Women are natural disruptors for health

“Disruption” is a well-used word these days in business and, in the past few years, in the health care business. That’s because there’s a general consensus that the U.S. health care system is broken. “System” is a word that I shouldn’t use as my friend J.D. Kleinke smartly argued that it’s that lack of system-ness that makes using the phrase “health care system” an Oxymoron. The fragmented health care environment creates innumerable pain points when accessing, receiving, and paying for services. And it’s women who feel so much of that pain. In that context, I’m gratified and humbled to be one

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Specialty pharmaceuticals’ costs in the health economic bulls-eye

This past weekend, 60 Minutes’ Leslie Stahl asked John Castellani, the president of PhRMA, the pharmaceutical industry’s advocacy (lobby) organization, why the cost of Gleevec, from Novartis, dramatically increased over the 13 years it’s been in the market, while other more expensive competitors have been launched in the period. (Here is the FDA’s announcement of the Gleevec approval from 2001). Mr. Castellani said he couldn’t respond to specific drug company’s pricing strategies, but in general, these products are “worth it.” Here is the entire transcript of the 60 Minutes’ piece. Today, Health Affairs, the policy journal, is hosting a discussion

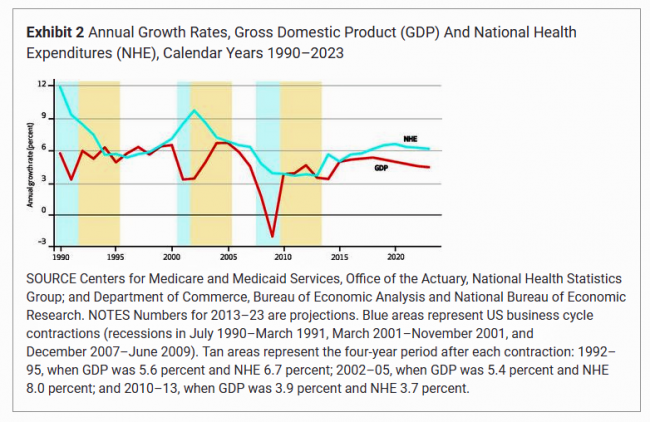

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

Over-the-counter drugs – an asset in the collaborative, DIY health economy

Nations throughout the world are challenged by the cost of health care: from Brazil to China, India to the Philippines, and especially in the U.S., people are morphing into health care consumers. Three categories of health spending in the bulls-eye of countries’ Departments of Health are prescription drugs, and the costs of care in hospitals and doctors’ offices. In the U.S., one tactic for cost containment in health is “switching” certain prescription drugs to over-the-counter products – those deemed to be efficacious and safe for patients to take without seeking treatment from a doctor. Over-the-counter drugs (OTCs) are available every

Consumer healthcare spending is up, and “fun spending” is down

This is the summer of big spending leaps for groceries, gas and health care. Here’s hoping that food, energy and visits to doctors make us happy, because we won’t be getting much joy from travel, dining out, leisure activities, or consumer electronics purchases, all of which are declining in terms of consumer spending. The Gallup survey published July 12, 2014, finds that 59% of people are spending more on groceries, 58% on gas/fuel, and 42% on health care. Net spending on each of those spending categories increased 49%, 46%, and 34% respectively this week compared with one year ago. Personal

Stress Is US

“Reality is the leading cause of stress among those in touch with it,” Lily Tomlin once quipped. Perhaps in 2014, America is the land of stress because we’re all so in touch with reality. THINK: reality TV, social networks as the new confessional, news channeling 24×7, and a world of too much TMI. So no surprise, then, that one-half of the people in the U.S. have had a major stressful event or experience in the last year. And health tops the list of stressful events in This American Life in the forms of illness and disease (among 27% of people)

In pursuit of healthiness – Lancet talks US public health

It’s Independence Day week in America, and our British friends at The Lancet, the UK’s grand peer reviewed medical journal, dedicate this week’s issue to the Health of Americans – exploring life, death (mortality), health costs, chronic disease, and the Pursuit of Healthiness. This project is a joint venture between The Lancet and the U.S. Centers for Disease Control (CDC) which took 18 months to foster, called The Health of Americans Series. Americans mostly die from chronic diseases, aka non-communicable diseases, which are largely amenable to lifestyle changes like eating right, quitting smoking, drinking alcohol in moderation, and moving around more. 1 in

World No Tobacco Day v2014 – let’s raise (more) taxes on tobacco

Tomorrow is World No Tobacco Day. The use of tobacco is one of the most preventable public health issues on the planet. And the global tobacco epidemic contributed to 100 million deaths around the world in the 20th century. 6 million people die every year due to tobacco use — including 600,000 deaths due to exposure to secondhand smoke. About 500 million people living today will be dead from the use of tobacco products if current smoking habits continue, the World Health Organization (WHO) expects. WHO sponsors the World No Tobacco Day every year on May 31. For this year’s

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

The new health economy, starring the consumer

“In the New Health Economy, ‘patients’ will be ‘consumers’ first, with both the freedom and responsibility that come with making more decisions and spending their own money.” This vision of the near-future is brought to you by the New Health Economy, a report from PwC’s Health Research Institute (HRI). The chart attests the fact that U.S. “consumers” are already spending nearly $3 trillion (with a capital “T”) on products and services that bolster personal health. This spending includes $94 billion on nutrition, $62 billion on weight loss, $59 billion on sporting goods and apparel, $45 billion on (so-called) organic and

Your health score: on beyond FICO

Over one dozen scores assessing our personal health are being mashed up, many using our digital data exhaust left on conversations scraped from Facebook and Twitter, via our digital tracking devices from Fitbit and Jawbone, retail shopping receipts, geo-location data created by our mobile phones, and publicly available data bases, along with any number of bits and pieces about ‘us’ we (passively) generate going about our days. Welcome to The Scoring of America: How Secret Consumer Scores Threaten Your Privacy and Your Future. Pam Dixon and Robert Gellman wrote this well-documented report, published April 2, 2014 by The World Privacy Forum.

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

FICO scores for health – chatting with a #BigData pioneer

I had the pleasure of spending quality time brainstorming with Mikki Nasch, co-founder of AchieveMint, yesterday. Mikki worked on the early days of building the FICO score with Fair Isaac, so has been involved in Big Data well before it became the well-#hashtagged buzzword it is today. In our conversation, we talked about the history of FICO and how it took about a decade for consumers to understand it, accept it, and use it as a tool for bettering their credit ratings. When a FICO score was below an acceptable threshold to a lender – say, for a new car

The four futures of health care: simple, guru, ecosystem, self-care

In the not-too-distant future, will our health care be universally available to all, standardized with limited choices? Or, will we be in self-care mode, able to “buy up” if we can afford it like luxury goods? Will health care delivery be totally tech- and information-driven? Or, will care be driven by insurers’ health plans with artful designs that (almost) predetermine our choices? Welcome to four futures of health care, brought to us by PA Consulting whose report, How Can We Stop Healthcare From Bankrupting Our Children? speaks to scenarios based on 2 uncertainties, whether: Health care will be a personal

Where’s TripAdvisor for health care? JAMA on physician ratings sites

As more U.S. health citizens enroll in high-deductible health plans – now representing about 30% of health-insured people in America – health plan members are being called on to play the role of consumer. Among the most important choices the health consumer makes is for a physician. Ratings sites and health care report cards ranking doctors by various characteristics have been in the market for over a decade. However, little has been known on the public’s knowledge about the availability of these information sources, nor of peoples’ use of physician rating sites. This question is addressed in Public Awareness, Perception, and

Health Axioms – inspiring self-care in patients and people

Most people face constraints in following a healthier lifestyle, according to new research from Bain & Company. Stress, time constraints, difficulty changing habits, getting enough sleep, and financial issues all militate against people project managing their health on a daily basis. Enter The Health Axioms, 32 mantras for simplifying healthcare DIY to empower and engage people in self-health. Conceived by health/tech designer Juhan Sonin, who teaches at MIT and is part of the team at Involution Studios, Health Axioms are 32 messages each designed on a 2×3 inch card and packaged as a deck to inspire and support health outside

A CT for $300 or $2,781 – why health price transparency matters

Charges for medical, pharmacy and dental services can vary by more than 300%. This means that in one place, a procedure that costs $100 can cost $300 for the same treatment in another location or practice, discovered by Change Healthcare in their latest Healthcare Transparency Index 2013 Q3 Report, published in January 2014. The 300% is the average overall across dozens of health services used by the 67,000 plan members Change Healthcare analyzed based on health plan enrollees’ health care utilization in the third quarter of 2013. These health care services include office visits (behavioral health, physical therapy and

What CVS going tobacco-free means for health and business

Bravo! to CVS/pharmacy who today announced it would pull tobacco products from store shelves by October 2014. “The sale of tobacco products is inconsistent with our purpose,” the company’s press release asserts. The move will cost CVS $1.5 billion in revenue annually, as the company seeks to consolidate its position as a health company. CVS/pharmacy is part of CVS Caremark, which includes the retail pharmacy chain (the second-largest in the U.S.), a pharmacy benefit management company (Caremark), and retail health clinics (Minute Clinics). CVS Caremark also participates in a healthy communities program issuing grants for projects that focus on health

U.S. families face medical financial burdens; health care in the SOTU

A growing proportion of American families are facing money problems related to health care, according to the report, Financial Burden of Medical Care: A Family Perspective, No. 142 in the NCHS Data Brief series from the CDC, published January 2014 and based on 2012 data. 1 in 4 families are dealing with some financial burden due to medical care. “Financial burdens” in health include problems paying medical bills in the past 12 months, shared by 16.5% of families; and medical bills being paid over time, faced by 21.4% of families. 1 in 10 families (9%) have medical bills they are

Employers will strongly focus on costs in health benefit plans for 2014; so must consumers

Employers who sponsor health insurance in America are at a fork on a cloudy road: they know that they’re in the midst of changes happening in the U.S. health system. Except for one certainty: that health care costs too much. So employers’ plans for health benefits in 2014 strongly focus on getting a return-on-investment from health spending in an uncertain climate, according to Deloitte’s 2013 Survey of U.S. Employers. Key findings are that: Employers will grow their use of workers’ cost-sharing, continuing to shift more financial responsibility onto employees They will expand other tactics they believe will help address cost

Color us stressed – how to deal

Coast-to-coast, stress is the modus vivendi for most Americans: 55% of people feel stressed in every day life, according to a study from Televox. A Stressful Nation: Americans Search for a Healthy Balance paints a picture of a nation of physically inactive people working too hard and playing too little. And far more women feel the stress than men do. 64% of people say they’re stressed during a typical workday. 52% of people see stress negatively impacting their lives. And nearly one-half of people believe they could better manage their stress. As a result, physicians say that Americans are experiencing negative

There’s fear of health care costs in peoples’ retirement visions

While working people in the U.S. are feeling better about the nation’s economy, Americans aren’t putting much money into savings for retirement. The reasons for this are many, but above all is what Mercer calls “the specter of health care costs in retirement” in the Mercer Workplace Survey for 2013. In addition to peoples’ concerns about future health care costs, reasons for not putting money away for the future include flat personal income, slow economic growth and financial literacy challenges around how much 401(k) savings can be tax-deferred. On the slow economic growth perception, Mercer found that, on the upside, people

Bundles in health care are the prix fixe menu

Ordering up and financing health care in the U.S. looks like the proverbial Chinese food menu, picking and paying for “one from column A, and one from column C.” But that’s no way to operate a well-oiled machine for delivering quality health care, according to Healthcare Shifts from á la Carte to Prix Fixe from Strategy&, an analysis of the fragmented, high-cost and only fair quality American health system. One solution to this challenge is bundled payment. “No one has an overarching view of the entire process,” the report opines, “with an eye toward improving customer service, quality, or costs.” Further exacerbating the sub-optimal

A new medical side-effect: out-of-pocket health care costs

When we say the phrase “side effects,” what do we think of? The FDA says that “all medicines have benefits and risks. The risks of medicines are the chances that something unwanted or unexpected could happen to you when you use them. Risks could be less serious things, such as an upset stomach, or more serious things, such as liver damage.” There’s a new risk in town in health care, and it’s the equivalent of an upset stomach when it comes to a co-pay for a branded on-formulary drug, or liver damage if it involves a coinsurance percent of “retail”

Whither price transparency in health care? The supply side may be growing faster than consumer demand

Online shopping for health care can drive costs down, according to research conducted by HealthSparq, a company that works with health insurance companies to channel health cost information to plan members (that is, consumers). Healthsparq partnered with one of the company’s health insurance company clients to conduct this study, which demonstrated that, over two years, consumers who used an online treatment cost estimator saved money on care for hernia conditions, digestive conditions, and women’s health issues. It’s early days for health care price transparency in health care, but HealthSparq’s findings demonstrate positive evidence that when consumers are offered a tool

7 Women and 1 Man Talking About Life, Health and Sex – Health 2.0 keeping it real

Women and binge drinking…job and financial stress…sleeplessness…caregiving challenges…sex…these were the topics covered in Health 2.0 Conference’s session aptly called “The Unmentionables.” The panel on October 1, 2013, was a rich, sobering and authentic conversation among 7 women and 1 man who kept it very real on the main stage of this mega-meeting that convenes health technology developers, marketers, health providers, insurers, investors, patient advocates, and public sector representatives (who, sadly, had to depart for Washington, DC, much earlier than intended due to the government shutdown). The Unmentionables is the brainchild of Alexandra Drane and her brilliant team at the Eliza

Food and the household health budget: one pocket, shrinking access

Over 1 in 5 people in the U.S. have not had enough money to buy food for themselves or their families in the past year, according to the August 2013 Gallup Healthways Index. This is as many consumers as those who couldn’t afford food during the deepest months of the last recession. Lack of access to food is a challenge for a cadre of Americans who lack access to other basic needs such as shelter and health care. Gallup’s Basic Access Index looks at this market basket, and has found that Americans’ access to basic needs at 81.4 in August

Consumers don’t get as much satisfaction with high-deductible health plans

Since the advent of the so-called consumer-directed health care era in the mid-2000s, there’s been a love-gap between health plan members of traditional plans, living in Health Plan World 1.0, and people enrolled in newer consumer-driven plans – high-deductible health plans (HDHPs) and consumer-directed health plans (CDHPs). That gap in plan satisfaction continues, according to the Employee Benefits Research Institute (EBRI)’s poll of Americans’ consumer engagement in health care. The survey was conducted with the Commonwealth Fund. As the bar chart illustrates, some 62% of members in traditional plans were satisfied (very or extremely) with their health insurance in 2012.

Criticizing health reform has jumped the shark for mainstream Americans

You might see potato and I might see po-tah-to when looking at the Affordable Care Act – health reform — but it’s clear we don’t want to call the whole thing off. (Go to 1:44 seconds in this video to get my drift, thanks to the Gershwin’s). I’m talking about the latest August 2013 Kaiser Health Tracking Poll from Kaiser Family Foundation finds a health citizenry suffering ennui or a form of split personality about health reform: while many Americans don’t believe the Affordable Care Act (ACA) will help them, most don’t want Congress to de-fund it, either. Several graphs from

People not up-close-and-personal about personalized medicine…yet

Only 1 in 4 U.S. adults over 30 know what “personalized medicine” (PM) really is, and only 8% of people feel very knowledgeable about the concept based on Consumer Perspectives on Personalized Medicine from GfK, published online in August 2013. GfK surveyed 602 online adults 30 years and over between February and March 2013 drawn from the company’s KnowledgePanel sample of U.S. adults. Only 4% of people who have heard of personalized medicine describe it accurately as “medicine based on genome/genetic make up.” About one-half of people (52%) defined PM as medical care, treatment, or medicine geared toward individual needs. The poll

HSAs for Dummies: improving health insurance literacy

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans. While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time. This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes

Chief Health Officers, Women, Are In Pain

Women are the Chief Health Officers of their families and in their communities. But stress is on the rise for women. Taking an inventory on several health risks for American women in 2013 paints a picture of pain: of overdosing, caregiver burnout, health disparities, financial stress, and over-drinking. Overdosing on opioids. Opioids are strong drugs prescribed for pain management such as hydrocodone, morphine, and oxycodone. The number of opioid prescriptions grew in the U.S. by over 300% between 1999 and 2010. Deaths from prescription painkiller overdoses among women have increased more than 400% since 1999, compared to 265% among men.

People are growing their health-consumer muscles in 2013

Most Americans are concerned about their ability to for medical bills, even when they have health insurance. As a result, most are comfortable asking their doctor about how much their medical treatment will cost. People are becoming savvier health care shoppers largely because they have to: 37% of people in the U.S. have an annual health insurance deductible over $2,000, according to the Spring/Summer 2013 Altarum Institute Survey of Consumer Health Care Opinion, published on 11th July 2013. Many of the media stories coming out of the Altarum survey since its publication have been about people and their trust in

Health and wellness, the economy and the grocery store

Consumers in America are spending more, and especially at the grocery store. Most people say they want to eat healthy — but, although they’re spending more at the food store, one-half of supermarket shoppers say cost is the main obstacle for healthy eating. 2 in 3 U.S. grocery shoppers define health and wellness as being physically fit and active, and over half believe that feeling good about yourself is another facet of health. Not being overweight equals health for about one-half of U.S. shoppers. The Why? Behind the Buy, from Acosta Sales & Marketing, explores buying patterns among U.S. consumers

Cost prevents people from seeking preventive health care

3 in 4 Americans say that out-of-pocket costs are the main reason they decide whether or not to seek preventive care, in A Call for Change: How Adopting a Preventive Lifestyle Can Ensure a Healthy Future for More Americans from TeleVox, the communications company, published in June 2013. TeleVox surveyed over 1,015 U.S. adults 18 and over. That’s the snapshot on seeking care externally: but U.S. health consumers aren’t that self-motivated to undertake preventive self-care separate from the health system, either, based on TeleVox’s finding that 49% of people say they routinely exercise, and 52% say they’ve attempted to improve eating habits.

Money and health, migraines and sleep: how stress directly impacts health and wealth

There’s an issue that doctors and patients don’t discuss that’s among the most important contributors to ill health: it’s money, and it’s something Alexandra Drane calls an “Unmentionable.” Alex, Founder, Chief Visionary, and Board Chair at Eliza Corporation, coined Unmentionables as those aspects of daily living which everyone deals with, but few like to talk about: like sex (whether too much, too little), drugs (abusing), drinking (too much), toileting problems (such as incontinence or pooping problems), sleep trouble, and caring for others (not ourselves so much). These daily life challenges can negatively impact health, with financial stress being one of

Health consumers, meet the medical bank

Health consumers, meet a new player in your health care world: the bank. Financial services companies will play a growing role in U.S. health care as patients morph into health care consumers responsible for making more money-based decisions about their health care. This shift could make paying for health care just like paying other bills in the consumer retail market. And that’s a new role for health providers – doctors and hospitals – to fill. The Impact of Growing Patient Financial Responsibility on Healthcare Providers, prepared for Citi Enterprise Payments by Boundary Information Group, discusses what the impact of consumers’ payments in

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

The health/wealth disconnect in America

Two in 3 Americans are uncomfortable with their financial situation. And most are totally oblivious to how much money they will need to spend on health care in the future. Seven in 10 people expect to spend less than 10% of their monthly retirement income on medical and dental expenses; but the real number is 30% of income needed for health care in retirement, according to The Urban Institute. The Wellness for Life survey, conducted for Aviva, the life and disability company, collaborating with the Mayo Clinic, finds an American health citizen out of touch with their personal health economics.

Caregiving in the USA – the burden intensifies, and technology’s promise

29% of people in the U.S. have served as unpaid family caregivers in the past year. That’s 66 million people, mostly female (66%), middle age (on average 48 years old), usually taking care of a relative (86%).These sobering stats come out of Caregiving in the U.S. 2009, a study from the National Alliance for Caregiving in collaboration with AARP. The research, funded by the MetLife Foundation, follows up a similar study in 2004 and shows the proportion of Americans caregiving has substantially changed over the past five years.But both caregivers of adults and those for whom they provide care are

The Future of Retail – Implications for Health

I’ve been looking at health care through a retail lens for some time. Perhaps it’s that I’m a rag trader’s daughter, or that I’ve been known to like shopping, that I have clients in consumer goods, or that I understand how tiered drug pricing impacts the consumption of medicines (answer: it’s all of the above). I’ve just reviewed the latest trend report from PricewaterhouseCoopers and TNS Retail Forward on the future of retailing. My mind is connecting the dots between the future of retail and the American health care consumer. Four future retail trends are already embedding in health care

Thank you, Jared Johnson, for including me on the list of the

Thank you, Jared Johnson, for including me on the list of the  I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a