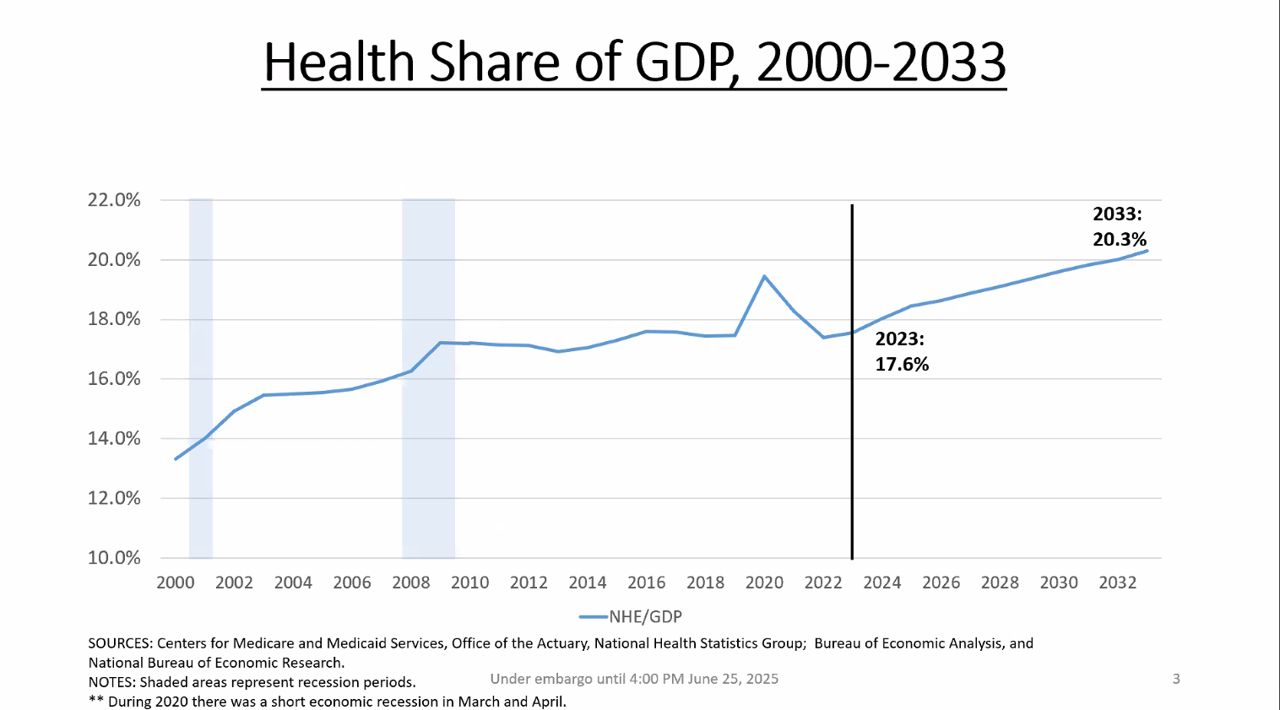

National Health Spending in the U.S. in 2033: What 20.3% of the GDP Will Be Spent On

By 2033, national health spending will comprise 20.3% of the U.S. GDP, based on the latest national health expenditure projections developed by researchers from the Centers for Medicare and Medicaid Services (CMS). This growth will be happening as CMS projects coverage of insured people to decline over the period. Earlier today, I attended a media briefing hosted by Health Affairs to receive the CMS team’s top-line forecast of NHE from 2024 to 2033 discussing these findings. Fuller details on the projections will be released in the July issue of Health Affairs on 7

That Big Beautiful Bill’s Healthcare Proposals Aren’t So Pretty in the Views of Most People in the U.S. – Including Josh Hawley (R-Mo.) – Listening to the Kaiser Family Foundation June Health Tracking Poll

Across all U.S. voters, the so-called “Big Beautiful Bill” Act (BBB) is seen unfavorably by nearly a 2:1 margin. Underneath that top-line, Democrats, Independents, and non-MAGA Republicans oppose it, while MAGA supporters favor it. But favorability erodes when people hear about possible health impacts, we learn in the June 2025 Health Tracking Poll from the Kaiser Family Foundation. The details on views of the BBB Act are shown in the first bar chart, with overwhelming disfavor among Democrats and Independents, and majority unfavorability among non-MAGA GOP supporters. Next check into partisans’ lenses

Come Together – A Health Policy Prescription from the Bipartisan Policy Center

Among all Americans, the most popular approach for improving the health care in the U.S. isn’t repealing or replacing the Affordable Care Act or moving to a Medicare-for-All government-provided plan. It would be to improve the current health care system, according to the Bipartisan Policy Center’s research reported in a Bipartisan Rx for America’s Health Care. The BPC is a truly bipartisan organization, co-founded by Former Democratic Senate Majority Leaders Tom Daschle and George Mitchell, and Former Republican Senate Majority Leaders Howard Baker and Bob Dole. While this political week in America has revealed deep chasms between the Dems and

Americans’ Financial Anxiety Ties to Personal Cash Flow and Health Care

“The Dow Jones Industrial Average was on the brink of claiming a thousand-point milestone for the first time since January 2018, ending the longest period without crossing such a psychologically significant level since the blue-chip benchmark crossed the 19,000 threshold three weeks after Donald Trump was elected president in November 2016,” Mark DeCambre of MarketWatch wrote yesterday morning. He noted that President Trump, “tweeted a simple call-out to the intraday record: ‘Dow just hit 27,000 for first time EVER!'” clipped here from Twitter. Indeed, the U.S. macro-economy has nearly full employment and the stock market hit a high mark this

Health Care and the Democratic Debates – Round 2 – Battle Royale for M4All vs Medicare for All Who Want It – What It Means for Industry

Looking at this photo of the 2020 Democratic Party Presidential candidate debater line-up might give you a déjà vu feeling, a repeat of the night-before debate. But this was Round 2 of the debate, with ten more White House aspirants sharing views — sometimes sparring — on issues of immigration, economic justice, climate change, and once again health care playing a starring role from the start of the two-hour event. The line-up from left to write included: Marianne Williamson. author and spiritual advisor John Hickenlooper, former Governor of Colorado Andrew Yang. tech company executive Pete Buttigieg, Mayor of South Bend,

The 3 A’s That Millennials Want From Healthcare: Affordability, Accessibility, Availability

With lower expectations of and satisfaction with health care, Millennials in America seek three things: available, accessible, and affordable services, research from the Transamerica Center for Health Studies has found. Far and away the top reason for not obtaining health insurance in 2018 was that it was simply too expensive, cited by 60% of Millennials. Following that, 26% of Millennials noted that paying the tax penalty plus personal medical expenses were, together, less expensive than available health options. While Millennials were least likely to visit a doctor’s office in the past year, they had the most likelihood of making a

The Importance of Broadband and Net Neutrality for Health, to the Last Person and the Last Mile

California’s Governor Jerry Brown signed into law a net neutrality bill this weekend. Gov. Brown’s proverbial swipe of the pen accomplished two things: he went back to the Obama-era approach to ensure that internet service providers treat all users of the internet equally; and, he prompted the Department of Justice, representing the Trump Administration’s Federal Communications Commission (FCC), to launch a lawsuit. California, home to start-ups, mature tech platform companies (like Apple, Facebook and Google), and countless digital health developers, is in a particularly strategic place to fight the FCC and, now, the Department of Justice. Nearly two dozen other states

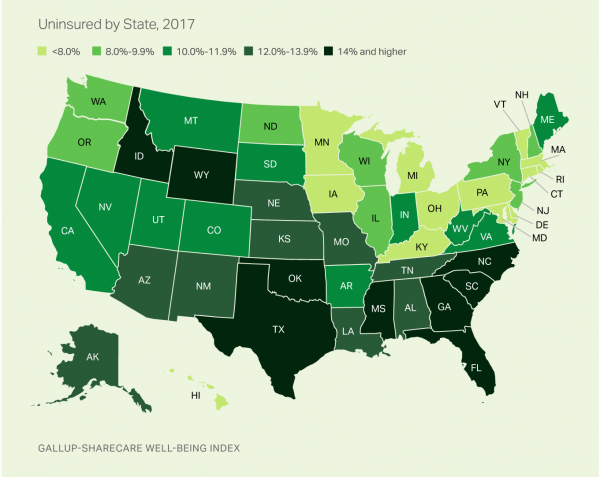

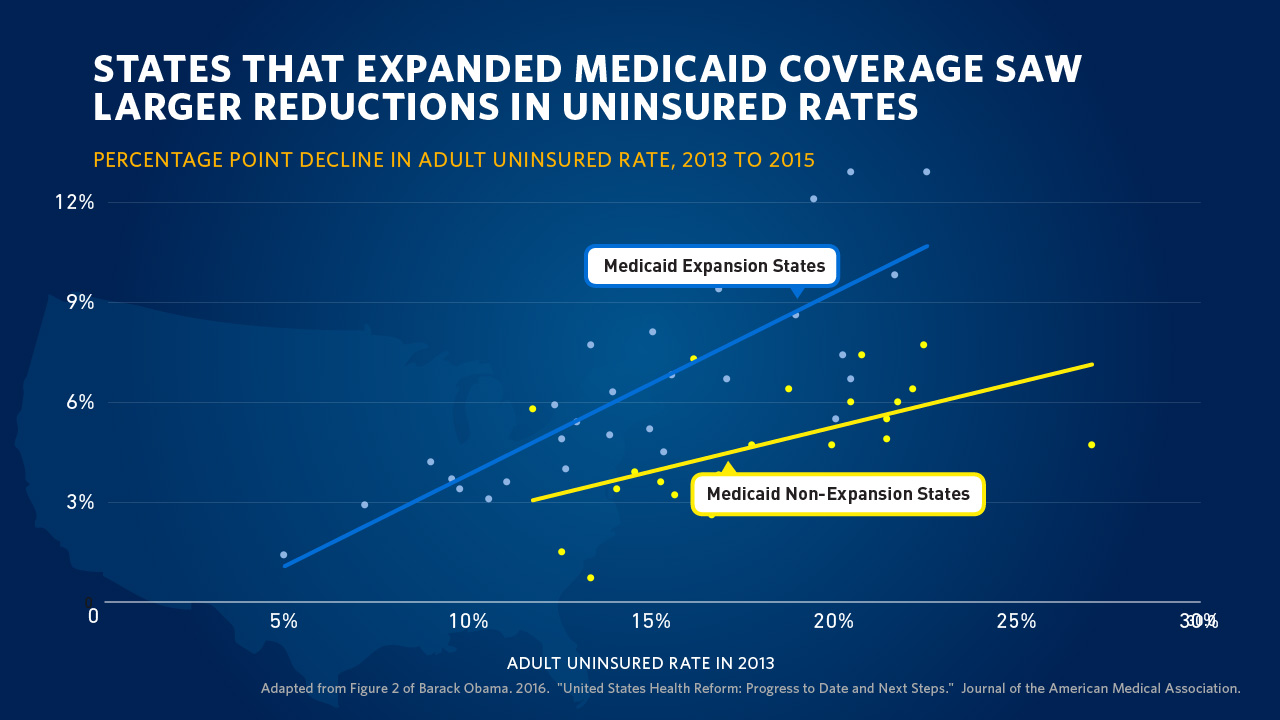

Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

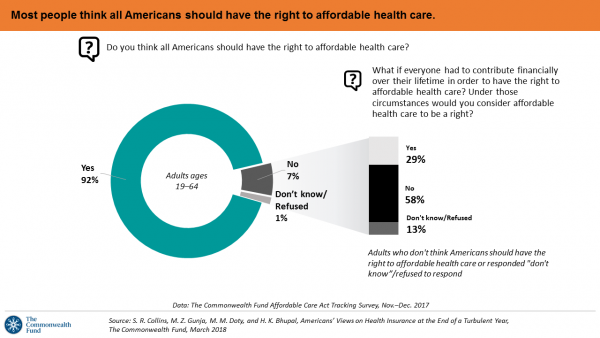

Majority Rules? The Right to Affordable Health Care is A Right for All Americans

If we’re playing a game of “majority rules,” then everyone in America would have the right to affordable health care, according to a new poll from The Commonwealth Fund. The report is aptly titled, Americans’ Views on Health Insurance at the End of a Turbulent Year. The Fund surveyed 2,410 U.S. adults, age 19 to 64, by phone in November and December 2017. This is the sixth survey conducted by the Fund to track Americans’ views of the Affordable Care Act; the first survey was fielded in mid-to-fall 2013. 9 in 10 working-age adults say “yes” indeed, my fellow Americans

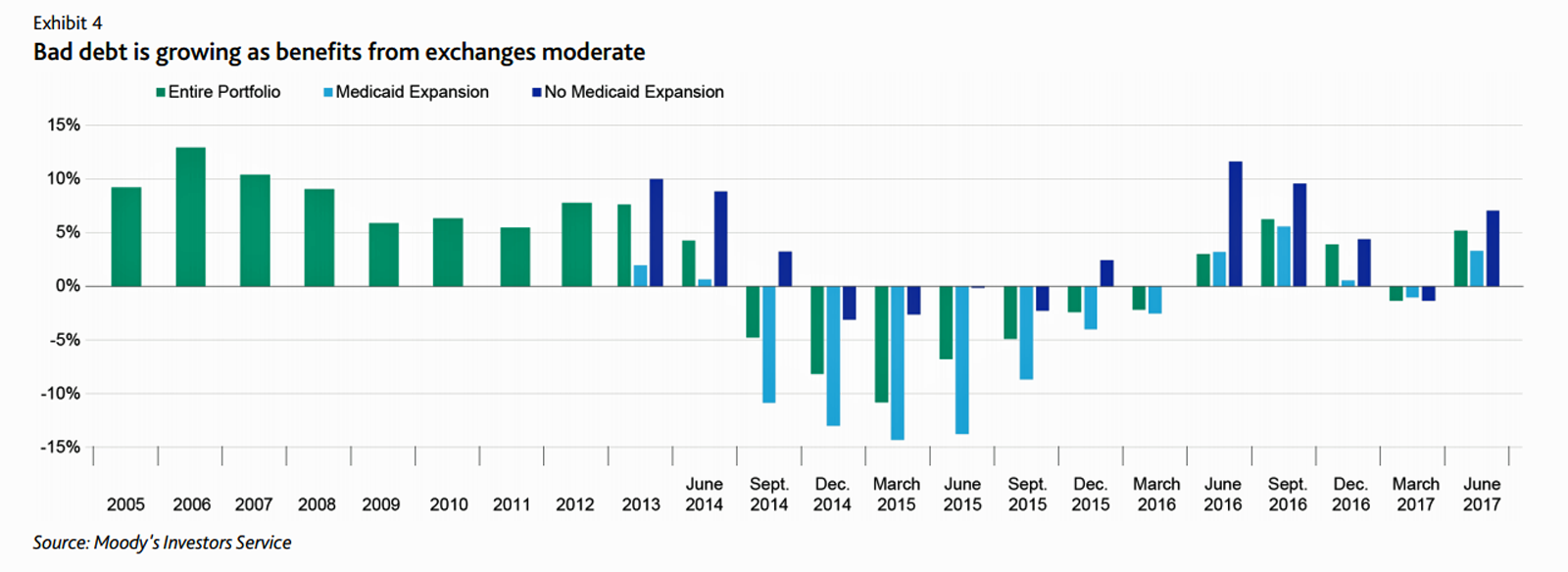

Six Healthcare News Stories to Keep Hospital CFOs Up At Night

At this moment, the healthcare job I’d least like to have is that of a non-profit hospital Chief Financial Officer (CFO). Five news stories, published in the past 24 hours, tell the tale: First, Moody’s forecast for non-profit hospitals and healthcare in 2018 is negative due to reimbursement and expense pressures. The investors report cited an expected contraction in cash flow, lower reimbursement rates, and rising expense pressures in the midst of rising bad debt. Second, three-quarters of Federally Qualified Health Centers plan to lay off staff given lack of budget allocations resulting from Congressional inaction. Furthermore, if the $3.6

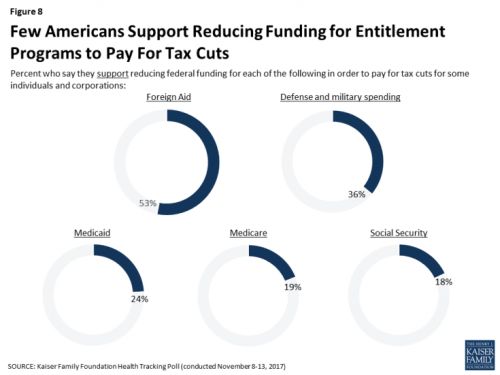

Don’t Touch My Entitlements to Pay For Tax Reform, Most Americans Say to Congress

To pay for tax cuts, take money from foreign aid if you must, 1 in 2 Americans say. But do not touch my Medicaid, Medicare, or Social Security, insist the majority of U.S. adults gauged by the November 2017 Kaiser Health Tracking Poll. This month’s survey looks at Americans’ priorities for President Trump and the Congress in light of the GOP tax reforms emerging from Capitol Hill. While reforming taxes is considered a top priority for the President and Congress by 3 in 10 people, two healthcare policy issues are more important to U.S. adults: first, 62% of U.S. adults

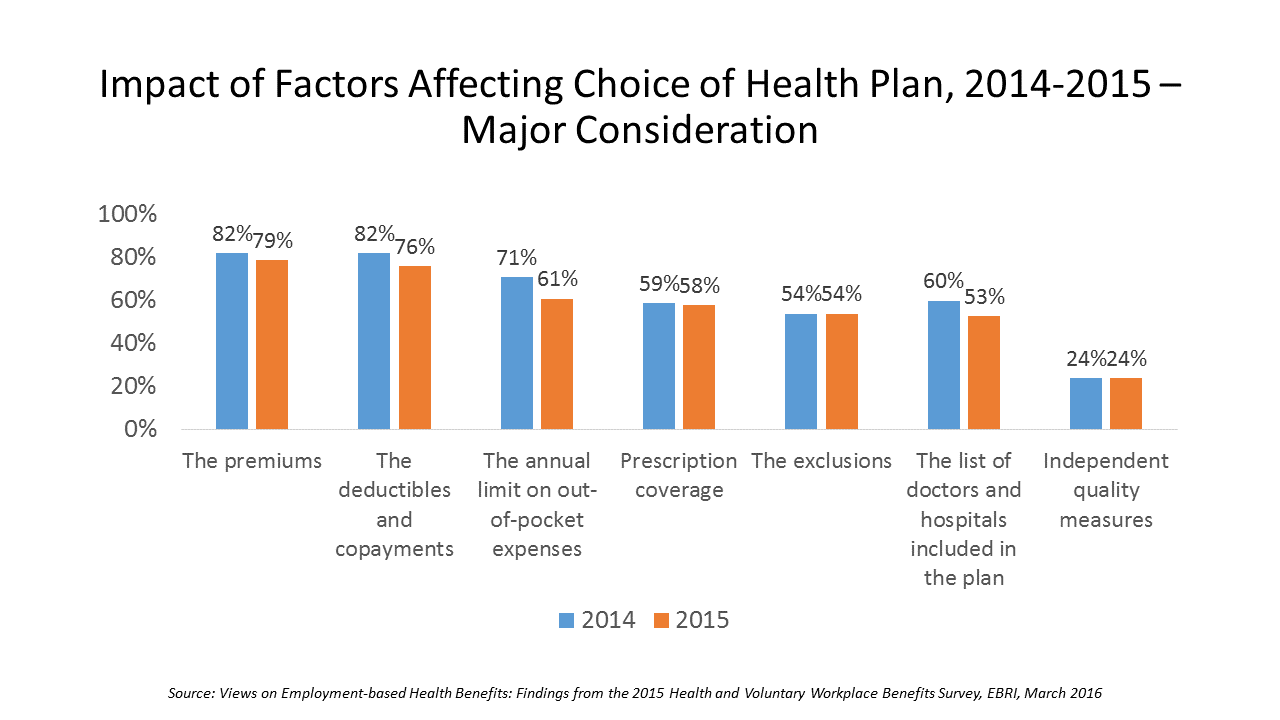

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

Costs of Healthcare Top Americans’ Financial Concerns: It’s Financial Health Matters Day

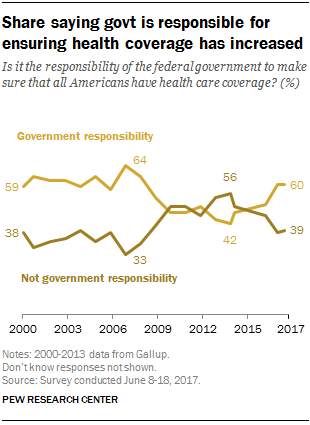

Americans are most worried about healthcare costs among all financial concerns; most people in the U.S. also believe the Federal government should ensure that all people have health coverage. Two polls published in the past week point to the fact that most U.S. health citizens are concerned about health care for themselves and their families, driving a growing proportion of people to favor a single-payer health system. The first line chart illustrates a dramatic trajectory up of the number of American identifying healthcare costs as their #1 financial problem, rising from 10% of people in 2013 to 17% in 2017.

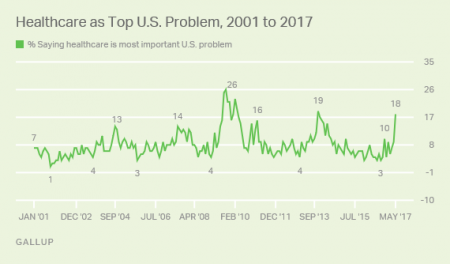

Americans Say Healthcare is the Nation’s #1 Problem – Tied with Dissatisfaction with Government

Healthcare tops the list of Americans’ concerns, tied with a dissatisfaction for government, this month (May 2017). According to a Gallup poll published 12 May, poor government leadership and healthcare are together the most important problem currently facing the U.S. Immigration, the economy, jobs, and race relations are distance 3rd places in this survey, which was conducted during the first week of May 2017 among 1,011 U.S. adults 18 years and older. The highest percent of Americans citing healthcare as America’s most important problem was 26%, found in August/September 2008 when town hall meetings round the country were protesting healthcare

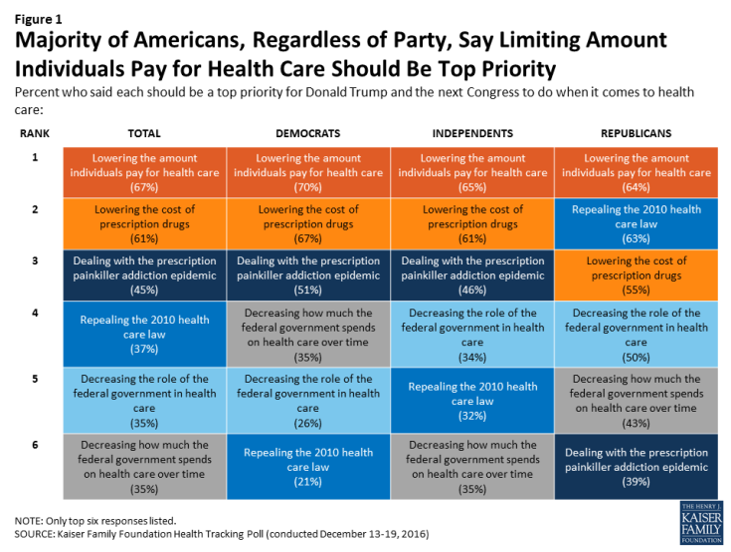

Health Care Costs Are A Top Worry for Americans Across Political Parties

Health care costs are out-of-reach for more Americans, among both people who have insurance through the workplace or via health insurance exchanges. The first chart illustrates the growing healthcare affordability challenge for American health consumers, discussed in a data note to the Kaiser Family Foundation Health Tracking Poll in March 2017. In 2017, 43% of consumers found it difficult to meet the health care deductible before insurance would kick in 37% of consumers found it difficult to pay for the cost of health insurance each month 31% said it was difficult to pay for copayments for doctor visits and prescription drugs.

Health Care Reform: President Obama Pens Progress in JAMA

“Take Governor John Kasich’s explanation for expanding Medicaid: ‘For those that live in the shadows of life, those who are the least among us, I will not accept the fact that the most vulnerable in our state should be ignored. We can help them.’” So quotes President Barack Obama in the Journal of the American Medical Association, JAMA, in today’s online issue. #POTUS penned, United States Health Care Reform: Progress to Date and Next Steps. The author is named as “Barack Obama, JD,” a nod to the President’s legal credentials. Governor Kasich, a Republican, was one of 31 Governors who

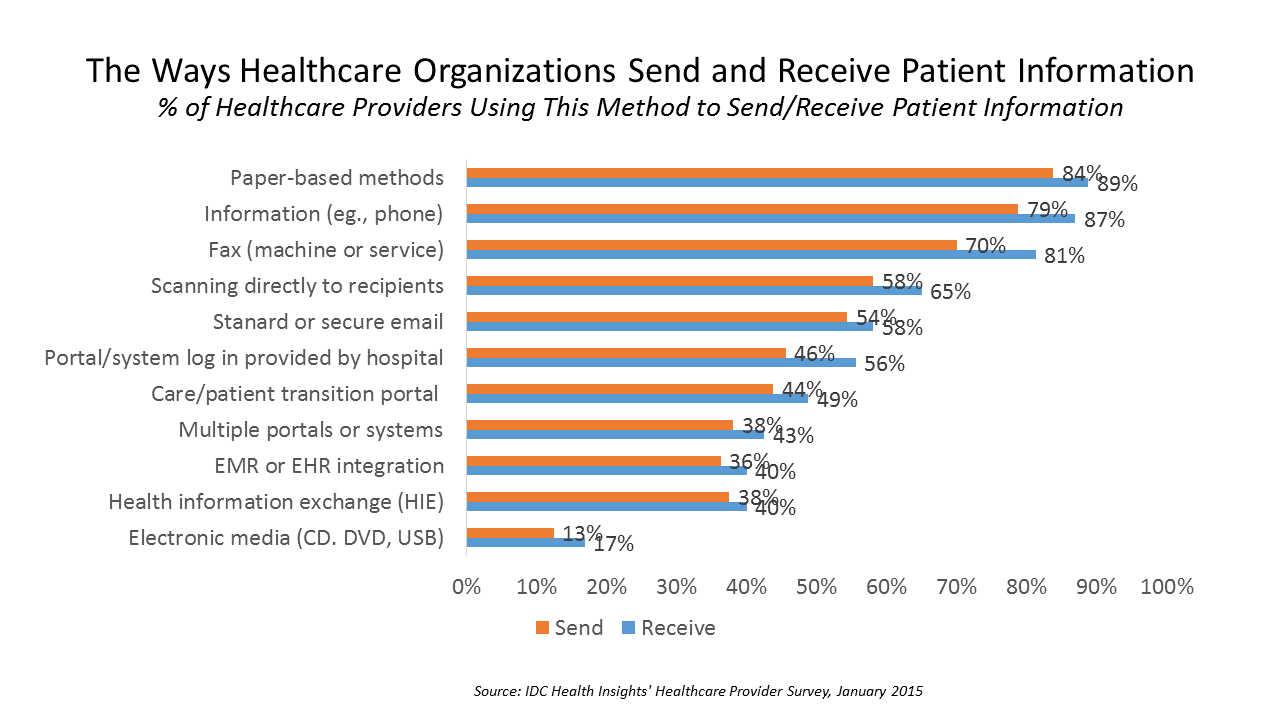

Paper and Fax, Not EHRs or Portals, Are Popular for Health Data Sharing

Faxing in health care ranks higher in patient data information sharing than using secure email, online portals, health information exchange (HIE), or leveraging electronic health records. Welcome to the American healthcare system in 2016, as described in a market spotlight published by IDC, The Rocky Road to Information Sharing in the Health System. IDC’s survey research among healthcare providers forecasts the “rocky road” to information sharing. That rocky road is built for medical errors, duplication of services, greater healthcare costs, and continued health il-literacy for many patients. “The holy grail of interoperability — lower-cost, better-quality care with an improved experience for

Cost Comes Before “My Doctor” In Picking Health Insurance

Consumers are extremely price-sensitive when it comes to shopping for health insurance. The cost of health insurance premiums, deductibles and copays, prescription drug coverage and out-of-pocket expenses rank higher in the minds of health insurance shoppers than the list of doctors and hospitals included in a health plan for health consumers in 2015. The Employee Benefit Research Institute (EBRI) surveyed 1,500 workers in the U.S. ages 21-64 for their views on workers’ satisfaction with health care in America. The results of this study are compiled in EBRI’s March 2016 issue of Notes, Views on Employment-based Health Benefits: Findings from the 2015 Health

Getting Beyond Consumer Self-Rationing in High-Deductible Health Plans

The rising cost of health care for Americans continues to contribute to self-rationing care in the forms of not filling prescriptions, postponing necessary services and tests, and avoiding needed visits to doctors. Furthermore, health care costs are threatening the livelihood of most American families, according to the Pioneer Institute. “What Will U.S. Households Pay for Health Care in the Future?” asks the title of a study by the Institute, noting that health care costs for an American family of average income could increase annually to $13,213 by 2025 — and as high as $18,251. Pioneer calculates that this forecasted spend will

Diagnosis: Acute Health Care Angst In America

There’s an overall feeling of angst about healthcare in America among both health care consumers and the people who provide care — physicians and administrators. On one thing most healthcare consumers and providers (can agree: that the U.S. health care system is on the wrong track. Another area of commonality between consumers and providers regards privacy and security of health information: while healthcare providers will continue to increase investments in digital health tools and electronic health records systems, both providers and consumers are concerned about the security of personal health information. In How We View Healthcare in America: Consumer and Provider Perspectives,

What the SCOTUS ACA ruling means for health consumers

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America? I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for

No relief for consumers’ healthcare costs

U.S. consumers are spending $1 in every $5 dollars in the household on health care, and personal cost curves aren’t going to bend down anytime soon. Three surveys published in April confirm my financially unwell forecast for American health citizens. Kaiser Family Foundation’s April 2015 Health Tracking Poll finds most people say health care costs or going up or holding flat, shown in the first diagram from the KFF survey. U.S. adults told KFF the top health care priorities for the President and Congress should focus on health costs, such as: Making sure high-cost drugs for chronic conditions, such as HIV,

Health = love. Care = love. Healthcare? Meh

Bruce Broussard, CEO of Humana, forgot the charger for his smartwatch on a business trip. Stopping into a consumer electronics store, he was struck by the options he faced of various wearable technologies. He ended up buying a new watch, which he uses for exercise tracking. “Technology is such an important part of the direction of health care,” Broussard told the HIMSS 2015 audience in his keynote address on 14 April 2015. But Broussard was quick to point out to the thousands of technology geeks that comprise HIMSS’s membership that improving the health/care system isn’t just about technology: “we have

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

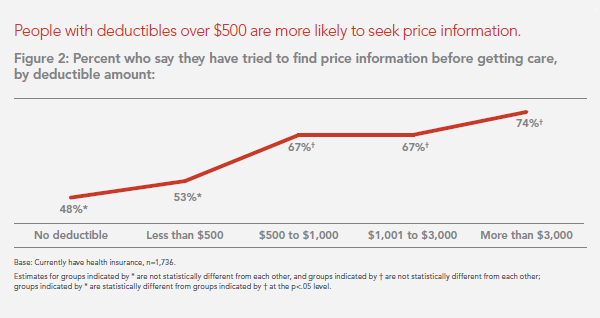

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

The Affordable Care Act As New-Business Creator

While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC. As the ACA turned five years of age, the PwC Health Research Institute led by Ceci Connolly identified at least 90 newcos addressing opportunities inspired by the ACA: Supporting telehealth platforms between patients and providers, such as Vivre Health Educating consumers, such as the transparency provider HealthSparq does Streamlining operations to enhance efficiency, the business of Cureate among others

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

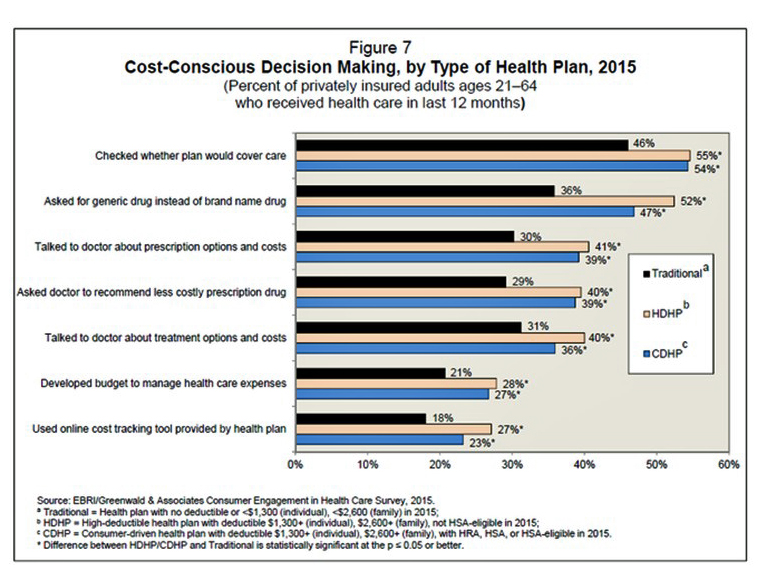

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Health insurance companies rank low on consumer experience

The corporate reputation, brand equity, of the health insurance continues to be low relative to other financial service industry benchmarks, found in the ACSI Finance and Insurance Report 2014. Customer satisfaction with health insurance companies fell between 2013 and 2014, especially attributed to higher costs hitting consumers in group (employer-based) policies. The 2014 American Customer Satisfaction Index (ACSI) is informed by interviews with 6,819 consumers interviewed via phone and email between July and September 2014. Customers of financial services companies (banks, credit unions, health insurance, life insurance, property & casualty, and internet brokerages) were asked to provide their opinions about named-firms

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Health Care in the 2014 Mid-Term Election

In the November 2014 mid-term elections, Democrats tend to favor continuing the Affordable Care Act (ACA) as-is, and Republicans favor scrapping it, scaling it back, or fully replacing the law with something yet to be defined. But it’s hard to read just where the ACA will end up after tomorrow’s election, because many key battleground states are too close to call…and the two major parties have such polar views on health reform. What’s most significant this year is that those most likely to vote are less likely to vote for a congressional candidate who supports the ACA (40%) than would

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

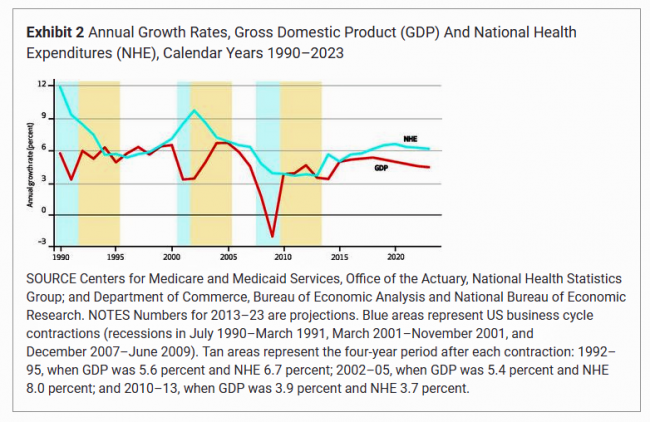

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Online is to go-to place for health insurance info, but lots of uninsured people live offline

A vast majority of people shopping for a health plan on a Health Insurance Exchange for coverage in 2014 obtained information online via websites. One-half of these shoppers used only online information, and 29% combined both websites and other sources like direct assistance, informal assistance, and via (offline) media. In the Health Reform Monitoring Survey from the Urban Institute Health Policy Center, a research team, funded by the Robert Wood Johnson Foundation and the Ford Foundation, looked into data collected from the Health Reform Monitoring Survey in March 2014 at the end of the 2014 open enrollment period for the

The Milliman Medical Index at $23,215: A Toyota Prius, a tonne of tin, or health insurance for a family?

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm. The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin. While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6%

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

What, We Worry? Thinking About Healthcare (Costs) Is Stressing Us Out

Three-quarters of us are concerned about health care, a fraction fewer than those of us worried about the economy. Underneath stress about healthcare, people are worried about costs and the impact of the Affordable Care Act (ACA). Say hello to the Healthcare Worry Scale, developed by Chase Communications, a firm focused on marketing and media, largely in the health industry. Chase found that: – 93% believe that their health care costs will continue to increase – 49% say the ACA’s impact is a “major” worry – 43% say getting a disease, medical condition, or injury that health insurance doesn’t fully

Health Care Everywhere at the 2014 Consumer Electronics Show

When the head of the Consumer Electronics Association gives a shout-out to the growth of health products in his annual mega-show, attention must be paid. The #2014CES featured over 300 companies devoted to “digital health” as the CEA defines the term. But if you believe that health is where we live, work, play, and pray, then you can see health is almost everywhere at the CES, from connected home tech and smart refrigerators to autos that sense ‘sick’ air and headphones that amplify phone messages for people with hearing aids, along with pet activity tracking devices like the Petbit. If

3 Things I Know About Health Care in 2014

We who are charged with forecasting the future of health and health care live in a world of scenario planning, placing bets on certainties (what we know we know), uncertainties (what we know we don’t know), and wild cards — those phenomena that, if they happen in the real world, blow our forecasts to smithereens, forcing a tabula rasa for a new-and-improved forecast. There are many more uncertainties than certainties challenging the tea leaves for the new year, including the changing role of health insurance companies and how they will respond to the Affordable Care Act implementation and changing mandates

Supermarkets and hospitals most-trusted industries in the U.S.

See the yellow highlighted rows? That single yellow bar at the top, that’s hospitals; at the bottom, you’ll see pharma, health insurance, and managed care. Hospitals, trusted; pharma, insurance, managed care? Down south on the trust barometer with oil, tobacco, phone companies and social media. The Harris Poll has gauged U.S. consumers’ views on honesty and trustworthiness across industries for the past ten years. Over those ten years, trust in these industries has eroded, from huge falls-from-grace for banks (a 17 point fall), packaged food (falling 12 points), and computer hardware and software substantially falling, as well. Hospitals are

Health care and costs on front-burner for people in America (again)

This week in America, the concept of “health care consumer” is in a tug-of-war, and those of us trying to behave as such feel bloodied in the skirmish. One side of the tug-of-war is the obvious, post October 1st reality of the sad state of the Health Insurance Exchanges. This has been well covered in mass media, right, left and center. And Americans polled by Gallup last week express their knowledge of that fact — even if they didn’t know what Healthcare.gov was on the 1st of October. The first chart shows that health care is now a front-burner issue

America’s health care is better due to Todd Park – detractors, be careful what you wish for

In the aftermath of the snafu that was/is the failed launch of the Affordable Care Act’s Health Insurance Exchange comes, today via Reuters, an article called Obama’s tech expert becomes target over healthcare website woes. The piece, by Roberta Rampton and Sarah McBride, states that Todd Park, Chief Technology Officer at The White House, “now finds himself among a handful of officials with targets on their backs as Republicans try to root out who is responsible for this month’s glitch-ridden rollout of Healthcare.gov,” going on to say that “The White House trotted him out in July to talk up the new version”

Whither price transparency in health care? The supply side may be growing faster than consumer demand

Online shopping for health care can drive costs down, according to research conducted by HealthSparq, a company that works with health insurance companies to channel health cost information to plan members (that is, consumers). Healthsparq partnered with one of the company’s health insurance company clients to conduct this study, which demonstrated that, over two years, consumers who used an online treatment cost estimator saved money on care for hernia conditions, digestive conditions, and women’s health issues. It’s early days for health care price transparency in health care, but HealthSparq’s findings demonstrate positive evidence that when consumers are offered a tool

U.S. Health Citizens Needed a Dummies Guide to the ACA

The Affordable Care Act (ACA) was signed in March 2010; that month, 57% of U.S. adults did something to self-ration health care, such as splitting prescription pills, postponing necessary health care, and putting off recommended medical tests, according to the Kaiser Family Foundation (KFF) Health Tracking Poll of March 2010. 57% of U.S. adults are still self-rationing health care in September 2013, according to KFF’s latest Health Tracking Poll, completed among 1,503 U.S. adults just two weeks before the launch of the Health Insurance Marketplaces on October 1, 2013. As of September 2013, only 19% of U.S. adults said they had heard

Health care and survey taking at the Big Box Store

Where can you shop the health and beauty aisles, pick up some groceries and a prescription, get a flu vaccine, and weigh in on Obamacare and what digital health tools you like? Why, at one of several thousand retail stores where you can find a SoloHealth kiosk. As of yesterday afternoon, over 32 million encounters were recorded on SoloHealth kiosks, based on an app I saw on the company CEO Bart Foster’s smartphone. Kiosks are locatted around the United States in retailers including Walmart and Sam’s Clubs, along with major grocery chains like Schnuck’s and Publix, and the CVS pharmacy

The slow economy is driving slower health spending; but what will employers do?

By 2022, $1 in every $5 worth of spending in the U.S. will go to health care in some way, amounting to nearly $15,000 for each and every person in America. From biggest line item on down, health spending will go to payments to: Hospitals, representing about 32% of all spending Physicians and clinical costs, 20% of spending Prescription drugs, 9% of spending Nursing, continuing care, and home health care, together accounting for over 8% of health spending (added together for purposes of this analysis) Among other categories like personal care, durable medical equipment, and the cost of health insurance.

Food and the household health budget: one pocket, shrinking access

Over 1 in 5 people in the U.S. have not had enough money to buy food for themselves or their families in the past year, according to the August 2013 Gallup Healthways Index. This is as many consumers as those who couldn’t afford food during the deepest months of the last recession. Lack of access to food is a challenge for a cadre of Americans who lack access to other basic needs such as shelter and health care. Gallup’s Basic Access Index looks at this market basket, and has found that Americans’ access to basic needs at 81.4 in August

Consumers don’t get as much satisfaction with high-deductible health plans

Since the advent of the so-called consumer-directed health care era in the mid-2000s, there’s been a love-gap between health plan members of traditional plans, living in Health Plan World 1.0, and people enrolled in newer consumer-driven plans – high-deductible health plans (HDHPs) and consumer-directed health plans (CDHPs). That gap in plan satisfaction continues, according to the Employee Benefits Research Institute (EBRI)’s poll of Americans’ consumer engagement in health care. The survey was conducted with the Commonwealth Fund. As the bar chart illustrates, some 62% of members in traditional plans were satisfied (very or extremely) with their health insurance in 2012.

Criticizing health reform has jumped the shark for mainstream Americans

You might see potato and I might see po-tah-to when looking at the Affordable Care Act – health reform — but it’s clear we don’t want to call the whole thing off. (Go to 1:44 seconds in this video to get my drift, thanks to the Gershwin’s). I’m talking about the latest August 2013 Kaiser Health Tracking Poll from Kaiser Family Foundation finds a health citizenry suffering ennui or a form of split personality about health reform: while many Americans don’t believe the Affordable Care Act (ACA) will help them, most don’t want Congress to de-fund it, either. Several graphs from

HSAs for Dummies: improving health insurance literacy

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans. While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time. This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes

Chief Health Officers, Women, Are In Pain

Women are the Chief Health Officers of their families and in their communities. But stress is on the rise for women. Taking an inventory on several health risks for American women in 2013 paints a picture of pain: of overdosing, caregiver burnout, health disparities, financial stress, and over-drinking. Overdosing on opioids. Opioids are strong drugs prescribed for pain management such as hydrocodone, morphine, and oxycodone. The number of opioid prescriptions grew in the U.S. by over 300% between 1999 and 2010. Deaths from prescription painkiller overdoses among women have increased more than 400% since 1999, compared to 265% among men.

Working for health care in 2013: workers’ health insurance cost burden still grows faster than wages

Insurance premium costs grew 4% for families between 2012 and 2013, with workers now bearing 39% of health premiums in 2013 compared with only 26% ten years ago, in 2003. That’s a 50% increase in health plan premium “burden” for working families, by my calculation. This snapshot of health insurance in 2013 comes to us from the 2013 Employer Health Benefits Survey, provided by the Kaiser Family Foundation (KFF) and the Health Research & Educational Trust (HRET). This research is one of the most important annual reports to hit the health care industry every year, and this year’s analysis provides strategic context

Americans’ health insurance illiteracy epidemic – simpler is better

Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week. The study was done by a multidisciplinary, diverse team of researchers led by one of my favorite health economists, George Loewenstein from Carnegie Mellon, complemented by colleagues from Humana, University of Pennsylvania, Stanford, and Yale, among other research institutions. Most people do not understand how traditional health plans work: the kind that have been available on the market for over a decade. See the chart, which summarizes top-line findings: nearly all consumers believe they understand what maximum out-of-pocket costs are, but only one-half do.

The health care automat – Help Yourself to healthcare via online marketplaces

Imagine walking into a storefront where you can shop for an arthroscopy procedure, mammogram, or appointment with a primary care doctor based on price, availability, quality, and other consumers’ opinions? Welcome to the “health care automat,” the online healthcare marketplace. This is a separate concept from the new Health Insurance Marketplace, or Exchange. This emerging way to shop for and access health care services is explored in my latest paper for the California HealthCare Foundation (CHCF), Help Yourself: The Rise of Online Healthcare Marketplaces. What’s driving this new wrinkle in retail health care are: U.S. health citizens morphing into consumers,

10 Reasons Why ObamaCare is Good for US

When Secretary Sebelius calls, I listen. It’s a sort of “Help Wanted” ad from the Secretary of Health and Human Services Kathleen Sebelius that prompted me to write this post. The Secretary called for female bloggers to talk about the benefits of The Affordable Care Act last week when she spoke in Chicago at the BlogHer conference. Secretary Sebelius’s request was discussed in this story from the Associated Press published July 25, 2013. “I bet you more people could tell you the name of the new prince of England than could tell you that the health market opens October 1st,” the

The promise of ObamaCare isn’t comforting Americans worrying about money and health in 2013

In June 2013, even though news about the economy and jobs is more positive and ObamaCare’s promise of health insurance for the uninsured will soon kick in, most Americans are concerned about (1) money and (2) the costs of health care. The Kaiser Health Tracking poll of June 2013 paints an America worried about personal finances and health, and pretty clueless about health reform – in particular, the advent of health insurance exchanges. Among the 25% of people who have seen media coverage about the Affordable Care Act (alternatively referred to broadly as “health reform” or specifically as “ObamaCare”), 3

As health cost increases moderate, consumers will pay more: will they seek less expensive care?

While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960. That’s due to “the imperative to do more with less has paved the way for a true transformation of the

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

Consumer-directed health isn’t always so healthy

Giving health consumers more skin in the game doesn’t always lead to them making sound health decisions. Over four years in consumer-directed health plans, enrollees used one-quarter fewer visits to doctors every year and filled one fewer prescription drugs. CDHP members also received fewer recommended cancer screenings, and visited the emergency room more often. These rational health consumer theory-busting findings were published in the June 2013 issue of the Health Affairs article, Consumer-Directed Health Plans Reduce The Long-Term Use of Outpatient Physician Visits And Prescription Drugs by Paul Fronstin of the Employee Benefit Research Institute and colleagues from IBM and RxEconomics,

The importance of being banked for getting health insurance

While having money in the bank is always a prescription for feeling well, having a bank account is a precursor to getting health insurance under the Affordable Care Act. That fact could prevent millions of people who are eligible for health insurance premium subsidies under health reform from enrolling in a health plan. The issue of banking the un-banked in health is a little talked-about detail that, if overlooked, will scuttle the best-laid plans for health reform. That’s because if people enroll in health insurance, their monthly premiums will need to be debited from a bank account. So, without a

The health and wellness gap between insured and uninsured people

If you have health insurance, chances are you take several actions to bolster your health such as take vitamins and supplements (which 2 in 3 American adults do), take medications as prescribed (done by 58% of insured people), and tried to improve your eating habits in the past two years (56%). Most people with insurance also say they exercise at least 3 times a week. Fewer people who are uninsured undertake these kinds of health behaviors: across-the-board, uninsured people tend toward healthy behaviors less than those with insurance. This is The Prevention Problem, gleaned from a survey conducted by TeleVox

Health care costs for a family of 4 in 2013: a college education, a diamond or a 4-door sedan

If you have $22,030 in your wallet, you can buy: A princess-cut diamond A Ford Focus 4-door A year’s tuition at James Madison University (in-state, 2013-14) A health plan for a family of four. The 2013 Milliman Medical Index gauges the annual health care costs for a typical American family at $22,030, up $1,302 from 2012 — a 6.3% increase, nearly 6x the all-items increase of 1.1% for the U.S. Consumer Price Index from April 2012-April 2013. That 1.1% includes the costs of food and energy, along with cars, tobacco, shelter, and other consumer goods. In 2013, the average family will

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

The health/wealth disconnect in America

Two in 3 Americans are uncomfortable with their financial situation. And most are totally oblivious to how much money they will need to spend on health care in the future. Seven in 10 people expect to spend less than 10% of their monthly retirement income on medical and dental expenses; but the real number is 30% of income needed for health care in retirement, according to The Urban Institute. The Wellness for Life survey, conducted for Aviva, the life and disability company, collaborating with the Mayo Clinic, finds an American health citizen out of touch with their personal health economics.

Americans feeling more financially insecure

One in three workers does not feel financially secure. The proportion of Americans who feel “not at all secure” grew to 16% from 12% between 2011 and 2012, based on the question, “When it comes to paying your bills and keeping up with living expenses, how financially secure do you feel these days?” Women are much more likely than men to feel financially insecure, representing a 33% growth rate in financial insecurity. These sobering financial statistics come to us from the UNUM study, 2012 Employee Education and Enrollment Survey: Employee Perspectives on Financial Security, published May 8, 2013. Based on the question asked – paying

Un-directed Americans in a consumer-directed healthcare world

U.S. employers have been implementing various flavors of consumer-directed health plans for the better part of a decade. But consumers feel neither “directed” nor especially competent in managing their way through these plans. It appears that employers also have their own sort of health plan illiteracy when it comes to understanding health reform — the Affordable Care Act — according to the 2013 Aflac WorkForces Report (AWR) based on a survey of 1,900 benefits managers and over 5,200 U.S. workers conducted in January 2013. While you might know the Aflac Duck, you may not be aware that Aflac is the

The Slow Economy Has Slowed Health Spending

Why has health cost growth in the U.S. slowed in the past few years? It’s mostly due to the economy, argues the Kaiser Family Foundation in Assessing the Effects of the Economy on the Recent Slowdown of Health Spending. The answer to this question is important because, as the American economy recovers, it begs the next question: will costs increase faster once again as they did in previous go-go U.S. economies, further exacerbating the budget deficit problems in the long-term? KFF worked with Altarum to develop an economic model to answer these questions. The chart illustrates the predicted vs. actual

US Health Executives Predict the ACA Will Increase Health Insurance Premiums

As a result of implementing the Affordable Care Act (health reform), most U.S. health executives crystal balls foresee health care insurance premiums will increase over 10% in the next three years. 4 in 10 predict premiums will grow over 25% over the next 3 years. This sobering forecast comes out of a Munich RE Health survey conducted among 326 health industry executives in March 2013. Those polled included representatives from health plans, managed care, disease management firms, and health insurance brokers and agents. How do health execs expect employers would deal with such fast-rising health premium costs? Why shift more

The need for a Zagat and TripAdvisor in health care

Patient satisfaction survey scores have begun to directly impact Medicare payment for health providers. Health plan members are morphing into health consumers spending “real money” in high-deductible health plans. Newly-diagnosed patients with chronic conditions look online for information to sort out whether a generic drug is equivalent to a branded Rx that costs five-times the out-of-pocket cost of the cheaper substitute. While health care report cards have been around for many years, consumers’ need to get their arms around relevant and accessible information on quality and value is driving a new market for a Yelp, Travelocity, or Zagat in

U.S. Health Costs vs. The World: Is It Still The Prices, and Are We Still Stupid?

Comparing health care prices in the U.S. with those in other developed countries is an exercise in sticker shock. The cost of a hospital day in the U.S. was, on average, $4,287 in 2012. It was $853 in France, a nation often lauded for its excellent health system and patient outcomes but with a health system that’s financially strapped. A routine office visit to a doctor cost an average of $95 in the U.S. in 2012. The same visit was priced at $30 in Canada and $30 in France, as well. A hip replacement cost $40,364 on average in the

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

Most consumers will look to health insurance exchanges to buy individual plans in 2013

As the Affordable Care Act, health reform, aka Obamacare, rolls out in 2013, American health insurance shoppers will look for sources of information they can trust on health plan quality and customer service satisfaction — as they do for automobiles, mobile phone plans, and washing machines. For many years, one of a handful of trusted sources for such insights has been J.D. Power and Associates. J.D. Power released its 2013 Member Health Plan Study (the seventh annual survey) and found that most consumers currently enrolled in a health plan have had a choice of only “one” at the time

Arianna and Lupe and Deepak and Sanjay – will the cool factor drive mobile health adoption?

Digital health is attracting the likes of Bill Clinton, Lupe Fiasco, Deepak Chopra, Dr. Sanjay Gupta, Arianna Huffington, and numerous famous athletes who rep a growing array of activity trackers, wearable sensors, and mobile health apps. Will this diverse cadre of popular celebs drive consumer adoption of mobile health? Can a “cool factor” motivate people to try out mobile health tools that, over time, help people sustain healthy behaviors? Mobile and digital health is a fast-growing, good-news segment in the U.S. macroeconomy. The industry attracted more venture capital in 2012 than other health sectors, based on Rock Health’s analysis of the year-in-review. Digital health

Consumer health empowerment is compromised by complex information

The U.S. economy is largely built on consumer purchasing (the big “C” in the GDP* – see note, below Hot Points). Americans have universally embraced their role as consumers in virtually every aspect of life — learning to self-rely in making travel plans, stock trades, photo development, and purchasing big-dollar hard goods (like cars and washing machines). Consumers transact these activities thanks to usable tools and information that empower them to learn, compare, and execute smarter decisions. That is, in every aspect of life but in health care. While the banner of “consumerism” in health care has been flown

Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Aetna and Costco – the broker is ‘us’

Costco and Aetna announced that the Big Box retailer would expand its marketing of Aetna health insurance policies to card-carrying members in California. Costco has already been selling health insurance through stores in Arizona, Connecticut, Georgia, Illinois, Michigan, Nevada, Pennsylvania, Texas and Virginia. Later in 2013, Aetna plans will be available in Costco stores in other state markets. BTW, Costco operates stores in 42 U.S. states (as well as Canada, the UK, Taiwan, Korea, Japan, Australia, and Mexico). All together, the company serves 37 million households. The Costco Personal Health Insurance Program offers five plans, a network of health providers, and

Health reform, costs and the growing role of consumers: PwC’s tea leaves for 2013

PwC has seen the future of health care for the next year, and the crystal ball expects to see the following: Affordable Care Act implementation, with states playing lead roles The role of dual eligibles Employer’s role in health care benefits Consumers’ role in coverage Consumers’ ratings impact on health care Transforming health delivery Population health management Bring your own device Pharma’s changing value proposition The medical device industry & tax impact. In their report, Top health industry issues of 2013: picking up the pace on health reform, PwC summarizes these expectations as a “future [that] includes full implementation of

Cost-conscious health consumers are adopting personal health IT

People enrolled in consumer-directed health plans (CDHPs) and high-deductible health plans (HDHPs) are more cost-conscious than those enrolled in more traditional plans, according to Findings from the 2012 EBRI/MGA Consumer Engagement in Health Care Survey from the Employee Benefit Research Institute (EBRI), published in December 2012. The logic behind CDHPs and HDHPs is that if health plan enrollees have more “skin in the game” — that is, personal financial exposure — they’ll behave more like health “consumers.” By 2012, 36% of employers with over 500 employees offered either HRA- or HSA-eligible plans. About 15% of working age adults are enrolled

Consumerism growing in health care, says Altarum

Patients are morphing into health care consumers with growing use of technology for medical shopping and health engagement, according to a survey conducted by Altarum, the health services research organization. Virtually all (99%) of U.S. health citizens want to play a role in medical decisions about their care. However, consumers vary in just how much of that responsibility they want to assume: – 35% want to make the final decision with some input from doctors and other experts – 29% want to be completely in charge of their decisions – 28% want to make a joint decision with equal input

The U.S. health consumer is health-finance illiterate, and resistant to linking wellness to health plan costs

Two in 3 employees (62%) can’t estimate how much their employers spend on health benefits. Of those who could estimate the number (which is, on average, about $12,000 according to the 2012 Milliman Medical Index), most weren’t very confident in their guess. Some 23% calculated the monthly spend by employers was less than $500 a month — less than 50% the actual contribution. Thus, most U.S. health consumers don’t fully value the amount of cash their employers spend on their health care, according to a poll from the National Business Group on Health, Perceptions of Health Benefits in a Recovering

Consumer ambivalence about health engagement – will OOP costs nudge us to engage?

In some surveys, U.S. consumers seem primed for health engagement, liking the ability to schedule appointments with doctors online, emailing providers, and having technology at home that monitors their health status. The chart illustrates some of these stats from a 2011 survey by Intuit. However, organizations that develop quality report cards on providers and plans, and developers of mHealth apps, will point out that consumers aren’t rushing to use the quality reports or sustain use of apps: in fact, most downloaded health apps aren’t used after one try, according to PwC’s research. How do we make sense of these different

Consumer Reports becomes a resource for doctor-shopping

There’s a long-held belief among us long-time health industry analysts that Americans spend more time shopping around for cars and washing machines than for health plans and doctors. Consumer Reports is betting that’s going to change, now that Consumers Union has decided to lend its valuable, trusted brand to developing report cards on physicians, having already rated hospitals and heart surgeons. CR will call their version of the doctor’s report card Patient Experience Ratings. CR has first entered the competitive medical market of Massachusetts, and has unveiled reports on 500 primary care physicians in the state. CR worked with physician survey

Consumer trust in health care: online information trumps health plans

Trust is a precursor to health engagement. Trust impacts health outcomes such as a patient’s willingness to follow a doctor’s or health plan’s instructions. Two new studies point out that U.S. consumers don’t trust every touchpoint in the health system. Online medical information has become a trusted channel. Health plans? Not so much. Wolters Kluwer’s Health Q1 Poll on Self-Diagnosis found that consumers trust online health information to inform themselves — even for self-diagnosis. 57% of U.S. adults turn to the Internet to find answers to medical information; 25% “never” do, and 18% rarely do. Two-thirds of people say they trust

The pharmaceutical landscape for 2012 and beyond: balancing cost with care, and incentives for health behaviors

Transparency, data-based pharmacy decisions, incentivizing patient behavior, and outcomes-based payments will reshape the environment for marketing pharmaceutical drugs in and beyond 2012. Two reports published this week, from Express Scripts–Medco and PwC, explain these forces, which will severely challenge Pharma’s mood of market ennui. Express-Scripts Medco’s report on 9 Leading Trends in Rx Plan Management presents findings from a survey of 318 pharmacy benefit decision makers in public and private sector organizations. About one-half of the respondents represented smaller organizations with fewer than 5,000 employees; about 20% represented jumbo companies with over 25,000 workers. The survey was conducted in the

A health plan or a car: health insurance for a family of four exceeds $20K in 2012

The saying goes, “you pays your money and you makes your choice.” In 2012, if you have a bolus of $20,700 to spend, you can choose between a health plan for a family of four, or a sedan for the same family. That’s the calculation from the actuaries at Milliman, whose annual Milliman Medical Index is the go-to analysis on health care costs for a family of four covered by a preferred provider organization plan (PPO). While the 6.9% annual average cost increase is lower than the 7.3% in 2011, it is nonetheless, a record $1,335 real dollar increase at

$12 water and $10 premium increases: how price elasticity is contextual in health and life

A $10 increase in a health plan premium drove up to 3% of retired University of Michigan employees to leave the plan, according to a study from U-M published in Health Economics, The Price Sensitivity of Medicare Beneficiaries. The U-M researchers analyzed the behaviors of 3,182 retirees over four years, to assess the impact of price on beneficiaries’ health plan choices. During the four years, the premium contribution for retirees increased significantly. The researchers conducted this study, in part, to anticipate how Americans will respond to health insurance exchanges in 2014 as they bring health plan information to the market

The ACA won’t undermine employer-based health insurance and could help the deficit, says CBO (again)

There’s intriguing fine print in the latest CBO analysis on the impact of the Affordable Care Act (ACA) on employer-sponsored health insurance in the U.S. CBO finds there will be 3 to 5 million working Americans without employer-sponsored health insurance due to the implementation of the ACA, according to the report, CBO and JCT’s Estimates of the Effects of the Affordable Care Act (ACA) on the Number of People Obtaining Employment-Based Health Insurance. Originally, the CBO and Joint Committee on Taxation (JCT) estimated that the number of people obtaining health insurance coverage through their employer would be 3 million people lower in 2019 under

Trust in doctors breeds trust in health IT – context-setting for patient engagement, HIMSS 2012

While the vast majority of people find value in electronic health records (EHRs) — both those whose doctors currently use them and those patients whose personal health information still resides in paper-based systems — most remain concerned about their patient rights, privacy and security of that data. Making IT Meaningful: How Consumers Value and Trust Health IT, a report based on a survey from the National Partnership for Women & Families (NPWF) published in February 2012, weaves the story of an American public, keen to have their PHI digitized, but deeply concerned about their rights to access and protect that

The Trust Deficit – what does it mean for health care?

Technology, autos, food and consumer products — two-thirds of people around the globe trust these four industries the most. The least trusted sectors are media, banks and financial services. Welcome to the twelfth annual poll of the 2012 Edelman Trust Barometer, gauging global citizens’ perspectives on institutions and their trustworthiness. This survey marks the largest decline in trust in government in the 12 years the Barometer has polled peoples’ views. Interestingly, trust in government among US citizens stayed stable. The top-line finds a huge drop in global citizens’ trust in government, with a smaller decline for business. There’s an interplay

Get into the sunshine, church is out – the GAO report on health care price transparency

This morning during my still-dark-at-5:15 am walk, my iPod was motivating me to “get up offa that thing,” as James Brown was motivating me to “release the pressure.” Two minutes into the song, he urges, “Get into the sunshine, church is out.” This brought to mind a publication I’ve taken time to review from the General Accounting Office (GAO) report to the U.S. Congress, Health Care Price Transparency – Meaningful Price Information Is Difficult for Consumers to Obtain Prior to Receiving Care, published in September 2011. While employers and health plans want consumers to become more engaged in their health, a key barrier facing

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

I'm gobsmackingly happy to see my research cited in a new, landmark book from the National Academy of Medicine on

Grateful to Gregg Malkary for inviting me to join his podcast

Grateful to Gregg Malkary for inviting me to join his podcast