The Power of Joy in Health and Medicine – Learning From Dr. Regina Benjamin

Former Surgeon General Dr. Regina Benjamin was the first person who quoted to me, “Health isn’t in the doctor’s office. It’s where people live, work, play and pray,” imparting that transformational mantra to me in her 2011 interview with the Los Angeles Times. I wrote about that lightbulb moment here in Health Populi. Dr. Benjamin was the 18th Surgeon General, appointed by President Obama in 2009. As “America’s Doctor,” she served a four-year term, her mission focused on health disparities, prevention, rual health, and children’s health. Today, Dr. Benjamin wears many hats: she’s the Times Picayune/NOLA.com professor of medicine at

Financial Stress As A Health Risk Factor Impacts More Americans

A family in Orange County, California, paid a brother’s 1982 hospital bill by selling 50 pieces of their newly-deceased mother’s jewelry. “It’s what she wanted,” the surviving son told a reporter from The Orange County Register. The cache of jewelry fetched enough to pay the $10,000 bill. Patients in the U.S. cobble together various strategies to pay for healthcare, as the first chart drawn from a Kaiser Family Foundation report on medical debt attests. As health care consumers, people cut back on household spending like vacations and household goods. Two-thirds of insured patients use up all or most of their savings

Health Care Costs Are A Top Worry for Americans Across Political Parties

Health care costs are out-of-reach for more Americans, among both people who have insurance through the workplace or via health insurance exchanges. The first chart illustrates the growing healthcare affordability challenge for American health consumers, discussed in a data note to the Kaiser Family Foundation Health Tracking Poll in March 2017. In 2017, 43% of consumers found it difficult to meet the health care deductible before insurance would kick in 37% of consumers found it difficult to pay for the cost of health insurance each month 31% said it was difficult to pay for copayments for doctor visits and prescription drugs.

Finding Health in Consumer Goods

People want to live healthier lives, and consumer good companies are responding to these demands to keep and gain market share and profit margins. Consumer product firms reformulated over 180,000 consumer products in 2016 for in response to consumers’ health and wellness wishes, based on data collected by Deloitte for The Consumer Goods Forum project (CGF) and published in The CGF Health & Wellness Progress Report. The CGF is an industry network of some 400 consumer goods, retail, and service companies supporting the global adoption of standards and practices. This Report focused on the CGF members’ progress toward health and wellness

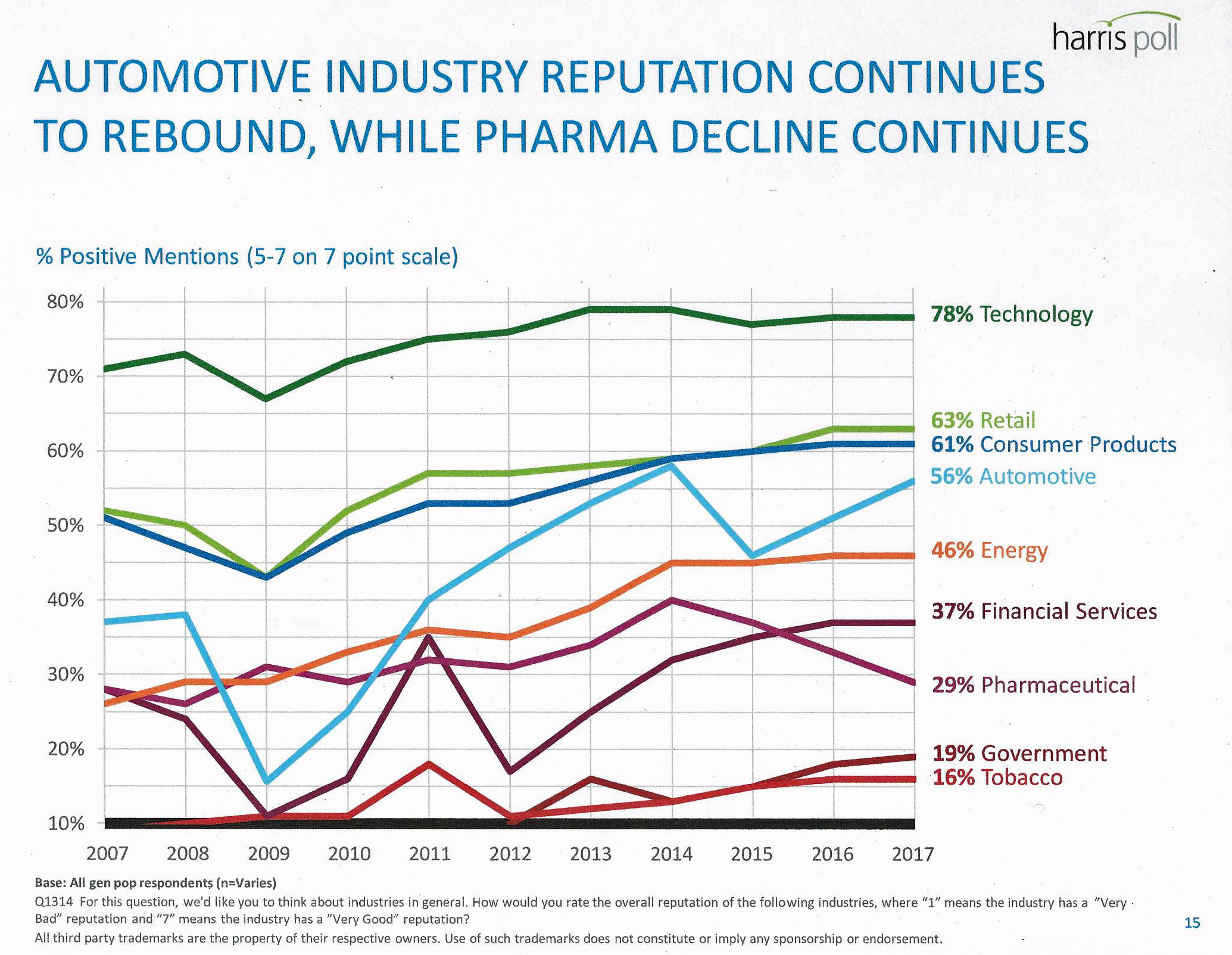

Pharma Industry Reputation Declines Second Year In A Row

U.S. consumers love technology, retail, and consumer products; automotive company reputations are improving, even with Volkswagen’s emission scandal potentially tarnishing the industry segment. The only corporate sector whose reputation fell in 2016 was the pharmaceutical industry’s, according to the Harris Poll’s 2017 Reputation Quotient report. The line chart illustrates the decline of pharma’s reputation, which puts it on par with its consumer perceptions in 2010 — just before Medicare Part D was legislated and implemented, which improved pharma’s image among American health citizens (especially older patients who tend to be more frequent consumers of prescription drugs). Pharma’s reputation quotient is back

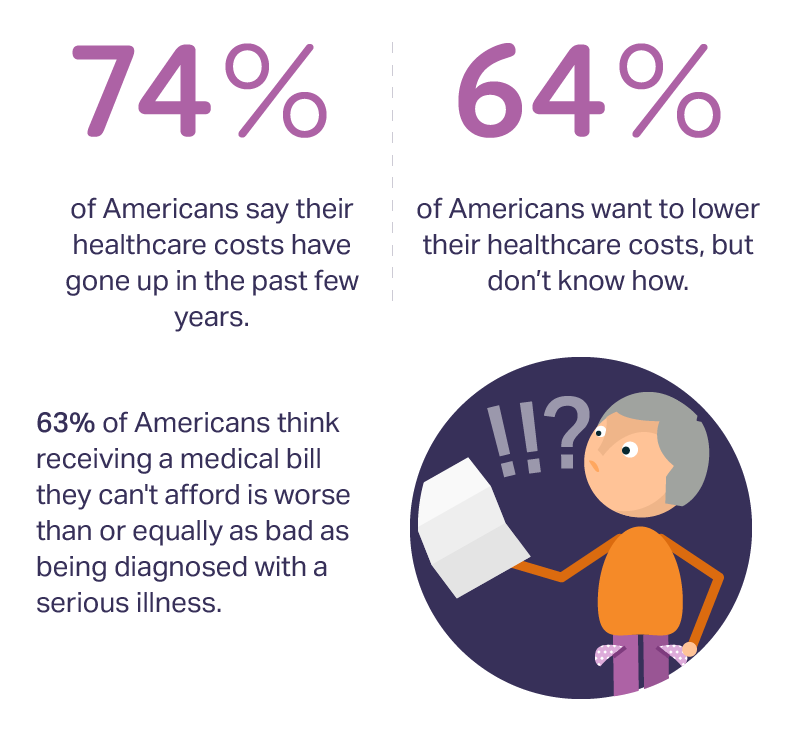

Medical Bill Toxicity: 53% of Americans Say A Big Bill Is As Bad As A Serious Diagnosis

3 in 4 Americans’ health care costs have risen in the past few years. Two-thirds of Americans want to lower their costs, but don’t know how to do that. A survey from Amino released this week, conducted by Ipsos, has found that one in five people could not afford to pay an unexpected medical bill without taking on debt, and another 18% of Americans could only afford up to $100 if presented with an unexpected medical bill. This medical debt side effect more likely impacts women versus men, the less affluent, the unmarried, and those with no college degree. While

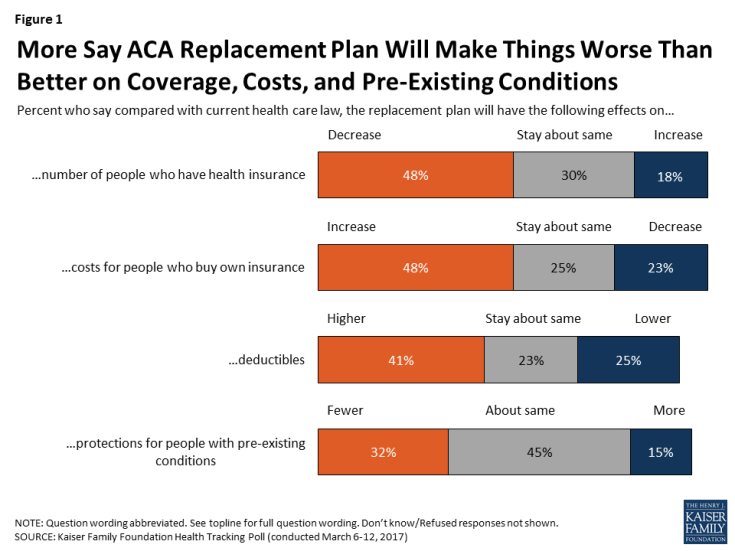

Americans Are Not Sold On the American Health Care Act

Most Americans do not believe that TrumpCare, the GOP plan to replace the Affordable Care Act (the ACA, aka ObamaCare), will make things better for U.S. health citizens when it comes to peoples’ health insurance coverage, the premium costs charged for those health plans, and protections for people with pre-existing medical conditions. The March 2017 Kaiser Family Foundation Health Tracking Poll examined U.S. adults’ initial perceptions of AHCA, the American Health Care Act, which is the GOP’s replacement plan for the ACA. There are deep partisan differences in perceptions about TrumpCare, with more Republicans favorable to the plan — although not

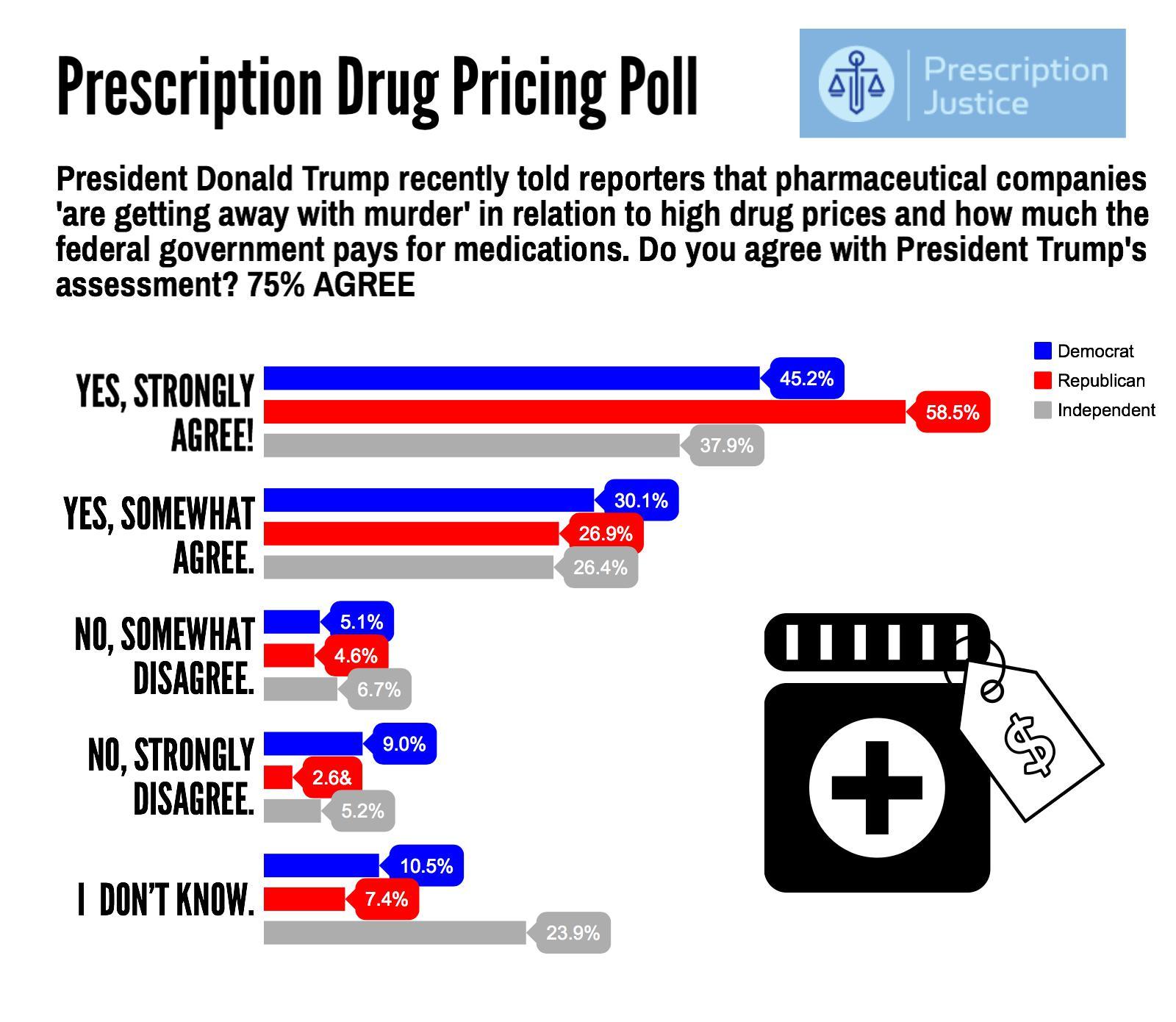

The Healthcare Reform Issue Americans Agree On: Lowering Rx Costs

Yesterday, the Tweeter-in-Chief President Donald Trump tweeted, “I am working on a new system where there will be competition in the Drug Industry. Pricing for the American people will come way down!” Those 140 characters sent pharma stocks tumbling, as illustrated by the chart for Mylan shares dated 7 March 2017. This is one issue that Americans across the political spectrum agree on with the POTUS. The latest Zogby poll into this issue, conducted for Prescription Justice, found 3 in 4 Americans agree that pharmaceutical companies are “getting away with murder,” as President Trump said in a TIME magazine interview

Your Zip Code Is Your Wellness Address

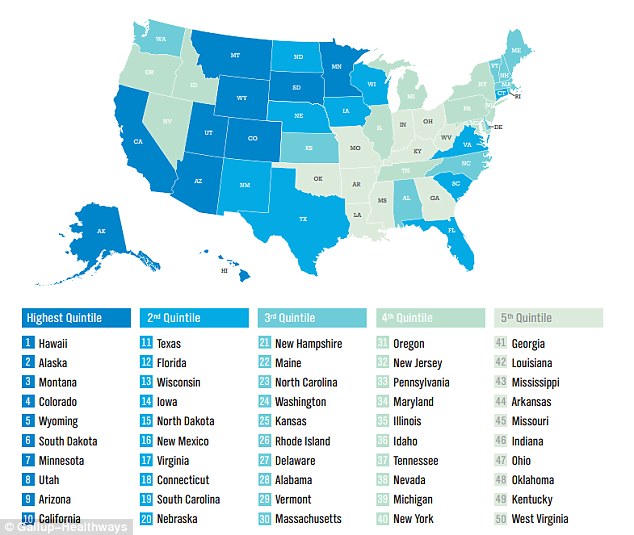

Geography is destiny, Napoleon is thought to have first said. More recently, the brilliant physician Dr. Abraham Verghese has spoken about “geography as destiny” in his speeches, such as “Two Souls Intertwined,” The Tanner Lecture he delivered at the University of Utah in 2012. Geography is destiny for all of us when it comes to our health and well-being, once again proven by Gallup-Healthways in The State of American Well-Being 2016 Community Well-Being Rankings. The darkest blue circles in the U.S. map indicate the metro areas in the highest-quintile of well-being. The index of well-being is based on five metrics, of consumer self-ranking

Stress Is A Social Determinant of Health – Money and Politics Top the List in 2017

The American Psychological Association reports that Americans are experiencing greater levels of stress in 2017 for the first time since initiating the Stress in America Survey ten years ago in 2007. This is a statistically significant finding, APA calculated. The member psychologists of the American Psychological Association (APA) began to report that patients were coming to appointments increasingly anxious about the 2016 Presidential election. So the APA polled U.S. adults on politics for the first time in ten years of conducting the Stress in America survey. Two-thirds of Americans are stressed and/or anxious about the future of the nation, and

Will Republican Healthcare Policy “Make America Sick Again?” Two New Polls Show Growing Support for ACA

Results of two polls published in the past week, from the Kaiser Family Foundation and Pew Research Center, demonstrate growing support for the Affordable Care Act, aka Obamacare. The Kaiser Health Tracking Poll: Future Directions for the ACA and Medicaid was published 24 February 2017. The first line chart illustrates the results, with the blue line for consumers’ “favorable view” on the ACA crossing several points above the “unfavorable” orange line for the first time since the law was signed in 2010. The margins in February 2017 were 48% favorable, 42% unfavorable. While the majority of Republicans continue to be solidly

Marketing Medicines: Going Boldly and Accessibly for Rx

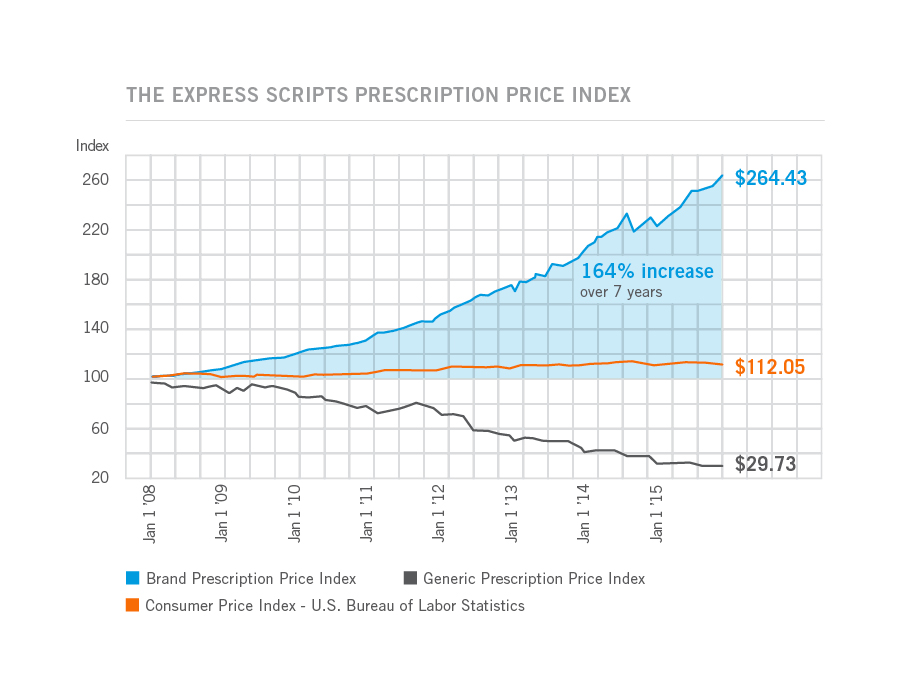

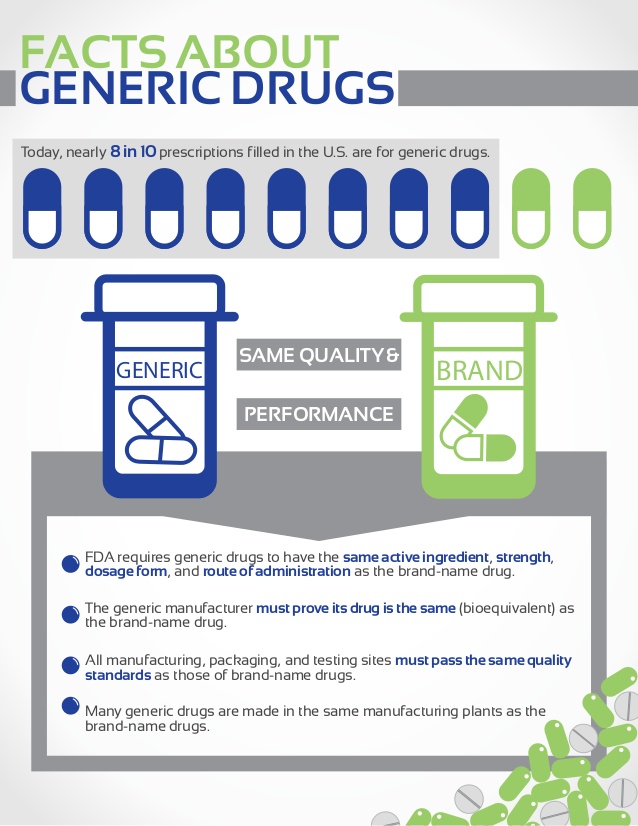

Over the past two weeks, we see two marketing campaigns emerge to market medicines: first, from the branded pharmaceutical association PhRMA, the #GoBoldly initiative with a theme of innovation and personalized medicine. Second, there’s a campaign from the Generic Pharmaceutical Association (GPhA), rebranding the organization as the Association for Accessible Medicines with the tagline, “keep medicines in reach.” What’s this all about? To put these marketing initiatives in context, let’s start with the publication of Express Scripts 2016 Drug Trend Report. “Drug trend” is short-hand for growth in prescription drug spending, year on year. The first graph illustrates the price index

My $100 Flu Shot: How Much Paper Waste Costs U.S. Healthcare

An abbreviated version of this post appeared in the Huffington Post on 9 February 2017. This version includes the Health Populi Hot Points after the original essay, discussing the consumer’s context of retail experience in healthcare and implications for the industry under Secretary of Health and Human Services Tom Price — a proponent of consumer-directed healthcare and, especially, health savings accounts. We’ll be brainstorming the implications of the 2016 CAQH Index during a Tweetchat on Thursday, February 16, at 2 pm ET, using the hashtag #CAQHchat. America ranks dead-last in healthcare efficiency compared with our peer countries, the Commonwealth Fund

Health Care Worries Top Terrorism, By Far, In Americans’ Minds

Health care is the top concern of American families, according to a Monmouth University Poll conducted in the week prior to Donald Trump’s Presidential inauguration. Among U.S. consumers’ top ten worries, eight in ten directly point to financial concerns — with health care costs at the top of the worry-list for 25% of people. Health care financial worries led the second place concern, job security and unemployment, by a large margin (11 percentage points) In third place was “everyday bills,” the top concern for 12% of U.S. adults. Immigration was the top worry for only 3% of U.S. adults; terrorism and

Patients Anxiously Prep to Be Healthcare Consumers, Alegeus Finds

Healthcare consumers are in a “state of denial,” according to research conducted for Alegeus, the consumer health benefits company. Overall, 3 in 4 consumers feel fear when it comes to their healthcare finances: most people worry about being hit with unexpected healthcare costs they can’t afford, and nearly half fear they won’t be able to afford their family’s healthcare needs. The wordle illustrates consumers’ mixed feelings about healthcare: while people feel frustrated, overwhelmed, powerless, confused and skeptical about healthcare in America, there are some emerging adjectives hinting at growing consumer health muscle-building: optimistic, hopeful, supported, engaged, accountable. Still, denial and

Americans Far More Likely to Self-Ration Prescription Drugs Due To Cost

Americans are more than five times more likely to skip medication doses or not fill prescriptions due to cost than peers in the United Kingdom or Switzerland. U.S. patients are twice as likely as Canadians to avoid medicines due to cost. And, compared with health citizens in France, U.S. consumers are ten-times more likely to be non-adherent to prescription medications due to cost. It’s very clear that more consumers tend to avoid filling and taking prescription drugs, due to cost barriers, when faced with higher direct charges for medicines. This evidence is presented in the research article, Cost-related non-adherence to prescribed

Health and Money: Americans’ New Year’s Resolutions for 2017

Health and money are the two issues about which Americans have set New Year’s resolutions, according to the Harris Poll, Americans Look to Get Their Bodies and Wallets in Shape with New Year’s Resolutions. The top goals U.S. consumers have set for 2017 are to: Eat healthier, 29% of all U.S. adults Save more money, 25% Lose weight, 24% Drink more water, 21% Pay down debt, 17% Spend more time with family and friends, 15% Get organized, 15% Travel more, 15% Read more, 14% Improve relationships, 14%. There are some marked differences between American men versus women across these resolutions;

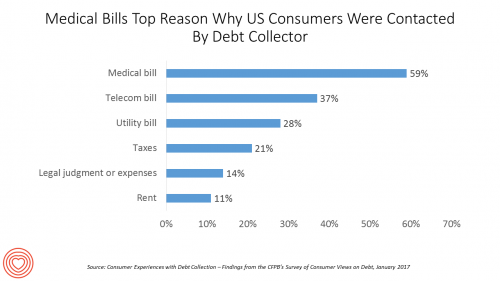

Medical Debt Is A Risk Factor For Consumers’ Financial Wellness

The top reason US consumers hear from a debt collector is due to medical bills, for 6 in 10 people in Americans contacted regarding a collection. This month, the Consumer Financial Protection Bureau (CFPB) published its report on Consumer Experiences with Debt Collection. Medical bill collections are the most common debt for which consumers are contacted by collectors, followed by phone bills, utility bills, and tax bills. The prevalence of past-due medical debt is unique compared with these other types because healthcare cost problems impact consumers at low, middle, and high incomes alike. Specifically: 62% of consumers earning $20,000 to

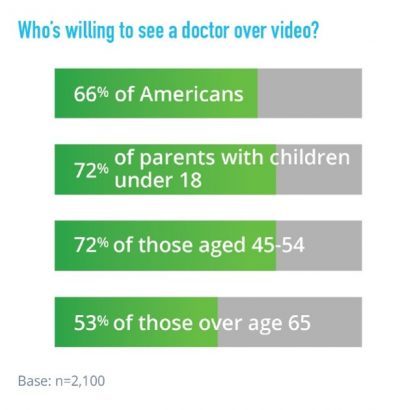

Most Consumers Willing to See Doctor Over Video in 2017

Two in three U.S. consumers are willing to see a doctor online. American health consumers welcome the opportunity to engage in virtual healthcare services via telehealth. American Well’s 2017 Telehealth Index surveyed 2,100 U.S. adults 18 and over in August and September 2016 to gauge consumers’ views on healthcare services, access, and receptivity to virtual care modes of delivery. Underneath the 66% of consumers open to telehealth are demographic differences: people with children are more likely to value virtual care, as well as people between 45 and 54, the survey found. Note, though, that a majority of older Americans over

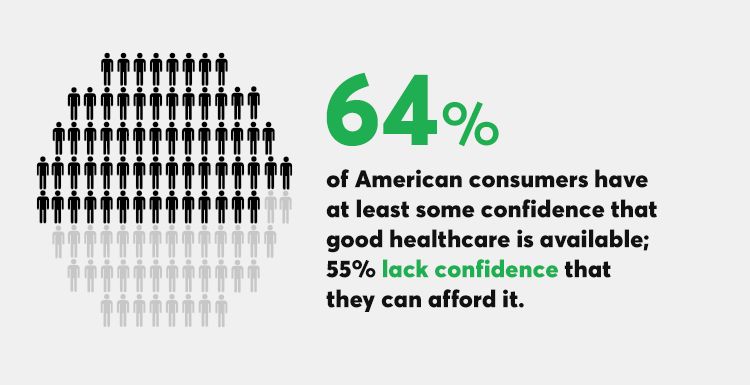

Health Care For All — Only Better, US Consumers Tell Consumer Reports

Availability of quality healthcare, followed by affordable care, are the top two issues concerning U.S. consumers surveyed just prior to Donald Trump’s inauguration as the 45th U.S. President. Welcome to Consumer Reports profile of Consumer Voices, As Trump Takes Office, What’s Top of Consumers’ Minds? “Healthcare for All, Only Better,” Consumer Reports summarizes as the top-line finding of the research. 64% of people are confident of having access to good healthcare, but 55% aren’t sure they can afford healthcare insurance to be able to access those services. Costs are too high, and choices in local markets can be spotty or non-existent.

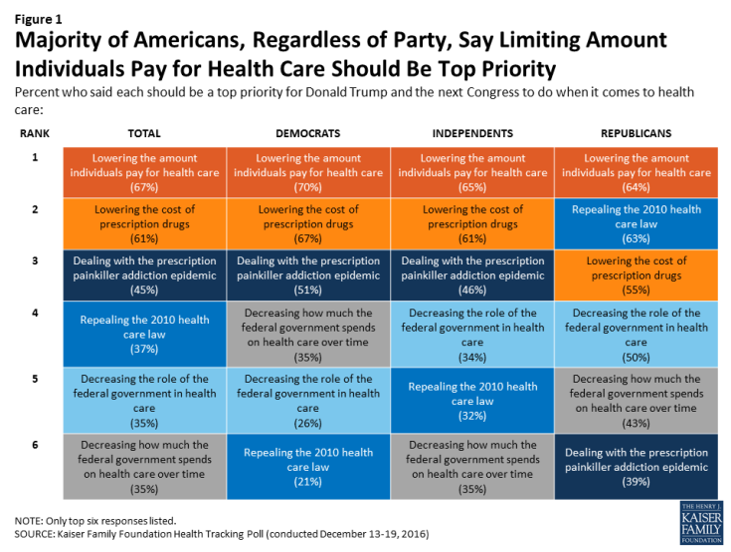

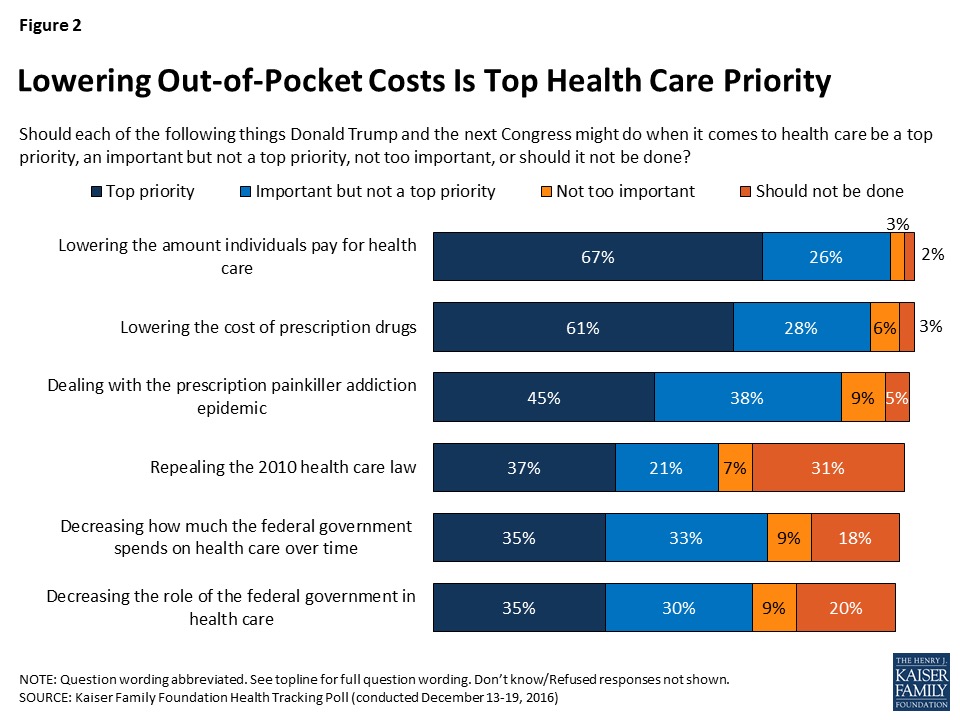

Health Care Costs, Not the ACA, Rank #1 in Americans’ Minds As President Trump Assumes the Presidency

More Americans are worried about their out-of-pocket health care costs than they are about repealing the Affordable Care Act (ACA), according to the Kaiser Family Foundation (KFF) Health Tracking Poll published 6th January 2017, the first KFF poll for the new year. Cost worries fall into two buckets of concerns: the cost of health care, and the cost of prescription drugs. Managing the opioid epidemic falls in third place after health care costs. Repealing the Affordable Care Act? It’s #4 on Americans’ health care priorities as of mid-December 2016, followed by shrinking the Federal’s government’s role in and spending on

Looking Beyond Tech for Health at CES 2017 – the Social Determinants

I’m at CES 2017 in Las Vegas all this week looking for signs of health in new technology announcements. While it’s no surprise there are hundreds of new and new-and-improved digital health innovations on the exhibition floor, you can look beyond those aisles to other companies who are new entrants in health. Arguably, these companies can bolster peoples’ health at least as much as activity tracking and calorie counting. Here are five examples I wrote about in my Huffington Post column yesterday, The Social Determinants of Health Live At CES 2017: Safety – Liberty Mutual Nutrition – Terraillon Healthy Sex

Retail Trumps Healthcare in 2017: the Health Populi Forecast for the New Year

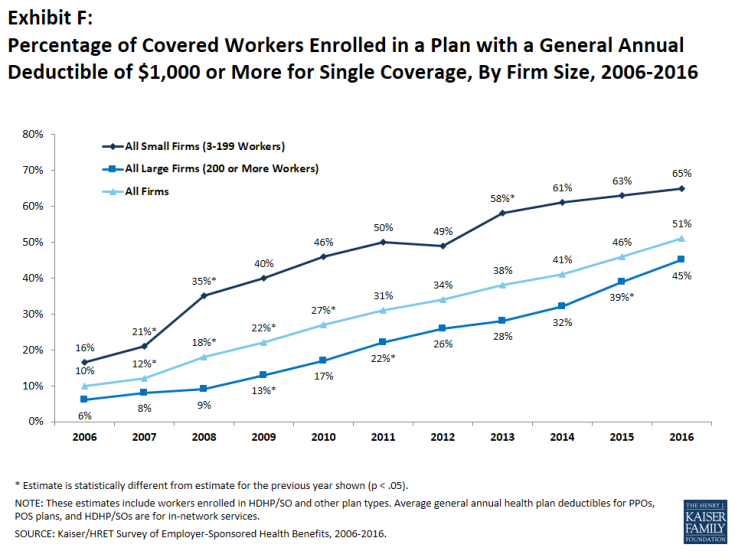

Health citizens in America will need to be even more mindful, critical, and engaged healthcare consumers in 2017 based on several factors shaping the market; among these driving forces, the election of Donald Trump for U.S. president, the uncertain future of the Affordable Care Act and health insurance, emerging technologies, and peoples’ growing demand for convenience and self-service in daily life. The patient is increasingly the payor in healthcare. Bearing more first-dollar costs through high-deductible health plans and growing out-of-pocket spending for prescription drugs and other patient-facing goods and services, we’re seeking greater transparency regarding availability, cost and quality of

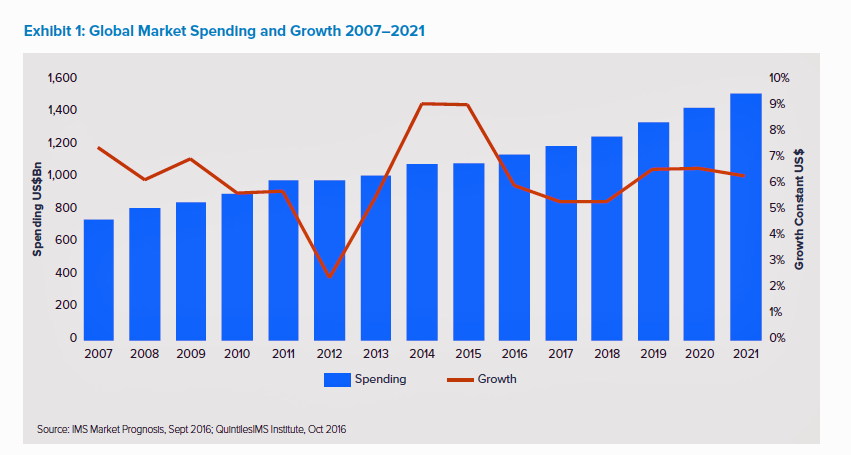

A Growing Medicines Bill for Global Health Consumers to 2021

The global market for spending on medicines will high $1.5 trillion by 2021, according to the latest forecast from QuintilesIMS. Drug spending grew about 9% in the past two years, and is expected to moderate to 4 to 7 percent annually over the next five years. That dramatic 9% growth was heavily driven by new (expensive) specialty drugs to treat Hepatitis C (e.g., Harvoni and Sovaldi) and cancer therapies that hit the market in the past couple of years. There will be a “healthy level” of new innovative meds coming out of the drug pipeline in the next several years

Fighting Cancer with Hormel Vital Cuisine – Food as Medicine Update

Think “Hormel,” and you may have visions of SPAM, Chi-Chi’s salsa, Skippy peanut butter, and Dinty Moore corned beef hash. So what’s Hormel doing in the title of a Health Populi post, anyway, you might ask? Like many food companies, Hormel is broadening its product portfolio expanding with health. The company isn’t just moving to healthy eating for wellness’s sake, but boldly going where most food companies haven’t yet gone: developing products for people battling cancer. Vital Choices, a well-titled line of frozen meals, was developed by Hormel in collaboration with the American Cancer Society, Cancer Nutrition Consortium, the Culinary Institute

See Me, Feel Me, Touch Me, Heal Me – What The Who’s Tommy Can Teach Healthcare

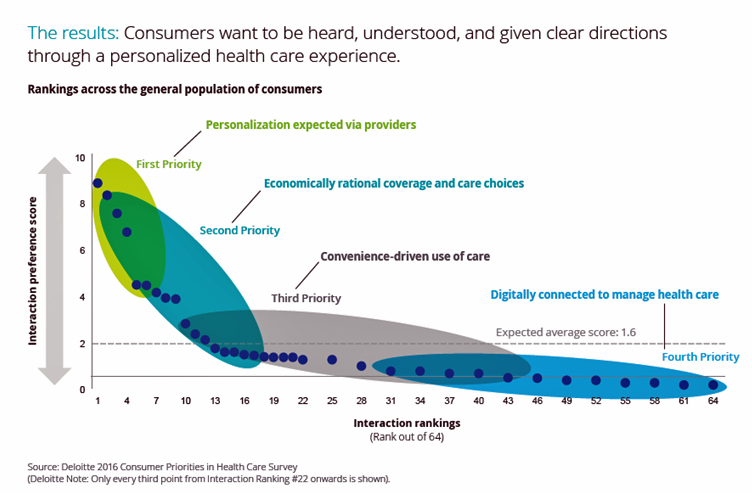

“See me, feel me, touch me, heal me,” is the lyrical refrain from The Who’s Tommy. These eight words summarize what Deloitte has learned from the firm’s latest look into healthcare consumers, published in the report, Health plans: What matters most to the health care consumer. U.S. consumers’ demands for health care are for: Personalization from doctors, hospitals, and other care providers — the most important priority; Economically rational coverage and care choices; Convenience-drive access and care experience; and, Digitally connected care. Personalization is Job 1: “Consumers want to be heard, understood, and given clear directions through a personalized health care

Healthcare Reform in President Trump’s America – A Preliminary Look

It’s the 9th of November, 2016, and Donald Trump has been elected the 45th President of the United States of America. On this morning after #2016Election, Health Populi looks at what we know we know about President Elect-Trump’s health policy priorities. Repeal-and-replace has been Mantra #1 for Mr. Trump’s health policy. With all three branches of the U.S. government under Republican control in 2018, this policy prescription may have a strong shot. The complication is that the Affordable Care Act (aka ObamaCare in Mr. Trump’s tweet) includes several provisions that the newly-insured and American health citizens really value, including: Extending health

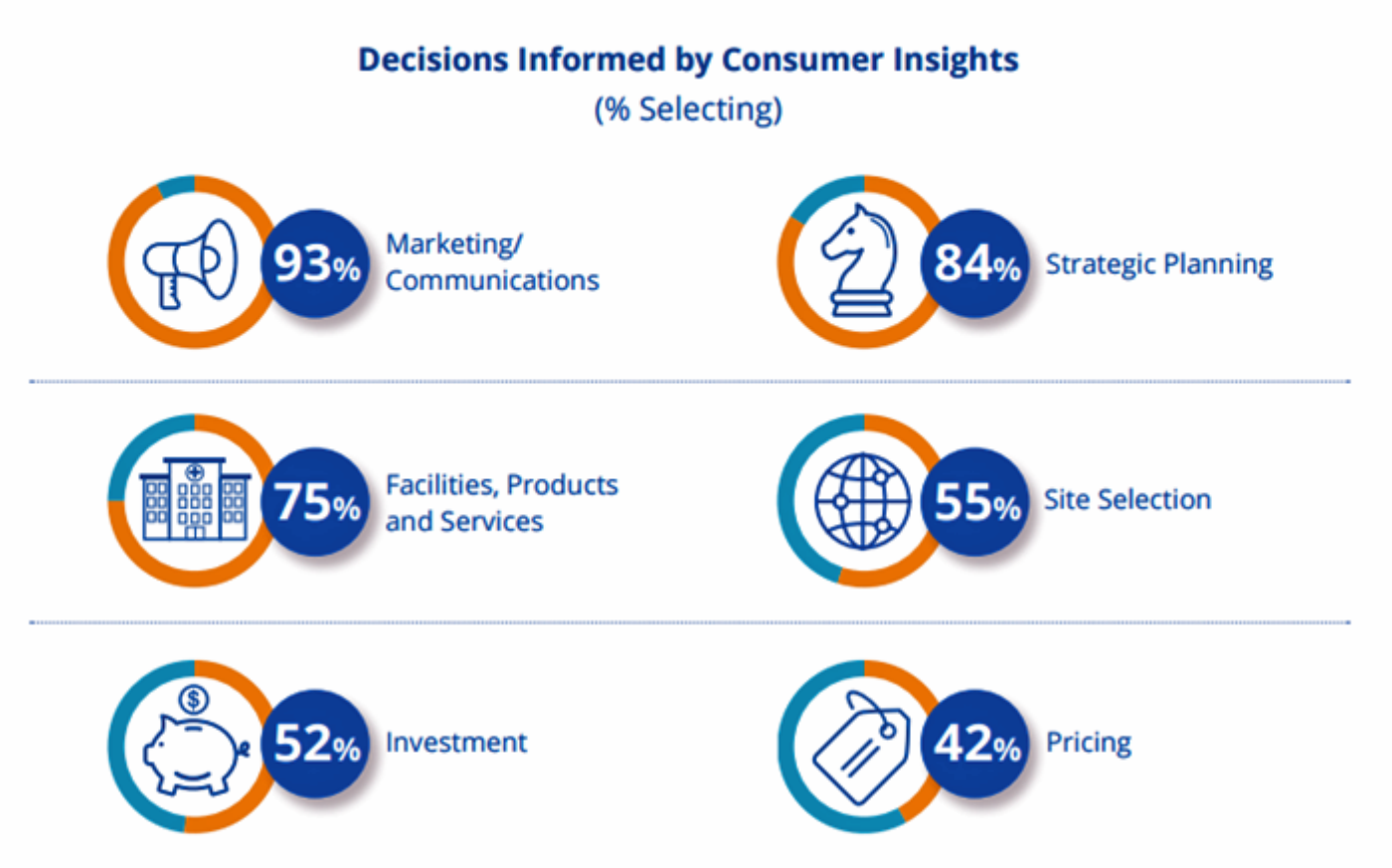

Hospitals Need to Cross the Health Consumer Chasm

Most U.S. hospitals have not put consumerism into action, a new report from KaufmanHall and Caden’s Consulting asserts from the second paragraph. Patient experience is the highest priority, but has the biggest capability gap for hospitals, the report calls out. KaufmanHall surveyed 1,000 hospital and health system executives in 100 organizations to gauge their perspectives on health consumers and the hospital’s business. KaufmanHall points out several barriers for hospitals working to be consumer-centered: Internal/institutional resistance to change Lack of urgency Competing priorities Skepticism Lack of clarity (vis-a-vis strategic plan) Lack of data and analytics. The key areas identified for consumer centricity

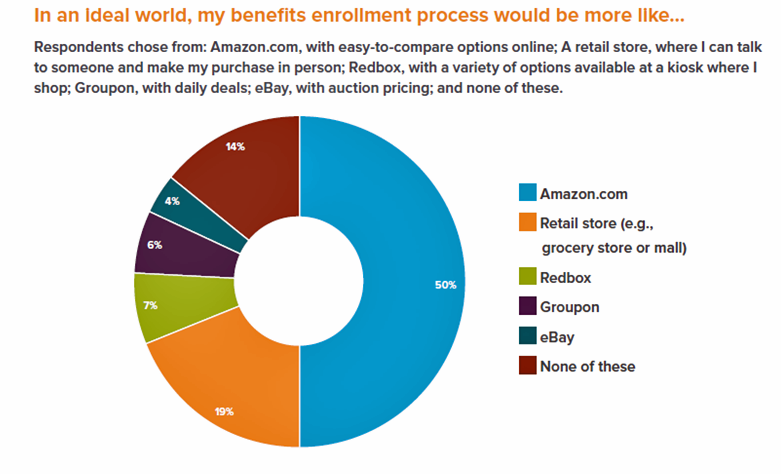

Looking for Amazon in Healthcare

Consumers have grown accustomed to Amazon, and increasingly to the just-in-time convenience of Amazon Prime. Today, workers who sign onto employee benefit portals are looking for Amazon-style convenience, access, and streamlined experiences, found in the Aflac Workforces Report 2016. Aflac polled 1,900 U.S. adults employed full or part time in June and July 2016 to gauge consumers’ views on benefit selections through the workplace. Consumers have an overall angst and ennui about health benefits sign-ups: 72% of employees say reading about benefits is long, complicated, or stressful 48% of people would rather do something unpleasant like talking to their ex or

Let’s Go Healthcare Shopping!

Healthcare is going direct-to-consumer for a lot more than over-the-counter medicines and retail clinic visits to deal with little Johnny’s sore throat on a Sunday afternoon. Entrepreneurs recognize the growing opportunity to support patients, now consumers, in going shopping for health care products and services. Those health consumers are in search of specific offerings, in accessible locations and channels, and — perhaps top-of-mind — at value-based prices as defined by the consumer herself. (Remember: value-based healthcare means valuing what matters to patients, as a recent JAMA article attested). At this week’s tenth annual Health 2.0 Conference, I’m in the zeitgeist

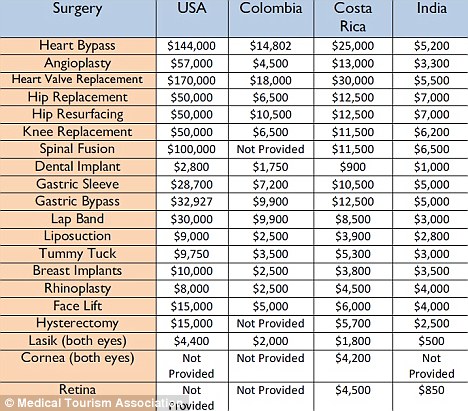

The Reshaping Medical Tourism Market: More US Patients Seek Lower-Priced Care Overseas

More U.S. patients are faced with spending more out-of-pocket for health care services, to meet high-deductible health plans and rationally spend their health savings account investments. As rational economic men and women, some are seeking care outside of the United States where many find transparently priced, high-value, lower-cost healthcare. Check out the table from the Medical Tourism Association, and you can empathize with cash-paying patients looking for, say, gastric bypass surgery or a heart valve replacement. My latest column in the Huffington Post discussed this trend, which points first to the Cleveland Clinic — a top-tier American healthcare brand that’s

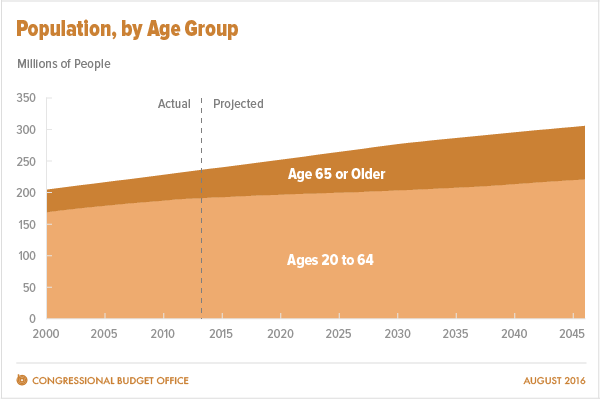

Aging America Is Driving Growth in Federal Healthcare Spending

Federal healthcare program costs are the largest component of mandatory spending in the U.S. budget, according to An Update to the Budget and Economic Outlook: 2016 to 2026 from the U.S. Congressional Budget Office (CBO). Federal spending for healthcare will increase $77 billion in 2016, about 8% over 2015, for a total of $1.1 trillion. The CBO believes that number overstates the growth in Medicare and Medicaid because of a one-time payment shift of $22 bn to Medicare (from 2017 back into 2016); adjusting for this, CBO sees Federal healthcare spending growing 6% (about $55 bn) this year. The driver

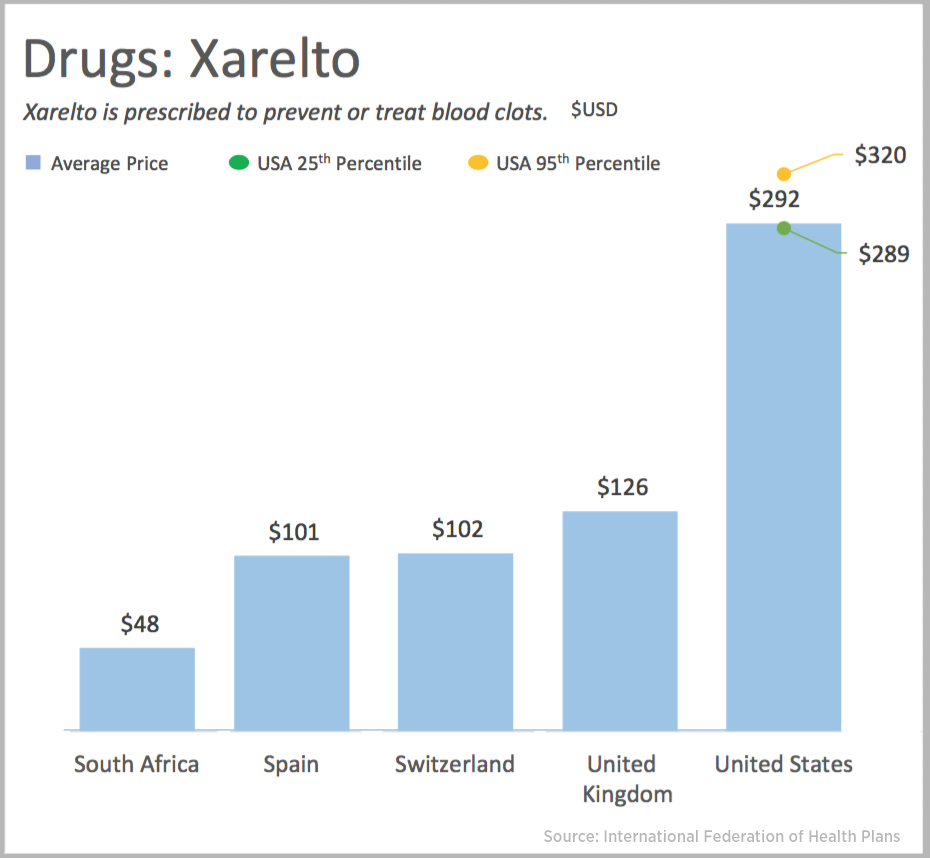

US Health Care Prices Would Be Sticker-Shocking For Europeans

The average hospital cost per day in the U.S. is $5,220. In Switzerland it’s $4,781, and in Spain that inpatient day looks like a bargain at $424. An MRI in the U.S. runs, on average, $1,119. In the UK, that MRI is $788, and in Australia, $215, illustrated in the first chart. Drug prices are strikingly greater in the U.S. versus other developed nations, as shown in the first chart for Xarelto. If you live in the U.S. and have a television tuned in during the six o’clock news, chances are you’ve seen an ad for this drug featuring Arnold

The Average Monthly Health Plan Premium in the U.S. Hit $885 in 2016

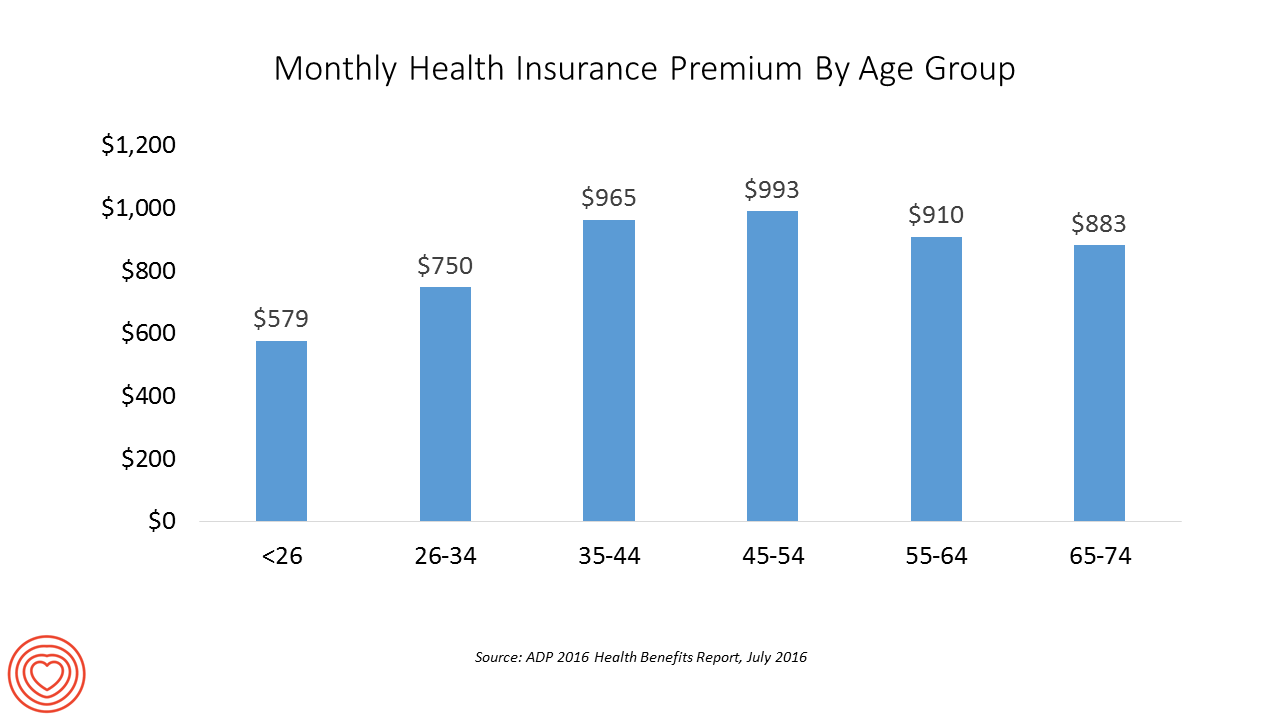

Three years after the launch of the Affordable Care Act (ACA), the big picture of employer-sponsored health benefits in the U.S. show stability, with modest changes in costs being kept in check by a growing younger workforce, according to the 2016 ADP Annual Health Benefits Report. Roughly 9 in 10 employees in large companies are eligible to participate in health insurance plans at the workplace, with two-thirds of people participating, shown in the chart. Younger people, under 26 years of age, have much lower participation rates than those over 26, with many staying on their parents’ plans (taking advantage of

More Patients Morph Into Financially Burdened Health Consumers

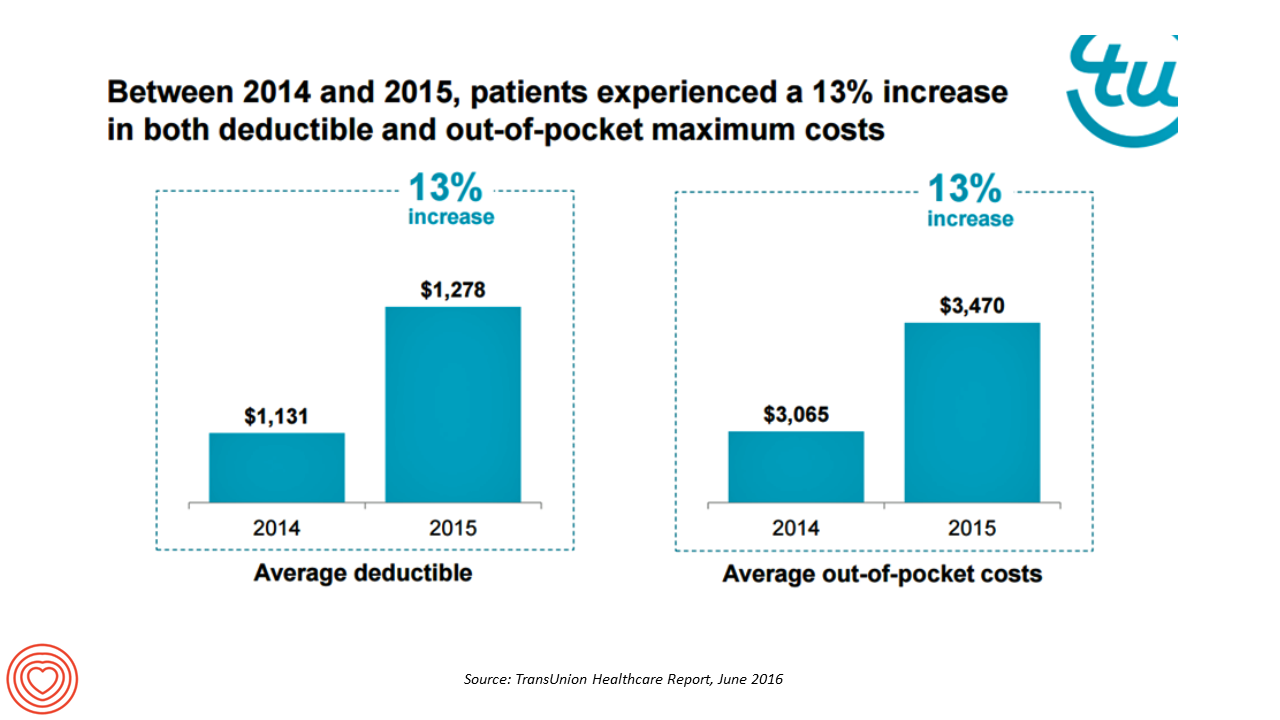

Health care payment responsibility continues to shift from employers to employee-patients, More of those patients are morphing into financially burdened health consumers, according to TransUnion, the credit agency and financial risk information company, in the TransUnion Healthcare Report published in June 2016. Patients saw a 13% increase in their health insurance deductible and out-of-pocket (OOP) maximum costs between 2014 and 2015. At the same time, the average base salary in the U.S. grew 3% in 2015, SHRM estimated. Thus, deductibles and OOP costs grew for consumers more than 4 times faster than the average base salary from 2014 to 2015. In

Workplace Wellness Goes Holistic, Virgin Pulse Finds

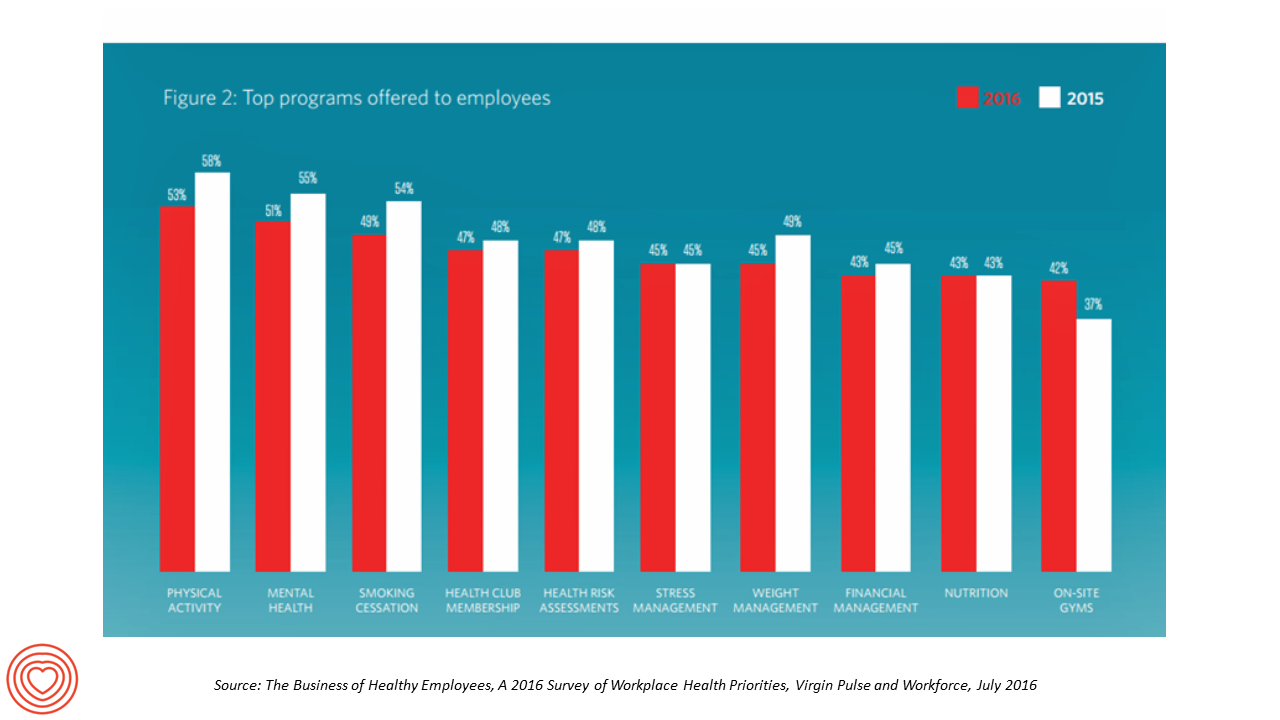

“Work is the second most common source of stress, just behind financial worries,” introduces The Business of Healthy Employees report from Virgin Pulse, the company’s 2016 survey of workplace health priorities published this week. Virgin Pulse collaborated with Workforce magazine, polling 908 employers and 1,818 employees about employer-sponsored health care, workers’ health habits, and wellness benefit trends. Workplace wellness programs are becoming more holistic, integrating a traditional physical wellness focus with mental, social, emotional and financial dimensions for 3 in 4 employers. Wearable technology is playing a growing role in the benefit package and companies’ cultures of health, as well

Healthcare Consumerism? Not So Fast, Alegeus Finds

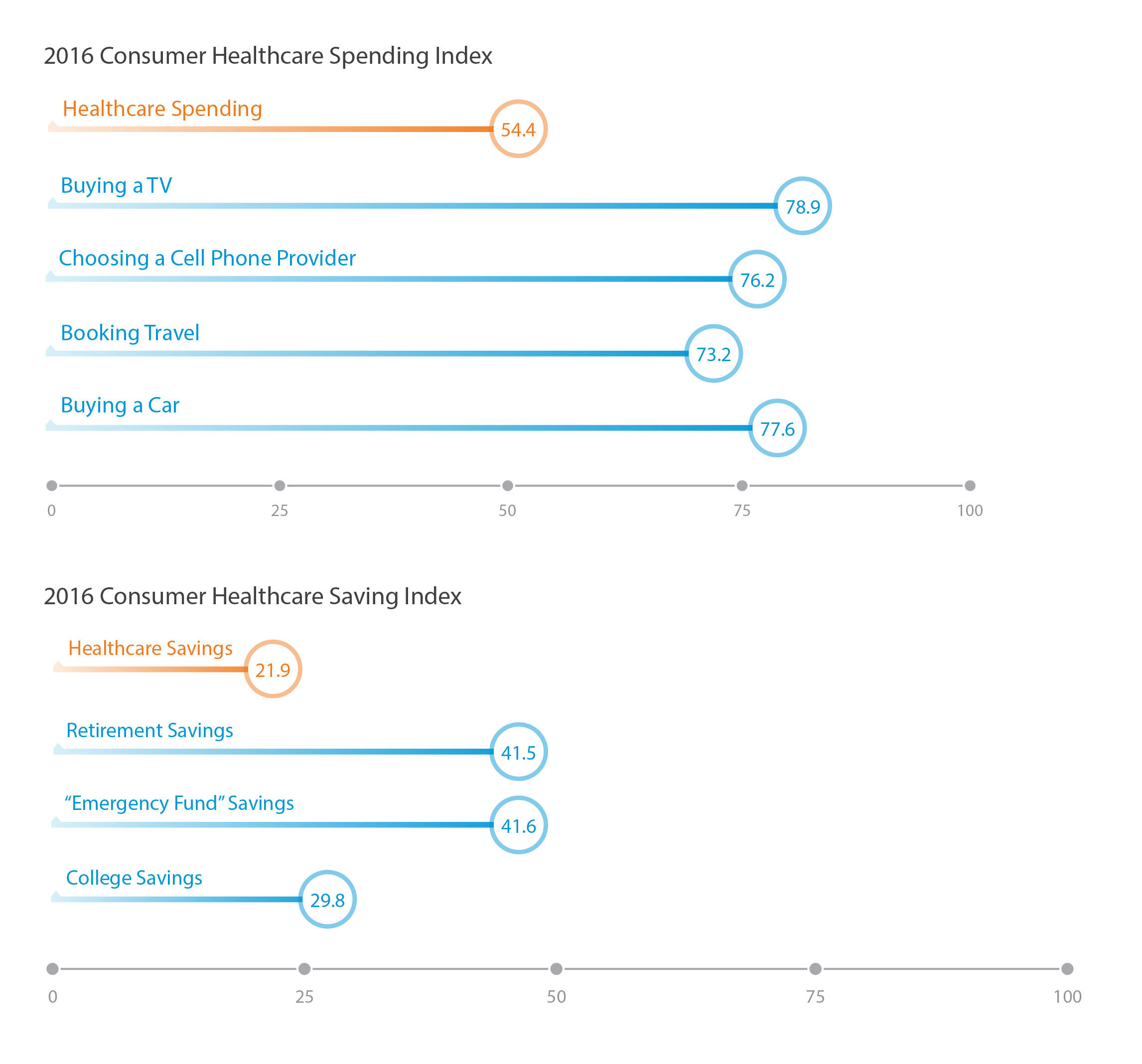

Millions of U.S. patients have more financial skin in the American health care game. But are they behaving like the “consumers” they are assumed to be as members in consumer-directed health plans? Not so much, yet, explained John Park, Chief Strategy Officer at Alegeus, during a discussion of his company’s 2016 Healthcare Consumerism Index. This research is based on an online survey of over 1,000 U.S. healthcare consumers in April 2016. Alegeus looks at healthcare consumerism across two main dimensions: healthcare spending and healthcare saving. As the chart summarizes, consumers show greater engagement and focus on buying a TV or car, choosing

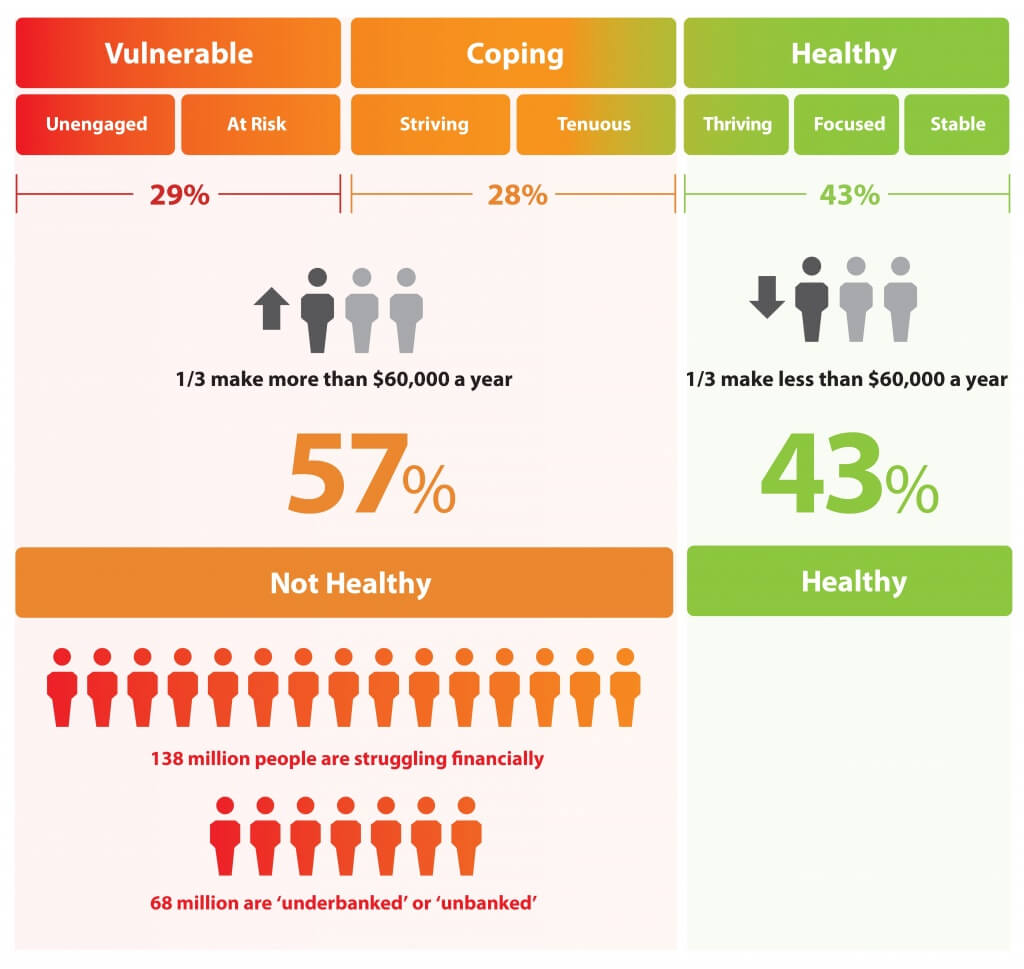

What Financial Health Means to Me: It’s Baked Into Wellness

Today is Financial Wellness Day. Do you know how financially well you are? Let me take a crack at that answer, even though I haven’t seen your bank account (which you may not even have as over 20% of people in the US are, as financial services companies would call you “un-banked” or “under-banked”.) You have some level of fiscal stress, ranging from a little to a lot. You aren’t taking all of your summer vacation your employer extends to you. You’re spending around $1 in every $5 of your household budget on health care. And your sleep isn’t as

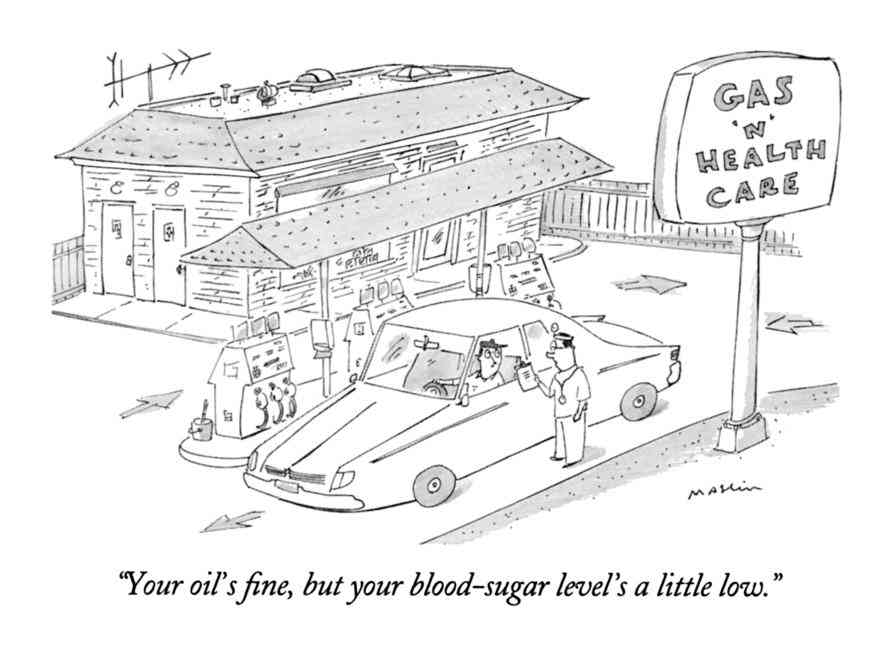

Will the Big Box Store Be Your Health Provider?

“Gas ‘N’ Health Care” is one of my most-used cartoons these days as I talk with health/care ecosystem stakeholders about the growing and central role of consumers in health care. You may be surprised to learn that the brilliant cartoonist Michael Maslin created this image back in 1994. That’s 22 years ago. When I first started using this image in my meetings with health care folks, they’d all giggle and think, ‘isn’t that funny?’ Legacy health care players — hospitals, doctors, Pharma, and medical device companies — aren’t laughing at this anymore. At a Costco a 20 minutes’ drive from

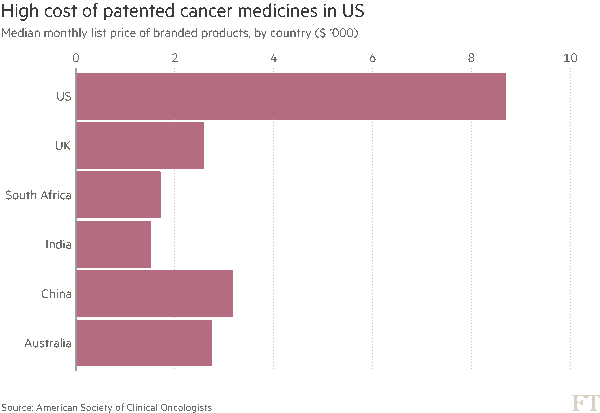

Financial Toxicity: The High Cost of Cancer Drugs in the U.S.

Two news items published in the past week point to the yin/yang of cancer survivorship and the high prices of cancer drugs. The good news: a record number of people in the US are surviving cancer, according to the American Cancer Society. That number is 15.5 million Americans, according to a study in the cancer journal CA. Note the demographics of cancer survivors: One-half are 70 years of age and older 56% were diagnosed in the past ten years, and one-third in the past 5 years Women were more likely to have had breast cancer (3.5 mm), uterine cancer (757,000),

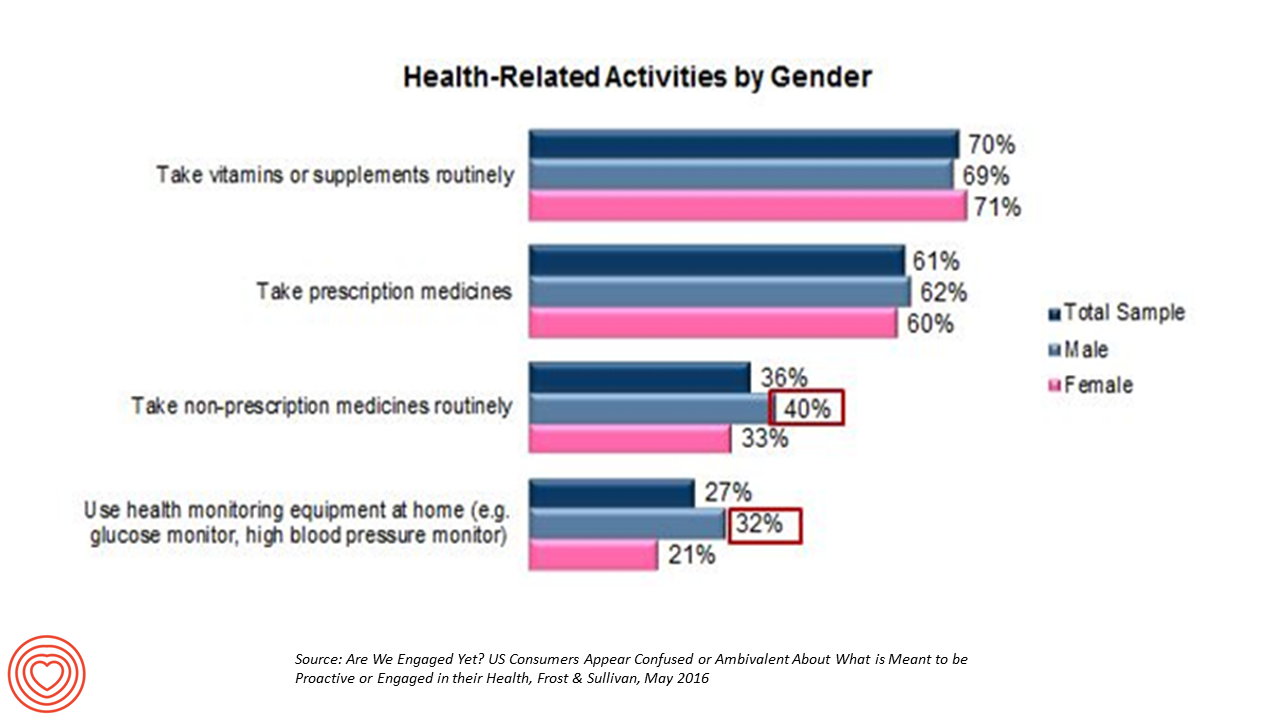

Are We Health Engaged Yet? Frost & Sullivan Responds “Meh”

The top health-related activities among U.S. adults include routinely taking vitamins and supplements, and prescription medicines, according to Frost & Sullivan’s report, Are We Engaged Yet? Their response to the titular question lies in in the subtitle: “US consumers appear confused or ambivalent about what it means to be proactive or engaged in their health.” 1 in 2 U.S. adults says they’re “somewhat engaged” in their healthcare, according to Reenita Das’s write-up on the study in Forbes magazine. She notes that: Consumers with higher incomes have more confidence in their access to health care services and quality of care Budget-constrained consumer

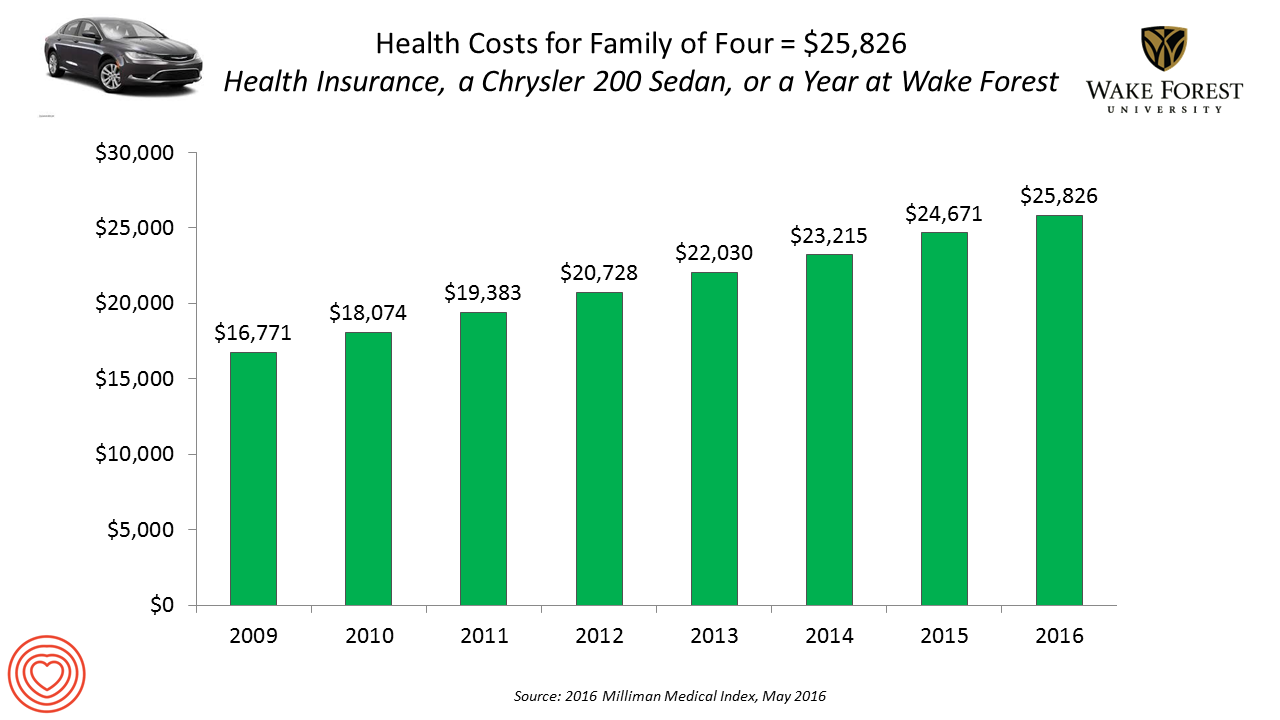

Healthcare Costs for a Family of Four Will Be $25,826 in 2016

If you had exactly $25,826 in your pocket today, would you rather buy a new Chrysler 200 sedan, send a son or daughter to a year of college at Wake Forest University, or pay for your family’s health care in an employer-sponsored preferred provider organization? Welcome to the annual 2016 Milliman Medical Index (MMI), one of the most important health economic studies I’ve relied on for many years. This year’s underlying question is, “Who cooked up this expensive recipe?” posed in the report’s title. The key statistics in this year’s MMI are that: Healthcare costs for a typical family of four

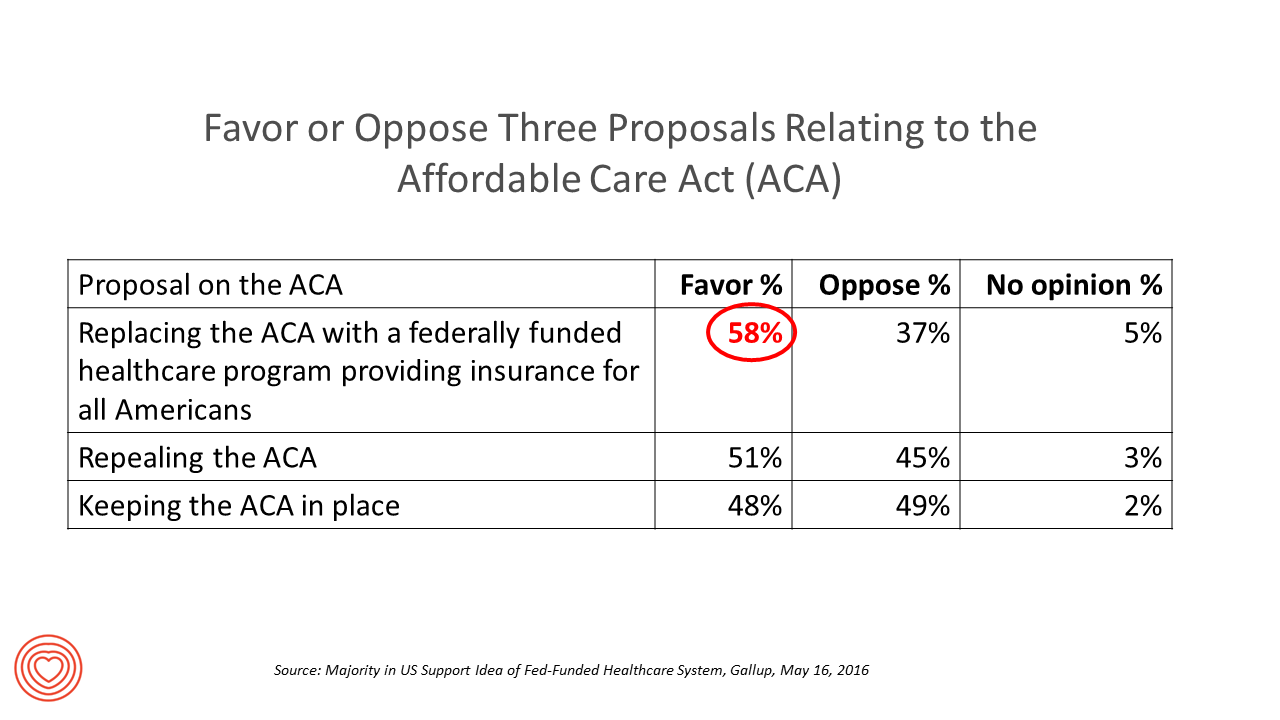

Most Americans Favor A Federally-Funded Health System

6 in 10 people in the US would like to replace the Affordable Care Act with a national health insurance program for all Americans, according to a Gallup Poll conducted on the phone in May 2016 among 1,549 U.S. adults. By political party, RE: Launch a Federal/national health insurance plan (“healthcare a la Bernie Sanders”): Among Democrats, 73% favor the Federal/national health insurance plan, and only 22% oppose it; 41% of Republicans favor it and 55% oppose it. RE: Repeal the ACA (“healthcare a la Donald Trump”): Among Democrats, 25% say scrap the ACA, and 80% of Republicans say to do

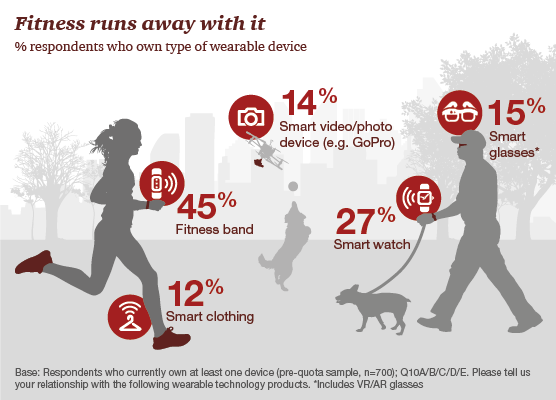

One in Two People Use Wearable Tech in 2016

Nearly 1 in 2 people own at least one wearable device, up from 21% in 2014; one-third of people own more than one such device that tracks some aspect of everyday life, according to PwC’s latest research on the topic, The Wearable Life 2.0 – Connected living in a wearable world, from PwC. Wearable technology in this report is defined as accessories and clothing incorporating computer and advanced electronic technologies, such as fitness trackers, smart glasses (e.g., Google Glass), smartwatches, and smart clothing. Specifically, 45% of people own a fitness band, such as a Fitbit, the most popular device in this

GoHealthEvents, An Online Source For Consumer Retail Health Opportunities

“Health comes to your local store,” explains the recently-launched portal, GoHealthEvents. This site is a one-stop shop for health consumers who are seeking health screenings and consults in local retail channels like big box stores, club stores, drug stores, and grocery stores. Events covered include cholesterol, diabetes, heart health, nutrition, osteoporosis, senior health, vaccinations and immunizations. By simply submitting a zip code, a health consumer seeking these kinds of services can identify where and when a local retailer will provide it. I searched on my own zip code in suburban Philadelphia, and found the following opportunities taking place in the

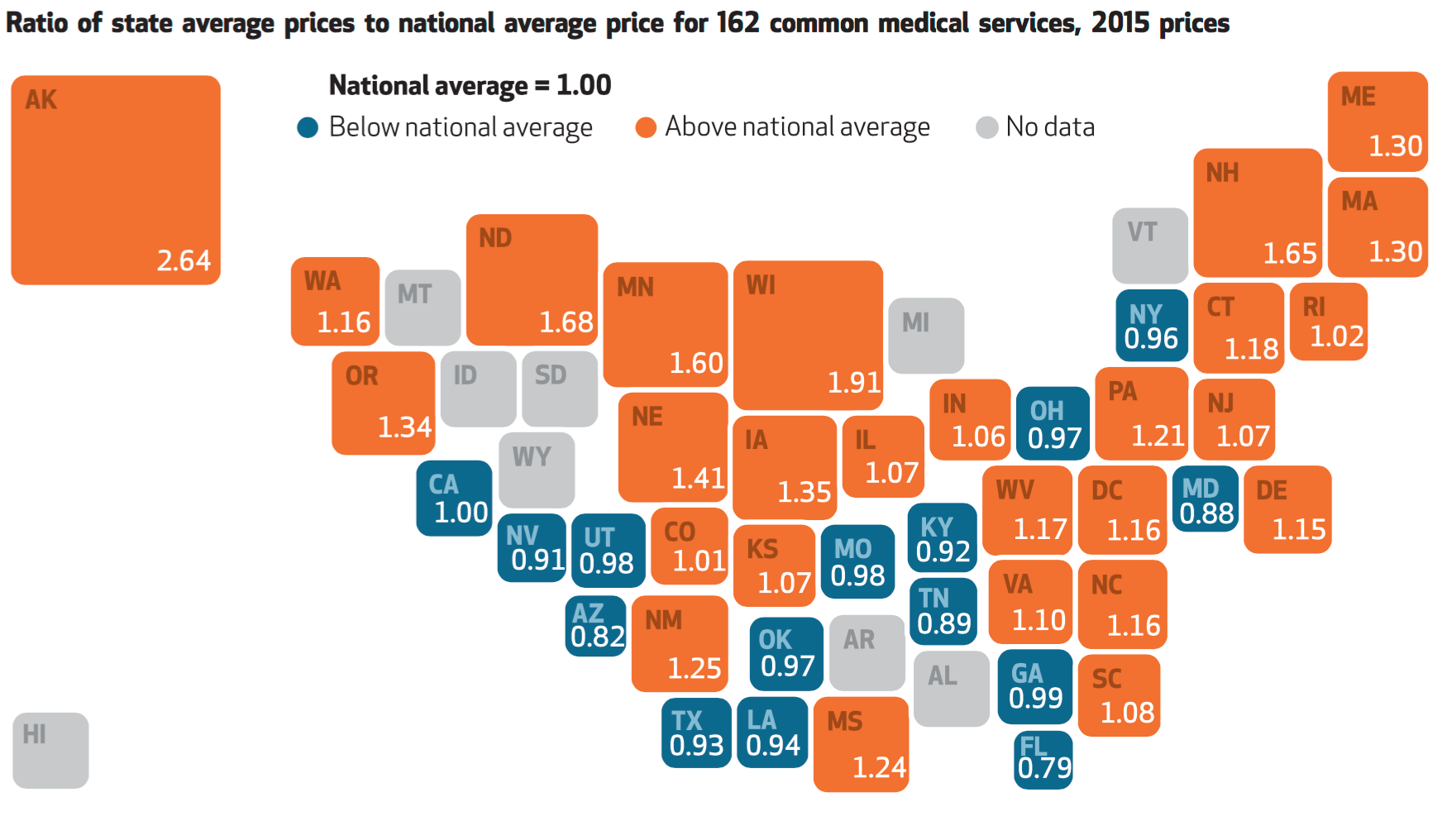

For Healthcare Costs, Geography is Destiny

Where you live in America determines what you might pay for healthcare. In this health economic scenario, as Napoleon is rumored to have said, “geography is destiny.” If you’re searching for low-cost health care, Ohio may just be your state of choice. The map illustrates these health care disparities across the U.S. in 2015, when the price of a single service could vary by more than 200% between one state and another: say, Alaska versus Arizona, or Wisconsin compared to Florida. Even within states, like Ohio, the average price of a pregnancy ultrasound in Cleveland ran nearly three times that received in

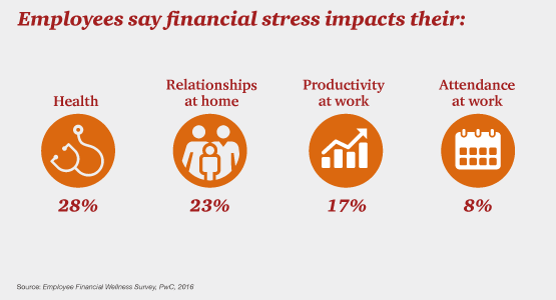

Money, Stress and Health: The American Worker’s Trifecta

Financial stress impacts health, relationships, and work productivity and attendance for employees in the U.S. It’s the American worker’s trifecta, a way of life for a growing proportion of people in the U.S. PwC’s 2016 Employee Financial Wellness Survey for 2016 illustrates the reality of fiscally-challenged working women and men that’s a national epidemic. Some of the signs of the financial un-wellness malaise are that, in 2016: 40% of employees find it difficult to meet their household expenses on time each month 51% of employees consistently carry balances on their credit cards (with a large increase here among Baby Boomers

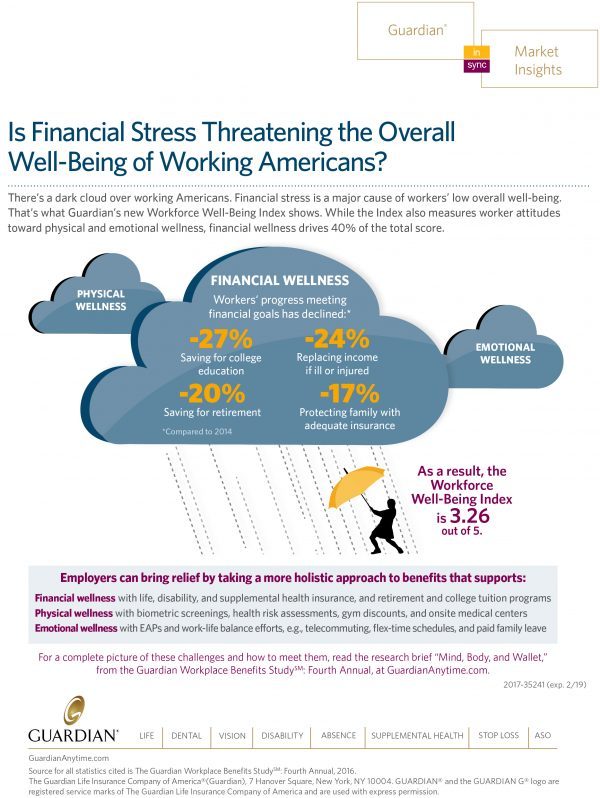

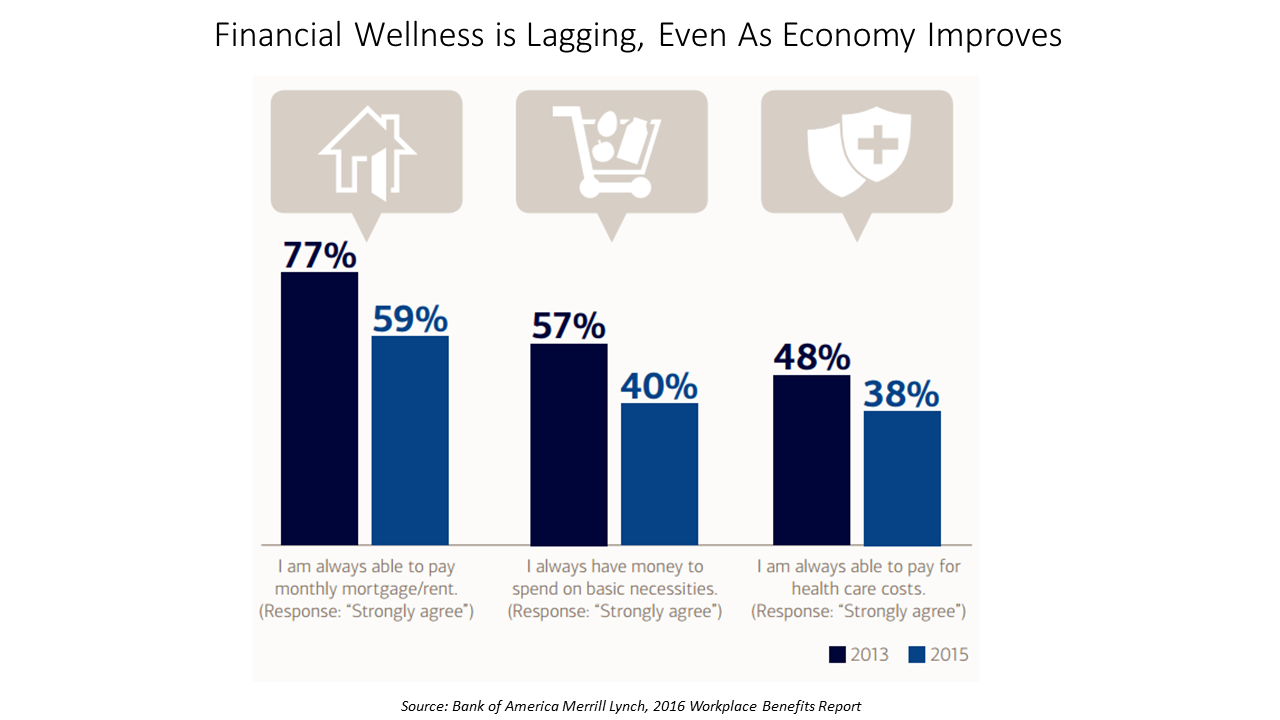

Financial Wellness Declines In US, Even As Economy Improves

American workers are feeling financial stress and uncertainty, struggling with health care costs, and seeking support for managing finances. 75% of employees feel financially insecure, with 60% feeling stressed about their financial situation, according to the 2016 Workplace Benefits Report, based on consumer research conducted by Bank of America Merrill Lynch. The overall feeling of financial wellness fell between 2013 and 2015. 75% of U.S. workers don’t feel secure (34% “not very secure” and 41% “not at all secure”), with the proportion of workers identifying as “not at all secure” growing from 31% to 41%. Financial wellness was defined for this

Generation Gaps in Health Benefit Engagement

Older workers and retirees in the U.S. are most pleased with their healthcare experiences and have the fewest problems accessing services and benefits. But, “younger workers [are] least comfortable navigating U.S. healthcare system,” which is the title of a press release summarizing results of a survey conducted among 1,536 U.S. adults by the Harris Poll for Accolade in September 2015. Results of this Accolade Consumer Healthcare Experience Index poll were published on April 12, 2016. Accolade, a healthcare concierge company serving employers, insurers and health systems, studied the experiences of people covered by health insurance to learn about the differences across age

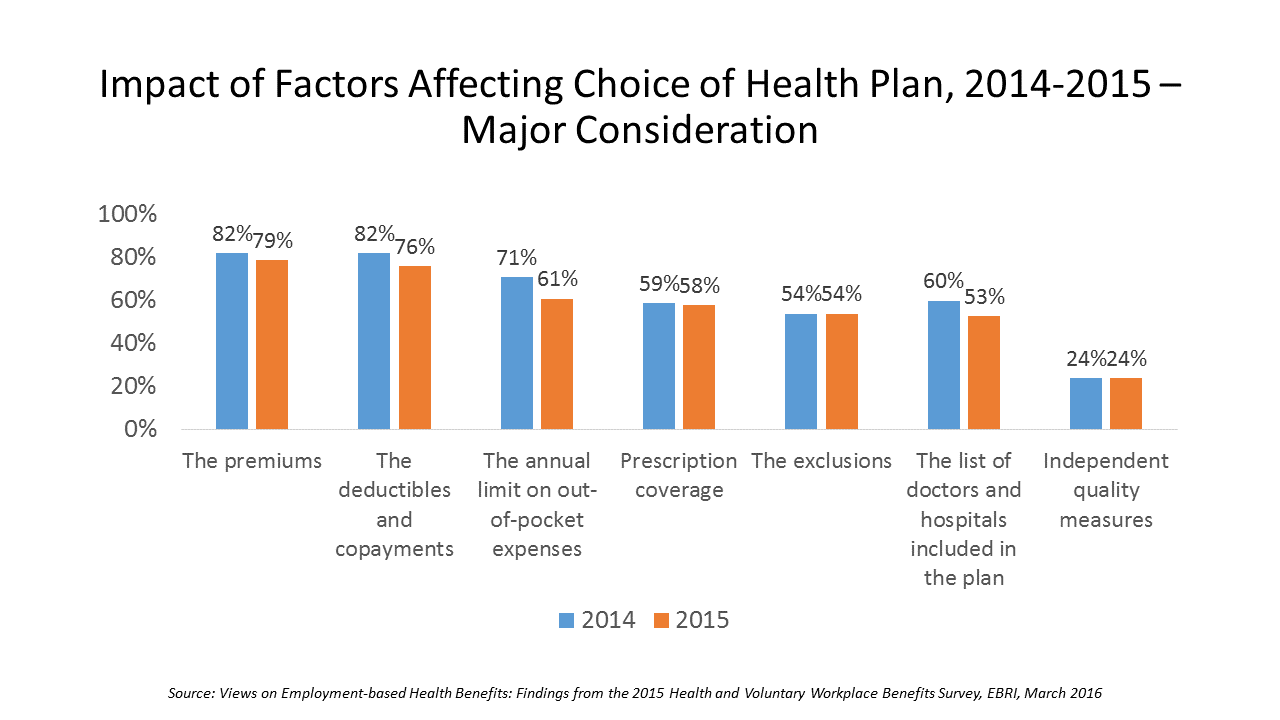

Cost Comes Before “My Doctor” In Picking Health Insurance

Consumers are extremely price-sensitive when it comes to shopping for health insurance. The cost of health insurance premiums, deductibles and copays, prescription drug coverage and out-of-pocket expenses rank higher in the minds of health insurance shoppers than the list of doctors and hospitals included in a health plan for health consumers in 2015. The Employee Benefit Research Institute (EBRI) surveyed 1,500 workers in the U.S. ages 21-64 for their views on workers’ satisfaction with health care in America. The results of this study are compiled in EBRI’s March 2016 issue of Notes, Views on Employment-based Health Benefits: Findings from the 2015 Health

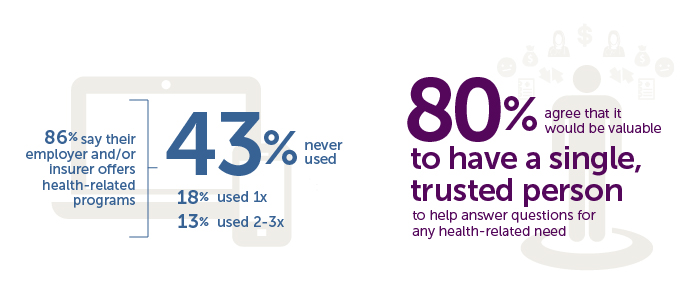

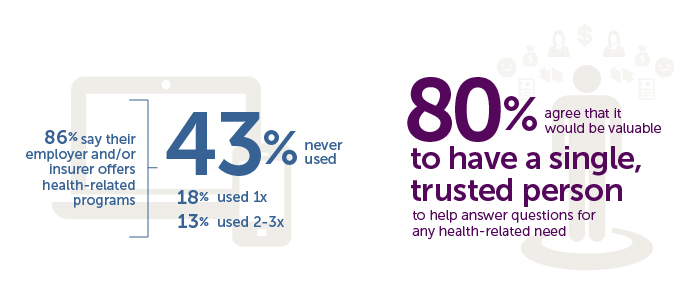

People Want Healthcare Sherpas

8 in 10 Americans would like one trusted person to help them figure out their health care, according to the Accolade Consumer Healthcare Experience Index Poll, conducted by The Harris Poll. The study gauged how Americans feel about their healthcare, especially focusing on employer-sponsored health insurance. One-third of people (32%) aren’t comfortable with navigating medical benefits and the healthcare system; a roughly percentage of people aren’t comfortable with their personal knowledge to make financial investments, either (35%). Buying a car, a home, technology and electronics? Consumers are much more comfortable shopping for these things. Consumers say that the most onerous

The Rise and Rise of (Specialty) Prescription Drug Prices

Prices for the most commonly used branded prescription drugs grew from a base index of $100 in 2008 to to $264 in 2015, based on the Express Scripts 2015 Drug Trend Report. This is illustrated by the upwardly-sloping blue line in the chart. In contrast, the market basket of the most commonly used generic drugs fell from the $100 index in 2008 to $29.73, shown by the declining black line in the graph. The $112.05 is calculated from a market basket of commonly purchased household goods which cost $100 in 2008, a relatively flat line which puts the 264% rise in

The Link Between Eating and Financial Health

People who more consistently track their calories and food intake are more likely to be fiscally fit than people who do not, suggesting a link between healthy eating and financially wellness. I learned this through a survey conducted in February 2016 among 4,118 people using the Lose It! mobile app, which enables people to track their daily nutrition. Some 25 million people have downloaded Lose It! The app is one of the most consistently-used mobile health tools available in app stores. The Rutgers School of Environmental and Biological Sciences has explored the financial impact of improved health behaviors, asserting that,

Being a Woman is a Social Determinant of Health – Happyish International Women’s Day

Today is International Women’s Day. Being a woman is a social determinant of health (for the worse). To mark the occasion of the Day, The International Labour Organization (ILO) published a report on women and work yesterday, finding that in the 178 countries studied, inequality between women and men persists across labor markets. And while there’s been progress in women’s education over the past twenty years, this hasn’t resulted in women advancing career paths and wage equality. It struck me this morning, reading both (paper versions of) the Wall Street Journal and the Financial Times that the latter had two FT-sponsored ads marking

Tying Health IT to Consumers’ Financial Health and Wellness

As HIMSS 2016, the annual conference of health information technology community, convenes in Vegas, an underlying market driver is fast-reshaping consumers’ needs that go beyond personal health records: that’s personal health-financial information and tools to help people manage their growing burden of healthcare financial management. There’s a financial risk-shift happening in American health care, from payers and health insurance plan sponsors (namely, employers and government agencies) to patients – pushing them further into their role as health care consumers. The burden of health care costs weighs heavier on younger U.S. health citizens, based on a survey from the Xerox Healthcare

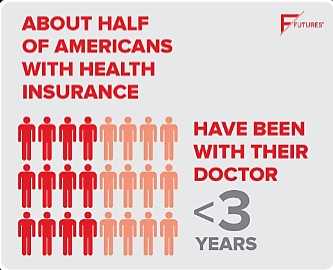

Health Consumers Look For Cost and Convenience

In a growing on-demand society, coupled with a burden of more out-of-pocket health care costs, U.S.health consumers tend to vote with their pocketbooks for healthcare based on cost and convenience, at least when it comes to prescription drug demand, according to the Finn Futures Health Poll conducted by Finn Partners. The survey was conducted in November 2015 among 1,000 U.S. online adults. 51% of consumers have been with their current health plans and primary care physicians for three years or less, which Finn Partners sees as a sign that brand loyalty isn’t a top motivation for health consumers signing on

Improving the Patient Experience in Legacy Health Systems – My Start-Up Health Interview

The so-called legacy healthcare system are the incumbents in American health care — hospitals, physician practices, pharma, health plans, and other organizations that have long-served and been reimbursed by traditional volume-based payment. Patients, now morphing in to health consumers, look to these stakeholders to provide new levels of service, accessibility, convenience, transparency and value — the likes of which people find in their daily life in other market sectors. Those consumer demands are pressuring the health system as we know it in many new ways, which I discussed with Unity Stoakes, Co-Founder of Startup Health, at the Health 2.0 Conference in

It’s Good to Be Hawaiian When It Comes to Health – the 2015 States of Well-Being

Where you live in the U.S. is a risk factor for your health. Hawaii, Alaska, Montana, Colorado and Wyoming rank highest on the State of American Well-Being 2015 State Well-Being Rankings, the Gallup-Healthways Well-Being Index. Well-Being is based on an index of five components that people self-assess: purpose, social, financial, community, and physical. See the map: the darker blue the state, the healthier the population perceives itself to be. Note more light blue to the northeast and south, and dark blue in the mountain states, Alaska and Hawaii. Some states have stayed in the top-tier of wellness since 2012: Hawaii

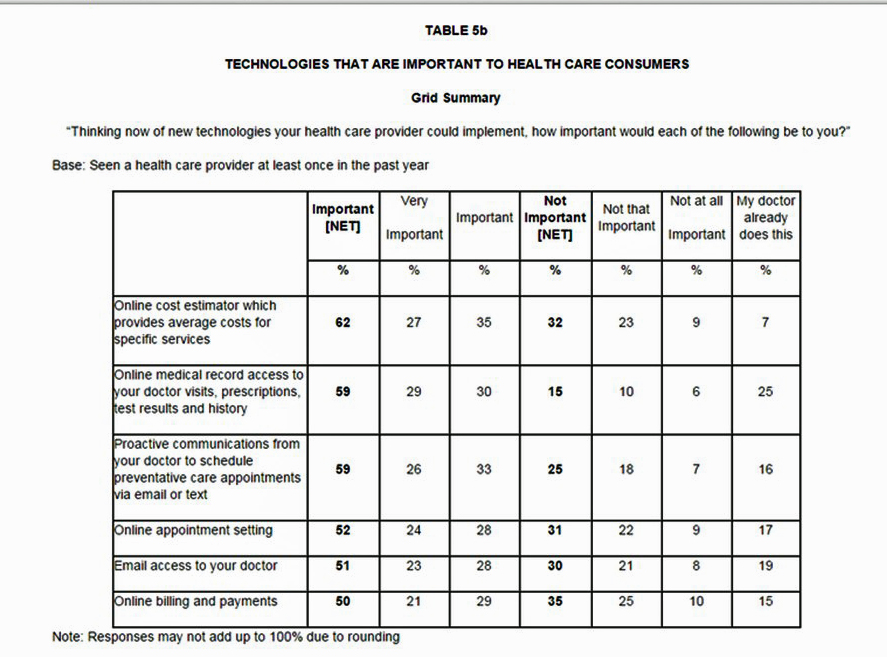

Health Consumers Happy With Doctor Visits, But Want More Technology Options

9 in 10 adults in the U.S. have visited a doctor’s office in the past year, and over half of these patients have been very satisfied with the visit; 35% have been “somewhat” satisfied. Being a highly-satisfied patient depends on how old you are: if you’re 70 or older, two-thirds of people are the most satisfied. Millennial or Gen X? Less than half. What underlies patient satisfaction across generations is the fact that younger people tend to compare their health care experience to other retail experiences, like visiting a bank, staying at a hotel, or shopping in a department store.

Prescription Drug Costs Will Be In Health Benefits Bullseye in 2016

Prescription drug costs have become a front-and-center health benefits cost issue for U.S. employers in 2015, and in 2016 the challenge will be directly addressed through more aggressive utilization management (such as step therapy and prior authorization), tools to enable prescription intentions like DUR, and targeting fraud, waste and abuse. Consumers, too, will be more financially responsible for cost-sharing prescription drugs, in terms of deductibles and annual out-of-pocket limits, as described in the PBMI 2015-206 Prescription Drug Benefit Cost and Plan Design Report, sponsored by Takeda. The Pharmacy Benefit Management Institute has published this report for 15 years, which provides neutral, detailed survey

Americans Like Generic Drugs Over Brands

“What’s in a name?” Juliet asked in Shakespeare’s play. For medicines consumers in the U.S., not much. Most Americans prefer generics products, according to The Harris Poll’s survey. 7 in 10 U.S. adults choose generics over brands when given a choice. 3 in 10 people say they would “always” choose generics, whether a prescription drug or an over-the-counter product (store brand, private label). While most people across all age groups would choose generics over brand ames for meds, parents with children in the households would more likely choose a brand name (36% with vs. 28% without kids). Still, 66% of

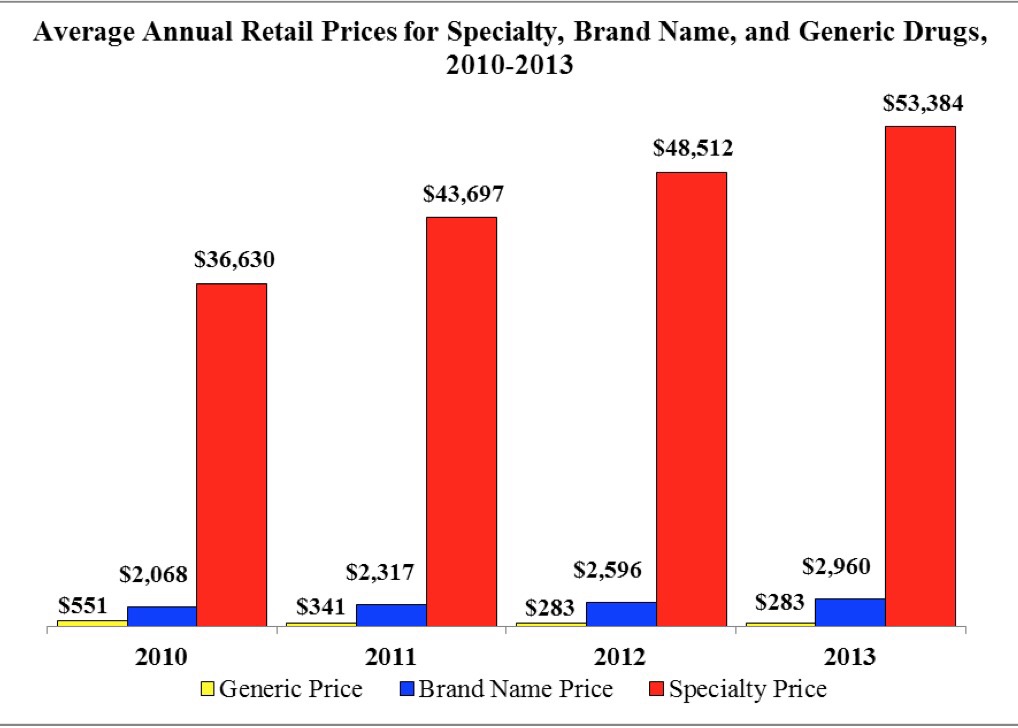

The Average Price of a New Specialty Drug Exceeds Median U.S. Annual Income; and a Tweet from Pam Anderson

The average price for a specialty drug was $53,384 in 2013; the average household income was $52,250. Thus, even allocating 100% of a family’s annual earnings to pay for a drug wouldn’t stretch far enough to cover it in 2013, nor would it do so today in 2015. This sober health economic artifact comes from the latest Rx Price Watch Report from the AARP, detailing cost trends for prescription drugs across all segments — generics, brands and specialty drugs. Contrast, as well, the $53K for the average specialty drug with the median 2013 Social Security benefit payout of $15,526 and median Medicare

American health citizens hungry for cost controls

Most Americans support price controls on drug and medical device manufacturers, hospitals, and payments to doctors, along with allowing Medicare to negotiate drug prices. U.S. health citizens, now consumers, have been experiencing sticker-shock when it comes to prices on medical bills upon hospital discharge, leaving the doctor’s office, filling a prescription at a pharmacy or receiving a specialty drug recommended for a serious medical condition. The HealthDay/Harris Poll of 5 November 2015 quantifies their observation that Americans Want Bold Steps to Keep Health Care Costs in Check. The topline of the Poll shows that: 73 percent support price controls on

My Breakfast With Alain – On Health Consumers and the New Retail Health

My National Health Care Consumer Week, I’ll coin this, looking back on flying some 12,000 airmiles over six days, criss-crossing America from the City of Brotherly Love to Sacramento, back to Philly and then to Los Angeles. Finally, today, heading home to Philadelphia and my beloved, most necessary Tempur-Pedic bed, a loving husband and some therapeutic TV binge-watching. It’s Friday and I’m at LAX, reflecting on a week of meeting with three groups of healthcare executives and stakeholders who all wanted to hear my take on the evolution of patients, people, caregivers, all, morphing into health care consumers. The lens

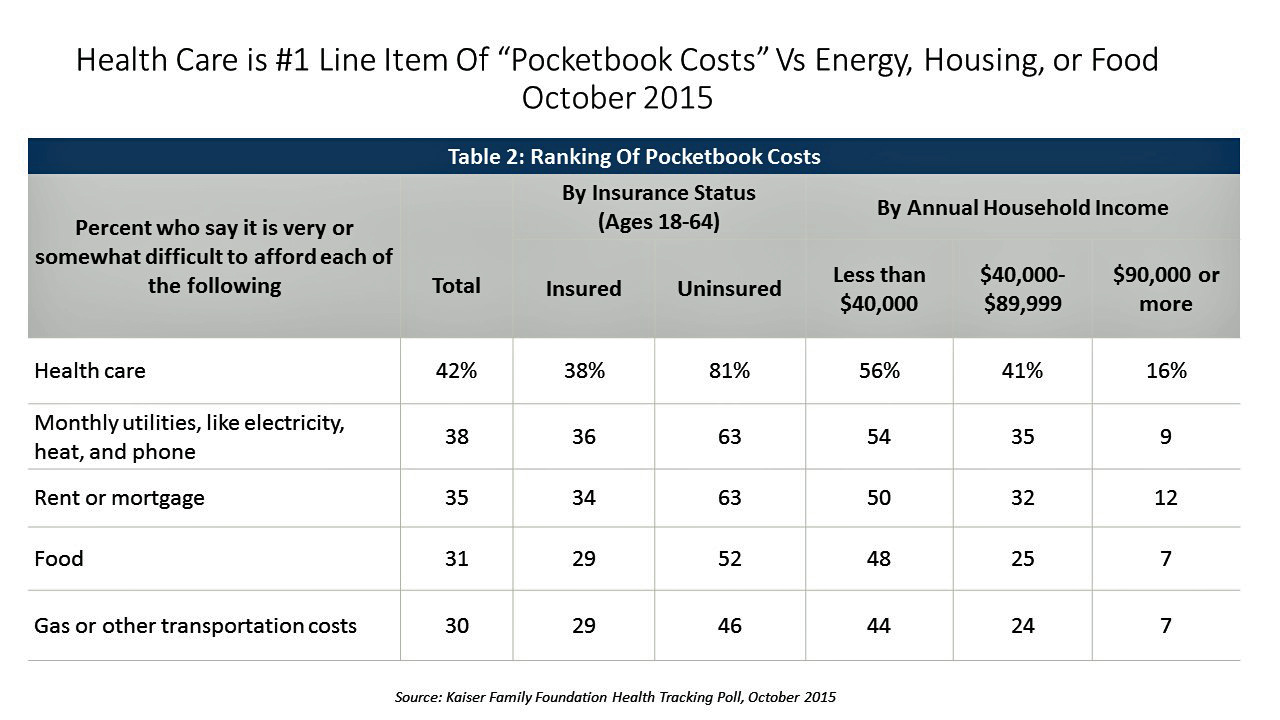

Health Care Costs Are #1 Pocketbook Issue, and Drug Prices Top the Line Items

Consumers are most concerned about health care costs among their kitchen table issues, above their ability to afford the utility bill, housing, food, or gas and transportation costs. The October 2015 Kaiser Family Foundation Health Tracking Poll finds 4 in 10 Americans finding it difficult to afford health care, including 16% of people earning $90,000 a year or more. Underneath that worrying healthcare cost umbrella are the price of prescription drugs, which the majority of Democrats, Independents, and Republicans all agree need to be “limited” by government regulation. Ensuring that the public have affordable access to high-cost drugs for chronic conditions

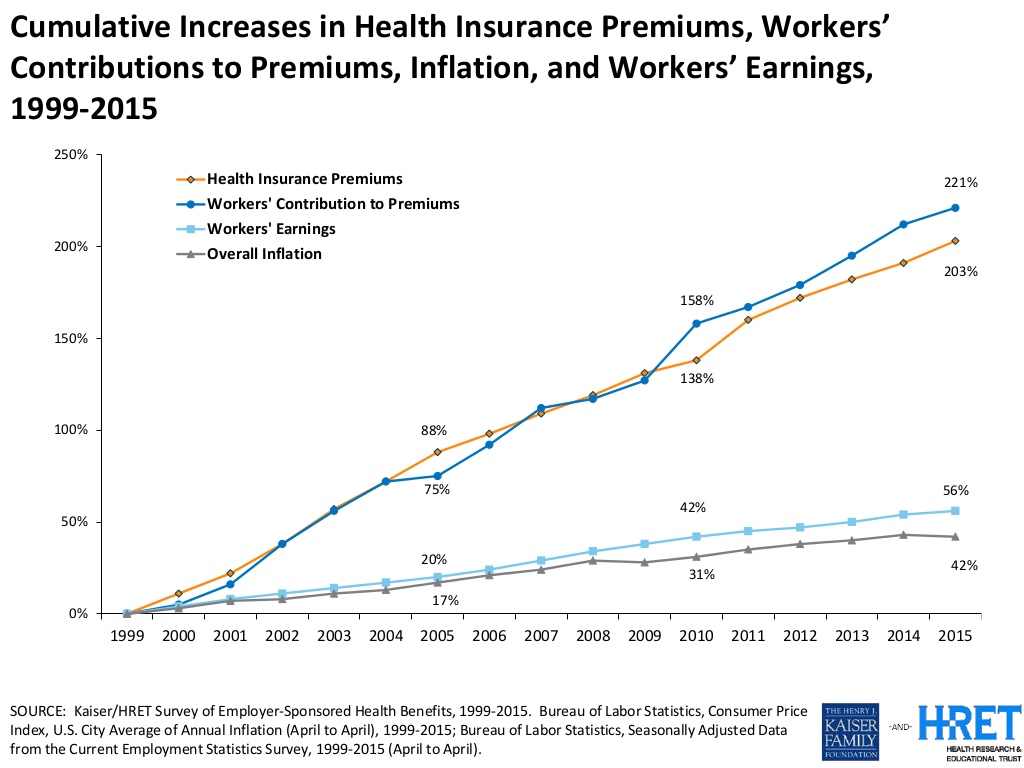

Health consumers’ cost increases far outpace wage growth

American workers are working to pay for health care costs, having traded off wage increases for health premiums, out-of-pocket costs and growing high deductibles. Welcome to the 2015 Employer Health Benefits survey conducted annually by the Kaiser Family Foundation (KFF) and Health Research & Educational Trust (HRET). Premiums are growing seven times faster than wages. The report calculates that high-deductibles for health insurance have grown 67% from 2010 to 2015. In the same period, wages grew a paltry 10%, while the Consumer Price Index rose 9%. The first chart illustrates that growing gap between relatively flat wages and spirally health

U.S. Consumers’ View of Pharma Goes Negative in 2015

Americans’ views of the pharmaceutical industry have fallen in the past year, with negative perceptions outweighing positive ones, shown in the line graph from the Gallup Poll. Pharma’s low-lying reputation among consumers sits among others including the legal field, healthcare, oil and gas, and the Federal government which ranked lowest across all 25 sectors Gallup analyzed. Gallup surveyed 1,011 U.S. adults in in the first week of August 2015 via telephone. Since 2003, Gallup notes, the pharma industry has consistently ranked in the bottom third of industries operating in the U.S. Pharma respect is in the eye of the consumer-beholder

Pocketbook Health Economics In One Chart

Covering the uninsured changes pocketbook problems, this chart demonstrates. The Kaiser Family Foundation (KFF) surveyed Californians between February and May 2015, and found that people newly enrolling in health insurance had less financial stress, and more health needs met. KFF asked previously uninsured Californians to rank five household “pocketbook” spending categories which they said were difficult to afford: health care, housing (rent/mortgage), gasoline, utilities, and food. Among the five, people gaining insurance worried much less about health care costs (49%, slipping to fourth place), and more about paying for shelter (58%), utility bills (54%), and gas (53%), shown in the

What the SCOTUS ACA ruling means for health consumers

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America? I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for

Most Americans say drug prices are unreasonable and blame company profits

Three-quarters of U.S. adults say the cost of prescription drugs are unreasonable, and blame high medication prices set by profitable pharmaceutical companies according to the Kaiser Family Foundation Health Tracking Poll for June 2015. Profits made by drug companies are the #1 reason Americans cite among major factors that contribute to the price of prescription drugs (among 77% of people), followed by the cost of medical research (64%), the cost of marketing and advertising (54%), and the cost of lawsuits (49%). Regardless of the cost, 71% of people say that health insurance should “always” pay for high-cost drugs. At the same

The 3 tectonic forces shaping patients – it’s BIO week

Patients in the U.S. are transforming into health care consumers, and in 2015 there are 3 underlying forces shaping that new consumer. This week kicks off the annual BIO conference in Philadelphia, and today Klick Health, the digital communications firm, convenes a group of thought leaders in healthcare to brainstorm markets, financing, and the state of pharmaceutical and life science innovation. An underlying theme throughout this meet-up is patient’s role in health/care. Patients are people, consumers, caregivers, mothers, fathers, sisters, brothers, friends, neighbors, community members, taxpayers, all. We’re old, we’re young, we’re mobile and not-so-much, we’re amputees, we’re migraneurs, we’re cancer

It’s still the prices, stupid – health care costs drive consumerism

“It’s the prices, stupid,” wrote Uwe Reinhardt, Gerald F. Anderson and colleagues in the May 2003 issue of Health Affairs. Exactly twelve years later, three reports out in the first week of June 2015 illustrate that salient observation that is central to the U.S. healthcare macroeconomy. Avalere reports that spending on prescription drugs increased over 13% in 2014, with half of the growth attributable to new product launches over the past two years. Spending on pharmaceuticals has grown to 13% of overall health spending, and the growth of that spending between 2013-14 was the fastest since 2001. In light of

Employers go beyond physical health in 2015, adding financial and stress management

Workplace well-being programs are going beyond physical wellness, incorporating personal stress management and financial management. Nearly one-half of employers offer these programs in 2015. Another one-third will offer stress management in the next one to three years, and another one-fourth will offer financial management to workers, according to Virgin Pulse’s 2015 survey of workplace health priorities, The Busness of Healthy Employees. The survey was published June 1st 2015, kicking off Employee Wellbeing Month, which uses the Twitter hashtag #EWM15. It takes a village to bolster population health and wellness, so Virgin Pulse is collaborating with several partners in this effort

How Growing Income Inequality Hurts Everyone, and Especially Our Health

Income inequality has increased in most developed countries, and especially in the U.S., according to the OECD’s report, In It Together: Why Less Inequality Benefits All, published in May 2015. The red arrow in the first chart shows where the U.S. ranks versus other developed nations in income inequality, which is defined as the wealth gap between rich and poor people. The U.S. has the greatest income inequality in the developed world. The second chart shows data for the U.S. on benefits provided to low-wage workers (the bottom 25% of wage earners) versus high-wage workers (the top 25% of earners).

Musings with Mary Meeker on the Digital/Health Nexus

People in the U.S. spend over five-and-a-half hours a day with digital media in 2015, with time on mobile devices exceeding use of laptop and desktop computers. The growth of mobile means people are using and seeking more just-in-time services in daily living, and this has big implications for health/care, based on the annual mega-report on Internet Trends from Mary Meeker, KPCB’s internet analyst. “People” in health/care are patients, consumers and caregivers; people in health/care are also health plan administrators, employer benefits managers, doctors, nurses, allied health professionals, financial managers in hospitals, pharmacists, and the entire range of humans who

Avoiding Wrinkles: A World Without Tobacco

May 31st is World No Tobacco Day, heralded by the World Health Organization, and celebrated by the advocacy group Action on Smoking and Health (with the very appropriate acronym ASH). Smoking is one of the most addictive (anti-)health behaviors around, so persuading people to quit the habit continues to challenge public health advocates. Enter ASH’s engaging campaign called “The Wrinkler,” with the introductory question, “Ever notice how some people who are 25 look 45?” The video continues to explain how we can “expedite the aging process….Ladies, wish you were half your age? Don’t wait for him to look younger; make yourself

All women are health workers

The spiritual and emotional top the physical in women’s definition of “health,” based on a multi-country survey conducted in Brazil, Germany, Japan, the UK and the U.S. The Power of the Purse, a research project sponsored by the Center for Talent Innovation, underscores women’s primary role as Chief Medical Officers in their families and social networks. The research was sponsored by health industry leaders including Aetna, Bristol-Myers Squibb, Cardinal Health, Eli Lilly and Company, Johnson & Johnson, Merck & Co., Merck KGaA, MetLife, Pfizer, PwC, Strategy&, Teva, and WPP. The study’s summary infographic is titled How the Healthcare Industry Fails

Health care costs for a family of four in the U.S. reach $24,671 in 2015

The cost of a PPO for a family of four in America hits $24,671 in 2015, growing 6.3% over 2014’s cost. The growth in health care costs will be driven by high specialty prescription drug costs. The 6.3% growth rate in health costs is a stark increase compared with the twelve month April 2014-March 2015 decline in the Consumer Price Index of -0.1%. Welcome to the 2015 Milliman Medical Index, subtitled “Will the typical American family of four be driving a ‘Cadillac plan’ by 2018?” The MMI gauges the average cost of an employer-sponsored preferred provider organization (PPO) health plan and includes all

Purchase of wearable fitness trackers expected to grow in 2015, but one-half of Americans would “never” buy one

Headphones and smartphones are the top two electronics products U.S. consumers intend to purchase in 2015. But the emerging consumer electronics categories of wearable fitness trackers, smart watches, and smarthome devices (especially “smart” thermostats) are positioned to grow, too, in 2015, according to the 17th Annual CE Ownership and Market Potential Study from the Consumer Electronics Association (CEA). Wearable trackers have an installed base of about 17 million devices in the U.S., with 11% of U.S. households intending to purchase a tracker in 2015 — 6 percentage points up from 2014 (about a 50% increase over 2014). There are about 6 million smart

Supersize Rx: the impact of specialty drug spending and Hep C in 2014

The number of people in the U.S. spending over $100,000 a year on prescription drugs tripled in 2014, according to Super Spending: U.S. Trends in High-Cost Medication Use, from The Express Scripts Lab. Express Scripts is a pharmacy benefits management company that manages over one billion prescriptions a year. The company analyzed prescription drug claims for 31.5 million health plan members for this study, in commercially insured, Medicare, and Medicaid plans. The big-dollar story in 2014 was Hepatitis C, with a relatively small patient population but a super-sized drug spend as the first chart shows: a very tall blue bar (Rx

Happy 25 million, MinuteClinic and CVS Health!

Call it a Silver Million Anniversary, if you will: The MinuteClinic just saw its 25 millionth patient. This is a milestone in the evolution and growth of retail health in America, a trend-marker in this growing health industry segment that will become increasingly used by consumers, patients, parents, and caregivers. CVS bought the MinuteClinic in 2006, when the organization treated seven illnesses. Today, MinuteClinic offers 65 services and vaccinations in nearly 1,000 clinics located in 31 states and Washington, DC. In addition, MinuteClinic will grow the number of clinic locations in both existing and new markets. The company will open

Consumers seek retail convenience in healthcare financing and payment

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute. The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being

The Consumer in the New Health Economy: Out-of-Pocket

The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not. Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.” U.S. News &

Capital investments in health IT moving healthcare closer to people

In recent weeks, an enormous amount of money has been raised by organizations using information technology to move health/care to people where they live, work, and play… This prompted one questioner at the recent ANIA annual conference to ask me after my keynote speech on the new health economy, “Is the hospital going the way of the dinosaur?” Before we get to the issue of possible extinction of inpatient care, let’s start with the big picture on digital health investment for the first quarter of 2015. Some $429 mm was raised for digital health in the first quarter of 2015,

Banks — a new entrant in the health/care landscape

TD Bank gifted free Fitbit activity trackers to new customers signing up for savings accounts in the 2015 New Year. John Hancock is discounting life insurance premiums for clients who track steps and take on preventive care strategies. And Banco Sabadell in Spain, along with Westpac in New Zealand and Standard Chartered in the United Kingdom are all piloting wearable technology for consumer financial management. Financial wellness is an integral part of peoples’ overall health, so financial services companies are putting their collective corporate feet into the health/care market. Banks and consumer investment companies are new entrants in health/care as

#OwnYourHealth: Health is everywhere, even underground

Living my mantra of Health is Everywhere, where we live, work, play, pray, and shop, I am always on the lookout for signs of health in my daily life. Today I’m in Washington, DC, speaking on a webinar led by the National Council on Patient Information and Education (NCPIE), discussing the findings in a survey of U.S. adults on self-care health care – my shorthand for healthcareDIY. And the hashtag for the webinar also speaks volumes: #OwnYourHealth. Here’s the link to the survey resources. On my walk from Farragut North Metro station to a nearby office where the meeting will take place,

Health = love. Care = love. Healthcare? Meh

Bruce Broussard, CEO of Humana, forgot the charger for his smartwatch on a business trip. Stopping into a consumer electronics store, he was struck by the options he faced of various wearable technologies. He ended up buying a new watch, which he uses for exercise tracking. “Technology is such an important part of the direction of health care,” Broussard told the HIMSS 2015 audience in his keynote address on 14 April 2015. But Broussard was quick to point out to the thousands of technology geeks that comprise HIMSS’s membership that improving the health/care system isn’t just about technology: “we have

Health is where we live, work, and shop…at Walgreens

Alex Gourley, President of The Walgreen Company, addressed the capacity crowd at HIMSS15 in Chicago on 13th April 2015, saying his company’s goal is to “make good health easier.” Remember that HIMSS is the “Health Information and Management Systems Society” — in short, the mammoth health IT conference that this year has attracted over 41,000 health computerfolk from around the world. So what’s a nice pharmacy like you, Walgreens, doing in a Place like McCormick amidst 1,200+ health/tech vendors? If you believe that health is a product of lifstyle behaviors at least as much as health “care” services (what our

John Hancock flips the life insurance policy with wellness and data

When you think about life insurance, images of actuaries churning numbers to construct mortality tables may come to mind. Mortality tables show peoples’ life expectancy based on various demographic characteristics. John Hancock is flipping the idea life insurance to shift it a bit in favor of “life” itself. The company is teaming with Vitality, a long-time provider of wellness tools programs, to create insurance products that incorporate discounts for healthy living. The programs also require people to share their data with the companies to quality for the discounts, which the project’s press release says could amount to $25,000 over the

Workers at work for the health benefits but absent when it comes to talking costs

As much as the Affordable Care Act is bolstering health insurance rolls for the uninsured, people who have enjoyed health insurance at work continue to highly value that benefit, according to a survey from Benz Communications and Quantum Workplace published April 2015. Based on a national sample of over 2,000 employees surveyed in October 2014 about workplace benefits. The research re-confirms the long-term reality of workers working in America for the health benefit. Benz/Quantum note that 89% of workers say health benefits play a part in remaining on-the-job, and half say the health benefit is a “major” part of remaining

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

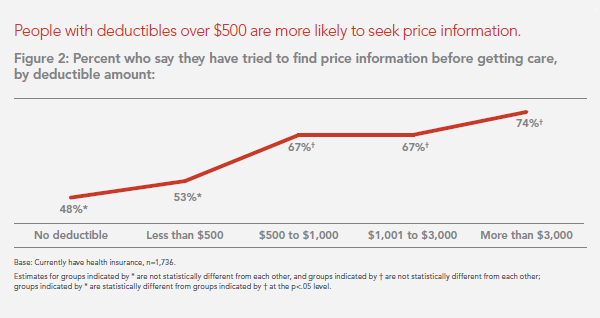

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Americans are spending $1 in $5 on health care

People in the U.S. are spending over 20.6% of their income on health care, according to data published by the U.S. Department of Commerce on March 2, 2015. This is up from 15% of personal income in 1990. Note the slope of this curve, moving up the X-Y axes from southwest to northwest. Now note the slope of the curves in the second chart, which illustrates consumer spending on other household goods and services: cars, housing, clothing, education, groceries, and eating outside of the home. Spending on these home budget line items remained relatively flat over the 25 year period 1990-2015,

Digital health love – older people who use tech like health-tech, too

As people take on self-service across all aspects of daily living, self-care in health is growing beyond the use of vitamins/minerals/supplements, over-the-counter meds, and trying out the blood-pressure cuff in the pharmacy waiting for a prescription to be filled. Today, health consumers the world over have begun to engage in self-care using digital technologies. And this isn’t just a phenomenon among people in the Millennial generation. Most seniors who regularly use technology (e.g., using computers and mobile phones) are also active in digitally tracking their weight, for example, learned in a survey by Accenture. Older people who use technology in daily

Most people want to go digital for health – especially the un-well

2 in 3 people in the U.S. would use a mobile app to manage their health, especially for diet and nutrition, medication reminders, tracking symptoms, and recording physical activity. The fifth annual Pulse of Online Health survey from Makovsky finds that digital health is blurring into peoples’ everyday lives. We’ve covered previous Makovsky digital health surveys here on Health Populi; last year, we focused on consumers managing risk in digital health platforms, and in 2013, the state of seeking health information online. That most consumers would go beyond health information search to the more engaging pursuit of managing health over

A health agenda comes to the 2015 Oscars

The 87th annual 2015 Oscars show (#Oscars15) feted more than the movie industry: the event celebrated health in both explicit and subtle ways. Julianne Moore took the golden statuette for Best Actress, playing the title role in Still Alice, the story a woman diagnosed with early-onset Alzheimer’s Disease. In accepting her award, Moore spoke of the need to recognize and “see” people with Alzheimer’s – so many people feel isolated and marginalized, Moore explained. Movies help us feel seen and not alone – and people with Alzheimer’s need to be seen so we can find a cure, she asserted. See Moore’s lovely

Employers grow wellness programs, and ramp up support for fitness tech

Offering wellness programs is universal among U.S. employers, who roughly divide in half regarding their rationale for doing so: about one-half offer wellness initiatives to invest in and increase worker health engagement, and one-half to control or reduce health care costs. Two-thirds of companies offering wellness will increase their budgets, according to the International Foundation of Employee Benefit Plans (IFEBP) report, Workplace Wellness Trends, 2015 survey results. The IFEBP polled 479 employers in October 2014, covering corporate, public, and multi-employer funds in the U.S. and Canada. The statistics discussed in this post refer solely to U.S. organizations included in the study

Whole (Health) Foods – the next retail clinic?

Long an advocate for consumer-directed health in his company, John Mackey, co-CEO and co-Founder of Whole Foods Market, is talking about expanding the food chain’s footprint in retail health. “Americans are sick of being sick,” Mackey is quoted in “Whole Foods, Half Off,” a story published in Bloomberg on January 29, 2015. Mackey talks about being inspired by Harris Rosen, a CEO in Florida, who has developed a workplace clinic for employees’ health care that drives high quality, good outcomes, and lower costs. Mackey imagines how Whole Foods could do the same, beginning in its hometown in Austin, TX. He

Fiscal and physical fitness: TD Bank makes the link

What does a bank have to do with health? Plenty, if you listen to 70% of consumers who say that financial health has a positive impact on physical health. TD Bank released the Fiscal Fitness survey this week, finding that consumers make a direct connection between fiscal and physical fitness. That’s what we here at THINK-Health refer to as financial wellness. TD learned that 80% of consumers made a health resolution in the New Year and 69% of people made a financial resolution 40% of people want to save more and spend less, and 42% want to get healthy and

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,