronavirus: Financial Unwellness

One in two people in the U.S. say their financial health has been negatively impacted by the COVID-19 pandemic, through job loss, income disruption, or reduced work hours. The 2020 Financial Wellness Census, from Prudential found that one-half of U.S. adults are anxious about their financial future as of May 2020, an increase from 38% in late 2019. Prudential surveyed 3,000 U.S. adults across three generational cohorts: Millennials, Gen X, and Baby Boomers. The economic hit from the pandemic has disproportionately impacted people of color, younger people, women, small business owners, gig workers, and people working in retailer harder than

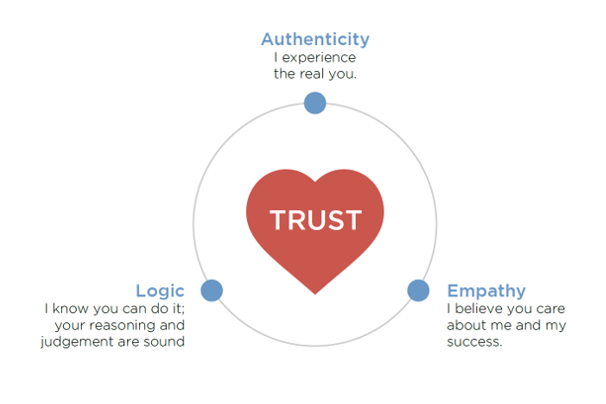

Trust Is a Key Social Currency for COVID-Embattled Consumers

The coronavirus pandemic has re-shaped patients into consumers, concerned about managing the risk of contracting the virus, millions of people experiencing months of sheltering, working, learning, and cooking at home. Combine these new life-flows with conflicting information about the nature, severity, and life-span of COVID-19: From three levels of government leaders: The President and the Executive Branch at the Federal Level, Governors of States, and Mayors of cities; Public health agencies, especially the U.S. Centers for Disease Control and the World Health Organization; Mass media; and, Social media. Re-entering life in the “next normal” requires a large dose of trust,

Juneteenth 2020: Inequality and Injustice in Health Care in America

“Of all the forms of inequality, injustice in health is the most shocking and the most inhuman because it often results in physical death,” Martin Luther King, Jr., asserted at the second meeting of the Medical Committee for Human Rights in Chicago on March 25, 1966. This quote has been shortened over the five+ decades since Dr. King told this truth, to the short-hand, “Of all the forms of inequality, injustice in health care is the most shocking and inhumane.” Professor Charlene Galarneau recently enlightened me on Dr. King’s original statement in her seminal essay, “Getting King’s Words Right.” Among

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

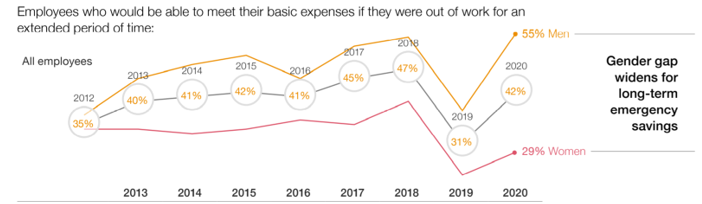

Financial Insecurity Among U.S. Workers Will Worsen in the Pandemic — Especially for Women

Millions of mainstream, Main Street Americans entered 2020 feeling income inequality and financial insecurity in the U.S. The coronavirus pandemic is exacerbating financial stress in America, hitting women especially hard, based on PwC’s 9th annual Employee Financial Wellness Survey COVID-19 Update. For this report, PwC polled 1,683 full-time employed adults between 18 and 75 years of age in January 2020. While the survey was conducted just as the pandemic began to emerge in the U.S., PwC believes, “the areas of concern back in January will only be more pronounced today,” reflecting, “the realities of the changing employee circumstances we are

Stress in America – COVID-19 Takes Toll on Finances, Education, Basic Needs and Parenting

“The COVID-19 pandemic has altered every aspect of American life, from health and work to education and exercise,” the new Stress in America 2020 study from the American Psychological Association begins. The APA summarizes the impact of these mass changes on the nation: “The negative mental health effects of the coronavirus may be as serious as the physical health implications,” with COVID-19 stressors hitting all health citizens in the U.S. in different ways. Beyond the risk of contracting the virus, the Great Lockdown of the U.S. economy has stressed the U.S. worker and the national economy, with 7 in 10

How COVID-19 Is Driving More Deaths of Despair

In the current state of the COVID-19 pandemic, we all feel like we are living in desperate times. If you are a person at-risk of dying a Death of Despair, you’re even more at-risk of doing so in the wake of the Coronavirus in America. Demonstrating this sad fact of U.S. life, the Well Being Trust and Robert Graham Center published Projected Deaths of Despair from COVID-19. The analysis quantifies the impact of isolation and loneliness combined with the dramatic economic downturn and mass unemployment with the worsening of mental illness and income inequity on the epidemic of Deaths of

TransUnion Reveals the Home Economics and Social Determinants of COVID-19

Today, 7th May 2020, the U.S. Bureau of Labor Statistics announced that about 3.17 million jobs were lost in the nation in the last week. This calculated to an unemployment rate of 15.5%, an increase of 3.1% points from the previous week. Total jobs lost in the COVID-19 pandemic, starting from the utterance of the “P” word, has been ___ in the I.S. The virus’s global impact has led to what IMF called the Great Lockdown, resulting in economic inertia and contraction since Asia and Europe reported the first patients diagnosed with the coronavirus. The economic impact the world

How COVID-19 is Hurting Americans’ Home Economics in 2020

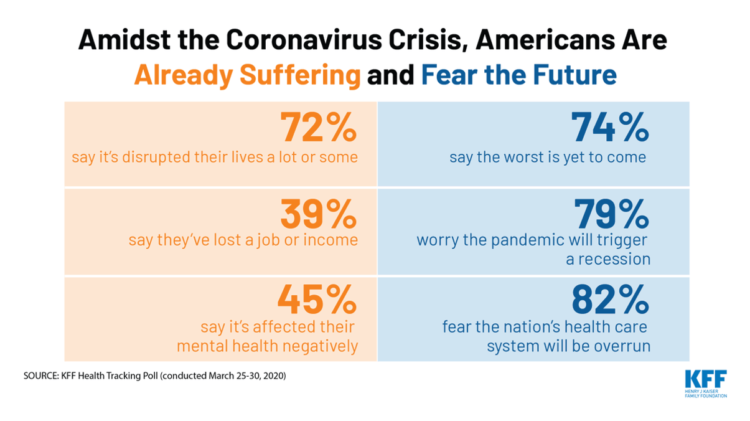

Beyond the physical and clinical aspects of the COVID-19 pandemic are financial hits that people are taking in the shutdown of large parts of the U.S. economy, impacting jobs, wages, and health insurance rolls. Some 1 in 2 people in the U.S. who have had their income impacted by the coronavirus have either fallen behind in paying off credit card debt or other bills, had problems paying for utilities, have lagged in paying for housing (rent or mortgage), been challenged paying for food, or other out-of-pocket costs. We learn about these fiscal hits from COVID-10 from the latest Health Tracking Poll

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

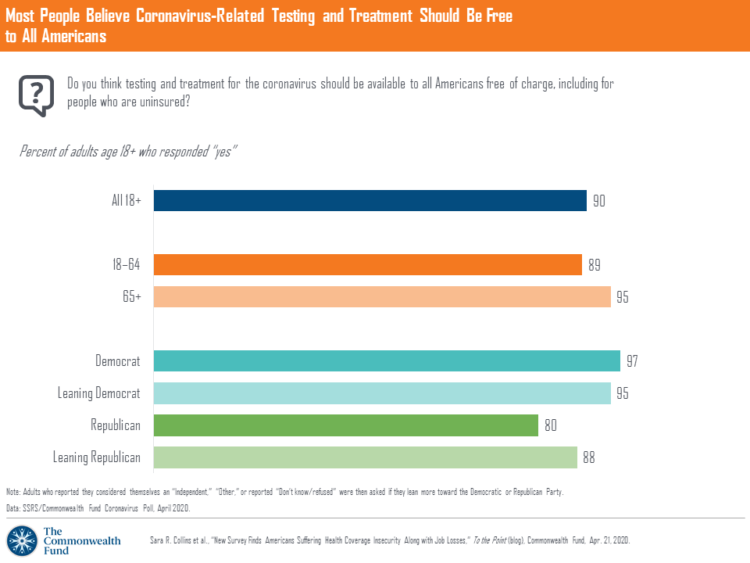

The Patient-as-Payor in the Coronavirus Pandemic

One in three working age people in the U.S. lost their job as a response to the COVID-19 pandemic, some of whom lost health insurance and others anxious their health coverage will be threatened, revealed in a survey from The Commonwealth Fund published on April 21, 2020. 2 in 5 people in America who are dealing with job insecurity are also health insurance insecure, the study found, as shown in the pie chart. The Commonwealth Fund commissioned the poll among 1,001 U.S. adults 18 to 64 years of age between 8-13 April 2020. Nearly all Americans believe the dots of

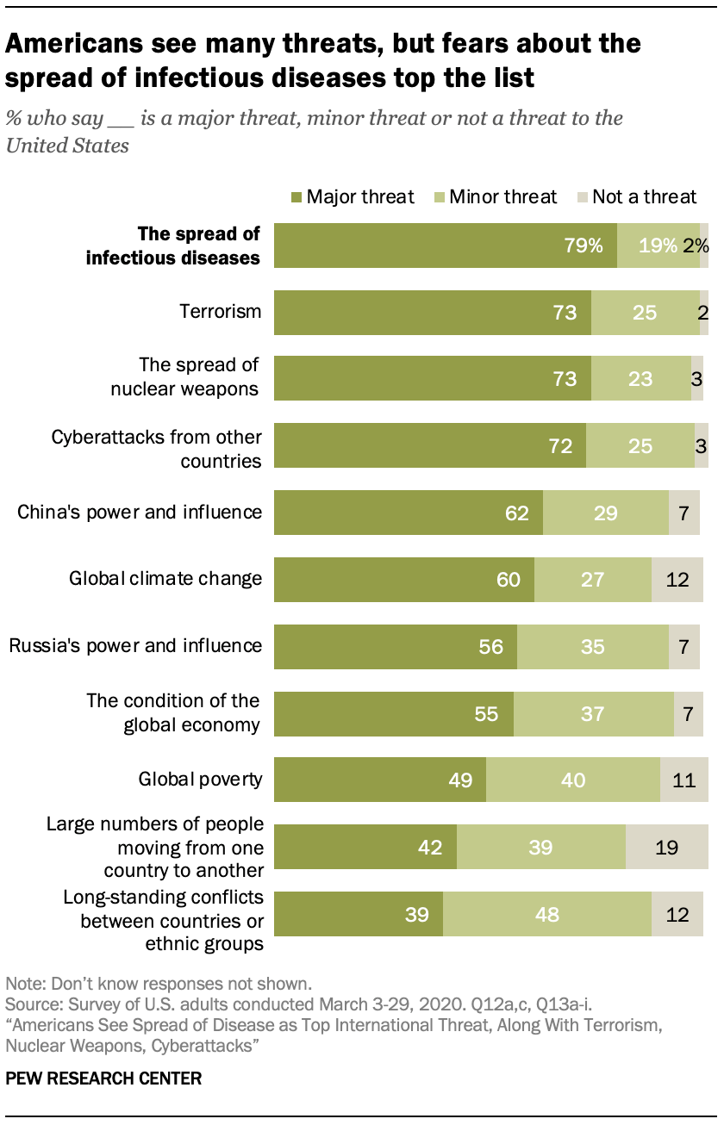

In the U.S., the Spread of Infectious Disease Now Seen As Bigger Threat Than Terrorism – Pew

The spread of infectious disease is the new terrorism in the eyes of Americans. The most significant major threat to the U.S. is infectious disease, four in five Americans said in March 2020, closely followed by terrorism (in general), the spread of nuclear weapons, and cyberattacks from other countries. For the study, the Pew Research Center commissioned a telephone survey conducted among 1,000 U.S. adults in March 2020. Large majorities of people are also highly concerned about China’s growing power and influence, global climate change, Russia’s power and influence, the condition of the global economy, and global poverty. The percent

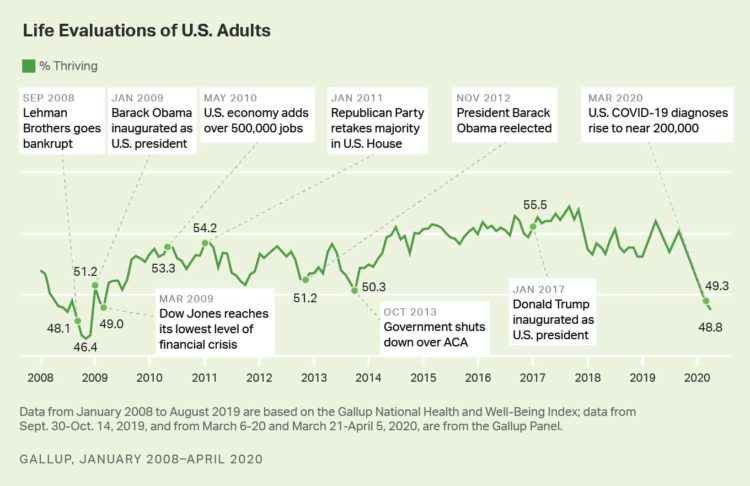

Americans’ Sense of Well-Being Falls to Great Recession Levels, Gallup Finds

It’s déjà vu all over again for Americans’ well-being: we haven’t felt this low since the advent of the Great Recession that hit our well-well-being hard in December 2008. As COVID-19 diagnoses reached 200,000 in the U.S. in April 2020, Gallup gauged that barely 1 in 2 people felt they were thriving. In the past 12 years, the percent of Americans feeling they were thriving hit a peak in 2018, as the life evaluations line graph illustrates. Gallup polled over 20,000 U.S. adults in late March into early April 2020 to explore Americans’ self-evaluations of their well-being. FYI, Gallup asks consumers

The Coronavirus Impact on American Life, Part 2 – Our Mental Health

As the coronavirus pandemic’s curve of infected Americans ratchets up in the U.S., people are seeking comfort from listening to Dolly Parton’s bedtime stories, crushing on Dr. Anthony Fauci’s science-wrapped-with-empathy, and streaming the Tiger King on Netflix. These and other self-care tactics are taking hold in the U.S. as most people are “social distancing” or sheltering in place, based on numbers from the early April 2020 Kaiser Family Foundation health tracking poll on the impact of the coronavirus on American life. While the collective practice of #StayHome to #FlattenTheCurve is the best-practice advice from the science leaders at CDC, the NIAID

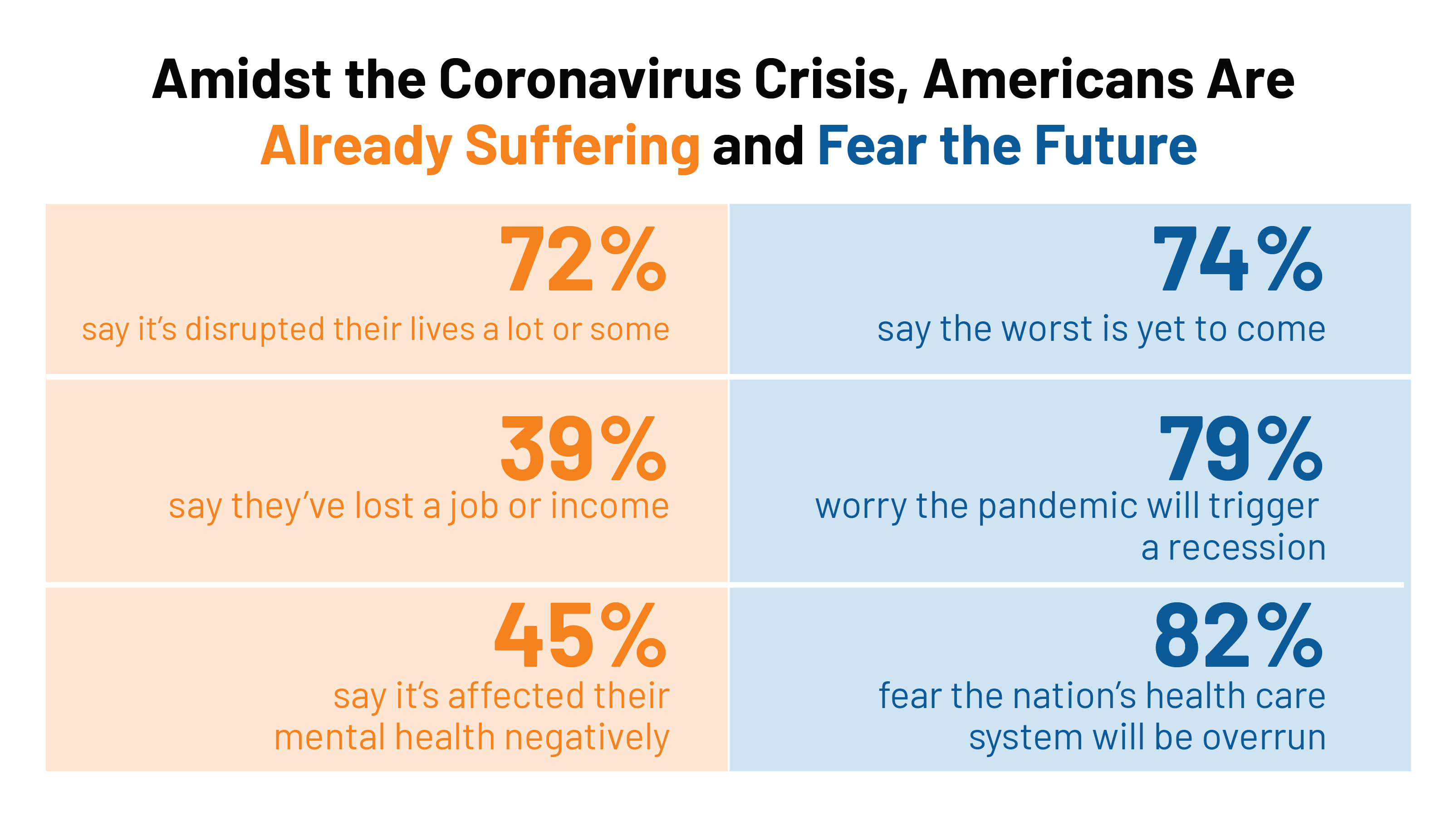

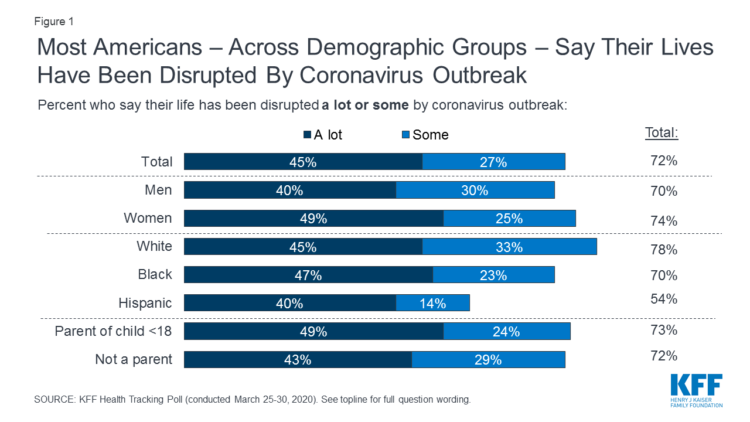

The Coronavirus Impact on American Life, Part 1 – Life Disrupted, and Money Concerns

Nearly 3 in 4 Americans see their lives disrupted by the coronavirus pandemic, according to the early April Kaiser Family Foundation Health Tracking Poll. This feeling holds true across most demographic factors: among both parents and people without children; men and women alike; white folks as well as people of color (although fewer people identifying as Hispanic, still a majority). There are partisan differences, however, in terms of who perceives a life-disruption due to COVID-19: 76% of Democrats believe this, 72% of Independents, and 70% of Republicans. Interestingly, only 30% of Republicans felt this way in March 2020, more than

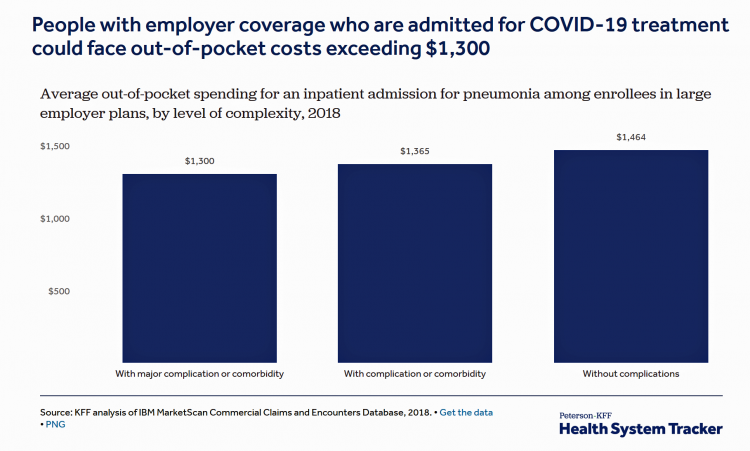

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

Waking Up a Health Consumer in the COVID-19 Era

With President Trump’s somber speech from the Oval Office last night, we wake up on 12th March 2020 to a ban on most travel from Europe to the U.S., recommendations for hygiene, and call to come together in America. His remarks focused largely on an immigration and travel policy versus science, triaging, testing and treatment of the virus itself. Here is a link to the President’s full remarks from the White House website, presented at about 9 pm on 11 March 2020. Over the past week, I’ve culled several studies and resources to divine a profile of the U.S. consumer

The Book on Deaths of Despair – Deaton & Case On Education, Pain, Work and the Future of Capitalism

Anne Case and Angus Deaton were working in a cabin in Montana the summer of 2014. Upon analyzing mortality data from the U.S. Centers for Disease Control, they noticed that death rates were rising among middle-aged white people. “We must have hit a wrong key,” they note in the introduction of their book, Deaths of Despair and the Future of Capitalism. This reversal of life span in America ran counter to a decades-long trend of lower mortality in the U.S., a 20th century accomplishment, Case and Deaton recount. In the 300 pages that follow, the researchers deeply dive into and

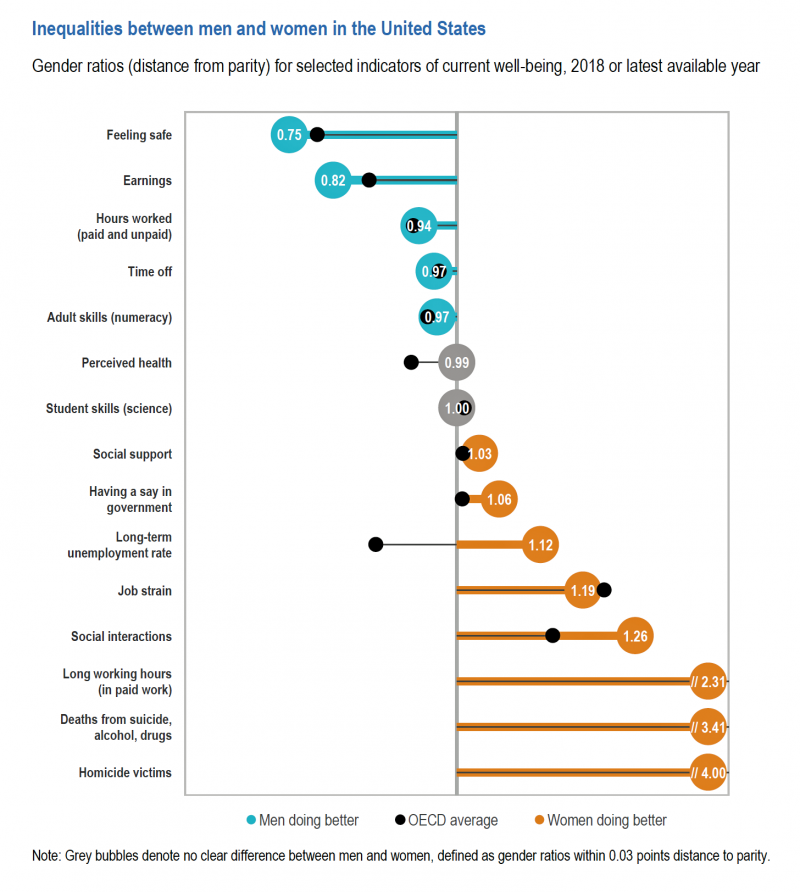

“How’s Life?” for American Women? The New OECD Report Reveals Financial Gaps on International Women’s Day 2020

March 8 is International Women’s Day. In the U.S., there remain significant disparities between men and women, in particular related to financial well-being. The first chart comes from the new OECD “How’s Life?” report published today (March 9th) measuring well-being around the country members of the OECD. This chart focuses on women versus men in the United States based on over a dozen key indicators. Top-line, many fewer women feel safe in America, and earnings in dollars and hours worked fall short of men’s incomes. This translates into lower socioeconomic status for women, which diminishes overall health and well-being for

Job #1 for Next President: Reduce Health Care Costs – Commonwealth Fund & NBC News Poll

Four in five U.S. adults say lowering the cost of health care in America should be high priority for the next American president, according to a poll from The Commonwealth Fund and NBC News. Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms. The first chart illustrates that lowering health care costs is a priority that crosses political parties. This is true for all flavors of health care costs, including health insurance deductibles and premiums, out-of-pocket costs for prescription drugs, and the cost of long-term care. While

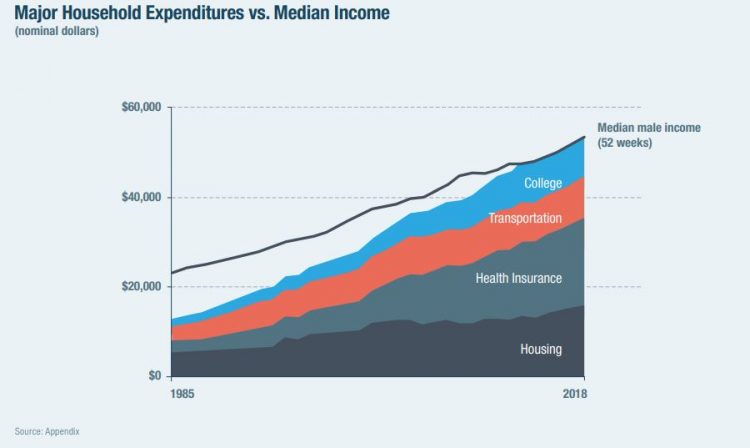

The High Cost-of-Thriving and the Evolving Social Contract for Health Care

Millions of Americans have to work 53 weeks to cover a year’s worth of household expenses. Most Americans haven’t saved much for their retirement. Furthermore, the bullish macroeconomic outlook for the U.S. in early 2020 hasn’t translated into individual American’s optimism for their own family budgets. (Sidebar and caveat: yesterday was the fourth day in a row of the U.S. financial markets losing as much as 10% of market cap, so the global economic outlook is being revised downward by the likes of Goldman Sachs, Vanguard, and Morningstar, among other financial market prognosticators. MarketWatch called this week the worst market

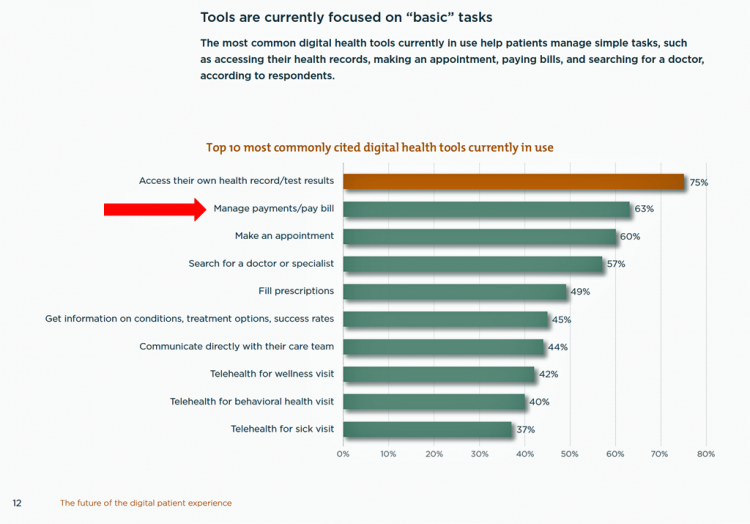

Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience, the latest report from HIMSS and the Center for Connected Medicine (CCM). The big gap in supply to patients vs. demand by health consumers is highlighted by what the arrow in the chart below points to: managing payments and paying bills. Nowhere in the top 10 most commonly provided digital tools is one for price transparency, cost comparing or cost estimating. In the

Americans’ Top 2 Priorities for President Trump and Congress Are To Lower Health Care and Rx Costs

Health care pocketbook issues rank first and second place for Americans in these months leading up to the 2020 Presidential election, according to research from POLITICO and the Harvard Chan School of Public Health published on 19th February 2020. This poll underscores that whether Democrat or Republican, these are the top two domestic priorities among Americans above all other issues polled including immigration, trade agreements, infrastructure and regulations. The point that Robert Blendon, Harvard’s long-time health care pollster, notes is that, “Even among Democrats, the top issues…(are) not the big system reform debates…They’re worried about their own lives, their own

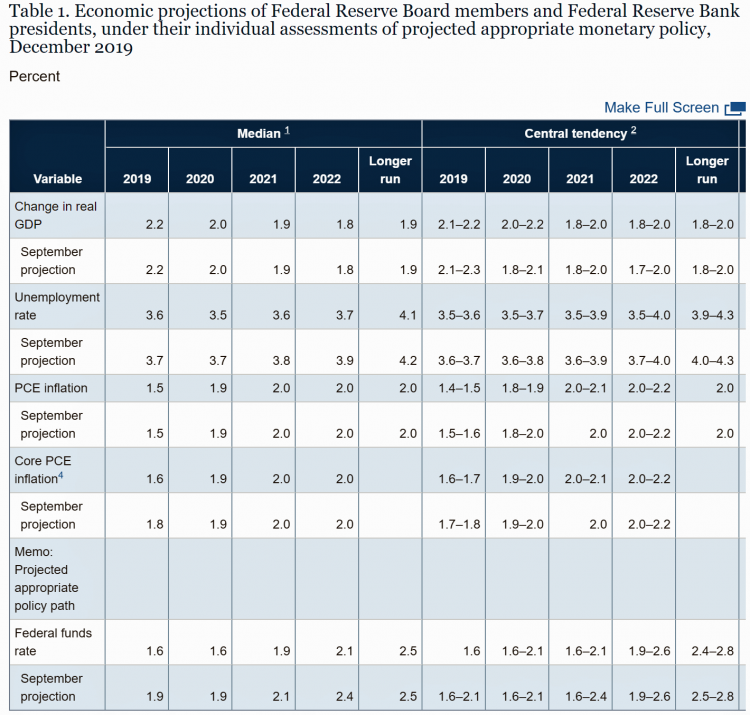

The Federal Reserve Chairman Speaks Out on Health Care Costs: “Spending But Getting Nothing”

On February 12, 2020, the Chairman of the Federal Reserve Bank of the U.S. submitted the Semiannual Monetary Policy Report to Congress and testified to the Senate Banking Committee. Chairman Jerome Powell detailed the current state of the economy, discussing the state of the macroeconomy, GDP growth, unemployment, inflation, and projections for 2022 and beyond. The top line data points are shown in the first chart. After his prepared remarks, Chairman Powell responded to questions from members of the Senate Banking Committee. Senator Ben Sasse (R-Neb.) asked him about health care costs’ impact on the national U.S. economy. The Chairman

Health@Retail Update: Kroger and Hy-Vee Morph Grocery into Health, Walmart’s Health Center, CVS/housing and More

With our HealthConsuming “health is everywhere” ethos, this post updates some of the most impactful recent retail health developments shaping consumers’ health/care touchpoints beyond hospitals, physicians, and health plans. For inspiration and context, I’ll kick off with Roz Chast’s latest New Yorker cartoon from the February 3rd 2020 issue — Strangers in the Night, taking place in a Duane Reade pharmacy. Roz really channels the scene in front of the pharmacy counter, from Q-tips to vitamins and tea. And it’s hummable to the tune of, well, Strangers in the Night. Check out the 24-hour pharmacist under the pick-up sign. Now,

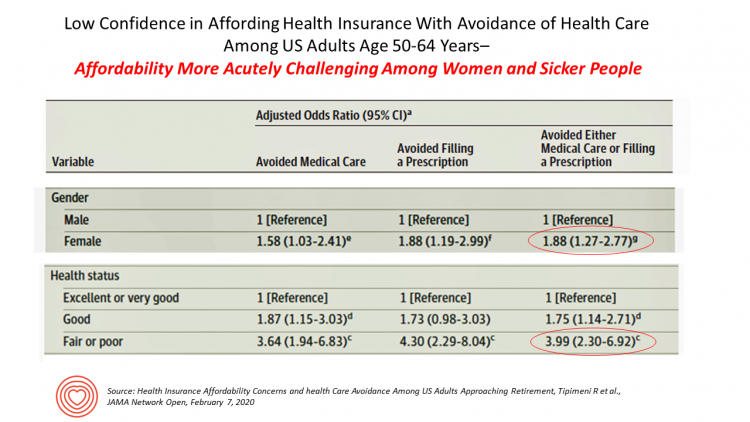

Health Care Costs Concern Americans Approaching Retirement – Especially Women and Sicker People

Even with the prospect of enrolling in Medicare sooner in a year or two or three, Americans approaching retirement are growing concerned about health care costs, according to a study in JAMA Network Open. The paper, Health Insurance Affordability Concerns and health Care Avoidance Among US Adults Approaching Retirement, explored the perspectives of 1,028 US adults between 50 and 64 years of age between November 2018 and March 2019. The patient survey asked one question addressing two aspects of “health care confidence:” “Please rate your confidence with the following:” Being able to afford the cost of your health insurance nad

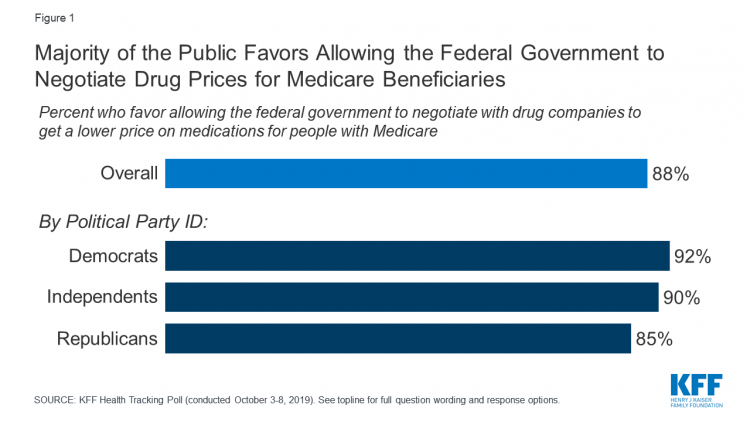

The State of the Union for Prescription Drug Prices

Tonight, President Trump will present his fourth annual State of the Union address. This morning we don’t have a transcript of the speech ahead of the event, but one topic remains high on U.S. voters’ priorities, across political party – prescription drug prices. Few issues unite U.S. voters in 2020 quite like supporting Medicare’s ability to negotiate drug prices with pharmaceutical companies, shown by the October 2019 Kaiser Family Foundation Health Tracking Poll. Whether Democrat, Independent, or Republican, most people living in America favor government intervention in regulating the cost of medicines in some way. In this poll, the top

Most Americans Regardless of Income Say It’s Unfair for Wealthier People to Get Better Health Care

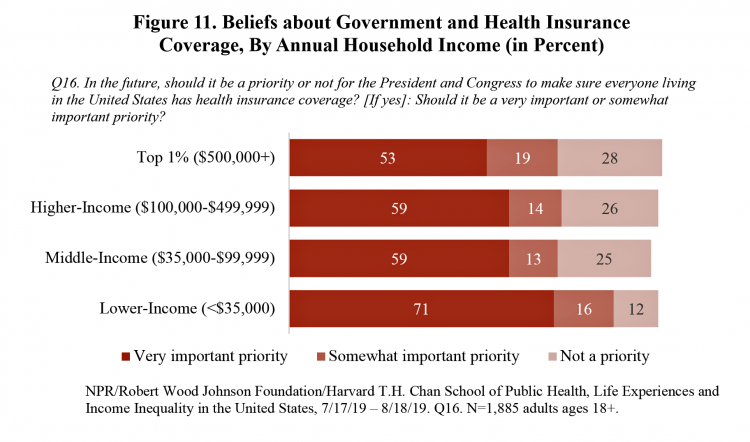

In America, earning lower or middle incomes is a risk factor for having trouble accessing health care and/or paying for it. But most Americans, rich or not, believe that it’s unfair for wealthier people to get better health care, according to a January 2020 poll from NPR, the Robert Wood Johnson Foundation and Harvard Chan School of Public Health, Life Experiences and Income Equality in the United States. The survey was conducted in July and August 2019 among 1,885 U.S. adults 18 or older. Throughout the study, note the four annual household income categories gauged in the research: Top 1%

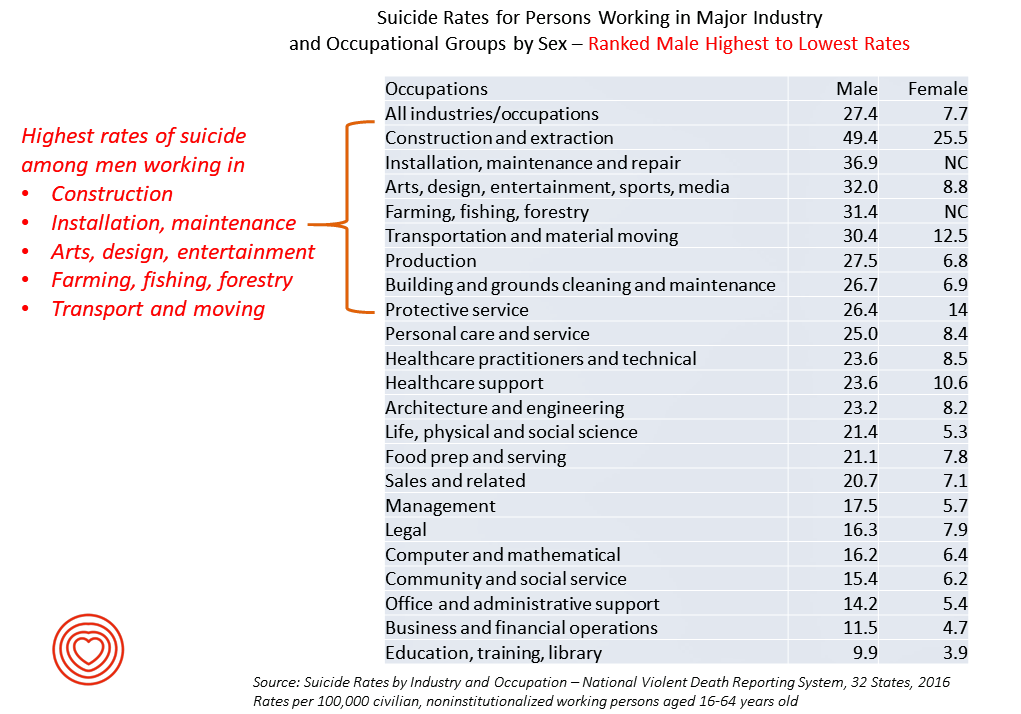

The Suicide Rate in America Increased by 40% between 2000 and 2017. Blue Collar Workers Were Much More At Risk.

The rate of suicide in the U.S. rose from 12.9 per 100,000 population to 18.0 between 2000 and 2017, a 40% increase. Those workers most at-risk for suiciding were men working in construction and mining, maintenance, arts/design/entertainment/sports/media, farming and fishing, and transportation. For women, working in construction and mining, protective service, transportation, healthcare (support and practice), the arts and entertainment, and personal care put them at higher risk of suicide. The latest report from the CDC on Suicide Rates by Industry and Occupation provides a current analysis of the National Violent Death Reporting System which collects data from 32 states,

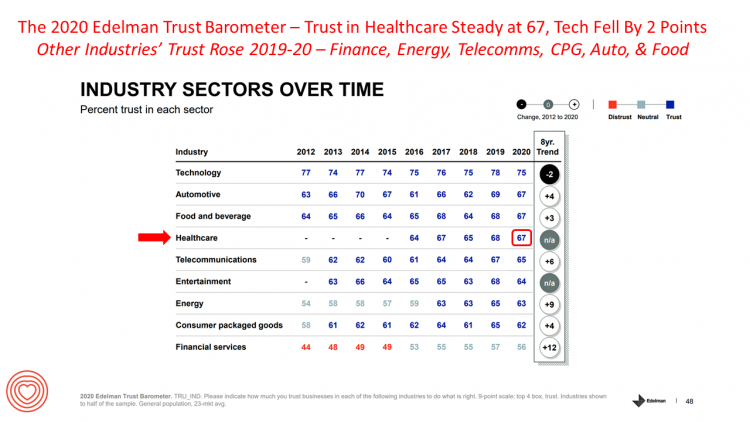

Income Inequality is Fostering Mis-Trust, the Edelman 2020 Trust Barometer Observes

Economic development has historically built trust among nations’ citizens. But in developed, wealthier parts of the world, like the U.S., “a record number of countries are experiencing an all-time high ‘mass-class’ trust divide,” according to the 2020 Edelman Trust Barometer. For 20 years, Edelman has released its annual Trust Barometer every year at the World Economic Forum in Davos, recognizing the importance of trust in the global economy and society. Last year, it was the employer who was the most-trusted touch-point in citizens’ lives the world over, I discussed in Health Populi one year ago. This year, even our employers can’t

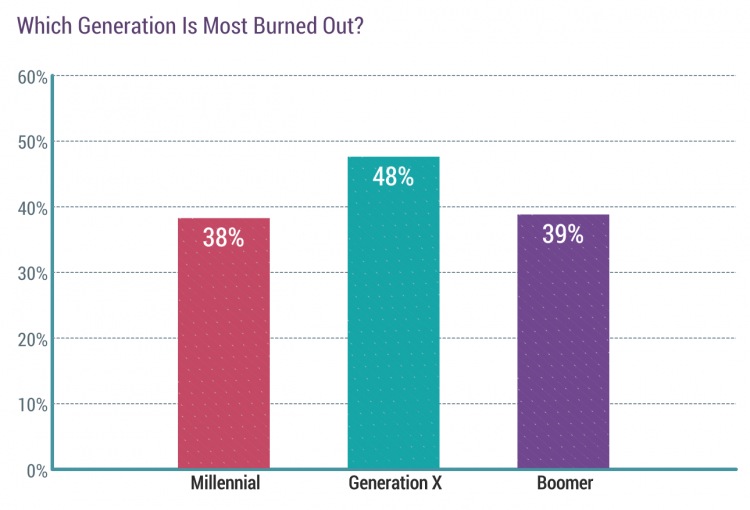

Physicians in America – Too Many Burned Out, Depressed, and Not Getting Support

Some one in three physicians is burned out, according to the Medscape’s National Physician Burnout & Suicide Report. The subtitle, “The Generational Divide,” tells a bit part of the subtext of this annual report that’s always jarring and impactful for both its raw numbers and implications for both patient care and the larger health care system in America. Nearly 1 in 2 physicians in Generation X, those people born between 1965 and 1979, feel burned out compared with roughly 4 in 10 doctors who are Millennials or Boomers. Furthermore, many more women than men physicians feel burned out: 48% of

The 2020 Social Determinants of Health: Connectivity, Art, Air and Love

Across the U.S., the health/care ecosystem warmly embraced social determinants of health as a concept in 2019. A few of the mainstreaming-of-SDoH signposts in 2019 were: Cigna studying and focusing in on loneliness as a health and wellness risk factor Humana’s Bold Goal initiative targeting Medicare Advantage enrollees CVS building out an SDOH platform, collaborating with Unite US for the effort UPMC launching a social impact program focusing on SDoH, among other projects investing in social factors that bolster public health. As I pointed out in my 2020 Health Populi trendcast, the private sector is taking on more public health

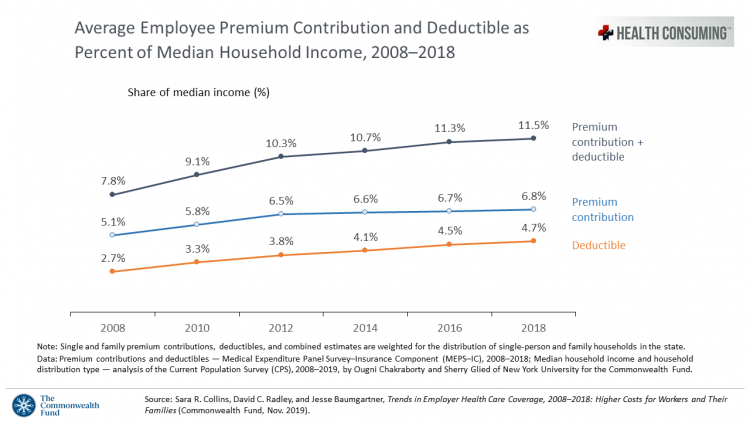

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

Despite Greater Digital Health Engagement, Americans Have Worse Health and Financial Outcomes Than Other Nations’ Health Citizens

The idea of health care consumerism isn’t just an American discussion, Deloitte points out in its 2019 global survey of healthcare consumers report, A consumer-centered future of health. The driving forces shaping health and health care around the world are re-shaping health care financing and delivery around the world, and especially considering the growing role of patients in self-care — in terms of financing, clinical decision making and care-flows. With that said, Americans tend to be more healthcare-engaged than peer patients in Australia, Canada, Denmark, Germany, the Netherlands, Singapore, and the United Kingdom, Deloitte’s poll found. Some of the key behaviors

Longevity Stalls Around the World And Wealth, More Concentrated

Two separate and new OECD reports, updating health and the global economic outlook, raise two issues that are inter-related: that gains in longevity are stalling, with chronic illnesses and mental ill health affecting more people; and, as wealth grows more concentrated among the wealthy, the economic outlook around most of the world is also slowing. First, we’ll mine the Health at a Glance 2019 annual report covering data on population health, health system performance, and medical spending across OECD countries. The first chart arrays the x-y data points of life expectancy versus health spending for each of the OECD countries

More Evidence of Self-Rationing as Patients Morph into Healthcare Payors

Several new studies reveal that more patients are feeling and living out their role as health care payors as medical spending vies with other household line items. This role of patient-as-the-payor crosses consumers’ ages and demographics, and is heating up health care as the top political issue for the 2020 elections at both Federal and State levels. In research from HealthPocket, 2 in 5 Americans said they needed to reduce other household expenses to be able to afford their monthly insurance premiums. Four in ten consumers said their monthly health insurance premiums were increasing. One in four people in the

A Tale of Two Americas as Told by the 2019 OECD Report on Health

It was the best of times, It was the worst of times, It was the age of wisdom, it was the age of foolishness, It was the epoch of belief, it was the epoch of incredulity, … starts Dickens’ Tale of Two Cities. That’s what came to my mind when reading the latest global health report from the OECD, Health at a Glance 2019, which compares the United States to other nations’ health care outcomes, risk factors, access metrics, and spending. Some trends are consistent across the wealthiest countries of the world, many sobering, such as: Life expectancy rates fell in 19 of the

The Link Between Wellness & Wealth Is Powerful for Everyone – and Especially Women

In the U.S., the link between wellness and wealth, money and health, is strong and common across people, young and old. But the impacts of money on health, well-being, and life choices varies across the ages, based on a study from Lively, a company that builds platforms for health savings accounts. The first chart illustrates that health care costs challenge people in many ways: the most obvious health care cost problems prevent people from saving more for retirement or paying down debt. Eight in 10 Americans concur that rising health care costs challenge their ability to save for retirement. Beyond the

Great Expectations for Health Care: Patients Look for Consumer Experience and Trust in Salesforce’s Latest Research

On the demand side of U.S. health care economics, patients are now payors as health consumers with more financial skin in paying medical bills. As consumers, people have great expectations from the organizations on the supply side of health care — providers (hospitals and doctors), health insurance plans, pharma and medical device companies. But as payors, health consumers face challenges in getting care, so great expectations are met with frustration and eroding trust with the system, according to the latest Connected Healthcare Consumer report from Salesforce published today as the company announced expansion of their health cloud capabilities. This is

Thinking About Health Care One Year From the 2020 Presidential Election

Today is 4th November 2019, exactly one year to the day that Americans can express their political will and cast their vote for President of the United States. Health care will be a key issue driving people to their local polling places, so it’s an opportune moment to take the temperature on U.S. voters’ perspectives on healthcare reform. This post looks at three current polls to gauge how Americans are feeling about health care reform 365 days before the 2020 election, and one day before tomorrow’s 2019 municipal and state elections. Today’s Financial Times features a poll that found two-thirds

While Costs Are A Top Concern Among Most U.S. Patients, So Are Challenges of Poverty, Food, and Housing

Rising health care costs continue to concern most Americans, with one in two people believing they’re one sickness away from getting into financial trouble, according to the 2019 Survey of America’s Patients conducted for The Physicians Foundation. In addition to paying for “my” medical bills, most people in the U.S. also say that income inequality and inadequate social services significantly contribute to high medical spending for every health citizen in the nation. The Physicians Foundation conducts this study into Americans’ views on the U.S. health care system every other year. This year’s poll was conducted in September 2019 and included input

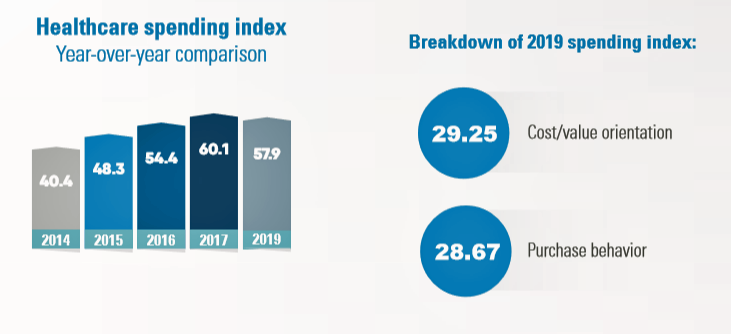

Health Consumer Behaviors in the U.S. Stall, Alegeus Finds in the 2019 Index

In the U.S., the theory of and rationale behind consumer-directed health has been that if you give a patient more financial skin-in-the-game — that is, to compel people to spend more out-of-pocket on health care — you will motivate that patient to don the hat of a consumer — to mindfully research, shop around, and purchase health care in a rational way, benefit from lower-cost and high-quality healthcare services. For years, Alegeus found that patients were indeed growing those consumer health muscles to save and shop for health care. In 2019, it appears that patients have backslid, according to the

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

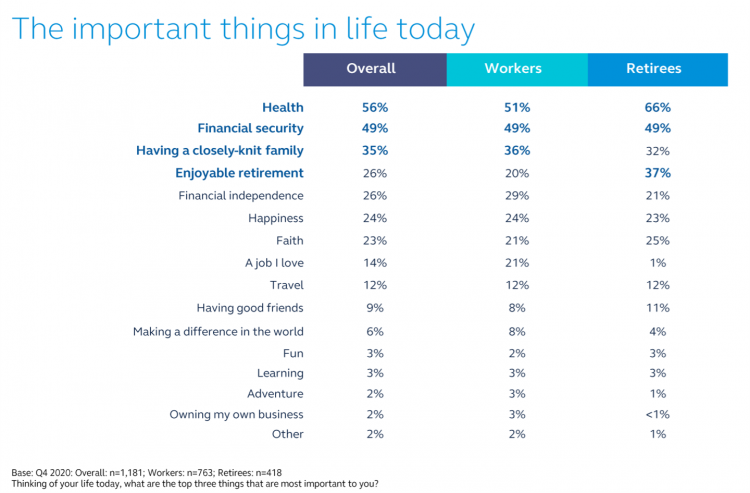

Worrying About Paying for Health Care Is the Norm in America

Among stresses facing people at least 50 years of age, health care costs rank top of mind compared with other issues like long-term care, health insurance, Social Security, taxes, and being read to retire. Worries about health care costs are particularly stressful among future retirees, 8 of 10 of whom share this top concern along with 7 in 10 recent retirees and 6 in 10 people retired for at least a decade. Health care stress cuts in two ways: most people are worried about paying for health care, as well as experienced an unanticipated decline in their health, according to

Worrying About Possible Recession Compels Health Consumers to Seek Less Care

Four in ten U.S. patients said the state of the economy changes how often they seek health care, according to a new study from TransUnion, the credit agency that operates in the health care finance space. Nearly two-thirds of patients said that knowing their out-of-pocket expenses in advance of receiving health care services influenced the likelihood of their seeking care. Given reports from mass media, business press and regional Federal Reserve press releases, the short-to-midterm economic outlook may be softening, which is the signal that TransUnion is receiving in this health consumer poll. The other side of this personal health

Health Care Providers Grow Consumer-Facing Muscles Driven by Retail & Tech-Health Competition

As patients continue to morph into health care payers, they’re increasingly expecting value-for-money, transparency, and customer experiences that show respect, bolster trust, and deliver quality services. Is that so much to ask from health care providers? Sure is, as it turns out, based on this year’s annual report from Kaufman Hall, the 2019 State of Consumerism in Healthcare: The Bar is Rising. For several years, Kaufman Hall have developed an Index of healthcare consumerism based on several pillars that, together, gauge health care providers’ performance on consumer health engagement. Providers fall into one of four tiers, ranging from Tier 1

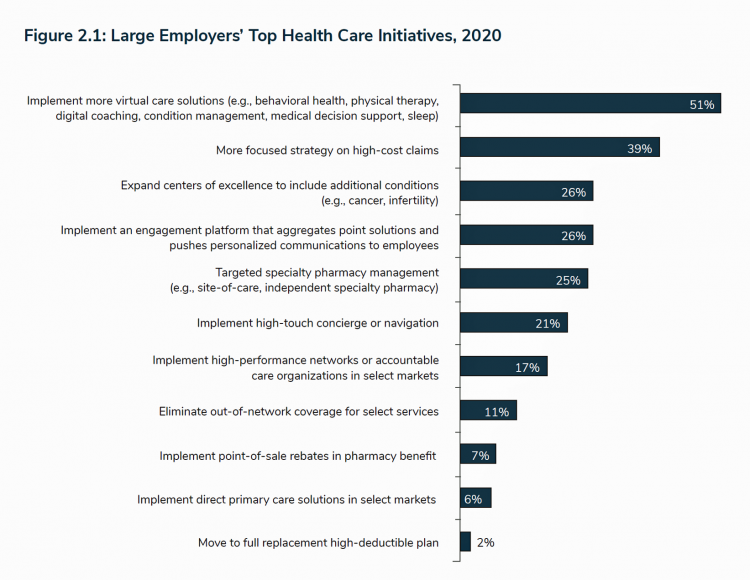

Getting More Personal, Virtual and Excellent – the 2020 NBGH Employer Report

In 2020, large employers will be “doubling down” efforts to control health care costs. Key strategies will include deploying more telehealth and virtual health care services, Centers of Excellence for high-cost conditions, and getting more personal in communicating and engaging through platforms. This is the annual forecast for 2020 brought to us by the National Business Group of Health (NBGH), the Large Employers’ Health Care Strategy and Plan Design Survey. The 42-page report is packed with strategic and tactical data looking at the 2020 tea leaves for large employers, representing over 15 million covered lives. Nearly 150 companies were surveyed

From Health Consumers to Health Citizens – a U.S. Patient Rights Moonshot?

Issue No. 4 of StartUp Health Magazine is dedicated to 8 Health Moonshot Principles. StartUp Health sees these moonshots taken together as, “a blueprint for achieving the impossible.” There’s an aspect of U.S. health care that currently feels impossible to achieve, and that’s consensus on what would constitute a sound approach to covering all Americans for health care as a civil right and whether the nation can “afford” doing so. On pages 22-23 of the digital magazine, you’ll find my essay, “From Health Consumers to Health Citizens.” This write-up summarizes the plotline of my book titled HealthConsuming, which features that

Health Care Bills’ Financial Toxicity – Remembering the Jones’ of Whatcom County, WA

“In an extreme example of angst over expensive medical bills, an elderly Washington couple who lived near the U.S.-Canadian border died in a murder-suicide this week after leaving notes that detailed concerns about paying for medical care,” USA Today reported on August 10, 2019. Five years ago, financial toxicity as a side-effect was noted by two Sloan Kettering Medical Center in a landmark report on 60 Minutes in October 2014. Epidemiologist Peter Bach and oncologist Leonard Saltz told CBS’s Lesley Stahl, “A cancer diagnosis is one of the leading causes of personal bankruptcy…We need to take into account the financial

Thank you FeedSpot for

Thank you FeedSpot for