Hug your physician – chances are, s/he’s burned out

If you’re meeting with a physician in the next week or two, put on your empathy hat: chances are, they are feeling burned-out. Overall 46% of physicians report they were burned out in 2014, up from just under 40% last year. Medscape’s Physician Lifestyle Report 2015 finds that at least one-half of physicians are burned-out who work in critical care, emergency medicine, family medicine, internal medicine, general surgery, and infectious disease (including HIV). And, at least 37% of physicians are burned-out working in all other specialties, shown in the first chart. Medscape gauges doctors’ self-assessments of burnout with a lens

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Getting real about consumer demand for wearables: Accenture slows us down

Are you Feelin’ Groovy about wearables? Well slow down, you move too fast… …at least, according to Accenture’s latest survey into consumers’ perspectives on new technologies, published this week in conjunction with the 2015 Consumer Electronics Show in Las Vegas, the largest annual convention in the U.S. featuring technology for people. At #CES2015, we’re seeing a rich trove of blinged-out, multi-sensor, shiny new wearable things at the 2015 Consumer Electronics Show. Swarovski crystals are paired with Misfit Wearables, called the Swarovski Shine, shown here as a shiny new thing, indeed. Withings launched its Activite fitness tracking watch in new colors.

The Internet of Healthy Me – putting digital health in context for #CES2015

Men are from Mars and Women, Venus, when it comes to managing health and using digital tools and apps, based on a poll conducted by A&D Medical, who will be one of several hundred healthcare companies exhibiting at the 2015 Consumer Electronics Show this week in Las Vegas. Digital health, connected homes and cars, and the Internet of Things (IoT) will prominently feature at the 2015 Consumer Electronics Show in Las Vegas this week. I’ll be attending this mega-conference, meeting up with digital health companies and platform providers that will enable the Internet of Healthy “Me” — consumers’ ability to self-track,

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Women-centered design and mobile health: heads-up, 2014 mHealth Summit

This post is written as part of the Disruptive Women on Health’s blog-fest celebrating the 2014 mHealth Summit taking place 7-11 December 2014 in greater Washington, DC. Women and mobile health: let’s unpack the intersection. On the supply side of the equation, Good Housekeeping covered health tracking-meets-fashion bling in the magazine a few weeks ago in article tucked between how to cook healthy Thanksgiving side dishes and tips on getting red wine stains out of tablecloths. This ad appeared in a major sporting goods chain’s 2014 Black Friday pre-print in my city’s newspaper last week. And along with consumer electronics brand faves like

Pharma industry update – drug spending, R&D costs, generics, and Botox

The U.S. leads in pharmaceutical drug spending. Global growth in pharmaceuticals will spike in 2014, according to the IMS Institute on Healthcare Informatics report on global pharma spending. The U.S. spends more per capita (per person) than any nation in the study, at about $1400 US dollars expected in pharmaceutical spending in 2018, owing to fewer patent expiries (the end, for now, of the patent cliff) and rising prices (think: specialty drugs like Sovaldi and oncology drugs). The next-biggest spender on Rx will be Japan, at just over $800 per person in pharmaceutical spending in 2018. The “EU5” (UK, Germany, France, Italy

Health insurance companies rank low on consumer experience

The corporate reputation, brand equity, of the health insurance continues to be low relative to other financial service industry benchmarks, found in the ACSI Finance and Insurance Report 2014. Customer satisfaction with health insurance companies fell between 2013 and 2014, especially attributed to higher costs hitting consumers in group (employer-based) policies. The 2014 American Customer Satisfaction Index (ACSI) is informed by interviews with 6,819 consumers interviewed via phone and email between July and September 2014. Customers of financial services companies (banks, credit unions, health insurance, life insurance, property & casualty, and internet brokerages) were asked to provide their opinions about named-firms

Women worry about being bag-ladies – the health implications of financial un-wellness

My post, Even Rich Girls Worry About Being Bag Ladies, was published in the Huffington Post this week. In the analysis, I weave the results of several seminal surveys on women, money, and health that have been conducted in the past few months. The bottom-line: even the most affluent women are financially stressed, and that stress is leading women to re-define what it means to be personally successful. When it comes to personal health, financial wellness is part of overall well-being, as defined by women who place being healthy above having money. Avoiding debt is the nuance here, not amassing

Health-committed consumers look to food to be healthy, wealthy, and wise

There’s an emerging health-committed consumer, one of over 70% of people who believe they’re less healthy than the generations who came before them. 9 in 10 consumers overall believe that what you eat impacts how you feel. Those who are health-committed spend 70% of their grocery budgets on healthy products, read food labels, spend more and shop more frequently than low health-committed consumers, according to Healthy, Wealthy, & Wise, a survey report from Dunnhumby. The number of health-committed consumers globally grew by 38% since 2009. Most consumers look first to themselves to drive health, then to doctors, and third to food companies

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

Health and financial well-being are strongly linked, CIGNA asks and answers

The modern view on wellness is “having it all” in terms of driving physical, emotional, mental and financial health across one’s life, according to CIGNA’s survey report, Health & Financial Well-Being: How Strong Is the Link? The key elements of whole health, as people define them are: – Absence of sickness, 37% – Feeling of happiness, 32% – Stable mental health, 32% – Management of chronic disease, 15% – Financial health, 14% – Living my dreams, 9%. 1 in 2 people (49%) agree that health and wellness comprise “all of these” elements, listed above. This holistic view of health is

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

Hug your doctor: s/he needs it, according to the 2014 Physician Foundation survey

While the medical profession has reached a so-called state of crisis, there’s also a “changing of the guard” happening in the profession where doctors are re-imagining what it means to be physician in the era of value-based, technology-enabled health care. Such is the state of the union — or dis-union — of the U.S. medical profession. The 2014 Survey of America’s Physicians from Physicians Foundation finds that 4 in 5 U.S. doctors are over-extended or reaching full capacity in their practices. This is up from 2012. Only 19% of doctors say they have time to see more patients. That may be

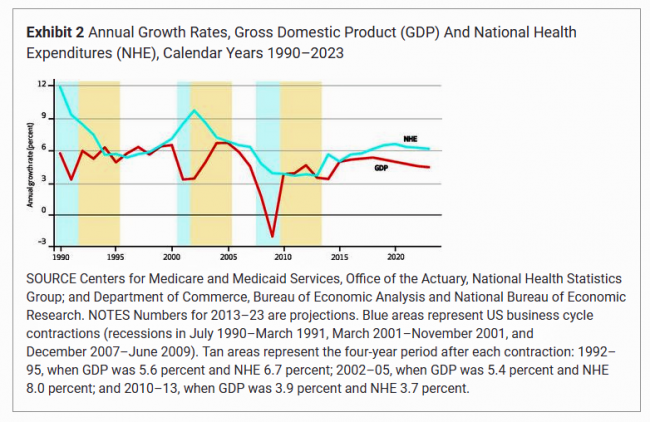

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Health on the 2014 Gartner Hype Cycle

Remote health monitoring is in the Trough of Disillusionment. Wearables are at the Peak of Inflated Expectations, with Big Data leapfrogging wearables from the 2013 forecast — both descending toward the Disillusionment Trough. Mobile (remote) health monitoring, however, has fallen into that Trough of Disillusionment as RHM has been undergoing reality checks in the health care system especially for monitoring and patient self-management of heart disease (most notably heart failure) and diabetes. Welcome to the 2014 edition of the Gartner Hype Cycle, one of my most-trusted data sources for doing health industry forecasts in my advisory work. Compared with last year’s

Understanding the patient journey – using real-world data

It’s de rigueur for any organization marketing a product or service in health care to be “patient-centered” these days. “Patient engagement” and “health engagement” are phrases found on health conference agendas, whether pitching to attendees in pharma and life sciences, health IT, health insurance, or healthcare (to hospitals and physicians, alike). One paradigm for patient-centricity that’s more mature than most is IMS Health’s Patient Journey construct, which the data-driven company has been talking about since 2012. While the concept focused mainly on pharmaceutical marketing and medication adherence, it’s useful for all industry segments looking to motivate behavior change in health

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

Employers engaging in health engagement

Expecting health care cost increases of 5% in 2015, employers in the U.S. will focus on several tactics to control costs: greater offerings of consumer-directed health plans, increasing employee cost-sharing, narrowing provider networks, and serving up wellness and disease management programs. The National Business Group on Health’s Large Employers’ 2015 Health Plan Design Survey finds employers committed to health engagement in 2015 as a key strategy for health benefits. More granularly, addressing weight management, smoking cessation, physical activity, and stress reduction, will be top priorities, shown in the first chart. An underpinning of engagement is health care consumerism — which

Blurred lines: health, pharmacy, food and care

In the past few weeks, several events bolster the reality that health and health care are in Blurred Lines mode. Not Robin Thicke Blurred Lines, mind you, but the Venn Diagram overlapping kind. Walmart launched real primary care clinics in South Carolina and Texas. These will provide services beyond urgent care, charging $4 a visit for company employees and $40 a visit for other people The U.S. Department of Agriculture issued a report promoting “nudges” to grocery shoppers enrolled in the Supplemental Nutrition Access Program (SNAP) to buy healthy foods Apple is talking with Cleveland Clinic, Johnson Hopkins, and Mount Sinai Medical

Over-the-counter drugs – an asset in the collaborative, DIY health economy

Nations throughout the world are challenged by the cost of health care: from Brazil to China, India to the Philippines, and especially in the U.S., people are morphing into health care consumers. Three categories of health spending in the bulls-eye of countries’ Departments of Health are prescription drugs, and the costs of care in hospitals and doctors’ offices. In the U.S., one tactic for cost containment in health is “switching” certain prescription drugs to over-the-counter products – those deemed to be efficacious and safe for patients to take without seeking treatment from a doctor. Over-the-counter drugs (OTCs) are available every

Novel concept: people + health pricing information = market competition

In the post-Recession American economy, people shop for value in all things. And that includes health care services like MRIs — when patients are informed of pricing differences among imaging facilities and given free rein to pick-and-choose among them. In addition to lowering imaging costs in a community, price transparency also generated competition between providers. Health Affairs published this research detailed in Price Transparency for MRIs Increased Use of Less Costly Providers And Triggered Provider Competition in August 2014. An Economics 101 course teaches us that a well-oiled (perfect) market depends on lots of sellers of a product and lots of

Self-care – the role of OTCs for personal health financial management

Make-over your medicine cabinet. That’s a key headline for International Self-Care Day (ISD) on July 24, 2014, an initiative promoting the opportunity for people to take a greater role in their own health care and wellness. Sponsored by the Consumer Healthcare Products Association (CHPA), consumer products companies, health advocacy organizations, and legislators including John Barrow (D-GA), a co-sponsor of H.R. 2835 (aka the Restoring Access to Medications Act), the Day talked about the $102 billion savings opportunity generated through people in the U.S. taking on more self-care through using over-the-counter medicines. After the 2008 Recession hit the U.S. economy, industry analysts

Consumer healthcare spending is up, and “fun spending” is down

This is the summer of big spending leaps for groceries, gas and health care. Here’s hoping that food, energy and visits to doctors make us happy, because we won’t be getting much joy from travel, dining out, leisure activities, or consumer electronics purchases, all of which are declining in terms of consumer spending. The Gallup survey published July 12, 2014, finds that 59% of people are spending more on groceries, 58% on gas/fuel, and 42% on health care. Net spending on each of those spending categories increased 49%, 46%, and 34% respectively this week compared with one year ago. Personal

Who’s Looking at You? consumer-generated data, Big Data, & health

Opportunities abound for sharing data “for good” – to turbocharge clinical trials, inform medical research, anticipate and better manage epidemics, and focus on individual health goals benchmarking oneself vs. peers. At the same time, third party data brokers and marketing interests with which consumers have no direct connection of knowledge are scraping together bits of personal information from internet clouds, social networks, and retail data from which profits are made. And that value does not accrue to the very individuals whose data are being sold. Here’s Looking At You: How Personal Health Information Gets Tracked And Used, published by California HealthCare

Stress Is US

“Reality is the leading cause of stress among those in touch with it,” Lily Tomlin once quipped. Perhaps in 2014, America is the land of stress because we’re all so in touch with reality. THINK: reality TV, social networks as the new confessional, news channeling 24×7, and a world of too much TMI. So no surprise, then, that one-half of the people in the U.S. have had a major stressful event or experience in the last year. And health tops the list of stressful events in This American Life in the forms of illness and disease (among 27% of people)

Health consumers – largely in charge, engaged and cost conscious

3 in 5 people in the U.S. would like to take the lead on making medical decisions for themselves, according to the Altarum Institute Survey of Consumer Health Care Opinions, Spring 2014 edition, published July 2014. Another 30% of people want to make a joint decision with equal input from their doctor. Together, the math calculates to 9 in 10 Americans seeking major roles in medical decisions. Altarum’s survey paints a picture of consumers looking to take charge in health care, seeking information about symptoms and clinical issues. 7 in 10 people look up health information before seeing their doctor,

In pursuit of healthiness – Lancet talks US public health

It’s Independence Day week in America, and our British friends at The Lancet, the UK’s grand peer reviewed medical journal, dedicate this week’s issue to the Health of Americans – exploring life, death (mortality), health costs, chronic disease, and the Pursuit of Healthiness. This project is a joint venture between The Lancet and the U.S. Centers for Disease Control (CDC) which took 18 months to foster, called The Health of Americans Series. Americans mostly die from chronic diseases, aka non-communicable diseases, which are largely amenable to lifestyle changes like eating right, quitting smoking, drinking alcohol in moderation, and moving around more. 1 in

How smart do you want your home to be?

Smarter homes can conserve energy, do dirty jobs, and remind you to take your medicine. In doing all these things, smart homes can also collect data about what you do inside every single room of that home. The fast convergence of Wi-Fi and sensors are laying the foundation for the Internet of Things, where objects embedded with sensors do things they’re specially designed to do, and collect information while doing them. This begs the questions: what do you want to know about yourself and your family? How much do you want to know? And, with whom do you want to

People want mobile health by phone, and FICO knows it

Most people (54%) want their mobile phones to enable health care interactions, according to Mobile Thought Leadership, a paper from FICO that summarizes data from a survey conducted with health citizens around the world. FICO conducted research among 2,239 adult smartphone users in the UK, Australia, Brazil, China, France, Germany, India, Italy, Japan, Korea, Mexico, Russia, Turkey and the United States. The data discussed here in Health Populi refer to a subset covering just U.S. consumers. Among the one-half of consumers interested in doing more health care interactions via mobile in the future, the most popular options are: receiving reminders of appointments,

Privatizing health privacy in the US?

8 in 10 people in the U.S. believe that total privacy in the digital world is history, based on a survey from Accenture conducted online in March and April 2014 and published in the succinctly-titled report, Eighty Percent of Consumers Believe Total Data Privacy No Longer Exists. 84% of U.S. consumers say they’re aware what tracking personal behavior can enable – receiving customized offers and content that match one’s interests. At the same time, 63% of people in the U.S. also say they have a concern over tracking behavior. Only 14% of people in the U.S. believe there are adequate safeguards

World No Tobacco Day v2014 – let’s raise (more) taxes on tobacco

Tomorrow is World No Tobacco Day. The use of tobacco is one of the most preventable public health issues on the planet. And the global tobacco epidemic contributed to 100 million deaths around the world in the 20th century. 6 million people die every year due to tobacco use — including 600,000 deaths due to exposure to secondhand smoke. About 500 million people living today will be dead from the use of tobacco products if current smoking habits continue, the World Health Organization (WHO) expects. WHO sponsors the World No Tobacco Day every year on May 31. For this year’s

The Milliman Medical Index at $23,215: A Toyota Prius, a tonne of tin, or health insurance for a family?

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm. The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin. While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6%

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Chaos, then Creation, Part 5

The consumer demand side for healthcare transparency is hungry for the light to shine on health care costs, quality and information that’s relevant and meaningful to the individual. The supply side is fast-growing, with websites and portals, government-sponsored projects, commercial-driven start-ups, and numerous mobile apps. These tools endeavor to: Help people find and access services Schedule appointments Compare peer consumers’ reviews for those providers Calculate and prepare for out-of-pocket co-payments deriving from their health plan Negotiate prices with providers Pay for the services, and Reconcile the payment with a high-deductible health plan or health savings account. On the demand side, consumers

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Will Your Health Plan Be Your Transparency Partner? – Part 3

Three U.S. health plans cover about 100 million people. Today, those three market-dominant health plans — Aetna, Humana and UnitedHealthcare — announced that they will post health care prices on a website in early 2015. Could this be the tipping point for health care transparency so long overdue? These 3 plans are ranked #1, #4 and #5 in terms of market shares in U.S. health insurance. Together, they will share price data with the Health Care Cost Institute (HCCI), a not-for-profit organization dedicated to research on U.S. health spending. An important part of the backstory is that the HCCI was

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

HealthcareDIY – from employee wellness incentives to #retailhealth, #pharmacy, & #CDHP

Most U.S. companies will increase the dollar value of health incentives offered to workers in 2012, based on the annual survey from Fidelity Investments and the National Business Group on Health addressing employers’ plans for health benefits. 3 in 4 employers used incentives in 2011 to engage employees in wellness programs, with an average incentive value of $460. This number was $260 in 2009. The poll found that employers expect employees to improve their personal health, and will increasingly ration access to benefits based on employees’ engagement with health criteria. Employers’ approaches to incentives have begun to adopt value-based benefit design strategies that

Health, love and saving money in the recession – insights from ING Direct

Americans love their cars, their houses, and their food. Based on a survey by ING Direct, the financial services company, these are the last 3 things we would sacrifice to save money. On the other hand, the most dispensable things for Americans include day care/nannies, cleaning services, education, and gifts. Women would be more likely to sacrifice health and fitness than men in the U.S. The ING survey compares the U.S. with eight other nations including Australia, Austria, Canada, France, Germany, Italy, Spain, and the United Kingdom. Health and fitness appear more highly valued by people in France and Spain;

Demand for health products and services is down in the recession; thinking about value and self-care in health

What is value in health care? Every year we spend more and seem to get less, John Seng, Founder of Spectrum, told attendees of a webinar on the Spectrum Health Value Study on 12th May 2009. As we consumers spend more of our own money, we’ll be looking for greater value and “health ROI” from our health spending. Measuring value across a population is confounded by the fact that what one person decides to spend on ‘health’ can be different from another’s health spending choices. In other words, our personal health “marketbaskets” for health spending vary from person to person.

Nearly 1 in 2 women delayed health care in the past year due to costs – the economic impact on a woman’s physical, emotional, and fiscal health

Nearly 1 in 2 women put off seeking health care because the cost was too high. The kinds of services delayed included visits to the doctor, medical procedures, and filling prescription medications. The fourth annual T.A.L.K. Survey was released this week by the National Women’s Health Resource Center (NWHRC), focusing on the declining economy and its impact on women and three dimensions of their health — physical, emotional, and fiscal. 40% of women say that their health has worsened in the past five years due to increasing stress and gaining weight, according to the survey. One of the most interesting

The Future of Retail – Implications for Health

I’ve been looking at health care through a retail lens for some time. Perhaps it’s that I’m a rag trader’s daughter, or that I’ve been known to like shopping, that I have clients in consumer goods, or that I understand how tiered drug pricing impacts the consumption of medicines (answer: it’s all of the above). I’ve just reviewed the latest trend report from PricewaterhouseCoopers and TNS Retail Forward on the future of retailing. My mind is connecting the dots between the future of retail and the American health care consumer. Four future retail trends are already embedding in health care

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,