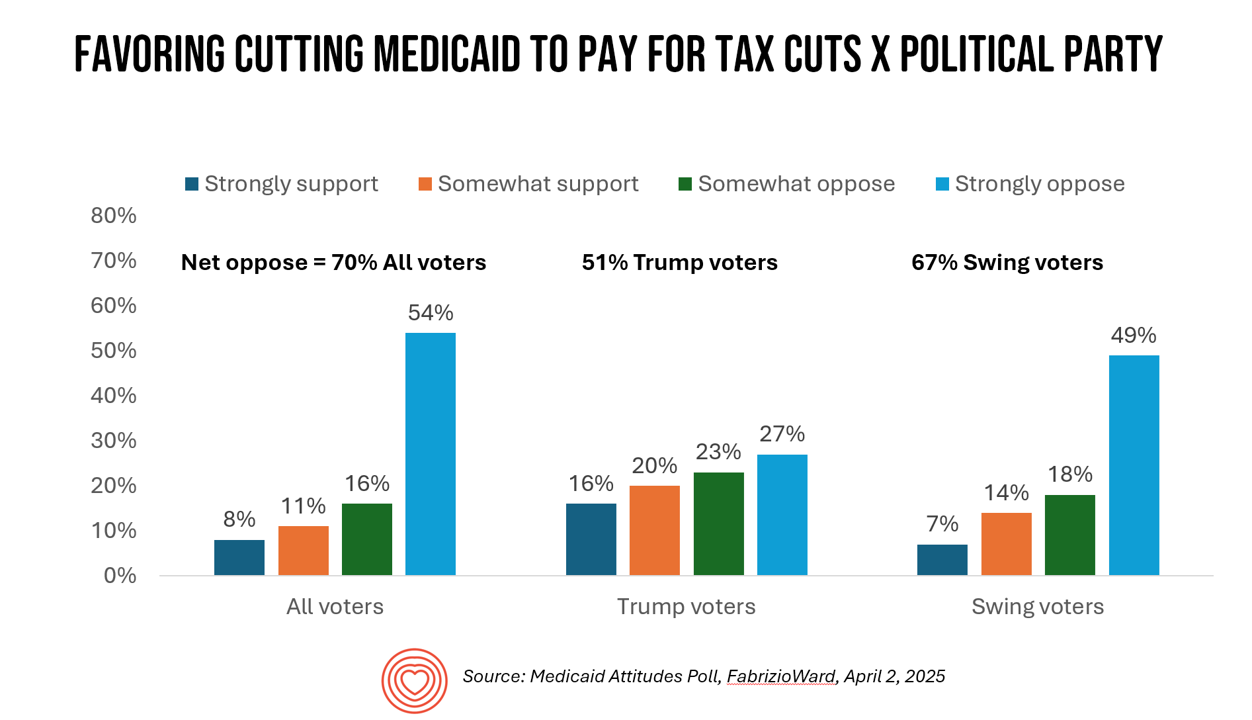

Most Americans Don’t Want to Cut Medicaid (Including Republicans)

With potential down-sizing of Medicaid on the short-term U.S. political horizon, a fascinating poll found that most people identifying as Republican would not favor cuts to Medicaid. What fascinates me about this survey, published earlier this week, is that it was conducted by FabrizioWard, a polling firm that has often been used by President Trump. The firm’s Bob Ward told POLITICO that, “There’s really not a political appetite out there to go after Medicaid to pay for tax cuts. Medicaid has touched so many families that people have made up their minds about what

Are We Liberated Yet? Tariffs Can Impact Financial Health (Riffing on MoneyLion’s Health Is Wealth Report)

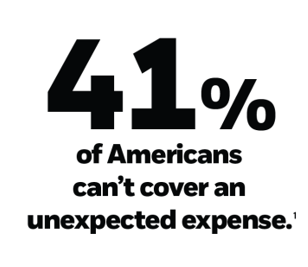

Americans’ financial health was already stressing consumers out leading up to Liberation Day, April 2nd, when President Trump announced tariffs on dozens of countries with whom the U.S. buys and sells goods. A new report from MoneyLion and Mastercard called Health is Wealth is well-timed for today’s Health Populi blog. The study was fielded by The Harris Poll online among 2,092 U.S. adults 18 and older between February 28 and March 4, 2025, so it was completed a month before the tariffs came to hit peoples’ 401(k) savings and employers’ company stock market caps.

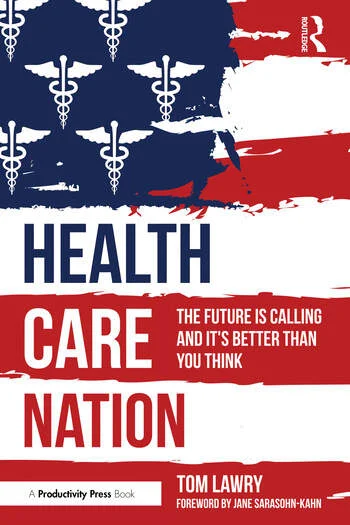

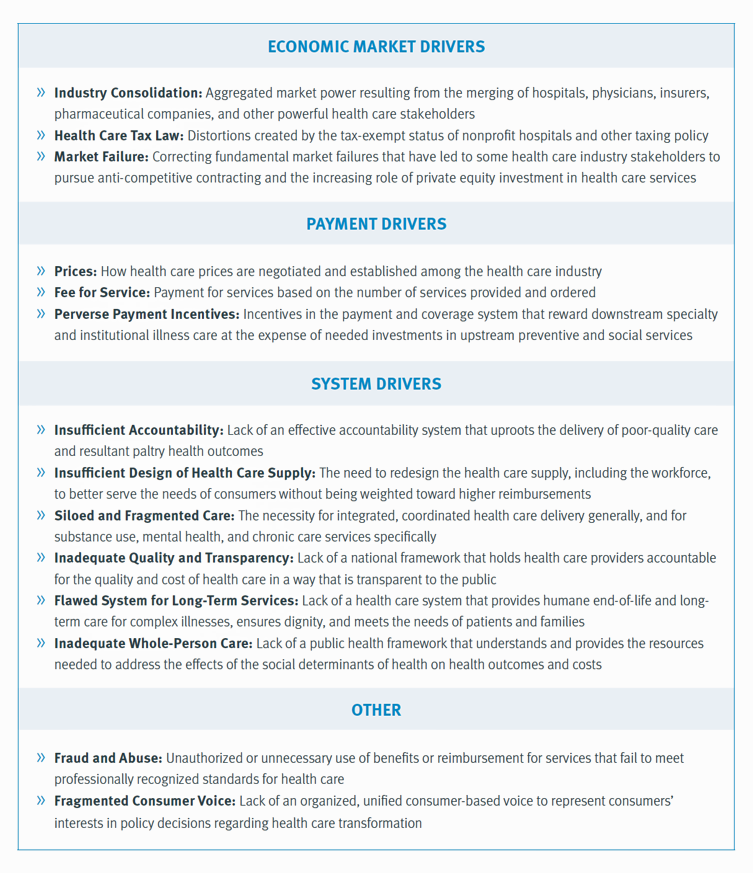

Health Care Nation – How to Inspire a Rosa Parks Moment for Healthcare in America?

Tom Lawry may be best-known as a leading voice on AI in health care; after all, he’s written two very well-selling books on the topic, speaks all over the world on the subject, and in his most recent company-based gig helped lead Microsoft’s efforts in AI in health care and life sciences. When his publisher asked him to write a third book on AI in health care – still a hot topic in publishing – Tom said he’d rather turn to a subject long on his mind: the state of health care in America and how to change the conversation

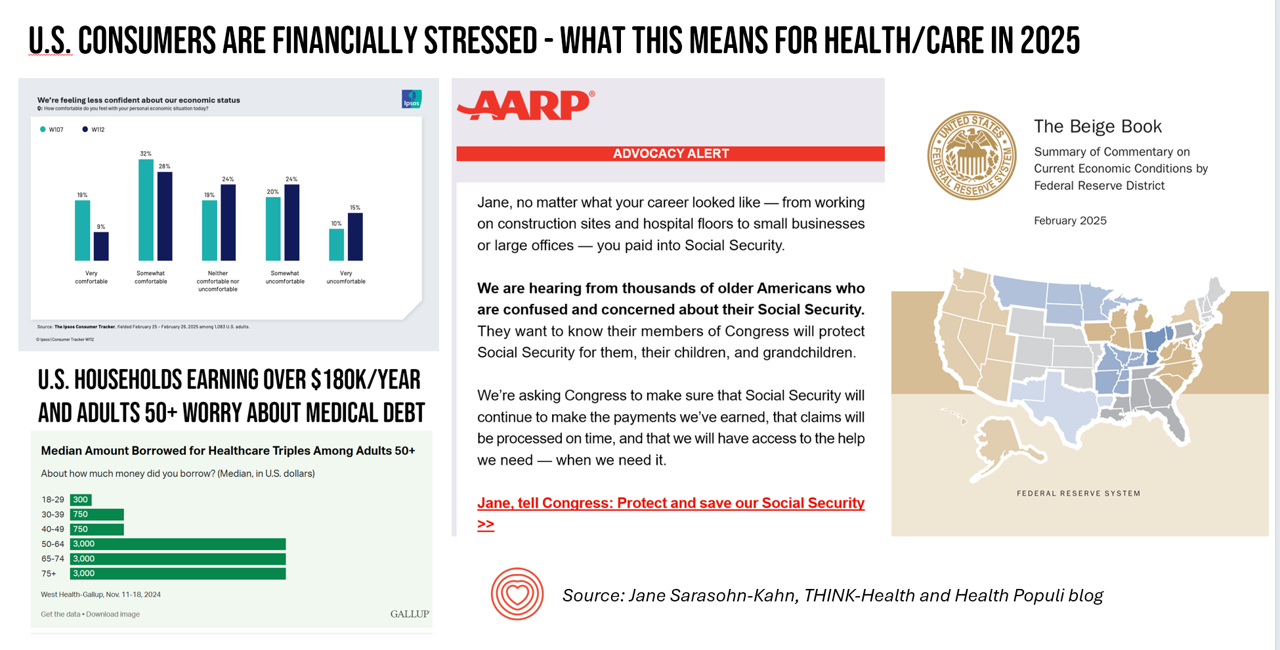

Consumers Are Financially Stressed – What This Means for Health/Care in 2025

People define health across many life-flows: physical health, mental health, social health, appearance (“how I look impacts how I feel”) and, to be sure, financial well-being. In tracking this last health factor for U.S. consumers, several pollsters are painting a picture of financially-stressed Americans as President Trump tallies his first six weeks into the job. The top-line of the studies is that the percent of people in America feeling financially wobbly has increased since the fourth quarter of 2024. I’ll review these studies in this post, and discuss several potential impacts we should keep in mind for peoples’ health and

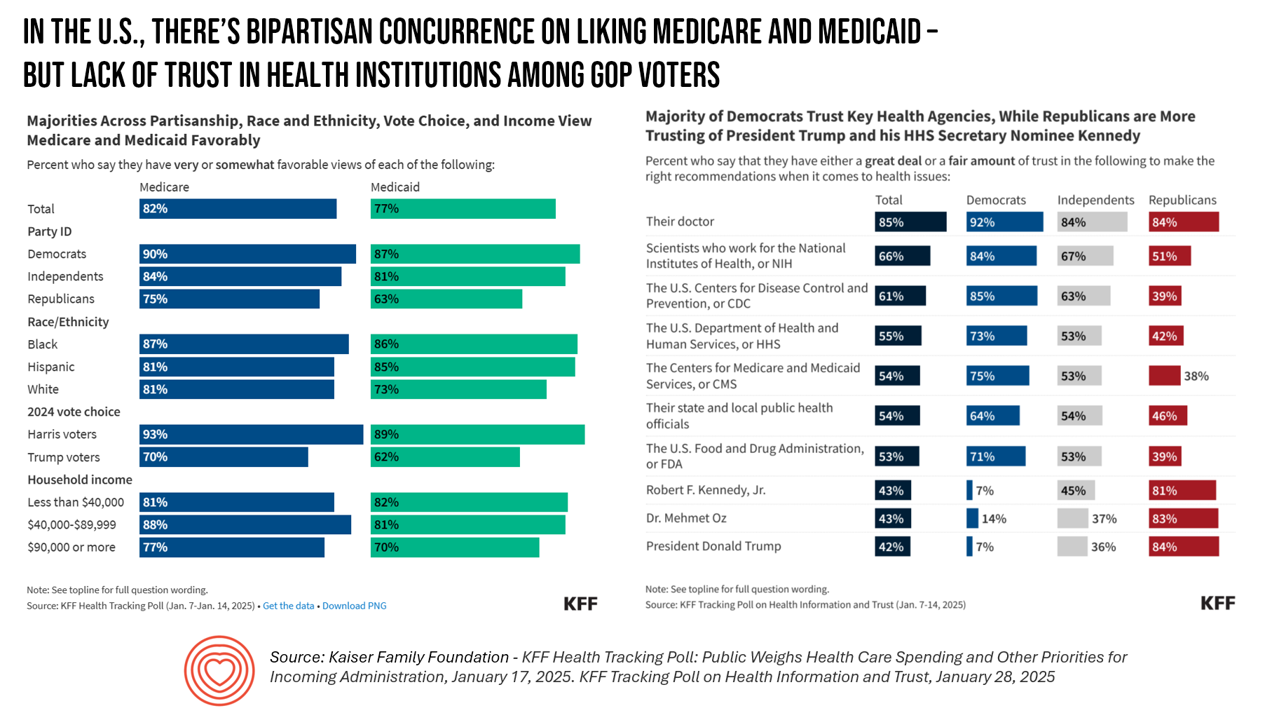

Some Bipartisan Concurrence on Health Care Issues in the U.S. – But Trust in Health Care Isn’t Bipartisan – KFF’s January 2025 Polls

Two polls from one poll source paint at once a bipartisan and bipolar picture of U.S. health citizens when it comes to health care issues versus health care institutions in America. The Kaiser Family Foundation has hit the 2025 health policy ground running in publishing the January 2025 Health Tracking Poll last week and a poll on health care trust and mis-information yesterday. First, the health tracking poll which finds some concurrence between Democrats and Republicans on several big issues facing Americans and various aspects of their health care. As

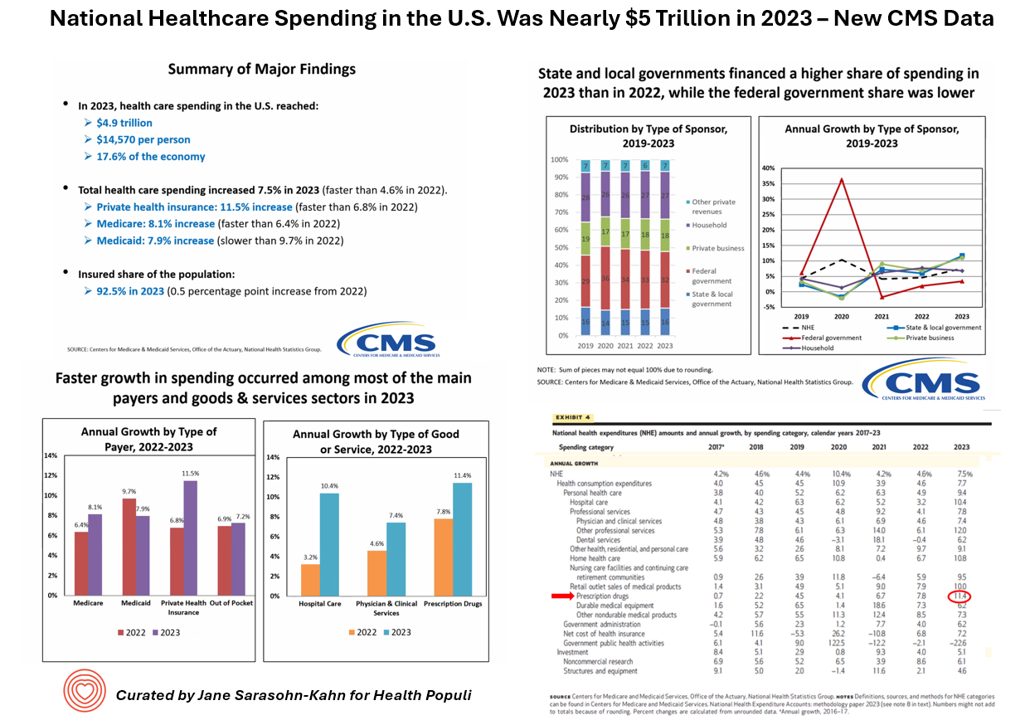

National Healthcare Spending in the U.S. Was Nearly $5 Trillion (with a “T”) in 2023 – New Data from CMS

What would $5 trillion be valued around the world or on the stock market? The economy of Germany was gauged around $5 trillion in 2024. India could be the world’s 3rd largest economy by 2026 valued at $5 trillion. Nvidia could be a $5 trillion company in 2025, as could Amazon. But today we report out the latest data from the Centers for Medicare and Medicaid Services (CMS) that national health spending in America reached $4.9 trillion in 2023. The full report on national health expenditures (NHE) in the U.S. was published today in Health Affairs, which came off embargo

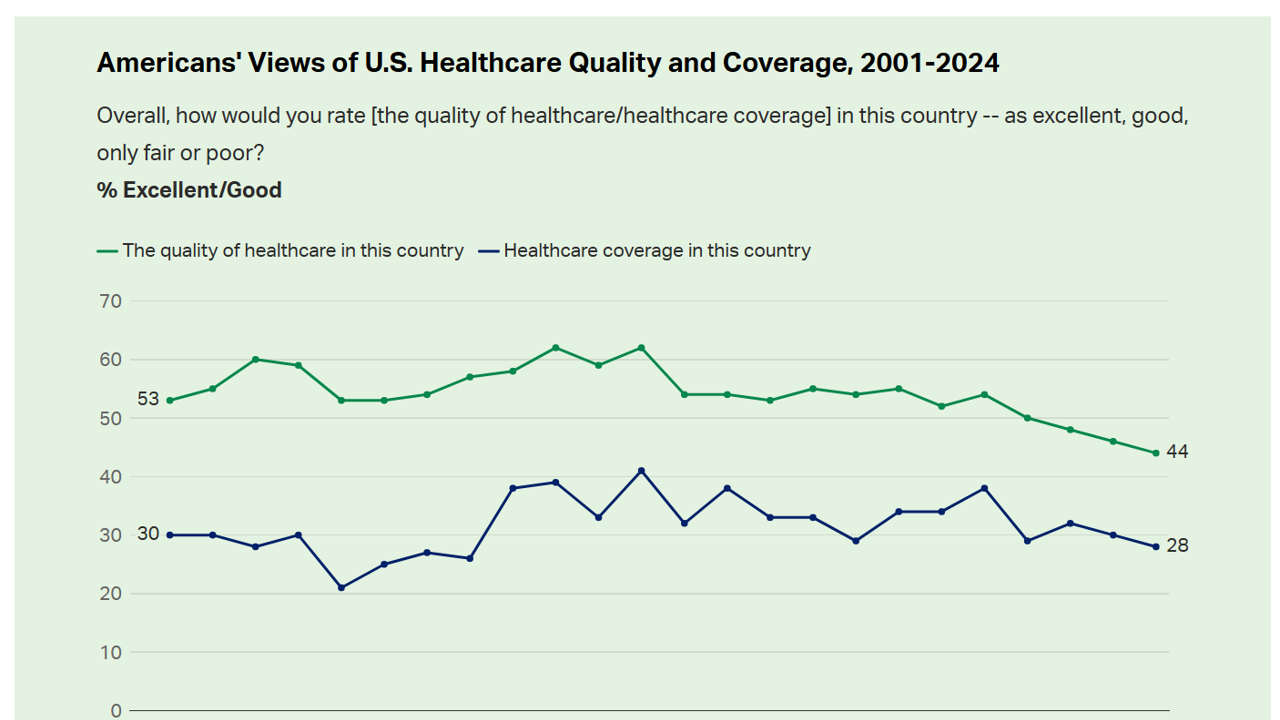

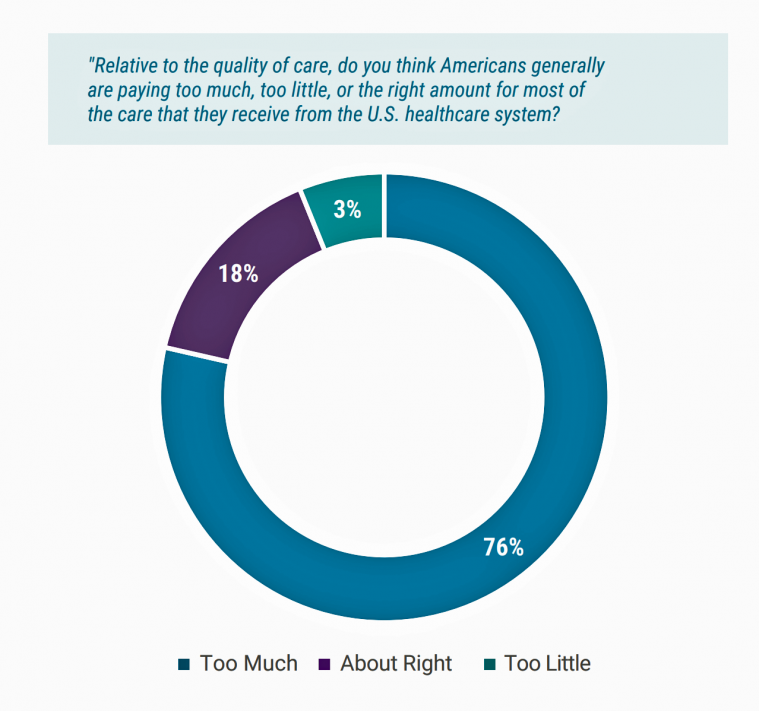

Americans’ Views on the Quality of Healthcare Fell to a Record Low — with Costs Ranking as the Most Urgent Problem for Health in the U.S.

Americans’ perception of the quality of health care in the U.S. fell to the lowest level since 2001, Gallup found in a poll of U.S. health citizens’ views on health care quality, published December 6, 2024. In 2024, only 44% of Americans said that the quality of health care int he U.S. was excellent or good — conversely, 56% of Americans though health care quality was only fair or poor. By political party, that included 50% of Democrats evaluating the quality of care highly compared with 42% of Republicans. Only 28% of people in

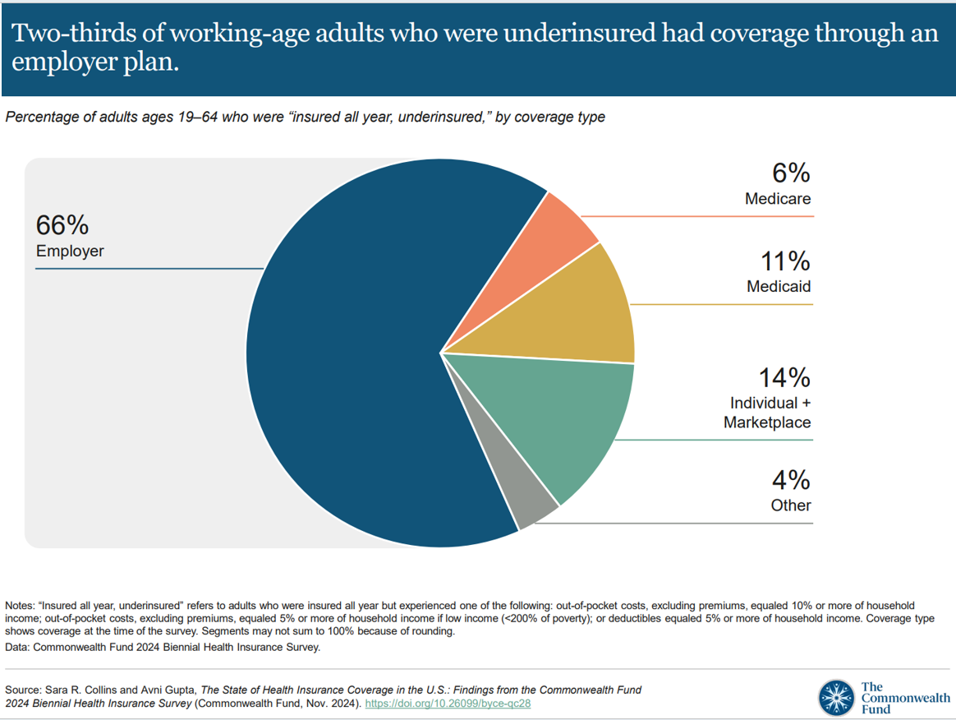

Workers Feel “Stuck,” Under-Insured, Financially Stressed, and Neglecting Mental Health

“It’s the economy stupid,” Jennifer Tescher, CEO of the Financial Health Network, titles her latest column in Forbes. Published two weeks after the 2024 U.S. elections, Jennifer’s assertion sums up what, ex post facto, we know about what most inspired American voters at the polls in November 2024: the economy, economics, inflation, the costs of daily living….pick your noun, but it’s all about those Benjamins right now for mainstream American consumers across many demographic cuts. With that realization, we must remind ourselves as we enter a new year under a second-term President Trump that health care spending for everyday people

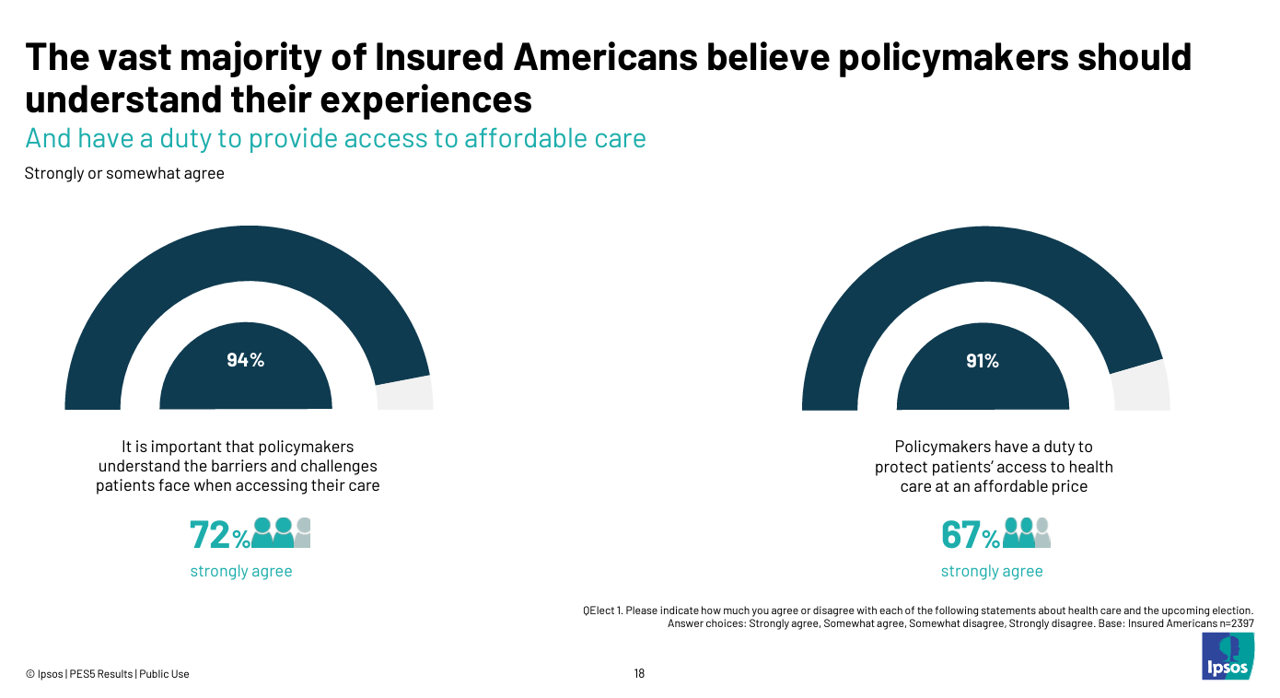

Health Care Costs and Access On U.S. Voters’ Minds – Even If “Not on the Ballot” – Ipsos/PhRMA

Today marks eight days before #Election2024 in the U.S. While many political pundits assert that “health care is not on the ballot,” I contend it is on voters’ minds in many ways — related to the economy (the top issue in America), social equity, and even immigration (in terms of the health care workforce). In today’s Health Populi blog, I’m digging into Access Denied: patients speak out on insurance barriers and the need for policy change, a study conducted by Ipsos on behalf of PhRMA, the Pharmaceutical Research and Manufacturers of America — the pharma industry’s advocacy organization (i.e., lobby

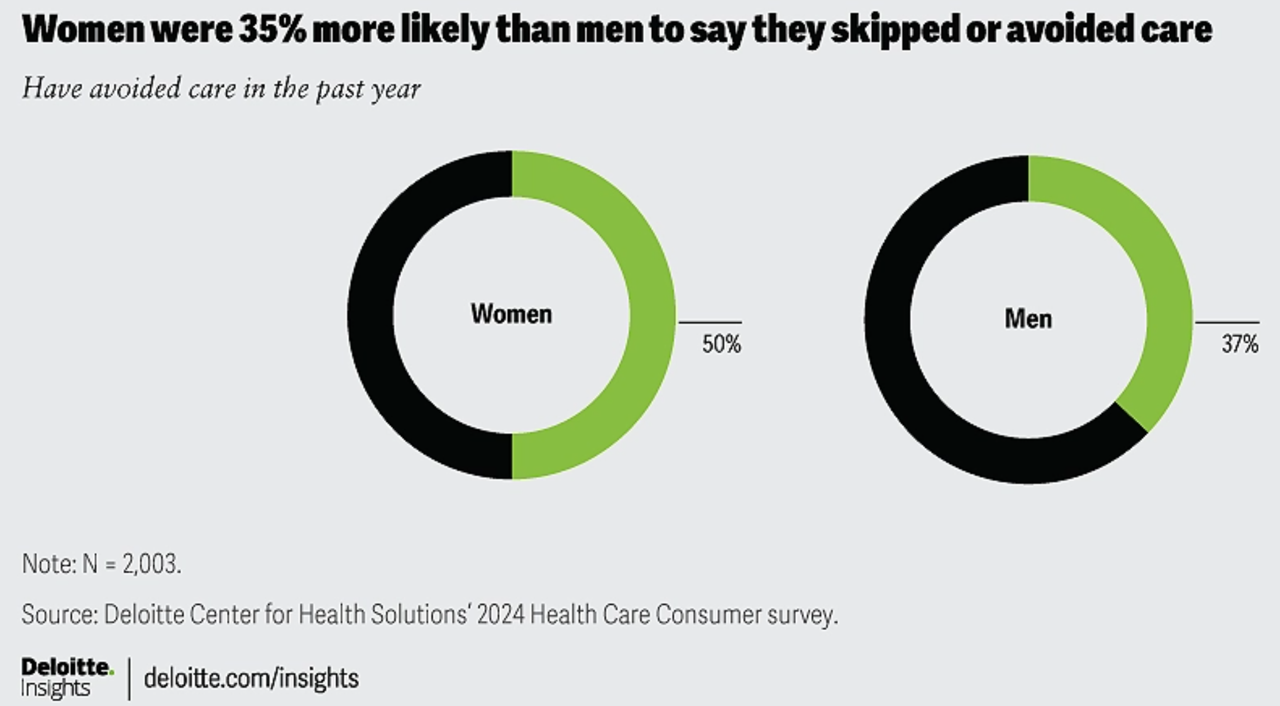

1 in 2 U.S. Women (“The Bedrock of Society”) Self-Ration Care – the Latest Deloitte Findings

Women in the U.S. are more likely to avoid care than men in America, Deloitte found in the consulting firm’s latest survey on consumers and health care. Deloitte coins this phenomenon as a “triple-threat” that women face in the U.S. health care environment, the 3 “threats” being, Affordability, Access, and, Prior experience — that is the health disparity among women who have seen personal mis-diagnosis, bias, or treatment that hasn’t been consistent with current protocols and practices. The data come out of Deloitte’s fielding of the U.S. consumer survey in February and March, 2024.

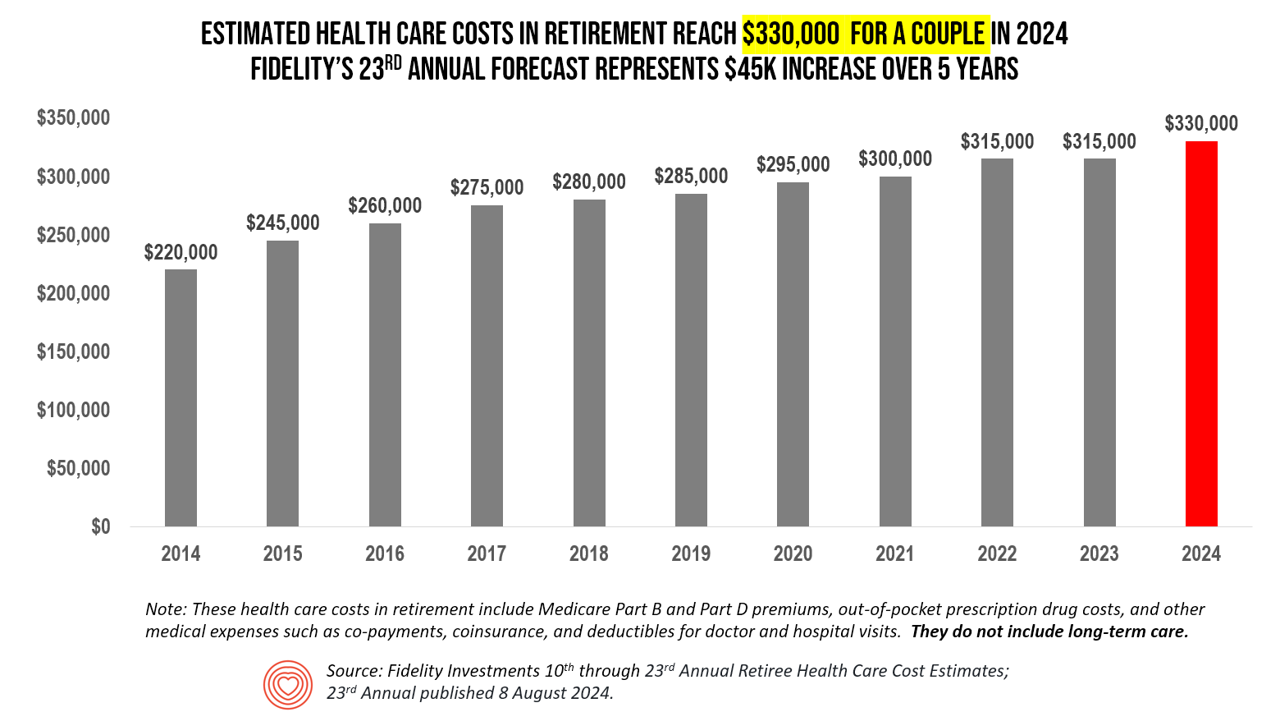

The Health Care Costs for Someone Retiring in 2024 in the U.S. Will Reach $165,000 – Fidelity’s 23rd Annual Update

The average person in the U.S. retiring in 2024 will need to bank $165,000 to pay for health care costs in retirement — a sum that does not include long-term care, Fidelity Investments advises us in the 23rd annual look at this always-impactful (and sobering) forecast. I’ve covered this study every year since 2011 here in Health Populi, continuing to add to this bar chart; in the interest of space and legibility, I started this year’s version of the chart at 2014, when the cost for a couple was gauged at $220K. Fidelity began

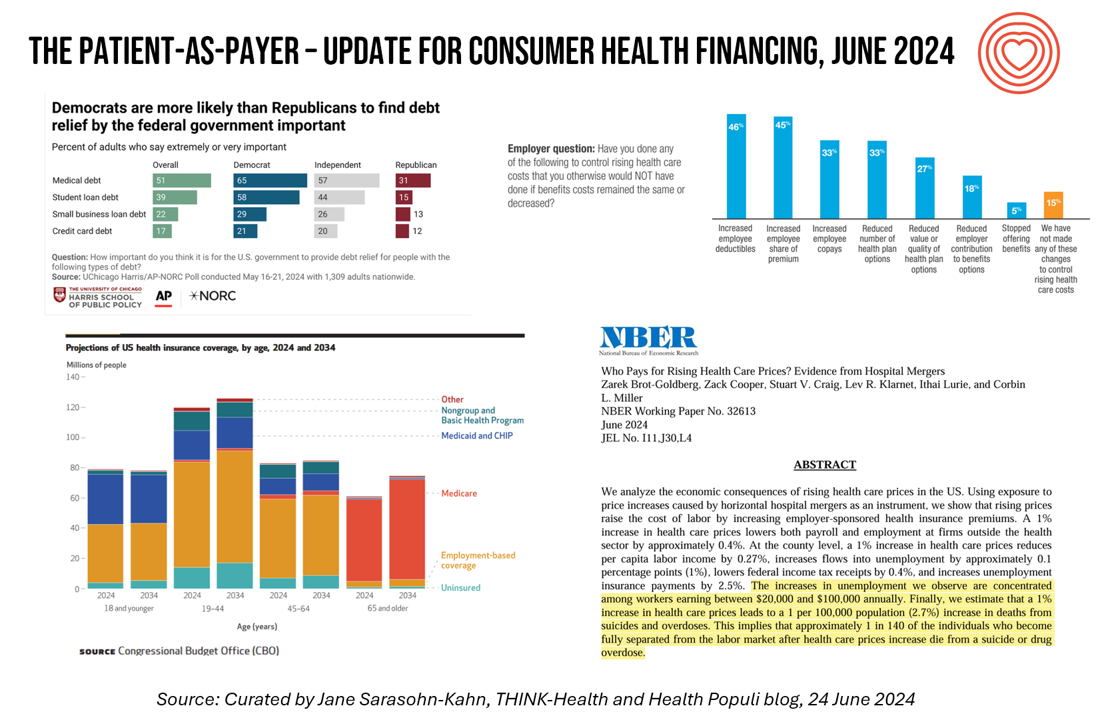

Medical Debt, Aflac on Eroding Health Benefits, the CBO’s Uninsured Forecast & Who Pays for Rising Health Care Prices: A Health Consumer Financial Update

On June 11, Rohit Chopra, the Director of the Consumer Financial Protection Bureau (CFPB) announced the agency’s vision to ban Americans’ medical debt from credit reports. He called out that, “In recent years, however, medical bills became the most common collection item on credit reports. Research from the Consumer Financial Protection Bureau in 2022 showed that medical collections tradelines appeared on 43 million credit reports, and that 58 percent of bills that were in collections and on people’s credit records were medical bills.” Chopra further explained that medical debt on a consumer credit report was quite different than other kinds

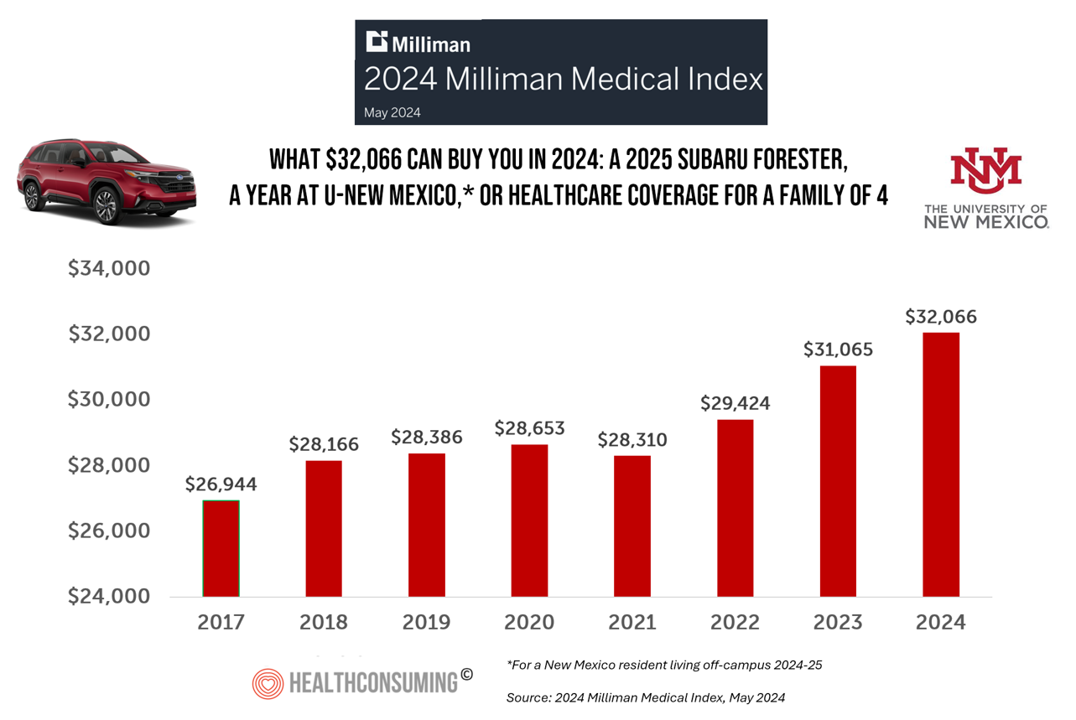

A 2025 Subaru Forester, a Year at U-New Mexico, or a Health Plan for a Family of Four: the 2024 Milliman Medical Index

Health care costs for an “average” person covered by an employer-sponsored PPO in the U.S. rose 6.7% between 2023 and 2024, according to the 2024 Milliman Medical Index. Milliman also calculated that the largest driver of cost increase in health care, accounting for nearly one-half of medical cost increases, was pharmacy, the cost of prescription drugs, which grew 13% in the year. The big number this year is $32,066, which is the cost of that employer-sponsored PPO for a family of 4 in 2024. I’ve curated the chart of the MMI statistic for many

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

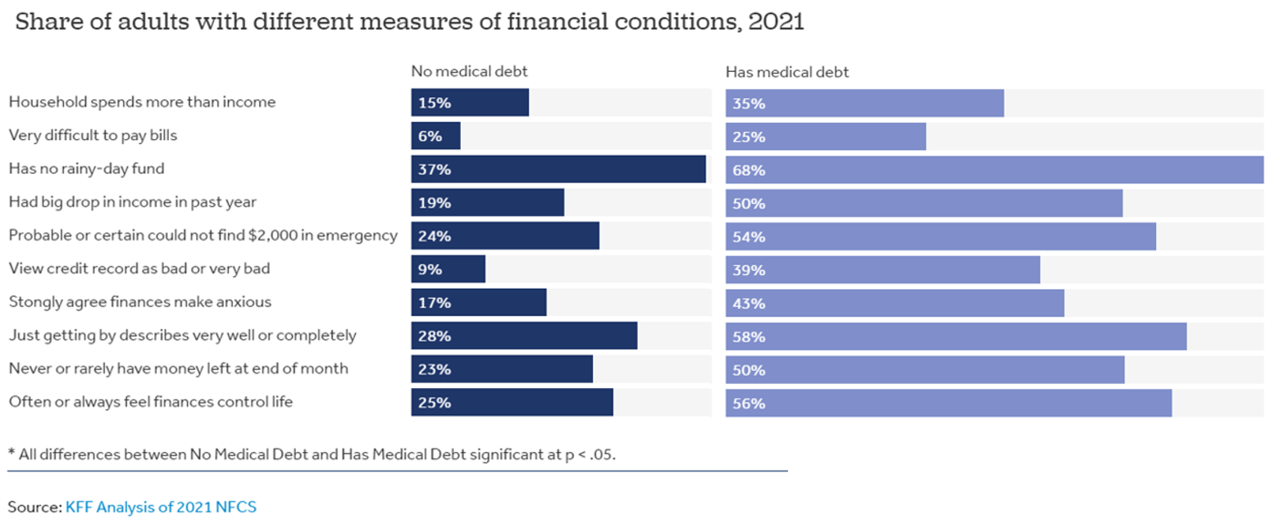

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

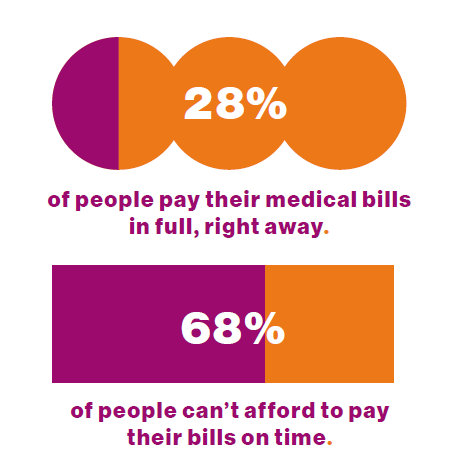

Healthcare Bills, Affordability, and Self-Rationing Care Will Continue to Challenge U.S. Health Consumers in 2024

Two-thirds of U.S. consumers say they can’t afford to pay their medical bills on-time, based on the 2023 Consumer Survey from Access One, a financial services company focused on healthcare payments. The report’s title page asks the question, “What options do consumers really want for paying healthcare expenses?” The survey report responds to that question, finding out that nearly one-half of patients have taken some kind of action to reduce their medical expenses. Furthermore, one-third of consumers are not confident they could pay a medical bill of $500 or more. Access One fielded

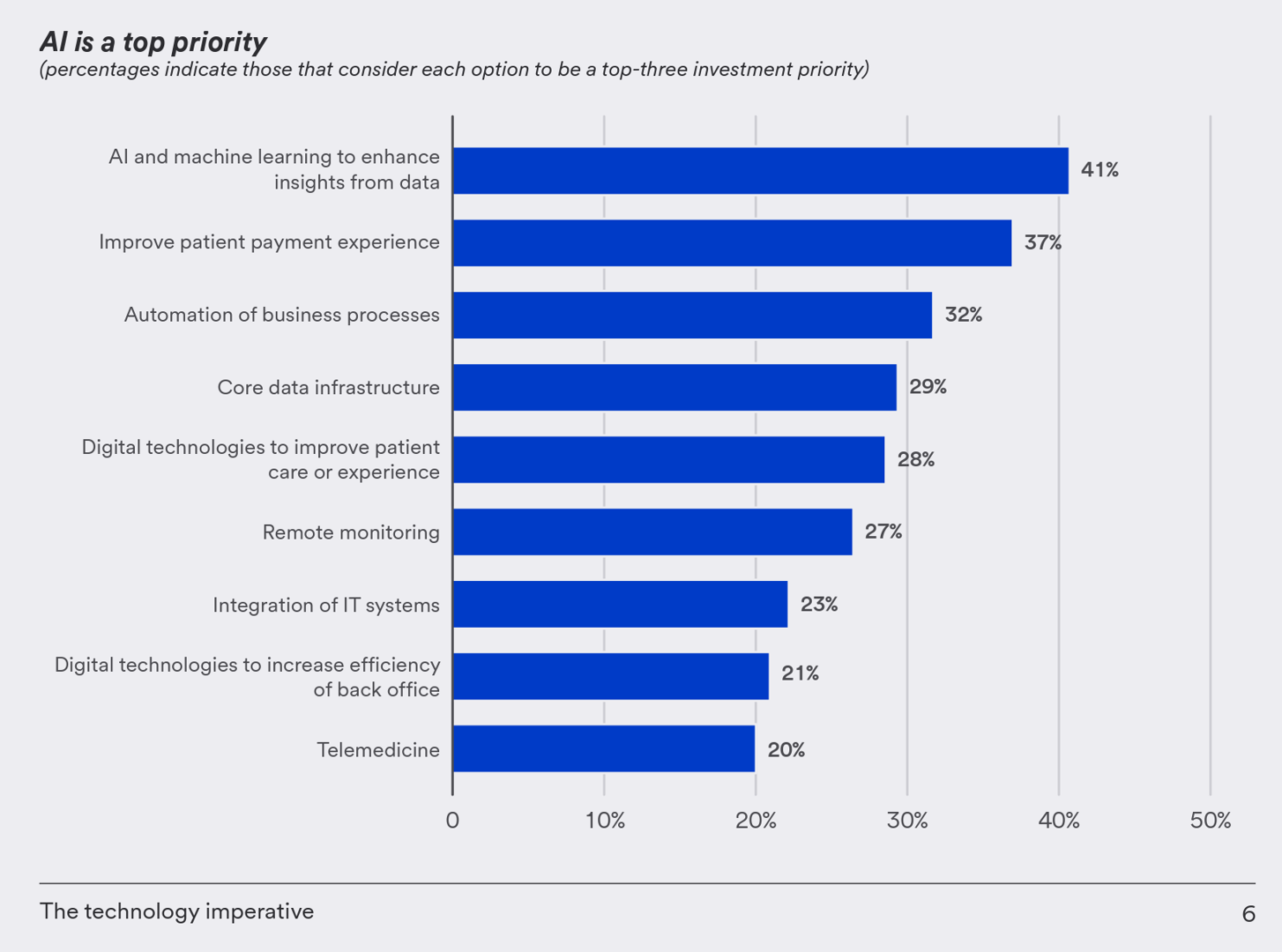

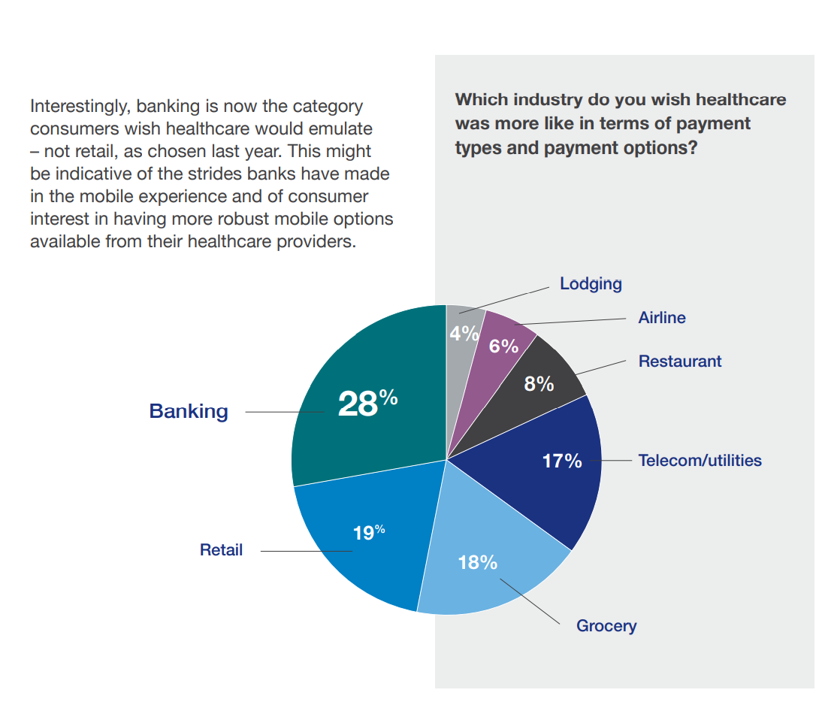

Health Care Finance Leaders Look to Cut Costs and Improve Patients’ Financial Experience — Think AI and Venmo

One half-of health care financial leaders plan to invest in technology to cut costs — and most believe that AI has the potential to re-define the entire finance function as they look to Leading the transformation, a study conducted by U.S. Bank among U.S. health finance leaders thinking about emerging technologies. U.S. Bank fielded a survey among 200 senior health care financial leaders in the U.S., 30% of whom were group CFOs, 20% regional/divisional CFOs, 25% senior managers, and the remaining various flavors of financial managers. All respondents were responsible for at least $100

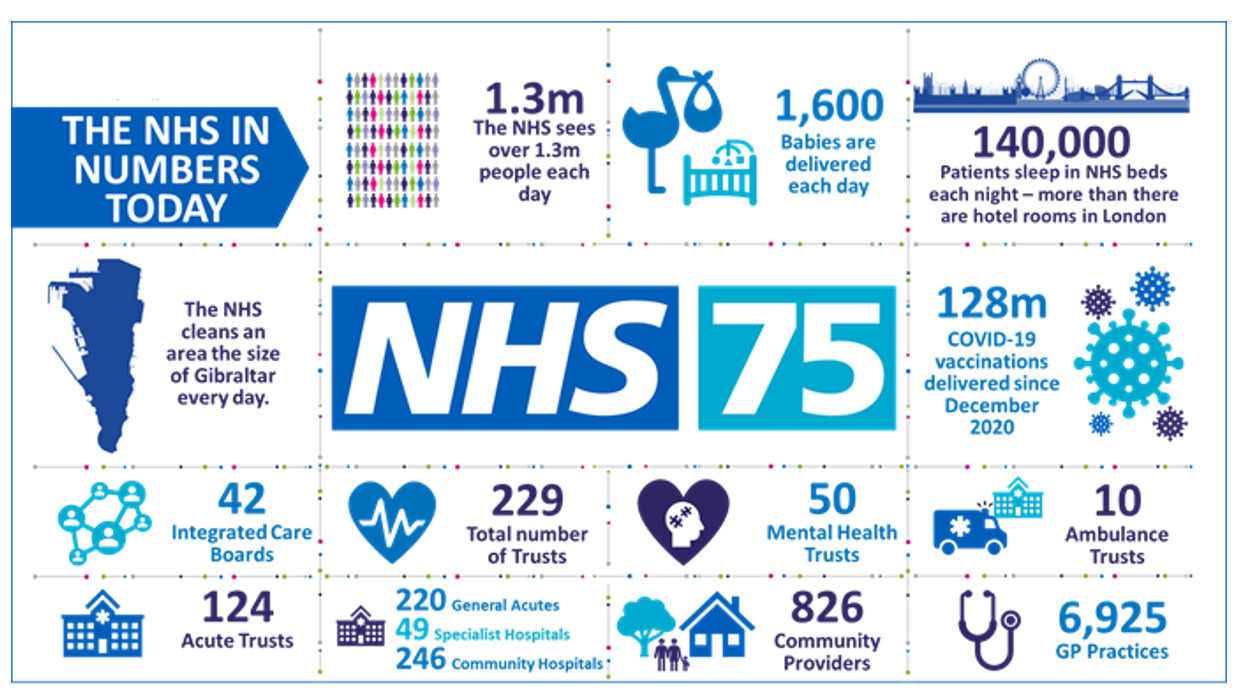

Happy 75th Birthday, NHS – Through A U.S. Health Care Lens

The UK’s National Health Service (NHS) turns 75 today. The NHS was the brainchild of Minister of Health Aneurin Bevan; he wrote in a statement to doctors and nurses in The Lancet on July 3, 1948, “My job is to give you all the facilities, resources, apparatus and help I can, and then to leave you alone as professional men and women to use your skill and judgement without hindrance.” This week in The Lancet, the editors assert, “The founding principles of the NHS put into practice 75 years ago are at risk of

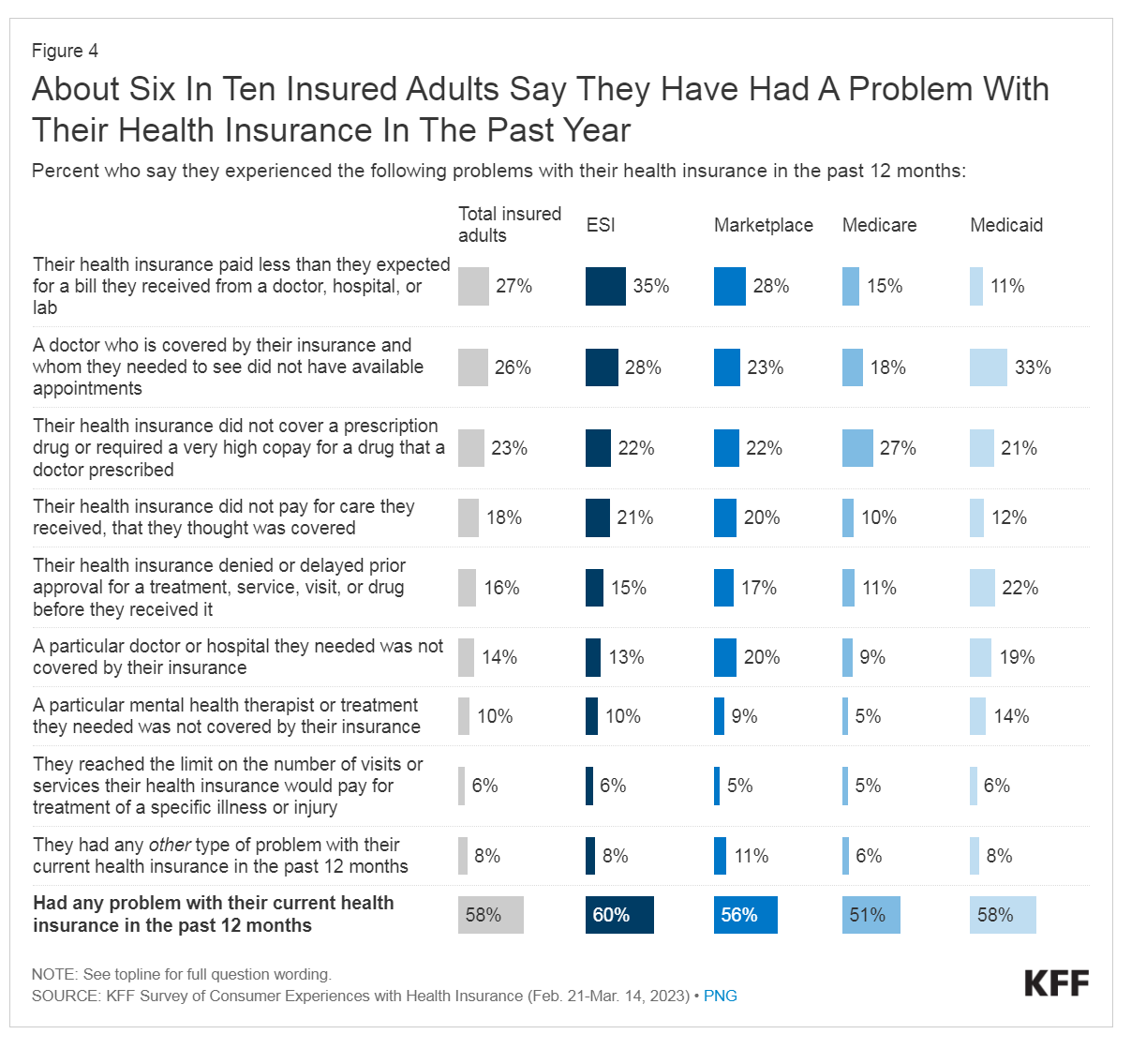

The Latest KFF Poll on Consumer Experiences with Health Insurance Speaks Volumes About Patients’ Administrative Burden

People love being health-insured, but their negative experiences with health plans create serious burdens on patients-as-consumers. And those burdens impact even more people who are unwell than healthier folks. The 2023 Kaiser Family Foundation Survey of Consumer Experiences with Health Insurance updates our understanding of and empathy for insured peoples’ Patient Administrative Burdens (PAB). For this study, KFF polled 3,605 U.S. adults 18 and over in February and March 2023 who had health insurance across different plan types. Over the past several years, I’ve come to appreciate the concept of PAB by listening to and learning from colleagues Dr, Grace

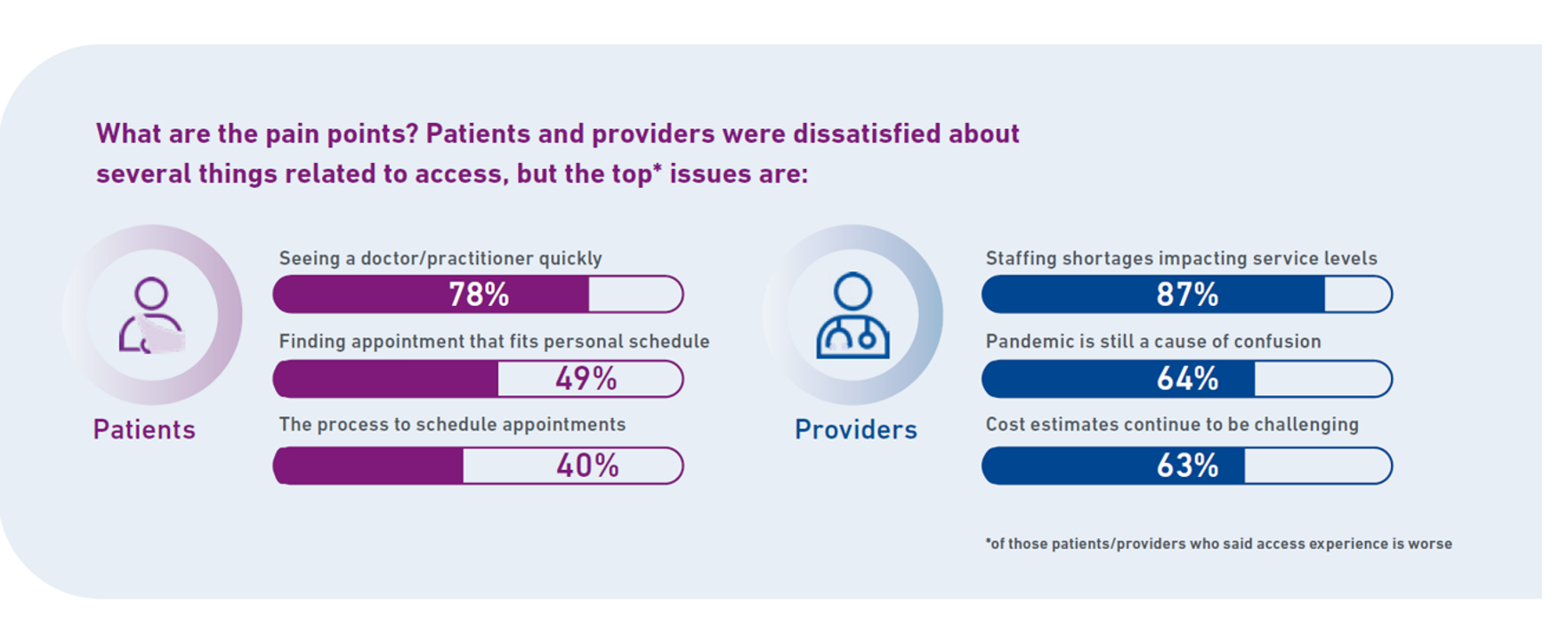

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

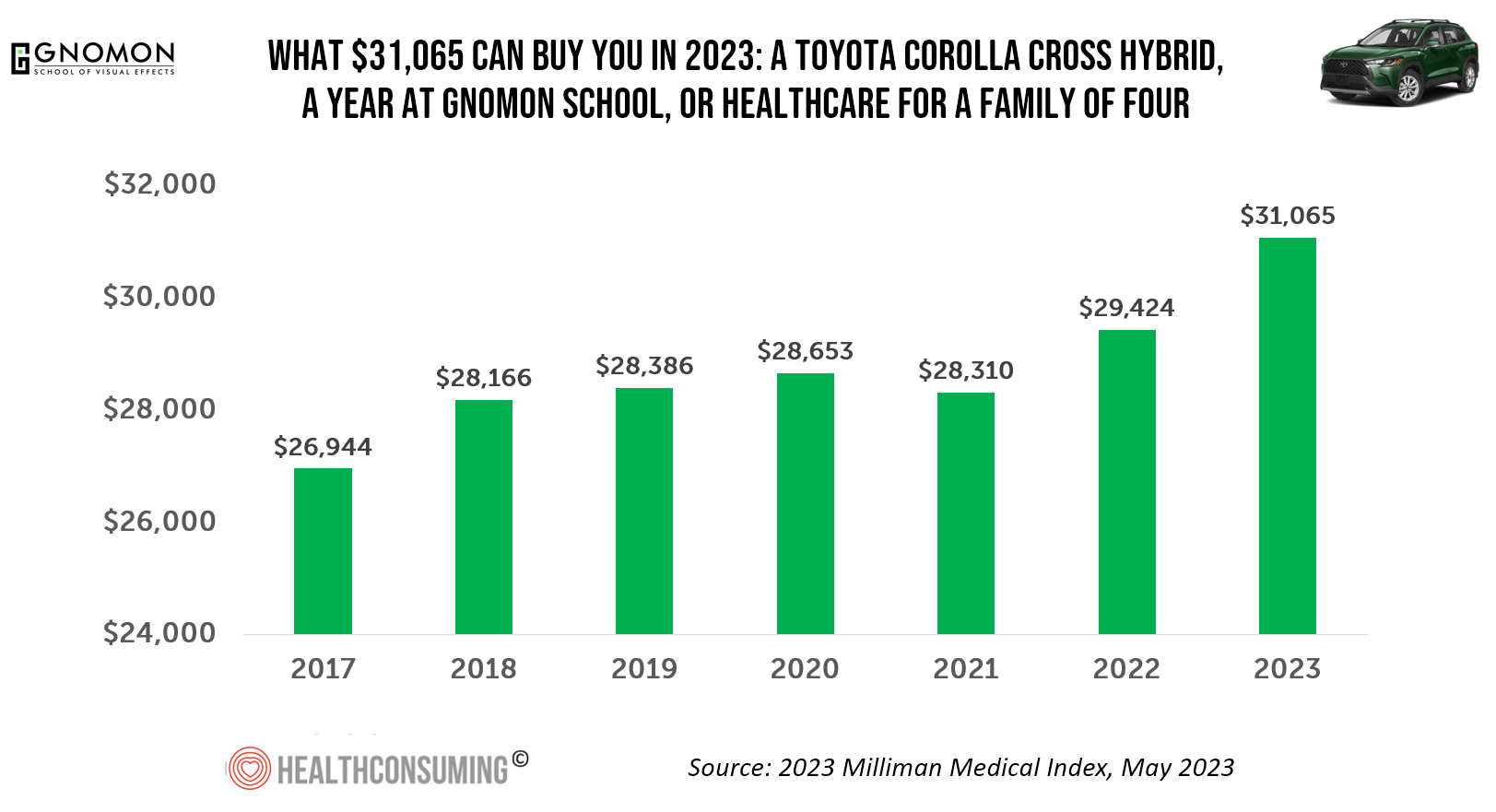

What $31,065 Can Buy You: a Toyota Corolla Cross Hybrid, a Year at Gnomon School, or Healthcare for a Family of 4 in America

“Healthcare costs came roaring back in 2021” after falling in 2020. In 2023, that roaring growth in health care costs continues with expected growth of 5.6%. For 2023, you could take your $31K+ and buy a Toyota Corolla Cross Hybrid auto, fund a year at the Gnomon School in Hollywood toward a degree in animation or game design, or buy healthcare for your family of 4. Welcome to this year’s annual look at health care costs for a “typical” U.S. family explained in the 2023 Milliman Medical Index (MMI).

Medical Debt: “The Debt of Necessity” – A Current U.S. Picture from the CFPB

On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report. For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed

Health Care Financing: How Inflation and Health Care Prices Could Hit the U.S. Consumer

In the U.S. in 2021, per person health care spending increased by nearly 15%, reversing 2020’s spending decline of 3.5% in the first year of the COVID-19 pandemic. The latest Health Care Cost and Utilization Report from the Health Care Cost Institute (HCCI) details health spending in 2021, dissecting the change in terms of utilization of services and prices by category. That’s a big rise over consumers’ household inflation for food, energy, and other kitchen-table considerations, prompting me to look for additional context from a recent paper published by the OECD on Health care financing in times of high inflation,

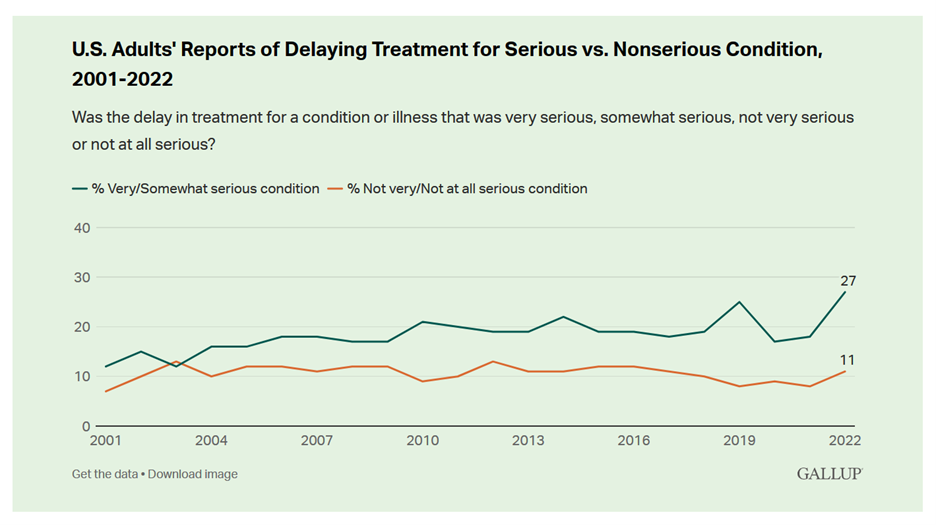

Record Numbers of People in the U.S. Putting Off Medical Care Due to Cost – A New “Pink Tax” on Women?

More people in the U.S. than ever have put off medical care due to cost, according to Gallup’s latest poll of patients in America. Gallup conducted the annual Health and Healthcare poll U.S. adults in November and December 2022. This was the highest level of self-rationing care due to cost the pollster has found since its inaugural study on the topic in 2001. This was also the most dramatic year-on-year increase of postponing treatment due to cost in the study’s history. Note the substantial difference in women avoiding

In Search of Clinical Effectiveness, But “Investment Exuberance?” Not So Much. Insights From FINN Partners and Galen Growth at HLTH 2022

While venture funding for digital health technology declined globally by 35% in the first three quarters of 2022 compared with 2021, this marks a “return to normal” based on the assessment in the Global State of Digital Health Report from FINN Partners and Galen Growth, published today and launched during the HLTH 2022 conference. The report analyzes data from over 12,000 digital health ventures tracked by Galen Growth’s HealthTech Alpha platform. The first chart illustrates the change in venture funding by therapeutic area, showing downturns in four of the five areas called

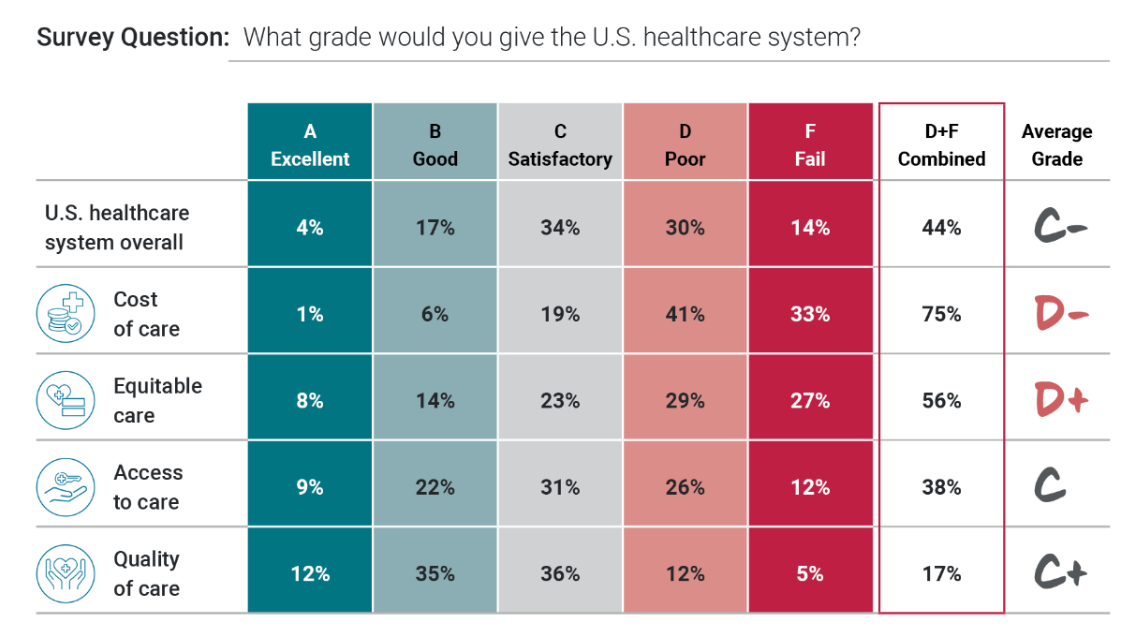

Health Care Costs Are a Driver of Health Across All of America – Especially for Women

Three in four people in America grade health care costs a #fail, at grade “D” or lower. This is true across all income categories, from those earning under $24,000 a year to the well-off raking in $180K or more, we learn in Gallup’s poll conducted with West Health, finding that Majorities of people rank cost and equity of U.S. healthcare negatively. Entering the fourth quarter of 2022, several studies were published in the past week which reinforce the reality that Americans are facing high health care costs, preventing many from seeking necessary medical services, and hitting under-served health citizens even harder

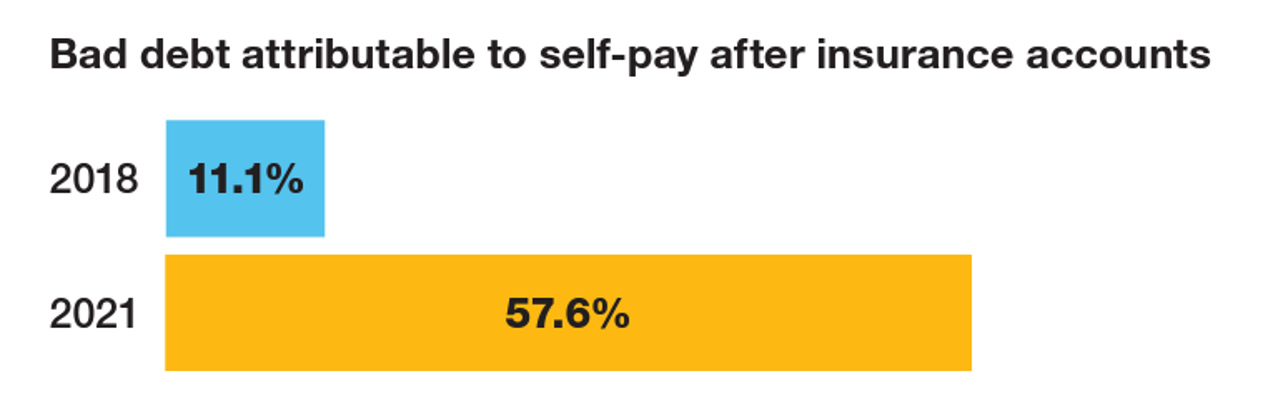

The Patient As the Payer: Self-Pay, Bad Debt, and the Erosion of Hospital Finances

“The odds are against hospitals collecting patient balances greater than $7,500,” the report analyzing Hospital collection rates for self-pay patient accounts from Crowe concludes. Crowe benchmarked data from 1,600 hospitals and over 100,00 physicians in the U.S. to reveal trends on health care providers’ ability to collect patient service revenue. And bad debt — write-offs that come out of uncollected patient bill balances after “significant collection efforts” by hospitals and doctors — is challenging their already-thin or negative financial margins. The first chart quantifies that bad debt attributable to patients’ self-pay payments

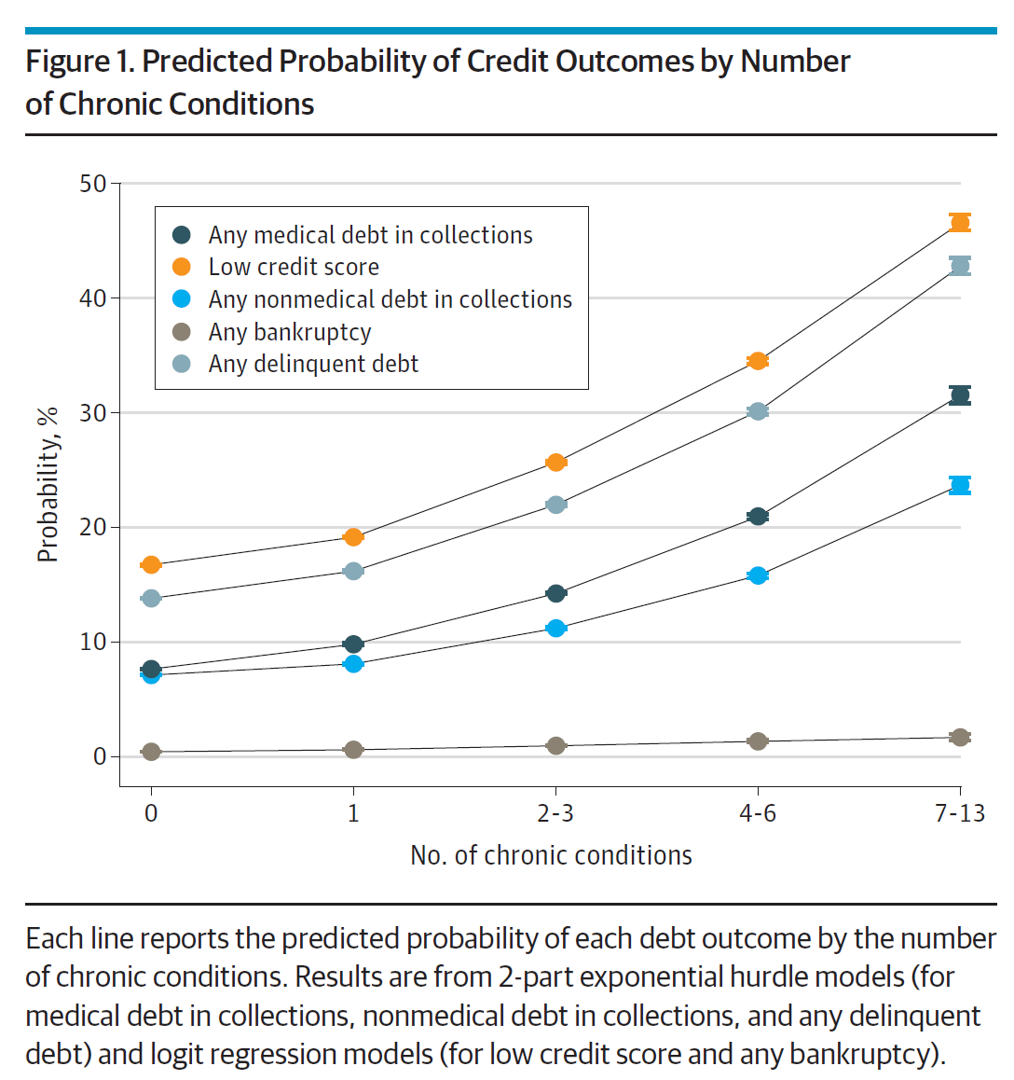

The More Chronic Conditions, the More Likely a Patient Will Have Medical Debt

There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine. Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan. The first chart illustrates the predicted probability of credit outcomes based on the

Changing Views of Retirement and Health Post-COVID: Transamerica’s Look At Workers’ Disrupted Futures

As more than 1 in 3 U.S. workers were unemployed during the pandemic and another 38% had reductions in hours and pay, Americans’ personal forecasts and expectations for retirement have been disrupted and dislocated. In its look at The Road Ahead: Addressing Pandemic-Related Setbacks and Strengthening the U.S. Retirement System from the Tramsamerica Center for Retirement Studies (TCRS), we learn about the changing views of U.S. workers on their future work, income, savings, dreams and fears. Since 1988, TCRS has assessed workers’ perspectives on their futures, this year segmented the 10,003 adults

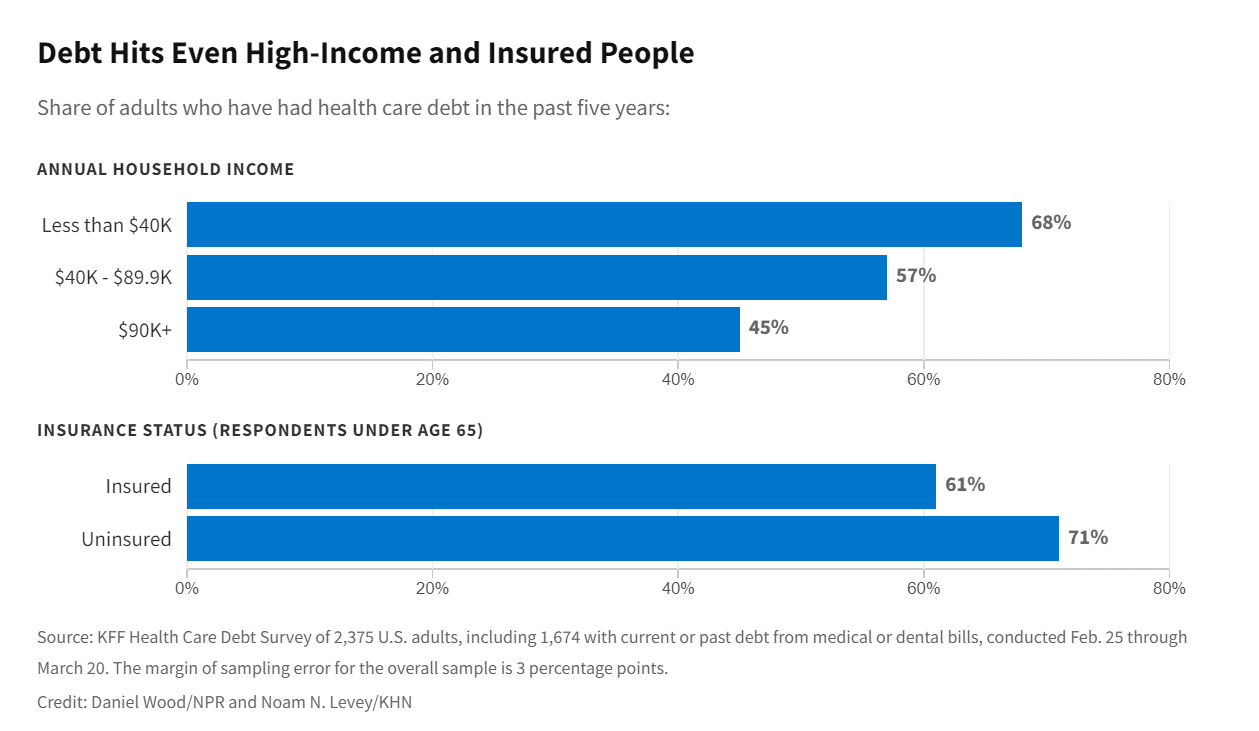

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

How Business Can Bolster Determinants of Health: The Marmot Review for Industry

“Until now, focus on….the social determinants of health has been for government and civil society. The private sector has not been involved in the discussion or, worse, has been seen as part of the problem. It is time this changed,” asserts the report, The Business of Health Equity: The Marmot Review for Industry, sponsored by Legal & General in collaboration with University College London (UCL) Institute of Health Equity, led by Sir Michael Marmot. Sir Michael has been researching and writing about social determinants of health and health equity for decades, culminating publications

In the New Inflationary Era, Gas and Health Care Costs Top Household Budget Concerns

Inflation and rising prices are the biggest problem facing America, most people told the Kaiser Family Foundation March 2022 Health Tracking Poll. Underpinning that household budget concern are gas and health care costs. Overall, 55% of people in the U.S. pointed to inflation as the top challenge the nation faces (ranging from 46% of Democrats to 70% of Republicans). Second most challenging problem facing the U.S. was Russia’s invasion into Ukraine, noted by 18% of people — from 14% of Republicans up to 23% of Democrats. The COVID-19 pandemic has fallen far down Americans’ concerns list tied third place with

The Financial Toxicity of Health Care Costs: From Cancer to FICO Scores

The financial toxicity of health care costs in the U.S. takes center stage in Health Populi this week as several events converge to highlight medical debt as a unique feature in American health care. “Medical debt is the most common collection tradeline reported on consumer credit records,” the Consumer Financial Protection Bureau called out in a report published March 1, 2022. CFPB published the report marking two years into the pandemic, discussing concerns about medical debt collections and reporting that grew during the COVID-19 crisis. Let’s connect the dots on: A joint announcement this week from three major credit agencies,

Medical Distancing Is Bad For Your Health

“Social distancing is great. Medical distancing? Not so much,” I observe in Medical Distancing in America: A Lingering Pandemic Side Effect., my essay published this week in Medecision’s Liberate Health blog. Since we learned to spell “coronavirus,” we also learned the meaning and risk-managing importance of physical distance early in the COVID-19 pandemic. But medical distancing became a corollary life-flow of the physical version, and for our collective health and well-being, it hasn’t been good for our health in ways beyond keeping our exposure to the virus at bay. For health care providers — physicians, hospitals, ambulatory clinics, diagnostic centers —

Will “Buy Now, Pay Later” Financing Help Health Consumers Pay Their Medical Bills?

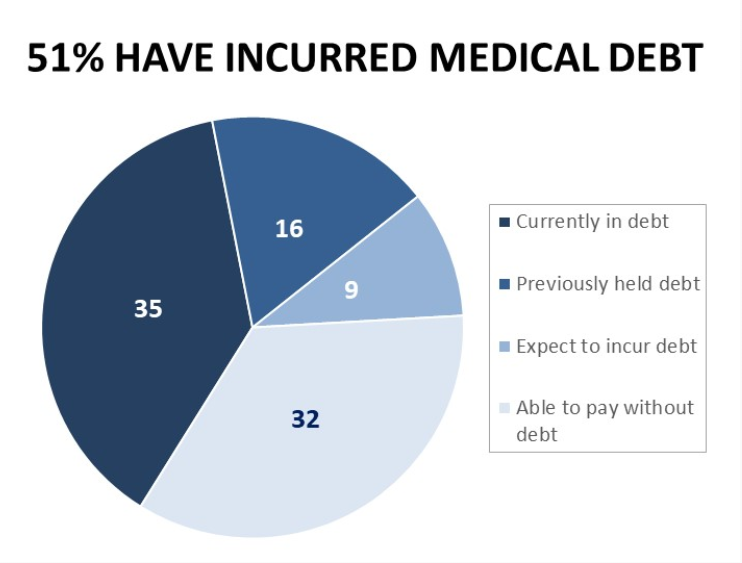

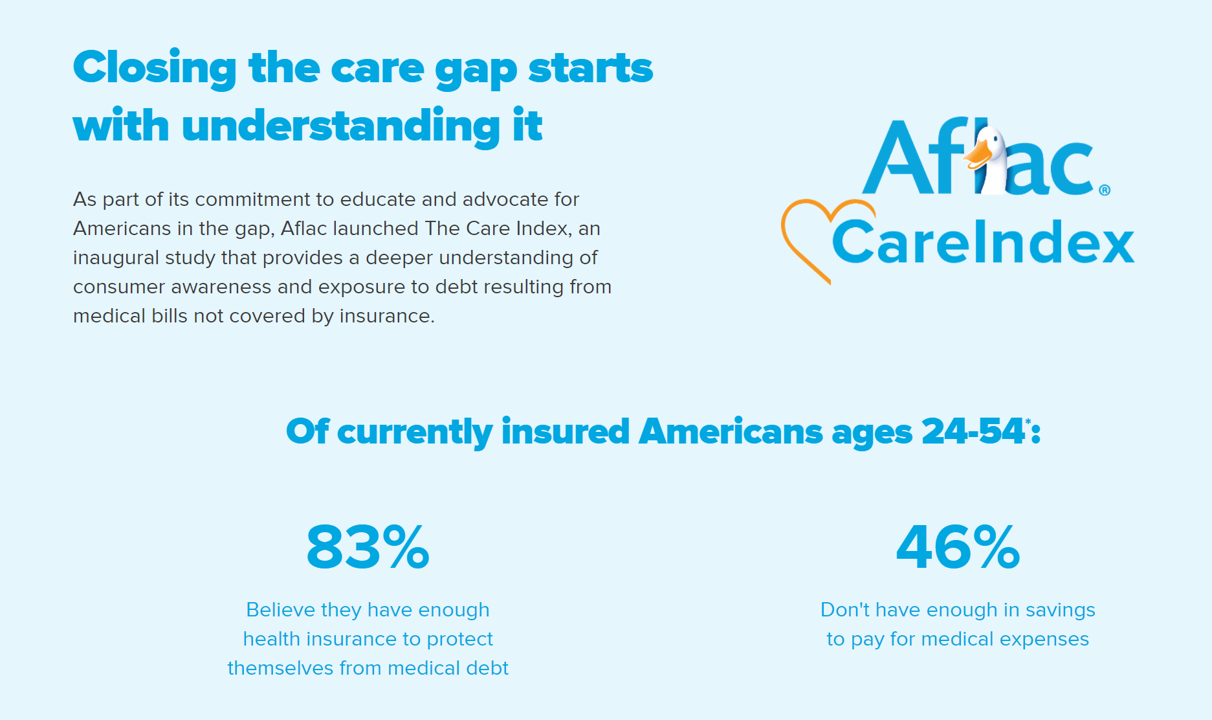

Aflac, our favorite duck-mascot-representing company, has launched the Close the Gap initiative featuring spokesman Deion Sanders, one of the good guys in the Football Hall of Fame. Recognizing the fact that nearly one-half of insured Americans don’t have enough in savings to pay for medical expenses, the company established the Aflac Care Index to educate and advocate for peoples’ health and financial security — including those people who have health care coverage. While U.S. consumers are facing historically high levels of inflation for household spending on food, petrol, and home goods, health consumers will be dealing with greater out-of-pocket spending based

3 in 4 Insured Americans Worried About Medical Bills — Especially Women

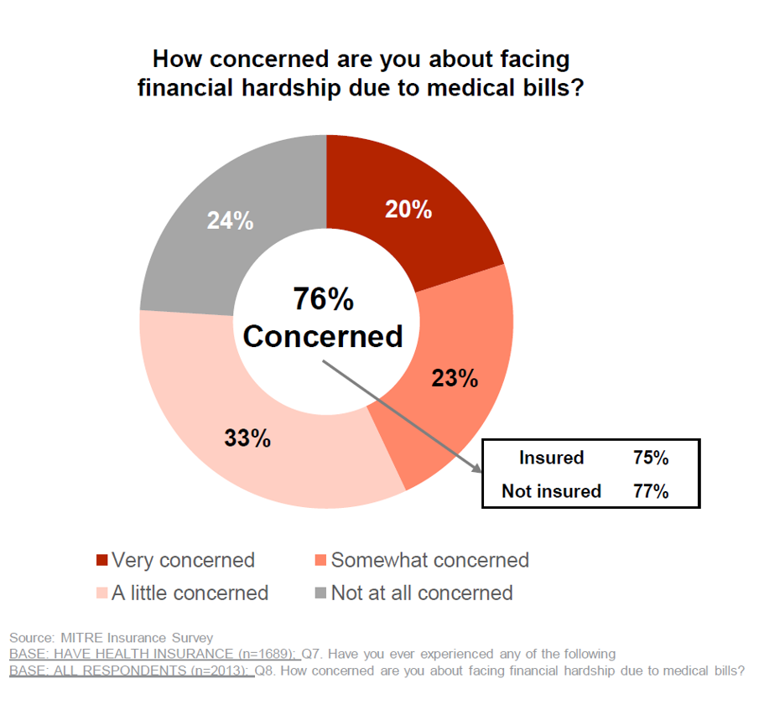

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care). But even with health insurance coverage, most health-insured people are concerned about medical costs in America, found in a MITRE-Harris Poll on U.S. consumers’ health insurance perspectives published today. “Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

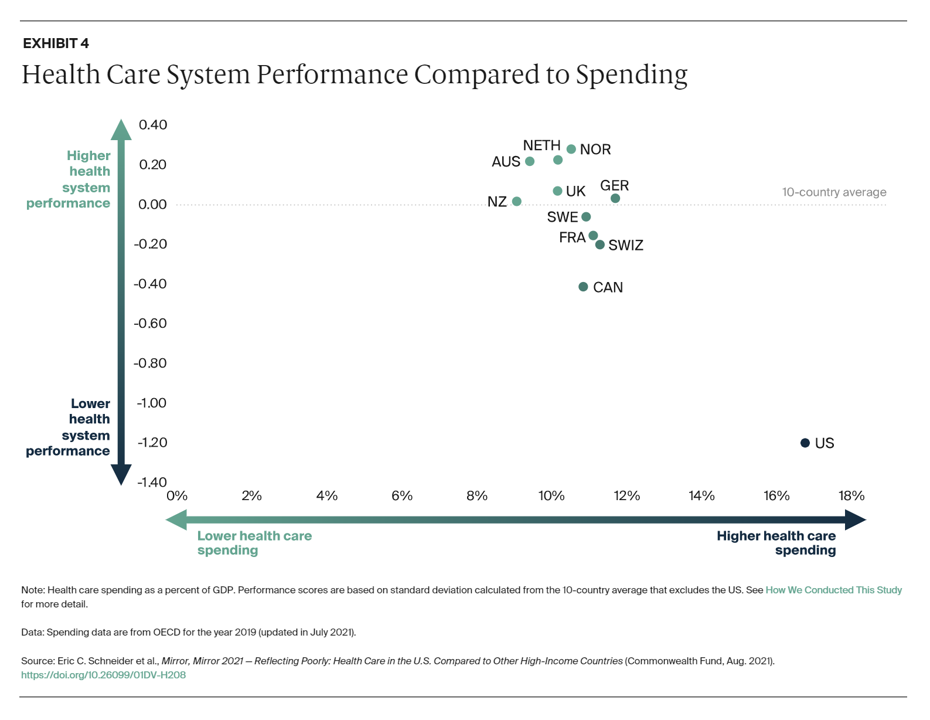

Can the U.S. Improve Health System Performance with Digital Health Tools? Pondering A Big Question for #HIMSS21

Simply put, is the equation, “Spend more, get less” a sustainable business model? Of course not. But that’s the simple math on U.S. health care spending and what comes from it, according to Mirror, Mirror 2021: Reflecting Poorly, a perennial report from The Commonwealth Fund that compares health system performance across eleven developed countries. The first table details the metrics that the Fund compares across the eleven peer nations, which included Australia, Canada, France, Germany, the Netherlands, New Zealand, Norway, Sweden, Switzerland, the United Kingdom, and the United States. The metrics compared were access to care, care process, administrative efficiency, equity,

Doctors’ Offices Morph into Bill Collectors As Patients Face Growing Out-Of-Pocket Costs

In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around. That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned

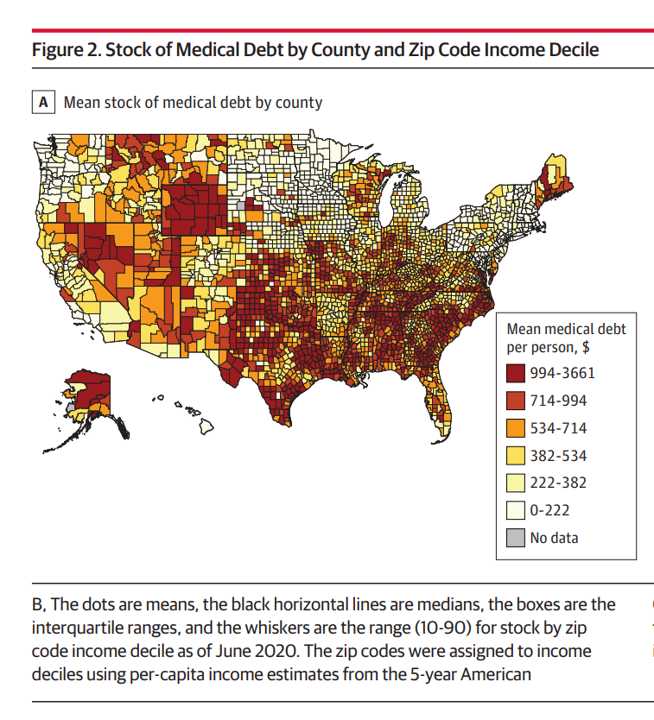

Medical Debt in the U.S. Greater in States That Did Not Expand Medicaid

The level of medical debt in America exceeded debt of other types in 2020. Furthermore, the flow of medical debt was greater among health citizens living in states that did not expand Medicaid as part of the Affordable Care Act, compared with patients who reside in Medicaid expansion states, according to an original research essay, Medical Debt in the US, 2009-2020 published in JAMA on 20 July 2021. The first line chart illustrates the trends in medical debt in collections by state expansion of Medicaid, with the bottom darkest line representing debt in collections in Medicaid expansion states from the

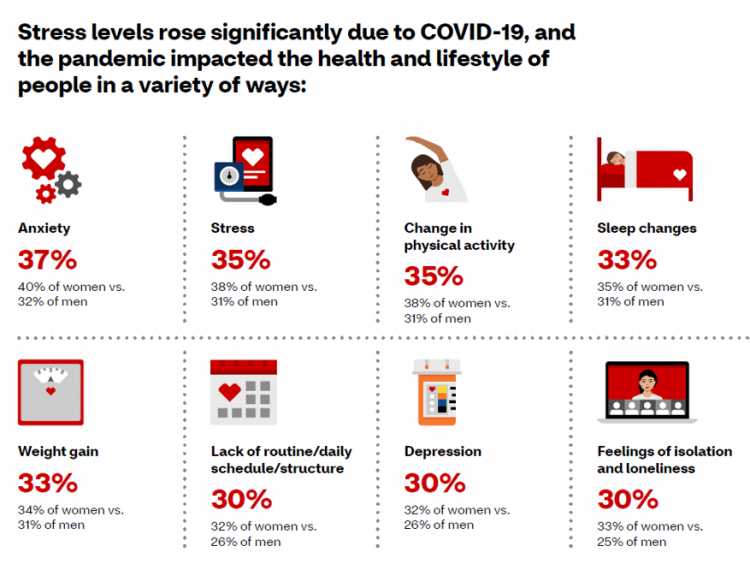

CVS Finds Differences in Mental and Behavioral Health Among Men Vs. Women in the Pandemic

As the COVID-19 pandemic shifts to a more endemic phase — becoming part of peoples’ everyday life for months to come — impacts on peoples’ mental health will persist, according to new research from CVS Health in the company’s annual Health Care Insights Study. CVS conducted the annual Health Care Insights Study among 1,000 U.S. adults in March 2021. To complement the consumer study, an additional survey was undertaken among 400 health care providers including primary care physicians and specialists, nurse practitioners, physician assistants, RNs and pharmacists. CVS has been tracking the growing trend of health care consumerism in the

COVID-19 Accelerated Digital Health Investments…But It Helps to Be Bigger, Mature and Scaling

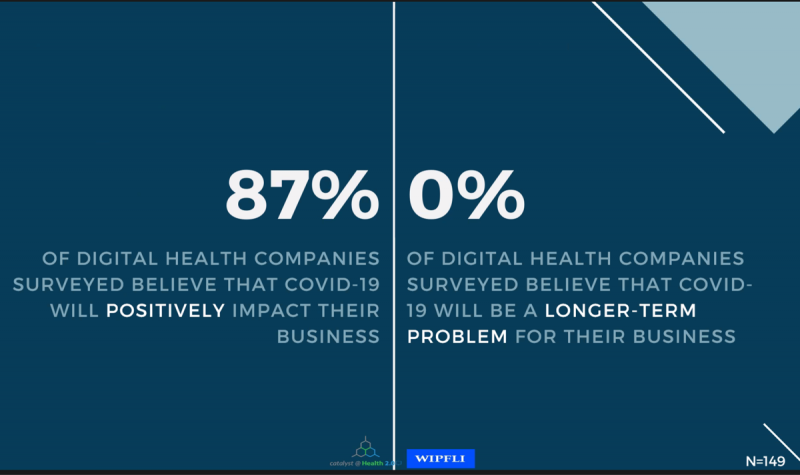

“Compare digital health to airlines, cruise lines, and other industries” and the sector looks quite privileged, opined Matthew Holt in a discussion on a study diving deeply into the State of Digital Health, conducted by Catalyst @ Health 2.0 and sponsored by WIPFLI.. The research was conducted among 335 respondents, which included 182 digital health companies polled between November 2020 and March 2021. Digital health companies represented 60% of the sample, the other 40% of which were consulting firms, subsidiaries of providers/payers/life science companies and tech corporations, and investors. As Matthew called out, the digital health sector has a relatively

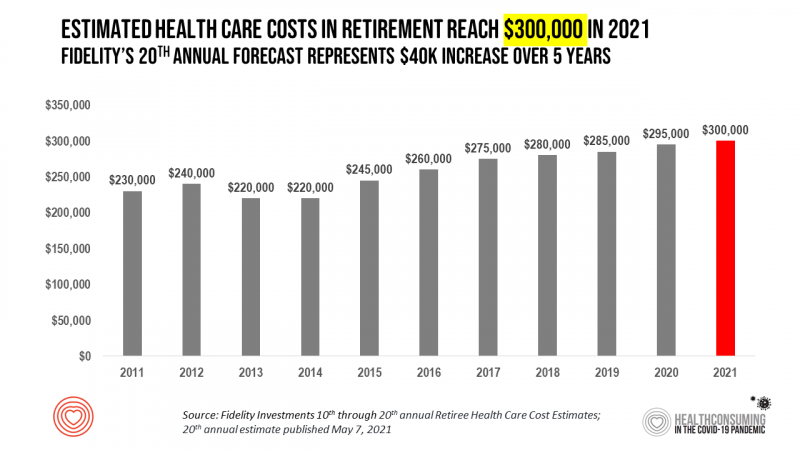

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

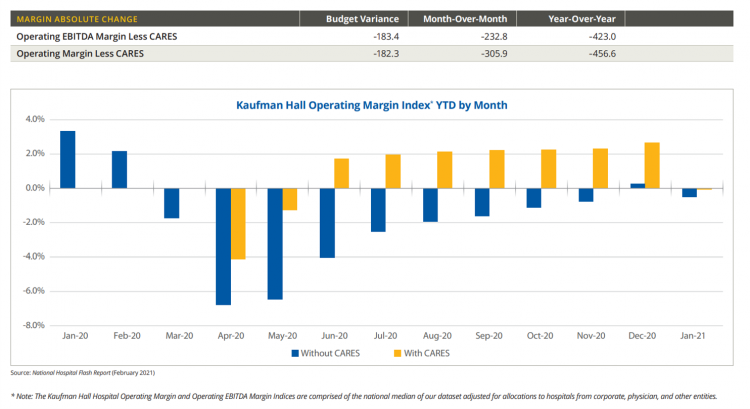

Hospitals Continue to Lose Money in Year 2 of the Pandemic

U.S. hospitals’ operating margins went negative in January 2021 after turning north for the first time in December 2020 since the start of the coronavirus pandemic, according to the February 2021 Hospital Flash Report from Kaufman Hall, commissioned by AHA, the American Hospitals Association. The first chart illustrates the importance of CARES Act funding to keep hospitals financially afloat during the public health crisis through most of last year. The start of 2021 was difficult for hospitals and health systems, Kaufman Hall explains, with falling outpatient revenues and increasing expenses resulting in that below-the-line blue bar for January 2021’s operating

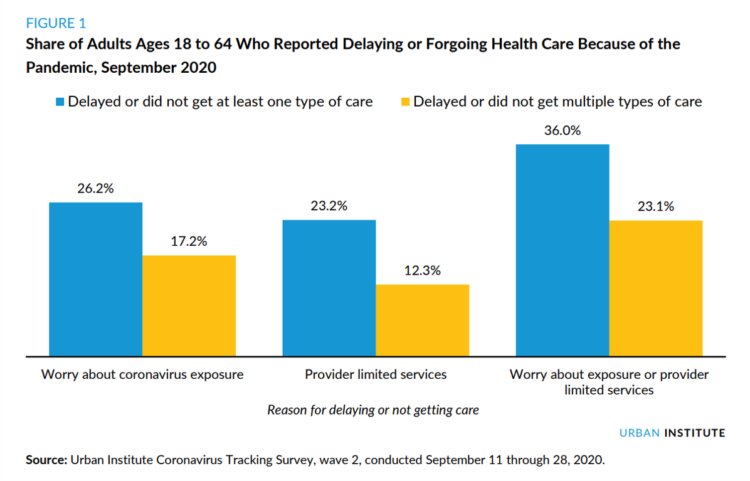

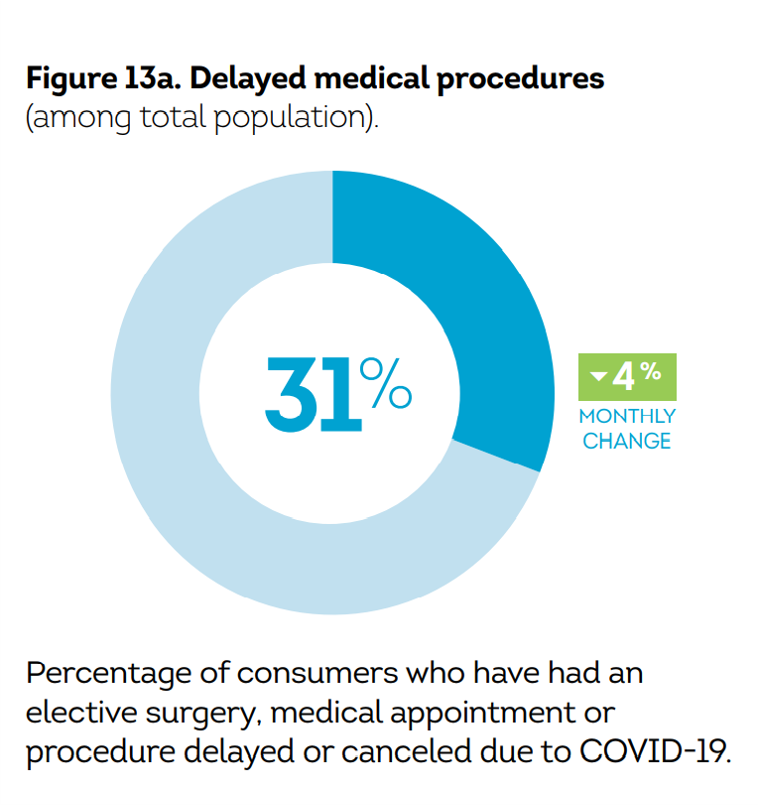

Three in Four People Avoiding Health Care in the Pandemic Have Had Chronic Conditions

By the autumn of 2020, U.S. physicians grew concerned that patients who were avoiding visits to doctor’s offices were missing care for chronic conditions, discussed in in Delayed and Forgone Health Care for Nonelderly Adults during the COVID-19 Pandemic from the Urban Institute. More than three-fourths of people who delayed or forewent care had at least one chronic health condition. The pandemic may have led to excess deaths from diabetes, dementia, hypertension, heart disease, and stroke, as well as record drug overdoses in the 12 months ending in May 2020. In their JAMA editorial on these data, Dr. Bauchner and

Ten In Ten: Manatt’s Healthcare Priorities to 2031

The coronavirus pandemic has exposed major weaknesses in the U.S. health care system, especially laying bare inequities and inertia in American health care, explained in The Progress We Need: Ten Health Care Imperatives for the Decade Ahead from Manatt Health. The report details the ten objectives that are central to Manatt’s health care practice, a sort of team manifesto call-to-action and North Star for the next decade. Their ten must-do’s for bending the cost curve while driving constructive change for a better health care system are to: Ensure access Achieve health equity Stability the safety net and rebuild public health

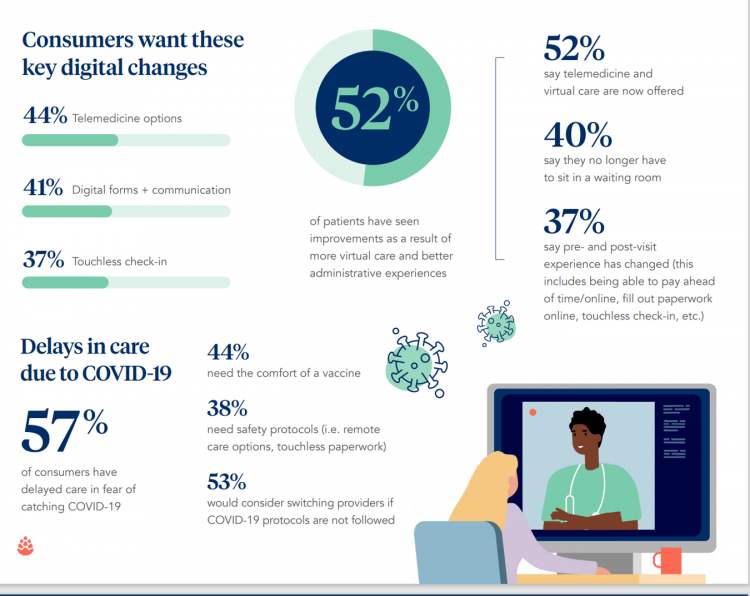

Consumers Demand Digital Transformation Across Their Health Care Experiences

From appointment scheduling to checking in, payment and clinical encounter follow-up, patients now expect digital experiences across the health care continuum….and really great ones, like they get from Amazon and other platforms that earn high net promoter scores. That is the big message from the 2020 Healthcare Consumer Experience Study published by Cedar, based on the input of 1,502 U.S. adults who paid a medical bill between October 2019 and October 2020. The timing of this study coincided with the start of the COVID-19 pandemic in the U.S. through at least seven months of American patients’ experiences in 2020. Two-thirds

U.S. Health Consumers’ Growing Financial Pressures, From COVID to Cancer

Before the coronavirus pandemic, patients had been transforming into health care payors, bearing high deductibles, greater out of pocket costs, and financial risk shifting to them for medical spending. In the wake of COVID-19, we see health consumers-as-payors impacted by the pandemic, as well as for existing diagnoses and chronic care management. There is weakening in U.S. consumers’ overall household finances, the latest report from the U.S. Bureau of Economic Analysis (BEA) asserted (published 25 November 2020). In John Leer’s look into the BEA report in Morning Consult, he wrote, “Decreases in income, the expiration of unemployment benefits and increased

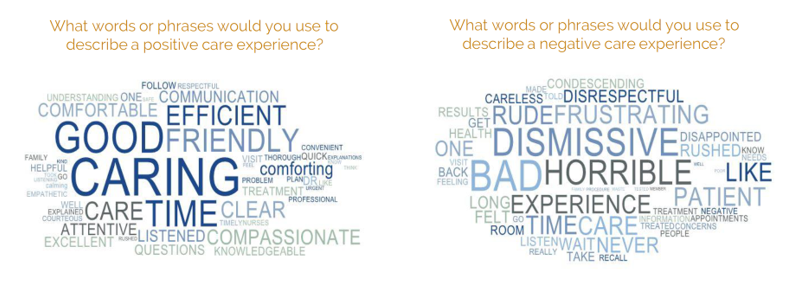

Healthcare Costs, Access to Data, and Partnering With Providers: Patients’ Top User Experience Factors

As patients returned to in-person, brick-and-mortar health care settings after the first wave of COVID-19 pandemic, they re-enter the health care system with heightened consumer expectations, according to the Beryl Institute – Ipsos Px Pulse report, Consumer Perspectives on Patient Experience in the U.S. Ipsos conducted the survey research among 1,028 U.S. adults between 23 September and 5 October 2020 — giving consumers many months of living in the context of the coronavirus. This report is a must-read for people involved with patient and consumer health engagement in the U.S. and covers a range of issues. My focus in this

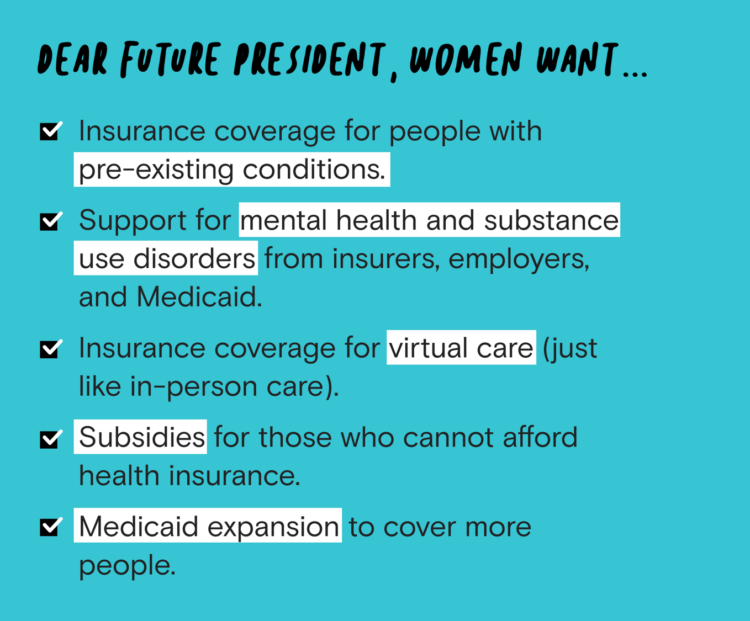

Women’s Health Policy Advice for the Next Occupant of the White House: Deal With Mental Health, the Pandemic, and Health Care Costs

2020 marked the centennial anniversary of the 19th Amendment to the U.S. Constitution, giving women the right to vote. In this auspicious year for women’s voting rights, as COVID-19 emerged in the U.S. in February, women’s labor force participation rate was 58%. Ironic timing indeed: the coronavirus pandemic has been especially harmful to working women’s lives, the Brookings Institution asserted last week in their report in 19A: The Brookings Gender Equality Series. A new study from Tia, the women’s health services platform, looks deeply into COVID-19’s negative impacts on working-age women and how they would advise the next occupant of

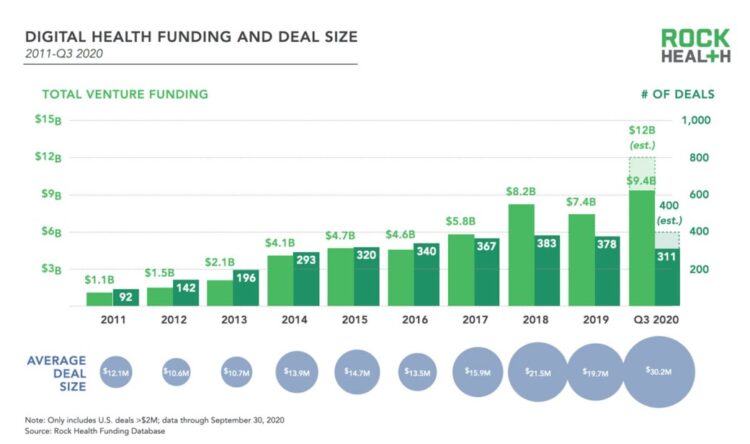

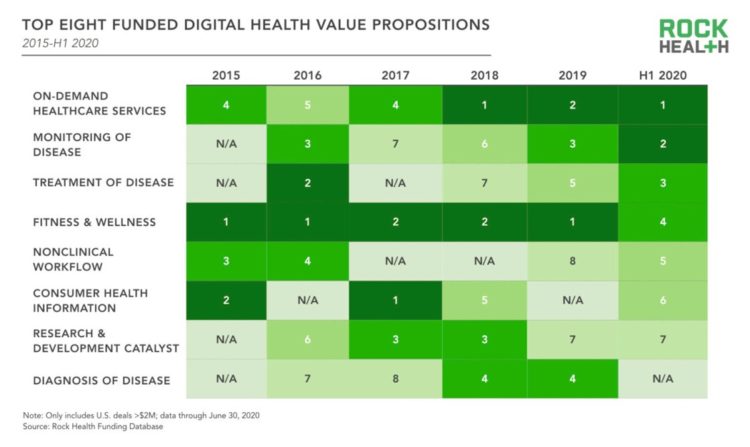

The Coronavirus Pandemic Turbocharged Digital Health Investment in 2020

2020 will be remembered for disruption and dislocation on many fronts; among the major blips in the year will be it remembered as the largest funding year for digital health recorded, according to Rock Health’s report on the 3Q2020 digital health funding. This funding record (“already” before year-end, tallied by the third quarter as Rock Health notes) was driven by “mega”-deals accelerated during the public health crisis of COVID-19. In the third quarter of 2020, some $4 billion was invested in U.S. based digital health start-ups adding up $9.4 billion in 2020….so far. This is $1.2 billion more than two

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

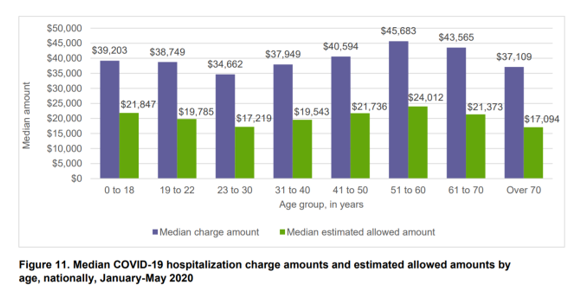

The Median Hospital Charge In the U.S. for COVID-19 Care Ranges From $34-45K

The median charge for hospitalizing a patient with COVID-19 ranged from $34,662 for people 23 to 30, and $45,683 for people between 51 and 60 years of age, according to FAIR Health’s research brief, Key Characteristics of COVID-19 Patients published July 14th, 2020. FAIR Health based these numbers on private insurance claims associated with COVID-19 diagnoses, evaluating patient demographics (age, gender, geography), hospital charges and estimated allowed amounts, and patient comorbidities. They used two ICD-10-CM diagnostic codes for this research: U07.1, 2019-nCoV acute respiratory disease; and, B97.29, other coronavirus as the cause of disease classified elsewhere which was the original code

A Toxic Side Effect of the Coronavirus: Financial Unwellness

One in two people in the U.S. say their financial health has been negatively impacted by the COVID-19 pandemic, through job loss, income disruption, or reduced work hours. The 2020 Financial Wellness Census, from Prudential found that one-half of U.S. adults are anxious about their financial future as of May 2020, an increase from 38% in late 2019. Prudential surveyed 3,000 U.S. adults across three generational cohorts: Millennials, Gen X, and Baby Boomers. The economic hit from the pandemic has disproportionately impacted people of color, younger people, women, small business owners, gig workers, and people working in retailer harder than

How Covid-19 Can Inspire Tech-Enabled Value-Based Health Care in a Cash-Constrained America

“The COVID-19 pandemic…has highlighted like never before the pitfalls of paying for healthcare based on the number of patients seen and services rendered,” a Modern Healthcare article asserted in mid-June 2020. In other words, the U.S. health care financing regime of volume-based payment didn’t fare well as millions of patients postponed or cancelled procedures and visits for fear of contracting the virus in the halls, offices and clinics of hospitals and doctor’s offices. “Just imagine if you were 100% fee-for-service,” commented Dr. Fuad Sheriff, a primary care physician whose practice is based on capitated payments. “You would have been dead

Faster Pace for Corporate Investments and Behavioral Health in COVID-Driven Digital Health Era

The pace of digital health investments quickened in the first half of 2020, based on Rock Health’s look at health-tech financing in mid-year. Digital health companies garnered $5.4 billion in the first half of the year, record-setting according to Rock Health. Underneath this number were very big deals, shown by the size of the blue bubbles in the first graphic from the report. Note that in H1 2020, the average deal size exceeded $25 mm. Among the largest deals valued at over $100 mm were ClassPass (raising $285 mm), in the business of virtual fitness classes; Alto Pharmacy, a digital

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

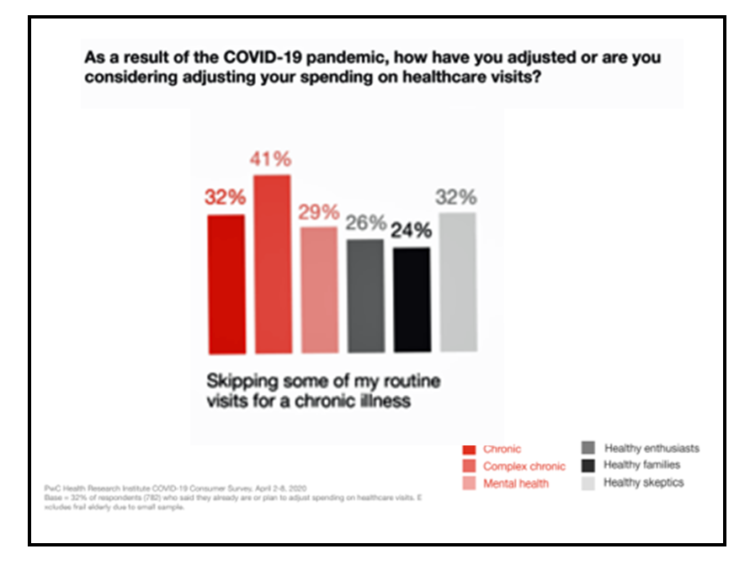

Health Care In the COVID-19 Era – PwC Finds Self-Rationing of Care and Meds Especially for Chronic Care

Patients in the U.S. are self-rationing care in the era of COVID-19 by cutting spending on health care visits and prescription drugs. The coronavirus pandemic’s impact on health consumers’ spending varies depending on whether the household is generally a healthy family unit, healthy “enthusiasts,” dealing with a simple or more complex chronic conditions, or managing mental health issues. PwC explored how COVID-19 is influencing consumers’ health care behaviors in survey research conducted in early April by the Health Research Institute. The findings were published in a May 2020 report, detailing study findings among 2,533 U.S. adults polled in early April

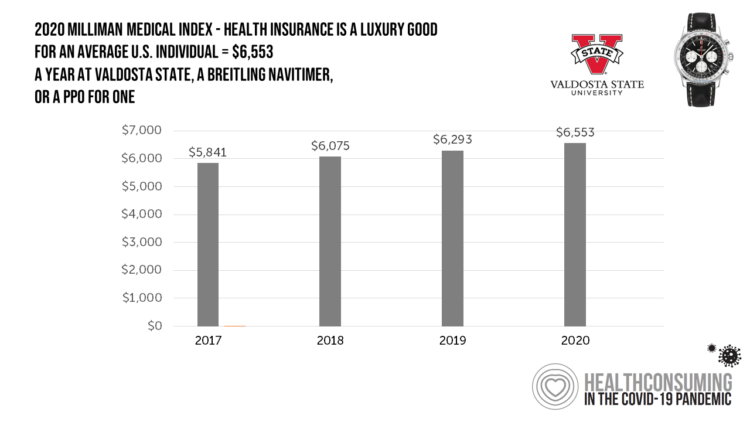

What $6,553 Buys You in America: A Luxury Watch, a Year at Valdosta State, or a PPO for One – the 2020 Milliman Medical Index

Imagine this: you find yourself with $6,553 in your pocket and you can pick one of the following: A new 2020 Breitling Navitimer watch; A year’s in-state tuition at Valdosta State University; or, A PPO for an average individual. Welcome to the annual Milliman Medical Index (MMI), which gauges the yearly price of an employer-sponsored preferred-provider organization (PPO) health insurance plan for a hypothetical American family and an N of 1 employee. That is a 4.1% increase from the 2019 estimate, about twice the rate of U.S. gross domestic product growth, Milliman points out in its report. Milliman bases

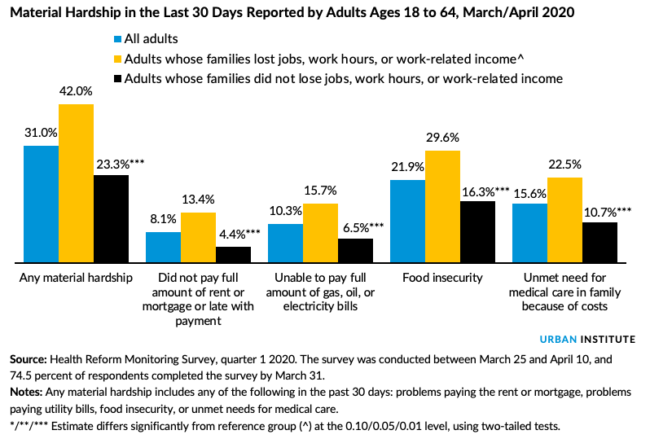

Food, Housing, Energy and Medical Care – the Material Hardships of COVID-19 in America

The Coronavirus has impacted every aspect of human life: first, the direct biological impact of COVID-19 on people, as of today the cause of over 63,000 deaths in the U.S. along with unquantifiable morbidity among millions of Americans who are surviving the virus and the toll on family caregivers. Beyond the direct physical impact of the virus, social and emotional health impacts are emerging now due to physical distancing, mandates to #StayHome, and telecommuting to jobs when possible. Mental health impacts will persist as a pandemic after the Coronavirus pandemic, I’ve previously detailed here in Health Populi. On a global

How COVID-19 is Hurting Americans’ Home Economics in 2020

Beyond the physical and clinical aspects of the COVID-19 pandemic are financial hits that people are taking in the shutdown of large parts of the U.S. economy, impacting jobs, wages, and health insurance rolls. Some 1 in 2 people in the U.S. who have had their income impacted by the coronavirus have either fallen behind in paying off credit card debt or other bills, had problems paying for utilities, have lagged in paying for housing (rent or mortgage), been challenged paying for food, or other out-of-pocket costs. We learn about these fiscal hits from COVID-10 from the latest Health Tracking Poll

The Patient-as-Payor in the Coronavirus Pandemic

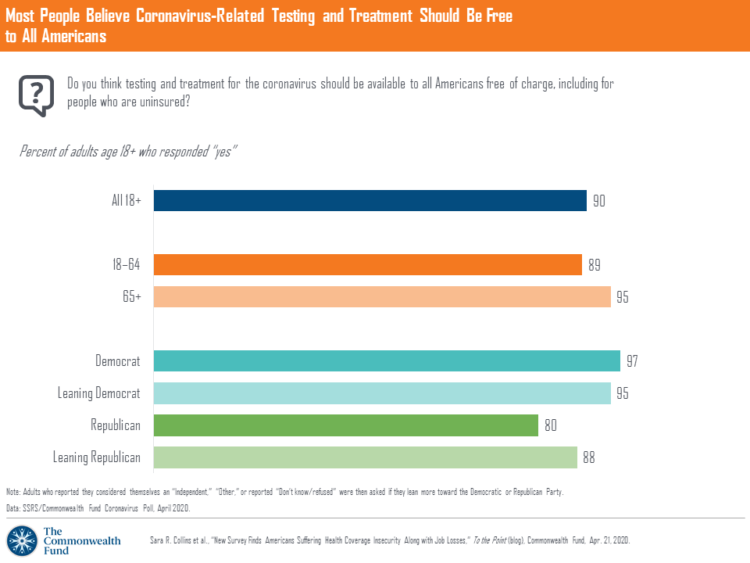

One in three working age people in the U.S. lost their job as a response to the COVID-19 pandemic, some of whom lost health insurance and others anxious their health coverage will be threatened, revealed in a survey from The Commonwealth Fund published on April 21, 2020. 2 in 5 people in America who are dealing with job insecurity are also health insurance insecure, the study found, as shown in the pie chart. The Commonwealth Fund commissioned the poll among 1,001 U.S. adults 18 to 64 years of age between 8-13 April 2020. Nearly all Americans believe the dots of

Americans’ Sense of Well-Being Falls to Great Recession Levels, Gallup Finds

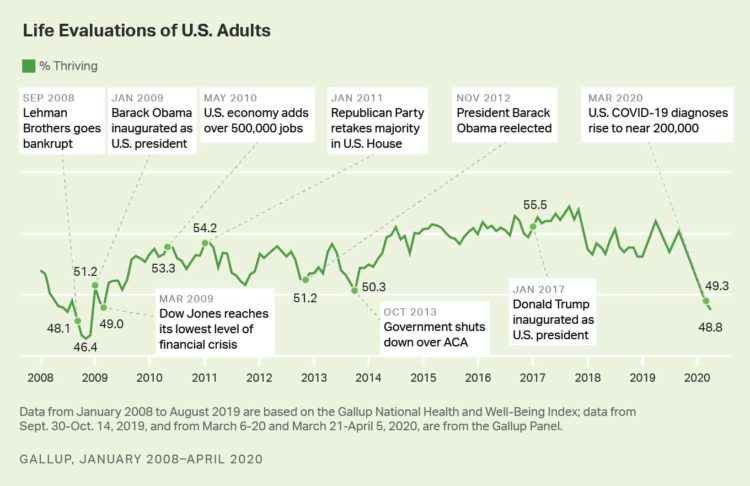

It’s déjà vu all over again for Americans’ well-being: we haven’t felt this low since the advent of the Great Recession that hit our well-well-being hard in December 2008. As COVID-19 diagnoses reached 200,000 in the U.S. in April 2020, Gallup gauged that barely 1 in 2 people felt they were thriving. In the past 12 years, the percent of Americans feeling they were thriving hit a peak in 2018, as the life evaluations line graph illustrates. Gallup polled over 20,000 U.S. adults in late March into early April 2020 to explore Americans’ self-evaluations of their well-being. FYI, Gallup asks consumers

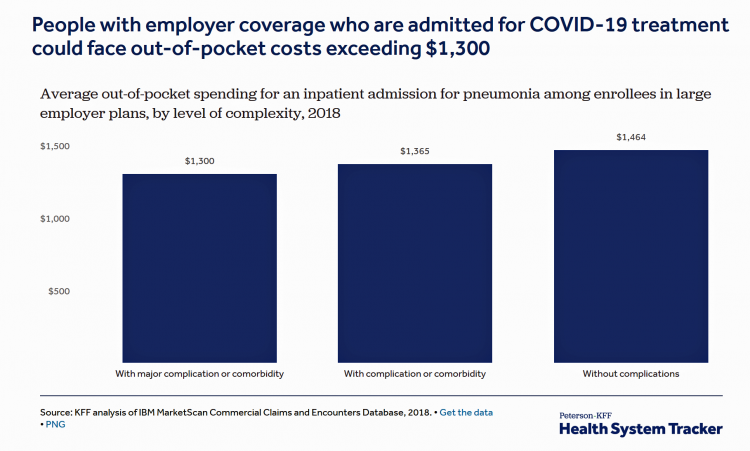

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

“How’s Life?” for American Women? The New OECD Report Reveals Financial Gaps on International Women’s Day 2020

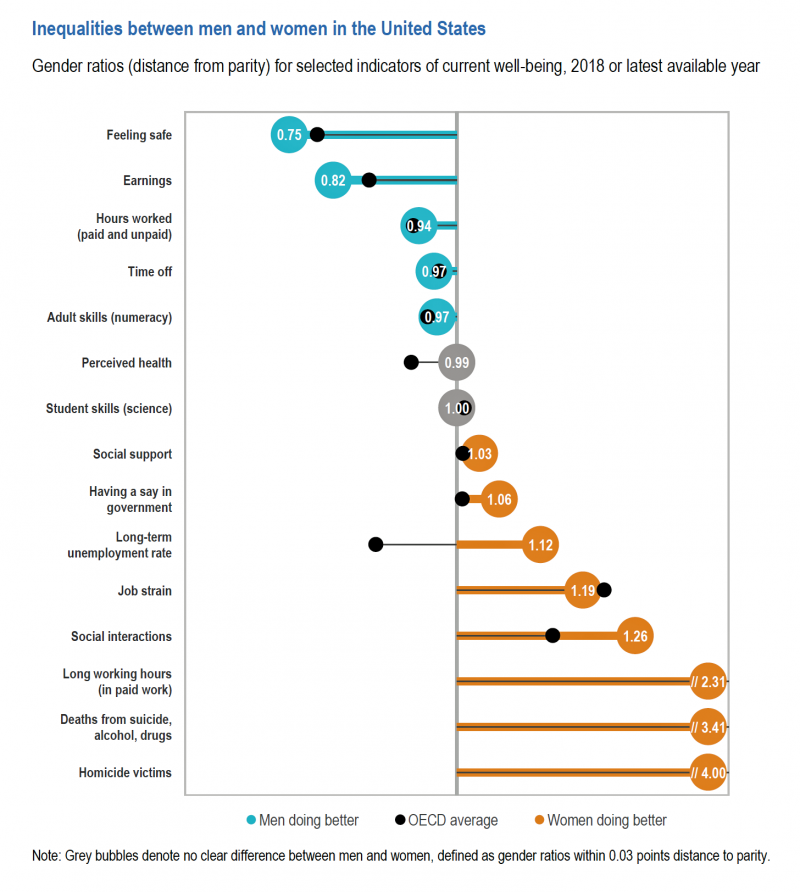

March 8 is International Women’s Day. In the U.S., there remain significant disparities between men and women, in particular related to financial well-being. The first chart comes from the new OECD “How’s Life?” report published today (March 9th) measuring well-being around the country members of the OECD. This chart focuses on women versus men in the United States based on over a dozen key indicators. Top-line, many fewer women feel safe in America, and earnings in dollars and hours worked fall short of men’s incomes. This translates into lower socioeconomic status for women, which diminishes overall health and well-being for

Job #1 for Next President: Reduce Health Care Costs – Commonwealth Fund & NBC News Poll

Four in five U.S. adults say lowering the cost of health care in America should be high priority for the next American president, according to a poll from The Commonwealth Fund and NBC News. Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms. The first chart illustrates that lowering health care costs is a priority that crosses political parties. This is true for all flavors of health care costs, including health insurance deductibles and premiums, out-of-pocket costs for prescription drugs, and the cost of long-term care. While

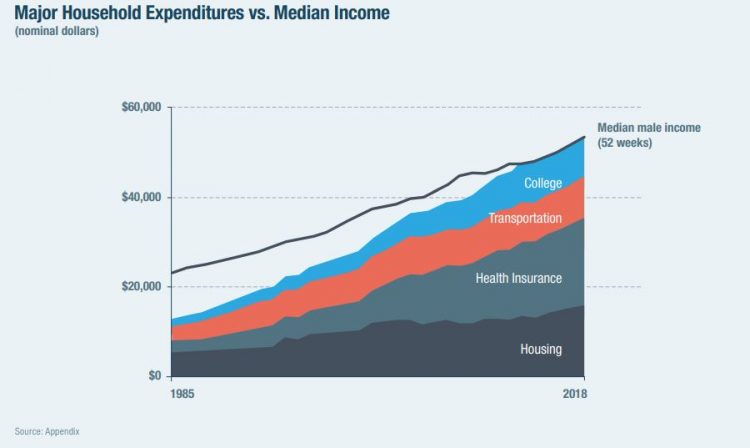

The High Cost-of-Thriving and the Evolving Social Contract for Health Care

Millions of Americans have to work 53 weeks to cover a year’s worth of household expenses. Most Americans haven’t saved much for their retirement. Furthermore, the bullish macroeconomic outlook for the U.S. in early 2020 hasn’t translated into individual American’s optimism for their own family budgets. (Sidebar and caveat: yesterday was the fourth day in a row of the U.S. financial markets losing as much as 10% of market cap, so the global economic outlook is being revised downward by the likes of Goldman Sachs, Vanguard, and Morningstar, among other financial market prognosticators. MarketWatch called this week the worst market

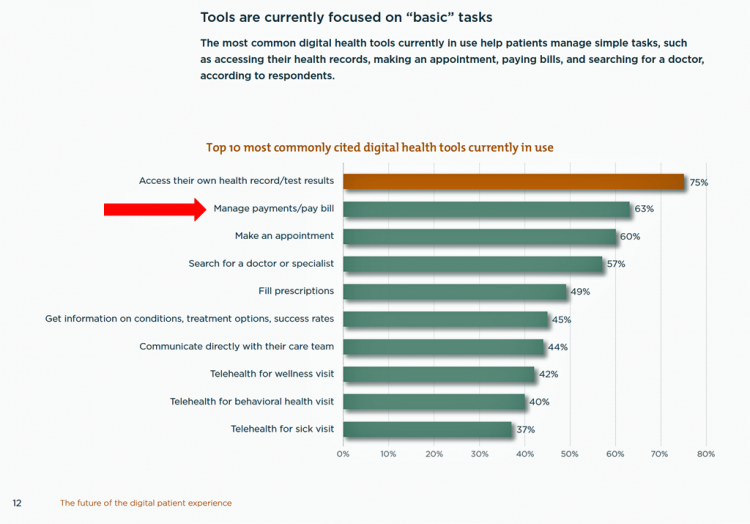

Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience, the latest report from HIMSS and the Center for Connected Medicine (CCM). The big gap in supply to patients vs. demand by health consumers is highlighted by what the arrow in the chart below points to: managing payments and paying bills. Nowhere in the top 10 most commonly provided digital tools is one for price transparency, cost comparing or cost estimating. In the

Americans’ Top 2 Priorities for President Trump and Congress Are To Lower Health Care and Rx Costs

Health care pocketbook issues rank first and second place for Americans in these months leading up to the 2020 Presidential election, according to research from POLITICO and the Harvard Chan School of Public Health published on 19th February 2020. This poll underscores that whether Democrat or Republican, these are the top two domestic priorities among Americans above all other issues polled including immigration, trade agreements, infrastructure and regulations. The point that Robert Blendon, Harvard’s long-time health care pollster, notes is that, “Even among Democrats, the top issues…(are) not the big system reform debates…They’re worried about their own lives, their own

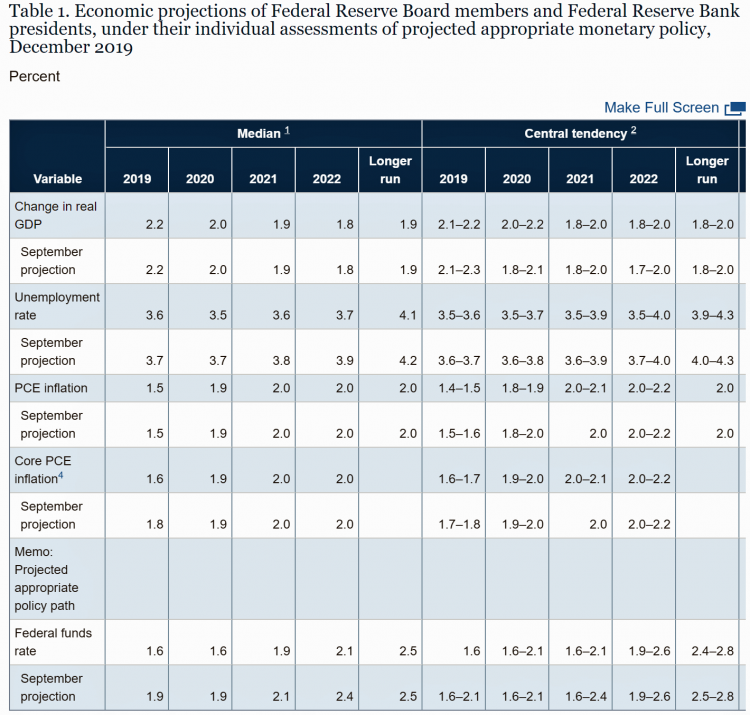

The Federal Reserve Chairman Speaks Out on Health Care Costs: “Spending But Getting Nothing”

On February 12, 2020, the Chairman of the Federal Reserve Bank of the U.S. submitted the Semiannual Monetary Policy Report to Congress and testified to the Senate Banking Committee. Chairman Jerome Powell detailed the current state of the economy, discussing the state of the macroeconomy, GDP growth, unemployment, inflation, and projections for 2022 and beyond. The top line data points are shown in the first chart. After his prepared remarks, Chairman Powell responded to questions from members of the Senate Banking Committee. Senator Ben Sasse (R-Neb.) asked him about health care costs’ impact on the national U.S. economy. The Chairman

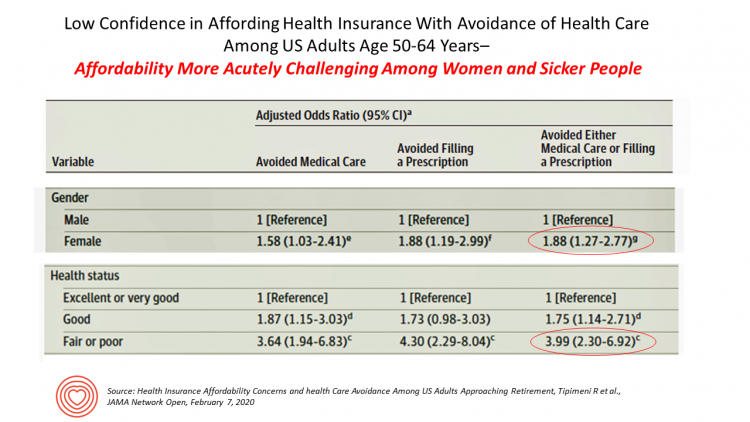

Health Care Costs Concern Americans Approaching Retirement – Especially Women and Sicker People

Even with the prospect of enrolling in Medicare sooner in a year or two or three, Americans approaching retirement are growing concerned about health care costs, according to a study in JAMA Network Open. The paper, Health Insurance Affordability Concerns and health Care Avoidance Among US Adults Approaching Retirement, explored the perspectives of 1,028 US adults between 50 and 64 years of age between November 2018 and March 2019. The patient survey asked one question addressing two aspects of “health care confidence:” “Please rate your confidence with the following:” Being able to afford the cost of your health insurance nad

The Heart of Health at CES 2020 – Evidence & Innovation Bridge Consumers and Doctors

The digital health presence at CES 2020 is the fastest-growing segment of consumer technologies at the Show this year, increasing by 25% over 2019. Heart-focused technologies are a big part of that growth story. In fact, in our search for devices and tools underpinned with clinical proof, evidence is growing for consumer-facing technology for heart-health, demonstrated by this year’s CES. Wrist-worn devices, digital therapeutics, patient engagement platforms, pharma and health plans converged at this year’s CES, with the professional association “blessing” of the American College of Cardiology who granted a continuing medical education credit for physicians attending a one-day “disruptive

Being Transparent About Healthcare Transparency – My Post on the Medecision Blog

With new rules emanating from the White House this month focusing on health care price transparency, health care costs are in the spotlight at the Centers for Medicare and Medicaid Services. A hospital transparency mandate will go into effect in January 2021 as a final rule, and a second rule with a focus on health plans and friendly explanations-of-benefits will receive comments in the Federal Register until January 14, 2020. As patients continue to grow muscles as payors and health consumers, transparency is one key to enabling people to “shop” for those health care and medical products and services that

Hospitals Suffer Decline in Consumer Satisfaction

While customer satisfaction with health insurance plans slightly increased between 2018 and 2019, patient satisfaction with hospitals fell in all three settings where care is delivered — inpatient, outpatient, and the emergency room, according to the 2018-2019 ACSI Finance, Insurance and Health Care Report. ACSI polls about 300,000 U.S. consumers each year to gauge satisfaction with over 400 companies in 46 industries. For historic trends, you can check out my coverage of the 2014 version of this study here in Health Populi. The 2019 ACSI report bundles finance/banks, insurance (property/casualty, life and health) and hospitals together in one document. Health

The Link Between Wellness & Wealth Is Powerful for Everyone – and Especially Women

In the U.S., the link between wellness and wealth, money and health, is strong and common across people, young and old. But the impacts of money on health, well-being, and life choices varies across the ages, based on a study from Lively, a company that builds platforms for health savings accounts. The first chart illustrates that health care costs challenge people in many ways: the most obvious health care cost problems prevent people from saving more for retirement or paying down debt. Eight in 10 Americans concur that rising health care costs challenge their ability to save for retirement. Beyond the

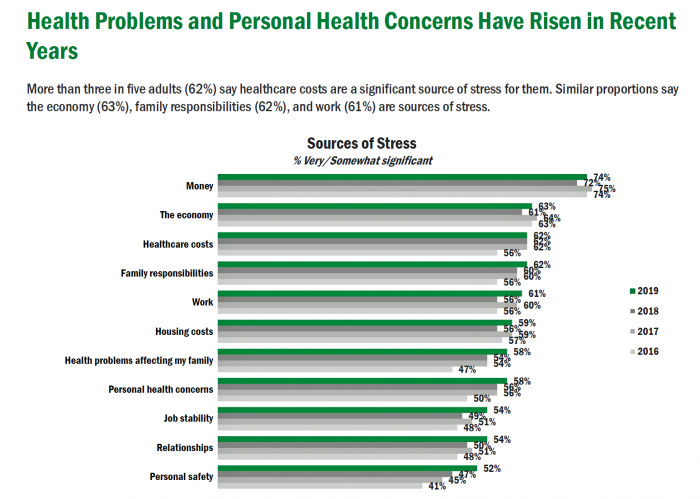

Americans’ Top Sources of Stress are Money, Money, Money and Family

ABBA sang the song “Money Money Money” back in 1976. The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019. “Work all night, I work all day, to pay the bills I have to pay Ain’t it sad And still there never seems to be a single penny left for me That’s too bad… Money, money, money must be funny In the rich man’s world.” That year, ’76, wasn’t just the U.S. bicentennial — it was a year when the U.S. allocated 8.6% of the nation’s Gross Domestic Product for health care.

Patients Growing Health Consumer Muscles Expect Digital Services

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned. Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year. One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

How Can Patients Be Health Consumers in an Un-Transparent World?

That question in the title of this post is begged in the annual 2019 consumer survey released this week from UnitedHealthcare (UHC). UHC gauges peoples’ views on health care, insurance, and costs in its yearly research. This year, transparency and health literacy challenges top the findings. When the three in ten folks do shop, four in ten people used the internet or mobile apps to do so — a dramatic increase from 2012. Shopping is most commonly done among Millennials, one-half of whom shop for health care services. Of people who have used digital tools for health care shopping, 8

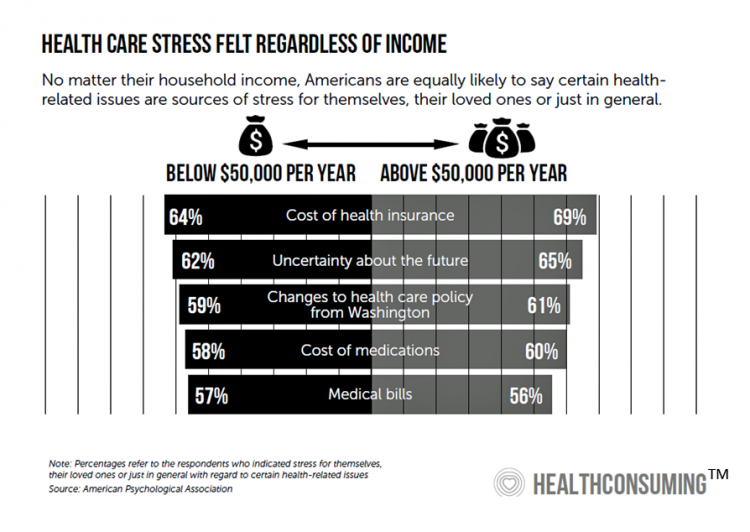

Worrying About Paying for Health Care Is the Norm in America

Among stresses facing people at least 50 years of age, health care costs rank top of mind compared with other issues like long-term care, health insurance, Social Security, taxes, and being read to retire. Worries about health care costs are particularly stressful among future retirees, 8 of 10 of whom share this top concern along with 7 in 10 recent retirees and 6 in 10 people retired for at least a decade. Health care stress cuts in two ways: most people are worried about paying for health care, as well as experienced an unanticipated decline in their health, according to

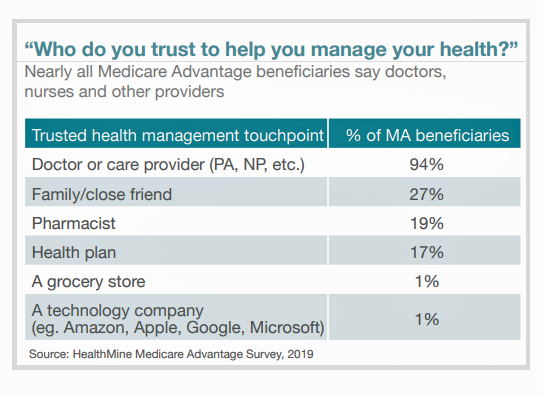

A Profile of People in Medicare Advantage Plans – HealthMine’s Survey of “Digital Immigrants”

There are over 60 million enrollees in Medicare in 2019, and fully one-third are in Medicare Advantage plans. Medicare is adding 10,000 new beneficiaries every day in the U.S. Medicare Advantage enrollment is fast-growing, shown in the first chart where over 22 million people were in MA plans in January 2019. Better understanding this group of people will be critical to helping manage a fast-growing health care bill, and growing burden of chronic disease, for America. To that end, HealthMine conducted a survey among 800 people enrolled in Medicare Advantage plans ag 65 and over with at least one diagnosed

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Americans’ Financial Anxiety Ties to Personal Cash Flow and Health Care

“The Dow Jones Industrial Average was on the brink of claiming a thousand-point milestone for the first time since January 2018, ending the longest period without crossing such a psychologically significant level since the blue-chip benchmark crossed the 19,000 threshold three weeks after Donald Trump was elected president in November 2016,” Mark DeCambre of MarketWatch wrote yesterday morning. He noted that President Trump, “tweeted a simple call-out to the intraday record: ‘Dow just hit 27,000 for first time EVER!'” clipped here from Twitter. Indeed, the U.S. macro-economy has nearly full employment and the stock market hit a high mark this

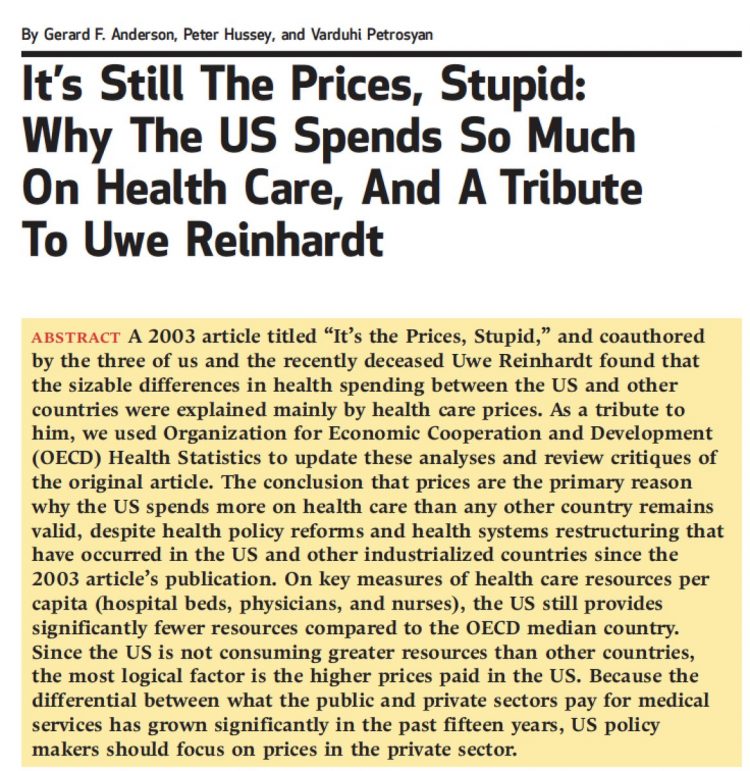

Retail Pricing in U.S. Health Care? Why Transparency Is Hard to Do

“It’s the prices stupid,” Uwe Reinhardt and Gerard Anderson and colleagues asserted in the title their seminal Health Affairs manifesto on U.S. healthcare spending. Sixteen years later, yesterday on 8th July 2019, a Federal U.S. judge blocked, in the literal last-minute, a DHHS order mandating prescription drug companies to publish “retail prices” of medicines in direct-to-consumer TV ads. I was getting this post on transparency together just before that announcement hit the press, so this post would have had a different nuance yesterday compared with today. And that’s how health care politics and economics in America roll these days. Welcome to

Americans Could Foster a Health Consumer Movement, Families USA Envisions

Employers, health care providers, unions, leaders and — first and foremost, consumers — must come together to build a more accessible, affordable health care system in America, proposes a call-to-action fostered by a Families USA coalition called Consumers First: The Alliance to Make the Health Care System Work for Everyone. The diverse partners in this Alliance include the American Academy of Family Physicians, AFSCME (the largest public service employees’ union in the U.S.), the American Benefits Council (which represents employers), the American Federation of Teachers (AFT), First Focus (a bipartisan children’s advocacy organization), and the Pacific Business Group on Health

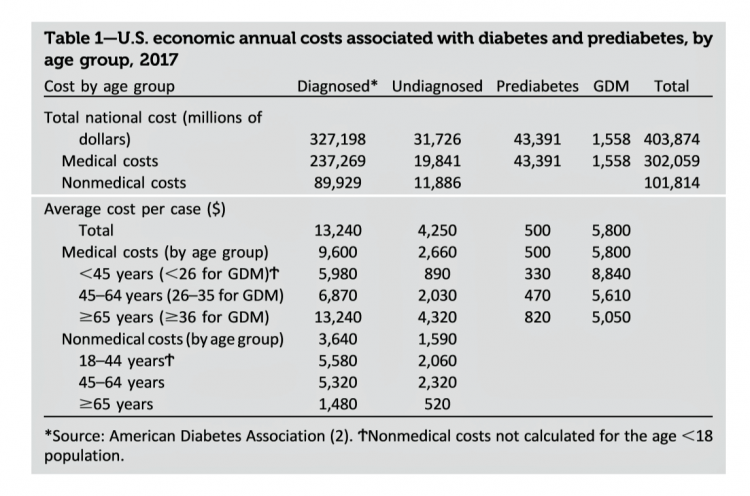

The United States of Diabetes: a $1,240 Tax on Every American

Pharmaceutical company executives are testifying in the U.S. Congress this week on the topic of prescription drug costs. One of those medicines, insulin, cost a patient $5,705 for a year’s supply in 2016, double what it cost in 2012, according to the Health Care Cost Institute. Know that one of these insulin products, Lilly’s Humalog, came onto the market in 1996. In typical markets, as products mature and get mass adoption, prices fall. Not so insulin, one of the many cost components in caring for diabetes. But then prescription drug pricing doesn’t conform with how typical markets work in theory.

Medical Costs Are Consuming Americans’ Financial Health

Spending on medical care costs crowded out other household spending for millions of Americans in 2018, based on The U.S. Healthcare Cost Crisis, a survey from West Health and Gallup. Gallup polled 3,537 U.S. adults 18 and over in January and February 2019. One in three Americans overall are concerned they won’t be able to pay for health care services or prescription drugs: that includes 35% of people who are insured, and 63% of those who do not have insurance. Americans borrowed $88 billion in 2018 to pay for health care spending, West Health and Gallup estimated. 27 million Americans

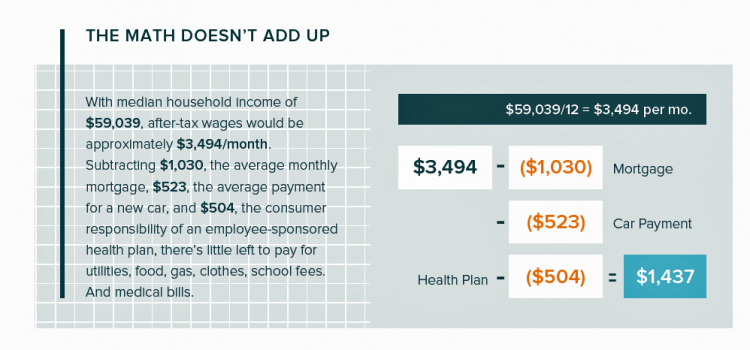

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

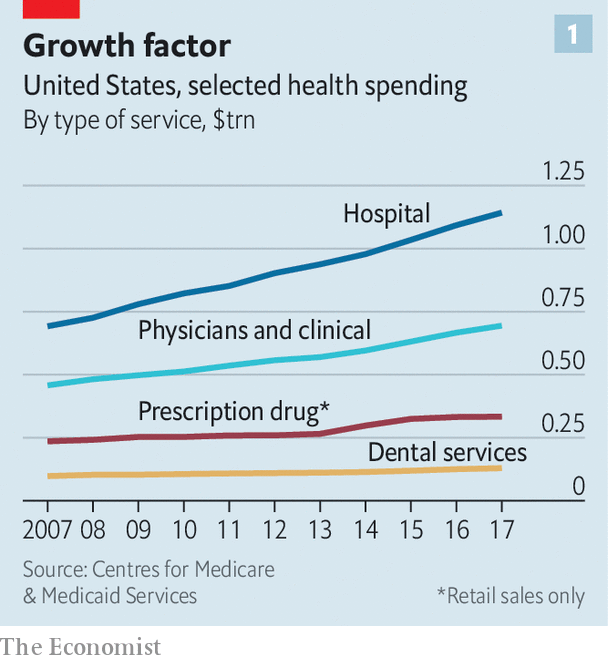

In U.S. Health Care, It’s Still the Prices, Stupid – But Transparency and Consumer Behavior Aren’t Working As Planned

I’m glad to be getting back to health economic issues after spending the last couple of weeks firmly focused on consumers, digital health technologies and CES 2019. There’s a lot for me to address concerning health care costs based on news and research published over the past couple of weeks. We’ll start with the centerpiece that will provide the overall context for this post: that’s the ongoing research of Gerard Anderson and colleagues under the title, It’s Still The Prices, Stupid: Why The US Spends So Much On Health Care, And A Tribute To Uwe Reinhardt. It is bittersweet to

Americans End 2018 Worried About Healthcare Costs

Nearly one-half of Americans are quite concerned they won’t have enough money to pay for medical care, according to the latest Gallup poll. Health insurance in-security is mainstream as of November 2018, when Gallup polled U.S. adults about views on healthcare costs. It’s a major concern among six in ten people that their health plan would require they pay higher premiums or a bigger portion of their healthcare expenses. It’s also a big concern for four in ten people that someone in their family would be denied health insurance covering for a pre-existing condition, or that they might have to

Most Americans Want the Federal Government to Ensure Healthcare for All

Most people in the U.S. believe that the Federal government should ensure that their fellow Americans, a new Gallup Poll found. This sentiment has been relatively stable since 2000 except for two big outlying years: a spike of 69% in 2006, and a low-point in 2003 of 42%. In 2006, Medicare Part D launched, which may have boosted consumers’ faith in Federal healthcare programs. In contrast, in 2013 the Affordable Care Act was in implementation and consumer-adoption mode, accompanied by aggressive anti-“Obamacare” campaigns in mass media. That’s the top lighter green line in the first chart. But while there’s majority support

Consumers Don’t Know What They Don’t Know About Healthcare Costs

The saving rate in the U.S. ranks among the lowest in the world, in a country that rates among the richest nations. So imagine how well Americans save for healthcare? “Consumers are not disciplined about saving in general,” with saving for healthcare lagging behind other types of savings, Alegeus observes in the 2018 Alegeus Consumer Health & Financial Fluency Report. Alegeus surveyed 1,400 U.S. healthcare consumers in September 2017 to gauge peoples’ views on healthcare finances, insurance, and levels of fluency. As patients continue to take on more financial responsibility for healthcare spending in the U.S., they are struggling with finances and

The Top Pain Point in the Healthcare Consumer Experience is Money

Beyond the physical and emotional pain that people experience when they become a patient, in the U.S. that person becomes a consumer bearing expenses and financial pain, as well. 98% of Americans rank paying their medical bills is an important pain point in their patient journey, according to Embracing consumerism: Driving customer engagement in the healthcare financial journey, from Experian Health. Experian is best known as the consumer credit reporting agency; Experian Health works with healthcare providers on revenue cycle management, patient identity, and care management, so the company has experience with patient finance and medical expense sticker shock. In the

Surprise, Surprise: Most Americans Have Faced a “Surprise” Medical Bill

Most Americans have been surprised by a medical bill, a NORC AmeriSpeak survey found. Who’s responsible? Nearly all Americans (86% net responsible) first blame health insurance companies, followed by hospitals (82%). Fewer U.S. patients blamed doctors and pharmacies, although a majority of consumers still put responsibility for surprise healthcare bills on them (71% and 64% net). Most of the surprise bills were for charges associated with a physician’s service or lab test. Most surprise charges were not due to the service being excluded from a health plans provider network. The poll was conducted among 1,002 U.S. adults 18 and over

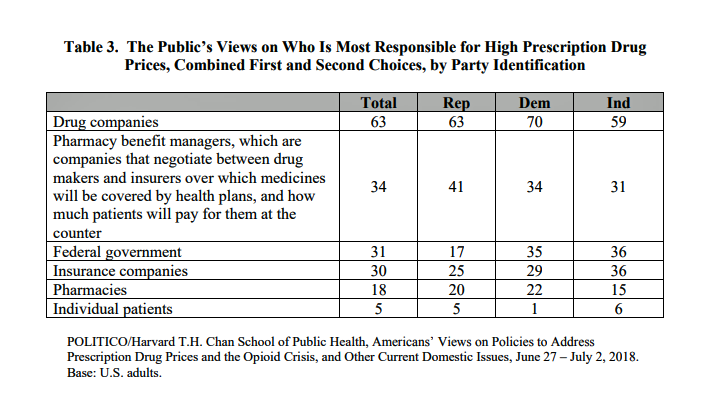

“Lower Prescription Drug Prices” – A Tri-Partisan Call Across America

There’s growing evidence that a majority of U.S. voters, across the three-party landscape, agree on two healthcare issues this year: coverage of pre-existing conditions, and lowering the consumer-facing costs of prescription drugs. A new poll jointly conducted by Politico and the Harvard Chan School of Public Health bolsters my read on the latter issue – prescription drug pricing, which has become a mass popular culture union. There may be no other issue on voters’ collective minds for the 2018 mid-term election that so unites American voters than the demand for lower-cost medicines. This is directly relates to consumers’ tri-party

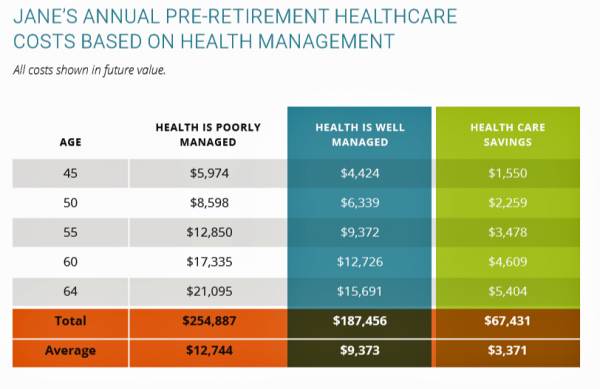

How Taking Care of Your Health Boosts Savings Accounts

It will cost about $275,000 for a couple retiring in the U.S. this year to cover their healthcare costs for the rest of their life in retirement, Fidelity estimated. But Americans are notoriously pretty undisciplined about saving money, compared with peers living in other developed countries. How to address this challenge? Show people what improving their personal health can do to boost their 401(k) plans. This tactic is discussed in Health & Retirement Savings: Leveraging Healthcare Costs to Drive 401(k) Contributions & Improve Health, from HealthyCapital, a joint venture of Mercy health systems and HealthView Services. The chart illustrates three

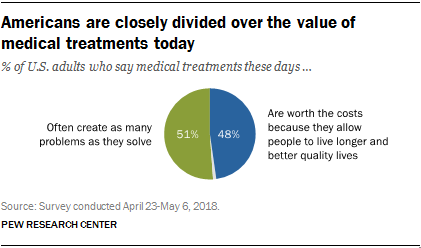

Consumers Consider Cost When They Think About Medical Innovation

While the vast majority of Americans say that science has made life easier for most people, and especially for health care, people are split in questioning the financial cost and value of medical treatments, the Pew Research Center has found. The first chart illustrates the percent of Americans identifying various aspects of medical treatments as “big problems.” If you add in people who see these as “small problems,” 9 in 10 Americans say that all of these line items are “problems.” In the sample, two-thirds of respondents had seen a health care provider for an illness or medical condition in

Obese, Access-Challenged and Self-Rationing: America’s Health Vs Rest-of-World

The U.S. gets relatively low ROI for its relatively exorbitant spending on healthcare, noted once again in the latest Health at a Glance, the annual OECD report on member nations’ healthcare systems. The report includes U.S. country data asking, “How does the United States compare?” with its sister OECD countries. The answer is, “not well across most population health, access, and mortality measures.” For the Cliff’s Notes/Where’s Waldo top-line of the research, find the two long bars in this chart heading “south” of the OECD average, and one long blue bar going “north.” The northern climbing bar

Good Coffee + Engaging Design + Banking = Financial Health

As I walked by windows with Marvel-inspired superhero characters, I stopped to read their talk-bubbles: “strengthen your savings, power your financial quest, be the hero of your money, be one with your budget.” The top-line message here is that you can be your own fiscal superhero. The sign read, Capital One Cafe with Peet’s Coffee. But was it a bank branch or a cafe? I asked myself, passing by this sign yesterday morning at the corner of Walnut and 18th Streets in center city Philadelphia. It’s both, as it turned out, and when I entered I found a welcoming, beautifully

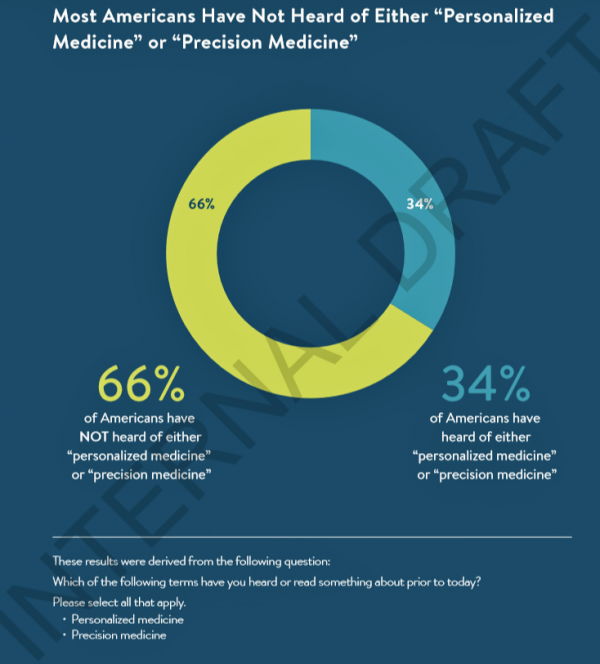

Personalized Medicine: Consumer Concerns About Coverage, Affordability and Privacy

Two in 3 Americans haven’t heard the phrases “personalized medicine” or “precision medicine.” When the concept of therapies tailored to individual patients is explained, most people like the idea of diagnostic tools that can identify biological markers and marry to personal medical records data to help determine medical treatments that best fit them. This picture of U.S. consumers’ views on personalized medicine comes from a survey conducted for PMC, the Personalized Medicine Coalition, and GenomeWeb, published in May 2018. The poll results are published in Public Perspectives on Personalized Medicine, with the top-line finding that life science industry innovators must

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,

I am so grateful to Tom Lawry for asking me to pen the foreword for his book, Health Care Nation,  I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider

I love sharing perspectives on what's shaping the future of health care, and appreciate the opportunity to be collaborating once again with Duke Corporate Education and a global client on 6th May. We'll be addressing some key pillars to consider in scenario planning such as growing consumerism in health care, technology (from AI to telehealth), climate change, and trust -- the key enabler for health engagement or dis-engagement and mis-information. I'm grateful to be affiliated with the corporate education provider  Thank you FeedSpot for

Thank you FeedSpot for