What to expect from health care between now and 2018

Employers who provide health insurance are getting much more aggressive in 2013 and beyond in terms of increasing employees’ responsibilities for staying well and taking our meds, shopping for services based on cost and value, and paying doctors based on their success with patients’ health outcomes and quality of care. Furthermore, nearly one-half expect that technologies like telemedicine, mobile health apps, and health kiosks in the back of grocery stores and pharmacies are expected to change the way people regularly receive health care. What’s behind this? Increasing health care costs, to be sure, explains the 18th annual survey from the National

The promise of ObamaCare isn’t comforting Americans worrying about money and health in 2013

In June 2013, even though news about the economy and jobs is more positive and ObamaCare’s promise of health insurance for the uninsured will soon kick in, most Americans are concerned about (1) money and (2) the costs of health care. The Kaiser Health Tracking poll of June 2013 paints an America worried about personal finances and health, and pretty clueless about health reform – in particular, the advent of health insurance exchanges. Among the 25% of people who have seen media coverage about the Affordable Care Act (alternatively referred to broadly as “health reform” or specifically as “ObamaCare”), 3

Health consumers, meet the medical bank

Health consumers, meet a new player in your health care world: the bank. Financial services companies will play a growing role in U.S. health care as patients morph into health care consumers responsible for making more money-based decisions about their health care. This shift could make paying for health care just like paying other bills in the consumer retail market. And that’s a new role for health providers – doctors and hospitals – to fill. The Impact of Growing Patient Financial Responsibility on Healthcare Providers, prepared for Citi Enterprise Payments by Boundary Information Group, discusses what the impact of consumers’ payments in

As health cost increases moderate, consumers will pay more: will they seek less expensive care?

While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960. That’s due to “the imperative to do more with less has paved the way for a true transformation of the

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

The part-time medical home: retail health clinics

The number of retail health clinics will double between 2012 and 2015, according to a research brief from Accenture, Retail medical clinics: From Foe to Friend? published in June 2013. What are the driving market forces promoting the growth of retail clinics? Accenture points to a few key factors: Hospitals’ need to rationalize use of their emergency departments, which are often over-crowded and incorrectly utilized in cases of less-than-acute care. In addition, hospitals are now financially motivated under the Affordable Care Act (ACA, health reform) to reduce readmissions of patients into beds (particularly Medicare patients with acute myocardial infarction [heart attacks],

Wellness at work – Virgin tells it all

Health, happiness and engagement among employees are closely-linked and drive productivity in the workplace. But there’s a gap between the kind of wellness services employers offer workers to bolster health, and the programs that people actually want. The current state of employer wellness programs is described in a survey conducted by Virgin HealthMiles and Workforce, The Business of Healthy Employees: A Survey of Workplace Health Priorities, published in June 2013. There’s a gap between what workers want for wellness and what employers are offering. Most-demanded by workers are health on-site food choices desired by 79% of employees; but, only 33%

The health and wellness gap between insured and uninsured people

If you have health insurance, chances are you take several actions to bolster your health such as take vitamins and supplements (which 2 in 3 American adults do), take medications as prescribed (done by 58% of insured people), and tried to improve your eating habits in the past two years (56%). Most people with insurance also say they exercise at least 3 times a week. Fewer people who are uninsured undertake these kinds of health behaviors: across-the-board, uninsured people tend toward healthy behaviors less than those with insurance. This is The Prevention Problem, gleaned from a survey conducted by TeleVox

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

The health/wealth disconnect in America

Two in 3 Americans are uncomfortable with their financial situation. And most are totally oblivious to how much money they will need to spend on health care in the future. Seven in 10 people expect to spend less than 10% of their monthly retirement income on medical and dental expenses; but the real number is 30% of income needed for health care in retirement, according to The Urban Institute. The Wellness for Life survey, conducted for Aviva, the life and disability company, collaborating with the Mayo Clinic, finds an American health citizen out of touch with their personal health economics.

Americans feeling more financially insecure

One in three workers does not feel financially secure. The proportion of Americans who feel “not at all secure” grew to 16% from 12% between 2011 and 2012, based on the question, “When it comes to paying your bills and keeping up with living expenses, how financially secure do you feel these days?” Women are much more likely than men to feel financially insecure, representing a 33% growth rate in financial insecurity. These sobering financial statistics come to us from the UNUM study, 2012 Employee Education and Enrollment Survey: Employee Perspectives on Financial Security, published May 8, 2013. Based on the question asked – paying

Un-directed Americans in a consumer-directed healthcare world

U.S. employers have been implementing various flavors of consumer-directed health plans for the better part of a decade. But consumers feel neither “directed” nor especially competent in managing their way through these plans. It appears that employers also have their own sort of health plan illiteracy when it comes to understanding health reform — the Affordable Care Act — according to the 2013 Aflac WorkForces Report (AWR) based on a survey of 1,900 benefits managers and over 5,200 U.S. workers conducted in January 2013. While you might know the Aflac Duck, you may not be aware that Aflac is the

The Slow Economy Has Slowed Health Spending

Why has health cost growth in the U.S. slowed in the past few years? It’s mostly due to the economy, argues the Kaiser Family Foundation in Assessing the Effects of the Economy on the Recent Slowdown of Health Spending. The answer to this question is important because, as the American economy recovers, it begs the next question: will costs increase faster once again as they did in previous go-go U.S. economies, further exacerbating the budget deficit problems in the long-term? KFF worked with Altarum to develop an economic model to answer these questions. The chart illustrates the predicted vs. actual

Bending the cost-curve: a proposal from some Old School bipartisans

Strange political bedfellows have come together to draft a formula for dealing with spiraling health care costs in the U.S. iin A Bipartisan Rx for Patient-Centered Care and System-Wide Cost Containment from the Bipartisan Policy Center (BPC). The BPC was founded by Senate Majority Leaders Howard Baker, Tom Daschle, Bob Dole, and George Mitchell. This report also involved Bill Frist, Pete Domenici, and former White House and Congressional Budget Office Director Dr. Alice Rivlin who together work with the Health Care Cost Containment Initiative at the BPC. The essence of the 132-page report is that the U.S. health system is

Food = Health for employers, hospitals, health plans and consumers

Food is inextricably bound up with health whether we are well or not. Several key area of the Food=Health ecosystem made the news this week which, together, will impact public and personal health. On the employer health benefits front, more media are covering the story on CVS strongly incentivizing employees to drop body mass index (BMI) through behavioral economics-inspired health plan design of a $50 peer month penalty. Michelin, whose bulky advertising icon Bibendum has more than one “spare tire,” introduced a program to combat health issues, including but not limited to BMI and high blood pressure, according to the

US Health Executives Predict the ACA Will Increase Health Insurance Premiums

As a result of implementing the Affordable Care Act (health reform), most U.S. health executives crystal balls foresee health care insurance premiums will increase over 10% in the next three years. 4 in 10 predict premiums will grow over 25% over the next 3 years. This sobering forecast comes out of a Munich RE Health survey conducted among 326 health industry executives in March 2013. Those polled included representatives from health plans, managed care, disease management firms, and health insurance brokers and agents. How do health execs expect employers would deal with such fast-rising health premium costs? Why shift more

The need for a Zagat and TripAdvisor in health care

Patient satisfaction survey scores have begun to directly impact Medicare payment for health providers. Health plan members are morphing into health consumers spending “real money” in high-deductible health plans. Newly-diagnosed patients with chronic conditions look online for information to sort out whether a generic drug is equivalent to a branded Rx that costs five-times the out-of-pocket cost of the cheaper substitute. While health care report cards have been around for many years, consumers’ need to get their arms around relevant and accessible information on quality and value is driving a new market for a Yelp, Travelocity, or Zagat in

U.S. Health Costs vs. The World: Is It Still The Prices, and Are We Still Stupid?

Comparing health care prices in the U.S. with those in other developed countries is an exercise in sticker shock. The cost of a hospital day in the U.S. was, on average, $4,287 in 2012. It was $853 in France, a nation often lauded for its excellent health system and patient outcomes but with a health system that’s financially strapped. A routine office visit to a doctor cost an average of $95 in the U.S. in 2012. The same visit was priced at $30 in Canada and $30 in France, as well. A hip replacement cost $40,364 on average in the

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

The Rationale for CVS “Sticking” (vs. “Carroting”) It To Employees for Wellness

The Boston Herald was one of the first newspapers talking about CVS requiring workers to disclose personal health information…”or pay a $600 a year fine,” as the LA Times succinctly put the situation. The story is that CVS Caremark, the pharmacy and Rx benefits management company, is implementing a health screening program to measure height, weight, body fat, and blood pressure. These metrics are commonly collected in the process known as health risk appraisals (HRAs), which most large employers have begun to implement to help employees prevent the onset of chronic disease (think: “metabolic syndrome,” diabetes combined with overweight, for

Most consumers will look to health insurance exchanges to buy individual plans in 2013

As the Affordable Care Act, health reform, aka Obamacare, rolls out in 2013, American health insurance shoppers will look for sources of information they can trust on health plan quality and customer service satisfaction — as they do for automobiles, mobile phone plans, and washing machines. For many years, one of a handful of trusted sources for such insights has been J.D. Power and Associates. J.D. Power released its 2013 Member Health Plan Study (the seventh annual survey) and found that most consumers currently enrolled in a health plan have had a choice of only “one” at the time

Arianna and Lupe and Deepak and Sanjay – will the cool factor drive mobile health adoption?

Digital health is attracting the likes of Bill Clinton, Lupe Fiasco, Deepak Chopra, Dr. Sanjay Gupta, Arianna Huffington, and numerous famous athletes who rep a growing array of activity trackers, wearable sensors, and mobile health apps. Will this diverse cadre of popular celebs drive consumer adoption of mobile health? Can a “cool factor” motivate people to try out mobile health tools that, over time, help people sustain healthy behaviors? Mobile and digital health is a fast-growing, good-news segment in the U.S. macroeconomy. The industry attracted more venture capital in 2012 than other health sectors, based on Rock Health’s analysis of the year-in-review. Digital health

Bill Clinton’s public health, cost-bending message thrills health IT folks at HIMSS

In 2010, the folks who supported health care reform were massacred by the polls, Bill Clinton told a rapt audience of thousands at HIMSS13 yesterday. In 2012, the folks who were against health care reform were similarly rejected. President Clinton gave the keynote speech at the annual HIMSS conference on March 6, 2013, and by the spillover, standing-room-only crowd in the largest hall at the New Orleans Convention Center, Clinton was a rock star. Proof: with still nearly an hour to go before his 1 pm speech, the auditorium was already full with only a few seats left in the

The future of sensors in health care – passive, designed, integrated

Here’s Ann R., who is a patient in the not-too-distance-future, when passive sensors will be embedded in her everyday life. The infographic illustrates a disruption in health care for people, where data are collected on us (with our permission) that can help us improve our own self-care, and help our clinicians know more about us outside of their offices, exam rooms and institutions. In Making Sense of Sensors: How New Technologies Can Change Patient Care, my paper for the California HealthCare Foundation, I set out to organize the many types of sensors proliferating the health care landscape, and identify key

Health consumers don’t understand overtreatment, and their role in driving health costs

Overuse of health care is defined as the delivery of health care services for which the risks outweigh the benefits, according to a study into the utilization of ambulatory care health services published in the January 28, 2013, issue of JAMA Internal Medicine (the new title for the Archives of Internal Medicine). “Trends in the Overuse of Ambulatory Health Care Services in the United States” found that, of the estimated $700 billion that is wasted annually in U.S. health care, overuse comprises about $280 billion – over one-third of waste — equal to over 10% of total health spending in

Wealthy Americans’ top financial concern is affording health care in retirement

The wealthiest Americans’ top financial concern is being able to afford healthcare and support they’ll need in old age. The #2 financial concern among wealthy investors is worrying about the financial situation of their children and grandchildren, closely followed by a major family health problem occurring and someone to care for them in their old age. These health-financial worries come out of a survey among 2,056 U.S. investors age 25 and over who have at least $250,000 in investable assets conducted by UBS in January 2013. UBS found that staying health and fit is investors’ top objective, with 73% of wealthy

Health cost transparency on the W-2: sticker shock at the point-of-paystub

If you receive health insurance benefits from your employer, you’ll see a new line item on your W-2, courtesy of the Internal Revenue Service: the cost of employer-sponsored group health plan coverage. This new piece of data, shown in Box 12, DD information, comes as part of health reform, The Affordable Care Act, which requires employers with over 250 workers to show how much they spend on employer-sponsored health benefits in total. This is the employer’s premium cost, and does not include the covered worker’s out-of-pocket spending (e.g., copays, coinsurance and deductibles). It is being furnished on W-2’s “for informational

Dark chocolate as health food – a healthy salute to Valentine’s Day

On a recent Whole Living segment on Martha Stewart’s Sirius XM radio channel, I learned of the artisan chocolatier, Gnosis. The company, whose name is Greek for “knowledge,” grew out of the kitchen of a holistic health counselor, Vanessa Berg, who began to make nutritionally-infused sweets for her private clientele. Word-of-mouth made its way to a buyer from Whole Foods, who subsequently did a deal with Berg to sell Gnosis goods in some of the company’s stores in New Jersey and New York. Here’s a link to the radio interview. Chocolate is a health food for this company, and for

Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Aetna and Costco – the broker is ‘us’

Costco and Aetna announced that the Big Box retailer would expand its marketing of Aetna health insurance policies to card-carrying members in California. Costco has already been selling health insurance through stores in Arizona, Connecticut, Georgia, Illinois, Michigan, Nevada, Pennsylvania, Texas and Virginia. Later in 2013, Aetna plans will be available in Costco stores in other state markets. BTW, Costco operates stores in 42 U.S. states (as well as Canada, the UK, Taiwan, Korea, Japan, Australia, and Mexico). All together, the company serves 37 million households. The Costco Personal Health Insurance Program offers five plans, a network of health providers, and

Retail and work-site clinics – medical homes for younger adults?

The use of retail and work-site health clinics is up, and their consumers skew young. Overall, 27% of all U.S. adults have stepped into a walk-in clinic in the past two years. But only 15% of people 65 and over have used such a clinic. This begs the question: are retail and on-site clinics at the workplace filling the role of medical homes for younger adult Americans? The Harris Interactive/HealthDay poll published in January 2013 discovered that use of retail clinics grew from 7% in 2008 to 27% in 2012. The largest age cohort using walk-in clinics is people between

Cost-conscious health consumers are adopting personal health IT

People enrolled in consumer-directed health plans (CDHPs) and high-deductible health plans (HDHPs) are more cost-conscious than those enrolled in more traditional plans, according to Findings from the 2012 EBRI/MGA Consumer Engagement in Health Care Survey from the Employee Benefit Research Institute (EBRI), published in December 2012. The logic behind CDHPs and HDHPs is that if health plan enrollees have more “skin in the game” — that is, personal financial exposure — they’ll behave more like health “consumers.” By 2012, 36% of employers with over 500 employees offered either HRA- or HSA-eligible plans. About 15% of working age adults are enrolled

People want more control over health care in the midst of rising costs: a tale of two surveys

Two surveys of American consumers point to their growing concern over (1) rising costs and (2) wanting control over their care. More than 1 in 3 U.S. adults put off health care due to costs in the past year, a Gallup poll found. As shown in the graph, this is the highest proportion of people forgoing care due to cost since Gallup began asking the question in 2012. This survey was conducted in November 2012. There are differences between people without insurance and those with commercial or public sector plans such as Medicare and Medicaid. Over one-half of uninsured people

Wired health: living by numbers – a review of the event

Wired magazine, longtime evangelist for all-things-tech, has played a growing role in serving up health-tech content over the past several years, especially through the work of Thomas Goetz. This month, Wired featured an informative section on living by numbers — the theme of a new Wired conference held 15-16 October 2012 in New York City. This feels like the week of digital health on the east coast of the U.S.: several major meetings have convened that highlight the role of technology — especially, the Internet, mobile platforms, and Big Data — on health. Among the meetings were the NYeC Digital Health conference, Digital

Aetna finds consumers aren’t very empowered in health

Americans find health insurance decisions the second most difficult major life decision only behind saving for retirement (36%) and slightly more difficult than purchasing a car (23%), via Aetna’s Empowered Health Index Survey. Why are health insurance choices so tough? Consumers told Aetna that the available information is confusing and complicated (88% percent), there is conflicting information (84%) and it’s difficult to know which plan is right for them (83%). Based on this survey’s findings, millions of Americans indeed feel dis-empowered by health care decision making. Who is empowered? Aetna says the empowered are likely to be more affluent, insured, married, take

Employers grow onsite health clinics, and employer-sponsored telemedicine will grow

With “Zero” large employers expecting to drop health insurance, as reported in the Washington Post, companies are getting creative and innovative about how to manage workers’ health and wellness, while addressing ever-growing costs. One strategy that’s getting more traction is the re-invention of the onsite health center. Towers Watson‘s 2012 Onsite Health Center survey report, finds that one-half of employers view establishing an onsite health center as a linchpin to enhancing productivity and health in the workplace. Following close behind productivity is the onsite health center’s promise of reducing medical costs, improving access to care, and the traditional reason for providing onsite

Wellness takes hold among large employers – and more sticks nudge workers toward health

Employee benefits make up one-third of employers’ investments in workers, and companies are looking for positive ROI on that spend. Health benefits are the largest component of that spending, and are a major cost-management focus. In 2012 and beyond, wellness is taking center stage as part of employers’ total benefits strategies. In the 2012 Wellness & Benefits Administration Benchmarking study, a new report from bswift, a benefits administration company, the vast majority of large employers (defined as those with over 500 workers) are sponsoring wellness programs, extending them to dependents as well as active workers. Increasingly, sticks accompany carrots for

Employees will bear more health costs to 2017 – certainty in an uncertain future

Amidst uncertainties and wild cards about health care’s future in the U.S., there’s one certainty forecasters and marketers should incorporate into their scenarios: consumers will bear more costs and more responsibility for decision making. The 2012 Deloitte Survey of U.S. Employers finds them, mostly, planning to subsidize health benefits for workers over the next few years, while placing greater financial and clinical burdens on the insured and moving more quickly toward high-deductible health plans and consumer-directed plans. In addition, wellness, prevention and targeted population health programs will be adopted by most employers staying in the health care game, shown in

The selling of a health plan, part two

Calling Don Draper, Donny Deutsch, and the spirit of David Ogilvy: the President needs you. The President must sell the Affordable Care Act to the American people now that Justice Roberts wrote the Supreme Court’s historic 5-4 majority opinion supporting the Act, and especially the individual mandate. He argued for the majority that while the mandate is unconstitutional under the Commerce Clause which would “command people to buy insurance,” he said that the mandate is a de facto tax, as people who would choose to opt out of insurance would have an alternative of paying an IRS fine. Senator Eric

The Online Couch: how “safe Skyping” is changing the relationship for patients and therapists

Skype and videoconferencing have surpassed the tipping point of consumer adoption. Grandparents Skype with grandchildren living far, far away. Soldiers converse daily with families from Afghanistan and Iraq war theatres. Workers streamline telecommuting by videoconferencing with colleagues in geographically distributed offices. In the era of DIY’ing all aspects of life, more health citizens are taking to DIY’ing health — and, increasingly, looking beyond physical health for convenient access to mental and behavioral health services. The Online Couch: Mental Health Care on the Web is my latest paper for the California HealthCare Foundation. Among a range of emerging tech-enabled mental health

Health costs will increase in 2013, and employees will bear more: can wellness programs help stem the rise?

Health spending will increase by 7.5% in 2013, with employees’ contributions rising for in-network deductibles, prescription drugs and emergency room visits. 3 in 4 employers, seeking to control rising health expenses, will offer wellness programs, even though a vast majority can’t yet measure an ROI on them. The Health and Well-Being: Touchstone Survey Results from PriceWaterhouseCoopers (PwC). PwC points out that the 7.5% medical cost increase is historically lower than in recent years, as a result of structural changes in the health care market including: A sluggish economy Growing focus on cost containment Lower utilization of health services by patients Employers’ efforts

Trust and authenticity are the enablers of health engagement

Without trust, health consumers won’t engage with organizations who want to cure them, sell to them, promote to them, help them. Here’s what I told a group of pharmaceutical marketers at The DTC Annual Conference in Washington , DC, on April 9, 2010. Let’s start with the World Health Organization’s definition of health: that is, the state of complete physical, mental and social wellbeing, and not just the absence of disease. This definition is being embraced by health citizens long before the silos in the health industry – including pharma – get it. That’s an important mindset to take on as

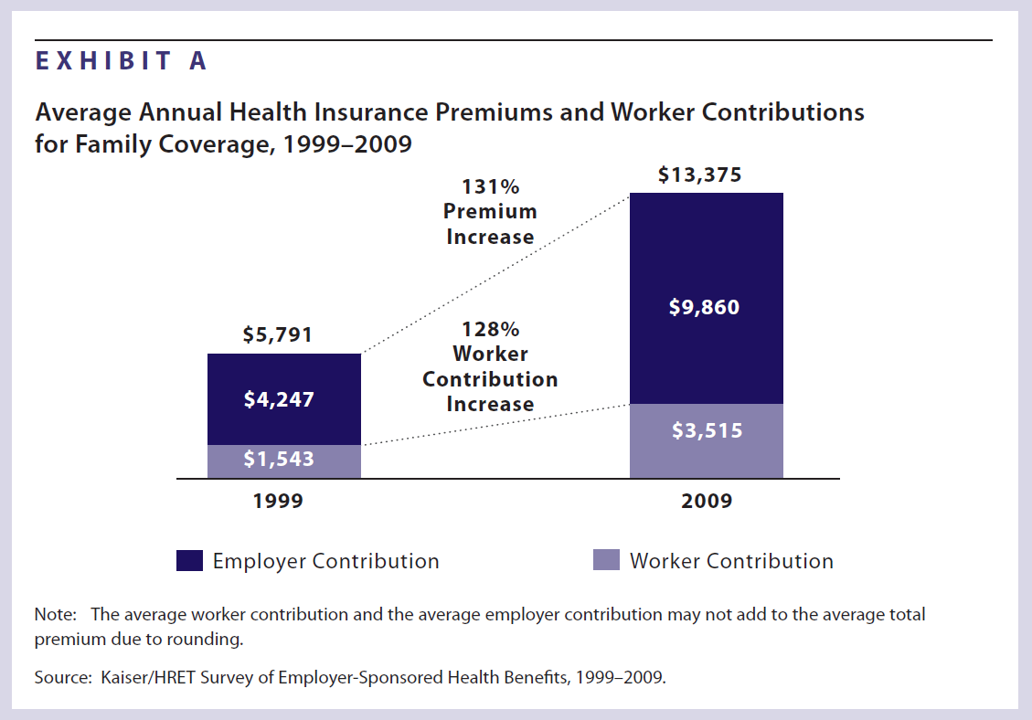

Health insurance costs have doubled in 10 years; the average monthly contribution is nearly $300

Health insurance premiums for a family increased 131% between 1999 and 2009, according to the latest survey from Kaiser Family Foundation (KFF) and Health Research & Educational Trust’s (HRET’s) Employer Health Benefits 2009 among employers. KFF and HRET have conducted this survey since 1999. In 2009, in raw number terms, family health insurance costs employers, on average, $13,375. Workers pay $3,515 of this premium, on average about 26% of the total. This approaches nearly $300 out of a monthly paycheck. Worker contributions substantially vary between small and large employers: the contribution is nearly $1,000 more if you work in a

Nearly 1 in 2 women delayed health care in the past year due to costs – the economic impact on a woman’s physical, emotional, and fiscal health

Nearly 1 in 2 women put off seeking health care because the cost was too high. The kinds of services delayed included visits to the doctor, medical procedures, and filling prescription medications. The fourth annual T.A.L.K. Survey was released this week by the National Women’s Health Resource Center (NWHRC), focusing on the declining economy and its impact on women and three dimensions of their health — physical, emotional, and fiscal. 40% of women say that their health has worsened in the past five years due to increasing stress and gaining weight, according to the survey. One of the most interesting

For those with health insurance, a growing bounty of benefits

For those employees fortunate enough to receive health insurance from work, there’s a bountiful array of health care services that are still covered by plans. The International Foundation of Employee Benefit Plans (IFEBP) polled its membership in late 2007 and found that employers are not only continuing to cover a broad range of services, but also new services the likes of which weren’t covered even two years ago…from medical tourism to biofeedback. These results are documented in IFEBP’s publication, Health Care Benefits: Eligibility, Coverage and Exclusions. The usual suspects are covered by well over 97% of employers, such as ER

Steel, Coffee Beans and Health Care

The UAW and GM have been debating health care as Friday’s deadline for their national contract approaches. This round of negotiation is about survival. Yesterday, I covered the rising costs of employer-sponsored health insurance. Today, let’s visit the intimately-related topic of retiree health benefits. These are eroding even faster than health benefits for employed workers. Many employers have significantly scaled back health benefits for retirees. Currently, one in three large employers offers retire benefits, compared with two in three in the late 1980s. Consider the predicament of the company ranked #3 on the 2006 Fortune 500 list, General Motors. Retirees

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  Thanks to Feedspot for naming this blog, Health Populi, as a

Thanks to Feedspot for naming this blog, Health Populi, as a