Americans’ Top Sources of Stress are Money, Money, Money and Family

ABBA sang the song “Money Money Money” back in 1976. The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019. “Work all night, I work all day, to pay the bills I have to pay Ain’t it sad And still there never seems to be a single penny left for me That’s too bad… Money, money, money must be funny In the rich man’s world.” That year, ’76, wasn’t just the U.S. bicentennial — it was a year when the U.S. allocated 8.6% of the nation’s Gross Domestic Product for health care.

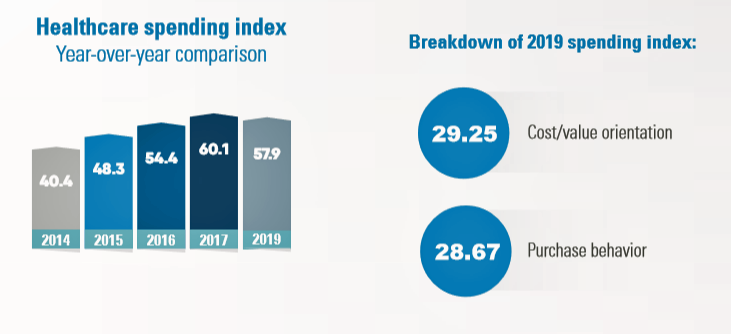

Health Consumer Behaviors in the U.S. Stall, Alegeus Finds in the 2019 Index

In the U.S., the theory of and rationale behind consumer-directed health has been that if you give a patient more financial skin-in-the-game — that is, to compel people to spend more out-of-pocket on health care — you will motivate that patient to don the hat of a consumer — to mindfully research, shop around, and purchase health care in a rational way, benefit from lower-cost and high-quality healthcare services. For years, Alegeus found that patients were indeed growing those consumer health muscles to save and shop for health care. In 2019, it appears that patients have backslid, according to the

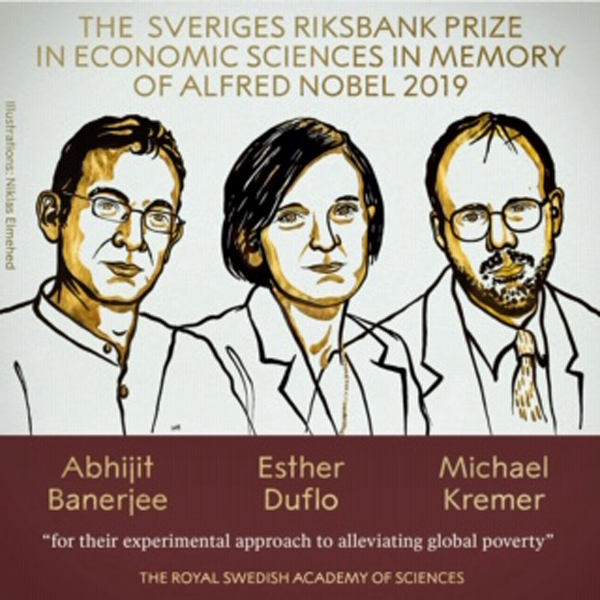

What the 2019 Nobel Prize Winners in Economics Teach Us About Health

The three winners of the 2019 Nobel Prize for Economics — Banerjee and Duflo (both of MIT) and Kremer (working at Harvard) — were recognized for their work on alleviating global poverty.” “Over 700 million people still subsist on extremely low incomes. Every year, five million children still die before their fifth birthday, often from diseases that could be prevented or cured with relatively cheap and simple treatments,” The Nobel Prize website notes. To respond to this audaciously huge challenge, Banerjee, Duflo and Kremer asked quite specific, granular questions that have since shaped the field of development economics — now

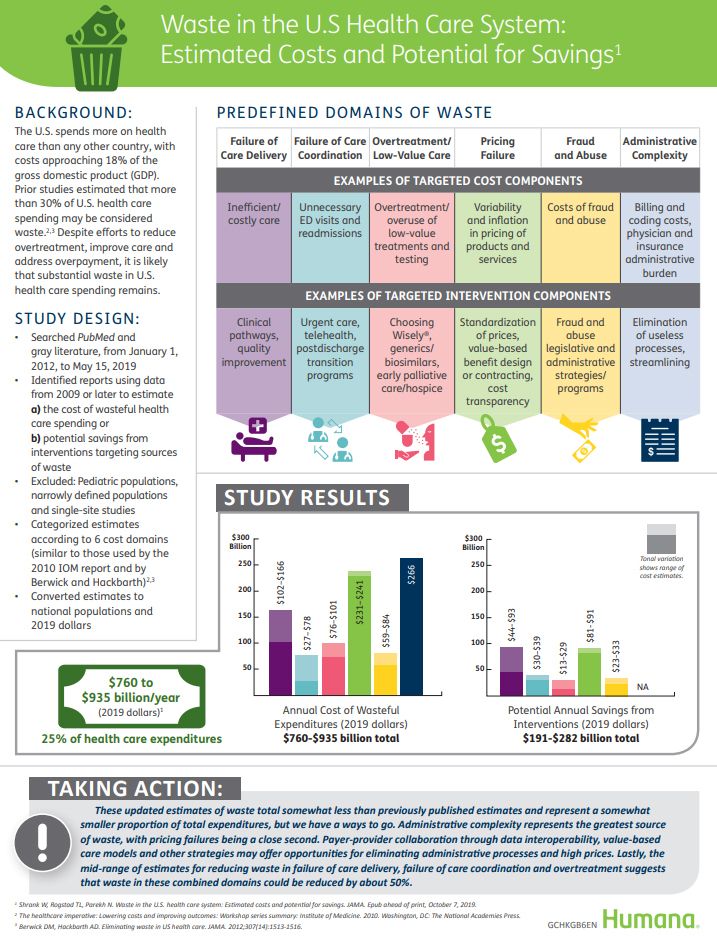

Wasted: $1 of Every $4 Spent on Health Care In America

A study in JAMA published this week analyzed research reports that have measured waste in the U.S. health care system, calculating that 25% of medical spending in America is wasted. If spending is gauged at $3.8 trillion, waste amounts to nearly $1 trillion. If spending is 18% of the American gross domestic product (GDP), then some 4.5% of the U.S. economy is wasted spending by the health care system and its stakeholders. In “Waste in the US Health Care System,” a team from Humana and the Univrsity of Pittsburgh recalibrated the previous finding of 30% of wasted spending to the 25%,

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

How Can Patients Be Health Consumers in an Un-Transparent World?

That question in the title of this post is begged in the annual 2019 consumer survey released this week from UnitedHealthcare (UHC). UHC gauges peoples’ views on health care, insurance, and costs in its yearly research. This year, transparency and health literacy challenges top the findings. When the three in ten folks do shop, four in ten people used the internet or mobile apps to do so — a dramatic increase from 2012. Shopping is most commonly done among Millennials, one-half of whom shop for health care services. Of people who have used digital tools for health care shopping, 8

The Pharma Industry Hits Bottom of Consumers’ Industry Rankings, and Healthcare Is Only Marginally Higher on the List

from Gallup’s 2019 survey into Americans’ Views of U.S. Business Industry Sectors. Since reaching a relative high regard in 2015, the pharma industry reputation among consumers has declined each year since to the low this year with 58% of Americans having a negative view. This was a 31 percentage point drop in reputation in one year. This is one negativity point above peoples’ low regard for the Federal government. Gallup notes that Americans are over two times more likely to rank the pharmaceutical industry negatively (58%) as positively (27%). The healthcare industry, apart from pharma, didn’t fare well this year in

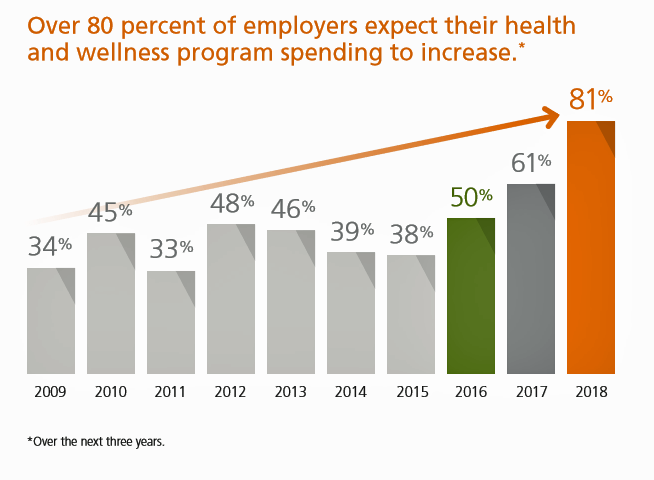

The New Employer Wellness Lens Includes Mental Health, Telehealth and Women’s Health

U.S. employers are tightening their focus on mental and behavioral health, addressing workers’ chronic conditions, emphasizing women’s health, and allocating more resources to digital and telehealth investments, we learn from Optum’s Ten Years of Health and Well-Being at Work: Learning from our past and reimagining the future. Four in five medium, large and jumbo companies expect their spending on health and wellness programs will increase over the next three years. That spending will have a strong focus on behavioral health services: 9 in 10 employers are concerned with the level of access workers have to mental health services. Companies will

Talking “HealthConsuming” on the MM&M Podcast

Marc Iskowitz, Executive Editor of MM&M, warmly welcomed me to the Haymarket Media soundproof studio in New York City yesterday. We’d been trying to schedule meeting up to do a live podcast since February, and we finally got our mutual acts together on 6th August 2019. Here’s a link to the 30-minute conversation, where Marc combed through the over 500 endnotes from HealthConsuming‘s appendix to explore the patient as the new health care payor, the Amazon prime-ing of people, and prospects for social determinants of health to bolster medicines “beyond the pill.” https://www.pscp.tv/MMMnews/1eaJbvgovBYJX Thanks for listening — and if you

Love ACA Provisions, Not the ACA – KFF Poll Reveals American Voters’ Views on Health Care Reform

Today is the bridge day between The Battle of the Democratic Primary Candidates Debate #2 Part 1 and tonight, Part 2. So it’s a good time to take stock of U.S. voters’ views on health care, through the lens of the Kaiser Family Foundation’s Health Tracking Poll for July 2019 published yesterday. Health care is the top issue Democrats want to hear about in the debates, well ahead of climate change, women’s issues, immigration and gun policy. Let’s start with an overall context statistic from this poll: that is that 86% of insured U.S. adults like their health insurance plan

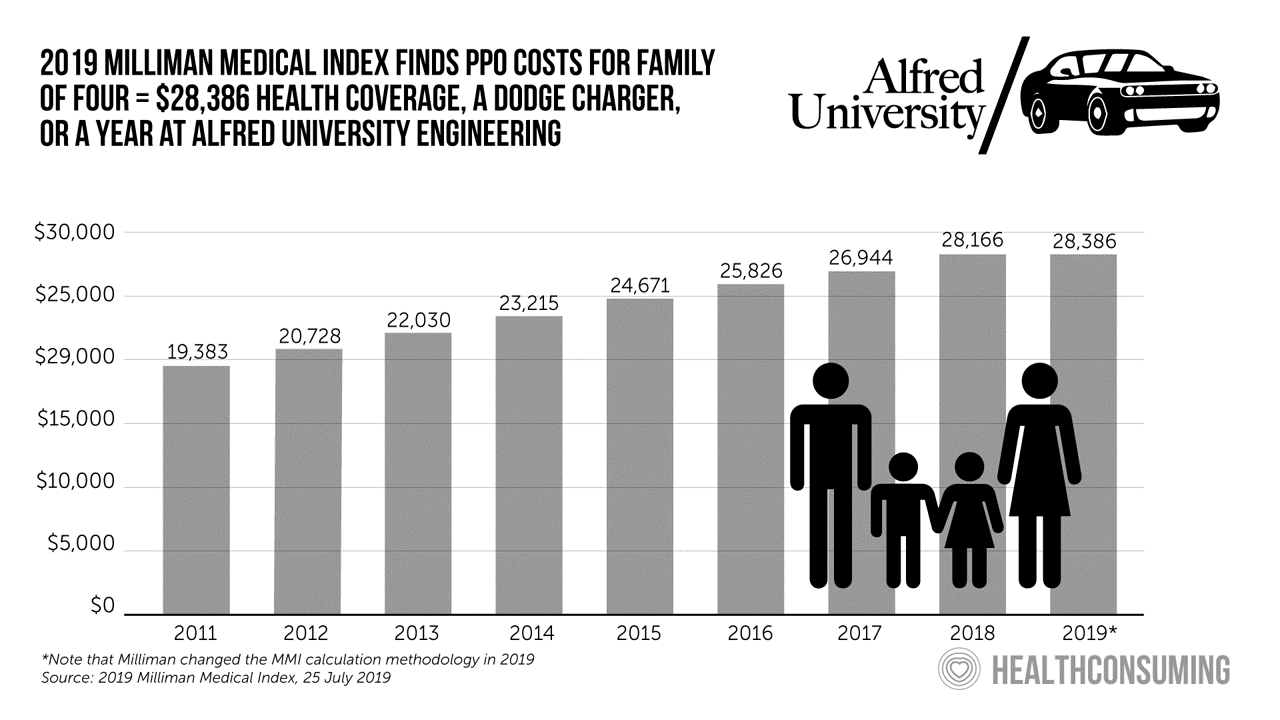

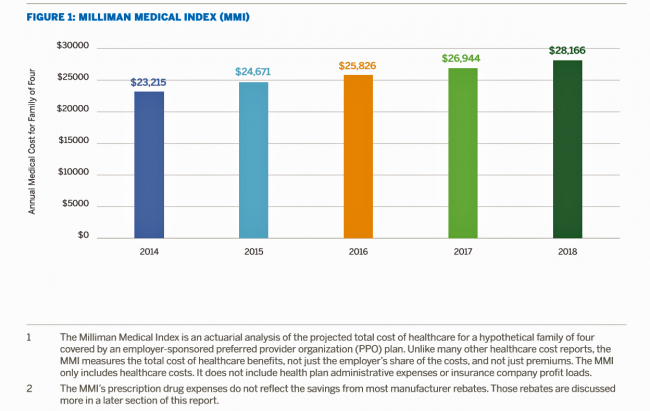

Milliman Finds PPO for Family of 4 in 2019 Will Cost $28,386

This year, an employer-sponsored PPO for a family of four in the U.S. will cost $28,386, a 3.6% increase over 2018, according to the 2019 Milliman Medical Index (MMI). Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University. The Milliman MMI team has updated the methodology for the Index; the chart shown here is my own, recognizing that the calculations and assumptions beneath the 2019 data point differ from previous years. The key points of the report are that:

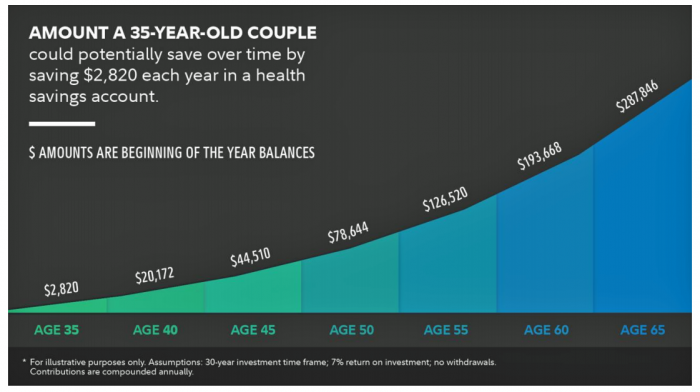

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

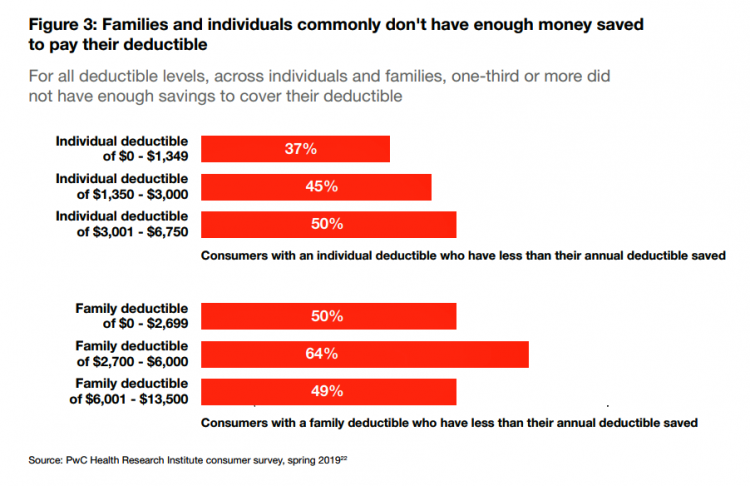

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Retail Pricing in U.S. Health Care? Why Transparency Is Hard to Do

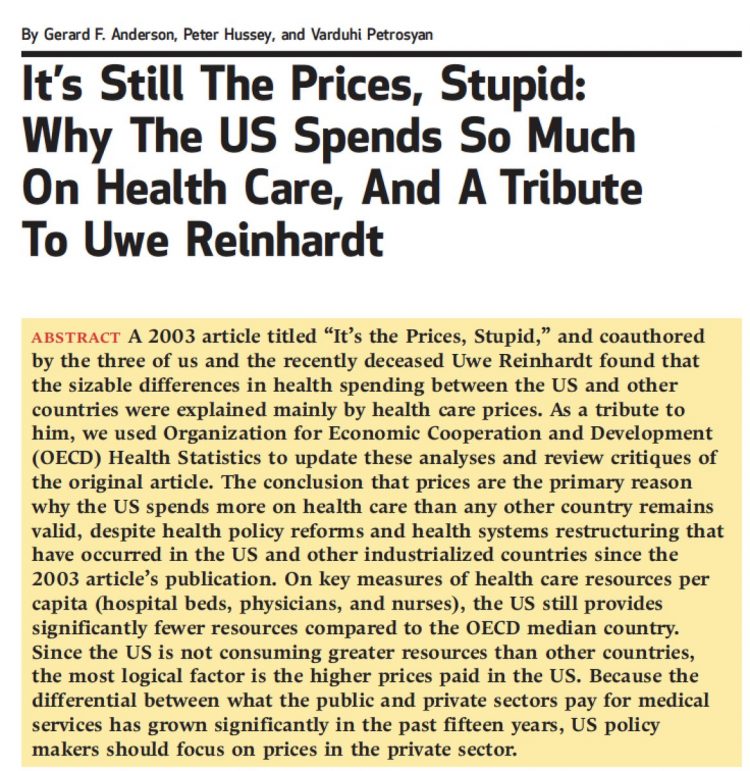

“It’s the prices stupid,” Uwe Reinhardt and Gerard Anderson and colleagues asserted in the title their seminal Health Affairs manifesto on U.S. healthcare spending. Sixteen years later, yesterday on 8th July 2019, a Federal U.S. judge blocked, in the literal last-minute, a DHHS order mandating prescription drug companies to publish “retail prices” of medicines in direct-to-consumer TV ads. I was getting this post on transparency together just before that announcement hit the press, so this post would have had a different nuance yesterday compared with today. And that’s how health care politics and economics in America roll these days. Welcome to

Gaps in Health Equity in America Are Growing

There’s been a “clear lack of progress on health equity during the past 25 years in the United States,” asserts a data-rich analysis of trends conducted by two professors/researchers from UCLA’s School of Public Health. The study was published this week in JAMA Network Open. The research mashed up several measures of health equity covering the 25 years from 1993 through 2017. The data came out of the Centers for Disease Control and Prevention’s Behavioral Risk Factor Surveillance System looking at trends by race/ethnicity, sex and income across three categories for U.S. adults between 18 and 64 years of age.

Prescription Drugs Are Becoming A Luxury Good in America – Join the #HCLDR Chat Tonight

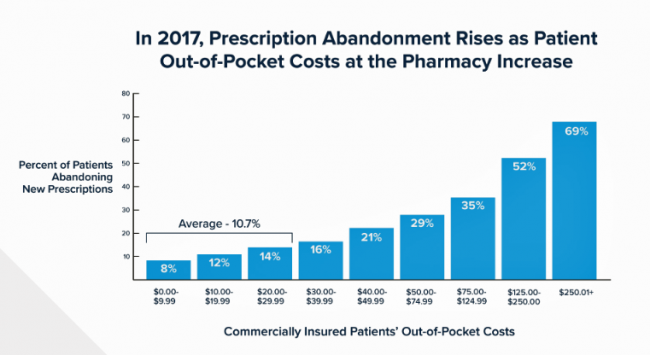

“Drugmakers Push Their Prices Higher” is the top story under the Business & Finance banner in today’s Wall Street Journal. That’s in terms of drugs’ list prices, which most patients don’t pay. But drug costs to patients are in the eye of the beholder, who in a high-deductible plan or Medicare Part D donut hole becomes the first-dollar payer. Patients continue to face rising drug costs, pushing them into what I’ve been thinking about as luxury-goods territory. The economic definition of a luxury good is a product for which demand increases more than proportionally as income rises, so that spending

Health Care and the Democratic Debates – Part 1 – Medicare For All, Rx Prices, Guns and Mental Health

Twenty Democratic Presidential candidates each have a handful of minutes to make their case for scoring the 2020 nomination, “debating” last night and tonight on major issues facing the United States. I watched every minute, iPad at the ready, taking detailed notes during the 120 minutes of political discourse conducted at breakneck speed. Lester Holt, Savannah Guthrie, and Jose Diaz-Balart asked the ten candidates questions covering guns, butter (the economy), immigration, climate change, and of course, health care — what I’m focusing on in this post, the first of two-debate-days-in-a-row. The first ten of twenty candidates in this debate were,

Healthcare Costs Inspire Employer Activism and Employee Dissatisfaction – What PwC Found Behind the Numbers

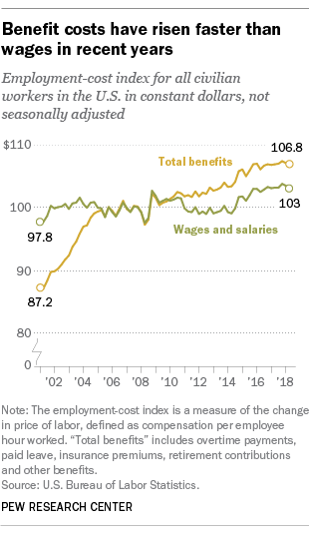

In the U.S. each year between 2006 and 2016, employees’ healthcare cost sharing grew 4.5%. In that decade, Americans’ median wages rose 1.8% a year, PwC notes in their annual report, Medical cost trend: Behind the numbers 2020 from the firm’s Health Research Institute. Medical cost trend is the projected percent growth in healthcare costs over a year based on an equivalent benefit package from one year to the next. As the first chart shows, trend will grow 6% from 2019 to 2020. This is an increase of 0.3 percentage points up from 5.7% for 2019, which was flat from

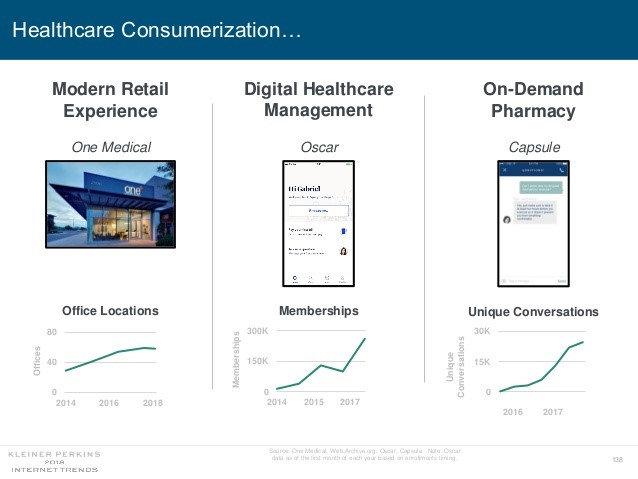

The Most Important Trends For Health in Mary Meeker’s 2019 Internet Report Aren’t About Health Care

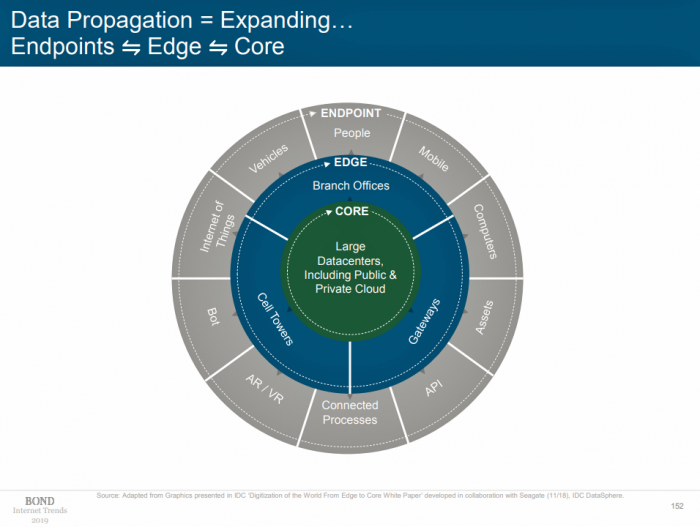

The health care section of Mary Meeker’s 334-page annual report, Internet Trends 2019, comprises 24 of those pages (270 through 293). These two dozen exhibits detail growing adoption of digital tech in health care, the growth of genomics and EHR adoption, examples of these tools from “A” (Apple) to “Z” (Zocdoc), and on the last page of that chapter, medical spending in the U.S., the highest in raw and per capita numbers versus the rest of the world. But the most important implications for American health care aren’t found in those pages: they’re in other parts of the report addressing

Americans Could Foster a Health Consumer Movement, Families USA Envisions

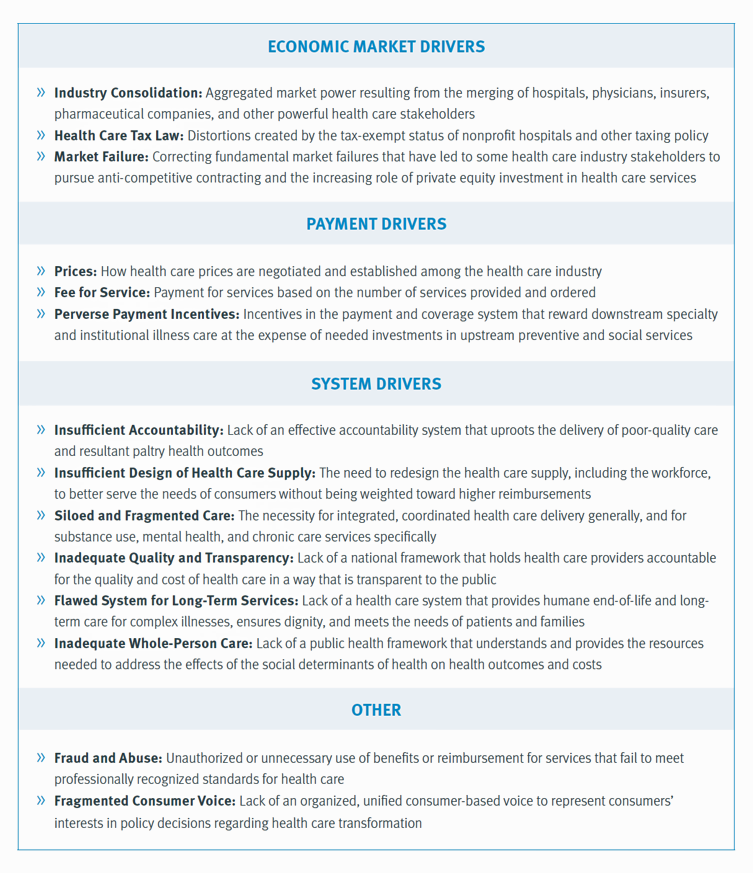

Employers, health care providers, unions, leaders and — first and foremost, consumers — must come together to build a more accessible, affordable health care system in America, proposes a call-to-action fostered by a Families USA coalition called Consumers First: The Alliance to Make the Health Care System Work for Everyone. The diverse partners in this Alliance include the American Academy of Family Physicians, AFSCME (the largest public service employees’ union in the U.S.), the American Benefits Council (which represents employers), the American Federation of Teachers (AFT), First Focus (a bipartisan children’s advocacy organization), and the Pacific Business Group on Health

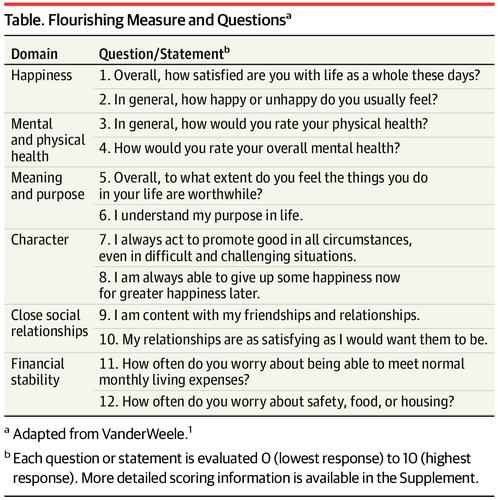

People Want to Flourish, Not Just Live – Speaking Health Politics to Real People

“How should we define ‘health?'” a 2011 BMJ article asked. The context for the question was that the 1948 World Health Organization definition of health — that health is, “a state of complete physical, mental and social well-being and not merely the absence of disease or infirmity”– was not so useful in the 21st century. The authors, a global, multidisciplinary team from Europe, Canada and the U.S., asserted that by 2011, human health was marked less by infectious disease and more by non-communicable conditions that could be highly influenced, reversed and prevented through self-care by the individual and public health policy

Health Care Costs Still Americans’ Top Financial Worry Among All Money Concerns

Health care costs rank ahead of Americans’ money-worries about low wages and availability of cash, paying for college, house payments, taxes, and debt, according to the latest Gallup poll on peoples’ most important family financial problems in 2019. Medical costs have, in fact, ranked at the top of this list for three years in a row, with a five percentage point rise between 2018 and 2019. No other financial concern had that growth in increase-of-money-worries in the past year. Health care costs rank the top financial problem for people across all income levels. One in five families (19%) earning under

Will Health Consumers Morph Into Health Citizens? HealthConsuming Explains, Part 5

The last chapter (8) of HealthConsuming considers whether Americans can become “health citizens.” “Citizens” in this sense goes back to the Ancient Greeks: I return to Hippocrates, whose name is, of course, the root of The Hippocratic Oath that physicians take. Greece was the birthplace of Democracy with a capital “D.” Hippocrates’ book The Corpus is thought to be one of the first medical textbooks. The text covered social, physical, and nutritional influences, and the concept of “place” for health and well-being. Here, the discussion detailed the roles of air and water for health. The Hippocratic texts also coached doctors to

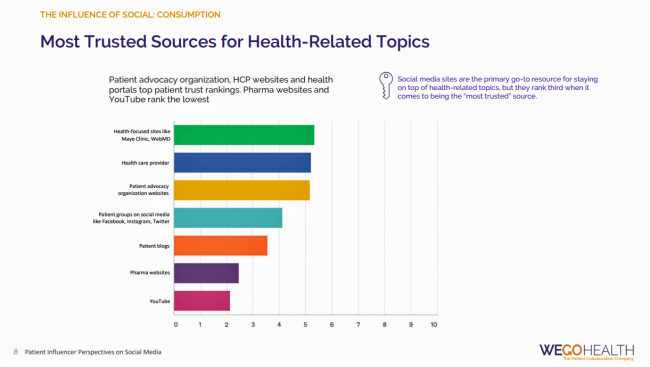

Listen Up, Healthcare: Hear The Patient’s Voice!

Consider the voice of a patient before the advent of the Internet in the digital 1.0 world, and then the proliferation of social networks in v 2.0. One patient could talk with another over their proverbial neighborhood fence, a concerned parent at the PTA meeting with others dealing with a children’s health issue, or a recovering alcoholic testifying in person at an AA session. Today, the voice of the patient is magnified one-to-many, omnichannel and multi-platform — via video, blogs, podcasts, social networks, listservs….and, yes, still in live forums like AA meetings, church basements, Y-spaces, and the Frazzled Cafe meet-ups

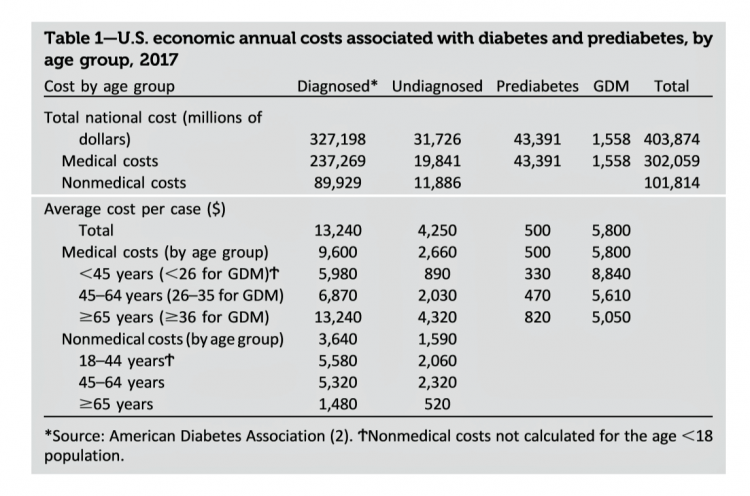

The United States of Diabetes: a $1,240 Tax on Every American

Pharmaceutical company executives are testifying in the U.S. Congress this week on the topic of prescription drug costs. One of those medicines, insulin, cost a patient $5,705 for a year’s supply in 2016, double what it cost in 2012, according to the Health Care Cost Institute. Know that one of these insulin products, Lilly’s Humalog, came onto the market in 1996. In typical markets, as products mature and get mass adoption, prices fall. Not so insulin, one of the many cost components in caring for diabetes. But then prescription drug pricing doesn’t conform with how typical markets work in theory.

What $285,000 Can Buy You in America: Medical Costs for Retirees in 2019

The average 65-year old couple retiring in 2019 will need to have a cash nest-egg of $285,000 to cover health care and medical expenses through retirement years, Fidelity Investments calculated. Fidelity estimates the average retiree will allocate 15% of their annual spending in retirement on medical costs. As if that top-line number isn’t enough to sober one up, there are two more caveats: (1) the $285K figure doesn’t include long-term care, dental services and over-the-counter medicines; and, (2) it’s an after-tax number. So depending on your tax bracket, you have to earn a whole lot more to net the $285,000

World Health Day 2019: Let’s Celebrate Food, Climate, Insurance Coverage and Connectivity

Today, 7 April, is World Health Day. With that in mind, I devote this post to three key social determinants of health (SDOH) that are top-of-mind for me these days: food for health, climate change, and universal health coverage. UHC happens to be WHO’s focus for World Health Day 2019. [As a bonus, I’ll add in a fourth SDOH in the Hot Points for good measure and health-making]. Why a World Health Day? you may be asking. WHO says it’s, “a chance to celebrate health and remind world leaders that everyone should be able to access the health care they need,

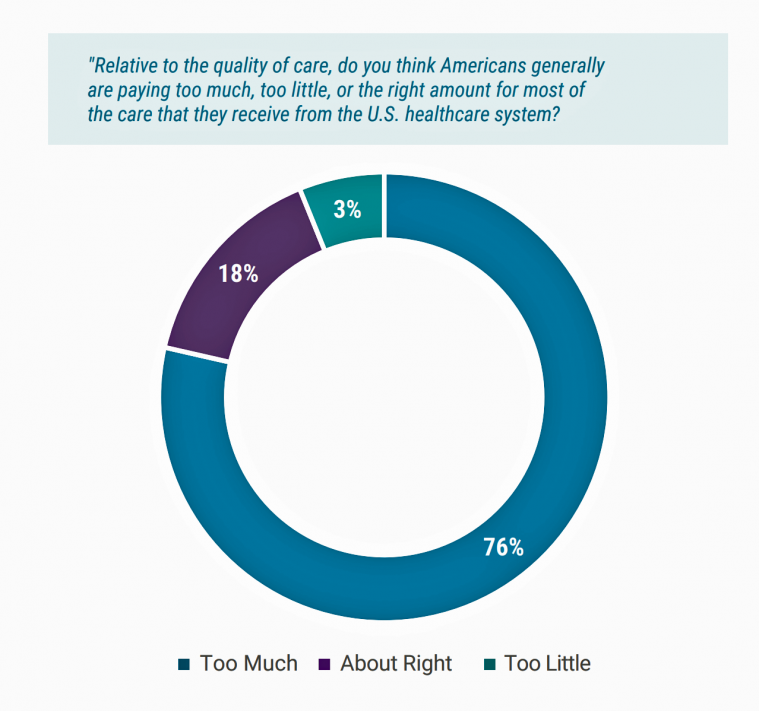

Medical Costs Are Consuming Americans’ Financial Health

Spending on medical care costs crowded out other household spending for millions of Americans in 2018, based on The U.S. Healthcare Cost Crisis, a survey from West Health and Gallup. Gallup polled 3,537 U.S. adults 18 and over in January and February 2019. One in three Americans overall are concerned they won’t be able to pay for health care services or prescription drugs: that includes 35% of people who are insured, and 63% of those who do not have insurance. Americans borrowed $88 billion in 2018 to pay for health care spending, West Health and Gallup estimated. 27 million Americans

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

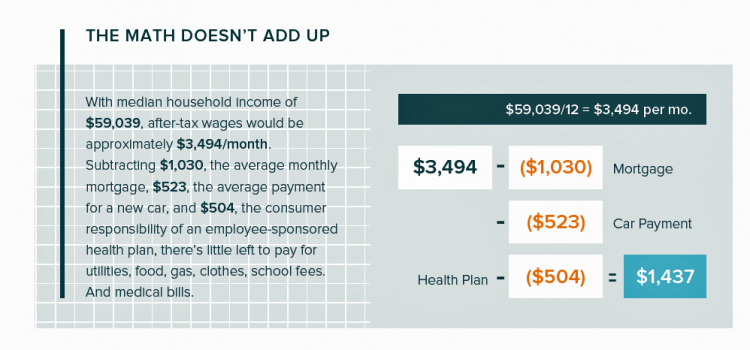

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

Most Americans Blame Drug Companies, Insurers, and Hospitals for High Health Care Costs

There’s little agreement between Democrats and Republicans on a plethora of issues in American public life. But one issue that brings U.S. citizens together is agreement that the cost of health care is too high in the country, and that pharma, health plans, and providers are to blame. Welcome to health politics in America as of March 2019, according to The Public and High U.S. Health Care Costs, a poll conducted by POLITICO and the Harvard T.H. Chan School of Public Health. The first chart illustrates the common ground shared by Americans by party affiliation, with vast majorities across parties playing

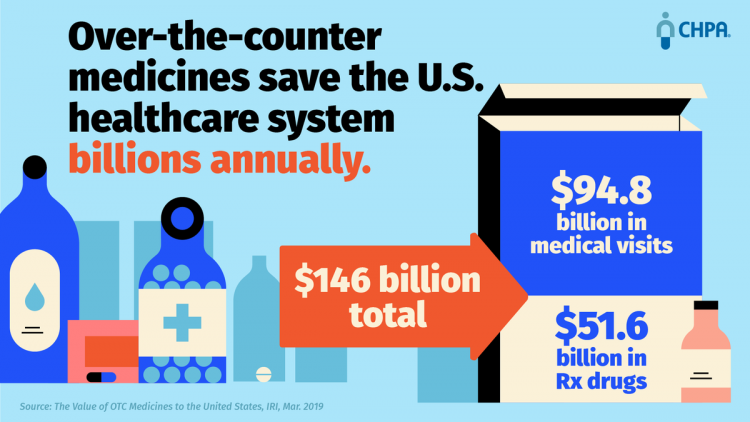

The Evolution of Self-Care for Consumers – Learning and Sharing at CHPA

Self-care in health goes back thousands of years. Reading from Hippocrates’ Corpus about food and clean air’s role in health sounds contemporary today. And even in our most cynical moments, we can all hearken back to our grandmothers’ kitchen table wisdom for dealing with skin issues, the flu, and broken hearts. The annual conference of the Consumer Healthcare Products Association (CHPA) convened this week, and I was grateful to attend and speak on the evolving retail health landscape yesterday. Gary Downing, CEO of Clarion Brands and Chairman of the CHPA Board, kicked off the first day with a nostalgic look

Medical Issues Are Still The #1 Contributor to Bankruptcy in the U.S., An AJPH Study Asserts

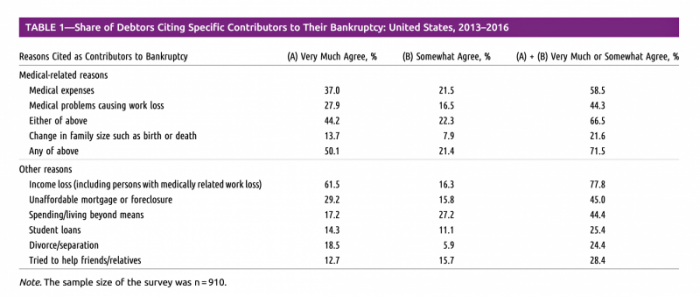

Medical costs in America are still the top contributor to personal bankruptcy in the U.S., a risk factor in two-thirds of bankruptcies filed between 2013 and 2016. That’s a sad fiscal fact, especially as more Americans gained access to health insurance under the Affordable Care Act, according to a study published this month in the American Journal of Public Health (AJPA). Between 2013 and 2016, about 530,000 bankruptcies were filed among U.S. families each year associated with medical reasons, illustrated in Table 1 from the study. The report, Medical Bankruptcy: Still Common Despite the Affordable Care Act, updates research from 2007 which

Patients, Health Consumers, People, Citizens: Who Are We In America?

“Patients as Consumers” is the theme of the Health Affairs issue for March 2019. Research published in this trustworthy health policy publication covers a wide range of perspectives, including the promise of patients’ engagement with data to drive health outcomes, citizen science and participatory research where patients crowdsource cures, the results of financial incentives in value-based plans to drive health care “shopping” and decision making, and ultimately, whether the concept of patients-as-consumers is useful or even appropriate. Health care consumerism is a central focus in my work, and so it’s no surprise that I’ve consumed every bit of this publication. [In

Can AI Make Healthcare Human Again? Dr. Topol Says “Yes”

“The Fourth Industrial Age,” Dr. Abraham Verghese writes, “has great potential to help, but also to harm, to exaggerate the profound gap that already exists between those who have much and those who have less each passing year.” Dr. Verghese asserts this in his forward to Deep Medicine, Dr. Eric Topol’s latest work which explores the promise of artificial intelligence (AI), Big Data, and robotics — three legs of the Fourth Industrial Age stool. [If you don’t know the work of Dr. Verghese, and since you’re reading the Health Populi blog, you must get to know Dr. V now. Your

National Health Spending Will Reach Nearly 20% of U.S. GDP By 2027

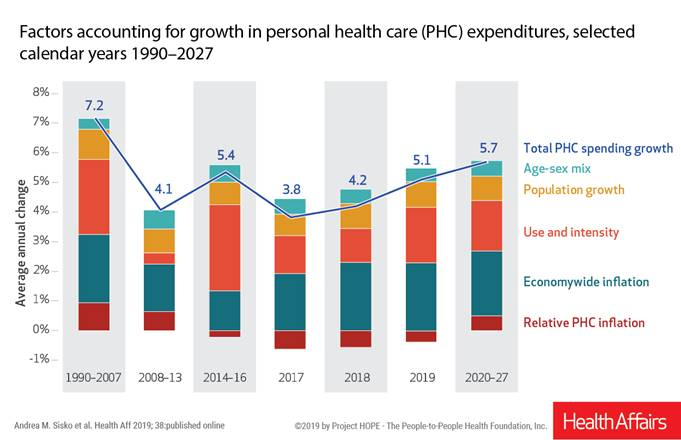

National health spending in the U.S. is expected to grow by 5.7% every year from 2020 to 2027, the actuaries at the Centers for Medicare and Medicaid Services forecast in their report, National Health Expenditure Projections, 2018-2927: Economic And Demographic Trends Drive Spending And Enrollment Growth, published yesterday by Health Affairs. For context, note that general price inflation in the U.S. was 1.6% for the 12 months ending January 2019 according to the U.S. Bureau of Labor Statistics. This growth rate for health care costs exceeds every period measured since the high of 7.2% recorded in 1990-2007. The bar chart illustrates the

Open Table for Health: Patients Are Online For Health Search and Physician Reviews

Seeking health information online along with researching other patients’ perspectives on doctors are now as common as booking dinner reservations and reading restaurant reviews, based on Rock Health’s latest health consumer survey, Beyond Wellness for the Healthy: Digital Health Consumer Adoption 2018. Rock Health has gauged consumes’ digital health adoption fo a few years, showing year-on-year growth for “Googling” health information, seeking peer patients’ physician and hospital reviews, tracking activity, donning wearable tech, and engaging in live telehealth consultations with providers, as the first chart shows. The growth of tracking and wearable tech is moving toward more medical applications beyond fitness

The Cost of Prescription Drugs, Doctors and Patient Access – A View from HIMSS19

Most patient visits to doctors result in a prescription written for a medicine that people retrieve from a pharmacy, whether retail in the local community or via mail order for a maintenance drug. This one transaction generates a lot of data points, which individually have a lot of importance for the individual patient. Mashed with other patients’, prescription drug utilization data can combine with more data to be used for population health, cost-effectiveness, and other constructive research pursuits. At HIMSS19, there’s an entire day devoted to a Pharma Forum on Tuesday 12 February, focusing on pharma-provider-payor collaborations. Allocating a full

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

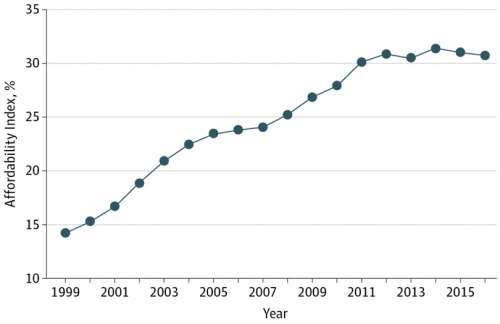

Rationing Care in America: Cost Implications Getting to Universal Health Coverage

It would not be surprising to know that when the Great Recession hit the U.S. in 2008, one in three Americans delayed medical treatment due to costs. Ten years later, as media headlines and the President boast an improved American economy, the same proportion of people are self-rationing healthcare due to cost. That percentage of people who delay medical cost based on the expense has remained stable since 2006: between 29 and 31 percent of Americans have self-rationed care due to cost for over a decade. And, 19% of U.S. adults, roughly one-in-five people who are sick and dealing with

Americans End 2018 Worried About Healthcare Costs

Nearly one-half of Americans are quite concerned they won’t have enough money to pay for medical care, according to the latest Gallup poll. Health insurance in-security is mainstream as of November 2018, when Gallup polled U.S. adults about views on healthcare costs. It’s a major concern among six in ten people that their health plan would require they pay higher premiums or a bigger portion of their healthcare expenses. It’s also a big concern for four in ten people that someone in their family would be denied health insurance covering for a pre-existing condition, or that they might have to

While National Health Care Spending Growth Slowed in 2017, One Stakeholder’s Financial Burden Grew: The Consumer’s

National health care spending growth slowed in 2017 to the post-recession rate of 3.9%, down from 4.8% in 2016. Per person, spending on health care grew 3.2% to $10,739 in 2017, and the share of GDP spent on medical care held steady at 17.9%. Healthcare spending in America is a $3.5 trillion micro-economy…roughly the size of the entire GDP of Germany, and about $1 trillion greater than the entire economy of France. These annual numbers come out of the annual report from the Centers for Medicare and Medicaid Services, published yesterday in Health Affairs. Underneath these macro-health economic numbers is

Most Americans Want the Federal Government to Ensure Healthcare for All

Most people in the U.S. believe that the Federal government should ensure that their fellow Americans, a new Gallup Poll found. This sentiment has been relatively stable since 2000 except for two big outlying years: a spike of 69% in 2006, and a low-point in 2003 of 42%. In 2006, Medicare Part D launched, which may have boosted consumers’ faith in Federal healthcare programs. In contrast, in 2013 the Affordable Care Act was in implementation and consumer-adoption mode, accompanied by aggressive anti-“Obamacare” campaigns in mass media. That’s the top lighter green line in the first chart. But while there’s majority support

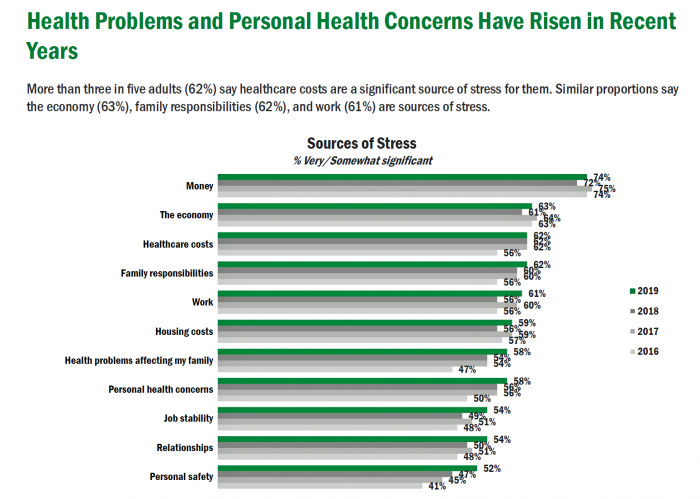

Healthcare Costs Stress Out U.S. Voters One Week Ahead of 2018 Mid-Term Elections

With seven days until voters go to the polls for what some call the most momentous U.S. election in decades, most Americans say that healthcare costs are a major stress, second only to money. So warns the Sixth Annual Nationwide TCHS Consumers Healthcare Survey, with the tagline: “Stressed Out: Americans and Healthcare.” Perhaps this is why healthcare has become a top voting issue for the 2018 mid-term elections that will be held on November 6 one week from today. The first chart illustrates that healthcare costs, the economy, and family responsibilities all closely cluster as sources of stress for a

Financial Stress Is An Epidemic In America, Everyday Health Finds

One in three working-age people in the U.S. have seen a doctor about something stress-related. Stress is a way of American life, based on the findings in The United States of Stress, a survey from Everyday Health. Everyday Health polled 6,700 U.S. adults between 18 and 64 years of age about their perspectives on stress, anxiety, panic, and mental and behavioral health. Among all sources of stress, personal finances rank as the top stressor in the U.S. Over one-half of consumers say financial issues regularly stress them out. Finances, followed by jobs and work issues, worries about the future, and relationships cause

The Single Market for Healthcare in Europe: Learnings for the U.S.

When I asked my longtime colleague and friend Robert Mittman, with whom I collaborated at Institute for the Future for a decade, how he managed international travel and jet lag, he said simply, “The time zone you’re in is the time zone you’re in.” This lesson has stayed with me since I received Robert’s advice over twenty years ago. Over the next two weeks, as I work alongside colleagues and clients in the EU and soon-to-Brexit UK, I am in time zones five and six hours later than my home-base of US Eastern Time. But the time zones I’m working

How MedModular Fits Into the New Lower-Cost, High-Quality, Consumer-Enchanted Healthcare World

In American health economics, there’s a demand side and a supply side. On the demand side, we’ve done a poor job trying to nudge patients and consumers toward rational economic decision making, lacking transparency, information symmetry, and basic health literacy. On the supply side, we’ve engaged in a medical arms race allocating capital resources to shinier and shinier new things, often without cost-benefit rationale or clinical evidence. On that supply side, though, I met up with an innovation that can help to bend the capital cost curve of how we envision and build new hospitals and clinics. This week, I

As Workers’ Healthcare Costs Increase, Employers Look to Telehealth and Wearable Tech to Manage Cost & Health Risks

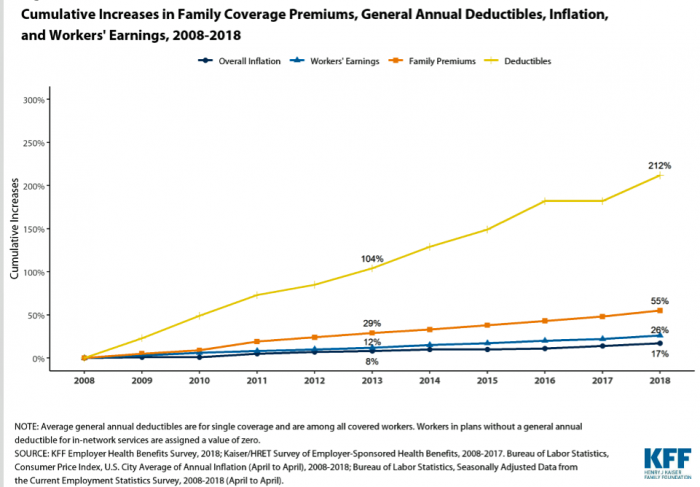

Family premiums for health insurance received at the workplace grew 5% in 2018: to $19,616, according to the 2018 KFF Employer Health Benefits Survey released today by the Kaiser Family Foundation (KFF). These two trends combine for a 212% increase in workers’ deductibles in the past decade. This is about eight times the growth of workers’ wages in the U.S. in the same period. Thus, the main takeaway from the study, KFF President and CEO Drew Altman noted, is that rising health care costs absolutely remain a burden for employers — but a bigger problem for workers in America. Given that

The Importance of Broadband and Net Neutrality for Health, to the Last Person and the Last Mile

California’s Governor Jerry Brown signed into law a net neutrality bill this weekend. Gov. Brown’s proverbial swipe of the pen accomplished two things: he went back to the Obama-era approach to ensure that internet service providers treat all users of the internet equally; and, he prompted the Department of Justice, representing the Trump Administration’s Federal Communications Commission (FCC), to launch a lawsuit. California, home to start-ups, mature tech platform companies (like Apple, Facebook and Google), and countless digital health developers, is in a particularly strategic place to fight the FCC and, now, the Department of Justice. Nearly two dozen other states

When Life and Health Insurance Blur: John Hancock, Behavioral Economics, and Wearable Tech

Most consumers look to every industry sector to help them engage with their health. And those companies include the insurance industry and financial services firms, we found in the 2010 Edelman Health Engagement Barometer. John Hancock, which covers about 10 million consumers across a range of products, is changing their business model for life insurance. Here’s the press release, titled, “John Hancock Leaves Traditional Life Insurance Model Behind to Incentivize Longer, Healthier Lives.” “We fundamentally believe life insurers should care about how long and well their customers live. With this decision, we are proud to become the only U.S. life insurance

Prescription Drugs: From Costs and Bad Reputation to Civica Rx and Amazon to the Rescue

The prices of medicines prescribed in outpatient settings rose, on average, 10.3% in 2018. Wages increased about 2.6%, and consumer prices, 1.3%, based on the 2019 Segal Health Plan Cost Trend Survey. Segal forecasts that medical cost trends will moderate for 2019, lower than 2018 rates. But to the patient, now feeling like a consumer dealing with high-deductibles and the growing sticker shock of specialty drug prices, a so-called “moderate” trend still feels like a big bite in the household budget. Specifically, specialty drug trend is expected to be 14.3% in 2019, compared with 17.7% in 2018 — still several

Consumers Don’t Know What They Don’t Know About Healthcare Costs

The saving rate in the U.S. ranks among the lowest in the world, in a country that rates among the richest nations. So imagine how well Americans save for healthcare? “Consumers are not disciplined about saving in general,” with saving for healthcare lagging behind other types of savings, Alegeus observes in the 2018 Alegeus Consumer Health & Financial Fluency Report. Alegeus surveyed 1,400 U.S. healthcare consumers in September 2017 to gauge peoples’ views on healthcare finances, insurance, and levels of fluency. As patients continue to take on more financial responsibility for healthcare spending in the U.S., they are struggling with finances and

Health Il-Literacy Costs

The complexity of the U.S. healthcare system erodes Americans’ health literacy, Accenture asserts in their report, The Hidden Cost of Healthcare System Complexity. And that complexity costs, Accenture calculated, to the tune of nearly $5 billion in administrative cost burden to payors. Accenture developed a healthcare system literacy index to quantify the relationship between peoples’ understanding of how health insurance works and what a lack of understanding can cost the system. The index looks at consumer comprehension of health insurance terms like premium, deductible, copayment, coinsurance, out-of-pocket

More U.S. Companies Offering Health Insurance After 8 Years of Decline

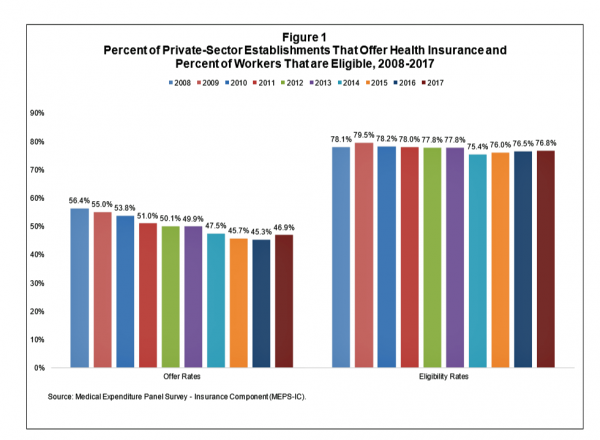

After eight years of decline, more U.S. employers offered health insurance to workers in 2017, EBRI reports in its latest Issue Brief. In 2017, 46.9% of U.S. companies offered health insurance to their employees, up by 1.6 percentage points from a low of 45.3% in 2016. For perspective, ten years earlier in 2008, 56.4% of employers offered health insurance, shown in the first bar chart (Figure 1 from the EBRI report). The largest percentage point increase in health plan offer-rates came from the smallest companies, those with less than 10 employees: while 21.7% of those companies offered health insurance in

Multimorbidity In the US – Obesity As A Key Driver of Health Spending

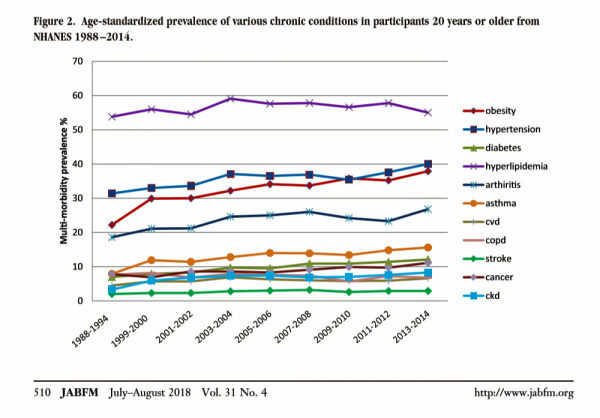

In the U.S., the growing prevalence of multi-morbidity is contributing to increased mortality and healthcare cost growth in America. Underlying this clinical and economic phenomenon is obesity, which primary care doctors are challenged to deal with as a chronic condition along with typically co-occurring comorbidities of hypertension, diabetes, and hyperlipidemia. The line chart come from a new study into Multimorbidity Trends in United States Adults, 1988-2014, published in the July-August 2018 issue of the Journal of the American Board of Family Medicine. The authors, affiliated with the West Virginia University Department of Family Medicine, call out that obesity (the pink-red line)

Disruption Is Healthcare’s New Normal

Googling the words “disruption” and “healthcare” today yielded 33.8 million responses, starting with “Riding the Disruption Wave in Healthcare” from Bain in Forbes, Accenture’s essay on “Big Bang Disruption in Healthcare,” and, “A Cry for Encouraging Disruption” in the New England Journal of Medicine Catalyst. This last article responded to the question, “Can we successfully deliver better quality care for patients at a lower cost?” asked by François de Brantes, Executive Director of the Health Care Incentives Improvement Institute. “Disruption” as a noun and an elephant in our room has been with us in healthcare since the September/October 2000 issue of

Wealth is Health and Health, Wealth, Fidelity Knows – with Weight a Major Risk Factor

The two top stressors in American life are jobs and finances. “My weight” and my family’s health follow just behind these across the generations. Total Well-Being, a research report from Fidelity Investments, looks at the inter-connections between health and wealth – the combined impact of physical, mental, and fiscal factors on our lives. The first chart summarizes the study’s findings, including the facts that: One-third of people have less than three months of income in the bank for emergency Absenteeism is 29% greater for people who don’t have sufficient emergency funds saved People who are highly stressed tend not to

Benefit Cost Increases Overwhelm Flat Wages for Most in US: Pew

Today’s financial news reports and the bullish stock market generate headlines saying that the U.S. economy is riding high. President Trump forecasted in late July, “we are now on track to hit an average GDP annual growth of over 3% and it could be substantially over 3%,” Trump said. “Each point, by the way, means approximately $3 trillion and 10 million jobs. Think of that.” Indeed, unemployment is at its lowest rate in decades at 4%. Today, NASDAQ reported that, “the U.S. economy stays strong as the Fed holds steady.” For mainstream working people, though, even with a job in a high employment

Healthcare, and Especially Covering Pre-Existing Conditions, Ranks High for Voters in 2018

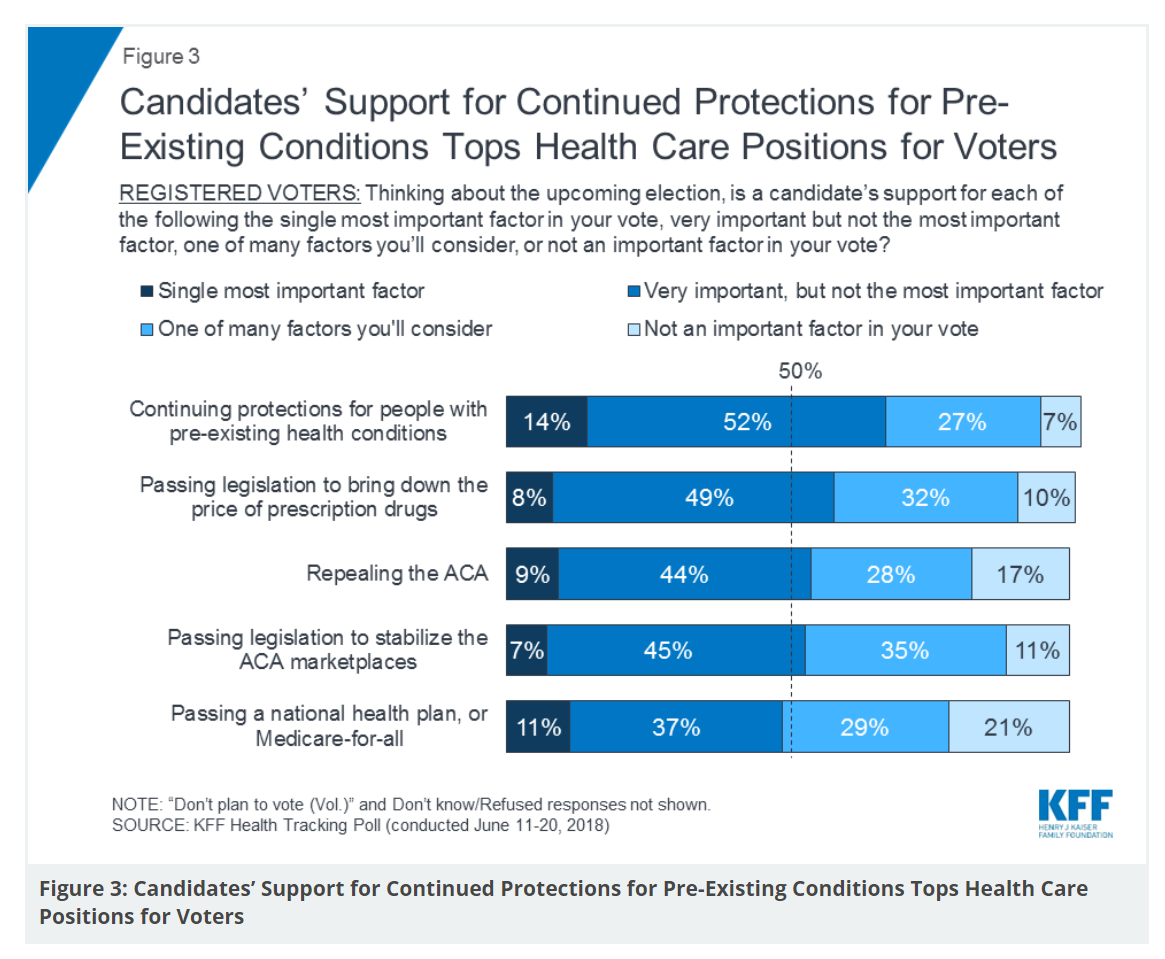

President Trump and his administrative have been trying to make the ACA fail, claim most U.S. adults. Thus, the public holds the POTUS and the Republican party responsible for moving the Affordable Care Act forward….or not, according to the July 2018 Kaiser Health Tracking Poll conducted by the Kaiser Family Foundation (KFF). Health care will be a key issue in the 2018 mid-term elections that will be held in November. Among U.S. voters’ key health care concerns in 2018, one ranks “most” or “very important” for two-thirds of Americans: that is continuing to protect people with pre-existing health conditions. Other issues

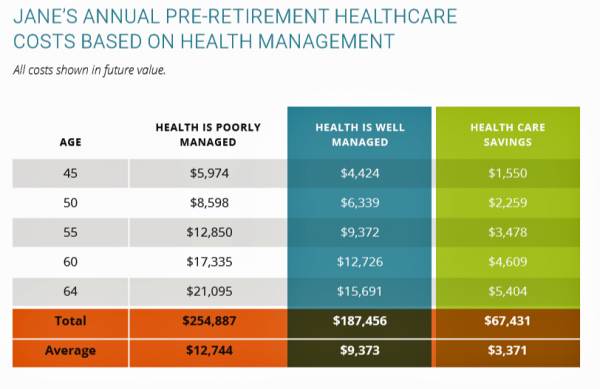

How Taking Care of Your Health Boosts Savings Accounts

It will cost about $275,000 for a couple retiring in the U.S. this year to cover their healthcare costs for the rest of their life in retirement, Fidelity estimated. But Americans are notoriously pretty undisciplined about saving money, compared with peers living in other developed countries. How to address this challenge? Show people what improving their personal health can do to boost their 401(k) plans. This tactic is discussed in Health & Retirement Savings: Leveraging Healthcare Costs to Drive 401(k) Contributions & Improve Health, from HealthyCapital, a joint venture of Mercy health systems and HealthView Services. The chart illustrates three

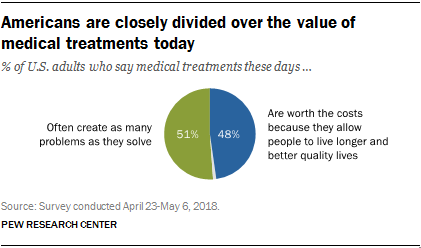

Consumers Consider Cost When They Think About Medical Innovation

While the vast majority of Americans say that science has made life easier for most people, and especially for health care, people are split in questioning the financial cost and value of medical treatments, the Pew Research Center has found. The first chart illustrates the percent of Americans identifying various aspects of medical treatments as “big problems.” If you add in people who see these as “small problems,” 9 in 10 Americans say that all of these line items are “problems.” In the sample, two-thirds of respondents had seen a health care provider for an illness or medical condition in

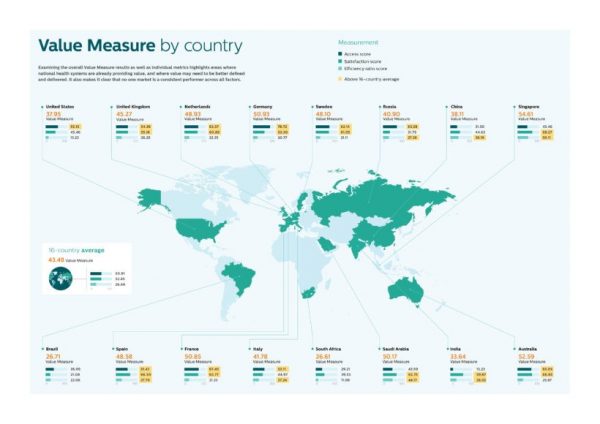

Value Comes to Healthcare: But Whose Value Is It?

The Search for Value is the prevailing journey to a Holy Grail in healthcare these days. On that, most stakeholders working on the ground, globally. can agree. But whose value is it, anyway? Three reports published in the past few weeks give us some useful perspective on that question, woven together in today’s Health Populi blog. Let’s start with the Philips Future Health Index, which assesses value to 16 national health systems through three lenses: access, satisfaction, and efficiency. The results are shown in the map. “Value-based healthcare is contextual, geared towards providing the right care in the right place, at

Healthcare Policies We Can Agree On: Pre-Existing Conditions, Drug Prices, and PillPack – the June 2018 KFF Health Tracking Poll

There are countless chasms in the U.S. this moment in social, political, and economic perspectives. but one issue is on the mind of most American voters where there is evidence of some agreements: health care, as evidenced in the June 2018 Health Tracking Poll from Kaiser Family Foundation. Top-line, health care is one of the most important issues that voters want addressed in the 2018 mid-term elections, tied with the economy. Immigration, gun policy, and foreign policy follow. While health care is most important to voters registered as Democrats, Republicans rank it very important. Among various specific health care factors, protecting

Obese, Access-Challenged and Self-Rationing: America’s Health Vs Rest-of-World

The U.S. gets relatively low ROI for its relatively exorbitant spending on healthcare, noted once again in the latest Health at a Glance, the annual OECD report on member nations’ healthcare systems. The report includes U.S. country data asking, “How does the United States compare?” with its sister OECD countries. The answer is, “not well across most population health, access, and mortality measures.” For the Cliff’s Notes/Where’s Waldo top-line of the research, find the two long bars in this chart heading “south” of the OECD average, and one long blue bar going “north.” The northern climbing bar

Good Coffee + Engaging Design + Banking = Financial Health

As I walked by windows with Marvel-inspired superhero characters, I stopped to read their talk-bubbles: “strengthen your savings, power your financial quest, be the hero of your money, be one with your budget.” The top-line message here is that you can be your own fiscal superhero. The sign read, Capital One Cafe with Peet’s Coffee. But was it a bank branch or a cafe? I asked myself, passing by this sign yesterday morning at the corner of Walnut and 18th Streets in center city Philadelphia. It’s both, as it turned out, and when I entered I found a welcoming, beautifully

Consumers Grow to View Food as the Prescription

Taking a page out of Hippocrates, “let food be thy medicine and medicine be thy food,” consumers are increasingly shopping for groceries with an appetite for health, found in research published this week by the International Food Information Center cleverly titled, An Appetite for Health. The top line: over two-thirds of older adults are managing more than one chronic condition and looking to nutrition to help manage disease. Most consumers have that “appetite for health” across a wide range of conditions, with two rising to the top as “extremely important:” heart health and brain function. Other top-ranked issues are emotional/mental

As Medical Cost Trend Remains Flat, Patients Face Growing Health Consumer Financial Stress

When it comes to healthcare costs, lines that decline over time are generally seen as good news. That’s how media outlets will cover the top-line of PwC’s report Medical cost trend: Behind the numbers 2019. However, there are other forces underneath the stable-looking 6.0% medical trend growth projected for 2019 that will impact healthcare providers, insurers, and suppliers to the industry. There’s this macro-health economic story, and then there’s the micro-economics of healthcare for the household. Simply put: the impact of growing financial risk for healthcare costs will be felt by patients/consumers themselves. I’ve curated the four charts from the

Technology, Aging and Obesity Drive Healthcare Spending, BEA Finds

The U.S. Department of Commerce Bureau of Economic Analysis (BEA) released, for the first time, data that quantifies Americans’ spending to treat 261 medical conditions, from “A” diseases like acute myocardial infarction, acute renal failure, ADHD, allergic reactions, anxiety disorders, appendicitis and asthma, to dozens of other conditions from the rest of the alphabet. High Spending Growth Rates For Key Diseases In 2000-14 Were Driven By Technology And Demographic Factors, a June 2018 Health Affairs article, analyzed this data. This granular information comes from the BEA’s satellite account, using data from the Medical Expenditure Panel Survey which nationally examines expenditures by disease;

Mary Meeker on Healthcare in 2018: Connectivity, Consumerization, and Costs

Health care features prominently in the nearly-300 slides curated by Mary Meeker in her always- informative report on Internet Trends 2018. Meeker, of Kleiner Perkins, released the report as usual at the Code Conference, held this year on 30 May 2018 in Silicon Valley. I’ve mined Meeker’s report for several years here on Health Populi: 2017 – Digital healthcare at the inflection point, via Mary Meeker 2015 – Musings with Mary Meeker on the digital/health nexus 2014 – Healthcare at an inflection point: digital trends via Mary Meeker 2013 – The role of internet technologies in reducing healthcare costs – Meeker

The Healthiest Communities Are Built on Education, Good Food, Mindfulness, and the Power of Love

Be the change you wish to see in the world, Gandhi has been attributed as saying. This sentiment was echoed by Lauren Singer as we brainstormed the social determinants of health and the factors that underpin healthy communities. Our Facebook Live session was convened by the Aetna Foundation, which sponsored research on the Healthiest Communities in 2018. In addition to Lauren, founder of Trash Is For Tossers, Dr. Garth Graham, President of the Aetna Foundation, Dr. Pedro Noguera, Distinguished Professor of Education at UCLA, and I joined the quartet, moderated with panache and sensitivity by Mark J. Ellwood, journalist. Each

Health Care for a Typical Working Family of Four in America Will Cost $28,166 in 2018

What could $28,166 buy you in 2018? A new car? A year of your child’s college education? A plot of land for your retirement home? Or a year of healthcare for a family of four? Welcome to this year’s edition of the Milliman Medical Index (MMI), one of the most important forecasts of the year in the world of the Health Populi blog and THINK-Health universe. That’s because we’re in the business of thinking about the future of health and health care through the health economics lens; the MMI is a key component of our ongoing environmental analysis of the

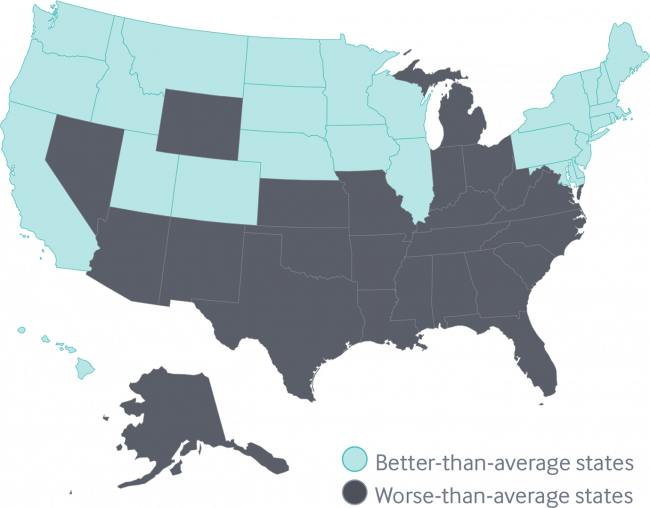

A Tale of Two America’s for Health

Disparities in Americans’ health vary among people living in each of the 50 states. These differences in health status generally fall into two regions: north and south, found in the Commonwealth Fund’s 2018 Scorecard on State Health System Performance. The map shows this stark geography-is-health-destiny reality: the worse-than-average states, the Fund found, run from Nevada southeast to Arizona, through New Mexico and Texas all the way to Atlantic Ocean and the Carolinas, then north west all the way up through the industrial Midwest states through Michigan to the north. Wyoming is the only non-contiguous state in the worse-performing U.S. state

Think Like a LEGO Builder in Healthcare – Considering PwC’s New Health Economy Vision

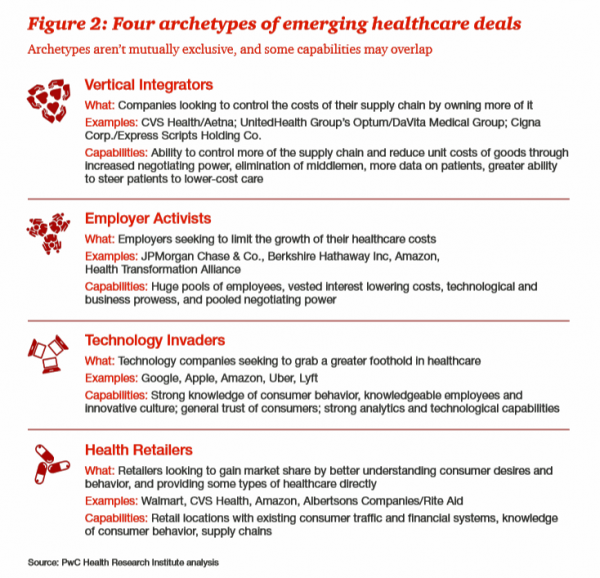

Expect “new combinations” of industry actors and technologies to reorganize and re-imagine healthcare, with an eye on both price and investments in customer experience (CX), PwC envisions in their latest report on The New Health Economy in the Age of Disruption. In this vision, healthcare will be a more flexible marketplace underpinned by data, platforms, and workers. Yes, it’s challenging to get from here-to-there, but PwC explains just how this can happen. Four archetypes, models, of healthcare deals have begun to emerge in the marketplace, illustrated by the Big Deals and announcements reshaping the industry in the past couple of years:

Americans’ Trust in the Healthcare System Low Compared to Rest-of-World’s Health Citizens

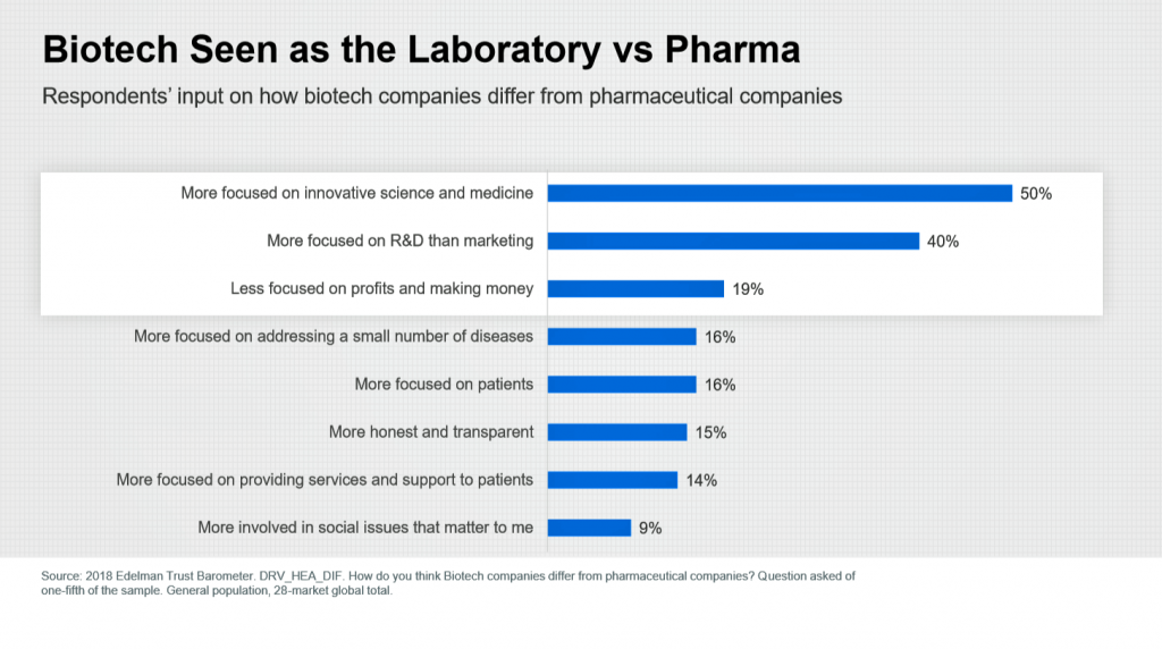

In the U.S., trust in the healthcare industry declined by 9 percentage points in just one year, declining from 62% of people trusting — that’s roughly two-thirds of Americans — down to 53% — closer to one-half of the population. I covered the launch of the 2018 Edelman Trust Barometer across all industries here in Health Populi in January 2018, when this year’s annual report was presented at the World Economic Forum in Davos as it is each year. The Edelman team shared this detailed data on the healthcare sector with me this week, for which I am grateful. Check

Livongo and Cambia Allying to Address Chronic Disease Burden and Scale Solutions to Consumers

Chronic diseases are what kill most people in the world. In the U.S., the chronic disease burden takes a massive toll on both public health and mortality, accounting for 7 in 10 deaths in America each year. That personal health toll comes at a high price and proportion of national health expenditures. A new alliance between Livongo and Cambia Health seeks to address that challenge, beginning with diabetes and scaling to other chronic conditions. Livongo has proven out the Livongo for Diabetes program, which has demonstrated positive outcomes in terms of patient satisfaction and cost-savings. The plan with Cambia is

The Patient As Payor: From Rationing Visits Due to Co-Pays to Facing $370K for Healthcare in Retirement

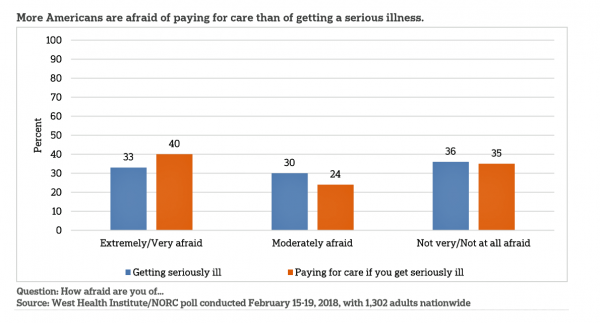

Health care in America is such a scary experience that more people are afraid of paying for care than the actually getting sick part of the scenario. The patient is the payor, and she is afraid…more afraid of the paying than of the illness, according to a survey conducted among U.S. health consumers from WestHealth Institute and NORC, Americans’ Views of Healthcare Costs, Coverage, and Policy from WestHealth and NORC. See the orange bar on the left: 40% of Americans are “extremely or very afraid” about paying for care if they get seriously ill, and 33% are that afraid

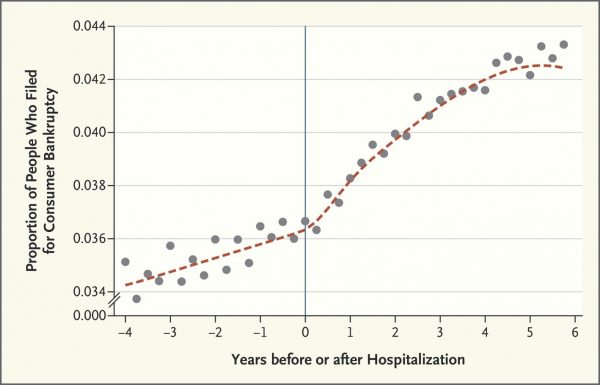

The New Financial Toxicity in Health Care: The Cost of Hospitalization

In healthcare, we use the word “toxicity” when it comes to taking a new medicine, especially a strong therapy to cure cancer. That prescription may be toxic as a harmful side effect on our journey to getting well. The concept of “financial toxicity” for cancer patients was raised by concerned clinicians at Sloane-Kettering Medical Center, who discussed the topic on 60 Minutes in 2014 and have published papers on the issue. Beyond strong medicines, a new financial toxicity has emerged for patients due to hospital inpatient admissions. A new article in the New England Journal of Medicine studies Myth and

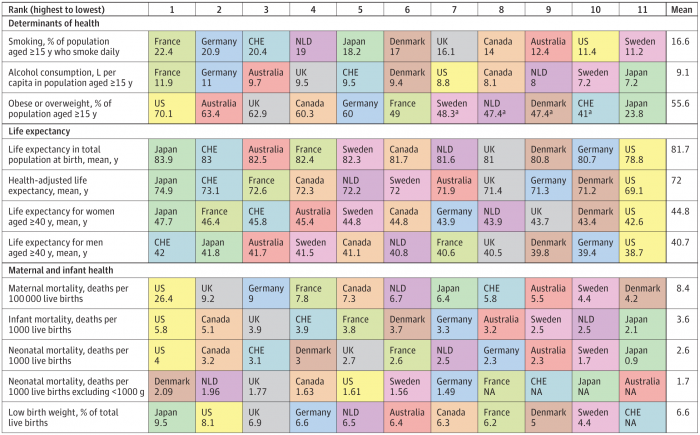

How We Spend Versus What We Get: America’s Healthcare Spending Makes for Poor Health

The U.S. spent nearly twice as much as other wealthy countries on healthcare, mostly due to higher prices for both labor and products (especially prescription drugs). And, America spends more on administrative costs compared to other high-income countries. What do U.S. taxpayers get in return for that spending? Lower life spans, higher maternal and infant mortality, and the highest level of obesity and overweight among our OECD peer nations. These sobering statistics were published in Health Care Spending in the United States and Other High-Income Countries this week in JAMA, the Journal of the American Medical Association. The study analyzes

Will People Enrolled in Medicaid Want to Be Amazon Prime’d?

Amazon is planning to extend Prime subscriptions to people enrolled in Medicaid for the discount price of $5.99 a month instead of the recent price increase to $12.99/month or $99 a year. The $5.99 a month calculates to a 27% break on the annual Prime membership cost. Medicaid enrollees who want to take advantage of the deal must provide Amazon with a scan or image of the card they use for their benefit (either Medicaid or EBT). These consumers can enroll annually, for a maximum of four years. Here’s what the Seattle Times, Amazon’s hometown newspaper, said about the program.

Tweets at Lunch with Paul Krugman – Health IT Meets Economics

I greatly appreciated the opportunity today to attend a luncheon at the HX360 meeting which convened as part of the 2018 HIMSS Conference. The speaker at this event was Paul Krugman, who won the Nobel Prize for Economics 10 years ago and today is an iconic op-ed columnist at the New York Times And Distinguished Professor of Economics at the City University of New York (CUNY). I admit to being a bit of a groupie for Paul Krugman’s work. It tickles me to look at Rise Global’s list of the Top 100 Influential Economists:

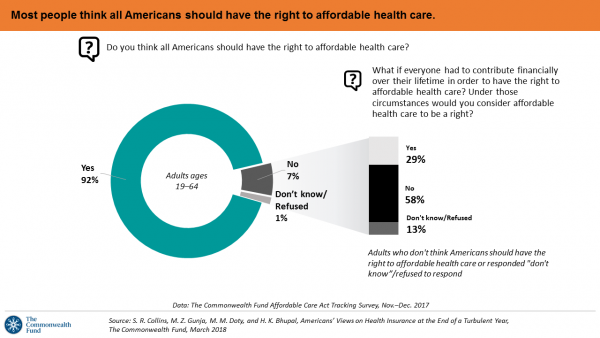

Majority Rules? The Right to Affordable Health Care is A Right for All Americans

If we’re playing a game of “majority rules,” then everyone in America would have the right to affordable health care, according to a new poll from The Commonwealth Fund. The report is aptly titled, Americans’ Views on Health Insurance at the End of a Turbulent Year. The Fund surveyed 2,410 U.S. adults, age 19 to 64, by phone in November and December 2017. This is the sixth survey conducted by the Fund to track Americans’ views of the Affordable Care Act; the first survey was fielded in mid-to-fall 2013. 9 in 10 working-age adults say “yes” indeed, my fellow Americans

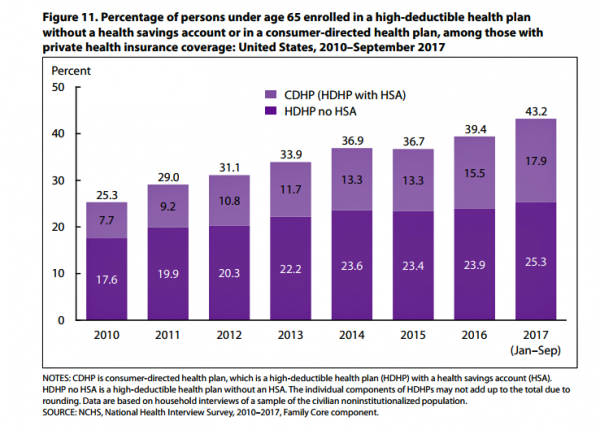

More Working Americans Enrolled in High-Deductible Health Plans in 2017

Over four in 10 U.S. workers were enrolled in a high-deductible health plan in the first 9 months of 2017, according to the latest research published by the National Center for Health Statistics, part of the Centers for Disease Control in the U.S. Department of Health and Human Services. The report details Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, January-September 2017. About 28 million people were uninsured in the U.S. in 2017, about the same proportion as in 2016 — but nearly 20 million fewer than in 2010, as the line chart illustrates. The

How Albertsons Grocery Stores and Rite Aid Can Help Remake Healthcare

Albertsons, the grocery group with popular brands like Acme, Safeway, and Vons, announced a merger with Rite Aid, the retail pharmacy chain. The deal has been discussed as Albertsons’ move to succeed in light of growing competition from Amazon and Whole Foods, the proposed CVS/Aetna merger, and Walgreens’ possible purchase of AmerisourceBergen (finalizing its acquisition of over 1,900 Rite Aid stores). If played out well, the combination could become an important player in the evolving U.S. health/care ecosystem that brings a self-care front-door closer to consumers, patients and caregivers. “The new company is expected to serve more than 40 million

Consumer Health and Patient Engagement – Are We There Yet?

Along with artificial intelligence, patient engagement feels like the new black in health care right now. Perhaps that’s because we’re just two weeks out from the annual HIMSS Conference which will convene thousands of health IT wonks, users and developers (I am the former), but I’ve received several reports this week speaking to health engagement and technology that are worth some trend-weaving. As my colleague-friends Gregg Masters of Health Innovation Media (@2healthguru) and John Moore of Chilmark Research (@john_chilmark) challenged me on Twitter earlier this week: are we scaling sustained, real patient engagement and empowerment yet? Let’s dive into the

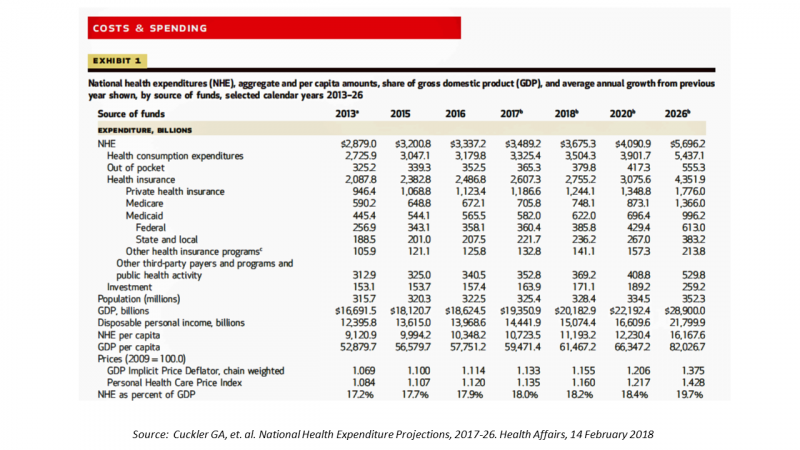

The $4 Trillion Health Economy of 2020

In 2020, national health expenditures (NHE) in the United States will exceed $4 trillion to cover 334.5 million Americans. That equates to 18.4% of the Gross Domestic Product (GDP) and $12,230.40 of health spending per person. I sat in on a press call today with researchers from the Office of the Actuary working in the Centers for Medicare and Medicaid Services (CMS) to review the annual forecast of the NHE, published in Health Affairs in a statistically-dense eleven page article titled, National Health Expenditure Projections, 2017-2026: Despite Uncertainty, Fundamentals Primarily Drive Spending Growth. What are those “fundamentals” pushing up healthcare spending?

The United States of Care Launches to Promote Healthcare for All of US

Let’s change the conversation and put healthcare over politics. Sounds just right, doesn’t it? If you’re reading Health Populi, then you’re keen on health policy, health economics, most of all, patients: now playing starring roles as consumers, caregivers, and payors in their own care. Andy Slavitt, former Acting Administrator of the Centers for Medicare and Medicaid Services (CMS), has assembled a diverse group of health care leaders who care about those patients/people, too, appropriately named the United States of Care. Founders include Dr. Bill Frist, former Republican U.S. Senator from Tennessee, Dave Durenberger, former Republican U.S. Senator from Minnesota, and

U.S. Workers Say Health Care is the Most Critical Issue Facing the Nation

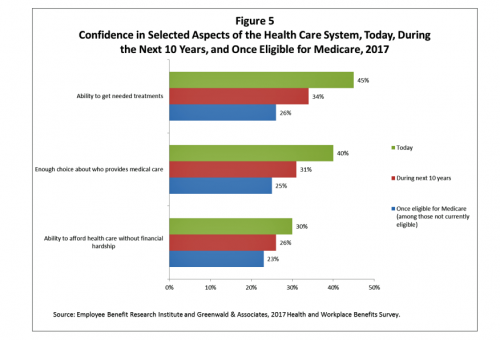

Health care ranks highest among working Americans as the top critical issue facing the country, well above terrorism, the role of the Federal government, unemployment and jobs, education, immigration and taxes. Over half of American workers also rate the country’s healthcare system as “poor” or “fair,” based on the results of the EBRI/Greenwald & Associates Health and Workplace Benefits Survey. Workers dissatisfaction with U.S. healthcare is based largely on cost: one-half of workers experienced an increase in health care costs in the past year. Furthermore, only 22% are satisfied with the cost of their health insurance plan, 18% are satisfied

Warren Buffett’s Healthcare Cost Tapeworm & His Alliance with Amazon and JPMorgan

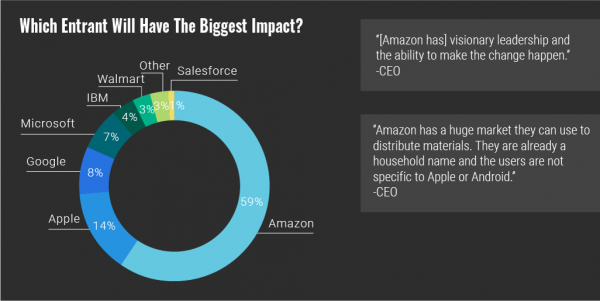

The fact that the average U.S. employer committed to spend nearly $27,000 a year for a PPO to cover a family of 4 in America in 2017 is the most important rationale underlying the announcement that Amazon, Berkshire-Hathaway, and JP Morgan made on 30th January 2017. That news immediately shook Wall Street trading, sending downward shocks down the proverbial spines of healthcare insurance plans and suppliers to the industry — legacy healthcare companies that scale patient-members and healthcare supplies, like pills and surgical implants. The “new competition” chart published in the Wall Street Journal in the morning illustrates those shock

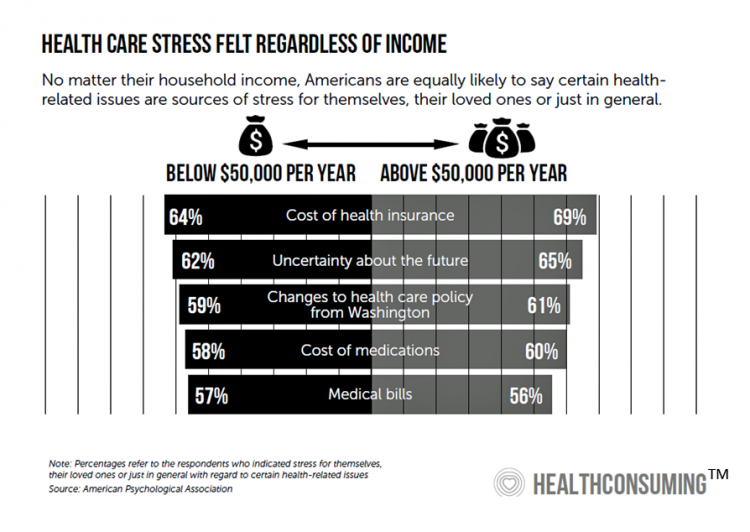

Health Insurance Costs Stress US Whether We’re Rich or Not / and Why a $0 Budget for CFPB Matters for Healthcare

Health care costs cause anxiety for U.S. adults, regardless of their affluence, we learn in Uncertainty About Healthcare, the latest Stress in America poll from the American Psychological Association. The big stat is that 2 in 3 Americans say the cost of health insurance is a stressor for them or their loved ones, whether the person earns more or less than $50,000 a year. Underneath that top-line are some demographic differences. Millennials are most concerned about access to mental health care compared with Boomers and older adults. Reproductive care access is of most interest to Millennials and Gen Xers. Two-thirds

In the U.S., Spend More, Get Less Health Care: the Latest HCCI Data

Picture this scenario: you, the consumer, take a dollar and spend it, and you get 90 cents back. In what industry is that happening? Here’s the financial state of healthcare in America, explained in the 2016 Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI). We live in an era of Amazon-Primed consumers, digital couponing, and expectations of free news in front of paywalls. We are all in search of value, even as the U.S. economy continues to recover on a macroeconomic basis. But that hasn’t yet translated to many peoples’ home economics. In this personal

Healthcare EveryWhere: Philips and American Well Streamline Telehealth

Two mature companies in their respective healthcare spaces came together earlier this month to extend healthcare services where patients live and doctors work, via telehealth services. Philips, celebrating 127 years in business this year, has gone all-in on digital health across the continuum of care, from prevention and healthy living to the ICU and hospital emergency department. American Well is among the longest operating telehealth companies, founded in 2006. Together, these two established organizations will transcend physician offices and ERs and deliver virtual care in and beyond the U.S. I had the opportunity to sit down with Ido Schoenberg, MD,

Calling Out Health Disparities on Martin Luther King Day 2018

On this day appreciating the legacy of Martin Luther King, Jr., I post a photo of him in my hometown of Detroit in 1963, giving a preliminary version of the “I Have a Dream” speech he would deliver two months later in Washington, DC. Wisdom from the speech: “But now more than ever before, America is forced to grapple with this problem, for the shape of the world today does not afford us the luxury of an anemic democracy. The price that this nation must pay for the continued oppression and exploitation of the Negro or any other minority group

Most Americans Say Healthcare is #1 Policy Issue Entering 2018

Concerns about health care are, by a large margin, the top domestic policy issue U.S. voters identified as they enter 2018. The proportion of Americans citing healthcare as the top public agenda priority grew by 50% since 2016, from 31% two years ago to 48%. Taxes rank #2 this year, garnering 31% of Americans’ concerned, followed by immigration, which has remained flat cited by about one-in-four Americans. The Associated Press (AP)-NORC Center for Public Affairs Research polled 1,444 U.S. adults 18 and over between November 30 and December 4, 2017 for this survey. While one-half of Americans would like the

Health Consumers Face the New Year Concerned About Costs, Security and Caring – Health Populi’s 2018 Forecast

As 2018 approaches, consumers will gather healthy New Year’s Resolutions together. Entering the New Year, most Americans are also dealing with concerns about healthcare costs, cybersecurity, and caring – for physical health, mental stress, and the nation. Healthcare costs continue to be top-of-mind for consumer pocketbook issues. Entrenched frugality is the new consumer ethos. While the economy might be statistically improving, American consumers’ haven’t regained confidence. In 2018, frugality will impact how people look at healthcare costs. 88% of US consumers are likely to consider cost when selecting a healthcare provider, a Conduent survey found. Physicians know this: 81% of

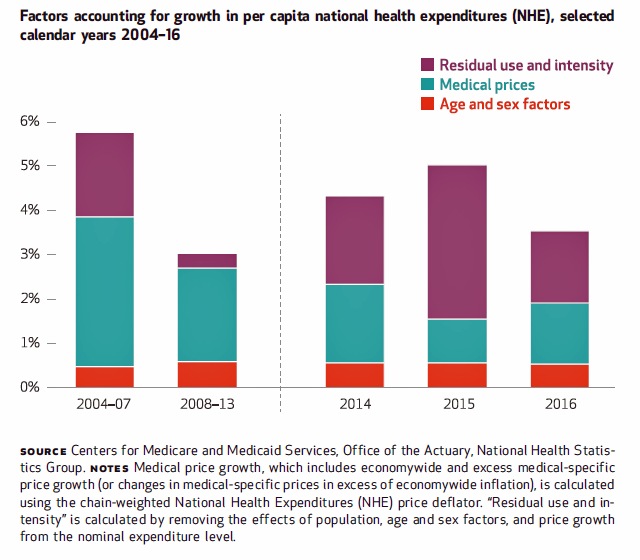

The Patient as Payor – Consumers and the Government Bear the Largest Share of Healthcare Spending in America

The biggest healthcare spenders in the United States are households and the Federal government, each responsible for paying 28% of the $3.3 trillion spent in 2016. Private business — that is, employers covering healthcare insurance — paid for 20% of healthcare costs in 2016, based on calculations from the CMS Office of the Actuary’s report on 2016 National Health Expenditures. The positive spin on this report is that overall national health spending grew at a slower rate in 2016, at 4.3% after 5.8% growth in 2015. This was due to a decline in the growth rates for the use of

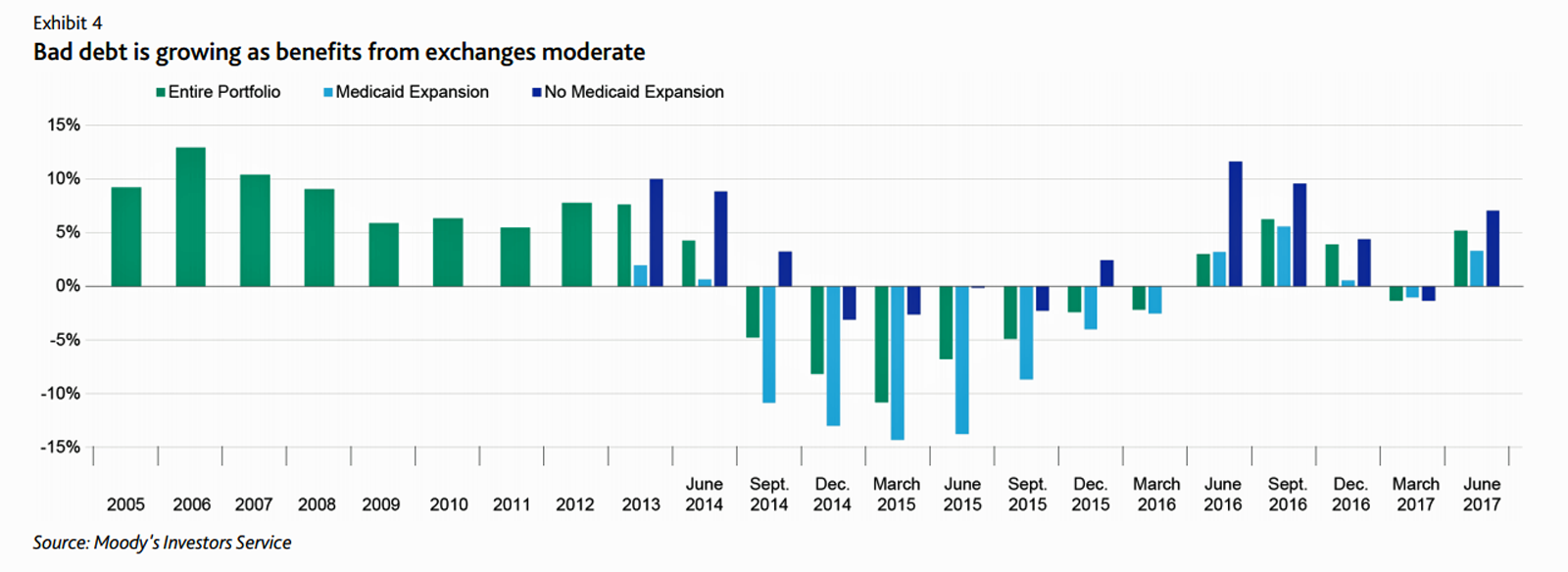

Six Healthcare News Stories to Keep Hospital CFOs Up At Night

At this moment, the healthcare job I’d least like to have is that of a non-profit hospital Chief Financial Officer (CFO). Five news stories, published in the past 24 hours, tell the tale: First, Moody’s forecast for non-profit hospitals and healthcare in 2018 is negative due to reimbursement and expense pressures. The investors report cited an expected contraction in cash flow, lower reimbursement rates, and rising expense pressures in the midst of rising bad debt. Second, three-quarters of Federally Qualified Health Centers plan to lay off staff given lack of budget allocations resulting from Congressional inaction. Furthermore, if the $3.6

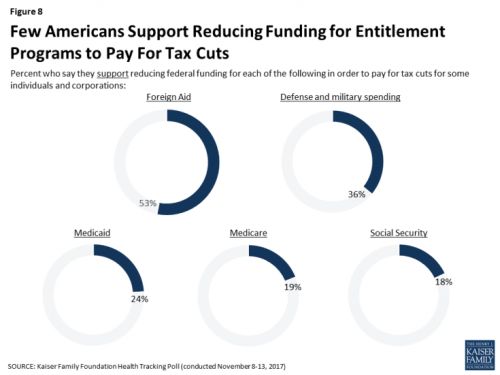

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

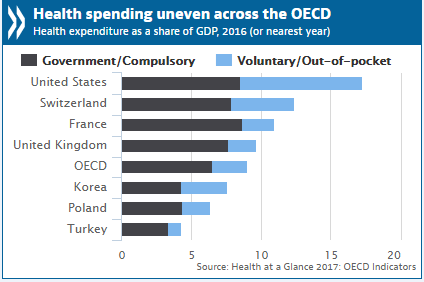

U.S. Healthcare Spending & Outcomes in Five Charts: #EpicFail in the 2017 OECD Statistics

“Spend more. Get less.” If a retailer advertised using these four words, how many consumers would buy that product or service? This is the American reality of healthcare spending in 2016, told in the OECD report, Health at a Glance 2017. I present five charts from the study in this post, which together take the current snapshot health-economic lesson for the U.S. First, look at health expenditures as a share of gross domestic product: the U.S. is number one above Switzerland, France, and the UK, and about two times the OECD average. Note, too, the proportion of out-of-pocket and so-called

Health Care Is 2.5 More Expensive Than Food for the Average U.S. Family

The math is straightforward. Assume “A” equals $59.039, the median household income in 2016. Assume “B” is $18,142, the mean employer-sponsored family insurance premium last year. B divided by A equals 30.7%, which is the percent of the average U.S. family’s income represented by the premium cost of health insurance. Compare that to what American households spent on food: just over $7,000, including groceries and eating out (which is garnering a larger share of U.S. eating opportunities, a topic for another post). Thus, health care represents, via the home’s health insurance premium, represents 2.5 times more than food for the

CVS Health in Talks to Acquire Aetna – The Changing Retail Health Landscape

Just a few days since CVS Health announced the company would be working with mega-health insurer Anthem on a prescription drug management program, the pharmacy chain today is reportedly in talks to buy Aetna, the national health insurance company, according to CNBC and other credible news outlets like the Wall Street Journal. Remember that Aetna’s bid to acquire Humana was scuttled earlier this year after many months of negotiation and positioning, along with FTC scrutiny about antitrust. That insurance merger “died” on one day in February 2017 along with an Anthem-CIGNA deal, covered here by CNN. A deal between CVS

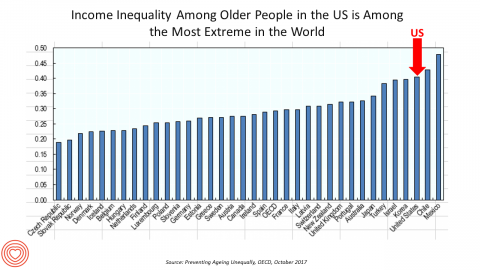

Income Inequality For Older Americans Among Highest in the World – What This Means for Healthcare

Old-age inequality among current retirees in the U.S. is already greater than in ever OECD country except Chile and Mexico, revealed in Preventing Ageing Unequally from the OECD. Key findings from the report are that: Inequalities in education, health, employment and income start building up from early ages At all ages, people in bad health work less and earn less. Over a career, bad health reduces lifetime earnings of low-educated men by 33%, while the loss is only 17% for highly-educated men Gender inequality in old age, however, is likely to remain substantial: annual pension payments to the over-65s today are

What Patients Feel About Technology, Healthcare Costs and Social Determinants

U.S. consumers feel positive about the roles of technology and social determinants in improving healthcare, but are concerned about costs, according to the 2017 Patient Survey Report conducted for The Physicians Foundation. The survey gauged patients’ perspectives across four issues: the physician-patient relationship, the cost of healthcare, social determinants of health, and lifestyle choices. Two key threads in the research explain how Americans feel about healthcare in the U.S. at this moment: the role of technology and the cost of health care. First, the vast majority of consumers view technology, broadly defined, as important for their health care. 85% of people

I was invited to be a Judge for the upcoming

I was invited to be a Judge for the upcoming  Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters

Thank you Team Roche for inviting me to brainstorm patients as health citizens, consumers, payers, and voters  For the past 15 years,

For the past 15 years,