Consumers Look to Brands to Both “Do Good” and Help Me “Feel Good” – Another Riff on the Edelman Trust Barometer and What This Means for Health Care

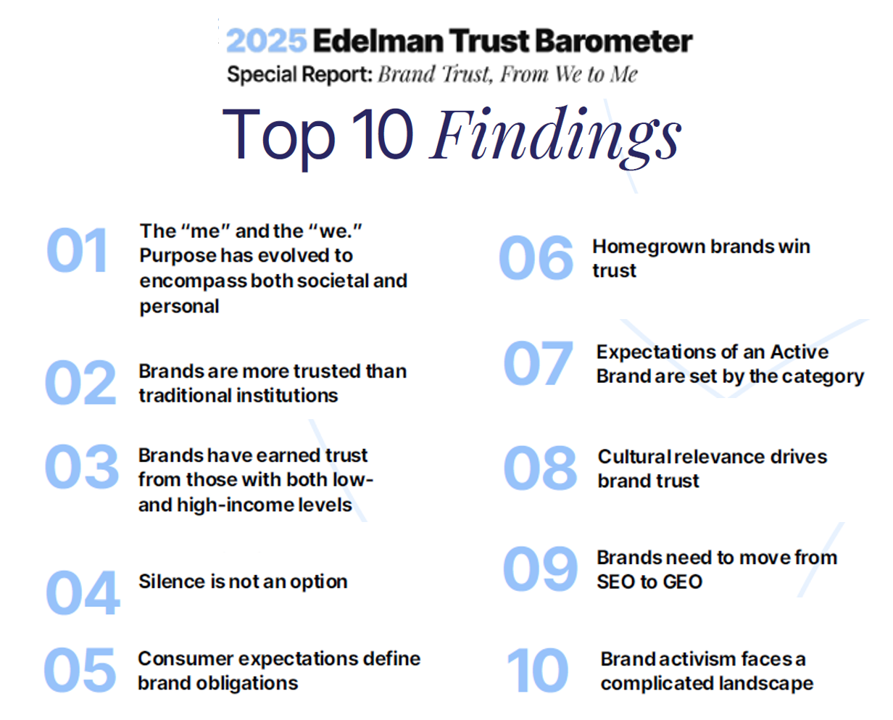

With consumers the world over feeling greater financial stress and social chasms in 2025, people are trusting brands more than institutions to help them both feel good and expecting them to “do” good, we learn in Brand Trust, From We to Me, a special report from the 2025 Edelman Trust Barometer. The overall theme of this year’s Trust Barometer was “Trust and the Crisis of Grievance.” One artifact of peoples’ grievance is their shift from “we” to “me;” in this new report with a lens on brands, Edelman finds that consumers expect

National Health Spending in the U.S. in 2033: What 20.3% of the GDP Will Be Spent On

By 2033, national health spending will comprise 20.3% of the U.S. GDP, based on the latest national health expenditure projections developed by researchers from the Centers for Medicare and Medicaid Services (CMS). This growth will be happening as CMS projects coverage of insured people to decline over the period. Earlier today, I attended a media briefing hosted by Health Affairs to receive the CMS team’s top-line forecast of NHE from 2024 to 2033 discussing these findings. Fuller details on the projections will be released in the July issue of Health Affairs on 7

What GoFundMe and Crowdfunding Campaigns Tell Us About Healthcare in America

“Can people afford to pay for health care?” a report from the World Health Organization asked and answered, with a focus on European health citizens. The same question underpins a new research paper published in Health Affairs Scholar, Insights from crowdfunding campaigns for medical hardship, Here, crowdfunding is a proxy for “can’t afford to pay for health care” in America. Here in blazing colors we have a snapshot of the study’s data in the form of a “heatmap.” FYI, a heatmap is a data visualization format that represents the magnitude of values of a dataset as a color — generally

A Toyota RAV4 Hybrid, a Playground Set, or Healthcare for a Family of 4: What $35,119 Can Buy in 2025 According to Milliman

If you went shopping for something that cost $35,119 in 2025, which would you most value? A new 2025 Toyota RAV4 Hybrid with some extras on board? A Canyon BYO playground set for your yard, school, or social-athletic club? Or, Healthcare coverage for a family of 4 in the form of a PPO? Welcome to this year’s 20th anniversary edition of the Milliman Medical Index (MMI), which I’ve looked forward to reviewing for most of its two-decade history. [You can read my annual takes on the MMI here in Health Populi by searching “MMI” and the year of publication in

Health, Wealth, and How Business Can Support Consumers in an Era of “Uncertainty on Steroids”

Facing uncertainties across everyday life flows, U.S. consumers look to economic and health security — and welcome businesses to support these, we learn in an analysis from The Conference Board. The Conference Board (TCB) polled 3,000 U.S. consumers gauging their perspectives on uncertainties emerging out of the new Trump administration’s policy changes introduced in the first quarter of 2025. The chart details people’s financial/fiscal responses in blue, and the health (mental, social, and physical aspects) in yellow: Consumers’ fiscal strategies for coping with uncertainty are to seek out more affordable brands and retailers, adjusting

How Consumers’ Economic Sentiments Are Shaping Peoples’ Financial and Emotional Well-Being (Spoiler: Not So Good): Learning from CivicScience

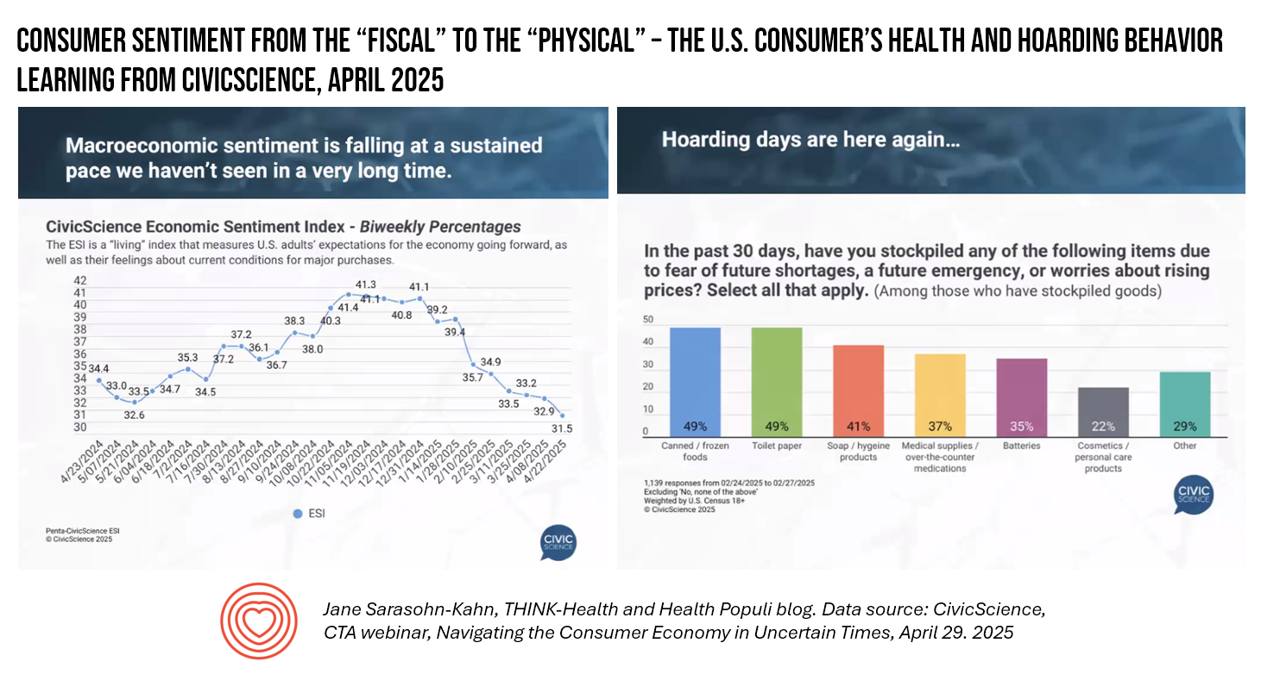

When it comes to health, the words “fiscal” and “physical” are morphing as peoples’ economic feelings (the “fiscal”) are shaping physical and emotional health, we find in U.S. consumer data presented by John Dick, Founder and CEO of CivicScience. The Consumer Technology Association convened a special session with John, who painted a portrait of the U.S. consumer at a point in time — late April 2025 — reminding us more than once during the hourlong session that, “Everything is constantly changing.” One certainty that we can be sure of, in the dismal-scientist way

Health Insurance Coverage Among Smaller U.S. Businesses Is Eroding: A Signal From JPMorganChase

Working-age people in the U.S. depend on their employers to provide health insurance; just over one-half of people in America receive employer-sponsored health insurance. But a concerning signal has emerged that calls into question how sustainable the uniquely American employer-sponsored health plan model is: that is that one in 3 small businesses in the U.S. stopped covering health insurance after the worst of the pandemic health effects in 2023 as the companies payroll expenses continued to increase, a statistic raised in The consistency of health insurance coverage in small business: industry challenges and insights, a report from the JPMorganChase Institute

Most Americans Don’t Want to Cut Medicaid (Including Republicans)

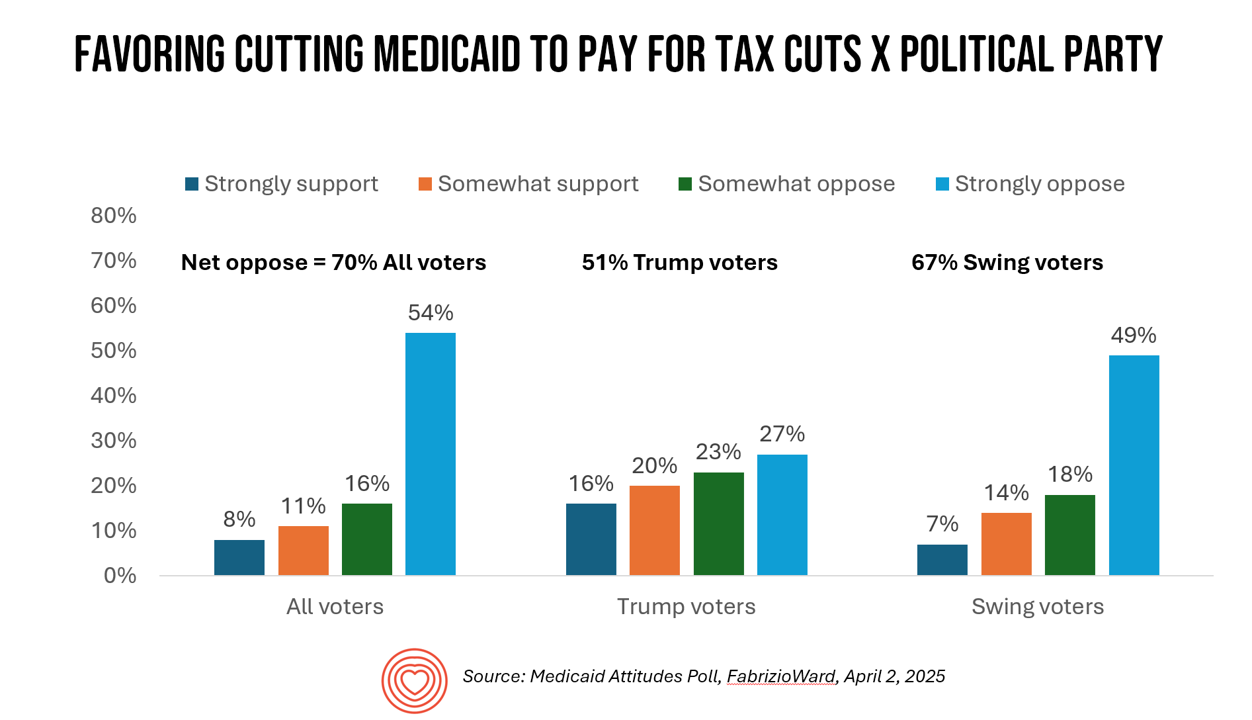

With potential down-sizing of Medicaid on the short-term U.S. political horizon, a fascinating poll found that most people identifying as Republican would not favor cuts to Medicaid. What fascinates me about this survey, published earlier this week, is that it was conducted by FabrizioWard, a polling firm that has often been used by President Trump. The firm’s Bob Ward told POLITICO that, “There’s really not a political appetite out there to go after Medicaid to pay for tax cuts. Medicaid has touched so many families that people have made up their minds about what

Are We Liberated Yet? Tariffs Can Impact Financial Health (Riffing on MoneyLion’s Health Is Wealth Report)

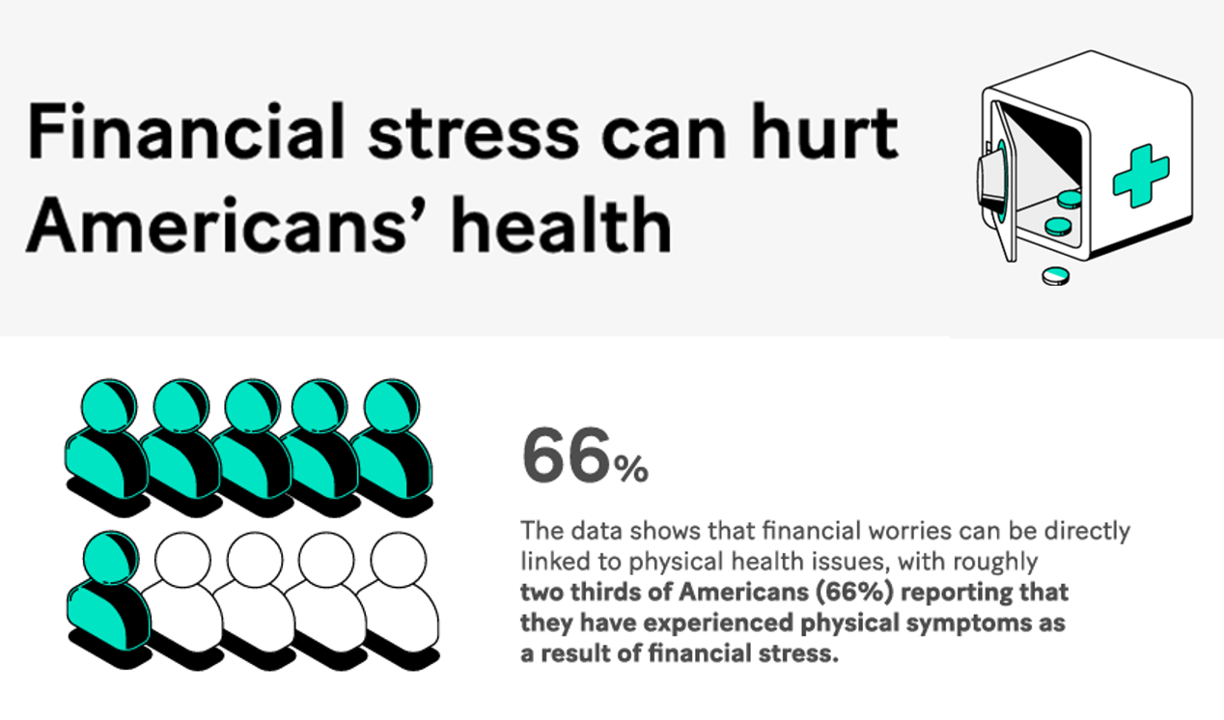

Americans’ financial health was already stressing consumers out leading up to Liberation Day, April 2nd, when President Trump announced tariffs on dozens of countries with whom the U.S. buys and sells goods. A new report from MoneyLion and Mastercard called Health is Wealth is well-timed for today’s Health Populi blog. The study was fielded by The Harris Poll online among 2,092 U.S. adults 18 and older between February 28 and March 4, 2025, so it was completed a month before the tariffs came to hit peoples’ 401(k) savings and employers’ company stock market caps.

Health Care Nation – How to Inspire a Rosa Parks Moment for Healthcare in America?

Tom Lawry may be best-known as a leading voice on AI in health care; after all, he’s written two very well-selling books on the topic, speaks all over the world on the subject, and in his most recent company-based gig helped lead Microsoft’s efforts in AI in health care and life sciences. When his publisher asked him to write a third book on AI in health care – still a hot topic in publishing – Tom said he’d rather turn to a subject long on his mind: the state of health care in America and how to change the conversation

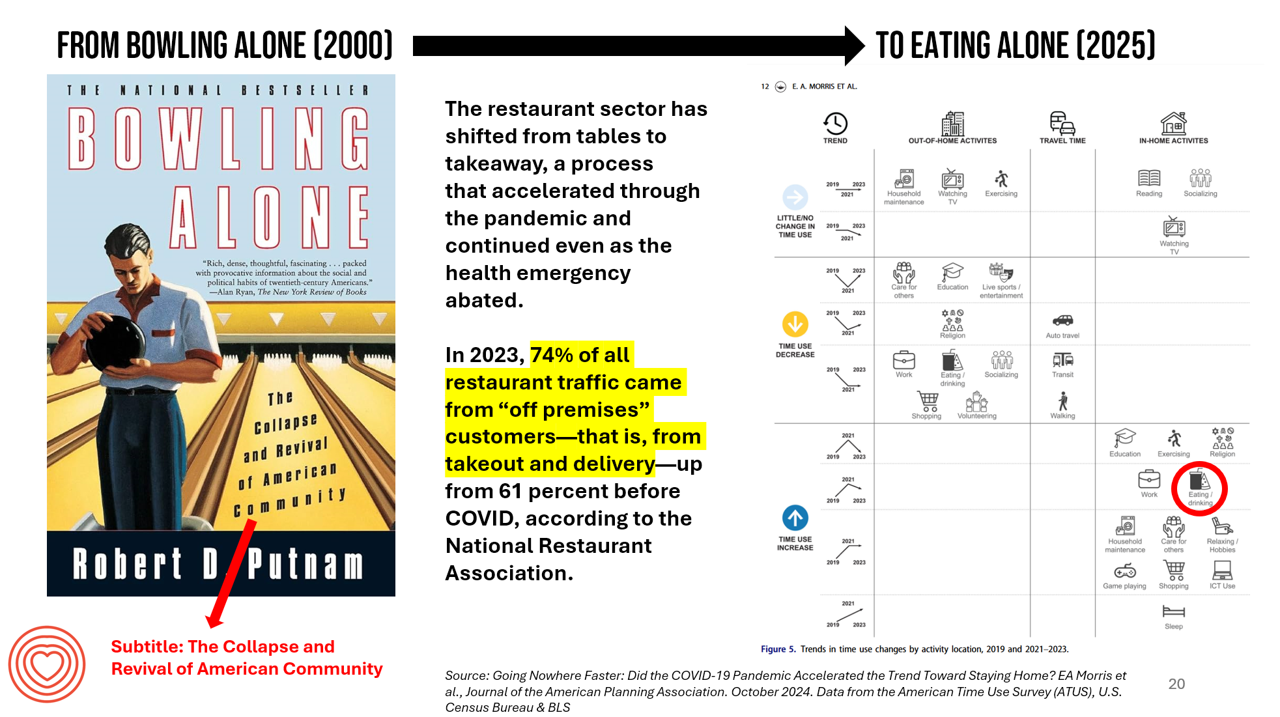

From Bowling Alone to Eating Alone – What the Shift to Take-Out Food Means for Our Social Well-Being and Mental Health

New data from the American Time Use Survey, research conducted by the U.S. Census Bureau and the Bureau of Labor Statistics, shows that Americans now favor eating in-home compared with eating out at restaurants. Corroborating this shift is other data from the National Restaurant Association sharing that 74% of all restaurant traffic in 2023 came from “off premises” customers — that is, from takeout and delivery — up from 61% in the pre-COVID era. What does this mean for our health, well-being, and sense of community and connectivity? I’m preparing a new talk to

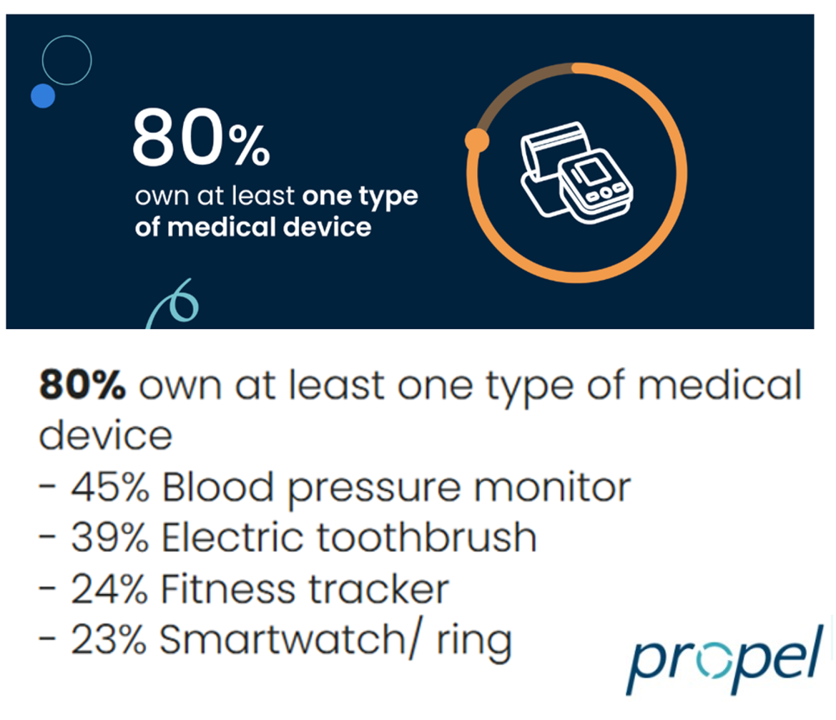

The Growth of DIY Digital Health – What’s Behind the Zeitgeist of Self-Reliance?

Most people in the U.S. use at least one medical device at home — likely a blood pressure monitor. used by nearly one-half of people based on a survey of 2,000 consumers conducted for Propel Software. The Propel study’s insights build on what we know is a growing ethos among health consumers seeking to take more control over their health care and the rising costs of medical bills and out-of-pocket expenses. That includes oral health and dental bills: 2 in 5 U.S. consumers use electric toothbrushes (a growing smart-device category at the

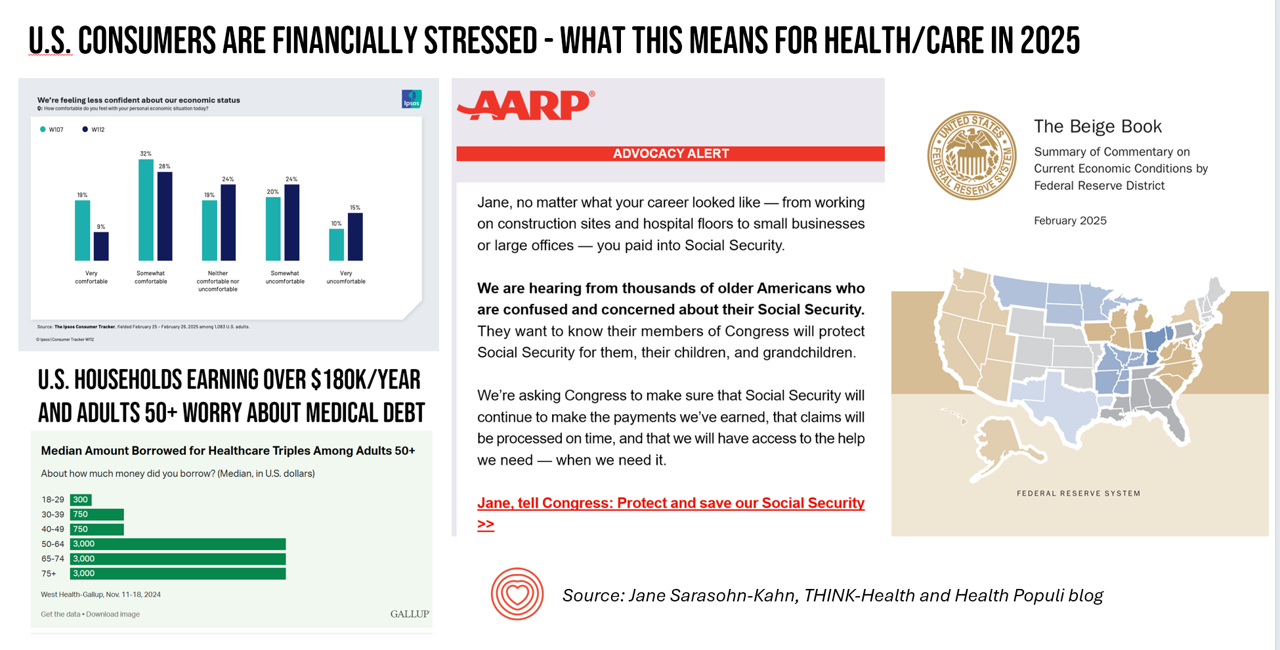

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

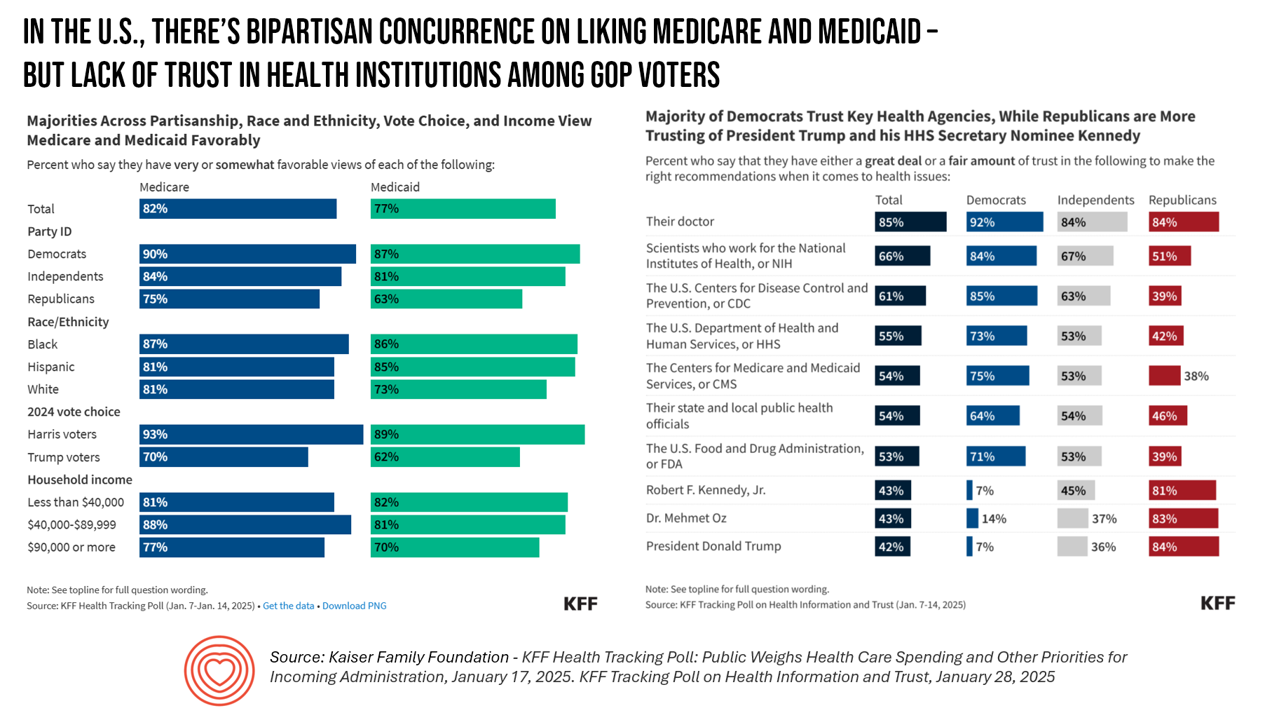

Some Bipartisan Concurrence on Health Care Issues in the U.S. – But Trust in Health Care Isn’t Bipartisan – KFF’s January 2025 Polls

Two polls from one poll source paint at once a bipartisan and bipolar picture of U.S. health citizens when it comes to health care issues versus health care institutions in America. The Kaiser Family Foundation has hit the 2025 health policy ground running in publishing the January 2025 Health Tracking Poll last week and a poll on health care trust and mis-information yesterday. First, the health tracking poll which finds some concurrence between Democrats and Republicans on several big issues facing Americans and various aspects of their health care. As

There’s a Health Gap for Women Around the World – and the World Economic Forum Has a Blueprint to Fix It

Even though women comprise one-half of the world’s population, their health outcomes and inputs do not match up to men’s: there’s a women’s health gap on Planet Earth. Meeting in Davos this week for #WEF2025, the World Economic Forum published a report on that gender-health chasm titled, Blueprint to Close the Women’s Health Gap: How to Improve Lives and Economies for All. In collaboration with the McKinsey Health Institute, the report focuses on nine key conditions that, if addressed, could reduce the global disease burden by 27 million disability adjusted life years and add

Trust and Grievance in 2025: The Edelman Trust Barometer on MLK Jr. Day Converging with the World Economic Forum Kick-Off and the Inauguration of the 47th U.S. President

At the start of each new year comes the World Economic Forum meet-up in Davos, Switzerland and with that conference start today, 20 January 2025, the publication of the Edelman Trust Barometer. Now in the study’s 25th annual edition, the Edelman Trust Barometer this year finds us, globally, in a Crisis of Grievance which is eroding trust. Edelman surveyed 1,150 residents (plus or minus) in each of 28 countries around the world, yielding over 33,000 citizens’ voices sharing perspectives on trust and institutions. Interviews were fielded from late October to mid-November 2024.

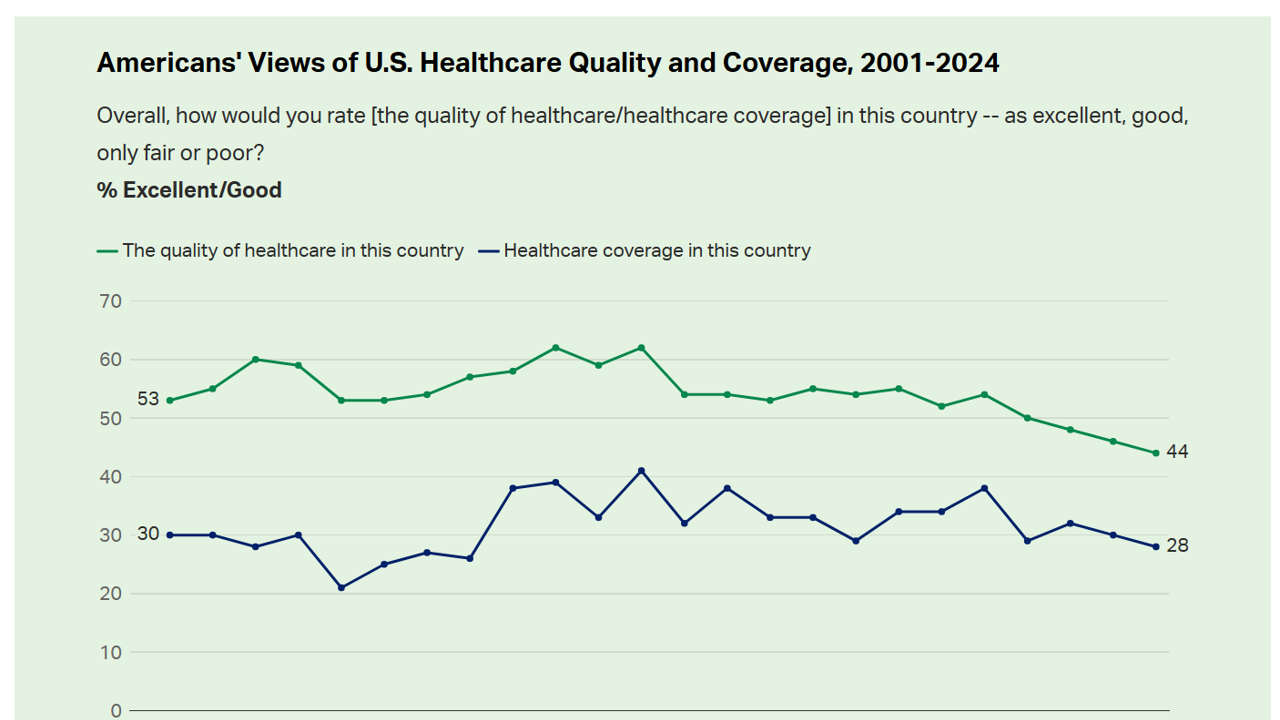

Americans’ Views on the Quality of Healthcare Fell to a Record Low — with Costs Ranking as the Most Urgent Problem for Health in the U.S.

Americans’ perception of the quality of health care in the U.S. fell to the lowest level since 2001, Gallup found in a poll of U.S. health citizens’ views on health care quality, published December 6, 2024. In 2024, only 44% of Americans said that the quality of health care int he U.S. was excellent or good — conversely, 56% of Americans though health care quality was only fair or poor. By political party, that included 50% of Democrats evaluating the quality of care highly compared with 42% of Republicans. Only 28% of people in

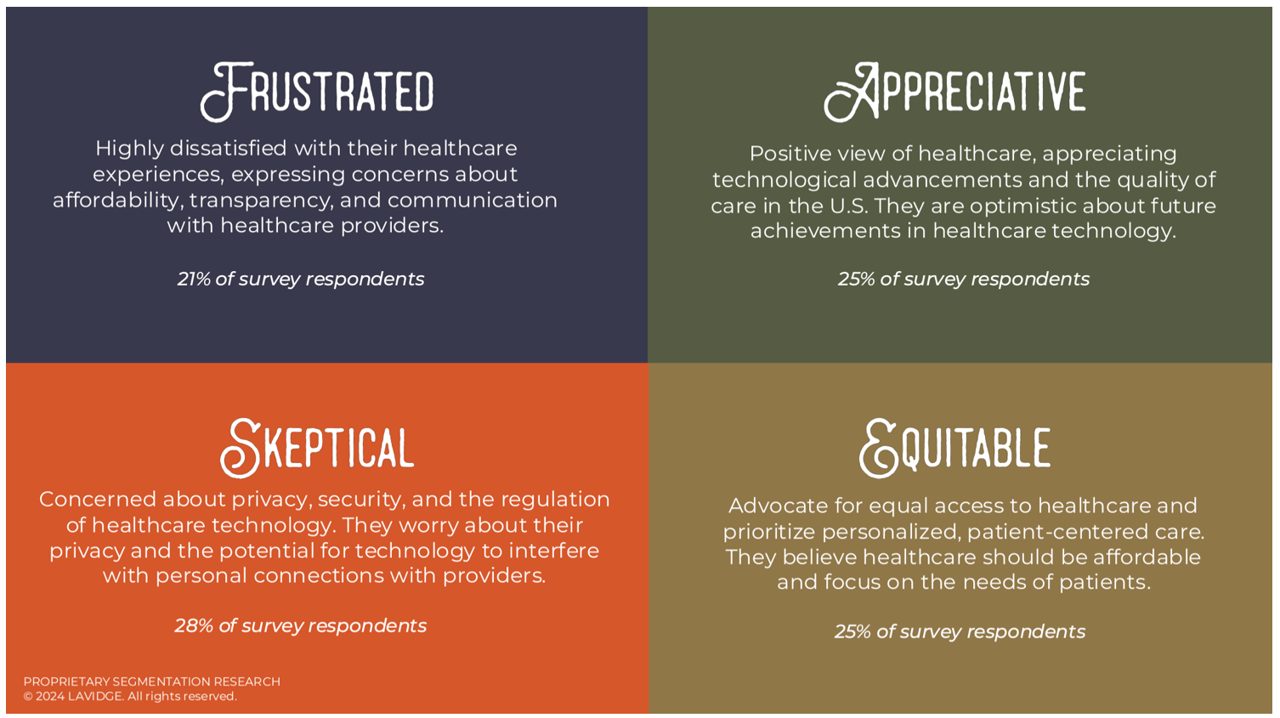

3 in 4 U.S. Patients Say the Healthcare System is Broken — But Technology Can Help

Patients “yearn” for personalized services and relationships in health care — optimistic that technology can help deliver on that hope — we learn in Healthcare’s Future: Balancing Progress and Perception, a health consumer survey report from Lavidge. Lavidge, a communications/PR/marketing consultancy, polled U.S. patients’ attitudes about health care and technology in June 2024, publishing the report earlier this month. Start with over-arching finding that, “Three out of four patients believe the U.S. healthcare system is broken and there is a strong sense of distrust,” Lavidge asserts right at the top of

Peace and Health: A Causal Relationship Explored in the AMA Journal of Ethics

“Peace and health are inextricably connected,” the Editors of the AMA Journal of Ethics introduce an issue of the journal devoted to Peace in Health Care published November 2024. In this timely journal issue, we can explore nearly one dozen essays exploring the interrelationship between peace and health in various clinical, care, and community settings — including hospice, maternal/child care, built environments, and adjacencies looking at the use of psychedelics and music for quieting one’s inner voices. You, the reader, will find your own favorite issues to explore based on your work, values, and interests.

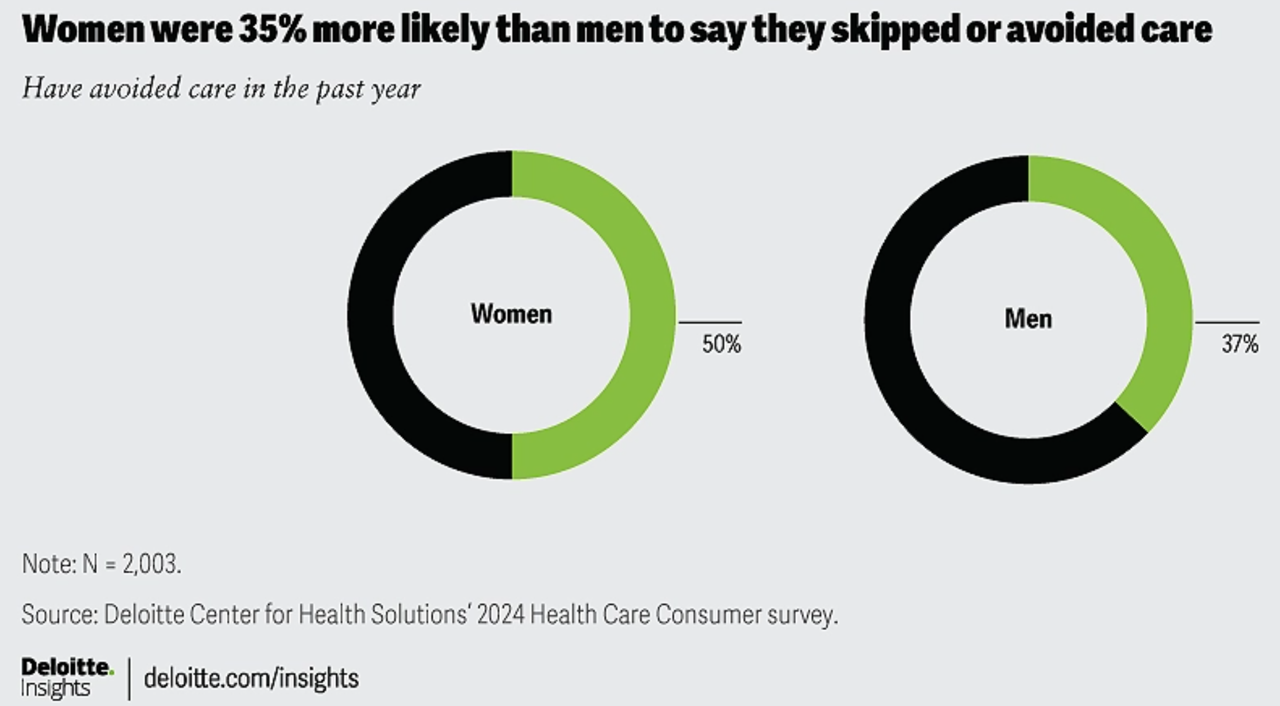

1 in 2 U.S. Women (“The Bedrock of Society”) Self-Ration Care – the Latest Deloitte Findings

Women in the U.S. are more likely to avoid care than men in America, Deloitte found in the consulting firm’s latest survey on consumers and health care. Deloitte coins this phenomenon as a “triple-threat” that women face in the U.S. health care environment, the 3 “threats” being, Affordability, Access, and, Prior experience — that is the health disparity among women who have seen personal mis-diagnosis, bias, or treatment that hasn’t been consistent with current protocols and practices. The data come out of Deloitte’s fielding of the U.S. consumer survey in February and March, 2024.

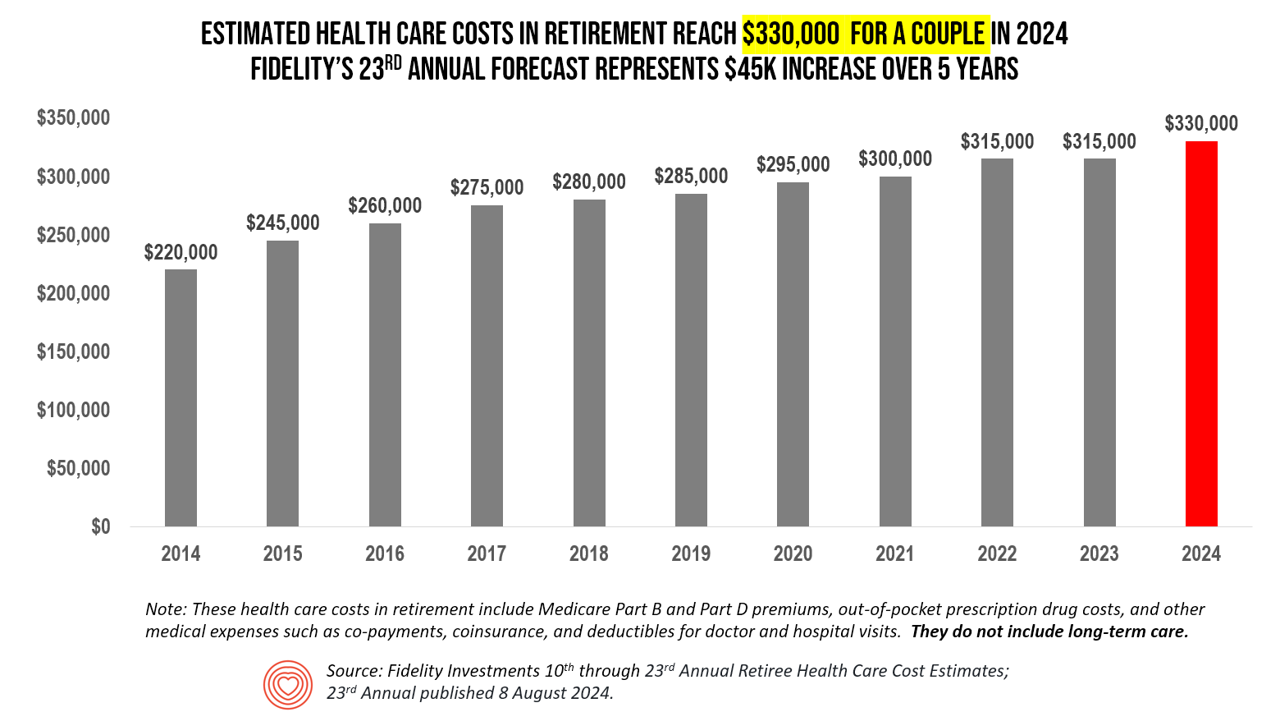

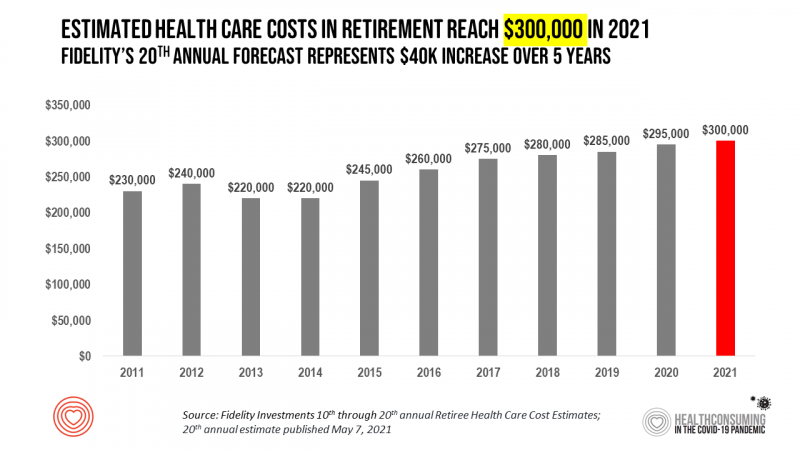

The Health Care Costs for Someone Retiring in 2024 in the U.S. Will Reach $165,000 – Fidelity’s 23rd Annual Update

The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast. I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K. Fidelity began

What the “Vibe-Cession” Means for Health Care in the U.S. – Spending is Personal

People living in the U.S. continue to feel a “vibe-cession” malaise, based on the American Mindset July 2024 update from Dentsu’s Consumer Navigator research. Notwithstanding generally good news about the American macroeconomy — in terms of growth, downward ticking inflation, and expected interest rate relief come September from the Federal Reserve — one in two Americans still thinks the country is in a recession. And this context is important for consumer’s personal spending on health care, fitness, and wellness, because, as Dentsu puts it, “consumers think in terms of personal finances.” As

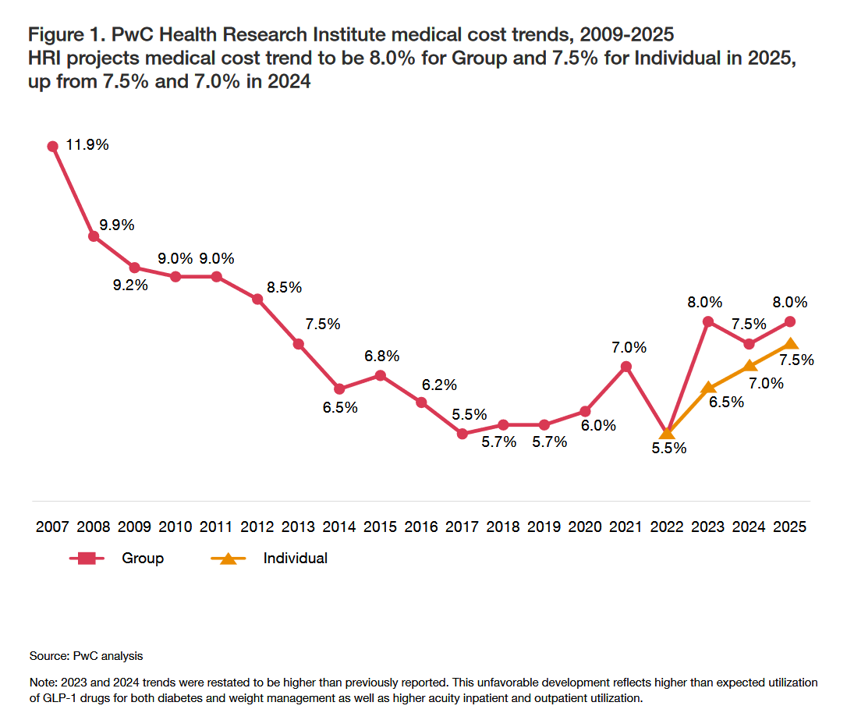

What’s Expected to Drive Up Health Plan Costs in 2025: GLP-1s, Behavioral Health, and Inflationary Pressures for Hospitals and Doctors – PwC’s Behind the Numbers 2025

The U.S. Bureau of Labor Statistics had good news for American consumers long-facing inflation for household spending over the past couple of years, announcing on July 11, 2024, that the general consumer price index (CPI) fell, lowering real prices for people buying airline tickets, used cars and trucks, communication, and petrol to fill auto tanks. That positive economic news did not extend to medical care and personal care, the BLS reported, whose costs increased by 3.3% and 3.2%, respectively. (Motor vehicle insurance costs grew a whopping 19.5% in the report, FYI). Following the

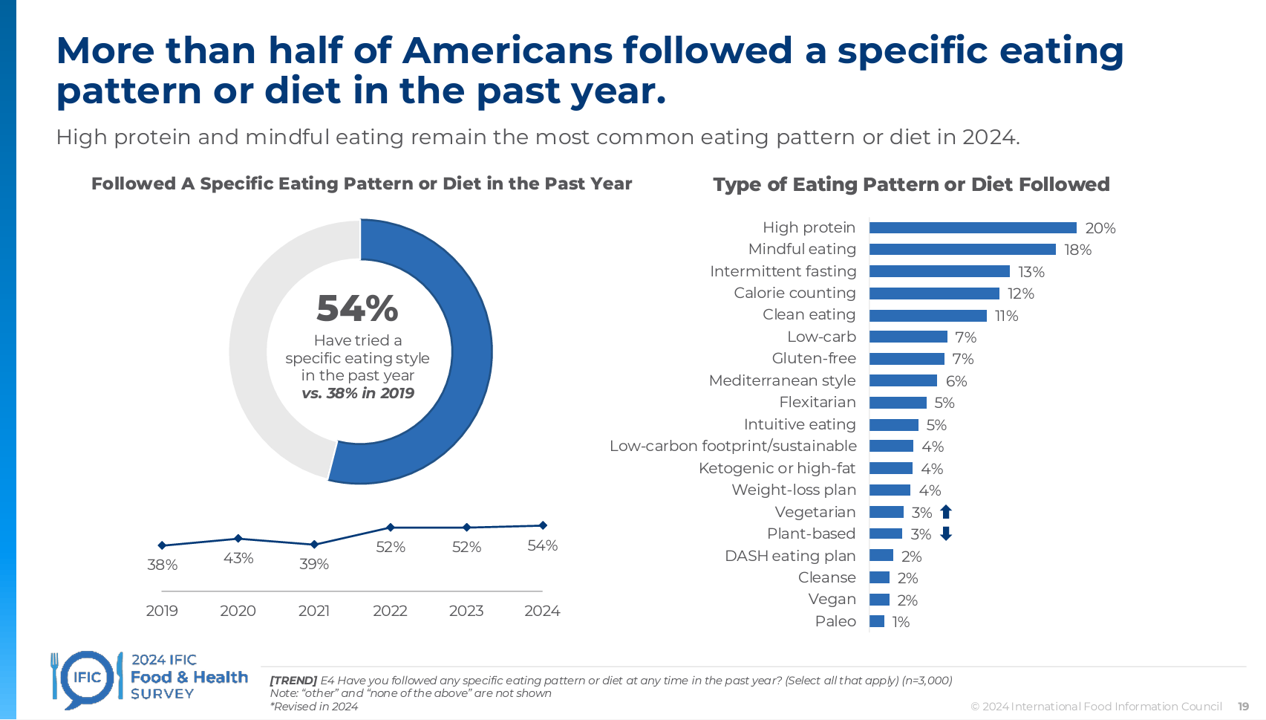

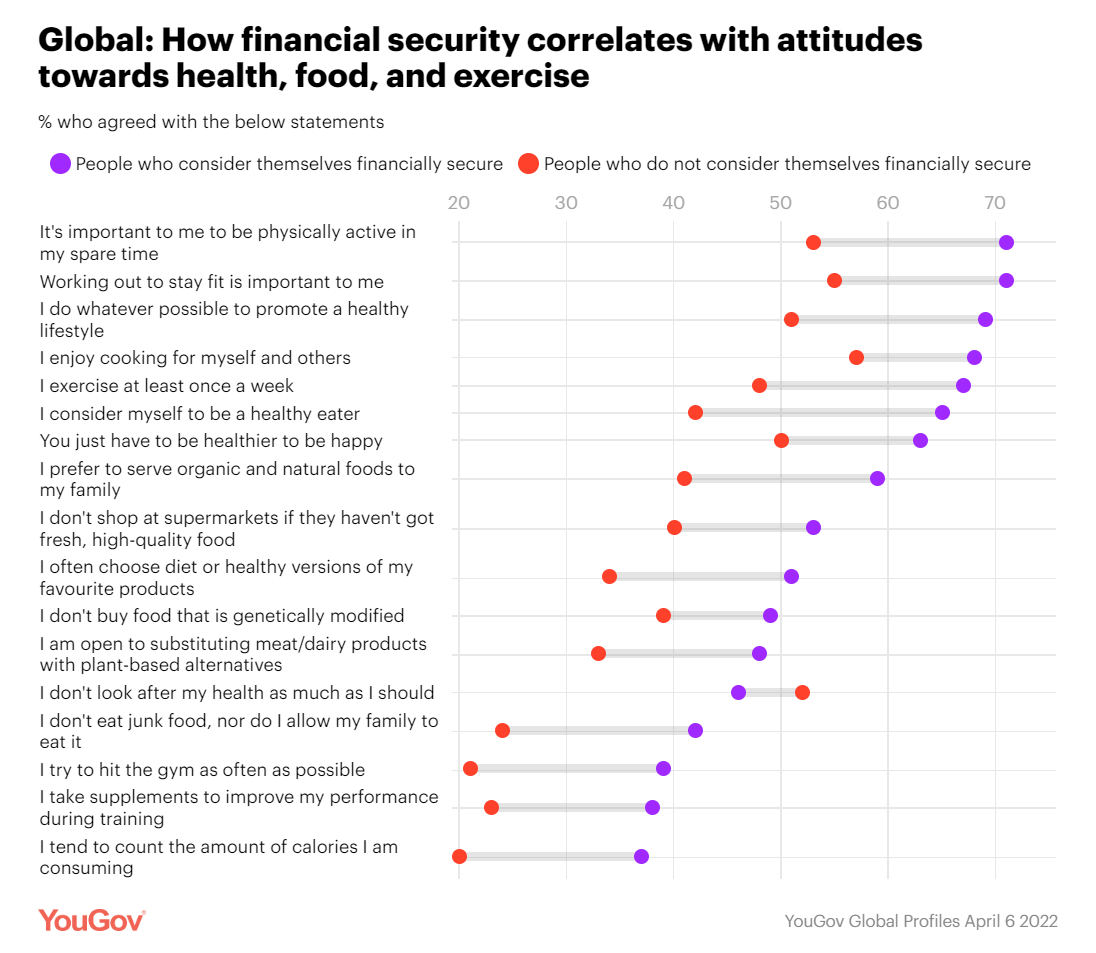

Most Americans Follow an Eating Pattern in Search of Energy, Protein, and Well-Being – With Growing Financial Stress: A Food as Medicine Update

Most Americans follow some kind of eating regime, seeking energy, more protein, and healthy aging, according to the annual 2024 Food & Health Survey published this week by the International Food Information Council (IFIC). But a person’s household finances play a direct role in their ability to balance healthful food purchases and healthy eating, IFIC learned. In this 19th annual fielding of this research, IFIC explored 3,000 U.S. consumers’ perspectives on diet and nutrition, trusted sources for food information, and new insights into peoples’ views on the GLP-1 weight-loss drugs and the growing sense

Most Americans, Both Younger and Older, Worry About the Future of Medicare and Social Security

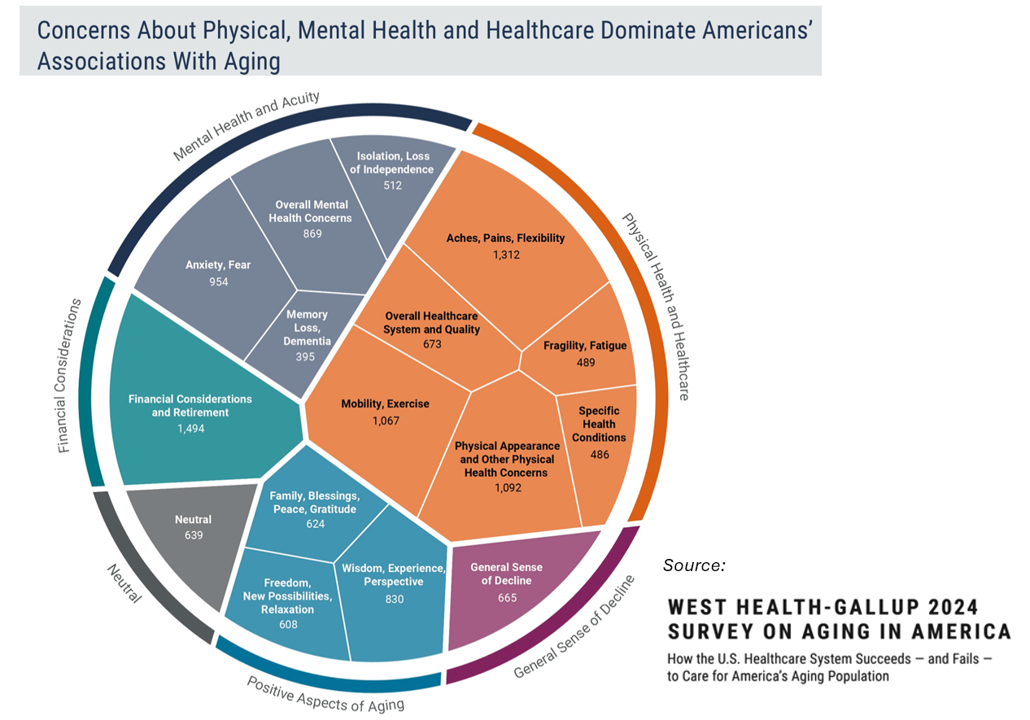

You would assume that most people over 50 would be worried about the financial future of Medicare to cover health care as those middle-aged Americans age. But a surprising two-thirds of young Americans between 18 and 29, and 7 in 10 between 30 and 39 years of age, are concerned that Medicare’s solvency will worsen leading to their not being able to receive Medicare when eligible to receive it, discovered in the 2024 Healthcare in America Report from West Health and Gallup. This year’s research focused on aging in America, exploring areas of U.S. health care system successes as well

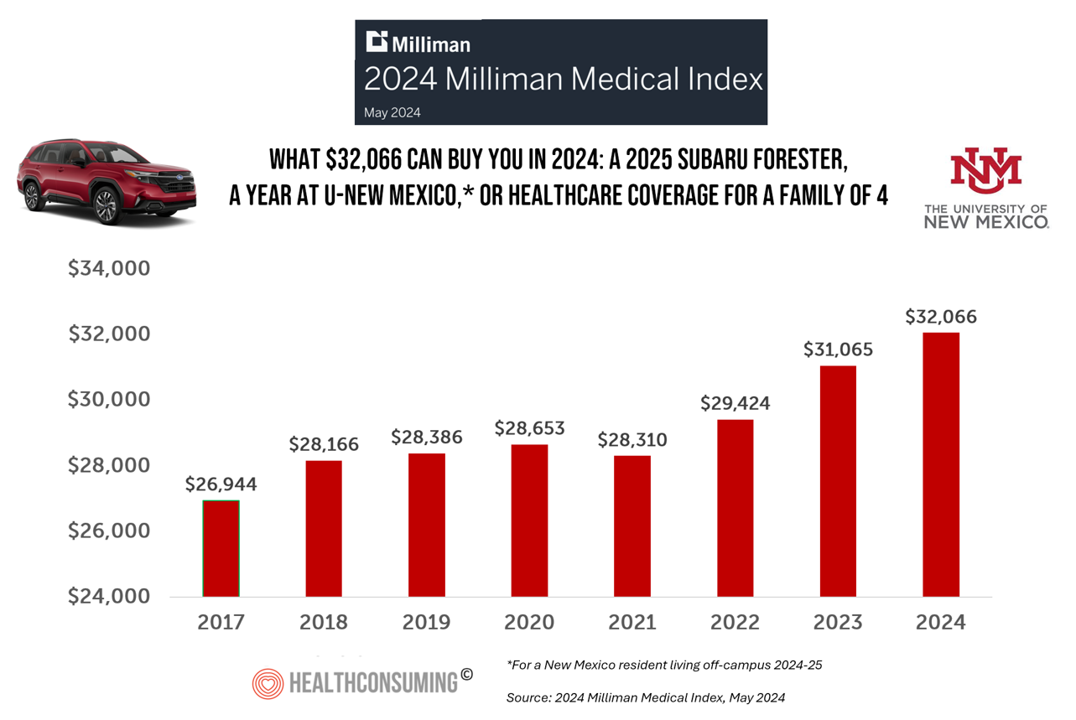

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

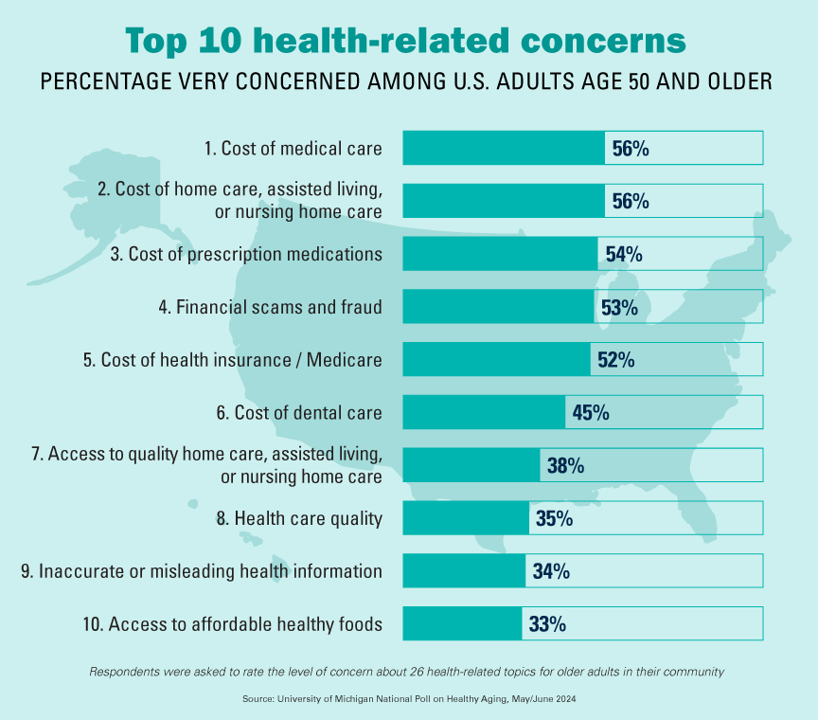

The Cost of Medical Care, Long-Term Care, and Prescription Drugs Top Older Americans’ Health-Related Concerns – With Social Security and Medicare Top of Mind

Among Americans 50 years of age and over, the top health-related concerns are Cost, Cost, and Cost — for medical services, for long-term and home care, and for prescription medications. Quality of care ranks lower as a concern versus the financial aspects of health care in America among people 50 years of age and older, as we learn what’s On Their Minds: Older Adults’ Top Health-Related Concerns from the University of Michigan Institute for Healthcare Policy and Innovation. AARP sponsors this study, which is published nearly every month of the year on the Michigan Medicine portal.

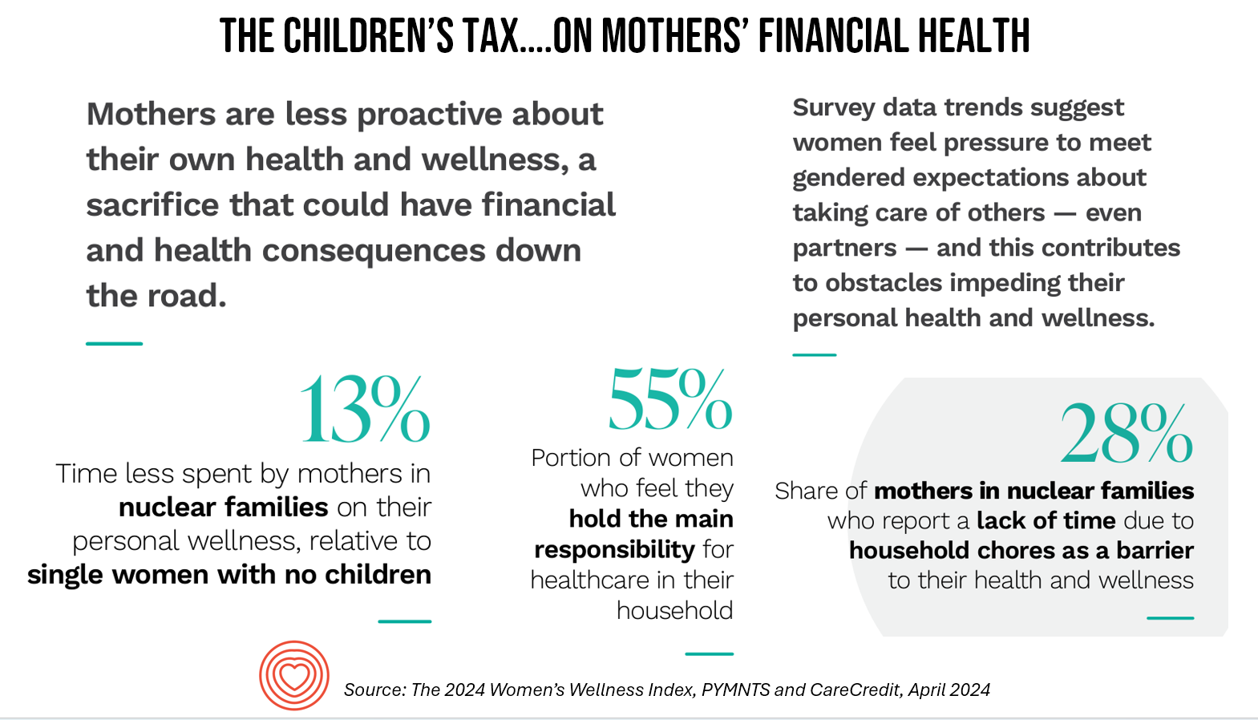

A Tax on Moms’ Financial and Physical Health – The 2024 Women’s Wellness Index

“Motherhood is the exquisite inconvenience of being another person’s everything” is a quote I turn to when I think about my own Mom and the remarkable women in my life raising children. With Mother’s Day soon approaching, the 2024 Women’s Wellness Index reminds us that the act of “being another person’s everything” has its cost. The Index, sponsored by PYMNTS in collaboration with CareCredit, was built on survey responses from 10,045 U.S. consumers fielded in November-December 2023. The study gauged women’s perspectives on finances, family, social life impacts on health and well-being. My key takeaway from

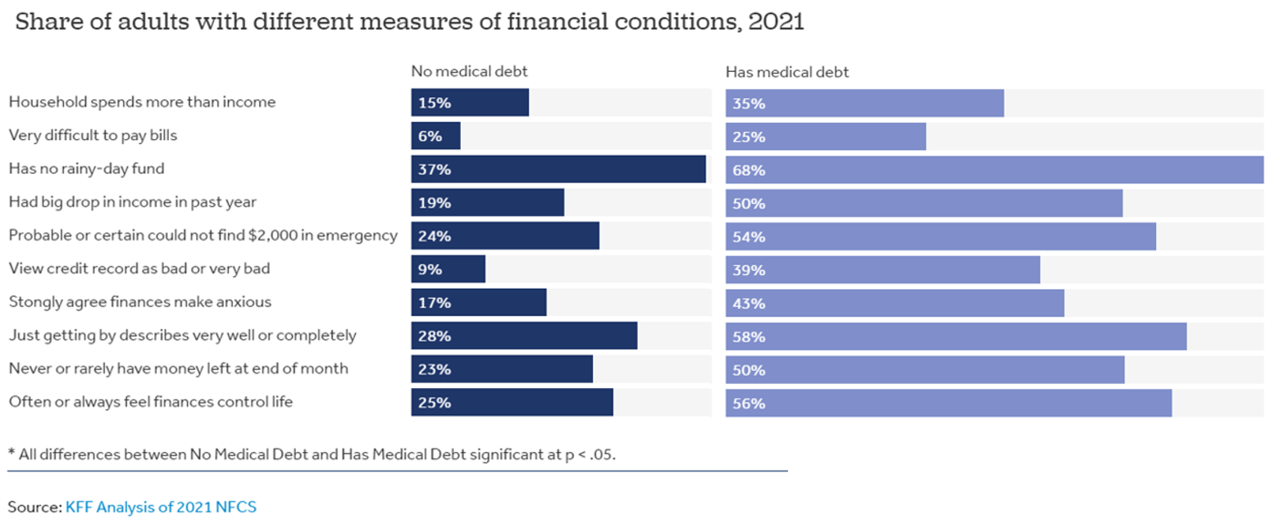

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

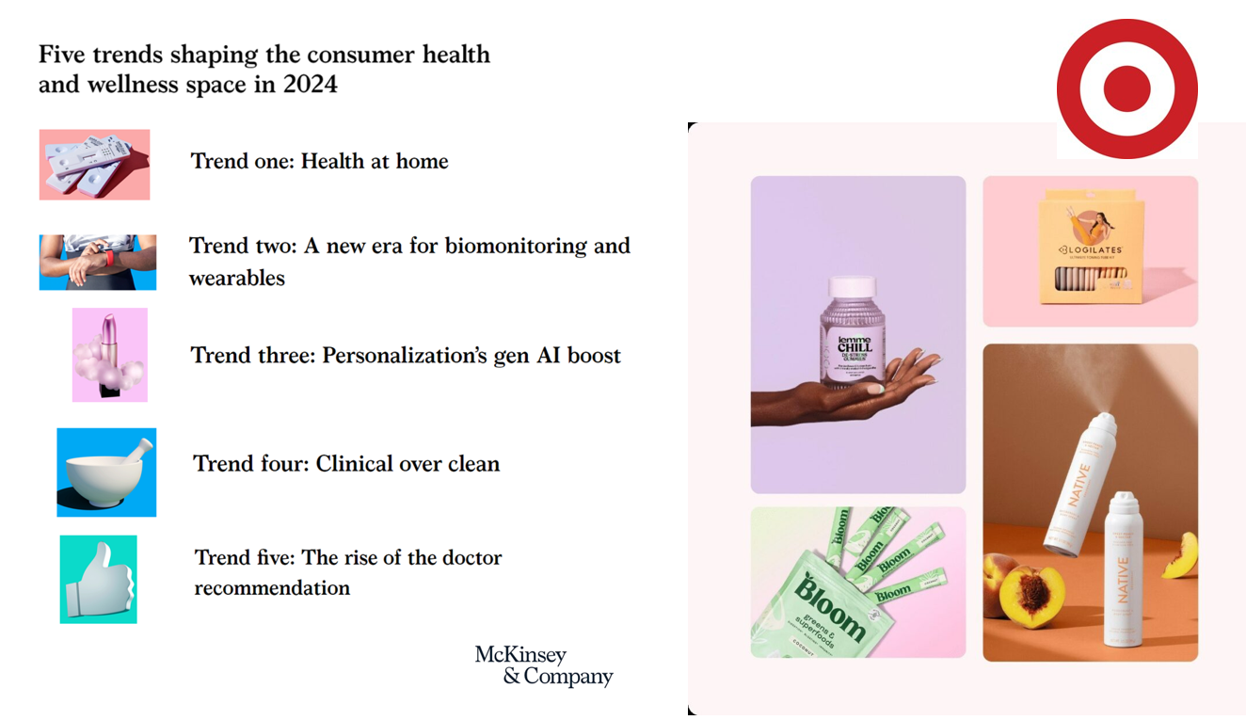

The Wellness Market Shaped by Health at Home, Wearable Tech, and Clinical Evidence – Thinking McKinsey and Target

Target announced that the retail chain would grow its aisles of wellness-oriented products by at least 1,000 SKUs. The products will span the store’s large footprint, going beyond health and beauty reaching into fashion, food, home hygiene and fitness. The title of the company’s press release about the program also included the fact that many of the products would be priced as low as $1.99. So financial wellness is also baked into the Target strategy. Globally, the wellness market is valued at a whopping $1.8 trillion according to a report published last week by McKinsey. McKinsey points to five trends

Why Elevance Health is “Prescribing” Phones for Members

You’ve heard of food-as-medicine and exercise-as-medicine. Now we see the emergence of telecomms-as-medicine — or more specifically, a driver of health, access, and empowerment. Elevance Health, the health plan organization serving 117 million members, launched a program to channel mobile phones and data plans into the hands of some Medicaid plan enrollees, explained in the organization’s press release on the program. To implement this program and get connectivity into consumers’ hands and homes, Elevance Health is collaborating with several telecomms companies including Verizon, AT&T, Samsung, and T-Mobile. Funding is supported by the FCC’s Affordable Connectivity Program.

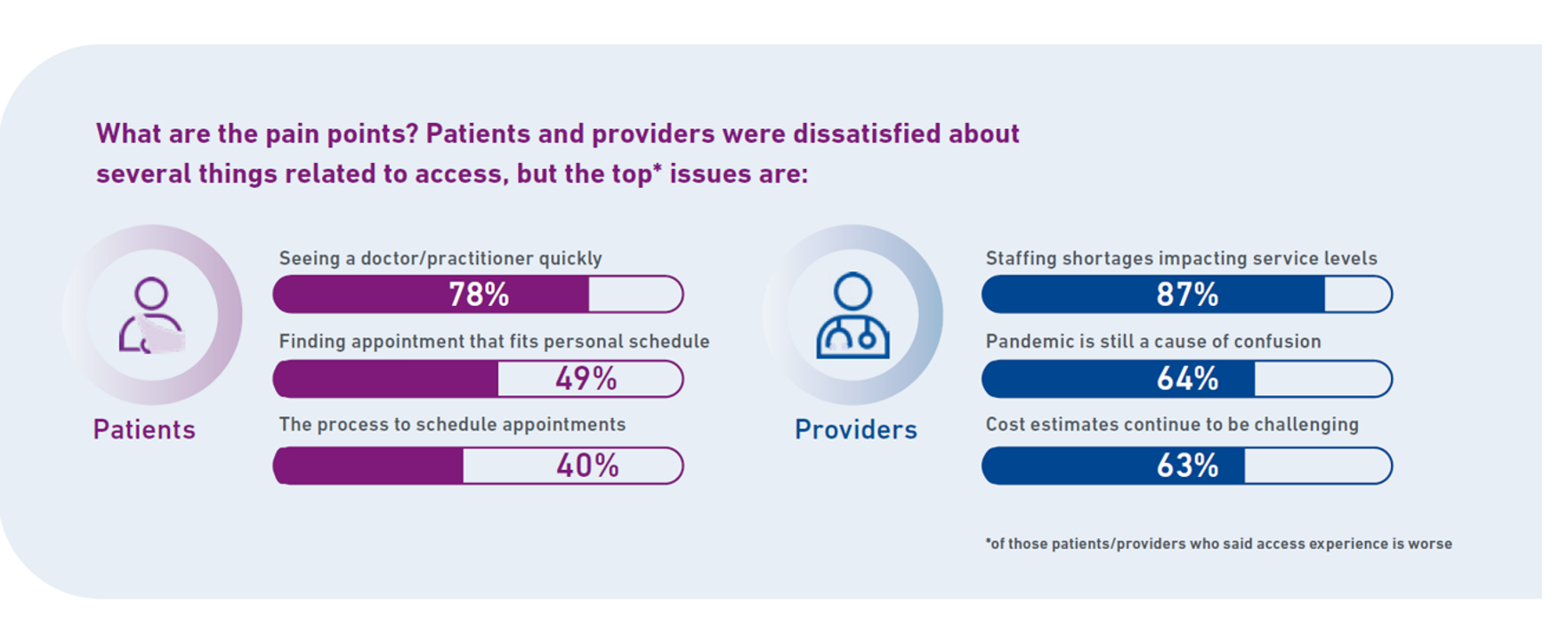

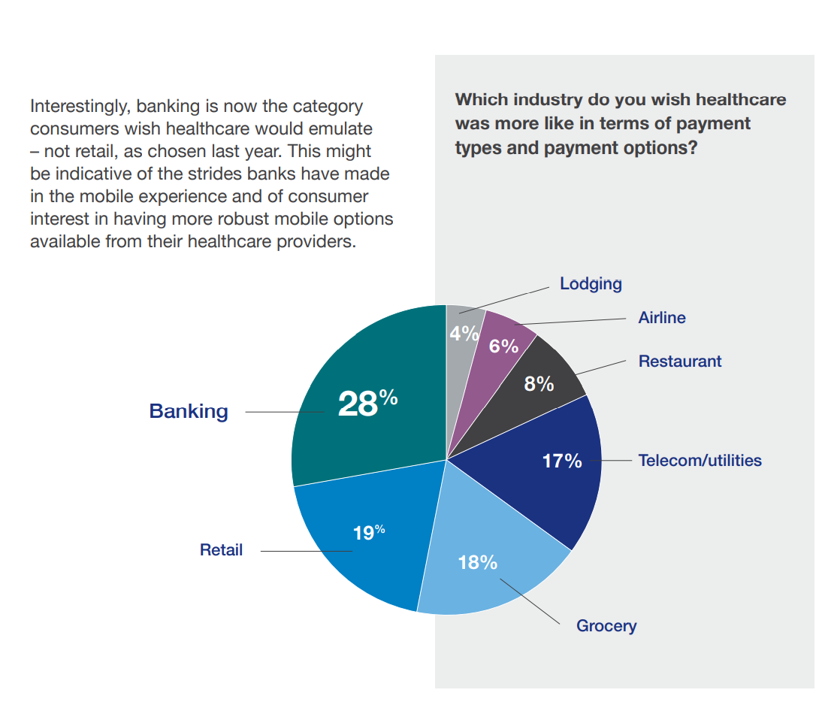

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

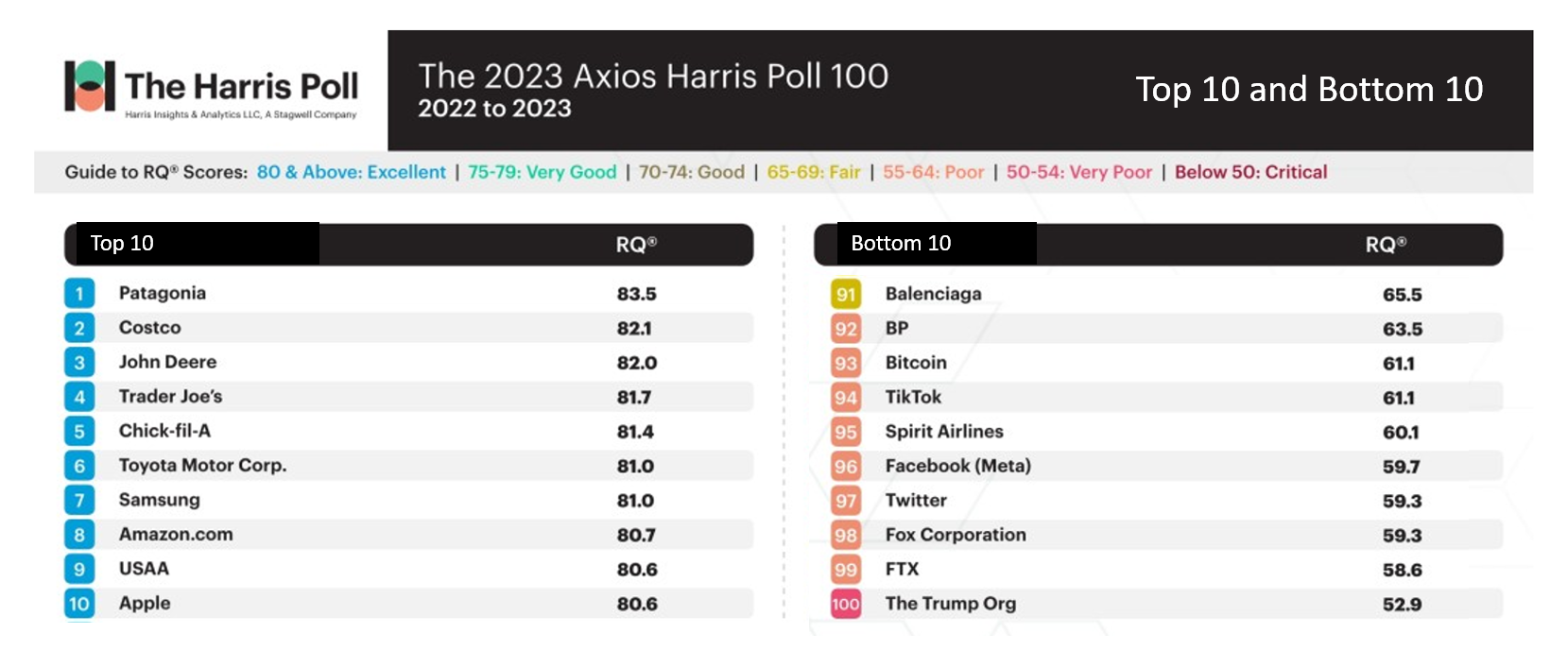

Searching for Health/Care Touchpoints in the 2023 Axios Harris Poll 100

Patagonia, Costco, John Deere, and Trader Joe’s are loved; Twitter, Fox Corp., FTX and The Trump Organization? Not so much. Welcome to 2023 Axios Harris Poll 100 list of companies U.S. consumers rate from excellent in terms of reputation to very poor and, one in particular, “critical.” Exploring the list, we can find insights into consumers’ preferred touchpoints for health, health care, and well-being curated in their daily lives. In this, today’s, Health Populi blog, I consider The 2023 Axios Harris Poll 100 reputation rankings in light of what we learned from the Morning Consult Most Trusted Brands 2023 study

The Growing Pet Economy – What It Means for Human Health, Well-Being, and Healthcare Costs

Our pets can be personal and family drivers of health and health care cost savings, according to a new study from according to a new report from researchers at George Mason University published in their paper, Health Care Cost Savings of Pet Ownership. Reviewing this new paper inspired me to explore the current state of the pet/health market and implications for their human families, my weaving of various stories explored in this Health Populi blog post. Some of the key signposts we’ll cover are: The report on pet ownership driving owners’ health care cost savings A new market analysis of

Medical Debt: “The Debt of Necessity” – A Current U.S. Picture from the CFPB

On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report. For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed

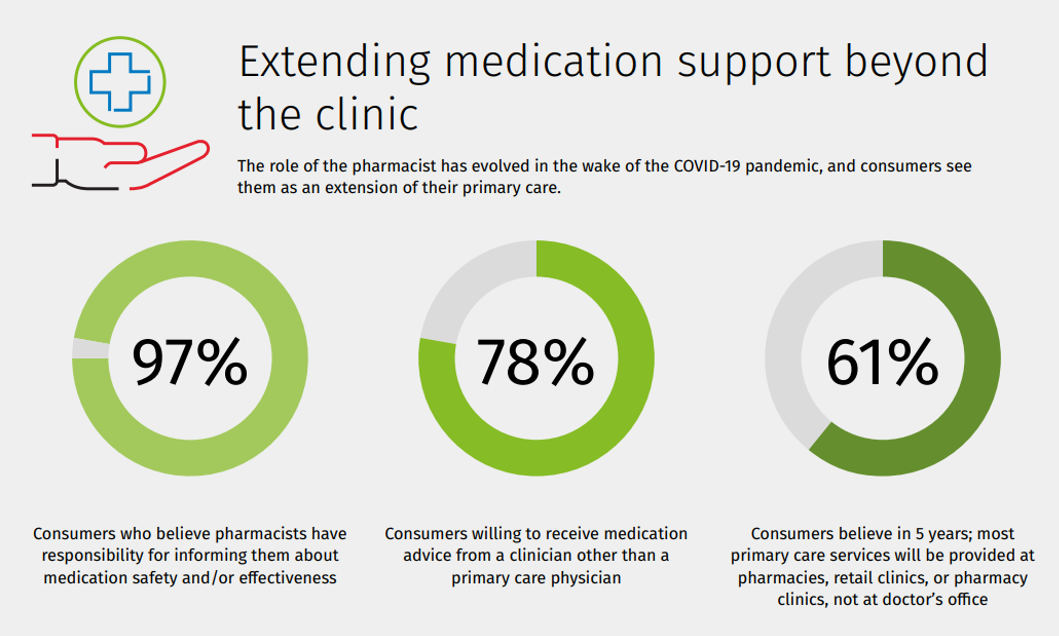

Getting Health Care at a Retail Pharmacy vs a Retail Store: Consumers May Be Favoring the Pharmacist Versus the Retailer

Not all “retail health” sites are created equal, U.S. consumers seem to be saying in a new study from Wolters Kluwer Health, the company’s second Pharmacy Next: Consumer Care and Cost Trends survey. Specifically, consumers have begun to differentiate between health care delivered at a retail pharmacy versus care offered at a retail store — such as Target or Walmart (both named as sites that offer “health clinics in department stores” in the study press release). While 58% of Americans were likely to visit a local pharmacy as a “first step” when faced with a non-emergency medical situation and 79%

Women’s Health on Her Own Terms – “She Knows” What She Needs

Despite some improvement in the representation of women by cinema, TV shows, and brands, distortions in media remain that are risks to women receiving appropriate health care. Breaking through taboos of weight, reproductive services, and mental health are the top 3 factors preventing women from getting proper care, according to Health On Her Terms, a research study from WPP and Ogilvy partnering with SeeHer, an organization of collaborations from media, technology, business, education, and other sectors (including over 7,000 brands) focused on the accurate portrayal of women and girls in society. Taglined as “The Marketer’s Hippocratic Oath to Women, the

Thinking Pharma on a Friday: Europe’s Big Reforms for a Health Union & the U.S. 50-State Fragments

The COVID-19 pandemic re-shaped European Union leaders to reimagine healthcare, public health, and health citizenship in the EU. Welcome to #HealthUnion, the hashtag that the European Commission has adopted with the vision of assuring access to medicines for all people living in the 27-nation EU area — regardless of socioeconomic status. On 26th April 2023, the EC unveiled the most significant reforms for the region’s pharmaceutical industry in twenty years. It’s really a package or “toolkit” in the words of EC Health and Food Safety Commissioner Stella Kyriakides for addressing several strategic health pillars

Health Care Financing: How Inflation and Health Care Prices Could Hit the U.S. Consumer

In the U.S. in 2021, per person health care spending increased by nearly 15%, reversing 2020’s spending decline of 3.5% in the first year of the COVID-19 pandemic. The latest Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI) details health spending in 2021, dissecting the change in terms of utilization of services and prices by category. That’s a big rise over consumers’ household inflation for food, energy, and other kitchen-table considerations, prompting me to look for additional context from a recent paper published by the OECD on Health care financing in times of high inflation,

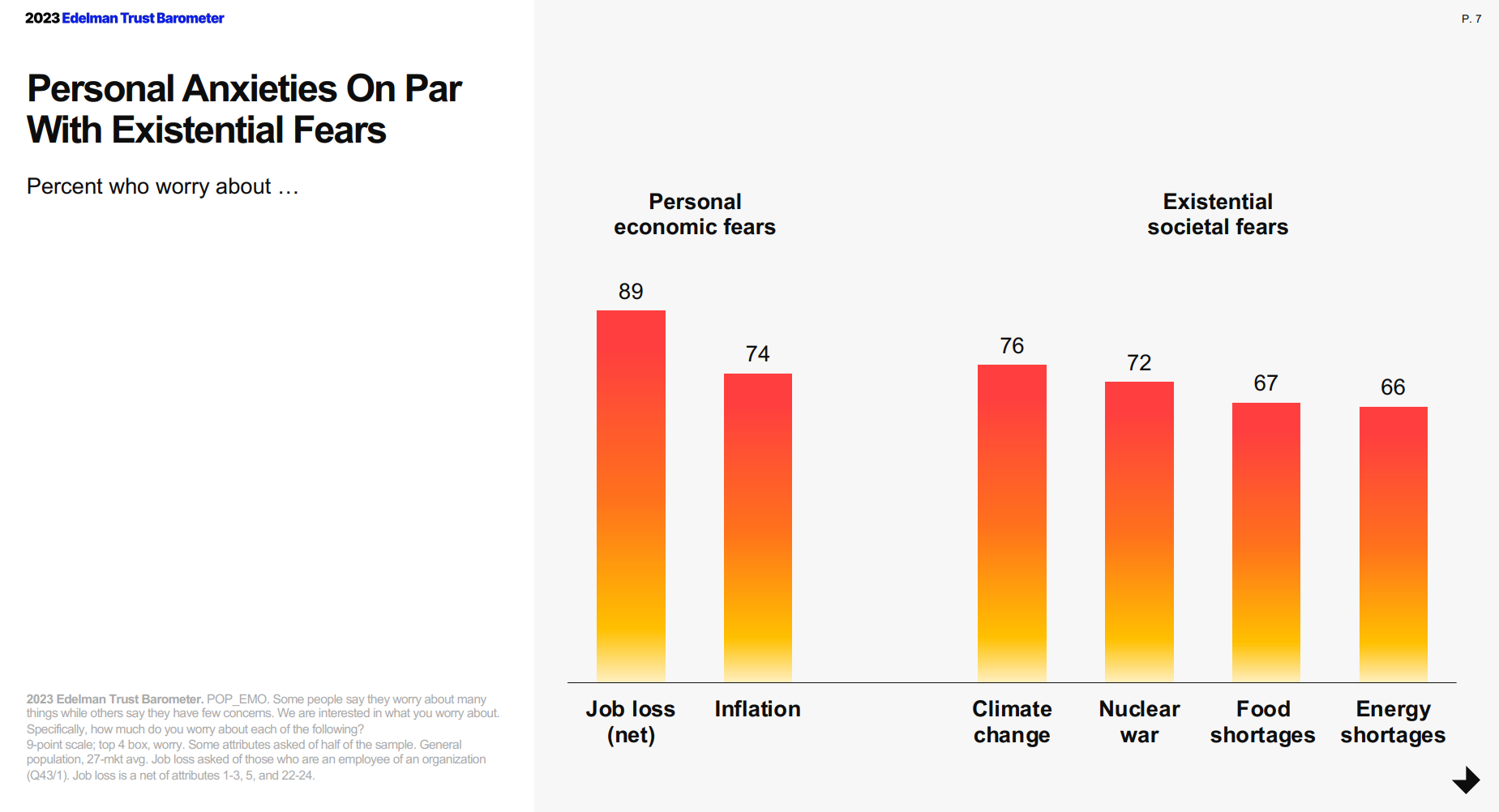

Consumers Expect Every Company to Play a Meaningful Role in “My Health” – New Insights from the 2023 Edelman Trust Barometer

People have expanded their definitions of health in 2023, with mental health supplanting physical health for the top-ranked factor in feeling healthy. Welcome to the Edelman Trust Barometer Special Report: Trust and Health, released this week, with striking findings about how the economic, post-pandemic life, pollution and climate change all feed mis-trust among citizens living in 13 countries — and their eroding trust for health care systems. While these factors vary by country in terms of relative contribution to citizen trust, note that in the U.S., social polarization plays an outsized role in factors that “make us

Appreciating Water as a Driver of Health: Designing for Good, from the UN to Liberia and Flint, Michigan

The United Nations (UN) convened the 2023 Water Conference convened March 22-24, 2023, in New York City. The meeting brought together stakeholders from all over the world to brainstorm how to meet UN sustainability development goals (SDGs) for #6 of the 17 SDGs addressing clean water and sanitation. This event was billed in the words of the conveners, a “watershed moment to tackle the global water crisis and ensure a water-secure future.” That water-secure future is a critical factor in the well-being for both people and Planet Earth, quantified in the first

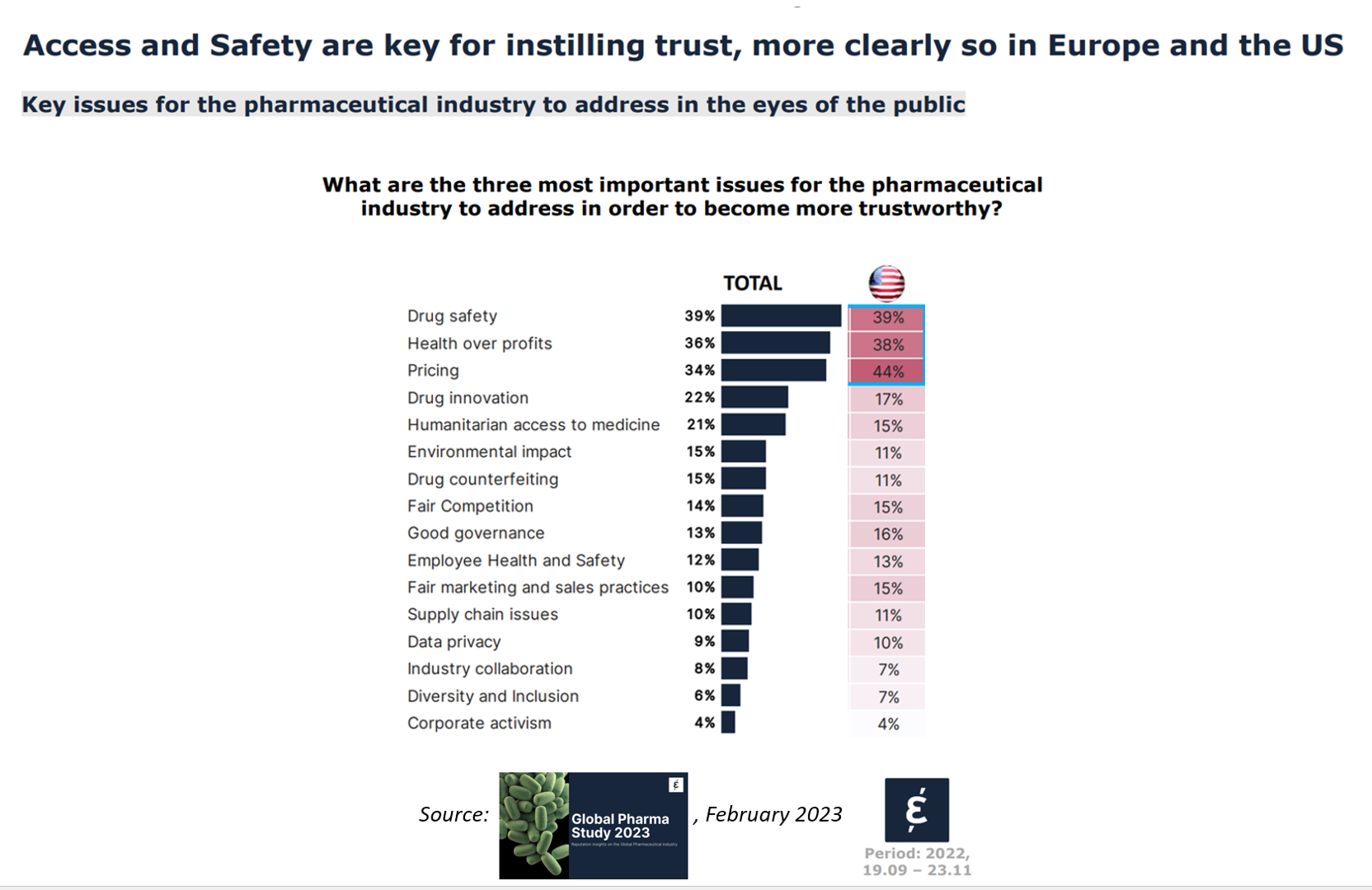

The Reputation of Pharma Among U.S. Consumers Is Tied More to Pricing Than to Innovation

In the U.S., price and the cost of medicines is tied to how people feel about the pharma industry, evidenced in the Global Pharma Study 2023 from Caliber. Caliber, a reputation and corporate strategy consultancy, fielded survey research among over 17,000 health consumers including U.S. adults between 18 and 75 years of age as well as health citizens living in Brazil, China, France, Germany, Japan, and the UK. Caliber assessed the reputation of 16 industries, globally, finding that pharma ranked 10th among the 16, just below automotive and just above chemicals (and well

Quick, Accessible, Inexpensive Health Care – A Retail Health Update from Amazon and Dollar General

Two announcements this week add important initiatives to patients’ growing choices that speak to their consumer-sides’ sense of value and personal healthcare cost-containment: Amazon launched RxPass, a generic medicines subscription service; and, Dollar General promoted its mobile health service powered by DocGo on demand for health visits, “right outside the store.” These two programs come from outside of the legacy health care system of so-called incumbents — hospitals, health systems, health insurance — leveraging two brand-names beloved to many consumers for convenience, price transparency, and sheer cost. First, check out Amazon Pharmacy’s RxPass. Amazon

Record Numbers of People in the U.S. Putting Off Medical Care Due to Cost – A New “Pink Tax” on Women?

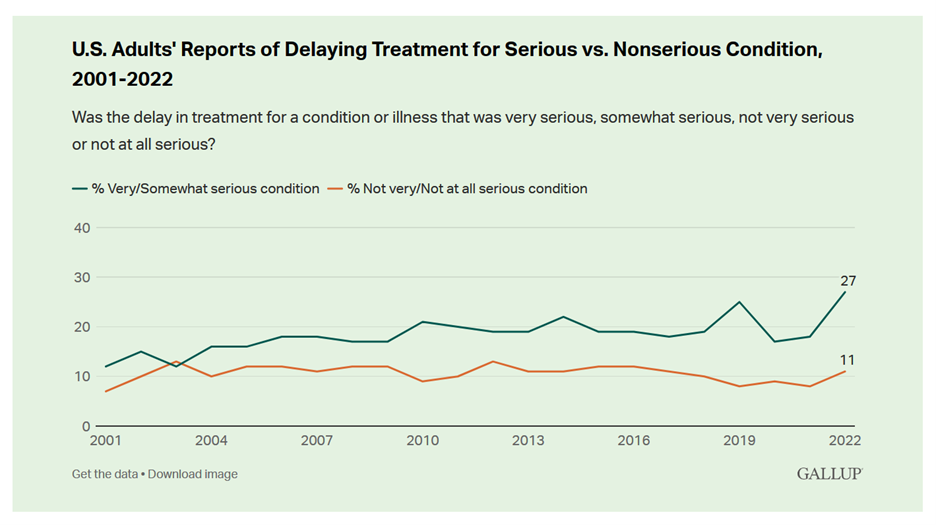

More people in the U.S. than ever have put off medical care due to cost, according to Gallup’s latest poll of patients in America. Gallup conducted the annual Health and Healthcare poll U.S. adults in November and December 2022. This was the highest level of self-rationing care due to cost the pollster has found since its inaugural study on the topic in 2001. This was also the most dramatic year-on-year increase of postponing treatment due to cost in the study’s history. Note the substantial difference in women avoiding

The Polarization of Trust in 2023 – What It Means for Health, via Edelman at Davos WEF 23

For the third year in a row, citizens in most of the world see business as the most-trusted institution, above government, media, and NGOs, found in the 2023 Edelman Trust Barometer, unveiled this week at the annual World Economic Forum in Davos, Switzerland. The Edelman team conducted this 23rd annual study in November 2022 in 28 countries, among over 32,000 people — some 1,150 residents per country polled. (Note that Russia, studied in the surveys between 2007 and 2022, was not included in the 2023 research). The first chart arrays

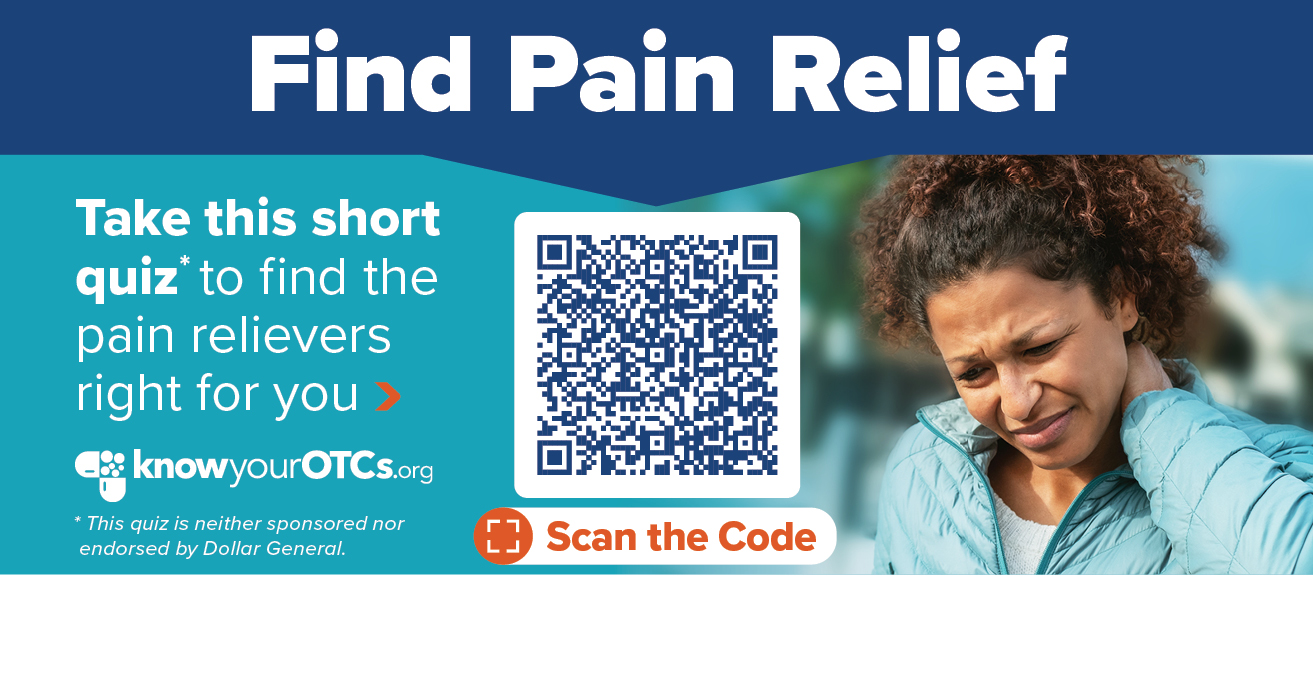

Dollar General & CHPA Collaborate to Bolster Health Consumers’ Literacy and Access for OTC Pain Meds and Self-Care

Health is “made” where we live, work, play, pray, learn….and shop. I spend a lot of time these days in the growing health/care ecosystem where retail health is broadening to address social determinants and drivers of health – namely food, transportation, broadband access, education, environment, and financial wellness – all opportunities for self-care and health engagement. For many years, I have followed the activities of CHPA, the Consumer Healthcare Products Association, and have participated in some of their conferences. Their recent announcement of a collaboration with Dollar General speaks to the growing role of self-care for all people.

The Food-Finance-Health Connection: Being Thankful, Giving Thanks

Food features central in any holiday season, in every one’s culture. For Thanksgiving in the United States, food plays a huge role in the history/legend of the holiday’s origins, along with the present-day celebration of the festival. At the same time, in and beyond the U.S., families’ finances will also be playing a central role in dinner-table conversations, shopping on the so-called “Black Friday” retail season (which has extended long before Friday 25th November), and in what’s actually served up on those tables. Let’s connect some dots today on food, finance and health as we enter the holiday season many

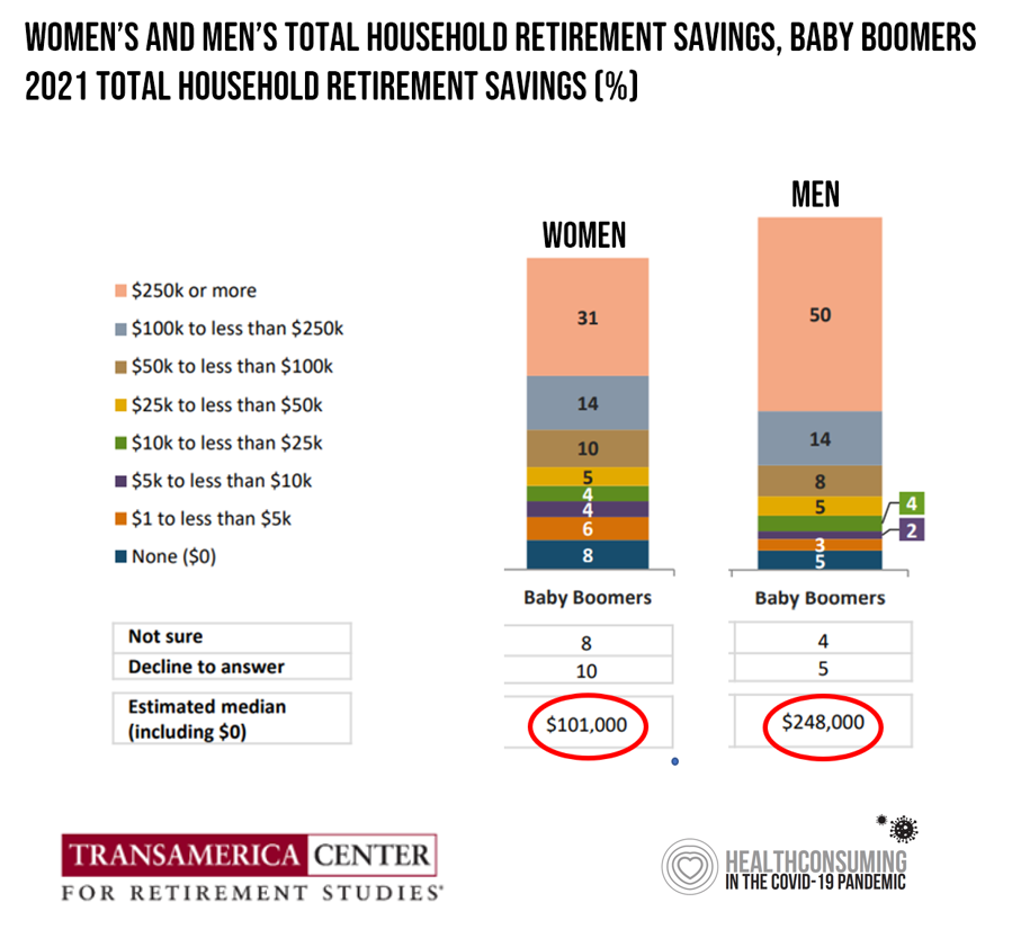

Men Work in Retirement for Healthy Aging; Women, for the Money – Transamerica Looks at Retirement in 2022

Due to gender pay gaps, time away from the workforce for raising children and caring for loved ones, women in the U.S. face a risky retirement outlook according to Emerging from the COVID-19 Pandemic: Women’s Health, Money, and Retirement Preparations from the Transamerica Center for Retirement Studies (TCRS). As Transamerica TCRS sums up the top-line, “Societal headwinds are undermining women’s retirement security.” Simply said, by the time a woman is looking to retire, she has saved less than one-half of the money her male counterpart has put away for aging after work-life. The

Dr. Santa Intends to Deliver Consumer Health-Tech for the 2022 Holidays

Even as consumers’ confess a tighter spending economy for 2022 holiday shopping, peoples’ intent to buy wearable tech for health and fitness and other wellness devices appear on gifting lists in the U.S., according to the 29th Annual Consumer Technology Holiday Purchase Patterns report from the Consumer Technology Association (CTA). In general, technology will be a top-selling category for 2022 holiday gift-giving, somewhat tempered by inflation and the increased cost of living that challenge household budgets in the fourth quarter of 2022. Tech spending will be down about 6% in 2022 according to CTA’s

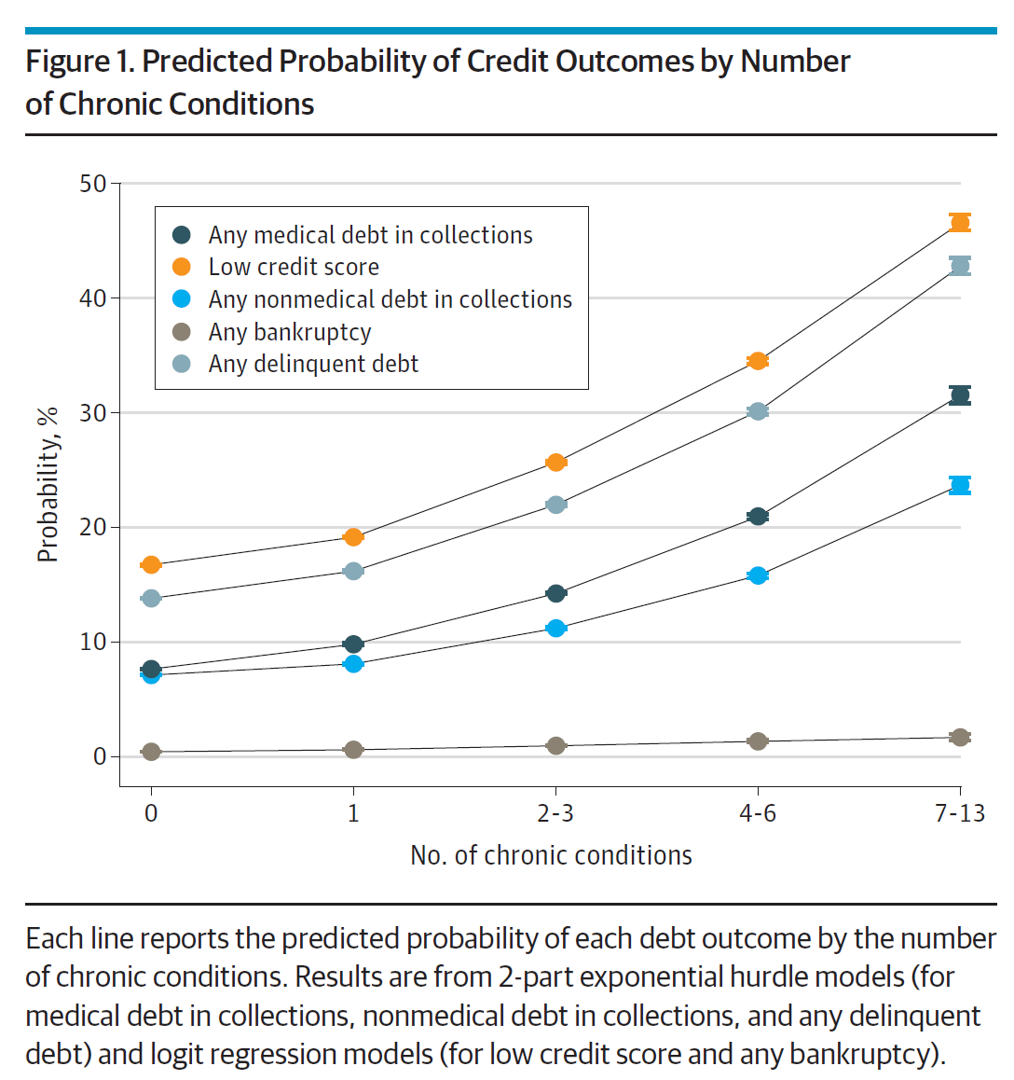

The More Chronic Conditions, the More Likely a Patient Will Have Medical Debt

There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine. Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan. The first chart illustrates the predicted probability of credit outcomes based on the

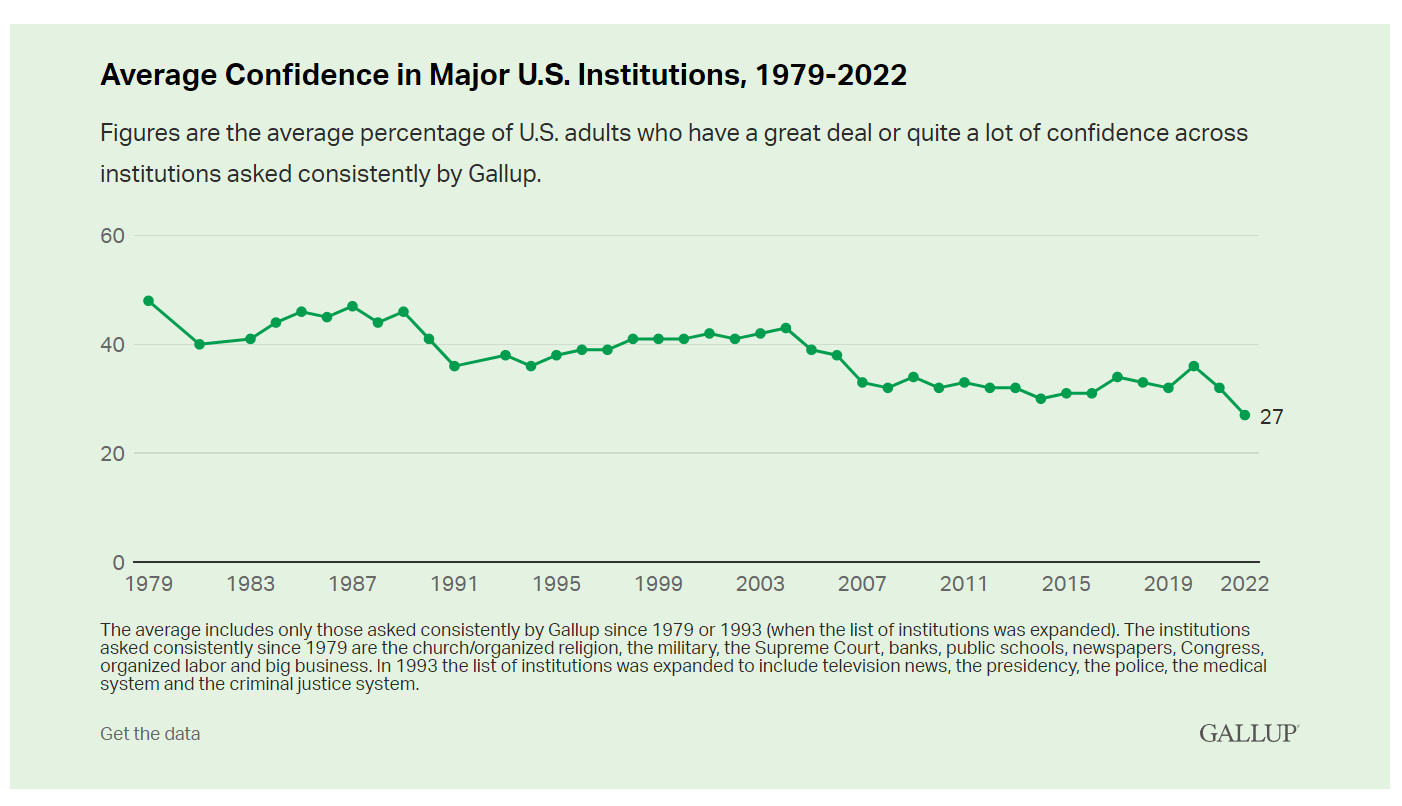

More Americans Trust Small Biz and the Military than the Medical System, Gallup Finds

The most trusted institutions in the U.S. are small business and the military, the only two sectors in which a majority of Americans have confidence. Americans’ trust in institutions hit new historic lows in 2022, Gallup found in its latest poll of U.S. sentiment across all major sectors. Today, more Americans have faith in the police than in the medical system, according to a Gallup poll finding that Confidence in U.S. Institutions Down; Average at New Low. published this week of Independence Day 2022. Confidence runs from a higher of 68% for

Consumers’ Dilemma: Health and Wealth, Smartwatches and Transparency

Even as spending on healthcare per person in the United States is twice as much as other wealthy countries in the world, Americans’ health status ranks rock bottom versus those other rich nations. The U.S. health system continues to be marred by health inequalities and access challenges for man health citizens. Furthermore, American workers’ rank top in the world for feeling burnout from and overworked on the job. Welcome to The Consumer Dilemma: Health and Wellness,, a report from GWI based on the firm’s ongoing consumer research on peoples’ perspectives in the wake of

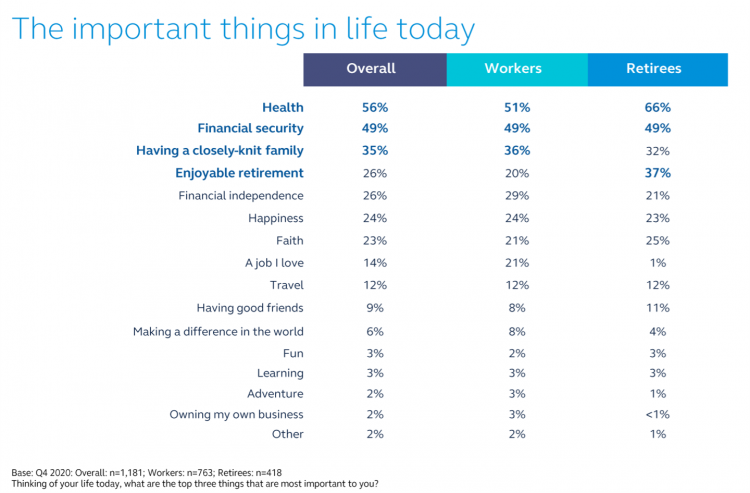

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

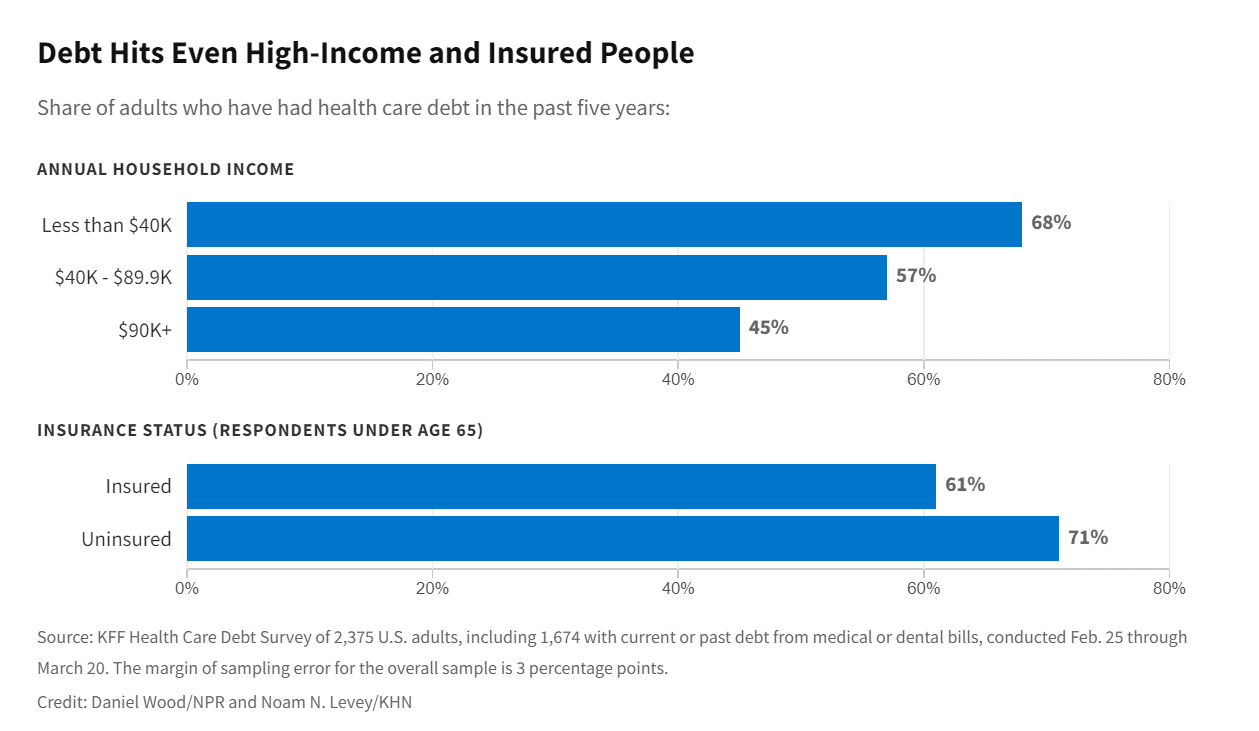

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

How Trust and Geopolitics Will Impact Health and Business – Edelman 2022 Trust Barometer at the World Economic Forum in Davos

When we think about the state of Trust in in mid-2022, there is some good news: Trust is rising (at least in democratic countries, while falling in autocratic ones). The bad news: the gap in Trust has dramatically widened between higher-income people compared with those earning lower-incomes, globally. And that gap is “tinder” that can be quickly sparked into a socio-political fire in countries around the world, Richard Edelman cautioned today when introducing the latest look at the 2022 Edelman Trust Barometer, focusing on geopolitics and business. We have never seen numbers like this

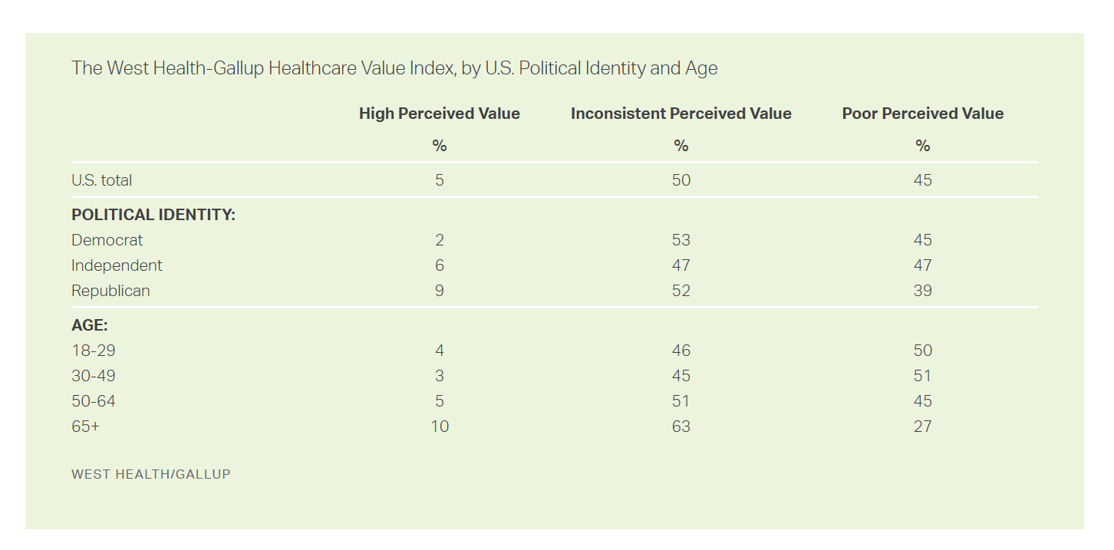

People Thinking More About the Value of Health Care, Beyond Cost

The rate of people in the U.S. skipping needed health care due to cost tripled in 2021. This prompted West Health (the Gary and Mary West nonprofit organizations’ group) and Gallup to collaborate on research to quantified Americans’ views on and challenges with personal medical costs. This has resulted in The West Health-Gallup Healthcare Affordability Index and Healthcare Value Index. The team’s research culminated in the top-line finding that some 112 million people in the U.S. struggle to pay for their care. That’s about 4.5 in 10 health citizens. Furthermore, 93% of people

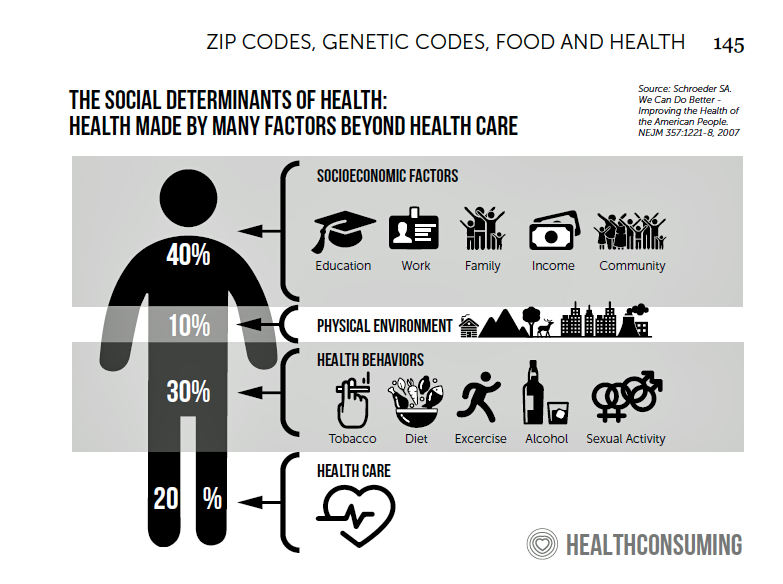

How Business Can Bolster Determinants of Health: The Marmot Review for Industry

“Until now, focus on….the social determinants of health has been for government and civil society. The private sector has not been involved in the discussion or, worse, has been seen as part of the problem. It is time this changed,” asserts the report, The Business of Health Equity: The Marmot Review for Industry, sponsored by Legal & General in collaboration with University College London (UCL) Institute of Health Equity, led by Sir Michael Marmot. Sir Michael has been researching and writing about social determinants of health and health equity for decades, culminating publications

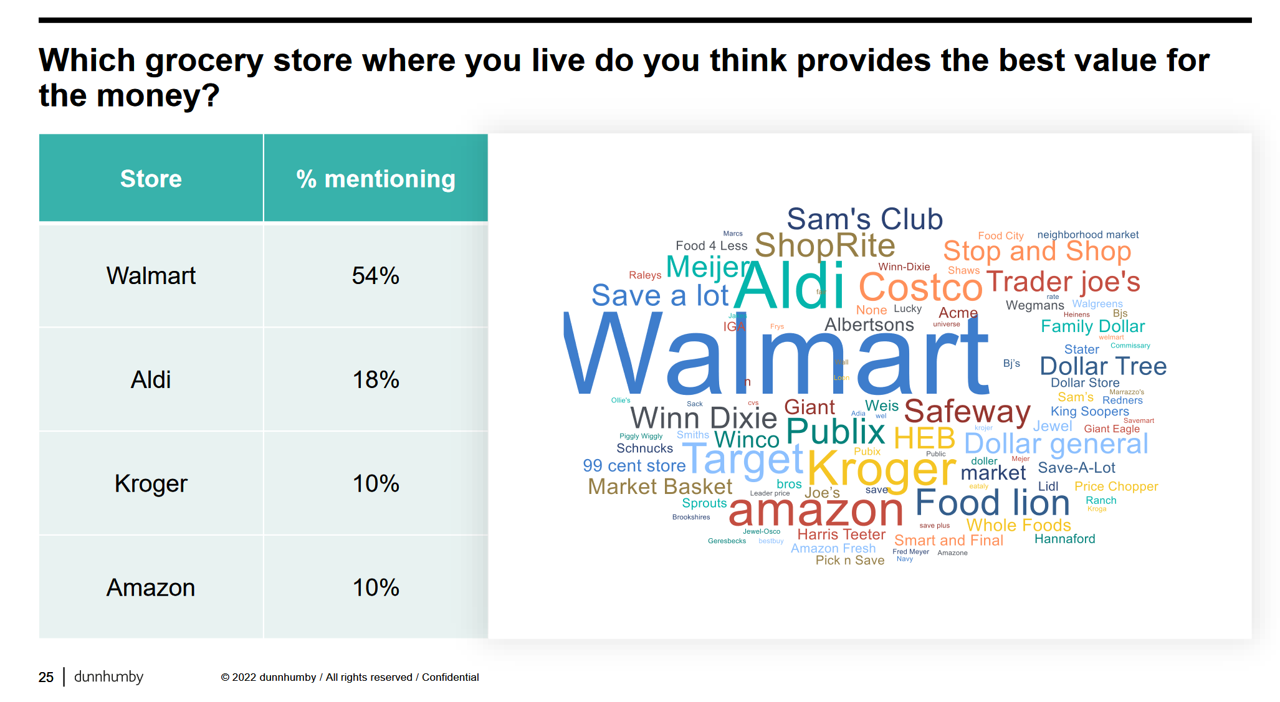

How the Pandemic, Inflation and Ukraine Are Re-Shaping Health Consumers – Learnings from dunnhumby

Too many dollars, stimulated by an influx of COVID-19 government stimulus, are chasing too few goods in economies around the world. Couple this will labor, material shortages, and disrupted supply chains, the exogenous shock of the Ukraine crisis amplifying cost increases and shortage driving higher prices for food and commodities, and global consumers are faced with strains in household budgets. This is impacting grocery stores and. through my lens, will impact health consumers’ spending, as well. In their discussion of Customer First Retailer Responses to Inflationary Times, dunnhumby, retail industry strategists, covered an update on inflation with the top-line that

In the New Inflationary Era, Gas and Health Care Costs Top Household Budget Concerns

Inflation and rising prices are the biggest problem facing America, most people told the Kaiser Family Foundation March 2022 Health Tracking Poll. Underpinning that household budget concern are gas and health care costs. Overall, 55% of people in the U.S. pointed to inflation as the top challenge the nation faces (ranging from 46% of Democrats to 70% of Republicans). Second most challenging problem facing the U.S. was Russia’s invasion into Ukraine, noted by 18% of people — from 14% of Republicans up to 23% of Democrats. The COVID-19 pandemic has fallen far down Americans’ concerns list tied third place with

Food Insecurity, Energy Prices, and Medical Debt Spike in February 2022

There’s a trifecta cost challenge hitting U.S. household budgets in February 2022, highlighted in a poll from Morning Consult: inflationary spikes for housing, food, and energy, and the COVID-19 Omicron variant forcing health care costs up for some consumers driving medical debt up. This further underscores the reality that medical spending in the U.S. is taking shape as a consumer service or good, competing with — potentially crowding out — other household line items like food and increasingly costly petrol to fill gas tanks. Or taken the other way, gas and food crowding out health care spending, leading to either

Love and Health: The Education of Abner Mason, SameSky Health

It felt super appropriate that I met up with Abner Mason, Founder of SameSky Health, on Valentine’s Day 2022. While we conversed via Zoom, Abner’s positive energy vibrated over the 5,600 miles between him in LA County and me in Brussels, Belgium – nine hours apart, but in the proverbial same room in the conversation. My initial ask of Abner was to discuss the re-branding of ConsejoSano to SameSky Health, but I first wanted to hear the man’s origin story. And that, you will learn, has everything to do with loving parents, the power of education from a young age,

Health Care Planning for 2022 – Start with a Pandemic, Then Pivot to Health and Happiness

One of my favorite Dr. Seuss characters is the narrator featured in the book, I Had Trouble In Getting to Solla-Sollew. I frequently use this book when conducting futures and scenario planning sessions with clients in health/care. “The story opens with our happy-go-lucky narrator taking a stroll through the Valley of Vung where nothing went wrong,” the Seussblog explains. Then one day, our hero (shown here on the right side of the picture from the book) is not paying attention to where he is walking….thus admitting, “And I learned there are troubles of more than one kind, some come from

The 2022 Health Populi TrendCast for Consumers and Health Citizens

I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra: “”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,” coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law. This feels especially apt right “now” as we enter 2022,

Does Inequality Matter in the U.S.? Health and the Great Gatsby Curve

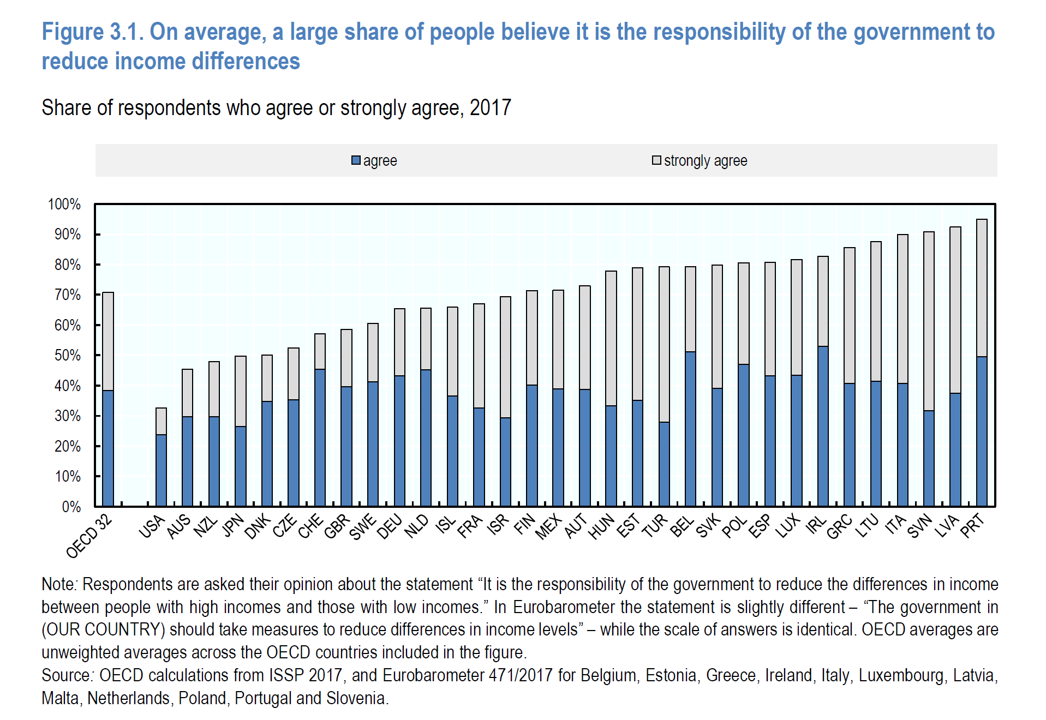

Compared with the rest of the developed world, people living in the U.S. may be concerned about income inequality, but their demand for income redistribution is the lowest among peer citizens living in 31 other OECD countries. In their latest report, Does Inequality Matter? the OECD examines how people perceive economic disparities and social mobility across the OECD 32 (the world’s developed countries from “A” Australia to “U,” the United Kingdom). Overall the OECD 32 average fraction of people who believe it is the government’s responsibility to reduce income differences among those who think disparities are too large is 80%

Be Mindful About What Makes Health at HLTH

“More than a year and a half into the COVID-19 outbreak, the recent spread of the highly transmissible delta variant in the United States has extended severe financial and health problems in the lives of many households across the country — disproportionately impacting people of color and people with low income,” reports Household Experiences in America During the Delta Variant Outbreak, a new analysis from the Robert Wood Johnson Foundation, NPR, and the Harvard Chan School of Public Health. As the HLTH conference convenes over 6,000 digital health innovators live, in person, in Boston in the wake of the delta

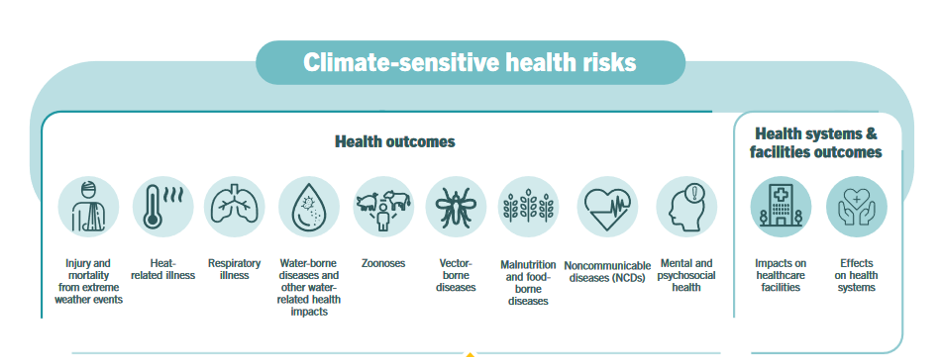

The Biggest Threat to Our Health Isn’t the Next Pandemic or Cancer…It’s Climate Change

Before the coronavirus emerged, the top causes of death in developed countries were heart disease, cancers, diabetes, and accidents. Then COVID-19 joined the top-10 list of killers in the U.S. and the issue of pandemic preparedness for the next “Disease X” became part of global public health planning. But the biggest health threat to human life is climate change, according to a new report from the World Health Organization titled The Health Argument for Climate Action. It’s WHO’s special report on climate change and health, dedicated to the memory of Ella Kissi-Debrah — a child who died succumbing to impacts

Genentech’s Look Into the Mirror of Health Inequities

In 2020, Genentech launched its first study into health inequities. The company spelled out their rationale to undertake this research very clearly: “Through our work pursuing groundbreaking science and developing medicines for people with life-threatening diseases, we consistently witness an underrepresentation of non-white patients in clinical research. We have understood inequities and disproportionate enrollment in clinical trials existed, but nowhere could we find if patients of color had been directly asked: ‘why?’ So, we undertook a landmark study to elevate the perspectives of these medically disenfranchised individuals and reveal how this long-standing inequity impacts their relationships with the healthcare system

Health Disparities in America: JAMA Talks Structural Racism in U.S. Health Care

“Racial and ethnic inequities in the US health care system have been unremitting since the beginning of the country. In the 19th and 20th centuries, segregated black hospitals were emblematic of separate but unequal health care,” begins the editorial introducing an entire issue of JAMA dedicated to racial and ethnic disparities and inequities in medicine and health care, published August 17, 2021. This is not your typical edition of the Journal of the American Medical Association. The coronavirus pandemic has changed so many aspects of American health care for so many people, including doctors. Since the second quarter of 2020,

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

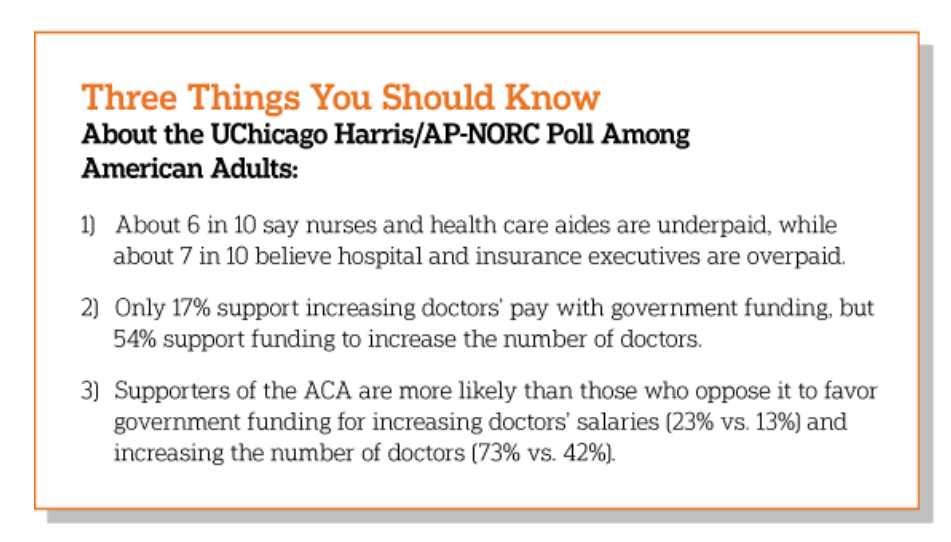

Nurses and Aides Are Beloved and Deserve Higher Pay; and a Spotlight on the Filipinx Frontline

A majority of Democrats, Independents, and Republicans agree that nurses are underpaid. Most Americans across political parties also believe that hospital executives are overpaid, according to a poll from The Associated Press-NORC Center for Public Affairs Research. The survey analysis is aptly titled, Most Americans Agree That Nurses and Aides Are Underpaid, While Few Support Using Federal Dollars to Increase Pay for Doctors, . Insurance executives are also overpaid, according to 73% of Americans — an even higher percent of people than the 68% saying hospital execs make too much money. In addition to nurses being underpaid, 6 in 10

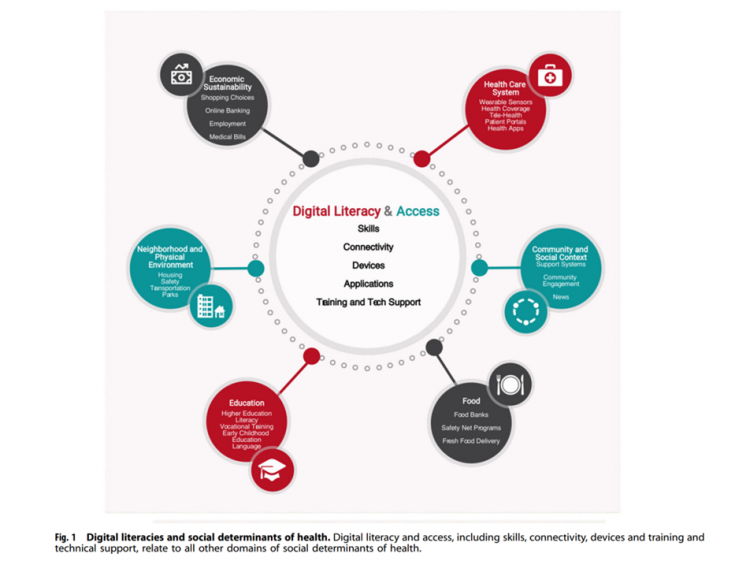

Digital Inclusion As Upstream Health Investment

Without access to connectivity during the pandemic, too many people could not work for their living, attend school and learn, connect with loved ones, or get health care. The COVID-19 era has shined a bright light on what some of us have been saying since the advent of the Internet’s emergence in health care: that digital literacies and connectivity are “super social determinants of health” because they underpin other social determinants of health, discussed in Digital inclusion as a social determinant of health, published in Nature’s npj Digital Medicine. On the downside, lack of access to digital tools and literacies

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

And the Oscar Goes To….Power to the Patients!

Health care has increased its role in popular culture over the years. In movies in particular, we’ve seen health care costs and hassles play featured in plotlines in As Good as it Gets [theme: health insurance coverage], M*A*S*H [war and its medical impacts are hell], and Philadelphia [HIV/AIDS in the era of The Band Played On], among dozens of others. And this year’s Oscar winner for leading actor, Anthony Hopkins, played The Father, who with his family is dealing with dementia. [The film, by the way, garnered six nominations and won two]. When I say “Oscar” here on the Health

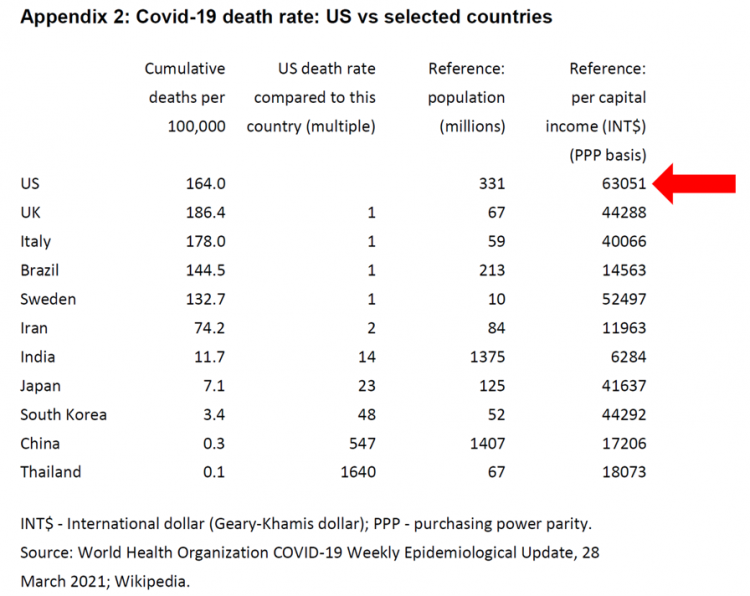

The Pandemic’s Death Rate in the U.S.: High Per Capita Income, High Mortality

The United States has among the highest per capita incomes in the world. The U.S. also has sustained among the highest death rates per 100,000 people due to COVID-19, based on epidemiological data from the World Health Organization’s March 28, 2021, update. Higher incomes won’t prevent a person from death-by-coronavirus, but risks for the social determinants of health — exacerbated by income inequality — will and do. I have the good fortune of access to a study group paper shared by Paul Sheard, Research Fellow at the Mossaver-Rahmani Center for Business and Government at the Harvard Kennedy School. In reviewing

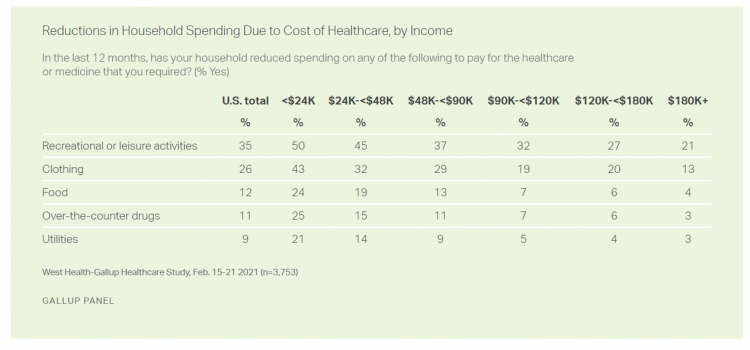

The Cost of Healthcare Can Drive Medical Rationing and Crowd Out Other Household Spending

One in five people in the U.S. cannot afford to pay for quality health care — an especially acute challenge for Black and Hispanic Americans, according to a West Health-Gallup poll conducted in March 2021, a year into the COVID-19 pandemic. “The cost of healthcare and its potential ramifications continues to serve as a burdensome part of day-to-day life for millions of Americans,” the study summary observed. Furthermore, “These realities can spill over into other health issues, such as delays in diagnoses of new cancer and associated treatments that are due to forgoing needed care,” the researchers expected. The first table

The Ongoing Reality of COVID-19 – My Conversation with Dr. Michael Osterholm at SXSW

“So close and yet so far” feels like the right phrase to use a year after the World Health Organization used the “P-word,” “pandemic,” to describe the coronavirus’s impact on public health, globally. One year and over 550,000 COVID-related deaths in the U.S. later, we face a New Reality that Dr. Michael Osterholm and I are brainstorming today at the 2021 South-by-Southwest Festival. Usually held live and very up-close-and-personally crowded in Austin, Texas, this year we are all virtual — including the film, music, and interactive festivals alike. While I regret to not be in the same room as Dr.

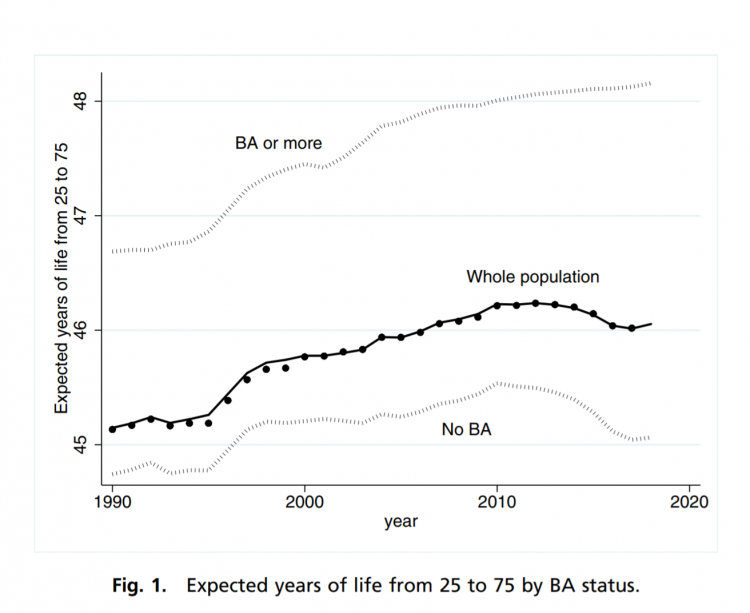

A BA Degree as Prescription for a Longer Life – Update on Deaths of Despair from Deaton and Case

“Without a four-year college diploma, it is increasingly difficult to build a meaningful and successful life in the United States,” according to an essay in PNAS, Life expectancy in adulthood is falling for those without a BA degree, but as educational gaps have widened, racial gaps have narrowed by Anne Case and Angus Deaton. Case and Deaton have done extensive research on the phenomenon of Deaths of Despair, the growing epidemic of mortality among people due to accidents, drug overdoses, and suicide. Case and Deaton wrote the book on Deaths of Despair (detailed here in Health Populi), Case and Deaton

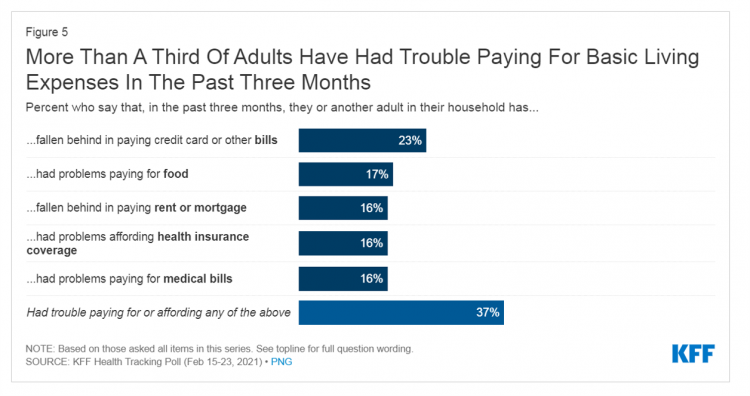

How to Restore Americans’ Confidence in U.S. Health Care: Deal With Access and Cost

With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves. But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices. Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access. The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one

“Hope Springs Eternal” With the COVID Vaccine for Both Joe Biden and Most People in the U.S.

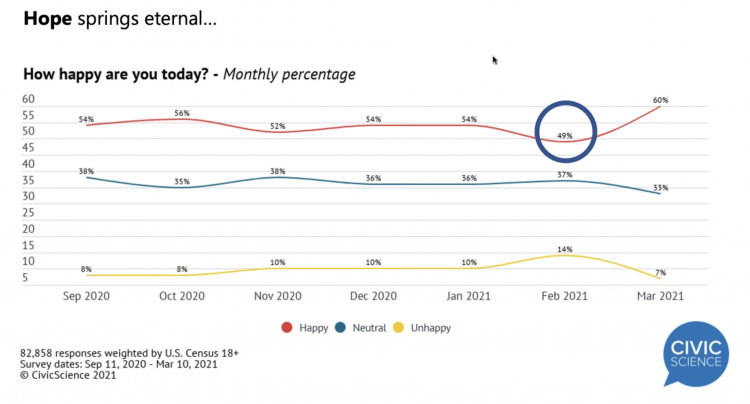

More Americans are happier in March 2021 than they’ve been for a year, based on consumer research from Civic Science polling U.S. adults in early March 2021. For the first time, a larger percent of Americans said they were better off financially since the start of the pandemic. This week, Civic Science shared their latest data on what they’re seeing beyond the coronavirus quarantine era to forecast trends that will shape a post-COVID America. Buoying peoples’ growing optimism was the expectation of the passage of the American Cares Act, which President Biden signed into effect yesterday. The HPA-CS Economic Sentiment Index

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

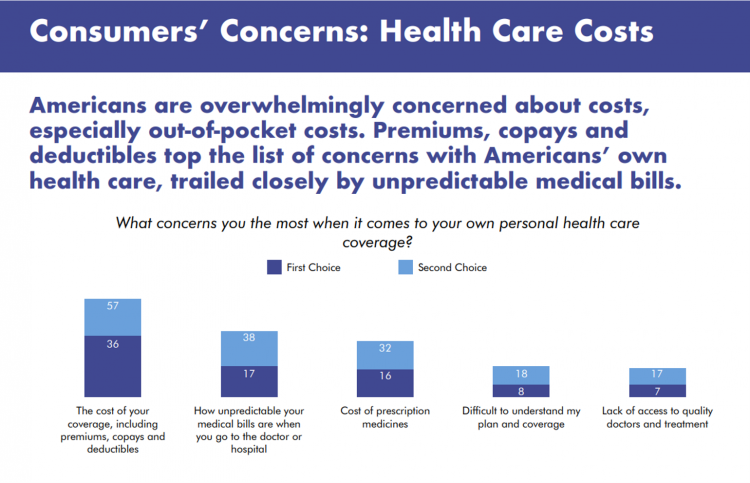

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

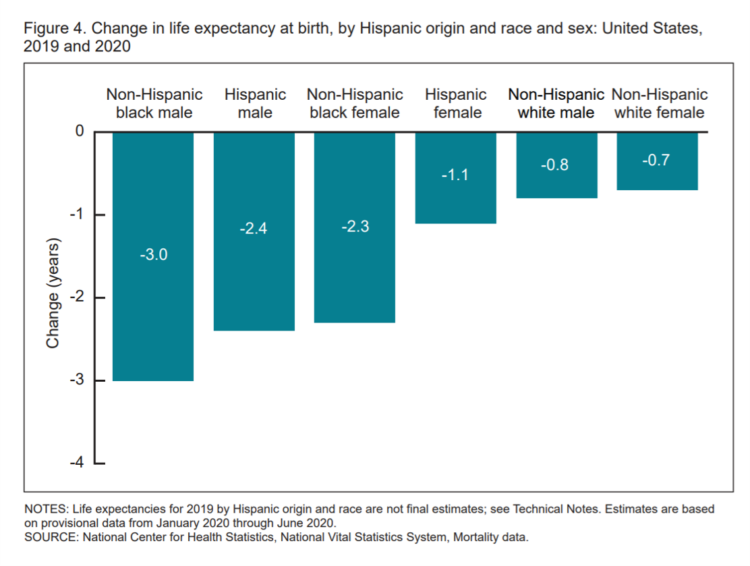

Americans Lost Future Life-Years in 2020: How Much Life Was Lost Depends on the Color of One’s Skin

Some people remark about 2020 being a “lost year” in the wake of the coronavirus pandemic. That happens to be a true statement, sadly not in jest: in the U.S., life expectancy at birth fell by one full year over the first half of 2020 compared with 2019, to 77.8 years. In 2019, life expectancy at birth was 78.8 years, according to data shared by the National Center for Health Statistics (NCHS), part of the Centers for Disease Control and Prevention (CDC). Life expectancy at birth declined for both females and males, shown in the first chart. The differences between

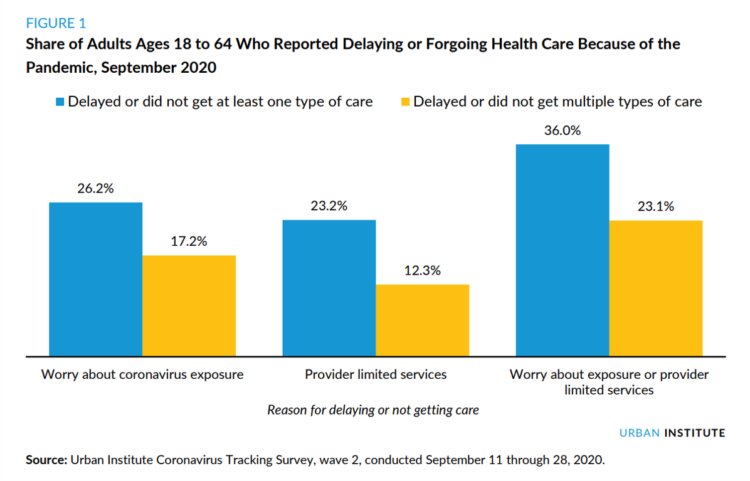

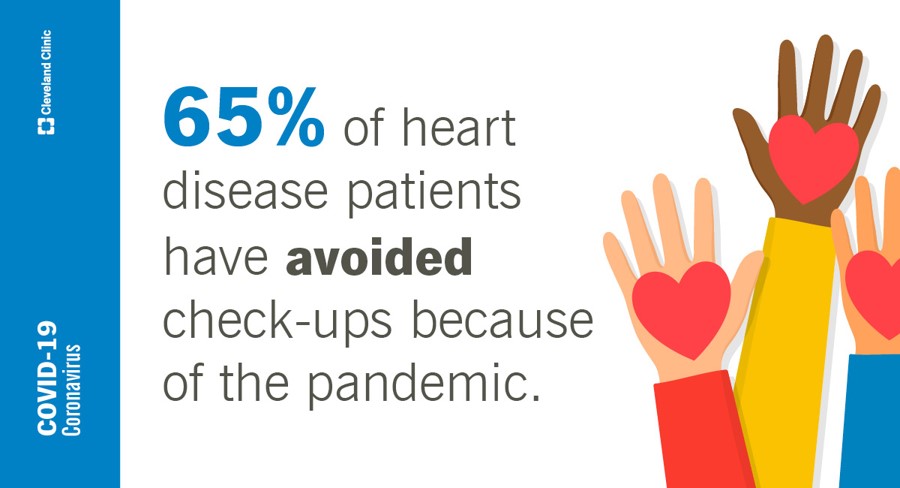

Three in Four People Avoiding Health Care in the Pandemic Have Had Chronic Conditions

By the autumn of 2020, U.S. physicians grew concerned that patients who were avoiding visits to doctor’s offices were missing care for chronic conditions, discussed in in Delayed and Forgone Health Care for Nonelderly Adults during the COVID-19 Pandemic from the Urban Institute. More than three-fourths of people who delayed or forewent care had at least one chronic health condition. The pandemic may have led to excess deaths from diabetes, dementia, hypertension, heart disease, and stroke, as well as record drug overdoses in the 12 months ending in May 2020. In their JAMA editorial on these data, Dr. Bauchner and

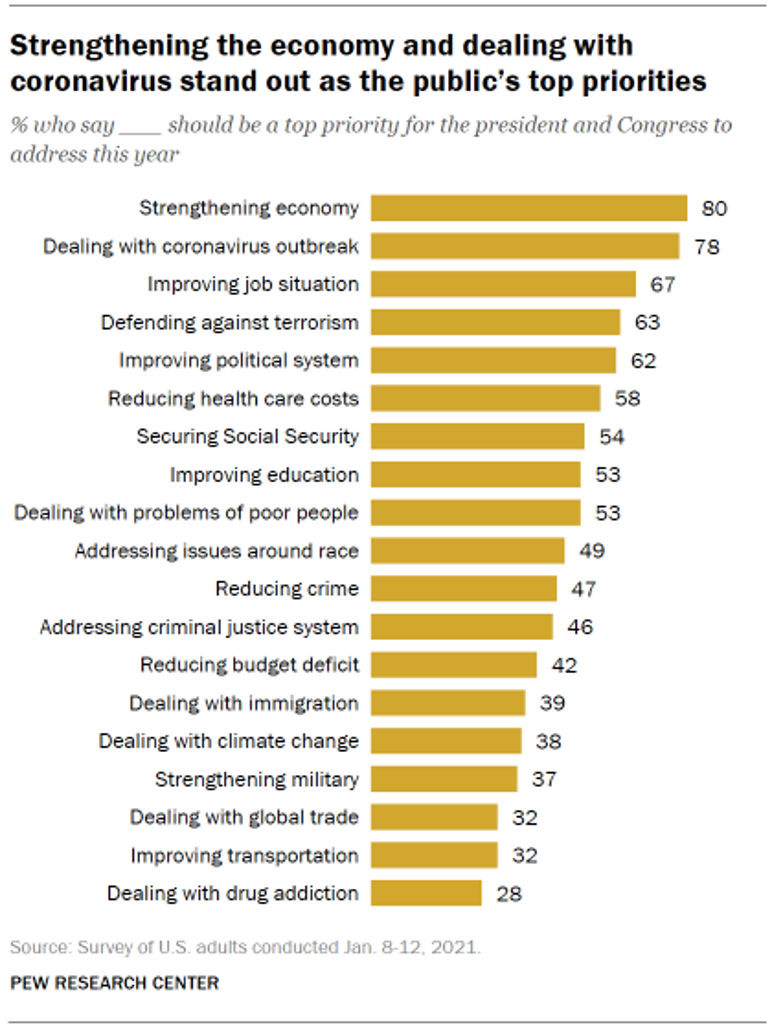

Americans A Year Into the Pandemic – A View from Pew

Nearly a year into the COVID-19 pandemic, the same percent of Americans say strengthening the U.S. economy and dealing with the coronavirus outbreak should be a top priority for President Biden and Congress to address this year, according to data from the Pew Research Center collected during the second week of January 2021. Two-thirds of people in the U.S. also want government leaders to prioritize improving the employment situation, defending against terrorism, and improving the political system, the study learned. At Americans’ low end of the priority list for the President and Congress are dealing with global trade, improving transportation,

Call It Deferring Services or Self-Rationing, U.S. Consumers Are Still Avoiding Medical Care

Patients in the U.S. have been self-rationing medical care for many years, well before any of us knew what “PPE” meant or how to spell “coronavirus.” Nearly a decade ago, I cited the Kaiser Family Foundation Health Security Watch of May 2012 here in Health Populi. The first chart here shows that one in four U.S. adults had problems paying medical bills, largely delaying care due to cost for a visit or for prescription drugs. Fast-forward to 2020, a few months into the pandemic in the U.S.: PwC found consumers were delaying treatment for chronic conditions. In October 2020, The American Cancer

Can Telemedicine Increase Health Equity? A Conversation with Antoinette Thomas, Dave Ryan, and Me with the ATA

“Yes,” we concurred on our session convened by the American Telemedicine Association (ATA) EDGE session today. “We” was a trio including Antoinette Thomas (@NurseTechExec1), Chief Patient Experience Officer with Microsoft, David Ryan (@DavidPRyan), former long-time Global Head of Intel’s Health/Life Science business; and, me. Antoinette posed three questions for all of us to brainstorm, addressing various aspects of health equity. We covered, The theory that telemedicine should increase health equity — where are we and what are the barriers to getting there? The role of social determinants of health in creating equitable opportunities for health citizens; and, Entering a post-pandemic world,

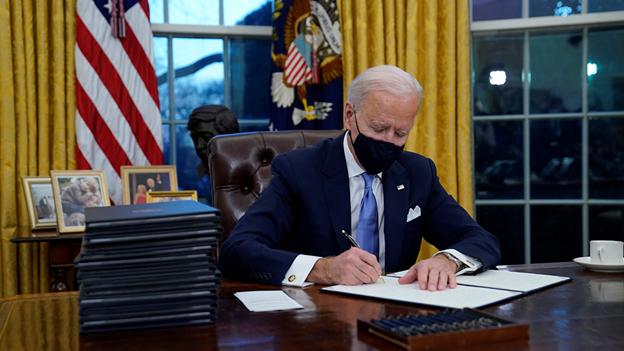

The Biden Administration’s Whole-of-Government Approach to Equity – in Health and Beyond

In the U.S., the COVID-19 pandemic has revealed disparities in housing, food, and job security, and the role that one’s ZIP code and social determinants play in health outcomes. Overall, America has done poorly in light of being 4% of the world’s population but having one-fifth of the planet’s deaths due to the coronavirus. But these have disproportionately hit non-white people, who are nearly three times as likely to die from COVID-19 than white Americans. I’ve been head-down reviewing the first two days of President Biden’s signing Executive Orders, reading the National Strategy for COVID-19 Response, and inventorying line items

Preaching Health Equity in the Era of COVID on Martin Luther King, Jr. Day

Today as we appreciate the legacy of Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would deliver two months later in Washington, DC. Wisdom from the speech: “But now more than ever before, America is forced to grapple with this problem, for the shape of the world today does not afford us the luxury of an anemic democracy. The price that this nation must pay for the continued oppression and exploitation of the Negro or any other minority group is

“The virus is the boss” — U.S. lives and livelihoods at the beginning of 2021

“The virus is the boss,” Austan Goolsbee, former Chair of the Council of Economic Advisers under President Obama, told Stephanie Ruhle this morning on MSNBC. Goolsbee and Jason Furman, former Chair of Obama’s Council of Economic Advisers, tag-teamed the U.S. economic outlook following today’s news that the U.S. economy lost 140,000 jobs — the greatest job loss since April 2020 in the second month of the pandemic. The 2020-21 economic recession is the first time in U.S. history that a downturn had nothing to do with the economy per se. As Uwe Reinhardt, health economist guru, is whispering in my

Consumers Seek Health Features in Homes: How COVID Is Changing Residential Real Estate

The coronavirus pandemic has shifted everything that could “come home,” home. THINK: tele-work, home schooling for both under-18s and college students, home cooking, entertainment, working out, and even prayer. All of this DIY-from-home stuff has been motivated by both mandates to #StayHome and #WorkFromHome by government leaders, as well as consumers seeking refuge from contracting COVID-19. This risk-shift to our homes has led consumers to re-orient their demands for home purchase features. Today, home is ideally defined as a safe place, offering comfort and refuge for families, discovered in the America at Home Study. The Study is a joint project of

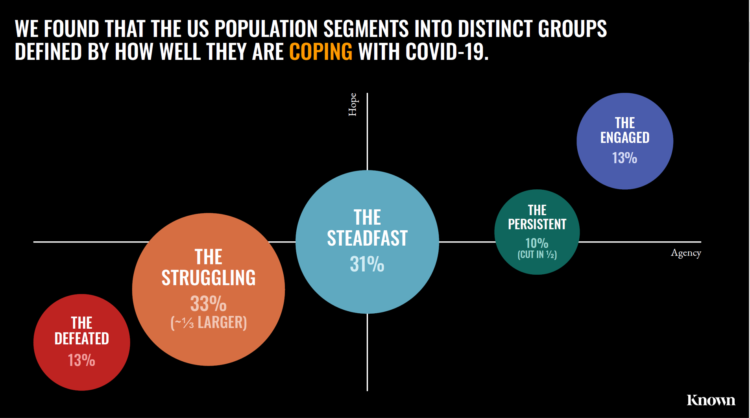

The Pandemic Has Been a Shock to Our System – Learning from Known

The coronavirus pandemic has been a shock to people across all aspects of everyday living, for older and younger people, for work and school, for entertainment and travel — all impacting our hearts, minds, and wallets. “As the bedrock of daily life was shaken, uncertainty predictably emerged as the prevailing emotion of our time but this universal problem was eliciting a highly differentiated reaction in different people,” Kern Schireson, CEO of Known, observed. His company has conducted a large quantitative and qualitative research program culminating in a first report, The Human Condition 2020: A Shock To The System. Known’s team of

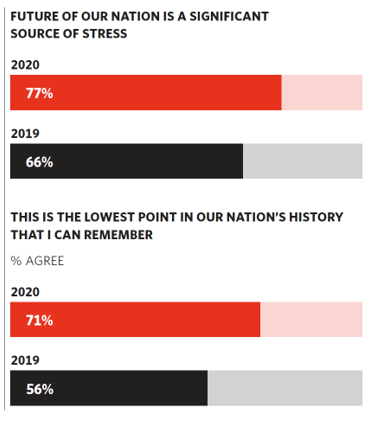

Stress in America, Like COVID-19, Impacts All Americans

With thirteen days to go until the U.S. #2020Elections day, 3rd November, three in four Americans say the future of America is a significant source of stress, according to the latest Stress in America 2020 study from the American Psychological Association. Furthermore, seven in 10 U.S. adults believe that “now” is the lowest point in the nation’s history that they can remember. “We are facing a national mental health crisis that could yield serious health and social consequences for years to come,” APA introduces their latest read into stressed-out America. Two in three people in the U.S. say that the

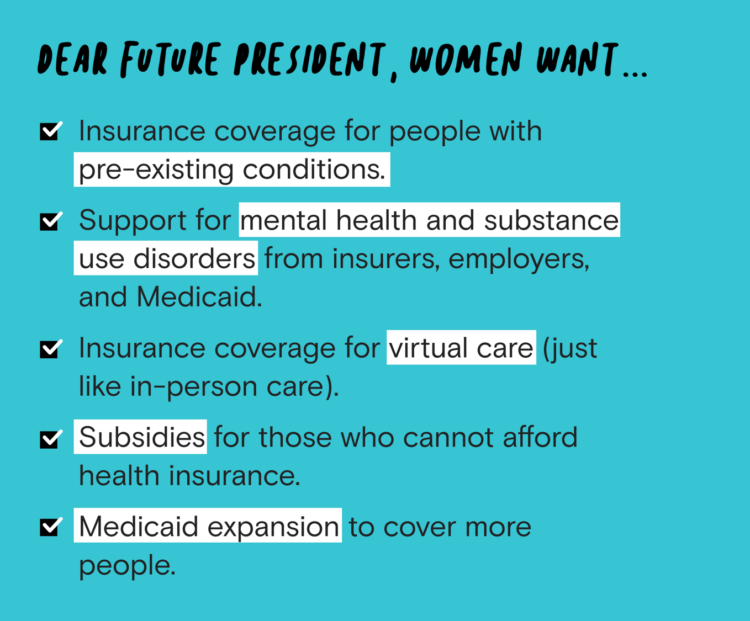

Women’s Health Policy Advice for the Next Occupant of the White House: Deal With Mental Health, the Pandemic, and Health Care Costs

2020 marked the centennial anniversary of the 19th Amendment to the U.S. Constitution, giving women the right to vote. In this auspicious year for women’s voting rights, as COVID-19 emerged in the U.S. in February, women’s labor force participation rate was 58%. Ironic timing indeed: the coronavirus pandemic has been especially harmful to working women’s lives, the Brookings Institution asserted last week in their report in 19A: The Brookings Gender Equality Series. A new study from Tia, the women’s health services platform, looks deeply into COVID-19’s negative impacts on working-age women and how they would advise the next occupant of

The COVID-19 Pandemic Has Accelerated Our Demand for Wellness – Learning from Ogilvy

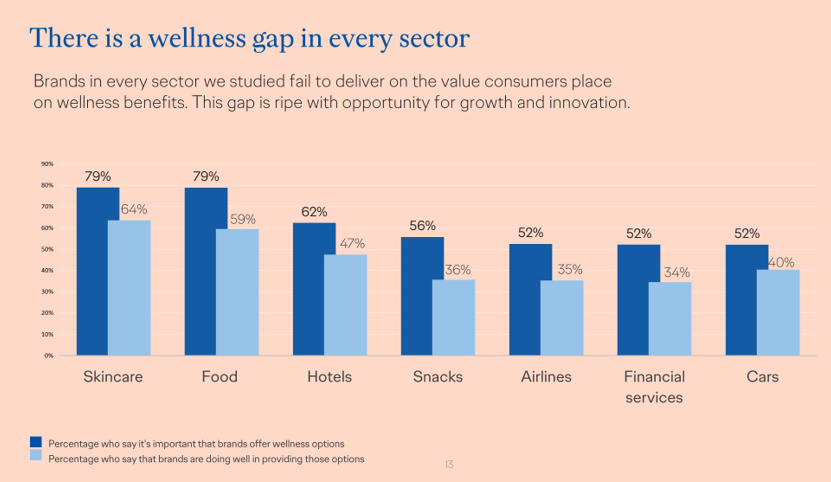

Every company is a tech company, strategy consultants asserted over the past decade. The coronavirus pandemic has revealed that every company is a health and wellness company now, at least in the eyes of consumers around the world. In The Wellness Gap, the health and wellness team at Ogilvy explores the mindsets of consumers in 14 countries to learn peoples’ perspectives on wellness brands and how COVID-19 has impacted consumers’ priorities. A total of 7,000 interviews were conducted in April 2020, in Asia, Europe, Latin America, and North America — including 500 interviews in the U.S. The first chart illustrates

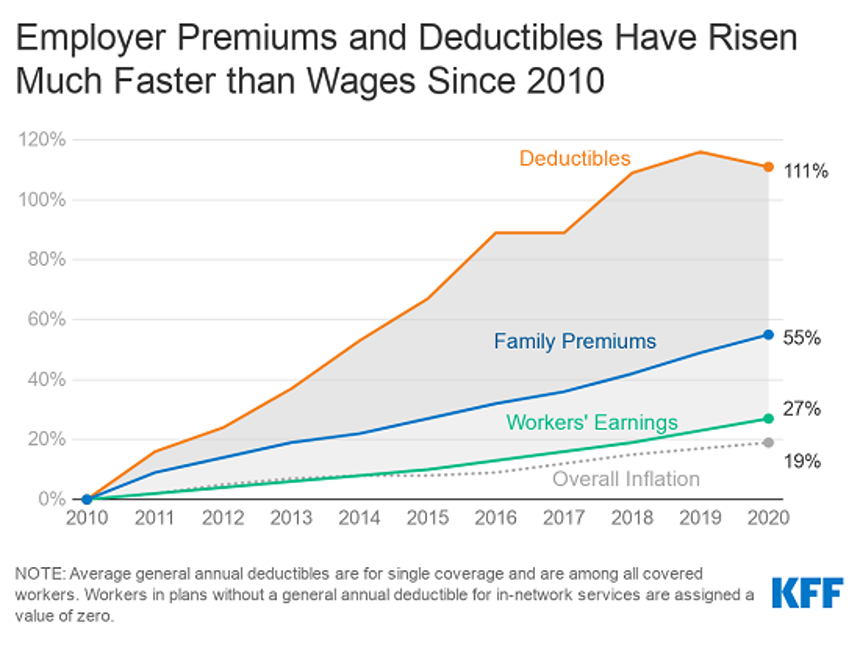

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

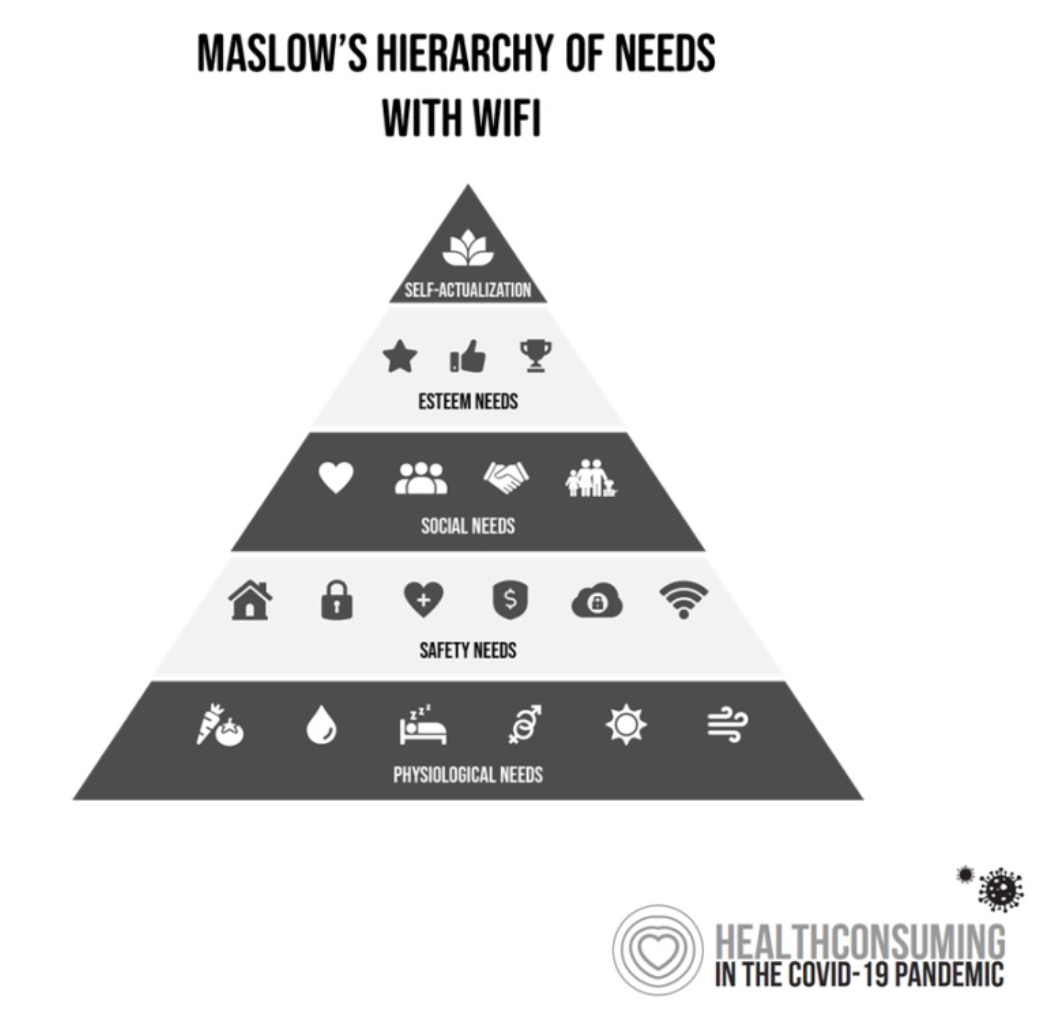

Our Home Is Our Health Hub: CTA and CHI Align to Address Digital and Health Equity

In the pandemic, I’ve been weaving together data to better understand how people as consumers are being re-shaped in daily life across their Maslow Hierarchies of Needs. One of those basic needs has been digital connectivity. People of color have faced many disparities in the wake of the pandemic: the virus itself, exacting greater rates of mortality and morbidity being the most obvious, dramatic inequity. Another has been digital inequity. Black people have had a more difficult time paying for phone and Internet connections during the COVID-19 crisis, we learned in a Morning Consult poll fielded in June 2020. In

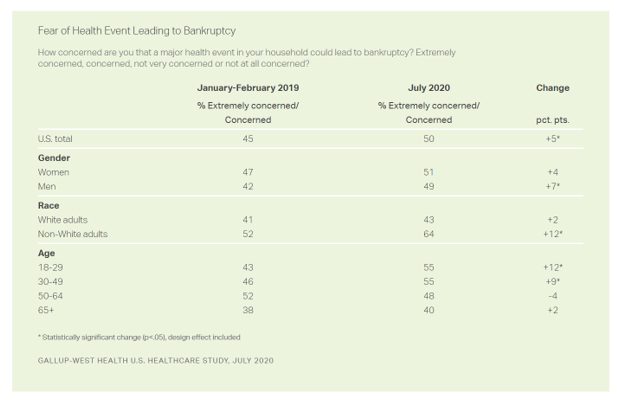

Americans Worry About Medical Bankruptcy, As Prescription Drug Costs Play Into Voters’ Concerns

One in two people in the U.S. are concerned that a major health event in their family would lead to bankruptcy, up 5 percent points over the past eighteen months. In a poll conducted with West Health, Gallup found that more younger people are concerned about medical debt risks, along with more non-white adults, published in their study report, 50% in U.S. Fear Bankruptcy Due to Major Health Event. The survey was fielded in July 2020 among 1,007 U.S. adults 18 and older. One of the basic questions in studies like these is whether a consumer could cover a $500

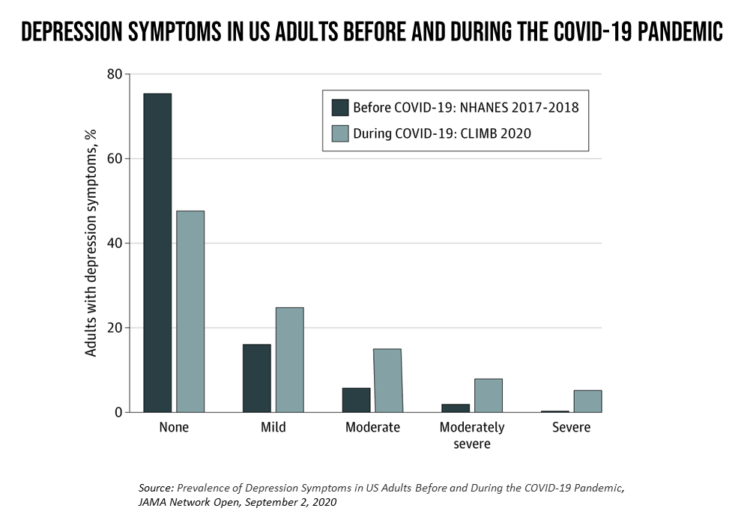

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

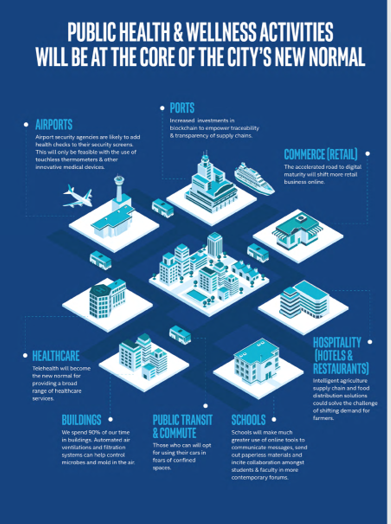

How COVID-19 Is Reshaping Cities and Inspiring Healthcare Innovation

The coronavirus pandemic added a new concept to our collective, popular lexicon: “social distancing” and “physical distancing.” This was one pillar for the public health prescription we were given to help mitigate the spread of a very tricky, contagious virus. A major negative impact of our sheltering in place, working from home, and staying indoors has been a sort of clearing out of cities where people congregate for work, for culture, for entertainment, for education, for travel and tourism…for living out our full and interesting lives and livelihoods. Intel gave Harbor Research a mandate to “re-imagine life in a post-pandemic

We Are All About Hygiene, Groceries, and Personal Care in the Midst of the Coronavirus Pandemic

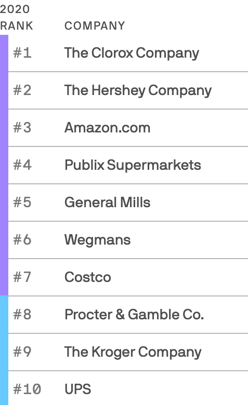

Pass me the Clorox…tip the UPS driver…love thy grocer. These are our daily life-flows in the Age of COVID-19. Our basic needs are reflected in the new 2020 Axios-Harris Poll, released today. For the past several years, I’ve covered the Harris Poll of companies’ reputation rankings here in Health Populi. Last year, Wegmans, the grocer, ranked #1; Amazon, #2. In the wake of the COVID-19 pandemic, U.S. consumers’ basic needs are emerging as health and hygiene, food, and technology, based on the new Axios-Harris Poll on the top 100 companies. This year’s study was conducted in four waves, with the

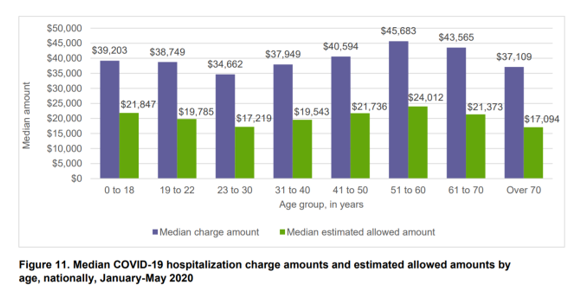

The Median Hospital Charge In the U.S. for COVID-19 Care Ranges From $34-45K

The median charge for hospitalizing a patient with COVID-19 ranged from $34,662 for people 23 to 30, and $45,683 for people between 51 and 60 years of age, according to FAIR Health’s research brief, Key Characteristics of COVID-19 Patients published July 14th, 2020. FAIR Health based these numbers on private insurance claims associated with COVID-19 diagnoses, evaluating patient demographics (age, gender, geography), hospital charges and estimated allowed amounts, and patient comorbidities. They used two ICD-10-CM diagnostic codes for this research: U07.1, 2019-nCoV acute respiratory disease; and, B97.29, other coronavirus as the cause of disease classified elsewhere which was the original code

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast