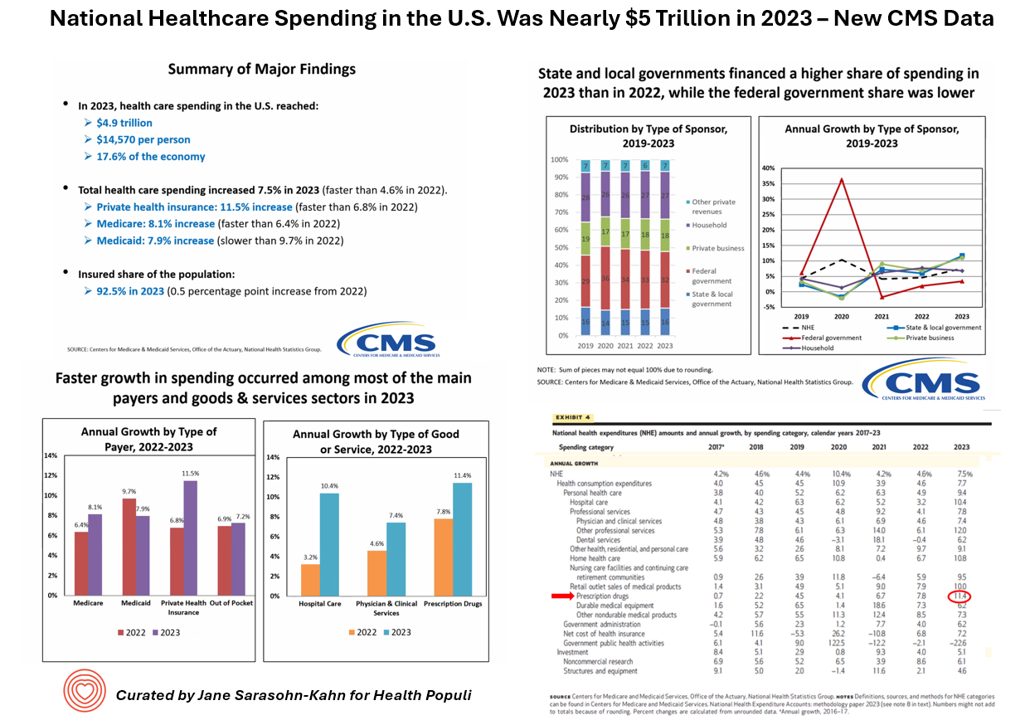

National Healthcare Spending in the U.S. Was Nearly $5 Trillion (with a “T”) in 2023 – New Data from CMS

What would $5 trillion be valued around the world or on the stock market? The economy of Germany was gauged around $5 trillion in 2024. India could be the world’s 3rd largest economy by 2026 valued at $5 trillion. Nvidia could be a $5 trillion company in 2025, as could Amazon. But today we report out the latest data from the Centers for Medicare and Medicaid Services (CMS) that national health spending in America reached $4.9 trillion in 2023. The full report on national health expenditures (NHE) in the U.S. was published today in Health Affairs, which came off embargo

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

Come Together – A Health Policy Prescription from the Bipartisan Policy Center

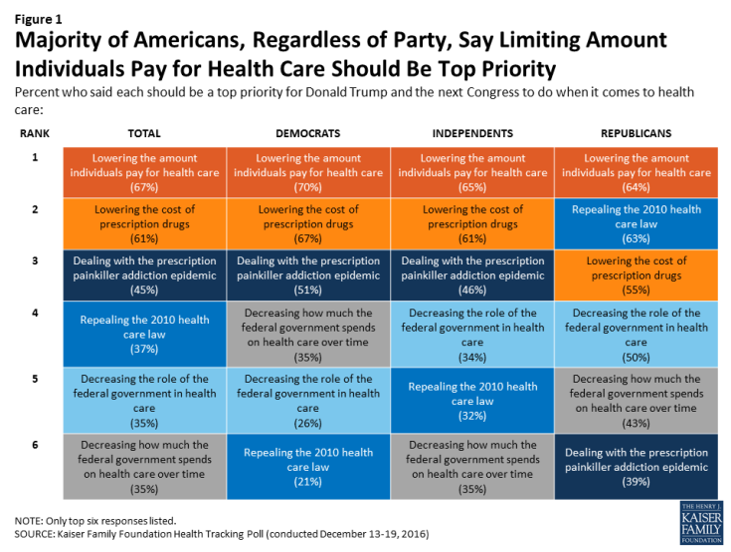

Among all Americans, the most popular approach for improving the health care in the U.S. isn’t repealing or replacing the Affordable Care Act or moving to a Medicare-for-All government-provided plan. It would be to improve the current health care system, according to the Bipartisan Policy Center’s research reported in a Bipartisan Rx for America’s Health Care. The BPC is a truly bipartisan organization, co-founded by Former Democratic Senate Majority Leaders Tom Daschle and George Mitchell, and Former Republican Senate Majority Leaders Howard Baker and Bob Dole. While this political week in America has revealed deep chasms between the Dems and

The Link Between Wellness & Wealth Is Powerful for Everyone – and Especially Women

In the U.S., the link between wellness and wealth, money and health, is strong and common across people, young and old. But the impacts of money on health, well-being, and life choices varies across the ages, based on a study from Lively, a company that builds platforms for health savings accounts. The first chart illustrates that health care costs challenge people in many ways: the most obvious health care cost problems prevent people from saving more for retirement or paying down debt. Eight in 10 Americans concur that rising health care costs challenge their ability to save for retirement. Beyond the

Americans’ Financial Anxiety Ties to Personal Cash Flow and Health Care

“The Dow Jones Industrial Average was on the brink of claiming a thousand-point milestone for the first time since January 2018, ending the longest period without crossing such a psychologically significant level since the blue-chip benchmark crossed the 19,000 threshold three weeks after Donald Trump was elected president in November 2016,” Mark DeCambre of MarketWatch wrote yesterday morning. He noted that President Trump, “tweeted a simple call-out to the intraday record: ‘Dow just hit 27,000 for first time EVER!'” clipped here from Twitter. Indeed, the U.S. macro-economy has nearly full employment and the stock market hit a high mark this

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

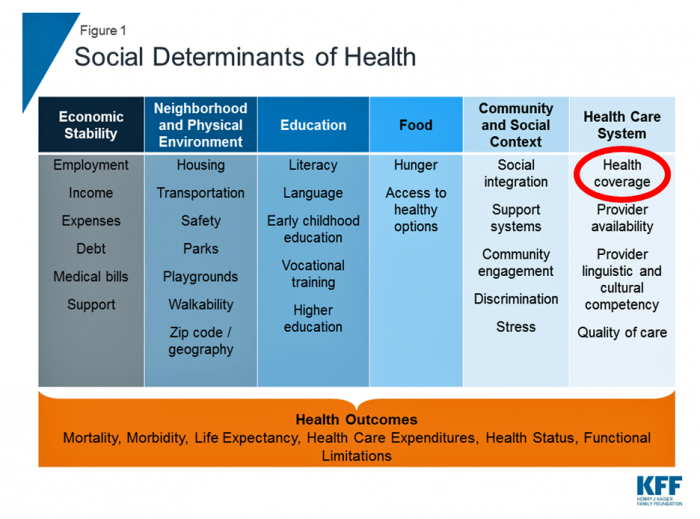

Having Health Insurance Is A Social Determinant of Health

Health insurance was on the collective minds of American voters in the 2018 midterm elections. Health care, broadly defined, drove many people to the polls voting with feet and ballots to protect their access to a health plan covering a pre-existing condition or to protest the cost of expensive prescription drugs. These were the two top health care issues among voters in late 2018, a Kaiser Family Foundation poll at the time assessed. Yesterday, President Trump verbally re-branded the Republican Party as “the party of healthcare.” That Presidential pronouncement was tied to a letter written on U.S. Department of Justice

Patients, Health Consumers, People, Citizens: Who Are We In America?

“Patients as Consumers” is the theme of the Health Affairs issue for March 2019. Research published in this trustworthy health policy publication covers a wide range of perspectives, including the promise of patients’ engagement with data to drive health outcomes, citizen science and participatory research where patients crowdsource cures, the results of financial incentives in value-based plans to drive health care “shopping” and decision making, and ultimately, whether the concept of patients-as-consumers is useful or even appropriate. Health care consumerism is a central focus in my work, and so it’s no surprise that I’ve consumed every bit of this publication. [In

Costs, Consumerism, Cyber and Care, Everywhere – The 2019 Health Populi TrendCast

Today is Boxing Day and St. Stephens Day for people who celebrate Christmas, so I share this post as a holiday gift with well-wishes for you and those you love. The tea leaves have been brewing here at THINK-Health as we prepared our 2019 forecast at the convergence of consumers, health, and technology. Here’s our trend-weaving of 4 C’s for 2019: costs, consumerism, cyber and care, everywhere… Health care costs will continue to be a mainstream pocketbook issue for patients and caregivers, with consequences for payors, suppliers and ultimately, policymakers. Legislators inside the DC Beltway will be challenged by the

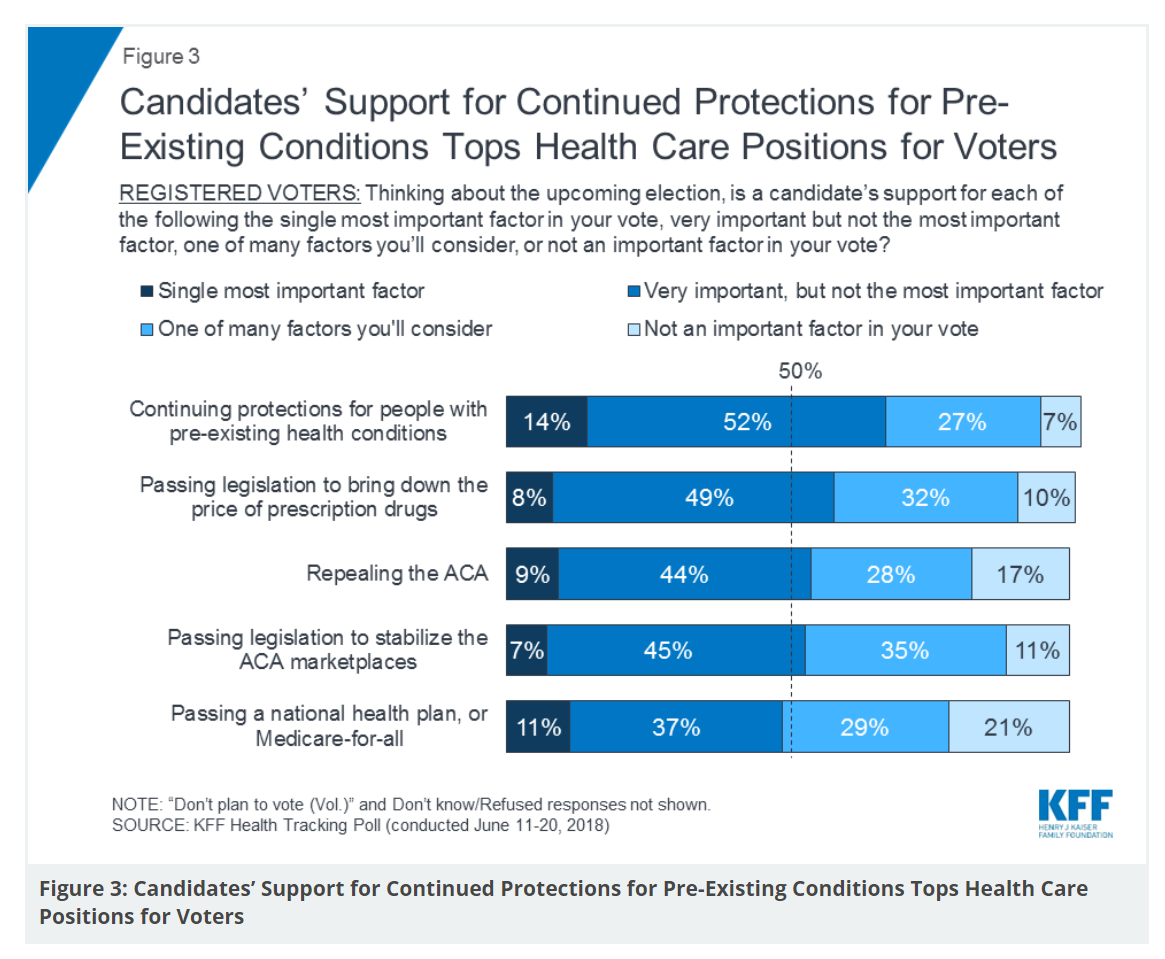

Healthcare Policies We Can Agree On: Pre-Existing Conditions, Drug Prices, and PillPack – the June 2018 KFF Health Tracking Poll

There are countless chasms in the U.S. this moment in social, political, and economic perspectives. but one issue is on the mind of most American voters where there is evidence of some agreements: health care, as evidenced in the June 2018 Health Tracking Poll from Kaiser Family Foundation. Top-line, health care is one of the most important issues that voters want addressed in the 2018 mid-term elections, tied with the economy. Immigration, gun policy, and foreign policy follow. While health care is most important to voters registered as Democrats, Republicans rank it very important. Among various specific health care factors, protecting

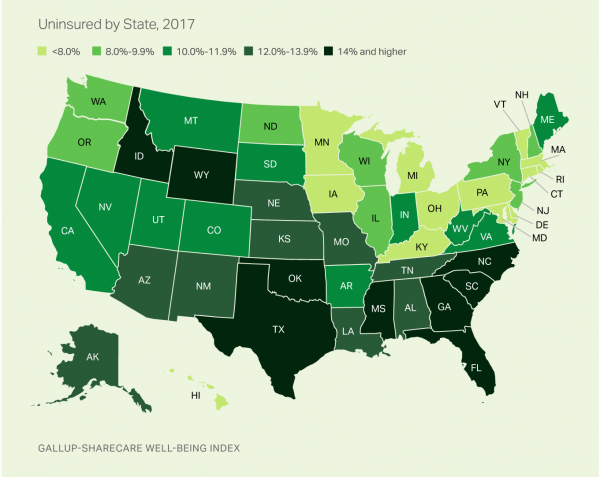

Having Health Insurance Is a Social Determinant of Health: the implications of growing uninsured in the U.S.

The rolls of the uninsured are growing in America, the latest Gallup-Sharecare Poll indicates. The U.S. uninsurance rate rose to 12.2% by the fourth quarter of 2017, up 1.3 percentage points from the year before. 2017 reversed advancements in health insurance coverage increases since the advent of the Affordable Care Act, and for the first time since 2014 no states’ uninsured rates fell. The 17 states with declines in insurance rates were Arizona, Colorado, Florida, Hawaii, Illinois, Indiana, Iowa, Missouri, New Mexico, New York, North Carolina, South Carolina, Texas, Utah, Washington, West Virginia, Wisconsin, and Wyoming. Among these, the greatest

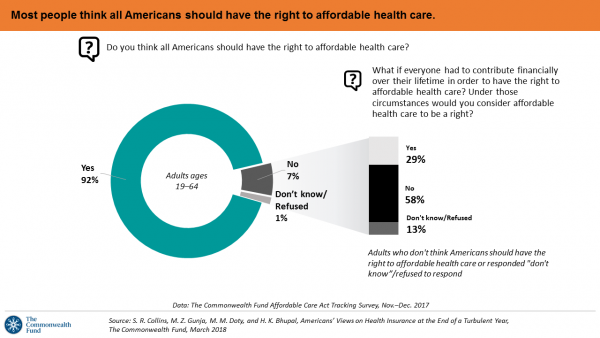

Majority Rules? The Right to Affordable Health Care is A Right for All Americans

If we’re playing a game of “majority rules,” then everyone in America would have the right to affordable health care, according to a new poll from The Commonwealth Fund. The report is aptly titled, Americans’ Views on Health Insurance at the End of a Turbulent Year. The Fund surveyed 2,410 U.S. adults, age 19 to 64, by phone in November and December 2017. This is the sixth survey conducted by the Fund to track Americans’ views of the Affordable Care Act; the first survey was fielded in mid-to-fall 2013. 9 in 10 working-age adults say “yes” indeed, my fellow Americans

Most Americans Say Healthcare is #1 Policy Issue Entering 2018

Concerns about health care are, by a large margin, the top domestic policy issue U.S. voters identified as they enter 2018. The proportion of Americans citing healthcare as the top public agenda priority grew by 50% since 2016, from 31% two years ago to 48%. Taxes rank #2 this year, garnering 31% of Americans’ concerned, followed by immigration, which has remained flat cited by about one-in-four Americans. The Associated Press (AP)-NORC Center for Public Affairs Research polled 1,444 U.S. adults 18 and over between November 30 and December 4, 2017 for this survey. While one-half of Americans would like the

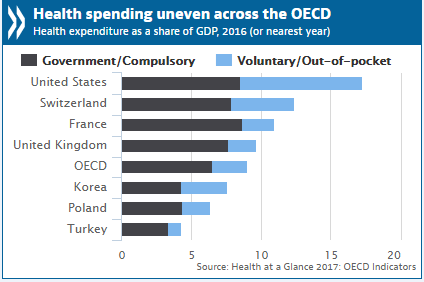

U.S. Healthcare Spending & Outcomes in Five Charts: #EpicFail in the 2017 OECD Statistics

“Spend more. Get less.” If a retailer advertised using these four words, how many consumers would buy that product or service? This is the American reality of healthcare spending in 2016, told in the OECD report, Health at a Glance 2017. I present five charts from the study in this post, which together take the current snapshot health-economic lesson for the U.S. First, look at health expenditures as a share of gross domestic product: the U.S. is number one above Switzerland, France, and the UK, and about two times the OECD average. Note, too, the proportion of out-of-pocket and so-called

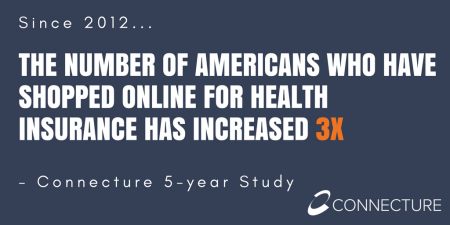

Cost and Personalization Are Key For Health Consumers Who Shop for Health Plans

Between 2012 and 2017, the number of US consumers who shopped online for health insurance grew by three times, from 14% to 42%, according to a survey from Connecture. Cost first, then “keeping my doctor,” are the two top considerations when shopping for health insurance. 71% of consumers would consider switching their doctor(s) to save on plan costs. Beyond clinician cost, health plans shoppers are also concerned with prescription drug costs in supporting their decisions. 80% of consumers would be willing to talk with their doctors about prescription drug alternatives, looking for a balance between convenience

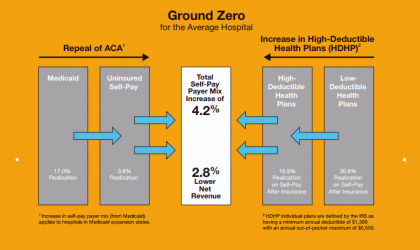

Self-Pay Healthcare Up, Hospital Revenues Down

For every 4.2% increase in a hospital’s self-pay patient population, the institution’s revenues would fall by 2.8% in Medicaid expansion states. This is based on the combination of a repeal of the Affordable Care Act and more consumers moving to high-deductible health plans. That sober metric was calculated by Crowe Horwath, published in its benchmarking report published today with a title warning that, Self-Pay Becomes Ground Zero for Hospital Margins. The “ground zero” for the average U.S. hospital is the convergence of a potential repeal of the Affordable Care Act (ACA), which could increase the number of uninsured Americans by 22 million

Costs of Healthcare Top Americans’ Financial Concerns: It’s Financial Health Matters Day

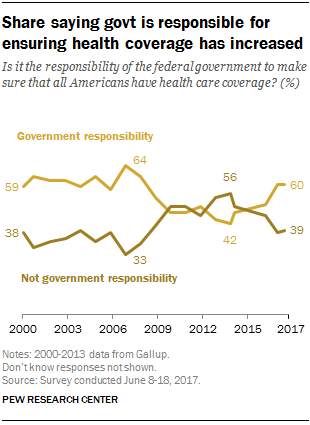

Americans are most worried about healthcare costs among all financial concerns; most people in the U.S. also believe the Federal government should ensure that all people have health coverage. Two polls published in the past week point to the fact that most U.S. health citizens are concerned about health care for themselves and their families, driving a growing proportion of people to favor a single-payer health system. The first line chart illustrates a dramatic trajectory up of the number of American identifying healthcare costs as their #1 financial problem, rising from 10% of people in 2013 to 17% in 2017.

Health Care Costs Are A Top Worry for Americans Across Political Parties

Health care costs are out-of-reach for more Americans, among both people who have insurance through the workplace or via health insurance exchanges. The first chart illustrates the growing healthcare affordability challenge for American health consumers, discussed in a data note to the Kaiser Family Foundation Health Tracking Poll in March 2017. In 2017, 43% of consumers found it difficult to meet the health care deductible before insurance would kick in 37% of consumers found it difficult to pay for the cost of health insurance each month 31% said it was difficult to pay for copayments for doctor visits and prescription drugs.

Health Care Reform: President Obama Pens Progress in JAMA

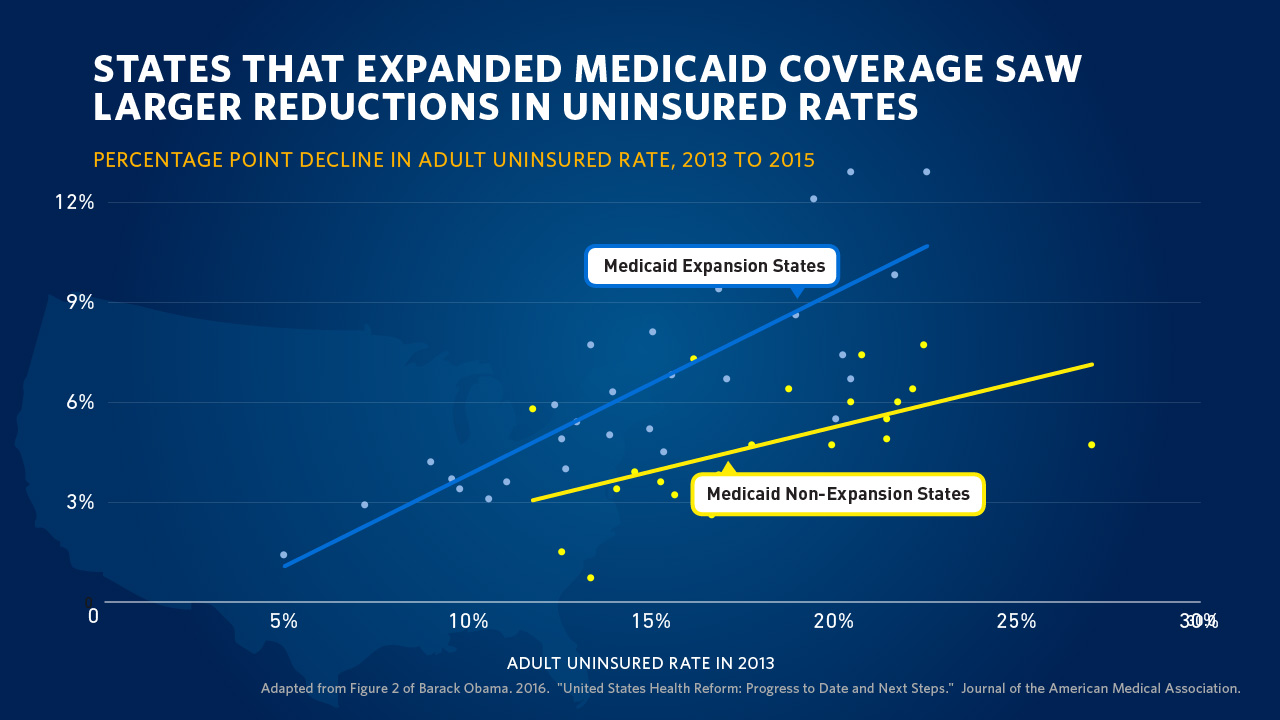

“Take Governor John Kasich’s explanation for expanding Medicaid: ‘For those that live in the shadows of life, those who are the least among us, I will not accept the fact that the most vulnerable in our state should be ignored. We can help them.’” So quotes President Barack Obama in the Journal of the American Medical Association, JAMA, in today’s online issue. #POTUS penned, United States Health Care Reform: Progress to Date and Next Steps. The author is named as “Barack Obama, JD,” a nod to the President’s legal credentials. Governor Kasich, a Republican, was one of 31 Governors who

Getting Beyond Consumer Self-Rationing in High-Deductible Health Plans

The rising cost of health care for Americans continues to contribute to self-rationing care in the forms of not filling prescriptions, postponing necessary services and tests, and avoiding needed visits to doctors. Furthermore, health care costs are threatening the livelihood of most American families, according to the Pioneer Institute. “What Will U.S. Households Pay for Health Care in the Future?” asks the title of a study by the Institute, noting that health care costs for an American family of average income could increase annually to $13,213 by 2025 — and as high as $18,251. Pioneer calculates that this forecasted spend will

Diagnosis: Acute Health Care Angst In America

There’s an overall feeling of angst about healthcare in America among both health care consumers and the people who provide care — physicians and administrators. On one thing most healthcare consumers and providers (can agree: that the U.S. health care system is on the wrong track. Another area of commonality between consumers and providers regards privacy and security of health information: while healthcare providers will continue to increase investments in digital health tools and electronic health records systems, both providers and consumers are concerned about the security of personal health information. In How We View Healthcare in America: Consumer and Provider Perspectives,

Coverage and price before brand for health plan shoppers

When Americans shop for health insurance (and they do – more, later in the post), they look most for covering major medical expenses, prescription drugs, preventive care, and price. Less important is the brand of the plan, or its high ratings. Valence Health surveyed 524 U.S. consumers in June 2015 to learn how healthcare shoppers feel about health insurance and health reform. The results are published in the report, U.S. Attitudes Toward Health Insurance and Healthcare Reform in August 2015. Key findings in the study were that: Price and coverage come before all other factors in evaluating health plans 73%

What the SCOTUS ACA ruling means for health consumers

Now that the Affordable Care Act is settled, in the eyes of the U.S. Supreme Court, what does the 6-3 ruling mean for health/care consumers living in America? I wrote the response to that question on the site of Intuit’s American Tax & Financial Center here. The top-line is that people living in Michigan, where the Federal government is running the health insurance exchange for Michiganders, and people living in New York, where the state is running the exchange, are considered equal under the ACA’s health insurance premium subsidies: health plan shoppers, whether resident New Yorkers or Michiganders, can qualify for

No relief for consumers’ healthcare costs

U.S. consumers are spending $1 in every $5 dollars in the household on health care, and personal cost curves aren’t going to bend down anytime soon. Three surveys published in April confirm my financially unwell forecast for American health citizens. Kaiser Family Foundation’s April 2015 Health Tracking Poll finds most people say health care costs or going up or holding flat, shown in the first diagram from the KFF survey. U.S. adults told KFF the top health care priorities for the President and Congress should focus on health costs, such as: Making sure high-cost drugs for chronic conditions, such as HIV,

Health = love. Care = love. Healthcare? Meh

Bruce Broussard, CEO of Humana, forgot the charger for his smartwatch on a business trip. Stopping into a consumer electronics store, he was struck by the options he faced of various wearable technologies. He ended up buying a new watch, which he uses for exercise tracking. “Technology is such an important part of the direction of health care,” Broussard told the HIMSS 2015 audience in his keynote address on 14 April 2015. But Broussard was quick to point out to the thousands of technology geeks that comprise HIMSS’s membership that improving the health/care system isn’t just about technology: “we have

Consumers trust retailers to manage health as much as health providers

40% of U.S. consumers trust Big Retail to manage their health; 39% of U.S. consumers trust healthcare providers to manage their health. What’s wrong with this picture? The first chart shows the neck-and-neck tie in the horse race for consumer trust in personal health management. The Walmart primary care clinic vs. your doctor. The grocery pharmacy vis-a-vis the hospital or chain pharmacy. Costco compared to the chiropractor. Or Apple, Google, Microsoft, Samsung or UnderArmour, because “digitally-enabled companies” are virtually tied with health providers and large retailers as responsible health care managers. Welcome to The Birth of the Healthcare Consumer according

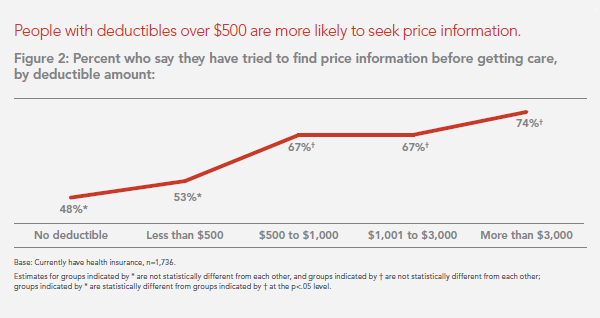

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

The Affordable Care Act As New-Business Creator

While there’s little evidence that the short-term impact of the Affordable Care Act has limited job growth or driven most employers to drop health insurance plans, the ACA has spawned a “cottage industry” of health companies since 2010, according to PwC. As the ACA turned five years of age, the PwC Health Research Institute led by Ceci Connolly identified at least 90 newcos addressing opportunities inspired by the ACA: Supporting telehealth platforms between patients and providers, such as Vivre Health Educating consumers, such as the transparency provider HealthSparq does Streamlining operations to enhance efficiency, the business of Cureate among others

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

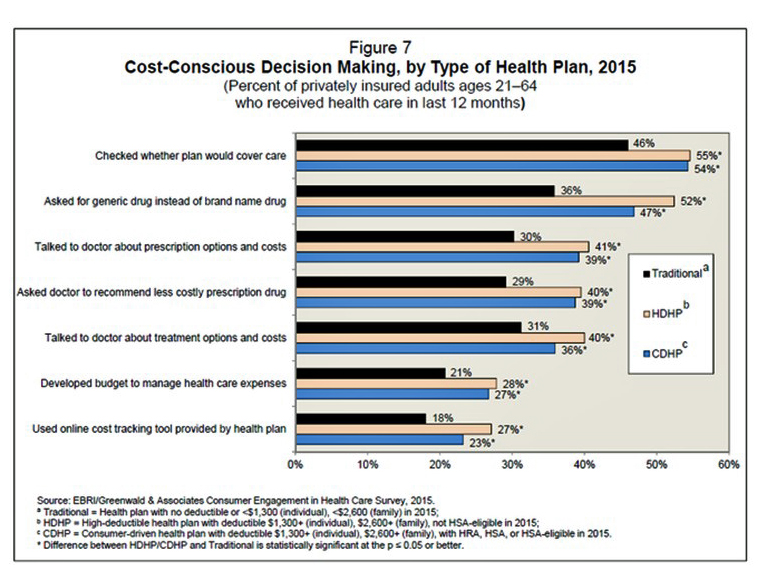

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Health IT Forecast for 2015 – Consumers Pushing for Healthcare Transformation

Doctors and hospitals live and work in a parallel universe than the consumers, patients and caregivers they serve, a prominent Chief Medical Information Officer told me last week. In one world, clinicians and health care providers continue to implement the electronic health records systems they’ve adopted over the past several years, respond to financial incentives for Meaningful Use, and re-engineering workflows to manage the business of healthcare under constrained reimbursement (read: lower payments from payors). In the other world, illustrated here by the graphic artist Sean Kane for the American Academy of Family Practice, people — patients, healthy consumers, newly insured folks,

Health care costs, access and Ebola – what’s on health care consumers’ minds

The top 3 urgent health problems facing the U.S. are closely tied for first place: affordable health care/health costs, access to health care, and the Ebola virus. While the first two issues ranked #1 and #2 one year ago, Ebola didn’t even register on the list of healthcare stresses in November 2013. Gallup polled U.S. adults on the biggest health issues facing Americans in early November 2014, and 1 in 6 people named Ebola as the nation’s top health problem, ahead of obesity, cancer, as well as health costs and insurance coverage. Gallup points out that at the time of

Health Care in the 2014 Mid-Term Election

In the November 2014 mid-term elections, Democrats tend to favor continuing the Affordable Care Act (ACA) as-is, and Republicans favor scrapping it, scaling it back, or fully replacing the law with something yet to be defined. But it’s hard to read just where the ACA will end up after tomorrow’s election, because many key battleground states are too close to call…and the two major parties have such polar views on health reform. What’s most significant this year is that those most likely to vote are less likely to vote for a congressional candidate who supports the ACA (40%) than would

$1 in $5 will go to health care in 2023 – the new health engagement is health cost engagement

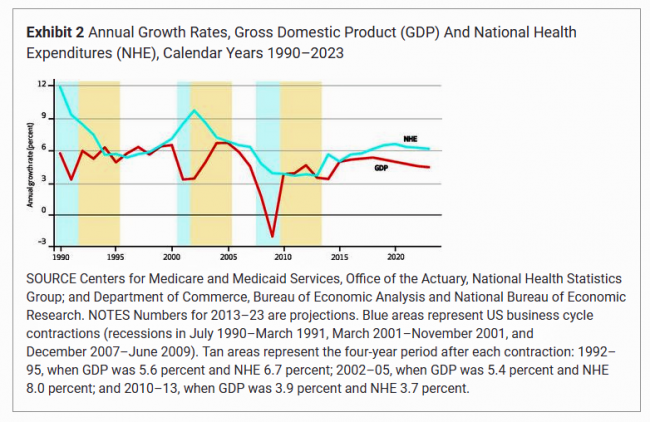

National health spending will comprise 19.3% of U.S. gross domestic product in 2023, nearly $1 in $5 of all American spending. This statistic includes the expenditure categories for health spending as defined by the Centers for Medicare and Medicaid Services (CMS), Office of the Actuary. The number includes hospital care, personal health care, professional services (physicians and other professionals), home health, long term care, retail sales of prescription drugs and durable medical equipment, and investment in capital equipment, among other line items. The forecast was published in Health Affairs article, National Health Expenditure Projections, 2013-23: Faster Growth Expected With Expanded

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

Online is to go-to place for health insurance info, but lots of uninsured people live offline

A vast majority of people shopping for a health plan on a Health Insurance Exchange for coverage in 2014 obtained information online via websites. One-half of these shoppers used only online information, and 29% combined both websites and other sources like direct assistance, informal assistance, and via (offline) media. In the Health Reform Monitoring Survey from the Urban Institute Health Policy Center, a research team, funded by the Robert Wood Johnson Foundation and the Ford Foundation, looked into data collected from the Health Reform Monitoring Survey in March 2014 at the end of the 2014 open enrollment period for the

The Milliman Medical Index at $23,215: A Toyota Prius, a tonne of tin, or health insurance for a family?

It costs $23,215 to cover a family of four for health care, according to the 2014 Milliman Medical Index (MMI), the annual gauge of healthcare costs from the actuarial firm. The growth rate of 5.4% from 2013 is the lowest annual change since Milliman launched the Index in 2002. This is equivalent to a new Toyota Prius or a tonne of tin. While employers cover most of these costs, the portion employees bear continues to increase. This year, insured workers will take on 42% of the total, or on average, $9,695. This is up by $552 over 2013, or 6%

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

Health consumers building up the U.S. economy

U.S. consumer spending on health care is boosting the nation’s economy, based on some new data points. First, health care spending grew at an annual rate of 5.6% at the end of 2013, USA Today reported. This was the fastest-growth seen in ten years, reversing the fall of health spending experienced in the wake of America’s Great Recession of 2008. Furthermore the Centers for Medicare and Medicaid Services (CMS) anticipates health spending to grow by 6.1% in 2014 with the influx of newly-insured health plan members. Healthcare was responsible for one-fourth of America’s GDP growth rate of 2.6%, which is

What, We Worry? Thinking About Healthcare (Costs) Is Stressing Us Out

Three-quarters of us are concerned about health care, a fraction fewer than those of us worried about the economy. Underneath stress about healthcare, people are worried about costs and the impact of the Affordable Care Act (ACA). Say hello to the Healthcare Worry Scale, developed by Chase Communications, a firm focused on marketing and media, largely in the health industry. Chase found that: – 93% believe that their health care costs will continue to increase – 49% say the ACA’s impact is a “major” worry – 43% say getting a disease, medical condition, or injury that health insurance doesn’t fully

Health Care Everywhere at the 2014 Consumer Electronics Show

When the head of the Consumer Electronics Association gives a shout-out to the growth of health products in his annual mega-show, attention must be paid. The #2014CES featured over 300 companies devoted to “digital health” as the CEA defines the term. But if you believe that health is where we live, work, play, and pray, then you can see health is almost everywhere at the CES, from connected home tech and smart refrigerators to autos that sense ‘sick’ air and headphones that amplify phone messages for people with hearing aids, along with pet activity tracking devices like the Petbit. If

3 Things I Know About Health Care in 2014

We who are charged with forecasting the future of health and health care live in a world of scenario planning, placing bets on certainties (what we know we know), uncertainties (what we know we don’t know), and wild cards — those phenomena that, if they happen in the real world, blow our forecasts to smithereens, forcing a tabula rasa for a new-and-improved forecast. There are many more uncertainties than certainties challenging the tea leaves for the new year, including the changing role of health insurance companies and how they will respond to the Affordable Care Act implementation and changing mandates

Supermarkets and hospitals most-trusted industries in the U.S.

See the yellow highlighted rows? That single yellow bar at the top, that’s hospitals; at the bottom, you’ll see pharma, health insurance, and managed care. Hospitals, trusted; pharma, insurance, managed care? Down south on the trust barometer with oil, tobacco, phone companies and social media. The Harris Poll has gauged U.S. consumers’ views on honesty and trustworthiness across industries for the past ten years. Over those ten years, trust in these industries has eroded, from huge falls-from-grace for banks (a 17 point fall), packaged food (falling 12 points), and computer hardware and software substantially falling, as well. Hospitals are

Health care and costs on front-burner for people in America (again)

This week in America, the concept of “health care consumer” is in a tug-of-war, and those of us trying to behave as such feel bloodied in the skirmish. One side of the tug-of-war is the obvious, post October 1st reality of the sad state of the Health Insurance Exchanges. This has been well covered in mass media, right, left and center. And Americans polled by Gallup last week express their knowledge of that fact — even if they didn’t know what Healthcare.gov was on the 1st of October. The first chart shows that health care is now a front-burner issue

America’s health care is better due to Todd Park – detractors, be careful what you wish for

In the aftermath of the snafu that was/is the failed launch of the Affordable Care Act’s Health Insurance Exchange comes, today via Reuters, an article called Obama’s tech expert becomes target over healthcare website woes. The piece, by Roberta Rampton and Sarah McBride, states that Todd Park, Chief Technology Officer at The White House, “now finds himself among a handful of officials with targets on their backs as Republicans try to root out who is responsible for this month’s glitch-ridden rollout of Healthcare.gov,” going on to say that “The White House trotted him out in July to talk up the new version”

Whither price transparency in health care? The supply side may be growing faster than consumer demand

Online shopping for health care can drive costs down, according to research conducted by HealthSparq, a company that works with health insurance companies to channel health cost information to plan members (that is, consumers). Healthsparq partnered with one of the company’s health insurance company clients to conduct this study, which demonstrated that, over two years, consumers who used an online treatment cost estimator saved money on care for hernia conditions, digestive conditions, and women’s health issues. It’s early days for health care price transparency in health care, but HealthSparq’s findings demonstrate positive evidence that when consumers are offered a tool

U.S. Health Citizens Needed a Dummies Guide to the ACA

The Affordable Care Act (ACA) was signed in March 2010; that month, 57% of U.S. adults did something to self-ration health care, such as splitting prescription pills, postponing necessary health care, and putting off recommended medical tests, according to the Kaiser Family Foundation (KFF) Health Tracking Poll of March 2010. 57% of U.S. adults are still self-rationing health care in September 2013, according to KFF’s latest Health Tracking Poll, completed among 1,503 U.S. adults just two weeks before the launch of the Health Insurance Marketplaces on October 1, 2013. As of September 2013, only 19% of U.S. adults said they had heard

Health care and survey taking at the Big Box Store

Where can you shop the health and beauty aisles, pick up some groceries and a prescription, get a flu vaccine, and weigh in on Obamacare and what digital health tools you like? Why, at one of several thousand retail stores where you can find a SoloHealth kiosk. As of yesterday afternoon, over 32 million encounters were recorded on SoloHealth kiosks, based on an app I saw on the company CEO Bart Foster’s smartphone. Kiosks are locatted around the United States in retailers including Walmart and Sam’s Clubs, along with major grocery chains like Schnuck’s and Publix, and the CVS pharmacy

The slow economy is driving slower health spending; but what will employers do?

By 2022, $1 in every $5 worth of spending in the U.S. will go to health care in some way, amounting to nearly $15,000 for each and every person in America. From biggest line item on down, health spending will go to payments to: Hospitals, representing about 32% of all spending Physicians and clinical costs, 20% of spending Prescription drugs, 9% of spending Nursing, continuing care, and home health care, together accounting for over 8% of health spending (added together for purposes of this analysis) Among other categories like personal care, durable medical equipment, and the cost of health insurance.

Food and the household health budget: one pocket, shrinking access

Over 1 in 5 people in the U.S. have not had enough money to buy food for themselves or their families in the past year, according to the August 2013 Gallup Healthways Index. This is as many consumers as those who couldn’t afford food during the deepest months of the last recession. Lack of access to food is a challenge for a cadre of Americans who lack access to other basic needs such as shelter and health care. Gallup’s Basic Access Index looks at this market basket, and has found that Americans’ access to basic needs at 81.4 in August

Consumers don’t get as much satisfaction with high-deductible health plans

Since the advent of the so-called consumer-directed health care era in the mid-2000s, there’s been a love-gap between health plan members of traditional plans, living in Health Plan World 1.0, and people enrolled in newer consumer-driven plans – high-deductible health plans (HDHPs) and consumer-directed health plans (CDHPs). That gap in plan satisfaction continues, according to the Employee Benefits Research Institute (EBRI)’s poll of Americans’ consumer engagement in health care. The survey was conducted with the Commonwealth Fund. As the bar chart illustrates, some 62% of members in traditional plans were satisfied (very or extremely) with their health insurance in 2012.

Criticizing health reform has jumped the shark for mainstream Americans

You might see potato and I might see po-tah-to when looking at the Affordable Care Act – health reform — but it’s clear we don’t want to call the whole thing off. (Go to 1:44 seconds in this video to get my drift, thanks to the Gershwin’s). I’m talking about the latest August 2013 Kaiser Health Tracking Poll from Kaiser Family Foundation finds a health citizenry suffering ennui or a form of split personality about health reform: while many Americans don’t believe the Affordable Care Act (ACA) will help them, most don’t want Congress to de-fund it, either. Several graphs from

HSAs for Dummies: improving health insurance literacy

Most Americans don’t understand what a health savings account (HSA) is – including people who are enrolled in the plans. While health literacy is generally acknowledged to be a public health challenge in America, health insurance literacy is not well recognized. Yet in the emerging consumer-directed health plan era of U.S. health care, peoples’ lack of understanding of health financial accounts will get in the way of people who really need care seeking care at the right time. This leads to greater health spending later when the consumer-patient can develop a health condition that could have been prevented (say, pre-diabetes

Chief Health Officers, Women, Are In Pain

Women are the Chief Health Officers of their families and in their communities. But stress is on the rise for women. Taking an inventory on several health risks for American women in 2013 paints a picture of pain: of overdosing, caregiver burnout, health disparities, financial stress, and over-drinking. Overdosing on opioids. Opioids are strong drugs prescribed for pain management such as hydrocodone, morphine, and oxycodone. The number of opioid prescriptions grew in the U.S. by over 300% between 1999 and 2010. Deaths from prescription painkiller overdoses among women have increased more than 400% since 1999, compared to 265% among men.

Working for health care in 2013: workers’ health insurance cost burden still grows faster than wages

Insurance premium costs grew 4% for families between 2012 and 2013, with workers now bearing 39% of health premiums in 2013 compared with only 26% ten years ago, in 2003. That’s a 50% increase in health plan premium “burden” for working families, by my calculation. This snapshot of health insurance in 2013 comes to us from the 2013 Employer Health Benefits Survey, provided by the Kaiser Family Foundation (KFF) and the Health Research & Educational Trust (HRET). This research is one of the most important annual reports to hit the health care industry every year, and this year’s analysis provides strategic context

Americans’ health insurance illiteracy epidemic – simpler is better

Consumers misunderstand health insurance, according to new research published in the Journal of Health Economics this week. The study was done by a multidisciplinary, diverse team of researchers led by one of my favorite health economists, George Loewenstein from Carnegie Mellon, complemented by colleagues from Humana, University of Pennsylvania, Stanford, and Yale, among other research institutions. Most people do not understand how traditional health plans work: the kind that have been available on the market for over a decade. See the chart, which summarizes top-line findings: nearly all consumers believe they understand what maximum out-of-pocket costs are, but only one-half do.

The health care automat – Help Yourself to healthcare via online marketplaces

Imagine walking into a storefront where you can shop for an arthroscopy procedure, mammogram, or appointment with a primary care doctor based on price, availability, quality, and other consumers’ opinions? Welcome to the “health care automat,” the online healthcare marketplace. This is a separate concept from the new Health Insurance Marketplace, or Exchange. This emerging way to shop for and access health care services is explored in my latest paper for the California HealthCare Foundation (CHCF), Help Yourself: The Rise of Online Healthcare Marketplaces. What’s driving this new wrinkle in retail health care are: U.S. health citizens morphing into consumers,

10 Reasons Why ObamaCare is Good for US

When Secretary Sebelius calls, I listen. It’s a sort of “Help Wanted” ad from the Secretary of Health and Human Services Kathleen Sebelius that prompted me to write this post. The Secretary called for female bloggers to talk about the benefits of The Affordable Care Act last week when she spoke in Chicago at the BlogHer conference. Secretary Sebelius’s request was discussed in this story from the Associated Press published July 25, 2013. “I bet you more people could tell you the name of the new prince of England than could tell you that the health market opens October 1st,” the

The promise of ObamaCare isn’t comforting Americans worrying about money and health in 2013

In June 2013, even though news about the economy and jobs is more positive and ObamaCare’s promise of health insurance for the uninsured will soon kick in, most Americans are concerned about (1) money and (2) the costs of health care. The Kaiser Health Tracking poll of June 2013 paints an America worried about personal finances and health, and pretty clueless about health reform – in particular, the advent of health insurance exchanges. Among the 25% of people who have seen media coverage about the Affordable Care Act (alternatively referred to broadly as “health reform” or specifically as “ObamaCare”), 3

As health cost increases moderate, consumers will pay more: will they seek less expensive care?

While there is big uncertainty about how health reform will roll out in 2014, and who will opt into the new (and improved?) system, health cost growth will slow to 6.5% signalling a trend of moderating medical costs in America. Even though more newly-insured people may seek care in 2014, the costs per “unit” (visit, pill, therapy encounter) should stay fairly level – at some of the lowest levels since the U.S. started to gauge national health spending in 1960. That’s due to “the imperative to do more with less has paved the way for a true transformation of the

As Account-Based Health Plans Grow, Will Americans Save More in Health Accounts?

The only type of health plan whose membership grew in 2012 was the consumer-directed health plan (CDHP), according to a survey from Mercer, the benefits advisors. Two-thirds of large employers expect to offer CDHPs by 2018, five years from now. 40% of all employers (small and large) anticipate offering a CDHP in five years. The growth in CDHPs going forward will be increasingly motivated by the impending “Cadillac tax” that will be levied on companies that currently offer relatively rich health benefits. Furthermore, Mercer foresees that employers will also expand wellness and health management programs with the goal of reducing health

Consumer-directed health isn’t always so healthy

Giving health consumers more skin in the game doesn’t always lead to them making sound health decisions. Over four years in consumer-directed health plans, enrollees used one-quarter fewer visits to doctors every year and filled one fewer prescription drugs. CDHP members also received fewer recommended cancer screenings, and visited the emergency room more often. These rational health consumer theory-busting findings were published in the June 2013 issue of the Health Affairs article, Consumer-Directed Health Plans Reduce The Long-Term Use of Outpatient Physician Visits And Prescription Drugs by Paul Fronstin of the Employee Benefit Research Institute and colleagues from IBM and RxEconomics,

The importance of being banked for getting health insurance

While having money in the bank is always a prescription for feeling well, having a bank account is a precursor to getting health insurance under the Affordable Care Act. That fact could prevent millions of people who are eligible for health insurance premium subsidies under health reform from enrolling in a health plan. The issue of banking the un-banked in health is a little talked-about detail that, if overlooked, will scuttle the best-laid plans for health reform. That’s because if people enroll in health insurance, their monthly premiums will need to be debited from a bank account. So, without a

The health and wellness gap between insured and uninsured people

If you have health insurance, chances are you take several actions to bolster your health such as take vitamins and supplements (which 2 in 3 American adults do), take medications as prescribed (done by 58% of insured people), and tried to improve your eating habits in the past two years (56%). Most people with insurance also say they exercise at least 3 times a week. Fewer people who are uninsured undertake these kinds of health behaviors: across-the-board, uninsured people tend toward healthy behaviors less than those with insurance. This is The Prevention Problem, gleaned from a survey conducted by TeleVox

Health care costs for a family of 4 in 2013: a college education, a diamond or a 4-door sedan

If you have $22,030 in your wallet, you can buy: A princess-cut diamond A Ford Focus 4-door A year’s tuition at James Madison University (in-state, 2013-14) A health plan for a family of four. The 2013 Milliman Medical Index gauges the annual health care costs for a typical American family at $22,030, up $1,302 from 2012 — a 6.3% increase, nearly 6x the all-items increase of 1.1% for the U.S. Consumer Price Index from April 2012-April 2013. That 1.1% includes the costs of food and energy, along with cars, tobacco, shelter, and other consumer goods. In 2013, the average family will

Most employers will provide health insurance benefits in 2014…with more costs for employees

Nearly 100% of employers are likely to continue to provide health insurance benefits to workers in 2014, moving beyond a “wait and see” approach to the Affordable Care Act (ACA). As firms strategize tactics for a post-ACA world, nearly 40% will increase emphasis on high-deductible health plans with a health savings account, 43% will increase participants’ share of premium costs, and 33% will increase in-network deductibles for plan members. Two-thirds of U.S. companies have analyzed the ACA’s cost impact on their businesses but need to know more, according to the 2013 survey from the International Foundation of Employee Benefit Plans (IFEBP).

The health/wealth disconnect in America

Two in 3 Americans are uncomfortable with their financial situation. And most are totally oblivious to how much money they will need to spend on health care in the future. Seven in 10 people expect to spend less than 10% of their monthly retirement income on medical and dental expenses; but the real number is 30% of income needed for health care in retirement, according to The Urban Institute. The Wellness for Life survey, conducted for Aviva, the life and disability company, collaborating with the Mayo Clinic, finds an American health citizen out of touch with their personal health economics.

Americans feeling more financially insecure

One in three workers does not feel financially secure. The proportion of Americans who feel “not at all secure” grew to 16% from 12% between 2011 and 2012, based on the question, “When it comes to paying your bills and keeping up with living expenses, how financially secure do you feel these days?” Women are much more likely than men to feel financially insecure, representing a 33% growth rate in financial insecurity. These sobering financial statistics come to us from the UNUM study, 2012 Employee Education and Enrollment Survey: Employee Perspectives on Financial Security, published May 8, 2013. Based on the question asked – paying

Un-directed Americans in a consumer-directed healthcare world

U.S. employers have been implementing various flavors of consumer-directed health plans for the better part of a decade. But consumers feel neither “directed” nor especially competent in managing their way through these plans. It appears that employers also have their own sort of health plan illiteracy when it comes to understanding health reform — the Affordable Care Act — according to the 2013 Aflac WorkForces Report (AWR) based on a survey of 1,900 benefits managers and over 5,200 U.S. workers conducted in January 2013. While you might know the Aflac Duck, you may not be aware that Aflac is the

The Slow Economy Has Slowed Health Spending

Why has health cost growth in the U.S. slowed in the past few years? It’s mostly due to the economy, argues the Kaiser Family Foundation in Assessing the Effects of the Economy on the Recent Slowdown of Health Spending. The answer to this question is important because, as the American economy recovers, it begs the next question: will costs increase faster once again as they did in previous go-go U.S. economies, further exacerbating the budget deficit problems in the long-term? KFF worked with Altarum to develop an economic model to answer these questions. The chart illustrates the predicted vs. actual

US Health Executives Predict the ACA Will Increase Health Insurance Premiums

As a result of implementing the Affordable Care Act (health reform), most U.S. health executives crystal balls foresee health care insurance premiums will increase over 10% in the next three years. 4 in 10 predict premiums will grow over 25% over the next 3 years. This sobering forecast comes out of a Munich RE Health survey conducted among 326 health industry executives in March 2013. Those polled included representatives from health plans, managed care, disease management firms, and health insurance brokers and agents. How do health execs expect employers would deal with such fast-rising health premium costs? Why shift more

The need for a Zagat and TripAdvisor in health care

Patient satisfaction survey scores have begun to directly impact Medicare payment for health providers. Health plan members are morphing into health consumers spending “real money” in high-deductible health plans. Newly-diagnosed patients with chronic conditions look online for information to sort out whether a generic drug is equivalent to a branded Rx that costs five-times the out-of-pocket cost of the cheaper substitute. While health care report cards have been around for many years, consumers’ need to get their arms around relevant and accessible information on quality and value is driving a new market for a Yelp, Travelocity, or Zagat in

U.S. Health Costs vs. The World: Is It Still The Prices, and Are We Still Stupid?

Comparing health care prices in the U.S. with those in other developed countries is an exercise in sticker shock. The cost of a hospital day in the U.S. was, on average, $4,287 in 2012. It was $853 in France, a nation often lauded for its excellent health system and patient outcomes but with a health system that’s financially strapped. A routine office visit to a doctor cost an average of $95 in the U.S. in 2012. The same visit was priced at $30 in Canada and $30 in France, as well. A hip replacement cost $40,364 on average in the

The Not-So-Affordable Care Act? Cost-squeezed Americans still confused and need to know more

While health care cost growth has slowed nationally, most Americans feel they’re going up faster than usual. 1 in 3 people believe their own health costs have gone up faster than usual, and 1 in 4 feel they’re going out about “the same amount” as usual. For only one-third, health costs feel like they’re staying even. As the second quarter of 2013 begins and the implementation of the Affordable Care Act (ACA, aka “health reform” and “Obamacare”) looms nearer, most Americans still don’t understand how the ACA will impact them. Most Americans (57%) believe the law will create a government-run health plan,

Most consumers will look to health insurance exchanges to buy individual plans in 2013

As the Affordable Care Act, health reform, aka Obamacare, rolls out in 2013, American health insurance shoppers will look for sources of information they can trust on health plan quality and customer service satisfaction — as they do for automobiles, mobile phone plans, and washing machines. For many years, one of a handful of trusted sources for such insights has been J.D. Power and Associates. J.D. Power released its 2013 Member Health Plan Study (the seventh annual survey) and found that most consumers currently enrolled in a health plan have had a choice of only “one” at the time

Arianna and Lupe and Deepak and Sanjay – will the cool factor drive mobile health adoption?

Digital health is attracting the likes of Bill Clinton, Lupe Fiasco, Deepak Chopra, Dr. Sanjay Gupta, Arianna Huffington, and numerous famous athletes who rep a growing array of activity trackers, wearable sensors, and mobile health apps. Will this diverse cadre of popular celebs drive consumer adoption of mobile health? Can a “cool factor” motivate people to try out mobile health tools that, over time, help people sustain healthy behaviors? Mobile and digital health is a fast-growing, good-news segment in the U.S. macroeconomy. The industry attracted more venture capital in 2012 than other health sectors, based on Rock Health’s analysis of the year-in-review. Digital health

Consumer health empowerment is compromised by complex information

The U.S. economy is largely built on consumer purchasing (the big “C” in the GDP* – see note, below Hot Points). Americans have universally embraced their role as consumers in virtually every aspect of life — learning to self-rely in making travel plans, stock trades, photo development, and purchasing big-dollar hard goods (like cars and washing machines). Consumers transact these activities thanks to usable tools and information that empower them to learn, compare, and execute smarter decisions. That is, in every aspect of life but in health care. While the banner of “consumerism” in health care has been flown

Butter over guns in the minds of Americans when it comes to deficit cutting

Americans have a clear message for the 113th Congress: I want my MTV, but I want my Medicare, Medicaid, Social Security, health insurance subsidies, and public schools. These budget-saving priorities are detailed in The Public’s Health Care Agenda for the 113th Congress, conducted by the Kaiser Family Foundation, Robert Wood Johnson Foundation, and the Harvard School of Public Health, published in January 2013. The poll found that a majority of Americans placed creating health insurance exchanges/marketplaces at top priority, compared with other health priorities at the state level. More people support rather than oppose Medicaid expansion, heavily weighted toward 75%

Thank you FeedSpot for

Thank you FeedSpot for