The Cost to Cover Health Insurance for a Family in America Is $22,221

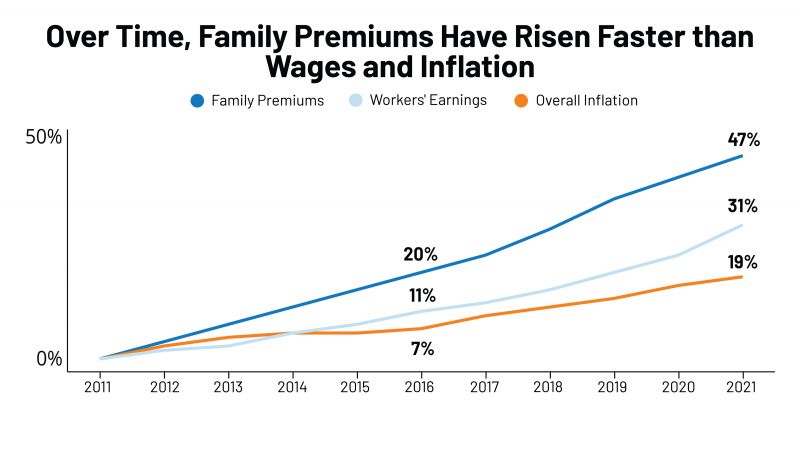

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages. That family health plan premium reached $22,221, an increase of 22% since 2016, we learn in the annual report from Kaiser Family Foundation, 2021 Employer Health Benefits Survey. This report is our go-to encyclopedia of statistics on health insurance year-after-year, surveying companies’ annual health insurance strategies for coverage and tactics for managing spending and workers’ health outcomes. This 2021 update takes into account the impacts and influence of COVID-19 on workers’

How Healthcare Experience Ranks Versus Other Industries (Not So Great)

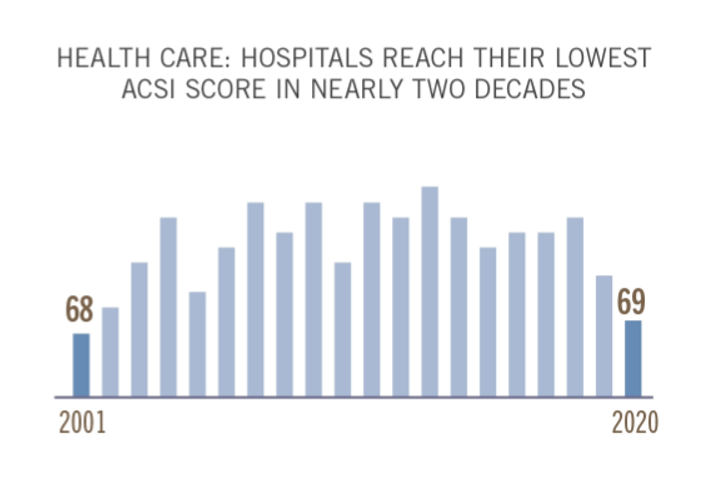

The coronavirus pandemic put health care at the top of peoples’ minds all over the world. As important as health became to humans at the base of our Hierachies of Needs, in the U.S., health care industries fell to their lowest consumer satisfaction scores in two decades, we learn in the latest evaluation by the American Consumer Satisfaction Index report. I explore consumer-patient experience for hospitals, health plans and ambulatory care compared with other industries in the November 2021 Medecision Liberation blog, calling out the importance of two key factors that drove peoples’ positive perceptions of brands and products in

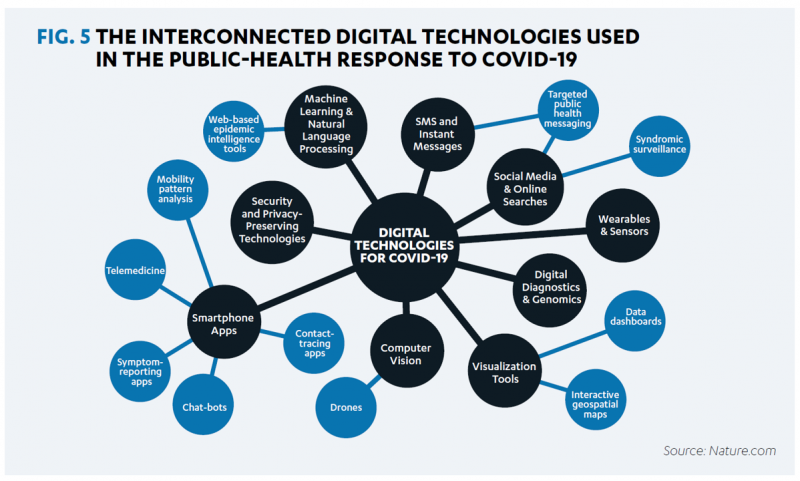

Designing Digital Health for Public Health Preparedness and Equity: the Consumer Tech Association Doubles Down

A coalition of health care providers, health plans, technology innovators, NGOs, and medical societies has come together as the Public Health Tech Initiative (PHTI), endorsed by the Consumer Technology Association (CTA) with the goal of advancing the use of trustworthy digital health to proactively meet the challenge of future public health emergencies….like pandemics. At the same time, CTA has published a paper on Advancing Health Equity Through Technology which complements and reinforces the PHTI announcement and objective. The paper that details the PHTI program, Using Heath Technology to Response to Public Health Emergencies, identifies the two focus areas: Digital health

Still Struggling with Stress in America in 2021

“Americans remain in limbo between lives once lived and whatever the post-pandemic future holds,” the American Psychological Association observes in their latest read into Stress in America 2021, with this phase of the perennial study focused on Stress and Decision-Making During the Pandemic. The top-line: people face a daily web of risk assessment, up-ended routines, and endless news about the coronavirus locally and globally. While most people in the U.S. believe that “everything will work out” after the pandemic ends, the mental, emotional, and logistical daily distance between “now” and “then” brings uncertainty and indeed, prolonged stress. More Millennials, who

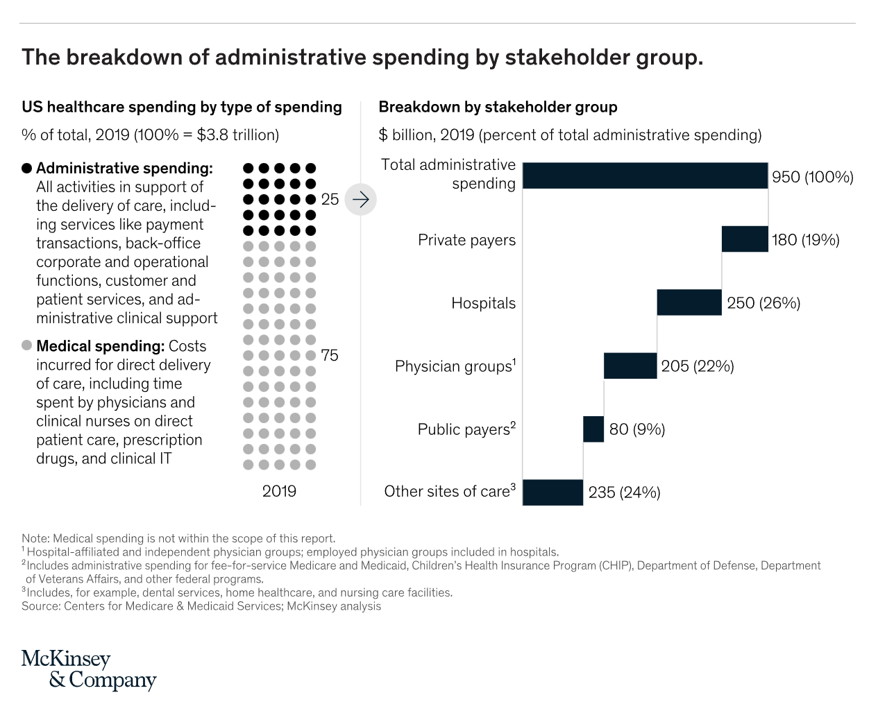

“Complexity is Profitable” in U.S. Healthcare – How to Save a Quarter-Trillion Dollars

In the U.S., “Health care is complicated because complexity is profitable.” So explain Bob Kocher, MD, and Anuraag Chigurupati, in a viewpoint on Economic Incentives for Administrative Simplification, published this week in JAMA. Dr. Kocher, a physician who is a venture capitalist, and Chigurupati, head of member experience at Devoted Health, explain the misaligned incentives that impede progress in reducing administrative spending. This essay joins two others in the October 20, 2021 issue of JAMA which highlight administrative spending in American health care: Administrative Simplification and the Potential for Saving a Quarter-Trillion Dollars in Health Care by Nikhil Sahni, Brandon

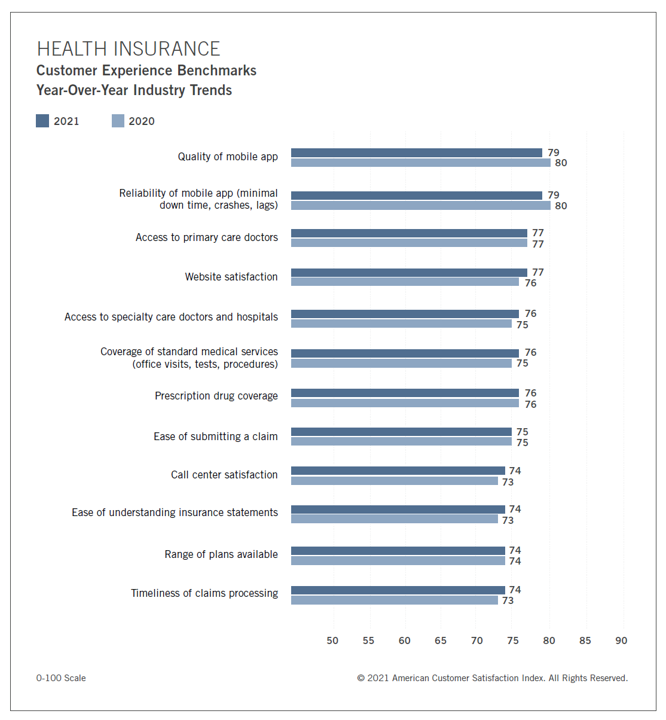

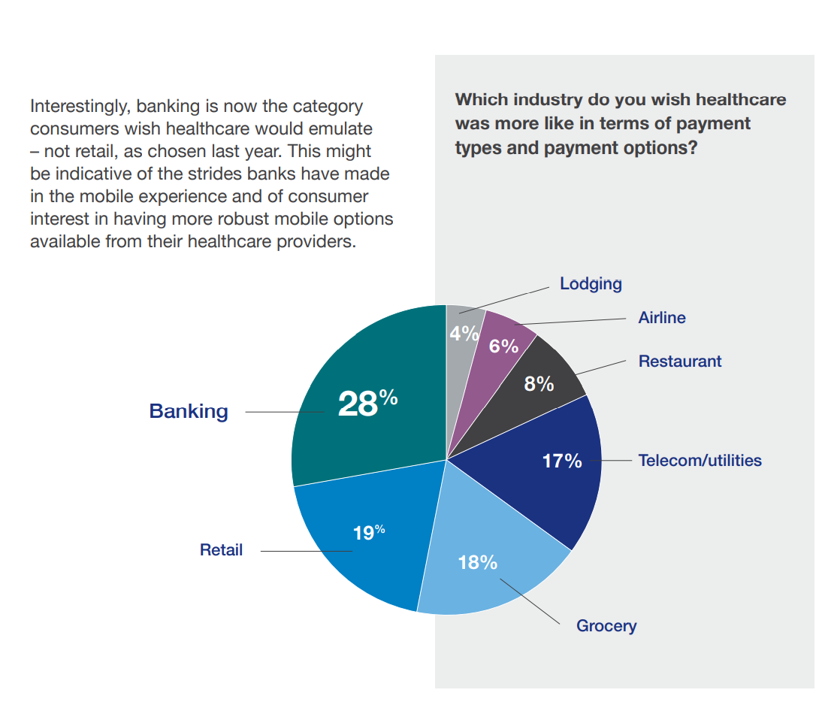

Health Plan Consumer Experience Scores Reflect Peoples’ Digital Transformation – ACSI Speaks

In the U.S., peoples’ expectations of their health care experience is melding with their best retail experience — and that’s taken a turn toward their digital and ecommerce life-flows. The American Customer Satisfaction Index Insurance and Health Care Study 2020-2021 published today, recognizing consumers’ value for the quality of health insurance companies’ mobile apps and reliability of those apps. Those digital health expectations surpass peoples’ benchmarks for accessing primary care doctors and specialty care doctors and hospitals, based on ACSI’s survey conducted among 12,274 customers via email. The study was fielded between October 2020 and September 2021. Year on year,

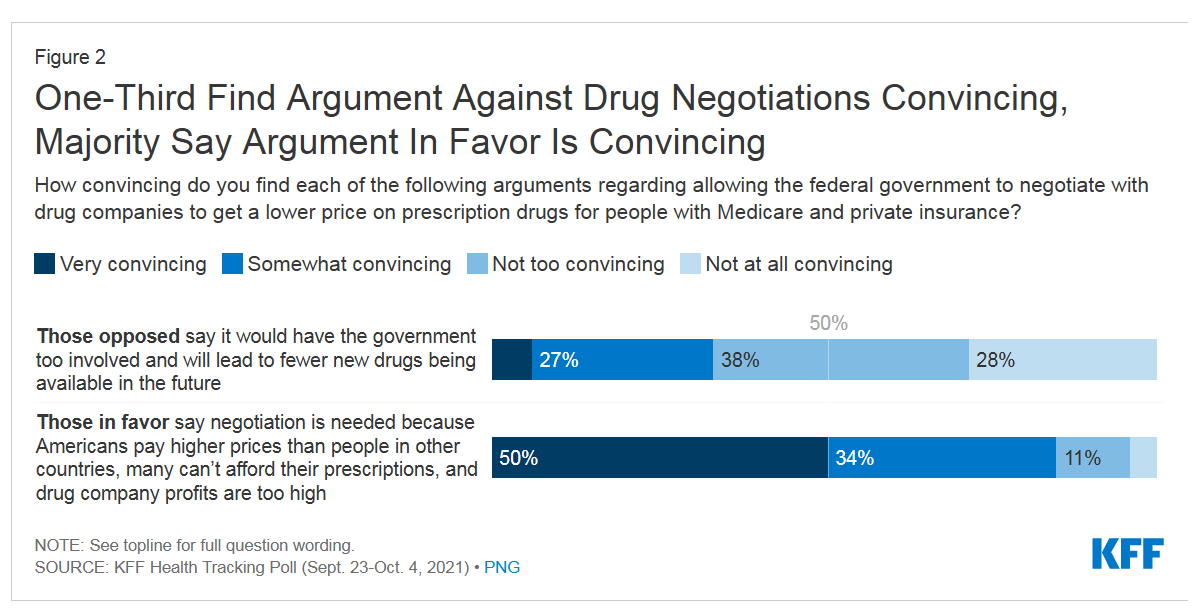

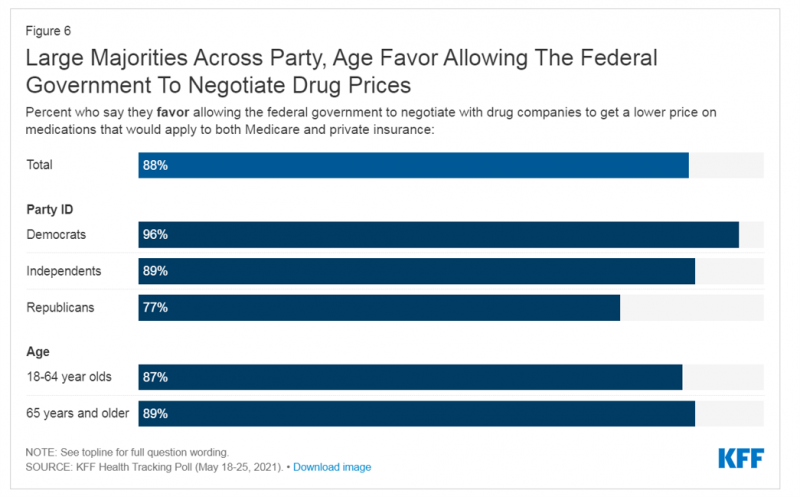

Support for Drug Price Negotiation Brings Partisans Together in the U.S.

Most U.S. adults across political parties favor allowing the Federal government authority to negotiate for drug prices — even after hearing the arguments against the health policy. Drug price negotiation, say by the Medicare program, is a unifying public policy in the current era of political schisms in America, based on the findings in a special Kaiser Family Foundation (KFF) Health Tracking Poll conducted in late September-early October 2021. Overall, 4 in 5 Americans favor allowing the Federal government negotiating power for prescription drug prices, shown in the first chart from the KFF report. By party, nearly all Democrats agree

Consider Mental Health Equity on World Mental Health Day

COVID-19 exacted a toll on health citizens’ mental health, worsening a public health challenge that was already acute before the pandemic. It’s World Mental Health Day, an event marked by global and local stakeholders across the mental health ecosystem. On the global front, the World Health Organization (WHO) describes the universal phenomenon and burden of mental health on the Earth’s people… Nearly 1 billion people have a mental disorder Depression is a leading cause of disability worldwide, impacting about 5% of the world’s population People with severe mental disorders like schizophrenia tend to die as much as 20 years earlier

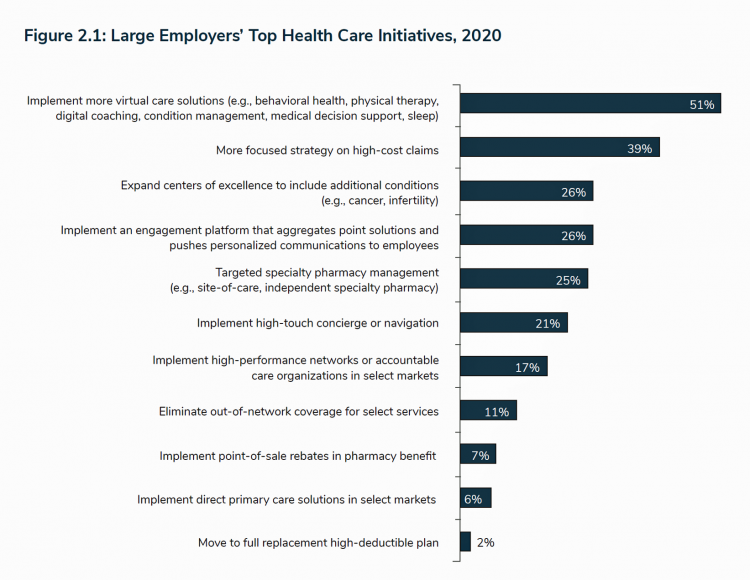

Chronic Medical Conditions, Mental Health, and Equity On Employers’ Minds for 2022 – Employee Health in the Wake of COVID-19

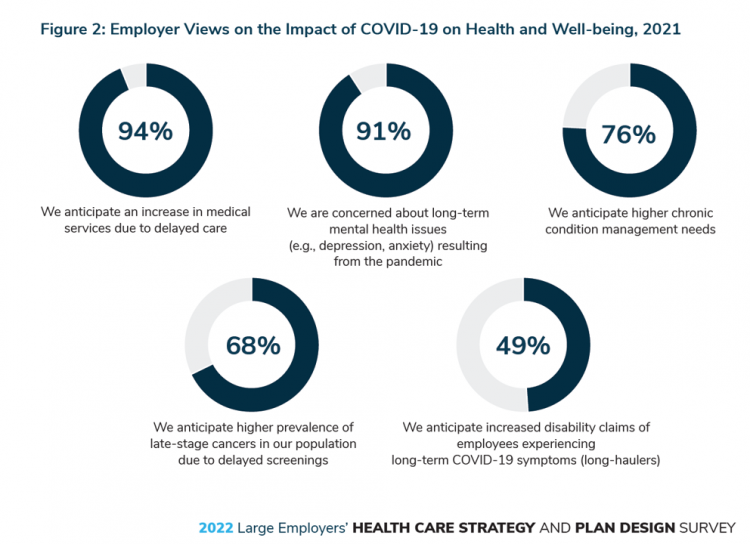

One in two people in the U.S. receive health insurance through employers. As large employers tend to be on the vanguard of benefit plan design, it’s useful to understand how these companies are thinking ahead on behalf of their employees. With that objective, it’s always instructive to explore the annual study from the Business Group on Health, the 2022 Large Employers’ Health Care Strategy and Plan Design Survey. As a result of the COVID-19 pandemic, large employees have many concerns about worker and dependents’ health. The biggest firms in America providing health insurance for workers are expecting an increase in

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

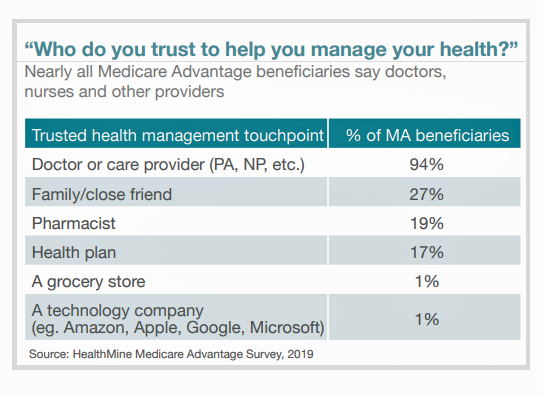

Health Insurance in Aisle 3: Why a Grocery Chain is Working on Medicare

“You can trust us to help you find the right Medicare coverage for you and your lifestyle,” the tagline reads. What kind of organization would be behind this campaign: a healthcare navigator company, an insurance company, or a social services agency? In fact, it’s a grocery store called Hy-Vee, which launched the “Medicare Aisle” to help consumers living in the eight states in which the chain’s 240+ stores operate to sort through the daunting labyrinth of Medicare choices. “Hy-Vee is a trusted leader in the health and wellness space, and as a retail and specialty pharmacy provider, we are deeply

Doctors’ Offices Morph into Bill Collectors As Patients Face Growing Out-Of-Pocket Costs

In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around. That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned

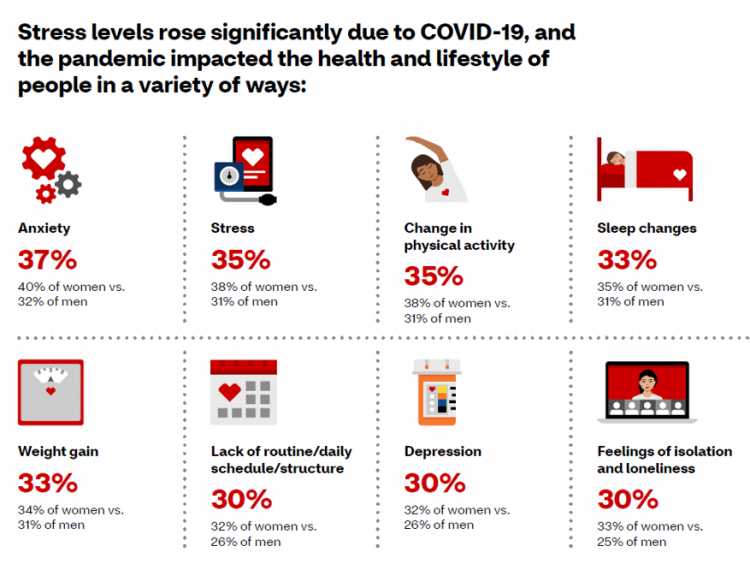

CVS Finds Differences in Mental and Behavioral Health Among Men Vs. Women in the Pandemic

As the COVID-19 pandemic shifts to a more endemic phase — becoming part of peoples’ everyday life for months to come — impacts on peoples’ mental health will persist, according to new research from CVS Health in the company’s annual Health Care Insights Study. CVS conducted the annual Health Care Insights Study among 1,000 U.S. adults in March 2021. To complement the consumer study, an additional survey was undertaken among 400 health care providers including primary care physicians and specialists, nurse practitioners, physician assistants, RNs and pharmacists. CVS has been tracking the growing trend of health care consumerism in the

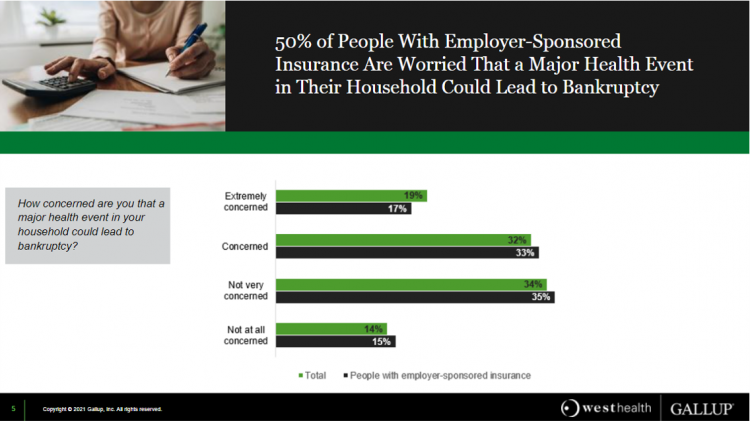

One in Two Americans with Work-Based Insurance Worries That Healthcare Costs Could Lead to Bankruptcy

One in two people in the U.S. with employer-sponsored health insurance worry that a major health event in their household could lead to bankruptcy, according to research gathered by West Health and Gallup in Business Speaks: The Future of Employer-Sponsored Insurance. Gallup and West Health presented their study in a webinar earlier this week; in today’s post, I feature a few key data points that particularly resonate as I celebrate/appreciate yesterday’s U.S. Supreme Court’s ruling on the Affordable Care Act (i.e., California v. Texas) combined with a new study published in JAMA Network Open, discussed below the digital fold in

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

What Do Democrats and Republicans Agree On? Allowing Negotiations to Lower Rx Prices

People living in the U.S. have weathered over fifteen months of life-shifts for work, school, prayer, fitness, and social lives. So you might think that the most important public priority for Congress might have something to do with COVID-19, vaccines, or health insurance coverage. But across all priorities, it turns out that prescription drug costs rank higher in Americans’ minds than any other issue in the Kaiser Family Foundation Health Tracking Poll for May 2021. Two-thirds of U.S. adults said that allowing the federal government and private insurance plans to negotiate for lower prices on Rx drugs was their top

Wearables Are Good For Older People, Too — The Latest From Laurie Orlov

The COVID-19 pandemic accelerated a whole lot of digital transformation for people staying home. For digital natives, that wasn’t such an exogenous shock. For older people who are digital immigrants, they will remember their initial Zoom get-together’s with much-missed family, ordering groceries online in the first ecommerce purchase, and using telemedicine for the first time as a digital health front-door. Laurie Orlov, tech industry veteran, writer, speaker and elder care advocate, is the founder of the encyclopedic Aging and Health Technology Watch website. She takes this propitious moment to assess The Future of Wearables and Older Adult in a new report.

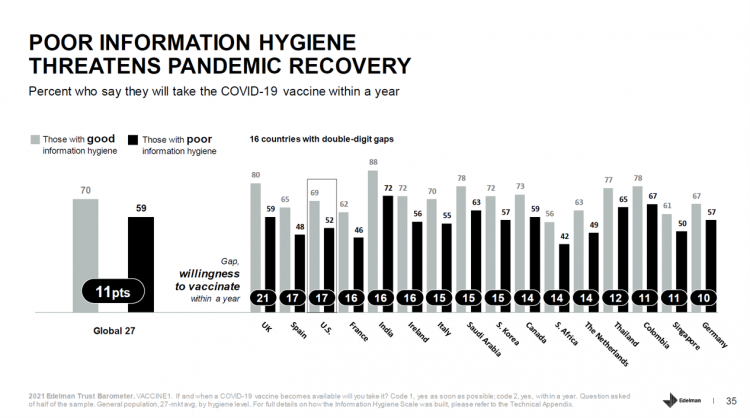

Healthcare, Heal Thyself! How the Industry Can and Should Play the Trust Card

The emergence of the COVID-19 vaccine “infodemic” has slowed the ability for nations around the world to emerge out of the public health crisis. Growing cynicism among some health citizens facing the politicization of public health tactics like vaccines and facial masks is what we’re talking about. At the root is peoples’ lack of trust across a range of information providers, including government, media, business, and even peers. The 2021 Edelman Trust Barometer spotlighted the infodemic and eroding trust in the U.S. in the voices of public health, the public sector, and media. This is a global challenge as well,

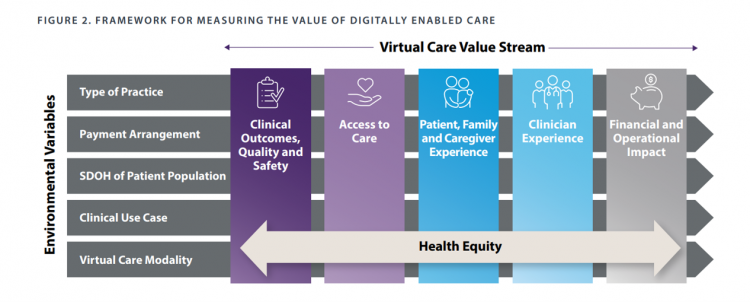

The ROI on Virtual Care – Thinking About Value and Future Prospects With the AMA

When a new technology or product starts to get used in a market, it follows a diffusion curve whose slope depends on the pace of adoption in that market. For telehealth, that S-curve has had a very long and fairly flat front-end of the “S” followed by a hockey stick trajectory in March and April 2020 as the COVID-19 pandemic was an exogenous shock to in-person health care delivery. The first chart from the CDC illustrates that dramatic growth in the use of telehealth ratcheting up since the first case of COVID-19 was diagnosed in the U.S. Virtual care has

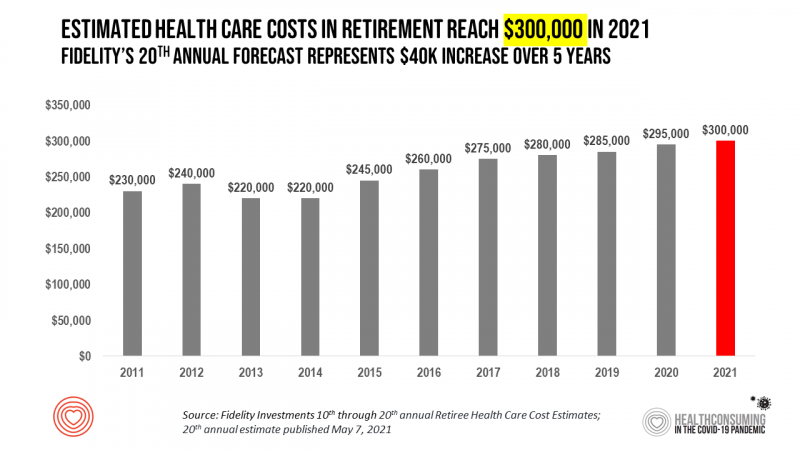

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

And the Oscar Goes To….Power to the Patients!

Health care has increased its role in popular culture over the years. In movies in particular, we’ve seen health care costs and hassles play featured in plotlines in As Good as it Gets [theme: health insurance coverage], M*A*S*H [war and its medical impacts are hell], and Philadelphia [HIV/AIDS in the era of The Band Played On], among dozens of others. And this year’s Oscar winner for leading actor, Anthony Hopkins, played The Father, who with his family is dealing with dementia. [The film, by the way, garnered six nominations and won two]. When I say “Oscar” here on the Health

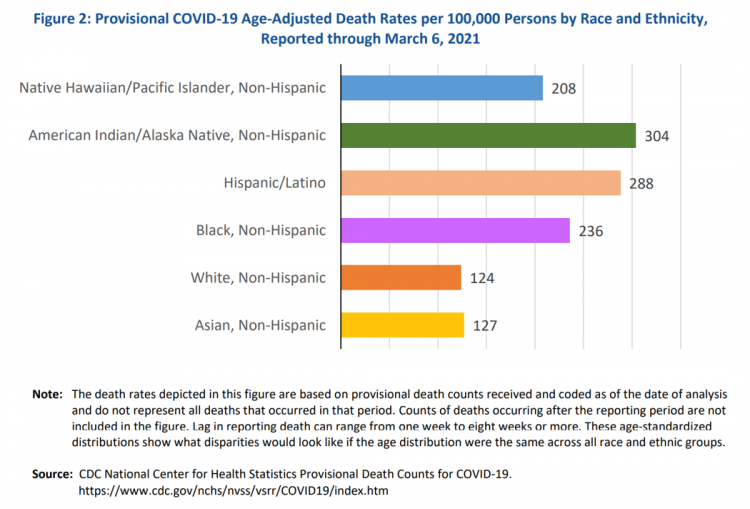

Health Disparities and the Risks of Social Determinants for COVID-19 – 14 Months of Evidence

In April 2020, the U.S. Centers for Disease Control issued a report featuring evidence that in the month of March 2020, the coronavirus pandemic was not an equal-opportunity killer. Within just a couple of months of COVID-19 emerging in America, it became clear that health disparities were evident in outcomes due to complications from the coronavirus. An update from that early look at differences in COVID-19 diagnoses and mortality rates was published in Health Disparities by Race and Ethnicity During the COVID-19 Pandemic: Current Evidence and Policy Approaches, In this report, the Assistant Secretary for Planning and Evaluation, part of

Health, the Great Unifier (For Most)

As the COVID-19 expanded peoples’ consciousness about infectious disease and opportunities to keep a tricky virus at bay, consumers grew new muscles about public and individual wellness…now, “more invested in achieving it,” according to In Health We Trust, a survey report from Healthline Media. To gauge Americans changing perspectives on personal health, HealthLine conducted surveys among 1,533 U.S. consumers age 18 and over in February 2020 (just about the time the coronavirus pandemic was emerging in the U.S.) and 1,577 consumers in December 2020. One of the subtle shifts in health care consumerism concerns cost, which before the pandemic has

How to Restore Americans’ Confidence in U.S. Health Care: Deal With Access and Cost

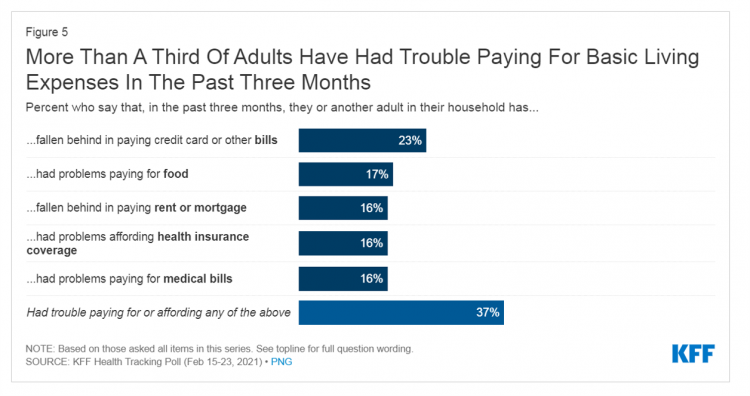

With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves. But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices. Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access. The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one

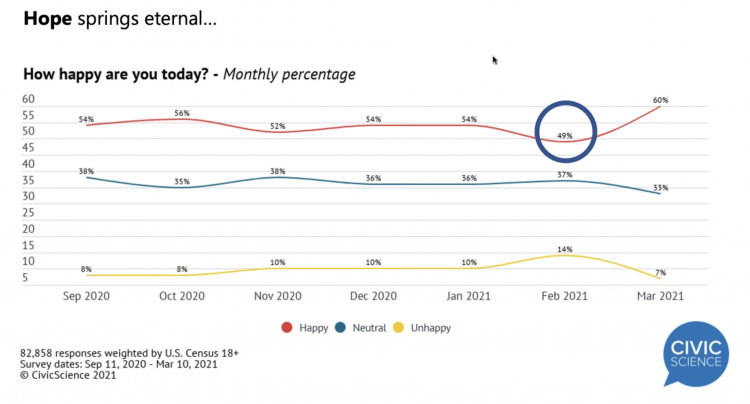

“Hope Springs Eternal” With the COVID Vaccine for Both Joe Biden and Most People in the U.S.

More Americans are happier in March 2021 than they’ve been for a year, based on consumer research from Civic Science polling U.S. adults in early March 2021. For the first time, a larger percent of Americans said they were better off financially since the start of the pandemic. This week, Civic Science shared their latest data on what they’re seeing beyond the coronavirus quarantine era to forecast trends that will shape a post-COVID America. Buoying peoples’ growing optimism was the expectation of the passage of the American Cares Act, which President Biden signed into effect yesterday. The HPA-CS Economic Sentiment Index

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

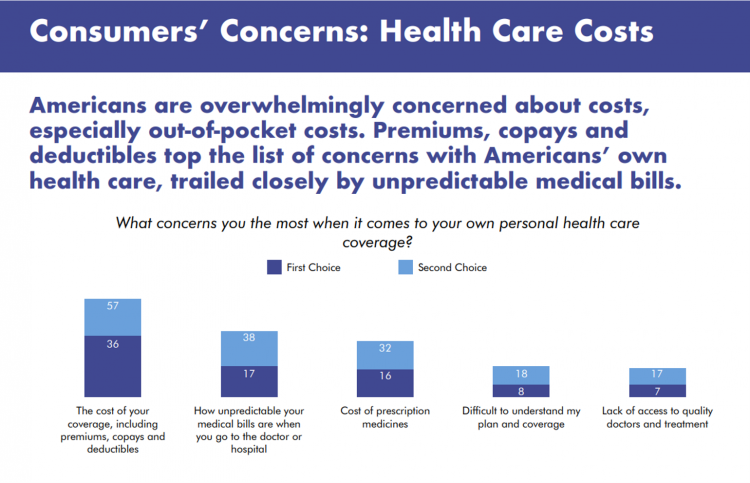

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

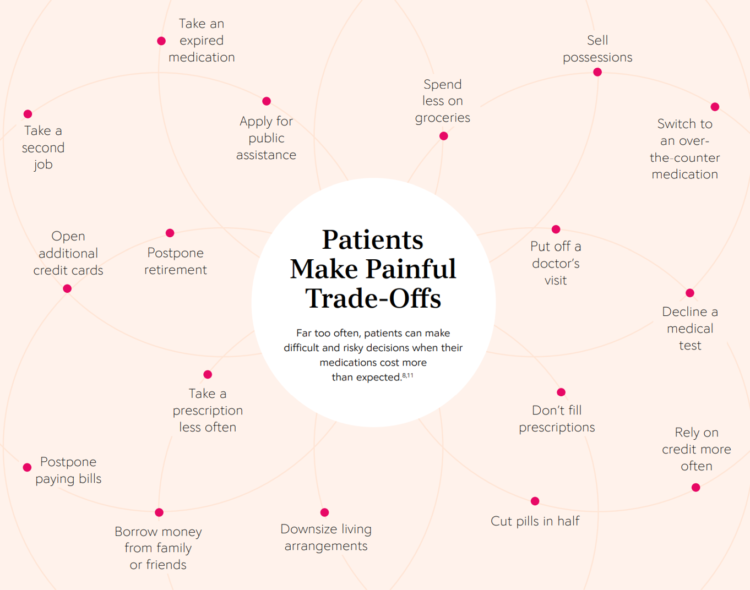

The Social Determinants of Prescription Drugs – A View From CoverMyMeds

The COVID-19 pandemic forced consumers to define what were basic or essential needs to them; for most people, those items have been hygiene products, food, and connectivity to the Internet. There’s another good that’s essential to people who are patients: prescription drugs. A new report from CoverMyMeds details the current state of medication access weaving together key health care industry and consumer data. The reality even before the coronavirus crisis emerged in early 2020 was that U.S. patients were already making painful trade-offs, some of which are illustrated in the first chart from the report. These include self-rationing prescription drug

Ten In Ten: Manatt’s Healthcare Priorities to 2031

The coronavirus pandemic has exposed major weaknesses in the U.S. health care system, especially laying bare inequities and inertia in American health care, explained in The Progress We Need: Ten Health Care Imperatives for the Decade Ahead from Manatt Health. The report details the ten objectives that are central to Manatt’s health care practice, a sort of team manifesto call-to-action and North Star for the next decade. Their ten must-do’s for bending the cost curve while driving constructive change for a better health care system are to: Ensure access Achieve health equity Stability the safety net and rebuild public health

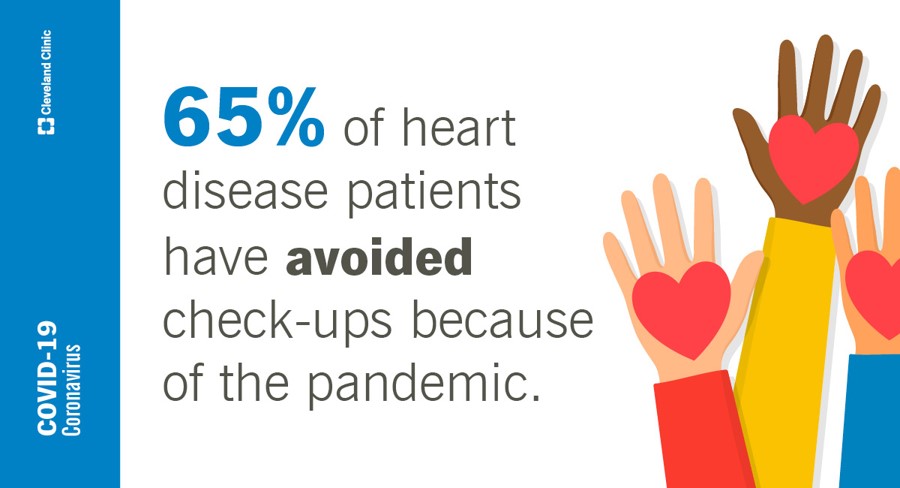

Call It Deferring Services or Self-Rationing, U.S. Consumers Are Still Avoiding Medical Care

Patients in the U.S. have been self-rationing medical care for many years, well before any of us knew what “PPE” meant or how to spell “coronavirus.” Nearly a decade ago, I cited the Kaiser Family Foundation Health Security Watch of May 2012 here in Health Populi. The first chart here shows that one in four U.S. adults had problems paying medical bills, largely delaying care due to cost for a visit or for prescription drugs. Fast-forward to 2020, a few months into the pandemic in the U.S.: PwC found consumers were delaying treatment for chronic conditions. In October 2020, The American Cancer

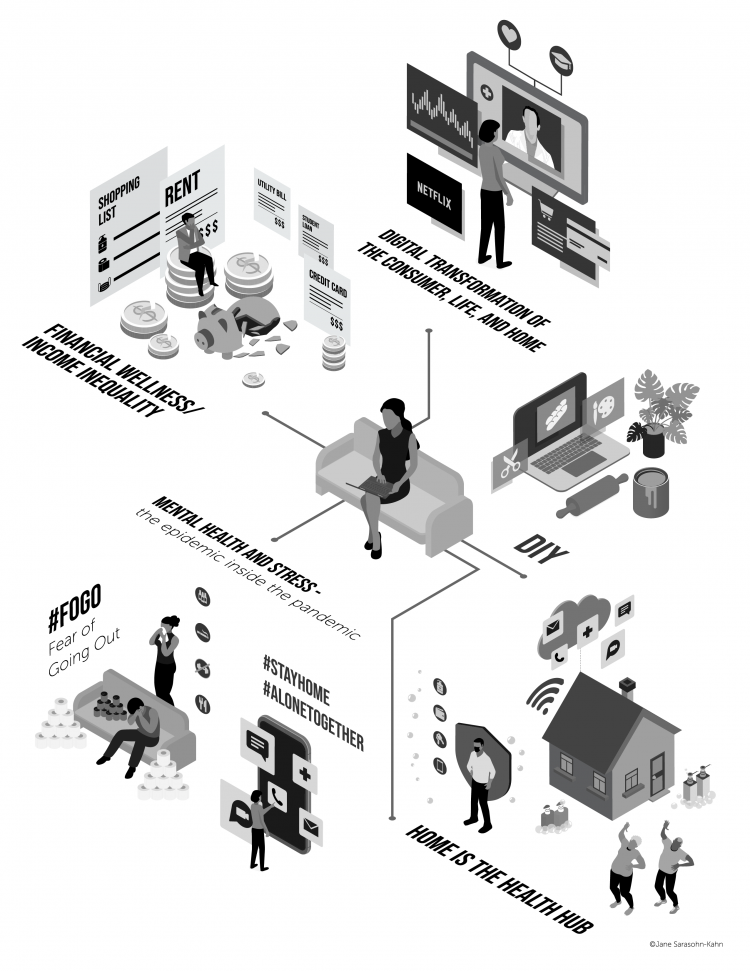

The COVID Healthcare Consumer – 5 Trends Via The Medecision Liberation Blog

The first six months into the coronavirus pandemic shocked the collective system of U.S. consumers for living, learning, laboring, and loving. I absorbed all kinds of data about consumers in the wake of COVID-19 between March and mid-August 2020, culminating in my book, Health Citizenship: How a virus opened hearts and minds, published in September on Kindle and in print in October. In this little primer, I covered the five trends I woven based on all that data-immersion, following up the question I asked at the end of my previous book, HealthConsuming: when and how would Americans claim their health

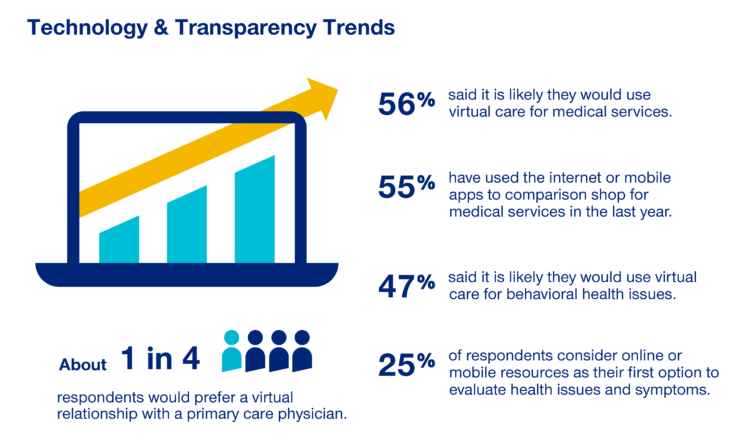

The COVID-19 Era Has Grown Health Consumer Demand for Virtual Care

Over one-half of Americans would likely use virtual care for their healthcare services, and one in four people would actually prefer a virtual relationship with a primary care physician, according to the fifth annual 2020 Consumer Sentiment Survey from UnitedHealthcare. What a difference a pandemic can make in accelerating patients’ adoption of digital health tools. This survey was conducted in mid-September 2020, and so the results demonstrate U.S. health consumers’ growing digital health “muscles” in the form of demand and confidence in using virtual care. One in four people would consider online options as their first-line to evaluating personal health

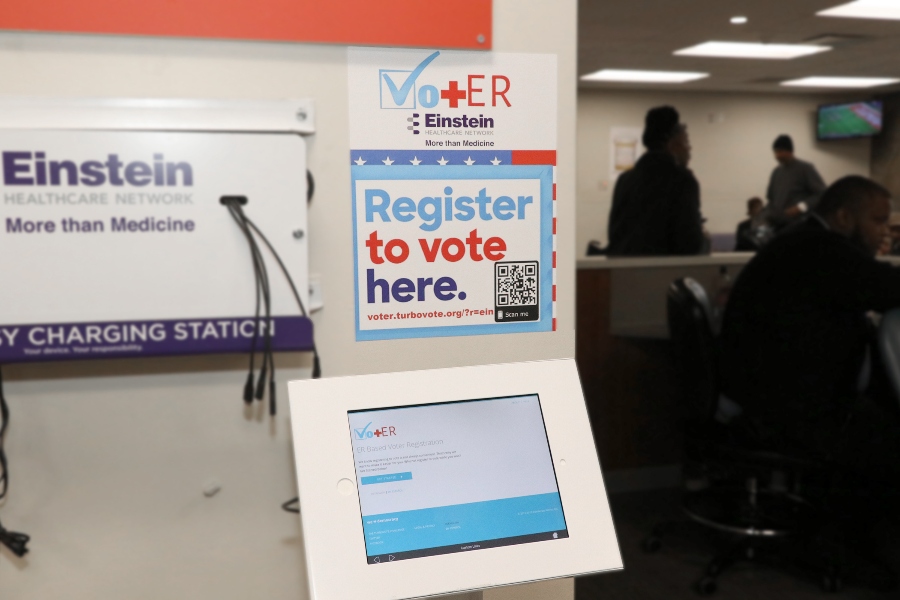

Health Care Providers Are More Politically Engaged in the 2020 Elections

Until 2016, physicians’ voting rates in U.S. elections had not changed since the late 1970s. Then in 2018, two years into President Donald Trump’s four-year term, the mid-term elections drove U.S. voters to the election polls…including health care providers. Based on the volume and intensity of medical professional societies’ editorials on the 2020 Presidential Election, we may be in an inflection-curve moment for greater clinician engagement in politics as doctors and nurses take claim of their health citizenship. A good current example of this is an essay published in the AMA’s website asserting, “Why it’s okay for doctors to ask

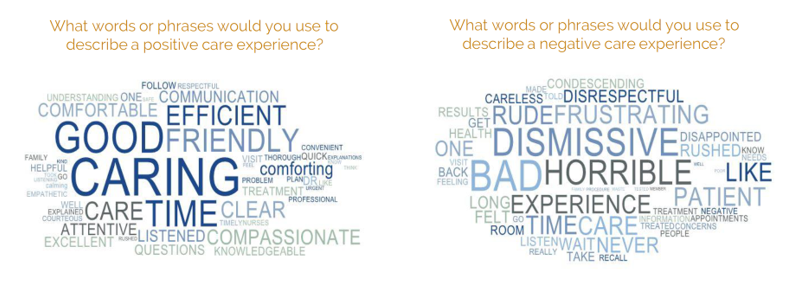

Healthcare Costs, Access to Data, and Partnering With Providers: Patients’ Top User Experience Factors

As patients returned to in-person, brick-and-mortar health care settings after the first wave of COVID-19 pandemic, they re-enter the health care system with heightened consumer expectations, according to the Beryl Institute – Ipsos Px Pulse report, Consumer Perspectives on Patient Experience in the U.S. Ipsos conducted the survey research among 1,028 U.S. adults between 23 September and 5 October 2020 — giving consumers many months of living in the context of the coronavirus. This report is a must-read for people involved with patient and consumer health engagement in the U.S. and covers a range of issues. My focus in this

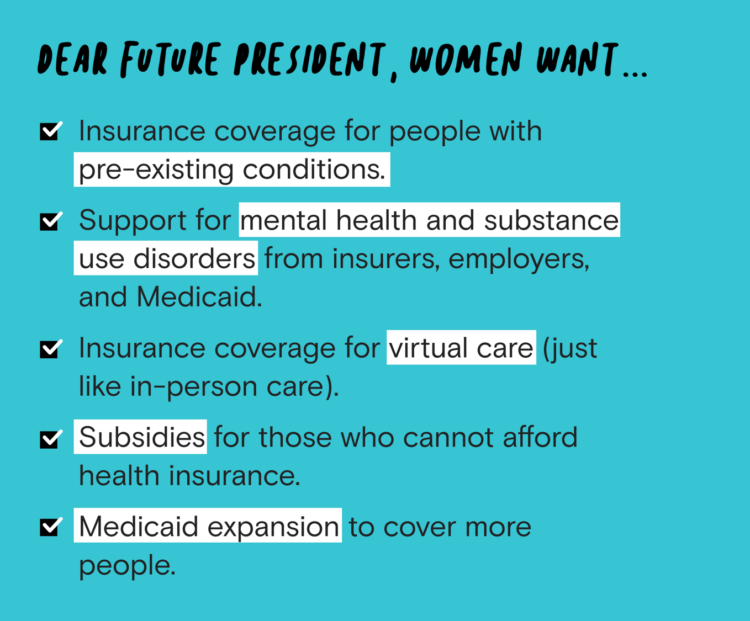

Women’s Health Policy Advice for the Next Occupant of the White House: Deal With Mental Health, the Pandemic, and Health Care Costs

2020 marked the centennial anniversary of the 19th Amendment to the U.S. Constitution, giving women the right to vote. In this auspicious year for women’s voting rights, as COVID-19 emerged in the U.S. in February, women’s labor force participation rate was 58%. Ironic timing indeed: the coronavirus pandemic has been especially harmful to working women’s lives, the Brookings Institution asserted last week in their report in 19A: The Brookings Gender Equality Series. A new study from Tia, the women’s health services platform, looks deeply into COVID-19’s negative impacts on working-age women and how they would advise the next occupant of

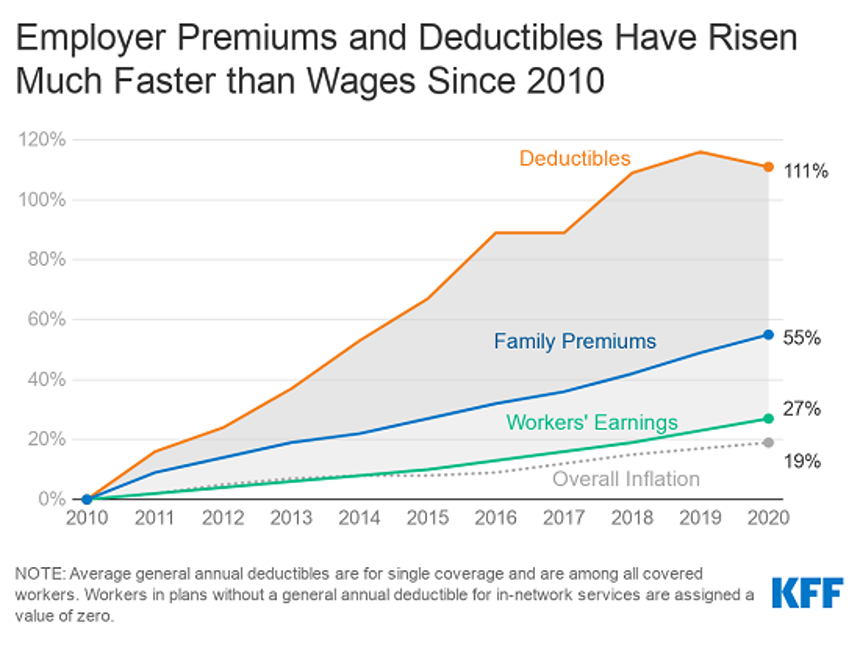

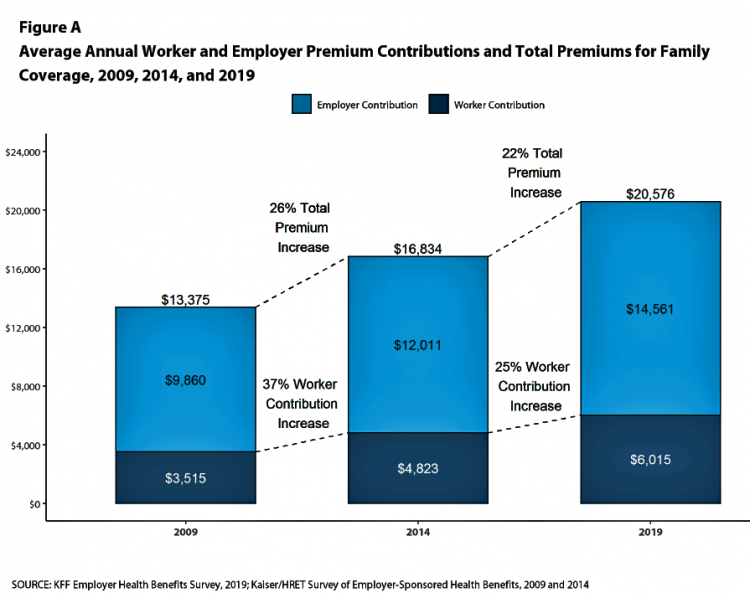

In the Past Ten Years, Workers’ Health Insurance Premiums Have Grown Much Faster Than Wages

For a worker in the U.S. who benefits from health insurance at the workplace, the annual family premium will average $21,342 this year, according to the 2020 Employer Health Benefits Survey from the Kaiser Family Foundation. The first chart illustrates the growth of the premium shares split by employer and employee contributions. Over ten years, the premium dollars grew from $13,770 in 2010 to $21K in 2020. The worker’s contribution share was 29% in 2010, and 26% in 2020. Single coverage reached $7,470 in 2020 and was $5,049 in 2010. Roughly the same proportion of companies offered health benefits to

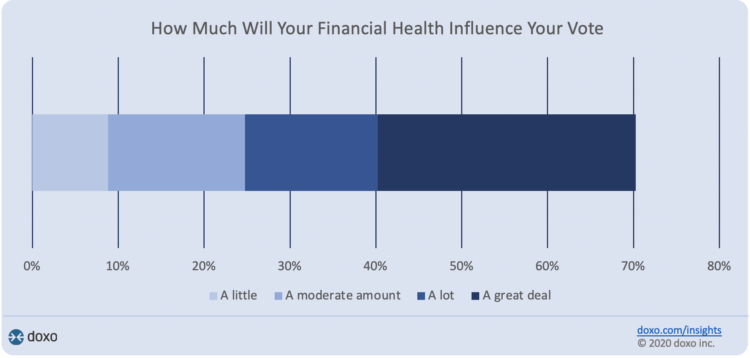

Financial Health Is On Americans’ Minds Just Weeks Before the 2020 Elections

Financial health is part of peoples’ overall health. As Americans approach November 3, 2020, the day of the real-time U.S. Presidential and down-ballot elections, personal home economics are front-of-mind. Twenty-seven days before the 2020 elections, 7 in 10 Americans say their financial health will influence their votes this year, according to the doxoINSIGHTS survey which shows personal financial health as a key voter consideration in the Presidential election. Doxo, a consumer payments company, conducted a survey among 1,568 U.S. bill-paying households in late September 2020. The study has a 2% margin of error. U.S. voters facing this year’s election are

Only in America: The Loss of Health Insurance as a Toxic Financial Side Effect of the COVID-19 Pandemic

In terms of income, U.S. households entered 2020 in the best financial shape they’d been in years, based on new Census data released earlier this week. However, the U.S. Census Bureau found that the level of health insurance enrollment fell by 1 million people in 2019, with about 30 million Americans not covered by health insurance. In fact, the number of uninsured Americans rose by 2 million people in 2018, and by 1.9 million people in 2017. The coronavirus pandemic has only exacerbated the erosion of the health insured population. What havoc a pandemic can do to minds, bodies, souls, and wallets. By September 2020,

Americans Worry About Medical Bankruptcy, As Prescription Drug Costs Play Into Voters’ Concerns

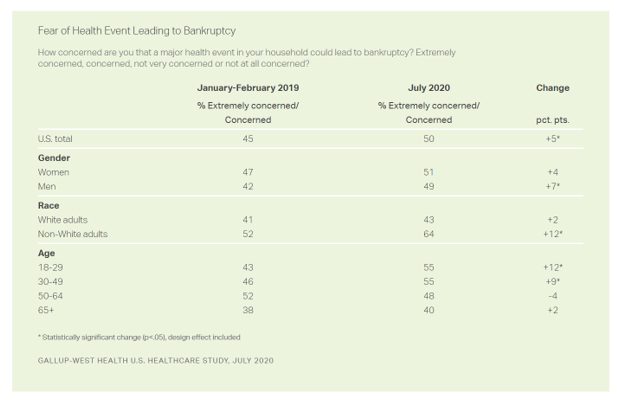

One in two people in the U.S. are concerned that a major health event in their family would lead to bankruptcy, up 5 percent points over the past eighteen months. In a poll conducted with West Health, Gallup found that more younger people are concerned about medical debt risks, along with more non-white adults, published in their study report, 50% in U.S. Fear Bankruptcy Due to Major Health Event. The survey was fielded in July 2020 among 1,007 U.S. adults 18 and older. One of the basic questions in studies like these is whether a consumer could cover a $500

The Burden of Depression in the Pandemic – Greater Among People With Fewer Resources

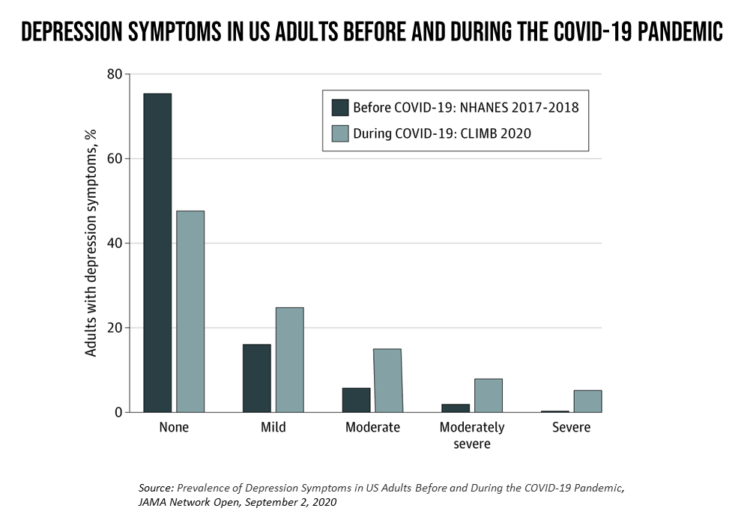

In the U.S., symptoms of depression were three-times greater in April 2020 in the COVID-19 pandemic than in 2017-2018. And rates for depression were even higher among women versus men, along with people earning lower incomes, losing jobs, and having fewer “social resources” — that is, at greater risk of isolation and loneliness. America’s health system should be prepared to deal with a “probable increase” in mental illness after the pandemic, researchers recommend in Prevalence of Depression Symptoms in US Adults Before and During the COVID-19 Pandemic in JAMA Network Open. A multidisciplinary team knowledgeable in medicine, epidemiology, public health,

Health Insurance Affordability in the Time of the Coronavirus Pandemic

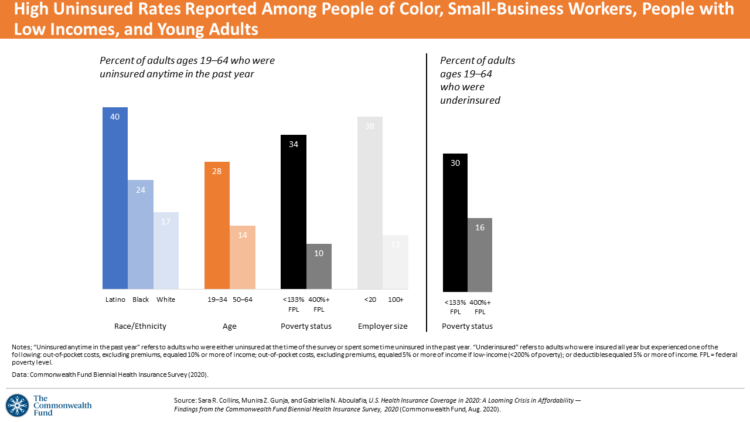

The coronavirus pandemic has revealed many flaws in the U.S. healthcare system, first and foremost the nation’s patchwork public health infrastructure and health inequities in mortality rates due to COVID-19. The Commonwealth Fund‘s biennial report, published as the pandemic continues into and beyond the third quarter of 2020, sheds light on another weakness in U.S. healthcare: the cost of health insurance relative to working Americans’ relatively flat incomes. I explored the details of this study in a post titled Health Insurance Affordability: A Call-to-Action for Healthcare Industry Stakeholders in the Pandemic, published on the Medecision Liberation blog site. The survey

The Unbearable Heaviness of Healthcare in America – the Change Healthcare/Harris Poll

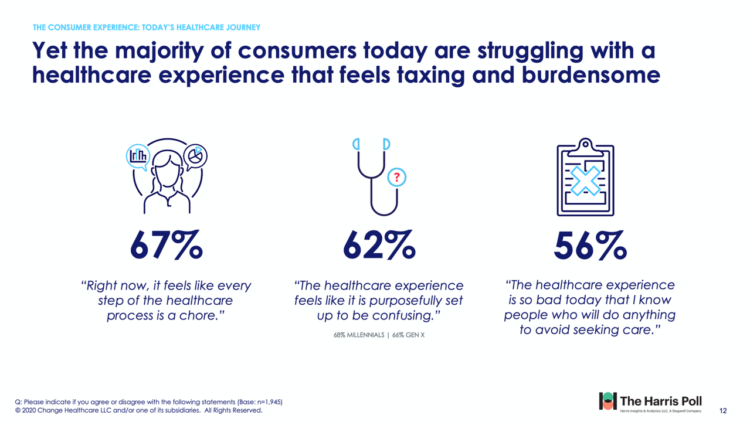

The phrase, “burden of health care,” has two usual meanings: one, to do with the massive chronic care burden, and the other, involving costs. There’s a third area of burden in U.S. health care — the onerous patient experience in finding and accessing care, assessed in the 2020 Change Healthcare – Harris Poll Consumer Experience Index. Two in three U.S. consumers feel like “every step of the healthcare process is a chore.” That burdensome patient experience leads to one in two people in America avoiding seeking care, the poll found. That’s not just self-rationing health care due to costs, but due

The Median Hospital Charge In the U.S. for COVID-19 Care Ranges From $34-45K

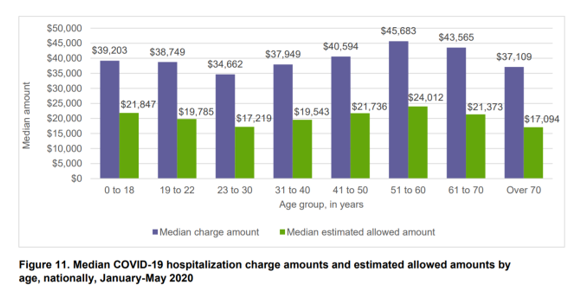

The median charge for hospitalizing a patient with COVID-19 ranged from $34,662 for people 23 to 30, and $45,683 for people between 51 and 60 years of age, according to FAIR Health’s research brief, Key Characteristics of COVID-19 Patients published July 14th, 2020. FAIR Health based these numbers on private insurance claims associated with COVID-19 diagnoses, evaluating patient demographics (age, gender, geography), hospital charges and estimated allowed amounts, and patient comorbidities. They used two ICD-10-CM diagnostic codes for this research: U07.1, 2019-nCoV acute respiratory disease; and, B97.29, other coronavirus as the cause of disease classified elsewhere which was the original code

A Toxic Side Effect of the Coronavirus: Financial Unwellness

One in two people in the U.S. say their financial health has been negatively impacted by the COVID-19 pandemic, through job loss, income disruption, or reduced work hours. The 2020 Financial Wellness Census, from Prudential found that one-half of U.S. adults are anxious about their financial future as of May 2020, an increase from 38% in late 2019. Prudential surveyed 3,000 U.S. adults across three generational cohorts: Millennials, Gen X, and Baby Boomers. The economic hit from the pandemic has disproportionately impacted people of color, younger people, women, small business owners, gig workers, and people working in retailer harder than

How Covid-19 Can Inspire Tech-Enabled Value-Based Health Care in a Cash-Constrained America

“The COVID-19 pandemic…has highlighted like never before the pitfalls of paying for healthcare based on the number of patients seen and services rendered,” a Modern Healthcare article asserted in mid-June 2020. In other words, the U.S. health care financing regime of volume-based payment didn’t fare well as millions of patients postponed or cancelled procedures and visits for fear of contracting the virus in the halls, offices and clinics of hospitals and doctor’s offices. “Just imagine if you were 100% fee-for-service,” commented Dr. Fuad Sheriff, a primary care physician whose practice is based on capitated payments. “You would have been dead

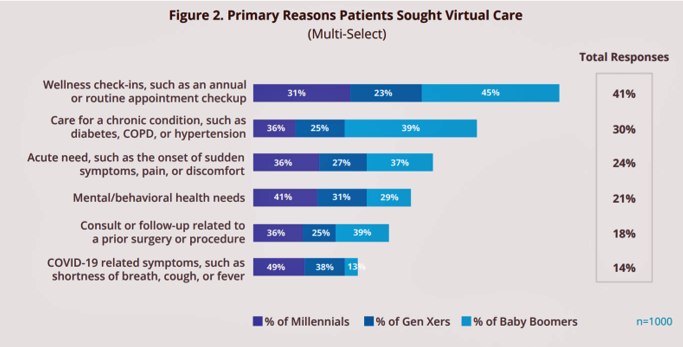

Most Virtual Care Consumers, Satisfied With Visits in the COVID Era, Expect It for Future Care

Within days of the coronavirus pandemic emerging in the U.S., health care providers set up virtual care arrangements to convene with patients. Three months into the COVID-19 crisis, how have patients felt about these telehealth visits? In Patient Perspectives on Virtual Care, Kyruus answers this question based on an online survey of 1,000 patients 18 years of age and older, conducted in May 2020. Each of these health consumers had at least one virtual care visit between February and May 2020. The key findings were that: Engaging in a virtual visit was a new-new thing for 72% of people Patients’

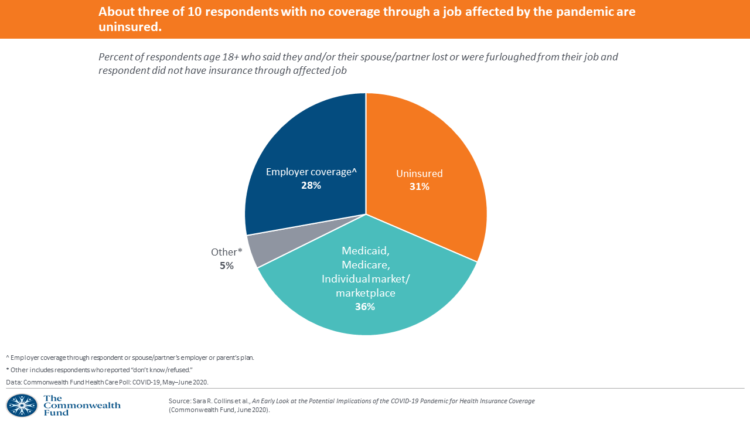

Health Insurance and Demand for Masking, Testing and Contact Tracing – New Data from The Commonwealth Fund

The coronavirus pandemic occasioned the Great Lockdown for people to shelter-at-home, tele-work if possible, and shut down large parts of the U.S. economy considered “non-essential.” As health insurance for working-age people is tied to employment, COVID-19 led to disproportionate loss of health plan coverage especially among people earning lower incomes, as well as non-white workers, explained in the Commonwealth Fund Health Care Poll: COVID-19, May-June 2020. The Commonwealth Fund commissioned interviews with 2,271 U.S. adults 18 and over between 13 May and 2nd June 2020 for this study. The survey has two lenses: first, on health insurance coverage among working

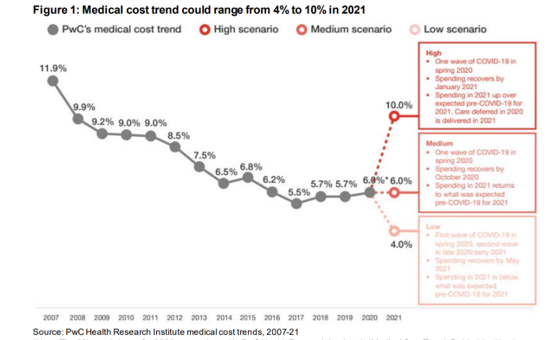

What Will Healthcare Costs Be After COVID? PwC Looks Behind the 2021 Numbers

Whether healthcare spending in 2021 increases by double-digits or falls by one-third directly depends on how the coronavirus pandemic will play out over the rest of 2020, based on PwC’s annual report on medical cost trends for 2021. The three cost scenarios are based on assumptions shown in the fine print on the first chart: The medium scenario, a sort of “return to normal” where medical trend could stay even at 6.0%, equal to the 2020 trend. This assumes that healthcare spending recovers by October 2020 as patients return to hospitals and doctors’ offices for regular care patterns. In 2021,

How Can Healthcare Bring Patients Back? A Preview of Our ATA Session, “Onward Together” in the COVID Era

Today kicks off the first all-virtual conference of the ATA, the American Telemedicine Association. ATA’s CEO Ann Mond Johnson and team turned on a dime over the past few months, migrating the already-planned live conference scheduled in early May to this week, all online. I’ll be midwifing a panel this afternoon at 440 pm Eastern time, initially focused on how health care can garner patient loyalty. That theme was given to us in the fourth quarter of 2019, when initial planning for ATA 2020 had begun. What a difference a few months make. Not only has ATA pivoted to an

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

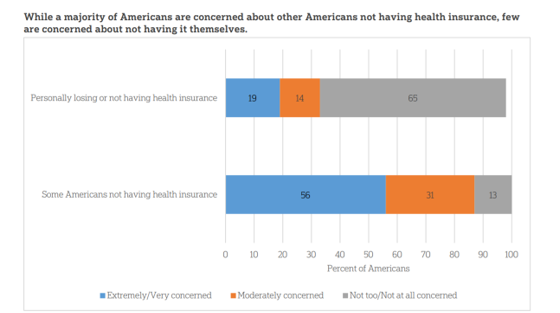

Americans’ Concerns About the US Healthcare System Loom Larger Than Worries About Their Own Care

The coronavirus pandemic has further opened the kimono of the U.S. healthcare system to Americans: four months into the COVID-19 outbreak, most consumers (62%) of people in the U.S. are more concerned about other people not having access to high quality health care versus themselves. This is a 16 point increase in concern in May 2020 compared with the response to the same question asked in February in a poll conducted by the University of Chicago Harris School of Public Policy and The Associated Press-NORC Center for Public Affairs Research (the AP-NORC Center). The AP-NORC Poll found more of this

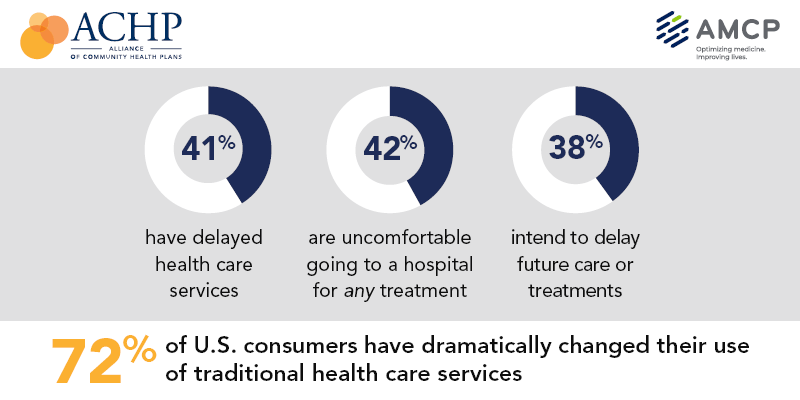

Trust My Doctor and Fear the Office: The Telehealth Opportunity in and Beyond the COVID-19 Pandemic

Doctors maintain their top status as U.S. patients’ most-trusted source of coronavirus information. However, as patients continue to be concerned about exposure to COVID-19, 3 in 5 are concerned about being at-risk to the virus in their doctor’s office, according to research from the Alliance of Community Health Plans (ACHP) and AMCP, the Academy of Managed Care Pharmacy. Patients’ concerns of COVID-19 risks have led them to self-ration care in the following ways: 41% have delayed health care services 42% felt uncomfortable going to a hospital for any medical treatment 45% felt uncomfortable using an urgent care or walk-in clinic,

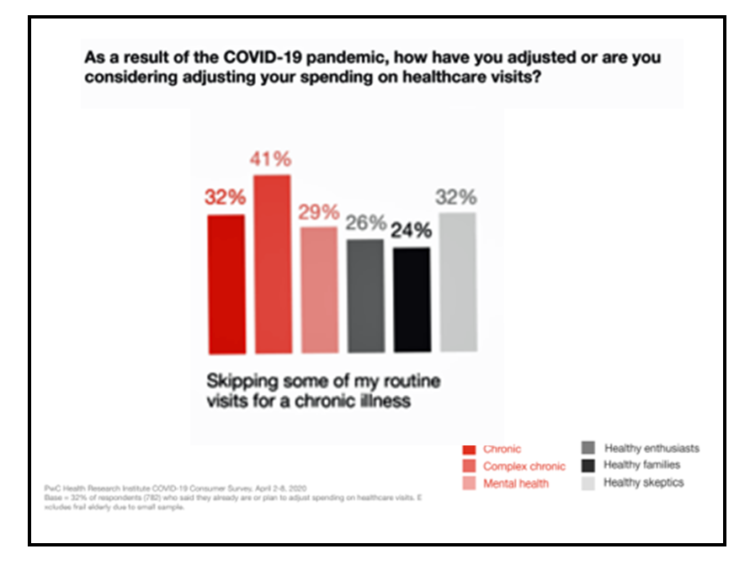

Health Care In the COVID-19 Era – PwC Finds Self-Rationing of Care and Meds Especially for Chronic Care

Patients in the U.S. are self-rationing care in the era of COVID-19 by cutting spending on health care visits and prescription drugs. The coronavirus pandemic’s impact on health consumers’ spending varies depending on whether the household is generally a healthy family unit, healthy “enthusiasts,” dealing with a simple or more complex chronic conditions, or managing mental health issues. PwC explored how COVID-19 is influencing consumers’ health care behaviors in survey research conducted in early April by the Health Research Institute. The findings were published in a May 2020 report, detailing study findings among 2,533 U.S. adults polled in early April

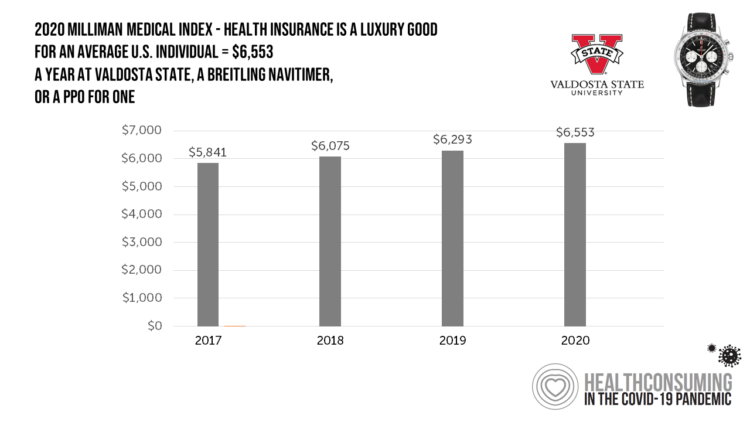

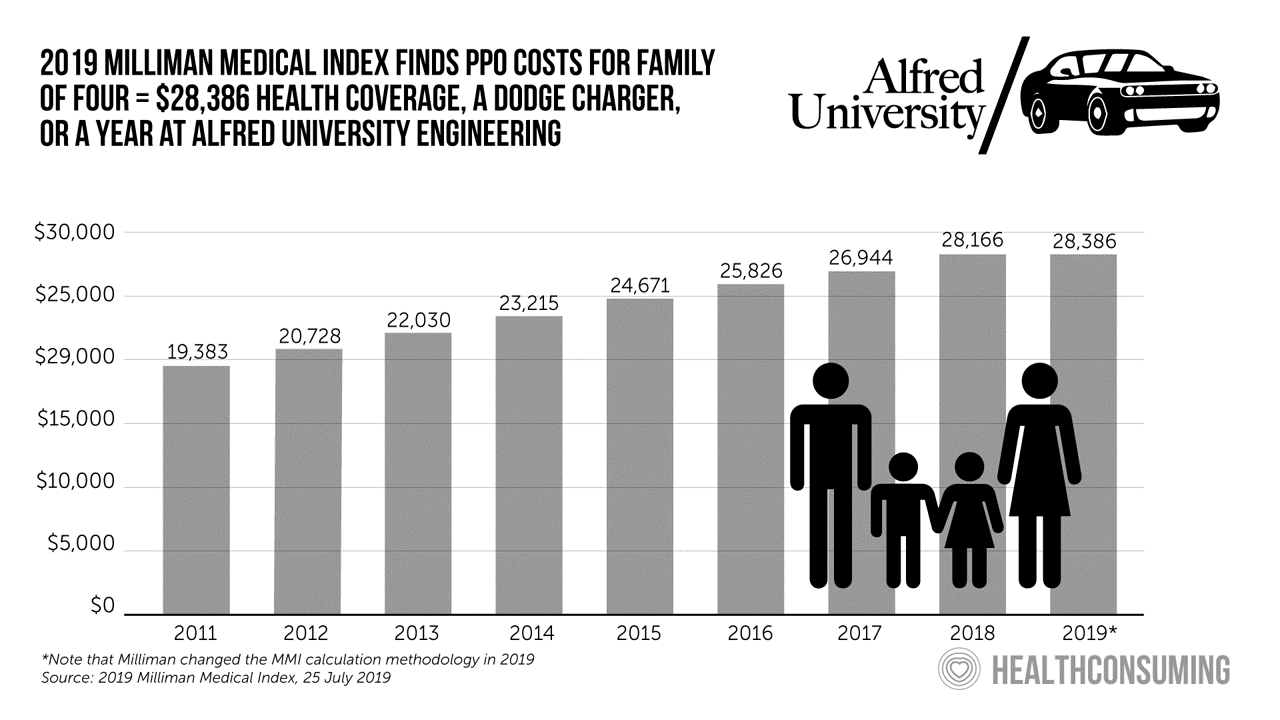

What $6,553 Buys You in America: A Luxury Watch, a Year at Valdosta State, or a PPO for One – the 2020 Milliman Medical Index

Imagine this: you find yourself with $6,553 in your pocket and you can pick one of the following: A new 2020 Breitling Navitimer watch; A year’s in-state tuition at Valdosta State University; or, A PPO for an average individual. Welcome to the annual Milliman Medical Index (MMI), which gauges the yearly price of an employer-sponsored preferred-provider organization (PPO) health insurance plan for a hypothetical American family and an N of 1 employee. That is a 4.1% increase from the 2019 estimate, about twice the rate of U.S. gross domestic product growth, Milliman points out in its report. Milliman bases

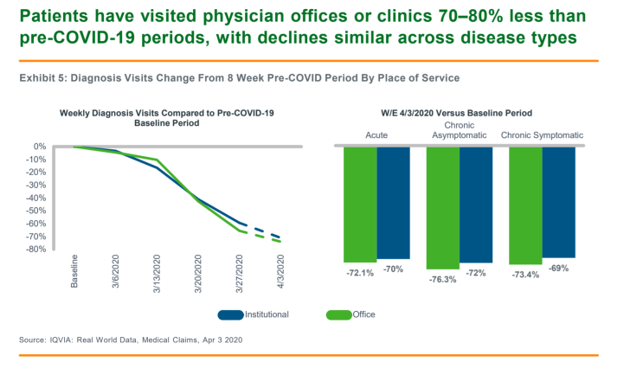

How COVID-19 Has Re-Shaped Health Care Delivery So Far

COVID-19 is re-shaping health care in America across many dimensions. In Shifts in Healthcare Demand, Delivery and Care During the COVID-19 Era, IQVIA presents a multi-faceted profile of the early impacts of the pandemic on U.S. health care. In the report, published in April 2020, IQVIA mined the company’s many data bases that track real-time data, including medical claims, flu data, sales data, oncology medical and pharmacy claims, formularies, among other sources. Top-line, IQVIA spotted the following key shifts in U.S. health care since the start of the coronavirus pandemic: Patients’ use of health services Impacts on medicine use, influenced

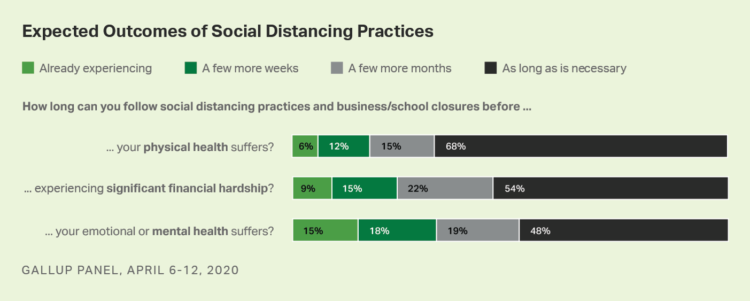

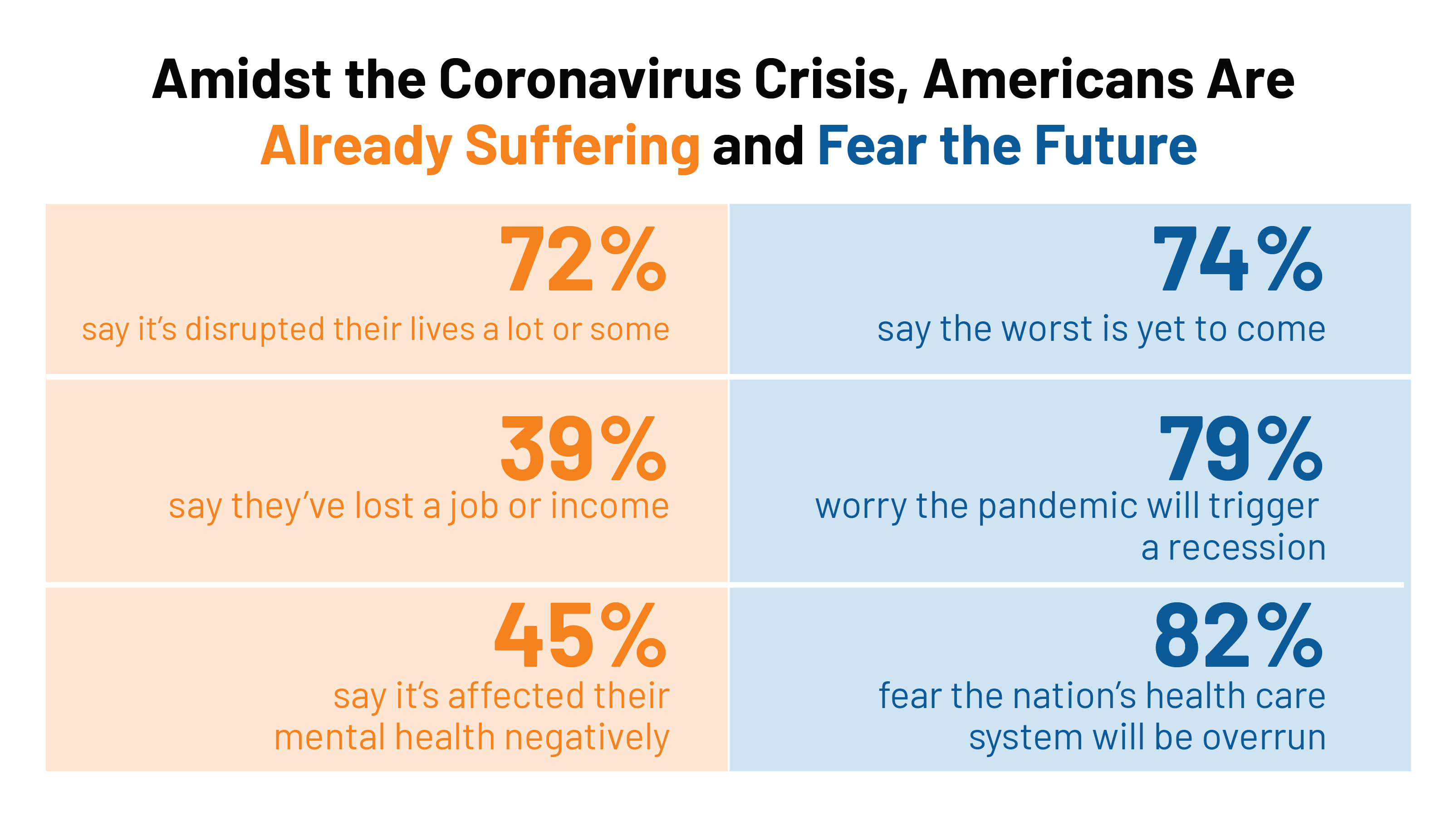

COVID-19 Reveals Urgent Need for Universal Mental Health Care

The coronavirus pandemic has dramatically disrupted every aspect of life for everyday people, ratcheting up stress across all families: The mandate to #StayHome, being physically distanced from work colleagues, beloved family and friends, and our community touchpoints The fear and risk-management of contracting the COVID-19 virus, for ourselves and our families The economic shock or either losing our jobs, seeing our savings eroding from 401(k) plans, losing our health insurance, or all of the above If we’ve kept our jobs in the pandemic, the novel work environment at-home — with children afoot, some of whom are now forced to be

Health, Wealth & COVID-19 – My Conversation with Jeanne Pinder & Carium, in Charts

The coronavirus pandemic is dramatically impacting and re-shaping our health and wealth, simultaneously. Today, I’ll be brainstorming this convergence in a “collaborative health conversation” hosted by Carium’s Health IRL series. Here’s a link to the event. Jeanne founded ClearHealthCosts nearly ten years ago, having worked as a journalist with the New York Times and other media. She began to build a network of other journalists, each a node in a network to crowdsource readers’-patients’ medical bills in local markets. Jeanne started in the NYC metro and expanded, one node at a time and through many sources of funding from not-for-profits/foundations,

The Patient-as-Payor in the Coronavirus Pandemic

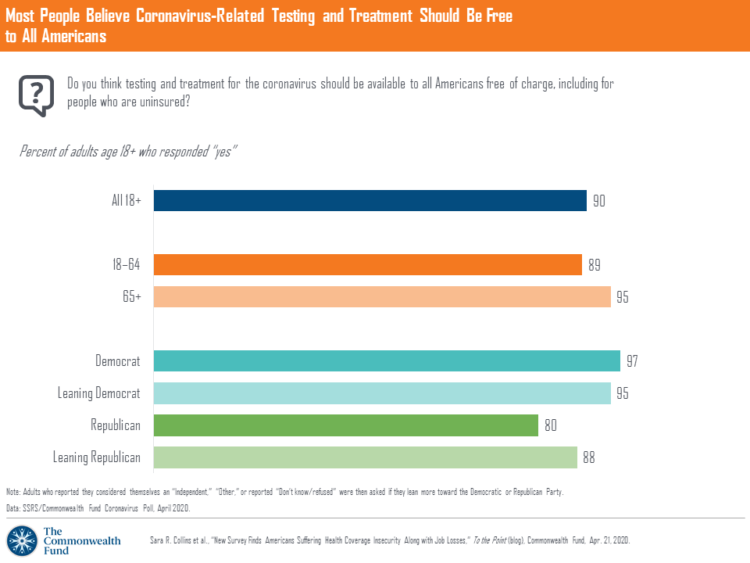

One in three working age people in the U.S. lost their job as a response to the COVID-19 pandemic, some of whom lost health insurance and others anxious their health coverage will be threatened, revealed in a survey from The Commonwealth Fund published on April 21, 2020. 2 in 5 people in America who are dealing with job insecurity are also health insurance insecure, the study found, as shown in the pie chart. The Commonwealth Fund commissioned the poll among 1,001 U.S. adults 18 to 64 years of age between 8-13 April 2020. Nearly all Americans believe the dots of

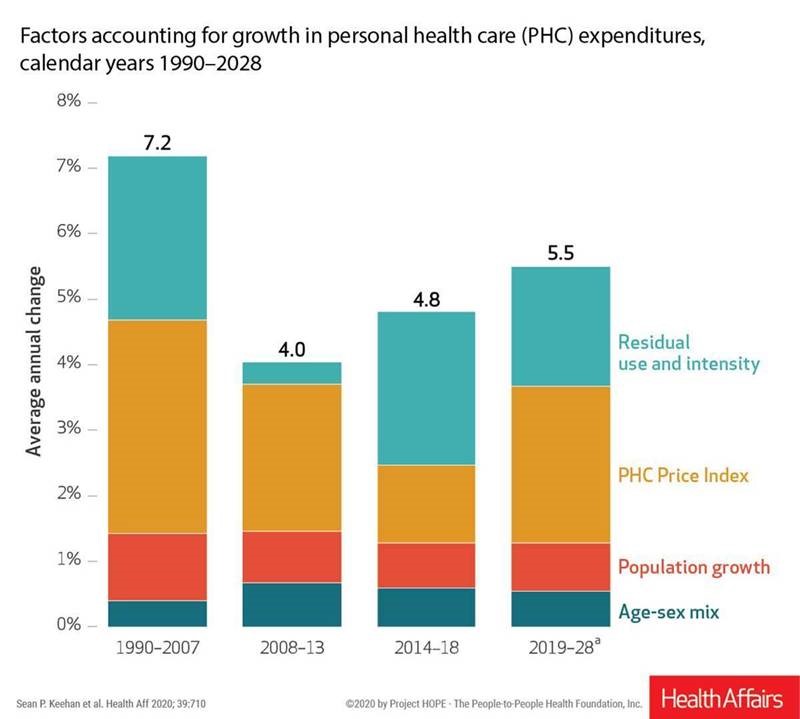

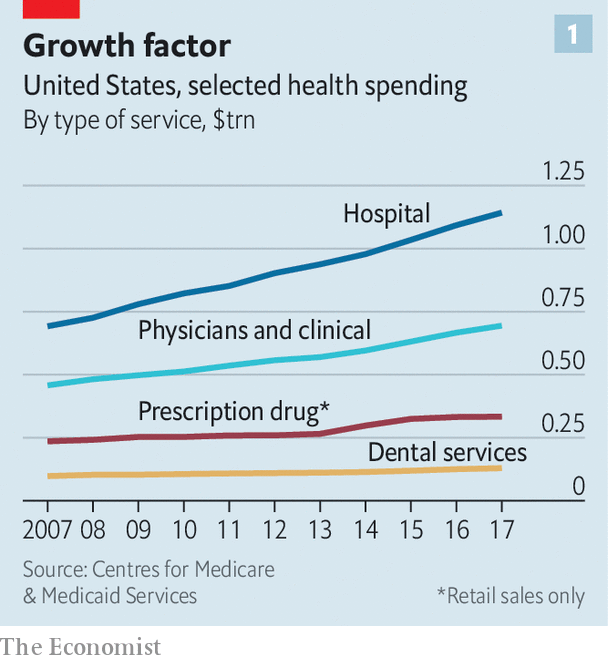

Wistful Thinking: The National Health Spending Forecast In a Land Without COVID-19

U.S. health care spending will grow to 20% of the national economy by 2028, forecasted in projections pre-published in the April 2020 issue of Health Affairs, National Health Expenditure (NHE) Projections. 2019-28: Expected Rebound in Prices Drives Rising Spending Growth. NHE will grow 5.4% in the decade, the model expects. But…what a difference a pandemic could make on this forecast. This year, NHE will be $3.8 trillion, growing to $6.2 trillion in 2028. Hospital care spending, the largest single component in national health spending, is estimated at $1.3 trillion in 2020. These projections are based on “current law,” the team

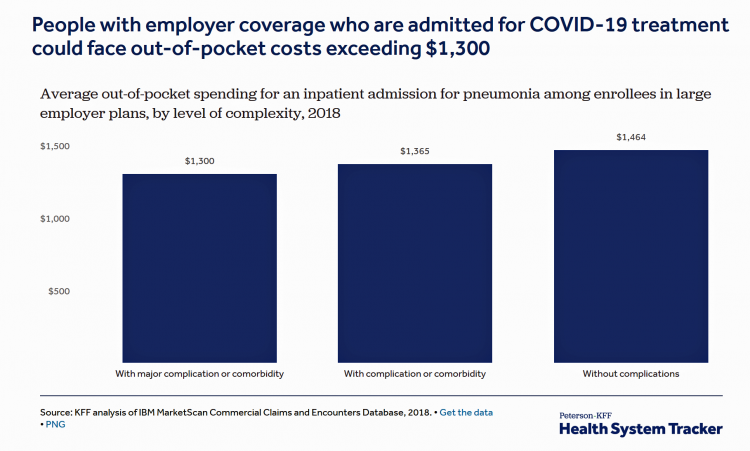

Estimates of COVID-19 Medical Costs in the US: $20K for inpatient stay, $1300 OOP costs

In the midst of growing inpatient admissions and test results for COVID-19, Congress is working as I write this post to finalize a round of legislation to help Americans with the costs-of-living and (hopefully) health care in a national, mandated, clarifying way. Right now in the real world, real patients are already being treated for COVID-19 in American hospitals. Patients are facing health care costs that may result in multi-thousand dollar bills at discharge (or death) that will decimate households’ financial health, particularly among people who don’t have health insurance coverage, covered by skinny or under-benefited plans, and/or lack banked

Lockdown Economics for U.S. Health Consumers

The hashtag #StayHome was ushered onto Twitter by 15 U.S. national healthcare leaders in a USA Today editorial yesterday. The op-ed co-authors included Dr. Eric Topol, Dr. Leana Wen, Dr. Zeke Emanuel, Dr. Jordan Shlain, Dr. Vivek Murthy, Andy Slavitt, and other key healthcare opinion leaders. Some states and regions have already mandated that people stay home; at midnight last night, counties in the Bay Area in California instituted this, and there are tightening rules in my area of greater Philadelphia. UBS economist Paul Donovan talked about “Lockdown Economics” in his audio commentary today. Paul’s observations resonated with me as

Telehealth and COVID-19 in the U.S.: A Conversation with Ann Mond Johnson, ATA CEO

Will the coronavirus inspire greater adoption of telehealth in the U.S.? Let’s travel to Shanghai, China where, “the covid-19 epidemic has brought millions of new patients online. They are likely to stay there,” asserts “The smartphone will see you now,” an article in the March 7th 2020 issue of The Economist. The article returns to the advent of the SARS epidemic in China in 2003, which ushered in a series of events: people stayed home, and Chinese social media and e-commerce proliferated. The coronavirus spawned another kind of gift to China and the nation’s health citizens: telemedicine, the essay explains. A

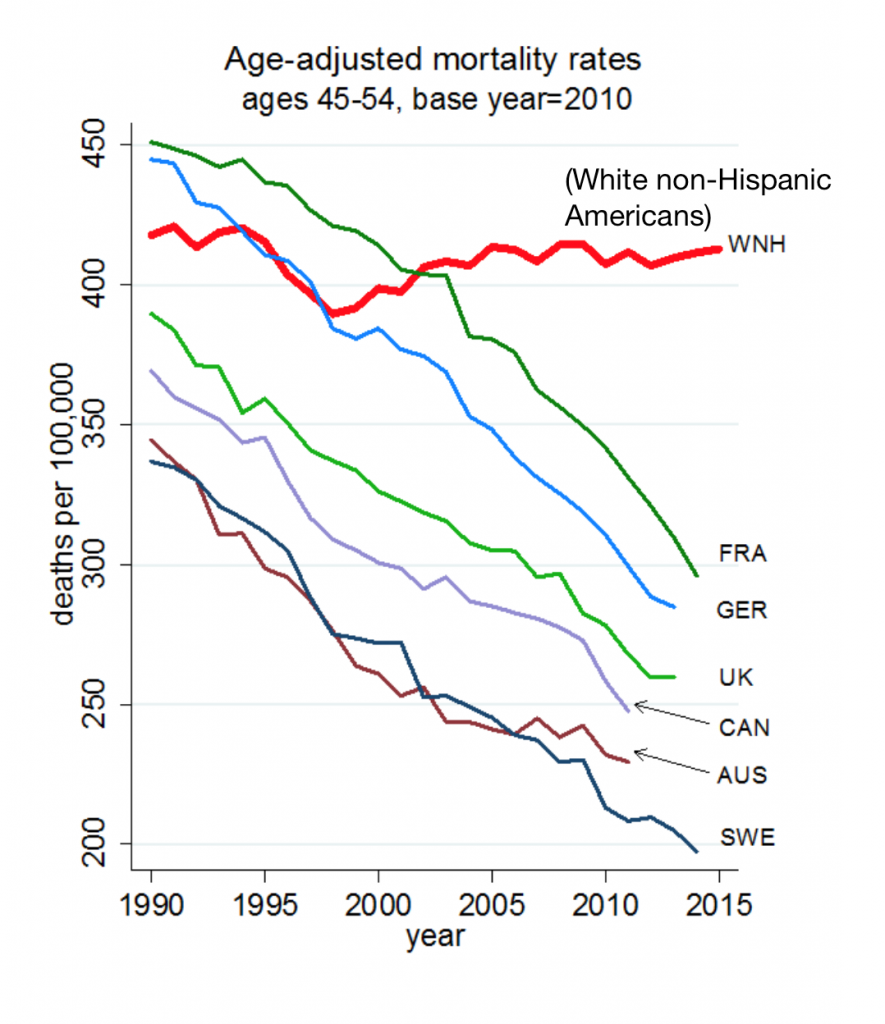

The Book on Deaths of Despair – Deaton & Case On Education, Pain, Work and the Future of Capitalism

Anne Case and Angus Deaton were working in a cabin in Montana the summer of 2014. Upon analyzing mortality data from the U.S. Centers for Disease Control, they noticed that death rates were rising among middle-aged white people. “We must have hit a wrong key,” they note in the introduction of their book, Deaths of Despair and the Future of Capitalism. This reversal of life span in America ran counter to a decades-long trend of lower mortality in the U.S., a 20th century accomplishment, Case and Deaton recount. In the 300 pages that follow, the researchers deeply dive into and

Job #1 for Next President: Reduce Health Care Costs – Commonwealth Fund & NBC News Poll

Four in five U.S. adults say lowering the cost of health care in America should be high priority for the next American president, according to a poll from The Commonwealth Fund and NBC News. Health care costs continue to be a top issue on American voters’ minds in this 2020 Presidential election year, this survey confirms. The first chart illustrates that lowering health care costs is a priority that crosses political parties. This is true for all flavors of health care costs, including health insurance deductibles and premiums, out-of-pocket costs for prescription drugs, and the cost of long-term care. While

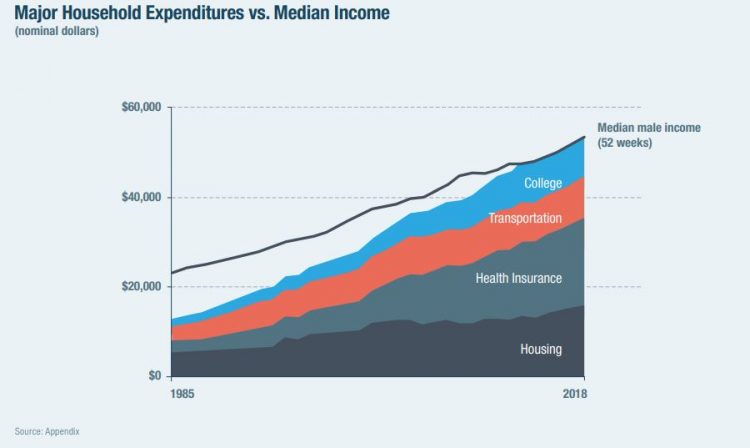

The High Cost-of-Thriving and the Evolving Social Contract for Health Care

Millions of Americans have to work 53 weeks to cover a year’s worth of household expenses. Most Americans haven’t saved much for their retirement. Furthermore, the bullish macroeconomic outlook for the U.S. in early 2020 hasn’t translated into individual American’s optimism for their own family budgets. (Sidebar and caveat: yesterday was the fourth day in a row of the U.S. financial markets losing as much as 10% of market cap, so the global economic outlook is being revised downward by the likes of Goldman Sachs, Vanguard, and Morningstar, among other financial market prognosticators. MarketWatch called this week the worst market

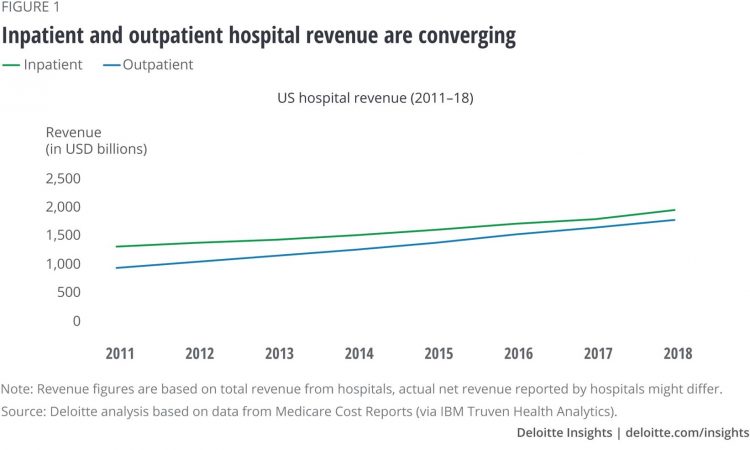

Outpatient is the New Inpatient – The Future of Hospitals in America

Outpatient revenue is crossing the curve of inpatient income. This is the new reality for U.S. hospitals and why I’ve titled this post, “outpatient is the new inpatient,” a future paradigm for U.S. hospitals This realization is informed by data in a new report from Deloitte, Where have the many hospital inpatient gone? The line chart illustrates Deloitte’s top and bottom line: “The shift toward outpatient is happening and will likely have a tremendous impact on operations, business models, staffing, and capital. Health systems should prepare for the future today and start thinking not only about how to manage their

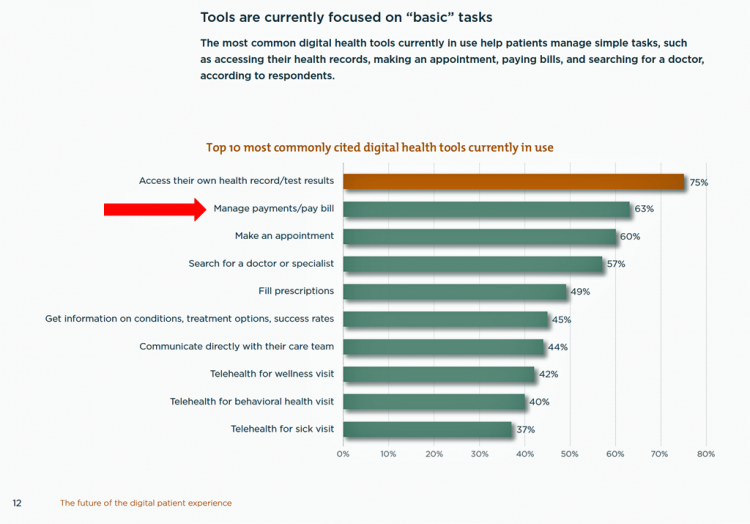

Tools for Paying Medical Bills Don’t Help Health Consumers Manage Their Financial Health

There’s a gap between the supply of digital health tools that hospitals and health systems offer patients, and what patients-as-consumers need for overall health and wellbeing. This chasm is illustrated in The future of the digital patient experience, the latest report from HIMSS and the Center for Connected Medicine (CCM). The big gap in supply to patients vs. demand by health consumers is highlighted by what the arrow in the chart below points to: managing payments and paying bills. Nowhere in the top 10 most commonly provided digital tools is one for price transparency, cost comparing or cost estimating. In the

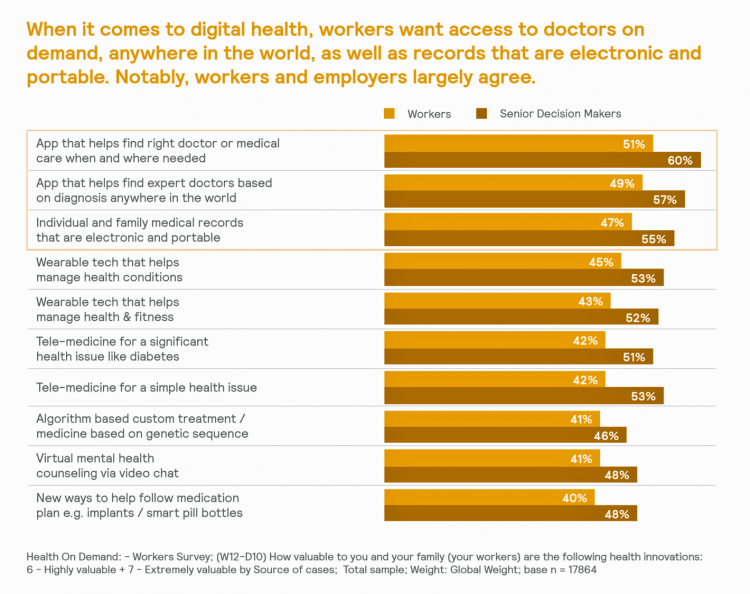

Most Workers and their Employers Want to Receive Digital Healthcare On-Demand

Most employers and their workers see the benefits of digital health in helping make health care more accessible and lower-cost, according to survey research published in Health on Demand from Mercer Marsh Benefits. Interestingly, more workers living in developing countries are keener on going digital for health than people working in wealthier nations. Mercer’s study was global, analyzing companies and their employees in both mature and growth economies around the world. In total, Mercer interviewed 16,564 workers and 1,300 senior decision makers in companies. The U.S. sample size was 2,051 employees and 100 decision makers. There’s a treasure trove of insights

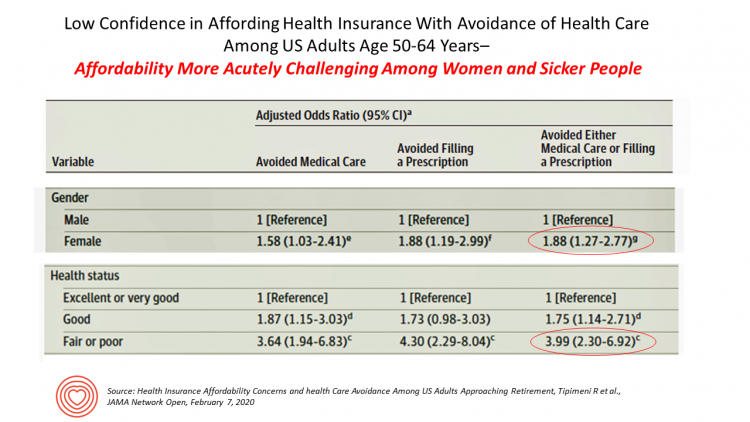

Health Care Costs Concern Americans Approaching Retirement – Especially Women and Sicker People

Even with the prospect of enrolling in Medicare sooner in a year or two or three, Americans approaching retirement are growing concerned about health care costs, according to a study in JAMA Network Open. The paper, Health Insurance Affordability Concerns and health Care Avoidance Among US Adults Approaching Retirement, explored the perspectives of 1,028 US adults between 50 and 64 years of age between November 2018 and March 2019. The patient survey asked one question addressing two aspects of “health care confidence:” “Please rate your confidence with the following:” Being able to afford the cost of your health insurance nad

Come Together – A Health Policy Prescription from the Bipartisan Policy Center

Among all Americans, the most popular approach for improving the health care in the U.S. isn’t repealing or replacing the Affordable Care Act or moving to a Medicare-for-All government-provided plan. It would be to improve the current health care system, according to the Bipartisan Policy Center’s research reported in a Bipartisan Rx for America’s Health Care. The BPC is a truly bipartisan organization, co-founded by Former Democratic Senate Majority Leaders Tom Daschle and George Mitchell, and Former Republican Senate Majority Leaders Howard Baker and Bob Dole. While this political week in America has revealed deep chasms between the Dems and

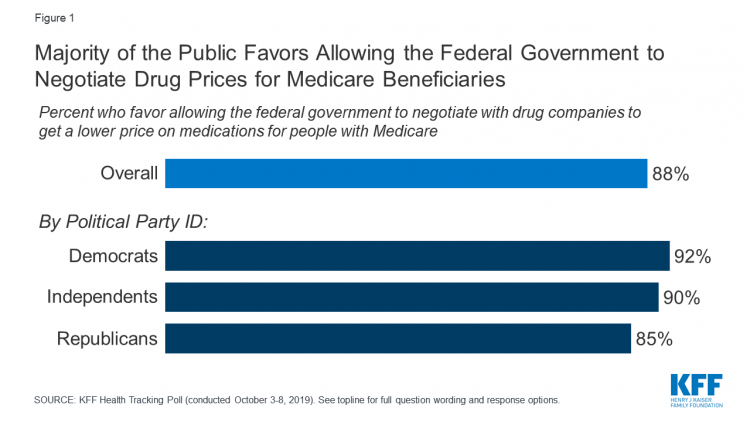

The State of the Union for Prescription Drug Prices

Tonight, President Trump will present his fourth annual State of the Union address. This morning we don’t have a transcript of the speech ahead of the event, but one topic remains high on U.S. voters’ priorities, across political party – prescription drug prices. Few issues unite U.S. voters in 2020 quite like supporting Medicare’s ability to negotiate drug prices with pharmaceutical companies, shown by the October 2019 Kaiser Family Foundation Health Tracking Poll. Whether Democrat, Independent, or Republican, most people living in America favor government intervention in regulating the cost of medicines in some way. In this poll, the top

A Uniting Issue in the United States is Lowering Prescription Drug Costs

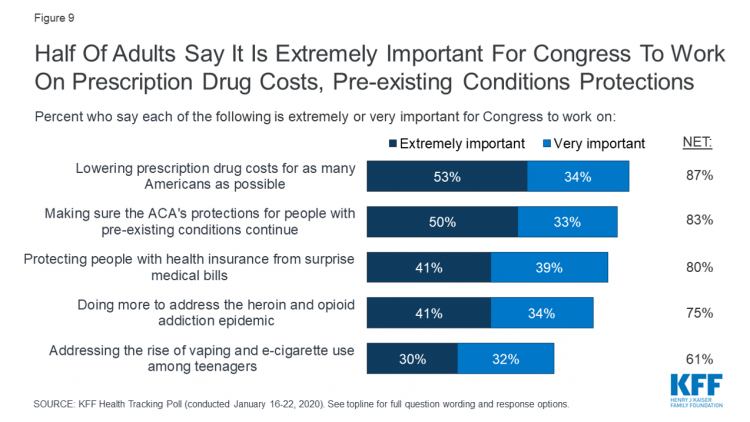

Health care continues to be the top-ranked voting issue in the U.S. looking to the November 2020 Presidential and Congressional elections. The Kaiser Family Foundation conducts the monthly poll which gauges U.S. adults’ perspectives on health care, and this month’s January 2020 Kaiser Health Tracking Poll explores Americans’ views on broad healthcare reform plans and specific medical policy issues. Overall, Americans point to prescription drug costs and the preservation of the Affordable Care Act’s protections for people with pre-existing conditions, the first chart tells us. Third and fourth on voters’ minds are protecting patients from surprise medical bills and better

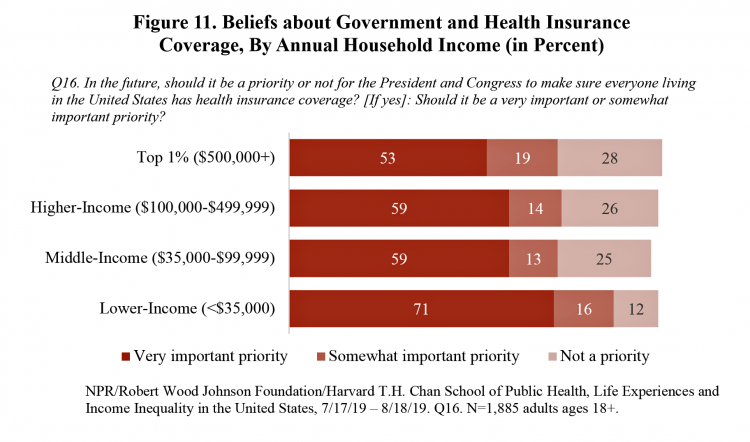

Most Americans Regardless of Income Say It’s Unfair for Wealthier People to Get Better Health Care

In America, earning lower or middle incomes is a risk factor for having trouble accessing health care and/or paying for it. But most Americans, rich or not, believe that it’s unfair for wealthier people to get better health care, according to a January 2020 poll from NPR, the Robert Wood Johnson Foundation and Harvard Chan School of Public Health, Life Experiences and Income Equality in the United States. The survey was conducted in July and August 2019 among 1,885 U.S. adults 18 or older. Throughout the study, note the four annual household income categories gauged in the research: Top 1%

The Heart of Health at CES 2020 – Evidence & Innovation Bridge Consumers and Doctors

The digital health presence at CES 2020 is the fastest-growing segment of consumer technologies at the Show this year, increasing by 25% over 2019. Heart-focused technologies are a big part of that growth story. In fact, in our search for devices and tools underpinned with clinical proof, evidence is growing for consumer-facing technology for heart-health, demonstrated by this year’s CES. Wrist-worn devices, digital therapeutics, patient engagement platforms, pharma and health plans converged at this year’s CES, with the professional association “blessing” of the American College of Cardiology who granted a continuing medical education credit for physicians attending a one-day “disruptive

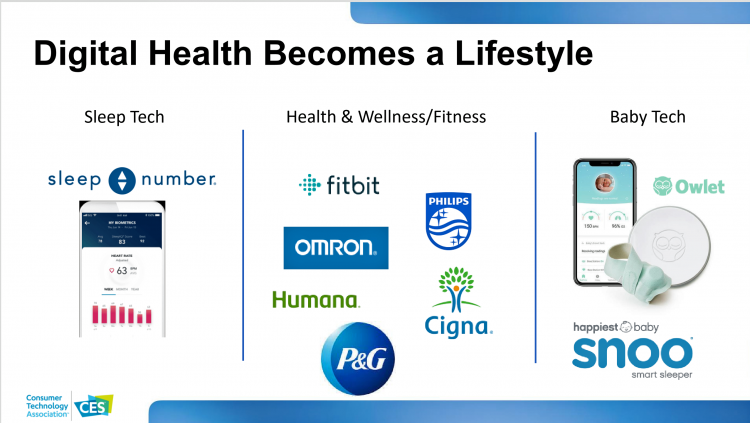

“Digital Health Is An Ecosystem of Ecosystems” – CTA’s 2020 Trends to Watch Into the Data Age

In CTA’s 2020 Consumer Tech Forecast launched yesterday at Media Day 1 at CES, Steve Koenig VP of Research, said that, “digital health is an ecosystem of ecosystems.” Health, medical and wellness trends featured large in the forecast, which brought together key trends for 5G, robotics, voice tech, AR/VR/XR, and the next iteration of IoT — which Steve said will still be called “IoT,” but in this phase will morph into the “Intelligence of Things.” That speaks to Steve’s phrase, “ecosystem of ecosystems,” because that’s not just “digital” health — that’s now the true nature of health/care, and what is

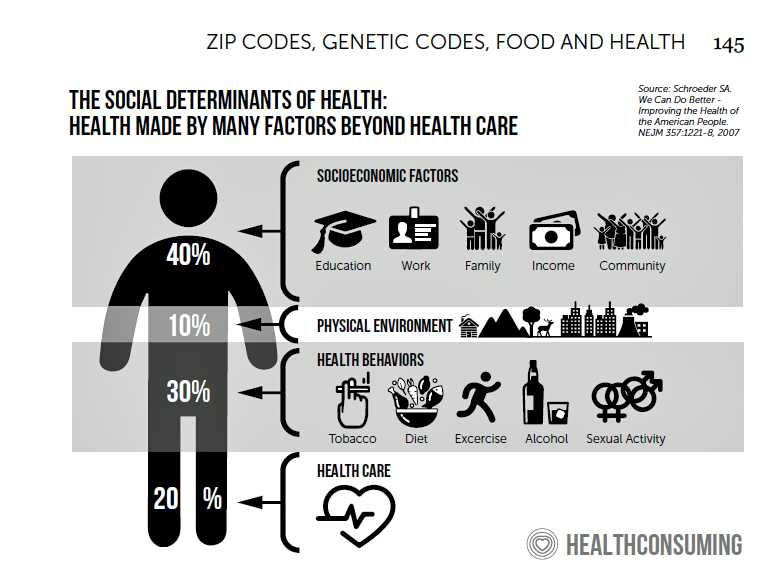

The 2020 Social Determinants of Health: Connectivity, Art, Air and Love

Across the U.S., the health/care ecosystem warmly embraced social determinants of health as a concept in 2019. A few of the mainstreaming-of-SDoH signposts in 2019 were: Cigna studying and focusing in on loneliness as a health and wellness risk factor Humana’s Bold Goal initiative targeting Medicare Advantage enrollees CVS building out an SDOH platform, collaborating with Unite US for the effort UPMC launching a social impact program focusing on SDoH, among other projects investing in social factors that bolster public health. As I pointed out in my 2020 Health Populi trendcast, the private sector is taking on more public health

Medicare Members Are Health Consumers, Too – Our AHIP Talk About Aging, Digital Immigrants, and Personalizing Health/Care

As Boomers age, they’re adopting mobile and smart technology platforms that enable people to communicate with loved ones, manage retirement investment portfolios, ask Alexa to play Frank Sinatra’s greatest hits, and manage prescription refills from the local grocery store pharmacy. Last week, the Giant Eagle grocery chain was the first pharmacy retailer to offer a new medication management skill via Alexa. That program has the potential to change our Medicare members manage meds at home to ensure better adherence, supporting better health outcomes and personal feelings of efficacy and control. [As an aside, consumers really value pharmacies embedded in grocery

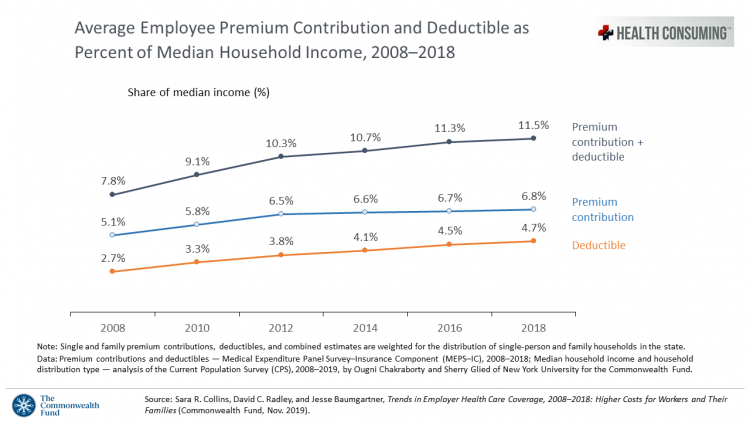

The Patient As Payor: Workers Covered by Employer Health Insurance Spend 11.5% of Household Incomes on Premiums and Deductibles

Workers covered by health insurance through their companies spend 11.5% of their household income on health insurance premiums and deductibles based on The Commonwealth Fund’s latest report on employee health care costs, Trends in Employer Health Coverage, 2008-2018: Higher Costs for Workers and Their Families. The topline of this study is that average annual growth in employer premiums rose faster between 2016 and 2017, by about 5% for both single and family plans. The bottom line for families is that workers’ premium payments grew faster than median incomes did over the ten years 2008 to 2018. Average deductibles also outpaced

Being Transparent About Healthcare Transparency – My Post on the Medecision Blog

With new rules emanating from the White House this month focusing on health care price transparency, health care costs are in the spotlight at the Centers for Medicare and Medicaid Services. A hospital transparency mandate will go into effect in January 2021 as a final rule, and a second rule with a focus on health plans and friendly explanations-of-benefits will receive comments in the Federal Register until January 14, 2020. As patients continue to grow muscles as payors and health consumers, transparency is one key to enabling people to “shop” for those health care and medical products and services that

More Evidence of Self-Rationing as Patients Morph into Healthcare Payors

Several new studies reveal that more patients are feeling and living out their role as health care payors as medical spending vies with other household line items. This role of patient-as-the-payor crosses consumers’ ages and demographics, and is heating up health care as the top political issue for the 2020 elections at both Federal and State levels. In research from HealthPocket, 2 in 5 Americans said they needed to reduce other household expenses to be able to afford their monthly insurance premiums. Four in ten consumers said their monthly health insurance premiums were increasing. One in four people in the

The Link Between Wellness & Wealth Is Powerful for Everyone – and Especially Women

In the U.S., the link between wellness and wealth, money and health, is strong and common across people, young and old. But the impacts of money on health, well-being, and life choices varies across the ages, based on a study from Lively, a company that builds platforms for health savings accounts. The first chart illustrates that health care costs challenge people in many ways: the most obvious health care cost problems prevent people from saving more for retirement or paying down debt. Eight in 10 Americans concur that rising health care costs challenge their ability to save for retirement. Beyond the

Thinking About Health Care One Year From the 2020 Presidential Election

Today is 4th November 2019, exactly one year to the day that Americans can express their political will and cast their vote for President of the United States. Health care will be a key issue driving people to their local polling places, so it’s an opportune moment to take the temperature on U.S. voters’ perspectives on healthcare reform. This post looks at three current polls to gauge how Americans are feeling about health care reform 365 days before the 2020 election, and one day before tomorrow’s 2019 municipal and state elections. Today’s Financial Times features a poll that found two-thirds

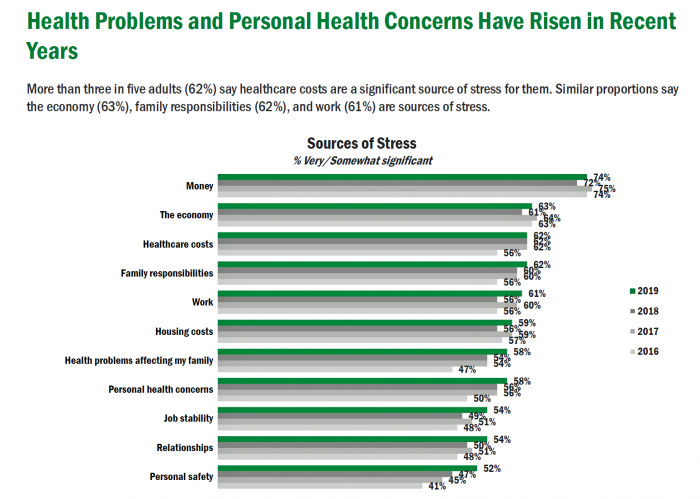

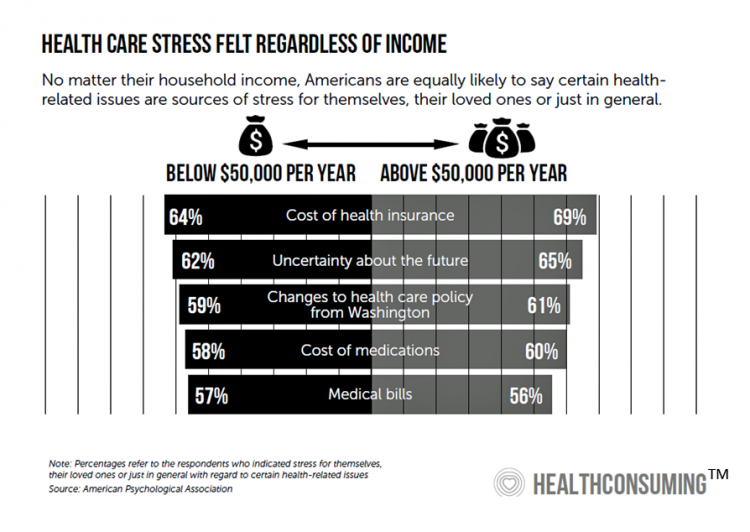

Americans’ Top Sources of Stress are Money, Money, Money and Family

ABBA sang the song “Money Money Money” back in 1976. The lyrics feel, sadly, spot-on when thinking about health care costs, job-lock and Americans’ home economics in 2019. “Work all night, I work all day, to pay the bills I have to pay Ain’t it sad And still there never seems to be a single penny left for me That’s too bad… Money, money, money must be funny In the rich man’s world.” That year, ’76, wasn’t just the U.S. bicentennial — it was a year when the U.S. allocated 8.6% of the nation’s Gross Domestic Product for health care.

Patients Growing Health Consumer Muscles Expect Digital Services

Patients’ experiences with the health care industry fall short of their interactions with other industries — namely online retail, online banking and online travel, a new survey from Cedar, a payments company, learned. Survata conducted the study for Cedar among 1,607 online U.S. consumers age 18 and over in August and September 2019. These study respondents had also visited a doctor or hospital and paid a medical bill in the past year. One-third of these patients had a health care bill go to collections in the past year, according to Cedar’s 2019 U.S. Healthcare Consumer Experience Study. Among those people

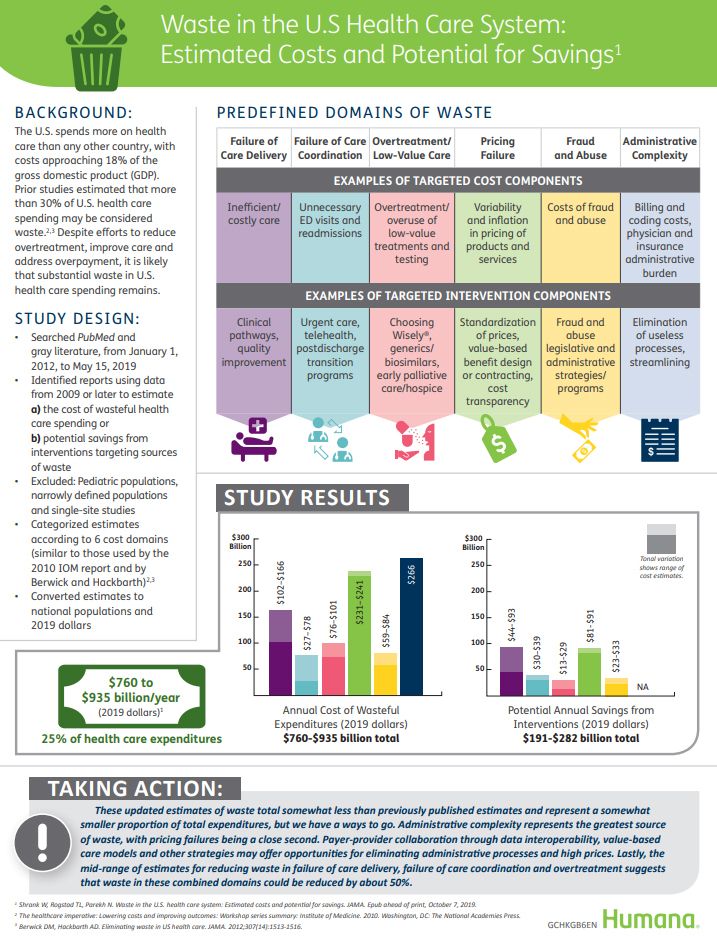

Wasted: $1 of Every $4 Spent on Health Care In America

A study in JAMA published this week analyzed research reports that have measured waste in the U.S. health care system, calculating that 25% of medical spending in America is wasted. If spending is gauged at $3.8 trillion, waste amounts to nearly $1 trillion. If spending is 18% of the American gross domestic product (GDP), then some 4.5% of the U.S. economy is wasted spending by the health care system and its stakeholders. In “Waste in the US Health Care System,” a team from Humana and the Univrsity of Pittsburgh recalibrated the previous finding of 30% of wasted spending to the 25%,

The Hospital CFO in the Anxiety Economy – My Talk at Cerner’s Now/Next Conference

As patients have taken on more financial responsibility for first-dollar costs in high-deductible health plans and medical bills, hospitals and health care providers face growing fiscal pressures for late payments and bad debt. Those financial pressures are on both sides of the health care payment transaction, stressing patients-as-payors and health care financial managers alike. I’m speaking to health industry stakeholders on patients-as-payors at Cerner’s Now/Next conference today about the patient-as-payor, a person primed for engagement. That’s as in “Amazon-Primed,” which patients in their consumer lives now use as their retail experience benchmark. But consumers-as-patients don’t feel like health care today

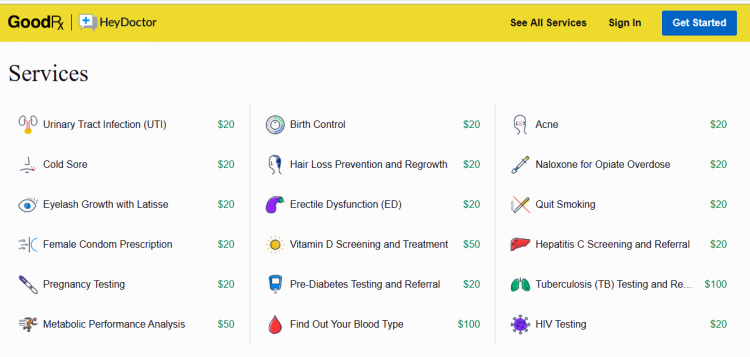

Health @ Retail – Prelude to GMDC SelfCare Summit with Updates from Hims & Hers, GoodRx, Sam’s Club and Amazon Care

“We knew millions of people weren’t getting the care they needed — they were either too embarrassed to seek help or felt stuck in a system that was confusing and intimidating. Digital health has the potential to radically change the way people approach their wellness and, since launching in 2017, we’ve outpaced even our own expectations, delivering more than 1 million Hims & Hers products to our customers. In collaboration with highly-qualified doctors and healthcare providers, we’ve built a digital health platform that is changing the way people talk about and receive the care they need.” That’s a verbatim paragraph

How Can Patients Be Health Consumers in an Un-Transparent World?

That question in the title of this post is begged in the annual 2019 consumer survey released this week from UnitedHealthcare (UHC). UHC gauges peoples’ views on health care, insurance, and costs in its yearly research. This year, transparency and health literacy challenges top the findings. When the three in ten folks do shop, four in ten people used the internet or mobile apps to do so — a dramatic increase from 2012. Shopping is most commonly done among Millennials, one-half of whom shop for health care services. Of people who have used digital tools for health care shopping, 8

“It’s the Deductible, Stupid” – Health Premiums Reach $20,576 in 2019 for a Family

Here’s the latest arithmetic on American workers’ financial trade-off of wages for health care insurance coverage: in the ten years since 2009, family premiums have risen 54% and workers’ contribution to health care spending grew 71%. Wages? They rose 26%, and general price inflation by 20%, according to the Kaiser Family Foundation survey on employer-sponsored benefits for 2019 released yesterday. Survey details for this 21st annual encyclopedia on employer-sponsored health care are published in Health Affairs October 2019 issue in a paper titled, Health Benefits in 2019: Premiums Inch Higher, Employers Respond to Federal Policy. Because this

Worrying About Paying for Health Care Is the Norm in America

Among stresses facing people at least 50 years of age, health care costs rank top of mind compared with other issues like long-term care, health insurance, Social Security, taxes, and being read to retire. Worries about health care costs are particularly stressful among future retirees, 8 of 10 of whom share this top concern along with 7 in 10 recent retirees and 6 in 10 people retired for at least a decade. Health care stress cuts in two ways: most people are worried about paying for health care, as well as experienced an unanticipated decline in their health, according to

Most U.S. Voters Support Building on the ACA, Not Medicare For All, As Fewer Americans Have Insurance Coverage

The vast majority of Americans favor lowering the cost of prescriptions, keeping the Affordable Care Act’s provisions to cover pre-existing conditions, lower overall medical costs, and protect people from surprise medical bills, according to the KFF Health Tracking Poll – September 2019: Health Care Policy In Congress And On The Campaign Trail. The big headline in this poll following last night’s third Democratic Presidential debate is that 55% of Democrats and Democrat-leaning Independent voters prefer a candidate that will build on the Affordable Care Act (ACA) versus a President that would replace the ACA with a Medicare For All plan (M4A).

Why Humana Joined CTA – The Pivot from “Health Insurance” to Behaving as a Health-Tech Start-Up

“Every company is a tech company,” Christopher Mimms asserted in the Wall Street Journal in December 2018. Connectivity, artificial intelligence, and automation are now competencies every company must master, Mimms explains. This ethos underpins Humana’s decision to join CTA, the Consumer Technology Association which hosts CES every January in Las Vegas. If you read this blog, you know one of the fastest-growing “aisles” at the annual conference is digital health. Humana joined up with CTA’s Health and Fitness Technology Division this month. Last year, Humana hired Heather Cox in the new post of Chief Digital Health and Analytics Officer, reporting directly

The Pharma Industry Hits Bottom of Consumers’ Industry Rankings, and Healthcare Is Only Marginally Higher on the List

from Gallup’s 2019 survey into Americans’ Views of U.S. Business Industry Sectors. Since reaching a relative high regard in 2015, the pharma industry reputation among consumers has declined each year since to the low this year with 58% of Americans having a negative view. This was a 31 percentage point drop in reputation in one year. This is one negativity point above peoples’ low regard for the Federal government. Gallup notes that Americans are over two times more likely to rank the pharmaceutical industry negatively (58%) as positively (27%). The healthcare industry, apart from pharma, didn’t fare well this year in

A Profile of People in Medicare Advantage Plans – HealthMine’s Survey of “Digital Immigrants”

There are over 60 million enrollees in Medicare in 2019, and fully one-third are in Medicare Advantage plans. Medicare is adding 10,000 new beneficiaries every day in the U.S. Medicare Advantage enrollment is fast-growing, shown in the first chart where over 22 million people were in MA plans in January 2019. Better understanding this group of people will be critical to helping manage a fast-growing health care bill, and growing burden of chronic disease, for America. To that end, HealthMine conducted a survey among 800 people enrolled in Medicare Advantage plans ag 65 and over with at least one diagnosed

Getting More Personal, Virtual and Excellent – the 2020 NBGH Employer Report

In 2020, large employers will be “doubling down” efforts to control health care costs. Key strategies will include deploying more telehealth and virtual health care services, Centers of Excellence for high-cost conditions, and getting more personal in communicating and engaging through platforms. This is the annual forecast for 2020 brought to us by the National Business Group of Health (NBGH), the Large Employers’ Health Care Strategy and Plan Design Survey. The 42-page report is packed with strategic and tactical data looking at the 2020 tea leaves for large employers, representing over 15 million covered lives. Nearly 150 companies were surveyed

Talking “HealthConsuming” on the MM&M Podcast

Marc Iskowitz, Executive Editor of MM&M, warmly welcomed me to the Haymarket Media soundproof studio in New York City yesterday. We’d been trying to schedule meeting up to do a live podcast since February, and we finally got our mutual acts together on 6th August 2019. Here’s a link to the 30-minute conversation, where Marc combed through the over 500 endnotes from HealthConsuming‘s appendix to explore the patient as the new health care payor, the Amazon prime-ing of people, and prospects for social determinants of health to bolster medicines “beyond the pill.” https://www.pscp.tv/MMMnews/1eaJbvgovBYJX Thanks for listening — and if you

Love ACA Provisions, Not the ACA – KFF Poll Reveals American Voters’ Views on Health Care Reform

Today is the bridge day between The Battle of the Democratic Primary Candidates Debate #2 Part 1 and tonight, Part 2. So it’s a good time to take stock of U.S. voters’ views on health care, through the lens of the Kaiser Family Foundation’s Health Tracking Poll for July 2019 published yesterday. Health care is the top issue Democrats want to hear about in the debates, well ahead of climate change, women’s issues, immigration and gun policy. Let’s start with an overall context statistic from this poll: that is that 86% of insured U.S. adults like their health insurance plan

Milliman Finds PPO for Family of 4 in 2019 Will Cost $28,386

This year, an employer-sponsored PPO for a family of four in the U.S. will cost $28,386, a 3.6% increase over 2018, according to the 2019 Milliman Medical Index (MMI). Based on my annual read of this year’s Index, the PPO costs roughly the same as a new Dodge Charger or a year attending the engineering school at Alfred University. The Milliman MMI team has updated the methodology for the Index; the chart shown here is my own, recognizing that the calculations and assumptions beneath the 2019 data point differ from previous years. The key points of the report are that:

Marketing Health To Consumers in the Age of Retail Disruption

Today, I am speaking with marketing leaders who are members of CHPA, the Consumer Healthcare Products Association on this very topic. This is CHPA’s 2019 Marketing Conference being held at the lovely historic Hotel du Pont in Wilmington, DE. The gist of my remarks will be to focus on the evolving retail health ecosystem, with my HealthConsuming lens on health/care, everywhere. And timing is everything, because today is International Self-Care Day to promote peoples’ health engagement. The plotline begins with a tale of two companies — CVS/health and Best Buy — discussing these two organizations’ approach to acquiring companies to expand

Finances Are the Top Cause of Stress, and HSAs Aren’t Helping So Much…Yet

If you heed the mass media headlines and President Trump’s tweets, the U.S. has achieved “the best economy” ever in mid-July 2019. But if you’re working full time in that economy, you tend to feel much less positive about your personal prospects and fiscal fitness. Nearly nine in 10 working Americans believe that medical costs will rise in the next few years as they pondering potential changes to the Affordable Care Act. The bottom line is that one-half of working people are more concerned about how they will save for future health care expenses. That’s the over-arching theme in PwC’s

Thank you FeedSpot for

Thank you FeedSpot for