Connected Wellness Growing As Consumers Face Tighter Home Economics

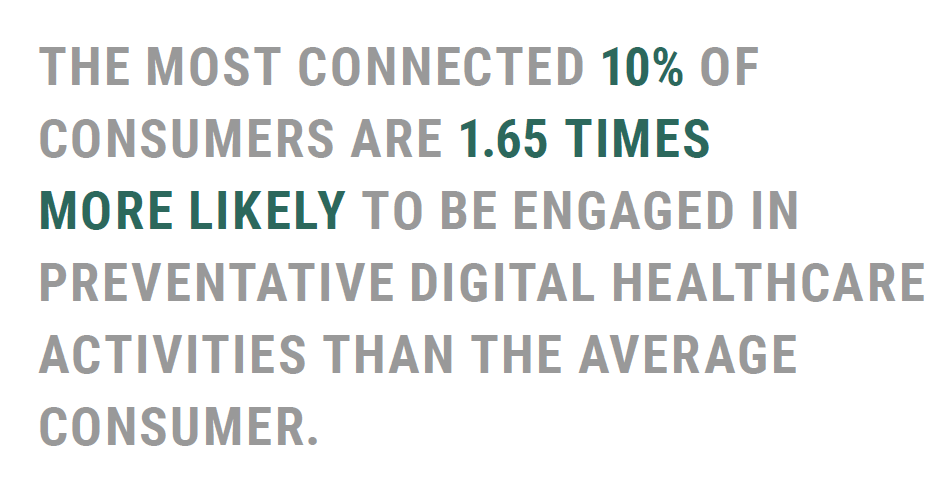

“Consumers are using the Internet to take their health into their own hands,” at least for 1 in 2 U.S. consumers engaging in some sort of preventive health care activity online in mid-2022. The new report on Connected Wellness from PYMNTS and Care Credit profiles American health consumers’ use of digital tools for health care promotion and disease prevention. The bottom-line here is that the most connected 10% of consumers were 1.65 times more likely to be engaged in preventive digital health activities than the average person. Peoples’ engagement with digital health

The Patient As the Payer: Self-Pay, Bad Debt, and the Erosion of Hospital Finances

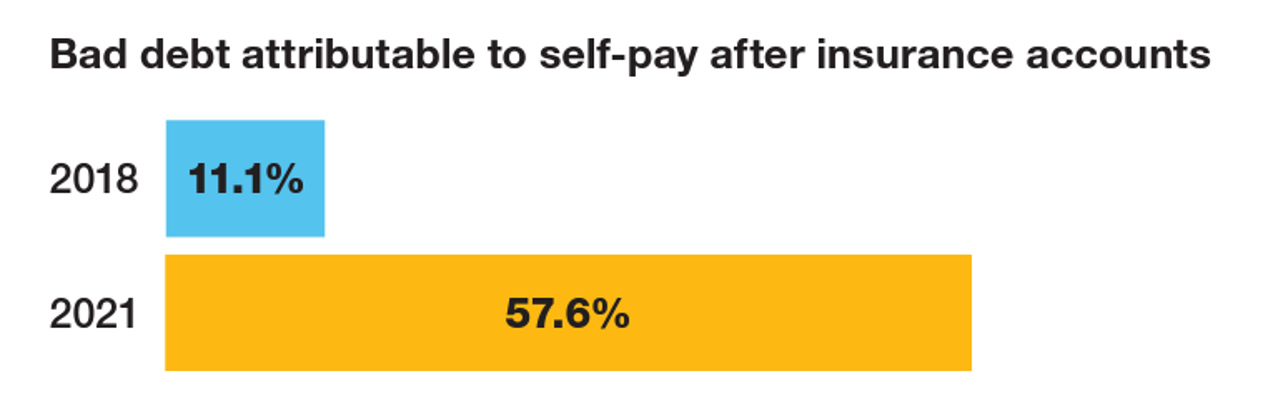

“The odds are against hospitals collecting patient balances greater than $7,500,” the report analyzing Hospital collection rates for self-pay patient accounts from Crowe concludes. Crowe benchmarked data from 1,600 hospitals and over 100,00 physicians in the U.S. to reveal trends on health care providers’ ability to collect patient service revenue. And bad debt — write-offs that come out of uncollected patient bill balances after “significant collection efforts” by hospitals and doctors — is challenging their already-thin or negative financial margins. The first chart quantifies that bad debt attributable to patients’ self-pay payments

The More Chronic Conditions, the More Likely a Patient Will Have Medical Debt

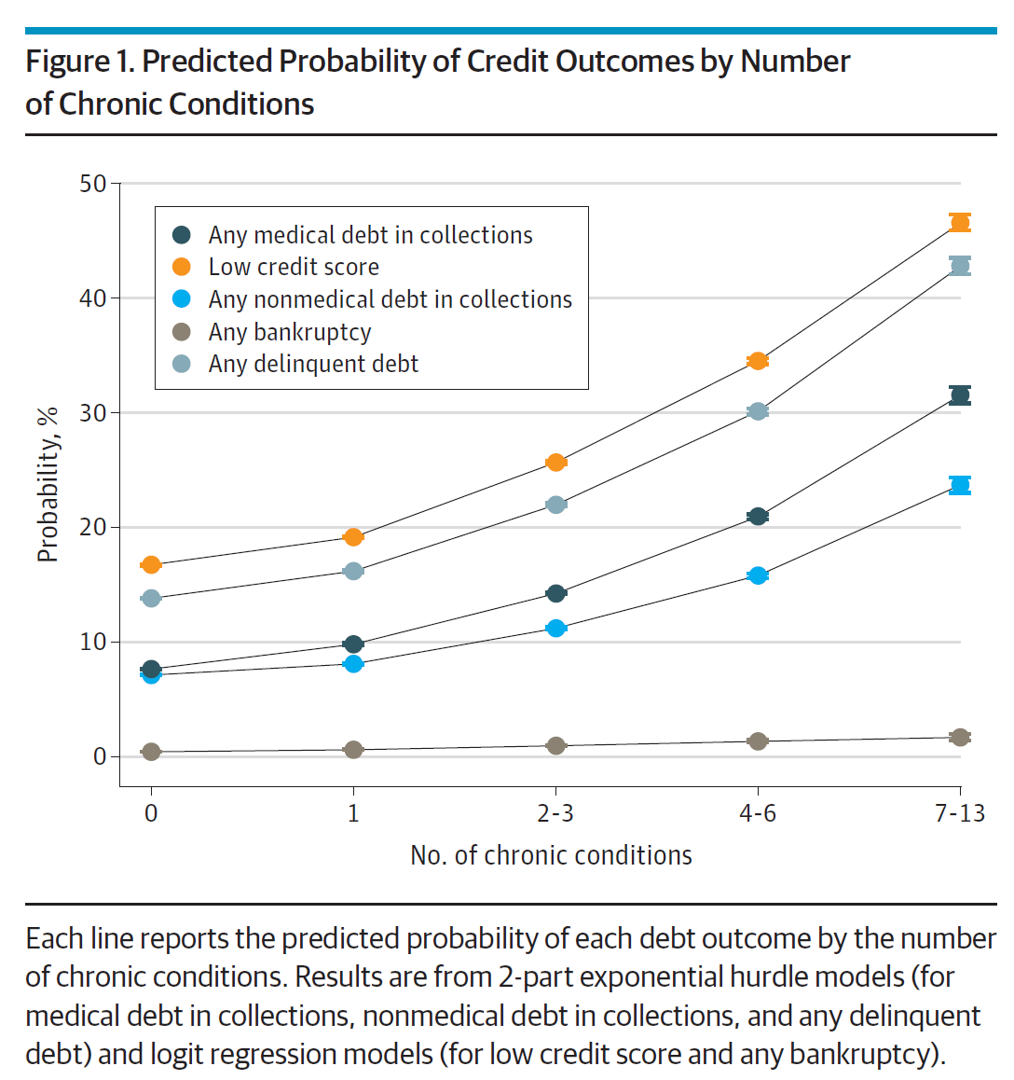

There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine. Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan. The first chart illustrates the predicted probability of credit outcomes based on the

Americans Rationing Healthcare in the Inflationary Era; Out-of-Pocket Expenses Are the Concern

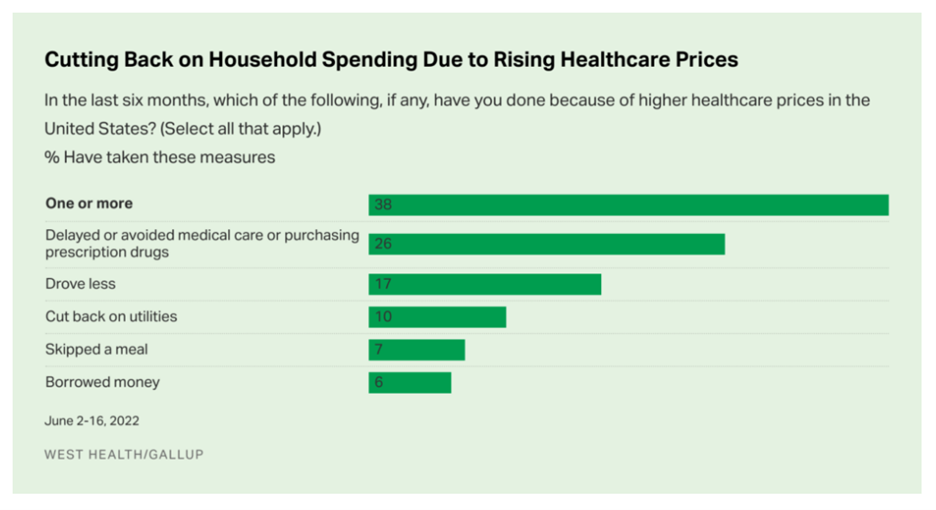

Nearly 100 million people in the U.S. cut back on healthcare due to costs in the first half of 2022, according to the latest poll on health care costs form Gallup and West Health, gauging Americans’ financial health in June 2022. That’s the month when inflation in the U.S. reached 9.1%, a 40-year high. Among Americans’ cuts to household spending was the most common medical self-rationing behavior, delaying or avoiding care or purchasing prescription drugs, the survey found. Nearly 4 in 5 people in the U.S. had delayed care or prescription meds between January

Gas ‘N Healthcare – How Transportation Links to Health Care Access and Financial Health

Some patients dealing with cancer at Mercy Health’s Lourdes Hospital have been supplied with gas cards. This gesture is enabling families to get to medical appointments around Paducah, Kentucky where, this week, car drivers faced regular gas priced at an average of $4.16 a gallon compared with $2.92 one year ago. Here’s the Hospital’s Facebook page featuring their gratitude to FiveStar Food Mart, the American Cancer Society, and the Mercy Health Foundation. “By providing cancer patients with gas cards, the cancer care team at Mercy Health Lourdes Hospital in Paducah hopes to mitigate financial challenges

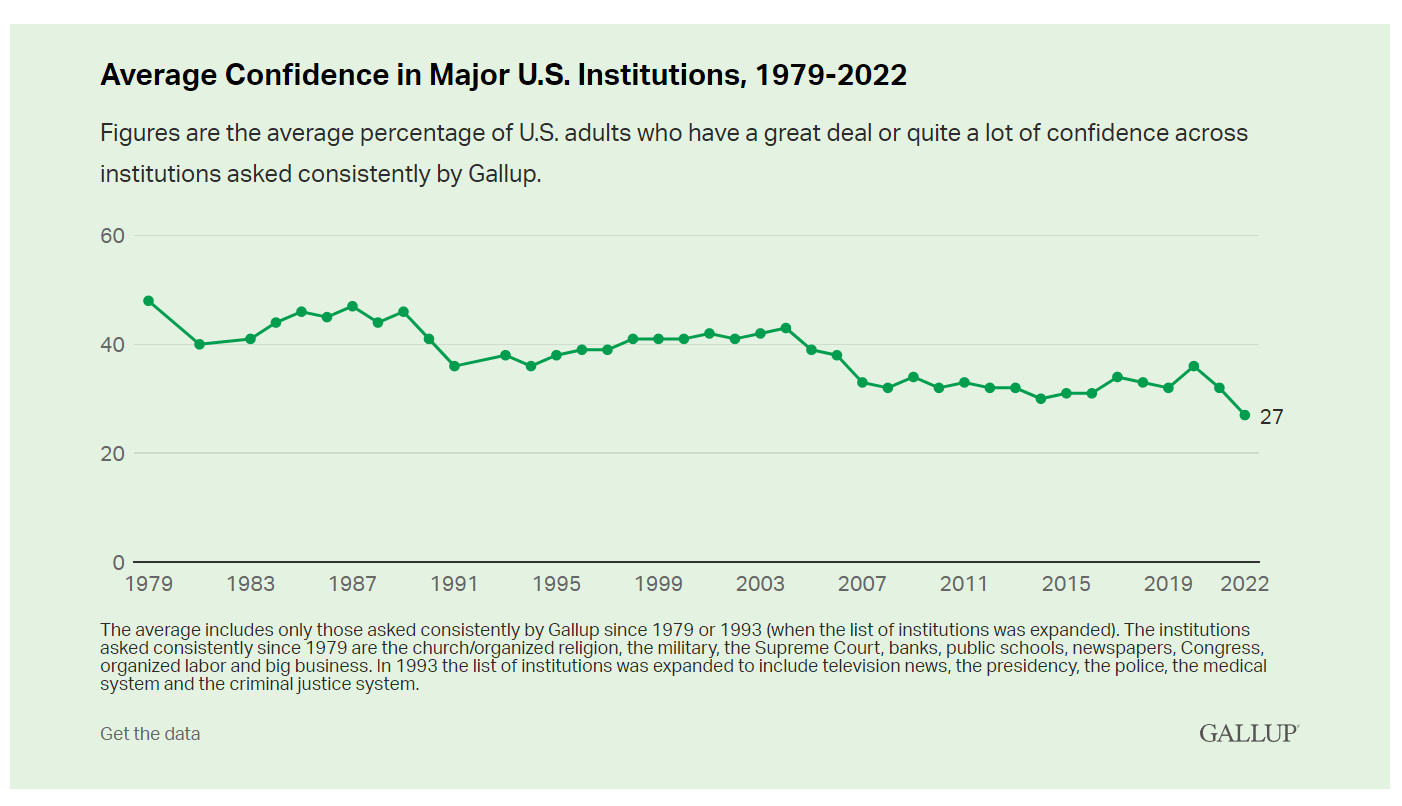

More Americans Trust Small Biz and the Military than the Medical System, Gallup Finds

The most trusted institutions in the U.S. are small business and the military, the only two sectors in which a majority of Americans have confidence. Americans’ trust in institutions hit new historic lows in 2022, Gallup found in its latest poll of U.S. sentiment across all major sectors. Today, more Americans have faith in the police than in the medical system, according to a Gallup poll finding that Confidence in U.S. Institutions Down; Average at New Low. published this week of Independence Day 2022. Confidence runs from a higher of 68% for

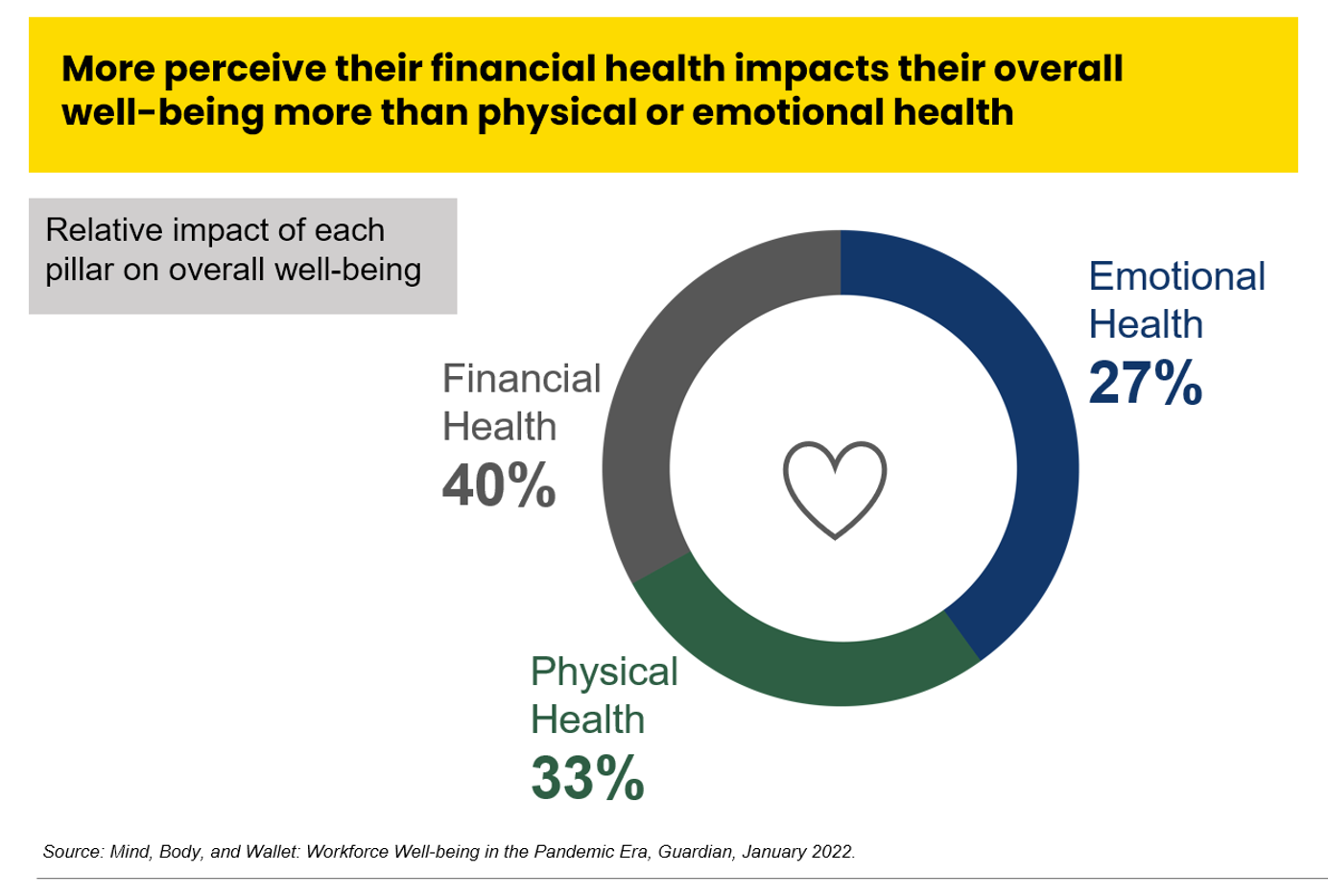

The Unbearable Heaviness of Inflation: Will Consumers’ Financial Stress Erode Their Health?

“Inflation is the big story,” the economics team at Morning Consult told us yesterday in a call on “How to Think Like An Economist.” While I already thought I did that, Team @MorningConsult updated us on the current state of consumers and what’s weighing most heavily on their minds…inflation being #1. An hour after the Morning Consult session, I brainstormed the topic of consumers-as-payers of medical bills and prescription drugs with GoodRx strategy leaders. In my data wonkiness, inflation certainly played a starring role in setting the stage for Mind, Body and Wallet — the title of one of the sources

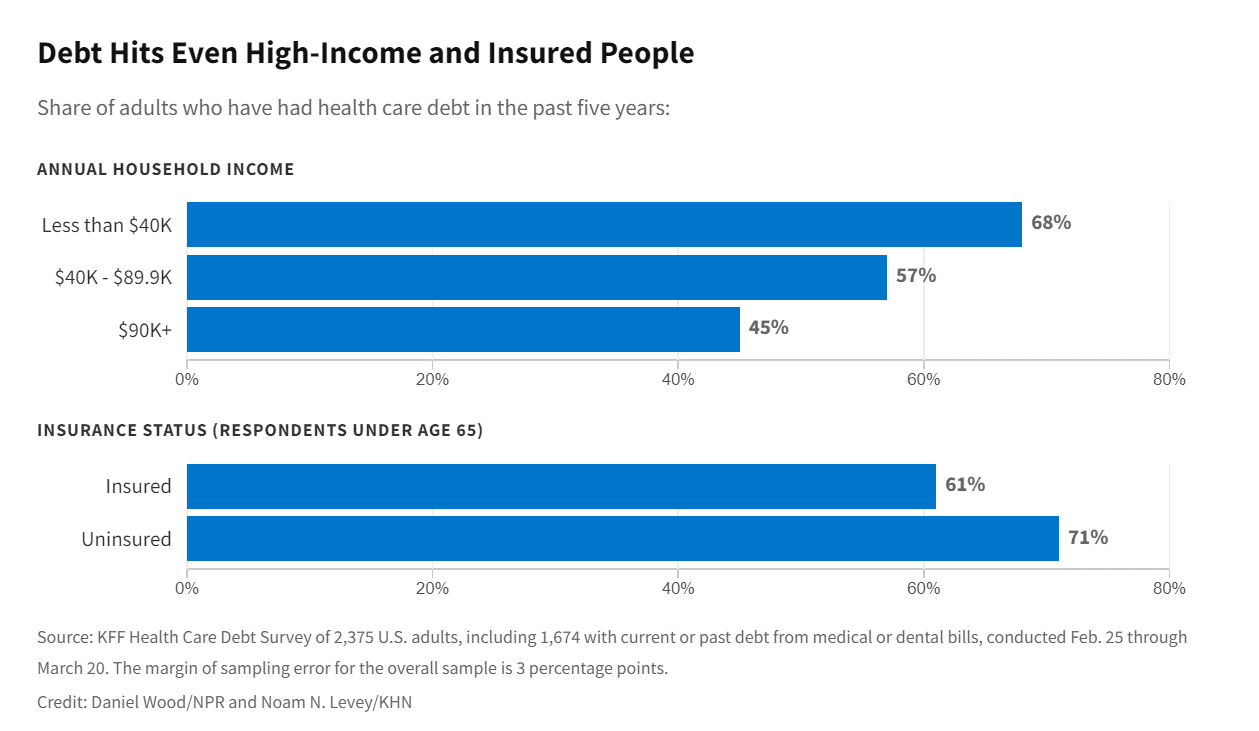

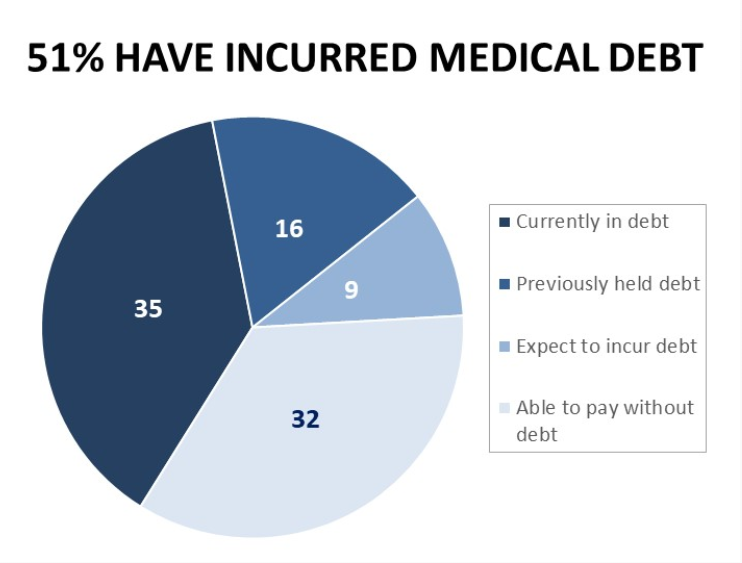

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

Consumers Intend to Invest in Technology — With Budget and Value in Mind

Consumers continued to invest in and use several technologies that supported self-care at home in 2021, with plans to purchase connected health devices, sports and fitness equipment in the next year. But these purchases will be made with greater attention to budget and value consumer mindsets firmly focused on (and stressed by) inflation. The 24th Annual Technology Ownership & Market Potential Study from the Consumer Technology Association (CTA) tells us that Americans in 2022 will have to manage challenging economic headwinds, shopping for technology is preparing people for their new normal —

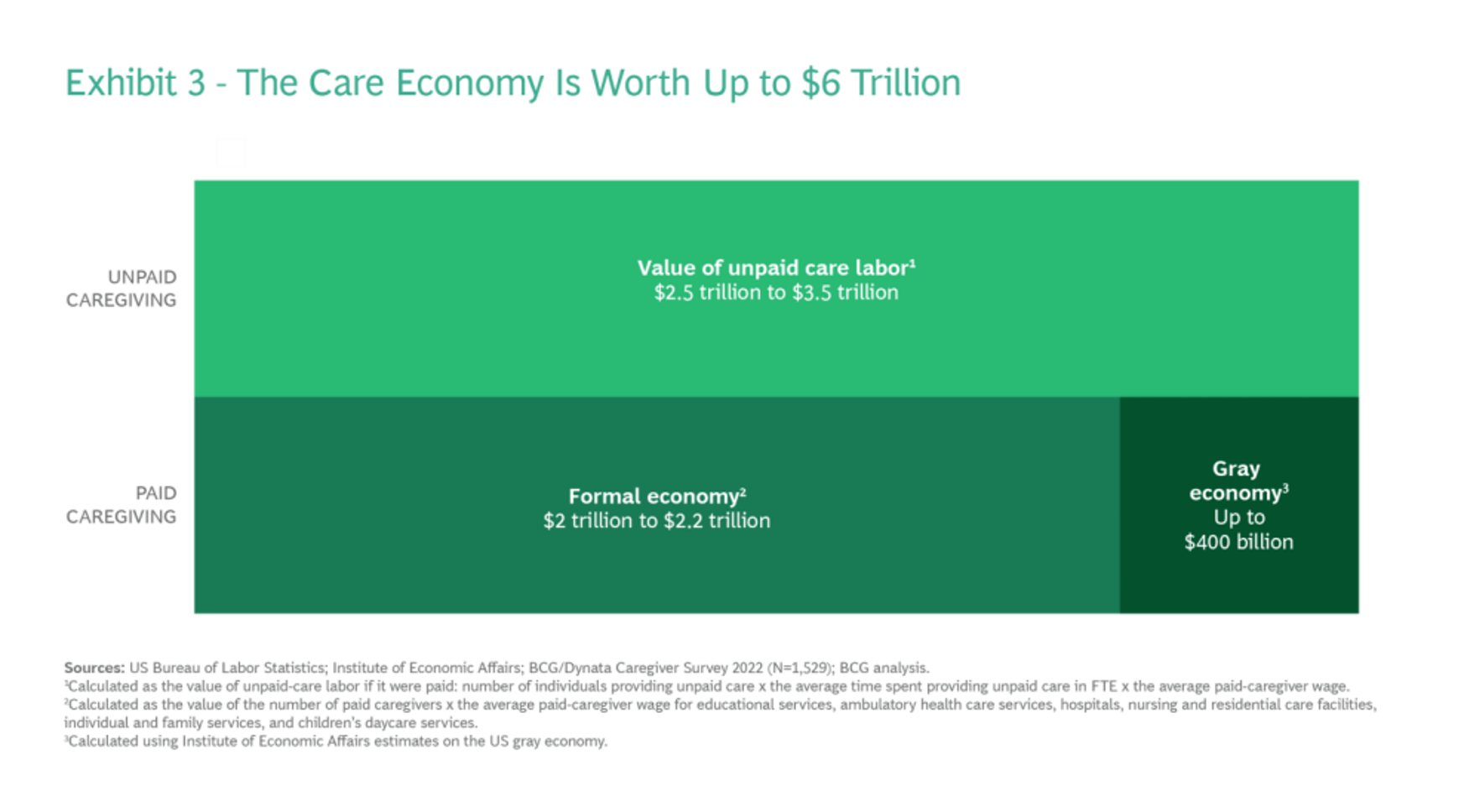

The Care Crisis – Robots Won’t Save Us

Among the many lessons we should and must take emerging out of the COVID-19 pandemic, understanding and addressing the caregiver shortage-cum-crisis will be crucial to building back a stronger national economy and financially viable households across the U.S. And if you thought robots, AI and the platforming of health care would solve the shortage of caregivers, forget it. Get smarter on the caregiver crisis by reading a new report, To Fix the Labor Shortage, Solve the Care Crisis, from BCG. You’ll learn that 9 of 10 new care-sector jobs will be in-person for

What If Costco Designed the Prescription Drugs Sales Model?

The good news about prescription drugs, in the context of medical spending in the U.S., is that 9 in 10 medicines prescribed are generics. They comprise only 3% of all U.S. healthcare spending. But there’s bad news about prescription drugs in the context of medical spending in America. U.S. Consumers Overpay for Generic Drugs, a new paper from the Leonard Schaeffer Center for Health Policy & Economics asserts, with recommendations to address the intermediaries who benefit from the way Americans currently pay for medicines. Generics are “an American success story,” the authors call out, bringing

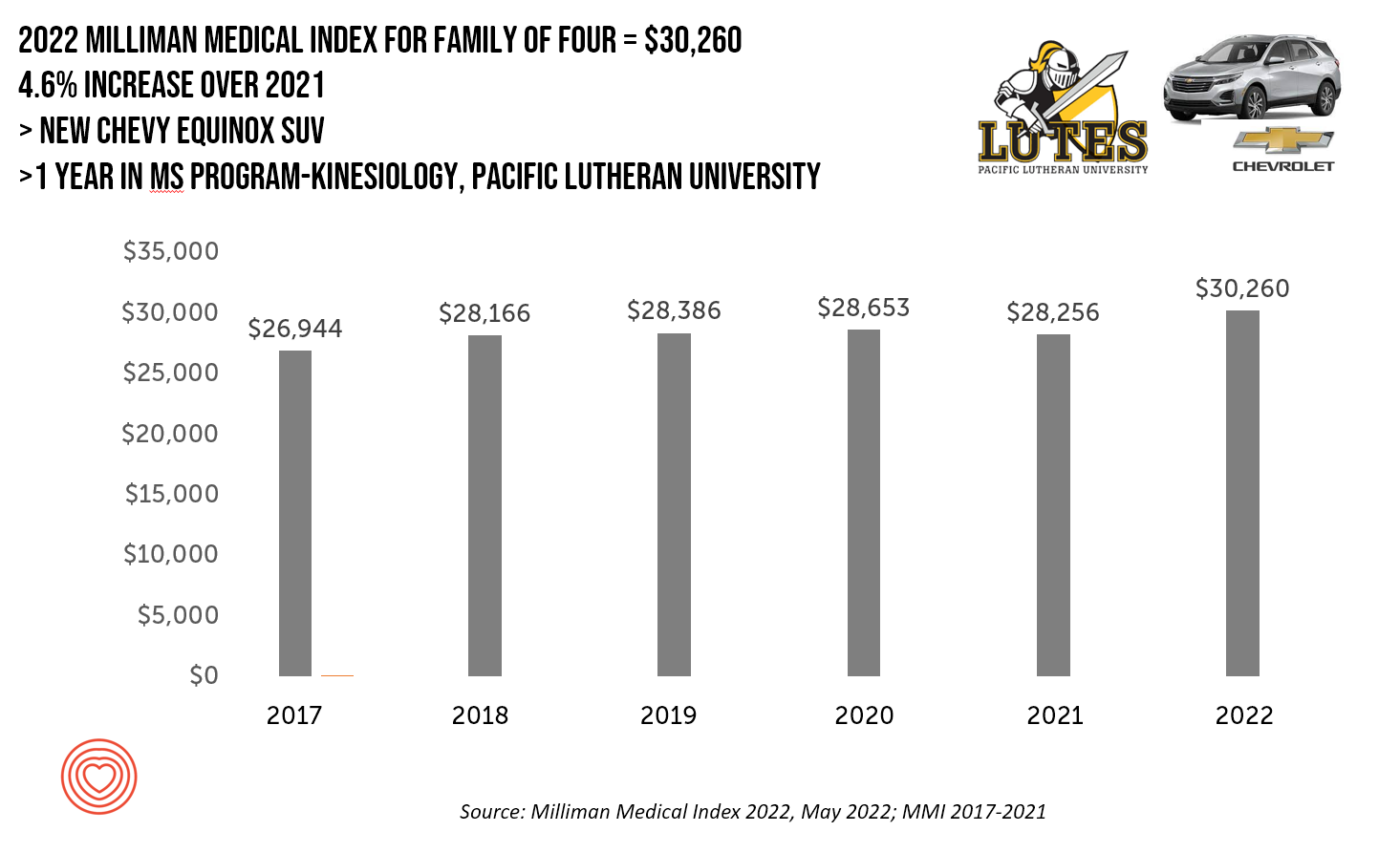

A New Chevy Equinox SUV, a Year in Grad School, or Health Care for Four – The 2022 Milliman Medical Index

A new Chevy Equinox SUV, a year in an MS program in kinesiology at Pacific Lutheran U., or health care for a family of four. At $30,260, you could pick one of these three options. Welcome to this year’s 2022 Milliman Medical Index, which annually calculates the health care costs for a median family of 4 in the U.S. I perennially select two alternative purchases for you to consider aligning with the MMI medical index. I have often picked a new car at list price and a year’s tuition at a U.S. institution of

The Patient as Consumer and Payer – A Focus on Financial Stress and Wellbeing

Year 3 into the COVID-19 pandemic, health citizens are dealing with coronavirus variants in convergence with other challenges in daily life: price inflation, civil and social stress, anxiety and depression, global security concerns, and the safety of their families. Add on top of these significant stressors the need to deal with medical bills, which is another source of stress for millions of patients in America. I appreciated the opportunity to share my perspectives on “The Patient As the Payer: How the Pandemic, Inflation, and Anxiety are Reshaping Consumers” in a webinar hosted by CarePayment on 25 May 2022. In this

How Trust and Geopolitics Will Impact Health and Business – Edelman 2022 Trust Barometer at the World Economic Forum in Davos

When we think about the state of Trust in in mid-2022, there is some good news: Trust is rising (at least in democratic countries, while falling in autocratic ones). The bad news: the gap in Trust has dramatically widened between higher-income people compared with those earning lower-incomes, globally. And that gap is “tinder” that can be quickly sparked into a socio-political fire in countries around the world, Richard Edelman cautioned today when introducing the latest look at the 2022 Edelman Trust Barometer, focusing on geopolitics and business. We have never seen numbers like this

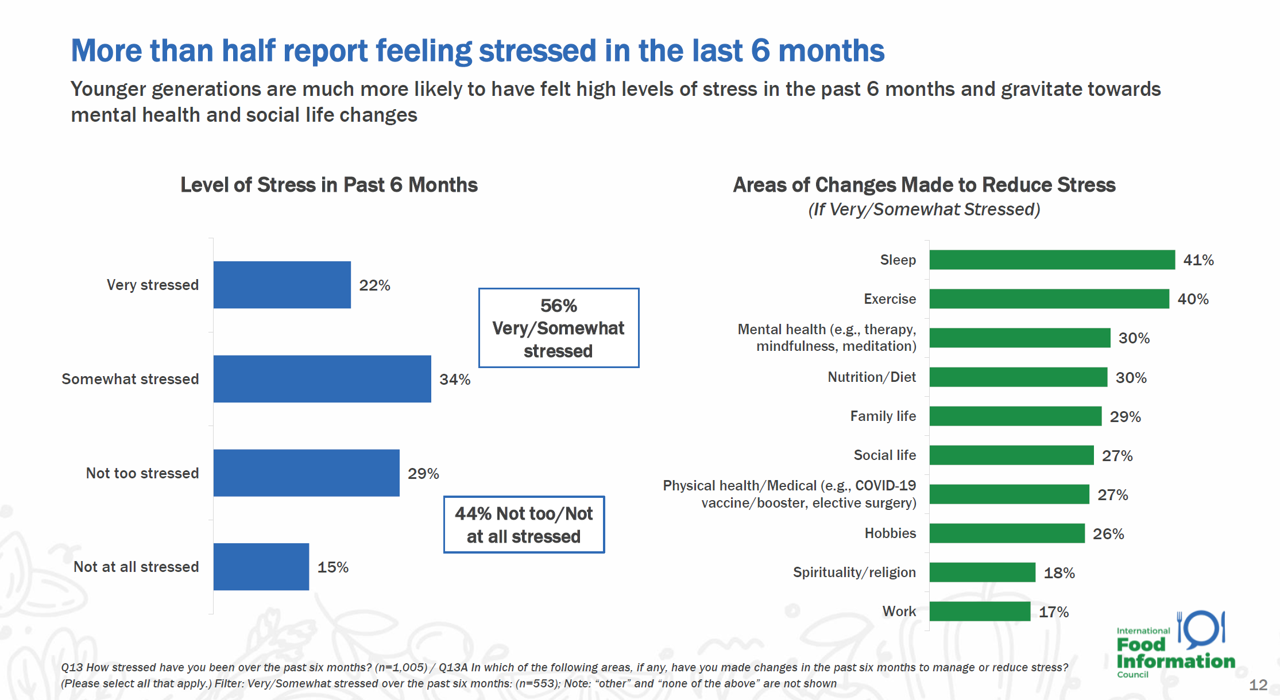

Stress Is Playing A Big Role in Consumers’ Food Habits: Food-As-Medicine Update from IFIC

The COVID-19 pandemic accelerated consumers, globally, to take on more DIY roles as well as self-care for health and well-being. In addition, anxiety and stress are mainstream across demographics and have impacted the way people select and consume food, based on findings in the 2022 Food and Health Survey from the International Food Information Council (IFIC). In this 17th annual consumer survey, IFIC points to two underlying macro trends that are re-shaping peoples’ relationship with food and health: the pandemic’s impact, and “significant” generational shifts in taste, consumption, and values about nutrition and sustainability.

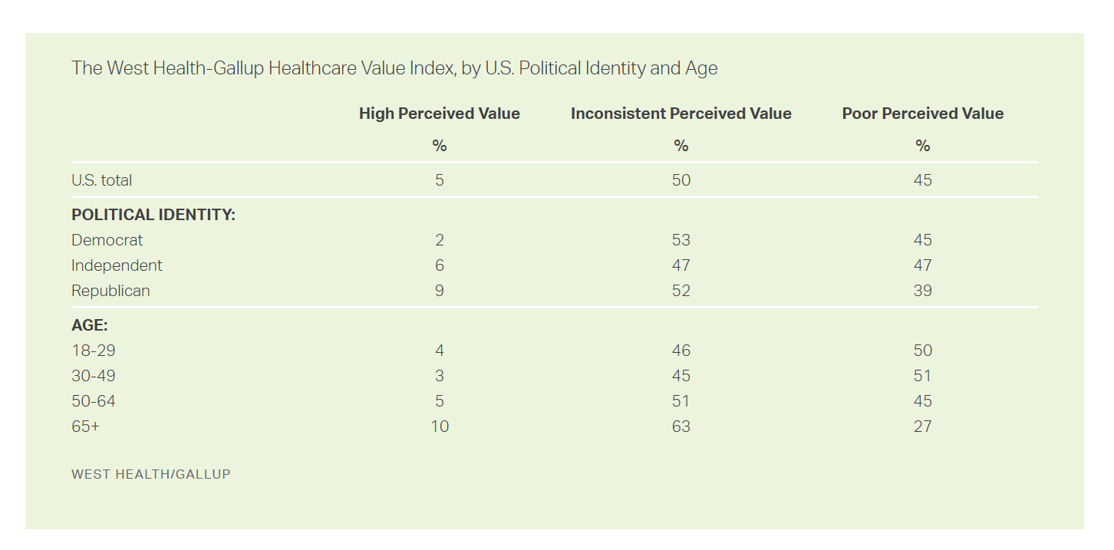

People Thinking More About the Value of Health Care, Beyond Cost

The rate of people in the U.S. skipping needed health care due to cost tripled in 2021. This prompted West Health (the Gary and Mary West nonprofit organizations’ group) and Gallup to collaborate on research to quantified Americans’ views on and challenges with personal medical costs. This has resulted in The West Health-Gallup Healthcare Affordability Index and Healthcare Value Index. The team’s research culminated in the top-line finding that some 112 million people in the U.S. struggle to pay for their care. That’s about 4.5 in 10 health citizens. Furthermore, 93% of people

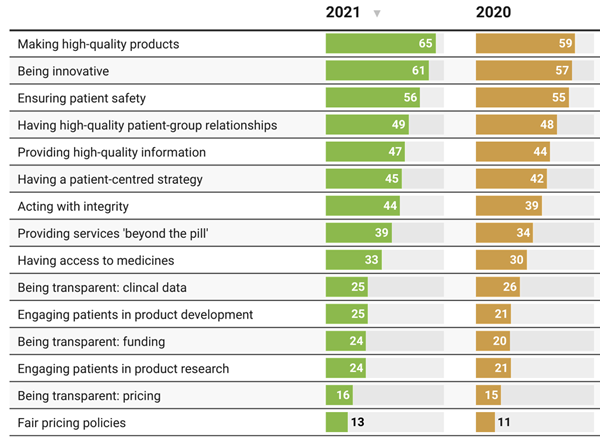

Patients Look Beyond the Pandemic to Pharma for Engagement, Innovation, and Integrity

The COVID-19 pandemic has impacted patients who were already deeply engaged with their own health care before the coronavirus emerged. Compared with a year ago, more patients and their advocates are seeking quality therapies, innovation, engagement, and integrity from pharmaceutical companies, based on research published today from PatientView. PatientView, based in the UK, has collaborated with over 40,000 patient advocacy organizations globally marking over 10 years doing this research. The eleventh annual report on the Corporate Reputation of Pharma was conducted among 2,150 patient groups between November 2021 and February 2022, covering health citizens in Europe (with 1,229 organizations), North

How Business Can Bolster Determinants of Health: The Marmot Review for Industry

“Until now, focus on….the social determinants of health has been for government and civil society. The private sector has not been involved in the discussion or, worse, has been seen as part of the problem. It is time this changed,” asserts the report, The Business of Health Equity: The Marmot Review for Industry, sponsored by Legal & General in collaboration with University College London (UCL) Institute of Health Equity, led by Sir Michael Marmot. Sir Michael has been researching and writing about social determinants of health and health equity for decades, culminating publications

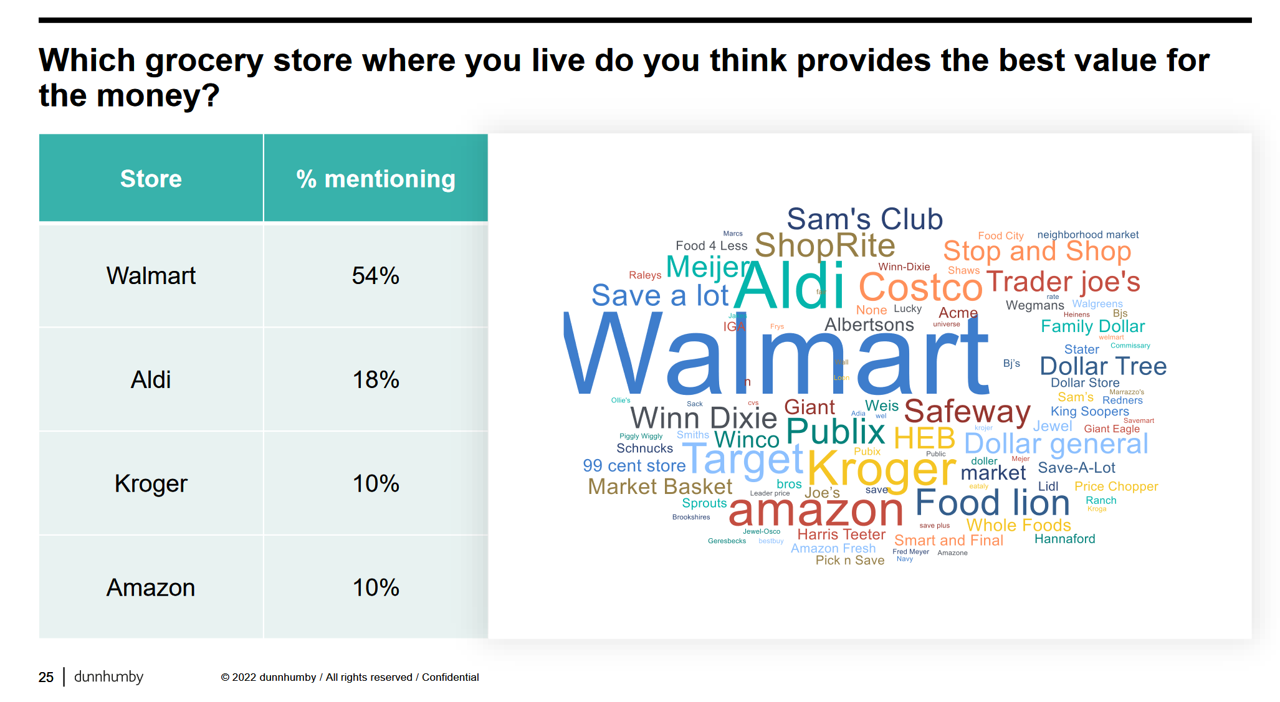

How the Pandemic, Inflation and Ukraine Are Re-Shaping Health Consumers – Learnings from dunnhumby

Too many dollars, stimulated by an influx of COVID-19 government stimulus, are chasing too few goods in economies around the world. Couple this will labor, material shortages, and disrupted supply chains, the exogenous shock of the Ukraine crisis amplifying cost increases and shortage driving higher prices for food and commodities, and global consumers are faced with strains in household budgets. This is impacting grocery stores and. through my lens, will impact health consumers’ spending, as well. In their discussion of Customer First Retailer Responses to Inflationary Times, dunnhumby, retail industry strategists, covered an update on inflation with the top-line that

In the New Inflationary Era, Gas and Health Care Costs Top Household Budget Concerns

Inflation and rising prices are the biggest problem facing America, most people told the Kaiser Family Foundation March 2022 Health Tracking Poll. Underpinning that household budget concern are gas and health care costs. Overall, 55% of people in the U.S. pointed to inflation as the top challenge the nation faces (ranging from 46% of Democrats to 70% of Republicans). Second most challenging problem facing the U.S. was Russia’s invasion into Ukraine, noted by 18% of people — from 14% of Republicans up to 23% of Democrats. The COVID-19 pandemic has fallen far down Americans’ concerns list tied third place with

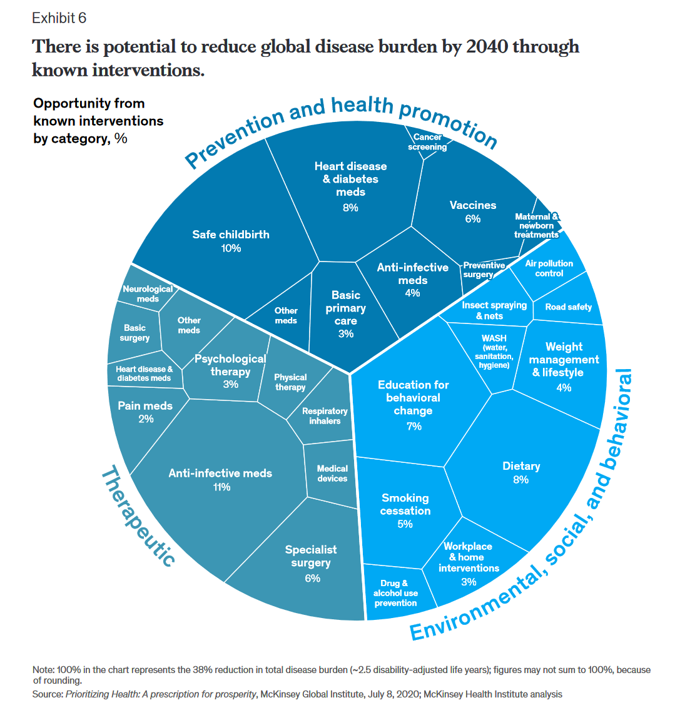

McKinsey’s Six Shifts To Add Life to Years — and One More to Consider

People spend one-half of their lives in “less-than-good health,” we learn early in the paper, Adding years to life and life to years from the McKinsey Health Institute. In this data-rich essay, the McKinsey team at MHI sets out an agenda that could help us add 45 billion extra years of higher-quality life equal to an average of six years per person (depending on your country and population demographics). The first graphic from the report illustrates four dimensions of health and the factors underneath each of them that can bolster or diminish our well-being: personal behaviors (such as sleep and diet),

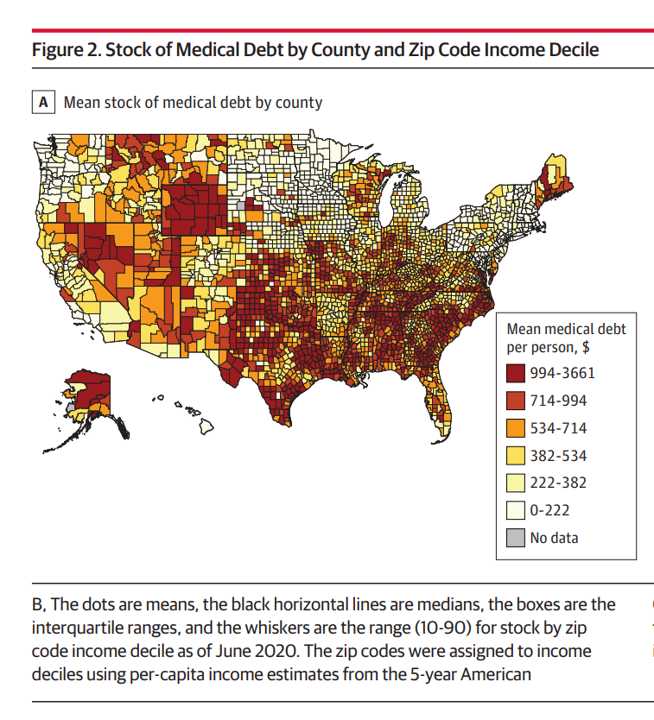

The Financial Toxicity of Health Care Costs: From Cancer to FICO Scores

The financial toxicity of health care costs in the U.S. takes center stage in Health Populi this week as several events converge to highlight medical debt as a unique feature in American health care. “Medical debt is the most common collection tradeline reported on consumer credit records,” the Consumer Financial Protection Bureau called out in a report published March 1, 2022. CFPB published the report marking two years into the pandemic, discussing concerns about medical debt collections and reporting that grew during the COVID-19 crisis. Let’s connect the dots on: A joint announcement this week from three major credit agencies,

Food Insecurity, Energy Prices, and Medical Debt Spike in February 2022

There’s a trifecta cost challenge hitting U.S. household budgets in February 2022, highlighted in a poll from Morning Consult: inflationary spikes for housing, food, and energy, and the COVID-19 Omicron variant forcing health care costs up for some consumers driving medical debt up. This further underscores the reality that medical spending in the U.S. is taking shape as a consumer service or good, competing with — potentially crowding out — other household line items like food and increasingly costly petrol to fill gas tanks. Or taken the other way, gas and food crowding out health care spending, leading to either

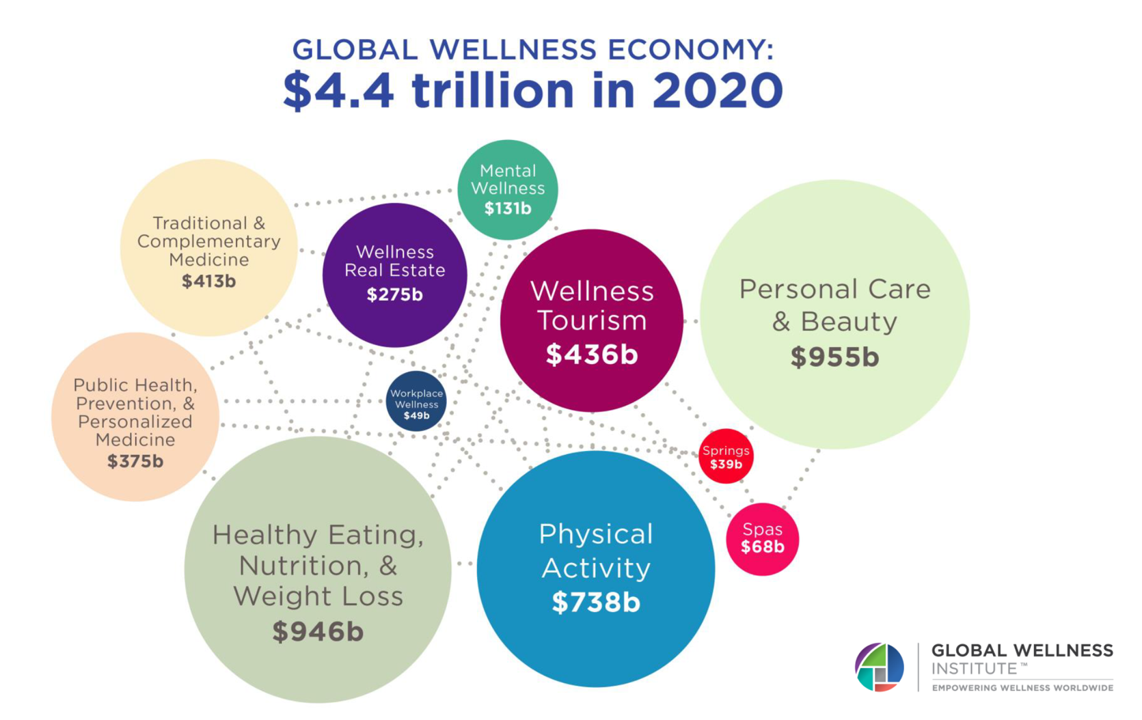

The Wellness Economy in 2022 Finds Health Consumers Moving from Feel-Good Luxury to Personal Survival Tactics

The Future of Wellness in 2022 is, “shifting from a ‘feel-good’ luxury to survivalism as people seek resilience,” based on the Global Wellness Institute’s forecast on this year’s look into self-care and consumer’s spending on health beyond medical care — looking beyond COVID-19. GWI published two research papers this week on The Future of Wellness and The Global Wellness Economy‘s country rankings as of February 2021. I welcomed the opportunity to spend time for a deep dive into the trends and findings with the GWI community yesterday exploring all of the data, listening through my health economics-consumer-technology lens. First, consider

Will “Buy Now, Pay Later” Financing Help Health Consumers Pay Their Medical Bills?

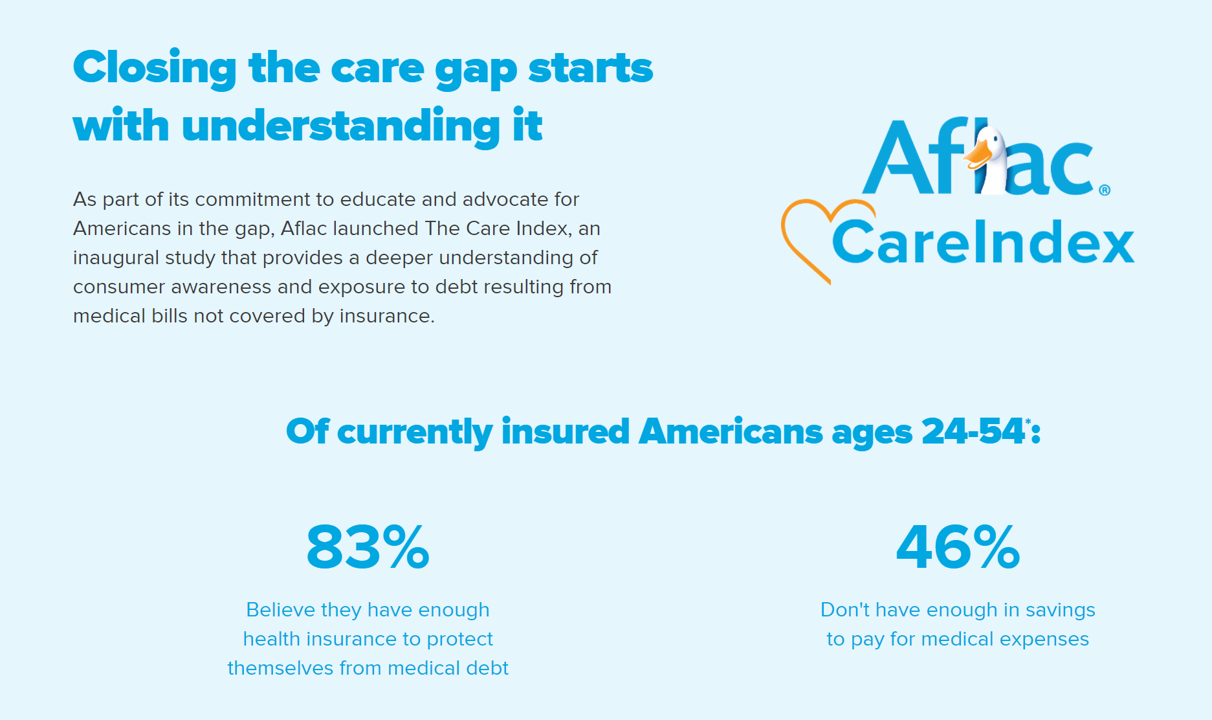

Aflac, our favorite duck-mascot-representing company, has launched the Close the Gap initiative featuring spokesman Deion Sanders, one of the good guys in the Football Hall of Fame. Recognizing the fact that nearly one-half of insured Americans don’t have enough in savings to pay for medical expenses, the company established the Aflac Care Index to educate and advocate for peoples’ health and financial security — including those people who have health care coverage. While U.S. consumers are facing historically high levels of inflation for household spending on food, petrol, and home goods, health consumers will be dealing with greater out-of-pocket spending based

The Trust Deficit Is Bad for Health: A Health/Care Lens on the 2022 Edelman Trust Barometer

“Health is the cornerstone to our core needs, thereby the cornerstone to trust.” So wrote Kirsty Graham, Global Leader of Sectors and Global Chair of Health at Edelman, in an essay explaining the 2022 Edelman Trust Barometer. If it’s January, it must be time for the World Economic Forum in Davos, the annual setting for Edelman’s launch of the company’s Trust Barometer. While WEF is mostly virtual this year due to the pandemic, Edelman has released the survey of global citizens’ views on trust in institutions right on-time and in full and sobering detail. I welcome and dig into the

The 2022 Health Populi TrendCast for Consumers and Health Citizens

I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra: “”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,” coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law. This feels especially apt right “now” as we enter 2022,

Aflac Finds Health Care and Financial Stress will “Dampen 2021 Holiday Magic” in U.S. Households

Most U.S. householders that experienced COVID-19 expect their 2021 December holidays will be impacted in terms of reducing their holiday gift or decor spending, canceling holiday travel plans to see family or friends, or canceling holiday events, according to the 2021 Aflac Health Care Issues Survey. Aflac polled 1,003 U.S. adults in September 2021 to gauge Americans’ financial health perspectives approaching the end of Year 2 of the COVID-19 pandemic in America. Families with children feel particularly strapped for the 2021 holiday season: while they will be less likely to reduce holiday spending, one-half are concerned about medical expenses compared with

Health Citizens Link Their Views on Democracy, the Economy and the Pandemic

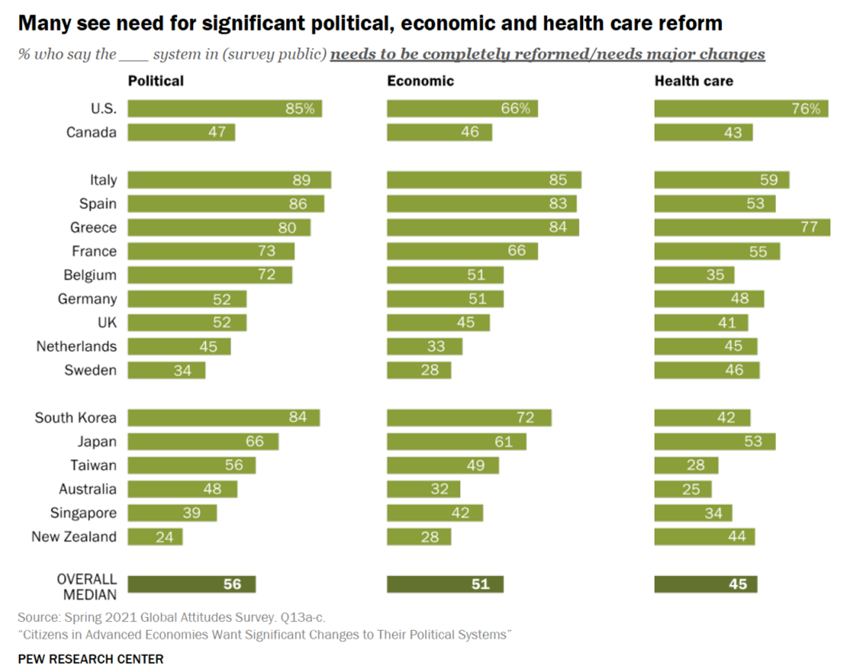

The pandemic has put health care top-of-mind for health citizens the world over. As the public health crisis continues its up-and-downticks around the globe, people are connecting health care to their national economies and politics, based on a global survey from the Pew Research Center, Citizens in Advanced Economies Want Significant Changes to Their Political Systems. For this analysis, the Pew research team assessed the views of some 2,600 health citizens living in 17 developed countries in February 2021. The study report was published in late October 2021. Shown in the first bar chart, the majority of people in at least

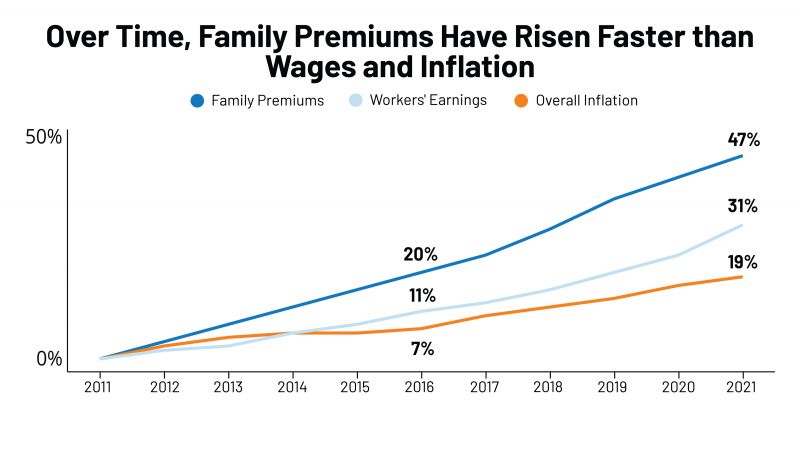

The Cost to Cover Health Insurance for a Family in America Is $22,221

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages. That family health plan premium reached $22,221, an increase of 22% since 2016, we learn in the annual report from Kaiser Family Foundation, 2021 Employer Health Benefits Survey. This report is our go-to encyclopedia of statistics on health insurance year-after-year, surveying companies’ annual health insurance strategies for coverage and tactics for managing spending and workers’ health outcomes. This 2021 update takes into account the impacts and influence of COVID-19 on workers’

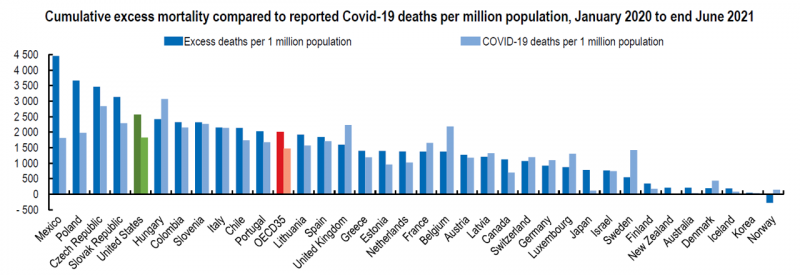

Effective Health Spending Is An Investment, Not a Cost: the Bottom-Line from OECD Health at a Glance 2021

“The pandemic has shown that effective health spending is an investment, not a cost to be contained: stronger, more resilient health systems protect both populations and economies,” the OECD states in the first paragraph of the organization’s perennially-updated report, Health at a Glance 2021. This version of the global report incorporates public health data from the “OECD35,” 35 nations from “A” to “U” (Australia to United States) quantifying excess deaths experienced during the COVID-19 pandemic, the obesity epidemic, mental and behavioral health burdens, and health care spending, among many other metrics. The first chart illustrates that calculation of excess deaths,

Health Consumers, Health Citizens, and Wearable Tech – My Chat with João Bocas

The most effective, engaging, and enchanting digital health innovations speak to patients beyond their role as health consumers and caregivers: digital health is at its best when it addresses peoples’ health citizenship. I had the great experience brainstorming the convergence of digital health, wearable tech, user-centered (UX) design, and health citizenship with João Bocas, @WearablesExpert, in a on his podcast. And if those topics weren’t enough, I wove in the role of LEGO for our well-being, “playing well,” and inspiring STEM- and science-thinking. João and I started our chat first defining health citizenship, which is a phrase I first learned from

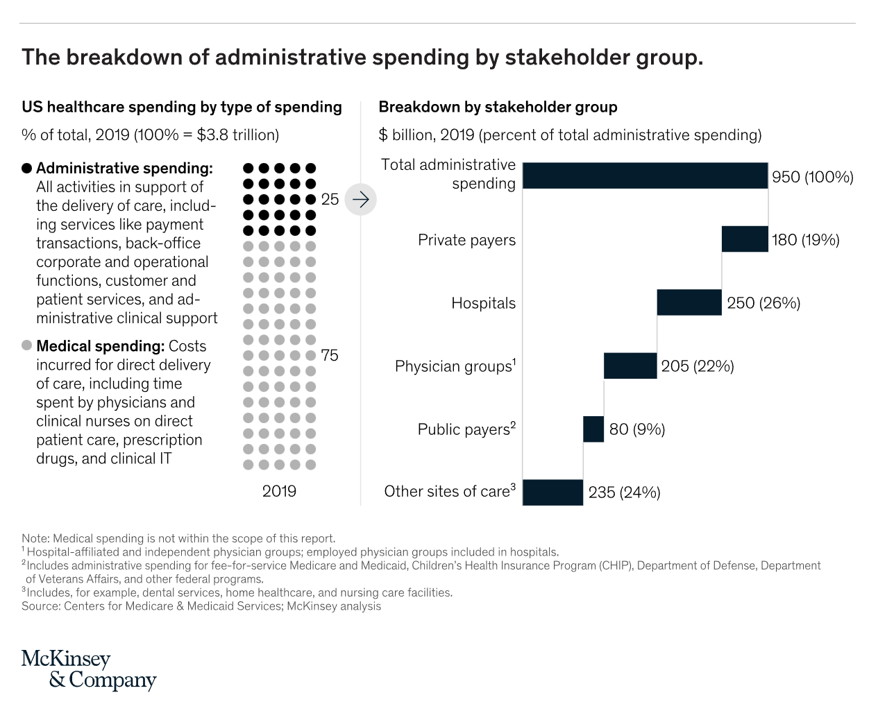

“Complexity is Profitable” in U.S. Healthcare – How to Save a Quarter-Trillion Dollars

In the U.S., “Health care is complicated because complexity is profitable.” So explain Bob Kocher, MD, and Anuraag Chigurupati, in a viewpoint on Economic Incentives for Administrative Simplification, published this week in JAMA. Dr. Kocher, a physician who is a venture capitalist, and Chigurupati, head of member experience at Devoted Health, explain the misaligned incentives that impede progress in reducing administrative spending. This essay joins two others in the October 20, 2021 issue of JAMA which highlight administrative spending in American health care: Administrative Simplification and the Potential for Saving a Quarter-Trillion Dollars in Health Care by Nikhil Sahni, Brandon

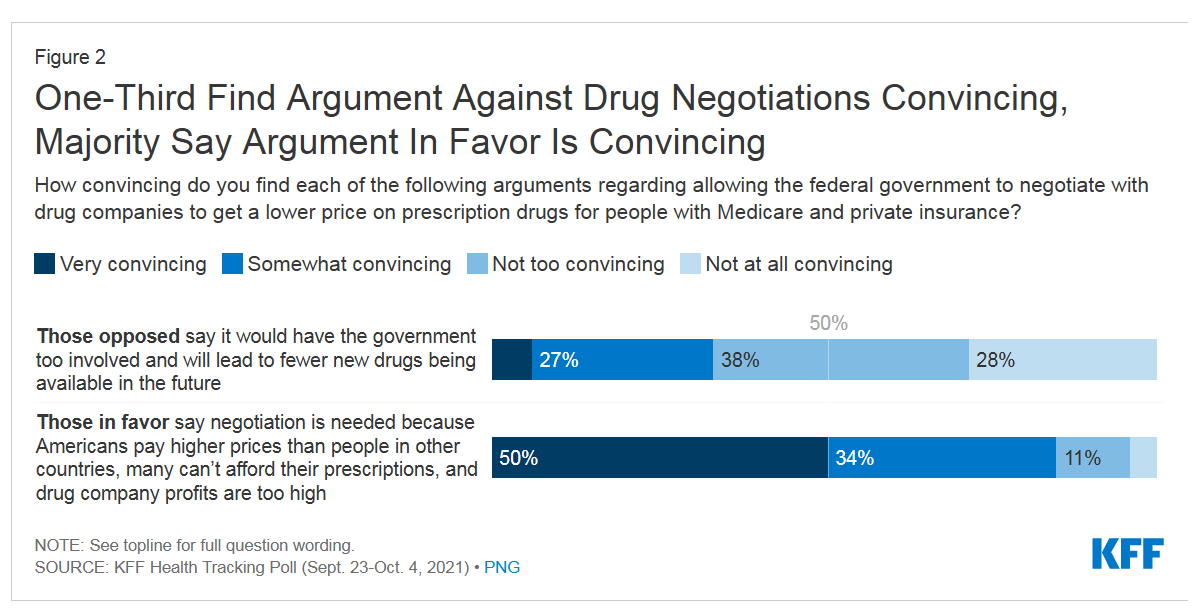

Support for Drug Price Negotiation Brings Partisans Together in the U.S.

Most U.S. adults across political parties favor allowing the Federal government authority to negotiate for drug prices — even after hearing the arguments against the health policy. Drug price negotiation, say by the Medicare program, is a unifying public policy in the current era of political schisms in America, based on the findings in a special Kaiser Family Foundation (KFF) Health Tracking Poll conducted in late September-early October 2021. Overall, 4 in 5 Americans favor allowing the Federal government negotiating power for prescription drug prices, shown in the first chart from the KFF report. By party, nearly all Democrats agree

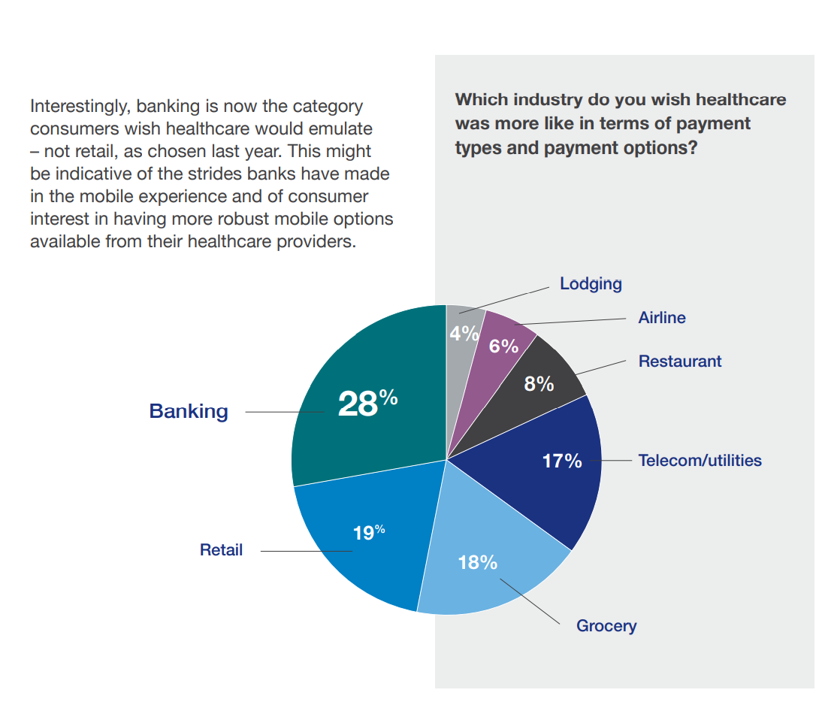

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

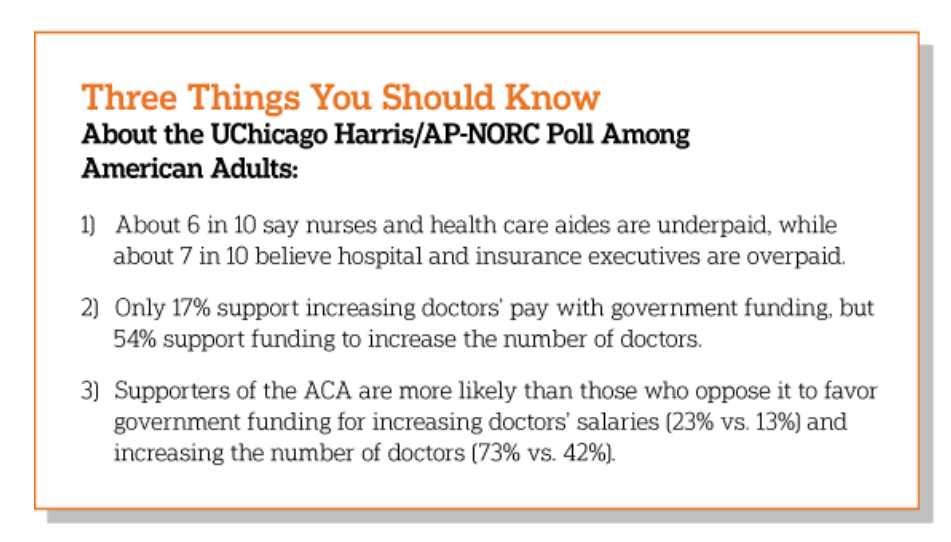

Nurses and Aides Are Beloved and Deserve Higher Pay; and a Spotlight on the Filipinx Frontline

A majority of Democrats, Independents, and Republicans agree that nurses are underpaid. Most Americans across political parties also believe that hospital executives are overpaid, according to a poll from The Associated Press-NORC Center for Public Affairs Research. The survey analysis is aptly titled, Most Americans Agree That Nurses and Aides Are Underpaid, While Few Support Using Federal Dollars to Increase Pay for Doctors, . Insurance executives are also overpaid, according to 73% of Americans — an even higher percent of people than the 68% saying hospital execs make too much money. In addition to nurses being underpaid, 6 in 10

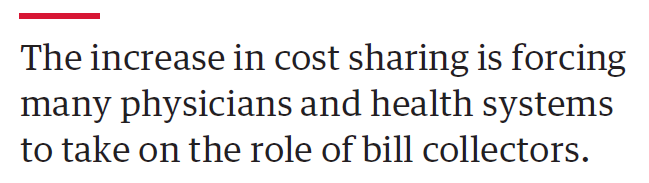

Doctors’ Offices Morph into Bill Collectors As Patients Face Growing Out-Of-Pocket Costs

In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around. That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned

Medical Debt in the U.S. Greater in States That Did Not Expand Medicaid

The level of medical debt in America exceeded debt of other types in 2020. Furthermore, the flow of medical debt was greater among health citizens living in states that did not expand Medicaid as part of the Affordable Care Act, compared with patients who reside in Medicaid expansion states, according to an original research essay, Medical Debt in the US, 2009-2020 published in JAMA on 20 July 2021. The first line chart illustrates the trends in medical debt in collections by state expansion of Medicaid, with the bottom darkest line representing debt in collections in Medicaid expansion states from the

Digital Inclusion As Upstream Health Investment

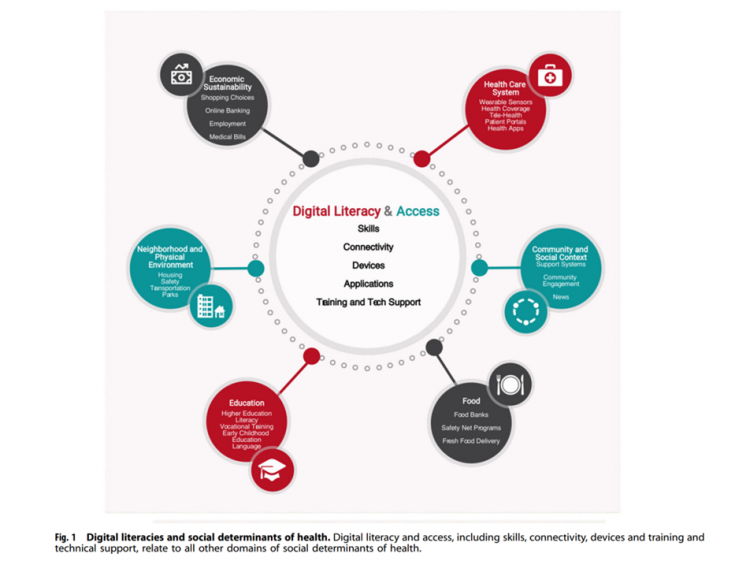

Without access to connectivity during the pandemic, too many people could not work for their living, attend school and learn, connect with loved ones, or get health care. The COVID-19 era has shined a bright light on what some of us have been saying since the advent of the Internet’s emergence in health care: that digital literacies and connectivity are “super social determinants of health” because they underpin other social determinants of health, discussed in Digital inclusion as a social determinant of health, published in Nature’s npj Digital Medicine. On the downside, lack of access to digital tools and literacies

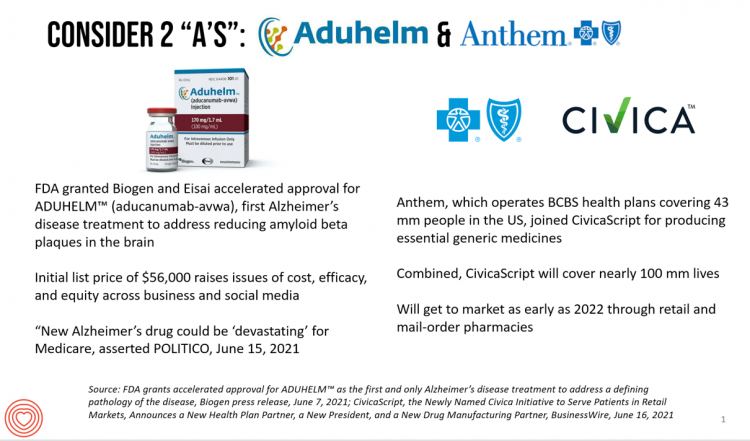

Aduhelm and Alzheimer’s Disease: A Potential Medicare Budget-Buster Puts A Blazing Light on Health Care Costs and Innovation

The FDA’s approval of the first therapy to treat Alzheimer’s Disease in over twenty years brought attention to a not-yet-convened debate of U.S. health care costs and spending, innovation, and return-on-the-investment (as well as “for whom” do the returns accrue). In my latest post for Medecision, I explore different angles on the Aduhelm and Alzheimer’s discussion, covering: The macro- and micro-economics of Alzheimer’s and the $56,000 list price for the drug The FDA regulatory process and aftermath U.S. consumers’ bipartisan support for drug price regulation through Medicare negotiation and private/commercial sector adoption Congressional legislation addressing the price of medicines in

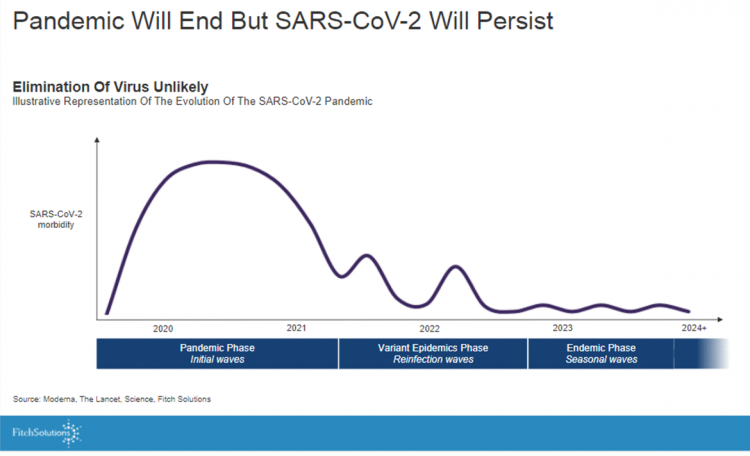

The Healthcare and Macro-Economic Impacts of Living with Endemic COVID – Listening to Fitch

Getting totally rid of the coronavirus isn’t likely, so we humans must accept the fact that SARS-CoV-2 will be endemic. The economic and healthcare system impacts of this were explored in the Post-Covid Healthcare Landscape, delivered by Fitch Solutions’ Jamie Davies and Beau Noafshar, leaders in the Pharmaceuticals, Healthcare, and Medical Devices groups. I welcomed the opportunity to learn from this team’s approach in weaving together the dynamic issues that help us to plan for the long-tail of COVID-19 and its impact on the economy and prospects for the health care industry and health citizens. The first graph illustrates the

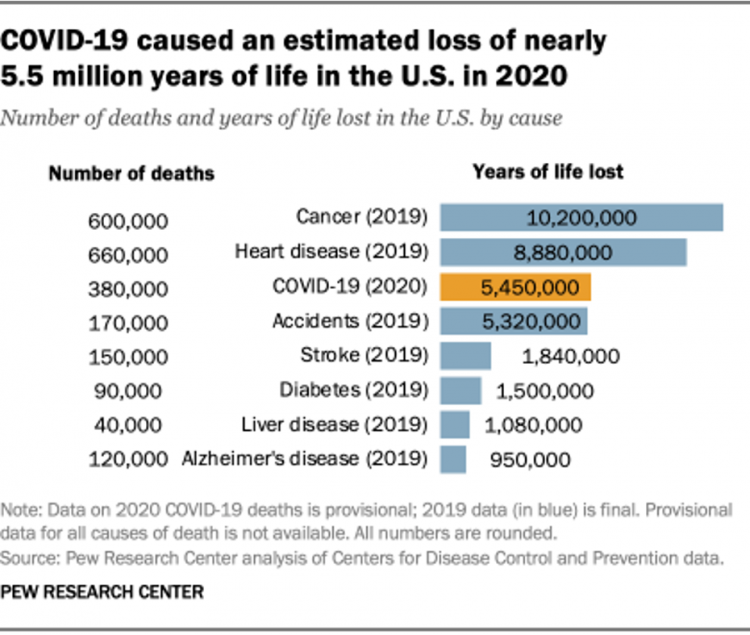

5.5 Million Years of Life Will Be Lost Due to COVID-19 in the U.S. in 2020

In 2020 in the U.S., 380,000 people are expected to die due to COVID-19. These people lost due to the coronavirus would, collectively, have lived another 5.5 million life-years would they not have succumbed to the virus. COVID-19 has cut lives short relative to their life expectancy, calculated in an analysis by the Pew Research Center based on CDC data from 2019 and 2020, coupled with additional statistics on life expectancy by age and gender. The bottom-line from the Pew Research Center’s analysis, simply stated, is that, “The pandemic…has killed many Americans who otherwise might have expected to live for

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

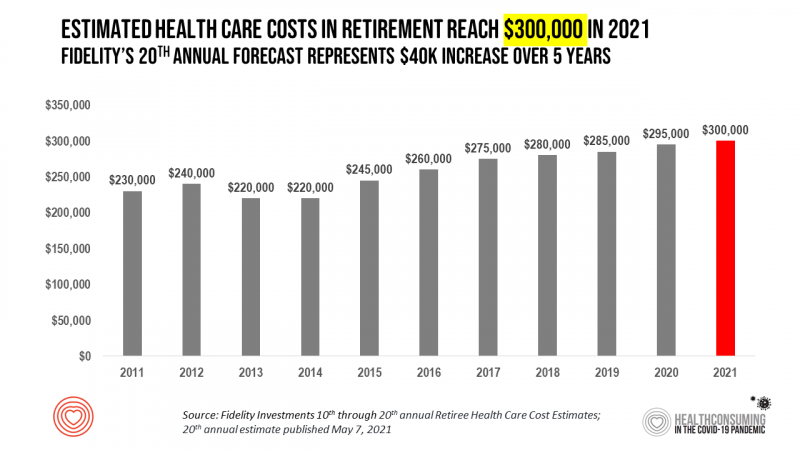

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

And the Oscar Goes To….Power to the Patients!

Health care has increased its role in popular culture over the years. In movies in particular, we’ve seen health care costs and hassles play featured in plotlines in As Good as it Gets [theme: health insurance coverage], M*A*S*H [war and its medical impacts are hell], and Philadelphia [HIV/AIDS in the era of The Band Played On], among dozens of others. And this year’s Oscar winner for leading actor, Anthony Hopkins, played The Father, who with his family is dealing with dementia. [The film, by the way, garnered six nominations and won two]. When I say “Oscar” here on the Health

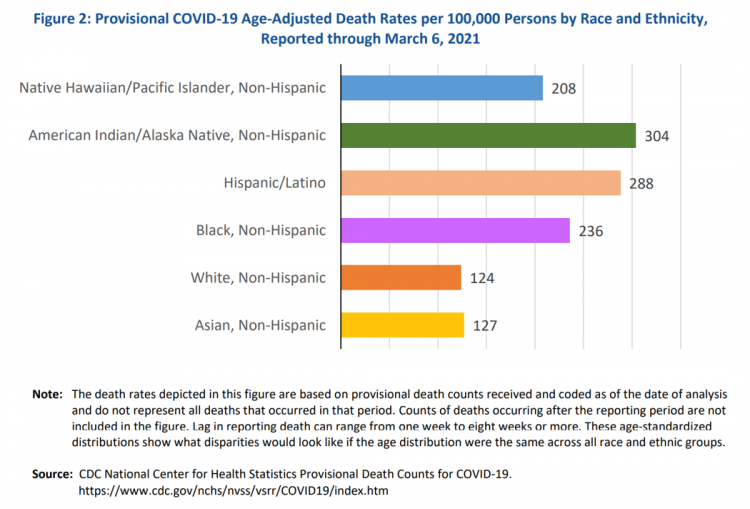

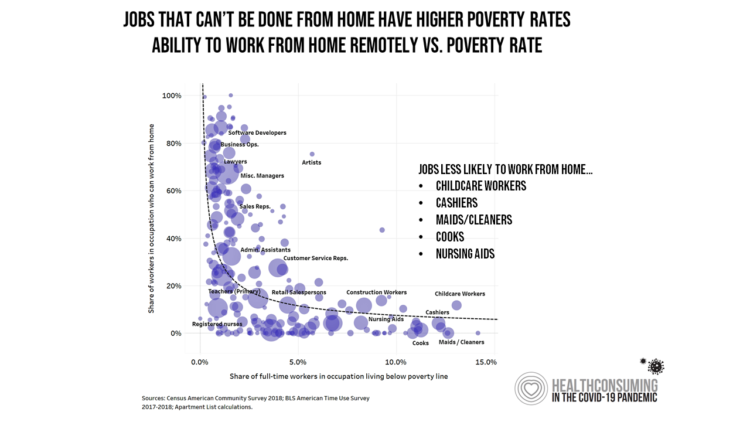

Health Disparities and the Risks of Social Determinants for COVID-19 – 14 Months of Evidence

In April 2020, the U.S. Centers for Disease Control issued a report featuring evidence that in the month of March 2020, the coronavirus pandemic was not an equal-opportunity killer. Within just a couple of months of COVID-19 emerging in America, it became clear that health disparities were evident in outcomes due to complications from the coronavirus. An update from that early look at differences in COVID-19 diagnoses and mortality rates was published in Health Disparities by Race and Ethnicity During the COVID-19 Pandemic: Current Evidence and Policy Approaches, In this report, the Assistant Secretary for Planning and Evaluation, part of

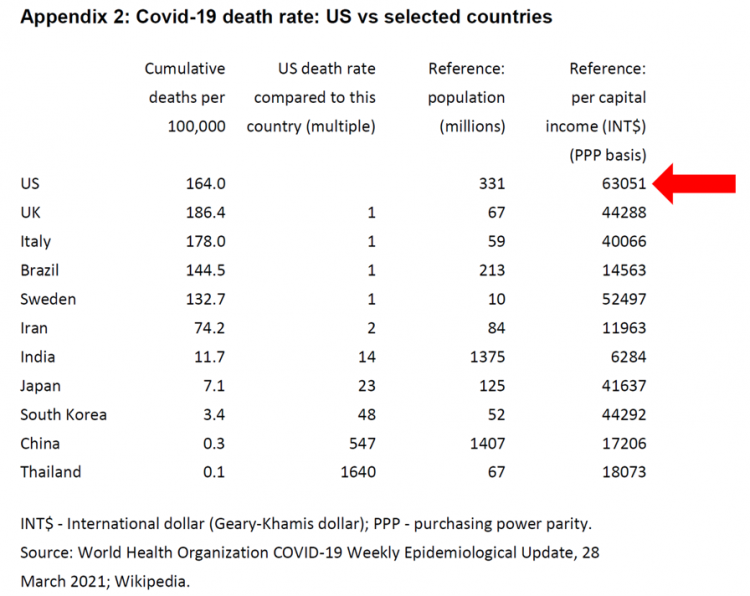

The Pandemic’s Death Rate in the U.S.: High Per Capita Income, High Mortality

The United States has among the highest per capita incomes in the world. The U.S. also has sustained among the highest death rates per 100,000 people due to COVID-19, based on epidemiological data from the World Health Organization’s March 28, 2021, update. Higher incomes won’t prevent a person from death-by-coronavirus, but risks for the social determinants of health — exacerbated by income inequality — will and do. I have the good fortune of access to a study group paper shared by Paul Sheard, Research Fellow at the Mossaver-Rahmani Center for Business and Government at the Harvard Kennedy School. In reviewing

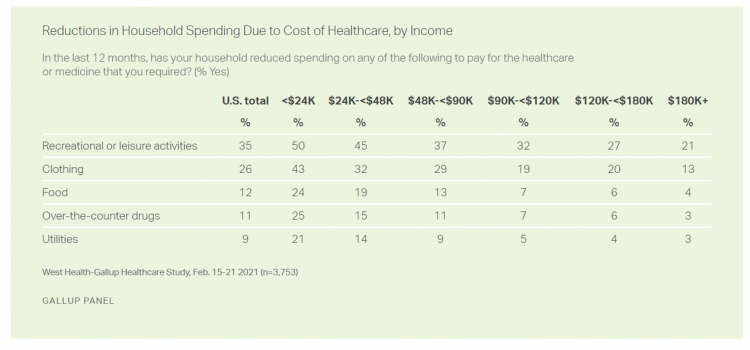

The Cost of Healthcare Can Drive Medical Rationing and Crowd Out Other Household Spending

One in five people in the U.S. cannot afford to pay for quality health care — an especially acute challenge for Black and Hispanic Americans, according to a West Health-Gallup poll conducted in March 2021, a year into the COVID-19 pandemic. “The cost of healthcare and its potential ramifications continues to serve as a burdensome part of day-to-day life for millions of Americans,” the study summary observed. Furthermore, “These realities can spill over into other health issues, such as delays in diagnoses of new cancer and associated treatments that are due to forgoing needed care,” the researchers expected. The first table

Housing as Prescription for Health/Care – in Medecision Liberation

COVID-19 ushered in the era of our homes as safe havens for work, shopping, education, fitness-awaking, bread-baking, and health-making. In my latest essay written for Medecision, I weave together new and important data and evidence supporting the basic social determinant of health — shelter, housing, home — and some innovations supporting housing-as-medicine from CVS Health, UnitedHealth Group, AHIP, Brookings Institution, the Urban Land Institute, and other stakeholders learning how housing underpins our health — physical, mental, financial. Read about a wonderful development from Communidad Partners, working with the Veritas Impact Partners group, channeling telehealth to housing programs serving residents with

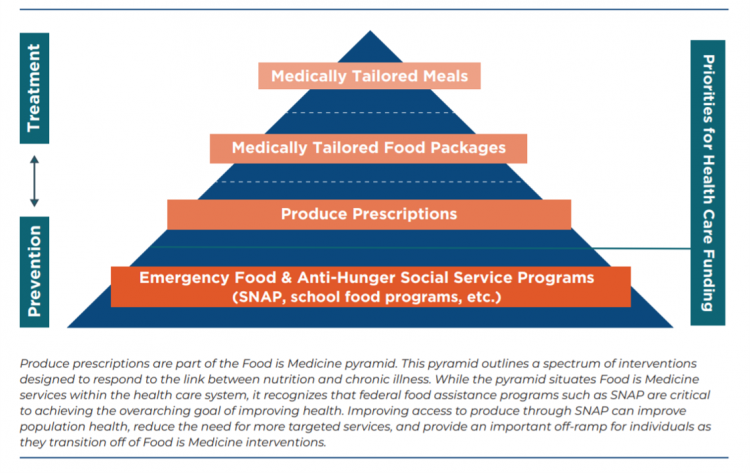

How Fruits and Veg Can Make Health and Lower Costs – Calling Chef José Andrés to the White House

Springtime is finally emerging on the east coast of the U.S. and my local CSA farm is on my mind. It’s timely, then, to re-visit a research paper on subsidizing fruits and vegetables from a March 2019 issue of PLOS as an introduction to a new initiative growing out of The Center for Health Law and Policy Innovation of Harvard Law School (CHLPI) on produce prescriptions. Timely, too, that Chef José Andrés has been called to President Biden’s White House to help address food security in America. First, let’s look at the research in PLOS: Cost-effectiveness of financial incentives for

The Ongoing Reality of COVID-19 – My Conversation with Dr. Michael Osterholm at SXSW

“So close and yet so far” feels like the right phrase to use a year after the World Health Organization used the “P-word,” “pandemic,” to describe the coronavirus’s impact on public health, globally. One year and over 550,000 COVID-related deaths in the U.S. later, we face a New Reality that Dr. Michael Osterholm and I are brainstorming today at the 2021 South-by-Southwest Festival. Usually held live and very up-close-and-personally crowded in Austin, Texas, this year we are all virtual — including the film, music, and interactive festivals alike. While I regret to not be in the same room as Dr.

How to Restore Americans’ Confidence in U.S. Health Care: Deal With Access and Cost

With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves. But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices. Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access. The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one

“Hope Springs Eternal” With the COVID Vaccine for Both Joe Biden and Most People in the U.S.

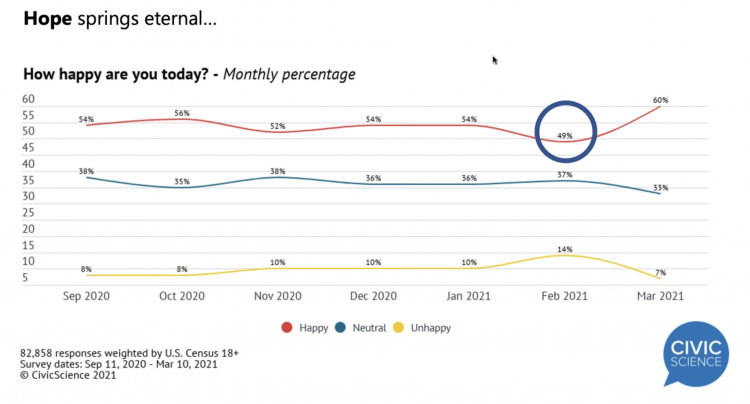

More Americans are happier in March 2021 than they’ve been for a year, based on consumer research from Civic Science polling U.S. adults in early March 2021. For the first time, a larger percent of Americans said they were better off financially since the start of the pandemic. This week, Civic Science shared their latest data on what they’re seeing beyond the coronavirus quarantine era to forecast trends that will shape a post-COVID America. Buoying peoples’ growing optimism was the expectation of the passage of the American Cares Act, which President Biden signed into effect yesterday. The HPA-CS Economic Sentiment Index

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

Ten Forces Shaping Health Care in 2021: A View from CVS Health

Expanding omni-channel, data-driven, cost-effective health care in the community, tailoring that care, and attending to mental health paint the picture of health through the lens of CVS Health. The company published the Health Trends Report 2021 today, calling out ten forces shaping health care this year. Those themes are, The Year of the Pharmacist The Next Step Forward in Cardiac Care Cancer Needs a Better Roadmap The EHR Hits Its Stride The Mental Health Shadow of COVID-19 Tailor Care to the Older Patient More Agents that Predict Disease Paying for the New Medical Miracle Virtual Care Goes Mainstream, and Diabetes

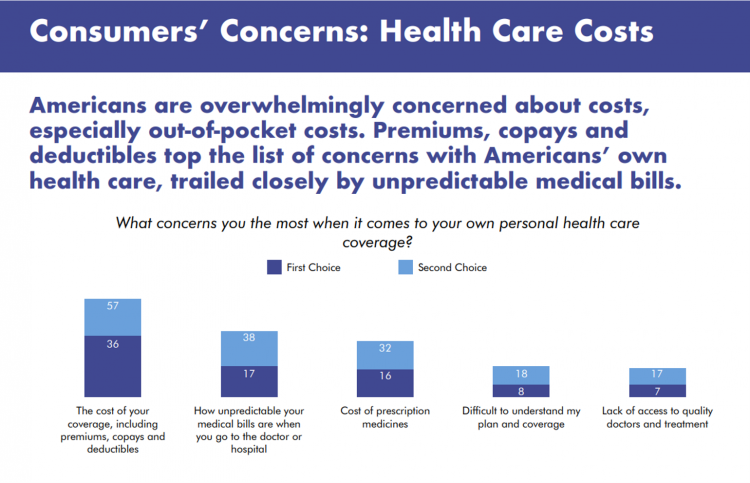

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

The Social Determinants of Prescription Drugs – A View From CoverMyMeds

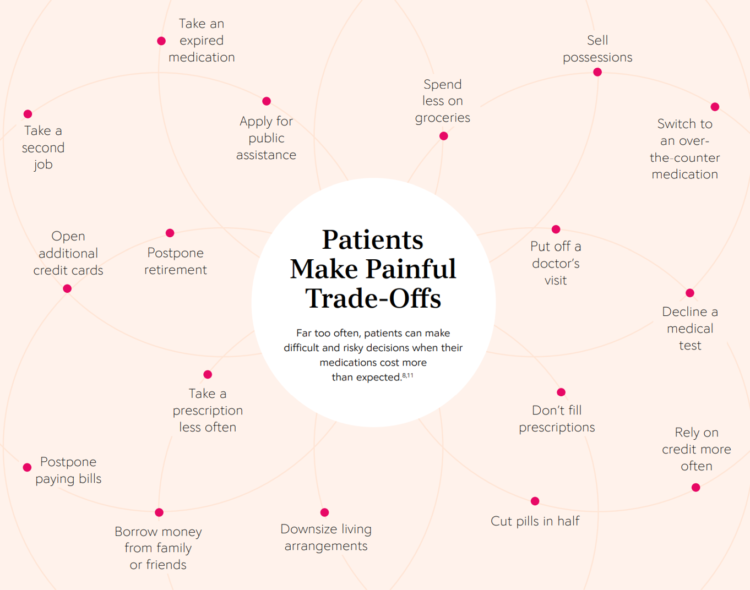

The COVID-19 pandemic forced consumers to define what were basic or essential needs to them; for most people, those items have been hygiene products, food, and connectivity to the Internet. There’s another good that’s essential to people who are patients: prescription drugs. A new report from CoverMyMeds details the current state of medication access weaving together key health care industry and consumer data. The reality even before the coronavirus crisis emerged in early 2020 was that U.S. patients were already making painful trade-offs, some of which are illustrated in the first chart from the report. These include self-rationing prescription drug

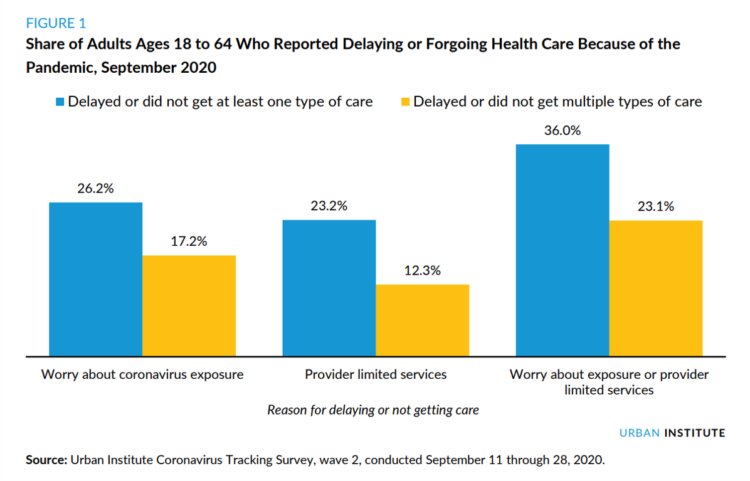

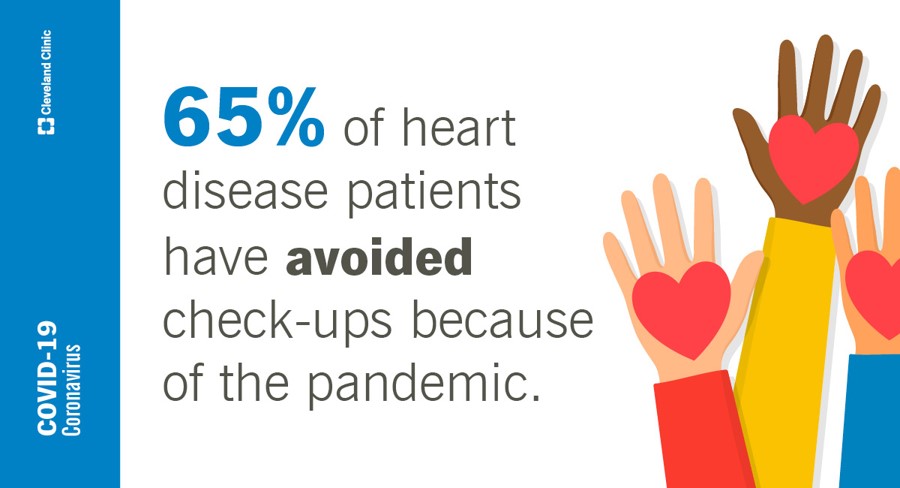

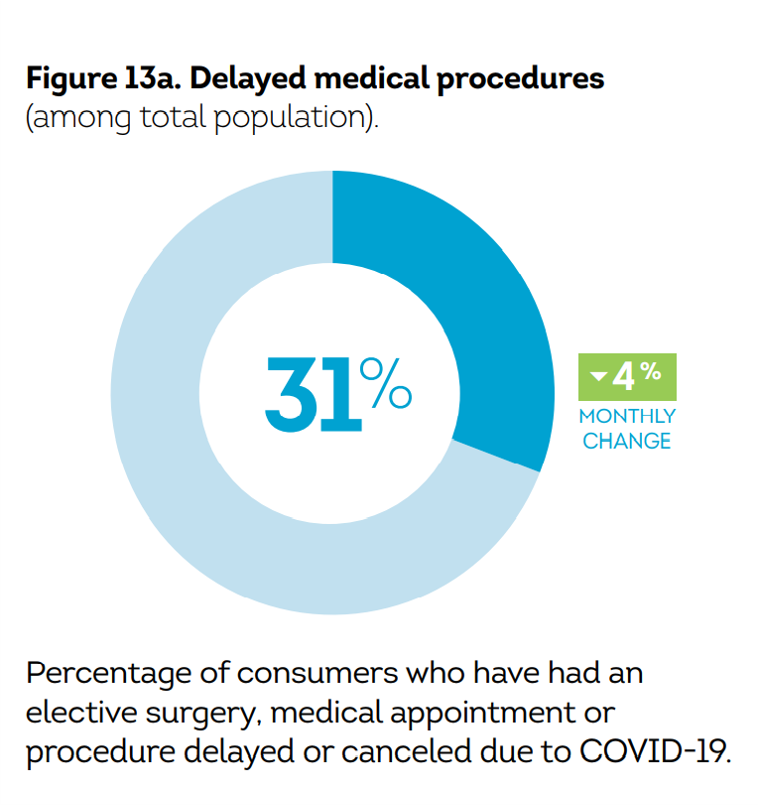

Three in Four People Avoiding Health Care in the Pandemic Have Had Chronic Conditions

By the autumn of 2020, U.S. physicians grew concerned that patients who were avoiding visits to doctor’s offices were missing care for chronic conditions, discussed in in Delayed and Forgone Health Care for Nonelderly Adults during the COVID-19 Pandemic from the Urban Institute. More than three-fourths of people who delayed or forewent care had at least one chronic health condition. The pandemic may have led to excess deaths from diabetes, dementia, hypertension, heart disease, and stroke, as well as record drug overdoses in the 12 months ending in May 2020. In their JAMA editorial on these data, Dr. Bauchner and

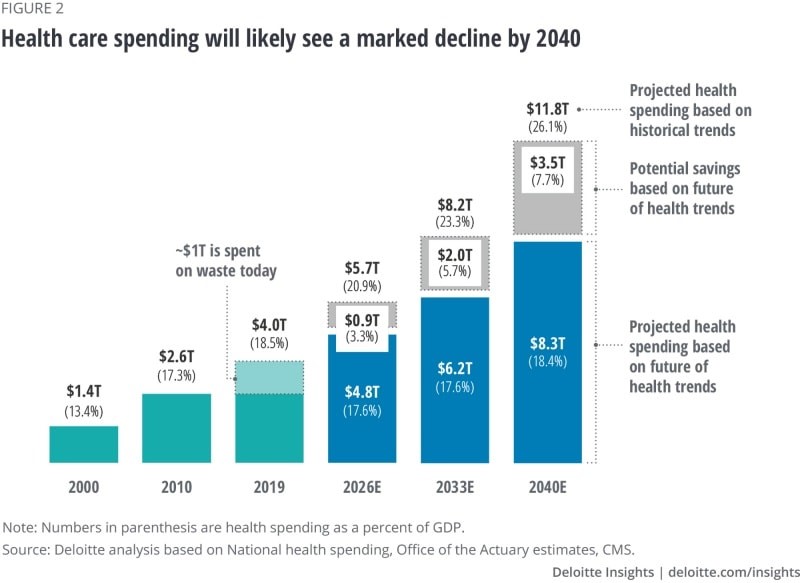

The Health Care Cost Curve is Bending Down – A New View from Deloitte

Over the next 20 years, health care spending in the U.S. will migrate toward well-being and the early detection of disease, away from the funding of America’s sick-care system, according to Breaking the cost curve, a forecast of U.S. health economics in the year 2040 from Deloitte. Current spending on health care in America is roughly $4 trillion (with a “t”) dollars, approaching 20% of the nation’s economy. By 2040, spending is projected to be $8.3 trillion based on future health trends — not historic workflows and delivery mechanisms which would consume an additional $3.5 trillion — close to what we

Ten In Ten: Manatt’s Healthcare Priorities to 2031

The coronavirus pandemic has exposed major weaknesses in the U.S. health care system, especially laying bare inequities and inertia in American health care, explained in The Progress We Need: Ten Health Care Imperatives for the Decade Ahead from Manatt Health. The report details the ten objectives that are central to Manatt’s health care practice, a sort of team manifesto call-to-action and North Star for the next decade. Their ten must-do’s for bending the cost curve while driving constructive change for a better health care system are to: Ensure access Achieve health equity Stability the safety net and rebuild public health

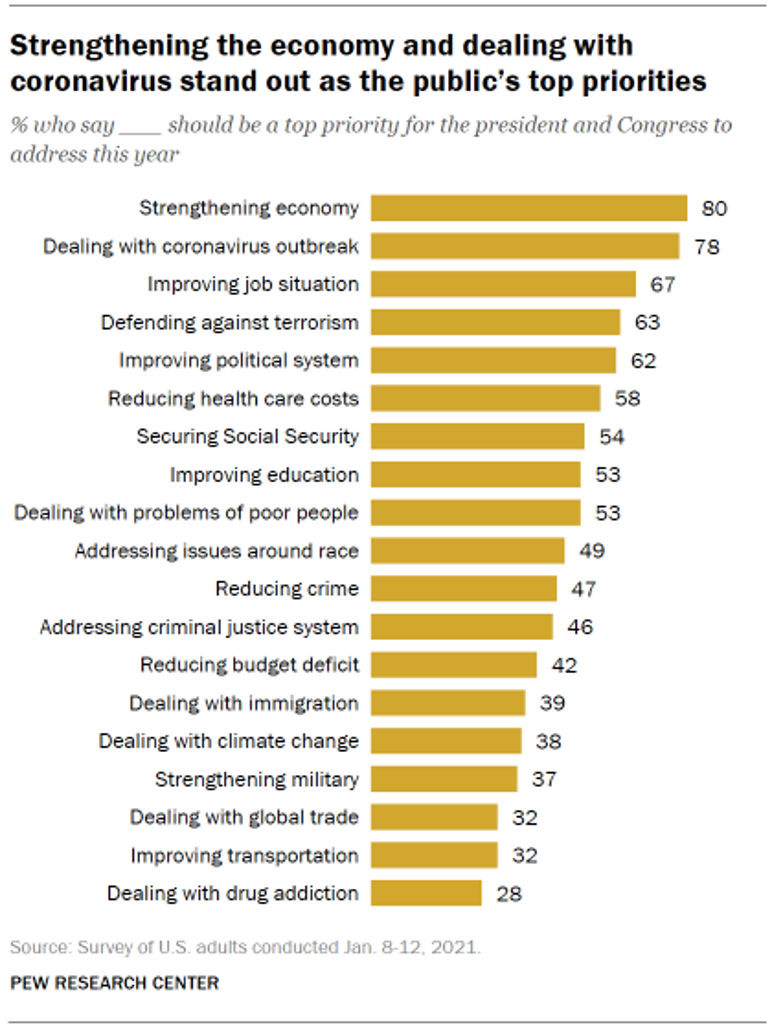

Americans A Year Into the Pandemic – A View from Pew

Nearly a year into the COVID-19 pandemic, the same percent of Americans say strengthening the U.S. economy and dealing with the coronavirus outbreak should be a top priority for President Biden and Congress to address this year, according to data from the Pew Research Center collected during the second week of January 2021. Two-thirds of people in the U.S. also want government leaders to prioritize improving the employment situation, defending against terrorism, and improving the political system, the study learned. At Americans’ low end of the priority list for the President and Congress are dealing with global trade, improving transportation,

Call It Deferring Services or Self-Rationing, U.S. Consumers Are Still Avoiding Medical Care

Patients in the U.S. have been self-rationing medical care for many years, well before any of us knew what “PPE” meant or how to spell “coronavirus.” Nearly a decade ago, I cited the Kaiser Family Foundation Health Security Watch of May 2012 here in Health Populi. The first chart here shows that one in four U.S. adults had problems paying medical bills, largely delaying care due to cost for a visit or for prescription drugs. Fast-forward to 2020, a few months into the pandemic in the U.S.: PwC found consumers were delaying treatment for chronic conditions. In October 2020, The American Cancer

The Biden Administration’s Whole-of-Government Approach to Equity – in Health and Beyond

In the U.S., the COVID-19 pandemic has revealed disparities in housing, food, and job security, and the role that one’s ZIP code and social determinants play in health outcomes. Overall, America has done poorly in light of being 4% of the world’s population but having one-fifth of the planet’s deaths due to the coronavirus. But these have disproportionately hit non-white people, who are nearly three times as likely to die from COVID-19 than white Americans. I’ve been head-down reviewing the first two days of President Biden’s signing Executive Orders, reading the National Strategy for COVID-19 Response, and inventorying line items

Our Homes Are Health Delivery Platforms – The New Home Health/Care at CES 2021

The coronavirus pandemic disrupted and re-shaped the annual CES across so many respects — the meeting of thousands making up the global consumer tech community “met” virtually, both keynote and education sessions were pre-recorded, and the lovely serendipity of learning and meeting new concepts and contacts wasn’t so straightforward. But for those of us working with and innovating solutions for health and health care, #CES2021 was baked with health goodness, in and beyond “digital health” categories. In my consumer-facing health care work, I’ve adopted the mantra that our homes are our health hubs. Reflecting on my many conversations during CES

“The virus is the boss” — U.S. lives and livelihoods at the beginning of 2021

“The virus is the boss,” Austan Goolsbee, former Chair of the Council of Economic Advisers under President Obama, told Stephanie Ruhle this morning on MSNBC. Goolsbee and Jason Furman, former Chair of Obama’s Council of Economic Advisers, tag-teamed the U.S. economic outlook following today’s news that the U.S. economy lost 140,000 jobs — the greatest job loss since April 2020 in the second month of the pandemic. The 2020-21 economic recession is the first time in U.S. history that a downturn had nothing to do with the economy per se. As Uwe Reinhardt, health economist guru, is whispering in my

The 2021 Shkreli Awards: Lown Institute Counts Down the Top 10 Healthcare Industry Abuses in the Coronavirus Pandemic

The first year of the coronavirus pandemic in America was a kind of stress test on the U.S. health care system, revealing weak links and opportunities for bad behavior. “These are not just about individual instances or bad apples,” Dr. Vikas Saini, President of The Lown Institute, explained, referring to them as “cautionary tales” of the current state of U.S. health care. Dr. Saini and his colleague Shannon Brownlee released the annual Lown Institute 2020 Shkreli Awards this week, highlighting their ten most egregious examples of the worst events in U.S. health care that happened in the past year —

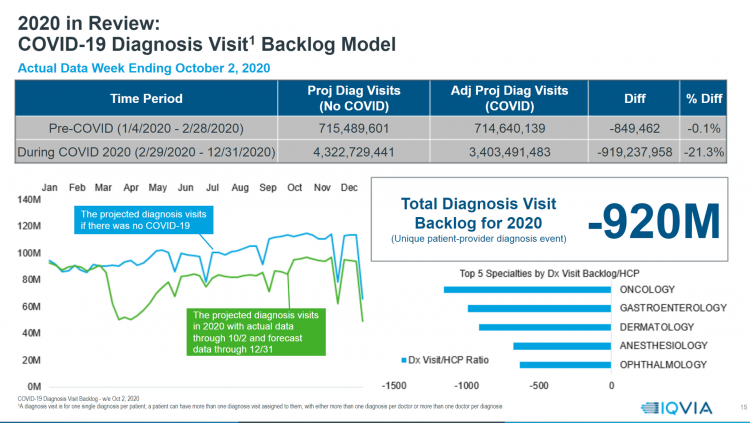

Will 2021 Be the Year of Sicker Americans? Pondering Late 2020 Data from IQVIA

Yesterday, IQVIA presented their end-of-year data based on medical claims in the U.S. health care system tracking the ups, downs, and ups of the coronavirus in America. IQVIA has been tracking COVID-19 medical trends globally from early 2020. The plotline of patient encounters for vaccines, prescribed medicines, foregone procedures and diagnostic visits to doctors begs the question: in 2021, will Americans be “sicker,” discovering later-stage cancer diagnoses, higher levels of pain due to delayed hip procedures, and eroded quality of life due to leaky guts? Here are a few snapshots that paint a picture for greater morbidity and potentially more “excess

U.S. Health Consumers’ Growing Financial Pressures, From COVID to Cancer

Before the coronavirus pandemic, patients had been transforming into health care payors, bearing high deductibles, greater out of pocket costs, and financial risk shifting to them for medical spending. In the wake of COVID-19, we see health consumers-as-payors impacted by the pandemic, as well as for existing diagnoses and chronic care management. There is weakening in U.S. consumers’ overall household finances, the latest report from the U.S. Bureau of Economic Analysis (BEA) asserted (published 25 November 2020). In John Leer’s look into the BEA report in Morning Consult, he wrote, “Decreases in income, the expiration of unemployment benefits and increased

Consumers Seek Health Features in Homes: How COVID Is Changing Residential Real Estate

The coronavirus pandemic has shifted everything that could “come home,” home. THINK: tele-work, home schooling for both under-18s and college students, home cooking, entertainment, working out, and even prayer. All of this DIY-from-home stuff has been motivated by both mandates to #StayHome and #WorkFromHome by government leaders, as well as consumers seeking refuge from contracting COVID-19. This risk-shift to our homes has led consumers to re-orient their demands for home purchase features. Today, home is ideally defined as a safe place, offering comfort and refuge for families, discovered in the America at Home Study. The Study is a joint project of

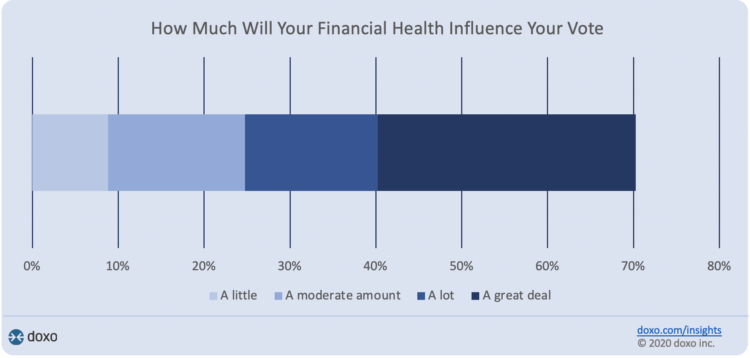

Financial Health Is On Americans’ Minds Just Weeks Before the 2020 Elections

Financial health is part of peoples’ overall health. As Americans approach November 3, 2020, the day of the real-time U.S. Presidential and down-ballot elections, personal home economics are front-of-mind. Twenty-seven days before the 2020 elections, 7 in 10 Americans say their financial health will influence their votes this year, according to the doxoINSIGHTS survey which shows personal financial health as a key voter consideration in the Presidential election. Doxo, a consumer payments company, conducted a survey among 1,568 U.S. bill-paying households in late September 2020. The study has a 2% margin of error. U.S. voters facing this year’s election are

Health Citizenship in America. If Not Now, When?

On February 4th, 2020, in a hospital in northern California, the first known inpatient diagnosed with COVID-19 died. On March 11th, the World Health Organization called the growing prevalence of the coronavirus a “pandemic.” On May 25th, George Floyd, a 46-year-old Black man, died at the hands of police in Minneapolis. This summer, the Dixie Chicks dropped the “Dixie” from their name, and NASCAR cancelled the confederate flag from their tracks. Today, nearly 200,000 Americans have died due to the novel coronavirus. My new book, Health Citizenship: How a virus opened hearts and minds, launched this week. In it, I

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

50 Days Before the U.S. Elections, Voters Say Health Care Costs and Access Top Their Health Concerns — More than COVID-19

The coronavirus pandemic has revealed deep cracks and inequities in U.S. health care in terms of exposure to COVID-19 and subsequent outcomes, with access to medical care and mortality rates negatively impacting people of color to a greater extent than White Americans. The pandemic has also led to economic decline that, seven weeks before the 2020 elections in America, is top-of-mind for health citizens with the virus-crisis itself receding to second place, according to the Kaiser Family Foundation September 2020 Health Tracking Poll. KFF polled 1,199 U.S. adults 18 years of age and older between August 28 and September 3,

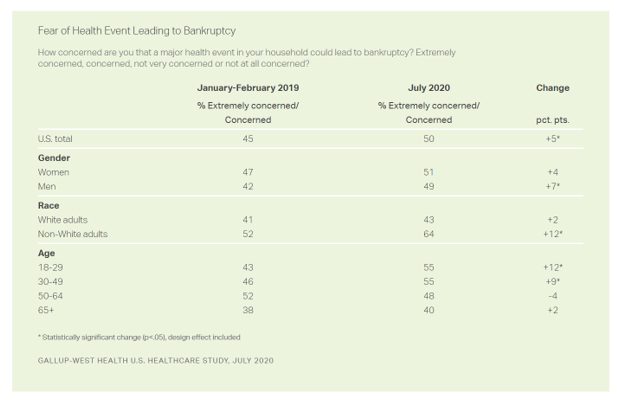

Americans Worry About Medical Bankruptcy, As Prescription Drug Costs Play Into Voters’ Concerns

One in two people in the U.S. are concerned that a major health event in their family would lead to bankruptcy, up 5 percent points over the past eighteen months. In a poll conducted with West Health, Gallup found that more younger people are concerned about medical debt risks, along with more non-white adults, published in their study report, 50% in U.S. Fear Bankruptcy Due to Major Health Event. The survey was fielded in July 2020 among 1,007 U.S. adults 18 and older. One of the basic questions in studies like these is whether a consumer could cover a $500

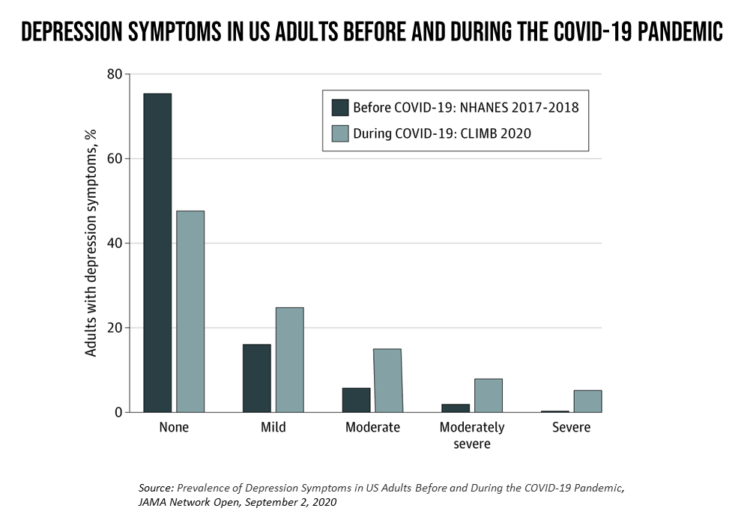

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

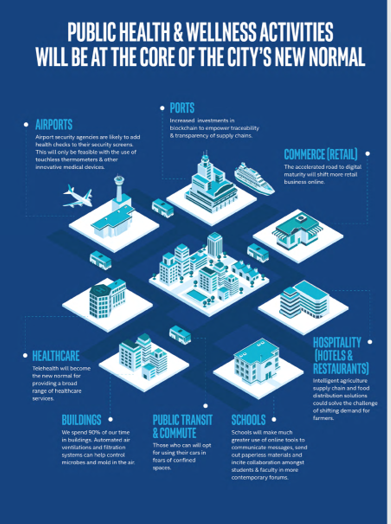

How COVID-19 Is Reshaping Cities and Inspiring Healthcare Innovation

The coronavirus pandemic added a new concept to our collective, popular lexicon: “social distancing” and “physical distancing.” This was one pillar for the public health prescription we were given to help mitigate the spread of a very tricky, contagious virus. A major negative impact of our sheltering in place, working from home, and staying indoors has been a sort of clearing out of cities where people congregate for work, for culture, for entertainment, for education, for travel and tourism…for living out our full and interesting lives and livelihoods. Intel gave Harbor Research a mandate to “re-imagine life in a post-pandemic

The She-Cession – a Financially Toxic Side-Effect of the Coronavirus Pandemic

Along with the life-threatening impact of the coronavirus on physical health, and the accompanying mental health distress activated by self-distancing comes a third unintended consequence with the pandemic: a hard hit on women’s personal economies. The recession of the pandemic is considered by many economists as a “She-Cession,” a downturn in the economy that’s negatively impacting women more acutely than men. This is markedly different than the Great Recession of 2008, the last major financial crisis: that financial decline was coined a “ManCession,” taking a more significant toll out of more typically men’s jobs like construction and manufacturing where fewer

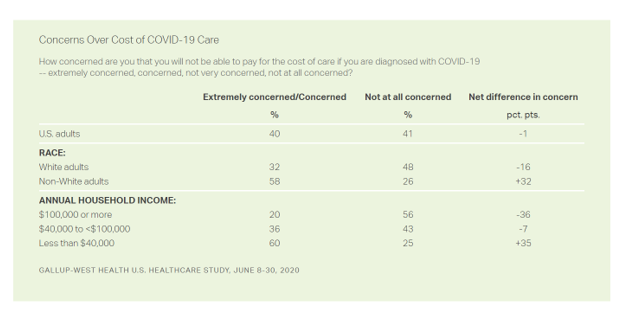

The Racial Divide Due to COVID-19 Also Applies to Healthcare and Pharma Costs

Into the sixth month of the coronavirus pandemic in the U.S., it’s clear that COVID-19 has wreaked a greater mortality and morbidity impact on people of color than on white adults. A new Gallup-West Health poll found that the coronavirus also concerns more non-white Americans than whites when it comes to the cost of health care and medicines to deal with the effects of COVID-19. Considering the cost of COVID-19 treatment, across all U.S. adults, 40% of people are concerned (extremely/concerned), and 41% are “not at all concerned.” Broken down by race, there is a stark difference in levels of

News from the Consumer Technology Association and Withings Further Demonstrates Private Sector’s Role in the Pandemic and Public Health

This week, announcements from the Consumer Technology Association (CTA) and Withings further bolster the case for the private sector bolstering public health in this pandemic…and future ones to come beyond the Age of the Coronavirus. Since the pandemic emerged, CTA has been reaching out to members and stakeholders to be a useful resource for the consumer electronics industry and its customers. Digital health resources have been an especially useful touch point for CTA’s constituents (including me, as a member who is active with the Association). On 27th July, CTA announced the Association’s launch of the Public Health Tech Initiative. In

Wear A Mask and Save 5% of US GDP: My Independence Day Holiday Wish

“And please…please…please wear a face covering,” Dr. Jerome Adams, the U.S. Surgeon General pleaded on June 30, 2020, during a speech to U.S. Public Health Workers. [You can fast forward to second #42 to hear Dr. Adams’ impassioned plea to his fellow Americans. s Wearing a mask or face covering reminds me of an early economics lesson from Adam Smith: that actions I take that are good for you can be good for me. “In addition to caring about our own well-being, we also naturally care about the well-being of others,” Ryan Patrick Hanley wrote in his assessment of Adam

U.S. Hospitals Will Lose $323 Billion in 2020 – Before Accounting for Growing COVID Cases

U.S. health systems are projected to lose $323 billion in 2020 due to declining inpatient and outpatient volumes caused by the COVID-19 pandemic’s impact on the “normal” hospital business. Hospitals racked up over $200 bn in losses between March and June 2020. according to the American Hospital Association’s report, Hospitals and Health Systems Continue to Face Unprecedented Financial Challenges Due to COVID-19. AHA suggests that the $323 bn loss figure may be underestimated, as growing coronavirus cases are emerging in certain states: as of this writing, Arizona, Arkansas, Florida, Louisiana, South Carolina, Texas, and Utah among those states heating up.

Growing Evidence for eConsults – the Asynchronous, Clinician-to-Clinician Platform for Telehealth

Health care providers stood up virtual health care services with lightning speed as the coronavirus pandemic emerged in the U.S. Telehealth and its various flavors enabled both patients and providers to manage the risk of contracting the virus, especially at a time when little was known about the nature of transmission, treatment and prevention — except for washing hands, covering one’s face, and isolating when showing symptoms. In Electronic Consultations (eConsults): A Triple Win for Patients, Clinicians, and Payers, the Milbank Memorial Fund explores the evidence supporting the growth of asynchronous electronic consultation encounters between patients and clinicians. Note that

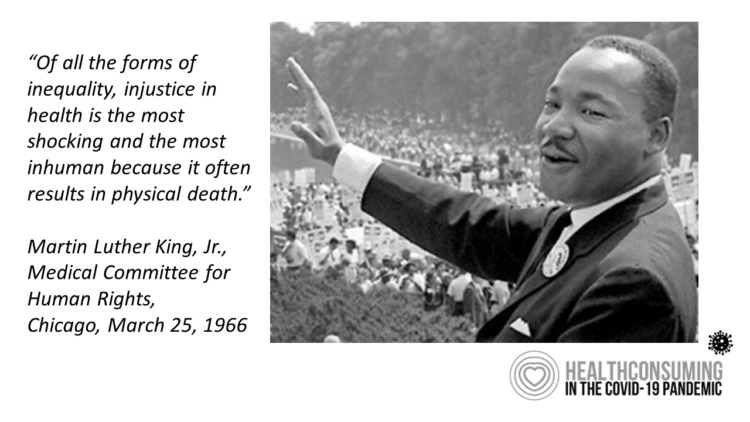

Juneteenth 2020: Inequality and Injustice in Health Care in America

“Of all the forms of inequality, injustice in health is the most shocking and the most inhuman because it often results in physical death,” Martin Luther King, Jr., asserted at the second meeting of the Medical Committee for Human Rights in Chicago on March 25, 1966. This quote has been shortened over the five+ decades since Dr. King told this truth, to the short-hand, “Of all the forms of inequality, injustice in health care is the most shocking and inhumane.” Professor Charlene Galarneau recently enlightened me on Dr. King’s original statement in her seminal essay, “Getting King’s Words Right.” Among

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

Stress in America – COVID-19 Takes Toll on Finances, Education, Basic Needs and Parenting

“The COVID-19 pandemic has altered every aspect of American life, from health and work to education and exercise,” the new Stress in America 2020 study from the American Psychological Association begins. The APA summarizes the impact of these mass changes on the nation: “The negative mental health effects of the coronavirus may be as serious as the physical health implications,” with COVID-19 stressors hitting all health citizens in the U.S. in different ways. Beyond the risk of contracting the virus, the Great Lockdown of the U.S. economy has stressed the U.S. worker and the national economy, with 7 in 10

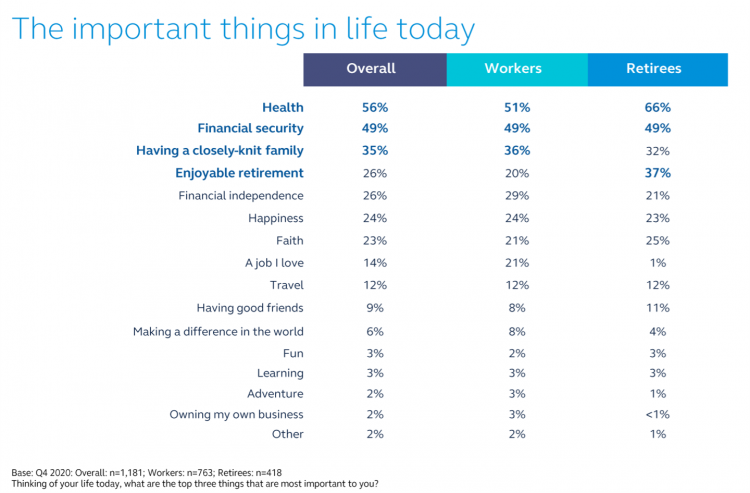

Consumers Focus on Basic Needs in the COVID-19 Pandemic: Is Self-Care a New Normal?

Personal health, food and medicine, safety and financial security are consumers’ top priorities as of April 2020, learned in consumer research analyzed in How COVID-19 will permanently change consumer behavior from Accenture. Both health and economic concerns plague consumers around the world as people “strive to adapt to a new normal,” Accenture reports. “Fear is running high as individuals contemplate what this crisis means for them…for their families and friends, and the society at large,” the report sets the table on the evolving behaviors of consumers in the pandemic. On an individual, personal level, two-thirds of people are fearful for

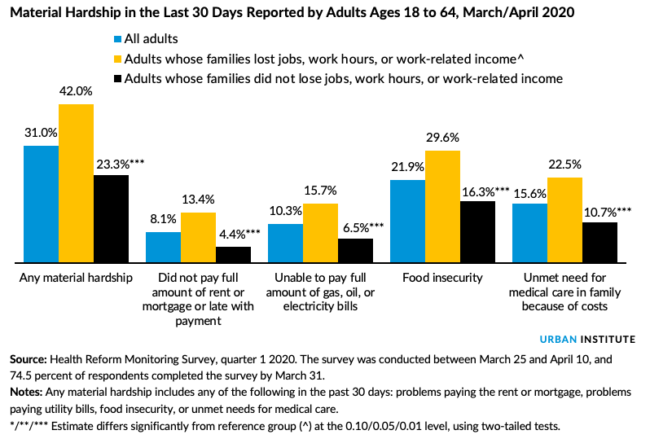

Food, Housing, Energy and Medical Care – the Material Hardships of COVID-19 in America

The Coronavirus has impacted every aspect of human life: first, the direct biological impact of COVID-19 on people, as of today the cause of over 63,000 deaths in the U.S. along with unquantifiable morbidity among millions of Americans who are surviving the virus and the toll on family caregivers. Beyond the direct physical impact of the virus, social and emotional health impacts are emerging now due to physical distancing, mandates to #StayHome, and telecommuting to jobs when possible. Mental health impacts will persist as a pandemic after the Coronavirus pandemic, I’ve previously detailed here in Health Populi. On a global

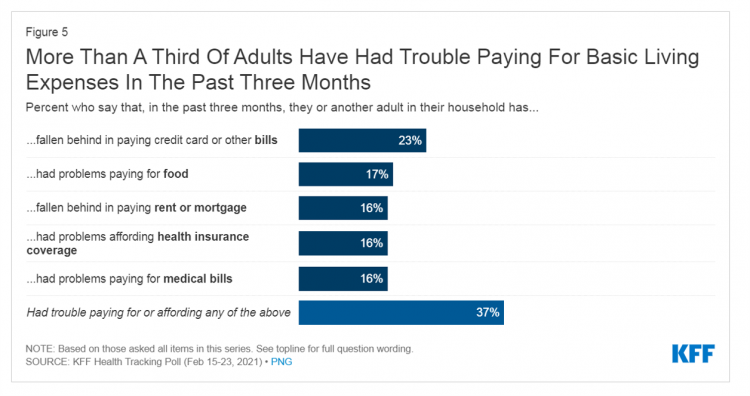

How COVID-19 is Hurting Americans’ Home Economics in 2020

Beyond the physical and clinical aspects of the COVID-19 pandemic are financial hits that people are taking in the shutdown of large parts of the U.S. economy, impacting jobs, wages, and health insurance rolls. Some 1 in 2 people in the U.S. who have had their income impacted by the coronavirus have either fallen behind in paying off credit card debt or other bills, had problems paying for utilities, have lagged in paying for housing (rent or mortgage), been challenged paying for food, or other out-of-pocket costs. We learn about these fiscal hits from COVID-10 from the latest Health Tracking Poll

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

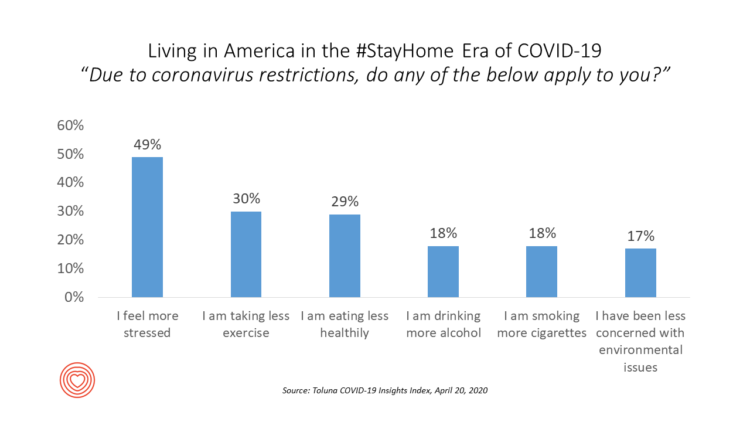

Healthy Thinking: Inside the Mind of the COVID-19 Consumer

Stress is up, smoking increasing, drinking more alcohol….Americans are tapping into a variety of coping mechanisms in the coronavirus outbreak, with health on their collective minds. Toluna and Harris Interactive are collaborating on the COVID-19 Barometer, publishing biweekly data on consumers’ views on the coronavirus pandemic. The data here are a snapshot of consumers taken through the Toluna-Harris poll conducted among 1,047 U.S. adults between 9-20 April 2020. The first chart shows various life-flows Americans have adopted in April, all risk factors impacting peoples’ overall health status and mental well-being. There were demographic differences across these factors: more women felt

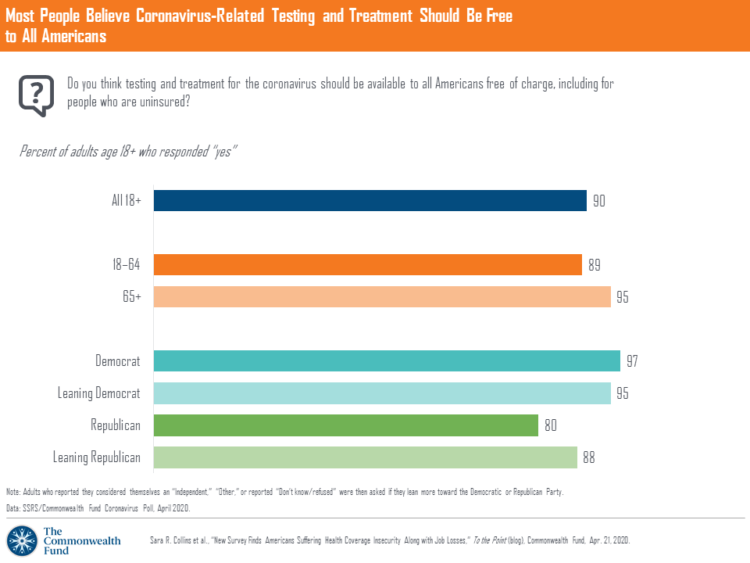

The Patient-as-Payor in the Coronavirus Pandemic

One in three working age people in the U.S. lost their job as a response to the COVID-19 pandemic, some of whom lost health insurance and others anxious their health coverage will be threatened, revealed in a survey from The Commonwealth Fund published on April 21, 2020. 2 in 5 people in America who are dealing with job insecurity are also health insurance insecure, the study found, as shown in the pie chart. The Commonwealth Fund commissioned the poll among 1,001 U.S. adults 18 to 64 years of age between 8-13 April 2020. Nearly all Americans believe the dots of

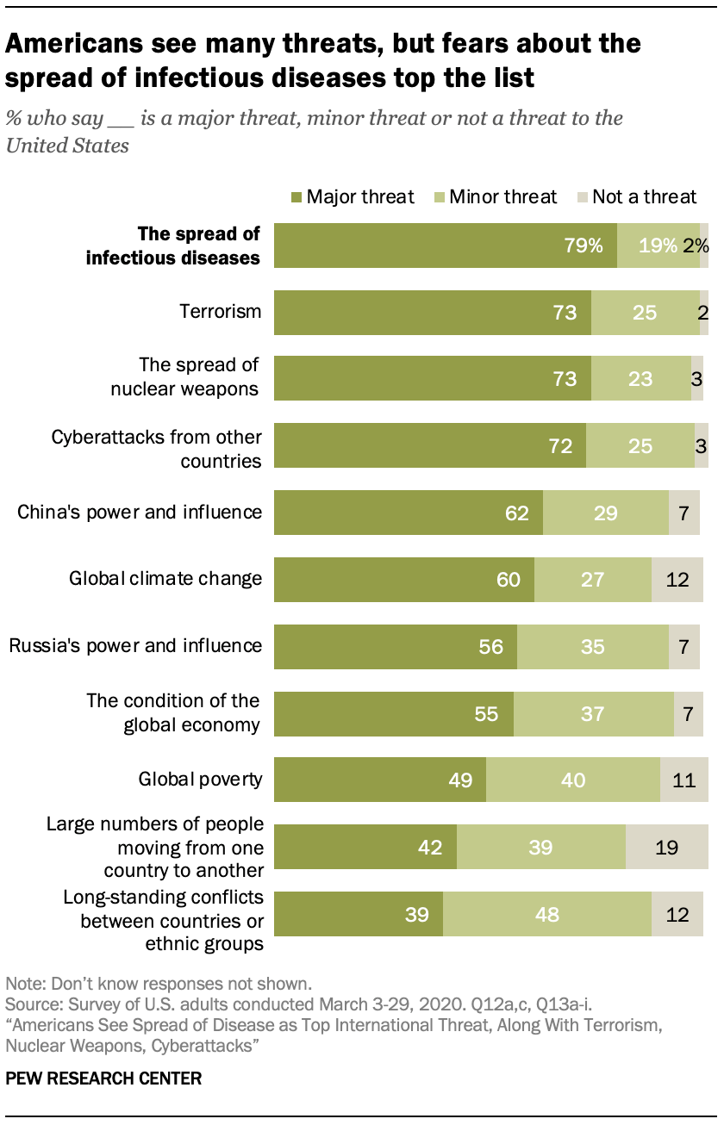

In the U.S., the Spread of Infectious Disease Now Seen As Bigger Threat Than Terrorism – Pew

The spread of infectious disease is the new terrorism in the eyes of Americans. The most significant major threat to the U.S. is infectious disease, four in five Americans said in March 2020, closely followed by terrorism (in general), the spread of nuclear weapons, and cyberattacks from other countries. For the study, the Pew Research Center commissioned a telephone survey conducted among 1,000 U.S. adults in March 2020. Large majorities of people are also highly concerned about China’s growing power and influence, global climate change, Russia’s power and influence, the condition of the global economy, and global poverty. The percent

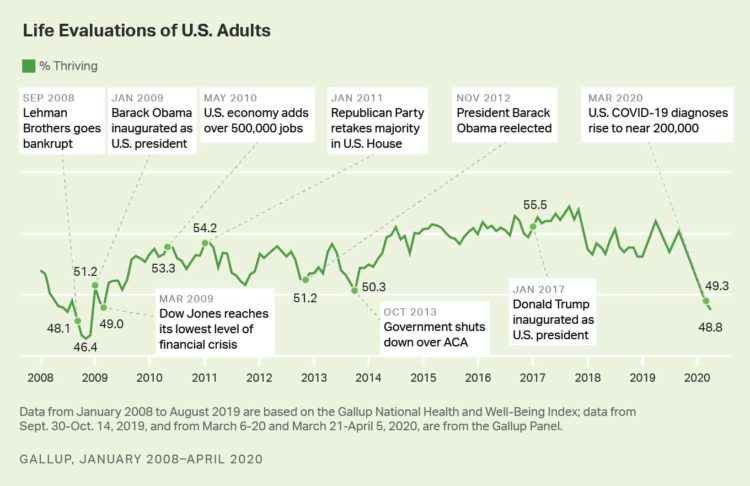

Americans’ Sense of Well-Being Falls to Great Recession Levels, Gallup Finds

It’s déjà vu all over again for Americans’ well-being: we haven’t felt this low since the advent of the Great Recession that hit our well-well-being hard in December 2008. As COVID-19 diagnoses reached 200,000 in the U.S. in April 2020, Gallup gauged that barely 1 in 2 people felt they were thriving. In the past 12 years, the percent of Americans feeling they were thriving hit a peak in 2018, as the life evaluations line graph illustrates. Gallup polled over 20,000 U.S. adults in late March into early April 2020 to explore Americans’ self-evaluations of their well-being. FYI, Gallup asks consumers

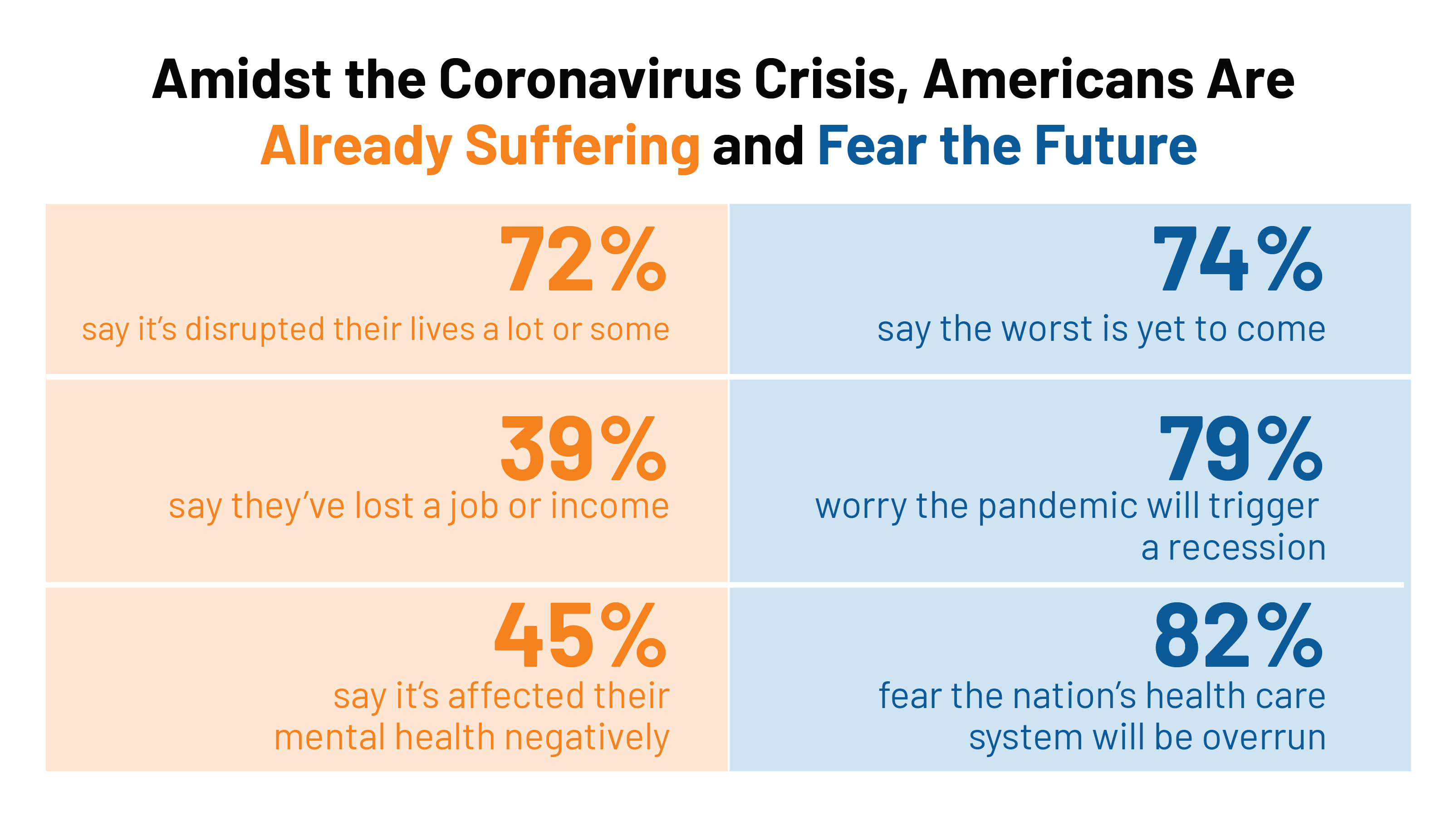

The Coronavirus Impact on American Life, Part 1 – Life Disrupted, and Money Concerns

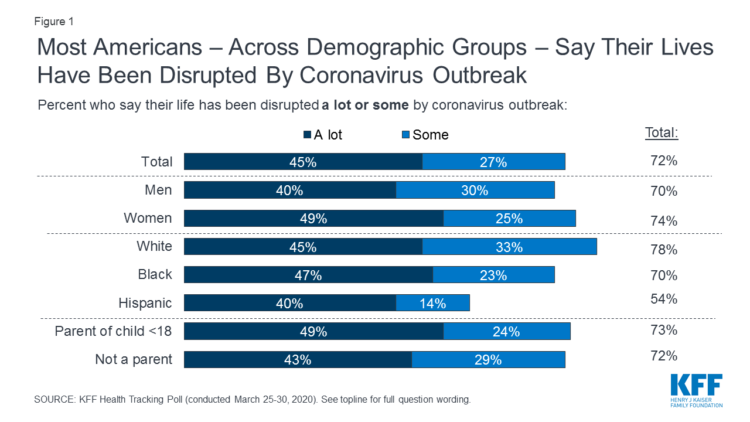

Nearly 3 in 4 Americans see their lives disrupted by the coronavirus pandemic, according to the early April Kaiser Family Foundation Health Tracking Poll. This feeling holds true across most demographic factors: among both parents and people without children; men and women alike; white folks as well as people of color (although fewer people identifying as Hispanic, still a majority). There are partisan differences, however, in terms of who perceives a life-disruption due to COVID-19: 76% of Democrats believe this, 72% of Independents, and 70% of Republicans. Interestingly, only 30% of Republicans felt this way in March 2020, more than

Honor Your Doctor – It’s National Doctors Day Today (and EveryDay)

Today, March 30, is National Doctors Day. We honor doctors annually on this day. But every day, we must honor physicians for bolstering the health and wellness of our fellow Americans, our beloved families and friends, and our selves. The Coronavirus Pandemic reminds us of the precious and scarce resource that is our national supply of physicians in America — numbering about 750,000 active clinicians in the U.S. according to the U.S. Bureau of Labor Statistics. Even before the COVID-19 crisis, physicians in America had been feeling increasingly burned out and depressed. The 2020 WebMD survey on the state of

Wistful Thinking: The National Health Spending Forecast In a Land Without COVID-19

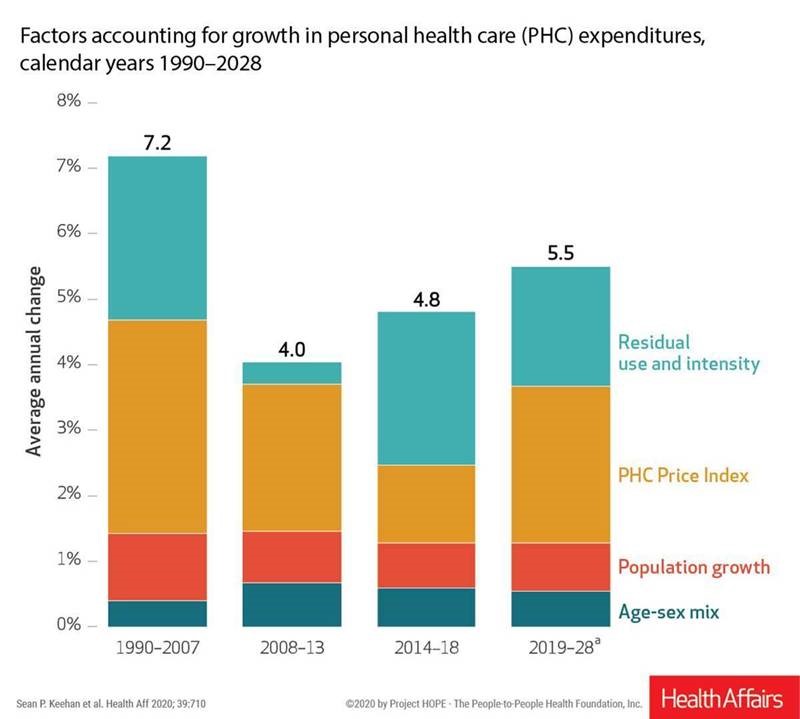

U.S. health care spending will grow to 20% of the national economy by 2028, forecasted in projections pre-published in the April 2020 issue of Health Affairs, National Health Expenditure (NHE) Projections. 2019-28: Expected Rebound in Prices Drives Rising Spending Growth. NHE will grow 5.4% in the decade, the model expects. But…what a difference a pandemic could make on this forecast. This year, NHE will be $3.8 trillion, growing to $6.2 trillion in 2028. Hospital care spending, the largest single component in national health spending, is estimated at $1.3 trillion in 2020. These projections are based on “current law,” the team

In the US COVID-19 Pandemic, A Tension Between the Fiscal and the Physical

“Act fast and do whatever it takes,” insists the second half of the title of a new eBook with contributions from forty leading economists from around the world. The first half of the title is, Mitigating the COVID Economic Crisis. The book is discussed in a World Economic Forum essay discussing the economists’ consensus to “act fast.” As the U.S. curve adds new American patients testing positive for the coronavirus, the book and essay illustrate the tension between health consumer versus the health citizen in the U.S. For clinical context, as I write this post on 24th March 2020, today’s U.S.

Lockdown Economics for U.S. Health Consumers

The hashtag #StayHome was ushered onto Twitter by 15 U.S. national healthcare leaders in a USA Today editorial yesterday. The op-ed co-authors included Dr. Eric Topol, Dr. Leana Wen, Dr. Zeke Emanuel, Dr. Jordan Shlain, Dr. Vivek Murthy, Andy Slavitt, and other key healthcare opinion leaders. Some states and regions have already mandated that people stay home; at midnight last night, counties in the Bay Area in California instituted this, and there are tightening rules in my area of greater Philadelphia. UBS economist Paul Donovan talked about “Lockdown Economics” in his audio commentary today. Paul’s observations resonated with me as

The Book on Deaths of Despair – Deaton & Case On Education, Pain, Work and the Future of Capitalism

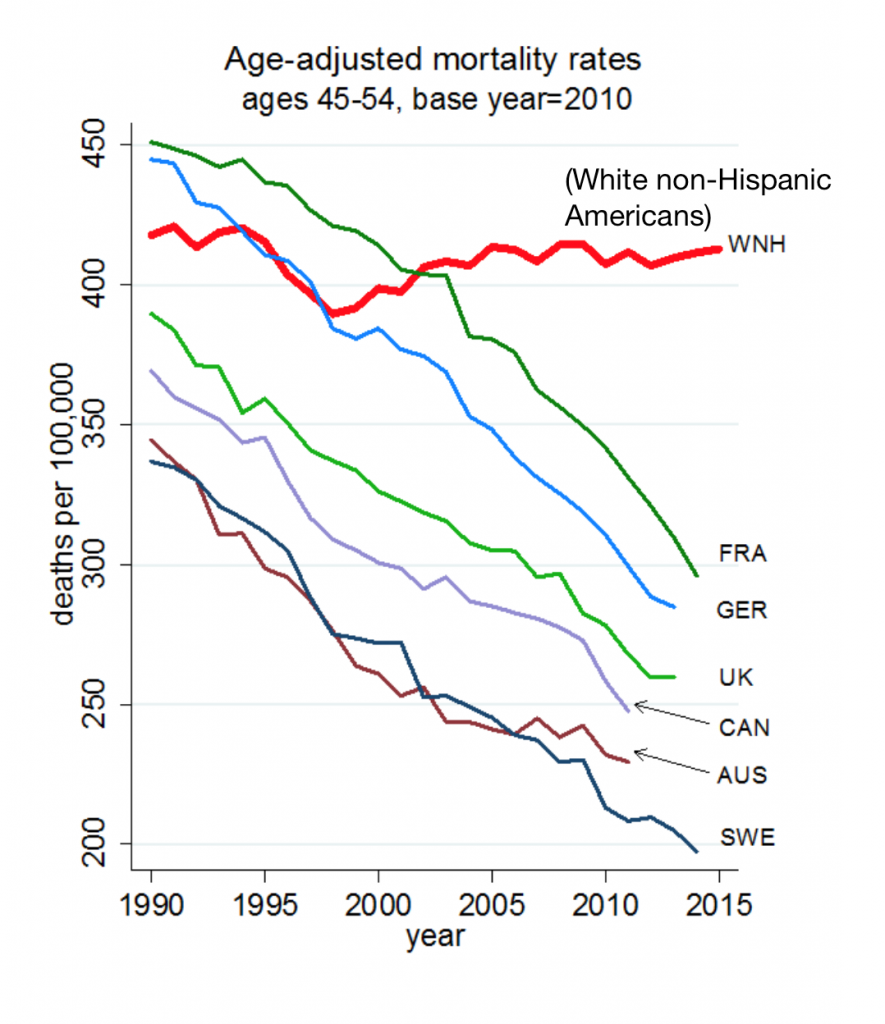

Anne Case and Angus Deaton were working in a cabin in Montana the summer of 2014. Upon analyzing mortality data from the U.S. Centers for Disease Control, they noticed that death rates were rising among middle-aged white people. “We must have hit a wrong key,” they note in the introduction of their book, Deaths of Despair and the Future of Capitalism. This reversal of life span in America ran counter to a decades-long trend of lower mortality in the U.S., a 20th century accomplishment, Case and Deaton recount. In the 300 pages that follow, the researchers deeply dive into and

Job #1 for Next President: Reduce Health Care Costs – Commonwealth Fund & NBC News Poll

Four in five U.S. adults say lowering the cost of health care in America should be high priority for the next American president, according to a poll from The Commonwealth Fund and NBC News. Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms. The first chart illustrates that lowering health care costs is a priority that crosses political parties. This is true for all flavors of health care costs, including health insurance deductibles and premiums, out-of-pocket costs for prescription drugs, and the cost of long-term care. While

Thank you FeedSpot for

Thank you FeedSpot for